Original Articles: 2018 Vol: 22 Issue: 3

Do Cognitive Style and Fairness Affect Accounting Students Performance?

Yusnaini Yusnaini, Sriwijaya University, Indonesia

Imam Ghozali, Diponegoro University, Indonesia

Susiana Susiana, Andalas University, Indonesia

Manatap Berliana Lumban Gaol, HKBP Nommensen University, Indonesia

Yulia Saftiana, Sriwijaya University, Indonesia

Abstract

This study examines the effect of cognitive style and fairness on individual performance in nonparticipative budgeting based on referent cognitions theory. This study shows the importance for organizations to understand and manage the level of justice and cognitive style of individuals in order to allocate organizational resources and improve individual performance. The 2x2-experimental design between subjects was used to test the hypotheses. Budget targets were manipulated by two levels of fair budget target and unfair target budget; while the cognitive style was manipulated by two levels as a field independent and field dependent. The participants were 88 undergraduates accounting students from the executive class of the Accounting Program. ANOVA's two-way analysis was used to test the hypotheses. The results show that performance is lower when unfair budget targets are compared with a fair budget target set. If the budget target is set fair, there is no significant difference between individual performance with cognitive style both field independent and field dependent. When unfair budget targets are set, individual performance with field independent is higher than the field dependent.

Keywords

Fairness, Referent Cognitions, Field Independence, Performance.

Introduction

The budget used in decentralized organizations has three main objectives: communicating strategic plans to organizational divisions, coordinating activities between divisions and motivating and evaluating the performance of divisional managers (Merchan, 1998). Budgets can be motivated if associated with a performance appraisal system and organizational compensation (Hopwood, 1972). Budget becomes a target that must be met in order for employees to get positive results, including bonus payments and promotions.

The organization hopes that the budget that has been set can be achieved by employees. Theory and empirical evidence suggests that the impact of motivation from budget targets partly depends on individual perceptions of two factors: the fairness of the established budget targets and the fairness of the budgeting process used (Libby, 1999; Wetzel, 1999; Lindquist, 1995). In the scenario of achieving budget targets, this study uses information on achieving budget targets presented in form of symbols. Participants are asked to learn and remember the symbols according to the target budget to be achieved. Thus, cognitive ability is required for participants to manage information and solve problems in experimental scenarios. This ability is known as cognitive style.

Differences in cognitive style in the field of dependence have been shown to be extended to various intellectual domains. Individuals who are field independent (FI) tend to be analytical, able to define their own information structure and have an impersonal orientation. In contrast, individuals with field dependent (FD) style understand globally, adhere to structures as they are and have a social orientation (Adams, 1965).

Gul’s (1984) results in the field of accounting show that FD individuals are more confident than FI students in judgment when dealing with ambiguous information. Lusk (1973) found that FI individuals showed higher cognitive abilities in analysing annual reports. Davis and Cochran (1989) argued that where the quantity of information to be processed is still small, there is little difference in performance between the subjects of FI and FD, but if the information has to be analysed or integrated is large, the performance of FI individuals is more accurate and efficient. Furthermore, Bernardi (2003) study showed that FI individuals have greater analytical abilities than FD individuals. Davis & Cochran (1989) studies also showed that students with FI cognitive styles reflect a higher level of achievement than FD students. However, different results are found by Neimark (1981) who argued that individuals who are field dependent lack the skills to handle unstructured tasks and ambiguous instructions.

The purpose of this paper is to know how the interaction between perception of fairness and cognitive style of FI/FD in achieving budget target is. Subjects perform production simulation tasks based on budget-based incentive contracts. The observed variable is the performance of the subjects on the experimental task. By the experimental method, fairness budget targets are manipulated at a level that is attainability (fair) and unattainability (unfair); while the cognitive style is manipulated by two levels of independent field (FI) and field dependent (FD).

This research is very important considering the achievement of one's performance can be determined by individual characteristics inherent in a person. This characteristic consists of one's cognitive and one-sided style. It is thus important for organizations to understand and manage the level of equity in allocating organizational resources. It is also important to understand the cognitive style of individuals in order to improve individual performance.

The results show as predicted by referent cognition theory. Performance is lower when budget targets are unfair than using fair budget targets. When budget targets are set fair, performance does not differ significantly either from individuals with FI or FD cognitive styles. If the budget target is unfairly determined, the individual's performance with FI is higher than that of the FD (Phillips, 1998).

These results contribute to the central manager as a decision maker. When making resource allocation decisions within an organization, they must balance the needs of division managers with the organization as a whole. Division managers cannot always be allocated the amount of resources they want. It is thus interesting to consider how the central manager can handle the allocation process without lowering the motivation of the division manager when budget allocations differ from the amount they want.

Theory and Hypotheses Development

Referent Cognition Theory

Referent cognition theory (RCT) was developed in the 1980s. The RCT argued that “people's reactions to procedural and distributive justice depend heavily on their counter-factual thinking” (Kahneman & Tversky, 1982). In essence, RCT reasoned that when distributive or procedural rules are broken down, people's thinking becomes highly referential. Someone uses a frame of reference to evaluate what happens which consists of mental comparison with what might happen (Cropanzano & Folger, 1989; Folger, 1986, 1987, 1993; Folger & Cropanzano, 1998, 2001; Folger & Kass, 2000).

Fairness

Bazerman (1994) stated that humans really pay attention to fairness that can affect their decisions and lives. Every single thing will lead to an individual's judgment on what is thought about this fairness. Fairness refers to an understanding of how cognitive processes shape anger, jealousy, and inefficiency. Fairness can be seen from two elements: the result and the process. Kahneman et al. (1986) tested fairness on the experimental setting of supply and demand. The study showed that fairness considerations can dominate rational choice in making economic decisions.

Martin's study (2016) examines the role of internal locus of control and consistent standards on perceptions of procedural justice, predicting organizational commitment and perceived learning in a multiple-supervisor environment. The results show that consistent standards among supervisors are significantly related to procedural fairness perceptions in a unique multiple-to-one performance appraisal environment. In addition, the internal locus of control will be significantly related to procedural fairness perceptions in many-to-one audit environments (Merchant, 1998).

Lane et al. (2017) tested the fairness of the manager's performance measurement setting with the balance scorecard (BSC). The results show that perception of fairness is one of the determinants of effectiveness of the balanced scorecard (BSC). Lindquist (1995) suggested that a fair process is defined through subordinate participation in fixation of budget targets and other varied outcomes including budget performance and looseness.

Brockner & Wiesenfeld (1996) reviewed 45 studies of individual reactions to resource allocation decisions. They studied the relationship between the perceptions of equity resulting from the allocation process, the equity of the allocation process itself, and the various psychological outcomes including organizational commitment, trust, intention to turnover, and job satisfaction. Their study showed a strong interactive effect that is consistent with the predicted referent cognition theory. Bazerman (1994) argued that “fairness can be observed by comparing the results received with expected results. Another way is to compare the results we receive with those received by the others alike (referral)”.

According to the referent cognition theory, “when individuals receive unfair results, they will inherently refer to the assessment” (Folger, 1986). That is, individuals make comparisons between the results they receive and the results that have been received by others equivalent, given their input relative to the input of others (Adam, 1965). If the results refer to the inequalities between the results individuals receive and the outcomes they are supposed to receive than others, it will produce feelings of resentment.

The current study examines the prediction of referent cognition theory in the context of accounting using budget-based incentive contracts. In this determination, the results of the allocation process are defined as budget targets assigned to subordinates and the elective process refers to the process used in determining the target budget to be assigned.

Lindquist (1995) also examined the results of budget targets and budgeting that are just and unfair from the perspective of referent cognition theory. This study predicted the combination of voice and subordinate voice in the budgeting process will result in higher performance than one’s own voice, self-voting, or no input when a fair budget target is received. Secondly, Lindquist (1995) predicted that “one’s own voice will result in higher performance than voice plus voice or voice only when budget targets are unfairly accepted”. These results fail to support the prediction of the main or interactive effects of the fairness of the budget targets and the shape of budget participation on performance.

To complement the referent cognition theory, alternative views are provided by goal theory. If goals are not achieved, the goal theory predicts that they will not be accepted by their subordinates (Locke, 1982). Consequently, unattainable goals will have no effect on subordinates, or, more likely, give demotivating effects and result in performance degradation (Locke, 1982). Based on the goal theory, if the budget target is not fair (unreachable), performance becomes lower than when the target budget is fair (can be achieved). This leads to the following hypothesis:

H1: Performance will be lower if budget targets are set unfairly compared to when they are set fairly.

Cognitive Style

According to Chen & Macredie (2002), cognitive style is an individual choice and a habitual approach to organizing and representing information. One form of cognitive style is field dependence consisting of field independent and field dependent (Hicks et al., 2007; Bernardi, 2003; Awasthi and Pratt, 1990; Gul, 1990; Gul, 1984). Individuals who are field dependent will have the perception and processing of information that is influenced by the contextual field in which they operate. The field dependent depends on the external reference frame, while the field independent depends on the internal frame of reference. Individuals who are field dependent focus on the most prominent features presented to them (Goodenough, 1976). The study of Davis & Cochran (1989) suggested that there is little difference in performance when the amount of information to be processed is still small; however, when the information to be analyzed or integrated is large, the performance of field independent individual becomes more accurate and efficient.

Davis & Frank's (1979) study showed that field independent learners can better recall word lists than field dependent learners when lists are made with more difficult organizational patterns (Davis & Cochran, 1989). In addition, field independent students are better at studying and remembering textual information that has high structural importance (Davis & Cochran, 1989). Leader and Klein (1996) suggested that field dependence involves perceptual ability and problem solving.

Accounting studies that tested the influence of independent / field dependent cognitive style (FI/FD) styles on accountant decisions, the results were not able to show any significant influence (eg Lusk 1973, 1979; Benbasat and Dexter 1979, 1982). In contrast to the results of the Pincus (1990) study that examined the effect of FI/FD on judgment audit found that the cognitive style significantly affected the presentation of fairness of the auditor's decision. Further research was conducted by Bernardi (1994) with a similar study with Pincus's and found that FD/FI had no significant effect on the fairness presentation of the auditor's decision. Mills (1996) tested the FD/FI cognitive style of the auditor's decision with respect to the internal audit function. The results are consistent with Bernardi's study but are not consistent with Pincus's results. In other words, the cognitive style of FD/FI has no significant effect on the result of the auditor's decision.

Jones & Wright's (2010) study examined a combination of cognitive and user or non-user styles from two types of hypertext learning aids and their interaction with student performance in advanced financial accounting. Cognitive style tested is field independent-field dependent (FI/FD). Total participants of 107 accounting students level four. The results show that for familiar exam questions, only significant learning aids are significant, and for unfamiliar exams, learning aids, cognitive styles and interactions both have a significant effect. For both types of questions/examinations, performance differs based on cognitive style.

Research Jones & Wright (2012) investigated the effect of cognitive force (field dependence) on performance on different exam questions in the context of familiarity and structure level. Participants involved were 160 students in the middle financial accounting class. This study found that the performance of students who field of independent high on the solution of unfamiliar questions than students who field dependent. There are no significant advantages to students who are field dependent when resolving familiar questions. For unstructured questions, the results of this study indicate that there is no significant difference between the performance of the students who are field dependent and field dependent. As for the structured questions, the results showed that the performance of students field independent is better than the students field dependent.

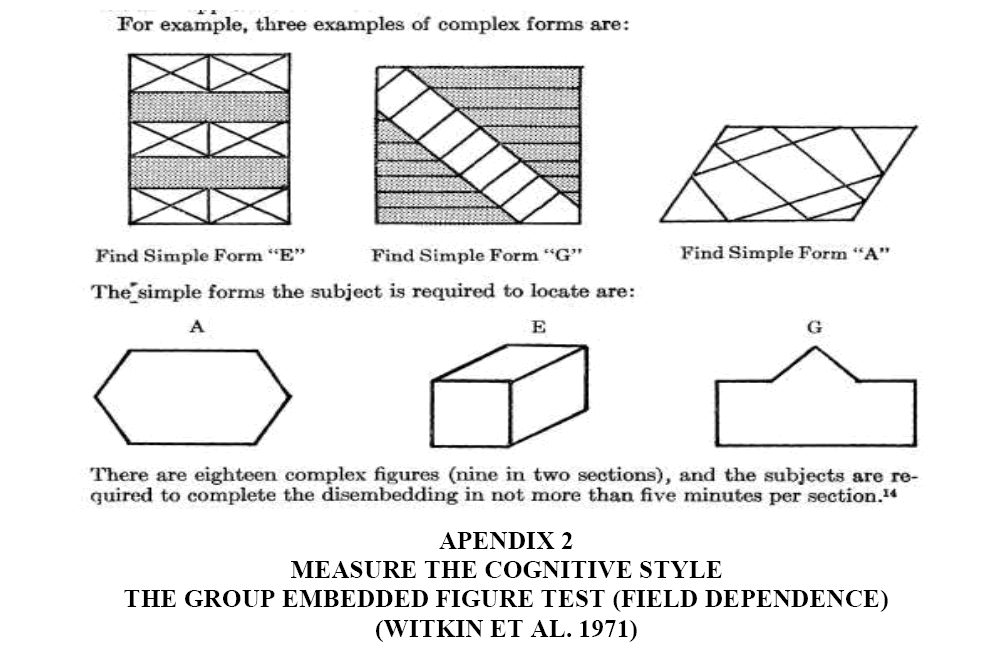

Witkin et al. (1971) developed the Group Embedded Test (GEFT), which can test the cognitive style of field dependence. It consists of finding simple figures in larger and more complex figures designed to insert or hide simpler figures an ability to find simple figures in complex figures. It also reflects the ability to solve cognitive problems by isolating critical elements and using them in different contexts (Leader & Klein, 1996). Individuals who are able to ignore complex environments and thus "see" simple figures in them are classified as individuals who are field independent, while those who have difficulty in finding simple figures are classified as individuals who are field dependent (Cakan, 2003).

The GEFT instrument is considered to be one of the more established and wellresearched models (O'Brien & Wilkinson, 1992) and continues to be used in accounting (Hicks et al., 2007; Bernardi, 2003) and other fields (Sisco & Leventhal, 2007; Chapman & Calhoun, 2006; Liu, 2006; Guillot & Collet, 2004; Chakan, 2003; Chao and Huang, 2003; McMorris et al., 2002; O'Brien et al., 2001; Salbod, 2001; Huang & Chao, 2000). Individuals who are field independent exhibit greater analytical skills than dependent field individuals (Bernardi, 1993), and disciplines such as accounting, engineering, and science tend to attract more independent individuals in the field, while the opposite is found for disciplines such as nursing and art (Hicks et al., 2007). In general, because the existing literature shows that students who are field independent are better than the field dependent students, it is said that field independent students will perform better in advanced financial accounting than students who are field dependent. This leads to the following hypothesis:

H2: Performance of field independent individuals is better than the field dependent individual when the fair budget target is determined fairly.

H3: Performance of field independent individual is better than the field dependent individual when the budget target is determined unfairly.

Methodology and Results

Participants

The participants were the fourth year uundergraduate accounting students in the executive class who were taking the advanced financial accounting courses of Sriwijaya University in Indonesia. The total sample was 88 people (53% male/47% female). The subjects were assigned randomly to experimental conditions. Participation was voluntary. Two successive experimental sessions were held. The subjects had no chance to communicate in the experimental session. The experiment session lastedfor 30 minutes (20 minutes to collect data and 10 minutes to complete the consent form).

After the experimental manipulation sessions, the subjects were asked to indicate whether the budget target given to them was higher, lower, or equal to the budget given to the others in their group. Five subjects failed to answer this question correctly, indicating that they did not understand the experimental manipulations of the reference targets. The subjects were excluded from the sample size. Thus, only 83 subjects could be used for final data processing.

Experimental Design

The experiment used 2x2-between-subject design with fairness measures based on fair (attainability) budget targets and unfair (unattainability) budget targets, while the cognitive style is manipulated by two levels as field independent (FI) and field dependent (FD). Table 1 shows the cell conditions.

| Table 1 Experimental Design 2x2 Between-Subject |

||

| Fairness of Budget Target | Field Dependency | |

| Field Independent (FI) | Field Dependent (FD) | |

| Attainability (Fair) | A N = 20 |

B N = 20 |

| Unattainability (Unfair) | C N = 23 |

D N = 25 |

Measure

The subjects performed experimental production tasks involving translation symbols to alphabetical letters using translation keys. The subjects were paid based on the number of words translated. Each word consisted of randomly arranged symbols that did not match any actual accounting account. The subjects were given 10 minutes to learn before performing the actual task.

The cognitive styles of FI and FD students were measured through their scores on the filling of GEFT instruments (see apendix). The test instruments were composed of two parts, time constrained, and scored continuously (not by using the average cut off). The researchers printed the completed instruments using the accompanying tagging guidelines. A range of possible scores between 0 and 18 with a higher value indicated a higher field independent rate, and a lower score indicated a higher field dependent rate. The dependent variable measured was the performance of the subjects on the experimental tasks in the production period after the experimental manipulation had been introduced.

Procedures

Upon entering the room, subjects were randomly seated where they found a map containing experimental materials. The material consisted of three booklets that corresponded to the three parts of the experiment: the period of practice, the period of work, and the questionnaire. Subjects were asked to imagine that they worked for the translation division manager of an accounting book publishing company. The subjects read a descriptive material and were put into practice of translation work for ten minutes. The subjects were given the key answers they use to statistically adjust the subjects’ skills in the assignment in the following analysis.

After completing the first and second tasks, respondents would learn and understood the third task at the core of the experiment. At this stage, they were asked to read the case illustration by positioning themselves as someone in the case. The given case was manipulated by fairness in the budget target or budget process. The time given for the third task was 20 minutes.

The experimental text was given in two stages. The first step: each scenario included a preliminary session, which concluded the respondents’ self-perception as a member of the accounting translation team at a publishing company. At this stage, respondents were asked to practice translating words that were symbolized as words in Indonesian. The next step, the respondents got a treatment from manipulated conditions. To manipulate performance conditions on a budget basis with incentive contracts, it was illustrated that every member who was able to reach the target of translating words correctly would be given a certain bonus.

Result

Manipulation Checks

As a check on the experimental manipulation of fairness of budget targets, the subjects were asked to respond to the statement "The budget target of 10 (20) words given to me is fair" on a scale of 1 (strongly disagree) to 7 (strongly agree). The one-way analysis of variance that compared the fairness ratings of subjects in fair and unjust groups showed significant effect of fair budget targets, (F = 164,872, p = 0,000). Table 2 presents the check manipulations.

| Table 2 Manipulation Check Of Fairness Perceptions |

||||

| Fairness Perception | Mean | F- Ratio | p-value | |

| Fair (Attainability /Equal) |

Unfair (Unattainability/Higher) | |||

| Fairness of Budget Target | 6.21 | 3.34 | 141.737 | 0.000 |

Hypothesis Tests

Panel A of table 2 shows descriptive statistics on performance under each experimental condition. Performance is measured by the number of words translated in the experimental task. The ability of a subject is measured by the number of words that have been translated in the practice session before reading the experimental task with manipulation. Performance in unfair budget targets is lower than fair budget target conditions. This can be seen from the average performance of budget achievements in both FI and FD conditions as described in panel A of Table 2. The average performance values of fair budget targets under FI conditions (18.25) and FD (16.05) are higher than the performance on unfair budget targets in both FI conditions (15.67) and FD (14.13). Thus, the results of this test support Hypothesis 1.

Panel B of Table 2 shows that the performance on a fair budget target determined by an individual who is an field independent is higher than the performance on a fair budget target determined by field dependent conditions. ANOVA test results indicate that fairness in determining the reasonableness of budget targets is significant (F = 67,001; p = 0,000). These results indicate that fairness to the budget target will have a significant impact on performance. The analysis of cognitive style showed F (3.157) and p (0,164). An interesting insight was obtained when comparing subject performance under unfair budget target/field independent conditions with subjects in fair budget target/field dependent conditions: their average performance did not show significant differences. These results indicate that the performance is not different for individuals who are field independent and field dependent when their budget targets are determined fairly. This result does not support Hypothesis 2.

The interaction between the budget target and the cognitive style in panel B of Table 3 shows that the unfair target budget determined by field independent individuals results in a higher performance than the target budget unfair determined by the field dependent individuals. The mean in Table 3 shows that in this condition the mean performance at FD condition (14,13) is lower than FI condition (15,67). The interaction between target fairness budget and cognitive field dependence style is significant (F = 9,311) and p = 0.003). This result supports Hypothesis 3. These results predict that performance is negatively affected if the budget targets are unfair and the individual has cognitive field dependent style.

| Table 3 Analisys Of Variance Result |

|||

| Panel A: Mean Performance | |||

| Budget Target / Budget Process | Mean | Std. dev. | |

| Attainability / FI ( Cell A) | 18.25 | 3.13 | |

| Attainability / FD ( Cell B) | 16.05 | 2.61 | |

| Unattainability / FI (Cell C) | 15.67 | 3.88 | |

| Unattainability / FD (cell D) | 14.13 | 3.37 | |

| Panel B: ANOVA Result : Performance | |||

| Sumber Variasi | Df | F-Ratio | p-value |

| Fairness of Budget Target | 1 | 67.001 | 0.000 |

| Field Dependency | 1 | 3.157 | 0.164 |

| Interaction Term (Budget Target * Field Dependency) | 1 | 9.311 | 0.003 |

Discussions

Research on the literature of justice suggests that participatory decision making creates a perception of justice. It can motivate subordinate attitudes and behaviors in decentralized organizations. The study described in this paper discusses the effects of fair budget targets and individual cognitive styles on performance. The results are as predicted by referent cognition theory. Individuals who get an unfair budget target allocation result in lower performance than individuals who get an unfair budget target allocation. In addition, individuals assigned as fair budget targets are equally well regardless of the individual's cognitive style attached to them. Based on the view of the referent cognition theory, motivational effects can be generated not only through involvement in the budgeting process but also as a reaction to communication about the treatment of individuals against others in the working group.

Overall, the results of this study support the proposed hypothesis. We contribute to the literature by developing a fairness testing model using translational symbols of accounting terms.

This study supports previous studies showing that individuals with field independent cognitive styles perform better than individual field dependent (Bernardi, 1993, Davis and Cochran, 1989, Jones and Wright's 2010, 2012). In addition, fairness is an important thing that becomes an individual consideration in performing (Libby, 1999; Wetzel, 1999; Lindquist, 1995).

Thus, the results of this study indicate that in the process of budgeting, the organization should consider the element of fairness in the process of setting targets and budgeting procedures. Besides its, understanding the cognitive style of individuals involved in the process of preparing the budget is also an important thing to be considered.

Limitations and Future Research

As in this type of research, some limitations should be considered. First, Van den Bos et al. (1997) suggested that the order of results presentation and process justice information can influence the subject's reaction to it. The author finds that what people perceive to be fair is more influenced by the information received first than the information received in advance of the information received subsequently, regardless of whether it is results-oriented or processoriented. In the current study, information about the outcome (i.e., budget targets) is consistently given prior to information about the process. Future work in this field should test whether varying the order in which the target budget presentation and assigned budgeting information affects motivation and performance.

Second, this research gets the influence of justice to motivation indirectly through the change of performance. Future research is needed, perhaps using data collected in the field, to explore variables such as organizational commitment and job satisfaction that may moderate the relationship between fairness in budgeting and performance.

The study of fairness is broad. Future research can explore other aspects of fairness that affect attitudes and behaviour of individuals. These results are very important for managers who contemplate the introduction of stretch targets in their organizations. Stretch targets are defined as unreachable targets given the current operating methods used. Stretch targets will not lead to improved performance unless individuals accept them as personal goals (Chow et al., 2001; Locke, 1982). The rate at which the results described in the current study can generalize to the field settings, especially where the stretching targets introduced provide an interesting path for further research.

Appendix

| α | β | © | ? | € | Ρ | ¢ | Ψ | ? | ♠ | Φ | £ | µ |

| A | B | C | D | E | F | G | H | I | J | K | L | M |

| Ω | ? | ¶ | ♣ | ? | $ | ? | ♥ | ♦ | ? | ? | ¥ | ≠ |

| N | O | P | Q | R | S | T | U | V | W | X | Y | Z |

Where:

$ ? ? © Φ : Stock

? € © € ? ♦ α β £ € : Receivable

€ Φ ♥ ? ? ¥ : Ekuity

β α £ α Ω © € : Balance

Apendix 2: Measure the cognitive style The group embedded figure test (field dependence) (witkin et al. 1971)

References

- Adams, J.S. (1965). Inequity in Social Exchange. In: L. Berkowitz (Ed). Advances in Experimental Social Psychology Vol.2, Edited by. L. Berkowitz. San Diego. CA: Academic Press.

- Awasthi, V., & Pratt, J. (1990). The effects of monetary incentives on effort and decision performance: The role of cognitive characteristics. The Accounting Review. 65(4), 797-811.

- Bazerman, M.H. (1994). Judgment in Managerial Decision Making. John Wiley & Sons, Inc. Singapore. Third Edition.

- Benbasat, I., & Dexter, A.S. (1979). Value and events approaches to accounting: An experimental evaluation. The Accounting Review, 54(4), 735-749.

- Benbasat, I., & Dexter, A.S. (1982). Individual Differences in the Use of Decision Support Aids. Journal of Accounting Research, 20(1), 1-11.

- Bernardi, R.A. (1993). Group Embedded Figures Test: Psychometric Data Documenting Shifts from Prior Norms in Field Independence of Accountants. Perceptual and Motor Skills, 77(2), 579-586.

- Bernardi, R.A. (1994). Fraud Detection: The effect of client integrity and competence and auditor cognitive style. A Journal of Practive & Theory, 13, 69-84.

- Bernardi, R.A. (2003). Students’ Performance in Accounting: Differential Effect of Field Dependence-Independence as a Learning Style. Psychological Reports, 93(1), 135-142.

- Brockner, J., & Wiesenfeld, B.M. (1996). An integrative framework for explaining reactions to decision: Interactive effects of outcomes and procedures. Psychological Bulleting, 120(2), 189-208.

- Cakan, M. (2003). Psychometric data on the group embedded figures test for Turkish undergraduate students. Perceptual and Motor Skills, 96(3), 993-1004.

- Chao, L., & Huang, J. (2003). A study of field independence versus field dependence of school teachers and university students in mathematics. Perceptual and Motor Skills, 97(3), 873-876.

- Chapman, D., & Calhoun, J. (2006). Validation of learning style measures: Implications for medical education practice. Medical Education, 40(6), 576-583.

- Chen, S.Y. & Macredie, R. (2002). Cognitive styles and hypermedia navigation: Development of a learning model. Journal of the American Society for Information Science and Technology, 53(1), 3-15.

- Cropanzano, R., & Folger, R. (1989). Referent cognitions and task decision autonomy: Beyond equity theory. Journal of Appliend Psychology, 74(2), 293-299.

- Cropanzano, R., and R. Folger. (1991). Procedural Justice and Worker Motivation. In Motivation and Work Behavior. Edited by R.M. Staw, and L.W. Porter, 131-143. New York, NY: McGraw-Hill.

- Davis, J. (1991). Educational implications of field dependence. In Field Dependence-Independence: Cognitive Styles across the Life Span, edited by Wagner, S., and J. Demick, 149-176. Hillsdale, NJ: Erlbaum.

- Davis, J.K., & Cochran, K.F. (1989). An information processing view of field dependence-independence. Early Child Development and Care, 51(1), 31-47.

- Davis, J.K., &. Frank, B.M. (1979). Learning and memory of field independent dependent individuals. Journal of Research in Personality, 13(4), 469-479.

- Folger, R., D. Rosenfeld, and T. Robinson. (1983). Relative Deprivation and Procedural Justification. Journal of Personality and Social Psychology, 45, 268-273.

- Folger, R. (1986). Rethinking Equity Theory: A Referent Cognitions Model. In Justice in Social Relations. Edited by H.W. Bierhoff, R.L. Cohen, & J. Greenberg. 145-162. New York. NY: Plenum Press.

- Goodenough, D. (1976). The role of individual differences in field dependence as a factor in learning and memory. Psychological Bulletin, 83(4), 675-694.

- Guillot, A., & Collet, C. (2004). Field dependence-independence in complex motor skills. Perceptual and Motor Skills, 98(2), 575-583.

- Gul, F.A. (1984). The joint and moderating role of personality and cognitive style on decision making. The Accounting Review, 59(2), 264-277.

- Gul. F.A. (1990). Qualified Audit Reports, Field Dependent Cognitive Style, and Their Effects on Decision Making. Accounting and Finance, 30(2), 15-27.

- Hopwood, A. (1972). An empirical study of the role of accounting data in performance evaluation. Journal of Accounting Research, 10 (Supplement), 156-182.

- Hicks, E., Bagg, R., Doyle, W., & Young, J. (2007). Public accountants’ field dependence: Canadian evidence. Perceptual and Motor Skills, 105(3), 1127-1135.

- Huang, J., & Chao, L. (2000). Field dependence versus independence of students with and without learning disabilities. perceptual and motor skills,90(1), 343-346.

- Jones, S.H., & Wright, M.E. (2010). The effects of a hypertext learning aid and cognitive style on performance in advanced financial accounting. Issues in Accounting Education, 25(1), 35-58.

- Jones, S.H., & Wright, M.E. (2012). Does cognitive style affect performance on accounting examination questions? Global Perspectives on Accounting Education, 9, 31-52.

- Kahneman, D., Knetsch, J.L., and Thaler, R. (1986). Fairness as a constraint on profit seeking: entitlements in the market. American Economic Review, 76(4), 728-741.

- Lane, S., Alino, N.U., & Schneeider, G.P. (2017). Manager behavior in a balance scorecard environment: effect of goal setting, perception of fairness, Rewards and feedback. Academy of Accounting and Financial Studies Journal. 21(2), 18-36.

- Leader, L.F., & Klein, J.D. (1996). The effects of search tool type and cognitive style on performance during hypermedia database searches. Educational Technology Research and Development, 44(2), 5-15.

- Libby, T. (1999). The influence of voice and explanation on performance in a participative budgeting setting. accounting, Organizations and Society, 24, 125-137.

- Lindquist, T.M. (1995). Fairness as an antecedent to participative budgeting: Examining the effects of distributive justice, procedural justice and referent cognitions on satisfaction and performance. Journal of Management Accounting Research, 7(Fall 1995), 122-147.

- Liu, W. (2006). Field Dependence-Independence and Participation in Physical Activity by College Students. Perceptual and Motor Skills, 102(3), 806-814.

- Locke, E.A. (1982). Relation of goal level to performance with a short work period and multiple goal levels. Journal of Applied Psychology, 67(4), 512-514.

- Lusk, E. (1973). Cognitive aspects of annual reports: Field independence/dependence. Journal of Accounting Research, 11 (Supplement), 191-202.

- Lusk, E. (1979). A test of differential performance peaking for a disembedding task. Journal of Accounting Research, 17(1), 286-294.

- Martin, R., & Simmering, M.J. (2016). Multippervisors in audit: fairness and the many-to-one performance appraisal environment. Academy of Accounting and Financial Studies Journal, 20(2), 1-22.

- McMorris, T., Sproule, J. & MacGillivary, W. (2002). Field dependence/independence, observational and decision-making skills of trainee physical education teachers. International Journal of Sport Psychology, 33, 195-204.

- Merchant, K.A. (1998). Modern Management Control Systems. Upper Saddle River. NJ: Prentice Hall.

- Mills, T.Y. (1996). The Effect of Cogntive Style on External Auditors’ Reliance Decisions on Internal Audit Functions. Behavioral Research in Accounting, 8, 49-73.

- O’Brien, T.P., Butler, S., & Bernold, L, (2001). Group embedded figures test and academic achievement in engineering education. International Journal of Engineering Education, 17(1), 89-92.

- Phillips, F. (1998). Accounting students’ beliefs about knowledge: Associating performance with underlying belief dimensions. Issues in Accounting Education. 13(1), 113-126.

- Pincus, K.V. (1990). Auditor individual differences and fairness of presentation judgments. Auditing: A Journal of Practice & Theory, 9 (Fall): 150-166.

- Sekaran, U. (2000). Research Methods for Business: A Skill_Building Approach (3rd Edition). John Wiley & Sons, Inc. Singapore.

- Salbod, S. (2001). Correlations between cognitive style and performance on the water-level task by female graduate students. Psychological Reports, 88(3), 747-748.

- Shields, J.F., & Shields, M.D. (1998). Antecedents of participative budgeting. Accounting, Organizations and Society, 23(1), 49-76.

- Sisco, H., & Leventhal, G. (2007). Effect of prior performance on subsequent performance evaluation by field independent-dependent raters. Perceptual and Motor Skills, 105(3), 852-861.

- Watson, S.F., Apostolou, B., Hassell, J.M. & Webber, S.A. (2007). Accounting education literature review (2003-2005). Journal of Accounting Education, 25(1), 1-58.

- Wentzel, K. (1999). The Influence of Budgetary Participation, Fairness Perceptions and Goal Acceptance on Managers’ Performance in a Scarce Resource Allocation Setting. Working Paper, Drexel University.

- Witkin, P., Oltman, K., Raskin, E., & Karp, S.A. (1971). Manual for the Embedded Figures Test, Children’s Embedded Figures Test and Group Embedded Figures Test. Palo Alto, CA: Consulting Psychologists Press, Inc.