Research Article: 2022 Vol: 26 Issue: 1S

Do Corporate Governance Mechanisms Matter for Dividend Policy? Evidence from Food and Beverage Industry in Southeast Asian Economies

Muhammad Edo Suryawan Siregar, Faculty of Economics Universitas Negeri Jakarta

Erwin Vitrianudin, Faculty of Economics Universitas Negeri Jakarta

Sholatia Dalimunthe, Faculty of Economics Universitas Negeri Jakarta

Gatot Nazir Ahmad, Faculty of Economics Universitas Negeri Jakarta

Adam Zakaria, Faculty of Economics Universitas Negeri Jakarta

Suherman, Faculty of Economics Universitas Negeri Jakarta

Citation Information: Siregar, M.E.S., Vitrianudin, E., Dalimunthe, S., Ahmad, G.N., Zakaria, A., & Suherman. (2021). Do corporate governance mechanisms matter for dividend policy? Evidence from food and beverage

industry in southeast asian economies. Academy of Accounting and Financial Studies Journal, 25(7),

1-10.

Abstract

This study aims to determine the impact of board independence, board size, diversity gender and board meetings on dividend policy of food and beverage firms in Indonesia, Malaysia and Singapore. The sample was selected from 36 public companies listed on the Indonesia Stock Exchange, the Kuala Lumpur Stock Exchange and the Singapore Stock Exchange. The observation period ranges from 2013 to 2018. Dividend policy is measured using 3 measures, namely 1) total dividend divided by total net income; 2) total dividends per share divided by share price per share; 3) total assets divided by total dividends. Meanwhile, corporate governance uses four indicators: the proportion of board independence, the size of the board of commissioners, the proportion of female commissioners and board meetings. This study uses panel data regression analysis, including the fixed effect model with clustered standard errors. Empirical evidence shows that in general corporate governance mechanism does not have a significant effect on dividend policy, except board meetings significantly affect dividend yield and aggregate dividend.

Keywords

Board Independence, Board Size, Diversity Gender, Board Meetings, Dividend Policy.

Introduction

Dividends are a focus among investors because it is a source of passive income besides capital gains from the funds they have invested (Abbas et al., 2018). In addition, dividends are considered as a signal for investors, where when a company is able to pay dividends, the company is considered to have good cash flow and financial performance (Abbas et al., 2018; Riaz et al., 2016).

Corporate governance is a collection of processes, guidelines, and regulations to direct or oversee both (individuals and organizations) as a whole, for the ultimate goal of improving organizational performance and minimizing agency costs, protecting shareholder rights so that they can influence the company's dividend policy (Afzal & Sehrish, 2011). Research on the impact of corporate governance mechanism on dividend policy is still being debated because the results generated by previous researchers have been mixed (Mehdi et al., 2016; Pahi & Yadav, 2018; Riaz et al., 2016).

Abor & Fiador (2013), Afzal & Sehrish (2011), Ajanthan (2013), Uwuigbe (2013) suggest that there is a significant positive relationship between board independence and dividend policy. This is based on the credibility of board independence who are not affiliated with company management. Unlike the case in the study of Batool & Javid (2014), and Mansourinia et al. (2013) argue that there is a significant negative relationship between board independence and dividend policy.

Previous studies have found that there is a relationship between board size and dividend policy. Afzal & Sehrish (2011), Mansourinia et al. (2013), Obradovich & Gill (2012) stated that there is a significant positive relationship between the board size and the dividend policy. This is due to the diversity of views held by each commissioner so as to provide direction and supervise management. Unlike the case with Abbas et al. (2018), Ajanthan (2013), and Bolbol (2012) suggest that there is a negative relationship between board size and dividend policy.

Gender diversity also encourages creating good corporate governance. According to Pucheta-Martínez & Bel-Oms (2015), gender diversity can help reduce agency problems that occur in companies. Adams & Ferreira (2009), Pucheta-Martínez & Bel-Oms (2015) suggest that there is a positive relationship between gender diversity and dividend policy. However, it is different with Elmagrhi et al. (2017) in their study stated that gender diversity has a negative relationship with dividend policy.

Adams & Ferreira (2009) argued the effectiveness and efficiency of corporate governance can be passed using the frequency of meetings held by the board of commissioners. Lipton & Lorsch (1992), and Vafeas (1999) suggest that there is a significant relationship between the board meetings and the dividend policy. However, in contrast to Elmagrhi et al. (2017), Mehdi et al. (2016), and Taghizadeh (2013), they found a significant negative relationship between the board meetings and dividend policy.

This study aims to determine the impact of board independence, board size, diversity gender and board meetings on dividend policy on food and beverage firms in Southeast Asian countries, particularly Indonesia, Malaysia and Singapore. Using balanced panel data from 36 public companies from food and beverages sector in Indonesia, Malaysia and Singapore from 2013 – 2018, we find that 1) board independence, board size, and diversity gender do not have a significant effect on dividend policy, and 2) board meetings is significantly associated with dividend policy.

Our study contributes in three ways: 1) we add the recent body of knowledge on dividend policy by giving evidence on the association between corporate governance mechanism and dividend policy, particularly in food and beverage industry, 2) to our knowledge, this is one of the first studies in Southeast Asian countries to use the aggregate dividend as a proxy of dividend policy, and 3) we add to the limited amounts of corporate governance literature in the course of Southeast Asian countries (Indonesia, Malaysia and Singapore), particularly in food and beverage sector.

Literature Review And Hypotheses Development

Theoretical Framework

A number of literature developing in corporate governance theory has well documented that there are 2 main theories, namely (signal theory and agency theory) which are generally used in dividend policy (Abbas et al., 2018; Elmagrhi et al., 2017; Mehdi et al., 2016). Signal theory stems from the work of Lintner, (1956), which showed how market prices often react to changes in dividend rates. The signal is considered a form of information that causes reactions and provides a decision for the party receiving the signal. Dividend policy is considered to be able to change information on the asymmetric information previously held by investors against the company. Because the dividend policy provides information to investors that the company has good cash flow and financial performance (Dionne & Ouederni, 2011). With this theory, it helps provide a structure for both parties (management and shareholders) to understand each other by exchanging the information they have and can improve relationships (Basoglu & Hess, 2014).

Then in relation to the relationship between management and investors that often conflicts of interest, this can be explained in agency theory. According to Jensen & Meckling (1976) agency theory is basically a theory that combines the environmental relationship between agents and principals in a company. The agency conflicts that often arise between management and investors are caused by two things, namely adverse selection, which refers to a condition in which the principal is unable to ascertain whether the agent's ability is in accordance with his / her ability. The second is moral hazard, which refers to the agent's actions that are not in accordance with what is agreed upon with the principal (Eisenhardt, 1989).

In dealing with agency problems, there will be costs called agency costs. Agency costs (agency costs)is considered as the sum of the principal costs for supervision of the agency. One of the supervisory systems that can reduce agency problems is by implementing corporate governance. Good corporate governance practices in an efficient and maximum manner can control the occurrence of agency theory problems and problems between shareholders and management, executives, thereby having maximum support in the continuity of payment dividends (Elmagrhi et al., 2017; Jahanzeb et al., 2016; Jensen & Meckling, 1976; Mehdi et al., 2016; Riaz et al., 2016; Shehu, 2015).

Corporate Governance Mechanism and Dividend Policy

Board Independence

According to the Komite Nasional Kebijakan Governance (2008), a company must be free from conflicts of interest, influence and pressure from other parties in order to make objective decisions. Therefore an independent commissioner is needed to ensure the integrity of the disclosure of financial statements and to ensure that internal controls are in accordance with the procedures applicable to the company. There are similarities between the 3 countries where the regulation for the proportion of board independence is at least 30% of the total number of commissioners. According to Abor & Fiador, (2013); Afzal & Sehrish, (2011); Ajanthan, (2013) concluded that there is a statistically significant positive relationship between board independenceand dividend policy. This is due to the absence of a relationship between the independent board of commissioners and company management, so that the supervisory system can be maximized. Thus, first hypotheses is developed as follows:

H1: Board independence have a positive effect on dividend policy.

Board Size

In the previous literature, the board size was considered to be an effective way of realizing good corporate governance (Pahi & Yadav, 2018). The diversity of backgrounds, expertise, and external relationships possessed by each board of commissioners is believed to be effective in increasing supervision to realize good corporate governance. Even Jahanzeb et al., (2016) stated that when the board size is large, the dividend payments will be large too. Kiel & Nicholson, (2003) and Pahi & Yadav, (2018) provide a standard regarding the number of commissioners, which is eight or more than eight because they are effective in managing the company. However, according to Haniffa & Hudaib, (2006) even a small board of commissioners has a good influence on dividend policy and is even more efficient in deciding dividend policy because a low number of commissioners does not require a long debate. In some other literature, it is stated that the board size with dividend policy does have a positive effect (Afzal & Sehrish, 2011; Jahanzeb et al., 2016; Mansourinia et al., 2013; Obradovich & Gill, 2012). Thus, the second hypotheses is developed as follows:

H2: Board size has a positive effect on dividend policy.

Gender Diversity

Gender diversity by including elements of women in the board of commissioners has encouraged the realization of good corporate governance. The female board of commissioners has a significant positive effect on dividend policy (Adams & Ferreira, 2009; Al-Rahahleh, 2017; Benjamin & Biswas, 2019; Gyapong et al., 2019; and Pucheta-Martínez & Bel-Oms, 2015). Furthermore, the influence of the female board of commissioners on dividend policy is explained as follows: women improve the diveden policy decision-making process (Byoun et al. 2016). This is due to better disclosure of financial statements and evaluation, deeper monitoring of the board of directors. Adams & Ferreira (2009) conducted by a female board of commissioners. In addition, in the literature, women boards of commissioners prefer to distribute dividends as a form of maintaining sustainable relationships with investors (Pucheta-Martínez & Bel-Oms, 2015). Thus the third hypotheses can be developed:

H3:Diversity gender has a positive effect on dividend policy.

Board Meetings

In order to carry out its duties and obligations, the board of commissioners holds regular meetings to evaluate and supervise policies implemented by the board of directors. The effectiveness and efficiency of corporate governance can be measured through the board meetings (Adams & Ferreira, 2009). Abbas et al., (2018), Al-Rahahleh, (2017), and Islami, (2018) the intensity of board meetings has a positive effect on dividend policy. The board meetings facilitates the interaction between managers and commissioners and, hence enhances the watchful oversight function of the board. Board meetings as a means of communication, coordination to discuss policies, strategic issues, and company operational activities. When the board meetings increases, this will reduce agency costs and will have a direct effect on dividend policy (Lipton & Lorsch, 1992). The higher the board meeting, the higher the dividend payment to investors. Thus, the fourth hypotheses can be developed as follows:

H4: Board meetings have a positive effect on dividend policy.

Research Methods

Data and Samples

The samples in this study were food and beverage companies listed in Indonesia Stock Exchange, Kuala Lumpur Stock Exchange and Singapore Stock Exchange. We chose this sector because it is one of the defensive industries, meaning that this sector is not significantly affected when the economic situation is not good and is able to maintain sales figures (Asyik, 2017; Fahmi, 2018). All data used in the study were obtained through financial reports and annual reports available on the official websites of Indonesia, Kuala Lumpur, Singapore Stock Exchanges and from the official websites of each company.

We used purposive sampling to maintain the same number of observations during the observed years (balanced panel data). We ended up with 36 publicly listed companies with consistent information during the observation period covering from 2013 to 2018. A more detailed sample distribution is presented in Table 1.

| Table 1 Sample Selection Criteria |

|||||

| No | Criteria | Country | Total | ||

|---|---|---|---|---|---|

| Indonesia | Malaysia | Singapura | |||

| 1 | Food and beverage sector companies issued financial reports in the period 2013 ? 2018 consecutively | 16 | 19 | 15 | 50 |

| 2 | The company does not have complete data and information needed by researchers regarding the variables in this study in full in financial and annual reports | (5) | (7) | (2) | (14) |

| 3 | Sample | 11 | 12 | 13 | 36 |

| 4 | Observations | 66 | 72 | 78 | 216 |

Dependent Variables

The dependent variable for the dividend policy model is measured as follows: 1) total the amount of dividends divided by the total net income; 2) the amount of dividends per share divided by the share price per share; 3) total assets divided by the total amount of dividends. The choice to measure dividends using a number of different proxies is important for assessing whether the results are sensitive to commonly used dividend policies. The choice of proxies for this dividend policy, the researchers refer to previous research (Elmagrhi et al., 2017; Mehdi et al., 2016).

Independent Variables

Following variables are included as independent variables, namely: 1) the proportion of board independence; 2) natural logarithm of board size; 3) the proportion of female commissioners on the board of commissioners; and 4) natural logarithm of board meetings. We cite those independent variables from the studies of (Benjamin & Biswas, 2019; Elmagrhi et al., 2017; Mehdi et al., 2016).

Control Variables

Following variables are included as control variables: 1) total equity divided by total debt; 2) natural log of total assets; 3) sales growth; 4) current assets divided by current debt; and 5) net income plus depreciation divided by total assets. We cite those control variables from the studies of (Elmagrhi et al., 2017; Mehdi et al., 2016; Shehu, 2015) in Table 2.

| Table 2 Variable Definition |

||||

| No. | Variabel | Definition | Formula | Data Form |

|---|---|---|---|---|

| Dependent Variables | ||||

| 1 | DPR | Dividend Payout Ratio | Total dividend / net income | Continous |

| 2 | DY | Dividend Yield | Dividend per share / market price per share | Continous |

| 3 | DA | Dividend Agregat | Total dividend / total assets | Continous |

| Independent Variables | ||||

| 4 | BI | Board Independence | Percent of board independence | Continous |

| 5 | BS | Board Sizes | Logarithm natural of board sizes | Continous |

| 6 | DG | Diversity Gender | Percent of female on board commissioner | Continous |

| 7 | BM | Board Meeting | Logarithm natural of board meeting | Continous |

| Control Variables | ||||

| 8 | LEV | Leverage | Total debt / total equity | Continous |

| 9 | FS | Firm Size | Logarithm natural of total assets | Continous |

| 10 | SG | Sales Growth | Current sales ? previous sales / previous sales | Continous |

| 11 | CR | Current Ratio | Current assets / current liabilities | Continous |

| 12 | CF | Cash Flow | Net income + depreciation / total assets | Continous |

Regression Models

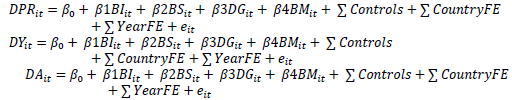

To estimate the relationship between corporate governance and dividend policy in listed companies in Indonesia, Malaysia and Singapore, We adopt panel data analysis by combining time-series (6 years) and cross-sectional (36 firms) data set. The following is the regression model we use to test our hypothesis:

Dividend policy is proxied by dividend payout ratio (DPR), dividend yield (DY) and aggregate dividend (DA). Subscript i means company i and subscript t denotes time (year) t. As previously explained, corporate governance mechanism is proxied by board independence (BI), board size (BS), diversity gender (DG) and board meetings (BM), while the control variables sigma consists of leverage (LEV), firm size (FS), sales growth (SG), current ratio (CR) and cash flow (CF).

To anticipate endogeneity in this study we used a one-year lag and produced what is called the one-year lagging independent variable (t-1). Then we are also aware of the heterogeneity problem that arises between samples. This is because we use several countries as samples in the study, where each country certainly has its own criteria. Therefore, in order to minimize the problem of heterogeneity, we use the country fixed-effect (FE) in the study. In addition, we also used year fixed-effect (FE) to see the effect of time series trends and parameter changes from time to time. Technically, the year FE can also identify variations in the dependent variable over time and display the independent variables of the remaining explanations in the model. We are also aware of other potential endogeneities that may arise, as there are serials within and between our unit of analysis (observation), and they are related to one another. Therefore, to solve this problem we use clustered standard error technique to produce a stronger and smaller standard error so as to increase the efficiency and estimate our estimates.

Results and Discussion

Descriptive Statistics

We begin to discuss our findings in advance presents descriptive statistics of the variables of our interest. It is also worth reporting that our continuous variables have been winsorized to avoid the potential econometrical issues related to the extreme values (outliers) in our dataset.. Hereby, we provide the information based on the mean value, standard deviation, minimum, percentiles 25th, 50th, 75th, and the maximum values of each variable. Table 1 presents the basic information with regard to descriptive statistics analysis.

Correlations

Table 2 show the correlation analysis output. There is no correlation between independent variables that is > 0.80. It can be concluded that the data in this study are free from multicollinearity.

Main Analysis

The results of the hypothesis testing are provided in Table 3, which details the main analyzes. In general, the mechanism of corporate governance does not have a significant positive effect on dividend policy, except board meetings.

| Table 3 Descriptive Statistics |

||||||||

| VARIABLES | N | Mean | SD | Min | p25 | p50 | p75 | Max |

|---|---|---|---|---|---|---|---|---|

| DPR | 216 | 0.537 | 0.781 | -0.562 | 0.163 | 0.378 | 0.635 | 4.563 |

| DY | 216 | 0.031 | 0.030 | 0.000 | 0.009 | 0.023 | 0.042 | 0.153 |

| DA | 216 | 0.059 | 0.098 | 0.000 | 0.009 | 0.019 | 0.055 | 0.449 |

| BI | 216 | 0.501 | 0.202 | 0.286 | 0.333 | 0.400 | 0.600 | 1.000 |

| BS | 216 | 1.776 | 0.427 | 1.099 | 1.498 | 1.792 | 2.079 | 2.485 |

| DG | 216 | 0.079 | 0.111 | 0.000 | 0.000 | 0.000 | 0.167 | 0.429 |

| BM | 216 | 1.540 | 0.342 | 0.693 | 1.386 | 1.386 | 1.609 | 2.485 |

| LEV | 216 | 0.396 | 0.227 | 0.022 | 0.209 | 0.368 | 0.544 | 1.162 |

| FS | 216 | 15.50 | 2.663 | 10.83 | 13.45 | 14.74 | 18.20 | 20.09 |

| SG | 216 | 0.066 | 0.215 | -0.448 | -0.011 | 0.049 | 0.122 | 1.253 |

| CR | 216 | 2.816 | 2.354 | 0.516 | 1.388 | 2.015 | 3.373 | 12.62 |

| CF | 216 | 0.119 | 0.107 | -0.061 | 0.051 | 0.100 | 0.146 | 0.589 |

Based on the test results in Table 3, BI has a positive and insignificant relationship with DPR with a coefficient value (β) = 0.140 and p-value (p) > 0.1, while BI has a negative and insignificant relationship with DY with the coefficient value (β) = -0.064 and p-value (p) > 0.1, and BI model has a positive and insignificant relationship with DA with a coefficient value (β) = 0.156 and p-value (p) > 0.1.

Furthermore, the relationship between BS and dividend policy is described in Table 3 with the results BS has a positive but insignificant relationship with the DPR with a coefficient value (β) = 0.629 and p-value (p) > 0.1, while BS has no significant relationship with DY with a coefficient value (β) = 0.010 and p-value (p) > 0.1, and BS has a negative and insignificant relationship with DA with a coefficient value (β) = -0.058 and p-value (p) > 0.1.

Then the relationship between DG and dividend policy is described in Table 3 with the results DG has a positive and insignificant relationship with DPR with a coefficient value (β) = 2.415 and p-value (p) > 0.1, whereas DG has a negative and insignificant relationship to DY with a coefficient value (β) = -0.003 and p-value (p) > 0.1, and DG has a negative and insignificant relationship with DA with a coefficient value (β) = -0.015 and p-value (p) > 0.1.

Finally, the relationship between BM and dividend policy is described in Table 3 with the results BM has a positive and insignificant relationship with DPR with a coefficient value (β) = 0.191 and p-value (p) > 0.1, while BM has a significant and positive relationship to DY with a coefficient value (β) = 0.012) and p-value (p) <0.1, and BM has a significant and positive relationship with DA with a coefficient value (β) = 0.058 and p-value (p) ≤ 0.1.

Robustness Check

We realize that there is still a potential endogeneity problem in our research models, so we consider the lag of the independent variables as a function of dividend policy (Dewasiri et al., 2019; Elmagrhi et al., 2017; Gyapong et al., 2019). We use a time lag of one year and produce what is called a one year lagging independent variable (t-1). The results shown in Table 4 remain consistent with the main research analysis, where 1) board independence, board size, and gender diversity do not have a significant effect on dividend policy, and 2) board meetings is significantly associated with dividend policy, namely DY and DA.

| Table 4 Correlation Analysis Output |

||||||||||||

| DPR | DY | DA | BI | BS | DG | BM | LEV | FS | SG | CR | CF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DPR | 1.00 | |||||||||||

| DY | 0.34*** | 1.00 | ||||||||||

| DA | 0.20*** | 0.19*** | 1.00 | |||||||||

| BI | 0.22*** | -0.01 | -0.11 | 1.00 | ||||||||

| BS | 0.14** | 0.18*** | 0.16** | -0.03 | 1.00 | |||||||

| DG | 0.15** | 0.02 | 0.12* | 0.10 | 0.27*** | 1.00 | ||||||

| BM | 0.00 | 0.11 | 0.09 | -0.18*** | 0.12* | 0.14** | 1.00 | |||||

| LEV | 0.02 | 0.04 | 0.14** | -0.18*** | -0.02 | 0.21*** | 0.26*** | 1.00 | ||||

| FS | 0.06 | 0.06 | -0.01 | 0.08 | 0.18*** | -0.21*** | 0.02 | -0.22*** | 1.00 | |||

| SG | -0.07 | -0.02 | 0.02 | -0.16** | -0.10 | -0.06 | -0.03 | 0.15** | 0.03 | 1.00 | ||

| CR | -0.05 | -0.11 | -0.10 | 0.24*** | -0.12* | -0.29*** | -0.21*** | -0.64*** | 0.08 | -0.16** | 1.00 | |

| CF | 0.08 | 0.11 | 0.70*** | -0.02 | 0.11* | 0.12* | -0.06 | -0.04 | -0.01 | 0.15** | -0.02 | 1.00 |

Discussion

Based on the regression results as a whole it can be stated that the first hypothesis (H1) which states that independent commissioners (board independence) have a positive and significant effect on dividend policy is rejected. This result is in line with research conducted by Abbas et al. (2018), Cholifah et al. (2018) and Mansourinia et al. (2013) which stated that board independence does not have a significant effect on dividend policy. According to Cholifah et al. (2018), this is due to limited information possessed by board independence. He/she comes from outside the company that does not have any affiliation with the company and this makes the role of board independence less effective in influencing dividend policy. On the other hand, the voting rights held by board independence are not too considered by the board of directors or other commissioners so that the effect on dividend policy is low.

The second hypothesis (H2) which states that the board size has a positive and significant effect on dividend policy is rejected. This result is in line with the research conducted by Ajanthan (2013), Bolbol (2012), Buchdadi et. al. (2019) , and Shehu (2015) which states that the board size has insignificant effect on dividend policy. According to Buchdadi et al. (2019), the board of commissioners is a company organ that acts as a representative for shareholders to supervise and provide advice to the board of management and ensure that the implementation of the company's strategy runs well in order to increase company value. Therefore, the board of commissioners is not allowed to interfere in making operational decisions such as dividend policy.

The third hypothesis (H3) which states that gender diversity has a positive and significant effect on dividend policy is rejected. This result is in line with research conducted by Elmagrhi et al. (2017), and Mishiel et al. (2020) which states that gender diversity has no influence on dividend policy. According to Mishiel et al. (2020), there is market uncertainty that causes female commissioners to suggest the company to hold more cash by reducing the amount of dividends to be distributed to the shareholders.

The fourth hypothesis (H4) which states that the board meeting has a positive and significant effect on dividend policy, namely DY and DA, is accepted. These results are in line with research conducted by Dewasiri et al. (2019), Pernamasari & Wahyudi (2019), and Riaz et al. (2016) which argue that board meetings have a significant effect on dividend policy. According to Riaz et al. (2016), the high number of meetings held by the board of commissioners shows their seriousness in realizing good corporate governance. These meetings also enhance the role of the commissioners as representatives of the shareholders, so that in these meetings the commissioners try to ensure that the directors/management defend the interests of shareholders. With this board of commissioners meeting, it can also provide wise advice to benefit shareholders by providing advice on dividend distribution to the board of directors/managers.

Conclusion

This study investigates the impact of board independence, board size, gender diversity and board meetings on dividend policy of food and beverage firms listed in Indonesia Stock Exchange, Kuala Lumpur Stock Exchange and Singapore Stock Exchange for period 2013 to 2018.

The findings in this study show that even though the proportion that is fulfilled in the need for board independence is solely aimed at meeting the prevailing laws and regulations. This can be seen from the test of board independence on the proxies of dividend policy in general does not have a significant effect. This finding is sufficient to illustrate that the role of board independence is still underestimated by other commissioners and their voting rights are not too heard and they consider the independent commissioner's duties to be sufficient to only disclose good financial statements and ensure that internal controls are in accordance with procedures.

The diversity of backgrounds, skills, external relations, and education contained in the board size is also not proven to affect dividend policy, as well. This shows that the diversity possessed by each individual on the board of commissioners does not make one-way thinking to consider dividend policy but instead makes this diversity produce other preferences that are owned by each individual on the board of commissioners, such as preferences for expansion needs, opportunities for investment, focus on increasing company value, and so on.

Furthermore, gender diversity also does not show a significant effect on dividend policy. This result is due to the low composition of female commissioners applied to food and beverage companies in Indonesia, Malaysia and Singapore. This finding also shows that the stereotype is still strong that male commissioners have better abilities than female commissioners. So that the structure of women commissioners on the board of commissioners is proven to be low.

The last result shows that the board meetings showed positive and significant impact on dividend policy. These results support our fourth hypothesis which states that board meetings have a significant and positive effect on dividend policy. These results also show that this meeting improves the relationship between commissioners and directors (managers) so that they can exchange information and commissioners can provide wise suggestions that benefit shareholders.

In the future, this research can still be developed in more depth by including several variables such as the characteristics of the board of management in order to obtain various results. Furthermore, the research subject can be expanded to several industries, not limited to the food and beverage sector.

References

Abor, J., & Fiador, V. (2013). Does Corporate Governance Explain Dividend policy in Sub-Saharan Africa? International Journal of Law and Management, 55(3), 201-225.

Afzal, M., & Sehrish, S. (2011). Ownership Structure, Board Composition and Dividend Policy in Pakistan. African Journal of Business Management, 7(11), 811-817.

Asyik, N.F. (2017). Reaksi Pasar Atas Variabel Makro Dan Profitabilitas: Kajian Perusahaan Di Bursa Efek Indonesia Terkategori Devensife Dan Cyclical Industry. EKUITAS (Jurnal Ekonomi Dan Keuangan), 15(2), 269.

Batool, Z., & Javid, A.Y. (2014). Dividend Policy and Role of Corporate Governance in Manufacturing Sector of Pakistan. PIDE Working Papers, (July).

Bolbol, I. (2012). Board Characteristics and Dividend Payout of Malaysian Companies. Unpublished Master Dissertation, (June). Retrieved from http://etd.uum.edu.my/3034/4/ISLAM_I._H._BOLBOL.pdf

Cholifah, Mifthachul, Nuzula, & Firdausi, N. (2018). Pengaruh Corporate Governance dan Leverage Terhadap Kebijakan Dividen (Studi Pada Perusahaan Sektor Keuangan yang Terdaftar di Bursa Efek Indonesia Tahun 2012-2016). Jurnal Administrasi Bisnis (JAB), 60(3), 1-9.

Dionne, G., & Ouederni, K. (2011). Corporate Risk Management and Dividend Signaling theory. Finance Research Letters, 8(4), 188-195.

Eisenhardt, M. (1989). Agency Theory : and Assessment Review, 14(1), 57-74.

Fahmi, I. (2018). Manajemen Investasi : Teori dan Soal Jawab (2nd ed.). Jakarta: Salemba Empat.

Gyapong, E., Ahmed, A., Ntim, C.G., & Nadeem, M. (2019). Board Gender Diversity and Dividend Policy in Australian Listed Firms: The Effect of Ownership Concentration. Asia Pacific Journal of Management.

Jahanzeb, A., Memon, P.A., Tunio, J.A., & Shah, S.S.A. (2016). Impact of Corporate Governance and Firm-Level Control Variables on Dividend Policy of Service Trade Sector of Malaysia. Journal of Economic and Social Development, 3(2), 102.

Komite Nasional Kebijakan Governance. (2008). Pedoman Umum Good Corporate Governance Indonesia. Jakarta. Retrieved from www.governance-indonesia.com.

Lintner, J. (1956). Distribution of Incomes of Corporations Among Dividends, Retained Earnings, and Taxes. The American Economic Review, 46(2), 97-113.

Lipton, M., & Lorsch, J.W. (1992). A Modest Proposal For Improved Corporate Governance. The Business Lawyer, 59-77.

Mansourinia, E., Emamgholipour, M., Rekabdarkolaei, E.A., & Hozoori, M. (2013). The Effect of Board Size, Board Independence and Ceo Duality on Dividend Policy of Companies: Evidence From Tehran Stock Exchange. International Journal of Economy, Management and Social Sciences, 2(6), 237-241.

Mishiel, P., Suwaidan, S., & Sameer, L. (2020). The Effect of Ownership Structures on Dividend Policy: Evidence from Jordan. Research Journal of Finance and Accounting, 14(8), 550–567.

Pernamasari, R., & Wahyudi, N. (2019). Profitabilitas as an Intervening Variable of Good Corporate Governance and Debt Policy to Dividend Policy. Scholars Bulletin, (July).

Pucheta-Martínez, M.C., & Bel-Oms, I. (2015). The Board of Directors and Dividend Policy: The Effect of Gender Diversity. Industrial and Corporate Change, 25, dtv040.

Taghizadeh, M., & S.S. (2013). Board of Directors and Firms Performance: Evidence from Malaysian Public Listed Firm Maryam. International Proceedings of Economics Development and Research, 59(37), 73-77. https://doi.org/10.7763/IPEDR

Uwuigbe, U. (2013). An Examination of the Effects of Ownership Structure and Financial Leverage on the Dividend Policies of Listed Firms in Nigeria. Journal of Economics, Business, and Accountancy | Ventura, 16(2), 251. https://doi.org/10.14414/jebav.v16i2.183