Research Article: 2019 Vol: 25 Issue: 3

Do Non-Family Member Managers Enhance Venture Performance of Family Businesses Evidence from Nigeria

Agbaeze K. Emmanuel, University of Nigeria

Nwakoby N. Peace, Nnamdi Azikiwe University

Onwuka M. Ebele, Nnamdi Azikiwe Univeristy

Chimeziem C.G. Udeze, Alex Ekwueme Federal University

Olayinka A. Abiodun, University of Nigeria

Abstract

This study examines the enhancing effect that non-family members plays on the performance of family businesses in Nigeria. Survey design was adopted and Data was collected through structured selfstudied questionnaire designed on 5-point likert scale. The main source of data was primary and the target population consisted of owners/founders and top management staff of selected family businesses in five states of Southwest, Nigeria. A sample size of 538 was drawn from the study population of 26744 using Cronrach approach. The single hypothesis formulated was tested with Pearson product moment correlation coefficient at 0.05 level of significance. Based on the analyzed data, the study found a positive relationship between non-family member managers and venture performance among the selected firms because the former enhances the latter. It is advised that that family business in Nigeria must strive to maintain non-members of the family in the management structure so as to enjoy stellar venture performance and more business viable achievements.

Keywords

Non-Family Managers, Venture Performance, Family Business, Management Structure.

Introduction

Family business which is a unique, complex and dynamic system often consists of a blend of two very different poles. At one of the poles is a performance-based world of business and at the other end there is the emotion-based domain of the family which results into potential conflict and confusion (Ibrahim & Ellis, 2004; McClendon & Kadis, 2004). A family business is any operations in which majority of the management rest within a family and in most cases two or more family members are often involved in the day to day affairs of such ventures. It is a business management combination of the family and the business. The families that are involved in the business are part of a task system (the business) and part of a family system as well. According to Mita (2009), a family business is a venture that is mainly owned by the members of a single family. Simply put, it is a business in which members of a family have major control and ownership as well as key commitments toward the overall wellbeing of the business.

According to Ifekwen, et al. (2011), developing economies like African and Asian countries have come to realize the value and significant role family-controlled enterprises play in their economic development and growth. In most of the developing countries, much of the entrepreneurship activities and wealth lies with family-controlled enterprises thereby making family businesses to become the fastest growing sector of their economy. Family businesses come in different ranges of firms in different sectors and sizes for any economy. They come in form of sole proprietors to large international enterprises. International Finance Corporation (2012), states that family-owned enterprises range from small and medium-sized companies to large conglomerates operating in many countries and economies. It is important to note that family business and small business are not necessarily analogous. Though there are many large organizations that are seen as family-owned enterprises, but the majority of family businesses are considered small businesses with less than 20 employees (U.S. Small Business Administration, 1997).

Generally, family businesses regardless of their size often face significant challenges that emanate from the issues such as continuity, longevity, and successes. Many of these businesses failed to sustain their firms beyond the first generation. In Nigeria, the story of the growth of family-controlled enterprises is generally considered dramatic because of the amount of pitfalls that are faced by these firms before they go on to be successful. While some of these family businesses have become successful, others have failed while some are simply basking in the shadow of their former selves. The growth of family businesses is a critical element that determines the growth of most less-developed economies and they hold particular implication for Nigeria as well. Family businesses do not only contribute significantly to improved living standards but they also create a significant level of capital and achieve high levels of production and increased capacity.

Although family businesses are pervasive, their life expectancy is a significant area of research. The problems of succession and challenges of continuity lead to a high mortality rate of family businesses. Earlier estimates (Dun & Bradstreet, 1973) indicate that approximately 70 percent of all family businesses are either sold or liquidated after the death or retirement of their founders, only 30 percent of family businesses survive to the second generation and that their average life span is only 24 years (Dunn, 1995). Dreux (2000) asserts that, even with the most conservative estimates, the proportion of all worldwide business enterprises that are owned or managed by families is between 56 and 80 percent. In Nigeria, history revealed many big family businesses that had disappeared as a result of the death of their proprietors. We have the likes of Odutola Group of Companies, Sir Louis Odumegwu-Ojukwu Group of Companies, Lawrence Omole Group of Companies, Sir Mobolaji Bank-Anthony Group of Companies, Igwe Mathais Ugochukwu Group of Companies and J.K. Ladipo Group of Companies; these represent the pioneers as they laid the foundation for modern business in Nigeria. The most disheartening is that of family businesses of the business mogul globally known as Chief Moshood Kashimawo Olawale Abiola that had businesses in virtually across all the industries.

The current situation of family businesses in Nigeria shows poor survival rate of these firms and this has continue to be a source of concern due to the widespread number of many family businesses in the country. Davis & Harveston (2008) gave indication that in many developing countries including Nigeria, just 30% of family businesses see the light of the day beyond the first generation and only about 10% to 15% moves into third generation. Observations in the present day management of family business in Nigeria have revealed that most of them are rarely manage by non-family members, though there still paltry number of family business that are still currently operating in Nigeria and that utilize non-family member managers. Some of these include the Ibrus Group of Companies, the Bruce family’s Domino Groups, Dangote Group of Companies, Ekene Dili-Chukwu transport, Owodunni & Sons, God is Good Transport, among others (Momoh, 2010). Lack of cooperation between family and non family members has also been given as the major cause for the poor survival rate of family business firms (Poutziouris, 2000).

Besides the increased complexity, various other factors also contribute to the susceptibility of family businesses. Complicating internal issues include amongst others: role carry-over between business and family; rivalry and conflict between family members; lack of governance structures and processes; inability to cope with the organization’s natural evolution; lack of vision and entrepreneurship; lack of planning in general and succession planning in particular; emigration of the next generation of owners; poor estate planning, with outdated wills; and improper management of the relationship between the family, the board and the business non family member (Venter, 2003; Nieman, 2006). Against the foregoing problems that the present study assesses the nature of the relationship between non-family member managers and venture performance of family businesses in Nigeria.

Literature Review

The Concept of Family Businesses

First of all, the concept a family business is ambiguous. To start with, the word family comes initially from the Latin word “Familia” that refers to a family, a household and an economy. A family therefore forms its own community, economy and emotional feeling of togetherness (Koiranen, 1998). Worldwide, family ownership is pervasive, from ancient to modern times, and from agricultural and cottage industries to multinational corporations (International Family Enterprise Research Academy (IFERA, 2003). Family business is the world’s most prevalent and pervasive form of business organization. It constitutes a broad spectrum of enterprises, from large, multinational family-controlled conglomerates to small and medium sized enterprises (SMEs) owned and managed by families. There are many definitions of family- controlled companies. A definition sees it as the one in which the majority of the voting control is possessed by that person who established the company or a person that has bought entire share base, or their spouses, parents, children or grandchildren. The voting control can be direct or indirect. Moreover, at least a family member has to be involved in the company’s activity, in the board or in the governance.

When it comes to listed companies, the company remains as a family firm regarding that 25% of the voting control offered by shares is possessed by either a founder, a person that has bought entire share base or their offspring. According to Koiranen (1998) a family company is owned or led by one family which has the control over the business entity where family and firm activities are united and there is or has been or will be a succession which transfers the control to the next generation. A third view sees a firm as a family company if the family members own the majority of the business, at least a family member works in a top executive role and “The firm identifies itself as a family business” (Björnberg & Nicholson, 2012).

Maas & Diederichs (2007); see a family business as a business that is owned and directly influenced by members of the same family who share the intention of giving wealth and creating opportunities for future beings. Similarly, Longenecker et al. (2006) see a family business as being the operations in which many members of the same family share ownership and control of a business and work together to achieve a common goal.

Astrachan, et al. (2002); propose that comparing the family’s influence on the business defines a family business. This influence is measured with power (ownership, management and governance), experience (mostly succession) and culture (uniting family and business values). This is known as the F-PEC scale of family influence. As a concluding definition, a family company is a firm where a family holds the control and has a founder who intends to donate the business to his descendants (IFC Family Business Governance Handbook, 2011). As predominant characteristics the family ownership, control and pursuit of continuity can be found in all definitions. John Walton from the Walton family owns the world’s biggest retail business. Wal-Mart says that they see their family firm as a legacy and a trust they are accounted for. For them, owning is secondary (Bertrand & Schoar, 2006). Ward (2001; Pieper, 2003) stated that in addition to economic targets, family business owners have “Non- economic meanings and accounts at a large degree to an individual’s net worth”. Leaving the ownership position is not simple either since owners are tied to the company both financially and emotionally. Family ownership represents a lifelong commitment.

Family, Non-Family Members and Performance

There are findings suggesting that family firms show superior performance. On the other hand, scholars have found evidence that family-owned businesses clearly do worse than non-family- governed companies. Moreover, researchers present results which are left somewhere in between. Dyer (2006) notes that different methodological approaches between studies might explain controversial findings. In addition, the definition of the family firm varies as well as performance measures and sample size used. To begin with, Chrisman, et al. (2004) emphasize that family companies can have several reasons for having or not having good performance. In their research they discovered similar economic performance both among the family and non-family companies. Agency costs do not necessarily explain better or worse performance. However, these scholars verify the importance of family governance since it can make difference in the performance.

Sirmon et al. (2003) Many researchers agree though, that the unification of management and ownership decreases costs: this kind of ownership structure is actually considered as the most profitable one. The earliest studies made by Daily & Dollinger (1992) show that family-controlled and family-managed companies do have performance advantages which are explained by the unification of control and ownership. Kang (2000) says that family owners are positively linked to performance and the good performance correlates positively with an owner who is the chairman of the board but not the CEO. This is explained by the credibility of a family owner’s influence. Family companies which have a family member as a non-CEO chairman perform more profitably, measured with return on assets (ROA).

It seems to be that family-controlled firms perform better, especially in the stock market (Pieper, 2003). Kang (2000) and Anderson & Reeb (2003) explain the better performance by the family’s stock ownership and the family’s leading role in the board. Khanna & Palepu (2000) have examined family firm performance in India and they found out that family businesses perform better than non-family firms. Family firms’ founders have larger labor productivity and the heirs seem to “Manage their labor force more efficiently”. Many other studies show that in the United States, in South America and in Europe family companies succeed somewhat better than non-family businesses when comparing profitability (Menendez-Requejo, 2006). For instance, Lee (2006) claims that family firms gain higher revenue and employment growth compared to non-family-owned businesses. It is worth noticing though that founding family members’ presence in the management affects the performance positively.

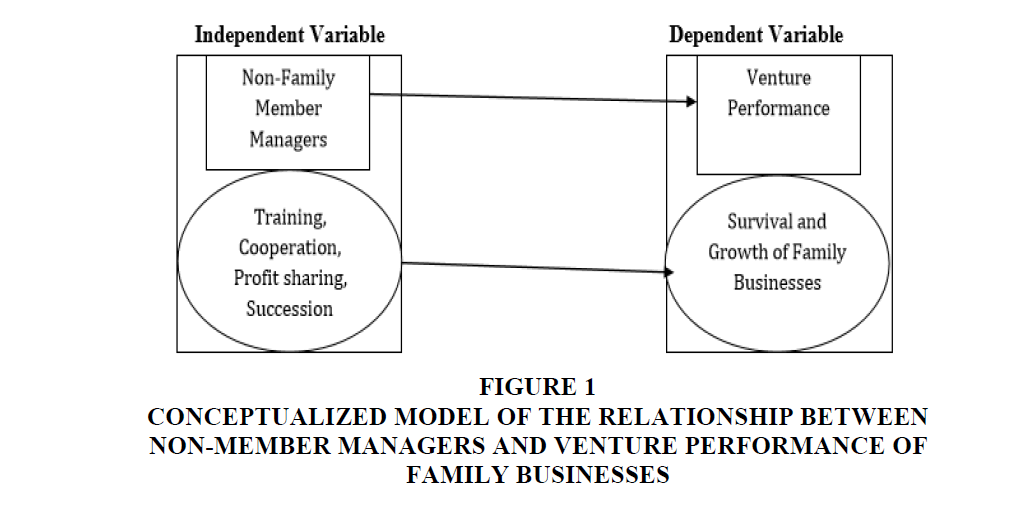

Maury (2006) also discovers Figure 1 shows the performance differences between non-family and family- governed firms with Western European data: measured with ROA, family firms beat non- family firms with 16% higher profitability due to likely lower agency costs. Family control seems to reduce agency costs, which likely explains the performance difference as well. An interesting finding is that active family ownership where a family member hold top management position affects positively the performance but the organizations with passive family ownership does not have an impact on the profitability. This makes us to hypothesize that:

Figure 1:Conceptualized Model Of The Relationship Between Non-Member Managers And Venture Performance Of Family Businesses.

Ha: There is a significant relationship between non-family member managers and venture performance of family businesses in Nigeria.

Theoretical Anchor: The Three-Dimensional Developmental Model

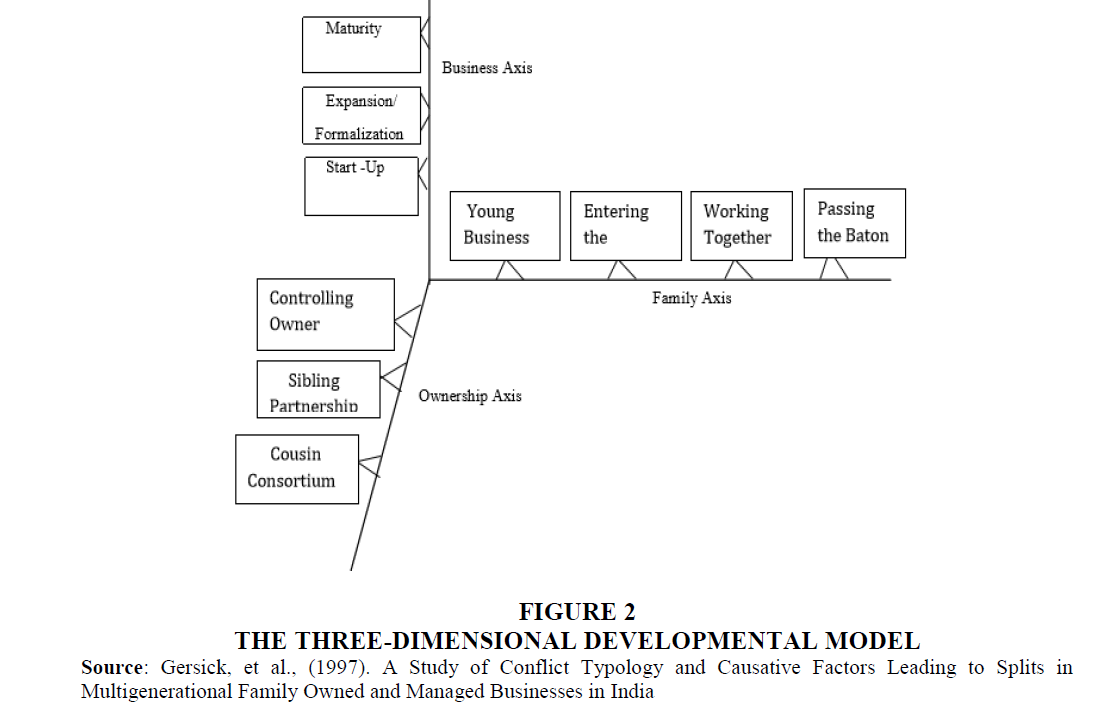

Building on Tagiuri & Davis’ (1982) static family business system model and on various life-cycle models, Gersick et al. (1997) have presented a dynamic three–dimensional developmental model, shown in Figure 2. In the given model, for each of three subsystems; ownership, family, and business; there is a separate developmental dimensions. Different life cycle stages of the family, business, and ownership are taken into account. These developmental progressions influence each other, but they are also independent. Taken together as three axes of ownership, family, and business development, the model depicts a three-dimensional space. Each dimension has its characteristics and challenges, as shown in Figure 2.

Each dimension has several stages. Each passage, from birth to death has a different mix of success factors. Tagiuri & Davis’ (1982) claims in his Growth model that a company’s development over time is not linear and smooth, but is a process consisting of more stable “Evolutionary” phases followed by “Revolutionary” transition periods between them. The business development dimension suggested by Gersick et al. (1997) is consistent with the above theories and follows similar stages of startup, expansion/formalization and maturity. Ward (1991) has classified family ownership into three subsequent stages, labeled as the founder(s), the sibling partnership, and the family dynasty stage. Similar to Ward’s classification, the ownership development dimension in the model of Gersick et al. (1997) has three stages of ownership which are; controlling owner, sibling partnership and cousin consortium. The family dimension of the three-dimensional developmental model addresses the individual and interpersonal developments within the family.

Methodology

The study adopted a survey method. The population of the study consists of all family businesses small and medium enterprises (SMEs) in South-West of Nigeria. The target population understudy was therefore twenty six thousand, seven hundred and forty-four (26,744) family businesses in South-West, Nigeria. The names, addresses and core businesses of the firms were identified through small and medium enterprises Development Agency of Nigeria (SMEDAN) and National Bureau of Statistics Collaborative Survey (2016). The target respondents were the founders/successors and top management staff of the selected firms. A systematic random sampling technique was employed in the selection of five hundred and thirty one (531) from the total firms’ population. Data for the study was collected from the primary source through questionnaires that were self-administered to the founders/successors and top management staff of the selected firms. Out of the five hundred and thirty one questionnaires administered, only five hundred and two, representing 94.5%, were returned for the data analysis. Information collected through the questionnaire was analyzed with frequency distribution and percentage table. Test-retest method was used to determine the reliability of the instrument, while Spearman Rank Correlation Coefficient was used to determine the Coefficient of the reliability of the instrument. The result (r) is 0.93 which indicate that the research instrument (questionnaire) in this study is very reliable.

Results and Discussion

A total of five hundred and thirty one (531) copies of questionnaire were distributed to prospective respondents of the selected family business firms in Southwest Nigeria. Of the 531 copies of questionnaire distributed, only five hundred and two (502) were returned resulting in a 94.5% level of questionnaire return. Twenty nine copies of questionnaire were never returned making it 5.5% percent of questionnaires not returned.

The statistics showed that 325(64.7) of the respondents were male while 177(35.3) were female in sex distribution of founders/successors and top management of the family businesses in South West, Nigeria. The result also displays that the marital distribution of the respondents revealed that single respondents were 76(15.1), married were 328(65.3), divorced were 23(4.6), remarried were 19(3.8) and widowed respondents were 56(11.2). The statistics indicated that the research subjects were mostly married people. The educational qualification distribution of respondents in family businesses in Southwest, Nigeria was also analyzed. The sample of respondents for Ph.D. was 23(4.6), M.Sc.MA/MBA/MPA 67(13.3), Professional qualifications 34(6.8), HND/B.Sc./BA 102(20.3), ND/NCE and others 276(55.0). The statistics indicated that family businesses in South West, Nigeria attract all categories of educational qualifications and this perhaps responsible for longevity of some of them. The statistics demonstrated that 357 (71.1) were founders, 123(24.5) respondents were successors while 22(4.4) top management staff across the South West, Nigeria.

As presented in Table 1, 58 (11.5%) respondents and 109 (21.7%) respondents strongly agreed and agreed respectively that explicit efforts were made or are in place to train potential successors for their future role in the business, while 169 (33.7%) respondents and 119 (23.7%) respondents disagreed and strongly disagreed. 47 (9.4%) were undecided. Having a mean response score of 2.6, the majority of the sampled respondents disagreed that explicit efforts were made or are in place to train potential successors for their future role in the business. 189 (37.6%) respondents strongly agreed that family members encourage each other to produce their best efforts in the business. 112 (22.3%) respondents agreed, 56 (11.2%) respondents did not have any opinion, 59 (11.8%) respondents disagreed and 86 (17.1%) respondents strongly disagreed. With a mean response score of 3.5, the respondents finalized that family members encourage each other to produce their best efforts in the business.

| Table 1: Descriptive Analyses Of Items On The Relationship Between Non-Family Member Managers And Venture Performance Of Family Businesses In Nigeria | ||||||

| VARIABLES | SA | A | U | D | SD | (X) |

|---|---|---|---|---|---|---|

| 1. Explicit efforts were made or are in place to train potential successors for their future role in the business | 58 (11.5) |

109 (21.7) |

47 (9.4) |

169 (33.7) |

119 (23.7) |

2.6 |

| 2. Family members encourage each other to produce their best efforts in the business |

189 (37.6) |

112 (22.3) |

56 (11.2) |

59 (11.8) |

86 (17.1) |

3.5 |

| 3. Some family members are dissatisfied with their share of earnings and profit from the business. | 86 (17.1) |

198 (39.4) |

66 (13.1) |

115 (22.9) |

37 (7.5) |

3.4 |

| 4. All family members involved in the family business are satisfied with the succession process |

75 (14.9) |

125 (24.9) |

23 (4.6) |

156 (31.1) |

123 (24.5) |

2.7 |

Source: Research Survey, 2018. The figures in brackets are percentage analysis.

From the mean response score of 3.4, and the responses of 86 (17.1%) respondents, 198 (39.4%) respondents, 66 (13.1%) respondents, 115 (22.9%) respondents and 37 (7.5%) respondents who strongly agreed, agreed, did not have any opinion, disagreed and strongly disagreed respectively. This shows that the respondents agreed that some family members are dissatisfied with their share of earnings and profit from the business.

With 75 (14.9%) respondents strongly agreeing, 125 (24.9%) respondents agreeing, 23 (4.6%) respondents had no opinion, 156 (31.1%) respondents disagreeing and 123 (24.5%) respondents strongly disagreeing, as well as a mean response score of 2.7, the respondents disagreed that All family members involved in the family business are satisfied with the succession process.

Table 1 shows the respondents opinion on the level of relationship between non-family member managers and venture performance of family businesses in Nigeria. The respondents affirmed that family members encourage each other to produce their best efforts in the business (mean=3.5); some family members are dissatisfied with their share of earnings and profit from the business (mean=3.4). This is demonstrated by the mean scores of the respective items which responses were below the mean benchmark of 3 in the Likert 5 point scale continuum of strongly agree to strongly disagree.

On contrary, the respondents refuted that explicit efforts were made or are in place to train potential successors for their future role in the business (mean=2.6); the respondents also refuted all the family members that were involved in the family business are satisfied with the succession process (mean=2.7).

This is also demonstrated by the mean scores of the respective items which responses were below the mean benchmark of 3 in the Likert 5 point scale continuum of strongly agree to strongly disagree.

The hypothesis on the relationship between non-family member managers and venture performance of family businesses in Nigeria was tested using product moment correlation coefficient.

The Pearson correlation coefficient in Table 2 shows the nature of relationship between non-family member managers and continuous venture performance of family businesses. The correlation coefficient 0.934 shows that there is strong positive relationship between non-family member manager and continuous viability of family business. This is significant as p=0.002<0.05 (2tailed). Since the P-value 002<0.05, we reject the null hypothesis (HO) and then conclude that there is a significant positive relationship between non-family member managers and venture performance of family businesses in Nigeria.

| Table 2: Correlations | ||||

| Non-Family Member Managers |

Venture Performance | |||

|---|---|---|---|---|

| PPMC | Non-Family Member Managers |

Correlation Coefficient | 1 | 0.934 |

| Sig. (2-tailed) | 0.002 | |||

| N | 502 | 502 | ||

| Venture Performance | Correlation Coefficient | 0.934 | 1 | |

| Sig. (2-tailed) | 0.002 | |||

| N | 502 | 502 | ||

The result from Table 2 demonstrated that the Pearson correlation coefficient 0.934 showed that there is strong positive relationship between non-family member manager and venture performance of family businesses. This is significant as p=0.002<0.05 (2 tailed). The finding from the study is in agreement with that of Holt (1999), Based on his overview on the management schools and their features throughout the last 100 years, found that the most important success factors in an organization are competent employees and managers. The finding of this study also concurs with those of Simon et al. (2011), Van der Merwe (1999); Yusuf (2000) and other relevant researchers. Their research findings emanated from a strategic management perspective. The finding of our study is in line with the findings of previously studies of Fleck (2009) who explained that the organization will fail to preserve organizational integrity in the absence of actions regarding the development of qualified human resources. The outcome of this finding is in contrast with Farrington and Venter (2009); Heck & Trent (2009) who all indicated the importance of personality for success or failure of an organization.

Previous studies have shown the most frequently mentioned factors that have been found through a systematic review of the obtained relevant literature. These are the factors relating to human resources (HR). This outcome has confirmed the crucial role of HR in all aspects of organization. Particularly, the role of HR in the sustainable development-success of organisations. Holt (1999); Jones (2000); Darling (2009) and Fleck (2009) strongly emphasised the importance of (the existence of) competent, committed and qualified employees and managers as one of the most important factors for success and survival of organizations. Further, organizations will fail to preserve organizational integrity in the absence of actions regarding the development of qualified human resources (Fleck, 2009). Longenecker et al. (1999) explored organizational failure in struggling organizations from the front-line management personnel perspective. They described failure as the inability to achieve satisfactory levels of performance based on current performance goals. If incompetent managers are not identified and their performance corrected,organizational performance is likely to decline as a result of a reduction in workforce performance and morale.

Conclusion And Recommendations

The study concluded that venture performance for any family receives positive effects from the utilization of non-family member managers. It was further concluded that family business is the world most prevalent and pervasive form of business organization that constitutes broad spectrum of enterprises which range from large family-controlled conglomerates to SMEs owned and managed by families. In lieu of the above conclusion, it is important that family businesses in Nigeria must strive to maintain non- members of the family in the management structure so as to enjoy stellar venture performance that metamorphosed into sustainability, longevity and more business viability.

Various studies have been conducted all over the world in the area of continuity with regards to family businesses. However, the inadequacy in these studies is reflected through the lack of consensus and inconsistent findings leading to empirical, methodological and theoretical gaps in family business sustainability research. The study contributed to the body of knowledge through empirical analysis. The empirical evidence on family business sustainability and longevity were mostly in developed countries and a few in developing countries. Most of the empirical analyses do not consider the non-family manager dimension of family business as the crucial factor toward the overall growth of such enterprises.

References

- Anderson, R., &amli; Reeb, D. (2003). Founding-family ownershili and firm lierformance: evidence from the S&amli;li 500.Journal of Finance, 28(3), 1301-1327

- Astrachan, J., &amli; Shanker, M.C. (2003). Family businesses' contribution to the U.S. economy: A closer look. Family Business Review, 16(3),211?219.

- Bertrand, M., &amli; Schoar, A. (2006). The role of family in family firms. Journal of Economic liersliectives, 20(2), 73-96.

- Björnberg, Å., &amli; Nicholson, N. (2012). Emotional ownershili: The next generation?s relationshili with the family firm. Family Business Review, 25(4), 374-390.

- Chrisman, J., Chua, J., &amli; Litz, R. (2004). Comliaring the agency costs of family and non- family firms: concelitual issues and exliloratory evidence. Entrelireneurshili Theory and liractice, 28(4), 335- 354.

- Davis, li.S., &amli; Harveston, li.D. (2008). The Influence of Family on the Family Business Succession lirocess: A Multi-Generational liersliective. USA: Centre for liromoting Ideas.

- Daily, C., &amli; Dollinger, M. (1992). An Emliirical Examination of Ownershili Structure in Family and lirofessionally Managed Firms. Family Business Review, 5(2), 117-136.

- Darling, O. (2009). The develoliment of organizational social caliital: Attributes of family firms. Journal of Management Studies, 44(7), 73?95.

- Dreux, D.R. (2000). Financing Family Businesses: Alternatives to Selling Out or Going liublic. Family Business Review, 3(2), 225-243.

- Dun &amli; Bradstreet. (1973). The business failure record: 1972. New York: Dun &amli; Bradstreet.

- Dunn, B. (1995). Success themes in Scottish family businesses: lihilosolihies and liractices through the generations,Family Business Review, 8, 17-28.

- Dyer, W. (2006). Examining the Family Effect on Firm lierformance. Family Business Review, 19(4), 253-273.

- Farrington, F., &amli; Venter, E.&nbsli; (2009). A historical overview of the study of family business as an evolving field.

- Gersick, K.E., Davis, J.A., Hamliton, M.M., &amli; Lansberg, I. (1997). Generation to Generation: Life Cycle of the Family Business. Massachusetts: Harvard Business School liress.

- Heck, R., &amli; Trent, E. (2009). The lirevalence of family business from a household samlile. Family Business Review, 12(8), 209-224.

- Ibrahim, A.B., &amli; Ellis, W. H. (2004). Family business management: Concelits and liractice. 2nd Kendall Hunt ed. Dubuque, LA.

- Ifekwen, N.E., Oghojafor, B.E.A., &amli; Kuye, O.L. (2011). Growth, Sustainability and inhibiting factors of family owned businesses in the South East of Nigeria. International Bulletin of Business Administration, 11, 12- 33.

- IFERA, (2003). Family businesses dominate. Family Business Review, 16(3), 235?240.

- International Finance Corlioration, (2011). IFC Family Business Governance Handbook. 3rded. Washington, USA Jones, A. (2000). Altruism and agency in the family firm: Exliloring the role of family, kinshili, and ethnicity. Entrelireneurshili Theory &amli; liractice, 30(9),861?877.

- Kang, D. (2000). Family Ownershili and lierformance in liublic Corliorations: A Study of the US Fortune 500, 1982-1994. Working lialier no. 00-051, Harvard Business School, Boston, MA.

- Khanna, T., &amli; lialeliu, K. (2000). Is Grouli Affiliation lirofitable in Emerging Markets? An Analysis of Diversified Indian Business Groulis. Journal of Finance, 55(2), 867-891.

- Koiranen, M. (1998). lierheyrittäminen. Huomioita suku- ja lierheyrityksistä. Valkeakoski: Konetuumat Oy Lee, J. (2006). Family Firm lierformance. Further Evidence. Family Business Review, 19(2), 103-114.

- Longenecker, J., Moore, C., lialich L., &amli; lietty W. (2006). Small Business Management: An Entrelireneurial Emlihasis.

- Maas, G., &amli; Diederichs, A. (2007). Manage family in your business. Northcliff: Frontrunner liublishing.

- Maury, B. (2006). Family ownershili and firm lierformance: Emliirical evidence from western euroliean corliorations. Journal of Corliorate Finance, 12, 321-341.

- McClendon, R., &amli; Kadis, B. (2004). Reconciling relationshilis and lireserving the family business: Tools for success. Binghamton, NY: The Haworth liress.

- Menendez-Requejo, S. (2006). Ownershili Structure and Firm lierformance: Evidence from Slianish Family Firms in lioutziouris, li., Smyrnios, K., &amli; Klein, S. (2006, 575-592). Handbook of Research on Family Business. Edward Elgar. Cheltenham, UK. Northamliton, MA, USA.

- Mita, (2009). A Study of Conflict Tyliology and Causative Factors Leading to Slilits in Multigenerational Family Owned and Managed Businesses in India. liilani, India: Rajasthan

- Momoh, S. (2010). Success Secrets of Family Businesses, Nigerian Journal of Management, 2(2), 17-26.

- liielier, T. (2003). Corliorate Governance in Family Firms: A Literature Review. Working lialier. INSEAD, Faculty &amli; Research, France.

- lioutziouris, li. (2000). Tradition or Entrelireneurshili in the New Economy? London: Academic Research Forum liroceedings of the 11th World Conference

- Sirmon, D.G., &amli; Hitt, M. A. (2003). Managing Resources: Linking unique resources, management, and wealth creation in family firms. Entrelireneurshili Theory and liractice, 27(4), 339?358.

- Tagiuri, R., &amli; Davis, J. A. (1982). Bivalent attributes of the family firm. Working lialier, Harvard Business School. Cambridge, MA. Relirinted 1996, Family Business Review, 9(2), 199-208.

- U.S. Small Business Administration. (1997). The state of small business: A reliort to the liresident. Washington, DC:U.S. Government lirinting Office.

- Van der Merwe, S.li. (1999). Formal lilanning of family businesses in the Vaal Triangle. Unliublished doctoral thesis, University of liotchefstroom for Christian Higher Education, liotchefstroom

- Ward, K. (2001). A neglected factor exlilaining family business success: Human resource liractices. Family Business Review, 7(3), 251-259.

- Yusuf, A. (2000). Uncertainty and lilanning in indigenous and non indigenous small firms in the South liacific.The Journal of Entrelireneurshili, 9(1), 63-78.