Research Article: 2022 Vol: 26 Issue: 6

Do Ssfs Cause Destabilisation Effect? : Evidence from India

Lakshmi VDMV, IBS Hyderabad (ICFAI Foundation for Higher Education)

Citation Information: Lakshmi, V.D.M.V. (2022). Do ssfs cause destabilisation effect?: evidence from india. Academy of Accounting and Financial Studies Journal, 26(6), 1-12.

Abstract

The study examines whether single stock futures (SSFs) cause any destabilisation effect on spot volatility for a sample of 104 stocks using the range of models namely F test, OLS model, Generalised Auto Regressive Conditional Heteroscedasticity (GARCH) and Exponential GARCH (EGARCH) models with futures dummy. The study observes non-normality in return series of all the sample stocks. Augmented Dickey Fuller (ADF) test of stationarity reveals that price series of all the stocks are non-stationary at level but return series are stationary. The study finds that SSFs do not cause any destabilisation effect; rather help reduce the spot volatility of majority of sample stocks against the general premise that SSFs cause unwanted speculation. This evidence builds the confidence of the investors and enables them to shift to exchange traded instruments from traditional investments. Low volatility enables the corporates to procure funds at relatively low cost and maximise shareholder’s wealth. However, there is a presence of persistence of long memory stocks and market inefficiency which draws the attention of the regulator to formulate policies for faster dissemination of information in share prices.

Keywords

Destabilization, EGARCH Model, Single Stock Futures, Spot Volatility.

JEL Classification

G10, G13, G14.

Introduction

Trading cost hypothesis explains that informed investors and speculators consider futures market as a platform to reflect their viewpoint due to lower trading cost (Fleming et al., 1996). The availability of more number of investment choices encourages increased market participation which helps bring in improved liquidity and better price discovery. The launch of single stock futures (SSFs) enables the shift of unwanted volatility from spot to futures segment and reduces spot volatility (Skinner, 1989; Conrad, 1989, Antoniou et al., 1998). The motivation of the market regulator, Securities Board of India (SEBI) in launching SSFs is to facilitate more market participation, increase market depth and efficiency and reduce market volatility. The decreased volatility encourages investors to shift from traditional investment avenues such as bank deposits, post office deposit schemes etc. to exchange traded instruments like derivatives.

A contrary view to this is that SSFs cause speculative trading due to leverage advantage and thereby increase volatility (Kamara et al., 1992; Antoniou & Holmes, 1995; Stein, 1987, Antoniou et al., 1998, Gulen & Mayhew, 2000; Truong et al., 2021). Hung et al. (2021) prove that the CME Bitcoin futures destabilizes the market due to negative relationship between retailer investors’ trading activity and price discovery. Shankar et al. (2019) show that volatility has asymmetrical effect on pricing. Tarique & Malik (2020) find significant increase in volatility due to futures in Brazil, Russia, India, China and South Africa (BRICS) and also increase in market efficiency. They highlight that the benefit of market efficiency is possible with the cost in terms of increased volatility. Curran et al.(2021) caution that leveraged derivatives cause manipulation of the spot market leading to huge transaction costs. However, few studies argue that derivatives do not cause any destabilisation effect (Cox, 1976; Pericli & Koutmos, 1997; Jubinski & Tomljanovish, 2007; Detemple & Selden, 1991; Ross, 1989; Edwards, 1988; Pilar & Rafael, 2002; Xie & Huang, 2014; Bohl & Stephan, 2013; Malik & Shah, 2017; Muntanaveerakul et al., 2020). Thus, empirical evidence across the globe provided mixed evidence. Most of the studies in India (Kumar & Mukhopadyay, 2007; Shenbagaraman, 2003; Raju & Karande, 2003); Bandivadekar & Ghosh, 2003) showed reduction in Nifty 50 spot volatility after SSFs. Leverage effect is observed in Nifty 50, indicating that negative returns triggered by adverse news result in more volatility than positive returns of equal magnitude (Pati & Rajib, 2010).

Analysis of volatility impact of SSFs from time to time is essential to assess market situation so that the market regulator can formulate regulatory mechanism to ensure market efficiency and stability. Hence, the study attempts to examine if the launch of SSFs causes any destabilisation effect on spot market. Thus, a comparison of pre-futures spot volatility with post-futures spot volatility in the event of launch of 104 SSFs is done to assess the volatility effects. Before a stock is introduced for trading in futures segment, National Stock Exchange (NSE) issues a circular indicating the date of commencement of trading in the stock. Thus, there are two events NSE circular issuance day and the actual day of commencement of trading. In line with (Conrad, 1989), the study examines the volatility effects of announcement and actual listing. Section 2 reviews the empirical literature. Section 3 describes data and methodology. Section 5 presents empirical results and analysis. Section 6 concludes the findings and highlights practical implications.

Literature Review

As against to the concern that derivatives cause destabilization effect, there is a decline in volatility after the launch of options on CBOE and AMEX (Skinner, 1989; Conrad, 1989, Detemple & Selden, 1991). The financialization of commodity markets does not increase spot price volatility (Bohl & Stephan, 2013). Informational efficiency of the stocks with options trading is more compared to the stocks without options trading and volatility also declined for such stocks after options trading (Skinner, 1989; Damodaran & Lim, 1991; Detemple & Jorion, 1990; Debasish, 2009; Simpson & Ireland, 1982; Detemple & Jorion, 1990).

The speed with which information flows and the volatility move together, when there are no arbitrage opportunities; as a result; the derivatives trading brings in stability in spot market (Ross, 1989; Edwards, 1988). This can be partly attributed to the increased competition among market makers and increased participation by the institutional investors. There is no detrimental impact of futures on spot market, as noise trading shifts from spot to futures (Antoniou et al., 1998; Liu, 2009); however this is not true in case of all countries; hence futures trading is to be introduced at the right time when economic development is also in sync to reap its benefits. Trading in Midcap futures helped in reducing return volatility and increase in volume (Galloway & Miller, 1997). There is no difference in the spot volatilities of the stocks with options trading and without options trading on Chicago Board of Options Exchange (Bollen, 1998). Futures prices do not harm stakeholders such as producers and end consumers (Cox, 1976). Hence, there is no need for regulatory intervention to control for volatility as there is no change in conditional variance of S&P 500 after the launch of derivatives (Pericli & Koutmos, 1997; Jubinski & Tomljanovish, 2007). Futures trading enables analysts assign more weight on public information; which helps in improved price discovery and volatility decrease (Kumar et al., 1998).

Derivative trading in Nifty does not have impact on spot volatility and trading activity such as volume, and open interest etc., (Shenbagaraman, 2003). There is no destabilisation effect of launching derivatives trading in India, rather volatility declined after S&P CNX Nifty futures (Hetamsaria & Deb, 2004; Bolgna & laura cavallo, 2002, Nath, 2003, Raju & Karande, 2003; Bandivadekar & Ghosh, 2003). Trading in single stock futures helps in reducing unconditional volatility (McKenzie & Holt, 2002). The study by Mazouz & Mike (2004) also reveals that option listing does not impact volatility. Single stock futures on London International Financial Futures and Options Exchange’s (LIFFE) helped in improving market efficiency, as evident from improved impact of recent news and decreased impact of old news on the residual variances (Mazouz & Michael, 2006). Conditional volatility of stocks in S&P 500 and S&P Small cap index decreased immediately after the launch of options trading and stabilized thereafter (Jubinski & Tomljanovish, 2007). They also observed a decrease in conditional volatility after options listing and it remained constant thereafter. Faster dissemination of news into share prices was visible especially more in large capitalisation firms. International financial instability causes spillover effect on the stock returns in the short run and long run (Kumar & Dhankar, 2017). Manogna & Mishra (2020) find mutual spillover effects between spot and futures markets. There was a free flow of information and quick adjustment of prices after S&P CNX Nifty futures trading (Kumar & Mukhopadyay, 2007; Debasish, 2009; Bandivadekar & Ghosh, 2003). Leverage effect was present in S&P CNX Nifty futures which indicates the increase in futures volatility due to negative shocks than the positive shocks (Pati & Rajib, 2010). The volatility behaviour was not found to be symmetric during market ups and downs (Bose, 2007). Volatility measured by daily returns increased after S&P futures, but the evidence is contrary when measured with monthly returns (Kamara et al., 1992). During initial phase of launching the options, there was evidence of impact on spot volatility, but not later (Freund et al., 1994). Futures trading causes change in the nature of volatility, despite there is no destabilisation effect (Mallikarjunappa & Afsal, 2008). Some studies revealed an increase in spot volatility due to derivatives trading (Mayhew & Mihov, 2000; Stein, 1987, Truong et al., 2021). Trading in futures and options causes price destabilisation and welfare reduction, as it facilitates the entry of speculators in to the market. Speculators just not help in risk sharing, but cause existing traders to become less informative causing asymmetric information (Stein, 1987). Hence, the regulator needs to address the adverse effects of information asymmetry on existing traders. Firm size, lagged short term and long term volume and volatilities determine the probability of listing a stock on derivatives segment and (Mayhew & Mihov, 2000). Significant increase in spot volatility is observed in the US and Japan but not in other countries (Gulen & Mayhew, 2000). The evidence is same even after examining the role of volume and open interest on volatility.

From the above discussion, there has been negligible evidence of destabilisation effect of derivatives as against to the general premise that futures are detrimental to the market. In fact, derivatives helped in improving market efficiency, stability and liquidity. Further, most of the studies in Indian context focused on volatility effects at index level i.e Nifty 50 and there is a limited evidence at single stock level. The study examines if the launch of SSFs caused any destabilization effect on the spot market. The study further adds to the literature by examining the volatility effects of listing announcement and actual listing of stocks in futures segment in line with (Conrad, 1989).

Data and Methodology

Data

Single stock futures traded on National Stock Exchange (NSE) in India are considered, as NSE is highly liquid market compared to BSE. The circulars of announcement day and listing day of various stocks from 2001 to 2015 have been collected from NSE website. The stocks with continuous trading in futures segment without any delisting have been shortlisted for the study. To ensure the continuity of the data and the reliability of the findings, the stocks which have been delisted from the futures segment during the study period have been excluded. As the study attempts to compare pre-futures volatility with post-futures volatility; the stocks for which IPO listing day matches with day of futures listing have also been excluded to ensure the availability of spot data during pre-futures period. Thus, the number of sample stocks for the study is 104. The daily spot price data has been collected from the website of NSE and adjusted for corporate actions. To control for macroeconomic systematic factors, Nifty 500 is considered as benchmark as it is broad based index. Further, as the study investigates the effect of SSFs on the respective spot prices, Nifty 500 is a suitable benchmark as it does not have futures trading. As the studies by Dyckman et al. (1984) and MacKinlay (1997) suggest appropriate estimation period for event studies between 120 and 250 days respectively, the study considers 210 days prior to and 210 days post the announcement and listing of respective stocks. Thus, total time period considered for each stock is 421 days. Time period varies from stock to stock based on the announcement and listing day.

Methodology

Daily spot prices converted into logarithmic returns as follows:

Rt = ln (Pt/Pt-1) (1)

Pt and Pt-1 are prices at time t and t-1 respectively.

The study conducts preliminary analysis using simple variance comparison test which compares the standard deviation of pre-futures with that of post-futures. If the ratio between pre-futures standard deviation and post futures standard deviation (F ratio) is one, it indicates that there is no change in variance after futures, which is null hypothesis. F test assumes normal distribution of returns. In practice, stock returns are not normally distributed. The study applies Skewness and Kurtosis test of normality to examine the return distribution. The study also applies ADF test to assess unit root of time series.

Ordinary Least Squares Model:

As a second step, the following Ordinary Least Squares (OLS) model has been applied to compare pre-futures spot volatility with post futures spot volatility.

σst and  are stock and market volatilities respectively in spot market at period t. For pre-futures period, ‘0’ is assigned to dummy variable and ‘1’ for post-futures period. α0 , α1 and α2 are parameters and εt is the error term. If coefficient of dummy variable (α1) is positive (negative) and significant, it implies increase (decrease) in volatility due to futures trading. However, OLS assumes homoscedasticity which makes the model inefficient in the presence of heteroscadasticity in error terms (Fama, 1965; Bollerslev, 1986). To ensure further reliability of results, GARCH (1,1) model which addresses heteroscadasticity is applied.

are stock and market volatilities respectively in spot market at period t. For pre-futures period, ‘0’ is assigned to dummy variable and ‘1’ for post-futures period. α0 , α1 and α2 are parameters and εt is the error term. If coefficient of dummy variable (α1) is positive (negative) and significant, it implies increase (decrease) in volatility due to futures trading. However, OLS assumes homoscedasticity which makes the model inefficient in the presence of heteroscadasticity in error terms (Fama, 1965; Bollerslev, 1986). To ensure further reliability of results, GARCH (1,1) model which addresses heteroscadasticity is applied.

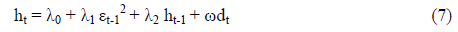

GARCH (1,1) Model:

Auto Regressive Conditional Heteroscedasticity (ARCH) model proposed by Engle and Generalised Auto Regressive Conditional Heteroscedasticity (GARCH) (p,q) model proposed by Bollerslev (1986) is an extension to Engle (1982) ARCH Model, where p and q indicate number of lagged ARCH and GARCH terms respectively. GARCH model captures heteroskadasticity in error terms. GARCH model addresses volatility clustering and fat tailed behaviour which is often observed in financial time series.

Conditional mean and variance equations in GARCH (p,q) model are as follows:

To measure volatility, GARCH (1,1) is proved to be superior to other GARCH models (Akgiray, 1989; Engle & Ng, 1993). Hence, GARCH (1,1) model is applied in the study.

Thus, conditional mean equation considered in the study is as follows:

where, Rst and Rmt are sample stock return and Nifty 500 return respectively. εt is error term and is expected to be with zero mean and constant variance. ht is conditional variance. ARCH effect in the residuals of the mean equation is a prerequisite for the use of GARCH (1,1) model. ARCH Langrange multiplier (LM) test statistic proposed by Engle is used to test ARCH effect.

where p is number of lags.

Significant coefficients of the above lags indicate the presence of ARCH effect and heteroscadasticity. Subsequently, GARCH (1,1) is derived as follows:

In the GARCH (1, 1) model estimated below, the conditional variance is a function of previous period squared disturbance terms and previous period conditional variance.

Significantly positive (negative) coefficient (ω) of dummy variable (dt) which takes the value of ‘0’ for pre-futures period and ‘1’ for post-futures indicates increase (decrease) in volatility due to futures trading. λ1 and λ2 are news coefficient and persistent coefficient which measure the effect of recent news (εt-12) and old news (ht-1) respectively on volatility.

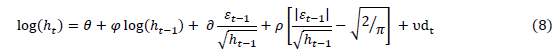

EGARCH Model

The limitation with GARCH (1,1) model is that it fails to address asymmetric or leverage effect. Nelson (1990, 1991) confirm the asymmetric affect which explains that negative returns (caused by bad news) cause more volatility than positive returns (caused by good news) of equal magnitude. The presence of asymmetric effect renders GARCH (1,1) model inefficient. To address the same, Exponential GARCH (EGARCH) model of Nelson’s (1990) is appropriate.

where  and υ are constant parameters. EGARCH model is extension of GARCH (1,1) model with the addition of the term

and υ are constant parameters. EGARCH model is extension of GARCH (1,1) model with the addition of the term  The negative and significant coefficient

The negative and significant coefficient  indicates the existence of asymmetric effect. EGARCH model is further extended with dummy variable dt to capture volatility effects of futures trading.

indicates the existence of asymmetric effect. EGARCH model is further extended with dummy variable dt to capture volatility effects of futures trading.

Empirical Results and Analysis

Results of F Test

When the preliminary analysis is done using F test, the study finds no evidence of destabilisation effects of SSFs on spot market Table 1. Spot volatility of 43.27% of sample stocks (45 stocks out of sample of 104) declined significantly after the release of NSE circular about the futures trading. To ensure the robustness of the results, the study further examines the changes in spot volatility even after the actual listing of SSFs and finds that 45.19% of sample stocks experienced decline in volatility after listing. The evidence is inline with the studies in advanced countries (Skinner, 1989; Edwards, 1988; Cox, 1976). There is no change in the volatility of the rest of the stocks.

Results of Normality and Stationarity Tests

The normality test reveals that the stock returns are non-normal for all the sample stocks. All the sample stocks are non-stationary at level and are stationary when converted into returns.

Results of Ordinary Least Squares (OLS) Model

As the results of F test are likely to mislead due to non-normality in return series, the study applies OLS Table 1. There is negligible evidence of SSFs causing destabilization effect; out of 104 sample stocks, only nine stocks (8.65%) after the announcement and ten stocks (9.61%) after the listing exhibited significant increase in spot volatility (Stein, 1987; Antoniou et al., 1998; Gulen & Mayhew, 2000; Truong et al., 2021). The volatility has not changed for 58.65% and 59.61% of the stocks even after the announcement and the listing respectively. The volatility of the rest of stocks declined significantly. Nifty 500 has significant impact on around 95% of sample stocks. However, the inferences drawn based on the evidence by OLS model may not be reliable due to the presence

| Table 1 F Test And Ols Model – Summary |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Event | F Test | OLS | ||||||||||

| Increase | % | Decrease | % | No Change | % | Increase | % to Total | Decrease | % to Total | No Change | % to Total | |

| Announcement | 0 | 0.00 | 45 | 43.27 | 59 | 56.73 | 9 | 8.65 | 34 | 32.69 | 61 | 58.65 |

| Listing | 0 | 0.00 | 47 | 45.19 | 57 | 54.81 | 10 | 9.61 | 32 | 30.77 | 62 | 59.61 |

| Total number of sample stocks is 104. Announcement indicates the release of the circular by NSE to announce the availability of a specified stock for trading in futures segment Actual listing indicates the day on which the stock is actually available for trading in futures segment Source: Author’s compilation |

||||||||||||

of heteroscadasticity in error terms, as the model assumes homoscadasticity.

Results of LM Test

Results of GARCH (1,1) and EGARCH (1,1) with Futures Dummy

The study further tests the presence of heteroscadasticity in error terms i.e. Auto Regressive Conditional Heteroscadasticity (ARCH) effects. Engle ARCH Lagrange Multiplier (LM) test reveals that 73 stocks have ARCH effects (around 70% of sample stocks) Table 2. Therefore, the study applies GARCH (1,1) model with derivatives dummy to address the problem of heteroscadasticity. The study further confirms that there is no destabilisation effects of SSFs, as only nine stocks out of 73 sample stocks (12.33%) at the time of announcement and twelve stocks (16.44%) at the time of actual listing exhibited increase in spot volatility Table 3. The spot market of around 50% of the stocks (36 out of 73 stocks) saw significant volatility decline after the announcement and listing. Coefficient of dummy variable has been insignificant for the rest of the stocks, indicating that there has been no change in volatility.

| Table 2 Summary Of Results Of Lm Test For Arch Effects |

|

|---|---|

| ARCH Effects Observed | 73/104 = 70% approx |

| Source: Author’s compilation | |

ARCH coefficient (β1) which is the coefficient of the lagged squared error term explains the impact of the news received at time t-1 on the changes in the stock price at time t. For daily data, it implies the impact of news (recent news) on today’s stock volatility. GARCH coefficient (β2) i.e. the coefficient of previous day’s volatility (ht-1) reflects the impact of old news (long memory shocks) on today’s volatility. If the sum of β1and β2 is close to unity, it indicates higher level of persistence. Statistically significant ARCH coefficient (β1) is an indication of effect of yesterday’s (recent) news on today’s price changes. Coefficient of ARCH(1) is positive and significant for 89% of stocks with ARCH effects Table 4. It implies that in case of 89% of the stocks, recent news positively impacts current period’s spot volatility Truong et al. (2021) and no impact was observed for the rest of the stocks. Old news has positive impact on 57.53% of the stocks and negative impact on 4.11% of the stocks. For the remaining stocks, the impact of old news was not found at the time of announcement. For 63% of the stocks, positive impact of long memory shocks was found at the time of listing and no such impact was observed for the 33% of the stocks. Current period volatility was impacted by long memory shocks for 63% of the stocks after the listing, indicating that the impact is long lived. Sum of β1 and β2 is near to unity for majority of the stocks. This evidence suggests that market regulator needs to take necessary steps to curb perseverance of such long memory shocks and ensure the speedy discounting of information into stock prices.

| Table 3 Garch(1,1) And Egarch (1,1) Models |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Event | GARCH (1,1) | EGARCH (1,1) | |||||||||||

| Increase | % | Decrease | % | No change | % | Increase | % | Decrease | % | No change | % | ||

| Announcement | 9 | 12.33 | 36 | 49.32 | 28 | 38.36 | 3 | 4.11 | 6 | 8.22 | 64 | 87.67 | |

| Listing | 12 | 16.44 | 36 | 49.32 | 25 | 34.25 | 4 | 5.48 | 3 | 4.11 | 66 | 90.41 | |

Total number of sample stocks with ARCH effects is 73. % indicates percentage to all stocks with ARCH effect.

Announcement indicates the release of the circular by NSE to announce the availability of a specified stock for trading in futures segment

Listing indicates the day on which the stock is actually available for trading in futures segment

Source: Author’s compilation

| Table 4

No. Of Stocks With Significant Arch(1) And Garch(1) Terms |

|||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Event | GARCH (1,1) | EGARCH (1,1) | |||||||||||||||||||||

| ARCH (1) | GARCH (1) | EARCH (1) | EGARCH (1) | EGARCH a (1) | |||||||||||||||||||

| No. | % | No. | % | No. | % | No. | % | No. | % | ||||||||||||||

| Announcement | Positive and Significant | 65 | 89.04 | 42 | 57.53 | 9 | 12.33 | 51 | 69.86 | 0 | 0 | ||||||||||||

| Negative and Significant | 0 | 0.00 | 3 | 4.11 | 5 | 6.85 | 4 | 5.48 | 0 | 0 | |||||||||||||

| Not Significant | 8 | 10.96 | 28 | 38.36 | 59 | 80.82 | 18 | 24.66 | 73 | 100 | |||||||||||||

| Listing | Positive and Significant | 66 | 90.41 | 46 | 63.01 | 9 | 12.33 | 49 | 67.12 | 0 | 0 | ||||||||||||

| Negative and Significant | 0 | 0.00 | 3 | 4.11 | 7 | 9.59 | 5 | 6.85 | 0 | 0 | |||||||||||||

| Not Significant | 7 | 9.59 | 24 | 32.88 | 57 | 78.08 | 19 | 26.03 | 73 | 100 | |||||||||||||

| ARCH (1) term is squared error term which represents recent news GARCH (1) term is previous period volatility which represents old news i.e. long memory shocks Announcement indicates the release of the circular by NSE to announce the availability of a specified stock for trading in futures segment Listing indicates the day on which the stock is actually available for trading in futures segment No. indicates the number of stocks with positive, negative and insignificant % indicates percentage of stocks out of total stocks Source: Author’s compilation |

|||||||||||||||||||||||

The GARCH (1,1) model assumes equal impact of positive news and negative news on the volatility. In practice, negative news is likely to result in more volatility than positive news, which is termed as leverage effect or asymmetric effect. To test the asymmetric effect, the study employs EGARCH(1,1) model. Negative and significant value of the coefficient γ indicates that volatility increase with negative return. Negative return due to bad news results in more volatility than positive return caused by good news. The negative and significant coefficient (γ) indicates the presence of asymmetric (leverage) effect. Application of EGARCH (1,1) model reveals that none of the sample stocks has reported asymmetric effect, as coefficient γ value of any stock is not significantly negative. The study could not find any change in volatility due to SSFs for around 87-91% of the stocks with ARCH effects. Thus, EGARCH model also provides evidence that SSFs do not cause any destabilisation effect (Detemple & Selden, 1991; Ross, 1989; Edwards, 1988; Pilar & Rafael 2002; Kumar & Mukhopadyay, 2007; Shenbagaraman, 2003; Malik & Shah, 2017). ARCH (1) term is not significant for approximately 80% of the stocks with ARCH effect. However, GARCH (1) term is significantly positive for around 67-70% of the stocks and significantly negative for approximately 25% of the stocks. Thus, EGARCH (1,1) model confirms the impact of large memory shocks on current period volatility. But, the model proves that the impact of recent news on volatility is negligible. As the study does not find leverage effect, it confirms the evidence provided by GARCH (1,1) model for 73 sample stocks with ARCH and presents the impact of current news and old news on current period volatility. The study confirms the results of OLS for the rest of 31 stocks, as they don’t have ARCH effects.

Table 5A and 5B presents further analysis of the agreement between the models in terms of the change in the behaviour of the stocks. There 25 common stocks between OLS and F test that exhibited decline in volatility and 41 common stocks have not shown any change in volatility after the announcement. Thus, 73.53% and 67.21% of total stocks that showed decline and no change in volatility as per OLS are in agreement with F test. When the study analyses the number of stocks which exhibited uniform behaviour as per OLS and GARCH (1,1) models, there have been 22 common stocks for which volatility declined and 18 common stocks for which volatility has not changed. This accounts for 61.11% and 64.29% of total stocks that showed volatility decline and stability respectively under GARCH (1.1) model. The findings are qualitatively same even after the listing of SSFs.

| Table 5A Number Of Stocks Exhibiting Common Behavior Under F Test And Ols |

|||||

|---|---|---|---|---|---|

| Announcement | |||||

| Common | F | % | OLS | % | |

| Increase | 0 | 0 | 0.00 | 9 | 0.00 |

| Decrease | 25 | 45 | 55.56 | 34 | 73.53 |

| No Change | 41 | 59 | 69.49 | 61 | 67.21 |

| Listing | |||||

| Common | F | % | OLS | % | |

| Increase | 0 | 0 | 0.00 | 11 | 0.00 |

| Decrease | 24 | 47 | 51.1 | 35 | 68.57 |

| No Change | 39 | 57 | 68.4 | 58 | 67.24 |

| Table 5B Number Of Stocks Exhibiting Common Behavior Under Ols And Garch (1,1) |

|||||

| Announcement | |||||

| Common | OLS | % | GARCH(1,1) | % | |

| Increase | 2 | 7 | 28.57 | 9 | 22.22 |

| Decrease | 22 | 27 | 81.48 | 36 | 61.11 |

| No Change | 18 | 39 | 46.15 | 28 | 64.29 |

| Listing | |||||

| Common | OLS | % | GARCH(1,1) | % | |

| Increase | 4 | 7 | 57.14 | 12 | 33.33 |

| Decrease | 22 | 25 | 88.00 | 36 | 61.11 |

| No Change | 17 | 41 | 41.46 | 25 | 68.00 |

| ‘Common’ indicates the number of stocks which exhibited common behavior under the two models being compared % indicates the percentage of stocks with common behavior out of total number of stocks with a specified behavior under a specified model Source: Author’s compilation |

|||||

Irrespective of the model applied, there is a strong evidence that SSFs do not cause any destabilization effect, rather they help reduce spot volatility for most of sample stocks (Skinner, 1989; Conrad, 1989, Detemple & Selden, 1991, Chen et al., 2013; Xie & Huang, 2014).

Conclusion

Volatility is a major concern for all stakeholders such as retail and institutional investors, fund managers, corporate, stock exchanges, regulators etc. The study provides evidence that SSFs do not result in any unwanted speculation and destabilization effect. Hence, the investors can gain confidence and shift to exchange traded instruments from traditional investments. Corporate can procure funds at lower rate due to the reduction in the perception of the investors, which can help maximise the shareholder’s wealth. However, the persistence of long memory shocks on current period volatility cautions that SEBI needs to take the necessary steps to ensure the faster dissemination of information in share prices and market efficiency.

References

Akgiray, V. (1989). Conditional heteroscedasticity in time series of stock returns: Evidence and forecasts. Journal of Business, 62(1), 55-80.

Indexed at, Google Scholar, Cross Ref

Antoniou, A., & Holmes, P. (1995). Futures trading, information and spot price volatility: Evidence for the FTSE-100 stock index futures contract using GARCH.Journal of Banking & Finance,19(1), 117-129.

Indexed at, Google Scholar, Cross Ref

Antoniou, A., Holmes, P., & Priestley, R. (1998). The Effects of stock index futures trading on stock index volatility: an analysis of the asymmetric response of volatility to news.Journal of Futures Markets: Futures, Options, and Other Derivative Products,18(2), 151-166.

Indexed at, Google Scholar, Cross Ref

Bandivadekar, S. & Ghosh, S. (2003). Derivatives and volatility on Indian stock markets. Reserve Bank of India Occasional Papers, 2(3), 187-201.

Bohl, M.T., & Stephan, P.M. (2013). Does futures speculation destabilize spot prices? New evidence for commodity markets. Journal of Agricultural and Applied Economics,45(4), 595-616.

Indexed at, Google Scholar, Cross Ref

Bollen, N.P. (1998). A note on the impact of options on stock return volatility. Journal of Banking & Finance, 22(9), 1181-1191.

Indexed at, Google Scholar, Cross Ref

Bollerslev T (1986). Generalized autoregressive conditional heteroscedasticity. Journal of Econometrics, 31(3), 307-327.

Indexed at, Google Scholar, Cross Ref

Bolgna, P., & Cavallo, L. (2002). Does the introduction of stock index futures effectively reduce stock market volatility? Is the'futures effect'immediate? Evidence from the Italian stock exchange using GARCH. Applied Financial Economics, 12(3), 183-192.

Indexed at, Google Scholar, Cross Ref

Bose, S. (2007). Contribution of Indian index futures to price formation in the stock market. ICRA Bulletin on Money and Finance, 3(1), 39-56.

Bose, S. (2007). Understanding the volatility characteristics and transmission effects in the Indian stock Index and Index futures market. ICRA Bulletin on Money and Finance, 3(1), 139-162.

Conrad, J. (1989). The price effect of option introduction. The Journal of Finance, 44(2), 487-498.

Indexed at, Google Scholar, Cross Ref

Cox, C.C. (1976). Futures trading and market information. The Journal of Political Economy, 84(6), 1215-1237.

Indexed at, Google Scholar, Cross Ref

Curran, E., Hunt, J., & Mollica, V. (2021). Single stock futures and their impact on market quality: be careful what you wish for.Journal of Futures Markets,41(11), 1677-1692.

Indexed at, Google Scholar, Cross Ref

Damodaran, A. & Lim J., (1991). The effects of option listing on the underlying stocks-return processes. Journal of Banking and Finance, 15(3), 647-664.

Indexed at, Google Scholar, Cross Ref

Debasish S.S. (2009). Effect of futures trading on spot-price volatility: Evidence for NSE Nifty using GARCH. The Journal of Risk Finance, 10(1), 67-77.

Indexed at, Google Scholar, Cross Ref

Detemple, J., & Jorion, P. (1990). Option listing and stock returns: An empirical analysis.Journal of Banking & Finance,14(4), 781-801.

Detemple, J., & Selden, L. (1991). A general equilibrium analysis of option and stock market interactions.International Economic Review, 32(2), 279-303.

Indexed at, Google Scholar, Cross Ref

Dyckman, T., Philbrick, D., & Stephan, J. (1984). A Comparison of event study methodologies using daily stock returns: A simulation approach.Journal of Accounting Research, 22(1), 1-30.

Indexed at, Google Scholar, Cross Ref

Edwards, F.R. (1988). Does futures trading increase stock market volatility?. Financial Analysts Journal, 44(1), 63-69.

Indexed at, Google Scholar, Cross Ref

Engle, R.F. & Ng, V. (1993). Measuring and testing the impact of news on volatility. Journal of Finance, 48(5), 1749-78.

Engle, R.F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation.Econometrica: Journal of the Econometric Society, 50(4), 987-1007.

Indexed at, Google Scholar, Cross Ref

Fama, E.F. (1965). The behavior of stock market prices. Journal of Business, 38(1), 34-105.

Indexed at, Google Scholar, Cross Ref

Fleming, J., Ostdiek, B., & Whaley, R.E (1996). Trading costs and the relative rates of price discovery in stock, futures, and option markets. Journal of Futures Markets: Futures, Options, and Other Derivative Products, 16(4), 353-387.

Indexed at, Google Scholar, Cross Ref

Freund, S.P., McCann, P.D. & Webb, G. P (1994). A regression analysis of the effects of options introduction on stock variances. The Journal of Derivatives, 1(3), 25-38.

Indexed at, Google Scholar, Cross Ref

Galloway, T.M., & Miller, J.M. (1997). Index futures trading and stock return volatility: evidence from the introduction of Mid Cap 400 index futures. Financial Review, 32(4), 845-866.

Indexed at, Google Scholar, Cross Ref

Gulen, H., & Mayhew, S. (2000). Stock index futures trading and volatility in international equity markets. The Journal of Futures Markets: Futures, Options, and Other Derivative Products, 20(7), 661-685.

Indexed at, Google Scholar, Cross Ref

Hetamsaria, N., & Deb. S.S. (2004). Impact of index futures on Indian stock market volatility: an application of GARCH Model. The ICFAI Journal of Applied Finance, 10(10), 51-63.

Indexed at, Google Scholar, Cross Ref

Hung, J.C., Liu, H.C., & Yang, J.J. (2021). Trading activity and price discovery in Bitcoin futures markets.Journal of Empirical Finance,62, 107-120.

Indexed at, Google Scholar, Cross Ref

Jubinski, P.D. & Tomljanovish, M. (2007). Options listing and individual equity volatility. The Journal of Futures Markets: Futures, Options, and Other Derivative Products, 27(1), 1-27.

Indexed at, Google Scholar, Cross Ref

Kamara, A., Miller Jr, T. W., & Seigel, A. F. (1992). The effects of futures trading on the stability of the S&P 500 Returns. The Journal of Futures Markets, 12(6), 645-658.

Kumar, K.K. & Mukhopadyay (2007). Impact of futures introduction on underlying Index volatility: evidence from India. Journal of Management Science, 1(1), 26-42.

Kumar, R., & Dhankar, R.S. (2017). Financial instability, integration and volatility of emerging South Asian stock markets.South Asian Journal of Business Studies, 6(2), 177-190.

Indexed at, Google Scholar, Cross Ref

Kumar, R., Sarin, A., & Shastri, K. (1998). The impact of options trading on the market quality of the underlying security: an empirical analysis.The Journal of Finance,53(2), 717-732.

Indexed at, Google Scholar, Cross Ref

Liu, S. (2009). The Impacts of index options on the underlying stocks: The Case of the S&P 100.The Quarterly Review of Economics and Finance,49(3), 1034-1046.

Indexed at, Google Scholar, Cross Ref

MacKinlay, A.C. (1997). Event studies in economics and finance.Journal of Economic Literature, 35(1), 13-39.

Malik, I.R., & Shah, A. (2017). The impact of single stock futures on market efficiency and volatility: A dynamic CAPM approach.Emerging Markets Finance and Trade,53(2), 339-356.

Indexed at, Google Scholar, Cross Ref

Mallikarjunappal, T., & Afsal, E.M. (2008). The impact of derivatives on stock market volatility: a study of the Nifty Index. Asian Academy of Management Journal of Accounting and Finance, 4(2), 43-65.

Manogna, R.L.,&Mishra,A.K.(2020). Price discovery and volatility spillover: an empirical evidence from spot and futures agricultural commodity markets in India.Journal of Agribusiness in Developing and Emerging Economies, 10(4), 447-473.

Indexed at, Google Scholar, Cross Ref

Mayhew, S., & Mihov, V. (2000) Another look at option listing effects, EconWPA, Finance Series 0004002, University Library of Munich, Germany.

Indexed at, Google Scholar, Cross Ref

Mazouz, K., & Michael, B. (2006). The volatility effect of futures trading: evidence from LSE traded stocks listed as individual equity futures contracts on LIFFE. International Review of Financial Analysis, 15(1), 1-20.

Indexed at, Google Scholar, Cross Ref

Mazouz, K., & Mike, B. (2004). The effect of CBOE option listing on the volatility of NYSE traded stocks: a time varying variance approach. Journal of Empirical Finance, 11(5), 695-708.

Indexed at, Google Scholar, Cross Ref

McKenzie, A.M., & Holt, M.T. (2002). Market efficiency in agricultural futures markets.Applied Economics,34(12), 1519-1532.

Indexed at, Google Scholar, Cross Ref

Muntanaveerakul, A., Tangjitprom, N., & Siwamogsatham, T. (2020). The impact of single stock futures on spot price volatility of underlying stock in the stock exchange of Thailand during 2006-2012.AU-GSB e-JOURNAL,13(2), 16-23.

Nath, G.C. (2003). Behaviour of stock market volatility after derivatives. (NSE Working Paper No. 19) Retrieved from National Stock Exchange of India (NSE).

Nelson, D. B. (1990). Stationarity and persistence in the GARCH (1, 1) model.Econometric Theory,6(3), 318-334.

Indexed at, Google Scholar, Cross Ref

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: a new approach.Econometrica: Journal of the Econometric Society, 59(2), 347-370.

Indexed at, Google Scholar, Cross Ref

Pati, P.C., & Rajib, P. (2010). Volatility persistence and trading volume in an emerging futures market- evidence from NSE Nifty stock index futures. The Journal of Risk Finance, 11(3), 296-309.

Indexed at, Google Scholar, Cross Ref

Pericli, A., & Koutmos, G. (1997). Index futures and options and stock market volatility.Journal of Futures Markets: Futures, Options, and Other Derivative Products,17(8), 957-974.

Indexed at, Google Scholar, Cross Ref

Pilar, C., & Rafael, S. (2002). Does derivatives trading destabilize the underlying assets? Evidence from the Spanish stock market. Applied Economics Letters, 2(5), 113-126.

Indexed at, Google Scholar, Cross Ref

Raju, M.T., & Karande, K. (2003). Price Discovery and Volatility on NSE Futures Market. SEBI Bulletin, 1(3), 5-15.

Ross, S.A. (1989). Information and volatility: The no-arbitrage martingale approach to timing and resolution irrelevancy. The Journal of Finance, 44(1), 1-17.

Indexed at, Google Scholar, Cross Ref

Shankar, R. L., Sankar, G., & Kiran, K. K. (2019). Mispricing in single stock futures: Empirical examination of indian markets.Emerging Markets Finance and Trade,55(7), 1619-1633.

Indexed at, Google Scholar, Cross Ref

Shenbagaraman, P. (2003). Do futures and options trading increase stock market volatility?. (National Stock Exchange Working Paper No. 60.

Simpson, G. W & Ireland, T. C (1982). The effect of futures trading on the price volatility of GNMA Securities. The Journal of Futures Markets, 2(4), 357-366.

Indexed at, Google Scholar, Cross Ref

Skinner, D.J. (1989). Options markets and stock return volatility. Journal of Financial Economics, 23(1), 61-78.

Indexed at, Google Scholar, Cross Ref

Stein, J.C. (1987). Informational externalities and welfare-reducing speculation. The Journal of Political Economy, 95(6), 1123-1145.

Indexed at, Google Scholar, Cross Ref

Tarique, J., & Malik, I.R. (2020). The impact of index futures on market efficiency and volatility of spot index: an empirical evidence from emerging economies (BRICS).Foundation University Journal of Business & Economics,5(2), 1-17.

Truong, L.D., Nguyen, A.T.K., & Vo, D.V. (2021). Index future trading and spot market volatility in frontier markets: Evidence from Ho Chi Minh Stock Exchange,Asia-Pacific Financial Markets,28(3), 353-366.

Indexed at, Google Scholar, Cross Ref

Xie, S., & Huang, J. (2014). The impact of index futures on spot market volatility in China. Emerging Markets Finance and Trade, 50(1), 167-177.

Indexed at, Google Scholar, Cross Ref

Received: 01-Jul-2022, Manuscript No. AAFSJ-22-12283; Editor assigned: 04-Jul-2022, PreQC No. AAFSJ-22-12283(PQ); Reviewed: 18-Jul-2022, QC No. AAFSJ-22-12283; Revised: 02-Aug-2022, Manuscript No. AAFSJ-22-12283(R); Published: 09-Aug-2022