Research Article: 2022 Vol: 28 Issue: 6

Do the Covid-19 Pandemic Affect Abnormal Returns of Stocks in Indonesia?

Muhammad Afdhal, Universitas Tadulako

Arung Gihna Mayapada, Universitas Tadulako

Sudirman Septian, Universitas Tadulako

Citation Information: Afdhal, M., Mayapada, A.G., & Septian, S. (2022). Do the covid-19 pandemic affect abnormal returns of stocks in Indonesia? Academy of Entrepreneurship Journal, 28(6), 1-8.

Abstract

The COVID-19 pandemic that occurred in 2020 to date in the world has had a negative impact on capital markets. Some of the largest stock market indices in the world had fell because the economy was deteriorating. The worsening of the economy could not be separated from the impact of policies taken by the government in breaking the chain of the spread of COVID-19, such as lockdowns. This study aims to determine and analyze the impact of lockdowns policies due to the COVID-19 pandemic on the abnormal return of stocks in the restaurant, hotel, and tourism sub-sector firms listed on the Indonesia Stock Exchange. This research is conducted by examining the periods before and after implementing government policies related to lockdowns, namely Large-Scale Social Restrictions in March 2020 and the Enforcement of Restrictions on Community Activities in January 2021. Abnormal returns of stocks are calculated using the single index model method. The research data are analyzed using paired sample t-test. The results of this study reveal differences in abnormal returns between before and after the implementation of Large-Scale Social Restrictions at the beginning of the spread of COVID-19 in Indonesia in 2020. However, this study reveals no difference in abnormal returns between before and after the Enforcement of Restrictions on Community Activities in 2021. These results indicate that investors in the restaurant, hotel, and tourism sub-sector were only reactive in the initial period of the spread of COVID-19 in Indonesia.

Keywords

Abnormal Returns of Stocks, Covid-19 Pandemic, Lockdowns Policy, Restaurant, Hotel, Tourism, Capital Market.

JEL Classifications

E60, G18, L83, Z33.

Introduction

The capital market is one of the wheels of a country's economy, which functions as a means of business funding to obtain funds from the investor community, both in stocks, bonds, and mutual funds (Kusnandar & Bintari, 2020). The public can invest the funds they own according to the characteristics of each instrument's benefits and risks. The capital market never skips the information presented on the stock market, and it is not uncommon that the information presented on the stock market affects price levels, stock returns and can even trigger high abnormal returns, which can affect the level of market efficiency (Susianti & Rahmawati, 2020).

Unreasonable market efficiency causes the capital market to no more extended display the actual economic condition. There is no guarantee of the correctness of the data presented because it is formed on conditions that do not come from actual information (Susianti & Rahmawati, 2020). As one of the several essential instruments in an economy, the capital market can quickly be affected by environmental conditions, both economic and non-economic. Although the non-economic environment's influence is not directly tied to the capital market dynamics, it cannot be separated from activities on the stock exchange (Lee & Setiawati, 2021). Some examples are related to non-economic environmental issues that can be the main cause of fluctuations in stock prices on the stock exchange, such as political events, environmental issues, acts of terrorism, disease, Monday effect, religious holidays, announcements of new stock launches, stock splits, elections for heads of state/regions, and events that have an impact on the national economy (Lee & Setiawati, 2021; Susianti & Rahmawati, 2020).

At the end of 2019, the world was shocked by a virus known as coronavirus that first appeared in Wuhan, China. Coronavirus is a collection of viruses that can infect the respiratory system and can be transmitted from human to human after this is referred to as COVID-19. The first COVID-19 case in Indonesia occurred in early March 2020, which was announced directly by the President of the Republic of Indonesia, Joko Widodo, at the Presidential Palace. The widespread presence of COVID-19 in Indonesia and the world, known as the COVID-19 pandemic, has affected all sectors, including the finance market sector.

The impact of the COVID-19 pandemic cannot be separated from the government's efforts in almost all countries in the world that are implementing social restrictions or lockdowns. As a result, most economic activity is carried out through the house and even has to stop. For the first time in Indonesia, the lockdown policy was implemented on March 16, 2020, in the DKI Jakarta Province, called Large-Scale Social Restrictions (termed PSBB), and implemented almost all cities in Indonesia. In June 2020, the new normal adaptation was introduced, which was slightly more relaxed than the PSBB. The increase in cases of COVID-19 infection at the end of 2020 prompted the central government to re-enforce the lockdown with the term Implementation of Restrictions on Community Activities (named PPKM), which only is applied on the islands of Java and Bali.

One of the economic sectors hardest hit by the COVID-19 pandemic and the resulting policies are the hotel, restaurant, and tourism sub-sector. With the operational restrictions of specific business sectors due to PSBB and PPKM, hotels and tourist attractions must temporarily limit their business activities (Gunawan, 2020). Besides, the PSBB policy, which initially required people not to travel, impacted the drastic decline in the number of tourists. Meanwhile, due to the prohibition on eating on the spot in restaurants that operate due to PSBB and PPKM policies, the restaurant business relies only on take-away orders or food purchases through the online motorcycle taxi application. This situation cuts the restaurant sector's revenue and ends in restaurants' efficiency and closure ( Gunawan, 2020).

The economic turbulence situation faced due to the COVID-19 pandemic and current market uncertainty affects investor confidence in its financial performance. During the COVID-19 pandemic, many companies, including restaurants, hotel, and tourism companies, were forced to go out of business or even manipulate reported profits to maintain investor confidence and fulfill debt agreements with creditors (Albitar et al., 2020). COVID-19 caused the stock prices to decline, especially after WHO declared that COVID-19 was a pandemic (AlAli, 2020).

Based on the background, the researcher is motivated to know whether there is a difference in the abnormal return of stocks before and when the PSBB and PKKM policies are implemented in the restaurant, hotel, and tourism sub-sector firms listed on the Indonesia Stock Exchange. This study's results contribute to help investors make investment decisions and serve as a reference for future policymaking related to the capital market.

Literature Review

Campbell and Kracaw (1980) state that the signaling theory states how a firm should provide a signal to users of financial statements, namely in the form of information disclosed by management. Jogiyanto (2010) revealed that the information published by management would provide a signal for investors and creditors to make decisions. A signal is an action taken by company management that provides investors instructions about how management views the company's prospects. When the information has been disclosed to the public, market players will interpret and analyze it as a good signal or a bad signal.

Abnormal return is the difference between the actual return and the expected return (Kusnandar & Bintari, 2020). Abnormal return is an indicator that can be used to see the current capital market situation. Information can be of value to investors if the information reacts to conducting transactions in the capital market (Jogiyanto, 2010; Kusnandar & Bintari, 2020 ). Abnormal returns usually occur around the announcement of an event, for example, including mergers and acquisitions, dividend announcements, announcements of productive companies, lawsuits, increased interest rates, and others.

To reduce the number of positive confirmed cases of COVID-19 in Indonesia, the government issued a policy to deal with the COVID-19 pandemic. One of them is Large-Scale Social Restrictions (termed PSBB), regulated by Government Regulation Number 21 of 2020 concerning Large-Scale Social Restrictions in the Context of Accelerating Handling Corona Virus Disease 2019 (COVID-19). Large-Scale Social Restrictions (termed PSBB), which are described in Law No. 6 of 2008 concerning Health Quarantine Article 1 Paragraph (11) states as follows: "Large-scale Social Restrictions are restrictions on certain activities of residents in an area suspected of being infected with a disease and/or contamination in such a way as to prevent the possibility of spreading disease or contamination."

Together with related parties and traditional villages, the local government issued policies and firm steps to make residents apply high social discipline, work from home, study from home, worship at home, and limit their activities mobility outside the home, as well as closely monitoring residents who come in and out of cities/regencies and villages. Thus, the implementation of the PSBB can change individual productivity through institutional changes and structural transformations that occur in society during the implementation of the PSBB.

After the termination of the PSBB, which was followed by the introduction of adaptation to new habits in Indonesia, on January 11, 2021, the Indonesian government again officially stipulated the Policy on the Enforcement of Restrictions on Community Activities (termed PPKM) specifically for the Java and Bali regions to suppress positive confirmed cases of COVID-19 which were increasing in early 2021. PPKM regulations include limiting employees' capacity in offices and online learning systems. Meanwhile, essential sectors such as health, food needs, and others continue to operate ( Feng & Yu, 2021). However, the restaurant is still limited in service.

Well-developed tourism industry will encourage the development of other economic activities, such as lodging/hotels (accommodation), food and beverages (bars and restaurants), tourist transportation (tourist buses), tour operators, handicraft industry (souvenir shop), guide (guiding and English course), educated staff (academy of tourism), telecommunication including information technology, and entertainment. Indonesia is one of the countries with the most and varied tourism potential (Junaedi & Salistia, 2020). Several world heritage sites are located in Indonesia. Biodiversity makes Indonesia attractive for tourists, especially foreign tourists who come from urban areas. Therefore, tourism and related sectors are essential to the Indonesian economy through its multiplier effect (Sujai, 2016).

The COVID-19 pandemic has hit the hotel, restaurant and tourism industry hardly with a sudden, temporary and significant decline in income (Song et al., 2020). This fact is inseparable from government policies that must be taken regarding breaking the chain of the spread of COVID-19, namely travel restrictions, social distancing, and lockdown policies. However, the hotel, restaurant and tourism industry is highly dependent on human mobility (Yang et al., 2020).

Research related to the impact of certain events on abnormal returns has been studied by previous researchers in the world, such as Chaabouni (2017) who examined the impact of dividend announcements on stock returns in the Saudi Arabian capital market, Gumanti et al. (2018) who examined the impact of Airasia airplane accident on stock returns of travel and leisure companies in Malaysia, and Obradovi? and Tomi? (2017) who examined the impact of the United States presidential election on stock returns on the New York Stock Exchange.

The COVID-19 pandemic is one of the most essential and phenomenal events that have occurred in the world. Research conducted by Liu et al. (2020) stated that the capital market in the majority of countries affected by COVID-19 experienced a decline in performance after the virus outbreak. Göker et al. (2020) revealed that the sectors most affected by stock returns in the Turkish capital market are sports, tourism, and transportation. Singh et al. (2020) revealed that investors reacted negatively at the beginning of increasing positive confirmed cases of COVID-19 in the G-20 countries. The same thing was also found by Alam et al. (2020) who studied the Australian capital market, and Chowdhury & Abedin (2020) who studied the United States' capital market.

AlAli (2020); Kulal and Kumar (2020); Kusnandar and Bintari (2020); Lee & Setiawati (2021); Maneenop and Kotcharin (2020); Rori et al. (2021) reveal that investor reactions differ between events during the COVID-19 pandemic, such as when the first case's official announcement was confirmed positive for COVID-19, the announcement of a policy to prevent the spread of COVID-19, and so on. The results of the study Alam et al. (2020); Anh and Gan (2020) reveal that there is a difference between the abnormal return of stocks before and when the lockdown policy was implemented in India and Vietnam. Huo and Qiu (2020) also revealed that the capital market in China reacted positively when Wuhan was locked down. Chiappini et al. (2021) revealed that the pandemic lockdown in Europe and the United States had an impact on abnormal returns.

The paper aims to analyze the effect of lockdowns policies due to the COVID-19 pandemic to abnormal returns of stocks. The following hypotheses are formulated:

H1: There is a difference in abnormal returns of stocks between before and when the PSBB was enforced.

H2: There is a difference in abnormal returns of stocks between before and when the PPKM was enforced.

Research Method

This research uses quantitative data, which is sourced from secondary data. Secondary data in the form of share price data are obtained through the Indonesia Stock Exchange's official website (www.idx.co.id). This research approach uses the event study method, which measures the level of abnormal returns in a month (6 days) before and during the implementation of the PSBB in 2020 (February-March 2020 period) and PPKM in 2021 (December 2020-January 2021 period). This research population is all firms in the restaurant, hotel, and tourism sub-sector listed on the Indonesia Stock Exchange. The sample selection refers to the purposive sampling criteria to have complete data that the researcher needs. So, the total population is 38, with a sample of 23 companies.

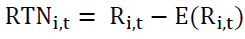

Abnormal returns of stocks in this study are calculated using the single index model method as used by Lee and Setiawati (2021); Susianti and Rahmawati (2020). The reason for using this method is that the single index model assumes that the price of a security fluctuates in the direction of the market price index (Jogiyanto, 2010). Thus, security returns are mutually correlated due to a general market value reaction (Adiningrum et al., 2016). Hypothesis testing techniques using paired sample t-test. The formula for knowing the selection between real return and abnormal return is as follows:

Information:

RTNi, t = Abnormal Return of the i-th security in the t-event period.

Ri, t = Actual return that occurs for the i-th security in the t-event period.

E (Ri, t) = Expected return of the i-th security in the t-event period.

This research's timing is the date of the announcement of the change in trading time for stock exchange transactions, namely March 16, 2020, for PSBB time and January 11, 2021, for PPKM time as t = 0. The event window period is divided into two, consisting of first t = -5 (5 days before PSBB/PPKM) and second t = + 5 (5 days after PSBB / PPKM). The event window period's determination is based on previous studies and to avoid confounding effects or information mixing.

Empirical Results

The analysis results on different tests using paired samples t-test indicate a significant difference between the abnormal return of stocks before and when the PSBB policy was implemented in Indonesia is shown in Table 1. This result is indicated by a significance value of 0.004 <0.05. These results support the first hypothesis and are in line with research (Alam et al. 2020 ; Anh & Gan, 2020; Huo & Qiu (2020); Rori et al., 2021).

| Table 1 The Result of Paired Samples T Test for PSBB | ||||

| T | Df | Sig. (2-tailed) | ||

| Pair 1 | Pre-Test - Post-Test | 2.927 | 114 | .004 |

Meanwhile, the different test results using the second paired sample t-test found no significant difference between before and when the PPKM policy was implemented in Indonesia. This result is shown in the significant value of 0.833> 0.05. This result rejects the second hypothesis and is in line with research Chiappini et al. (2021); Susianti and Rahmawati (2020), which reveal that lockdowns do not significantly impact changes in abnormal returns is shown in Table 2.

| Table 2 The Result of Paired Samples T Test for PPKM | ||||

| T | df | Sig. (2-tailed) | ||

| Pair 1 | Pre-Test - Post-Test | -.212 | 114 | .833 |

Discussion

This study indicates that the Indonesian government imposed a PSBB policy at the beginning of the COVID-19 pandemic, which significantly impacted the abnormal return of stocks in the restaurant, tourism, and hotel firms. The results of descriptive statistics show that the average abnormal return of stocks before the implementation of PSBB in Indonesia is higher than the average abnormal return of shares when the PSBB was implemented. This result means that the stock returns obtained by investors are more in line with the stock returns expected by investors before the implementation of the PSBB policy.

The PSBB policy is a policy taken by the Indonesian government to prevent the spread of COVID-19 in Indonesia at the beginning of its appearance period. This policy limits community activities outside the home, which impact national economic losses, including in the restaurant, tourism, and hotel sector (Hadiwardoyo, 2020). This situation has resulted in company revenue in the restaurant, tourism, and hotel sector decreasing drastically, as stated by Gunawan (2020); Hadiwardoyo (2020); Rori et al. (2021) stated that public demand has decreased due to restricted community movements. Therefore, investors reacted to the PSBB policy.

The results of this study verify the signal theory that companies provide signals to investors through financial statement information disclosed by management. The signal given will be one of the bases for investors' decision-making. A good signal will make investors react positively, and vice versa bad signal will make investors react negatively. This study indicates that the PSBB policy implemented by the Indonesian government makes investors in the restaurant, tourism, and hotel sector react negatively because the policy reduces the operating profit of that sector.

The PPKM policy implemented in early 2021 to control the significant increase in positive confirmed cases of COVID-19 in Indonesia has proven not to affect the abnormal return of stocks in the restaurant, tourism, and hotel companies. The empirical results show no significant difference between abnormal returns before and when PPKM is implemented. This result means that investors do not react significantly to PPKM policies which only apply in Java and Bali. This result is influenced by a part of the PPKM policy regulating that essential sectors such as health, foodstuffs, energy, communication, communication and technology, finance, logistics, hospitality, construction, and strategic industries as daily related to basic needs for communities can still operate 100% by regulating operating hours, capacities, and implementing more stringent health protocols. Besides, the PPKM policy was taken after previously the community was introduced to adapt to new normal activities, namely doing activities outside by always wearing a mask, washing their hands regularly, and always keeping their distance.

This study indicates that investors' reactions to an event do not last long and tend to be temporary. Chauhan and Kaushik (2017) revealed that stock price movements are influenced by rapid perceptual indicators that are influenced by various other factors such as company-specific factors and real-time industry-related issues. Therefore, investors reacted to different PPKM policies with the previous PSBB policy. Also, this PPKM policy tends to be more flexible than the PSBB policy in which tourist attractions are closed.

Conclusion

The results of this study reveal that the policies taken by the government regarding the COVID-19 pandemic have an impact on investors' reactions in the stock market. This study found that investors in the restaurant, tourism, and hotel sectors reacted negatively when the lockdown policy was implemented for the first time in Indonesia, known as the PSBB. However, after that, investors were no longer reactive to the following lockdown policy, namely PPKM, which was implemented after the new normal adaptation was implemented. This result shows investors are starting to have confidence in the restaurant, tourism, and hotel sector prospects after almost a year of the COVID-19 pandemic hit Indonesia. This result also implies that investors tend to react temporarily to good or bad news. These results can be used as input for regulators in formulating policies to tackle the COVID-19 pandemic that will not hurt the economy. Further researchers are suggested to examine the impact of the COVID-19 pandemic on the abnormal return of stocks by considering a country's institutional factors and economic recovery policies.

References

Adiningrum, T.R., Hidayat, R.R., & Sulasmiyati, S. (2016). The use of the single index model method in determining the optimal portfolio for 2012-2015 (Study on Stocks Listed in the Idx30 Index on the Indonesian Stock Exchange for the Period of February 2012-August 2015). Journal of Business Administration, 38(2), 89-96.

AlAli, M.S. (2020). Risk velocity and financial markets performance: measuring the early effect of covid-19 pandemic on major stock markets performance. International Journal of Economics and Financial Research, 64, 76–81.

Alam, M.N., ALAM, M.S., & Chavali, K. (2020). Stock market response during COVID-19 lockdown period in India: An event study. The Journal of Asian Finance, Economics, and Business, 7(7), 131-137.

Indexed at, Google Scholar, Cross Ref

Albitar, K., Gerged, A.M., Kikhia, H., & Hussainey, K. (2020). Auditing in times of social distancing: the effect of COVID-19 on auditing quality. International Journal of Accounting & Information Management.

Anh, D.L.T., & Gan, C. (2020). The impact of the COVID-19 lockdown on stock market performance: evidence from Vietnam. Journal of Economic Studies.

Campbell, T.S., & Kracaw, W.A. (1980). Information production, market signalling, and the theory of financial intermediation. The Journal of Finance, 35(4), 863-882.

Chaabouni, I. (2017). Impact of dividend announcement on stock return: A study on listed companies in the Saudi Arabia financial markets. Business and Management, 9(1), 1-13.

Chauhan, S., & Kaushik, N. (2017). Impact of demonetization on stock market: Event study methodology. Indian Journal of Accounting, 49(1), 127-132.

Chiappini, H., Vento, G., & De Palma, L. (2021). The impact of COVID-19 lockdowns on sustainable indexes. Sustainability, 13(4), 1846.

Chowdhury, E.K., & Abedin, M.Z. (2020). COVID-19 effects on the US stock index returns: An event study approach. Available at SSRN 3611683.

Feng, Y., & Yu, X. (2021). The impact of institutions on financial development: Evidence from East Asian countries. Australian Economic Papers, 60(1), 122-137.

Indexed at, Google Scholar, Cross Ref

Göker, I.E.K., Eren, B.S., & Karaca, S.S. (2020). The impact of COVID-19 (Coronavirus) on borsa istanbul sector index returns: A Case Study. Gaziantep University Journal of Social Sciences.

Gumanti, T.A.G.A., Savitri, E., Nisa, N.W., & Utami, E.S. (2018). Event study on the crash of Airasia plane: a study on travel and leisure companies listed at Malaysian stock market. Journal of Accounting and Finance, 20(1), 20-26.

Gunawan, R.A. (2020). The relationship between the Covid-19 pandemic and the stock prices of hotels, Restaurants and Tourism Sub-Sector Companies Listed on the IDX. Proceedings of Working Papers Series In Management, 12(2), 55-70.

Hadiwardoyo, W. (2020). National economic loss due to the Covid-19 pandemic. Baskara: Journal of Business and Entrepreneurship, 2(2), 83-92.

Huo, X., & Qiu, Z. (2020). How does China’s stock market react to the announcement of the COVID-19 pandemic lockdown? Economic and Political Studies, 8(4), 436-461.

Indexed at, Google Scholar, Cross Ref

Jogiyanto, H. (2010). Portfolio theory and investment analysis. Seventh Edition. BPFE. Yogyakarta.

Junaedi, D., & Salistia, F. (2020). The Impact of the Covid-19 Pandemic on the Capital Market in Indonesia. Al-Kharaj: Journal of Sharia Economics, Finance & Business, 2(2), 109-131.

Kulal, A., & Kumar, Y. (2020). Impact of coronavirus on indian stock market-an event study with reference to nifty 50.

Kusnandar, D.L., & Bintari, V.I. (2020). Comparison of abnormal stock returns before and after changes in trading times during the Covid-19 pandemic. Journal of Capital Markets and Business, 2(2), 195-202.

Lee, M.E., & Setiawati, L. (2021). Analysis of the impact of the corona virus announcement in indonesia in 2020 on abnormal returns and trading volume activity event study in companies listed at Lq45 on the Indonesia Stock Exchange. Indonesian Journal of Social Technology, 2(1), 92–103.

Liu, H., Manzoor, A., Wang, C., Zhang, L., & Manzoor, Z. (2020). The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health, 17(8), 2800.

Maneenop, S., & Kotcharin, S. (2020). The impacts of COVID-19 on the global airline industry: An event study approach. Journal of Air Transport Management, 89, 101920.

Obradovic, S., & Tomic, N. (2017). The effect of presidential election in the USA on stock return flow–a study of a political event. Economic Research 30(1), 112-124.

Indexed at, Google Scholar, Cross Ref

Rori, A., Mangantar, M., & Maramis, J.B. (2021). The capital market's reaction to the Announcement of Large-Scale Social Restrictions (PSBB) Due to Covid-19 in the Telecommunications Industry on the IDX. EMBA Journal: Journal of Economic Research, Management, Business And Accounting, 9(1).

Singh, B., Dhall, R., Narang, S., & Rawat, S. (2020). The outbreak of COVID-19 and stock market responses: An event study and panel data analysis for G-20 countries. Global Business Review, 0972150920957274.

Indexed at, Google Scholar, Cross Ref

Song, H.J., Yeon, J., & Lee, S. (2021). Impact of the COVID-19 pandemic: Evidence from the US restaurant industry. International Journal of Hospitality Management, 92, 102702.

Indexed at, Google Scholar, Cross Ref

Sujai, M. (2016). The strategy of the Indonesian government in attracting foreign tourist visits. Economics and Financial Studies, 20(1), 61-76.

Susianti, N., & Rahmawati, N. (2020). JII Stock Return Abnormal Pre-Post PSBB COVID-19. Journal of Enterprise and Development, 2(2), 38–46.

Yang, Y., Zhang, H., & Chen, X. (2020). Coronavirus pandemic and tourism: Dynamic stochastic general equilibrium modeling of infectious disease outbreak. Annals of Tourism Research, 83, 102913.

Received: 28-Sep-2022, Manuscript No. AEJ-22-9518; Editor assigned: 29-Sep-2022, PreQC No. AEJ-22-9518(PQ); Reviewed: 15-Oct-2022, QC No. AEJ-22-9518; Revised: 20-Oct-2022, Manuscript No. AEJ-22-9518(R); Published: 25-Oct-2022