Research Article: 2021 Vol: 25 Issue: 3

Do Zakat and Tax Payment Increase Islamic Organization Performance?

Agus Munandar, Fakultas Ekonomi dan Bisnis, Universitas Esa Unggul

Abstract

The purpose of this study is to investigate the impact of zakat and tax payment on the firm financial performance. The Motivation for this research is obligation for Islamic organization to obey the sharia law and rules of the country, by tax and zakat payment. Besides that, previous studies focuses on single country and conventional industries. Our sample comprises all islamic organization which discloses their zakat payment and tax payment for the period from 2007 to 2017. In contrast to previous study, this research using zakat payment as a islamic compliance indicator and tax payment as government compliance. Besides that, this study is cross country analysis. Our results indicate that highly zakat payment firms are more likely to increases their ROE and ROA. Also, highly tax payment firms are more likely to increases their ROE and ROA. Further, corporate charitable giving especially zakat and tax payment is important platform in increasing its corporate performance. Results of this study provide support to government especially tax department to considers about integration between zakat and tax in government law.

Keywords

Measurement, Zakat, Islamic Compliance, Taxes Payment.

Introduction

The Islamic industry continues to grow rapidly in the recent decades. The results of the study presented in the report of State of the Global Islamic Economy Report 2016/2017 explain that 172 survey participants confirmed that the Islamic economy is on an aggregate basis, for which 86% of respondents are optimistic related to the future prospects of the Islamic industry (Reuters, 2016). As an Islamic organization, it should consistently ensures their practice complies with the Islamic law. Corporate Charitable Giving defined as the act of institution donation to community and social. It will supports public benefits for community such as education, healthcare, and others (Godfrey, 2005; Wang et al., 2008). McGee (1998) stated that obligation to pay zakat is important thing due to supporting act for the poor and for the legitimate functions of government. In the Islamic compliance index, Vinnicombe (2010) indicated that zakat is the most important considerations for Islamic companies. Islamic literature shows that a taxes allowed if the amount raised by zakat is insufficient to cover costs of government. For that, Some research also shows that an integration between tax and zakat reporting is vital especially in Islamic capital markets (Noor et al., 2011).

Some research have attempted to examine the impacts of corporate charity on corporate performance (Brammer & Millington, 2008; Lev et al., 2009;Wang et al., 2008). However, the results of those study provide mixed evidence on impact of corporate charity on corporate performance (Brammer & Millington, 2008; Wang et al., 2008)). Consistent with value enhancement theory, Alqahtani et al. (2017) argued that corporate charity enhances and maximize shareholders value because it provide higher corporat reputaion. On the other hand, Based on agency theory, some research studies showed that corporate charity has negative impact on corporate performance because additional agency cost (Griffin & Mahon, 1997).

There has not been any research examining the association between corporate charity and firm performance using Islamic organization context. Since economic, ethic, social, and culture and firm-related factors are different, this study contributes to the current discussion by extending investigation on corporate charity especially in zakat and taxes expenses toward corporate performance (Seifert et al., 2003).

To the authors’ knowledge, there is no empirical research that has yet investigated on islamic industry and cross country. It has grown in recent decade with some contributions such as (Marty & Hunt-Ahmed, 2011; Mayes & Alqahtani, 2015; Noor et al., 2011). Several studies were conducted in the emerging countries (Chen & Lin, 2015) and in the developed countries (Brammer & Millington, 2008b; Seifert et al., 2004). Besides that, previous studies focus on single industry (Chen & Lin, 2015, Mayes & Alqahtani, 2015).

The organization of this paper is well developed as follows: the next section provides literature review and hypotheses development. In section 3, it discuss the design of research, variable measurement, and empirical models. The main results in section 4. In section 5 offers conclusion and avenue for future research.

As an Islamic organization, they have obligation for conduct their business within Shariah principles. For that, these companies have high pressure to ensure that their business are ethical and compasionate. Zakat payment can be broadly defined as mandatory Muslim actions who met the muzakki (zakat payers) requirements. It is designed to improve social conditions.Taxes are also a compulsory contribution for furthering social and increasing economic welfare of citizens. For moslem, obedience to islamic government is important because some verses told to obey Allah, the Messenger, and those in command among you.

“O you who believe, obey Allah, the Messenger, and those in command among you. If you disagree about something, refer it back to Allah and the Messenger, if you believe in Allah and the Last Day. That is the best thing to do and gives the best result. (Surat an-Nisa: 59)

Different with tax payment, zakat is calculated based on wealth (Siswantoro & Nurhayati, 2012). Based on different calculation method, high profit of corporate might lower zakat payment. In general, company zakat calculations method consist of two types, (1) Productive asset and (2) Net growing capital (Siswantoro, 2012). Payment of zakat and taxes is symbol of compassionate companies. In the non-Islamic organizations, previous research shows mixed results. (Chen & Lin, 2015) reveals that in Taiwan’s publicly traded hospitality companies, corporate charity can affect significantly on on return on asset (ROA) and return on equity (ROE). This finding consistent with value enhancement theory. This theory also supported by Wang et al., (2008) which reveals that corporate charity has positive association with corporate financial performance.

In addition, according to agency cost theory, corporate charity creates aditional cost between shareholder and managers (Brown et al., 2006). For that, some research shows that corporate charity could not significant impact on return on asset of corporate (Berman et al., 1999). This finding supported by (Griffin & Mahon, 1997) who found that no support corporate charity and return on asset or return on equity relationship.

Based on signaling theory, payment of zakat and taxes indicates that the institution has high liquidity of cash. Beside that, it shows that insitution have high charity to social. For that, high payment on zakat and taxes will produces interest for sharia customers that will lead to increase of corporate performance. This paper is the first study who extend the research about the impact corporate charity on firm financial performance in islamic industry. For that, this research contributes shedlight on the literature about the associaton between corporate charity and corporate performance in islamic industry. Although not consistent result in this relationship between corporate charity and firm performance, this study suggests hypothesis that,

H1a: Zakat payment has a positive effect on corporate financial performance.

H2a: Tax payment has a positive effect on corporate financial performance.

Data and Research Methodology

In this section, we introduce the proxies for corporate taxes, zakat and corporate financial performance in our study. The selection of corporate performance variables follows prior studies on corporate charity in Asia and Taiwan (Berman et al., 1999; Chen & Lin, 2015; Griffin & Mahon, 1997)

The Data

The sample was collected from Thomson Reuters database that covers all countries for the period from 2007 to 2017 (10 years). This study uses a sample of 602 islamic institutions in Sudan, Saudi Arabia, Qatar, Malaysia, and Kuwait. The total value of zakat and taxes at the end of each year for every company are retrieved from Thomson Reuters database on 31 Nov 2018. Accounting and financial data at the end of each year for every companies also collected from Thomson Reuters the for measuring corporate performance.

Variable Measurement

The degree of zakat and taxes engagement is measured using zakat and taxes scaled by total asset. This measurement measures levels of intensity of corporate charity. The variables of zakat and taxes measure each charity per dollar of assets, respectively: Returns on assets (ROA) and returns on equity (ROE) are commonly measures past performance of corporates (Brealey & Myers, 2002; Chen & Lin, 2015). These measurement indicates profit per dollar of assets and per dollar ofe quity. These proxies indicates profitability and quality of earning and management efficiency to create profits (Athanasoglou et al., 2008). Beside that, these measurements also appropriate for comparing profitability and quality of earning across different firms (Capon et al., 1990)

Control Variables

The control variables in this study are country (COUNTRY) and industrial specialties (INDUSTRI). It also used asset (ASSET) as a control variable. These control variables have been used in previous studies.

Empirical Design

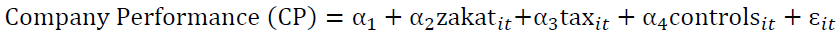

This study use regression design to test research hypotheses. The model is specified as follows.

This research using panel data for 10 years since 2009. In the equation model, α2 and α2 addresses the hypothesis (H1&H2). Both α should be significant suggesting that affect company performance (CP) affected significantly by zakat and tax (charitity giving of corporation). Beside that, sign of both α also important for considering the theoritical background. Theory of value enhancement suggets that both signs should positive. In contrast, agency theory indicates that both signs should negative.

Empirical Result

Summary of descriptive statistics in Table 1 present for variables characteristics of islamic firms. Looking at the ten-year average, the mean ten-year values for zakat payment and tax payment, respectively is also 0,5% and 1%.

| Table 1 Descriptive Statistic | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| Zakat | 606 | 0.0058491 | 0.0067876 | -0.0160079 | 0.0595012 |

| Taxes | 607 | 0.0116938 | 0.0148399 | -0.0345569 | 0.150379 |

| ROA | 607 | 7.439576 | 8.90605 | -17.35897 | 50.52611 |

| ROE | 603 | 12.11417 | 15.11543 | -44.01243 | 135.6135 |

| Asset | 607 | 2.35e+13 | 7.56e+13 | 1.46e+11 | 7.77e+14 |

Based on descriptive statistic for every country such as Bahrain, Kuwait, Malaysia, Qatar, Saudi Arabia, and Sudan. In Bahrain, there is only one company which is the sample in this research. Compare to means of full sample, the mean of zakat and taxes is lower. For zakat, the average of zakat payment in Saudi Arabia and Qatar is below full sample means. For Taxes, the average of taxes payment in Malaysia is above full sample means.

Table 2 presents correlation between variables. It reports insignificantly correlation between variables. For that, it is not a problem of multicollinearity. Note that the analysis of correlation shows the positive relationship between dependent variables and independent variables. The analysis consistent with hyphotesis and theory of enhancement which stated that corporate charity will improve their performance.

| Table 2 Correlation | ||||

| Zakat | Tax | ROA | ROE | |

| Zakat | 1.000 | |||

| Tax | 0.2870 | 1.000 | ||

| ROA | 0.3167 | 0.1254 | 1.000 | |

| ROE | 0.2979 | 0.1606 | 0.8816 | 1.000 |

Based on result of variance inflation factors (VIF) for measuring multicollinierity. Multicollinearity problem will increases the standard errors of the coefficients for some independent variables. It leads some variables statistically insignificant seems significant. The VIF value is below from 10 which inditate that it support previous inferrence that this model doesn’t have multicollinierity problem.

Based on regression results on primary tests in Tables 3 and 4 for the ten-year average tax payment and zakat payment for both ROE and ROA. Focus on H1 that examines the effect of zakat payment ROA and ROE, results strongly support H1 that zakat payment significantly increases ROE. In contrast, results shows that ROA doesn’t affected by zakat payment. It consistent with value enhancement theory that indicates corporate charity enhances and maximise shareholders value. It also indicates, this study supports previous study such as Brownet al. (2006) who argued that corproate charity has positive impact on performance of corporate.

| Table 3 Regression result for ROA | |||

| Variable | FE | RE | OLS |

| Zakat | 91.599748 | 91.599748 | 91.599748 |

| Taxes | 92.880719*** | 92.880719*** | 92.880719*** |

| LnAsset | 0 .64423561 | 0.64423561 | 0.64423561 |

| Country | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| legend: * p<0.05; ** p<0.01; *** p<0.001 | |||

| Table 4 Regression result for ROE | |||

| Variable | FE | RE | OLS |

| Zakat | 253.43395* | 253.43395* | 253.43395* |

| Taxes | 121.00671** | 121.00671** | 121.00671** |

| LnAsset | 0.27289255 | 0.27289255 | 0.27289255 |

| Country | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| legend: * p<0.05; ** p<0.01; *** p<0.001 | |||

For hypothesis 2 which examines the effect of tax payment ROA and ROE, Table 2 and 3 shows that tax payment has significant impact on ROA and ROE. Focus on H2, the results strongly support the hypothesis. For that, payment of zakat should enhances the value of corporate which indicated by value enhancement theory. For that, it is consistent with previous studies who support this theory such as Brown et al., (2006) who argued that corproate charity has positive impact on performance of corporate in Table 4.

Conclusion

This study examines the impact of charity corporate giving especially zakat and tax payment on corporate performance. This results shed light on charity literature and giving additional insight into how giving affects performance of corporate. This examination find that corproate performance is so sensitive to charity giving. For that, high payment of zakat will increase their ROE. It also support hypothesis 2 who indicates that tax payment will enhances their ROA and ROE.

This finding plays an important role in tax and zakat management; companies with optimal charity disbursement has high performance. For that, larger focus on zakat and tax also provides incentives for managements especially directors and CEOs to focus on corporate earning. This study findings makes several unique contributions to the study of the association between charity disbursement and corporate performance. By focusing on charity performance, it enhances measurement using zakat scales for islamic charity indicator. Scales and index is different because index based on compiling score from a variety statements and scales measure levels of intensity. Thus, scales is more reflect its chariti activity. Second contribution focusing on understanding of the charity effects on corporate performance. This findings allows make better understanding on how charity management affects what company may pursue, especially return.

References

- Alqahtani, F., Mayes, D.G., & Brown, K. (2017). Islamic bank efficiency compared to conventional banks during the global crisis in the GCC region. Journal of International Financial Markets, Institutions and Money, 51, 58-74. https://doi.org/10.1016/j.intfin.2017.08.010

- Athanasoglou, P.P., Brissimis, S.N., & Delis, M.D. (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money, 18(2), 121-136. Retrieved from https://ideas.repec.org/a/eee/intfin/v18y2008i2p121-136.html

- Berman, S.L., Wicks, A.C., Kotha, S., & Jones, T.M. (1999). Does Stakeholder Orientation Matter? The Relationship Between Stakeholder Management Models And Firm Financial Performance. Academy of Management Journal, 42(5), 488-506. https://doi.org/10.2307/256972

- Brammer, S., & Millington, A. (2008a). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal, 29(12), 1325-1343. https://doi.org/10.1002/smj.714

- Brammer, S., & Millington, A. (2008b). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal, 29(12), 1324-1343. https://doi.org/10.1002/smj.714

- Brealey, R.A., & Myers, S.C. (2002). Principles of corporate finance. Tata McGraw-Hill.

- Brown, W.O., Helland, E., & Smith, J.K. (2006). Corporate philanthropic practices. Journal of Corporate Finance, 12(5), 855-877. https://doi.org/10.1016/J.JCORPFIN.2006.02.001

- Capon, N., Farley, J.U., & Hoenig, S. (1990). Determinants of Financial Performance: A Meta-Analysis. Management Science. INFORMS. https://doi.org/10.2307/2632657

- Chen, M.H., & Lin, C.P. (2015). The impact of corporate charitable giving on hospitality firm performance: Doing well by doing good? International Journal of Hospitality Management, 47, 25-34. https://doi.org/10.1016/j.ijhm.2015.02.002

- Godfrey, P.C. (2005). The Relationship Between Corporate Philanthropy And Shareholder Wealth: A Risk Management Perspective. Academy of Management Review, 30(4), 777-798. https://doi.org/10.5465/amr.2005.18378878

- Griffin, J.J., & Mahon, J.F. (1997). The Corporate Social Performance and Corporate Financial Performance Debate. Business & Society, 36(1), 5-31. https://doi.org/10.1177/000765039703600102

- Lev, B., Petrovits, C., & Radhakrishnan, S. (2009). Is doing good good for you? how corporate charitable contributions enhance revenue growth. Strategic Management Journal, 31(2), n/a-n/a. https://doi.org/10.1002/smj.810

- Marty Martin, W., & Hunt-Ahmed, K. (2011). Executive compensation: the role of Shari’a compliance. International Journal of Islamic and Middle Eastern Finance and Management, 4(3), 196–210. https://doi.org/10.1108/17538391111166449

- Mayes, D., & Alqahtani, F. (2015). Underpricing of IPOs in Saudi Arabia and Sharia compliance. Journal of Islamic Accounting and Business Research, 6(2), 189–207. https://doi.org/10.1108/JIABR-12-2013-0042

- McGee, R.W. (1998). The Ethics of Tax Evasion in Islam: A Comment. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2691863

- Noor, R.M., Nik Mohd Rashid, N.M.N., & Mastuki, N. (2011). Zakat and tax reporting: Disclosures practices of Shariah compliance companies. In 2011 IEEE Colloquium on Humanities, Science and Engineering, CHUSER 2011. https://doi.org/10.1109/CHUSER.2011.6163862

- Reuters, T. (2016). STATE OF THE GLOBAL ISLAMIC ECONOMY REPORT 2016/17. Pediatrics International, 25(4), 335-341. https://doi.org/10.1111/j.1442-200X.1983.tb01709.x

- Seifert, B., Morris, S.A., & Bartkus, B.R. (2003). Comparing Big Givers and Small Givers: Financial Correlates of Corporate Philanthropy. Journal of Business Ethics. Springer. https://doi.org/10.2307/25075066

- Seifert, B., Morris, S.A., & Bartkus, B.R. (2004). Having, Giving, and Getting: Slack Resources, Corporate Philanthropy, and Firm Financial Performance. Business & Society, 43(2), 135-161. https://doi.org/10.1177/0007650304263919

- Siswantoro, D. (2012). The Need of Standardization of Individual Zakat Calculation in Indonesia. Tazkia Islamic Finance and Business Review, 7(1), 109–120.

- Siswantoro, D., & Nurhayati, S. (2012). Factors on Zakat (Tithe) Preference as a Tax Deduction in Aceh, Indonesia. International Journal of Management and Business Research, 03(01), 1-20. https://doi.org/10.15575/ijni.v3i1.133

- Vinnicombe, T. (2010). AAOIFI reporting standards: Measuring compliance. Advances in Accounting, 26(1), 55–65. https://doi.org/10.1016/j.adiac.2010.02.009

- Wang, H., Choi, J., & Li, J. (2008). Too Little or Too Much? Untangling the Relationship Between Corporate Philanthropy and Firm Financial Performance. Organization Science, 19(1), 143-159.