Research Article: 2021 Vol: 25 Issue: 3S

Does Corporate Governance moderate the relationship between Capital Structure and Financial Performance? New Insight from GCC Markets

Muhammad Sadiq Shahid, Bahauddin Zakariya University

Nadia Bajaber, King Abdulaziz University

Abstract

This study examined the impact of corporate governance practices on company performance in GCC countries. Data from 236 non-financial firms listed on GCC stock exchanges from 2015-2020 has been collected. In this study, taking into consideration the nature of panel data, Pooled OLS, fixed effects and Random effect methods were employed.

Findings indicates that corporate governance is significantly associated with industry-adjusted returns. Findings revealed that corporate governance has a significant impact on the financial performance of firms in GCC countries. We have also found that Board size, institutional ownership' and moderate the relationship between capital structure and financial performance of firms.

Further found that those firms which have strong corporate governance practices in terms of a board of directors and frequency of meetings perform well. Findings also show that a firm’s performance increases significantly in the presence of institutional ownership. We also documented that financial performance of firms improved after implementation of a corporate governance soft code. These findings suggest that internal and external coalitions interact with each other to influence the firm's conduct. This paper contributes to existing literature on factors that boost financial performance, particularly as regards the association between corporate governance and the financial performance of companies in GCC countries. The practitioners and managers are obliged to exercise greater caution in terms of policy making and risk managing, and this paper provides supporting evidence for this.

Keywords:

Corporate Governance, Financial Performance, Capital Structure, OLS and GCC

Introduction

The importance of corporate governance has become recognized worldwide because corporate governance mobilizes domestic savings and foreign portfolio investment (Younas et al., 2011). The development of corporate governance (CG) soft codes in developed and developing countries has escalated following the Sarbanes-Oxley Act (SOX, 2002). This growing consideration of corporate governance has also been followed closely by academics. However, the vast majority of corporate governance has adopted a financial and economics perspective, adopting an agency theory as the primary research mechanism (Biswas et al., 2008). However, numerous researchers have recently in the area of governance consider the assumptions of agency theory to be too narrow (Hassan, 2016) to identify and explain the size, structure and board’s roles in terms of the performance of various organizations (Roberts et al., 2005). However, Hermalin & Weisbach, (2003) point out that there is no single, wide-ranging theory to account for all the dimensions of corporate governance; therefore, there exists a need to examine corporate governance, particularly board-related research, through a multi-theory perspective.

Corporate governance has been regarded as an interesting topic of debate due to its significant contribution to company performance and the economic growth of a country. It also plays a vital role in a company’s survival, and the lack of good corporate governance is a major cause of failure for many firms, and it consequently fosters investor confidence. Especially, Ownership structure has the capability to diversify their investments and encourage the invested companies to pursue the projects with prospects. The impact of corporate governance on a company’s financial performance has attracted substantial academic interest over the last two decades. Practitioners concord that this impact constitutes a significant development in the field of corporate governance practices.

Currently, the focus of investigations related to corporate governance and capital structure has gradually moved away from conventional studies with the researcher directly examining the impact of corporate governance on firm performance, an approach which examines the impact of corporate governance reforms on company performance through a mediating mechanism such as board roles (Van Ees et al., 2009). It is discussed in literature, leverage is important for a firm to complete innovation and ensure the financial resources required to launch new products.

This study examines a model that is derived from the extensive literature and examines the impact of corporate governance reforms, such as the impact of board structure and size on company performance, by combining agency and resource-dependence theories. In current literature, there is a lacking of the determinants of board independence combining agency and resource dependence theories. According to Barroso, et al., (2014) the determinant of board independence has been seen as an important mechanism of shareholder representation and activism.

Good corporate governance practices reduce the risk for investors, enhance investor confidence about capital investment and improve the firm financial performance. The business organization needs financial resources to meet its objectives related to earning. The literature review identifies a research gap, which indicates that the direct relationship between corporate governance and company performance is ambivalent in oil-rich countries. This provides sufficient grounds for this study to examine the can corporate governance reforms mitigate the influence of Capital Structure on the Performance of firms in four Gulf Cooperation Council (GCC) emerging stock Markets. In particular, we examine the impact of CG mechanisms adopted by listed firms in the GCC, oil rich countries, with a special preference to family-controlled firms on their market value as measured by Tobin’s Q and market to book value. So, there is a need of exploring factors that may affect the capital structure and financial performance of the firm. Previous literature lacks in this context. There is no consensus, among researchers, on the factors affecting the firm performance. in both developing and developed markets. The objective of this study is to examine the influence of corporate governance practice on capital structure and profitability of firms focusing on GCC emerging stock markets.

The current study examined the following research objectives:

• To examine the relationship between corporate governance and firm performance in GCC countries.

• To examine the association between corporate governance, capital structure and profitability in GCC markets.

• To examine whether corporate governance moderates the relationship between capital structure and profitability in GCC markets.

• To develop recommendations for board members and policy-makers regarding their role in contributing added value to the firm overall.

Corporate governance is central element of a firm’s core values, and has a direct effect on the way a company is able to manage its relationship with its shareholders. The researchers have confidence that the highest standards of corporate governance are essential for business reliability, performance and sustainable growth in future. GCC countries are committed to having a sound corporate governance principles and practices (Bindabel et al., 2017; Abdullah et al., 2015; Hasan, 2011).

The GCC stock markets are also a major source of foreign investment capital: by 2021, GCC countries are expected to have over US$3.5 trillion in foreign direct investment holdings. Furthermore, the region is being positioned as a leading trading hub serving the Middle East, Africa and Southeast Asia. The pooled market capitalization of GCC stock exchanges increased 1.9% month-on-month to $1.03 trillion in January 2015 despite a fall in equities in line with oil prices (Global Investment House report, 2015). Moreover, the importance of this study, three GCC stock markets (Qatar, UAE and Saudi Arabia) top list of frontier markets with the best risk-adjusted outlook over the next two years (Bloomberg, 2015). The GCC markets are well positioned and the world's fastest growing markets with technological advancements materially impacting the development of its financial market infrastructure (The Asian Bankers, 2015). The increasing participation by retail investors, the record growth in market capitalization of select markets and emergence as a separate asset class have all contributed to the unique evolution of GCC’s financial markets (Asian Bankers, 2015). GCC stock markets are more liquid stock exchanges in the Middle East region, with no taxes on dividends or capital gains. These are major factors that enhance the confidence among foreign and local investors regarding investment decisions in the equity market.

The relationship between corporate governance practices, corporate capital structure decisions and firm performance in emerging markets has not received the same attention in the literature. There is a lack of harmony among researchers regarding the factors that influence the firm performance and capital structure decisions in both developing and developed markets. The limited researches that describe the corporate governance impact on capital structure decisions in emerging markets are reasons that have evoked the need for this research. According to our knowledge, the findings of this empirical study will not only fill this gap but also provide some groundwork upon which a more detailed evaluation could be based.

To extend this, this study explored the relationship between corporate governance and company performance. In addition, this study has developed an understanding of how the board structure, board size and the corporate board can strengthen the performance of firms in GCC countries. Furthermore, a model has been developed to investigate the impact of corporate governance on company performance, and it has tested the existing literature specifically by examining this relationship after the implementation of corporate governance reforms in GCC countries.

The original contribution of this study consists of three parts. Firstly, the role of the board has been found to be a partial mediator of the relationship between corporate governance and a company’s financial performance. Secondly, the study provides a piece of new knowledge and an in-depth understanding of board structure and its roles following the corporate governance reforms in GCC. It will be a first-hand quantitative study to examine corporate governance and its impact on the role of the board and company performance using data from GCC firms. Specifically, this study will contribute to the existing literature in several ways. This study has followed the Agency and resource dependence theory approach in order to demonstrate the facilitation of gender roles in the relationship between corporate governance and company performance. Secondly, this study has examined the effectiveness of corporate governance reforms in the context of oil-rich countries, and it thereby contributes both theoretically and empirically to the knowledge of boards’ structural changes and boards’ roles. From an empirical perspective, this study will contribute to the knowledge of boards of directors, their monitoring role and the relationship between the proportion of non-executive directors, the independence of the audit committee and company performance with respect to market measure. This study makes use of advanced empirical analysis techniques, to allow a richer interpretation of corporate governance across a sample of 236 firms in the non-financial sector in GCC markets. This is a first study used firm level data on GCC markets and covered the special event ‘‘Aab Spring’’(The Arab Spring was a series of anti-government protests, uprisings and armed revolutions that spread across the Middle East in early 2011). To some extent, these GCC firms believed in Islamic corporate governance. Meanwhile, we used techniques for efficiently conducting large scale empirical studies of corporate governance to mitigate the influence of capital structure on the firm performance that has been possible to date.

Literature Review and Theoretical Background

There exists a perception that poor corporate governance practices in emerging markets were the major reason for the economic crisis in 1997-98 in Asia. The existing literature indicates that weak corporate governance practices reduced companies’ performance during this crisis (Mitton, 2002, among others). Good corporate governance practice is a central component of a firm's core values, and this has a direct effect on the way a company can manage its relationship with stakeholders and shareholders particularly. The researchers have confidence that the utmost standards of corporate governance are essential for business reliability, company performance and sustainable growth in the future. GCC countries are committed to having sound corporate governance principles and practices.

According to Lewis (2005) point of view, corporate governance brings up the relationship between the corporation and its constituents. At the same, a question arises, who are the constituents of the corporation and why only constituents. Although, there is a strong point of view that conceptions having a broad corporate responsibility directive. While the relationship between conventional corporate governance notions is restricted. In contrast, Islamic corporate governance unavoidably has a wide range of constituents, with commitments extended to major stakeholders such as customers, brokers, competitors, employees and time-based needs of the Islamic community. The mandate and ethical underpinnings are clear, however, some challenges are in executing this vision (Lewis, 2005).

There is a wider debate on corporate governance and performance as regards companies that are run by professional managers, who may be unaccountable to disperse shareholders. It has been recognized that modern firms suffer from a problem centered on the separation of ownership and control. The issue is how to ensure that managers pursue the interests of shareholders. Agency theory offers a well-established view on corporate governance difficulties associated with dispersed owners (Van Ees et al., 2009). Therefore, agency theory was put forward by Jensen & Meckling, (1976) as an explanation of the nature and existence of the modern corporation in the context of self-interested managers whose decisions will not be in the best interests of the owners of the organization. Agency theory adopts a contractual approach, which states that managers or agents try to maximize their personal utility as compared to striving for the utility of principles in the context of the separation of ownership and control in the modern firm (Bhagat & Bolton, 2008). The principal is confronted with the problem of agency when the agent starts behaving in his own best interests, as opposed to the best interests of the principal. Biswas, et al., (2008) have described the agency problems like the costs needed to implement the mechanisms by the board on behalf of the shareholders in order to ascertain that their money is being used in their best interests.

In the existing literature, a direct linkage of corporate governance and performance was found; however, the empirical results reveal a lack of consensus regarding the relationship between corporate boards and firm performance (Xie et al., 2019; Pillai & Al-Malkawi, 2018; Bhagat & Bolton, 2008). Prettirajh (2017) evidence a positive relationship between the proportion of non–executive directors (NEDs) on board, and market-related performance measure of firm (Tobin Q).

A similar study by El Mehndi (2007) reported the same association between NEDs and company performance. Similarly, Gupta & Fields (2009) report that there is an average 1% net loss in the market value of a firm when a NED resigns from a firm. This suggests that the presence of NEDs on board will influence an organization to better align itself with its shareholders’ interests.

Although, the relationship between the dual role of CEO and a company’s financial performance calculated relatively better in avoiding duality as compared to practicing duality (Rechner & Dalton, 1991). The findings of a study by Dahya, et al., (1996) in the UK revealed that, when using a market-based measure of company performance (Tobin Q), the separation of the roles of the CEO and board chairperson was responded to positively by the market, and share prices went up. However, conversely, numerous studies have indicated that the practice of CEO duality has in fact a positive relationship with a company’s financial performance; these studies have clearly demonstrated that those companies practicing this dual role outperformed their non-dual (Kiel & Nicholson, 2003) among others. These scholars were of the view that this dual role encourages unity of command, and that decision-making consequently becomes more focused. A similar kind of study was conducted by Kyereboah-Coleman (2007), which found that when a CEO serves longer in a firm, this enhances his/her incentives to promote the interests of shareholders, apart from job security, the CEO is afforded the opportunity to witness the results of the decisions he/she has taken.

Numerous researches discover a adverse relationship between the independence of board committees and company performance. For example, Barbu & Bocean (2007) found a negative relationship, while Klein (2002) found that there is no relationship between the independence of the audit committee and company performance. Anderson, et al., (2004) argued that if a firm has entirely independent audit committees, then the cost of its debts will be lower. While Shahid & Abbas, (2019) found a positive relationship between corporate governance and firm investment which leads to investor confidence.

Ahmed & Lu, (2015) examined how the corporate governance structure affected firms’ earnings quality in China. This study provides evidence that firms with a higher control-ownership disparity showed lower profitability, the weak corporate governance structure of firms offered few obstacles against the controlling shareholders’ expropriation of minority shareholders. The weak corporate governance structures in developing countries permitted poorly managed firms to carry out operational activities with consequently inefficient capital resource allocation and extensive firm profitability (Tricker, 2015). This is a major issue because weak corporate governance enhances the value of non-performing loans and diminishes the financial sector. Thus, it might be beneficial to examine the policies that develop corporate governance systems at the country level, and thus support economic growth and stability.

There is a distinct effect of corporate governance systems on the adjustment speed of capital structure. According to Chang, et al., (2014) evidence, a weaker enforcement mechanism is the main hurdle in the execution of standard accounting practices in emerging markets. They have speculated that this may be due to a lack of investor protection laws, along with the poor implementation of the law through the courts, which makes it difficult for investors to maintain confidence in the capital markets.

The consequence of effective monitoring by independent directors includes the rejection of strategic plans that are high-risk in nature. Board members function through a mechanism of collaboration and control, and therefore they pay attention to monitoring in an agency role (Cohen et al., 2008). In addition, the wealth of shareholders can be maximized by reducing the systematic risk of a firm; all other things being equal, this effective, independent monitoring is associated with a lower risk. Likewise, large board size is more effective in terms of monitoring as compared to a smaller board size. Where directors have a large proportion of their personal wealth invested in a company, they can be expected to take less risky decisions.

It is assumed that corporate governance factors have a negative association with risk. However, riskier firms may require more effective governance practices. In previous studies, such as that by Brown & Caylor, (2004), it has been found that US companies with weaker governance had higher volatility and lower profitability and liquidity than other companies. Similarly, Ferreira & Laux (2007) found for US firms, with results being driven by the probability of a takeover, rather than other factors

A small number of researchers have examined the relationship between corporate governance and various risk types. Aguilera & Cuervo-Cazurra, (2009) concluded that governance structures worldwide changed after the implementation of corporate governance reforms. The adoption and development of corporate governance codes and regulations globally also paved the way for the corporate governance reforms in GCC countries. Previous studies are unable to prove the exact nature of this relationship. Therefore, practitioners are unsure whether the current wave of implementation of corporate governance reforms worldwide in the shape of either hard or soft codes will have a concrete impact on the field of corporate governance in general, and onboard roles specifically (Kang & Shivdasani, 1995; Bhagat & Black, 2001). Hence, following Spence & Rinaldi, (2014), it is necessary to evaluate the more linkage between board structure and firm performance through some intervening variable mechanism. However, in GCC countries, corporate governance reforms served as a push factor for companies to assume governance requirements. It is for this reason that this study will make a novel and timely contribution to the development of our understanding of board structure and board roles in the light of corporate governance.

The impact of governance codes on board structure and roles in the context of a global environment offers a strong foundation for advancing our theoretical understanding of governance codes and board structure beyond the boundaries of any single country. Akinyomi (2013) highlighted the relationship between board composition, structure, and size with corporate financial performance. Their arguments provide an insight into many factors that affect board roles, and they remind us that only a multi-theoretic perspective that examines the board structure and roles can provide a complete picture of the modern day board of directors.

Corporate governance has now emerged as an important area of research in Gulf economies, yet most of the studies have used one-year cross-sectional data, and few have used two years. Nor did they present a comparison of pre and post corporate governance law implementation effects on the corporate sector in Saudi Arabia. Overall, there is a gap in the literature regarding the development of governance codes in different countries and their impact on shaping board structure in order to foster board roles to achieve better financial performance. This further strengthens our motivation to conduct this research project. Corporate governance, in this context, offers numerous interesting insights, taking into account the factors of legal background, cultural diversity and regional location. Therefore, this topic is multidimensional and is governed by various sets of company laws, as well as by the recently-developed corporate governance reforms in GCC countries. Scrutinizing the relevant laws, along with CMA’s vision, offers a foundational perspective to understanding corporate governance structure. The CMA code has provided a mechanism for making boards more independent from the influence of top management through minimum limits on the presence of non-executive members, and by separating the role of CEO from that of the chairperson of the board.

Ibrahim (2006) examined the significance of Islamic corporate governance in the financial services sector. Furthermore, Ibrahim forecasts that the Islamic financial services sector likely to diverge from modern governance practices, and this sector need to have a homogeneous and specialized regional securities market to realize its true potential.

Bhatti & Bhatti, (2010) examined the legal issues associated with corporate governance in the Islamic finance industry based on a contractual pyramid. While they discussed the viability of the Islamic corporate governance model in a 21st-century corporate structure. In this study, the model employed is based on the institution of Hisba, which required appropriate bookkeeping, transparency and disclosure according to Islamic Shariah principles. Further, they suggest a model of Islamic corporate governance that brings together the objectives of Islamic Shariah law with corporate governance stakeholder model.

However, there is a debate that this model may be practical because of Shariah laws based on property and Islamic financial contractual rights. The article also discusses a model of Islamic corporate governance that consists of the codes stated by OECD and Islamic Shariah law. These types of corporate governance model encourage capital formation in GCC countries and also encourage judgment and transparency, which are all principles central to Shariah laws

The literature regarding corporate governance in the GCC countries is sparse, which is largely attributable to the lack of a research culture in academic and institutional areas in these countries. Therefore, this study strives to bridge this gap by outlining the corporate governance reforms introduced in these countries, and their impact on board roles in organizations as a result of structural changes in the board’s composition. The main objective of the study is to fill the knowledge gap in the literature by examining the relationship between corporate governance and company performance. In detail, this study takes a perspective from beyond a single theory, such as agency theory, to examine board structure characteristics and their relationship with company performance; it will discuss this relationship from multiple theoretical perspectives on role mediation. As the literature has indicated, the key finding is that there is a direct relationship between board structure and company performance; the research question is, how do board roles mediate this relationship, and what is the influence of corporate governance reforms in this relationship? Consequently, this study examines a specific model of the relationship between corporate governance and company performance. Furthermore, this study will examine the relationship between board structure characteristics and the factors that affect company performance through a multi-perspective approach.

This study seeks to make a number of new contributions to the knowledge of boards of directors. It will suggest that the central role of the board of directors is found to be a mediator of the relationship between a board’s structural characteristics and company performance. The review of the literature found a conventional, direct relationship of structure-performance of the corporate governance approach in general, specifically with regards to the board of directors.

Therefore, by combining two theoretical perspectives, this study argues that the board contributes a monitoring and resource allocation role. A critical contribution of this study is a more fully-specified and a richer model of the relationship between board structure and company performance as mediated by board roles within the context of GCC countries. The literature gap suggests that the research field of corporate governance urgently requires empirical research to provide insights into the “black-box” of board decision-making. Based on the literature on board roles, we can conclude that our study is novel in its setting to empirically demonstrate that changes in board structure after the corporate governance reforms strengthened the board’s roles in achieving better corporate financial performance. Organizations need such mechanisms through which they can establish and sustain strong boards to achieve success by incorporating both agency controls and resource dependence.

Al-Malkawi, et al., (2014) investigated the corporate governance practices in GCC firms listed on oil rich emerging stock markets. They found that GCC firms adhere to 69% of the characteristics reported in the CGI. Moreover, findings indicate that the companies listed in the UAE stock market exhibit the greatest adherence to the CG attribute examined in the study followed by Oman, Saudi Arabia, Qatar and Kuwait, respectively. We addressed the issue of board role providing an intervening mechanism within the relationship of board structure and company performance. Therefore, we have discussed board structure, board roles and company performance through the lens of agency and resource dependence perspectives. This study also provides valuable help to policymakers to progressively embed robust and specific governance practices. Especially, GCC policymaker considers board effectiveness and structural frameworks in order to ensure a sustainable quality of corporate governance practices in the GCC region. These issues will be fully integrated into the central arguments in the context of corporate governance reforms. In the literature, it was found that those boards larger in size are better able to attract more experienced and talented star directors to their organizations (Daily et al., 1999). However, in the literature, there exists no prior research on the impact of the audit committee’s diligence as regards the board’s roles (agency, resource dependence). Hence, the following hypotheses are operationalized in relation to the existing literature for analyzing the association between corporate governance, the capital structure and financial performance of GCC listed firms.

H1: There is a significant relationship between corporate governance and financial performance of GCC firms.

H2: There is a significant relationship between capital structure and performance of GCC Firms.

H3: Corporate governance moderates the relationship between capital structure and financial performance of GCC firms.

Research Methodology

This study uses a quantitative approach because it is believed that quantitative study is primarily concerned with establishing a causal relationship among theoretical constructs; in addition, it endeavors to establish that the results of a particular study can be generalized, regardless of the study location. This study uses reliable repository data of the annual reports of a company to test the model and hypotheses. The data is a panel in nature, and the researcher uses panel estimation techniques such as fixed effects and random effects. The sample of 236 firms was derived from the companies registered on GCC stock exchanges. The major firms were selected from only four major sectors: oil, manufacturing, consumer goods and industrial. To qualify for the final sample, a firm has to fulfill the following decisive characteristics:

(1) the company’s full six annual reports, from 2015-2020 inclusive, must be available because the researcher has built up a special data set for comparison to judge the performance of firms.

(2) Corresponding six year information must available to compute Tobin Q.

The sample data collected from annual reports to manually extract the corporate governance data for several reasons despite the existence of other means by which companies can disclose timely corporate governance information and annual report disclosures of the data are positively associated with the magnitude of the disclosure provided through alternative media (Botosan, 1997). Therefore, annual reports may be considered as reliable sources of corporate information and firm performance.

Measurements of Variables

This study used two distinctive measurements of financial performance (ROA & Tobin’s Q) as dependent variable following Klapper & Love, (2004); Guest (2009). These represent the accounting and market measures, respectively. The decision to use these specific measures of financial performance is motivated by the literature, which suggests that management and investors (outsiders) value corporate governance differently (Black et al., 2006). Therefore, accounting measure of performance (ROA) endeavor to enclose the wealth effects of corporate governance mechanisms from the perspective of a company’s management; by contrast, the market measure of performance (Tobin’s Q) epitomizes investors’ financial valuation of corporate governance structures. Therefore, the use of two measures signifies an attempt to investigate the robustness of the results against both accounting and market-based measures of financial performance.

ROA

This may be calculated as the book value of operating profits divided by the book value of total assets at the end of a financial year (Guest, 2009). This instrument measures how efficiently a firm utilize assets to generate earnings (Ross et al., 1998).

Tobin Q

This is a financial performance measure, defined as the market value of equity plus the book value of total assets, minus the book value of equity, divided by the book value of total assets at the end of a financial year (Beiner et al., 2006). This is a secondary measurement of financial performance of firm which is a proxy for market valuation of the quality of a firm’s corporate governance. The use of a control (omitted) variable is vital in any study, because omitting an important variable may bring biased results (Black et al., 2006). Therefore, following control variables, firm size, directors’ shareholdings and industry dummies are added in the analysis to boost the results of main variable.

Research and Development Ratio (R&D)

Theoretically, those firms who invest more in the field of innovation through enhanced products and services should gain competitive advantages (Barbu & Bocean, 2007) and gain premium prices for their shares in the market in order to maximize the wealth of their stockholders (Jermias, 2007). Therefore, the proxy R&D ratio is found by dividing capital expenditure to total sales (Capex) by following the relevant prior literature.

Leverage (LEV)

This variable is measured in the same way as by Rajan & Zingales, (1995). This measure is based on the book value of loans, and we use the book value of loans in the current study because the payment of debts is dependent upon the book value of loans (Banerjee et al., 2000). In addition, the capital structure of firms in developing countries is primarily based on short-term debt. For these reasons, we adopt the book value of loans.

Firm Size (SIZE)

This is a proxy measured as a log of total sales, following the method of previous researchers (Titman & Wessels, 1988; Frank & Goyle, 2009). It is expected that a positive relationship will be evident between size and company performance.

Corporate governance practices are different from firm to firm, because due to contrasting ownership levels and the varying complexity of operations (Lim et al., 2007). The external environment affects different industries differently. The prior literature on corporate governance proposed that industry dummies can use to control industry-specific effects (Beiner et al., 2006).

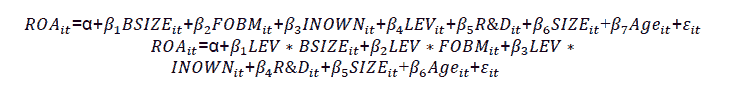

In this study, the independent variables consist of various board structural characteristics as a mechanism of corporate governance. Those measured are mediating variables, with the board control role measured as the frequency of board meetings (FOBM). Contrastingly, the board resource dependence role is measured by board size (BSIZE), computed as the total number of directors working in board of a company at end of accounting year. The consequence of corporate governance measures on firm performance can be evaluated by employing the following panel methods:

Alternative Financial Performance Measures

Where, ROA= financial performance of firm; TQ= financial performance of firm; BSIZE=Board size of firm; FOBM = Frequency of Board meetings of firm; INOWN=Institutional ownership; LEV =debt ration of firm; R&D =R&D ratio of firm; SIZE = Size of firm; Age= age of firm; ε = Error Term.

Results and Discussion

This section observes how corporate governance can influence the financial performance of firms in GCC countries. In addition to corporate governance, the performance of firm can be subject to various other attributes, such as firm size, industry, financial structure and yearly effects, etc. Controlling other factors, we examined impact of BSIZE, FOB and institutional ownership on financial performance.

Descriptive results of all variables are presented in table. The mean value of board size of the firms is 8.5 for Kuwait, and the minimum is 6.30 for Omani firms. The mean value of frequency of board meetings (FOBM) is 3.96 for Qatar, and the minimum is 2.50 for Saudi Arabia respectively. On average, financial performance (ROA) is a 4.85% maximum for Saudi Arabia and 3.47% for Kuwait, while the accounting financial performance measure (Tobin Q) is 1.34 for Qatar and 0.44 for UAE. These results show that firms with smaller board size have a better performance because a larger board size have lower levels of net profits. Similarly, firms with higher FOBM performed better and financial performance be improved; because firm protect right of stakeholders with more connection. as shows in Table 1.

| Table 1 Descriptive Statistics Of All Data 2015-2020 |

||||||||

|---|---|---|---|---|---|---|---|---|

| Roa | T Q | Lev | Fobm | R&D | Bosize | Size | ||

| Saudi Arabia | ||||||||

| Mean | 4.851 | 0.883 | 0.674 | 2.503 | 1.607 | 6.708 | 1.239 | |

| Median | 1.293 | 0.35 | 0.458 | 1.974 | 0.673 | 4.406 | 0.564 | |

| Std. Dev. | 0.749 | 0.092 | 0.14 | 0.869 | 0.984 | 0.97 | 0.285 | |

| Bahrain | ||||||||

| Mean | 3.128 | 0.794 | 0.718 | 3.694 | 1.958 | 7.607 | 1.058 | |

| Median | 1.49 | 0.558 | 0.616 | 2.106 | 1.054 | 3.106 | 0.564 | |

| Std. Dev. | 0.694 | 0.867 | 0.349 | 0.678 | 0.946 | 1.108 | 0.489 | |

| Kuwait | ||||||||

| Mean | 3.471 | 1.309 | 0.489 | 2.605 | 1.459 | 8.503 | 1.437 | |

| Median | 1.396 | 0.559 | 0.365 | 2.078 | 0.878 | 5.405 | 0.865 | |

| Std. Dev. | 0.748 | 0.962 | 0.148 | 0.066 | 0.087 | 0.976 | 0.389 | |

| Oman | ||||||||

| Mean | 3.745 | 0. 856 | 0.515 | 3.805 | 1.659 | 6.308 | 1.439 | |

| Median | 1.294 | 0.558 | 0.346 | 2.107 | 0.896 | 3.204 | 0.908 | |

| Std. Dev. | 1.049 | 0.819 | 0.078 | 0.678 | 1.108 | 0.167 | 0.087 | |

| Qatar | ||||||||

| Mean | 2.819 | 1.345 | 0.494 | 3.967 | 2.106 | 6.604 | 1.408 | |

| Median | 1.107 | 0.796 | 0.287 | 1.906 | 1.107 | 3.009 | 0.806 | |

| Std. Dev. | 0.096 | 0.849 | 0.348 | 0.389 | 0.918 | 1.018 | 0.217 | |

| United Arab Emirate | ||||||||

| Mean | 3.059 | 0.449 | 0.518 | 3.059 | 1.958 | 8.109 | 1.705 | |

| Median | 1.657 | 0.218 | 0.387 | 2.108 | 0.756 | 5.897 | 0.904 | |

| Std. Dev. | 0.598 | 0.037 | 0.446 | 0.895 | 0.195 | 0.736 | 0.281 | |

We applied a pairwise correlation matrix, all pair of variables are correlated to each others. Further results indicate that there is no multi-collinearity problem. as shows in Table 2. and Table 3.

| Table 2 Correlation Result Of Corporate Governance And Firm Performance |

||||||

|---|---|---|---|---|---|---|

| Country | Variables | Bsize | Fobm | Inow | Lev | Size |

| Saudi Arabia | Roa | 0.025 | 0.315 | 0.21 | 0.104 | 0.301 |

| Tobin Q | 0.035 | 0.203 | 0.107 | -0.057 | -0.069 | |

| Qatar | ROA | 0.017 | 0.101 | 0.284 | -0.069 | 0.439 |

| Tobin Q | 0.128 | 0.054 | 0.168 | 0.107 | 0.057 | |

| Bahrain | ROA | 0.121 | -0.014 | -0.192 | -0.102 | -0.357 |

| Tobin Q | 0.178 | 0.189 | 0.274 | 0.478 | 0.151 | |

| Kuwait | ROA | -0.274 | -0.109 | 0.086 | -0.147 | 0.189 |

| Tobin Q | 0.151 | -0.069 | 0.074 | -0.134 | 0.136 | |

| Oman | ROA | -0.023 | -0.164 | 0.24 | -0.17 | 0.121 |

| Tobin Q | 0.018 | 0.158 | 0.14 | -0.018 | 0.385 | |

| UAE | ROA | 0.115 | 0.035 | 0.181 | -0.061 | 0.165 |

| Tobin Q | 0.012 | 0.149 | 0.21 | -0.01 | 0.287 | |

| Table 3 Pooled OLS Results firm performance (Tobin Q) |

|||||||

|---|---|---|---|---|---|---|---|

| variable | Saudi | Qatar | Oman | Kuwait | Bahrain | UAE | Whole sample |

| BSIZE | 0.186** | 0.284** | -0.302 | -0.018 | 0.138 | 0.005*** | 0.108*** |

| (2.68) | (1.90) | (-1.46) | (-1.08) | (0.84) | (2.18) | (2.34) | |

| FOBM | 0.359 | 0.163** | 0.249 | -0.34 | -0.583** | -0.084 | 0.089*** |

| (0.98) | (1.82) | (2.38) | (-1.24) | (-1.73) | (-1.03) | (3.58) | |

| INOW | 0.508* | 0.374** | 0.369* | 0.402* | 0.33 | 0.019* | 0.018** |

| (1.69) | (2.09) | (1.96) | (2.38) | (0.85) | (3.67) | (2.16) | |

| LEV | -0.187 | -0.159* | -0.317 | -0.263 | -0.134** | -0.108** | -0.094*** |

| (-0.94) | (-1.89) | (-1.09) | (-0.63) | (-5.10) | (-2.01) | (-2.18) | |

| SIZE | 0.125*** | 0.068 | 0.027*** | 0.021*** | 0.031** | 0.020*** | 0.018*** |

| (3.44) | (0.53) | (3.51) | (2.86) | (2.35) | (5.44) | (5.15) | |

| R&D | 0.025*** | 0.037*** | 0.032** | 0.029* | 0.051** | 0.025*** | 0.037*** |

| (3.24) | (4.42) | (2.44) | (1.88) | (2.06) | (3.24) | (4.42) | |

| Age | 0.026*** | 0.284*** | 0.087*** | 0.082*** | 0.239** | 0.126*** | 0.318* |

| (3.44) | (3.56) | (2.45) | (7.06) | (8.16) | (5.21) | (1.58) | |

| Ind. Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-Square | 0.36 | 0.429 | 0.284 | 0.473 | 0.449 | 0.248 | 0.388 |

| F-value | 4.65 | 3.001 | 7.993 | 10.839 | 6.174 | 6.138 | 10.386 |

Results presented in tables 3 indicates that the relationship between corporate governance and firm financial performance (Tobin’s Q) is significant except in Kuwait; this indicates that high corporate governance practices lead to high financial performance. Furthermore, capital structure shows a significant relationship with firm performance. Overall, it is found that size and leverage have a significant relationship with firm performance, while research and development show a mixed and significant association. Further, the growth has a positive and significant impact on firm’s performance. The above findings are consistent with Abdullah, et al., (2011) findings. On the other hand, the results of leverage in both models indicate that leverage has a negative relationship with firm’ performance; which are also consistent with Abdullah, et al., (2011) findings. When leverage ratio increases then debts of the firm increases and as a result the firm has to pay high interest which directly affects corporate value and declines profitability

Corporate governance structures may differ in specific types of firms in different countries. For instance, private firms may have weaker (stronger) corporate governance structures. Further, results show a negative relationship between leverage and firm performance, which is according to the trade-off and pecking order theory. Since financing decision makers reflect a firm’s expected earnings as a debt shield (Mehran, 1992), the debt has an impact on risky firms. These findings are consistent with Subadar, et al., (2010); Ibhagui & Olokoyo, (2018), among others. However, well performed and more liquid firms generally add less debt in corporate capital structure. Among others, Lazzem & Jilani, (2018); Sarlija & Harc, (2012); Akdal, (2010); Lipson & Mortal, (2009) support the negative relationship between firm performance and leverage.

Findings suggest that to maximize shareholder value, institutional investors should consider limiting the controlling power of insider owners when developing their investment strategies. as shows in Table 4.

| Table 4 Moderating Results Of Cg Between Lev And Financial Performance (Tobin Q) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | Saudi Arabia | OMAN | Bahrain | |||||||||

| LEV | -0.370* | -0.096 | -0.316* | -0.320* | -0.49 | -0.109* | -0.082* | -0.036*** | -0.32 | |||

| (-2.01) | (-4.10) | (-1.83) | (-1.52) | (-0.48) | (-1.72) | -1.66 | (-6.20) | (-1.11) | ||||

| BSIZE*LEV | -0.086*** | -0.038 | -0.064* | |||||||||

| (-3.22) | (-0.38) | (-1.73) | ||||||||||

| FOBM*LEV | -0.490** | -0.062** | -0.078 | |||||||||

| (-2.50) | (-1.73) | (-1.91) | ||||||||||

| INOW*LEV | -0.118* | -0.160** | -0.092 | |||||||||

| (-1.66) | (-2.19) | (-0.03) | ||||||||||

| SIZE | 0.363* | 0.294* | 0.469 | 0.142*** | 0.108 | 0.246*** | 0.436 | 0.396 | 0.426 | |||

| (1.92) | (1.68) | (1.326) | (5.11) | (0.62) | (4.57) | (0.23) | (3.21) | (2.51) | ||||

| R&D | 0.198* | 0.217* | 0.130** | 0.126 | 0.096* | 0.027** | 0.108** | 0.092** | 0.204 | |||

| (1.62) | (1.77) | (2.09) | (1.04) | (1.55) | (1.63) | (1.73) | (1.84) | (1.41) | ||||

| Age | 0.317*** | 0.427*** | 0.325*** | 0.704** | 0.023*** | 0.020*** | 0.018*** | 0.027* | 0.021* | |||

| (9.77) | (5.97) | (5.65) | (2.53) | (5.27) | (5.44) | (5.5) | (3.51) | (2.86) | ||||

| Ind. Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |||

| Time Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |||

| R-Square | 0.279 | 0.495 | 0.274 | 0.49 | 0.276 | 0.493 | 0.46 | 0.43 | 0.503 | |||

| F-value | 1.538* | 1.636* | 1.530* | 1.637** | 1.53* | 1.63* | 3.68** | 5.36* | 6.00* | |||

| Variables | Qatar | Kuwait | Bahrain | |||||||||

| LEV | -0.158 | -0.086 | -0.164 | -0.289* | -0.302 | -0.529** | -0.149** | -0.184 | -0.126* | |||

| (-0.99) | (-1.37) | (-0.74) | -1.9 | (-0.34) | (-2.16) | (-3.44) | (-0.45) | (-1.55) | ||||

| BSIZE*LEV | -0.060** | -0.118* | -0.318** | |||||||||

| (-1.99) | (-1-65) | (-2.10) | ||||||||||

| FOBM*LEV | -0.219*** | -0.126 | -0.214 | |||||||||

| (-6.24) | (-0,99) | (-0.88) | ||||||||||

| INOW*LEV | -0.136* | -0.086** | -0.367** | |||||||||

| (-1.65) | (-4.55) | (5.11) | ||||||||||

| SIZE | 0.107 | 0.210*** | 0.590*** | 0.574** | 0.108*** | 0.308** | 0.474*** | 0.406* | 0.219 | |||

| (0.48) | (5.11) | (7.10) | (2.11) | (3.44) | (2.65) | (2.16) | (1.64) | (1.3) | ||||

| R&D | -0.279 | 0.307 | 0.286** | 0.218** | 0.246 | 0.549 | 0.496 | 0.428** | 0.301* | |||

| (-1.05) | (0.04) | (2.36) | (1.77) | (0.82) | (0.34) | (0.68) | (1.88) | (-1.92) | ||||

| Age | 0.062 | 0.014*** | 0.061 | 0.158** | 0.049 | 0.038 | 0.081 | 0.165* | 0.281** | |||

| (1.37) | (3.36) | (1.47) | (2.26) | (1.55) | (0.33) | (0.43) | (1.67) | (7.52) | ||||

| Ind. Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |||

| Time Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |||

| R-Square | 0.37 | 0.338 | 418 | 0.374 | 0.39 | 0.329 | 0.378 | 0.33 | 0.428 | |||

| F-value | 1.528* | 2.203* | 3.22 | 1.591* | 4.11 | 2.261* | 1.514* | 2.214* | 5.01 | |||

Further, we investigate weather corporate governance moderate the relationship between leverage and firm performance. We also add time and an industry dummy to record time and the sector’s effect. Results in table 5 show that corporate governance moderate the relationship between leverage and financial performance, results also indicate that board size seems to play a vital role in the financing decisions of firms in the way which can mitigate the impact of leverage on firm performance. The role of controlling can reduce agency problems (Pfeffer & Salancick, 1978); results are in support of Abor (2007) and among others. Similarly, moderating results of FOBM show a significant association between between leverage and financial performance (Tobin’s Q). Corporate governance and leverage are very important for a firm to complete innovation and ensure the financial resources required to launch new products, as results financial performance firm increased (Jiang & Kim, 2015).

Robustness Test

In literature, various robustness tests are performed to check heteroskedasticity and multicollinearity. So in our study, Following literature, we used ROA as alternative measure of financial performance to test the above issues. The results in 5 show a significant positive association between CG and firm performance, and negative between leverage and financial performance of firm, which is consistent with the results obtained from the primary tests shown in table 4). Further, we control for a potentially endogenous relationship between variable by using 2SLS technique, however results are largely consistent with Pooled OLS. as shows in Table 5. and Table 6.

| Table 5 Pooled Ols Results Firm Performance (Roa) |

|||||||

|---|---|---|---|---|---|---|---|

| Variables | Saudi | Qatar | Oman | Kuwait | Bahrain | UAE | Whole sample |

| Lev | -0.174* | -0.349* | -0.185* | -0.097* | -0.160* | -0.362* | -0.29 |

| (-1.77) | (-1.93) | (-2.00) | (-1.77) | (-1.62) | (-1.58) | (-1.44) | |

| Bsize | 0.156** | 0.270*** | 0.219*** | 0.352*** | 0.167 | 0.375* | 0.153*** |

| (7.96) | (2.45) | (3.65) | (2.55) | (1.34) | (1.88) | (-5.33) | |

| Fobm | 0.254* | 0.316** | 0.406*** | 0.496 | 0.259* | 0.163* | 0.314 |

| (1.63) | (1.88) | (7.11) | (1.99) | (1.88) | (1.76) | (3.44) | |

| Inow | 0.162* | 0.194*** | -0.572* | 0. 358** | 0.428* | 0.429* | 0.052*** |

| (1.91) | (5.44) | (1.73) | (2.31) | (1.75) | (1.94) | (6.22) | |

| Size | 0.126* | 0.146* | 0.374*** | 0.154 | 0.249*** | 0.258** | 0.139 |

| (1.84) | (3.12) | (3.66) | (1.16) | (3.12) | (2.16) | (0.84) | |

| R&D | 0.158 | 0.172* | -0.026* | 0.372* | 0.136* | -0.509* | 0.146) |

| (0.66) | (1.92) | (-1.83) | (0.06) | (2.66) | (5.02) | (0.09) | |

| Age | 0.015* | 0.031 | 0.017* | 0.186* | 0.281 | 0.308 | 0.142*** |

| (1.72) | (0.88) | (1.88) | (1.99) | (0.04) | (0.55) | (2.55) | |

| Ind. Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-Square | 0.293 | 0.369 | 0.274 | 0.496 | 0.374 | 0.33 | 0.41 |

| F-value | 1.450* | 1.741* | 1.536* | 1.639* | 1.510* | 2.216* | 5.100* |

| Table 6 Moderating Results Of Cg Between Lev And Financial Performance (Roa) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variables | Saudi Arabia | OMAN | Bahrain | |||||||

| Lev | -0.439* | 0.284* | 0.347** | -0.428** | -0.032* | -0.396 | -0.160* | -0.251 | -0.364 | |

| (-1.74) | (-1.89) | (-1.76) | (-3.11) | (-1.77) | (-0.66) | (-1.69) | (-0.38) | (-1.00) | ||

| Bsize*Lev | 0.029** | -0.174* | -0.184 | |||||||

| (-1.82) | (-1.92) | (-2.07) | ||||||||

| Fobm*Lev | -0.109*** | -0.049 | -0.143* | |||||||

| (-3.21) | (-1.66) | (-1.92) | ||||||||

| Iown*Lev | -0.304*** | -0.084 | -0.084** | |||||||

| (-3.66) | (-3.55) | (-4.32) | ||||||||

| Size | 0.126* | 0.089*** | 0.059* | 0.176* | 0.217** | 0.074*** | 0.236*** | 0.245 | 0.064 | |

| (2.23 | (3.45) | (1.82) | (1.55) | (2.56) | (5.22) | (6.10) | (0.42) | (0.61) | ||

| R&D | 0.153 | 0.138 | 0.260* | 0.049** | 0.029* | 0.204** | 0.184*** | 0.061 | 0.164* | |

| (0.06) | (0.86) | (1.63) | (1.99) | (1.84) | (4.28) | (6.33) | (1.47) | (1.71) | ||

| Age | 0.214** | 0.226 | 0.089 | 0.026 | 0.046 | 0.302 | 0.116 | 0.202 | 0.116 | |

| (2.11) | (0.29) | (0.94) | (0.73) | (-0.66) | (1.12) | (0.7) | (1.2) | (3.6) | ||

| Ind. Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Time Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| R-Square | 0.295 | 0.364 | 0.26 | 0.321 | 0.19 | 0.46 | 0.296 | 0.36 | 0.401 | |

| F-value | 1.456* | 1.740* | 1.650*** | 1.782** | 1.601* | 1.440* | 1.459* | 1.704* | 2.008* | |

| Variables | Qatar | Kuwait | Bahrain | |||||||

| -0.34 | -0.270* | -0.069 | -0.068** | -0.096* | -0.041** | -0.33 | -0.28 | -044*** | ||

| (-0.88) | (-1.63) | (-1.86) | (-2.66) | (-1.89) | (-2.47) | (-0.34) | (-0.88) | (-2.73) | ||

| BSIZE*LEV | -0.079** | -0.146** | -0.194 | |||||||

| (-1.92) | (-1.73) | (-0.82) | ||||||||

| FOBM*LEV | -0.108 | -0374* | -0.187 | |||||||

| (-1.05) | (-1.88) | (-3.48) | ||||||||

| INOWN*LEV | -0.104** | -0.109* | -0.244** | |||||||

| (-2.00) | (-1.88) | (-2.21) | ||||||||

| SIZE | 0.546 | 064*** | 0.244** | 0.164 | 0.138* | 0.204** | 0.327*** | 068*** | 0.108** | |

| (0.78) | (4.73) | (2.21) | (1.38) | (1.90) | (2.45) | (5.24) | (3.73) | (2,47) | ||

| R&D | 0.674* | 0.096** | 0.223** | 0.358** | 0.482* | 0.230** | 0.214* | 0.223** | 0.076 | |

| (1.81) | (5.22) | (2.32) | (2.09) | (6.77) | (5.32) | (7.15) | (2.32) | (0.36) | ||

| Age | 0.318 | 0.146*** | 0.130*** | 0.327** | 0.323** | 0.242 | 0.097*** | 0.087*** | 0.086*** | |

| (3.04) | (4.60) | (3.71) | (2.38) | (2.53) | (1.14) | (4.05) | (3.83) | (3.42) | ||

| Ind. Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Time Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| R-Square | 0.378 | 0.339 | 0.36 | 0.394 | 0.347 | 0.33 | 0.374 | 0.336 | 0.368 | |

| F-value | 1.514* | 2.218* | 5.210* | 3.814* | 2.541* | 2.281* | 1.517* | 2.210* | 3.218* | |

Conclusion

Institutional ownership and board structure are key force in capital markets. As institutional investors rapidly expand in emerging markets, their access to the stock markets has drawn increasing attention from both academics and policymakers. Therefore this paper provides a major contribution to the existing literature on corporate governance and its consequence on company performance. The novelty of paper is its use of a multi-theoretic perspective on corporate governance studies in the context of studies conducted in emerging markets. Conversely, study provides support to existing studies by providing evidence that corporate governance reforms can enhance board performance, better through their monitoring roles in order to achieve the goals of shareholders.

The results of the current study revealed the importance of the good corporate governance for managing the capital structure and financial performance of firm.This paper contributes to research on boards in several ways, specifically, as regards the influence of corporate governance reforms on shaping board structure. The induction of new board members with relevant professional backgrounds caused an increase in board size to work as board resource, as well as improving the monitoring capability of the board. Finally, offers thoughts on future research directions on company boards.

This study has the following limitations such as the sample size consisting of only non-financial sector firms registered on stock exchanges. This study used GCC countries’ data, and therefore its findings may be limited and not generally applicable to globally. Similar cross-country researches have same limitations due to existence of contrasting legal structures. Corporate governance is the process of controlling and monitoring the agency relations among the different stakeholders especially the managers and the shareholders. Good corporate governance is the source of increasing the value of the firm and the quality of the information used by all the stakeholders. However, researchers have acknowledged the transformations between the practices and mandatory corporate governance issues in the listed firms in both emerging and developed stock markets. Thus, corporate governance regulations should be rigorously directed in GCC countries. In addition, the economic, political and social/ cultural characteristics of the GCC countries should be reflected in their corporate governance policy frameworks. In our judgement, limited role of independent boards and committees in firm value, the same requirements for increasing composition of non-executive director to improve governance and monitoring effectiveness of firms. Because according to the agency theory when the managers will be the shareholders also then they can safeguard the rights of other shareholders as well.

Author Contributions:

All the authors contributed to the conceptualization, formal analysis, investigation, methodology, writing of the original draft, and writing review and editing. All authors have read and agreed to the published version of the manuscript.

Funding: This research received no external funding

Conflicts of Interest: The authors declare no conflict of interest.

References

- Aguilera, V., & Cuervo-Cazurra, A. (2009). Codes of good governance. Corporate governance. An international review, 17(3), 376-387.

- Akinyomi, J. (2013). Impact of board structure on corporate financial performance. International Journal of research in commerce, IT and Management, 3(6), 135-139.

- Al-Malkawi, N., Pillai, R., & Bhatti, I. (2014). Corporate governance practices in emerging markets: The case of GCC countries. Economic Modelling, 38, 133-141.

- Anderson, C., Mansi, A., & Reeb, M. (2004). Board characteristics, accounting report integrity, and the cost of debt. Journal of accounting and economics, 37(3), 315-342.

- Barbu, M., & Bocean, G. (2007). Corporate governance and firm performance. Management & Marketing-Craiova, (1), 125-131.

- Biswas, P.K., Bhuiyan, M., & Ullah, H. (2008). Corporate governance and firm performance: Theory and evidence from literature. Corporate Governance and Firm Performance: Theory and Evidence from Literature.

- Bhagat, S., & Bolton, B. (2008). Corporate governance and firm performance. Journal of Corporate Finance, 14(3), 257-273.

- Bhatti, M., & Bhatti, I. (2010). Toward understanding Islamic corporate governance issues in Islamic finance. Asian Politics & Policy, 2(1), 25-38.

- Bryman, A., & Bell, E. (2007). Business research methods, 2nd edition, Oxford: Oxford University Press

- Chang, K., Chou, K., & Huang, H. (2014). Corporate governance and the dynamics of capital structure: New evidence. Journal of Banking & Finance, 48, 374-385.

- Cohen, R., Krishnamoorthy, G., & Wright, M. (2008). Form versus substance: The implications for auditing practice and research of alternative perspectives on corporate governance. Auditing: A Journal of Practice & Theory, 27(2), 181-198.

- Dahya, J., Lonie, A., & Power, M. (1996). The case for separating the roles of chairman and CEO: An analysis of stock market. Corporate Governance: An International Review, 4(2), 71-77.

- El Mehdi, K. (2007). Empirical evidence on corporate governance and corporate performance in Tunisia, Corporate Governance: An International Review, 15(6), 1429-1441.

- Gollakota, K., & Gupta, V. (2006). History, ownership forms and corporate governance in India. Journal of Management history, 12(2), 185-198.

- Hasan, Z. (2011). A survey on Shari'ah governance practices in Malaysia, GCC countries and the UK: Critical appraisal. International Journal of Islamic and Middle Eastern Finance and Management, 4(1), 30-51.

- Hassan, M. (2016). Corporate governance under multi theoretical perspective. IBT Journal of Business Studies (JBS), 12(2).

- Ibrahim, A. (2006). Convergence of corporate governance and Islamic financial services industry: Toward Islamic financial services securities market. Graduate Paper Series, 3.

- Ibhagui, O.W., & Olokoyo, F.O. (2018). Leverage and firm performance: New evidence on the role of firm size. The North American Journal of Economics and Finance, 45, 57-82.

- Jensen, C. (1993). Modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance, 48(3), 831-880.

- Ji, X., Ahmed, K., & Lu, W. (2015). The impact of corporate governance and ownership structure reforms on earnings quality in China. International Journal of Accounting & Information Management.

- Jensen, C. & Meckling, H. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(1),305-360.

- John, K., & Senbet, L.W. (1998) Corporate governance and board effectiveness. Journal of Banking and Finance, 22(4), 371-403

- Kiel, C., & Nicholson, J. (2003). ‘Board composition and corporate performance: How the austrian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review, 11(3), 189-205.

- Kang, K., & Shivdasani, A. (1995). Firm performance, corporate governance, and top executive turnover in Japan. Journal of financial economics, 38(1), 29-58.

- Klein, A., (2002). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33(3), 375–400.

- Lynall, M.D., Golden, B.R. & Hillman, A.J. (2003) Board composition from adolescence, Academy of Management Review, 28(3), 416-431.

- Lazzem, S., & Jilani, F. (2018). The impact of leverage on accrual-based earnings management: The case of listed French firms. Research in International Business and Finance, 44, 350-358.

- Lewis, M.K. (2005). Islamic corporate governance. Review of Islamic Economics, 9(1), 5-29.

- Netter, J., Poulsen, A., & Stegemoller, M. (2009). The rise of corporate governance in corporate control research. Journal of Corporate Finance, 15(1), 1-9.

- Pfeffer, J., & Salancik, G.R. (2003). The external control of organizations: A resource dependence perspective. Stanford University Press.

- Pye, A., & Pettigrew, A. (2005) Studying board context, process and dynamics: Some challenges for the future, British Journal of Management, 16, S27-S38

- Pillai, R., & Al-Malkawi, H.A.N. (2018). On the relationship between corporate governance and firm performance: Evidence from GCC countries. International Business and Finance, 44, 394-410.

- Rechner, L. & Dalton, R. (1991). CEO duality and organizational performance: A longitudinal analysis’, Strategic Management Journal, 12(2), 155-160.

- Roberts, J., McNulty, T., & Stiles, P. (2005). Beyond agency conceptions of the work of the non-executive director: creating accountability in boardroom, British Journal of Management, 16, S5-S26

- Shil, C. (2008). Accounting for good corporate governance. JOAAG, 3(1), 22-31.

- Shleifer, A., & Vishny, R.W. (1997). A survey of corporate governance, Journal of Finance, 52(2), 737-783

- Shahid, S., & Abbas, M. (2019). Does corporate governance play any role in investor confidence, corporate investment decisions relationship? Evidence from Pakistan and India. Journal of Economics and Business, 105, 105839.

- Spence, J., & Rinaldi, L. (2014). Governmentality in accounting and accountability: A case study of embedding sustainability in a supply chain. Accounting, Organizations and Society, 39(6), 433-452.

- SOX (2002). The sarbanes-oxley act of 2002, United States House of Representatives, Public Law 107-204 [H.R. 3763], US Government Printing Office, Washington, DC, .

- Sundaramarthy, C. & Lewis, M. (2003). Control and collaboration: Paradoxes of governance, Academy of Management Review, 28(3), 397-415

- Tricker, R.I. (2015). Corporate governance: Principles, policies, and practices. Oxford University Press, USA.

- Van Ees, G., & Huse. (2009). Toward a behavioural theory of boards and corporate governance. Corporate Governance-an International Review, 17(3), 307-319.

- Weir C., Laing, D., & McKnight, P.J. (2002). Internal and external governance mechanisms: Their impact on the performance of large UK public companies. Journal of Business Finance and Accounting, 29(5), 579-611.

- Wintoki, B., Linck, S., & Netter, M. (2012). Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics, 105(3), 581-606.

- Xie, J., Nozawa, W., Yagi, M., Fujii, H., & Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance?. Business Strategy and the Environment, 28(2), 286-300.

- Younas, I., Siddiqi, Muhammad, W., Saeed, A., & Mehmood, B. (2011). Relationship between corporate governance and default risk: Empirical evidence from Pakistan’ International Journal of Contemporary Research in Business, 2(2).