Research Article: 2018 Vol: 22 Issue: 1

Does Islamic banking development regarding size and activity lead to financial crisis? Case of Sudan

Elhachemi Hacine Gherbi, College of Business Administration, Prince Sattam Bin Abdulaziz University

Keywords

Crisis, Size, Activity, Development, Causality, ARDL, Islamic Banking.

Introduction

Financial System globally failed many times to adopt financial flow, as financial crisis worldwide affects the entire financial system. Various financial crisis and failed system neon some errors that asked, what kind of financial system transformed should be made. These new transformed financial systems come from innovation that would be safe from future crisis; regarding this financial system frequency and severity are the lesson (Abduh & Chowdhury, 2012; Alam, Begum, Buysse, Rahman & Van Huylenbroeck, 2011).

The appropriate theoretical argument presented by Islamic finance towards an alternative to the current international financial system, specifically in the context of Islamic countries. Islamic financial systems are a more modern generation in financial development and growth than a conventional system. Modern majority of economists expressed that economic recovery and financial system with more growth-oriented and directly contributed by Islamic financial system. (Abidin, Bakar & Haseeb, 2014; Warde, 2000). Islamic financial model alternatively is based on theory rather than any empirical pieces of evidence. It does not provide base evidence that is alternatively used as Islamic banking development and growth for the current financial system. There is very less number of empirical studies in Islamic banking development unluckily (Farhani & Shahbaz, 2014; Furqani & Mulyany, 2009).

Those studies on Islamic financial development showed inconsistent results and findings and most of them ignored the critical strengthen the link between financial crisis and Islamic financial development. In Islamic finance growth, it may consider the critical analysis of the study, in policies, planning’s, for emerging economies as we stated in our sample in the study, which is already characterised by financial perspectives (Abidin, Bakar & Haseeb, 2015; Elhachemi & Othman; Fukuda & Dahalan, 2012). The investigation of the short and long-run relationship between Islamic banking developments and economic growth via financial crises covers the existing gap that was found from literature. This study expresses all gaps found in literature about the long and short-run relationship between Islamic banking developments and economic growth. This paper also studies the Granger causality hypotheses of the short and long run between Islamic banking developments that are expressed as Size and Activity development and economic growth, in the context of emerging economy. Besides, it provides the causal strengthen the linkage between the financial crisis and Islamic financial development.

In this entire study, there are some central questions. Does size and activity in Islamic banking development lead to a financial crisis in Sudan for both short and long run? What is the Granger Causality hypothesis between the financial crisis and Islamic banking development activity such size and activity for both short and long run in Sudan?

Sudan is selected for this paper to obtain information and available data based on compatibility and to get findings after testing theoretically. Iran and Sudan have completed Islamic operating concepts, the overall banking model is under Islamic Shariah and it is stated that the results from this Islamic system are more efficient based on resources and allocation aspects. It is also stated that average scale of efficiency was 89.1% and technical efficiency averaged was found 95%, between the sample period of 1990 to 2010 (Hassan, 2003).

Data and Methodology

There is very less number of studies on Islamic banking development system, in the perspective of size and activity of Islamic banking development Sudan and Iran were chosen for the accomplishment of this study because there are only these countries those have data available on Islamic banking development activity and its size from the year 1990-2010. The sample country (Sudan), the model disused according to size and activity of Islamic banking in the study determine the nature and the direction of causality between the Islamic banking development and financial crisis. World Bank and Market database are the world development indicators, in these studies, these are the sources of getting data.

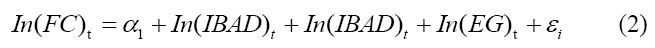

Autoregressive Distributive Lag (ADRL), this model was adapted to this study, based on the test of Granger-causality and its co-integration that describes the direction and nature of causality between EG, IBD, FC in both selected countries Iran and Sudan. Limited availability of data, in this study it is divided into the quarter by using the Gandolgo (1981) method. An econometric model is used which is given below.

For the study of Islamic banking activity development (IBAD), Domestics credit to the private sector is used as a proxy in this study (Beck & Levine, 1999). Another proxy of this study is a percentage of deposit money bank assets to GDP (DMBA) in Islamic Banking size development (Abduh & Chowdhury, 2012). To study the economic growth GDP per capita (%) is used as a proxy (King & Levine, 1993); Total reserve ratio Volatility to Money and quasimoney used as a proxy of Financial Crisis (FC) (Fukuda & Dahalan, 2012). The Average mean describes the parameters used in the study, also explains error terms. After the previous equation, the extended run corruption aid model is describing which as below.

Entire variables in the equation is significant and measurement of economic growth is in the natural logarithm. In this way, the relationship of long-run estimations determines with the help of bounds testing patterns, which are forward by Hasem & Pesaran (1997). ADRL cointegration method at the initial level and according to F-test value or Wald of Statistic. However, the test describes no co-integration (H_0: β_0^I = β_1^I = 0) kept accordingly.

Addition to the above interpretations, the value of f-test was used from the bound test had no standard distribution, at the described level of significance level, recommended by Hasem & Pesaran (1997). There are two values which are critically computed from the bound test. View of the lower band the overall variables I (0), after that the other upper band views are to be I (1). Calculated f-statistics is higher than the upper critical values which present the Co-integration in above explanation. If the t-values are between two critical values of bands, the test becomes inconclusive and if it becomes a lower critical value, which shows the absence of co-integration. Here we have precisely specified equation in which each variable comes after the dependent variable.

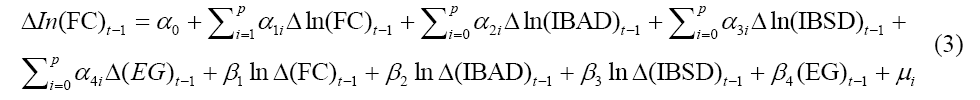

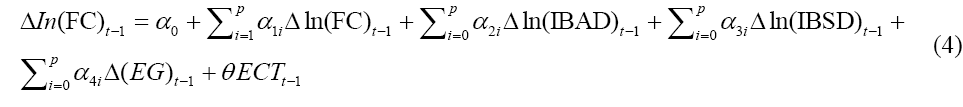

After putting entire equation, the test of Granger-causality is the primary test to compute the long and short run estimation, relationship among variables. After this equation below is another equation of estimation. It is a composite of short run and error correction estimation.

Above equation of (4) describe and presents broad speed adjustment and in the above equation ECT derived from estimation model of co-integration model of Equation (3). The researcher adopted this crucial model and equation to evaluate the variables causality relationship from both points of view; short and long run estimation. These tests are mostly used to determine the dynamic nobility relationship between variables of time series in nature. These are determined in widely literature of economics and magnitude of the relationship between two variables.

ARDL model analysis in the study, a method of three phase is adapted as recommended by previous researchers like Kouakou (2011). The first phase of this model ARDL, the variables are determining and computed from the unit root test. After this phase, the co-integration relationship among mentioned variables was tested from bound test discussed before. The last phase of this ARDL model, the causality test of ganger, adapted to determine and examine the relationship between variables.

Results and Empirical Findings

Table 1 describes the criterion and fundamental of ARDL method. In addition of a description of this table, the result is computed and diagnostic tests reveal that in the fourth model that there are no serial correlations between all variables, heteroscedasticity is non-existent as correct functional forms presented. Variables are documented at levels of significance such (1 or 5 or 10%).

| Table 1 Unit Root Tests |

||||

| Variables | Levels | First Differences | ||

| ADF | PP | ADF | PP | |

| LDCPB | -0.045 | -0.45 | -2.41 | -4.42*** |

| GDPPCGR | -2.1 | -3.38*** | -3.92*** | -5.95*** |

| LDMBA | -1.2 | -0.48 | -3.49*** | -3.46*** |

| LM2RV | -5.01*** | -5.06*** | -11.36*** | -16.39*** |

Notes: The null hypothesis is no stationarity. The significance levels of *** and ** imply stationarity at 1% and 5 % respectively

After the previous step, next have to be the examination of bound test which is shown in Table 2. F-statistics value of FC and IBAD showed more significant than the upper bound of 1%, while EG bound test F-statistics values show greater than upper bound of 5% on the table. The result of 1% and 5% showed the significant co-integration relationship between variables. In table IBSD bound test also showed less than upper bound 10% of IBSD, that describes there is no co-integration relationship between variables in the model of IBSD.

| Table 2 Bound Test Result |

|||||||

| Dependent Variable | F-statistics | 10% | 5% | 1% | |||

| I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | ||

| IBAD | 9.726*** | 2.37 | 3.2 | 2.79 | 3.67 | 3.65 | 4.66 |

| IBSD | 2.33 | 2.37 | 3.2 | 2.79 | 3.67 | 3.65 | 4.66 |

| EG | 4.65** | 2.37 | 3.2 | 2.79 | 3.67 | 3.65 | 4.66 |

| FC | 6.78*** | 2.37 | 3.2 | 2.79 | 3.67 | 3.65 | 4.66 |

*, **, *** imply 10%, 5% and 1% level of significance respectively. The null hypothesis is no co-integration. Critical values are from Pesaran and Pesaran (2001)

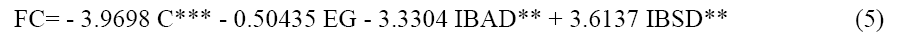

The result from this finding shows the relationship between financial crisis and development of Islamic banking size and activity, also providing long-run equilibrium. The presence of long-run equilibrium and variables such financial crisis development of Islamic banking size modelled by followings equation.

FC has a negative relationship with IBAD that shows the significant at 5 percent, effect between variables which is shown by the Table 3 according to long-run equilibrium equation (5). In the increase of every 1 percent of IBAD, the FC has to fall by 3.33 percent respectively. This is contributed by the Islamic financial system into economic recovery and describes no financial crisis.

| Table 3 Diagnostic Test of Ibad Long-Run Equilibrium Model |

|||||

| Test Statistic | LM Version | F Version | |||

| A: Serial Correlation | CHSQ (4) | 5.943[0.203] | F(4.67) | 1.362[0.256] | |

| B: Faction Form | CHSQ (1) | 1.518[0.218] | F(1.70) | 1.370[0.245] | |

| C: Heteroscedasticity | CHSQ (1) | 0.025[0.872] | F(1.77) | 0.025[0.874] | |

*, **, *** Imply 10%, 5% and 1% level of significance respectively. The null hypothesis is no Granger causality. The chi-square statistics are reported for the variables, while the t-statistic is reported for the ECT.

Regression of IBSD show the positive symbols but opposite to the theory, at the significance level of 5%. It is documented that every single 1% increase in IBSD, FC also increases by 3.61 %. Further explanations of the result of EG are also positive but insignificantly on FC. The test determines in above Table 3 that indicates and estimates the heteroscedasticity or correlation serial. The study has followed the order lag such (1,2,0,1) based on Akaike information criterion.

In Table 4 the major test of the study includes, in the test ARDL analysis Granger-causality test the result of these test describes that Economic growth are not having Granger determinants causes in both of long run and short run estimation. This study describes that there is supply leading hypothesis between Economic growth and IBAD for both of the estimation model. IBSD Granger computed causes for EG same for both estimations short and long.

| Table 4 Granger Causality Results |

|||||

| Variable | ? EG | ? FC | ? IBAD | ? IBSD | ECT(-1) |

| ? EG | - | 1.979 | 6.9*** | 24.33*** | 30.35*** |

| ? FC | 0.04 | - | 4.21** | 7.87*** | 27.61*** |

| ? IBAD | 0.885 | 3.276* | - | 2.47 | 0 .059 |

| ? IBSD | 0.905 | 10.417*** | 5.510*** | - | 6.164*** |

Previous studies on the financial crisis and Islamic banking development empirically determine the impact of the financial crisis on Islamic financial development, author are as Kassim & Majid (2010); Abidin & Haseeb (2015) these studies found conventional and Islamic banking system is very influenced by the financial crisis. These studies also deny the truth and widespread belief that the Islamic financial systems are immune on the fact that is interest-free from all financial perspective.

There are decidedly fewer studies which empirically finds the impact of Islamic banking development on financial crisis perspectives stated in the study of Elhachemi & Othaman (2015). This study also finds the effect of size, activity impacts on the Islamic Republic of Iran, after more the studies describe that there doesn’t have any impact of the crisis. Sudan had a significant adverse effect on the financial crisis at the level of 5 percent. Furthermore, the explanations of study that stated that IBAD performs a key important part in the economy of both countries Iran and Sudan. In addition, the result stated that Islamic banking development (Size and activity) not suffered any financial crises. While Sudan has, in the long run, contrary to the theory and finds liquidity problem that Sudan suffers from it (Abidin, Haseeb, Azam & Islam, 2015; Abidin, Haseeb & Islam, 2016; Abidina, Haseeb & Jantan, 2016). This means that IBAD plays its essential role in the economy in both countries. In addition, Islamic banking size development in Islamic republic does not lead to financial crisis while in Sudan country in the long run, while in Sudan Islamic banking size development leads to a crisis which is contrary to the theory, this reflected the excess liquidity problem that suddenness Islamic banks suffer from it. In the above discussion that Islamic banking activity development has positive impacts on economic development and negative impact on the financial crisis in the long run relationship discussed above based on evidence. These results are same consistent as other studies of different authors such Abduh and Chowdhury (2012) and Waters & Russell (2016).

Gudarzi & Dastan (2013) described in their studies the Islamic bank's roles for financing in development of the economy in many countries like Malaysia, Indonesia, Bahrain, UAE, Saudi Arabia, Egypt, Kuwait, Qatar and Yemen. The findings come from this study are IBAD indicates long run does not affect the crisis and the hypothesis of bidirectional that exists in both estimations of the long and short run. In the study of Gheeraert & Weill (2015) documented that IBAD has effects on the crisis, describes negative performance on the process of economic development. Further discussion of the study of Gheeraet and Weill, they determine the Islamic bank's influences on the variables of macroeconomics and took a sample of 70 countries from the period of 2000 to 2010 and stochastic frontier methods used and showed negatively and significantly impact on Islamic bank development activities on impact efficiency.

Conclusion

Analysis of the study and above tables describes, there is a significant negative relationship between financial crisis Islamic banking development activities. These results are evidence that the study results stated negative relationship between studied variables, (Activity of Islamic banking development and FC). The result indicates that implementation of economic growth and implementation of policies in the Islamic banking activities are efficient to encourage without creating a crisis. Islamic banking activities have to be marketed such as Musharakah and Mudarabah, which are actually equity based. It is suggested that there should be specific policies on financial institution by concerned authorities, which can provide financing facilities. There should be reserved for promising sectors such as mining, electricity, manufacturing and agriculture. The result of this implementation would be productivity and growth by the firms. The second result of the study has a positive effect on the crisis and Islamic banking size in Sudan. The results state that there must be appropriate implication to address such financial crisis issues by Sudan policymakers to improve Islamic banking activities.

Findings give evidence from this study; Granger causality hypothesis plays an essential role in economic growth and Islamic banking activities development. This study finding is quite related and aligned with Majid & Kassim (2010). In Addition, with the results, both size and activity in Islamic banking development Granger cause the financial crisis in both short and long run estimation. The policies makers of Sudan more concerned to focus at liquidity and Islamic banking activities such as deposit, size and all activities, in that way it leads when the sampled country is suffering from the financial and economic crisis.

This study finds evidence, which it contributes fruitful, positive results, if the Islamic banking development activities based on Islamic banking system; in case of any financial crisis this system shows positive manners. The finding from the study shows Islamic banking system and all of its activities which are playing a very crucial part to attract the international blockade from last thirty years in Sudan, such blockade is more significant in frequency and with intensity, has negatively impacted as well. At the end of this study concluded, this study put all efforts to answer the above-given question that does activity and size of Islamic banking developments leads to the financial crisis or not? The answer and evidence from this study help to the dominant player of the economy of Sudan and their monetary policymakers as well to identify the determinants the financial crisis and their essential solutions, which helps to attain the achieve economic sustainability. After, this study contributes to an idea of Islamic financial system is sound alternative comparatively with a conventional financial system based on empirical evidence. There is evidence that Islamic banking development has positive contribution through its significant adverse effect on the crisis. This study encourages applying full Islamic financial system.

References

- Abduh, M. & Chowdhury, N.T. (2012). Does Islamic banking matter for economic growth in Bangladesh. Journal of Islamic Economics, Banking and Finance, 8(3), 104-113.

- Abidin, I.S.Z., Bakar, N.A.A. & Haseeb, M. (2014). An empirical analysis of exports between Malaysia and TPP member countries: Evidence from a panel cointegration (FMOLS) model. Modern Applied Science, 8(6), 238.

- Abidin, I.S.Z., Bakar, N.A.A. & Haseeb, M. (2015). Exploring trade relationship between Malaysia and the OIC member countries: A panel cointegration approach (1995-2012). Asian Journal of Scientific Research, 8(1), 107.

- Abidin, I.S.Z. & Haseeb, M. (2015). Investigating exports performance between Malaysia and OIC member countries from 1997-2012. Asian Social Science, 11(7), 11.

- Abidin, I.S.Z., Haseeb, M., Azam, M. & Islam, R. (2015). Foreign direct investment, financial Development, international trade and energy consumption: Panel data evidence from selected ASEAN Countries. International Journal of Energy Economics and Policy, 5(3).

- Abidin, I.S.Z., Haseeb, M. & Islam, R. (2016). Regional integration of the association of Southeast Asian Nations economic community: An analysis of Malaysia-Association of Southeast Asian Nations exports. International Journal of Economics and Financial Issues, 6(2).

- Abidina, I.S.Z., Haseeb, M. & Jantan, M.D. (2016). Trans-pacific partnership (TPP) agreement: Comparative trade and economic analysis for Malaysia. The Social Sciences, 11(13), 3375-3380.

- Alam, M.J., Begum, I.A., Buysse, J., Rahman, S. & Van Huylenbroeck, G. (2011). Dynamic modeling of causal relationship between energy consumption, CO2 emissions and economic growth in India. Renewable and Sustainable Energy Reviews, 15(6), 3243-3251.

- Beck, T. & Levine, R. (1999). A new database on financial development and structure. (Vol. 2146): World Bank Publications.

- Elhachemi, H.G. & Othman, M.A. (2015). Empirical analysis on the nexus between islamic banking development in terms of size and activity, economic growth and financial crisis in islamic republic of iran.International Journal of Scientific Research and Innovative Technology , 2(6), 24-44.

- Farhani, S. & Shahbaz, M. (2014). What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2 emissions in MENA region? Renewable and Sustainable Energy Reviews, 40, 80-90.

- Fukuda, T. & Dahalan, J. (2012). Finance-growth-crisis nexus in Asian emerging economies: Evidence from VECM and ARDL assessment. International Journal of Economic Sciences and Applied Research, 5(2),69-100.

- Furqani, H. & Mulyany, R. (2009). Islamic banking and economic growth: Empirical evidence from Malaysia. Journal of Economic Cooperation & Development, 30(2).

- Gheeraert, L. & Weill, L. (2015). Does Islamic banking development favor macroeconomic efficiency? Evidence on the Islamic finance-growth nexus. Economic Modelling, 47, 32-39.

- Gudarzi, F.Y. & Dastan, M. (2013). Analysis of Islamic banks' financing and economic growth: A panel cointegration approach. International Journal of Islamic and Middle Eastern Finance and Management, 6(2), 156-172.

- Hasem, P.M. & Pesaran, B. (1997). Working with Microfit 4.0: Interactive econometric analysis: Oxford University Press.

- Hassan, M.K. (2003). Cost, profit and X-efficiency of Islamic banks in Pakistan, Iran and Sudan. Islamic Financial Architecture, 497.

- Kassim, S.H. & Majid, M.S. (2010). Impact of financial shocks on Islamic banks: Malaysian evidence during 1997 and 2007 financial crises. International Journal of Islamic and Middle Eastern Finance and Management, 3(4), 291-305.

- King, R.G. & Levine, R. (1993). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717-737.

- Kouakou, A.K. (2011). Economic growth and electricity consumption in Cote d'Ivoire: Evidence from time series analysis. Energy Policy, 39(6), 3638-3644.

- Majid, S.A. & Kassim, S. (2010). Islamic finance and economic growth: The Malaysian experience. Paper presented at the Kuala Lumpur Islamic Finance Forum, Kuala Lumpur.

- Warde, I. (2000). Islamic finance in the global economy: Edinburgh University Press.

- Waters, S. & Russell, W.B. (2016). Virtually Ready? Pre-service teachers’ perceptions of a virtual internship experience. Research in Social Sciences and Technology, 1(1).