Research Article: 2018 Vol: 22 Issue: 4

Does Risk Governance Impact Bank Performance? Evidence From the Nigerian Banking Sector

Olayinka Erin, Covenant University

Osariemen Asiriuwa, Covenant University

Paul Olojede, Covenant University

Opeyemi Ajetunmobi, Covenant University

Timothy Usman, University of Benin

Abstract

This study investigates the impact of risk governance on the performance of money deposit banks in Nigeria. Eleven (11) banks were sampled out of fifteen (15) listed banks in Nigeria for the period of 2012 to 2016. Risk governance variables was proxy by presence of Chief Risk Officer (CRO_presence), Chief Risk Officer Centrality (CRO_centrality), Board Risk Committee Independence (BRC_independence), Board Risk Committee Activism (BRC_activism), Board of Director Independence (BOD_independence), and Enterprise Risk Management Score (ERM_score) while the study controlled for other variables such as firm size, board size, audit committee independence, cost to income ratio and loan. Bank performance was measured by return on assets (ROA). The empirical finding revealed that all the explanatory variables except CRO_centrality have a positive and significant impact on the performance of listed banks in Nigeria. The study recommends that the regulatory authorities (Central Bank of Nigeria, Financial Reporting Council of Nigeria, and Securities and Exchange Commission) should continue to ensure strict compliance regarding risk governance framework. Also, regulatory authorities should place more importance on the remuneration of CRO in order to further strengthen risk management practices in Nigerian banks. This study provides original insight into risk governance variables that affect the performance of money deposit banks in Nigeria. It carries significant importance for risk managers, bank executives, regulatory authorities, policymakers and future researchers.

Keywords

Chief Risk Officer, Enterprise Risk Management, Bank Performance, Listed Banks in Nigeria, Risk Governance.

Introduction

The call for greater accountability and regulatory oversight function is a growing interest in corporate governance practices (Zemzem & Kacem, 2014). In recent times, the subject of risk governance has been a global discourse among academia, finance and risk professionals. Risk governance received global attention due to series of corporate scandals and financial crisis that engulfed the corporate and financial institutions in recent times (Aebi et al., 2011). International Risk Governance Council (IRGC) in 2002 initiated and developed a risk governance framework to tackle corporate failures especially in the financial institutions. This framework received accolades especially from risk professionals as a step from conventional silo-based risk management practices to a more integrated approach to risk management governance (Gordon et al., 2009). Risk governance is the governance process affected by the board to oversee the effectiveness of risk management within the organization (Bartram, 2000). Similarly, Klinke and Renn (2011) opine that risk governance cannot be underestimated if organizations would proactively tackle a wide array of risks confronting business environment.

Hoyt and Liebenberg (2003) state that prior to risk governance framework; conventional risk management has proved to be inadequate and effective in tackling new and emerging risks in today’s business environment. They emphasized the need for more robust and integrative method in risk management challenges which risk governance framework is capable of solving. Sobel and Reding (2004) argue that both external and regulatory pressure in the corporate environment have necessitated the demand for effective risk governance both in the developed and emerging economies. Recently, risk governance framework has become a major risk practice across the world due to the failure of traditional silo-based risk approach that has not produced any meaningful results. Marjolein et al. (2011) view risk governance as a major step in creating and enhancing shareholders’ value. They believe that risk governance creates value by managing all threats and uncertainties that may negatively affect firm’s objective of maximizing shareholders wealth. Similarly, Erin et al. (2017) posit that effective risk governance is linked to firm performance in the long run.

The aftermath effect of the global financial crisis of 2008 had a negative impact on the Nigerian financial industry especially the banking institutions. Many depositors’ fund was lost due to ineffective risk governance mechanism in the Nigerian banks. This unpleasant incidence compelled the banks’ regulatory agency in charge of the financial sector in Nigeria (Central Bank of Nigeria) (CBN) to develop a policy that strengthened the risk management practices within the financial industry. In 2012, the CBN issued a governance code to all companies with the Nigerian financial industry (insurance firms, investment companies, banks) to implement risk governance framework as part of their corporate governance structure. This governance code requires all companies in the financial sector to have functional risk management department, institutionalized risk culture, implementation of Enterprise Risk Management (ERM), appointment of Chief Risk Officer (CRO), and effective board risk committee. The purpose of risk governance in the Nigerian financial sector is to strengthen the practice of risk management, align corporate objectives with risk culture, reduces the incidence of systemic failure and more emphasis on the function of the board in monitoring risk governance and compliance (CBN, 2012).

Despite the plethora of studies (Marjolein et al., 2011; Klinle and Renn, 2014; Mollah et al., 2014; Liaropoulous et al., 2016) on risk governance and firm performance in developed economies, there is lack of empirical evidence on the subject of risk governance and firm performance within the Nigerian context. At the time of this research, there are few studies (Owojori, et al., 2011; Fadun, 2013; Onafulajo and Efe, 2013; Ishaya and Siti, 2015; Kakanda et al., 2017; Soliman and Adam, 2017) found on risk management. These studies only examined risk management from the perspective of Enterprise Risk Management (ERM) and credit risk management without considering risk governance structure as a whole vis-à-vis its impact on firm performance. These studies failed to capture important risk governance variable like the appointment of CRO. Against this backdrop, this study seeks to examine the impact of risk governance on firm performance of listed banks in Nigeria. Also, we are motivated to carry out this study due to the inconsistent results from prior studies from the developed economies. The important question to consider is do risk governance actually impacts bank performance? The main objective of this research is to empirically examine the extent to which risk governance structure has impacted the performance of listed banks in Nigeria.

The rest of the paper is organized as follows. Section 2 discusses the concept of risk governance, risk governance determinants, and empirical studies. Section 3 discusses the methodology adopted as well as specification of the model. Section 4 presents information regarding the data analysis, results, and discussion while Section 5 concludes the paper and provides managerial implications from findings.

Literature Review

Risk Governance

There is no universal or single definition of risk governance; several authors have described risk governance in different perspectives though pointing to the same meaning. There are several ways risk governance have been described in journals and literature; Anderson (2008) views risk governance as a sound corporate governance mechanism that enables the board of directors aligns corporate objectives with the management of risks in order to satisfy all stakeholders. Similarly, Checkley (2009) posits that risk governance is seen as the board oversight responsibility for directing risk strategy and setting clearly defined risk appetite that is communicated throughout the organization. Rahim et al. (2015) posit that risk governance deals with the way and manner board of directors optimize and monitor risk within the organization. Also, Gordon et al. (2009) opine that risk governance is more concerned with the role of the board, senior management and risk management functions. It emphasizes that board must continue to monitor risk information, analysis and disclosure in order to provide a basis for sound management decisions. One thing that is common in all these definitions, risk governance provides a platform for the board to monitor risk compliance and communicate risk issues to all stakeholders.

Several authors have argued that risk governance has a quite similar meaning as corporate risk governance, integrated risk governance, strategic risk governance, holistic risk governance and business risk governance (Kleffner et al., 2003; Bromiley et al., 2005; Hoyt and Liebenberg, 2011). Bromiley et al. (2005) believe that risk governance is an interdisciplinary body of literature that combines both risk and governance. It is the state of affairs that pertain to the regulation of many risks within the organization. Pagach and Warr (2011) on the other hand, emphasize the term “risk” within the context of risk governance. They believe that central to risk governance is the recognition of various new and emerging risks; therefore, risk governance is the ability of the firm to identifies, assess and manages an array of risks that may disrupt business continuity. In the same Vein et al. (2003) describe risk governance as a concerted and integrated governance approach requiring the board and senior management by engaging all business units on the matter of risk that may affect business performance.

Furthermore, there are several ways risk governance have been defined or described by industry publication, rating agencies, professional firms and standard-setting organizations. IRGC (2005) emphasize the inclusion of stakeholders in the risk governing process of an organization. They perceive stakeholders as a socially organized body that will be affected by the outcome of risk management decisions taken by the organization. Hence, risk governance should be private-public participation where all stakeholders’ interest will be taken into cognizance. Also, Risk and Management Society (RIMS) (2011) view risk governance as a strategic corporate decision to address the full spectrum of firm’s risk by engaging all stakeholders in risk and governance process. KPMG (2015) maintain that risk governance is the institutionalization of risk culture and processes within the organization with the aim of continuous improvement. Committee of Sponsoring Tread way Commission (COSO) (2004) describe risk governance as a process by which company’s board identify potential threats that may affect its entity and manage those risks within its risk appetite.

Determinants of Risk Governance Framework

In literature, several studies argue that risk governance framework is determined by various factors that influences risk governance process (IRGC, 2005; Beasley et al., 2005; Bromiley et al., 2005; Hoyt & Liebenberg, 2011; KPMG, 2015). These studies found that effective risk governance contributes to high firm value, reduction in price volatility and improvement in business performance. Risk governance has become the subject of attention due to industry consolidation, increased regulatory scrutiny, and external agitation for improved corporate governance (Meulboek, 2002; Erin et al., 2017). Important risk governance determinants found in the literature are discussed below:

Board Risk Committee

Board risk committee is an important factor in risk governance framework; without effective risk committee, risk governance process would be undermined (Li et al., 2014; Soliman & Adam, 2017). KPMG (2015) found that risk committee is the major driver of risk governance framework in any organization. The major function of board risk committee is to set the expectation and ensure that the expectations are met with various risk information at their disposal. It is required that members of risk committee have risk management skills that would enable them function as risk executive.

Presence of Chief Risk Officer (CRO)

The major feature of an effective risk governance structure is the supervising role of a CRO. The role of CRO is evidently more significant as risk elements widen and compliance requirement becomes more complex (Liebenberg & Hoyt, 2003; Pagach & Warr, 2011). The managerial position of CRO is to provide specialized supervision and coordination of risk management issues within the organization. The study of Walker et al. (2003) reported that hiring of CRO shows commitment to risk governance framework. It also allows CRO to oversee the entire enterprise risk management process within the organization. In fact, it is a mandatory and regulatory requirement for all financial institutions to hire a CRO to oversee the risk management affairs within the organization.

Implementation of Enterprise Risk Management (ERM)

The subject of ERM has been a global discourse in recent times especially with the failure of traditional risk-based approach. Implementation of ERM is under the purview of risk governance framework within the organization (Beasley et al., 2005; Gordon et al., 2009). Many authors posit that without the implementation of ERM, risk governance becomes useless and worthless (Meulboek, 2002; Liebenberg & Hoyt, 2003; Kleffner et al., 2003; Pagach & Warr, 2011; Li et al., 2014). ERM gives the board and senior management the enabled capacity to effectively implement risk management framework. ERM being integrative and holistic in nature makes risk governance to be all-inclusive by ensuring various stakeholders are captured in the risk net.

Risk Management Department

One important determinant of risk governance structure is a functional and effective risk management department. Sobel and Reding (2004) opine that without risk management department it is practically impossible to practice risk governance framework. Mikes (2009) stated that the foundation of risk governance is the establishment of a functional risk management department or unit in any organization. The policies and rules are carried out from risk department to other functional departments within the organization. In the same Vein et al. (2012) study revealed that functional risk department is germane to effective risk governance because it helps to coordinate risk across the enterprise.

Risk Technology

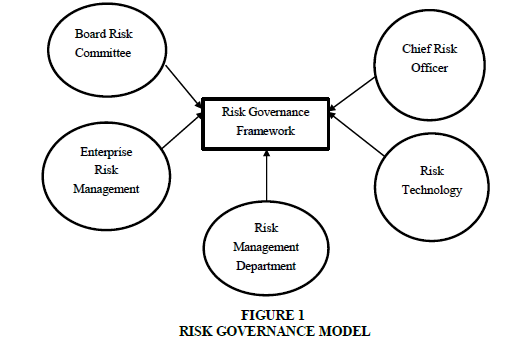

A lot of firms especially in the financial industry are struggling to keep up with the complexity of risk governance process due to the poor automated system (KPMG, 2015). Bromiley et al. (2005) view risk technology has an enabler of risk governance framework because it helps to contribute to overall improvement of risk information and disclosure to relevant parties. Without sophisticated risk automated system, it becomes difficult to carry out stress-testing and perform independent risk appraisal within the organization (Figure 1:).

Empirical Review and Hypotheses Development

In this section, we explore some studies conducted on the relationship between risk governance and firm performance. Mollah at al. (2014) examines the relationship between risk governance and performance of 52 Islamic banks in fourteen (14) countries from 2005 to 2014. The study used independent directors, board size, board committee, female directors, board attendance, and CEO qualification as the governance variables while Return on Assets (ROA) was used as a proxy for firm performance. The study found that risk governance variables have a crucial and significant impact on the performance of sampled banks. However, the study failed to examine the critical risk governance measures such as CRO appointment, board risk committee size and implementation of ERM framework. Similarly, Zemzem and Kacem (2014) investigate the impact of risk management and governance on the performance of financial institutions in Tunisia. The study explored 17 Tunisia banks from the period of 2001 to 2011. In tandem with the study of Mollah et al. (2014); Zemzem and Kacem (2014) study failed to consider important risk governance variables recommended by IRGC. The result of the study shows a negative relationship between risk governance and firm performance of financial institutions in Tunisia.

Ellul and Yerramilli (2012) examine the effect of strong risk control and governance on the firm performance of 74 banks operating in the US. The study covered the period of 2006 to 2011 using Risk Management Index (RMI) to measure risk control and governance. The essence of RMI is to measure the strength of risk management in relation to governance variables of the sample firms. The RMI was derived through the combination of CRO appointment, implementation of ERM, audit committee independence, existence of risk department and board risk committee. The study found that most of the risk governance variables have a positive and significant impact on the firm performance of sample banks in the US. Also, they find that strong risk control mechanism restrains the risk-taking behavior of banks in the US. Furthermore, Quen et al. (2012) examine the critical role of risk management on the firm performance of 156 non-financial firms listed on Toronto Stock Exchange (TSE) for the periods of 2007 and 2008. The study measured firm performance from three perspectives: operational performance (proxy by changes in sales); accounting performance (proxy by changes in EBIT); and financial market performance (proxy by Tobin’Q). The study reveals that risk management has no significant impact on the firm performance of sample firms.

Rahim et al. (2015) investigate the effect of risk governance on banks’ performance of two hundred (200) Islamic banks across twenty-one (21) countries for the year 2014. The study employed multivariate regression analysis and structural equation model to analyze the data. The study measured risk governance variables through CEO duality, Shariah committee member, board size, CRO appointment and external audit size while ROE, ROA, and profit margin were used as a proxy for banks’ performance. The study found that risk governance significantly and positively impacts banks’ performance of sampled Islamic banks. This study is consistent with the findings of Mollah et al. (2014) that shown a positive relationship between risk governance and firm performance of 52 Islamic banks across 14 countries. Mojtaba and Davoud (2017) examine the impacts of risk governance and Enterprise Risk Management (ERM) on firm performance of sixty-six (66) financial institutions listed on the Tehran Stock Exchange (TSE) in Iran. The study found that risk governance variables like board independence, the composition of board risk, board size have significant on firm performance of selected companies.

Cavezzali and Garddenal (2015) focus on the empirical analysis of risk governance and firm performance with evidence from Italian listed banks. The study considered twenty on (21) Italian listed banks from the period of 2005 to 2013. A review of the study reveals that several risk governance and control variables were used. The used both ROE and ROA as performance variable while CRO presence, the board of director independence, level of risk committee meeting, risk committee experience, firm size, board size were used as a proxy for risk governance. The findings show some element of the relationship between risk governance variables and banks performance while some variables do not have a significant relationship with performance. The study provides an avenue for further investigation on risk governance in other climes. The study of Mongiardino and Plath (2010) reveal few lessons on risk governance of large banks in Europe. The study investigated 25 large banks in Europe on the subject of risk governance and performance after the financial crisis. The outcome of the study shows large banks have improved only to a limited extent immediately after the financial crisis.

Aebi et al. (2011) provide insight into the impact of risk management and governance on bank performance during the financial crisis. The study examined whether the presence of Chief Risk Officer (CRO) and other risk governance variables have a significant impact on bank performance. The study measured risk governance through the CRO presence, independent directors with finance or risk background, the existence of risk committee, board size, institutional shareholding while ROE and ROA were used as a proxy for bank performance. The findings reveal that CRO which report directly to the board of directors perform extremely better than banks which CRO report directly to the CEO during the financial crisis. The study underscores the importance of independent directors in promoting shareholders wealth. McConnell (2012) examines the importance of strategic risk governance on performance. The study focused primarily using Lehman Brother as a case study; while identifying areas of strategic risk as reputational risk, development of ERM and emerging risks. The study found a weakness in the area of strategic risk in practice and has not contributed significantly to bank performance.

The above empirical studies reveal that risk governance have a positive and significant impact of bank performance (Aebi et al., 2011; Ellul and Yerramilli, 2012; Mollah et al., 2014; Rahim et al., 2015) while other studies such as (Quen et al., 2012; Zemzem and Kacem, 2014; Cavezzali and Garddenal, 2015) show that risk governance does not have any impact on firm performance of selected firms. Based on this premise, we hypothesized that:

H01: There is no significant difference between the impacts of risk governance and performance of listed banks in Nigeria.

Gaps in Literature

The aim of this study is to examine the impact of risk governance on bank performance from the Nigerian banking sector perspective. Few studies carried out on the relationship between risk governance and firm performance are from developed economies, however, there are studies (Ishaya and Siti, 2015; Ishaya & Siti, 2015; Kakanda, 2017) on the risk management in Nigeria. These studies failed to capture important risk governance variable like the appointment of CRO, centrality of CRO and board of directors’ activism. Therefore, it was needed to examine this study in order to capture important risk governance variables and contribute to growing literature in the area of risk governance. In addition, previous studies produced inconclusive and mixed results, therefore, the need to bridge the gap in this study.

Research Methods

This study used panel data to investigate the impact of risk governance on bank performance of deposit money banks in Nigeria for the period of 2012 to 2016. The population of the study is fifteen (15) deposit money banks while the sample size for the study is fourteen banks (14) which were derived from Taro Yamane formula. However, the study finally used eleven (11) deposit money banks as the sample size because they have available data for the several variables used in this study. We captured our data variables from the annual reports of the selected banks. This study investigated Nigerian deposit money banks due to its role in stabilizing the economy and prevents a systemic collapse of the financial industry. Risk governance mechanism is very critical to the survival of the banking system, therefore, it is imperative to critically examine the subject of risk governance in the Nigerian banking sector. This study used descriptive statistics, correlation and fixed effect regression model to analyze the result of this study.

Model Specification

To examine the impact of risk governance on firm performance, a fixed effect panel regression model was used to perform the analysis regarding various parameters included in our model. This study modified the model of Cavezzali and Garddenal (2015) by including Board Risk Committee Independence (RMCI) and Enterprise Risk Management Score as two new explanatory variables to test return on assets (firm performance).

This can be expressed explicitly in equation 1 and 2

ROA=f(Risk Governance)……………………………………………............……... Eq. (1)

OA=β0it+β1CRO_presenceit+β2itCRO_centralityit+β3BRC_independenceit+β4

ERM_scoreit+β5 BRC_activismit+β6 BOD_independenceit+β7 AUDCOM_independenceit+β8

BSIZEit+β9 FSIZEit+β10 CIit+β11 LOANit+μit …………………………………. Eq. (2)

β0=Intercept of the regression line, regarded as constant.

β1-11=Coefficient or slope of the regression line or independent variables.

μ=Error term; t year or period and i=firm

The a priori expectation is that; β1–β11>0

Operationalization of Variables

In this section, we examined the variables used in this study ranging from the dependent variable to independent variables, however, the same set of variables were used in all the study periods respectively.

Results

This section presents the descriptive and inferential results obtained from the dataset and discussion was made based on the findings.

Table 2 presents the descriptive results of the dependent variable, independent variables, and control variables. The result shows that 30% (0.2924) of non-executive directors are represented on the board risk committee while 37% (0.3652) of non-executive directors are represented on the audit committee board. The result indicates that all banks in Nigeria have designated CRO to manage their risk architecture and perform executive oversight function. The CRO_centrality shows 46% which implies that 64% (1-46) of CFO collect higher remuneration than CRO of listed banks in Nigeria. The BRC_activism shows that the highest number of risk board meeting in a financial year is 4 times while the lowest is once in a year. Averagely most banks meet 2 or 3 times in a financial year to discuss riskrelated matters. Also, all listed banks have ERM system in place; which is a good demonstration of commitment to risk culture and holistic risk management practices.

| Table 1 OPERATIONALIZATION OF VARIABLES |

|||

| Variable(s) | Symbols | Operationalisation | Prior Studies |

| Dependent Variable |

|||

| Return on Assets (Performance) | ROA | Proxy by net income divided by total assets | Baxter et al. (2013); Okoye et al. (2017) |

| Independent Variables | |||

| Chief Risk Officer Presence | CRO_presence | CRO is dummy variable, set equal to 1 for firms with CRO designation, and 0 otherwise | McShane et al. (2011); Elisa and Gloria (2015) |

| Chief Risk Officer Centrality | CRO_centrality | CRO remuneration divided by CFO remuneration. Note CFO means Chief Financial Officer | Elisa and Gloria (2015) |

| Board Risk Committee Independence | BRC_independence | The proportion of non-executive directors divided by total numbers of directors | Gordon et al. (2009); Soliman and Adam (2017) |

| Board Risk Committee Activism | BRC_activism | BRC activism is dummy variable, it is 1 if the number annual meeting is equal or more than four times, otherwise 0 | Aebi et al. (2011); Li et al. (2014) |

| Enterprise Risk Management Score | ERM_score | ERM is dummy variable, 1 for banks with ERM framework, otherwise 0 | Hoyt & Liebenberg (2011); Arnold et al. (2011) |

| Board of Director Independence | BOD_independence | The proportion of non-executive directors divided by total numbers of directors | Ellul and Yerramilli (2012) |

| Control Variables | |||

| Audit Committee Independence | AC_independence | The proportion of non-executive directors divided by total numbers of directors | Zemzem and Kacem (2014) |

| Board Size | BSIZE | The actual number of directors on the firm’s board | Ame et al. (2017) |

| Firm Size | FSIZE | Proxy by the natural logarithm of Total Assets | Uwuigbe et al. (2017) |

| Cost to Income Ratio | CI | Operating cost divided by operating income | Motjaba and Davoud (2017) |

| Loan | LOAN | Total loan divided by total assets | Elisa and Gloria (2015); Eriki et al. (2017) |

Source: Compiled by the Author (2018)

| Table 2 DESCRIPTIVE ANALYSIS |

|||||||

| Variable | N | Min | Max | Mean | Std. Dev. | Skewness | Kurtosis |

| CRO_presence | 55 | 0 | 1 | 0.5 | 0.53214 | 0.643 | 1.021 |

| CRO_centrality | 55 | 0.32 | 0.61 | 0.4651 | 0.17472 | 1.012 | 1.516 |

| BRC_independence | 55 | 0.14 | 0.45 | 0.2924 | 0.59471 | 1.341 | 1.721 |

| ERM_score | 55 | 0 | 1 | 0.5 | 1.84814 | -0.561 | -1.461 |

| BRC_activism | 55 | 1 | 4 | 2.5215 | 2.41084 | -0.425 | -1.325 |

| BOD_independence | 55 | 0.1 | 0.4 | 0.2554 | 0.15382 | 1.482 | 1.945 |

| AUDCM_independence | 55 | 0.2 | 0.4 | 0.3652 | 2.75233 | -0.342 | 1.346 |

| BSIZE | 55 | 6 | 10 | 8.53 | 3.43211 | 1.433 | -1.532 |

| FSIZE | 55 | 14.86 | 27.83 | 21.3451 | 5.63082 | 1.678 | 1.379 |

| CI | 55 | 0.325 | 0.653 | 0.4891 | 0.12116 | 1.246 | 1.272 |

| LOAN | 55 | 0.236 | 0.454 | 0.3452 | 0.11242 | -0.261 | -1.173 |

| ROA | 55 | 0.346 | 0.643 | 0.5445 | 0.11476 | -0.347 | -1.187 |

Source: Authors Computation (2018) using E-view

Furthermore, the result shows that bank with the highest number of board composition have 10 members while lowest has 6 members. Average board members range between 7 and 8 which are still within the regulatory standard. The cost to income ratio reveals an average of 48% (0.4891); this implies that banks incur less than 50% of its operating cost to generate operating income. This implies that Nigerian banks are operationally efficient in managing daily operational expenses. The loan variable reveals an average of 35% (0.3452) coverage; this signifies that the loan exposure in less than 40% of its total assets. This means that listed banks in Nigeria assets quality are efficient.

Table 3 presents us with the correlation matrix of the study variables. The results show that CRO_presence is positively correlated with ROA. The same is observed for BRC_independence, ERM_score, BRC_activism, BOD_independence, FSIZE, CI, and LOAN while CRO_centrality, AUDCOM, and BSIZE show a negative relationship with ROA. This analysis provides evidence that risk governance is more likely to have an impact on the firm performance of listed banks in Nigeria. All the explanatory variables with the exception of CRO_centrality have a positive relationship with firm performance. This implies that the presence of CRO contributes to firm’s growth and bottom line which invariably impacts performance. Also, ERM implementation is a major indicator of firm’s ability to reduce threat and risk that may affect performance. The same applies to effective board risk committee, board independence and efficient utilization of loan; all these variables have an impact on growth and performance respectively.

| Table 3 CORRELATION MATRIX |

||||||||||||

| ROA | CRO_presence | CRO_centrality | BRC_independence | ERM_ score |

BRC_ activism |

BOD_independence | AUDCM_independence | BSIZE | FSIZE | CI | LOAN | |

| ROA | 1 | |||||||||||

| CRO_ presence |

0.03 | 1 | ||||||||||

| CRO_ centrality |

-0.09 | -0.14 | 1 | |||||||||

| BRC_ independence |

0.01 | 0.05 | -0.45 | 1 | ||||||||

| ERM_ score |

0.23 | 0.45 | 0.15 | 0.48 | 1 | |||||||

| BRC_ activism |

0.32 | -0.21 | 0.59 | 0.47 | -0.55 | 1 | ||||||

| BOD_ independence |

0.04 | 0.04 | 0.32 | 0.02 | 0.23 | 0.52 | 1 | |||||

| AUDCM_ independence |

-0.34 | 0.03 | 0.01 | -0.32 | 0.04 | -0.08 | 0.92 | 1 | ||||

| BSIZE | -0.12 | -0.43 | -0.06 | 0.23 | -0.43 | 0.22 | 0.13 | 0.32 | 1 | |||

| FSIZE | 0.02 | -0.25 | 0.63 | 0.01 | 0.63 | 0.67 | -0.34 | 0.04 | 0.02 | 1 | ||

| CI | 0.01 | 0.03 | 0.03 | 0.03 | 0.23 | -0.63 | 0.02 | 0.39 | 0.07 | 0.01 | 1 | |

| LOAN | 0.05 | 0.14 | -0.04 | -0.34 | 0.24 | 0.01 | 0.34 | 0.63 | -0.01 | -0.43 | 0.02 | 1 |

Source: Authors Computation (2018) using E-view

The study conducted Hausman specification test (Appendix 1) to help in making a choice between Fixed Effect Model (FEM) and Random Effect Model (REM) to panel regression. The decision rule under Hausman test is to accept the null hypothesis where the pvalue is greater than the 0.05 Mackinnon value. If the null hypothesis must be rejected, then the fixed effect model is appropriate to use (Gujarati & Porter, 2009). The Hausman test shows that the p-value is less than 0.05 absolute Mackinnon value. Therefore, FEM is the appropriate model to use in this study.

Hypotheses Restatement and Discussion

H01: There is no statistically significant difference between the impacts of risk governance and firm performance of listed banks in Nigeria.

The regression analysis reveals that F-statistic of 0.00001 indicates a strong significant relationship between the dependent variable and independent variables. The analysis further shows that R2 of 60% implies that total change in the dependent variable (ROA) can be explained by the explanatory variables. The autocorrelation test of Durbin-Watson reveals 1.61 values which mean there is a presence of serial correlation. Although 1.61 signifies the presence of serial correlation but does not affect the consistency of the estimated regression coefficient. However, Durbin-Watson value of less than 1 may be cause for alarm and invalidates the conduct of statistical test (Hateka, 2010). Furthermore, the p-values of CRO_presence (0.01), BRC_independence (0.04), ERM_score (0.02), BRC_activism (0.05) and BOD_independence (0.02) are statistically significant at 5% level.

This analysis focused on key risk governance variables of Nigerian deposit money banks. The positive relationship between CRO_presence and ROA implies that hiring of CRO is an important risk governance variable that contributes to the performance of a bank. Similarly, the implementation of ERM provides an interconnectivity among business units that reduces the risk that may likely affect performance negatively. The independence of directors on risk committee and the board show a positive relationship with bank performance. This connotes the importance of non-executive directors on various companies’ board and committees cannot be underestimated. The result of this study is consistent with the studies of (Aebi et al., 2011; Ellul and Yerramilli, 2012; Mollah et al., 2014). These prior studies reveal that risk governance has a positive impact on the firm performance of banks in USA, Iran and other 14 Islamic countries. Our study further confirms that risk governance impacts performance of deposit money banks in Nigeria.

Conclusion and Recommendation

This study provides empirical evidence into the impact of risk governance on the performance of deposit money banks in Nigeria for the periods 2012-2016. We used six (6) explanatory variables (CRO_presence, CRO_centrality, ERM_score, BRC_activism, BRC_independence, BOD_independence) to measure risk governance framework while the firm performance was proxy by Return on Asset (ROA). The overall result shows that risk governance contributes positively to the performance of listed banks in Nigeria. This study recommends that regulatory authorities should place more importance on the remuneration of CRO and further strengthens risk management policies in Nigerian banks.

Implication of Finding and Contribution

The result of this study provides a major implication on risk management practices and corporate sustainability of Nigerian banks. An effective risk governance framework has a positive impact on performance; which invariably affects the long-term sustainability of a firm both financially and operationally. Risk managers play a crucial role in the financial stability of banks which in turn assures national and global financial stability. Therefore, the role of risk managers and executives cannot be undermined if banks or firms would continue to enjoy the goodwill of all its stakeholders. This study contributes to existing literature in the area of risk governance framework by examining a number of variables not found in previous studies conducted in Nigeria. Our study provides original insight into risk governance variables that affect bank performance. This carries significant importance for risk managers, bank executives, regulatory authorities, policymakers and future researchers. Future research could extend beyond the banking industry to other financial institutions like insurance companies, investment firms, and microfinance institutions. Further studies could consider other performance indicators other than ROA.

Limitations

This research takes a logical step towards understanding the relationship between risk governance and firm performance; however, few limitations should be noted. First, the study only focused on the banking sector without holistically considering the whole financial sector. This limited our sample size and number of observations (n=55). Second, while the study calculated robust findings, other performance measures asides Return on Assets (ROA) were not taken into consideration which could be useful for wider range of firms and industries.

| Appendix 1 HAUSMAN SPECIFICATION TEST |

||

| Test of Cross-Section Random Effects | ||

| Test Summary | Chi-Sq. Stat. | P-Value |

| Cross-Section random | 41.4126 | 0.000 |

Authors Computation 2018

References

- Arnold, V., Benford, T., Canada, J., & Sutton, S. (2011). The role of strategic enterprise risk management and organizational flexibility in easing new regulatory compliance. International Journal of Accounting Information Systems, 12(3), 171-188.

- Ame, J., Arumona, J., & Erin, O. (2017). The impact of ownership structure on firm performance: Evidence from listed manufacturing companies in Nigeria. International Journal of Accounting, Finance and Information System, 1(1), 293-305.

- Aebi, V., Sabato, G., & Schmid, M. (2012). Risk management, corporate governance, and bank performance in the financial crisis. Journal of Bank Finance, 32(2), 3213-3226.

- Baxter, R.., Bedard, J., Hoitash, R., & Yezegel, A. (2013). Enterprise risk management program quality: Determinants, value relevance, and the financial crisis. Contemporary Accounting Research, 4(2), 34-54.

- Bromiley, P., McShane, M., Nair, A., & Rustambekov, E. (2014). Enterprise risk management: Review, critique, and research directions. Long Range Planning, 2(1), 1-12.

- Bartram, S. (2000). Corporate risk management as a lever for shareholder value creation. Financial Markets, Institutions, and Instruments, 9(5), 279-324.

- CBN (2012). Exposure draft CODE for banks in Nigeria. Central Bank of Nigeria (CBN).

- Committee of sponsoring organizations of the tread way commission. (COSO, 2004). Enterprise risk management–integrated framework: Executive summary. Retrieved from http://www.coso.org, accessed 07/02/2018.

- Checkley, M. (2009). The inadvertent systemic risk in the financial network: Venture capital and institutional funds. Long Range Planning, 42(3), 341-358.

- Cavezzali, E., & Garddenal, G. (2015). Risk governance and performance of the Italian banks: An empirical analysis. Working paper, University of Foscari, Venezia, Italy.

- Ellul, A., & Yerramilli, V. (2012). Stronger risk controls, lower risk: Evidence from U.S. bank holding companies. Journal of Finance 68(5), 1757-1803.

- Erin, O., Eriki, E., Arumona, J., & Ame, J. (2017). Enterprise risk management and financial performance: Evidence from emerging market. International Journal of Management, Accounting and Economics 4(9), 937-952.

- Fadun, O. (2013). Risk management and risk management failure: Lessons for business enterprise. International Journal of Academic Research in Business & Social Sciences, 3(2), 225-241.

- Gordon, L., Loeb, M., & Tseng, C. (2009). Enterprise risk management and firm performance: A contingency perspective. Journal of Accounting and Public Policy, 28(4), 301-327.

- Gujarati, D., & Porter, D. (2009). Basic Econometrics. New York: McGraw-Hill

- Haketa, N. (2010). Principle of econometrics: An introduction (using R). UK: SAGE Publishers

- Hoyt, R., & Liebenberg, A. (2011). The value of enterprise risk management. Journal of Risk and Insurance. 78(4),795-822.

- Ishaya, J. & Siti, Z. (2015). A theoretical framework in the level of risk management implementation in the Nigerian Banking Sector: The moderating effect of top management support. Procedia-Social and Behavioural Science, 164(3), 627-634.

- Ishaya, J. & Siti, Z. (2015). Determinants influencing the implementation of ERM in the Nigerian banking sector. International Journal of Asian Social Science, 5(12), 740-754.

- International Risk Governance Council (IRGC) (2005). White Paper No. 1: Risk governance towards an integrative approach. Geneva: International Risk Governance Council (IRGC).

- Kakanda, M., Salim, B., & Chandren, S. (2017). Corporate governance, risk management disclosure, and firm performance: A theoretical and empirical review perspective. Asian Economic and Financial Review, 7(9), 836-845.

- Kleffner, A., Lee, R., & McGannon, B. (2003). The effect of corporate governance on the use of enterprise risk management: Evidence from Canada. Risk Management and Insurance Review, 6(1), 53-73.

- KPMG (2015). Enterprise Risk Management (ERM)-An emerging model for building shareholder value. Retrieved from http:www.kpmg.com.

- Liebenberg, A.P., & Hoyt, R.E., (2003). The determinants of enterprise risk management: Evidence from the appointment of chief risk officers. Risk Management and Insurance Review, 6(1), 37-52.

- Li, Q., Wu, Y., Ojiako, U., Marshall, A., & Chipulu, M. (2014). Enterprise risk management and firm value within China’s insurance industry. Acta Commercii, 14(1), 1-10.

- Liaropoulous, A., Sapountzaki, K., & Nivolianitou, Z. (2016). Risk governance gap analysis in search and rescue at offshore platforms in the Greek territory. Safety Science, 86, 132-141.

- Mikes, A., (2009). Risk management and calculative cultures. Management Accounting Research, 20(1), 18-40.

- Mojtaba, M., & Davoud, S. (2007). Enterprise risk management and firm performance evidence from financial market of Iran. Research Journal of Management Sciences, 6(3), 6-12.

- Meulbroek, L. (2002). Integrated risk management for the firm: A senior manager’s guide. Journal of Applied Corporate Finance 14(1), 56-70.

- McShane, M., Nair, A., & Rustambekov, E. (2011). Does enterprise risk management increase firm value? Journal of Accounting, Auditing & Finance 16(4), 641-658.

- McConnell, P. (2012). The governance of strategic risks in systemically important banks. Journal of Risk Management in Financial Institutions, 5(2), 128-142.

- Mollah, S., Hassan, M., Al-farooque, O. & Mobarek, A. (2014). The governance, risk-taking, and performance of Islamic banks. Journal of Financial Services Research, 2(2), 141-155.

- Mongiardino, P., & Plath, C. (2010). Risk governance at large banks: Have any lessons been learned? Journal of Risk Management in Financial Institutions, 3(2), 116-123.

- Marjolein, B., Van, A., & Renn, O. (2011). Risk governance. Journal of Risk Research, 14(4), 431-44.

- Onafalujo, A., & Eke, P. (2012). Influence of enterprise risk management on competitive advantage in the Nigerian manufacturing sector. International Journal of Management Science, 3(3),95-101.

- Owojori, A., Akintoye, I., & Adidu, F. (2011). The challenge of risk management in Nigerian banks in the post-consolidation era. Journal of Accounting and Taxation, 3(2), 23-31.

- Quen, T., Zeghal, D., & Maingot, M. (2012). Enterprise risk management and firm performance. Procedia - Social and Behavioural Sciences, 62(2), 263-267.

- Okoye, L., Adetiloye, K., Erin, O., & Evbuomwan, G. (2017). Impact of banking consolidation on the performance of the banking sector in Nigeria. Journal of Internet Banking and Commerce, 22(1), 1-16.

- Pagach, D. & Warr, R., (2011). The characteristics of firms that hire chief risk officers. Journal of Risk and Insurance, 78(1), 185-211.

- Rahim, S., F. Mahat., A. Nassar., & Yahya, M. (2015). Re-thinking: Risk governance? Procedia Economics and Finance, 31(2), 689-698.

- Risk and Insurance Management Society (RIMS). (2011). RIMS Risk Maturity Model (RMM) for Enterprise Risk Management (ERM). Executive Summary, RIMS.

- Sara, S., Siti, Z., Nargess, M., & Wan, K. (2015). Business strategy, enterprise risk management, and organizational performance. Management Research Review, 39(9), 1016-1033.

- Sobel, P., & Reding, K. (2004). Aligning corporate governance with enterprise risk management. Management Accounting Quarterly, 5(2), 1-9.

- Soliman, A., & Adam, M. (2017). Enterprise risk management and firm performance: an integrated model for the banking sector. Banks and Banks Review, 12(2), 116-123.

- Uwuigbe, U., Erin, O., Uwuigbe, O., Igbinoba, E., & Jafaru, J. (2017). Ownership structure and financial disclosure quality: Evidence from listed firms in Nigeria. Journal of Internet Banking and Commerce, 22(8), 1-12.

- Verbuggle, J., Smith, C., Niehaus, G., Briscoe, C., Cohman, W., Lawder, K., Ramamurtie, S., & Chew, D. (2003). University of Georgia roundtable on enterprise-wide risk management. Journal of Applied Corporate Finance, 15(4), 8-26.

- Walker, P., Shenkir, Gof, W., & Barton, T. (2006). ERM in practice. Internal Auditor, 60(4), 51-55.

- Zemzem, A. & Kacem, O. (2014). Risk management, board characteristics and performance in the Tunisian lending institutions. International Journal of Finance and Business Studies, 3(1), 186-200.