Research Article: 2017 Vol: 21 Issue: 3

Does Transparency and Openness Pay When the Market Is Uncertain? Evidence From Disclosure on Securitization Losses

Michele Fabrizi, Universita degli Studi di Padova

Keywords

Disclosure, Securitization, Market reaction, Transparency.

Introduction

This paper investigates whether during the unfolding of the subprime mortgage crisis the market rewarded banks that were transparent in disclosing information about securitization losses. Theoretical research suggests that enhanced disclosure can reduce the adverse selection component of the bid-ask spread (Amihud and Mendelson, 1986) and the non-diversifiable estimation risk (Klein and Bawa 1976; Barry and Brown 1985; Coles and Loewenstein 1988; Handa and Linn 1993). Nonetheless, disclosing information can be costly for firms, in particular when being open and transparent to the market means communicating negative news. Indeed, Skinner (1994) shows that the market responds negatively to bad news disclosure, and Kasznik and Lev (1995) find that returns of firms that warn about earnings shortfall are significantly lower than returns of those that likely anticipate an earnings shortfall but do not warn. This finding has been interpreted as a market penalty for openness. Tucker (1995) challenges this viewpoint and shows that, after controlling for self-selection, openness is penalized by investors in the short-term but not in the long-term. Therefore, the economic impact of openness and transparency is a currently debated issue with proponents and opponents of the view that openness is penalized by the market.

In this paper, I use the unique research setting of securitization disclosure of U.S. financial institutions to investigate whether the market – during the unfolding of the subprime mortgage crisis – rewarded those financial institutions that were transparent in disclosing losses on securitized assets.

Securitization transactions, which consist of converting illiquid assets into liquid securities, were the engine of financial innovation in the pre-crisis years and gave rise to exotic financial instruments that found their way, either directly or indirectly, onto commercial and investment banks’ balance sheets. When the subprime mortgage market collapsed, these financial instruments revealed their high risk and swamped the financial industry (Cerbioni et al., 2015). One of the major issues related to securitization transactions was the lack of information available to investors about the risks undertaken by banks. Indeed, the near absence of information available has made it difficult for banks’ investors to control and discipline the process of originating and securitizing risky loans (Barth and Landsman 2010). In early 2007, the risks undertaken by banks through securitization transactions started becoming evident, with media and business press reporting an increasing number of news about the severe and negative consequences of banks’ subprime mortgage positions. Given the poor disclosure offered by banks about the nature of their securitization transactions, investors were left with the uncertainty about the potential risks embedded in the securitization transactions undertaken by banks. Specifically, although very important to evaluate the potential risk of securitization transactions (Cerbioni et al., 2015), the amount of losses recorded on securitized assets was often not disclosed. Indeed, even if SFAS 140 required financial institutions to disclose information about losses on securitized assets, there was ample variation among banks on the extent to which such disclosure was provided.

In a context of high uncertainty, in which investors assist to the unfolding of the subprime crisis and become aware of the risks embedded in securitizations, the market might react to disclosure about securitization losses in two ways: i) either by penalizing banks that communicate losses, or ii) by rewarding them because of their transparency and openness. This is the empirical question I investigate in this paper.

To empirically address the research question, I use hand-collected data on securitization disclosure for a sample of 79 US financial institutions and abnormal market returns around 28 event dates that marked the unfolding of the subprime crisis according to three information sources (USA Today, BBC News, Wall Street Journal). In the analysis, I document three main findings: 1) banks experienced negative market returns around event dates leading to the subprime crisis; 2) the investors’ negative market reaction was significantly stronger for banks with large exposure to securitizations compared to banks with few securitization transactions; 3) investors reacted less negatively in the presence of disclosure about securitization losses, regardless of whether banks disclosed positive or negative news. Overall, these results suggest that investors imposed lower penalties on banks that openly disclosed the amount and nature of their losses, thereby indicating that transparency and openness are welcome by investors even when they entail communicating bad news. In additional analyses, I show that results reported in the paper are not driven by the underlying riskiness of securitization transactions.

This study mainly contributes to extant research on disclosure with a specific focus on the economic consequences of disclosing bad news (Skinner, 1994; Kasznik and Lev, 1995; Tucker, 1995). Specifically, I use a particular research setting in which there is high market uncertainty to document that investors appreciate openness and disclosure in the presence of bad news. I also add to research that focuses on disclosure in the banking industry (e.g. Nier and Baumann, 2006; Frolov, 2007; Pérignon and Smith, 2010). Nier and Baumann (2006) document that discipline resulting from uninsured liabilities and disclosure creates incentives for banks to limit their risk of insolvency, by choosing a larger capital buffer for given risk and provide new insights on the effects of disclosing bad news. Frolov (2007) suggests that mandated disclosure rules for banks are a consequence of the government policy of financial safety net, while Pérignon and Smith (2010) - using panel data over the period 1996-2005 document an overall upward trend in the quantity of information released to the public by commercial banks. I add to these results by providing insights on the consequences of bad news disclosure by banks.

The paper proceeds as follows. Section II reviews related literature and develops the research question investigated in the paper; Section III describes the methodology used; Section IV reports and discusses the main findings; Sections V concludes.

Related Literature and Research Question

Prior Research

Disclosure is one of the most debated research topics that span at least three literatures (Verrecchia, 2001): accounting, finance and economics. One reason of such fervid debate around disclosure is due to the absence of a comprehensive and unified theory of disclosure (Verrecchia, 2001). Indeed, there is no central paradigm that gives rise to all subsequent research on the topic (Verrecchia, 2001). As Botosan (1997) points out, there is no consensus on whether firms benefit from increased disclosure, although many asset pricing models suggest that increased disclosure can reduce cost of equity capital. From a theoretical viewpoint, there are two main channels through which increased disclosure can benefit firms by reducing cost of equity capital. The first argument is that greater disclosure enhances stock market liquidity and thus reduces cost of equity capital through reduced transaction costs and increased demand for a company’s stocks (Botosan, 1997). The second channel, instead, is the reduced estimation risk arising from investors’ estimates of the parameters of an asset’s return as a consequence of increased disclosure (Botosan, 1997). Research on the economic consequences of disclosure is vast and many contributions support a negative association between disclosure level and cost of equity capital (Diamond and Verrecchia, 1991; Coles et al., 1995; Clarkson et al., 1996).

A related stream of research narrows the scope of the investigation to managers’ attitude to disclose bad news to the market (Skinner, 1994; Kasznik and Lev, 1995; Tucker, 1995). The intriguing research question asked by those studies relates to the potential benefits and costs of being transparent and open to investors and stakeholders even when this entails disclosing negative news. Prior research argues that disclosing bad news reduces expected legal costs in two ways (Skinner, 1994): i) if the information is disclosed prior to the mandated release date, it is difficult to argue that managers withheld information, ii) disclosing early limits the nondisclosure period, and thus the potential damage that one could claim against the firm. Managers are also likely to have reputational incentives to disclose negative news since in many circumstances they cannot realistically claim of being unaware of the bad news (Skinner, 1994).

Although the potential benefits of openness discussed in the literature, empirical evidence suggests that investors impose penalties on firms that disclose negative news. Specifically, Kasznik and Lev (1995) investigate management's discretionary disclosures prior to a large earnings surprise and show that the combined reaction to the warning and the subsequent earnings announcement is significantly more negative for firms that warned investors of bad news than the reaction to the earnings announcement of the non-warning firms. This finding has been interpreted by scholars and the business press as a penalty for openness (Tucker, 2007). In a related paper, Tucker (2007) starts from results reported in Kasznik and Lev (1995) and further investigates the penalties imposed by investors on firms that disclose bad news. Specifically, Tucker (2007) finds that, on average, warning firms have a larger amount of other bad news than non-warning firms, such as discontinuation of new product development, plans for store closings, trouble with alliances. After controlling for other bad news, Tucker (2007) finds that warning firms’ returns remain lower than those of non-warning firms in a short-term window but – in the long-term – warning and non-warning firms exhibit similar returns. Thus, Tucker (2007) concludes that openness is ultimately not penalized by investors. Many other researchers have examined whether investors appreciate firms being transparent and open when this means disclosing negative news, but conclusions on investors’ reaction to bad news disclosure are far from being unanimous (Atiase et al., 2006; Shu, 2003; Xu, 2003).

In this paper, I aim at contributing to the debate on the desirability of firms’ openness by investigating managers’ disclosure on securitization losses during the US subprime crisis. As I discuss in the following, this research setting allows me to investigate whether investors penalize or reward banks that disclose negative news (losses on securitizations) in a situation in which market uncertainty and information asymmetry are particularly high.

Securitization Transactions

The issuance of exotic financial instruments played a prominent role in the recent financial crisis because it induced the financial sector to misallocate resources to real estate (Diamond and Rajan, 2009). “Securitization transactions, which consist of converting illiquid assets into liquid securities, were the engine of financial innovation in the pre-crisis years and gave rise to exotic financial instruments that found their way, either directly or indirectly, onto commercial and investment bank balance sheets. When the subprime mortgage market collapsed in 2007, these financial instruments revealed their high risk and swamped the financial industry” (Cerbioni, 2015, p. 155). The risky nature of such transactions is also testified by empirical research documenting that executives incentivized on risk engaged into securitization transactions to a larger extent than executives with low risk incentives (Fabrizi and Parbonetti, 2015). Moreover, using a sample of bank holding companies, Cheng et al. (2011) document that banks involved into securitizations face greater information uncertainty. This is because market participants have difficulty in assessing the true extent of securitization recourse because of the complexity and lack of transparency associated with asset securitization transactions (Cheng et al., 2011).

Overall, one of the major issues related to securitizations was the lack of information available to investors about the risks underlying such transactions. The near absence of information available on the riskiness of securitizations has made it difficult for investors to control and discipline the process of originating and securitizing risky loans (Cerbioni et al., 2015). In this context of lack of transparency and disclosure, some banks undertook steps towards a more open and transparent approach, and provided investors with detailed information on the amount of losses on securitizations incurred by the bank during the unfolding of the subprime crisis. Given the existing evidence in the literature, this strategy is potentially a double-edged sword because on one hand investors could appreciate transparency and openness, while on the other hand the market could penalize the disclosure of bad news. Given the contrasting evidence from prior research on the economic consequences of disclosing negative news, whether the market penalizes or rewards openness and transparency in the securitization setting is an empirical question that I investigate in this study.

Methodology

Event Dates

The empirical strategy used in this study relies on the analysis of abnormal stock returns for a sample of US financial institutions around event dates that marked the unfolding of the subprime crisis. To identify such dates I searched three news providers: USA Today, BBC News and Wall Street Journal. I identified 28 event dates over the period 2007-2008. The first event date is April, 2nd 2007 when the subprime mortgage lender New Century Financial filed for bankruptcy-court protection and the last event date is March, 14th 2008 when Bear Stearns received emergency funding, after its exposure to mortgage-backed investments undermined confidence in the bank. In order to identify which dates to include in the analysis, I decided to retain those dates that were mentioned by at least two news providers as milestones in the unfolding of the US financial crisis. Appendix 1 reports the event dates used in this study and the corresponding news provider.

Research Design

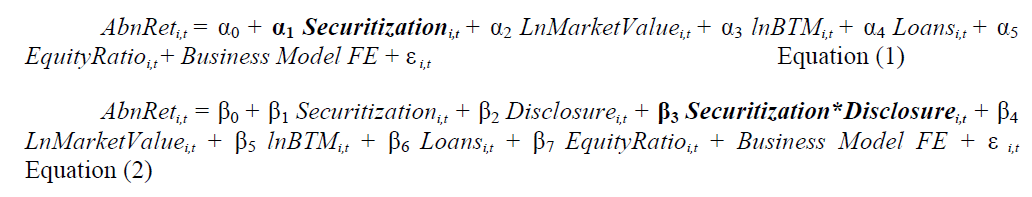

To investigate investors’ reaction to disclosure of bad news I analyse whether the expected negative market reaction around the event dates above identified is moderated by banks’ disclosure on the amount of losses recorded on securitization transactions. If the market rewards openness, I would expect that increased disclosure reduces investors’ negative reaction around event dates, while if investors fixate on the negative news; I would expect a more negative reaction around event dates in the presence of disclosure of losses on securitizations. I empirically address the research question by estimating the following OLS models:

Where AbnRet is computed as the difference between the daily stock return for an individual bank in the sample and the capitalization-weighted daily market return, cumulated over a 3-day window centered around the event date; Securitization is the amount of securitized assets standardized by total assets as reported in the 10-K filing; LnMarketValue is the natural logarithm of the bank’s market value and it controls for size; lnBTM is the natural logarithm of the book-to-market ratio and it proxies for growth opportunities; Loans is the amount of loans standardized by total assets and it captures the banks’ business model; Equity Ratio is the bank’s equity ratio and it controls for any capital constraint. Finally, to better control for the heterogeneity in the business model across financial institutions, I include fixed effects based on 2-digit SIC codes in each equation. Data are collected from the database COMPUSTAT, CRSP and from banks’ annual reports. Robust standard errors are clustered at firm level.

In Equation (1) I expect a negative and significant coefficient on α1, thus showing that around event dates investors reacted more negatively in banks involved into securitization transactions. Equation (2) directly investigates the research question by introducing in the model the variable Disclosure. Information on banks’ disclosure about securitization losses is retrieved by manually analyzing the 10-K reports. Disclosure ranges from 0 to 5 and it takes the following values:

1. if the amount of losses on securitization cannot be computed;

2. if the amount of losses on securitization can be computed only partially;

3. if the amount of losses on securitization is not disclosed in a table but it can be computed indirectly;

4. if the amount of losses on securitization is disclosed in a table;

5. if the amount of losses on securitization is disclosed in a table and it is divided among types of securitizations.

Disclosure takes the value of 0 in the presence of no securitization transactions. In Equation (2) the coefficient of interest is β3, that is the interaction term between bank’s securitization (Securitization) and the disclosure index (Disclosure). A negative and significant sign on the interaction term would indicate that banks which are more transparent and open are more penalized by the market. In contrast, a positive and significant sign on β3 would suggest that openness is not penalized but actually investors’ reward banks that disclose more.

Sample

I started the analysis by identifying the 100 largest financial institutions included in the database COMPUSTAT. For these companies, I retrieved data on securitization transactions and disclosure on securitization losses from the 10-K filings for fiscal years 2006-2007-2008 and I merged such data with COMPUSTAT and CRSP to compute all variables needed to estimate equations (1) and (2). Abnormal returns around event dates are merged with accounting data based on the most recent financial statement publicly available at the time of the event. Overall, I was able to collect full data for 79 unique banks and I estimate the regression models using a pooled sample of 2,133 observations.

Results

Descriptive Statistics and Univariate Analysis

Table 1 reports descriptive statistics for the final sample. As expected, around event dates the average abnormal return is negative (AbnRet, mean: -0.003, median: -0.007). Data on securitization show a significant variation in the sample (Securitization, mean: 0.099; median: 0.000) and statistics on the disclosure index suggest that on average banks’ disclosure on securitization losses is poor. Nonetheless, when interpreting these values it is important to consider that the average value reported in Table 1 for the variable Disclosure is affected by several banks that did not engage into securitizations and thus have a value of 0 on the disclosure index. To make sure that this research design choice does not affect results, in a robustness test I run the main model specification restricting the sample to banks with non-zero securitizations. Finally, Table 1 suggests that - in the sample - loans represent a large proportion of banks’ assets (Loans, mean 0.598, median 0.661).

| Table 1: Descriptive Statistics | ||||||

| N | Mean | Std Dev | p25 | Median | p75 | |

|---|---|---|---|---|---|---|

| AbnRet | 2133 | -0.003 | 0.048 | -0.028 | -0.007 | 0.018 |

| Securitization | 2133 | 0.099 | 0.533 | 0.000 | 0.000 | 0.044 |

| Disclosure | 2133 | 1.089 | 1.624 | 0.000 | 0.000 | 2.000 |

| LnMarketValue | 2133 | 8.619 | 1.634 | 7.153 | 8.182 | 10.033 |

| lnBTM | 2133 | -0.723 | 0.368 | -0.937 | -0.692 | -0.459 |

| Loans | 2133 | 0.598 | 0.232 | 0.487 | 0.661 | 0.733 |

| EquityRatio | 2133 | 0.108 | 0.095 | 0.076 | 0.093 | 0.106 |

Table 1 reports descriptive statistics for the variables included in the analysis. Variables are defined in Appendix 2.

| Table 2: Correlation Matrix | |||||||

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| (1) | AbnRet | 1 | |||||

| (2) | Securitization | -0.105*** | 1 | ||||

| (3) | Disclosure | -0.033 | 0.057** | 1 | |||

| (4) | LnMarketValue | -0.028 | 0.027 | 0.521*** | 1 | ||

| (5) | lnBTM | -0.033 | 0.070** | 0.114*** | -0.163*** | 1 | |

| (6) | Loans | 0.012 | -0.162*** | -0.112*** | -0.423*** | 0.347*** | 1 |

| (7) | EquityRatio | 0.028 | -0.057** | 0.026 | -0.046* | -0.113*** | 0.147*** |

Table 2 reports correlation coefficients among the variables included in the regression models. The negative and statistically significant correlation between Securitization and AbnRet suggests that, around event dates marking the unfolding of the subprime crisis, banks that were deeply involved into securitization transactions experienced the largest market penalties. Table 2 also suggests that large firms disclose more, and that disclosure is lower in financial institutions with a large proportion of assets invested in loans. Overall, correlations reported in Table 2 do not raise multicollinearity issues.

The table reports the Pearson correlation coefficients among the variables used in the analyses. *, **, *** indicate statistical significance at 10%, 5%, 1% level, respectively. Variables are defined in Appendix 2.

Multivariate Analysis

The table reports regression results obtained from estimating Equation (1) and Equation (2). *, **, *** indicate statistical significance at 10%, 5%, 1% level, respectively. P-values are two tailed. Robust t-statistics are reported in brackets and are based on standard errors clustered at bank level. Variables are defined in Appendix 2.

| Table 3: Market Reaction, Securitization, And Disclosure | ||

| (1) | (2) | |

| AbnRet | ||

| Securitization | -0.007*** | -0.029*** |

| [-5.905] | [-3.792] | |

| Disclosure | -0.002** | |

| [-2.294] | ||

| Securitization*Disclosure | 0.023*** | |

| [2.747] | ||

| LnMarketValue | -0.000 | -0.000 |

| [-0.622] | [-0.444] | |

| lnBTM | -0.004 | -0.004 |

| [-1.357] | [-1.490] | |

| Loans | -0.003 | -0.002 |

| [-0.327] | [-0.276] | |

| EquityRatio | 0.017 | 0.020* |

| [1.325] | [1.807] | |

| Constant | -0.010 | -0.015 |

| [-0.858] | [-1.230] | |

| SIC Fixed Effects | YES | YES |

| Observations | 2,133 | 2,133 |

| R-squared | 0.016 | 0.019 |

Table 3 reports the main results. Column (1) in Table 3 presents results from estimating Equation (1) while Column (2) shows results obtained from Equation (2). In Column (1) the coefficient on Securitization is negative and significant at 1% level, thereby indicating that the larger the amount of securitizations, the stronger the market penalty around event dates. This result is consistent with the univariate analysis reported in Table 2. Importantly, Column (2) shows that the interaction term between Securitization and Disclosure is positive and significant (1% level), thus indicating that when banks increase their disclosure on the amount of securitization losses, investors impose lower penalties on the bank. Therefore, investors seem to appreciate and reward transparency and openness, even when it implies communicating bad news such as losses on securitizations. Untabulated results indicate that the sum of the coefficients on Securitization and Securitization*Disclosure is negative and significant (p-value<0.00). This implies that around event dates, in the presence of disclosure on securitization losses, investors still penalize banks that engaged into securitizations but significantly less compared to non-disclosing banks.

Additional Analyses

In this section, I further investigate the research question to corroborate the support to the intuition that investors reward transparency and openness. A critical research design choice in all event studies is the selection of the window over which to compute abnormal returns. A small window may cause a loss of information due to some anticipation effects, while a long window might capture market reactions that are not related to the event analysed. To make sure that the results are not driven by the selection of a specific event window, Table 4 replicates Equation (1) and Equation (2) by computing abnormal returns over a window of five days instead to three days. Results reported under this alternative specifications are qualitatively similar to those reported in the main analyses and do not affect conclusions.

| Table 4: Different Estimation Windows | ||

| (1) | (2) | |

| AbnRet (5days) | ||

| Securitization | -0.007*** | -0.033*** |

| [-3.749] | [-2.649] | |

| Disclosure | -0.003*** | |

| [-2.843] | ||

| Securitization*Disclosure | 0.027** | |

| [2.002] | ||

| LnMarketValue | -0.000 | 0.000 |

| [-0.388] | [0.222] | |

| lnBTM | -0.008* | -0.007 |

| [-1.807] | [-1.610] | |

| Loans | -0.010 | -0.009 |

| [-0.629] | [-0.554] | |

| EquityRatio | 0.043** | 0.048** |

| [2.020] | [2.525] | |

| Constant | -0.021 | -0.030 |

| [-1.054] | [-1.500] | |

| SIC Fixed Effects | YES | YES |

| Observations | 2,133 | 2,133 |

| R-squared | 0.019 | 0.023 |

The table reports regression results obtained from estimating Equation (1) and Equation (2) using a 5-day window around the event date. *, **, *** indicate statistical significance at 10%, 5%, 1% level, respectively. P-values are two tailed. Robust t-statistics are reported in brackets and are based on standard errors clustered at bank level. Variables are defined in Appendix 2.

| Table 5: Restricting The Sample To Securitizing Banks | |

| (1) | |

| AbnRet | |

| Securitization | -0.025** |

| [-2.083] | |

| Disclosure | -0.000 |

| [-0.061] | |

| Securitization*Disclosure | 0.020* |

| [1.694] | |

| LnMarketValue | -0.000 |

| [-0.224] | |

| lnBTM | -0.005 |

| [-1.002] | |

| Loans | -0.024 |

| [-1.254] | |

| EquityRatio | 0.001 |

| [0.051] | |

| Constant | -0.002 |

| [-0.104] | |

| SIC Fixed Effects | YES |

| Observations | 864 |

| R-squared | 0.031 |

The table reports regression results obtained from estimating Equation (2) restring the sample to only banks with positive securitizations. *, **, *** indicate statistical significance at 10%, 5%, 1% level, respectively. P-values are two tailed. Robust t-statistics are reported in brackets and are based on standard errors clustered at bank level. Variables are defined in Appendix 2

As I mentioned when describing the computation of the disclosure index, in order to keep all observations in the sample I assigned a value of 0 to the disclosure index when there is no securitization. In the next analysis, I investigate whether this research design choice biases the results. First of all, it is important to notice that since in each regression I control for the total amount of securitized assets this concern is partially addressed. Nonetheless, in Table 5 I report the main findings restricting the sample to observations with non-zero securitization. The coefficient on Securitization is negative and significant (5% level) and, importantly, the interaction term between Securitization and Disclosure remains positive and significant (10% level). Therefore, when I restrict the sample to banks with non-zero securitizations I still find that investors reward transparency and openness.

| Table 6: Disclosing High Securitization Losses | |

| (1) | |

| AbnRet | |

| Securitization | -0.566** |

| [-2.583] | |

| Disclosure | -0.012*** |

| [-3.325] | |

| Securitization*Disclosure | 0.192*** |

| [3.405] | |

| HighLosses*Securitization*Disclosure | -0.005 |

| [-0.470] | |

| HighLosses | -0.001 |

| [-0.236] | |

| LnMarketValue | -0.005*** |

| [-8.268] | |

| lnBTM | -0.021*** |

| [-3.643] | |

| Loans | -0.065*** |

| [-5.846] | |

| EquityRatio | 0.427*** |

| [19.450] | |

| Constant | 0.037** |

| [2.573] | |

| SIC Fixed Effects | YES |

| Observations | 351 |

| R-squared | 0.026 |

Another important concern relates to the fact that the disclosure index could (at least partially) capture the riskiness of securitizations and banks that disclose more could be those banks that undertook the less risky securitization transactions. This concern is particularly relevant in this research setting because I am interested in documenting the effect of disclosure regardless of the riskiness of the underlying securitizations. I try to address this problem in several ways. First, I compute a variable (HighLosses) that takes the value of 1 (0) if the amount of losses on securitizations is above (below) the sample median. Second, I generate a three-way interaction between High Losses, Securitization and Disclosure and include it in the regression model. Results are reported in Table 6. As it is possible to notice, the interaction term between Securitization and Disclosure remains positive and significant (1% level) while the three-way interaction is not statistically significant at any conventional level. This suggests that the market rewards banks’ disclosure regardless of whether they communicate high or low amounts of losses. This finding is therefore consistent with the view that investors reward openness also when it requires disclosing bad news. Obviously, this analysis can only be performed on the subsample of banks for which I am able to retrieve data on securitization losses and this significantly reduces the sample.

The table analyzes the effect of disclosing high losses on securitizations. *, **,*** indicate statistical significance at 10%, 5%, 1% level, respectively. P-values are two tailed. Robust t-statistics are reported in brackets and are based on standard errors clustered at bank level. Variables are defined in Appendix 2.

To further make sure that the disclosure index does not capture the underlying riskiness of the bank, I compute banks’ abnormal returns (Returns) and the standard deviation of banks’ returns (SD Returns) during the sample period and I generate a ranking variable (Risk) with the decile distribution of either Returns or SD Returns. The underlying assumption is that riskier bank activities, including securitizations, translated into lower returns and higher volatility during the subprime crisis. In Table 7, I interact the variable Risk with Securitization in the attempt to better control for the potentially confounding effect of the riskiness of the bank’ activity and securitization transactions. In Column (1) of Table 7 I use Returns to compute the ranking variable Risk, while in Column (2) the variable Risk is based on SD Returns. Regardless of the model specification used, the coefficient on Securitization remains negative and significant (1% level) and the interaction term Securitization*Disclosure remains positive and significant (5% level). Therefore, results from this additional analysis are consistent with those previously reported.

| Table 7: Controlling For Risk | ||

| (1) | (2) | |

| AbnRet | AbnRet | |

| Risk=Returns | Risk=SD Returns | |

| Securitization | -0.029*** | -0.136*** |

| [-3.719] | [-4.254] | |

| Disclosure | -0.002** | 0.000 |

| [-2.194] | [0.035] | |

| Securitization*Disclosure | 0.023** | 0.017** |

| [2.509] | [2.416] | |

| Securitization*Risk | -0.000 | 0.013*** |

| [-0.274] | [3.841] | |

| Risk | 0.000 | -0.002*** |

| [0.007] | [-4.692] | |

| LnMarketValue | -0.000 | 0.000 |

| [-0.358] | [0.434] | |

| lnBTM | -0.004 | 0.001 |

| [-1.571] | [0.430] | |

| Loans | -0.003 | 0.002 |

| [-0.334] | [0.183] | |

| EquityRatio | 0.021* | -0.002 |

| [1.848] | [-0.319] | |

| Constant | -0.003 | 0.010* |

| [-0.409] | [1.690] | |

| SIC Fixed Effects | YES | YES |

| Observations | 2,106 | 2,106 |

| R-squared | 0.019 | 0.032 |

The table reports regression results obtained from estimating Equation (2) while controlling for the underlying risk. *, **, *** indicate statistical significance at 10%, 5%, 1% level, respectively. P-values are two tailed. Robust t-statistics are reported in brackets and are based on standard errors clustered at bank level. Variables are defined in Appendix 2.

Finally, I use a third approach to address the concern that the disclosure index is capturing bank’s risk and I estimate the following model:

Disclosure = ρ0 + ρ1 Returns+ ρ2 SD Returns + μ Equation (3)

| Table 8: Two-Stage Approach | |

| (1) | |

| AbnRet | |

| Securitization | -0.013*** |

| [-6.498] | |

| Disclosure (Res) | -0.000 |

| [-0.330] | |

| Securitization*Disclosure (Res) | 0.022*** |

| [2.922] | |

| LnMarketValue | -0.001 |

| [-1.177] | |

| lnBTM | -0.005* |

| [-1.803] | |

| Loans | -0.003 |

| [-0.326] | |

| EquityRatio | 0.017 |

| [1.395] | |

| Constant | 0.000 |

| [0.038] | |

| SIC Fixed Effects | YES |

| Observations | 2,106 |

| R-squared | 0.019 |

Next, I use the residuals from Equation (3) as a proxy for disclosure and interact it with Securitization. By doing so I study the component of disclosure that is unrelated to the riskiness of bank’ activities (including securitizations). Results are reported in Table 8 and they are in line with those discussed in the main analyses.

The table reports regression results obtained from estimating Equation (2) using the residuals from Equation (3) as a proxy of disclosure. *, **, *** indicate statistical significance at 10%, 5%, 1% level, respectively. P-values are two tailed. Robust t-statistics are reported in brackets and are based on standard errors clustered at bank level. Variables are defined in Appendix 2.

Conclusion

I use the research setting of securitization disclosure of US financial institutions to investigate whether the market - during the unfolding of the subprime mortgage crisis – rewarded those financial institutions that were transparent in disclosing losses on securitized assets. In doing so, I study whether the market punishes or rewards banks that are open and transparent to the market by communicating that they have suffered losses on securitizations. Using a sample of 79 US banks and 28 event dates, I document that investors’ negative reaction around event dates was significantly lower in the presence of disclosure about securitization losses, regardless of whether banks disclosed high or low losses. Importantly, subsequent analyses show that this result is not driven by the overall riskiness of the bank.

Overall, the results suggest that in the presence of high uncertainty investors react less negatively when disclosure increases, even in those instances in which disclosure requires communicating bad news.

An important caveat must be considered when interpreting results reported in this study: although I try to address the problem that the disclosure index might reflect the riskiness of securitization transactions, endogeneity is still an issue in my research setting. Indeed, I am not able to control for all omitted correlated variables that can jointly affect disclosure and investors’ reaction around event dates.

Appendix

| Appendix 1: Event Dates | |||

| Date | USA Today | BBC News | WSJ |

|---|---|---|---|

| 2-April-2007 | x | x | |

| 14-June-2007 | x | x | |

| 22-June-2007 | x | x | |

| 13-July-2007 | x | x | |

| 20-July-2007 | x | x | |

| 31-July-2007 | x | x | |

| 6-August-2007 | x | x | x |

| 10-August-2007 | x | x | |

| 16-August-2007 | x | x | x |

| 23-August-2007 | x | x | |

| 19-September-2007 | x | x | |

| 20-September-2007 | x | x | |

| 1-October-2007 | x | x | |

| 16-October-2007 | x | x | |

| 17-October-2007 | x | x | |

| 8-November-2007 | x | x | |

| 14-November-2007 | x | x | |

| 15-November-2007 | x | x | |

| 27-November-2007 | x | x | |

| 11-December-2007 | x | x | |

| 7-January-2008 | x | x | |

| 11-January-2008 | x | x | |

| 15-January-2008 | x | x | |

| 21-January-2008 | x | x | |

| 22-January-2008 | x | x | |

| 3-March-2008 | x | x | |

| 11-March-2008 | x | x | |

| 14-March-2008 | x | x | |

| Appendix 2: Variable Definition | |

| Name | Definition |

|---|---|

| AbnRet | Difference between the daily stock return for an individual bank in the sample and the capitalization-weighted daily market return, cumulated over a 3 day window centred around the event date |

| Securitization | Amount of securitized assets standardized by total assets as reported in the 10 K filing |

| Disclosure | Quality of disclosure on securitization losses computed as describe in Section III |

| LnMarketValue | Natural logarithm of the bank’s market value |

| lnBTM | Natural logarithm of the book-to-market ratio |

| Loans | Amount of loans standardized by total assets |

| EquityRatio | Bank’s equity ratio |

| HighLosses | Dummy variable that takes the value of 1 (0) is the amount of losses on securitizations is above (below) the sample median. |

| Returns | Bank's abnormal returns cumulated over the sample period |

| SD Returns | Standard deviation of banks’ returns computed over the sample period |

| Risk | Ranking variable containing the decile distribution of either Return Crisis or SD Returns |

Endnote

1. Similarly to previous studies on securitization (e.g. Amiram et al. 2011), the sample includes banks as well as other financial institutions and I use the terms interchangeably throughout.

2. As robustness test, I run the main model by excluding each event date one by one. Untabulated results are unchanged. Evidence from this test suggests that the results documented in the paper are not driven by a specific event date.

References

- Amihud, Y. and Mendelson, H. (1986). Asset pricing and the bid-ask spread.Journal of Financial Economics, 17(2), 223-249.

- Amiram, D., Landsman, W.R., Peasnell, K.V. and Shakespeare, C. (2011). Market reaction to securitization retained interest impairments during the financial crisis of 2007-2008: Are implicit guarantees worth the paper they?re not written on? SSRN Working Paper.

- Atiase, R.K., Supattarakul, S. and Tse, S. (2006). Market reaction to earnings surprise warnings: The incremental role of shareholder litigation risk on the warning effect. Journal of Accounting, Auditing and Finance, 21(2), 191-222.

- Barry, C. and Brown, S. (1985). Equilibrium information and security market equilibrium. Journal of Financial and Quantitative Analysis, 20(4), 407-422.

- Barth, M.E. and Landsman, W.R. (2010). How did financial reporting contribute to the financial crisis? European Accounting Review, 19(3), 399-423.

- Botosan, C.A. (1997). Disclosure level and the cost of equity capital. The Accounting Review, 72(3), 323-349.

- Cerbioni, F., Fabrizi, M. and Parbonetti, A. (2015). Securitizations and the financial crisis: Is accounting the missing link? Accounting Forum, 39(3), 155-175.

- Cheng, M., Dhaliwal, D.S. and Neamtiu, M. (2011). Asset securitization, securitization recourse and information uncertainty. The Accounting Review, 86(2), 541-568.

- Clarkson, P., Guedes, J. and Thompson, R. (1996). On the diversification, observability and measurement of estimation risk. Journal of Financial and Quantitative Analysis, 31(1), 69-84.

- Coles, J.L. and Loewenstein, U. (1988). Equilibrium pricing and portfolio composition in the presence of uncertain parameters.Journal of Financial Economics,22(2), 279-303.

- Coles, J., Loewenstein, U. and Suay, J. (1995). On equilibrium pricing under parameter uncertainty. Journal of Financial and Quantitative Analysis, 30(3), 347-364.

- Diamond, D.W. and Verrecchia, R.E. (1991). Disclosure, liquidity, and the cost of capital.The Journal of Finance,46(4), 1325-1359.

- Diamond, D.W. and Rajan, R. (2009). The credit crisis: Conjectures about causes and remedies. NBER Working Paper No. 14739.

- Fabrizi, M. and Parbonetti, A. (2015). CEO risk incentives and the riskiness of securitisation transactions in the financial industry, International Journal of Banking, Accounting and Finance, 6(2), 122-150.

- Frolov, M. (2007). Why do we need mandated rules of public disclosure for banks? Journal of Banking Regulation, 8(2),177-191.

- Handa, P. and Linn, S.C. (1993). Arbitrage pricing with estimation risk.Journal of Financial and Quantitative Analysis,28(1), 81-100.

- Kasznik, R. and Lev, B. (1995). To warn or not to warn: Management disclosures in the face of an earnings surprise.The Accounting Review, 70(1), 113-134.

- Klein, R. and Bawa, V. (1976). The effect of estimation risk on optimal portfolio choice. Journal of Financial Economics, 3(3), 215-231.

- Nier, E. and Baumann, U. (2006). Market discipline, disclosure and moral hazard in banking. Journal of Financial Intermediation, 15(3), 332-361.

- Pérignon, C. and Smith, D.R. (2010). The level and quality of value-at-risk disclosure by commercial banks. Journal of Banking and Finance, 34(2), 362-377.

- Shu, S. (2003). Why do firms issue earnings in the face of earnings disappointments? A self-selection analysis. Working paper, Boston College.

- Skinner, D.J. (1994). Why firms voluntarily disclose bad news.Journal of Accounting Research. 32(1), 38-60.

- Tucker, J.W. (2007). Is openness penalized? Stock returns around earnings warnings.The Accounting Review,82(4), 1055-1087.

- Verrecchia, R.E. (2001). Essays on disclosure.Journal of Accounting and Economics, 32(1), 97-180.

- Xu, W. (2003). Market reaction to warnings of negative earnings surprises: Further evidence. Working paper, University of Vanderbilt.