Research Article: 2020 Vol: 24 Issue: 4

Does Unsystematic Risk Management Affect the Relationship Between Banks' Performance and The Objectives of Saudi Arabia Economic Vision 2030

Dabboussi Moez, Jouf University

Lachachi Abdelhaq, Jouf University

Abstract

While Banks’ performance was regarded as an important driver of economic growth, the relationship between Banks’ performance and economic growth is more complex than linear. Of many factors moderating this relationship, unsystematic risk management is one that received inadequate research attention. The present study aims to investigate the moderating effect of unsystematic risk management on the relationship between banks’ performance and Saudi Arabia's economic growth, which has been a key objective of the Kingdom Vision 2030. Focusing on a sample of 10 publicly traded banks during the period 2005-2017, this paper supports the positive relationship between Banks’ performance and economic growth. Even more, the results indicate that this positive relationship is weakened respectively by unsystematic risk management, especially by credit risk, liquidity risk, and operational risk.

Keywords

Banks’ Performance, Unsystematic Risk Management, Economic Growth, Saudi Arabia Economic Vision 2030.

JEL Classifications

E44, F43, G21, O43.

Introduction

Broadly speaking, banking activity is considered relentless, vague, and complex. This sector is an essential element of economic life in all countries of the world. According to Diamond & Dybvig, (2000), Banks offers liquidity creators and providers and risk transformers to any economy. However, the success with which banks perform their main function is related to their ability to adapt to the variance in profits, losses, or cash flows arising from an uncertain event. The 2008 financial crisis clearly illustrated the failure of risk management in many financial institutions, including Lehman Brothers, Bear Stearns, and Citigroup. The latter collapsed because of poor management of the risks they face. In addition, the diversity of off-balance-sheet financial instruments has allowed banks to have greater access to funds. They have the opportunity to design new products and provide more services to their clients to meet prudential capital requirements. As a result, traditional banking activity based on deposit collection and lending now constitutes a portion of net banking income. Therefore, the correlation between different types of risk, both within an individual bank and across the banking system, has increased and become more complex. This change in the banking business has undergone considerable academic and regulatory interest in how to mitigate banking risk via good risk management, reduce the volatility of firm value, and to gain a competitive advantage in risk-bearing. In order to achieve better performance, the bank needs to define and develop its own risk culture while using caloric decision parameters and access to relevant information on various potential risks. By way of explanation, minimizing expected losses lead to maximizing banks’ Performance which presents a key goal of corporate risk management programs.

In Saudi Arabia, the banking sector is an important pillar in the national economy and plays a leading role in the Saudi Arabian economy. The performance of Saudi Banks is essential to achieve sustainable economic growth. It plays the essential role of financial service provider to the population and generates in the process of producing a key added value for the economy. Hence, Saudi banks seek to manage multiple risks more effectively. Therefore, the focus is on the need to control and absorb these risks by adopting preventive measures and applying instruments of a comprehensive precautionary policy, including the Basel III requirements.

These measures will maximize shareholders' profits in addition to the provision of various credit and savings products to serve the economy in a manner consistent with the requirements of the domestic economy and to achieve one of the objectives of Saudi Arabia namely increasing the size of the economy. The Financial Sector Development Program launched by the Council of Economic and Development Affairs1 present one of the main objectives of the Vision 2030 reform plan. It attempts to create a diversified and effective financial services sector, to increase financial assets as a percentage of GDP and to support, as a consequence, the development of the economy of Saudi Arabia. The challenges facing the banking sector is to support the development of the Saudi national economy through stimulating savings, efficient financing, and by increasing the productivity of investments. More specifically, it aims to increase economic growth. To reach these high goals, the Saudi banking sector should require extensive efforts by mastering unsystematic risk they run including credit risk, liquidity risk, and operational risk. Therefore, the objective of this study is to investigate the moderating effect of unsystematic risk management on the relationship between banks’ performance and Saudi Arabia's economic growth. More specifically, we want to verify if the Saudi banking sector can contribute to the fulfillment of the vision programs’ objectives by taking into consideration the existence of various unsystematic risks.

The remainder of the paper is structured as follows. The second section reviews review the relevant theory and develop our research hypothesis. The third section presents the sample’s formation process and describes the research design. The fourth section reports on an empirical study of the Saudi context. Finally, suggestions from the research are set out in section five.

Literature Review and Research Hypotheses

The scandals of the financial crises of 2007-2009 and its repercussions have proved that the financial situation of banks has a significant impact on the macroeconomic environment by providing funding assistance to both government and private sectors. Based on endogenous growth theory, the development of the financial sector can impact economic growth by increasing the productivity of investments, reducing transmission costs, and promoting or decline saving.

Banks’ Performance and Long-Run Economic Growth

Most scholars offer strong evidence that Banks’ Performance has great positive effects on economic growth (Hicks, 1969; Cole et al, 2008; Jia, & Wang, 2010 & Ueda, 2013). This relationship can be examined by using the bank-based theory. According to this theory, banks play an important role in mobilizing resources, managing risks, and producing better improvement in corporate governance by reducing agency problems (Luintel et al, 2008). Additionally, Flannery & Rangan (2008) and Ijaz et al (2020) argue that performance improvement in Banking increases its shareholders' equity and promote, consequently, its financial stability. This can positively affect economic growth. Using unbalanced panel data from 11 MENA countries during the period (1980–1990), Naceur & Ghazouani (2007) found that there is no significant relationship between banking economic growth. The authors attribute this result to the underdeveloped financial systems that hamper economic growth. More recently, substantial theoretical and empirical works on the relationship between banks’ performance and economic growth can be found. Lai et al (2018) find that the banking industry has significant predictive power on economic growth after controlling for stock, bond, and inflation variables. Using a sample size comprises of 78 observations from the period of 2010 to 2015 of thirteen banks in Jordan, Alkhazaleh (2017) found that banks’ profitability has a significant effect on economic growth. This also confirms Klein & Weil (2019) who show that greater banks’ profitability increases financial stability and therefore fosters economic growth.

According to the Council of Economic and Development Affairs (CEDA), the financial growth of banking sectors in Saudi Arabia has aimed to support the development of the national economy by stimulating savings, finance, and investment. Also, Dwight & Radzewicz-Bak (2012) confirmed that an inefficient financial system prevents monetary policy transmission and considered unhelpful for future economic growth. In his study on the Saudi economy, Masih et al. (2010) argue that the financial sector will help enhance economic growth in an open developing economy like Saudi Arabia. According to the diverse set of empirical results reviewed above, we assume that there is a positive relationship between Banks’ Performance and Economic growth.

H1: Banks’ Performance has a positive effect on economic growth

The Moderating Effect of Risk Management on The Relationship Between Banks’ Performance and Economic Growth

The analysis of bank risk management is a key task of bank supervisors and financial analysts. According to Van Greuning & Bratanovic (2009), banking risks belong to three categories: financial, operational, and environmental risks2. For this study, we retain risks that are controllable by banks namely credit risk, liquidity risk, and operational risk.

The Moderating Effect of Credit Risk

Owing to his strong connection with bank profitability and economic growth, credit risk is the most important risk faced by banks. According to Bouteillé & Coogan-Pushner (2012), Credit risk presents the probability of losing money by cause of the inability, unwillingness, or non-timeliness of a counterparty to honor a financial obligation, which expose bank to a counterparty credit risk that will lead to a financial loss. The question arises, how credit risk affects economic growth. In fact, credit banks are needed for economic growth by leading to an increase in spending, thus increasing income levels in the economy. This in turn leads to higher gross domestic product and thereby faster productivity growth. In the financial market literature, credit risks have become an issue of research concern. It linked to losses resulting from the inability of the bank's customers or other parties to meet their financial obligations. Heider et al. (2009) show that banks were exposed to credit risk because of the information asymmetries in the loan market. Similarly, risk presents the loss associated with counterparty’s inability or refusal to honor its contractual obligations, which may take the form of loans, bonds, or derivative contracts.

Several scholars have confirmed the negative impact of credit risk on Banks’ Performance. Martines-Miera & Repullo, (2010) found that a higher ratio of non-performing loans indicates that the bank is more likely to experience default losses and, conversely, a low ratio is an indicator of better asset quality and lower impaired loans and, as a result, lower credit risk. Ekinci & Poyaraz (2019) argued that a higher credit risk might lead to the failure of banks. This could cause, as a result, instability in the financial system. Various academic research has studied the relationship between credit risk and economic growth. Using Time series analysis from 1969 to 2013 in Cameroon, Thierry et al (2016) found that financial development in bank credit presents a key economic engine to boost economic development. By studying the effect of credit risk on the Nigerian economic growth, Ojima & Ojima (2019) found that credit risk is an inhibitor of economic growth. In this context, we assume that the ratio of non-performing loans negatively affects the relationship between Banks’ Performance and economic growth.

H2: Credit risk has a negative effect on the relationship between Banks’ Performance and economic growth

The Moderating Effect of Liquidity Risk

The main objective of liquidity risk management is to safeguard enough cash available to address the problem posed by (i) customer drawdowns on loan commitments, (ii) the increasing drawdowns under revolving credit facilities, and (iii) demands for repayment from depositors. Banks create liquidity in the economy from two main channels. Firstly, by using the deposits of their clients to finance risky projects. Secondly, by opening credit lines from off-balance-sheet. According to Al-Khouri et al (2019), banks' liquidity encourages the production of goods and speed economic growth and facilitate production and investment.

There is little evidence of a direct effect of liquidity risk on the relationship between Banks’ Performance and economic growth. However, during the past decade, financial market evolution has increased the complexity of liquidity risk and its management because a lack of financial liquidity at a single institution provides system wide repercussions (Hlebik & Ghillani, 2017).

According to Diamond & Dybvig (2000), liquidity risk arises from a poor understanding and forecasting creditors’ expected needs for liquidity. In such situations, if the depositors call their funds, this leads to a fire sale of assets and result in poor performance and safety hazards, (Diamond & Rajan, 2001).

In addition, it is also possible that mismanagement of credit can cause harmful consequences for the country’s economy. Therefore, we expect that liquidity risk negatively affects the relationship between Banks’ Performance and economic growth.

H3: Liquidity risk has a negative effect on the relationship between Banks’ Performance and economic growth

The Moderating Effect of Operational Risk

Operational is the risk of loss resulting from different types of human or technical error, namely organizational inefficiencies and, in particular, failures of the Bank's internal systems. It include internal fraud, external fraud, employment practices, workplace safety, clients, products, and business practices, damage to physical assets, business disruptions and system failures, and execution, delivery, and process management, Basel II. Additionally, it is often associated with the risks inherent in settlements or payments, business interruption, administrative and legal risks. According to the New Basel Capital Accord of January 2001, the Basel Committee on Banking Supervision3 (2001) defined the operational risk as ‘the risk of direct or indirect loss resulting from inadequate or failed internal processes, people and systems or from external events’. In Addition, managing operational risk in bank consist in detecting risks and preserve a part of capital for potential and unexpected losses. In this context, better operational risk management permits the reduction of organizational losses, insurance premiums, and capital costs.

H4: operational risk has a negative effect on the relationship between Banks’ Performance and economic growth.

Empirical Research: Data, Variables, and Econometric Models

Sample for Analysis

Our sample consists of 12 domestic banks listed on the Saudi Stock Exchange (Tadawul) over the period 2008-2017. WorldScoop database represent our data source of financial variables. Macroeconomic variables, such as the GDP growth, are extracted from the World Bank Development Indicators. Among these 1 banks, we have chosen to exclude National Commercial Bank that organized as a privately held entity. We build a balanced panel of data with 110 banks-year observations. All banks included in this study are reported in Table 1.

| Table 1 List of Saudi Banks |

| Al Rajhi Banking & Investment Corp |

| Alawwal Bank |

| Alinma Bank |

| Arab National Bank |

| Bank AlJazira |

| Bank Albilad |

| Banque Saudi Fransi |

| Riyad Bank |

| Samba Financial Group |

| Saudi British Bank |

| Saudi Investment Bank |

| Source: TADAWL web site |

Variables Measurement

Dependent Variable

In general, most academic research use GDP growth rate. It provides insight into the general direction of growth for the overall economy, was the dependent variable used in the study. As literature had identified, many scholars and researchers calculated as same as current study calculated like as Alkhazaleh (2017). Therefore, we followed this measure in this article as well.

Independent Variables

In this research, we consider four indicators of Banks’ Performance. As profitability indicators, we select the return on invested capital (ROIC) and the net profit margin (NPM). The main advantage of the first ratio is that it attempts to measure the returns earned on capital invested by a company. This ratio indicates how much NOPAT is generated by each dollar of operating capital and used to evaluate capital productivity, managerial performance and to select investment projects when it exceeds the cost of capital (Brewer et al, 1999). According to Damodaran (2007), ROIC is the most useful in assessing performance than the return on assets and return on equity. This ratio allows us to measure the return earned on capital invested in an investment. As a general rule, the net profit margin (NPM) is used to study the bank's financial self-sustainability. As reported by Muhammad et al (2014), this ratio shows how much of the earnings by the company are translated into profits. In addition, we retain bank deposits as performance indicators. It gives us an idea about money that people offer to banks and obtain interest as profit (Mckinnon, 1973). By studying the contributions of banking sector performance in economic, Alkhazaleh (2017) find that any change in banks’ deposit will significantly cause a change in economic growth. Finally, we select the total net loan to capture Banks’ Performance. Imam & Kpodar (2016) show that bank loans reduce information retrieval costs and decrease transaction costs. As a consequence, bank loans can stimulate investment that reduces unemployment, increases savings, and improves household incomes. This finding is confirmed by Boukhatem & Ben Moussa (2018) using the economic growth of 13 countries in the MENA region during the 2000–2014 period. Besides, lending is use as good way to achieve the objectives of monetary policies and affects real GDP per worker. Therefore, lending function is considered as a promoter for economic growth.

Moderating Variable

To reflect the mechanism of risk management, three proxies are constructed. (i) The ratio of non-performing loans to measure credit risk (Berger & DeYoung, 1997; Rajan & Dhal, 2003 & Ruziqa, 2013). (ii) Liquidity risk is measured based on the net loan to total deposit. This ratio presents the standard and commonly used metric and calculates the capacity of banks to cover the outflow of funds invested by existing clients (Bonfim & Kim, 2017). A credit institution that accepts deposits must have some measure of liquidity to maintain its normal daily activities. According to the standards of prudence, the ideal liquidity rate is between 80 and 90%. If the ratio is less than 100%, the bank is relying on its own deposits to make loans to its customers without any external borrowing. If, on the other hand, the ratio is greater than 100%, the bank borrowed money at higher rates, rather than relying entirely on its own deposits and may not have enough cash to cover financing needs or unforeseen economic crises. In February 2016, the Saudi Arabia Central Bank (SAMA) has raised banks’ maximum allowable loan-to-deposit ratio to 90 % to limit their need to use expensive long-term borrowing. To capture liquidity risk, we include a binary dummy that is 1 if the net loan to total deposit ratio exceeds 90 % and equal to 0 otherwise. (iii) According to the Basel Committee on Banking Supervision (2015), all the Saudi banks use either the basic indicator approach or the standardized approach. In September 2015, Saudi Arabia Central Bank (SAMA) declared that no bank uses the advanced approach for regulatory capital purposes. Therefore, we adopt the ‘Basic Indicator Approach’ as per the Basel II guidelines regarding operational risk measurement. It measures capital needed to protect the bank against operational risk. This measure has been adopted by several previous studies such as Hassan et al (2016) and calculated based on of the average net profit of the bank (BNP) over the last three fiscal years4. Thus, KBIA presents the capital requirement according to the basic indicator approach (capital requirement) and formulated as follows:

Where: KBIA = Capital charge under the Basic Indicator Approach.

GNP = Net banking income, where positive, over the previous three years.

N = Number of the previous three years for which gross income is positive.

α = 15%, denoted as the alpha factor, and representing the proportion between the capital level of the entire banking sector and the corresponding indicator.

Control Variables

In order to control for other factors affecting economic growth, we retain the real gross fixed capital formation5 to real GDP (INV), which measures Saudi Arabia's public and private investment, Barkhordari et al (2019). Based on theoretical models of Harrison et al. (1999), the real gross fixed capital formation is considered to be an important process that could accelerate economic growth, Zeqiraj et al (2020). Second, we also retain the ratio of government expenditure6 to GDP (GOV). This ratio presents the role of government in making of macroeconomic policies and their quality on economic growth. According to Wu et al (2010), government expenditure is helpful to economic growth regardless of how we measure government size and economic growth. Table 2 summarizes the selected measures of the different variables.

| Table 2 Variables, Definitions and Sources | ||||||

| Variables and Abbreviation | Measurement | Sources | ||||

| Gross domestic product | GDP | GDP growth which represents economic growth | World bank | |||

| Return on Invested Capital | ROIC | EBIT (1 - tax rate) / (Book Value of Equity + Net Debt) | WorldScoop | |||

| Net Profit Margin | NPM | Profit margin = Profit after tax / Net sales | WorldScoop | |||

| Ln (Total deposit) | Deposit | The natural logarithm of banks' total deposits | WorldScoop | |||

| Ln (Total Net Loan) | Loan | The natural logarithm of banks' total net loan | WorldScoop | |||

| Credit risk | CR | non-performing loans / total loans | WorldScoop | |||

| Liquidity risk | LR | Dummy variable taking the value 1 if the net loan to total deposit ratio exceed 90 % and 0 otherwise | Authors' calculations |

|||

| Operational risk | OR | Operational risk (KBIA)= [∑(GNP…n*∝]/n | WorldScoop | |||

| Total Investment | INV | Gross fixed capital formation / GDP | World bank | |||

| Government Consumption | GOV | General government final consumption expenditure / GDP | World bank | |||

Models and Technique of Analysis

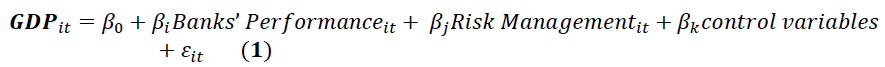

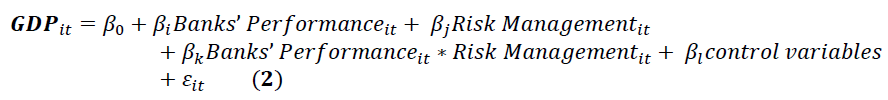

In the first step, our first model the econometric formulation proposed in this study is designed to test the hypothesis exploring the impact of banks’ performance on Saudi Economic growth. In this stage, it should be noted that the moderating effect of bank risk variables on the relationship between Banks’ Performance and economic growth is not considered. By using the cross-sectional time series FGLS regression, model 1 is defined by:

In the second step, we looked at the main moderator effect of bank risk management on the relationship between banks’ performance and GDP growth. By using risk management as a moderator’s variables we will explain the strength of the relationship between the predictor variable and the outcome. In this context, we include four moderating variables by multiplying banks’ performance variables by credit risk, liquidity risk, and operational risk respectively. Bennett, (2000) suggest that applying all interaction terms in a single model cannot clarify the distinct effect of each interaction term. Therefore, we entered separately the interaction terms of each variable of bank performance and risk management. The second empirical model to be tested is presented as follows:

Finding

Descriptive Statistics

Table 3 displays the detailed descriptive statistics for dependent variable, independent variables, and control variables. The sample size comprises of 110 observations from the period of 2008 to 2017 of eleven banks. It can be seen that the average GDP growth is 3,60% from 2008 until 2017, reaching an all-time high of 9.99 percent in 2012.

| Table 3 Descriptive Statistics | ||||||

| Variables | Obs | Mean | Median | SD | Skewness | Kurtosis |

| GDP | 110 | 0.0360 | 0.0387 | 0.0331 | 0.0493 | 2.6406 |

| ROIC | 110 | 0.0798 | 0.0752 | 0.0505 | 0.4216 | 3.4779 |

| NPM | 110 | 0.3747 | 0.4058 | 0.1615 | -0.8671 | 3.8266 |

| Deposit | 110 | 20.407 | 20.662 | 0.9216 | -1.5905 | 7.0018 |

| Loan | 110 | 24.995 | 25.205 | 0.7140 | -0.5674 | 2.4752 |

| CR | 110 | 0.0283 | 0.0230 | 0.0207 | 1.5982 | 7.0714 |

| OR | 110 | 19.394 | 19.510 | 0.9880 | -0.9000 | 3.8828 |

| INV | 110 | 24.696 | 24.354 | 2.1342 | 1.1461 | 3.8271 |

| GOV | 110 | 22.822 | 22.317 | 3.5828 | 0.4836 | 2.3457 |

| Variables | Modality | Frequency | (%) | |||

| LR | 1 if the net loan to total deposit ratio exceed 90 % | 49 | 44.55 | |||

| 0 otherwise | 61 | 55.45 | ||||

Regarding the banking performance variables, the findings imply that the average ROIC is 7.89 %, showing that the overall Saudi banking system is enjoying healthy profitability. Also, the NPM has an average of 37.47% with an SD of 0.16. The overall mean value of the deposit was 20.40 with SD of 0.92. Similarly, the mean value of Net loan was 24.99 with SD of 0.714. These results show that Saudi banks have a highly liquid and well-capitalized system that is resilient to withstand external shocks. Therefore, this indicates the important role of Saudi banks loan as a source of funding for Saudi Arabia's economic development.

Concerning banks Risk Management, the results detect that the average of credit risk is about 2,83 with an SD of 2%. These results confirm that credit risk remains remarkably low relative to other economies, SAMA (2019). For the liquidity risk, it is observable at 44,55 % during the study period. This result indicates that Saudi banks have not yet been able to apply the guidance provided by the Saudi Arabian Monetary Authority. An examination of operational risk shows an average of 19.39 % with SD of 0.98. Among control variables, the mean value of total Investment was 24.69 with SD of 2.13. Also, the mean value of government expenditure was 22.82 with an SD of 3.58. Finally, we can see that the normality of our data is within acceptable ranges since skewness is not high enough to affect the normality of data. Likewise, kurtosis value for all the variables is positive.

Correlation Matrix

Table 4 report the correlations among the selected variables. Using the Pearson correlation matrix, we find that the coefficients do not exceed the threshold of 0.7 as indicated by Kervin (1992). Therefore, we can confirm the inexistence of multicollinearity problem.

| Table 4 Correlation Matrix |

|||||||||

| ROIC | NM | Deposit | Loan | CR | LR | OR | INV | GOV | |

| ROIC | 1 | ||||||||

| NPM | 0.6441 | 1 | |||||||

| Deposit | 0.5496 | 0.4499 | 1 | ||||||

| Loan | 0.5287 | 0.5632 | 0.6179 | 1 | |||||

| CR | -0.2446 | -0.4264 | 0.0679 | -0.0352 | 1 | ||||

| LR | -0.1636 | -0.1005 | -0.3201 | -0.1739 | -0.1355 | 1 | |||

| OR | 0.5033 | 0.6288 | 0.6337 | 0.6962 | -0.1852 | -0.1040 | 1 | ||

| INV | -0.1106 | 0.0543 | 0.1337 | 0.1575 | 0.0753 | -0.0454 | 0.1469 | 1 | |

| GOV | -0.0063 | 0.1720 | 0.2589 | 0.2709 | 0.1662 | -0.1434 | 0.1797 | 0.6765 | 1 |

Findings

Step1: check the relationship between banks’ Performance and Saudi economic growth: Table 5 has shown the results of the incidence of banks’ Performance on Saudi economic growth. The coefficient of Return on Invested Capital (ROIC) is positive and statistically significant, which proves that an increase in ROIC leads to an increase in economic growth. This finding is consistent with the results of Alkhazaleh (2017) who found that banks’ profitability has a significant effect on economic growth. In addition, we find that a positive and significant relationship is established between net profit margin (NPM) and economic growth. The coefficient implying that a unit increase in NPM leads to an increase in GDP growth by 0.085 units. This result underlines that, in the context of Saudi Arabia, the financial self-sustainability of Banks is desperately needed to achieve the objectives of Saudi Arabia’s economic vision 2030.

| Table 5 Results of FGLS Estimates: The Impact of Banks’ Performance on Saudi Economic Growth | ||||||||

| Coeff | P-value | Coeff | P-value | Coeff | P-value | Coeff | P-value | |

| ROIC | 0.1273 | 0.027 | ||||||

| NPM | 0.0859 | 0.000*** | ||||||

| Deposit | 0.0097 | 0.00 9 *** | ||||||

| Loan | 0.0227 | 0.015*** | ||||||

| CR | -0.6519 | 0.000*** | -0.5256 | 0.000*** | - 0.7 241 | 0.000*** | -0.9587 | 0.000*** |

| LR | -0.0122 | 0.015** | -0.0132 | 0.004*** | - 0.0091 | 0.0 74 * | -0.0124 | 0.046** |

| OR | -0.0098 | 0.000*** | -0.0143 | 0.000*** | - 0.012 3 | 0.000*** | -0.0192 | 0.000*** |

| INV | -0.00009 | 0.971 | 0.0017 | 0.478 | - 0.000 7 | 0. 759 | 0.0039 | 0.205 |

| GOV | -0.0028 | 0.061 | -0.0014 | 0.004*** | - 0.0028 | 0.0 53 ** | -0.0073 | 0.003** |

| Constant | 0.3065 | 0.000 | 0.3555 | 0.000 | 0.18 25 | 0.00 8 | -0.0556 | 0.783 |

| Wald chi2(6) | 79.26 | 104.85 | 81.01 | 86.63 | ||||

| obs | 120 | 120 | 120 | 120 | ||||

As shown in this model, banks’ performance, as measured by deposits, has a significantly positive effect on Saudi economic growth. In fact, deposit of Saudi Banks was in increasing trend based on financial sector reform program. The coefficient was 0.009, implying that a unit increase in deposit leads to an increase in GDP growth by 0.009 units. This result confirms the finding of Mckinnon (1973), who find that deposits are significant with economic growth. As seen in Table 5, we find that bank loans have a significantly positive effect on economic growth. This result proves that Saudi banks are more carefulness about their credit administration process which increases the performing loans and this has a positive effect on bank capital and, as a consequence, the economic growth. This finding is consistent with the results of Boukhatem & Ben Moussa (2018), who consider lending function is considered as a promoter for economic growth.

As summarized below, the findings obtained confirm the economic growth theory, which considers that bank helpful tool for improving the nation's economic productivity with the existence of a strong demand-leading relationship (Abusharbeh, 2017). Besides, the financial stability provided by the banks become gradually more important for future economic growth (Feyen, and Levine, 2011 and Ijaz et al, 2020). Therefore, banks’ Performance presents a major determinant of economic growth (Zeqiraj et al, 2020). Accordingly, Hypothesis H1 is supported.

Table 5 shows that credit risk, liquidity risk, and operational risk have a significantly negative effect on economic growth. This result may imply that unsystematic risk management is an inhibitor of economic growth and can cause harmful consequences for the country’s economy (Tu, 2015; & Ojima & Ojima, 2019).

The findings also reveal that the relationship between investment and economic growth is found to be insignificant. This result are not conform to theoretical economics literature and leading us to suggest that, in the Saudi context, the real gross fixed capital formation is considered to be an important process only for long-term economic growth as current investment leads to greater future production. Also, the coefficient of Government Consumption (GOV) is negative and statistically significant, which proves that government expenditures increases is predicted to reduce economic growth (Carlstrom & Gokhale, 1991; Ghura, 1995).

Step2: Check the moderating effect of banks risk management on the relationship between banks’ Performance and Saudi economic growth: According to Table 6, the results of model 5 estimates show the negative effect of liquidity risk and operational risk on the relationship between banks’ performance and Saudi Economic growth. As shown in this model, the estimated coefficient of ROIC is significantly positive, while the estimated coefficient of ROIC*LR is statistically significant and negatively associated with economic growth. The economic magnitude of this result suggests that mismanagement of credit can cause harmful consequences on the efficiency of banks ‘capital invested. Also, this result suggests that liquidity risk can prevent banks to allocate its capital in profitable investment and might lead to the failure of banks. This could cause instability in the financial system and decrease the long-term growth of Saudi Arabia’s economy. In addition, when we interact return on invested capital with operational risk, we find that the coefficient on the interaction term is negative - ) 0.0364) and significant at 1% level and the relationship between banks’ performance and Saudi Economic growth is negatively moderated by operational risk. These slope coefficients indicate that the negative relation is weakened by failed internal processes, people and systems or from external events.

The findings of the study indicate that the relationship between net profit margin and Saudi Economic growth is negatively moderated by liquidity risk. The estimated coefficient of NPM is significantly positive, while the estimated coefficient of NPM*LR is statistically significant and negatively associated with economic growth. This result suggests that the unplanned decreases or changes in banking funding sources could decrease its profit. In addition, when banks have only long term assets that cannot be quickly converted to liquid funds, the net margin seems to be ineffective in promoting economic growth.

When we interact bank deposits with credit risks, we found that the coefficient on the interaction term is negative (-0.0069) and significant at 1% level. Therefore, the relationship between bank deposit and economic growth is negatively moderated by credit risk. This result suggests that the survival of banks deposit is significantly determined by how banks efficiently manage credit risk. According to Bajwa et al (2019), a higher ratio of credit risk denotes uncontrolled loan management quality, which can cause bank’s troubled conditions. In addition, an increase in the amount of non-performing loans could cause instability in the financial system and, therefore, decrease the long-term economic growth. This result corroborates with the finding of Anaman et al (2017). The authors suggest that credit risk could negatively affect the banks’ viability and therefore, reduce economic growth. In addition, the increased in nonperforming loan in poor-performing Saudi sectors have continued to experience higher NPL growth, SAMA (2019). This may explain that best management credit risk is essential for Saudi banks’ Performance and, therefore, for the objectives of Saudi Arabia's national Vision 2030.

As seen in Table 6, the relationship between bank loans and economic growth is negatively moderated by credit risk. The intensity of the moderation relationship is high for credit risk (-0.2175). This result indicates that credit risk is negatively related to the bank loans. This result suggests that loans in the form of credit present the largest income for banks. A higher non-performing loan could decrease income, its investment project, and therefore its performance. This can decrease the long-term economic growth.

| Table 6 Results of FGLS Estimates: The Moderating Effect of Banks Risk Management on the Relationship Between Banks’ Performance and Saudi Economic Growth | ||||||||

| Coeff | P-value | Coeff | P-value | Coeff | P-value | Coeff | P-value | |

| ROIC | 0.7933 | 0.000*** | ||||||

| NPM | 0.1425 | 0.004*** | ||||||

| Deposit | 0.0063 | 0.002*** | ||||||

| Loan | 0.0092 | 0.000*** | ||||||

| CR | -0.3692 | 0.000*** | -0.3214 | 0.000*** | -0.3443 | 0.000*** | -5.987 | 0.000*** |

| LR | -0.0027 | 0.217 | 0.0124 | 0.000*** | -0.0362 | 0.117 | -0.0549 | 0.047** |

| OR | -0.0025 | 0.002*** | -0.0100 | 0.000*** | -0.0076 | 0.000*** | -0.0147 | 0.000*** |

| ROIC *CR | -0.3645 | 0.642 | ||||||

| ROIC *LR | -0.0392 | 0.072* | ||||||

| ROIC *OR | -0.0364 | 0.000*** | ||||||

| NPM *CR | -0.0851 | 0.531 | ||||||

| NPM *LR | -0.0568 | 0.000*** | ||||||

| NPM *OR | -0.0032 | 0.193 | ||||||

| Deposit *CR | - 0 .0069 | 0.030*** | ||||||

| Deposit *LR | 0 .0015 | 0.174 | ||||||

| Deposit *OR | 1.40e-06 | 0.892 | ||||||

| Loan *CR | - 0.2175 | 0.000*** | ||||||

| Loan *LR | 0.0017 | 0.104 | ||||||

| Loan *OR | -1.17e-06 | 0.925 | ||||||

| INV | -0.0029 | 0.182 | 0.0003 | 0.658 | -0.0066 | 0.001 | .00167 | 0.226 |

| GOV | -0.0014 | 0.284 | -0.0034 | 0.000*** | 0.0005 | 0.711 | -0.0053 | 0.000*** |

| Constant | 0.2048 | 0.000*** | 0.2837 | 0.000 | 0.2276 | 0.000 | 0.1916 | 0.000*** |

| Wald chi2(9) | 250.07 | 2138.42 | 268.22 | 678.87 | ||||

| Obs | 120 | 120 | 120 | 120 | ||||

As summarized below, the positive relationship between bank performance- economic growth is weakened respectively by credit risk, liquidity risk, and operational risk. Therefore, Saudi banks should be required for extensive efforts by mastering its unsystematic risk they run. Specifically, they should be able to apply the guidance provided by the Saudi Arabian Monetary Authority.

Concluding Remarks

The study was carried on challenges, in terms of risk management in banking, that confront Saudi Vision and its likelihood of success. To understand the approach that Saudi banks adopt face to risk we examine, firstly, the contributions of banking sector performance in the economic growth of Saudi Arabia represented by the gross domestic product. Secondly, we investigate how risk management in banking can affect the relationship between bank performance and economic growth. The gathered data have covered the period from 2005 to 2017 of 11 banks. Our findings have several interesting policy implications. First, we found that banks’ Performance has great positive effects on Saudi economic growth. Also, the results indicate that risk management in Saudi banks, as measured by credit risk, liquidity risk, and operational risk, constitute an important determinant of Saudi economic growth. These risks can represent a significant barrier for the future progress and sustainability of Saudi Arabia 2030’s economic reforms.

Our results support recent regulatory efforts mainly by the International Monetary Fund. The main goal is that banks must have in place a comprehensive risk management process to evaluate, control or mitigate risks that can affect the performance of the Saudi banking system and, therefore, economic growth. Thereby, SAMA has guidelines for unsystematic risk management in order to mitigate associated potential risk. The study, therefore, recommended that banks in Saudi Arabia should enhance their capacity in risk analysis while the regulatory authority should pay more attention to banks’ compliance with relevant provisions of the Bank and prudential guidelines.

Suggestions for Further Research

The study opens up opportunities to pursue further research. Firstly, future studies can extend the sample period. Secondly, risk management variables used in this study does not fully explain the moderating effect of bank performance and economic growth. Thirdly, we use an approximate formula to measure the operational risk. Therefore, we propose using the advanced measurement approach (AMA) for these measures. Fourthly, we propose extending the study by taking into account other variables, such as the market risk which reflect the effects of different factors of potential economic loss caused by the decreases in the market values.

Endnote

1.The Council of Economic and Development Affairs (CEDA), established in the year 2015 by King Salman bin Abdulaziz, aimed primarily at establishing the overall governance, the mechanisms and measures necessary to achieve Saudi Vision 2030.

2.Financial risks cover two types of risks. Traditional banking risks which is derived from poor management and include credit and solvency risks. Treasury risks witch result from losses arising from financial arbitrage and include liquidity, interest rate, currency, and market risks. Environmental risks are associated with a bank’s macroeconomic and policy concerns, legal and regulatory factors, and the overall financial sector infrastructure and payment systems of the jurisdictions in which it operates.

3.The Basel Committee on Banking Supervision (BCBS) was created by the central bank governors of the Group of Ten countries in 1974. This Committee is the world's leading standard-setter for prudential banking regulation and serves to encourage convergence towards common approaches and standards.

4.Figures for any year in which annual gross income is negative or zero should be excluded from both the numerator and denominator when calculating the average.

5.Gross fixed capital formation (formerly gross domestic fixed investment) includes land improvements (fences, ditches, drains, and so on); plant, machinery, and equipment purchase; and the construction of roads, railways, and the like, including schools, offices, hospitals, private residential dwellings, and commercial and industrial buildings.

6.General government final consumption expenditure (formerly general government consumption) includes all government current expenditures for purchases of goods and services (including compensation of employees). It also includes most expenditures on national defense and security, but excludes government military expenditures that are part of government capital formation.

Acknowledgment

The author is grateful to Jouf University, Sakaka, Saudi Arabia for the financial support granted to cover the publication fee of this research article.

Corresponding Author: Jouf University, Sakaka 72388, Saudi Arabia, email address: mdabboussi@ju.edu.sa

Abusharbeh, M. (2017). The impact of banking sector development on economic growth: Empirical analysis from Palestinian economy. Journal of Emerging Issues in Economics, Finance and Banking, 6(2), 2306-2316.

Alkhazaleh, A. (2017). Does banking sector performance promote economic growth? Case study of Jordanian commercial banks. Problems and Perspectives in Management, 15(2), 55-64.

Al-Khouri, R., Arouri, H., & Elliott, C. (2019). Market power and the role of banks as liquidity providers in GCC markets. Cogent Economics & Finance, 7.

Anaman, A., Gadzo, G., Gatsi, G., & Pobbi, M. (2017). Fiscal aggregates, government borrowing and economic growth in Ghana: An error correction approach. Advances in Management & Applied Economics, 7(2), 83–104.

Barkhordari, S., Fattahi, M., & Azimi, N.A. (2019). The impact of knowledge-based economy on growth performance: Evidence from MENA Countries. Journal of the Knowledge Economy, 10(3), 1168-1182.

Bajwa, I.A., Syed, A.M., Alaraifi, A., & Rafi, W. (2019). Assessment of credit risk management of saudi banks. Academy of Accounting and Financial Studies Journal, 23(5).

Basel Committee on Banking Supervision. (2015). Regulatory Consistency Assessment Programme (RCAP)- Assessment of Basel III risk-based capital regulations – Saudi Arabia, September. www.bis.org.

Bennett, J.A. (2000). Mediator and moderator variables in nursing research: Conceptual and statistical differences. Research in Nursing & Health, 23(5), 415-420.

Berger, A.N., & DeYoung, R. (1997). Problem loans and cost efficiency in commercial banks. Journal of Banking and Finance, 21(6), 849-870.

Bonfim, D., & Kim, M. (2017). Liquidity risk and collective moral hazard. European Banking Center Discussion Paper No. 2012-024. Available at SSRN: https://ssrn.com/abstract=2163547.

Boukhatem, J., & Ben Moussa, F. (2018). The effect of Islamic banks on GDP growth: Some evidence from selected MENA countries. Borsa Istanbul Review, 18(3), 231-247.

Bouteillé, S., & Coogan-Pushner, D. (2012). The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit Exposures. Wiley Finance (813).

Brewer, P.C., Chandra, G., & Hock, C.A. (1999). Economic Value Added (EVA): Its uses and limitations. SAM Advanced Management Journal, 64(2), 4- 11 .

Carlstrom, C.T., & Jagadeesh, G. (1991). Government consumption, taxation, and economic activity. Federal Reserve Bank of Cleveland, 27(3),18-29.

Chang, P, C., Jia, C., & Wang, Z. (2010). Bank fund reallocation and economic growth: Evidence from China. Journal of Banking & Finance, 34, 2753–2766.

Cole, R.A., Moshirian, F., & Wu, Q. (2008). Bank stock returns and economic growth. Journal of Banking & Finance, 32, 995–1007.

Damodaran, A. (2007). ROC, ROIC and ROE: Measurement and Implication, 2007, Available at SSRN: https://ssrn.com/abstract=1105499.

Demirgüç-Kunt, A., Feyen, E., & Levine, R. (2011). The evolving importance of banks and securities markets. World Bank Economic Review, 27(3), 1–31.

Diamond, D.W., & Dybvig, P.H. (2000). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91(3), 401–19.

Douglas W.D., & Raghuram G.R. (2001). Liquidity risk, liquidity creation and financial fragility: A Theory of Banking. Working Paper, 476, Available at SSRN: https://ssrn.com/abstract=112473

Dwight, N. & Radzewicz-Bak, B. (2012). Challenges posed by shallow financial systems. IMF Background Note, Washington, DC: International Monetary Fund.

Ekinci, R., & Poyraz, G. (2019). The effect of credit risk on financial performance of deposit banks in Turkey. Procedia Computer Science, 158, 979-987.

Flannery, M., & Rangan, K. (2008). What caused the bank capital build-up of the 1990s. Review of Finance,12, 391–429.

Ghura, D. (1995). Macro policies, external forces, and economic growth in Sub-Saharan Africa. Economic Development and Cultural Change, 43(4), 759-78.

Harrison, P., Sussman, O., & Zeira, J. (1999). Finance and Growth: Theory and Evidence. Board of Governors of the Federal Reserve System, Finance and Economics Discussion Series, 1999/35.

Hassana, K., Unsal, O., & Tamer., H. (2016). Risk management and capital adequacy in Turkish participation and conventional banks: A comparative stress testing analysis. Borsa Istanbul Review, 16(2), 72-81.

Heider, F., Hoerova, M., & Holthausen, C. (2009). Liquidity hoarding and interbank market spreads: The role of counterparty risk, ECB Working Paper. Available at SSRN: https://ssrn.com/abstract=1343606.

Hicks, J. (1969). A Theory of Economic History. Clarendon Press, Oxford, 9,181 - 25.

Hlebik, S., & Ghillani, L. (2017). Management strategies for bank’s liquidity risk. International Journal of Economics and Finance, 9(6).

Ijaz, S., Hassan, A., Tarazi, A., & Fraz, A. (2020). Linking bank competition, financial stability, and economic growth. Journal of Business Economics and Management, 21(1), 200-221.

Imam. P., & Kpodar, P. (2016). Islamic banking: Good for growth? Economic Modelling, 59, 387-401.

Kervin, J.B. (1992). Methods for business research. Harpercollins College Div, January 1992.

Klein, P.O., & Weill, L. (2019). Profitability and Economic Growth. BOFIT Discussion Paper No. 15/2018. Available at SSRN: https://ssrn.com/abstract=3207171

Lai,V, S., Xiaoxia, Y., & Lu, Z. (2018). Are market views on banking industry useful for forecasting economic growth. Pacific-Basin Finance Journal, Forthcoming. Available at SSRN: https://ssrn.com/abstract=3273429 .

Luintel, K.B., Khan, M., Arestis, P., & Theodoridis, K. (2008). Financial structure and economic growth. Journal of Development Economics, 86, 181-200.

Martinez-Miera, D., & Repullo, R. (2010). Does Competition Reduce the Risk of Bank? Review of Financial Studies, 23(10), 3638-3664.

Masih, M., Al-Elg, A., & Madani, H. (2010). Causality between financial development and economic growth: an application of vector error correction and variance decomposition methods to Saudi Arabia. Applied Economics, 41(13), 1691-1699.

McKinnon, R.I. (1973). Money and Capital in Economic Development. Washington D.C.: Brookings Institution.

Muhammad, H., Shah, B., & Islam, Z. (2014). The Impact of Capital Structure on Firm Profitability: Evidence from Pakistan. Journal of Industrial Distribution and Business, 5-2 (2014), 13-20.

Naceur, S., & Ghazouani, S. (2007). Stock markets, banks, and economic growth: Empirical evidence from the MENA region. Research in International Business and Finance, 21(2), 297-315.

Ojima, D., & Ojima, N. (2019). Credit risk and economic growth in Nigeria. European Journal of Business, Economics and Accountancy, 7(1), 74-85.

Ruziqa, A. (2013). The impact of credit and liquidity risk on bank financial performance: The case of indonesian conventional bank with total asset above 10 trillion rupiah. International Journal of Economic Policy In Emerging Economies, 6(2),93-106.

Saudi Arabian Monetary Agency (SAMA). (2015). SAMA Fifty first Annual Report. Available at: http://www.sama.gov.sa/en-US/EconomicReports/AnnualReport/5600_R_Annual_En_51_Apx.pdf.

Saudi Arabian Monetary Agency (SAMA). (2016). SAMA Fifty Second Annual Report. Available at: http://www.sama.gov.sa/enUS/EconomicReports/AnnualReport/Fifty%20Second%20Annual%20Report.pdf

Saudi Arabian Monetary Agency (SAMA). (2019). SAMA 55th Annual Report. Available at: http://www.sama.gov.sa/enUS/EconomicReports/AnnualReport/Fifty%20Second%20Annual%20Report.pdf

Thierry, B., Junb, Z., & Ericc, E. (2016). Causality relationship between bank credit and economic growth: Evidence from a time series analysis on a vector error correction model in Cameroon. Procedia /Social and Behavioral Sciences, 235, 664-671.

Ueda, K. (2013). Banks as coordinators of economic growth and stability: Micro foundation for macroeconomy with externality. Journal of Economic Theory, 148(1), 322-352.

Van Greuning, H., & Bratanovic, S, B. (2009). Analyzing banking risk: A framework for assessing corporate governance and risk management: World Bank Publications, Th e International Bank for Reconstruction and Development,3rd Edition.

Wu, S.Y., Tang, J.H., & Lin, E.S. (2010). The impact of government expenditure on economic growth: How sensitive to the level of development . Journal of Policy Modeling, 32(6), 804–817.

Zeqiraj, V., Hammoudeh,S., Iskenderoglu, O., & Tiwari, A. (2020). Banking sector performance and economic growth: evidence from Southeast European countries. Post-Communist Economies, 32(2).