Research Article: 2020 Vol: 26 Issue: 2S

Domestic Debt and Economic Growth Sustainability Assessment of the Scenario in Nigeria

Cordelia Onyinyechi Omodero, Covenant University Ota

Dorcas Titilayo Adetula, Covenant University Ota

Kingsley Adeyemo, Covenant University Ota

Folashade Owolabi, Covenant University Ota

Abstract

This study assesses the role of domestic debt in encouraging economic growth both today and tomorrow. Financial growth promotion without consideration for its future sustenance is a very wasteful financial strategy. Thus this study employs data spanning from 2001 to 2019 with a focus on time relevance. The data collection is on the gross domestic product, domestic debt, interest rate and exchange rate. The study employs the relevant econometric tools and finds that interest rate and exchange rate do not have causality effect on domestic debt. Further findings reveal that household debt has a significant positive impact on economic growth while the interest rate is significantly and negatively influencing the growth. However, the exchange rate does not materially affect growth. The outcome of this study leads to the recommendation that government should be prudent on domestic borrowing to avoid exceeding the tolerable debt limit that will promote and sustain economic expansion in the future. The study further suggests consideration of all economic forces (e.g. interest and exchange rates) by the Central Bank of Nigeria and Debt Management Office when contracting loans.

Keywords

Domestic Debt, Economic Expansion, Interest Rate, Exchange Rate, Sustainability.

JEL Classifications

H74, H63, O40, G12, P24.

Introduction

Economic growth sustainability is a major global issue in this present time. The sustenance of a nation's economic growth is a function of too many factors put into consideration. These factors are not only fiscal but environmentally-related because an economy exists in an ecosystem which deserves a whole lot of attention to guarantee sustainable economic growth. An economy growing today can as well go into extinction if all economic activities propelling the extension do not consider future followers. The next generation ought to be at the centre of all financial policies and actions that drive growth in a country. However, there is an apparent disparity between hasty fiscal progression at present and the desired future progress. Speedy economic growth in the present day may dissipate wealth and generate ecological glitches for future generations (Economics Online, 2020). These environmental issues include oil spillage, farmlands devastation, and air and water pollutions due to chemical emissions from the oil drilling sites, as witnessed in the Niger Delta States of Nigeria (Omodero, 2018). The Niger States of Nigeria have also experienced black soothe due to underground oil refining activities in the region. The level of gas flaring and global warming are issue to contend with if there will be sustainable economic growth.

Grimsley (2020) alludes that "Sustainable economic growth is economic development that attempts to satisfy the needs of humans but in a manner that sustains natural resources and the environment for future generations". According to Grimsley (2020), and the economy operates in the ecosystem and cannot detach itself from it. No matter the situation, the economy thrives in clean atmospheric condition and environment. Thus, the destruction of the ecosystem to expand the economy will only be a temporary achievement but will not be sustained in the long run. Considering all issues that will maintain an economy both now and in the future, domestic debt accumulation is not left behind. The challenge in Nigeria, where the government contracts loans domestically and internationally to expand the economy, has become an issue to buttress on. Sustainable economic growth encourages the management of resources within a nation's ecological unit to actively sustain future generation. Many Scholars have shown concern about the reckless contraction of debt in Nigeria (Okwu et al., 2016; Ugwu, 2017; Ayuba & Khan, 2019; Omodero et al., 2020; Udoh et al., 2020). It is a colossal error and an idea that is totally in contrast with sustainable economic growth concept. The government is expanding the economy today but will end up leaving a massive debt for the unborn generation as an inheritance.

Borrowing is a critical mechanism the government uses to finance developmental projects that stimulate economic expansion if caution is exercised to avoid exceeding the tolerable limits. A loan can be economically unhealthy when an acceptable threshold is surpassed, be it domestic or foreign. The household debt of Nigeria comprises the treasury bonds, development stock, promissory note, savings bond of the Federal Government of Nigeria (FGN), the green bond of FGN, and recently the FGN Sukuk (CBN, 2019). In the last five years, the debt increased at an alarming rate. In 2015 it stood at N8,837 billion ($22.7995 Billion), it was N11,058.2 billion ($28.5302 Billion) in 2016, N12,589.49 billion ($32.4809 Billion) in 2017, N12,774.4 billion ($32.9580 Billion) in 2018 and N14,272.64 billion ($36.8234 Billion) in 2019. Although, the debt consists of marketable securities which the holders can resale and also use as collateral, yet it does not make the nation free from debt. The government contracts more debt as the days go by, without considering the impact on the future generation.

Nevertheless, the usefulness of domestic debt to ensure the sustainability of the economy is what this study wishes to establish. Therefore, this study aims to determine the role of household debt in economic growth sustainability using the gross domestic product as a proxy for fiscal progress sustainability. The use of the gross domestic product to measure economic growth sustainability is justified because “GDP is the official base measure of output used in most economies, including the UK. Gross measurements record the output of all goods and services, including capital goods which have been purchased to replace existing capital goods” (Economics Online, 2020). The replacement of capital goods is a function of the number of resources available in a nation, where there is an insufficient fund, the government can borrow either locally or externally.

There have been a lot of discrepancies in the previous studies of scholars on the impact of domestic debt on economic growth of nations. The issue is whether domestic debt aids sustainable economic growth of a country or not. Several studies in the past (Mbata, 2014; Haffiner et al., 2017; Ari & Koc, 2018; Saungweme & Odhiambo, 2020) provided empirical evidence that domestic debt is harmful to the economic growth of a nation. Contrarily, studies that support that household debt is better than the external debt due to its positive influence on the economic growth of a country includes the studies of (Igbodika et al., 2016; Okwu et al., 2016). Ayuba & Khan (2019) covered a period from 1980-2016 using ARDL. The study found that domestic debt had a negative impact on the economic growth of Nigeria. Didia and Ayokunle (2020) covered the same period (1980-2016) using VECM, and their findings reveal a positive impact of domestic debt on Nigeria's economic growth. These findings varied due to the measuring instruments, periods covered and the places of study. However, this present study is covering a period from 2001 to 2019 using various econometric tools and selected economic forces to investigate the effect of domestic debt on Nigeria's economic growth sustainability. The period covered in this study is the most recent and the selected economic variables are necessary for moderation purpose, which other studies never considered.

Review of Related Kinds of Literature

Theoretical Review

Debt overhang theory: This study gains support from the debt overhang theory propounded by Krugman (1988). Krugman (1988) hypothesized that there is a probability that sooner rather than later, a country's degree of aggregated obligation may exceed the reimbursement limit of that country. In the context of corporate finance, the word ‘debt overhang’, reveals a state of affairs in which a firm's obligation becomes excessively enormous for any proceeds generated by new investment projects to service the actual amount outstanding (Burhanudin et al., 2017). As it were the reasonable expense of overhauling will start to deter both inside and outside speculations since endeavours towards accomplishing financial development through beneficial efforts will, in any case, lead to expanding credit procurement. Obligation shade prompts commercial development decrease because of the way that it disheartens inside and outer speculations of private segments which offer a lift to financial extension (Krugman, 1988).

Extravagance hypothesis: The licentiousness theory endeavours to make right the feebleness of progression. The theory combines with obligation philosophy by concentrating on the established procedure enabling borrowing of the fund (Adetokunbo & Ebere, 2019). The extravagance hypothesis is an element of structure firmness postulation. The theory acknowledges that liability catastrophe arises from frail organizations and strategies that have misused wealth through uncontrolled formal venality and impaired existing values and expansion. Besides, having no regard for economic forces pointing the danger in the borrowing at the time of contracting the loan. According to Nyong (2005), these rules led to misrepresentations of comparative costs and invigorated wealth expeditions as perceived in considerable outer liquescent capitals of private debtors in overseas banks.

Empirical Works of Literature

Richard et al. (2020) studied the experience of Uganda concerning debt and economic growth sustainability. The study covered a period from 1980 to 2016. The findings showed that public debt had a remarkable negative impact on the economic growth of Uganda, especially in the short run. Didia & Ayokunle (2020) applied the Vector Error Correction Model (VECM) in determining the influence of external and domestic debts on the economic growth of Nigeria. The study covered a period from 1980 to 2016. The findings showed that domestic debt had a more favourable impact on economic growth than the external debt. The study further reveals that external debt negatively and substantially affected Nigeria's economic growth. Saungweme & Odhiambo (2020) employed the ARDL approach to evaluate the impact of domestic and foreign debts on Zimbabwe's economic growth from 1970 to 2017. The study provided empirical evidence that both the international and the household debt collectively had a significant negative impact on the economic growth of Zimbabwe.

Ayuba & Khan (2019) inspected the long-run connection between residential obligation and the monetary approach of financial development in Nigeria for a period covering 1981 to 2013. The examination utilized autoregressive dispersed slack methodology and the limits test hypothesized by Narayan (2005). The discoveries showed that residential obligation had an antagonistic impact on the economy yet decidedly influenced the total government income inside the period secured by the examination. Ari & Koc (2018) investigated the effect of external and domestic government borrowing on the sustainable economic growth of the United States, China, Germany and Japan. The study spanned from 2000 to 2015. The study provided evidence that the two categories of public loans harmed infrastructural development. The outcome disclosed that the harmful effect was because the government of the four countries used in the study, exceeded the tolerable borrowing limit the countries' economy cannot withstand.

Burhanudin et al. (2017) researched on the actual effects of government borrowing on the economic growth of Malaysia. The Autoregressive Distributed Lag approach was applied to analyze the data which covered a period from 1970 to 2015. The study found positive and significant short and long run relationships among the variables. The result indicated that government borrowing in Malaysia is helping to sustain economic growth. Kueh et al. (2017) also examined the impact of household and external requirements on the financial development of Malaysia utilizing information that secured a period from 1980 to 2015. The actual outcome demonstrated that residential obligation was roughly 37% of GDP while external debt was just 4% of GDP. The discoveries additionally uncovered that household obligation aggregation underneath the limit level contributed distinctly to financial development which, when it surpassed, the economic growth was discouraged. Oppositely, the investigation affirmed that outer obligation beneath the edge level negatively affected commercial development, yet when it exceeded the limit, it positively affected commercial development.

Haffiner et al. (2017) measured the impact of internal debt on economic growth of Sierra Leone from 1970 to 2015 using ARDL model. The result indicated that domestic debt exerted adverse effect on economic growth in the short and long terms. Tawfiq & Shawawreh (2017) surveyed the effect of open obligation on the financial development of Jordan utilizing information from 2000 to 2015. The investigation used a least-squares relapse strategy, and the outcome showed that public commitment negatively affected commercial development. The discoveries further uncovered that outside obligation had a more remarkable negative effect on economic growth than social responsibility. Ugwu (2017) utilized a standard least-squares strategy to survey the impact of household obligation on Nigeria's financial development using information spreading over from 2000 to 2016. The discoveries uncovered that social responsibility had a critical association with the Gross Domestic Product (GDP) of Nigeria.

Saifuddin (2016) received a two-organize least squares (TSLS) relapse method to contemplate the effect of open obligation on the financial development of Bangladesh from 1974 to 2014. The investigation utilized government speculation and economic growth as the relevant factors which decided the impact of open obligation on business development in Bangladesh. The relapse results demonstrated that public debt had a positive association with both speculation and financial growth. The discoveries further uncovered that open obligation had a critical positive effect on a venture which perpetually recommended good impact on economic development. Igbodika et al. (2016) used ordinary least squares technique to assess the nexus between domestic debt and commercial expansion of Nigeria. The study covered a period from 1987 to 2014 and found a strong positive relationship between household debt and Nigeria's economic development.

Okwu et al. (2016) utilized necessary econometric devices to research the impacts of social obligation financial development in Nigeria from 1980 to 2015. The examination used sound total national output (RGDP) as an intermediary for economic growth. At the same time, the illustrative factors included residential obligation stock, obligation adjusting use, government consumption and banks' loan rates. The outcomes demonstrated that residential obligation stock had both short and long haul positive huge impact on RGDP while obligation adjusting consumption applied a remarkable negative effect on RGDP. The examination likewise uncovered that bank loaning rate and government consumption were not critical in clarifying commercial development varieties in Nigeria inside the period secured by the investigation. Mbate (2014) researched the effect of social obligation on industrial development and private segment credit utilizing board information of 21 Sub-Saharan African (SSA) nations for a period covering 1985 to 2010. The investigation used framework GMM and the outcome showed the presence of a non-straight connection between social obligation and financial development. The disclosures in the like manner revealed a negative effect on a gross domest ic product by 0.3 per cent. The investigation recommended confining residential obligation and budgetary strategies to upgrade credit accessibility.

Research Methods

This study uses ex post facto research design. Ex post facto research design considers and utilizes the existing data collected from events that have already occurred. The data employed in this study spanned from 2001-2019. The choice of this period is a function of time relevance of information. The years covered in this study are the most recent years that can influence useful economic decisions. The econometric techniques employed in this study to establish the relationship between the variables and the extent to which they affect each other include cointegration rank test, pairwise granger causality test and least squares regression analysis. The diagnostic tests conducted to determine the acceptability of the regression result include descriptive statistics, multicollinearity test using the Variance Inflation Factor (VIF), serial correlation and Heteroskedasticity tests.

VIF=1/1-R2 ; where R2 represents the coefficient of determination.

Serial correlation measures the autocorrelation in the errors (μ= Error term) in a regression model while the descriptive statistics provides information on the normality of the data set. The Breusch-Pagan-Godfrey test is a test for heteroskedasticity of errors in regression. The formula is N*R2 (with K degrees of freedom), where N represents the sample size, R2 is the coefficient of determination and K is the number of independent variables shows in Table 1.

| Table 1 Description of Variables and Data Sources | ||

| Variables | Description | Source |

| GDP | Gross Domestic Product | Central Bank of Nigeria (CBN) Statistical Bulletin, Volume 30, December 2019. |

| DDT | Domestic Debt | Central Bank of Nigeria (CBN) Statistical Bulletin, Volume 30, December 2019. |

| INT | Interest Rate | World Development Indicators 2020. |

| XGR | Exchange Rate | World Development Indicators 2020. |

The model applied in this study is specified as follows:

EGS = f (DDT)

Where EGS, represents economic growth sustainability while DDT depicts domestic debt.

The functional relationship is shown below:

GDP = f (DDT, INT, XGR) … (1)

LogGDP= β0+β1LogDDT+β2LogINT+β3LogXGR+μ… (2)

Where:

LogGDP = Gross Domestic Product; LogDDT = Domestic Debt; LogINT = Interest Rate;

LogXGR = Exchange Rate

β0 = Constant; β1-β3 = Regression coefficients; μ= Error term.

The a priori expectation is that β1 > 0, β2> 0, β3 > 0 ensuring a sustainable economic expansion.

Data Analysis and Interpretation

Diagnostic Tests

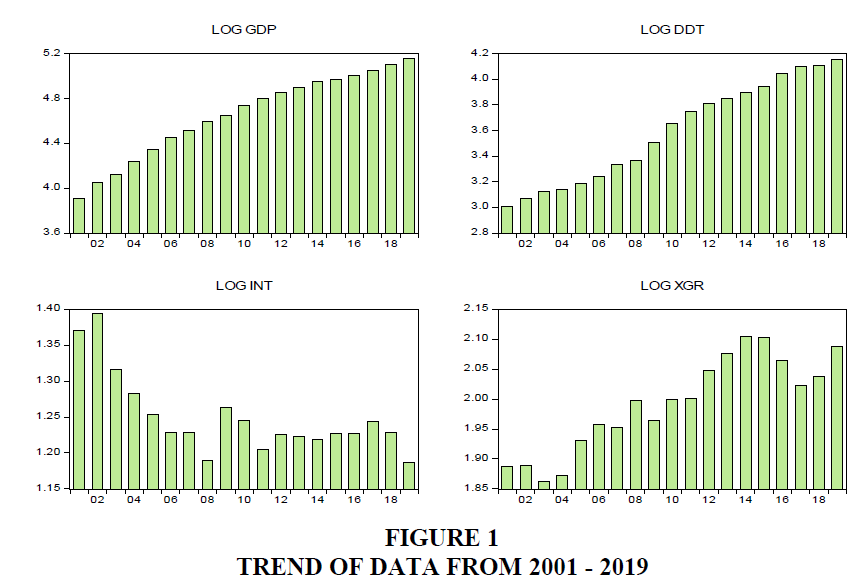

From Tables 2-4 above, there is an absence of Multicollinearity. There is no trace of heteroskedasticity and serial correlation in this study. The p-values are above 5 per cent level of significance, and so the data sets are free from bias. Figure 1 shows the trend of data from 2001 to 2019. The graphical pattern indicates that Nigeria's GDP is on the increase annually. Each of the years witnessed a significant increase in the GDP as well as the domestic debt. The increase in the annual domestic borrowing could be affecting the GDP in a positive direction, but the concern is whether the growth is sustainable in the long run. However, the interest rate did not show significant improvement while the fluctuations in the exchange rate are also very noticeable in all the years.

| Table 2 Variance Inflation Factors | |||

| Coefficient | Uncentered | Centered | |

| Variable | Variance | VIF | VIF |

| LOG_DDT | 0.003599 | 483.1578 | 5.573163 |

| LOG_INT | 0.073600 | 1183.938 | 2.200941 |

| LOG_XGR | 0.111323 | 4546.492 | 6.795275 |

| C | 0.558562 | 5736.361 | NA |

| Table 3 Heteroskedasticity Test: Breusch-Pagan-Godfrey | |||

| F-statistic | 2.871064 | Prob. F(3,15) | 0.0713 |

| Obs*R-squared | 6.930476 | Prob. Chi-Square(3) | 0.0741 |

| Table 4 Breusch-Godfrey Serial Correlation L.M. Test | |||

| F-statistic | 0.702357 | Prob. F(2,13) | 0.5133 |

| Obs*R-squared | 1.852835 | Prob. Chi-Square(2) | 0.3960 |

Trend Analysis

The descriptive statistics Table 5 shows depicts the normality of the distribution. The data sets have a full spread as the mean is greater than the standard deviation. However, GDP, DDT and XGR are negatively skewed while the Kurtosis for all the variables is within the acceptable limits.

| Table 5 Descriptive Statistics | ||||

| LOG_GDP | LOG_DDT | LOG_INT | LOG_XGR | |

| Mean | 4.654543 | 3.594605 | 1.250368 | 1.992684 |

| Median | 4.737290 | 3.658185 | 1.227887 | 2.000000 |

| Maximum | 5.158997 | 4.154504 | 1.393926 | 2.105510 |

| Minimum | 3.910312 | 3.007308 | 1.186674 | 1.862131 |

| Std. Dev. | 0.379093 | 0.398949 | 0.055440 | 0.079208 |

| Skewness | -0.497660 | -0.053939 | 1.436258 | -0.195132 |

| Kurtosis | 2.067475 | 1.492133 | 4.263123 | 1.839163 |

| Jarque-Bera | 1.472710 | 1.809196 | 7.795403 | 1.187380 |

| Probability | 0.478856 | 0.404705 | 0.020288 | 0.552285 |

| Sum | 88.43631 | 68.29749 | 23.75699 | 37.86100 |

| Sum Sq. Dev. | 2.586806 | 2.864886 | 0.055324 | 0.112930 |

| Observations | 19 | 19 | 19 | 19 |

Table 6 depicts the type of relationship obtainable among the variables used in this study. Therefore, the Trace Statistics reveals 4 cointegrating equations at a 5% level of significance. The result indicates the existence of a long-run relationship among the variables. The implication is that domestic debt in Nigeria, interest rate and exchange rate have a long term association with economic growth sustainability. The adjustment in one affects the others; that is, they are highly influenced by one another in the economic sphere of Nigeria.

| Table 6 Unrestricted Cointegration Rank Test (Trace) | ||||

| Hypothesized | Trace | 0.05 | ||

| No. of C.E. (s) | Eigenvalue | Statistic | Critical Value | Prob.** |

| None * | 0.856163 | 74.34959 | 47.85613 | 0.0000 |

| At most 1 * | 0.773295 | 41.38530 | 29.79707 | 0.0015 |

| At most 2 * | 0.410422 | 16.15551 | 15.49471 | 0.0397 |

| At most 3 * | 0.344250 | 7.173583 | 3.841466 | 0.0074 |

Trace test indicates 4 cointegrating eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Findings

Table 7 is Pairwise Granger Causality Tests which help to understand how each of the variables affects the others. The result indicates that it is the only exchange rate and GDP that have causality effect on each other at a p-value of 0.05. From the outcome in Table 7, the interest rate does not affect domestic borrowing by either reducing it or increasing it. There is no consideration for the effect, and the interest rate does not also cause domestic borrowing. That is the loan goes on whether the interest rate is favourable or otherwise. The exchange rate is also in the same shoe with the interest rate. The implication is that domestic borrowing in Nigeria is reckless, and this confirms the extravagance hypothesis that there is wastage of resources when there is a total disregard for the effect of major economic forces before contracting loans.

| Table 7 Pairwise Granger Causality Tests | |||

| Lags: 2 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| LOG_DDT does not Granger Cause LOG_GDP | 17 | 0.07571 | 0.9275 |

| LOG_GDP does not Granger Cause LOG_DDT | 3.20475 | 0.0767 | |

| LOG_INT does not Granger Cause LOG_GDP | 17 | 0.02145 | 0.9788 |

| LOG_GDP does not Granger Cause LOG_INT | 0.62774 | 0.5504 | |

| LOG_XGR does not Granger Cause LOG_GDP | 17 | 11.7620 | 0.0015 |

| LOG_GDP does not Granger Cause LOG_XGR | 5.84125 | 0.0169 | |

| LOG_INT does not Granger Cause LOG_DDT | 17 | 2.54078 | 0.1202 |

| LOG_DDT does not Granger Cause LOG_INT | 0.36240 | 0.7034 | |

| LOG_XGR does not Granger Cause LOG_DDT | 17 | 1.79266 | 0.2084 |

| LOG_DDT does not Granger Cause LOG_XGR | 2.55841 | 0.1187 | |

Table 8 is the regression result which depicts that F-statistic is 461.0735 while the p-value is 0.000, which lower than 5% level of significance. There is an indication that the model selected for this study is appropriate and has numerical importance. The result also implies that the explanatory variable jointly and materially influenced economic growth sustainability in Nigeria. Furthermore, the result shows a correlation (R) value of 99%, which represents a robust positive relationship existing between the dependent and the independent variables. The Rsquared value of 99% is also very sturdy. What it means is that it is only 1% that relates to other factors that the model for this study omits. The Adjusted R-squared is also 99% while the Standard Error of regression is 0.04. The result shows the absence of errors in the regression line because it is less than 1. The Durbin-Watson is 2.1, which means that the sample used in this study does not have auto-correlation.

| Table 8 Regression Result Dependent Variable: Log_GDP | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| LOG_DDT | 0.729934 | 0.059992 | 12.16724 | 0.0000 |

| LOG_INT | -1.778910 | 0.271294 | -6.557133 | 0.0000 |

| LOG_XGR | 0.170632 | 0.333651 | 0.511410 | 0.6165 |

| C | 3.914994 | 0.747370 | 5.238363 | 0.0001 |

| R-squared | 0.989272 | Mean dependent var | 4.654543 | |

| Adjusted R-squared | 0.987126 | S.D. dependent var | 0.379093 | |

| S.E. of regression | 0.043012 | Akaike info criterion | -3.269991 | |

| Sum squared resid | 0.027751 | Schwarz criterion | -3.071162 | |

| Log likelihood | 35.06491 | Hannan-Quinn criter. | -3.236341 | |

| F-statistic | 461.0735 | Durbin-Watson stat | 2.172933 | |

| Prob(F-statistic) | 0.000000 | |||

The result in Table 8 is showing the effect of the individual predictor variables on the response variable. From Table 8, the domestic debt t-statistic is 12.167 while the p-value is 0.000. The result shows that, at 5% material level, household debt has a significant positive impact on GDP. This result agrees with the finding of (Ugwu, 2017; Okwu et al., 2016; Saifuddin, 2016) while there is a discrepancy between this finding and the study of (Ayuba & Khan, 2019; Tawfiq & Shawawreh, 2017). The interest rate t-statistic is -6.557 while the p-value is 0.000. Thus at 5% level of significance, the interest rate has a significant negative impact on economic growth sustainability. However, the exchange rate is not substantial enough to explain the variations in the economic growth sustenance.

Conclusion

The examination assessed the impact of local debt financing on sustainable economic expansion. Sustainability of economic growth is a function of many economic factors, including domestic debt acquisition, its usage and application. The examination is motivated by the reckless purchase of social obligation without considering the future generation. The finding from the Granger causality test shows that economic elements, such as interest rate and exchange, do not influence debt acquisition locally. In other words, local debt contraction does not bother about their existence and effect in the long run. The investigation additionally finds that interest rate applies a substantial negative impact on GDP while the exchange rate has an irrelevant positive effect on GDP. However, the findings reveal that domestic debt ignites economic growth within the period under review.

Thus, the study recommends more caution in domestic government borrowing to keep the debt profile within a tolerable limit that would not lead to debt overhang that could affect the future generation. The study is encouraging domestic borrowing that is more dominated by marketable securities because it serves as a monetary tool to strengthen the financial markets and also helps to achieve economic expansion in the country. However, the study is advising that the relevant authorities in the country should consider all economic pointers when contracting loans. Such economic factors include the interest rate, inflation and exchange rate volatility. There is a need because by and large, they affect all financial activities and decisions directly or indirectly.

Policy Implication

The causality tests of this study depicts reckless contractual of public debt. The policy issue is that the government plays down on the dynamics of economic indicators while taking such decisions. There are absence of policies to watch macroeconomic changes before contracting loans. The truth is that these economic forces in turn increase the debt profile due to their instability and time value of money. Thus, domestic loan would be more useful if it is tied to a viable project such as agricultural enhancement, human capital development and infrastructural development. This research shows that more prudent investment in these areas highlighted above could improve the standard of living in the country and ensure economic growth sustainability.

Acknowledgement

The authors express their profound gratitude to Covenant University Ota, Ogun State, Nigeria for encouraging and funding this research work.

References

- Adetokunbo, A.M., &amli; Ebere, C.E. (2019).&nbsli; Determinants and analysis of domestic debt in Nigeria:1970-2015. Acta Universitatis Danubius, 15(2), 275-287.

- Ari, I., &amli; Koc, M. (2018). Sustainable financing for sustainable develoliment: Understanding the

- Interrelations between liublic investment and sovereign debt.&nbsli; Sustainability, 10(3901), 1-25.

- Ayuba, I.K., &amli; Khan, S.M. (2019). Domestic debt and economic growth in Nigeria: An ARDL

- Bounds test aliliroach. Economics and Business, 33(1), 50-68.&nbsli;

- Burhanudin, M.D., Muda, R., Nathan, S.B., &amli; Arshad, R. (2017).&nbsli; Real effects of government debt On sustainable economic growth in Malaysia. Journal of International Studies, 10(3), 161-172.

- Central Bank of Nigeria (CBN) Statistical bulletin, 30, December 2019.

- Didia, D., &amli; Ayokunle, li. (2020). External debt, domestic debt and economic growth: The case

- of Nigeria.&nbsli; Advances in Economics and Business 8(2), 85-94.

- Economics Online (2020). Sustainable Growth. Retrieved on August 1, 2020 from: httlis://www.economicsonline.co.uk/Managing_the_economy/Sustainable_growth.html

- Grimsley, S. (2016). What is sustainable economic growth? - Definition &amli; Overview. Retrieved&nbsli;&nbsli;&nbsli;

- On August 1, 2020 from: httlis://study.com/academy/lesson/what-is-sustainable-economic-growth-definition-lesson-quiz.html.

- Haffiner, O.C., Aruna, A.J., &amli; Adams, K. (2017). Imliact of domestic debt on economic growth in Sierra Leone: An emliirical investigation. West African Journal of Monetary and Economic Integration, 17(2), 1-24.

- Igbodika, M.N., Jessie, I.C., &amli; Andabai, li.W. (2016). Domestic debt and the lierformance of

- Nigerian economy (1987-2014): An emliirical investigation. Euroliean Journal of Research And Reflection in Management Sciences, 4(3), 34-42.

- Krugman, li. (1988).&nbsli; Financing versus forgiving a debt overhang.&nbsli; NBER working lialier 2486. Available online at: www.nber.org/lialiers.

- Kueh, J., Liew, V.K., &amli; Yong, S. (2017).&nbsli; Modelling Malaysia debt threshold: Debt comliosition

- liersliective.&nbsli; International Journal of Business and Society, 18(4), 800-807.

- Mbate, M. (2014).&nbsli; Domestic debt, lirivate sector and economic growth in Sub-Saharan Africa.

- African Develoliment Review, 25(4), 434-446.&nbsli;

- Narayan, li.K. (2005).&nbsli; The saving and investment nexus for China: Evidence from co-integration Test. Alililied Economics, 37(17), 1979-1990.&nbsli;

- Okwu, A.T., Obiwuru, T.C., Obiakor, R.T., &amli; Oluwalaiye, O.B. (2016).&nbsli; Domestic debt and

- Economic growth in Nigeria: Data-based Evidence.&nbsli; Greener Journal of Economics and Accountancy, 5(1), 1-12.&nbsli;

- Omodero, C.O., Ekwe, M.C., &amli; Ihendinihu, J.U. (2018).&nbsli; Derivation funds management and

- economic develoliment of Nigeria: Evidence from Niger Delta States of Nigeria. International Journal of Financial Research, 9(2), 165-171.

- Omodero, C.O., Egbide, B., Madugba, J.U., &amli; Ehikioya, B.I. (2020). A Mismatch between External Debt Finances and Consumlition Cost in Nigeria.&nbsli; Journal of Olien Innovation: Technology, Market, and Comlilexity, 6(58), 1-13.

- Richard, S., Kurayish, S., &amli; Enoch, T. (2020). Uganda’s exlierience with debt and economic Growth: an emliirical analysis of the effect of liublic debt on economic growth – 1980-2016. Journal of Economic Structures, 9(48), 1-18.

- Saifuddin, M. (2016).&nbsli; liublic debt and economic growth: Evidence from Bangladesh.&nbsli; Global

- Journal of Management and Business Research: B Economics and Commerce, 16(5), 65-73.

- Saungweme, T., &amli; Odhiambo, N.M. (2020).&nbsli; The imliact of domestic and foreign liublic debt on

- Economic growth: Emliirical evidence from Zimbabwe. International Economics, 73(1), 77-106.

- Tawfiq, A.M. &amli; Shawawreh, A.M. (2017).&nbsli; The imliact of liublic debt on the economic growth

- of Jordan: An emliirical study (2000-2015).&nbsli; Accounting and Finance Research, 6(2), 114-120.

- Udoh, B.E., Ekeowa, K.L., Okechukwu, I.S., Afamefuna, O.O., &amli; Nwonye, A.C. (2020). Effect

- of intergenerational debt burden on economic growth in Nigeria.&nbsli; Humanities and Social Sciences Letters, 8(2), 133-144.

- Ugwu, O.J. (2017).&nbsli; Imlieratives of domestic debt liayments and economic growth: The Nigerian

- Evidence. IOSR Journal of Economics and Finance, 8(1), 46-51.

- World Develoliment Indicators 2020.