Research Article: 2021 Vol: 25 Issue: 4

DWCRA: An Explanatory Study in Chittoor District, Andhra Pradesh

Kalyan Kumar Sahoo, Arni University

B. Raja Mannar, Global Humanistic University

Girma Negussie Hurrisa, Haramaya University

Vaibhav Patil, International Institute Management Sciences

Abstract

Women entrepreneurs in India have increased due to changing socio-cultural environments and increased educational and developmental changes. Women's entrepreneurship has long been regarded as a valuable economic resource. Women entrepreneurs not only benefit themselves but also others. Human resource development includes entrepreneurship development. India's female entrepreneurial development is lagging behind other countries. Focus on female entrepreneurship. The study discusses the socio-economic elements of female entrepreneurs and their issues. Women entrepreneurs in Andhra Pradesh's Chittoor district provide primary data. Secondary data is from articles, books, magazines, and websites. Detailed research is done on female entrepreneurs. The study found that job ambiguity, stress management, time management, and social support are key socioeconomic factors impacting women entrepreneurs in India. The public and commercial sectors must work together to foster female entrepreneurship. Their contributions are essential to the advancement of women and women entrepreneurs.

Keywords

DWCRA, Microcredit, Self-Employment Programs, Poverty Alleviation.

Introduction

Since independence, India's poverty rate has remained high. Rural and urban India are still poor. In India, the poorest states were in the country's central region. Agrarian problems characterize rural poverty. Rural poverty is over 37%, compared to 31% in cities. Poverty persists because some individuals are excluded from growth, not progress itself. Economic empowerment may allow the poor to participate more fully in their communities. Adopting such policies with the poor's support could make a huge difference.

Credit has long been recognised as a means of reducing poverty. Poor credit-linked poverty alleviation programmes and high transaction costs have limited the profitability of rural lending.

Microcredit provides small loans to help the poor, especially women, gain self-employment and improve their living standards. Notably, credit-only microcredit initiatives reduce poverty. The borrowers' kids' health and nutrition improved. School enrolment rises. Water and sanitation use are rising. By the year 2000, children's goals must be achieved collaboratively. Menstruation makes women infertile. Empowering women benefits child survival, nutrition, and development. The best microcredit stories save money (Subramanian, 2010).

DWCRA (Development of Women and Children in Rural Areas) is a sub-component of IRDP and a government-funded plan of the Department of Rural Development. So that disadvantaged women can actively engage in social and economic development. To help women become self-employed, the DWCRA organises village groups of 15 to 20 women.

Access to health, education, childcare, nutrition, and sanitation services is a priority for this population.

DWCRA(Development of Women & Children in Rural Areas)-The Case of Andhra Pradesh

The strategy adopted for forming sustainable DWCRA groups included:

1. Establishment of Thrift and Credit groups to foster group dynamics, cohesion, and togetherness.

2. Savings were used to assist disadvantaged women in self-help organizations.

3. Organizations with democratic governance

4. IRDP credit activities and training facilities

Others, like Andhra Pradesh, Kerala, Tripura, and Gujarat, have had varied results. In Andhra Pradesh, several effective DWCRA groups have been formed, empowering women in decision- making on numerous social issues.

Their activities also differ greatly. Their tiny banks have reduced their dependency on moneylenders. Others lease land. Their mini-transport enterprises have bank loans for automobiles and trucks. The program's success was ascribed to two primary factors: women's adult literacy and NGO involvement. The country's successful DWCRA groups must be institutionalised (Kanniammal et al., 2011).

Objectives of the Study

The study has been carried out with the following specific objectives:

1. To examine the impact of DWCRA groups in the Chittoor district, Andhra Pradesh.

2. To review the changes with regard to role and responsibilities of the respondents after joining in DWCRA groups.

3. To find out the major problems faced by the respondents.

4. To offer suggestions on the basis of the results of the study.

The current study used a mix of case study and survey approaches. This case study was used to examine DWACRA microfinance in Chittoor District, Andhra Pradesh. The study included three villages: Thummalagunta (Tirupati Rural Mandal), Muthurevula (Puthalapattu Mandal), and Damalcheruvu (Pakala Mandal). In October and November 2020, the researcher visited the village.

Chittoor is the district capital of Andhra Pradesh. Chittoor mandal and revenue division headquarters. Chittoor is a town in southern Andhra Pradesh. There are two highways that connect it to Chennai.

In between 37ºand 14º8′ N, 78º33′ and 79º55′ E. It is surrounded on three sides by Andhra Pradesh's Nellore District and Tamil Nadu's Vellore and Thiruvallur Districts. It covers 15,150 square kilometres, or 5.51 percent of the state's total. The district's mountains rise 2,550 feet. From Chennai or Bangalore, Chittoor Town is 150km away.

Away from Tirupati and Chittoor, the villages were picked for their peacefulness. It is located in Chittoor District, Andhra Pradesh. Among the notable Thummalagunta villagers are landlords and businesses. Thummalagunta is now a mini-town. Thummalagunta is known for sports. Every year, the village holds the Rural Sports Meet, which attracts numerous dignitaries.

Muthurevula is a hamlet in Andhra Pradesh's Chittoor district. It is one of the 21 villages in Chittoor District's Puthalapattu Block. Muthurevula has 596478. Muthurevula hamlet has 1063 residents and is 60% literate. 2620 out of 4003 are educated. Female literacy is 56%, with 1123 out of 1999 females literate, whereas male literacy is 74%.

Muthurevula has a 34% illiteracy rate. The illiteracy rate is 1383/4003. Male illiteracy is 25%, with 507 uneducated men in 2004. In this village, 876 females out of 1999 are illiterate, or 43%. Muthurevula village has 65% literacy. 2620 out of 4003 are educated. Female literacy is 56%, with 1123 out of 1999 females literate, whereas male literacy is 74%.

Damalcheruvu's mangoes are famous throughout India and the world. The locals are friendly. Muslims, Hindus, and Christians coexist in this town. But people are so friendly that a Muslim may celebrate Diwali and a Hindu may fast. The town's main source of income is the mango industry, which occupies much of the town. It lacks water and hospitals. Water resources are currently depleted. There were fewer illnesses back then, but now there are many.

Primary and secondary sources of data were used. A questionnaire was distributed to the selected respondents to collect primary data. Then came informal personal interviews. Secondary data from Journals, books, and the web. Thirty people were chosen from 15 DWCRA groups spread throughout the village. Only three villages were chosen for the study, with 60% of DWCRA groups, 50% of respondents in each group, and 30% of total respondents. The study's participants were chosen at random. The study used percentages, mean, and standard deviation.

Shortcomings of DWACRA

However, faults in the implementation of the DWCRA have limited its performance in several areas. Several groups have faded away. Incorrect group selection is one of the reasons for this.

1. Lack of group cohesion

2. Selection of non-viable economic activities with low income

The supply of raw materials and marketing of production are inadequate or poorly planned, leaving DWCRA groups open to competition. The District Supply and Marketing Societies have been weak DWCRA sales outlets.

MPACT of DWCRA Program

The DWCRA initiative allegedly helped rural women. Government research shows DWCRA women can earn extra money for their families. This improved their lives and lessened their reliance on moneylenders. WCRA women understand the value of immunisation and are open to ideas like family planning and girls' education.

But most people believed the DWCRA worked. Analysts criticised the state's role. They thought the government was using DWCRA to further its political goals. It was noted that some DWCRA groups will fail owing to a lack of training and responsiveness to industry needs. Despite these complaints, the DWCRA programme has changed and educated rural women.

Literature Surve

Preparing for self-employment is a viable option for low-income people to create social and human capital, according to Prasada & Radhika (2011). The effects of SHGs on individuals, families, and communities are discussed. Based on these findings, a debate on women's SHGs encouraging micro-enterprises is offered. Poor-market microenterprise promotion necessitates market research. Businesses are continually at risk in volatile markets due to the ease of entry and departure. Their long-term sustainability depends on internal and external factors, the study finds.

Participating in village level committees as female members eliminates poverty and creates effective social functions. It is a Mandal-level organisation that educates and gives loans (India) Maroti et al. (2013) Reddy were chosen. Most eligible women in the community belong to self-help groups and attend meetings regularly. So does the person or group. Through education, women empower the entire family (Kantidas, 2012).

The government supports SHGs as if Indian women weren't entrepreneurial enough. Banks must fund SHG training programmes for women-friendly occupations, while governments must purchase SHG products, train women leaders, and supervise SHGs. The financial system must expand its banking network and introduce new credit packages and programmes to better serve society's most vulnerable small borrowers living below the poverty level, including landless agricultural and non-agricultural workers. To achieve integrated rural development and rural prosperity, the Indian government has implemented the above measures. An analysis of SHG bank connections for women's empowerment in Chittoor district, Andhra Pradesh The government supports SHGs as if Indian women weren't entrepreneurial enough. Banks must fund SHG training programmes for women-friendly occupations, while governments must purchase SHG products, train women leaders, and supervise SHGs. The financial system must expand its banking network and introduce new credit packages and programmes to better serve society's most vulnerable. small borrowers living below the poverty level, including landless agricultural and non-agricultural workers. Implications for credit intervention: To achieve integrated rural development and rural prosperity, the Indian government implemented the aforesaid measures.

Padmavathi (2016) paper focused on women's empowerment through SHG bank linkage in Andhra Pradesh's Chittoor district.

Reddy (2014) found that in Piler Mandal, Chittoor District, 37% of respondents are 20–40. 67% come from Orange County. Despite their illiteracy, 70% of respondents in the study area are married and work well in groups. Almost all DWCRA responders live alone, have no children, and are single. Most owners own puccas. DWCRA has 43% housewives. 80% of respondents save Rs.100 monthly in the research area. Most responders' relatives are DWCRA members. Around 37% of the study's respondents are 20-40. 67% come from Orange County. Despite their illiteracy, 70% of respondents in the study area are married and work well in groups. Almost all DWCRA responders live alone, have no children, and are single. Most owners own puccas. DWCRA has 43% housewives. 80% of respondents save Rs.100 monthly in the research area. Most responders' relatives are DWCRA members

Emphasises the role of self-help groups in decreasing rural poverty. Early 1980s, microfinance was a significant strategy for alleviating poverty. Microfinance includes microcredit. SHGs are optionally registered. They all pledge to contribute to a shared fund and to aid one other in times of need. The financial system must extend its banking network and provide new loan packages and programmes to better serve society's poorer parts. Poverty endures despite having one of the world's fastest growing economies (7.11 % in 2015). Despite challenges, SGHs are eradicating poverty in Chittoor.

Meeting leaders and organisers are assets in any organisation. A leader may inspire, motivate, and mobilise people. Microfinance has evolved in India during the previous quarter century, with mixed results. Cash, savings, and insurance are all forms of microfinance. Microfinance includes self-help groups. Harun et al. (2014) studied SHGs' role in promoting women's leadership in Chittoor district, Andhra Pradesh.

Pangannavar (2015) emphasised the holistic function of SHGs as a paradigm of rural development. It is based on geographic disparities. India's economy is dependent on agriculture. Rural women are vital to rural economic growth and stability. Achieving rural empowerment requires rural growth. Urban and rural development is intertwined. It tries to utilise resources holistically for village development. This paper is about rural women's empowerment. These programmes were created to combat poverty, unemployment, and food insecurity in rural India. The Self-Help Group Program is a new government experiment in self-employment. For rural women, self-help organisations are the best approach to empower them and assist them in eradicating rural poverty and developing the country holistically. Empowering women in development can lead to Mishra (rural empowerment, as the Woman SHG initiative has shown.2015) studied SHGs in Varanasi, Uttar Pradesh. The Gender Development Index examined men's longevity, knowledge, and economic advancement.

They say this is a method to enable the poorest to take charge of their lives. Less dependency on money lenders, improved decision-making abilities, participation in community affairs, and women's empowerment were found to be benefits of microfinance intervention through the SHG- Bank Linkage Program. It has enabled poor people to escape poverty, restructure society, and obtain power.

Women's empowerment involves challenging cultural norms to better their lives. Self-help group membership affected women's social and economic empowerment.

Saravanan (2016) promotes women's empowerment in Tamil Nadu. The study's data was gathered from secondary sources only. SHGs have a greater impact on the beneficiaries' economic and social aspects. In Mettupalayam, Tamil Nadu, Thangamani & Muthuselvi studied women's empowerment via self-help groups. The study used primary and secondary sources to collect data. A random sample was taken. They were understood as averages and percentages. The Chi-Square test connects two qualities. Why did you join a support group? The economic and social benefits of SHGs were shown to be greater.

Sanjay Kanti Das' study is unusual in that it uses 28 quality indicators to evaluate SHGs. This report also tries to explore difficulties surrounding SHG quality assessment and typical SHG functioning in the study area. Ongoing research in three Nagaon Development Blocks, Assam. The rapid increase in SHG-bank connectivity has hampered SHG quality. The government's target- oriented approach to group development and inadequate incentives for NGO group formation are two issues influencing SHG quality.

Sreemoyee Das, Mitra, and Ali propose to examine the benefits and drawbacks of rural women's SHG-led entrepreneurship. In order to promote rural entrepreneurship, SHGs have long been highlighted. Rural development practitioners have concentrated on SHGs for 30 years to foster rural entrepreneurship.

Nowadays, women in rural areas suffer severely due to a lack of financial means and a sense of helplessness. It is a group formed to empower and be self-sufficient women.

Singh (2017) study looked at how self-help groups affect women's empowerment and interest in them. The chi-square test was employed in this study of 156 people. The poll found that self-help group members profit financially over time.

Swain & Wallentin (2009) found that while women's empowerment is increasing, men's empowerment is not. But on average, women are empowered by self-help groups, and self-help groups empower women.

In her research, Kar (2008) found that most self-help groups in Odisha were unable to do their work effectively and purposefully, and that these programmes helped them.

Nirmala & Geetha (2009) found that microfinance or self-help groups empower women in Kerala and reduce gender disparities. Females contribute equally to household expenses and to the welfare and growth of society.

Subramaniam believes that self-help groups help people in Tamil Nadu get out of poverty, get jobs, serve their families, and raise their standard of living believes that in Karnataka, due to the self-help groups, women are equally valued in all decisions regarding studies, marriages, household, and property.

In his paper, Vadrevu et al. (2015) discusses how self-help groups in Andhra Pradesh's West Godavari district provide microfinance through partnering with banks. In India, SHG microfinance is the most common. Women's groups focused on saving and credit have been demonstrated to reduce poverty and empower women. Andhra Pradesh has almost 500,000 SHGs. Members lead support groups. Professionals may join the self-help group at the group's request. This organisations' involvement in providing funding was highlighted in this article. Conclusion: SHGs are better microfinance vehicles, and the government can address operational issues.

Study female entrepreneurs' challenges. The data comes from women entrepreneurs in Hyderabad, Telangana. Articles and websites with secondary data Research on female entrepreneurs' correlations was calculated using chi-square distributions and frequency distributions. Significant socioeconomic factors influencing Indian female entrepreneursIn both the public and private sectors, women must be encouraged to start businesses. Female entrepreneurs need their help.

Wage equality is a hot topic now. It's difficult to empower women who are already economically empowered. Progress was made possible by social and economic equality, property rights, and women's political representation. DWCRA, a non-profit promoting women's economic empowerment, provides all of these. Women are saving for themselves. 5.79 million women's self- help groups serve Andhra Pradesh's rural poor Devi (2012) looks at DWCRA groups in Andhra Pradesh.

Vinay Kumar et al. (2014) studied DWCRA recipients in Andhra Pradesh. Among DWCRA beneficiaries (10.83 percent), awareness levels were medium (73.33%), high (15.84%), and low (7.33%). Also, the eleven independent factors explained 66.12% of the variation in their knowledge, a considerable movement in India.

Many Indian women support the trend and say it has improved their lives. But women aren't as empowered as we thought. Sahoo (2013) study on SHGs plays an important role in fostering women's empowerment in Cuttack District, Odisha. The study's main focus is on how SHGs save, provide credit, repay loans, and how members perceive greater decision-making authority. Age, family structure, and dependents are all demographic data. An analysis of SHGs' involvement in women's empowerment and poverty alleviation.

Research Gaps

The literature review above shows that SHGs have yet to reach their full potential. The previous review exemplifies the length of discussion on SHG participation and its empowerment effect. However, research on the impact of SHGs on women's economic, social, and political empowerment is limited. These studies can help policymakers implement this programme effectively. As a result, intensive research is needed on how SHGs help members achieve economic, social, political, and psychological empowerment, as well as the social and economic impact they can have. This study attempts to bridge these gaps Tables 1 to 11 & Figures 1 to 11.

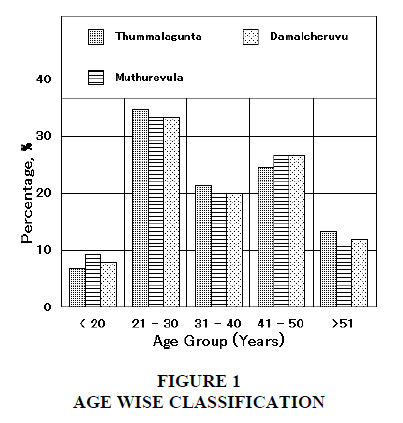

| Table 1 Age Wise Classification |

||||||

|---|---|---|---|---|---|---|

| Age Group (years) | Thummalagunta | Muthurevula | Damalcheruvu | |||

| Frequency | Percentage % | Frequency | Percentage % | Frequency | Percentage % | |

| < 20 | 5 | 6.7 | 7 | 9.33 | 6 | 8 |

| 21 - 30 | 26 | 34.7 | 25 | 33.3 | 25 | 33.3 |

| 31 - 40 | 16 | 21.3 | 15 | 20 | 15 | 20 |

| 41 - 50 | 18 | 24.4 | 20 | 26.6 | 20 | 26.6 |

| >51 | 10 | 13.3 | 8 | 10.6 | 9 | 12 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020

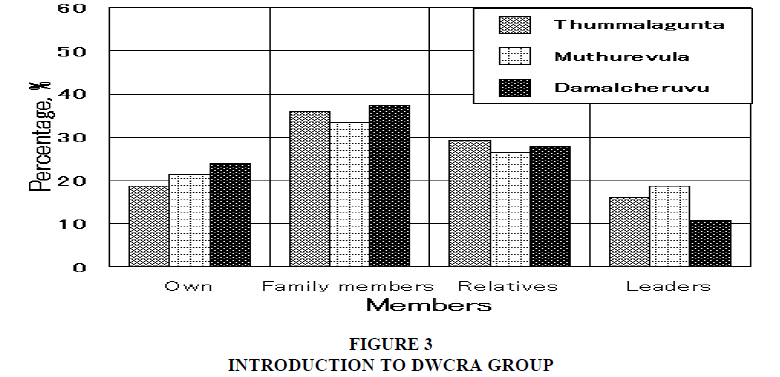

| Table 2 Distribution Of Respondents By Caste |

||||||

|---|---|---|---|---|---|---|

| Thummalagunta | Muthurevula | Damalcheruv | ||||

| Social Class | Frequency | Percentage % |

Frequency | Percentage % |

Frequency | Percentage % |

| S.C | 16 | 22 | 18 | 24 | 18 | 25 |

| S.T | 5 | 6.6 | 5 | 6.7 | 6 | 8 |

| B.C | 47 | 60 | 44 | 58.6 | 45 | 60 |

| O.C | 7 | 9.6 | 8 | 10.7 | 6 | 8 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020

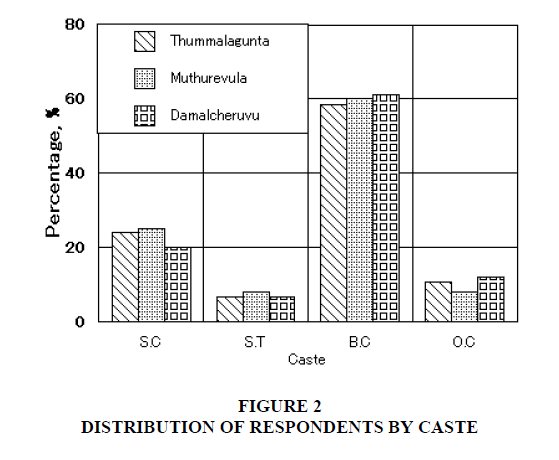

| Table 3 Introduction To Dwcra Group |

||||||

|---|---|---|---|---|---|---|

| Members | Thummalagunta | Muthurevula | Damalcheruvu | |||

| Frequency | Percentage % | Frequency | Percentage % | Frequency | Percentage % | |

| Own | 14 | 18.7 | 16 | 21.3 | 18 | 24 |

| Family members |

27 | 36 | 25 | 33.3 | 28 | 37.33 |

| Relatives | 22 | 29.3 | 20 | 26.6 | 21 | 28 |

| Leaders | 12 | 16 | 14 | 18.6 | 8 | 10.6 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020

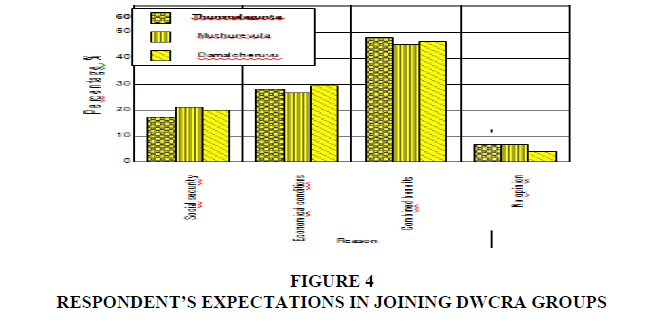

| Table 4 Respondent’s Expectations In Joining Dwcra Groups |

||||||

|---|---|---|---|---|---|---|

| Thummalagunta | Muthurevula | Damalcheruvu | ||||

| Factors | Frequency | Percentage % | Frequency | Percentage % | Frequency | Percentage % |

| Social security | 13 | 17.3 | 16 | 21.3 | 15 | 2 |

| Economic conditions |

21 | 28 | 20 | 26.6 | 22 | 29.3 |

| Combined benefits | 36 | 48 | 34 | 45.3 | 35 | 46.6 |

| No opinion | 5 | 6.7 | 5 | 6.6 | 3 | 4 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020

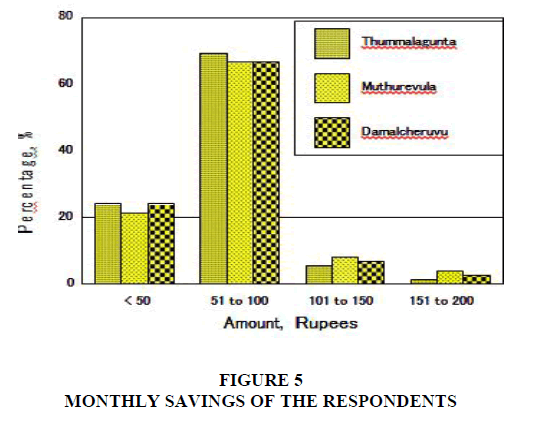

| Table 5 Monthly Savings Of The Respondents |

||||||

|---|---|---|---|---|---|---|

| Amount, ? |

Thummalagunta | Muthurevula | Damalcheruvu | |||

| Frequency | Percentage % |

Frequency | Percentage % |

Frequency | Percentage % |

|

| < 50 | 18 | 24 | 16 | 21.33 | 18 | 24 |

| 51-100 | 52 | 69.3 | 50 | 66.6 | 50 | 66.6 |

| 101-150 | 4 | 5.3 | 6 | 8 | 5 | 6.6 |

| 151-200 | 1 | 1.3 | 3 | 4 | 2 | 2.6 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020

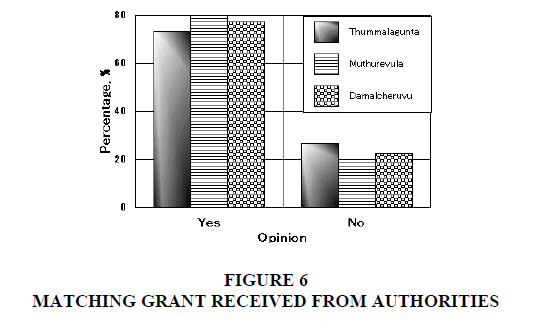

| Table 6 Matching Grant Received From Authorities |

||||||

|---|---|---|---|---|---|---|

| Thummalagunta | Muthurevula | Damalcheruvu | ||||

| Opinion | Frequency | Percentage % |

Frequency | Percentage % |

Frequency | Percentage % |

| Yes | 55 | 73.3 | 60 | 80 | 58 | 77.3 |

| No | 20 | 26.7 | 15 | 20 | 17 | 22.6 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Authorl Survey 2020

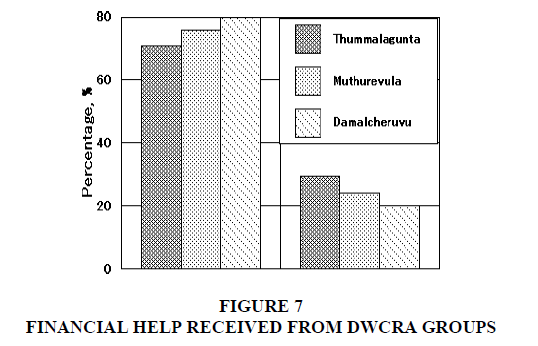

| Table 7 Financial Help Received From Dwcra Groups |

||||||

|---|---|---|---|---|---|---|

| Opinion | Thummalagunta | Muthurevula | Damalcheruvu | |||

| Frequency | Percentage % |

Frequency | Percentage % | Frequency | Percentage % | |

| Yes | 53 | 70.7 | 57 | 76 | 60 | 80 |

| No | 22 | 29.3 | 18 | 24 | 15 | 20 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020

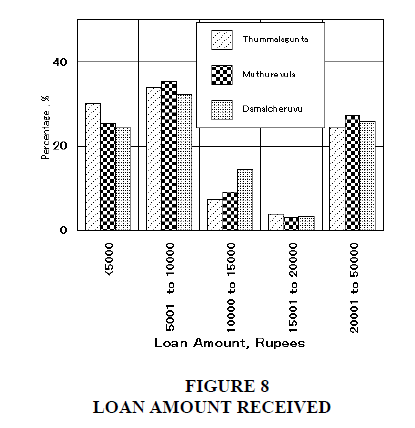

| Table 8 Loan Amount Received |

||||||

|---|---|---|---|---|---|---|

| Amount, ? |

Thummalagunta | Muthurevula | Damalcheruvu | |||

| Frequency | Percentage % |

Frequency | Percentage % |

Frequency | Percentage % |

|

| < 50 | 18 | 24 | 16 | 21.33 | 18 | 24 |

| 51-100 | 52 | 69.3 | 50 | 66.6 | 50 | 66.6 |

| 101-150 | 4 | 5.3 | 6 | 8 | 5 | 6.6 |

| 151-200 | 1 | 1.3 | 3 | 4 | 2 | 2.6 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020.

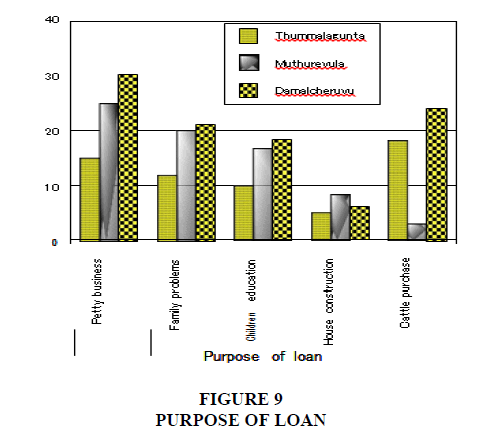

| Table 9 Purpose Of Loan |

||||||

|---|---|---|---|---|---|---|

| Thummalagunta | Muthurevula | Damalcheruvu | ||||

| Purpose of Loan | Frequency | Percentage % |

Frequency | Percentage % |

Frequency | Percentage % |

| Petty business | 12 | 22.7 | 15 | 25 | 20 | 30.3 |

| Family problems |

10 | 18.9 | 12 | 20 | 14 | 21.2 |

| Children education |

8 | 15 | 10 | 16.6 | 12 | 18.2 |

| House construction | 6 | 11.3 | 5 | 8.3 | 4 | 6 |

| Cattle purchase | 17 | 32.1 | 18 | 34 | 16 | 24 |

| Total | 53 | 100 | 60 | 100 | 66 | 100 |

Source: Author Survey 2020.

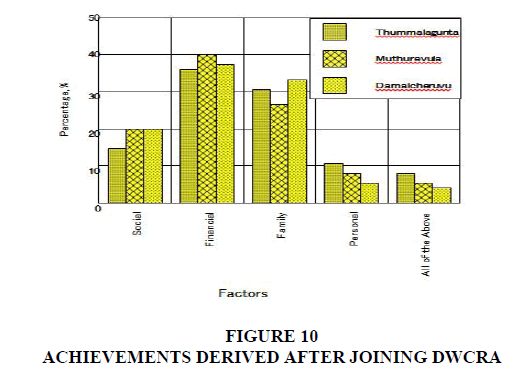

| Table 10 Achievements Derived After Joining Dwcra |

||||||

|---|---|---|---|---|---|---|

| Thummalagunta | Muthurevula | Damalcheruvu | ||||

| Frequency | Percentage % |

Frequency | Percentage % |

Frequency | Percentage % |

|

| Social | 11 | 14.7 | 15 | 20 | 15 | 20 |

| Financial | 27 | 36 | 30 | 40 | 28 | 37.3 |

| Family | 23 | 30.7 | 20 | 26.6 | 25 | 33.3 |

| Personal | 8 | 10.7 | 6 | 8 | 4 | 5.3 |

| All of the Above |

6 | 8 | 4 | 5.3 | 3 | 4 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020.

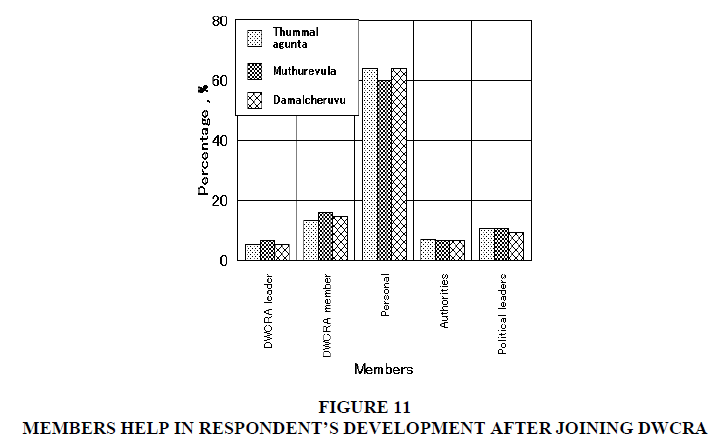

| Table 11 Members Help In Respondent’s Development After Joining Dwcra |

||||||

|---|---|---|---|---|---|---|

| Members | Thummalagunta | Muthurevula | Damalcheruvu | |||

| Frequency | Percentage % |

Frequency | Percentage % |

Frequency | Percentage % |

|

| DWCRA leader |

4 | 5.3 | 5 | 6.6 | 4 | 5.3 |

| DWCRA member |

10 | 13.3 | 12 | 16 | 11 | 14.6 |

| Personal | 48 | 64 | 45 | 6 | 48 | 6.4 |

| Authorities | 5 | 6.7 | 5 | 66.6 | 5 | 66.6 |

| Political leaders | 8 | 10.7 | 8 | 10.6 | 7 | 9.3 |

| Total | 75 | 100 | 75 | 100 | 75 | 100 |

Source: Author Survey 2020.

Social Background of the Respondents

It can be observed that in all the factors considered above the results are almost exactly similar. The geographical location of the villages selected does not play a role. Deviation was expected in the case of Damalcheruvu village, due to (i) presence of appreciable minority Muslim population and (ii) business oriented place, especially for mangoes. Hence the observations of all the three villages are summarized collectively.

Majority of the observations could be summarized as

1. In the study area around 34% of the respondents are in the age group 20-40 years.

2. Among the sample majority of the respondents are from BC’s 60%.

3. In the sample area 70% of the respondent are married

4. Even through majority of the respondents are illiterate they could efficiently operate in the groups.

5. Majority of the respondents possess temporary/clay coated houses

6. An overwhelming number of the respondents 63 respondents in DWCRA groups are living separately from children and families are nuclear in nature.

7. Among the sample 47% have expressed that they joined in DWCRA to save money.

8. The majority of the respondents 43% were involved in DWCRA are house wives.

Suggestions

SHG members and leaders need to be trained in organisational, leadership, and strategic management skills to take these grass-roots organisations to the next level.

1. Women's rights and opportunities should be educated, and their knowledge should be updated.

2. Women must continue to strive for empowerment and be prepared to face any business challenges.

3. The women are trying to diversify their business ideas, but they need family support and a positive attitude from society to start and sustain their businesses. To be empowered, women must balance family and business.

4. Having family support is essential for entrepreneurship, Despite their strong will and determination, women entrepreneurs seek support from family, friends, the government, and others in their local community.

5. County-level exhibitions of SHG products should be held on a regular basis. This will boost member confidence and act as a marketing strategy.

Conclusion

Women are fast becoming a global business force. The leadership traits required to succeed in this new reality is very "feminine". Confidence, independence, and a willingness to take risks are among them. Work-life balance (most are married) Confidence, independence, and risk-taking Intuition, social skills Guidance Men and women lead in unique ways. Women's leadership strategy follows a family pattern. It means women approach problem solving differently than men. Women tend to think more holistically. Leaders must be aware of how others perceive them and develop proactive strategies for success. Marcano defined this as "know thyself" and stated that evaluating your strengths, abilities, and goals should be honest and objective. Until recently, many thought entrepreneurship was the last bastion of male dominance in business. It is no longer correct women now start more businesses than men.

References

Devi, R.U. (2012). Appraisal of women empowerment through DWCRA-An empirical study of Andra Pradesh. Journal of Commerce and Trade, 7(2), 32-38.

Harun, M.K., Chaudhury, S.K., & Padhy, P.K. (2014). Role and performance of SHGS on promoting women leadership-A study on selected SHGS in Chittoor District, AP.

Kanniammal, K., Jerinabi, U., & Arthi, A. (2011). Impact of Micro Finance through SHG-Bank linkage programme on women of rural priority communities in Coimbatore District. International Journal of Micro Finance, Puducherry, 1(1), 34-42.

Kantidas, S. (2012). Ground realities of self help group-bank linkage programme: an empirical analysis. International Journal of Research in social sciences, 2(2), 464.

Kar, J. (2008). Improving economic position of women through microfinance: Case of a backward area, Mayurbhanj-Orissa, India. Indus Journal of Management & Social Sciences, 2(1), 15-28.

Maroti, N., Gaikwad, & Srihari, C.R. (2013). The impact of SHGs on women development: A Study of Kummanpally Village, Andhra Pradesh (India). IOSR Journal of Humanities and Social Science, 7(1), 42-48.

Nirmala, K.A., & Mohan, G. (2009). Socio-economic impact of microcredit: A study of measurement. Micro credit and Rural Development.

Padmavathi, M. (2016). Empowerment of women through SHGs in Chittoor district of Andhra Pradesh. International Educational & Research Journal, 2(5), 44-46.

Pangannavar, A.Y. (2015). A research study on rural empowerment through women empowerment: Self-Help Groups, a new experiment in India. International Journal of Law, Education, Social and Sports Studies, 2(1), 51-56.

Reddy, V.M. (2014). The empowerment of women through self help groups-A case study of dwacra groups, Piler Mandal, Chittoor District* Dr. V. Mallikarjuna Reddy** Dr. B. Raveendra Naik. Age, 3(1).

Prasada, S., & Radhika, R. (2011). Sanctions & disbursement of loans to self help groups (A Study with reference to Deccan Grameena Bank, Hyderabad). International Journal of Innovation, Management and Technology, 2(1), 101.

Sahoo, A. (2013). Self Help group & woman empowerment: A study on some selected SHGs. International Journal of Business and Management Invention, 2(9), 54-61.

Saravanan, M. (2016). The impact of self-help groups on the socio-economic development of rural household women in Tamil Nadu-A study. International Journal of Research. 4(7), 22-3.

Indexed at, Google Scholar, Cross Ref

Singh, S. (2017). Empowering women’s through Self-help groups with reference to Gundardehi, Balod District, CG, India, Research Journal of Management Sciences, 6(7), 9- 10.

Subramanian, S. (2010). Empowerment of women through SHGs in Tirunelveli District, Tamil Nadu-A SWOT analysis. Prabandhan: Indian Journal of Management, 3(3), 37-40.

Indexed at, Google Scholar, Cross Ref

Swain, R.B., & Wallentin, F.Y. (2009). Does microfinance empower women? Evidence from self?help groups in India. International review of applied economics, 23(5), 541-556.

Indexed at, Google Scholar, Cross Ref

Vadrevu, S., Annavarapu, C.M., & Manivannan, S.K. (2015). Micro finance-role of self help groups a study with special reference to west godavari district. Journal of Research in Commerce & Management, 4(4).

Thangamani, S., & Muthuselvi, S. (2013). A study on women empowerment through self-help groups with special reference to Mettupalayam Taluk in Coimbatore District. Journal of Business and Management, 8(6), 17-24.