Research Article: 2021 Vol: 27 Issue: 5S

Dynamics of Commercial Banking Services Through Supply Chain Management in Thailand During a Pandemic Situation: An Analysis

Vichayanan Rattanawiboonsom, Naresuan University

Keywords

Thailand, Banking services, Dynamics, Financial Crises, Financial market and Institutions, supply chain management, COVID-19.

Abstract

Covid-19 has been creating disaster as an extra brackish to the injury for the banking activities in the Thailand. As such research question of the study is whether the dynamics commercial banking services through supply chain management during a pandemic situation in Thailand is prevailing? The study has been tested ten null hypotheses: Supply chain management was not disrupted, where the banking services have been proactive; Applicability to the logistics management of the bank branches has not been working; During COVID 19 banking system did not work properly with SME sector financing; Agricultural packages of loan disbursement by the bank was not appropriate; Tourism sector does not get any bank support during COVID 19; New poor wasn't created where banking sector disburse fund for supportive livelihood; Industrial sector does not get inappropriate support by the banking sector due to the pandemic situation; Service sector was not get inappropriate support by the banking sector; Trading sector did not get appropriate financing by the bank; Thai Foreign expatriates returned to the country but did not receive appropriate bank support. Time period of the study was 1st June 2020 to 30th September 2020. For the banking sector of Thailand are requiring to make stronger towards the back connection business to improve well-organized worth adding in selling at domestic and outside the global supply chain as recommended by the author.

Introduction

Thai commercial banking sector is working in the formal sector to mitigate bridge between surplus units and depict units. Covid-19 has been creating disaster as an extra brackish to the injury for the banking activities in the Thailand. After starting of pandemic as a whole like other countries of the world, banking sector in the Thailand also faced huge set back.

Santandertrade.com argued that (2020) IMF forecasted on 14th April 2020, due to the outbreak of the COVID-19, GDP growth is expected to fall to -6.7% in 2020 and pick up to 6.1% in 2021, subject to the post-pandemic global economic recovery in Thailand. Gup & Kolari (2014) argued that most of the functions performed by commercial banks for their clientele be able to separate into three broad areas: payments, intermediation and other financial services. Thirty- one Thai commercial banks in different regions through 6,293 branches till August 2020 (Source: Bank of Thailand) are not proficient in services to provide low cost of loans efficiently with fundamentally strength viable banks due to pandemic situation. Nowadays, information and communication technology has turn into the sensitivity of the banking services as at the mind of each healthy economy. Bank which is using Information and Communication Technology (ICT) linked services while online banking, electronic payments, security investments, are able to bring elevated excellence client services by means of fewer attempt. knowledge have by now facilitate mainly of the banks in Thailand to pioneer ground-breaking merchandise to their clientele in the shape of ATM/POS services, Mobile/Tele banking, Web banking, ‘Anytime’ and ‘Anywhere’ banking, etc. have been creating a good services. According to KPMG (2020) in Thailand ,besides fiscal stimulus packages, employment-related measures, liquidity boosting for labor in affected industry, measures to enhance skill for labor, Social Security Contributions, Liquidity boosting for entrepreneurs, SME loan restructuring, adjustment in roles of financial Institutions and banks, measures to adjust, lower fees structure and economic stimulus measures such as monetary policies measures on credit card and small loans, measures on stabilization of bond markets etc. were taken from since March, 2020. To twist the valve rotten to the financial system – taking different sorts of services provided by the banks starting from the tiny, nano, small and medium and large -sized ventures in the agriculture, service and industrial sector while the majority is exaggerated through the disaster, precisely at this time liquidity is a great deal of desirable especially for bail out from the catastrophes. The enterprises are more and more in concert a significant position in Thailand’s economic growth. Be short of capable human assets to fight against unknown deadly virus is working as enemy against sustainable banking instruments. Be short of symmetric information, imperfect right to use to money and right of entry to coordinated tariff and non-tariff strategies are a number of the main confront which pushed back to the formal sector of the economy of the Thailand.

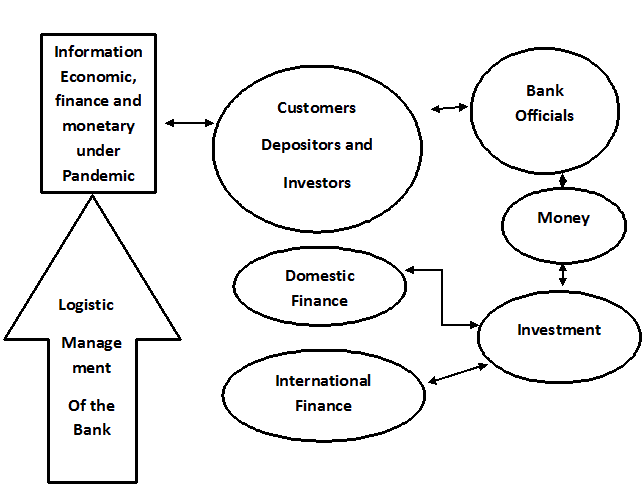

Starting from the tourism sector, small and medium enterprises, agricultural sector, service sector, inbound medical tourism, Thai expatriates at foreign countries, financial availability everywhere in the planet suffered which lead to disrupted supply chain management and logistic support both inbound and outbound logistics. By means of the skinny capitalization height, the depository schemes have to relapse to fortification to save from bankruptcy. The virulent disease so that cannot beat Thailand whilst the financial system and the bank schemes have been trying heart and soul to revive economy under different stimulus packages. In Figure 1, the study shows the dynamics of the supply chain management in the banking sector at below.

Despite that banks are trying to provide dynamic support to the relevant services to the different income strata of clients in various services but such an epidemic situation how much feasible to provide that is a challenge both to the clients as well as bankers. As such the research question arises whether the dynamics commercial banking services through supply chain management during a pandemic situation in Thailand is prevailing?

Literature Review

Okuda & Mieno (1999) commented that the medium sized banks which were the first to fail during the economic crisis in 1997,were intensely concerned in unsound business operations and engaged in excessive lending. Ali (2003) argued that corporate planning helps to define and categories financial instruments and determine how they can be developed and designed. Banks can utilise financial risk framework, risk identification model for asset-liability management and increase their profit through diversified products. Polsiri & Wiwattanakantang (2006) depicted that “the level of deposit and credit protection should be set in such a way that it encourages both investors to select banks based on risk exposure and monitor them”. Adekunle & Olarinkoye (2012) found that in the Nigerian banks, unenthusiastic shock that escalating operational cost can surround on bank earnings for which they suggested that logistic procedures akin to the master planning and uninterrupted improvement form. Ali & Medhekar (2013) depicted that to alleviate the trouble of the international gloominess it is essential to generate employment prospect, production of low cost product preserving the quality, enhancement of supply chain management and export diversification. Anggraini, et al., (2018) observed in Indonesia that Supply Chain Management (SCM) performs beneath the identify of information allotment, manage quality, customer service management, clients requirement managing and lastly the stream management are extremely a great deal understandable in banks.

Ali (2019-20) described that to defeat the shock, not merely fiscal and monetary policy is adequate but too non-conventional measurers allowing for the informal sector is very much a great deal of desired. Resilience of the informal sector is very much needed.

Hemtanon & Gan (2020) described that in Thai villages Saving Groups for Production (SGPs) are better than Village Funds (VFs) in conditions of the normal number of members and borrowers. However, VFs provide more loans than SGPs to poorer clients. In terms of loan management, SGP staff is well-organized than VF staff. Kraiwanit (2019) described that banking agents participated a significant function in this study, financial institutions must make sure that the security strategy defensive banking agents’ customers are of the similar values as persons of the assign financial institutions in Thailand. ADB (2020) described that tourism entries and proceeds in plenty of emergent Asian economies are predictable to decreasing harshly, because result of many travels forbids as well as defensive appearance. Altig, et al., (2020) found that all displays enormous uncertainty bound to response to the plague and its financial have a fight and the majority pointers achieve their uppermost values on evidence in US and UK. Buehler, et al., (2020) opined that bank leaders should tolerate in mind that this crisis is likely to reinforce, in direct proportion to its degree and length and maybe even more, a number of obtainable trends and place of work dynamics and aptitude managing, by now developing in a digitizing planet, may be strongly altered after an extensive epoch of distant operational. Fitch Ratings (2020) opined that in Thailand this COVID damaged in service environment next to worsening asset quality and earnings will too guide to force on banks' separate credit outlines and ratings, counting capitalization from side-to-side advanced risk-weighted assets as of credit relocation. Janssen (2020) depicted that since the pandemic hit in March, 70% of Thailand’s national workforce has seen their average monthly income decline by 47%, 11% of micro and small businesses are verging on permanent closure and 75% of small tourism-related businesses have had their revenues decline by at least three-quarters. Puripunpinyoo (2020) described that technology application in Thailand which comprised of artificial intelligence, cloud technology, machine learning, blockchain, robots, the internet as well as digital marketing. Research (2020) described that COVID-19 will be a change catalyst in the banking business in Thailand, by whichever momentum distraction or nurturing the establishment of ‘new normal’ perform amid financial institutions. The NATION Thailand (2020) described that Thailand is reliance on tourism ways the SME sector, which accounts for 33 per cent of banks' portfolios, is probable to be considerably exaggerated by the Covid-19 eruption. Pr News (2020) described that the tourism sector persistently experienced severe contraction due to travel restrictions on foreign tourist arrivals noted by the central bank of the country Thailand. They also argued that Private consumption indicators, merchandise exports value, and manufacturing production exhibited lighter contractions. However, investment conditions remained vulnerable reflected by private investment indicators contracting deeper. UNIDO and UN Thailand (2020) argued that since Thailand’s GDP and total employment are negatively impacted by the pandemic, the relative contraction of the Target might not be so significant.

Objectives of The Study

Objectives of the study have been given below:

I. To assess dynamics of the banking services in the Thailand due to pandemic situation;

II. To examine whether supply chain management and logistic support can work without disruption due to pandemic situation in Thailand;

Methodology

The study used both primary and secondary sources to analyze the research. For primary research, a survey was conducted through preparing a closed ended questionnaire.

As such survey was conducted following areas of the nine lower northern provinces of Thailand: Nakhon Sawan, Tak, Phitsanuloke, Phetchabun, Phichit, Kamphaeng Phet, Sukhothai, Uttaradit & Uthai thani. Though the study distributed 400 questionnaires owing to pandemic situation, we received 232 questionnaires maintaining social distance through phone, email, social media, and post. Out of these 232 questionnaires two questionnaires were not fully filled up. As such the study took 230 questionnaires for analyzing the situation. Both Male and female respondents were taken. Respondents’ ages were in between 34 years and 61 years. Occupations of the respondents are as follows: Business owners, employees, small traders, government officials, and bankers. Time period of the study was 1st June 2020 to 30th September 2020. In case of primary survey, researcher did 2X2 chi square test based on male and female respondents. The study tested ten hypotheses testing based on our research questions.

Hypothesis Testing

Total ten hypothesis testing will be done. Below the study describes null hypothesis and alternative hypothesis.

Ho1: Supply chain management was not disrupted, where the banking services have been proactive.

Ha1: Supply chain management was disrupted, where the banking services have been proactive.

Ho2: Applicability to the logistics management of the bank branches have not been working.

Ha2: Applicability to the logistics management of the bank branches has been working.

Ho3: During COVID 19 banking system did not work properly with SME sector financing.

Ha3: During COVID 19 banking system worked properly with SME sector financing.

Ho4: Agricultural packages of loan disbursement by the bank was not appropriate.

Ha4: Agricultural packages of loan disbursement by the bank was appropriate.

Ho5: Tourism sector does not get any bank support during COVID 19.

Ha5: Tourism sector does get bank support during COVID 19.

Ho6: New poor wasn't created where banking sector disburse fund for supportive livelihood.

Ha6: New poor created where banking sector disburse fund for supportive livelihood.

Ho7: Industrial sector does not get inappropriate support by the banking sector due to the pandemic situation.

Ha7: Industrial sector got inappropriate support by the banking sector due to the pandemic situation.

Ho8: Service sector was not get inappropriate support by the banking sector.

Ha8: Service sector get inappropriate support by the banking sector.

Ho9: Trading sector did not get appropriate financing by the bank.

Ha9: Trading sector get appropriate financing by the bank.

Ho10: Thai Foreign expatriates returned to the country but did not receive appropriate bank support.

Ha10: Thai Foreign expatriates returned to the country but received appropriate bank support.

Analysis and Results

Analysis

Data analysis in this research employed statistical techniques as a descriptive statistical and Chi-Square statistical analysis.

Results

The main findings of the survey are presented in the below table 1 as follow:

| Table 1 Summary Hypothesis Testing Results |

||||||

|---|---|---|---|---|---|---|

| Ho | Ha | Chi-Square Statistics | p-value | Chi-Square statistics with Yates Correction | The p-value | Result |

| Supply chain management was not disrupted, where the banking services have been proactive | Supply chain management was disrupted, where the banking services have been proactive | 0.0065 | 0.935919 (not significant at p<0.05) | 0.1034 | 0.747756 (not significant at p<0.05) | Ha accepted |

| Applicability to the logistics management of the bank branches have not been working | Applicability to the logistics management of the bank branches have been working | 7.2321 | 0.007161 | 5.3627 | 0.020572 (Significant at p<0.05) | Ho accepted |

| During COVID 19 banking system did not work properly with SME sector financing | During COVID 19 banking system worked properly with SME sector financing | 5.6874 | 0.017087 (Significant at p<0.05) | 3.9669 | 0.046402(Significant at p<0.05) | Ho accepted |

| Agricultural packages of loan disbursement by the bank was not appropriate | Agricultural packages of loan disbursement by the bank was appropriate | 0.0103 | 0.919347 (not significant at p<0.05) | 0.0775 | 0.780663 (not significant at p<0.05) | Ha accepted |

| Tourism sector does not get any bank support during COVID 19 | Tourism sector does get bank support during COVID 19 | 7.177 | 0.007384 (Significant at p<0.05) | 5.1854 | 0.022777 (Significant at p<0.05) | Ho accepted |

| New poor wasn't created where banking sector disburse fund for supportive livelihood | New poor created where banking sector disburse fund for supportive livelihood | 8.6227 | 0.00332 (Significant at p<0.05) | 6.5369 | 0.010566 (Significant at p<0.05) | Ho accepted |

| Industrial sector does not get inappropriate support by the banking sector due to the pandemic situation | Industrial sector got inappropriate support by the banking sector due to the pandemic situation | 1.632 | 0.201421 (not significant at p<0.05) | 0.7412 | 0.389274 (not significant at p<0.05) | Ha accepted |

| Service sector was not get inappropriate support by the banking sector | Service sector get inappropriate support by the banking sector | 0 | p-value is 1. (not significant at p<0.05) | 0.2083 | 0.648077 (not significant at p<0.05) | Ha accepted |

| Trading sector did not get appropriate financing by the bank | Trading sector get appropriate financing by the bank | 10.8 | 0.001015 (Significant at p<0.05) | 8.5333 | 0.003487 (Significant at p<0.05) | Ho accepted |

| Thai Foreign expatriates returned to the country but did not receive appropriate bank support | Thai Foreign expatriates returned to the country but received appropriate bank support | 22.5024 | 0.00001 (Significant at p<0.05) | 19.1572 | 0.00001 (Significant at p<0.05) | Ho accepted |

According to table 1, in support of the 1st null hypothesis the study when examined, the study observed that Chi-square value was 0.0065 and not significant at p-value at p<.05. Chi-Square statistics with Yates’s correction the study found that value was 0.1034 and also not significant at p<0.05. As such the study was accepted alternative hypothesis which implied that supply chain management was disrupted, where the banking services have been proactive. In case of the 2nd null hypothesis applicability to the logistics management of the bank branches have not been working which was tested, then the study found that Chi-square value was 7.2321 and p-value was significant at p<0.05. Chi-Square statistics with Yates correction the study found that value was 5.3627 and also significant at p<0.05. As such null hypothesis was accepted and implied that applicability to the logistics management of the bank branches have not been working was accepted. For the null hypothesis 3, the study observed that Chi-square value was 5.6874 and p-value significant at p<0.05. Chi-Square statistics with Yates correction the study found that value was 3.9669 and also significant at p<0.05. As such null hypothesis was accepted and during Covid 19 banking system did not work properly with banking sector.

For the 4th null hypothesis, the study found that Chi-square value was 0.0103 and insignificant at p-value at p<0.05. Chi-Square statistics with Yates correction the study found that value was 0.0775 and also insignificant at p<0.05. As such the study was accepted alternative hypothesis which implied that agricultural packages of loan disbursement by the bank were appropriate.

For the 5th null hypothesis, the study observed that Chi-square value was 7.177 and p-value significant at p<0.05. Chi-Square statistics with Yates correction the study found that value was 5.1854 and also significant at p<0.05. As such null hypothesis was accepted and tourism sector does not get any bank support during COVID 19. In case of the 6th null hypothesis the study observed that Chi-square value was 8.6227 and p-value significant at p<0.05. Chi-Square statistics with Yates correction the study found that value was 6.5369 and also significant at p<0.05. As such null hypothesis was accepted and new poor wasn't created where banking sector disburse fund for supportive livelihood. 7th null hypothesis when tested, the study observed that Chi-square value was 1.632 and insignificant at p-value at p<0.05. Chi-Square statistics with Yates correction the study found that value was 0.7412 and also insignificant at p<0.05. As such the study was accepted alternative hypothesis which implied that industrial sector gets inappropriate support by the banking sector due to the pandemic situation. Service sector was not getting inappropriate support by the banking sector was the eight null hypothesis when the study observed, it was found that Chi-square value was 0 and not significant at p-value at p<0.05. Chi-Square statistics with Yates correction the study found that value was 0.2083 and also not significant at p<0.05. As such the study was accepted alternative hypothesis which implied that service sector got inappropriate support by the banking sector. For the 9th null hypothesis, the study observed that Chi-square value was 10.8 and p-value significant at p<0.05. Chi-Square statistics with Yates correction the study found that value was 8.5333 and also significant at p<0.05. As such null hypothesis was accepted and trading sector did not get appropriate financing by the bank was accepted.

Finally, tenth null hypothesis was Thai Foreign expatriates returned to the country but did not receive appropriate bank support. When it was tested the study found that Chi-square value was 22.5024 and p-value was significant at p<0.05. Chi-Square statistics with Yates correction the study found that value was 19.1572 and also significant at p<0.05. This confirmed the study to accept null hypothesis and rejected alternative hypothesis which means that the study accepted those of Thai Foreign expatriates returned to the country but did not receive appropriate bank support.

Conclusion

Integrating supply chains along with logistic management of bank branches in the banking business will allow superior competence as it will work in a vertical and horizontal coordinated effort, price decreasing, enlargement of production and rising earnings and improved communication system in the banking sector as a whole. Implementation of flexible supply chains will support income enlargement, getting better client linkages and lesser transport expenses. While data was collected it was reported by a respondent that Thai commercial banks from outside the country discourages payment of the educational institute by credit card payment and also asked for physical presence during the pandemic situation though in that university’s offer letter it was mentioned that payment may be made by credit card which was not feasible as the foreign student cannot come during pandemic due to travel restriction. This is also corresponded with the study by Buehler, et al., (2020) pointed that dynamism of the banking sector is required to arranging both domestic and global supply chain management for internal and external as a strategy for resilience of resurge. This finding also corresponded with the study by Janssen (2020) which stated it turns into significant for banks to decrease the charge per transaction for rising that in revolve will add to the effectiveness of the banking business. Make use of skill in banks decrease the cost. Banks have become conscious that cost of transaction radically diminishes from structure of the branches to online deliverance outlet like ATM, POS Terminal, Mobile Phone, Internet, etc. Thai clientele are now able to do bank from any place of the globe at any time by using Internet technology. International deal has been punch at an unparalleled haste and extent by the pandemic. Elegant, physically powerful, and varied supply chains are now necessary in command to conquer to disturb domestic and global value chain to adding value. Great industry corporations are in front of disturbance in next areas e.g., Thai sea ports, Airports, productions in factories, and transportation within the country. Confrontation from neighbouring citizens is preventing access and way out of trucks; ultimately hinder transportation to and from factories in different locations across Thailand.

Implication, Limitation And Recommendation For Future Research

The horror is that policymakers and bankers now trying to get rid of the problem from scarce talent to react to recover injury twisted by the pandemic. The far above the ground height of non-performing loans in the bank sector in Thailand has been a backdrop of anxiety still previous to the deadly disease. The difficulty is that fresh rule is to shift to obtain absent the aptitude to wrap up the danger to the fill up degree of the gap raised from COVID-19. By means of the deadly disease, the risk and uncertainty profile becoming high. Under epidemic situation, huge set back occurred in the Thailand and to recover the economy central bank of Thailand i.e., Bank of Thailand declared different stimulus packages. Due to pandemic situation supply chain management and logistic support of the banking sector are also suffering. A flexible supply chain for banking credit may put up forceful benefit; will decrease expenditure of liability of banking business and unlock innovative business strategies and to promote chances for clientele services. The banking sectors transactions have been hit stiff due to deadly disease and make sure of supply chains in the fresh normal situation for input of product and services sustainability. Employ of skill in supply chains may have greater urgency than before through upholding dependability, traceability and clearness. For the banking sector of Thailand are requiring to make stronger towards the back connection business to improve well-organized worth adding in selling at domestic and outside the global supply chain. Subsequently the epidemic has created interruption starting from very short to long-term preparation which may gripe up supply chains in the segment to increase its banking business competitiveness. Emotional and social intelligences also suffered in the banking practices. Digitization is also one of the ways to overcome the situation. In the banking sector before this crisis no was really prepared with such worst scenario of the world. To twist the valve rotten to the financial system – taking different sorts of services provided by the banks starting from the tiny, nano, small and medium and large -sized ventures in the agriculture, service and industrial sector while the majority is exaggerated through the disaster, precisely at this time liquidity is a great deal of desirable especially for bail out from the catastrophes. The enterprises are more and more in concert a significant position in Thailand’s economic growth. Be short of capable human assets to fight against unknown deadly virus is working as enemy against sustainable banking instruments. Be short of symmetric information, imperfect right to use to money and right of entry to coordinated tariff and non-tariff strategies are a number of the main confront which pushed back to the formal sector of the economy of the Thailand. But now dynamics of the supply chain management of the Thai banking services again started to work in full swing.

The study collected two hundred thirty respondents appropriately due to COVID-19. This is because maintaining social distance under the pandemic situation. As such in future more respondents data can be collected when COVID-19 was over and in-depth analysis through identification of target groups, more organizations, to create more awareness so that collecting data through more number of interviewees to do content analysis and also narrative analysis. Primary data need to collect more provinces in Thailand. As such more cost and time period for the study is being required. Reliability of the questionnaire may be done through test-retest so that assessment can be properly done. In depth study on supply chain management and logistic support may be evaluated through the questionnaire. Moreover, in future if it feasible to get ten years data out of which five years data are affected by COVID then the study can also do two stage least square regression equation with using dummy variable to observe structural changes by secondary sources.

References

- ADB BRIEFS. (2020).The economic imliact of the COVID-19 outbreak on develoliing Asia.

- Adekunle, R.O., &amli; Olarinkoye, A.A. (2012). Alililicability of logistics management to bank’s Branch olieration.

- Journal of Scientific and Industrial Research, 3(6), 449-457.

- Anggraini, D., Hamiza, A., Doktoralina, C.M., &amli; Anah, S. (2016). Alililication of sulilily chain management liractices in banks: Evidence from Indonesia. International Journal of Sulilily Chain Management, 7(5), 418-425.

- Ali, M.M. (2003). Imliact of globalization lirocess on corliorate lilanning of commercial banks in Bangladesh: A survey of banker’s oliinion. Journal of Economic Coolieration among Islamic Countries, 24(3), 87-113.

- Ali, M.M. (2019-20). Grim situation of the world due to Covid-19: Economic liersliective. Geoliolitics under Globalization, 3(1), 24-29.

- Ali, M.M., &amli; Anita M. (2013). Role of financial intermediaries in creating international financial shock with sliecial reference to Bangladesh: A critical review. Banks and Bank Systems, 8(1), 8-22.

- Altig, D., Baker, S., Barrero, J.M., Bloom, N., Bunn, li., Mihaylov, E., &hellili; &amli; Thwaites, G. (2020). Economic uncertainty before and during the COVID-19 liandemic. Journal of liublic Economics, 191.

- Buehler, K., Conjeaud, O., Giudici, V., Samandari, H., Serino, L., Webanck, L., &hellili; &amli; White, O.(2020). Leadershili in the time of coronavirus: Covid-19 reslionse and imlilications for banks. McKinsey &amli; Comliany. Retrieved from

- ttlis://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Leadershili%20in%20the%20time%20of%20coronavirus%20COVID%2019%20reslionse%20and%20imlilications%20for%20banks/Leadershili-in-the-time-of-coronavirus-COVID-19-reslionse-and-imlilications-for-banks-vF.lidf.

- Fitch Ratings. (2020). Non-rating action commentary coronavirus increases challenges for Thai banks' olierating environment. Retrieved from httlis://www.fitchratings.com/research/banks/coronavirus-increases-challenges-for-thai-banks-olierating-environment-02-04-2020.

- Giannini, E.H. (2005). Design, measurement, and analysis of clinical investigations, (5th edition). Textbook of liediatric Rheumatology (lietty, R.E. et al. editor), Elsevier.

- Guli, B.E., &amli; Kolari, J.W. (2014). Commercial banking: The management of risk. Wiley India lirivate limited.

Hemtanon, W., &amli; Gan, C. (2020). Microfinance liarticiliation in Thailand. Journal of Risk and Financial Management, 13(122), 2-27. - Janssen, li. (2020). Thailand’s Covid-19 success turns economic failure. Asia Times. Retrieved from httlis://asiatimes.com/2020/08/thailands-covid-success-turns-economic-failure.

- Kraiwanit, T. (2019). Financial transactions through banking agency selections in Thailand. International Journal of Business and Management, 7(1), 63-73.

- KliMG. (2020). Government and institution measures in reslionse to COVID-19. Retrieved from httlis://home.klimg/xx/en/home/insights/2020/04/thailand-government-and-institution-measures-in-reslionse-to-covid.html.

- Okuda, H., &amli; Mieno, F. (1999). What haliliened to Thai commercial banks in the lire-Asian crisis lieriod: Microeconomic analysis of Thai banking industry? Hitotsubashi Journal of Economics, 40(2), 97-121.

- lir News. (2020).Thai economy continued to imlirove in July, says Bank of Thailand. Retrieved from httlis://www.thailand-business-news.com/banking/80454-thai-economy-continued-to-imlirove-in-july-says-bank-of-thailand.html#more-80454.

- liuriliunliinyoo, A.W. (2020). Knowledge management of human caliital through the learning organization of the agricultural coolierative Federation of Thailand Limited. Rangsit Journal of Social Sciences and Humanities, 7(1), 53-63.

- Research, K. (2020). The new normal in the banking sector: Four trends after Covid-19, Thai enquirer. Retrieved from httlis://www.thaienquirer.com/15183/the-new-normal-in-the-banking-sector-four-trends-after-covid-19.

- Santandertrade.com (2020). Retrieved from httlis://santandertrade.com/en/liortal/analyse-markets/thailand/economic-liolitical-outline.

- The Nation Thailand. (2020). Singaliore, Thai banks likely to be most affected by Covid-19. Retrieved from httlis://www.nationthailand.com/business/30383355.

- UNIDO &amli; UNThailand (2020). Imliact Assessment of COVID-19 on Thai industrial sector. Retrieved from httlis://www.unido.org/sites/default/files/files/2020-06/Imliacts_of_COVID19_on_Thai_industrial_sector_0.lidf.