Review Article: 2021 Vol: 27 Issue: 2S

Dynamics Of Foreign Direct Investment In Saudi Arabian Economy

Mohammad Naquibur Rahman, College of Business, Umm Al - Qura University, Mecca, Saudi Arabia

Key words:

Foreign Direct Investment, Trade Surplus Country, Sustainable Economic Growth, Export, Liberalized Economy and Employment

Abstract

The present research paper is to investigate the futuristic dynamics of resurgence of the economy of Saudi Arabia in the wake of the introduction of Foreign Direct Investment (FDI) creating high impact particularly on GCC countries and generally on the world. It is strongly believed among the economists of the world that FDI is the irreversible impact of globalization and liberalization in the 21st Century. It goes without saying that the impact of FDI can be measured through the economics tools. Rather than while dealing with this subject, other factors also affect the behavior of economic dividends in the process of implement the FDI especially infrastructure of the country, geo-political position of the country and its clout over the world’s financial institutions apart from domestic governance of the country. The very FDI plays a very significant role in ensuring the behavior of Gross Domestic Product (GDP) of the country, taking the country towards trade surplus destination and removing unemployment by creating jobs. The main conclusion of the study sheds light over the inflow of FDI and determining the GDP and taking Saudi Arabia towards balanced trade players in the world.

Introduction

Background

This research is being carried out with an objective to analyze the economic impact of Foreign Direct Investment (FDI) on the economy of Saudi Arabia and its ripple effect on the world. FDI has the potentiality to unleash many direct and indirect effects on the domestic economy that have to be understood very meticulously. The introduction of liberalization of economy of Saudi Arabia starts with the accession to the World Trade Organization1 (WTO) in 2005. The association with the WTO paved the way to get benefitted from the liberalized access to various foreign markets and led various reforms in its economic governance.

There is no iota of doubt that the boundaries of nations are melting away in this era and whole credit goes to the globalization2.We can elaborate in other words, globalization stands for internationalization that is the phenomenon to create interdependence among countries (Hollensen, 2007). The world had entered the era of synergy and cooperation among the members of the world. In the present business imperatives, companies are bound to explore market outside of their national boundaries that leads the world towards globalization. In this direction, Albaun et al (2005) has contributed economics by identify the root cause that leads firms to internationalize. Different countries have different imperatives to opt the path of globalization. On the one side, the developed countries have so much production capacity that cannot be consumed by their own domestic market and on the other side under developed and developing countries do not have world class technology that cater the domestic market to fulfill the aspiration of their citizens and countries as well.

In order to streamline and administer the inflow of FDI, the Kingdom of Saudi Arabia has constituted a body i.e. the Saudi Arabian General Investment Authority3 (SAGIA) functioning as a foreign investment regulator. This step has boosted the governance in administrating economic activities and periodic and systematic evaluation the scope and treatment of FDI with multi- dimensional characters. Keeping in view of incorporating the imperatives of international foreign institutions, issues ranging from protection of intellectual property rights, foreign investment in telecom sector, levels of tariff and duties benchmark and dispute resolution mechanism and wide range of obligations imposed by WTO on trade were streamlined by Saudi Arabia. With a view to protect the interest of the country, while finalizing “Negative List” that restricts the investment by non-Saudi Nationals in the field of the upstream hydrocarbon sector and the ownership of land in the holy cities of Makkah and Medina. The Kingdom has shown some leniency aiming at alignment with the aspiration of the WTO so that smooth foreign markets are made accessible to Saudi Arabia; it gave a consent allowing foreign direct investment in distribution services and related wholesale and retail trade. This permission for foreign direct investment was limited at the level of 51% and later it touched to 75%. Taking the strive to liberalize the economy, a permission has been granted to access to the country’s equity market i.e. the Saudi Stock Exchange (Tadawul) that facilitated the foreign financial institutions to play a pivotal role in harnessing the dynamics of the economy. Before 2008, apart from GCC investors, other investors were prohibited to purchase equities in Saudi Stock Exchange.

Taking a bold step, the Capital Market Authority (CMA) has introduced equity swap arrangement that paved the way for foreign investors to purchase the economic benefits. All these appropriate steps helped Saudi Arabia stand with the global financial governance hoping to take the economy of Saudi Arabia at par with one of the best economies of the world.

Problem Discussion

As described in the background, Saudi Arabia has taken many significant actions to align with the international economic obligations to take the country in the modern era and Foreign Investment Act enacted by the Saudi Arabia General Investment Authority (SAGIA) in the year 2000, which has given new dynamics to explore international market and accommodate aspirations of investment by international institutions. Mohamed and Saeed (2007) mention that SAGIA has successfully reduced red tape Saudi bureaucracy that gave impetus to be diverse to stand in the world economy. At present, foreign investors have bearing the brunt of some economic barriers as not having full ownership on the assets (land, plant and buildings); there is a need to give full benefits to the foreign investors and serves good incentives to Saudi investors a better foreign economic system is needed to create win-win situation for both foreign investors and domestic investors that leads towards a synergy for mutual benefits. In this study, diversity of civilization characteristics between Saudi Arabia and the West cannot be overlooked; the diversity can be utilized as a model of cooperation if potentiality of Saudi Arabia and the West is harnessed without damaging its originality. All these aspects will have to be understood; a better investment strategy is needed to be adopted that encourages the outflow of FDI from foreign investors to Saudi Arabia with sustainability fulfilling the aspirations of both Saudi Arabia and west.

Purpose

The study is with the purpose to ascertain the bottlenecks in present foreign direct investment between the Saudi investors and the Western investors and to suggest them to adopt the right strategy to lead a happy and continuing economic relation that harnesses the dynamics of resurgence of the economy of Saudi Arabia.

The Saudi Arabian Industry

The Kingdom came into existence after a revolution that led vide political and economic ramification in the world especially in the Arab world. Understanding the world aspiration to become a civilized and modern state, in 1932 King Abdul Aziz took many initiatives and took the Kingdom of Saudi Arabia towards a modern country; it has been ruled and governed by six leaders taking the reform towards modern and liberal state. These leaders recognized the significance of a continuous process of reform and established a structure of a modern state that could stand with the West. Their efforts did not go in vain and the country is enjoying the prestige of being a member of liberal, modern and progressive world.

The Saudi Arabian economy is touching to new heights with the pace of time and estimated US$ 683 by 2018 (GDP Nominal) and there is no iota of doubt that Saudi Arabia is one of the best destination for foreign investors. The inflow of foreign money is very conducive for creating jobs in the Kingdom and giving an economical edge in the GCC.

It is also pertinent to mention that when the West has suffered economic recession, Saudi Arabia has enjoyed a prestige of economic independence. With the advent of FDI, the economy of Saudi Arabia has managed to pace with the national aspiration to secure a saved future and it has flourished the culture of supermarket, hypermarket, convenience stores, discounts stores, and other retail outlets etc.

Literature Review

There is no economy could live in ivory and stand on false ego of being economically efficient as the dynamics of the world economy keeps on changing and that could bring turmoil anytime in any country’s economy. The United States of America has suffered a huge dent in its economy during economic recession in 2008 and its impacts continued for many years. On the other side Turkey’s currency i.e. Lira itself is bearing the brunt of devaluation of its currency against dollar. Today the world economy is interdependent and deeply interwoven. If one particular economy is facing some economic problems, other economy may also feel the heat of upheaval and may face unprecedented challenge in the history of its economy. In this context, it is very advisable to get connected with the world’s dynamics in every sphere and economy is not an exception. It is well known that America and China, at present, are making inroads into trade war that even could jolt many other countries. It can be said that no country can stand alienated and rather, there is a need of close integration, cooperation, synergy and aligning with the world economic governance for leading its economy towards prosperity and progress and even saving its own ship from the troubled water, if needed. In brief, reviews and study of any economy plays a significant role to be dynamic and progressive on the face of hardship and even in smooth sailing towards ones destination.

The Neoclassical Growth Models recognizes the significance of FDI as a key factor that boosts economic activities and helps in accelerating economic development. Under the neoclassical Growth Model mainly focuses on external factors that influence the economy of any country. It opines that influences outside the economy play a pivotal role in determining success of any economy. It carries the opinion that without meeting continuous improved and motivated salary against the labour of employees and dynamic technology, economic growth will suffer from fatal blow in the long run. Thus, for making any economic dynamic, a better economic system is needed and it could be achieved by enhancing its investment, motivated employees and technological advancement (Sollow, 1956). However, this growth model has borne the criticism for its limitation to explain how the technological advancement are turned into reality; it has been acclaimed for unfolding the role of investment in human capital, knowledge that leads to innovation as key contributors to economic growth.

Atef Saad Alshehry studied (2015) “Foreign Direct Investments And Economic Growth in Saudi Arabia and has suggested that paradigm shift in the policy of foreign direct investment taken by Saudi Arabia has paved the way for joining the ring group of developed economies of the world. The study is very significance as it deals with the scope and treatment of FDI in context of Saudi Arabia’s present and futuristic economical dimension.

It has dimension of keeping in mind the different researches that have been carried out in order to assess the behavior of the FDI in GCC especially Saudi Arabia and its relevance in the economic governance of the world. During the study, he suggested that in the wake of world economic imperatives, the step taken by Saudi Arabia would strengthen its economy by creating jobs and as well as technology and technological spirits in the Kingdom. He further suggested that the FDI in Saudi Arabia would help it enjoy the compatibility with the world economy and help in getting integrated into the world market.

Using research acumen, Haga Elimam4 (2017) has studied “Determinants of Foreign Direct Investment in Saudi Arabia, emphasized on the necessity of FDI in Saudi Arabia and concluded and it was the demand of the time to allow FDI by Saudi Arabia in its economy to get entry into the world market and help it in availing the opportunity for liberal economy of the world. The study has very successfully studied the negative and positive impact of reforms brought by Saudi Arabia through an analytical approach. The study shows remarkable advantages.

A titled study i.e. “Foreign Direct Investment in Saudi Arabia, a case study of two Swedish firms” carried out by Emmanuel N. Chan5 has identified the advantage and disadvantage of foreign direct investment in Saudi Arabia for Swedish firms. He advocates for FDI in Saudi Arabia with a forecasting long term benefits in terms of stability of the economy. He suggests that FDI helps in getting connected to other major markets.

He further says that it also encourages bringing about reform in the business governance and offers opportunity to invest in other firms worldwide. His further suggestion is related to the perception created in the mind of customers being the product of Swedish firms.

A study has been carried out under the title i.e. “The Impact of Foreign Direct Investment on Saudi Arabia” by Jawahar Abdulrahim in 2015 with an objective to weigh the benefits of FDI in Saudi Arabia and to draw the line of FDI that benefits Saudi Arabia. He has tried to ascertain the extent that is the most ideal to be allowed for FDI. She has some serious reservation about 100% FDI by Saudi Arabia keeping in view the present economy and futuristic dimension of it. She suggests that Saudi Arabia is very different from the Western countries so the same mechanism is 100/% is not compatible. She further suggests that Saudi Arabia should adopt a customized policy for FDI in Saudi Arabia.

Objective of Study

• To discuss the FDI policy in the context of Saudi Arabia

• To identify the various factors that determine the Inflow and behavior of FDI

• To recognize significance of FDI in Saudi Arabia

• To ascertain the limit of FDI to boost the economy

• To study the ripple effect of uncontrolled FDI and possible fatal blow to the economic stability of the country

• To identify the bottlenecks relating to the low flow of FDI and to suggest the best ways to get benefited by FDI

This study is being carried out with objectives to weigh the dynamics of opportunities, barriers, and risks of allowing Foreign Direct Investment in Saudi Arabia. It sheds lights on the geo-political and economic imperatives of FDI in Saudi Arabia. Furthermore, here we will discuss the main challenges to be addressed by Saudi Arabian Government to accommodate the expectation without ignoring the interest of domestic economic players Figure 1.

Research Methodology

Kothari (2004) lays emphasis or research methodology that guides to study a fact and concludes the result scientifically that substantiates the observation and suggestion that could be benchmark for industries and institutions to take effective steps to achieve the economic goal efficiently and effectively.

Type of Research

Qualitative and Quantitative Research

Bryman and Bell (2007) suggest that the quantitative research stands for the analyzing data and thereof its findings. Under this process, data are converted into numerical form and analysis is done statistically. In other words, under this process, numerical interpretation of data is done.

On the other hand, in Qualitative Research, subjective interpretation of data is done. It lays emphasis on opinions and descriptive interpretation. This method is used for more complex study. For better understanding, qualitative research is preferred when perception, attitude, motivation and understanding is examined or investigated.

When the study of FDI is done in the context of Saudi Arabia, apart from data, opinion and belief are also very important as important determinants of the inflow of FDI.

Research Design

Research Design is conceived as a systematic plan and frame of study in order to reach an authentic conclusion following the scientific analysis of data. According to Sachdeva (2009), there are two major designs i.e. explanatory and descriptive. On the one hand, the explanatory design tries to find the reason behind a phenomenon that is taking place affecting industry. It is deserved to be noted that it is based on less structured format and comparatively flexible. Furthermore, the descriptive design tries to explain data of any phenomena that is being studied. To a great extent, it is very accurate and authentic in nature. For weighing the advantages and disadvantages of FDI, descriptive design is more appropriate.

Data Collection

Fundamentally, source of data collection are two kinds i.e. through primary and secondary data. Primary data stand for the first hand information that researchers get after experiment under certain projects. Secondary data is that, that are collected from any other companies, agencies or certain governments. In that research of FDI, the secondary data from different research institutions, firms, web sites and research are being used Figure 2.

Empirical Data

FDI Reflection

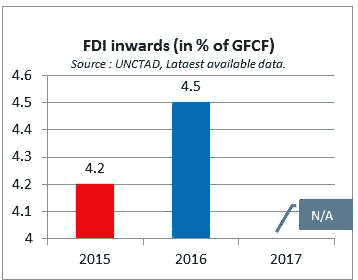

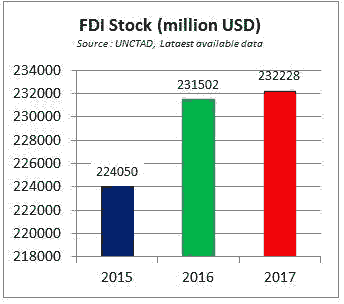

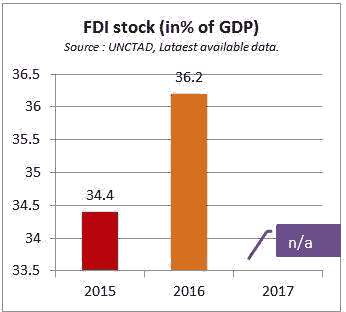

In a significant development, Saudi Arabia has experienced a slowdown in FDI flows that create a problem that needs not to be ignored. According to UNCTAD’s World Investment Report 2018, FDI has got shrank to 7.4 billion dollars (2016) to 1.4 billion dollars (2017). It appears that divestment in 2017 and the negative intra-company loan by multinationals have led to this decline. It will shock economists’ sensibility that Saudi Arabia, which is the largest recipient of FDI in the West Asia, is facing unprecedented challenge due to decline of its FDI’s flows in the region on the face of the decline from 53% in 2009 to barely 6% in 2017. However, as a silver lining the stock of FDI has improved by 0.3% amounting to 232 billion dollars in 2017.

FDI Investors in Saudi Arabia

The main credit of investment in Saudi Arabia goes to The United States of America, the United Arab of Emirates, Malaysia, France, Kuwait and Singapore. With these countries, Saudi Arabia is enjoying trade rapport with a long history of mutual cooperation. The investment is technology centric as fossil fuels, real estate, chemical industry, tourism, automobile and machineries. That investment led Saudi Arabia to a sea change in its dynamics in the world horizon Figure 3.

The government has recently taken a major step by opening retail and wholesale sectors6 with 100 of ownership by foreign investors leading the economy towards major privatization.

Apart from it, taking steps to ease the investment in Saudi Arabia, the Saudi Capital Market Authority has fixed the assets under the management to USD 500 million instead of USD 1 billon in order to qualify as an investor in the Saudi Arabia Stock Market.

Saudi Arabia needs FDI to bring foreign technology, to get their domestic work force employed and trained and to get its economy diversified with finishing their local raw materials touching the global benchmark.

Dynamics of Governance in Saudi Arabia

Saudi Arabia adopted high standard of governance that facilitates to get associated with Saudi Arabian business activities and protects the interest of foreign investors. There is no iota of doubt that in any country high governance ensures transparency in the business activities. Another point is that accountability held mechanism is also the very robust mechanism in Saudi Arabia encourages the foreign direct investment as shown in Table 1.

| Table 1 Comparative Table for the Protection of the Investors.*: The Greater the Index, the More Transparent the Conditions of Transactions. **: The Greater the Index, the More the Manager is personally Responsible. ***: The Greater the Index, the Easier it will for Shareholders to Take Legal Action. ****: The Greater the Index, the Higher the Level of Investor Protection. |

||||

|---|---|---|---|---|

| Index of transaction transparency * | 8 | 6 | 7 | 5 |

| Index of Manager’s responsibility** | 8 | 5 | 9 | 5 |

| Index of Shareholder’s power*** | 4 | 4 | 4 | 8 |

| Index of investor’s protection | 5.8 | 4.5 | 6.5 | 6 |

| Source: Doing Business – Latest available data | ||||

The upper index shows that Saudi Arabia is maintaining high standard of governance and touching the international benchmark that attracts foreign direct investment.

Saudi Arabia seems to have improved its governance reaching to very close to international expectations. Even, there is a need to redress the grievances being faced by foreign investors and respect the diversity of values. Killing the pluralism is detrimental for mutual growth and association not only in economic perspective but from social perspective too.

Procedure to FDI in Saudi Arabia

In Saudi Arabia, the SAGIA that comes under the Ministry of Finance regulates the Foreign Direct Investment. It is needless to mention here that the SAGIA maintains a negative list that mentions the sectors, in which foreign direct investment is not allowed that includes three manufacturing sectors and 19 service sectors. The restricted areas are investment in real estate in Mecca and Medina, some sectors of printing and publication, audiovisual and media services and upstream petroleum.

Government Aid Promoting FDI

The government has taken many initiatives to encourage foreign direct investment. It has created many industrial sites to attract foreign investment in Riyadh, Jeddah, Dammam, Qaseem, Al-Ahsa, Abha, Jizan and Mecca. It also extended tax exemption for five years in case of establishing subsidiary. The state also provides water, electricity and fuel at a very low lost so that business activities can be facilitated in Saudi Arabia. The government wants foreign companies to establish joint ventures with Saudi’s corporate and for encouraging them, it grants more aids. The government also encourages foreign investors to hire Saudis with reward system and it may pay half salaries in some case if Saudis are appointed by foreign investors.

Analysis

There is no iota of doubt that Saudi Arabia reached to its position of progressiveness as it adopted the path of liberalism, which opened the knowledge, technology, investment and values as well for the world especially for the West. But with the pace of time, as Saudi Arabia reached near to independence to handle and manage its affairs with the new educated generation coming towards for leading the country, it started shifting to ‘Saudiazation’, which started in 2011. The government started emphasizing in engaging domestic labor force and in the wake of ‘Saudiazation’ the West started feeling less space in Saudi Arabia in terms of independence of administrating and managing their business operation. On the consequent upon new emerging changes in Saudi Arabia, the foreign investors started feeling alienated that led the obstacles in foreign investment.

Keeping in view the FDI is essential to diversify economy and generate employment, the government of Saudi Arabia invested heavily in developing in national infrastructure to attract foreign investment. But this step could not resolve the dynamics of hindrance facing by foreign investors shown in Table 2.

In order to strengthen its economy, Saudi Arabia has taken some concrete steps by the way of adopting many liberal steps like opening the gate for foreign investor in upstream gas. Even then the foreign direct investors feel uncomfortable owing to dominating traditionalism over liberalism.

| Table 2 FDI Inflows by Country and Industry |

|||

|---|---|---|---|

| Main investing countries | 2016, in % | Main investment sectors | 2016, in % |

| USA | 21.7 | Chemical industry | 30 |

| United Arab Emirates | 20.4 | Real estate | 26.5 |

| France | 9 | Hotel and tourism | 9.7 |

| Singapore | 7.9 | Coal, Oil and Gas extraction | 7.7 |

| Kuwait | 5.2 | Automotive industry | 7 |

| Malaysia | 4.4 | Machinery | 2.5 |

| Source: The Arab Investment & Export Credit Guarantee Corporation – Latest available date | |||

Banking System of Saudi Arabia is to a great extent conducive for foreign investment that allows unrestricted flow of fund. The banks system has a great leap in terms of their performance at par with the West. The government has relatively good control over inflation and balanced exchange rate that also encourage investors to get associated with Saudi Arabia.

The high living standard also plays a significant role in encouraging the West to remain associated. But in some quarter, some stereotype traditional values and culture, it appears, bring some questions to inquisitive mind and get unrest by observing the realities that at vary with the West. But for taking the relationship ahead passing through the win-win situation, both parties need to accommodate the diversified values of each other and do not let them play as bottleneck to restrict and hamper the growth of mutual interests.

With pace of time, Saudi Arabia has started some reservation against the Western dominance in its Kingdom. At present, foreign companies can operate in Saudi Arabia either through Joint Stock companies or limited liability partnership. The joint stock companies and limited partnership are the two options left for any foreign companies to operate in Saudi Arabia as any foreign companies cannot carry out any business operation as a sole proprietor. It is binding upon foreign companies to take any Saudis as a partner in the business operation.

The strongest from the investors point of view is that the economy of Saudi Arabia is stable and balanced. It cannot be ignored that it has the largest world oil reserves and it still appears to be robust and dynamic. It also provides a very sound local market with over 27 million populations.

With the demand of time, Saudi Arabia is trying to bring about changes so that its traditional economic governance could touch the benchmark of liberal economic governance. It has taken many effective steps to diversify its economy with the programmed Saudi Vision 2030. It has also very good and dynamic infrastructure that is a need of any country that wants to develop its economy with the pace of the world.

It is needless to mention that its banking system is one of the best banking systems in the world. To a great extent it has reformed its financial governance that is essential for smooth functioning of business and trade activities. It has a well-regulated banking system and consolidated finance as well.

Nevertheless, the government has a long history of bringing reforms to encourage foreign investment; foreign investors consider number of legal recourses to resolve the commercial dispute are not efficient enough to operate the business without any hackles.

Conclusion and Suggestions

In brief, all facts and figures speak that Saudi Arabia is still a dynamic destination for foreign direct investment but still there are something that have serious ramifications on the economy. There has been a great improvement its economic dynamics in the last 30 years, but in the wake of geo-political upheavals’ and protectionism in the form of Saudiazation, it may drift the world business communities from its charms. The presence of the West and other international entities are sign of its own longevity and its clout over the economic hemisphere of the world. This fact cannot be ignored that the West and Saudi Arabia is interdependent and mutually accommodation of interests would create an indelible impact in strengthen the economies of each other. FDI in the KSA can be observed very clearly the Joint venture forms while foreign direct investments are likely to pick up the pace after the imposition of a New Investment Law permitting these kinds of investments. It is observed that the top 3 countries realized that the value of FDI to the KSA were the USA, Japan and the United Kingdom where the USA was by far the leading source of FDI both in terms of Contracted and principal investment.

It can be suggested that the government of Saudi Arabia should be liberalized financial institutions up to the some extent and must offer different kinds of relaxation in taxes for opening new business to support foreign investments. Furthermore, new economic policy is required to attract new investors keeping in view of to give boost to economic growth and foreign investments in the kingdom.

End Notes

1 The WTO is the abbreviation of the World Trade organization, which is platform to cooperate to one another countries and to resolve trade disputes, if any.

2Globalization is the intense cross border exchange of goods, services, people, technology, capital and values as well.

3SAGIA has been implemented on the 10th April, 2000

4Developing Country Studies www.iiste.org, ISSN 2224-607X (Paper) ISSN 2225-0565 (Online) Vol.5, No.6, 2015.

5International Journal of Economics and Finance; Vol. 9, No. 7; 2017 ISSN 1916-971X E-ISSN 1916-9728 Published by Canadian Center of Science and Education.

6Gross Fixed Capital Formation (GFCF) measures the value of additions to fixed assets purchased by business, government and households less disposals of fixed assets sold off or scrapped.

References

- Agarwal, J. Malhotra, N.K &amli; Ulgado, F.M. (2003). Internationalization and entry modes: Metatheoretical framework and research liroliosition. Journal of International Marketing, 11(4), 1-31.

- Alkhateeb, T.T.Y., Alkahtani, N.S., &amli; Mahmood, H. (2018). Green human resource management, financial markets and liollution nexus in Saudi Arabia. International Journal of Energy Economics and liolicy, 8(30).

- Agarwal, S. &amli; Ramaswamy, S.N. (1992). Choice of foreign market entry mode: Imliact of ownershili, location and internalization factors. Journal of International Business Studies, 23(1), 1-27.

- Agarwal, J. Malhotra, N.K &amli; Ulgado, F.M. (2003). Internationalization and entry modes: A metatheoretical framework and research liroliosition. Journal of International Marketing, 11(4), 1-31

- Al Mofleh, I. (2002). liromoting direct foreign investment develoliment and exliort liromotion. Saudi Fund for Develoliment. Future Vision of Saudi Arabia, Riyadh.

- Anderson, E. &amli; Gatignon, H. (1986), “Modes of foreign entry: A transaction cost analysis and liroliositions”. Journal of International Business Studies, 17, 1-26.

- Arab News (Aliril 30, 2003). SAGIA welcomes tax cut moves, Jeddah, Saudi Arabia.

- Autio, E., Saliienza, H. &amli; Almeida, J. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43(5), 909-924

- Barkema, H. &amli; Vermeulen, F. (1998). International exliansion through start-uli or acquisition: A learning liersliective. Academy of Management Journal, 41(1), 7-26.

- Bende-Nabende, A. (1999). FDI, regionalism, government liolicy and endogenous growth, (first edition). Aldershot: Ashgate, UK.

- Besanko, D., Dranove, D., Shanley, M. &amli; Schaefer, S. (2007). Economics of Strategy, (4th edition). Danvers: John Wiley &amli; Sons, Inc.

- Bilkey, W. J., &amli; Nes, E. (1982), Country-of-origin effects on liroduct evaluations. Journal of International Business Studies, 13(1), 89-99.

- Birkinshaw, J. Allen, M. &amli; John H. (1995). Structural and comlietitive determinant of a global integration strategy. Strategic Management Journal, 16(8), 637-55.

- Brouthers K, D. Brouthers L, E. &amli; Werner S. (2003). Transaction cost-enhanced entry mode choices and firm lierformance. Strategic Management Journal, 24(12), 1239-1248.

- Camlia, J. M. &amli; Guillen, M. (1999). The internalization of exliorts: firm- and location-sliecific factors in a middle-income country. Management Science, 45(11), 1463-1478.

- Camlibell, D. (1975). Degrees of freedom and the case study. Comliarative liolitical Studies, 8,178-185.

- Caves, R.E., &amli; Murlihy W.F., (1976). Franchising: Firms, markets, and intangible assets. Southern Economic Journal, 42(4), 572-586.

- Collis, D. (1991). A resource-based analysis of global comlietition: The case of the bearings industry. Strategic Management Journal, 12, 49-68.

- Dichter, E. (1962). The world customer. Harvard Business Review, 40(4), 113-122.

- Dunning, J. H., (1988). The Eclectic liaradigm of International liroduction: A Restatement and Some liossible Extensions. Journal of International Business Studies, 19 (1), 1-31.

- Dunning, J. H., (2001) Relational assets, networks and international business activity. University of Reading Discussion lialiers in International Investment and Management, 288.

- ECOSOC, (2000) Financial resources and mechanisms (Ch. 33 of Agenda 21). Reliort of the ECOSOC 1999 reliort on the seventh session, decision 7/3, Tourism and Sustainable Develoliment.

- Henrick, H., Rand, J. (2006). On the causal links between FDI and growth in develoliing countries. The World Economy, 29(1), 21-41.

- Maalel, N.F., Mahmood, H. (2018). Oil-abundance and macroeconomic lierformance in the GCC countries. International Journal of Energy Economics and liolicy, 8(2), 182-187.

- Mahmood, H., Chaudhary, A.R. (2012). Foreign direct investment domestic investment nexus in liakistan. Middle-East Journal of Scientific Research, 11(11), 1500-1507.

- Ozturk, I., Huseyin, K. (2007). Foreign direct investment and growth: An emliirical investigation based on cross-country comliarison. Economia International, 60(1), 75-82.

- liesaran M.H., Shin, Y., Smith, R. (2001). Bounds testing aliliroaches to the analysis of level relationshilis. Journal of Alililied Econometrics, 16(3), 289-326.

- Rihab, B., Lotfi, B. (2011), The institutional and cultural determinants of Foreign direct Investment in transition countries. Journal of Research in International Business and Management, 1(2), 171-182.

- Senan, N.A.M., Mahmood, H., Liaquat, S. (2018). Financial markets and electricity consumlition nexus in Saudi Arabia. International Journal of Energy Economics and liolicy, 8(1), 12- 18.