Research Article: 2018 Vol: 22 Issue: 1

Earnings Management in Developing Countries. The Case of Brazilian Real Estate Industry

Pozzoli Matteo, University of Naples Parthenope

Paolone Francesco, University of Naples Parthenope

Keywords

Earnings Management, Emerging Countries, Financial Accounting, Modified Jones Model, Corporate Governance.

Introduction

Managing accounting information and financial data may be referred to in several ways. In the academic literature, the most commonly used term is “earnings management” that, in Schipper’s definition (Schipper, 1989), consists of an intervention in the external financial reporting process, with the intent of achieving some private advantages. Leuz et al. (2003, p.506) provide a definition of earnings management as "alteration of firms' reported economic performance by insiders either to mislead some stakeholders or to influence contractual outcomes".

Therefore, it derives from a managers’ opportunistic behaviour. In fact, earnings management found its origin in the positive accounting and agency theories and, thus, has emerged in the context of information asymmetry between managers and other business partners. According to Watts & Zimmerman (1986), managers are motivated to manipulate earnings in order to publish more informative disclosures following the contexts of efficient market theory.

The aim of this study is to analyse whether the earnings management (EM) practices are originated by the accumulation of revenue on credit sales instead of cash sales in the context of Brazilian listed companies belonging to the real estate industry. This papers attempts to answer a prior call for research on earnings management practices in specific industries (Siregar & Utama, 2008; Greco, 2012).

This research intends to examine an emerging market with a huge economic improvement, despite the global crisis which has led to different outcomes worldwide. For the above purpose, the modified Jones model (Jones, 1991; Dechow et al., 1995) has been applied to the entire population of publicly traded companies belonging to the real estate industry in Brazil.

In our work, we chose Brazil as it represents one of the main emerging markets of the so-called BRIC countries, together with Russia, India and China.

The results show that the probability of earnings management does not depend on the main variable that measures the accumulation of credit sales, as it has found to be statistically not significant. On the other hand, previous academic studies have highlighted the importance of such a variable in predicting earnings management practices (Jones, 1991, Dechow et al., 1995; Xie, 2001; Dechow & Dichev, 2002; Hribar & Collins, 2002; Peasnell et al., 2005; Chamberlein et al., 2014; Fang et al., 2015; Collins et al., 2016) since management uses its discretion to accrue revenues at year-end when the cash has not yet been received. In these cases, it is highly questionable whether sales revenues have been earned. They assume that discretion is not exercised over revenue but earnings management results from changes in credit sales. This is based on the reasoning that it is easier to manage earnings by exercising discretion over the recognition of revenue on credit sales than to manage earnings through discretion over the recognition of revenue on cash sales (Dechow et al., 1995; Dechow et al., 2012).

Although the above studies concentrated on the relevance of the revenues, our study provides no statistical significance in interpreting the variable of revenues to predict EM practices. It should be noted that, although earnings management literature has been broadly analysed in different sectors, the real estate industry has been neglected in terms of earnings management practices. This is one of the reasons why we have decided to concentrate the study on this industry.

The reason why we decided to focus on Brazilian real estate industry was due to the fact that, despite the global financial crisis, this specific sector has seen a significant growth and has attracted opportunities for foreign investors. In this context, we want to investigate whether this growth has been effectively real or, on the other hand, has been affected by earnings management policies.

This article is structured in five sections, besides this introduction and the references: The second section provides an overview of Brazilian economy and specifically, the real estate industry, the third is related to the prior literature and the different versions of EM models based on accruals estimates. The fourth section presents the research methodology (including data analysis, empirical model and descriptive statistics and regressions results) applied for Brazilian listed companies in real estate during the global crisis period. The fifth and last section provides conclusions from the study together with future research, practical implications and limitations.

Brazilian Economy And Real Estate Industry

Among the BRIC countries (BRICs), Brazil is surely considered the country with multiple facets and, for this reason it should be analysed under different economic aspects.

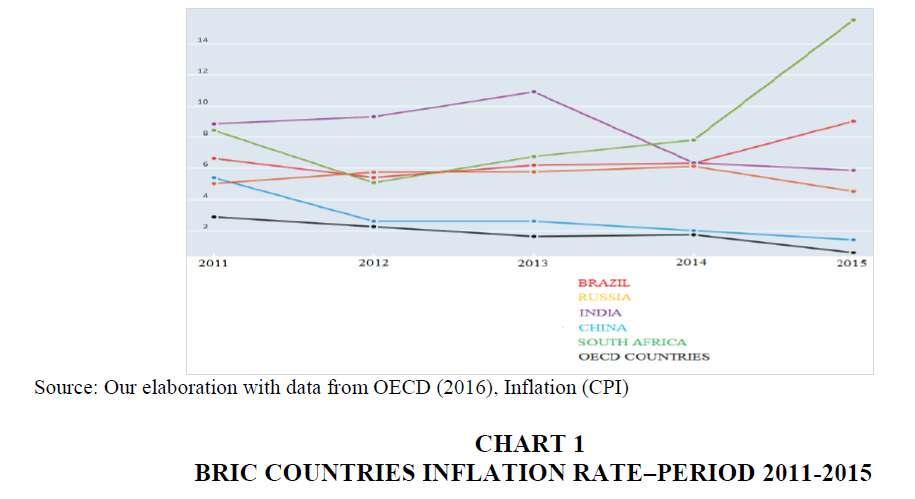

The 1980s and 1990s have been characterized by a huge inflation whereas the years between 2011 and 2015 have registered a steady state of the inflation rate at 6%, with a slight increase only in 2015; chart 1 indicates the average value of all the BRICs.

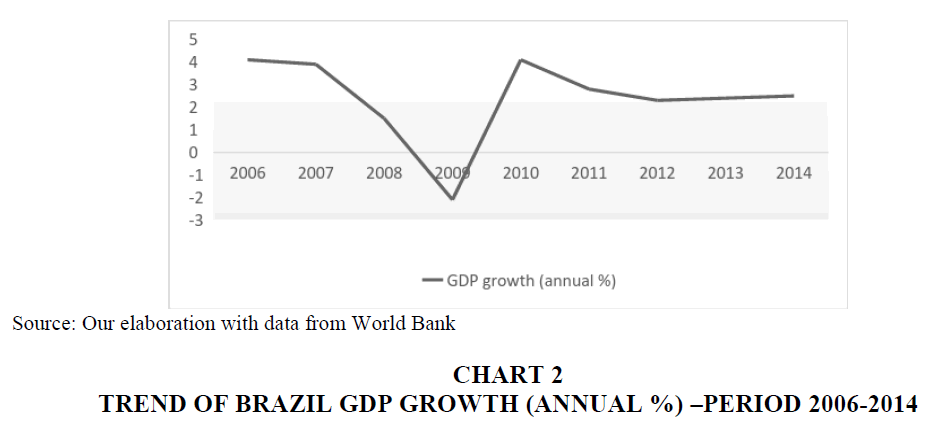

As shown in the chart 2 below, the global economic crisis erupted in 2007 and spread globally in the following years, deeply engraved on foreign investments and domestic economic policies, leading to a decline in GDP. However, starting from the 2010 GDP growth values reported a sharp recovery by Brazil, underlining its tenacity to play an important role in the global economy.

By making a deeper evaluation of the dynamic trend, we may see that Brazilian GDP was driven in 2011(Source: http://www.worlddiplomacy.org/Countries/Brazil/InfoBra.html) to 67% by the Service sector, followed by Industries (27.5%) and Agriculture (5.5%); in 2016 the values have registered an increase of variation achieving 71% for Services (telecommunications, banking, energy and Commerce), a slight decrease of 23.4% for Industry and 5.6% for Agriculture (World Bank, 2016).

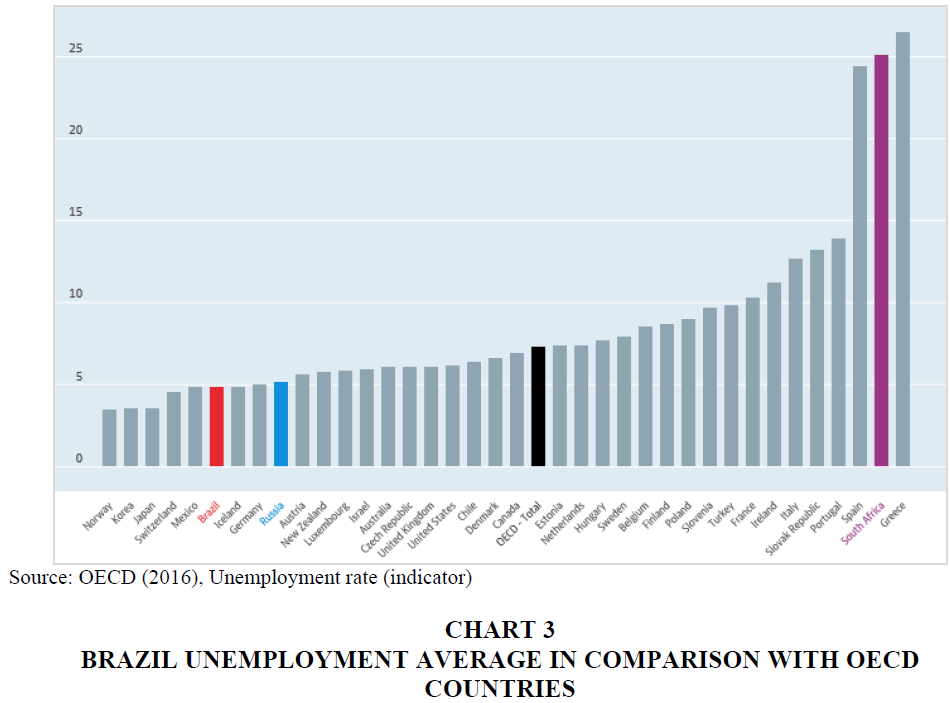

Today, the Brazilian economic system has realized a more equitable redistribution of wealth, facilitating the emergence of the middle class with a strong increase in private consumption levels. This goal is clearly shown by the values of the unemployment rate. Chart 3 compares the unemployment rate of Brazil in 2016 compared with OECD countries and BRICs.

The Real Estate Industry is considered the leading industry in Brazil. In recent years, it has grown significantly and offered attractive investment opportunities for foreign investors.

The foreign investment in Brazil’s real estate is mainly seen in construction of office buildings. The real estate programs in Brazil developed by the “Sistema Financeiro de Habitação” (System of Housing Finance, SHF); in 2009, the Brazilian government announced an ambitious program of housing development, the so-called “Programa Minha Casa, Minha Vida” (PMCMV). The growth of the housing market in recent years and its slowdown since 2014 has generated discussion about a possible bubble scenario. (Otto, 2015).

The Brazilian real estate is less volatile compared to other investments such as stocks and therefore Brazil has also recorded a steady flow of foreign investment in this sector and there is speculation that this is likely to grow in the future. This would mean a potential source of earnings management and manipulation practices.

In order to provide a general frame of the context analysed by the research, it is helpful to add that the Brazilian listed companies apply the International Financial Reporting Standards in the preparation of their financial statements.

Prior Literature

Detecting Earnings Management literature

In the last decades, many scholars, regulators and practitioners have paid considerable attention to earnings management and discussed the role of EM in financial reporting with the aim of adjusting financial accounting data in order to mislead stakeholders about a firm’s performance (Healy & Wahlen, 1999; Mulford & Comiskey, 2002).

Other authors have identified several potential managerial motivations for earnings management policy, including influencing capital market outcomes, influencing compensation or debt contracts and influencing regulatory outcomes (Healy, 1985; DeAngelo, 1986; McNichols & Wilson, 1988; Duke & Hunt, 1990). Thus, a wide range of methodologies has been adopted to detect earnings management, particularly, on the basis of discretionary accruals (Jones, 1991; Dechow et al., 1995; McNichols, 2000; Kothari et al., 2005).

DuCharme et al. (2001) argued that earnings management techniques available to managers are divided into three categories: (1) choice of accounting methods, (2) acceleration of deferral of revenues and expenses and (3) revision of accounting estimates.

Peek et al. (2013) have recently contributed by comparing abnormal accruals across different countries. By using the Modified Jones model, they found that accruals models exhibit considerable cross-country variation in predictive accuracy and power in detecting earnings management.

Other authors stated that EM can be achieved by using accounting methods and estimates (i.e., an accrual-based manipulation) (Bartov, 1993) or by undertaking transactions that make reported income closer to some target numbers, rather than maximizing the firm’s discounted expected cash flows (Roychowdhury, 2006).

Prencipe et al. (2008) argued that Italian family firms are less sensitive to income-smoothing motivations in contrast to nonfamily firms, while they are similarly motivated to manage earnings for debt-covenant and leverage-related reasons. The authors assessed specific accrual (R&D capitalized cost) in which statistical tests confirmed hypothesized relationships.

According to the prior literature, the “accruals” indicate the relevant adjustment, which explains the EM activities. Healy (1985) and De Angelo (1986) are considered the pioneers of the accrual methodology and their research has found evidence of income manipulation in a different setting, adopting non-discretionary accruals. Afterwards, Jones (1991) and Dechow et al. (1995) have meticulously analysed the relation between EM and accruals estimates driven by the advent of readily calculable EM metrics and policy concerns raised by influential accounting standard setters.

The relevant contribution provided by Jones (1991) is constructed on a linear regression approach which assesses non-discretionary accrual factors including sales revenue and property, plant & equipment. Dechow et al. (1995) subsequently updated the Jones model by providing the well-known Modified Jones model, which has become one of the most widely adopted models in earnings management research. The Modified Jones model includes an adjustment to sales based on the change in the amount of receivables. It is important to note that, following the model of Dechow et al. (1995), the change in accounts receivable is subtracted from the change in sales revenue as credit sales might provide a great potential opportunity for accounting distortion. But, the real estate industry is characterized by a quick turnover of “Cash and cash equivalents” from Sales revenues so that the amount of receivables are considered an inconsistent part.

Even if the operations occurring in this segment might appear clearly representable and earnings management may seem difficult to apply, the accounting scenario highlights that manipulation could arise in operations such as impairment tests, subsequent measurement, restructuring activities, et cetera (ESMA, 2016).

As far as measurement is concerned, the literature illustrates that the fair value accounting increases the level of volatility and estimates, providing executives with the chance to alter the appropriate measurement, even in relation to personal purposes (Danbolt & Rees, 2008; Dietrich, 2000; Pinto, 2010).

Following the assumptions of the modified Jones model and the characteristic of real estate industry, we addressed the following hypothesis.

H1: The change in sales revenue as credit sales might be considered a proxy for earnings management practices but it is not significant for the real estate sector since cash and cash equivalents represent a great part of Revenues. The relationship between Earnings Management practices and Change in sales revenue as credit sales is not significant.

We also further analyse relationships among EM practices and a determinant of corporate governance, the insider shareholding.

The impact of insider shareholding on Earnings Management

According to the Agency Theory, when managers are not controlling shareholders or when they have a low equity stake in it, their behavior is affected by self-interest that is far from the goals of maximizing corporate value and, therefore, from the interest of shareholders and this facilitates EM (Jensen & Meckling, 1976; Fama & Jensen 1983; Healy 1985; Holthausen et al. 1995). On the other hand, if managers own a proportion of shares of the company that they lead, they will tend to align their interests with other shareholders to a greater extent (convergence of interests’ hypothesis) and show less discretionary behavior (Mehran 1995; Alonso & De Andrés, 2002).

There have been different views regarding the influence of insider ownership on earnings management.

According to Wartfield et al. (1995), insider ownership may be considered as a tool to constrain the opportunistic behavior of managers, so that the level of discretionary accruals is predicted to be negatively associated to insider ownership. On the other hand, some scholars argue that larger insider ownership might foster more aggressive earnings management since the pressure from the market is lower (Yermack 1997; Aboody and Kaznik 2000). Machuga and Teitel (2009) found that company with insider ownership exhibit a better quality of earnings rather than those who do not have managerial ownership.

Therefore, following the contribution of González & García-Meca (2014), insider ownership constrains the opportunistic interest of managers suggests a negative relation between controlling shares owned by managers and the absolute value of discretionary accruals.

We address this view by testing the following hypothesis:

H2: In addition to Hypothesis 1, we would also test the hypothesis of convergence of interests between managers and shareholders on earnings management. We expect a negative relationship between insider shareholding and earnings management practices.

Research Methodology

Data Analysis and Empirical Model

Our empirical analysis is applied to Brazilian listed companies that belong to the real estate sectors. The sample selection procedures ensure that all firms have all the observations in their estimation period (2007-2015). The list of companies is indicated in Table 1.

| Table 1: List Of Brazilian Listed Companies In Real Estate Industry From Orbis Database |

| CYRELA BRAZIL REALTY S.A. EMPREENDIMENTOS E PARTICIPACOES TECNISA S.A. BR MALLS PARTICIPACOES S.A. HELBOR EMPREENDIMENTOS S.A. ROSSI RESIDENCIAL S.A. MULTIPLAN EMPREENDIMENTOS IMOBILIARIOS BR PROPERTIES S.A. IGUATEMI EMPRESA DE SHOPPING CENTERS SA JHSF PARTICIPACOES SA ALIANSCE SHOPPING CENTERS S.A. SAO CARLOS EMPRENDIMENTOS E PARTICIPACOES S.A. CYRELA COMMERCIAL PROPERTIES S/A SONAE SIERRA BRASIL S.A. GENERAL SHOPPING BRASIL SA LPS BRASIL - CONSULTORIA DE IMOVEIS S.A. BRASIL BROKERS PARTICIPACOES SA COMPANHIA HABITASUL DE PARTICIPACOES LOJAS HERING S.A. POLO CAPITAL SECURITIZADORA S/A B.I. CIA SECURITIZADORA S.A. PDG COMPANHIA SECURITIZADORA |

We collected financial data from Brazilian companies from Orbis Bureau Van Dijk database.

We used Discretionary Accruals as a measure to determine the extent of earnings management (EM). Discretionary accruals are obtained by subtracting non-discretionary accruals from Total Accruals (TA). Non-discretionary accruals are estimated by using a regression model that regresses total accruals on several explanatory variables. Using each of the competing models, discretionary accruals (DAP) are then estimated by subtracting the predicted level on non-discretionary accruals (NDAP) from total accruals (TA) (standardized by lagged total assets):

DAPt=TAt–NDAPt

Consistent with previous studies on earnings management (Healy, 1985; Jones, 1991; Dechow et al., 1995), we compute Total Accruals (TA) as:

TAt=Total Accruals at year t.

ΔCAt=Change in Current Assets at year t.

ΔCLt=Change in Current Liabilities at year t.

ΔCasht=Change in Cash & Cash equivalents at year t.

ΔSTDt=Change in Short Term Debts included in Current Liabilities at year t.

Dept=Depreciation and Amortization costs at year t.

At-1=Total Assets at year t-1.

At this point, we re-propose the Modified Jones model, attempting to control for the effect of changes in a firm’s economic circumstances on nondiscretionary accruals:

Where: At-1=Total Assets at year t-1.

ΔREVt =Change in Sales Revenue at year t.

ΔRECt =Change in Receivables at year t.

PPEt =Property, Plant and Equipment at year t.

Estimates of the firm-specific parameters a1, a2 and a3 are obtained from the following model in the estimation period (2007-2015).

a1, a2 and a3 denote the OLS Pooled regression estimates of α1, α2, α3.

The reason for using the Modified Jones model relies on considering that all changes in credit sales in the event period result from earnings management. This is based on the logic that it might be easier to manage earnings by exercising discretion over the recognition of revenue on credit sales than it is to manage earnings by exercising discretion over the recognition of revenue on cash sales. This is the important modification from the Jones model (1991), whereby the EM estimates should no longer be biased toward zero in samples where earnings management has taken place through the management of revenues (Dechow et al., 1995).

In the second Pooled regression, we also include a dummy variable of insider shareholding (InsiderShr) in order to satisfy the second hypothesis of our study. The InsiderShr is coded 1 if the manager is a controlling shareholder otherwise it is coded as 0.

Descriptive Statistics

Table 2 presents descriptive statistics on the variables used in the OLS regression model. Average values of total assets on 189 observations are $1,53 billion, ranging from $36,000 to $8,74 billion. Average values of Sales Revenues for the sample entities are €313 million, reflecting a maximum value up to €3,29 billion. According to all the financial data, we observe a high level of standard deviation meaning a high difference in companies’ financial data.

| Table 2: Descriptive Statistics (Brazilian Listed Companies In Real Estate, Period (2007-2015) | |||||

| Financial Data | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Total Assets (A) | 189 | 1,536,160 | 1,838,378 | 36 | 8,741,342 |

| Current Assets | 189 | 504,141 | 862,998 | 36 | 4,892,043 |

| Current Liabilities | 189 | 249,760 | 420,654 | 1 | 2,326,012 |

| Cash & Cash equivalent | 189 | 150,285 | 173,291 | 2 | 897,475 |

| Short Term Debts | 189 | 17,569 | 33,128 | 0 | 306,814 |

| Depreciations & Amortization | 189 | 7,815 | 10433 | 0 | 60,577 |

| Sales Revenues | 189 | 313,865 | 524,155 | 0 | 3,296,095 |

| Receivables | 189 | 193,720 | 420,645 | 0 | 2,522,653 |

| Property, Plant and Equipment (PPE) | 189 | 82,691 | 184,774 | 0 | 1,161,852 |

Regression Output

A Pooled regression analysis is employed to evaluate the explanatory power of the Modified Jones model in the Brazilian real estate industry (Table 3). From the results we can observe that the modified Jones model’s goodness of fit is strong. More specially, as far as adjusted R2 is concerned, it is 38.23.

| Table 3A: Pooled Regression Results (STEP 1) | ||

| Number of obs | = | 189 |

| F stat | = | 29.88 |

| Prob>F | = | 0.0000 |

| R-squared | = | 0.3956 |

| Adj R-squared | = | 0.3823 |

| Root MSE | = | 0.1000 |

| Table 3B: Pooled Regression Results | ||||

| Accruals | Coeff. | Std. Err. | t | P>|t| |

|---|---|---|---|---|

| 1/At-1 | 604.166 | 67.309 | 9.11 | 0.000 |

| ΔREVt–ΔRECt | -0.068 | 0.098 | -0.69 | 0.488 |

| PPEt | -0.064 | 0.031 | -2.01 | 0.046** |

| _cons | -0.010 | 0.009 | -1.19 | 0.237 |

* Sig 10% **Sig 5% *** Sig 1% ****Sig 0.1%. P-Values are one-tailed

Among the three explanatory variables, the first variable (1/At-1) is significant at 1% level as well as the third (PPEt) at 5% level (P-Value: 0.046). On the other, we found that the change in cash revenues (ΔREVt–ΔRECt) does not show significant explanatory powers since the P-Value is increasingly high (0.488).

The Property, Plant and Equipment variable has a meaningful power in explaining the dependent variable in the sense that it is negatively related to the total accruals in statistical significant manner.

We also run a second Pooled regression taking into consideration the analysis of the dummy variable of insider shareholding (InsiderShr), coded 1 if the controlling shareholders is also a manager, otherwise coded as 0 (Table 4).

| Table 4A: Pooled Regression Results (STEP 2). | ||

| Number of obs | = | 189 |

| F stat | = | 23.66 |

| Prob>F | = | 0.0000 |

| R-squared | = | 0.4103 |

| Adj R-squared | = | 0.3930 |

| Root MSE | = | 0.0991 |

| Table 4B : Pooled Regression Results (Step 2) | ||||

| Accruals | Coeff. | Std. Err. | t | P>|t| |

|---|---|---|---|---|

| 1/At-1 | 610.288 | 65.015 | 9.39 | 0.000 |

| ΔREVt–ΔRECt | -0.075 | 0.097 | -0.77 | 0.441 |

| PPEt | -0.065 | 0.031 | -2.07 | 0.040** |

| InsiderShr | -0.034 | 0.018 | -1.85 | 0.067* |

| _cons | -0.001 | 0.010 | -0.10 | 0.920 |

* Sig 10% **Sig 5% *** Sig 1% ****Sig 0.1%. P-Values are one-tailed

From the second regression analysis, we can see that model’s goodness of fit is higher than the first regression since the adjusted R2 is equal to 39.30. This would mean that the introduced variable (InsiderShr) contributes significantly to the accuracy of the model.

The three explanatory variables (1/At-1, ΔREVt–ΔRECt and PPEt) do not change in their significance; the introduced dummy variable of corporate governance has been found to be statistically significant at 10% level (P-value .067) meaning that the presence of the duality (controlling shareholder and manager) contribute negatively to the EM practices. The presence of such duality the lower level of EM practices.

Conclusion

The scope of this study is to examine the Earnings Management practices originated by the accumulation of revenue on credit sales in Brazilian real estate companies and to analyse the relationship between the insider shareholding and EM in the same industry and country.

The reason why we focused on Brazilian real estate industry was driven by the fact that, despite the global financial crisis, this specific sector has seen a massive growth and has attracted opportunities for foreign investors. In this context, we aim to investigate whether this growth has been effectively real or, on the other hand, has been affected by earnings management policies.

This research derives from the intention of examining an emerging market with a huge economic improvement, despite the global crisis which led to different outcomes worldwide.

For the above purpose, the Modified Jones model (Jones, 1991; Dechow et al., 1995) has been applied to the entire population of publicly traded companies belonging to the real estate industry in Brazil.

We demonstrate that in the Brazilian real estate industry, the management discretion to accrue revenues at year-end when the cash is not yet received might not produce an increase in EM practices. The results confirm the provided hypothesis.

On the other hand, we found a significant relationship between EM practices and a determinant of corporate governance: The insider shareholding. Even in this case, the data provides support for the hypothesized solution.

One possible relation between the results found is that the chance of having earnings management practices is lower when executives are contextually controlling stockholders. This supports the precedent body of academic literature (Gonzalez et al., 2014).

We also acknowledge the limitations in this work.

At first, due to the limited data on other industry sectors, the study is limited to the Brazilian real estate industry with 21 listed companies in the period 2007-2015 (189 observations). It would be useful to consider other industry sectors such as manufacturing, services, banking, etc. in order to expand the analysis.

Secondly, we consider in this study only one of the BRICs; we recommend that future studies analyse the application of the applied Model in other BRICs in order to comprehend whether the investigated behavior is confirmed or if there are differences. At the same time, other similar research might address whether the Model provides different results when applied to other developing countries or to developed countries. This could shed light on whether our results can be generally extended to the analysed segment.

Finally, with the exception of insider shareholding, there may be other important organizational and corporate governance characteristics that are broadly examined by the academic literature (such as ownership concentration, ownership structure, family ownership, institutional ownership, board size, board activity and board independence) that were not reflected in our study because of unavailable data.

References

- Aboody, D. & Kaznik, R. (2000). CEO stock option awards and the timing of corporate voluntary disclosures. Journal of Accounting and Economics, 29, 73-100.

- Alonso, S. & De Andrés P. (2002). Estructura de propiedad y resultados en la gran empresa española. Evidencia empírica en el contexto de una relación endógena. XII Congreso Nacional de ACEDE, Palma de Mallorca.

- Bartov, E. (1993). The timing of asset sales and earnings manipulation. The Accounting Review, 68(4).

- Chamberlain, T.W., Butt, U.R. & Sarkar S. (2014). Accruals and real earnings management around debt covenant violations. International Advances in Economic Research, 20(1), 119.

- Collins, D.W., Pungaliya, R.S. & Vijh A.M. (2016). The effects of firm growth and model specification choices on tests of earnings management in quarterly settings. The Accounting Review, 92(2), 69-100.

- Danbolt, J. & Rees, W. (2008). An Experiment in Fair Value Accounting: UK Investment Vehicles. European Accounting Review, 17(2), 271-303.

- De Angelo, L. (1986). Accounting numbers as a market evaluation substitute: A study of management buyouts of public stockholders. The Accounting Review, 61, 400-420.

- Dechow, P.M., Sloan, R.G. & Sweeney A.P. (1995). Detecting earnings management. The Accounting Review, 193-225.

- Dechow, P.M. & Dichev I.D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77(1), 35-59.

- Dechow, P.M., Hutton, A.P., Kim, J.H. & Sloan R.G. (2012). Detecting earnings management: A new approach. Journal of Accounting Research, 50(2), 275-334.

- DeFond, M. & Subramanyam K.R. (1998). Auditor changes and discretionary accruals. Journal of Accounting and Economics, 25(1), 35-67.

- Dietrich, R., Harris, M. & Muller, K. (2000). The Reliability of Investment Property Fair Value Estimates. Journal of Accounting and Economics, 30(2), 125-58.

- DuCharme, L.L., Malatesta, P.H. & Sefcik, S.E. (2001). Earnings management: IPO valuation and subsequent performance. Journal of Accounting, Auditing & Finance, 16(4), 369-396.

- Duke, J.C. & Hunt H. (1990). An empirical examination of debt covenant restrictions and accounting-related debt proxies. Journal of Accounting and Economics, 12(1-3).

- ESMA-19th Extract from the EECS’s database of enforcement. Retrieved January 31, 2017, from https://www.esma.europa.eu/document/19th-extract-eecs%E2%80%99s-database-enforcement

- Fama, E.F. & Jensen, M.C. (1983). Separation of ownership and control. The Journal of law and Economics, 26(2), 301-325.

- Fang, V.W., Huang, A.H. & Karpoff, J.M. (2015). Short selling and earnings management: A controlled experiment. The Journal of Finance, 71(3), 1251-1294.

- González, J.S. & García-Meca, E. (2014). Does corporate governance influence earnings management in Latin American markets? Journal of Business Ethics, 121(3), 419-440.

- Greco, G. (2012). Ownership structures, corporate governance and earnings management in the European Oil Industry. SSRN Electronic Journal. July 2012.

- Healy P.M. (1985). Evidence on the effect of bonus schemes on accounting procedure and accrual decisions. Journal of Accounting and Economics, 7, 85-107.

- Healy, P.M. & Wahlen, J.M. (1999). Commentary: A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

- Holthausen, R.W., Larcker, D.F. & Sloan, R.G. (1995). Annual bonus schemes and the manipulation of earnings. Journal of Accounting and Economics, 19(1), 29-74.

- Hribar, P. & Collins, D.W. (2002). Errors in estimating accruals: Implications for empirical research. Journal of Accounting Research, 40(1), 105-134.

- Jensen, M. C. & W.H. Meckling (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jones, J.J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 193-228.

- Kothari, S.P., Leone, A.J. & Wasley, C.E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163-197.

- Leuz, C., Nanda, D. & Wysocki, P.D. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69(3), 505-527.

- Machuga, S. & Teitel, K. (2009). Board of director’s characteristics and earnings quality surrounding implementation of a corporate governance code in Mexico. Journal of International Accounting, Auditing and Taxation, 18(1), 45-74.

- McNichols, L. & Wilson, P. (1988). Evidence of earnings management from the provision of bad debts. Journal of Accounting Research, 26, 1-31.

- McNichols, M. (2000). Research design issues in earnings management studies. Journal of Accounting and Public Policy, 19(4-5), 313-345.

- Mehran, H. (1995). Executive compensation structure, ownership and firm performance. Journal of Financial Economics, 38, 163-184.

- Mulford C.W. & Comiskey, E.E. (2002). The financial numbers game: Detecting creative accounting practices. New York, John Wiley & Sons.

- OECD (2016). Inflation (CPI) (indicator). doi: 10.1787/eee82e6e-en (Retrieved January 31, 2017).

- OECD (2016). Unemployment rate (indicator). doi: 10.1787/997c8750-en (Retrieved January 31, 2017).

- Otto, S. (2015). Real estate policy in Brazil and some comparisons with the United States. Stanford, Centre for International Development.

- Peasnell, K.V., Pope, P.F. & Young, S. (2005). Board monitoring and earnings management: Do outside directors influence abnormal accruals? Journal of Business Finance & Accounting, 32(7-8), 1311-1346.

- Peek, E., Meuwissen, R., Moers, F. & Vanstraelen, A. (2013). Comparing abnormal accruals estimates across samples: An international test. European Accounting Review, 22(3), 533-572.

- Pinto, I. (2010). Management of the net asset value in the real estate sector: An empirical evidence. Retrieved October 31, 2016, from http://eres.org/eres2010/

- Prencipe, A., Markarian, G. & Pozza, L. (2008). Earnings management in family firms: Evidence from R&D cost capitalization in Italy. Family Business Review, 21(1), 71-88.

- Roychowdhury, S. (2006). Earnings Management through real activities manipulation. Journal of Accounting and Economics, 42(3).

- Schipper, K. (1989). Commentary on earnings management. Accounting Horizons, 3(4), 91-102.

- Siregar, S.V. & Utama, S. (2008). Type of earnings management and the effect of ownership structure, firm size and corporate-governance practices: Evidence from Indonesia. The International Journal of Accounting, 43(1), 1-27.

- Wartfield, T., Wild, J. & Wild, K. (1995). Managerial ownership, accounting choices and informativeness of earnings. Journal of Accounting and Economics, 20(1), 61-91.

- Watts, R.L. & Zimmerman, J.L. (1986). Positive accounting theory. Prentice Hall, Englewood Cliffs, NJ.

- Xie, H. (2001). The mispricing of abnormal accruals. The Accounting Review, 76(3), 357-373.

- Yermack, D. (1997). Good timing: CEO stock option awards and company news announcements. Journal of Finance, 52, 449-476.