Research Article: 2019 Vol: 23 Issue: 4

Earnings Management of Listed Companies in Vietnam Stock Market: An Exploratory Study and Identification of Influencing Factors

Pham Duc Hieu, Thuongmai University

Le Thi Thanh Hai, Thuongmai University

Lai Thi Thu Thuy, Thuongmai University

Nguyen Thi Hong Lam, Thuongmai University

Hoang Thi Bich Ngoc, Thuongmai University

Abstract

Based on data from 1,281 observations on Vietnam's stock market in the period 2009-2015, the article clarified two fundamental issues by identifying the existence of earnings management of listed companies and analyzing the factors influencing earnings management such as business sectors, auditing firms, and debt-to-equity ratio. The findings of the article contributed to the limited research on earnings management on Vietnam’s stock market in particular as well as on the disclosure of earnings information of Vietnam’s enterprises in general.

Keywords

Earnings Management, Stock Market, Listed Companies, Vietnam.

Introduction

Earnings management has become well known during the last decade when a number of accounting scandals were discovered. Among them there was a scandal of Enron, the seventh-largest US company, reporting revenues up to 100 billion USD a year before it was forced to bankrupt in 2001. Enron was later jailed by numerous individuals involved in fraudulent accounting data. In Vietnam, although there are no official statistics, in the recent time, the deviation of profit before and after the audit reported by listed companies on the stock market (e.g. VCG, PPC) is increasing. Some companies had to be delisted due to fraudulent accounting data in general, profit figures in particular (e.g. BBT, DVD).

According to Michell et al. (1997), compared to private and/or non-listed companies, listed companies have more reasons to manipulate earnings figures. The main reason is to reduce the conflict of interest between shareholders and banks with managers. The adjustment of earnings figures is also supposed to convince the users of financial statements on the stability of business operations and profitability, thus increasing the liquidity of the company's stock.

Studies on earnings management are controversial. In this regard, studies in Vietnam are rather limited, as the boundaries between profit adjustment (legal one) and accounting fraud (illegal one) are often quite fragile. Several studies on this subject have just come up with quantification of earnings adjustment based on the application of some models of scholars in the world under specific conditions of Vietnam (Pham, 2013; Nguyen, 2014; Hoang & Tran, 2015). Up to now, according to our knowledge, there have been no studies on the existence of earnings management behavior as well as on the influence of factors on earnings management of listed companies on the stock market of Vietnam. Thus, this paper will focus on the research gap by identifying and analyzing the factors affecting the adjustment of earnings figures of listed companies on the stock market of Vietnam. Two research questions were asked:

1. Does the earnings management exist among listed companies on the stock market of Vietnam?

2. Do factors such as business sectors, debt-to-equity ratio, and independent audit affect the earnings management of listed companies in Vietnam?

In which, the first question is the main question of the research to examine whether there exists in practice the earnings management of listed companies in Vietnam. If the empirical results show the existence of earnings management, the study will continue to answer the second question to assess the factors that affect this behavior of enterprises.

The remaining part of this paper is structured as follows. In the next section, we will systematize the theory, relevant studies and the research hypotheses, followed by research methods and data processing. Next, we will present the results to answer the research questions and provide some additional analyses. The final section is concluding remarks and suggestions for future research.

Underlying Theories, Related Studies and Research Hypotheses

The term earnings management is widely used by researchers in many respects and for different purposes. The definition developed by Healy & Wahlen (1999) is the most commonly used. Accordingly, earnings management as managers use estimates and judgments in preparing financial statements and/or in setting business transactions to alter financial statements, making the user misunderstood about the results of the company’s operation, which influences their making decisions based on the information (already be adjusted) provided by the accountant.

There exists a delicate boundary between the choice of a suitable and legal accounting policy and fraudulent misconduct (Dechow & Skinner, 2000). Firms are more likely to choose to report stable annual growth rates rather than fluctuation in profitability as a result of changes in the market, which is called stabilization or profit smoothing. Managers therefore use flexible accounting policies to create a stable return on their earnings by cutting back on high profits and reporting a reasonable profit margin through flexible accounting techniques for profit (or revenue) transfer between reporting periods; or they can take unrealized profits in the coming year to offset the loss in the reporting year for the purpose of achieving a positive result (Jones, 2001). The current accounting standards have a lot of content that allows managers to use flexible accounting, for example: capitalization or non-capitalization of R&D costs, determining the useful life of fixed asset, selecting the depreciation methods, allocating the prepaid expenses or determining the provisions, and changing the valuation method of inventories. If applying a flexible accounting policy is always considered as legal, then beyond that limit is fraud. The difference between earnings management activities and fraudulent behavior is that the latter is an illegal activity as violating prescribed framework while the former is related to the application of flexible accounting policies within the framework of norms, laws and regulations. In fact, it is difficult to distinguish between fraud and flexible accounting and boundaries of these two concepts are difficult to delineate. Vietnamese Auditing Standards 240 (VAS 240) guided the auditors to identify frauds in the financial statements in paragraphs A3 and A4. Compared with the concept of earnings management, it can be seen that earnings management is not a fraudulent activity because managers do not directly interfere with accounting data as fraudulent behavior. The application of flexible accounting policies for specific purposes and in accordance with the specific circumstances of enterprises within the framework of norms and laws is the difference of earnings management compared with fraud.

Underlying Theories

The threshold theory (Degeorge et al., 1999) suggests that earnings adjustment is one of the following fundamental thresholds:

1. Creating stability in performance.

2. Ensuring the expectations of analysts.

3. Reporting a positive result and also a positive image of the company.

And reporting a positive result is the main reason. Hayn (1995) argues that companies adjust their profits to cross the red line to place themselves not low, but not too far away from the zero point (unprofitable). Limitations are often outlined by managers as having passed the negative threshold, so that zero point or just passing zero points are the threshold or red line for many executives. Thus, threshold theory is used as a basis for explaining why companies are considered by researchers to be earnings management if the result goes beyond the negative range and the net rate of return fluctuates around the threshold 0-5% for a long time.

According to prospect theory (Kahneman & Tversky, 1979), companies often attract investors’ attention when they move from loss (negative) to positive result and when they maintain a stable return. Prospect theory is associated with behavioral finance, where the fear of losing is always dominant among investors, so the chances of investing in a company are more appreciated for a steady return rather than a high return but erratic. Therefore, to attract investors and shareholders, managers often find ways to meet their expectations as well as reduce fear of failure by announcing a positive annual return at a stable level.

Related Studies and Research Hypotheses

McNichols (2000) argues that there are three methods commonly used in academic research on studying earnings management:

1. Based on the distribution of profit.

2. Based on the analysis of total accrual accounting.

3. Based on analysis of specific accrual accounting components.

In particular, the model that relies on the probability distribution of profits indicates whether there exists earnings management behavior and how it is used. The two remaining methods are based on the differences between accrual accounting and cash accounting to quantify earnings management as well as showing how earnings are adjusted through accrual accounting (Jones, 1991; Dechow, 1994).

However, Gerakos (2012) evaluates that the models based on the accrual accounting analysis do not yield really relevant and reliable results because they are based on many assumptions. He argues that the research on earnings management behavior should be based on a time series rather than random selections. Hence, the probability distribution model of profits as proposed by Burgstahler and Dichev (1997), and Degeorge et al. (1999) would be more appropriate as it provides a more comprehensive view on earnings management over time. One of the other advantages of this approach is that it avoids the problems associated with econometric data processing in the analysis and calculation of accruals accounting (Burgstahler & Dichev, 1997).

One of the studies using the profit distribution method was the study by Ball and Shivakumar (2005) in the UK. Findings suggest that private companies in the UK adjust for more often than publicly held companies. However, the study by Beatty et al. (2002) in the banking sector shows that listed banks tend to adjust their profit than non-listed ones. The authors also found that the field of activity also partly affected the trend of earnings adjustment.

In the study of the relationship between earnings management and audit quality, Tendeloo and Vanstraelen (2008) find that earnings management is a reality in European countries. Earnings management correlated with independent auditors and companies often adjust their earnings to surpass the loss status, and most of them are audited by non-Big 4; the authors also found a correlation between earnings management and debt to equity ratio.

Hayn (1995) examined 65,466 profit distributions observed from US companies. The findings show that companies often have profit distributions around point 0, especially the majority focuses on the right of score 0. The analysis also shows that companies with profit below zero tend to adjust returns around or greater than zero at a moderate level. The results conclude that about 30-40% of companies tend to adjust profit from negative to positive to overcome the red line in the business results.

Thus, in this study the first hypothesis was developed to answer the first research question:

H1 Listed companies on the stock market of Vietnam adjust their earnings to avoid reporting losses (negative results).

And, the followings hypotheses were developed to answer the second research question:

H2 Business sectors affect earnings management of listed companies on the stock market of Vietnam.

H3 The debt to equity ratio affects earnings management of listed companies on the stock market of Vietnam.

H4 Independent audit has different effects on earnings management of listed companies on the stock market of Vietnam.

Research Method and Data Processing

Research Method

The quantitative method was chosen to study earnings management behavior by examining the profit distributions of listed firms over time series. The secondary data is the financial information on the annual reports of companies listed on the Hanoi Stock Exchange (HNX) and Ho Chi Minh Stock Exchange (HOSE) in 7 years (2009-2015) through their websites and cophieu68.vn. Due to constraints of time and budget, only 206 listed companies were randomly selected, accounting for 32% of the total listed companies on both HNX and HOSE as on December 31st, 2015. However, during the data collection process, 23 companies were eliminated due to insufficient data for 7 years consecutive. As a result, 183 listed companies, corresponding to 1,281 observations, were included in the data processing by SPSS software.

The variables of the research model are as follows:

Dependent Variable

In principle, the dependent variable is the net profit after tax, however, because companies differ in size, so as suggested by Burgstahler & Dichev (1997), the net return on sales will be used in order to eliminate differences in scale.

Independence Variables

1. Business sectors: All observations are categorized by sectors based on the classification of listed companies according to the criteria of the State Securities Commission of Vietnam (SSC). However, to ensure the concentration of data, some adjustments have been made, for example: energy goes with oil & gas; trade, service with education; construction with real estate. Finally, 14 business sectors are included in statistical analysis.

2. Debt ratio: The debt ratio is determined by the ratio of total liabilities to equity.

3. Audit firm: Audit firms are divided into Big 4 and non-Big 4.

The Table 1 below summarizes and explains the variables of the research model.

| Table 1 Definition of Variables | |||

| Code | Definition | Measurement | Classification |

| NPR | Net profit ratio | Profit after tax/Net sales | |

| EARMGT | Earnings management | 1 when net profit ratio in the range of 0-7%; otherwise 0 | Dependent, binary variable |

| SECTOR | Business sector | by sequential number, starting at 1, 2,… n | Independent, continuous variable |

| DEBT | Debt ratio | Total liability/Equity | Independent, continuous variable |

| AUDIT | Audit firm | 1 if it is a Big 4 firm; otherwise 0 | Independent, binary variable |

Data Processing

To test the hypothesis, the data processing process comprises two stages.

Stage 1 will be based on descriptive statistics to examine the probability distribution of profit of 183 listed companies corresponding to 1,281 observations. To identify whether a listed firm has adjusted its earnings, the study uses the criteria proposed by previous studies and has been validated by empirical research (Burgstahler & Dichev, 1997; Degeorge et al., 1999). Accordingly, the profit distribution of firms with adjusted behavior will not follow the normal distribution that deviates above zero; fluctuate in the range of 0-5%. However, as suggested by several authors (Hamdi & Zarai, 2013; Pududu & de Villiers, 2016) in the emerging stock market like Vietnam, profitability may be higher and more fluctuated, so in this study the adjusted threshold was widened between 0 and 7%. Thus, in order to be able to perform further analyzes to test hypotheses about the effect of factors on the earnings management behavior of listed companies in Vietnam, the earnings management variable (EARMGT) is further coded as binary dependent variables as follows:

1. Firms with a net profit ratio between 0 and 7% are assumed to adjust profit and received a value of 1;

2. Firms with a net profit ratio outside the range of 0-7%, i.e. net profit ratios reported <0% and/or >7%, are assumed not to adjust profit and received a value of 0.

Stage 2 will answer the research question 2 and test hypotheses about the impact of business sectors, debt ratios, and independent audit on earnings management. The second data processing step depends on the first test result, when H1 is recognized. To test hypotheses H2, H3, and H4 binary logistic regression analysis will be applied because the dependent variable (EARMGT) is encoded in binary form (0, 1).

Results and Analysis

The Existence of Earnings Management of Listed Companies in Vietnam

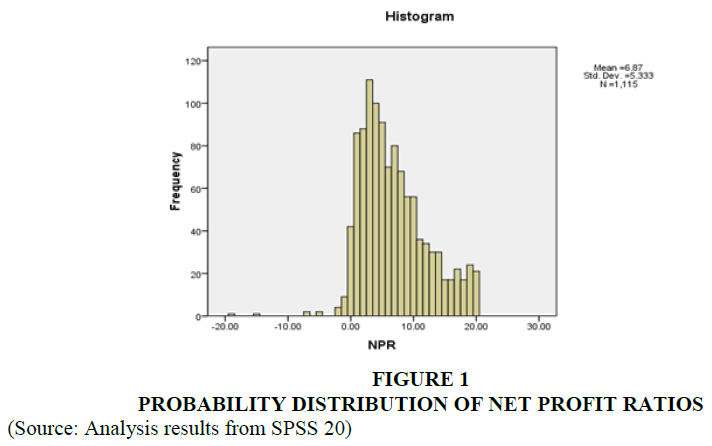

The probability distribution of net profit ratios of 183 listed companies during 7 years, corresponding to 1,281 observations are shown in the following figure:

Among 1,281 observations during the 7-year period (2009-2015), only 1,115 observations were retained for analysis to ensure the density distribution of net profit ratios. Observations with a net profit ratios out of +/-20% will be excluded from the dataset (166 observations are excluded).

Figure 1 shows the probability distribution of net profit ratios of listed firms mostly in the range 0-7%, with an average value of 6.87. The mean standard deviation is very low (0.094), indicating that the sample mean is reliable and can be generalized to the population. Especially, there are almost no enterprises reporting negative profit. The threshold theory or cross the red line has been partially verified, showing that most enterprises want to report a positive rate of return. The value of skewness is 0.365, which shows that the majority of the frequency of the probability distribution is on the right of zero, indicating that it is not a normal distribution. Test Kolmogorow-Smirnov with sig. = 0.000 and Q-Q plot also confirmed that NPR does not follow the standard distribution. Statistical results on the probability distribution of net returns indicate that these findings are consistent with studies conducted by Hayn (1995), Burgstahler & Dichev (1997), and Degeroge et al. (1999). Thus, the hypothesis H1 has been confirmed, proving the existence of profit adjustment within listed companies in Vietnam in order to avoid reporting a negative profit margin.

The Factors Affecting Earnings Management

The probability distribution has shown that there exists earnings management of listed companies on the stock market of Vietnam; so the next part of this study will examine the influence of factors on the earnings management of firms. As mentioned above, companies with a net profit ratio between 0 and 7% are reported to have adjusted profitability and received the value of 1, while others have a value of 0. Binary Logistic regression was used to test hypotheses related to the second research question.

Business Sectors and Earnings Management

Overall, the logistic regression showed that the sector of operation had a statistically significant influence on the earnings management behavior of firms (sig. <0.05). In detail, there are 13 (14-1) verified domains in which 11 sectors show a statistically significant and positive impact on the earnings management of listed firms (sig. <0,05; B>0); on the other hand, Odds Ratio values (Exp(B)) of these sectors are >1, indicating a high level of profit adjustment. Among 11 sectors, Trade ranked first with the Odds ratio of 8.38; followed by Fishery (5.12); Food (5,09); Construction materials (4.67); Manufacturing (4.10); Construction & Real Estate (4,02); Mineral (3.50); Energy, Oil & Gas (3.25); Chemicals & Pharmaceuticals (3.10); Plastic (2.94); and Telecommunications (2.66). As a result, it can be concluded that the business sector has a significant influence on the earnings management behavior of some listed companies on the stock market of Vietnam. Thus, the hypothesis H2 has been confirmed (Tables 2 and 3).

| Table 2 Logistic Regression Between Earnings Management and Business Sectors | ||||||

| B | S.E. | Wald | df | Sig. | Exp(B) | |

| SECTOR | 47.356 | 13 | 0.000 | |||

| PLASTIC | 1.079 | 0.514 | 4.411 | 1 | 0.036 | 2.940** |

| FISHERY | 1.632 | 0.539 | 9.179 | 1 | 0.002 | 5.115*** |

| TRADE | 2.125 | 0.495 | 18.421 | 1 | 0.000 | 8.375*** |

| BANKING | 0.044 | 0.555 | .006 | 1 | 0.937 | 1.045 |

| CONSTRUCTION MATERIALS | 1.539 | 0.483 | 10.148 | 1 | 0.001 | 4.662*** |

| TELECOMMUNICATION | 0.978 | 0.503 | 3.778 | 1 | 0.042 | 2.660** |

| CHEMICALS & PHARMACEUTICALS | 1.132 | 0.476 | 5.649 | 1 | 0.017 | 3.101*** |

| MINERAL | 1.253 | 0.516 | 5.901 | 1 | 0.015 | 3.500*** |

| MANUFACTURING | 1.410 | 0.442 | 10.201 | 1 | 0.001 | 4.098*** |

| ENERGY, OIL & GAS | 1.179 | 0.464 | 6.463 | 1 | 0.011 | 3.253*** |

| FOOD PROCESSING | 1.627 | 0.497 | 10.698 | 1 | 0.001 | 5.089*** |

| CONSTRUCTION & REAL ESTATE | 1.391 | 0.456 | 9.293 | 1 | 0.002 | 4.019*** |

| TRANSPORTATION | 0.476 | 0.507 | 0.878 | 1 | 0.349 | 1.609 |

| CONSTANT | -0.865 | 0.421 | 4.212 | 1 | 0.404 | 0.421 |

| Table 3 Logistic Regression Between Earnings Management and Debt Ratio | ||||||

| B | S.E. | Wald | df | Sig. | Exp(B) | |

| DEBT | 0.067 | 0.028 | 5.755 | 1 | 0.017 | 1.069*** |

| CONSTANT | 0.294 | 0.076 | 15.093 | 1 | 0.000 | 1.342 |

Debt Ratio and Earnings Management

The logistic regression showed that the debt-to-equity ratio had a statistically significant impact on the earnings management of listed companies on the Vietnam’s stock market (sig = 0.017<0.05; B = 0.067>0; Exp(B) = 1.069>1). Therefore, the hypothesis H3 is confirmed, indicating that the pressure from borrowing and debt also causes listed companies to adjust profit on their financial statements (Table 4).

| Table 4 Logistic Regression Between Earnings Management and Independent Audit | ||||||

| B | S.E. | Wald | df | Sig. | Exp(B) | |

| AUDIT | -0.567 | 0.126 | 20.342 | 1 | 0.000 | 0.567*** |

| CONSTANT | 0.633 | 0.080 | 62.503 | 1 | 0.000 | 1.883 |

Independent Audit and Earnings Management

Regression results show that auditing firms have a statistically significant effect on the earnings management behavior of listed companies on the stock market in Vietnam (sig = 0.000 <0.05; B = - 0.567<0).

The results presented on the Table 5 show that Pearson Chi-Square values at 20.508 with p-value = 0.000<0.05, indicating that there exists the relationship between the audit firm and earnings management, in which companies audited by Big 4 correspond to 220 observations (32.8%), while those not audited by Big 4 are up to 450 observations (67.2%). That proved that the big auditing firms (Big 4) significantly reduce the earnings management of listed companies on the stock market in Vietnam. Thus, the hypothesis H4 is confirmed.

| Table 5 Audit Cross Tabulation | ||||

| Audit | Total | |||

| = non big 4 | = big 4 | |||

| 0 = no earnings management | % within Earnings | 53.7 | 46.3 | 100.0 |

| % within Audit | 34.7 | 48.4 | 39.9 | |

| 1 = earnings management | % within Earnings | 67.2 | 32.8 | 100.0 |

| % within Audit | 65.3 | 51.6 | 60.1 | |

| Total | % within Earnings | 61.8 | 38.2 | 100.0 |

| % within Audit | 100.0 | 100.0 | 100.0 | |

| Chi-Square Tests | Value | df | Sig. (2-sided) | |

| Pearson Chi-Square | 20.508 | 20.508 | 20.508 | |

| Likelihood Ratio | 20.410 | 1 | .000*** | |

| N of Valid Cases | 1,115 | |||

Conclusion and Recommendations

Through empirical evidence, the research has achieved two target objectives that support the hypotheses about the existence of earnings management on the stock market of Vietnam and clarify the factors affecting earnings management of these companies.

Findings from the study have contributed to the theoretical and empirical evidence on the earnings management behavior of listed companies in Vietnam, which provided the basis for further research on this subject by examining the distribution of net profit margin of enterprises over time.

Two recommendations are generated from the study. First, it should be officially recognized earnings management behavior of listed companies from the standards setting bodies and the State Securities Commission of Vietnam (SSC). At the same time, standard setting bodies also need to set limits on the absolute and/or relative amounts of earnings adjustment in order to unify and facilitate audit firms in the audit of financial statements of listed companies. Second, for users of financial statements (investors), caution should be taken on earnings information reported by listed companies, especially those with stable profit for many years.

The following limitations of the article are also the basis for future studies. The research model can increase the sample size, which can be investigated for both non-listed and other types of businesses. In addition, factors influencing earnings management can be broadened by adding independent variables such as size of enterprise, duration of operation, number of board members, internal audit, etc. On the other hand, the fluctuation range of profit may be broader, for example, between 0-10% or from -5 to + 5% to examine the difference from the results presented in the article. Additional research in the future will reassess presented results and also contribute to overcoming the limitations inherent in this study.

End Notes

1. Corresponding author: Pham Duc Hieu, Thuongmai University, Hanoi, Vietnam. Email: hieuphamduc@gmail.com

References

- Ball, R., & Shivakumar, L. (2005). Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics, 39(1), 83-128.

- Beatty, A.L., Ke, B., & Petroni, K.R. (2002). Earnings management to avoid earnings declines across publicly and privately held banks. The Accounting Review, 77(3), 547-570.

- Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24(1), 99-126.

- Dechow, P.M. (1994). Accounting earnings and cash flows as measures of firm performance: The role of accounting accruals. Journal of Accounting & Economics, 18(1), 3-42.

- Dechow, P.M., & Skinner, D.J. (2000). Earnings management: Reconciling the views of accounting academics, practitioners, and regulators. Accounting Horizons, 14(2), 235-250.

- Degeorge, F., Patel, J., & Zeckhauser, R. (1999). Earnings management to exceed thresholds. The Journal of Business, 72(1), 1-33.

- Gerakos, J. (2012). Discussion of detecting earnings management: A new approach. Journal of Accounting Research, 50(2), 335-347.

- Hamdi, F.M., & Zarai, M.A. (2012). Earnings management to avoid earnings decreases and losses: Empirical evidence from Islamic banking industry. Research Journal of Finance and Accounting, 3(3), 88-106.

- Hayn, C. (1995). The information content of losses. Journal of Accounting and Economics, 20(2), 125-153.

- Healy, P.M, & Wahlen, J.M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

- Hoang, K., & Tran, T.T.H. (2015). Detection of frauds and errors on the financial statements of listed construction companies. Journal of Economics and Development, 218(2), 42-49.

- Jones, J.J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193-228.

- Jones, M.J. (2011). Creative Accounting, Fraud and International Accounting Scandals. England: John Wiley & Sons Ltd.

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-292.

- McNichols, M.F. (2000). Research design issues in earnings management studies. Journal of Accounting and Public Policy, 9(4-5), 313-345.

- Michell, R.K, Agle, B.R, & Wood, D.J. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. The Academy of Management Review, 22(4), 853-886.

- Nguyen, T.N.T. (2014). Research on frauds and errors on the financial statements of listed companies on Vietnam securities market. Unpublished Doctoral Dissertation. Danang Universities.

- Pham, T.B.V. (2013). Methods to measure the reliability of profit. Banking Review, 1, 39-43.

- Pududu, M.L., & de Villiers, C. (2016). Earnings management through loss avoidance: Does south africa have a good story to tell? South African Journal of Economics and Management Sciences, 19(1), 18-34.

- Tendeloo, B.V., & Vanstraelen, A. (2008). Earnings management and audit quality in europe: evidence from the private client segment market. European Accounting Review, 17(3), 447-469.