Research Article: 2020 Vol: 24 Issue: 6

Earnings Quality and Cash Holdings of Listed Firms in Jordan

Majd Iskandrani, The University of Jordan, Jordan

Amneh Hamad, The University of Jordan, Jordan

Hadeel Yaseen, The University of Jordan, Jordan

Tariq AlZoubi, The University of Jordan, Jordan

Mohammad Almaharmeh, The University of Jordan, Jordan

Abstract

This study investigates the relationship between cash holdings and earnings quality of listed firms in Jordan. To attain the aim of the study, this research investigates the importance of earnings quality as a determinant of cash holdings by companies listed in Amman Stock Exchange (ASE). Companies in countries with lower investor protection and highly concentrated ownership hold less cash, supporting the role of information asymmetry (i.e., earning quality) in determining cash levels. The study conducts a pooled ordinary least square (OLS) data analysis on a sample of 39 industrial firms covering the period of 2010–2016, this study provides evidence that as earnings quality decreases, firms tend to hold more cash. Moreover, the research suggests that cash balances are positively influenced by the presence of greater information asymmetries arising from poor earnings quality but also from the existence of lower levels of regulatory oversight and the occurrence of losses, both of which reduce the importance of earnings quality as a determinant of cash levels. The study also implies that companies with higher levels of earnings opaqueness seem to benefit from having higher cash holdings so as to avoid dependence from costly external funding. Keeping in mind the importance of earning quality for the companies, it can be argued that the findings of this research have implications for the current and potential scholars and policymakers. Therefore, the outcome of this study demands that firms should pay more attention to disclosure policy and improve quality of the disclosed information as much as possible.

Keywords

Earnings Quality, Cash Holdings, Amman Stock Exchange.

Introduction

Previous research has shown that the costs of external financing outweigh the benefits and this may affect the levels of cash holdings (Jensen & Meckling 1976; Myers & Majluf, 1984). Based on these seminal works, costly external financing arises from the degree of information asymmetries between managers and shareholders. Scholars and academic researchers have devoted their works to the determinant of cash holdings (Aftab et al. 2018; Gill & Shah 2012; Kim et al. 2011).

Moreover, a large body of research on the effect of the degree of information asymmetry between manger and shareholders on cash holdings has been detected in developed markets settings (Chung et al. 2015; Mansali et al. 2019; Sun et al. 2012). In the US context, Sun et al. (2012) show a negative impact of earnings quality on corporate cash holdings. Chung et al. (2015) document that companies in industries with greater levels of information asymmetry hold lower cash. However, little research has gauged the effect of the degree of information asymmetry between manger and shareholders on cash holdings in Emerging markets (Wijaya & Bandi 2018; Shin et al. 2018).

Emerging markets are an interesting context to investigate the association between earnings quality and cash-holdings by focusing on Jordan where the market suffers from certain issues related to the status of a developing country, such as poor corporate governance, weak shareholder protection, high asymmetric information, and the agency problem. In particular, in Jordan (Al-Rahahleh 2016; Alzoubi 2016). For instance, Alzoubi (2016) finds that the weak corporate governance system leads to lower cash holdings. Moreover, Al-Rahahleh (2016) recommends that ASE firms should improve their working capital management efficiency.

Nevertheless, with respect to cash holdings, to the best of the author’s knowledge very few studies have investigated the association between earning quality and cash holdings, which further indicates a clear gap in the literature. In contrast, one of the most striking differences between countries’ corporate governance systems is in the ownership and control of firms, and the identity of controlling shareholders. Moreover, this study is also motivated to investigate the impact of executive and non-executive directors’ ownership on market liquidity. This relationship is weakly addressed in the literature since the focus of existing literature is mainly based on the aggregate level of insider ownership and market liquidity (Chiang & Venkatesh 1988; Comerton-Forde & Rydge 2006; Kini & Mian 1995; Zhou 2011).

This research contributes to the previous works on the determinants of cash holdings in emerging markets (i.e. Jordan). First, this study extends previous works in developed markets such as UK and US (i.e., Farinha et al. 2018). In particular, this study use data from Amman Stock Exchange industrial firms that have different regulatory environments and financial disclosure requirements. Second, prior studies that have been conducted on Amman Stock Exchange (ASE) concentrate mainly on the effect of corporate governance on cash holdings and earning management (Abbadi et al. 2016; Al Othman & Al zoubi, 2019; Azzoz & Khamees, 2016) and the determinates of earning quality and cash holdings (Al-Rahahleh, 2016) and ignore the direct effect of earing quality on cash holdings. Therefore, this study aims to investigate the effect of earning quality on cash holdings in Jordan.

This study proceeds as follows. In section 2 this research provides a literature review background. This study then in section 3 states the sample and the methodology used. In Section 4 this research explores the empirical results and discussion whereas the final part of this study documents the main findings.

Literature Review

Earnings quality has been examined as a measure of information asymmetry in different work (Chung et al. 2015; Chang et al. 2018; Clarkson et al. 2020) find evidence in favor of monitoring cost a hypothesis for the relation between cash holdings and information asymmetry. According to such a hypothesis, active monitoring by shareholders will restrict the access of managers to free-cash-flow to avoid value-destroying activities (Jensen, 1986) and this will be more likely in the face of environments with a high level of information asymmetry. As a result, there should be a negative relation between cash holdings and the level of information asymmetry.

Prior studies that gauged the effect of earnings quality on cash holdings have documented mixed results. On the one hand, a number of scholars (Chung et al. 2015; Mansali et al. 2019; Sun et al. 2012) have shown that cash holdings are negatively associated with earnings quality. In accordance with this, Mansali et al. (2019) examine Euronext Paris during the period 2000-2015 to test how information asymmetry influences cash holdings, documenting that firms with poor accruals quality hold more cash holdings. This result is consistent with the precautionary motive for cash holdings. Furthermore, Sun et al. (2012) explore the effect of information asymmetry on cash holdings in the United States during the period 1980-2005. They indicate that high information asymmetry has a negative influence on the value of cash holdings. In a similar vein, Chung et al. (2015) analyze the effect of information asymmetry on corporate cash holdings in the United States during the period 1993-2009. They show that companies that operate in environments with higher information asymmetry have smaller cash holdings.

On the other hand, some researchers have confirmed that cash holdings are positively correlated with earnings quality (Farinha et al. 2018). For instance, Farinha et al. (2018) examine the effect of earnings quality on cash holdings for firms listed in Alternative Investment Markets in UK during the period 1998-2015. They conclude a positive association between earnings quality and cash holdings for both markets.

The other scheme of literature has studied the effect of earnings quality on cash holdings in emerging markets context. For example, Wijaya and Bandi (2018) test an Indonesian sample where the impact of corporate governance on cash holdings, using a sample of manufacturing firms listed in the Indonesian Stock Exchange for the period of 2009-2010, observing that corporate governance has a positive impact on cash holdings. Nevertheless, accrual quality has a negative impact on cash holdings. Similar to that, Shin et al. (2018) analyze the effect of earnings quality on cash holdings for a sample of Korean firms for the period of 2000-2014. They note that there is a negative effect of earnings quality on cash holdings and the marginal value of excess cash holdings. More recently, Khuong et al. (2020) investigate the association between accrual-based earnings management and real activities management and cash holdings, using a sample of 29 firms listed on Vietnamese stock exchange market during the period 2010- 2016. They document that real activities management has a positive impact on cash holdings. However, accrual-based earnings management has a negative impact on cash holdings. Similar to that, Mahdi et al. (2013) examine the effect of earnings quality on cash holdings using a sample of 96 firms listed on Tehran Stock Exchange during the period 2002-2010. They conclude that earnings quality has a negative impact on cash holdings and the effect is stronger for smaller firms.

As noted already, there is limited evidence on the effect of earnings quality on cash holdings in Amman Stock Exchange (ASE). For instance, Alzoubi (2016) examines the effect of the recent financial crisis on cash holdings using a sample of 80 non-financial firms listed on ASE during the period 2001-2011. He finds that the weak corporate governance system leads to lower cash holdings. Moreover, he documents that the financial crisis has caused shareholders to value cash at a premium, even with the existence of the aforementioned problems in the Amman Stock Exchange, as cash became the most convenient source of financing when the financial crisis made external financing limited and much more expensive. In a similar vein, Al-Rahahleh (2016) investigates a sample of ASE industrial firms during the period 2009-2013, finding that there is a negative association between earnings quality and cash holdings and recommending that ASE firms should improve their working capital management efficiency.

Taken into consideration the mixed results in the previous works. Our research hypothesis is stated as follows:

H1a: There is a significant positive effect of earnings quality on cash holdings of Jordanian companies.

H1b: There is a significant negative effect of earnings quality on cash holdings of Jordanian companies.

Methodology

The analysis begins by collecting the essential accounting information for all the listed industrial firms on Amman Stock Exchange (ASE) from the annual reports, between the years 2010 to 2016. This study excluded all observations that do not meet the necessary data requirements for calculating the variables used in this paper. In particular, this study excludes firms with missing data for either of the study’s major variables (earning quality and cash holding). Lastly, this study ignores observations of each variable that fall outside the 1st and 99th percentile range. After this selection process, the final sample is comprised of 39 firms.

Statistical Model Used

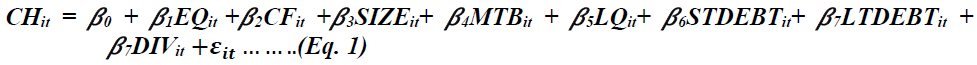

Statistical model used to test the effect of the earnings quality on the level of cash holdings as in the following (Eq.1):

CHit: Cash holdings (cash and cash equivalents)/ total assets.

EQit: (Earnings quality) Standard deviation for residuals estimated from Eq. 2

CFit: (Operating income + depreciation + amortization)/ total assets.

SIZEit: The natural logarithm of the total assets.

MTBit: (Total assets – total shareholders' equity + market capitalization)/ total assets.

LQit: (Receivables + inventory – accounts payable)/ total assets.

STDEBTit: (Short term debt + current portion of long term debt)/ total assets.

LTDEBTit: (Long term debt)/ total assets.

DIVit: Dummy variable which takes the value of 1 if a firm pays a dividend in year t, and zero otherwise.

Variables Measurement

Dependent variable: Cash Holdings

The dependent variable in this research is cash holding that is measured as cash and cash equivalents to total assets (Farinha et al. 2018; Mansali et al. 2019).

Independent variable: Earnings quality

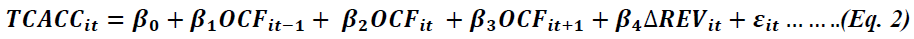

Following Farinha et al. (2018), this study used the residuals estimated from OLS regressions of the (Eq.2) to measure the earnings quality.

Where

TCACCit= Total Current accruals/ Total Assets

= (ΔCAit - ΔCLit - ΔChit + ΔSTDEBTit)/ Total Assets

ΔCAit : change in current assets between year t-1 and year t for firm i.

ΔCLit: change in current liabilities between year t-1 and year t for firm i.

ΔChit: change in cash and cash equivalents between year t-1 and year t for firm i.

ΔSTDEBTit: change in short-term debt between year t-1 and year t for firm i.

OCFit = NIit - TACCit

NIit: net income for firm i in year t.

TACCit (Total Accruals) = (ΔCAit - ΔCLit - ΔChit + ΔSTDEBTit - DEPNit)/ Total Assets.

DEPNit : depreciation and amortization expense in year t for firm i.

ΔREVit : the ratio of change in total revenue in year t for firm i.

εit: The residuals and its outcome is a measure of the earnings quality (EQ).

EQ = σ (εit).

σ (εit): the standard deviation of firm i's residuals (εit). Calculated over years t-4 through t.

Control Variables

Cash Flow

A vast body of research has documented a mixed result between cash flow and cash holdings. On the one hand, some studies stated a negative association between cash flow and cash holdings (Ferreira & Vilela 2004; Kim et al. 1998). On the other hand, Opler et al. (1999) and Ozkan and Ozkan (2004) argue for a positive relationship between cash flows and cash holdings, explaining that firms with high cash flows accumulate cash to finance future investments. According to Farinha et al. (2018) and Hamad et al. (2019), this variable is measured as the ratio of cash flows from operations to total book assets.

Firm Size

Prior studies have stated a negative association between firm size and cash holdings (Al Najjar 2015; Ozkan & Ozkan 2004; Opler et al., 1999) smaller firms have more information asymmetry, implying high costs of external finance and thus a higher propensity to hoard cash. Furthermore, this relation is based on the existence of economies of scale associated with the cash levels required to manage a firm’s normal transactions, so larger firms can maintain lower cash holdings. According to Farinha et al. (2018) and Hamad et al. (2018, 2019), this variable is measured as the natural logarithm of the book value of assets.

Market-To-Book Value

According to pecking order theory, companies with high market to book ratio hold more cash to avoid financial distress (Myers & Majluf, 1984). Thus, a vast body of literature has shown a positive association between market to book ratio and cash holdings (Al Najjar, 2015; Ozkan & Ozkan 2004). Following Farinha et al. (2018) this variable is regarded as a control variable and measured as the market-to-book ratio.

Liquidity

Extant of literature have shown a negative relationship between firm liquidity and cash holdings (Ozkan & Ozkan 2004; Al-Najjar & Belghitar 2011; Ferreira & Vilela 2004). Liquid assets can also affect cash holdings since they can substitute each other. Based on the work of Farinha et al. (2018) and Hamad et al. (2019), liquidity is calculated as receivables plus inventory minus accounts payable over total assets.

Leverage

Based on the work of Farinha et al. (2018), this variable is calculated as by subdividing the debt into short and long term relative to the total assets. Prior studies documents that leverage and cash holdings association is ambiguous (Guney et al. 2007; Hall et al. 2014). This emphasizes the argument that at a certain point of leverage, companies are supposed to decrease cash reserve. However, when this amount increases dramatically, companies will start to reserve cash to prevent the firm’s bankruptcy. In other words, when companies are expected to enter in financial distress due to higher long-term debt, they will reserve more cash levels. According to Farinha et al. (2018), the ratio of short-term debt portion is measured as short-term debt plus current portion of long-term debt divided by total assets. Nevertheless, the ratio of long-term debt portion is measured as long-term debt divided by total assets.

Dividends

Following Farinha et al. (2018), dividends are measured as a dummy variable that denotes the value of 1 if firms pay dividends and 0 otherwise. Previous studies have documented that mixed results on the relationship between cash holdings and dividend payout. On the one hand, previous studies have documented that companies that pay dividends are ought to reserve less cash (Chan 2018). On the other hand, companies that pay dividends might hold more cash (Alzoubi 2019).

Results and Discussion

Descriptive Statistics

Table 1 documents the descriptive statistics for cash holding (CH) with an average and standard deviation of 11% and 12% respectively. The average earnings quality (EQ) is 5%. This study observes that the mean and median of cash flow (CF) are 15% and 13% respectively. The average market-to-book ratio (MTB) is 1.13. Regarding the firm's size (log of total assets) is 7.39. With respect to the leverage, this study measures both short-term debt (STD) and long-term debt (LTD). The average of STD and LTD is 3% and 3% respectively. Our figures are similar to the findings of Abed et al. (2014).

| Table 1 Descriptive Statistics for Research Variables. | |||||||||

| Variables | CH | EQ | CF | SIZE | MTB | LIQ | STD | LTD | DIV |

| Mean | 0.11 | 0.05 | 0.15 | 7.39 | 1.13 | 0.24 | 0.03 | 0.03 | 0.47 |

| Median | 0.08 | 0.04 | 0.13 | 7.28 | 0.97 | 0.22 | 0 | 0 | 0 |

| Standard deviation | 0.12 | 0.05 | 0.11 | 0.57 | 0.77 | 0.14 | 0.07 | 0.06 | 0.5 |

| Maximum | 0.84 | 0.58 | 0.52 | 9.08 | 7.6 | 0.72 | 0.41 | 0.34 | 1 |

| Minimum | 0 | 0 | 0 | 5.59 | 0.27 | 0 | 0 | 0 | 0 |

Cash holdings (CH), earnings quality (EQ), Cash flow (CF), market to book ratio (MTB), firm size (SIZE), short term debt (STD), long term debt (LTD), liquidity (LIQ), and dividend (DIV).

Correlation Matrix

Table 2 presents the Pairwise correlations among the research variables. It is noticeable from the table that the highest correlation, compared with other variables, is found between cash holdings (CH) and dividends (DIV) is (0.37) and market to book ratio (MTB) and cash flow (CF) is (0.37). Moreover, the highest correlation is found between short-term debt (STD) and longterm debt (LTD) is (0.47). Furthermore, the highest association is detected between long-term debt (LTD) and dividends (DIV) is (-0.36).

| Table 2 Correlations Between the Research Variables | |||||||||

| Variable | CH | EQ | CF | SIZE | MTB | LIQ | STD | LTD | DIV |

| CH | 1 | ||||||||

| EQ | 0.04 | 1 | |||||||

| CF | 0.35 | 0.1 | 1 | ||||||

| SIZE | -0.14 | -0.1 | 0.09 | 1 | |||||

| MTB | 0.28 | 0.01 | 0.37 | 0.18 | 1 | ||||

| LIQ | 0.06 | 0.11 | 0.16 | -0.25 | -0.11 | 1 | |||

| STD | -0.2 | -0.03 | -0.04 | 0.18 | 0.06 | -0.06 | 1 | ||

| LTD | -0.22 | 0.15 | -0.09 | 0.29 | 0.01 | -0.13 | 0.47 | 1 | |

| DIV | 0.37 | -0.28 | 0.28 | 0.05 | 0.28 | 0.04 | -0.24 | -0.36 | 1 |

Cash holdings (CH), earnings quality (EQ), Cash flow (CF), market-to-book ratio (MTB), firm size (SIZE), short-term debt (STD), long term debt (LTD), liquidity (LIQ), and dividend (DIV). Significant level at 5% and more

The Effect of Earnings Quality on Cash Holdings

This Table 3 contains coefficient values and t-statistics from the regression of cash holdings (CH) against earnings quality (EQ), Cash flow (CF), market to book ratio (MTB), firm size (SIZE), short term debt (STD), long term debt (LTD), liquidity (LIQ), and dividend (DIV). Figures recorded in parentheses represent t-statistics which are based on clustered standard errors, where ***, **, * mean significance at the 1%, 5% and 10% levels respectively.

| Table 3 Coefficient Values and T-Statistics | |

| Variables | CH |

| EQ | 0.19 (1.81)* |

| CF | 0.18 (2.88)*** |

| SIZE | -0.05 (-4.79)*** |

| MTB | 0.06 (6.06)*** |

| LIQ | -0.06 (-1.49) |

| STD | 0.01 (0.22) |

| LTD | -0.28 (-2.23)** |

| DIV | 0.04 (3.44)*** |

| Constant | 0.41 (4.77)*** |

| Adj. R2 | 0.43 |

The findings in table 3 confirm that there is an effect between earnings quality and cash holdings for the 10% significance level. Based on the findings of this study, H1a is accepted which states that there is a statistically a significant positive effect of earnings quality on cash holdings of Jordanian companies. However, liquidity is negatively related with cash holdings indicating that firms tend to hold less cash when a firm’s liquidity is higher. With respect to firm’s size, the results indicate a negative association between a firm’s size and cash holdings. This emphasizes the argument that smaller companies are more expected to encounter financial distress. Consequently, they ought to hold more cash. Nevertheless, the variables market to book and cash flow have the anticipated positive and statistically significant relationship with cash holdings. In the case of the dividend, the study analysis indicates a positive association between dividend and cash holdings.

Regarding the short-term and long-term debt, the research results show two findings. First, in accordance with debt maturity predictions, the study findings emphasize the argument that at a certain point of leverage, companies are supposed to decrease cash reserves to prevent a firm’s bankruptcy. In other words, when companies are expected to enter in financial distress due to higher long-term debt, they will reserve more cash levels. To sum up, the full sample model has an Adjusted R-squared of 0.43 which can be considered a good fit for a panel data analysis. Lastly, this research runs the Variance Inflation Factor (VIF) command through STATA 11 to detect multicollinearity issues. The findings of VIF test reveals that this issue does not exist. From table 4 it is clear that all values less than 10.

| Table 4 Reported The Maximum Variance Inflation Factors (VIFS) for all Research Variables | |

| Variable | VIF |

| EQ | 1.08 |

| CF | 1.55 |

| SIZE | 1.20 |

| MTB | 1.63 |

| LIQ | 1.16 |

| STD | 1.25 |

| LTD | 1.38 |

| DIV | 1.46 |

| Mean VIF | 1.34 |

Conclusion

Many scholars have documented that the effect of earnings quality on cash holdings for emerging markets has been ignored in the literature. The investigation of earnings quality for emerging markets is important due to the highly agency and information asymmetry problems. Using panel data analysis, this research investigates a sample of 39 firms in the Amman Stock Exchange (ASE) for the period 2010 to 2016. This study finds that earnings quality is an important determinant of cash holdings. Moreover, this research concludes a positive relationship between earnings quality and cash holdings, which in the line with the argument of those companies with lower levels of earnings informativeness have greater difficulty in obtaining external finance and thus accumulate larger cash reserves as a buffer for future financing needs.

References

- Abbadi, S.S., Hijazi, Q.F., & Al-Rahahleh, A.S. (2016). Corporate governance quality and earnings management: Evidence from Jordan. Australasian Accounting, Business and Finance Journal, 10(2), 54-75.

- Aftab, U., Javid, A.Y., & Akhter, W. (2018). The determinants of cash holdings around different regions of the world. Business and Economic Review, 10(2), 151-181.

- Al?Najjar, B. (2015). The effect of governance mechanisms on small and medium?sized enterprise cash holdings: evidence from the United Kingdom. Journal of Small Business Management, 53(2), 303-320.

- Al?Najjar, B., & Belghitar, Y. (2011). Corporate cash holdings and dividend payments: Evidence from simultaneous analysis. Managerial and Decision Economics, 32(4), 231-241.

- Al-Othman, L.N., & Al-Zoubi, M.N. (2019). The impact of the board of directors’ characteristics on earnings quality of listed industrial companies on the Amman stock exchange. Academy of Accounting and Financial Studies Journal, 23(1), 1-16.

- Al-Rahahleh, A.S. (2016). Corporate governance quality and cash conversion cycle: Evidence from Jordan. International Business Research, 9(10), 140-150.

- AL-Shar, O.Z.A.K., & Dongfang, Q. (2017). Evaluations on the earning quality of listed firms in Jordan. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(4), 21-32.

- Alzoubi, T. (2016). The value of cash holding and the financial crisis: Evidence from Jordan. Dirasat: Administrative Sciences, 43(1), 325-333.

- Azzoz, A.R.A.M. and Khamees, B.A. (2016). The impact of corporate governance characteristics on earnings quality and earnings management: Evidence from Jordan. Jordan journal of business administration, 407(3654), 1-21.

- Chan, A. (2018). The role of cash holdings, working capital, dividend payout on capital investment. Journal of Applied Business Research (JABR), 34(3), 419-426.

- Chang, C.C., Kao, L.H., & Chen, H.Y. (2018). How does real earnings management affect the value of cash holdings? Comparisons between information and agency perspectives. Pacific-Basin Finance Journal, 51, 47-64.

- Chung, K.H., Kim, J.C., Kim, Y.S., & Zhang, H. (2015). Information asymmetry and corporate cash holdings. Journal of Business Finance & Accounting, 42(9-10), 1341-1377.

- Clarkson, P., Gao, R., & Herbohn, K. (2020). The Relationship between a Firm’s Information Environment and its Cash Holding Decision. Journal of Contemporary Accounting & Economics, 100201.

- Farinha, J., Mateus, C., & Soares, N. (2018). Cash holdings and earnings quality: evidence from the Main and Alternative UK markets. International Review of Financial Analysis, 56, 238-252.

- Ferreira, M.A., & Vilela, A.S. (2004). Why do firms hold cash? Evidence from EMU countries. European financial management, 10(2), 295-319.

- Gill, A., & Shah, C. (2012). Determinants of corporate cash holdings: Evidence from Canada. International journal of economics and finance, 4(1), 70-79.

- Guney, Y., Ozkan, A., & Ozkan, N. (2007). International evidence on the non-linear impact of leverage on corporate cash holdings. Journal of Multinational financial management, 17(1), 45-60.

- Hall, T., Mateus, C., & Mateus, I.B. (2014). What determines cash holdings at privately held and publicly traded firms? Evidence from 20 emerging markets. International Review of Financial Analysis, 33, 104-116.

- Hamad, A., & AL-Momani, M. (2018). The effect of accounting conservatism in managing the risk of downside of operating cash flows of companies listed in Amman Stock Exchange: An analytical study, University of Jordan. Jordan Journal of Business Administration, 14(1), 81–107.

- Hamad, A., Mohammad, A.M., & Al-Mawali, H. (2019). Does accounting conservatism mitigate the operating cash flows downside risk. The Journal of Social Sciences Research, 5(2), 472-483.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American economic review, 76(2), 323-329.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360.

- Khuong, N.V., Liem, N.T., & Minh, M.T.H. (2020). Earnings management and cash holdings: Evidence from energy firms in Vietnam. Journal of International Studies, 13(1).

- Kim, J., Kim, H., & Woods, D. (2011). Determinants of corporate cash-holding levels: An empirical examination of the restaurant industry. International Journal of Hospitality Management, 30(3), 568-574.

- Kruja, A., & Borici, A. (2016). Determinants of firm’s cash holding. International Journal of Economics, Commerce and Management, 4(4), 41-52.

- Mansali, H., Derouiche, I., & Jemai, K. (2019). Accruals quality, financial constraints, and corporate cash holdings. Managerial Finance, 45(8), 1129-1145.

- Moradi, M., Salehi, M., Majomerd, H.H., & Khamseloei, M.Y. (2013). The effect of earning quality on level of cash holding of listed companies on the Tehran stock exchange. Asian Journal of Research in Banking and Finance, 3(11), 97-109.

- Myers, S.C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have (No. w1396). National Bureau of Economic Research.

- Opler, T., Pinkowitz, L., Stulz, R., & Williamson, R. (1999). The determinants and implications of corporate cash holdings. Journal of financial economics, 52(1), 3-46.

- Ozkan, A., & Ozkan, N. (2004). Corporate cash holdings: An empirical investigation of UK companies. Journal of banking & finance, 28(9), 2103-2134.

- Shin, M., Kim, S., Shin, J., & Lee, J. (2018). Earnings quality effect on corporate excess cash holdings and their marginal value. Emerging Markets Finance and Trade, 54(4), 901-920.

- Sun, Q., Yung, K., & Rahman, H. (2012). Earnings quality and corporate cash holdings. Accounting & Finance, 52(2), 543-571.

- Wijaya, A.L. (2018). The effect of corporate governance and accruals quality on the corporate cash holdings: study on the manufacturing companies in Indonesian Stock Exchange. Audit Financiar, 16(151).