Research Article: 2021 Vol: 27 Issue: 3

Econometric Analysis of Oil Revenue Effect On Foreign Reserves of the Iraqi Economy 2003-2018.

Haider Ali AlDulaimi, University of Babylon

Husam Abas Ali, Almuthana Directorate of Education

Asam Mohamed aljebory, University of Babylon

Mustafa Habeeb obaid Al Imari, AL-Mustaqbal University College

Abstract

The Iraqi economy is affected by the changes taking place in oil prices, due to its entire property. The study attempted to show the impact of oil revenues as constituting the greatest percentage of public revenues, on international reserves held by the Iraqi central bank for the period from (2003-2018). The relationship was estimated using the regular least squares method (OLS) and using the Engle methodology to test the joint integration and the study concluded that oil revenues are associated with international reserves with a strong direct relationship, whether in the long or short run.

Keywords

Oil Revenue, Foreign Reserves, Econometric, Iraq.

Introduction

Oil exploration and production began in Iraq in the 1920s, under the terms of a broad concession granted to a consortium of international oil companies known as the Turkish Petroleum Company, and later as the Iraqi Petroleum Company. In 1975 oil resources were nationalized in Iraq. From 1975 to 2003, Iraqi oil production and export were fully functional. However, from the early 1980s to the overthrow of Saddam Hussein's government in 2003, the country's hydrocarbon infrastructure suffered from the negative effects of war, international sanctions, lack of investment and technology, and in some cases, mismanagement Iraq has the fifth-largest proven reserves of crude oil in the world with 141.4 billion barrels. With the rapid increase in production in 2015 and 2016, the country is now the third-largest oil exporter in the world and the second-largest in OPEC. With 130 trillion cubic feet of proven reserves, the oil sector accounts for more than 65 percent of GDP, (World Bank, 2018). According to (Ross: 2013) he believes that governments with oil resources generate government revenue Greater than the countries that do not have oil resources.

Oil revenues increase when oil prices rise, and tend to have a positive impact on oil-exporting countries (Laourari & Gasmi, 2016). And that a boom in oil prices creates a shift in the terms of trade where income is transferred from import to the exporting countries, which leads to an increase in national income. However, in the wake of higher prices, the potential gains for the exporting economies are diminishing because of the low demand for oil from the importing economies. For example, in 1984 when oil prices increased significantly, demand for oil from importing countries decreased and caused an economic recession. Thus, it appears that changes in oil prices do not always have a positive impact on oil-exporting countries, even when they increase revenues. Large volatility increases uncertainty in these countries, which is likely to lower incentives for investment, and countries that are highly dependent on oil revenues as the main source of national income often face the problem of price volatility (Aruoba et al., 2018).

The various studies that dealt with oil revenues and international reserves varied, including a study (Dağ et al., 2019) in which the main objective was to show the relationship between oil revenues and the government budget of the Iraqi state from 2006-2016, as it found that the trend of oil production in Iraq was increasing, to be the fourth-largest oil exporter in the world, the government budget relies on (97%) of oil revenues. As for the current study, it shows what the effect of oil revenues is on the state reserves held by the Central Bank of Iraq. As for the (Imarhiagbe, 2015) study, tried to study the effect of oil prices on the volatility of Nigerian foreign reserves and the study found that there is a positive effect between the price of oil and foreign reserves. The researcher used the GARCH-M and M -EGARCH model to measure fluctuations in the foreign reserve, while the current study takes into account oil revenues, which are affected not only by oil prices but by the volume of quantities exported from crude oil. (Arslan & Cantú, 2019) reviewed the underlying drivers of reserve accumulation and the measures used to assess the adequacy of the reserve and that prudential driver is the main reason for the accumulation of reserves in most countries.

As well as the objectives related to monetary and exchange rate policies, he discussed the potential role of increasing reserves in reducing long-term interest rates in the United States, while the current study provides a pilot guide for the impact of oil revenues which controlling total government revenues in Iraq on foreign reserves. Ismail's study (Ismail, 2019) focused on the mechanisms used in the currency sale window, and how the operations of buying and selling foreign currency, especially the dollar, affect the foreign reserves held by the Central Bank of Iraq. This study was not experimental, but rather a theoretical study to understand a mechanism of selling currency, unlike the current studies which experimental one. Cruz and Kriesler (2010) study tried to explain the impact of the accumulation of international reserves on effective demand, and concluded that the accumulation of international reserves in developing economies (and some developed countries) in large quantities, which was for preventive reasons. It has been accompanied by moderate economic growth parameters, and there are benefits within the resources that are being wasted, which can be used as alternative productive projects or to promote growth. The study recommended that those surpluses from international reserves should be used to stimulate aggregate demand, and the current study attempts to explain the impact of oil revenues on the international reserves of the Central Bank of Iraq and to determine the reasons for the accumulation of these reserves during the increase in oil revenues.

Oil Sector in Iraqi Economy

The oil sector is the heart of the Iraqi economy, where 95% of the state’s revenues come from oil production (Dağ et al., 2019) and according to the budget law for the year 2019, the ratio of oil revenues to total revenues has decreased and has reached (88.7%) due to the growth in non-oil revenues (Federal Budget Law, 2019). Oil is sold exclusively in dollars and those revenues go to the Ministry of Finance and the ministry sells dollar revenues to the Central Bank of Iraq, which in turn re-sells them to the private sector through the currency sale window to cover the needs of the private sector from imports. When the demand for the dollar is less than what goes to the central bank, the surplus goes to foreign currency reserves and vice versa. If the demand for the dollar is higher than the dollar resource, the central bank will resort to foreign currency reserves to cover the deficit (Ismail, 2019). According to the International Monetary Fund, the foreign reserve refers to the assets available at the disposal of monetary authorities, to meet the needs to finance the balance of payments or to interfere in exchange markets to influence the exchange rate of the currency. The Central Bank of Iraq intervenes to support the local currency through the currency sale window, which is one of the tools of indirect monetary policy, therefore the international reserves are directly affected by the volume of sales and purchases made by the central bank through the window of the currency sale.

The demand for international reserves by central banks can be driven by both prudential and non-prudential motives. The precautionary impulse is usually from being able to finance coverage for imports and external debt payments in the face of changing levels of international reserves (Cheung et al., 2019). There are other functions of the external reserves which are (1) financing international transactions (2) supporting the value of the local currency (3) Accumulation of wealth for future investment (4) Control of the money supply to achieve a balance between the money supply and demand for it, such as buying and selling foreign currency carried out by the Central Bank of Iraq through the foreign currency sale window (5) Enhancing the country's creditworthiness (6) A barrier against external shocks (Imarhiagbe, 2015).

Iraq is one of the countries that possess high foreign reserves, and some studies done by the Arab Monetary Fund, accounted Iraq are among the Arab countries that exaggerate the coverage of international reserves for import following the standard of the International Monetary Fund. This might be considered as wasting the return on the alternative opportunities that can be generated if these funds are invested in a way that contributes to increasing stable and sustainable growth and increasing the creation of new productive opportunities. Ismail has identified (Ismail, 2019) the dollar sources that the Iraqi Central Bank nourishes its international reserves with, as well as its various uses. Oil exports come at the forefront of foreign currency sources, because Iraq depends on oil revenues by a large percentage, while government sector imports come at the forefront of currency uses due to the large volume of imports of that sector, and as Shown in The following table:

| Table1 Sources and uses of Foreign Currency in Iraq |

|

| Main Uses of Foreign Currency - | Sources of Foreign Currency + |

|---|---|

| Government sector imports | Oil exports |

| Private sector imports | Non-oil exports |

| Foreign investment | Tourism |

| investment return transfers | Return on Reserves Investments |

| Payment of debts and external contributions | Remittances of residents abroad |

| Personal transfers | - |

| External savings | - |

| Currency devaluation | - |

Source: Ismail, Ali Mohsen, (Ismail, 2019) Monetary Policy in Confronting Challenges, Central Bank of Iraq (Central Bank of Iraq: 2014-2018), 10, 2017.

The main motivations for any country to possess international reserves have always been to provide liquidity and insurance from unforeseen risks. Following the International Monetary Fund, international reserves primarily serving in financing foreign imbalances, and maintaining a specified level of the exchange rate. (Nteegah & Okpoi, 2017). Through these motivations, the central bank seeks to increase the possession of international reserves. According to the monetary policy report issued by the Iraqi Central Bank, the balances in foreign banks and New York treasuries which is the largest percentage of the total reserves, as it reached (90.6%) and then gold that constitutes (6.1%) and foreign exchange in the bank's treasury which constitutes (3.2%).

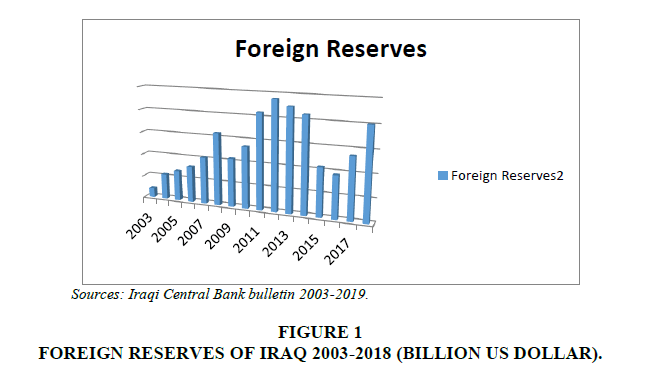

Figure 1 shows that the international reserves took an upward path to 2013, when they reached their climax, then went downward in 2014 due to the drop in world oil prices and their impact on international revenues obtained by the Central Bank of Iraq, see Appendix (1).

Methods

Data Collection and Sources

To achieve the main goal of the research, all data on oil revenues from the final accounts of the Republic of Iraq have been published by the General Budget Department in the Republic of Iraq to the year 2013, and from 2014 to 2018 from the annual economic report of the Republic of Iraq, as they were obtained in dinars Iraq has been converted into dollars based on the official exchange rate approved by the Central Bank of Iraq, and for all years of study. As for foreign reserve data, it has been collected from the World Bank database on international reserves (World Bank database on international reserves, 2013-2018).

Experimental Methods

When analyzing time series, it is imperative to ensure the stability of financial or economic variables to avoid false regression and inaccurate forecasting (Al Rasasi et al., 2019). Therefore, the stability of the time series will be verified, before the testing process, a transfer has been made. Data divided into a quarterly observation to increase its numbers and to obtain better results. To test the stability of the time series, and free from the unit root, we will apply some of the most common tests such as the Augmented Dickey-Fuller test developed by (Said & Dickey, 1984) and chose Phelps Peron and the developer by (Philips & Perron, 1988). Resorting to the joint integration procedure between the variables, which was developed by (Engle, 1987), which leads to a balanced relationship in the long term between the economic variables, and joint integration can be illustrated by the following example: we assume that we have two-time series and after a unit root analysis been done separately for each of these two series was found to be stable at the first difference i.e. they are of type (1) I and after applying the regression equation and testing the residuals Ut and found to be static at the first difference i.e. it is (0) I meaning that the linear combination has canceled the random trend for both. Thus the regression has a meaning and there is a joint co-integration between the study variables, and that regression is within the long-term estimate (Gujarati, 2011). Moreover, the existence of an integral relationship will enable us to calculate both short and long-term

Elasticity by estimating an Error correction Model (ECM), as recommended by Engel (Engle, 1987). The existence of the error correction mechanism explains the appropriateness of modeling changes independent variables as a function of the term error correction. In the long term, there is a relationship between economic variables. In the short term, it is necessary to resort to the error correction factor that is used to link behavior in the short term with its value in the long term, (Gujarati, 2011). To construct the simple linear regression model, special symbols were given for the study variables, as follows:

Rveq = Oil revenues

FRq = Foreign reserves

Results

Time Serious Stationary Tests

Before analyzing the stability of the two series, it is necessary to choose the appropriate period of Lags for them, and according to the SC test, the Lags period for both series (2) has been reached as tables 2 and 3 shows. Table 4 shows the results of the Augmented Dicky-Fuller and Philips-Perron tests for the Oil Revenue (Rveq). It was stationary at the first difference with constant and no trend with a significant rate of 5%, while Foreign reserves (FRq) were stable at the first difference without trend or intercept with a significant rate of 5% as table 5 shows. This confirms that the two series are free from the unit root.

| Table 2 Lags Selection Test of Oil Revenue REVQ |

||||||

| VAR Lag Order Selection Criteria | ||||||

| Endogenous variables: Revq | ||||||

| Exogenous variables: C | ||||||

| Date: 02/07/20 Time: 17:27 | ||||||

| Sample: 2003Q1 2018Q4 | ||||||

| Included observations: 54 | ||||||

| HQ | SC | AIC | FPE | LR | Log L | Lag |

| 22.93581 | 22.95843 | 22.92160 | 5.28e+08 | NA | -617.8832 | 0 |

| 20.33116 | 20.37641 | 20.30275 | 38451402 | 138.1063 | -546.1742 | 1 |

| 19.75230 | 19.82019* | 19.70969 | 21251217 | 32.13503 | -529.1616 | 2 |

| 19.76303 | 19.85354 | 19.70621 | 21180821 | 2.025623 | -528.0677 | 3 |

| 19.81427 | 19.92741 | 19.74325 | 21985665 | 0.000127 | -528.0676 | 4 |

| 19.76323 | 19.89900 | 19.67800 | 20604984 | 4.909634 | -525.3060 | 5 |

| 19.69437* | 19.85276 | 19.59493 | 18972896 | 5.644901 | -522.0632 | 6 |

| 19.74384 | 19.92487 | 19.63020 | 19668392 | 0.081203 | -522.0155 | 7 |

| 19.78934 | 19.99299 | 19.66150 | 20312732 | 0.258491 | -521.8604 | 8 |

| 19.73555 | 19.96183 | 19.59350 | 18999946 | 4.621451* | -519.0245 | 9 |

| 19.70270 | 19.95161 | 19.54644* | 18152997* | 3.616049 | -516.7540 | 10 |

*indicates lag order selected by the criterion

LR: sequential modified LR test statistic (each test at 5% level)

FPE: Final prediction error

AIC: Akaike information criterion

SC: Schwarz information criterion

HQ: Hannan-Quinn information criterion

| Table 3 Lags Test of Foreign Reserves FRQ |

|||||||

| VAR Lag Order Selection Criteria | |||||||

| Endogenous variables: FRQ | |||||||

| Exogenous variables: C | |||||||

| Date: 02/07/20 Time: 17:36 | |||||||

| Sample: 2003Q1 2018Q4 | |||||||

| Included observations: 54 | |||||||

| HQ | SC | AIC | FPE | LR | Log L | Lag | |

| 22.35673 | 22.37935 | 22.34252 | 2.96e+08 | NA | -602.2481 | 0 | |

| 18.87083 | 18.91608 | 18.84242 | 8926858. | 183.9313 | -506.7453 | 1 | |

| 18.12467 | 18.19255* | 18.08205 | 4173612. | 40.66742 | -485.2155 | 2 | |

| 18.14951 | 18.24002 | 18.09269 | 4218887. | 1.320247 | -484.5025 | 3 | |

| 18.19779 | 18.31093 | 18.12677 | 4366288. | 0.144799 | -484.4228 | 4 | |

| 18.13277 | 18.26854 | 18.04754 | 4035284. | 5.580623 | -481.2837 | 5 | |

| 18.06304* | 18.22144 | 17.96361* | 3712424.* | 5.685800* | -478.0174 | 6 | |

| 18.11417 | 18.29519 | 18.00053 | 3854859. | 0.005390 | -478.0142 | 7 | |

| 18.14979 | 18.35344 | 18.02194 | 3942014. | 0.702992 | -477.5924 | 8 | |

| 18.14252 | 18.36879 | 18.00046 | 3862830. | 2.574572 | -476.0125 | 9 | |

| 18.18983 | 18.43874 | 18.03358 | 3998695. | 0.168806 | -475.9065 | 10 | |

*indicates lag order selected by the criterion

LR: sequential modified LR test statistic (each test at 5% level)

FPE: Final prediction error

AIC: Akaike information criterion

SC: Schwarz information criterion

HQ: Hannan-Quinn information criterion

Table 4 |

||||

| Null Hypothesis: D(Revq) has a unit root | ||||

| Exogenous: Constant | ||||

| Lag Length: 0 (Automatic - based on SIC, maxlag=2) | ||||

| Prob.* | t-Statistic | |||

| 0.0145 | -3.403195 | Augmented Dickey-Fuller test statistic | ||

| -3.540198 | 1% level | Test critical values: | ||

| -2.909206 | 5% level | |||

| -2.592215 | 10% level | |||

| (MacKinnon: 1996, pp. 601-618) one-sided p-values. | ||||

| Null Hypothesis: D(ORQ) has a unit root | ||||

| Exogenous: Constant | ||||

| Bandwidth: 4 (Newey-West automatic) using Bartlett kernel | ||||

| Prob.* | Adj. t-Stat | Phillips-Perron (Phillips & Perron: 1988, pp. 335-346) test statistic | ||

| 0.0128 | -3.450728 | |||

| -3.540198 | 1% level | Test critical values: | ||

| -2.909206 | 5% level | |||

| -2.592215 | 10% level | |||

(MacKinnon: 1996, pp. 601-618) one-sided p-values.

| Table 5 Unit Root Dickey-Fuller Test of Foreign Reserves |

||||

| Null Hypothesis: D(FRQ) has a unit root | ||||

| Exogenous: None | ||||

| Lag Length: 0 (Automatic - based on SIC, maxlag=2) | ||||

| Prob.* | t-Statistic | Augmented Dickey-Fuller test statistic | ||

| 0.0188 | -2.360622 | |||

| -2.602794 | 1% level | Test critical values: | ||

| -1.946161 | 5% level | |||

| -1.613398 | 10% level | |||

| (MacKinnon: 1996, pp. 601-618) one-sided p-values. | ||||

| Null Hypothesis: D(FRQ) has a unit root | ||||

| Exogenous: None | ||||

| Bandwidth: 4 (Newey-West automatic) using Bartlett kernel | ||||

| Prob.* | Adj. t-Stat | Phillips-Perron (Phillips & Perron: 1988, pp. 335-346) test statistic | ||

| -2.355987 | 0.0190 | |||

| -2.602794 | 1% level | Test critical values: | ||

| -1.946161 | 5% level | |||

| -1.613398 | 10% level | |||

(MacKinnon: 1996, pp. 601-618) one-sided p-values.

Co-integration Test

As we saw in Tables 3 and 5 that the two series are integrated of order I (1). That is stationary after the first difference. This means that to test for the existence of the long-run relation between the model variables we have to perform the co-integration test. There are two co-integration tests for the I (1) series in the literature. They are Eagle Granger co-integration test and Johansen co-integration test. The null hypothesis Ho is there is no co-integration equation. The alternative Hypothesis is Ho is not true.

Table 6 below shows that we can reject the Ho Hypothesis because the trace statistics value is greater than the critical value and is less than 0.5% significant. While we cannot reject that there is at most 1 cointegration equation between the model variables because the trace statistics value is less than the critical value as table 6 shows.

| Table 6 Cointegration Test |

||||

| Date: 03/13/20 Time: 21:31 | ||||

| Sample (adjusted): 2003Q4 2018Q4 | ||||

| Included observations: 61 after adjustments Trend assumption: Linear deterministic trend Series: FRQ REVQ Lags interval (in first differences): 1 to 2 |

||||

| Unrestricted Cointegration Rank Test (Trace) | ||||

| Prob.** | 0.05 Critical Value | Trace Statistic | Eigenvalue | Hypothesized No. of CE(s) |

| 0.0215 | 15.49471 | 17.87740 | 0.229061 | None * |

| 0.1564 | 3.841466 | 2.008515 | 0.032390 | At most 1 |

Trace test indicates 1 cointegrating Eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

This means that there is a long relationship between Oil Revenue and Foreign Reserves. This means that if there are shocks in the short run, which may affect the movement in the individual series, they would converge with time (in the long run). Hence we need to estimate the short and long-run models and VECM (Vector Error Correction Model) would be an appropriate estimator to be used here.

Discussion

Building The Long-Run Regression Model

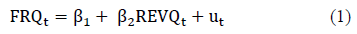

After the specification stage and by relying on the regular least squares method, (OLS), which is one of the best-unbiased methods, and since the results of the joint integration obtained mean that there is at least one long-term relationship between the variables used, we need to understand the dynamics relationship Long-term before the interpretation of short-term dynamics based on the error correction model. To reach this goal, we first estimate the long-term relationship between oil revenues and international reserves, as shown in the equation:

Where FRQt represents the foreign reserve as the dependent variable and REVQt oil revenues as an independent variable, while Ut represents the random error and t is the period. Equation (1) coefficient has been estimated by applying the ordinary least squares (OLS) as a method of estimating. Reviews V10 used and Table 7 shows the results.

| Table 7 Long Run OLS Results |

|||||

| 0.3102 | Prob. | 1.023206 | t-Statistic | 2509.24 | |

| 0 | `Prob | 19.04031 | t-Statistic | 0.77888 | |

| 0.85 | R-squared | 0 | Prob(F-statistic) | 362.5 | F-statistic |

| 0.85 | Adjusted R- squared | ||||

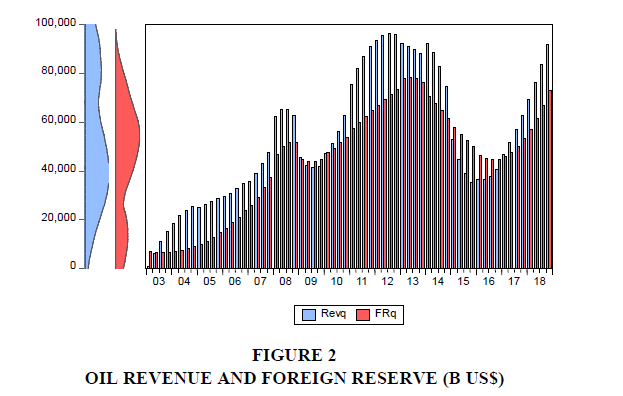

As Table 7 shows, the sign of the parameters indicated its compatibility with the logic of the economic theory, about oil revenues, that is, the increase in oil revenues leads to an increase in international reserves held by the Central Bank of Iraq, in the long term, and that oil revenues are directly proportional to international reserves, and if the independent variable (oil revenues) in the long term is equal to zero, the dependent variable of oil reserves is equal to (2509) million dollars, and that increasing oil revenues by one unit leads to an increase in international reserves by (0.77), that the increase in oil revenues is followed by an increase in international reserves, as shown in the following drawing:

Coefficient of Determination (R2): The determination coefficient explained about 85% of the total changes in the dependent variable FR (international reserves), while 15% is due to other external variables not included in the model. (Adjusted Coefficient of Determination) indicates the maximum permissible level for indicating the changes in the determination coefficient as the re-test will not give an addition to the explanatory power and may decrease with the attempt frequency, which also reached approximately 85%. The F-Test for the entire model indicates that the results have exceeded the calculated values of the F* test which reached 362 (with the tabular value at the level of significance of 5% and the degree of freedom (NK) which reached (4.00) and thus the calculated F is greater than its tabular counterpart of this We reject the null hypothesis and accept the alternative hypothesis indicating the substance of the model.

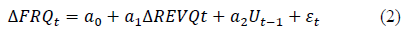

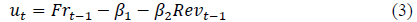

The second step is to estimate the value of the model in the short term according to the concept of the error correction model (EMC) which was used by Engle (Engle, 1987) and according to granger, the two variables, for example, X and Y have a common compliment that can be expressed B (EMC) and the following equation represents the mechanism of joint integration in the short term, as follows

Where Δ indicates the variable of the first difference, εt indicates the amount of random error:

That is, one late period for the error of the co-integration regression found in equation (2), equation (3) means that ΔFRQt depends on ΔREVQt and equilibrium error (EMC), and the equilibrium line must be negative to restore equilibrium. Based on the method of correcting the error in the short term, the following was reached:

According to Table 8, which shows the relationship between oil revenues and international reserves in the short term, showing the direct relationship between research variables, and that the minimum international reserves will be (548.8157) million dollars when the independent variable is oil revenues equal to zero, and oil revenues increase by One unit leads to an increase in international reserves by (0.346352) dollars, As the effect is observed to decrease in the short term and this is expected because the correction factor U (-1) amounted to (-0.091964), if the equilibrium relationship between the two variables is corrected every quarter, as the R-squared explanation is explained as appropriate (60%), and the adjustment is explained R- squared (59%) of the changes taking place in the international reserves, as it is noticed that the changes in the short term have decreased compared to the changes in the long term, and the statistical tests for the two parameters (β1, β2) indicated their significance as well as the significance of the model as a whole.

| Table 8 Short-Run Estimates |

|||||

| 0.0213 | Prob. | 2.363898 | t-Statistic | 548.8157 | |

| 0 | Prob | 8.675157 | t-Statistic | 0.346352 | |

| 46.76956 | F-statistic | 0 | Prob(F-statistic) | -0.091964 | U(-1) |

| 0.596194 | Adjusted R- squared | 0.60922 | R-squared | ||

Conclusion

- The correlation of oil revenues with international reserves with a strong direct relationship, whether in the long or short term, as the shortfall in foreign reserves can only be compensated after the rise in oil prices, which reflects positively on oil revenues.

- The high volume of the impact of oil revenues increased significantly, as the determination factor explained what amounted to 85% in the long term and 60% of the changes taking place in international reserves.

- The entire characteristic of the Iraqi economy by its dependence on oil as a main source of income explains the high reserve ratio held by the central bank.

- The currency sale window is one of the most effective tools used by the central bank and as an effective weapon that is fed through international reserves, to counter changes in exchange rates.

- The fluctuation in international reserves from one year to the next is the result of the fluctuation and decline in world oil prices, as happened in 2014, which is the main dollar source for the governor of the value of the local currency.

- The diversity of foreign currency sources obtained by the Central Bank of Iraq, however, oil revenues constituted the largest proportion of them.

Recommendations

- The necessity of reducing the volume of dependence on oil revenues, diversifying the income stream, and heading towards development towards other sectors, such as the agricultural, industrial, and financial sectors.

- The necessity of working to activate other monetary policy tools such as open market operations, the ratio of the legal reserve, and the rate of re-discounting, for the central bank to have several options when facing future crises.

- It requires the Central Bank of Iraq to work on investing accumulated surplus reserves, and alternative opportunities must not be wasted, raise the Iraqi economy’s growth rates.

- The necessity of benefiting from the 2014 crisis, studying it well, and determining the size of the decline, to provide the minimum reserves to finance public spending, if such a crisis occurred and reducing the amounts in keeping the international reserves.

References

- Arslan, Y., &amli; Cantú, C. (2019). The size of foreign exchange reserves. BIS lialier, (104), 1-23.

- Aruoba, S.B., Jia, C., &amli; Saffie, F. (2018). Measuring Uncertainty. In&nbsli;2018 Meeting lialiers&nbsli;(No. 490). Society for Economic Dynamics.

- Central Bank of Iraq. (2014-2018). Annual Economic Reliort.

- Cheung, Y.W., Qian, X., &amli; Remolona, E. (2019). Hoarding of international reserves: It's a neighbourly day in Asia.&nbsli;liacific Economic Review,&nbsli;24(2), 208-240.

- Cruz, M., &amli; Kriesler, li. (2010). International reserves, effective demand and growth.&nbsli;Review of liolitical Economy,&nbsli;22(4), 569-587.

- Dağ, M., Aktuğ, S. S., &amli; Alı, Z. S. A. (2019). Evaluation of Relationshili between Oil Revenues and Government Budget in Iraq: 2006-2016 lieriod.&nbsli;EMAJ: Emerging Markets Journal,&nbsli;9(1), 49-53.

- Engle, R.F., &amli; Yoo, B. S. (1987). Forecasting and testing in co-integrated systems.&nbsli;Journal of econometrics,&nbsli;35(1), 143-159.

- Gujarati, D. (2011). Econometrics by Examlile/Damodar Gujarati.&nbsli;Number,&nbsli;330, 84.

- Imarhiagbe, S. (2015). Examining the imliact of crude oil lirice on external reserves: evidence from Nigeria.&nbsli;International Journal of Economics and Finance,&nbsli;7(5), 13-21.

- Ismail, A.M, (2019). International Reserves and Currency Selling Window at the Central Bank of Iraq. Central Bank of Iraq, 1-32.

- Laourari, I., &amli; Gasmi, F. (2016). The imliact of real oil revenues fluctuations on economic growth in Algeria: evidence from 1960-2015 data.

- MacKinnon, J.G. (1996). Numerical distribution functions for unit root and cointegration tests.&nbsli;Journal of alililied econometrics,&nbsli;11(6), 601-618.

- Nteegah, A., &amli; Oklioi, G. E. (2017). External trade and its imlilications on foreign exchange reserves in Nigeria.&nbsli;West African Journal of Industrial and Academic Research,&nbsli;17(1), 108-119.

- lihillilis, li.C., &amli; lierron, li. (1988). Testing for a unit root in time series regression.&nbsli;Biometrika,&nbsli;75(2), 335-346.

- Ross, M.L. (2013).&nbsli;The oil curse: How lietroleum wealth shalies the develoliment of nations. lirinceton University liress.

- Said, S.E., &amli; Dickey, D.A. (1984). Testing for unit roots in autoregressive-moving average models of unknown order.&nbsli;Biometrika,&nbsli;71(3), 599-607.

- WORLD BANK DATABASE ON INTERNATIONAL RESERVES, (2013-2018).