Research Article: 2024 Vol: 30 Issue: 2

Economic sustainability of the Covid 19 pandemic in the Uemoa countries: Relevance of the rescue plan in Senegal

Mamadou MBAYE, Iba Der Thiam University of Thies

Citation Information: MBAYE. M (2023). Economic Sustainability of the Covid 19 Pandemic in the Uemoa Countries:Relevance of the Rescue Plan in Senegal. Academy of Entrepreneurship Journal, 30(S2), 1-7.

Abstract

With a population of 120.2 million inhabitants (INS/C, 2018), UEMOA is facing a crisis in a context of almost general underdevelopment and the fight against terrorism. The pandemic is blocking growth efforts, worsening precariousness and testing already immature and very vulnerable economies. In each state, specific measures have been implemented to preserve citizens' income and the activity of its businesses. In Senegal, after a month of fighting against Covid 19, GDP fell by 0.5% compared to the previous quarter due to the underperformance of activities in the primary and tertiary sectors respectively estimated at (-0.6 %) and (-1.1%) according to Ands (2020). The objective of this article is to analyze the sustainability of the pandemic in the face of falling growth indicators.

Keywords

Fund levying, Growth, Crisis

JEL Classifications

E22, F33

Introduction

Humanity today has a common enemy, a common predator (Thiam, 2020). Most countries have suspended growth efforts to protect the population from the Covid-19 pandemic. Economy has therefore entered into recession. However, faced with a previously unknown virus, the extent and duration of the crisis are currently unknown. The daily publication of indicators is hardly reassuring. They suggest that the worst is yet to come because, in most countries in the area, the peak of the pandemic has not yet been reached. To strengthen the resilience of the populations, the rulers decided to close the borders and suspend the payment of taxes. However, they have to face several incompressible expenses of a sovereign order ; such as those linked to the minimal functioning of the institutions, the pursuit of the fight against endemic diseases, the current financial commitments, and the priority social expenditures. The pandemic has immediate consequences for public finances.

It is for these various reasons, that a task force has been set up in Africa to request from donors an immediate availability of funds, accompanied by debt cancellations and moratorium suspensions, in order to contain the economic impacts of the pandemic in the short term. Its measures, although desirable, cannot last and alternative solutions focusing on the social solidarity economy are thought out and implemented.

The renewed interest in this type of economy is motivated by the urgency to change the economic paradigm in the face of a sudden crisis situation. Indeed, the pandemic reveals the gap between growth and social well-being. Classical indicators show their artificial nature and their subordination to a mechanistic vision of development (Viveret, 2002). Moreover, Méda (2002) confirms this vision by saying that the GDP that serves as a compass for the economy does not care about the nature of the activities that it adds up provided that these generate monetary flows. These indicators prioritize the qualitative factors of wealth while ignoring inequalities, the values specific to the different social worlds, civilizational values, and the meaning that social actors give to their actions and to their lives.

Sustainability of the Covid 19

In times of crisis, the challenge for the economy is to enhance the creativity of local economic agents to make up for the shortage of basic necessities and to generate social support among residents. In the context of Covid 19, there are several initiatives by economic agents. As a result of the closure of the borders, goods that have always been imported are now produced locally with an acceptable pricequality ratio. The crisis is therefore a source of motivation, and the solidarity economy allows innovation and the mobilization of resources to meet the challenge. In order to cope with the pandemic, Senegal set up a response and solidarity fund against the effects of the coronavirus called Force-Covid-19. It is estimated at 1000 billion. These rapidly mobilized resources come from several institutions, as shown in Table 1.

The analysis in Table 1 shows that the largest part of this fund comes from international institutions. These amounts add to the commitments already made by the State vis-à-vis the partners. According to the IMF (2020), Senegal is going into debt faster than expected, and its public debt represents 64% of GDP. It has reached a worrying threshold and is now one of the countries at risk of moderate debt distress.

In parallel with this initiative, a call for national solidarity was launched. According to the Ministry of Finance (2020), the amount of voluntary contributions amounts to FCFA 29 627 100 104 for 372 donors, made up of individuals, the private sector, associations and public figures. The table below shows the distribution.

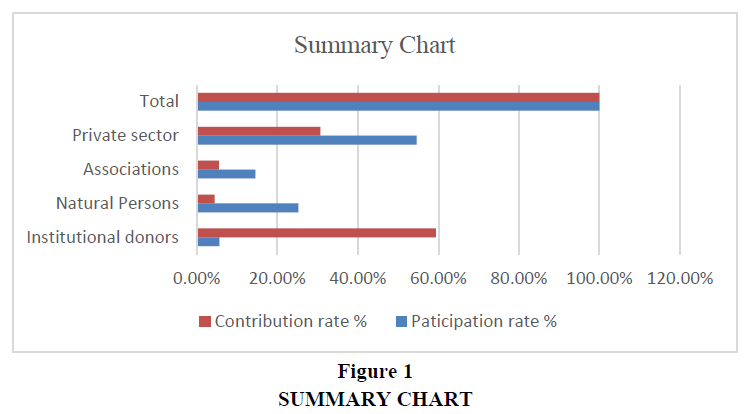

The analysis in Table 2 shows us a predominance of the private sector (54.56%). This could be explained by the united impulse generated by the pandemic, but also by an opportunistic hope of future gains. For this present crisis, the concept of donation is biased because the contributions to the Covid 19 fund are offset by the taxes owed to the state by the said companies. We are close to a form of public offering. Societies could also hope for future recognition of their philanthropic acts. Second, we have the natural persons who make 25.26% of the donors. Relative to the number of participants, they represented a significant portion. Compared to the active population of Senegal estimated at 9919985 inhabitants (Ansd, 2020), the rate is marginal or even insignificant. This reflects the very low level of wealth of Senegalese. The majority poor population is unable to participate in a significant and massive way in voluntary fundraising. It has a preference for liquidity (Keynes, 1936) for fear of an uncertain tomorrow due to the persistence and generalization of the pandemic in the territory.

The analysis in Table 3 shows that institutional donors provided the highest amount. This is understandable insofar as they are made up of national and international institutions that sometimes have the obligation to intervene in times of crisis. This skews the notion of freedom of action, characteristic of the social solidarity economy. The intervention of natural persons is the weakest. This is in line with our analysis relating to Table 2. We can notice the fact that economic agents are becoming more and more individualistic, preserving selfish interests in an uncertain environment.

Regarding the private sector, we note that we have 203 companies for a private sector that has 407,882 companies (Ansd, 2020). They participated for 4.9% or 9 076 618 465 FCFA in the solidarity surge. However, as a growth engine, it could have been higher. This reaction is an attitude of prudence comparable to that adopted by natural persons. As for associations and NGOs, their participation is beneficial but marginal.

The summary table. Table 4 allowed us to establish the graph below. Figure 1 This allows us to directly compare the data.

Conclusion

Social and solidarity economy practices are at the heart of the dynamics of accelerated social transformation. It reflects the failure of the classical model in the face of sudden crises and highlights the initiatives carried out by actors operating on the fringes of the dominant system (Favreau, 2000). It carries an endogenous approach to development that starts within societies. It has always been made up of sharing and monetary accumulation, but also of symbolic capital gains.

Its relative success in developing countries is based above all on the ability of individuals and the group to anticipate changes, while retaining flexibility in their strategies. This is what differentiates it from the classical system. Stiglitz (2002) confirms this by saying: "When crises strike, the IMF prescribes solutions that are standard, but archaic and unsuitable, without taking into account the effects that they would have on the inhabitants of the countries to which they are asked to apply them. There is one prescription and only one, and we are not looking for a different opinion.

Frank and open debate is discouraged, and there is no room for it. Ideology guides prescribing, and countries are expected to follow the IMF line without discussion. Not only do these ways of doing things work; they are undemocratic. ” Analysis of strategies and data shows that WAEMU countries like Senegal cannot sustain the pandemic sustainably. All the policies that are being implemented to deal with the crisis are short-term, while the duration of the pandemic is not under control.

The solidarity that helped mobilize resources is crumbling over time, and complementary financial resources are almost non-existent. Already, pandemic has greatly affected the WAEMU, which has noted a significant deterioration in the economy, with a forecast average growth rate that would stand at 2.7%, a reduction of almost four percentage points compared to the forecast. 6.6% initial. To continue to face the pandemic, the need for additional financial resources for the area is estimated at 5,284.9 billion CFA francs.

References

Ansd (2020) Report National Agency for Statistics and Demography of Senegal.

Favreau L. (2000), “Social economy and development in societies in the South”, Economy and Solidarity, 31-2 2, p. 45-63.

IMF (2020) International Monetary Fund Report

Ins / C. Uemoa (2018), West African Monetary Economic Union report

Keynes, J.M. (1936) General Theory of Employment, Interest and Money. PAYOT Edition, Paris France

Méda (2002, What is wealth ?, Paris, Flammarion.

Senegal Ministry of Finance (2020) Report April 2020

Stiglitz J. E. (2002) The Great Disillusionment. Paris, Fayard.

Tidiane Thiam (2020), Speech on the coronavirus, member of the Council on Foreign Relations (United States), former CEO of Credit Suisse

Viveret P. (2002), Reconsidering wealth, mission report “New factors of Wealth "to the Secretary of State for the Solidarity Economy.

Received: 15-Dec-2023, Manuscript No. AEJ-24-14409; Editor assigned: 20-Dec-2023, PreQC No. AEJ-24-14409(PQ); Reviewed: 30-Dec-2023, QC No. AEJ-24-14409; Revised: 04-Jan-2024, Manuscript No. AEJ-24-14409(R); Published: 11-Jan-2024