Research Article: 2021 Vol: 25 Issue: 1

Ecuadorian Wholesale and Retail Trade Companies: Analysis of the Financial Situation and Bankruptcy Forecast under Altman Z-Score

Irene Buele, Universidad Politécnica Salesiana

Andrea Mora, Universidad Politécnica Salesiana

Solano Santiago, Universidad Politécnica Salesiana

Abstract

Financial analysis helps companies identify their financial strengths and evaluate their performance, which benefits decision-making within the organization. This document analyzes the financial situation and identifies the probability of failure of the wholesale and retail trade companies in the province of Azuay, Ecuador based on the Altman Z-Score method. For this purpose, a database has been built by taking the financial information published in the Superintendency of Companies, Securities, and Insurance of Ecuador. The results show a liquidity index of 1.80, which means that the companies have enough assets to meet their short-term obligations. The solvency ratio, 66.5%, indicates that companies are financially dependent on third parties. In the management indicator, a value of 1.99 was obtained, which indicates that companies use their assets efficiently; and, finally, the profitability indicator of 5% refers to the profits obtained after good financial management. By applying the Altman Z-Score, it was found that the companies that are in the so-called safe zone, with a score higher than 2.90, are those dedicated to fuel distribution (5.86), the machinery sector (3,98), food sector (3.90), hospital devices (3.12) and construction sector (2.93). In the meantime, the sectors that are in the ignorance zone, due to their low liquidity and indebtedness indexes, are: the agricultural sector (2.4), the clothing sector (2.44) and the household appliances sector (1.98); these sectors should improve their financial soundness. According to the present analysis, now there are 8% of companies that are in the gray zone, that is, with a score lower than 1.30, which indicates that these companies have financial problems with a possibility of future bankruptcy. Finally, the average Altman Z score is 3.28, this result reflects that none of the wholesale and retail companies are in a possible bankruptcy because they have sufficient liquidity to meet their obligations in the short term (2.31). Companies use their assets efficiently to achieve projected sales (1.99); they also meet their long-term debts (66.5%) and maintain a moderate profitability (5%).

Keywords

Altman, Management, liquidity, Forecast, Profitability, Solvency, Z-Score.

Introduction

All commercial activity is aimed to obtain a profit or earning (Ron Amores & Sacoto Castillo, 2017). Regardless of the size or economic activity, companies face several challenges when trying to stay in the market. Currently, companies play an important role within the economic variables of a country, since they generate employment and satisfy the physiological, psychological, and social self-realization needs (Ramírez Molina & Ampudia Sjogreen, 2018). Small and medium-sized enterprises represent the main source of employment in most countries. They have an important contribution to economic development, productivity, competitiveness, and innovation in Latin American and Caribbean countries (Pedraza Melo et al., 2015).

According to Godás (2007), the wholesale trade is distinguished by buying finished merchandise either from manufacturers, other wholesalers, distributors, or retailers, and distributing them to other wholesalers except for final consumers. Pereyra Reyna (2016) defines retail trade as the commercial organization or independent person that offers goods or services to the final consumer. This type of trade is considered the last link in the distribution channel; that is, it has direct contact with the market.

According to data from the World Trade Organization (WTO) (2019) in 2018, the amount of commercial activity was 3.0% in relation to the Gross Domestic Product (GDP). It mentions that technology and trade are the two main forces that are driving this global economic transformation. It also points out that wholesalers and retailers play a fundamental role in the international market, since they connect producers and consumers from all over the world and, therefore, they guarantee consumer access to various products with competitive prices.

Peña Montenegro (2013) indicates that in Ecuadorian enterprises, especially small and medium-sized companies (SMEs), have enormous potential to generate production, employment, and income, since they generate almost 100% of the services that an Ecuadorian use in one day. They form 90% of the productive units, have 60% of employed personnel, and maintain 50% of the production. According to the National Institute of Statistics and Censuses (INEC, for its acronym in Spanish) (2019), by March 2019, trade was the branch of activity that generated the highest participation of suitable employees in the country, with 16.4%.

Due to these economic figures and their importance for the country, it is necessary to constantly carry out financial analysis to monitor the stability of companies. López Solís et al. (2018) emphasize that financial analysis is used to evaluate the financial and operational performance of the company, by means of several processes such as the compilation, representation, comparison, and analysis of each of the financial and operational documents of a business.

An adequate financial diagnosis allows to indicate the level of liquidity, profitability, and leverage of organizations, through the application of strategies and processes during business activity, thus assessing the performance of a business (Cardona Olaya et al., 2015). It also allows obtaining information to identify the strengths and weaknesses of a business entity compared to companies in the same sector; thus, concluding with a more reliable decision-making (Ochoa González et al., 2018).

Villa Maura et al. (2018) ensures that currently, in the business environment, the calculation of the profitability of a company is one of the fundamental points in the analysis of its annual accounts and it offers financial information of vital importance for external agents, shareholders and managers to make the best decisions. Chávez et al. (2017) highlights that the most used tools for a financial diagnosis are financial ratios, due to their ability to forecast the future based on historical accounting data. Profitability ratios, as well as liquidity ratios, provide the greatest amount of information on the future strength of the entity. Likewise, they are the main indicators for a diagnosis of the economic and financial environment and contribute to determine its viability. The liquidity index assesses the proportion of assets and investments that can be made effective or liquid in short term (Caro et al., 2018). On the other hand, the solvency index makes it possible to measure how financed the assets are by the total debt. In other words, it allows identifying all the debts that the entity has invested in each item of its total assets (Lizarzaburu, 2014).

Ollague et al. (2017) points out that management indicators are considered as predictors of solvency to reduce the risk of business failure, therefore monitoring them is of great importance. Furthermore, with this indicator it is possible to contribute to generating value for the company. According to Girón et al. (2017), half of business failures in Ecuador are due to economic-financial mismanagement. Therefore, it is necessary to analyze and evaluate a company to avoid bankruptcy. Bankruptcy is understood to be the legal situation where a person or an institution cannot comply with the obligations it maintains with third parties because these exceed the economic resources that the entity possesses (Moreno & Bravo, 2018).

The objective of this research is to analyze and forecast business failure of Ecuadorian wholesale and retail companies in the province of Azuay by applying the Altman Z-Score model. This method gathers several indicators that identify the financial strengths of companies to define whether they are on the verge of business failure or bankruptcy. This bankruptcy prediction model can diagnose the financial situation of companies from their financial statements (Malavé et al., 2017).

Methodology

For the financial study, the wholesale and retail trade companies of the province of Azuay with legal status of Public or Limited Companies were taken as reference. The population obtained was 664 legally constituted companies. The values examined were taken from the financial information for 2018 that companies report to the Superintendency of Companies, Securities, and Insurance of Ecuador (2018). The sample formula was used with a confidence level of 92% and with a margin of error of 8%, resulting in a sample value equal to 102 companies to analyze. To achieve this objective, the wholesale and retail trade sector is divided into 8 sub-activities: agriculture, food, fuel, construction, hospital devices, electrical appliances, machinery, and clothing.

The indicators considered for the analysis of the financial statements were liquidity, solvency, management, and profitability indicators. These ratios were used to analyze current liquidity, acid test, asset indebtedness, sales turnover, profit margin and net asset profitability.

For the business failure forecast, the Altman Z-Score scoring formula was used. This formula is used to predict the probability of bankruptcy of a company, based on the values of the Statement of Financial Position and the Statement of Comprehensive Income of the wholesale and retail trade companies in the province of Azuay. The Altman Z-score formula used is described in Table 1.

| Table 1 Altman “Z” Scoring Model |

| Z = 1.2(X1) + 1.4(X2) + 3.3(X3) + .6(X4) + 1(X5) |

| Where: |

| X1 = Working Capital / Total Assets |

| X2 = Retained Earnings / Total Assets |

| X3 = Earnings before Interest and Tax / Total Assets |

| X4 = Market Values of Equity/Total Liabilities |

| X5 = Sales/ Total Assets |

| Z = General index |

Lizarzaburu (2014) refers that each indicator’s result (X1, X2, X3, X4 y X5) is aimed to find the Z value (general index). These values are in the following ranges, as indicated in Table 2.

| Table 2 Altman Non-Manufacturing Companies “Z” Score Limits | |

| Distress zone | < 1,23 |

| Grey zone | Between 1,23 y 2,90 |

| Safe zone | >2,90 |

Altman considers five financial indicators in his formula. According to the result of the sum of these five indicators, it can be determined that an Altman Z index below 1.23 (distress zone) reflects a vulnerable situation for the company and the existence of a possible bankruptcy. On the other hand, if the value of Z is between the range of 1.23 to 2.90 (gray zone), it is defined within the ignorance zone. In this case, it is suggested to look at the limits to issue a criterion regarding the greater or lesser risk. Finally, a higher score of 2.90 (safe zone) suggests that the company has a comfortable financial position and that there are no reasons to assume a bankruptcy. The company will most likely continue in the market due to its great financial performance.

Results

The results consist of two parts which are organized as follows: in the first part, a financial analysis of the national wholesale and retail trade companies in the province of Azuay was carried out based on the Statement of Financial Position and the Statement of Comprehensive Income; and, in a second part, the financial forecast was carried out under the Altman Z-Score Model.

Financial Analysis

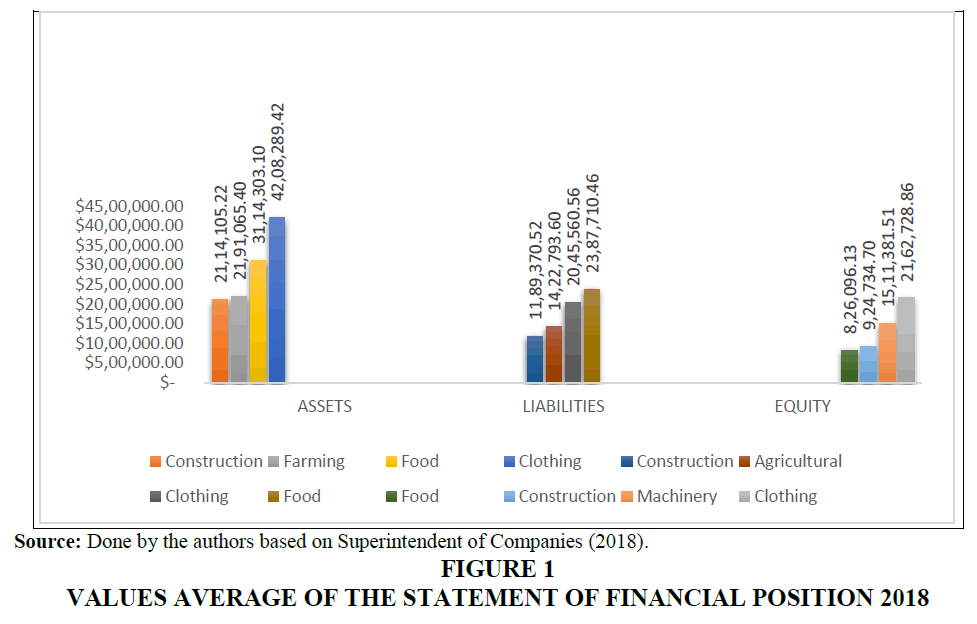

Figure 1 reflects the highest values of each subactivity. In the case of the first group, Assets, which refers to the goods and rights that the company owns, the Clothing subactivity is the most representative with regard to the other companies due to the value of the inventories available for sale. Within the clothing subactivity group, there are companies that are dedicated to the trade of fabrics, jeans, shoe distribution, etc. On the other hand, there are the fuel distribution companies, whose Assets Values are the lowest: $1´020.273,84. These companies are dedicated to the distribution of fuel, diesel, and oils.

On the other hand, Liabilities refer to the obligations that the entity maintains with third parties. In other words, they constitute external financing and that, in the future, whether in the short, medium, or long term, must be restored to creditors. In this section, the most representative companies are those of Food sub activity, with $2´387.710,46. This group of companies, includes those dedicated to the trade of basic necessities and machinery companies, such as: tractors, dump trucks, construction machinery, etc.

Finally, regarding equity or stockholder’s equity, these are all the contributions made by the partners of the company and the profits generated during the fiscal year. Equity constitutes the difference between Assets and Total Liabilities (Ollangue Valarezo et al., 2017). According to Figure 1, the company with the lowest value belongs to those dedicated to the purchase and sale of Fuel $ 202.442,62. On the other hand, are the Clothing companies that lead the Heritage group with a value of $ 2.162.728,86, due to the amount of retained earnings: $ 1´146.305,37.

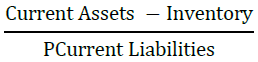

With the results shown in Table 3, it can be stated that the most significant ratio corresponds to the Current Liquidity (2.31), which suggests that commercial companies can meet all their obligations, on the assumption that they are asked for immediate payment. This indicator helps determine the real situation of any entity or organization in relation to short-term solvency (Molina et al., 2018). In other words, companies have $2.31 to comply with their debt in short term. The Acid Test corroborates this statement by presenting a value of 1.29. These data make it possible to affirm that the wholesale and retail companies have not had insolvency problems; because for every dollar that is owed in the short term, they have 0.29 cents to make their payments in a term of less than one year and without depending on the sale of their inventories.

| Table 3 Financial Ratios Average 2018 | |||

| Indicators | Financial Ratios | Formula | Result |

| Liquidity | Current Liquidity |  |

2,31 |

| Acid Test |  |

1,29 | |

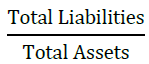

| Solvency | Assets indebtedness |  |

66,5% |

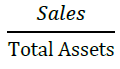

| Management | Sales Turnover |  |

1,99 |

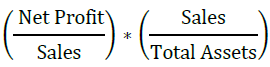

| Profitability | Profit margin |  |

4% |

| Assets Net Profitability |  |

5% | |

Regarding the indicator of Asset Indebtedness, it was determined that wholesale and retail trade companies are not in a comfortable situation since creditors have rights to 66.5% of Assets while the shareholders or owners of the company own only 33.5%. According to Herrera el al. (2017), this situation is not optimal because the indebtedness of an organization indicates the cost of third-party money, which is used to generate profits. In other words, this ratio indicates the degree and form of financial participation within the company by creditors. Therefore, it could be said that working with someone else’s money is satisfactory if the profits generated are higher than the interest that must be paid for that loan.

To measure the efficiency of companies in terms of the use of resources, the Sales Turnover indicator was analyzed and an average value of 1.99 was obtained. This represents that these companies do not maintain inefficient and fruitless assets. As indicated by Plúa Plúa, et al. (2017), it is of utmost importance that companies optimize asset management to generate an appropriate profitability, seeking a balance between merchandise and storage. Hence, avoiding debt levels that cannot be faced which might affect the financial structure of the company.

For the analysis of the Profitability indicators, the Profit Margin (4%) was reviewed. This value represents the profit generated by the companies and it allows to know if they carry out an efficient cost control. The Net Return on Asset ratio was also used, which results from multiplying the Profit Margin by the Turnover of the Assets; it was used to estimate the economic income of the unit from the net sales made in combination with the estimate of the volume of activity developed by the company (Gironella Masgrau, 2005). The total average of this indicator is 5%, this value assumes that the organization makes adequate decision-making and uses its resources efficiently, since with good company management, sales can be converted into future profits.

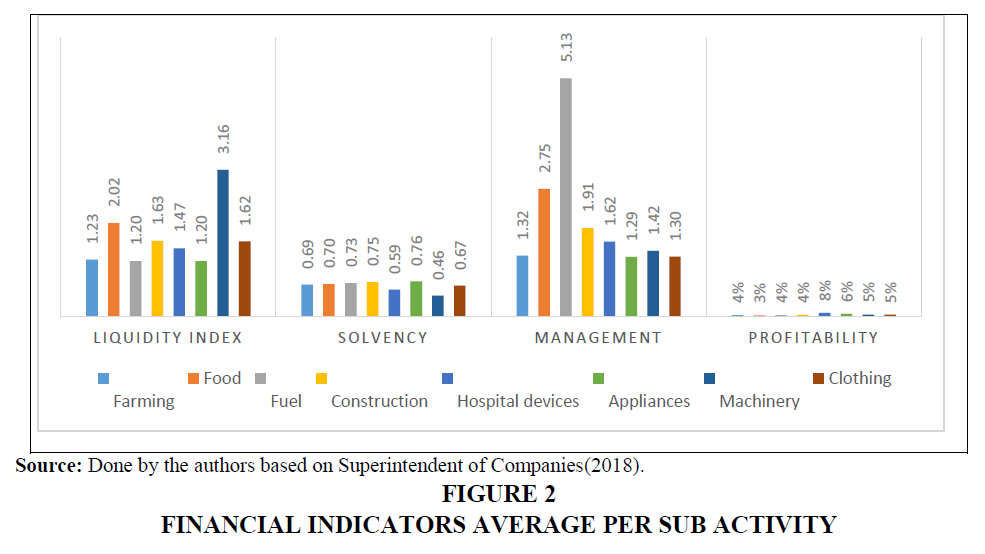

Figure 2 highlights the companies that trade machinery, since their liquidity index of 3,16 is the highest compared to other companies of the sector, which means they do not have any problem regarding their current obligations. Concerning the solvency index, low values were found, but the lowest corresponds to the companies that buy and sell Machinery, with an average of 46%, which means this type of trade does not depend on third parties.

In terms of Sales Turnover, the companies that are engaged in the fuel trade (5.13) are the ones that lead the wholesale and retail trade group. The subgroup with a low result is related to electrical appliances (1.29).

Finally, in terms of profitability analysis, the companies whose activity is the trade of hospital devices appear with a better performance. Their profitability of 8% exceeds other companies involved in other activities even though the rotation of inventories is less significant.

Altman Z-Score model

In the second part, the results of the Altman Z-score formula application are shown. The Z-score will offer an optimal measure that will allow to assess the financial health of the companies.

In the Altman model five indicators were used (Table 1) which are X1=labor capital/total assets. This result is related to liquidity and for Altman it is considered the most important (Aldazábal & Napán ). X2=retained earnings / total assets, it is the most representative factor, as stated by Lizarzaburu (2014), since it is related to the profits that have been generated in previous years for the company in order to increase assets and improve its stability and profitability.X3=Profits before interest and taxes (PBIT) / total assets, is one of the most important indicators, because this index refers to how productive and how profitable the total assets owned by the company are. It does not consider the interest or taxes. X4=market value of equity / Total Liabilities. After some studies, this ratio allowed Altman to consider the book value of equity; this is because many companies which are not listed on the stock exchange. With this value any type of company could be evaluated with the formula total equity among total liabilities. This indicator is considered the least important, however, it is still important, because it represents the obligations that the company keeps based on its equity. Finally, X5=sales/total assets, the return on assets (ROA), takes into account sales in relation to total assets and this provides us an insight into how much the assets generate sales to generate income (León Valdés, 2002).

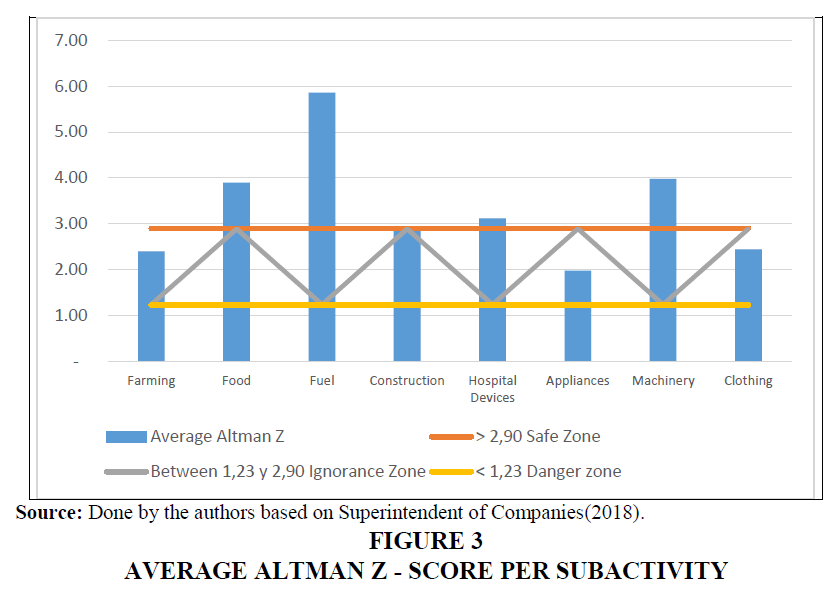

According to the results presented in Figure 3 that includes different indicators of the Altman formula, there were identified companies that have a score above 2.90. These companies are in the "safe zone" range; they have a low risk of bankruptcy, since they seem to have a good financial performance. Among them are the fuel sector (5.86), machinery (3.98), food (3.90), hospital devices (3.12) and construction (2.93). These sub-activities have higher values in the ratios X4 (market value of equity / book value of total debt) and X5 (sales/ total assets), which show they are working efficiently, since this sector has used its assets to generate profits. Also, the ratios with the lowest values are X2 (retained earnings/total assets) and X3 (earnings before interest and taxes/total assets). The indicator X2 (retained earnings/total assets) is low since these businesses do not have a significant accumulated profit. A similar situation occurs with the ratio X3(earnings before interest and taxes/total assets). It could be noticed that the pre-tax profits are considerably low, these results could affect the efficiency of these companies in the future.

However, within the group of wholesale and retail trade companies, there are also companies with ranges below 2.90; which means that they are in the so-called ignorance zone. It is not possible to affirm that the results are totally convenient, but it is possible to notice a greater attention in terms of improving its financial solidity. These companies belong to the sub-activities agriculture (2.40), clothing (2.44) and household appliances (1.98). In this group, X1 (working capital / total assets) is identified as the lowest ratio. This means that they do not have enough cash to meet their obligations. There are not companies in a danger zone.

Conclusions

The wholesale and retail trade companies are financially healthy as they have more assets (Ps. 2,395,398.55) than liabilities (Ps. 1,407,238.81). That means they acquire debts to increase their assets and they are responsible for the obligations generated in the short term. By preserving an organized economic and financial structure, assets, liabilities, and equity fulfill the function of achieving a balance between the sources of financing and the assets it owns. Thus, providing useful and reliable information to identify risks and opportunities in a timely way, which contributes to more agile decision making.

Regarding the results achieved from the financial ratios; the Current Liquidity ratio was identified with a representative value of 2.31. This value suggests that commercial companies can meet all their obligations if they are required to make an immediate payment. On the other hand, the Acid Test index has a value of 1.29, implying that wholesale and retail trading companies do not have major bankruptcy problems, since for each dollar owed in the short term, they have 0.29 cents to make their short-term payments, regardless of their inventories sales. According to these indicators, a healthy financial situation relating to liquidity and solvency can be identified in the short term.

The indicators of solvency, in particular the ratio of debt to assets, has experienced some falls since the creditors own 66.5% while the shareholders or owners of the companies have only 33.5%. As it is related to the commercial area, it is not a good idea to work with other people's money, since it would only be appropriate when the profits achieved are higher than the interest that must be paid for the loan acquired.

Regarding the use of total assets, the ratio of sales rotation was analyzed and an average of 1.96 was achieved. This result is positive for this type of company, since the rotation of assets is very fast, which means that wholesale and retail trade companies in the province of Azuay do not seem to keep inefficient assets.

As for the profit margin index, the value of 4% represents the profit generated by commercial companies and allows to know the efficiency of their cost control. On the other hand, the indicator of net asset profitability is used to measure how capable the asset is to generate profits, 5% of profits were earned with sales. These results are positive for commercial companies, since they have profits thanks to adequate decision making, that allows them to take advantage of their resources efficiently.

Among the four indicators examined by activity, there are the wholesale and retail trade companies, such as household appliances (0.97), building (0.95) and agriculture (0.63) that report values less than 1 in the Acid Test ratio. The value suggests that these companies, without the inventory, will not be able to meet their current obligations. In this analysis, we also found companies that sell machinery with a value of 2.54. These companies have a large availability of cash or goods and rights to meet their obligations to third parties without reliance on their inventories.

The trade whose line of business is clothing, has a cost in inventories of $1'410,122.62 and keeps low sales margins (432. 923.14); this results in a low margin of profitability because as it has very significant values in the inventory item, the cost of capital invested is high. This causes companies to lose cash as mentioned by Brealey, Myers, and Allen (2010), from the capital invested in the inventories no income is earned, since insurance and storage must be paid, and it has risks such as obsolescence and losses. Therefore, it is essential to improve these indicators because this will influence the possibilities of permanence, growth, and value generation of the business.

It was also considered that household appliance companies should be aware of the risk since their financial ratio of debt (76%) is very high in comparison to other companies and their liquidity is low. In other words, these companies are in debt and the probability of meeting their current financial obligations is low. The objective of this indicator is that the companies use their debt to make new investments; so that the income becomes higher than the interest they must pay and make a profit for the company. However, it seems that the electrical appliance companies are indebted more than they can pay; this causes the companies not to have an adequate profitability and end up in a possible bankruptcy.

According to the Altman Z-Score model, the main and most representative sub-activity is the one of wholesale and retail trade companies engaged in the marketing of fuel (5.86), followed by the machinery companies (3.98), food sector (3.90), hospital devices (3.12) and construction (2.93). All these sub-activities have in common the highest value in the indicator X5 (sales/total assets). This is one of the most distinctive indicators, because it shows the rotation speed of the assets, that means the speed of the companies to generate sales. These companies are in the so-called safe zone, meaning that the probability of bankruptcy is low.

The Altman Z-Score model should be considered as a tool of analysis and forecast within the companies since this method helps to predict the probability of failure and to know the financial situation of companies. In this paper, 102 companies engaged in wholesale and retail trade in the province of Azuay were analyzed with the following results: 49% of the companies are in a safe area; it seems that these companies will not have bankruptcy problems in the future. 43% of the companies are in the ignorance zone or gray zone. This is a significant percentage if we consider that the indicator suggests high possibilities of suffering bankruptcy problems within the next few years; therefore, it is convenient that these companies focus their studies on improving their financial situation. Finally, it was found that 8% of the companies are in danger zone, which means that the probability of bankruptcy soon is very high.

References

- Aldazábal, J.C., & Napán, A.F. (2014). Análisis discriminante aplicado a modelos de predicción de quiebra. Quipukamayoc Revista de la Facultad de Ciencias Contables, 22(42), 53-59.

- Brealey, R.A., Myers, S.C., & Allen, F. (2010). Principios de Finanzas Corporativas (Novena edición ed.). México: McGraw-Hill.

- Cardona Olaya, J.L., Martínez Carvaja, A., Velásquez Restrepo, S.M., & López Fernández, Y.M. (2015). Análisis de indicadores financieros del sector manufacturero del cuero y marroquinería: un estudio sobre las empresas colombianas. Informador Técnico, 79(2), 156-168.

- Caro, N.P., Guardiola, M., & Ortíz, P. (2018). Árboles de clasificación como herramienta para predecir dificultades financieras en empresas Latinoamericanas a través de sus razones contables. Contaduría y Administración, 63(1), 1-14.

- Chávez, N., Córdova, C., & Alvarado, P. (2017). Medición del riesgo de la gestión financiera de las compañías con la utilización del análisis discriminante: el caso de las industrias de la región 7 del Ecuador. Publicando, 4(13), 90-107.

- Cortez Rivas, D.A., & Burgos Burgos, J.E. (2016). La gestión de cartera de crédito y el riesgo crediticio como determinante de morosidad o liquidez de las empresas comerciales. Revista Observatorio de la Economía Latinoamericana, Ecuador. Obtenido de http://www.eumed.net/cursecon/ecolat/ec/2016/riesgo.html

- Girón Calva, H.C., Villanueva García, J., & Armas Herrera, R. (2017). Determinantes de la quiebra empresarial en las empresas ecuatorianas en el año 2016. Publicando, 4(13), 108-126.

- Gironella Masgrau, E. (2005). El apalancamiento financiero:de cómo un aumento del endeudamiento puede mejorar la rentabilidad financiera de una empresa. Revista de Contabilidad y Dirección, 2, 71-91.

- Godás, L. (2007). La distribución: comercio mayorista y minorista Instrumentos para el diseño de estrategias de marketing en la oficina de farmacia VIII. Offarm, 26(3), 110-114.

- Hernández Ramírez, M. (2014). Modelo financiero para la detección de quiebras con el uso de análisis discriminante múltiple. InterSedes, 15(32), 4-19.

- Herrera Freire, A., Betancourt Gonzaga, V., Herrera Freire, A., Vega Rodríguez, S., & Vivanco Granda, E. (2017). Razones Financieras de Liquidez en la Gestión Empresarial Para la Toma de Decisiones. QUIPUKAMAYOC, 24(46), 153 -162.

- Instituto Nacional de Estadísticas y Censos (INEC). (Marzo de 2019). Encuesta Nacional De Empleo,Desempleo y Subempleo (ENEMDU). Ecuador.

- Instituto Nacional de Estadísticas y Censos. (2017). Panorama Laboral y Empresarial del Ecuador 2017. Quito:INEC. Obtenido de http://www.ecuadorencifras.gob.ec/documentos/web-inec/Bibliotecas/Libros/Panorama%20Laboral%202017.pdf

- Laverde Sarmiento, M.Á., Lezama Palomino, J.C., & García Carrillo, J.F. (2018). ropuesta para la valoración de pymes en Colombia. Estudio de caso en el sector comercial e industrial. Revista Activos,, 16(31), 19-54.

- León Valdés, C.A. (2002). El Análisis Financiero como Herramienta en la Predicción de Quiebra e Insolvencia Financiera. Revista Científica de Contabilidad “Apuntes Contables”(14), 21-32.

- Lizarzaburu, E.R. (2014). Análisis del Modelo Z de Altman en el mercado peruano. Universidad & Empresa, 16(26), 141-158. doi:dx.doi.org/10.12804/rev.univ.empresa.26.2014.05

- López Solís, O.P., Lara Haro, D.M., Villacis Uvidia, J.F., Hernández Altamirano, H.E., & Carrión Gavilanes, G. (2018). Análisis financiero y su incidencia en la toma de decisiones en la fundación cultural y educativa Ambato. Revista Caribeña de Ciencias Sociales.

- Malavé, L.A., Figueroa, I.J., Espinoza, J.E., & Carrera, A. (2017). Una aplicación del modelo de Altman: Sector manufacturero del Ecuador. Revista de Planeación y Control Microfinanciero, 3(10), 47-52.

- Molina, J., Oña, J., Tipán, M., & Topa, S. (2018). Análisis financiero en las empresas comerciales del Ecuador. Revista de Investigación SIGMA, 5(1), 8-28.

- Moreno, E., & Bravo, F. (2018). Análisis de la probabilidad de quiebra de las empresas cotizadas españolas. Revista de Estudios Empresariales(2), 57-72.

- Ochoa González, C., Sánchez Villacres, A., Andocilla Cabrera, J., Hidalgo Hidalgo, H., & Medina Hinojosa, D. (2018). El análisis financiero como herramienta clave para una gestión financiera eficiente en las medianas empresas comerciales del Cantón Milagro. Revista Observatorio de la Economía Latinoamericana.

- Ollague Valarezo, J.K., Ramón Ramón, D.I., Soto Gonzalez , C.O., & Novillo, E.F. (2017). Indicadores financieros de gestión: análisis e interpretación desde una visión retrospectiva y prospectiva. INNOVA Research Journal, 2(8), 22-41.

- Organización Mundial del Comercio. (2019). El crecimiento del comercio mundial pierde impulso en tanto que persisten las tensiones comerciales.

- Organizacion Mundial del Comercio. (2019). Organizacion Mundial del Comercio (OMC). Obtenido de El futuro del comercio de servicios: https://www.wto.org/spanish/res_s/booksp_s/00_wtr19_s.pdf

- Pedraza Melo, N.A., Verástegui, J.L., Delgado Rivas, G., & Bernal González, I. (2015). Prácticas de liderazgo en empresas comerciales en Tamaulipas (México). Revista Facultad de Ciencias Económicas: Investigación y Reflexión, 23(1), 251-265.

- Peña Montenegro, M. (2013). La importancia del análisis de la trayectoria empresarial bajo dos dimensiones: Posición económica y financiera en las empresas ecuatorianas. Retos, 3(5), 96-104.

- Pereyra Reyna, M.J. (2016). Capacidad emprendedora del sector comercio minorista en el centro comercial Zona Franca de la ciudad de Trujillo 2016. Trujillo, Perú.

- Plúa Plúa, D.I., Loor Salazar, M., Zurita Fabre, A., Espinoza Pérez, P., & Pine Ramirez, W. (2017). Los inventarios y sus efectos en la liquidez de las empresas comerciales. CE Contribuciones a la Economía, 2017-03.

- Ramírez Molina, R.I., & Ampudia Sjogreen, D.E. (2018). Factores de Competitividad Empresarial en el Sector Comercial. Revista Electrónica de Ciencia y Tecnología del Instituto Universitario de Tecnología de Maracaibo. (RECITIUTM), 4(1), 16-32.

- Ron Amores, R.E., & Sacoto Castillo, V.A. (2017). Las PYMES ecuatorianas: su impacto en el empleo como contribución del PIB PYMES al PIB total. Espacios, 38(53), 15.

- Supercias. (2018). Indicadores financieros. Retrieved from http://reporteria.supercias.gob.ec/portal/samples/images/docs/tabla_indicadores.pdf

- Superintendencia de Compañías Valores y Seguros. (2018). Portal de Información / Directorio de Compañías. Recuperado el Enero de 2019, de https://reporteria.supercias.gob.ec/portal

- Varona Castillo, L. (2015). Modelo de supervivencia empresarial a partir del índice Z de Altman. Asociación Económica del Perú, 46, 1-39.

- Villa Maura, C.A., Vargas Ulloa, D.E., & Merino Villa, E.F. (2018). Análisis financiero del sector societario en el Ecuador. mktDescubre - ESPOCH FADE(12), 104-114.