Research Article: 2021 Vol: 25 Issue: 1

Effect of Banking Internal Controls on Reducing Non-Performing Loans in Commercial Banks in Kosovo Using Linear Regression Model and Mediation Analysis

Bujar Statovci, University of Pristina

Skender Ahmeti, University of Pristina

Hysen Ismajli, University of Pristina

Muhamet Aliu, University of Pristina

Abstract

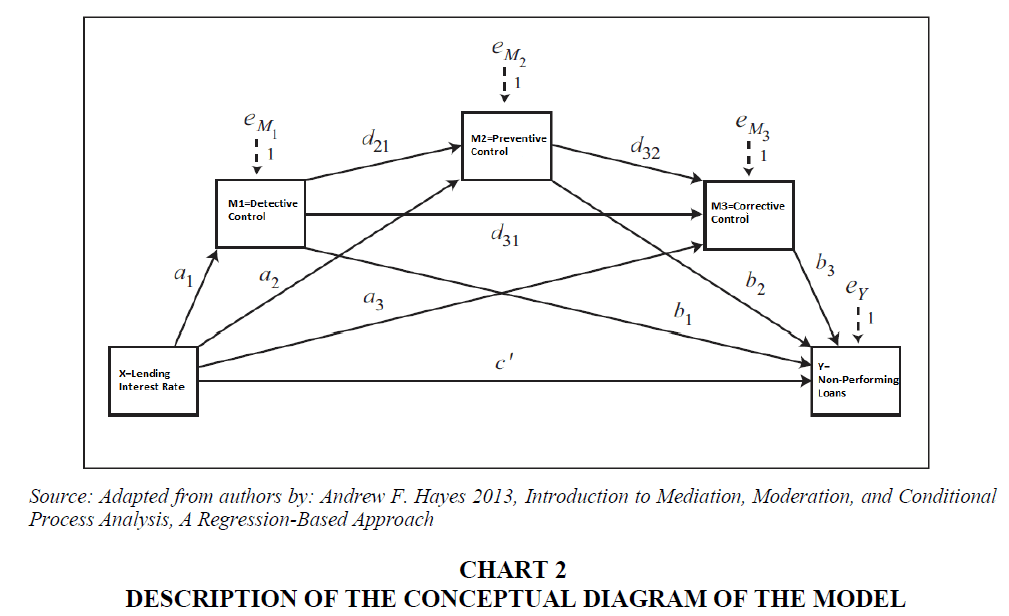

The purpose of this research is to identify the effect of internal banking controls as mediation variables on reducing non-performing loans in banks in Kosovo. The methodology used in this research paper is the linear regression model and mediation analysis. Non-performing loans are determined as dependent variable and lending interest rate as independent variable whereas detective control, preventive control and corrective control are used as mediation variables.

Keywords

Non-performing Loans, Internal Control, Banks, Mediation Analysis, Indirect Effect.

JEL Classifications

G2, G21, G32, M42.

Introduction

Non-performing loans are considered as one of the main factors of banking stability since they have a negative effect on the performance of the banking sector and deteriorates banks’ balance sheet. Non-performing loans (henceforth NPLs) are considered loans past due > 90 days. Determinants of NPLs are examined in several studies. Factors impacting NPLs are distinguished in specific banks’ factors and external or country factors. Main internal factors used in literature and research papers are lending interest rate, ROA (Return on Assets), ROE (Return on Equity), loan portfolio growth and loan to deposit ratio, while main external factors used for NPLs are GDP (Gross Domestic Product), inflation, unemployment rate and exchange rate. NPLs are examined in several studies, such as (Beck et al., 2015) Key Determinants of Non-performing Loans: New Evidence from a Global Sample, Dimitrios et al., (2016) Determinants of non-performing loans: Evidence from Euro-area countries, Vasiliki Makri et al., (2014) Determinants of Non-Performing Loans: The Case of Eurozone, Ghosh, (2015) Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states, Espinoza and Prasad, (2010) Nonperforming Loans in the GCC Banking System and their Macroeconomic Effects, Messai, (2013) Micro and macro determinants of non-performing loans).

Non-performing loans have a major negative effect on the banking sector, if there is lacking of effective internal controls and preventive measures are not taken. Non-performing loans have a negative effect on the performance of the banking sector by reducing lending, profit, liquidity development and performance in general. According to The Basel Committee in Banking Supervision, (2012) controls must be in place to detect, prevent and discover irregularities. Literature has also discussed the different types of internal controls used within the banking sector. According to Dube & Gulati, (2008) types of internal controls used in banking sector are detective internal control, preventive internal control and corrective internal control.

Based on above factors, in our study, NPLs will be used as dependent variable while lending interest rate as independent variable. This is considered as direct impact of independent variable X in the dependent variable Y. However, besides the direct impact of NPLs factors, the aim of this study is to analyse and identify indirect effect of mediation variables by using mediation analysis. According to Hayes, (2018) the goal of mediation analysis is to establish the extent to which some putative causal variable X, influences some outcome Y, through one or more mediator variables. Based on the above literature, detective control, preventive control and corrective control will be used as mediation variables to identify the mediation effect of X to Y through the variables Mi.

Literature Review

Beck et al., (2015) in their research Key Determinants of Non-performing Loans: New Evidence from a Global Sample, concludes that the following variables are found to significantly affect NPLs: real GDP growth, share prices, the exchange rate, and the lending interest rate. Dimitrios et al., (2016) Determinants of non-performing loans: Evidence from Euro-area countries uses NPLs as dependent variable, whereas as the bank-specific variables used are ROA, ROE and the ratio of loans to deposits, while the country-specific determinants used are unemployment, inflation etc. Based on Vasiliki Makri et al., (2013) in their study Determinants of Non-Performing Loans: The Case of Eurozone NPLs is used as dependent variable, whereas independent variables used are ROA, ROE, loan to deposit ratio, GDP, inflation, unemployment etc. According to Amit Ghosh, (2015) in his research Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states, among other determinants, concludes that higher state real GDP, real personal income growth rates and changes in state housing price index reduce NPLs, while inflation, state unemployment rates, and US public debt significantly increase NPLs. Espinoza and Prasad, (2010) in their research, Nonperforming Loans in the GCC Banking System and their Macroeconomic Effects, used a panel data for period 1995 to 2008 for around 80 banks in the Gulf Co-operation Council region and found out that NPLs worsen as economic growth lowers and interest rates and risk aversion increase. Messai, (2013) in his study Micro and macro determinants of non-performing loans, found that the NPLs vary negatively with the GDP growth and ROA, while unemployment and the real interest rate effects NPLs positively.

Based on European Central Bank – Banking Supervision Guidance to Banks on Non-performing loans, (2017) banks must ensure sufficient internal controls over non-performing loans. The Basel Committee in Banking Supervision, (2012) or the Bank's Internal Audit Function, states that controls must be in place to detect, prevent and discover irregularities. According to the Internal Audit function in Banks, (2012) a strong internal control system, including an independent and effective internal control function, is part of sound corporate governance. Dube & Gulati, (2008) types of internal controls used in banking sector are detective internal control, preventive internal control and corrective internal control.

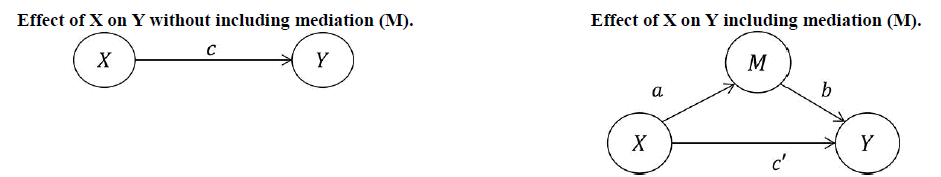

According to Hayes, (2018) the test of how X exerts its effect on Y frequently postulates a model in which one or more intervening variables M is located causally between X and Y. Hayes continues that these intervening variables called mediators, are conceptualized as the mechanism through which X influences Y. Based on Fred M. Feinberg, (2012) in his research Mediation analysis and categorical variables: Some further frontiers, explains the process of mediation effects on dependent variable. Y = cX; M = aX; Y = c’X + bM.

What happens to c when the mediator M intervenes?

Hypotheses

Objective derived from various researches and literature review is below. The effect of internal controls as mediation variables on NPLs.

Hypothesis:

H1: This Lending interest rate has impact on non-performing loans in Banks in Kosovo.

Hypothesis:

H1.1: The impact of lending interest rate on NPLs is effected by detective control.

H1.2: The impact of lending interest rate on NPLs is effected by preventive control.

H1.3: This is my third hypothesis and it uses a subscript.

Research Methodology

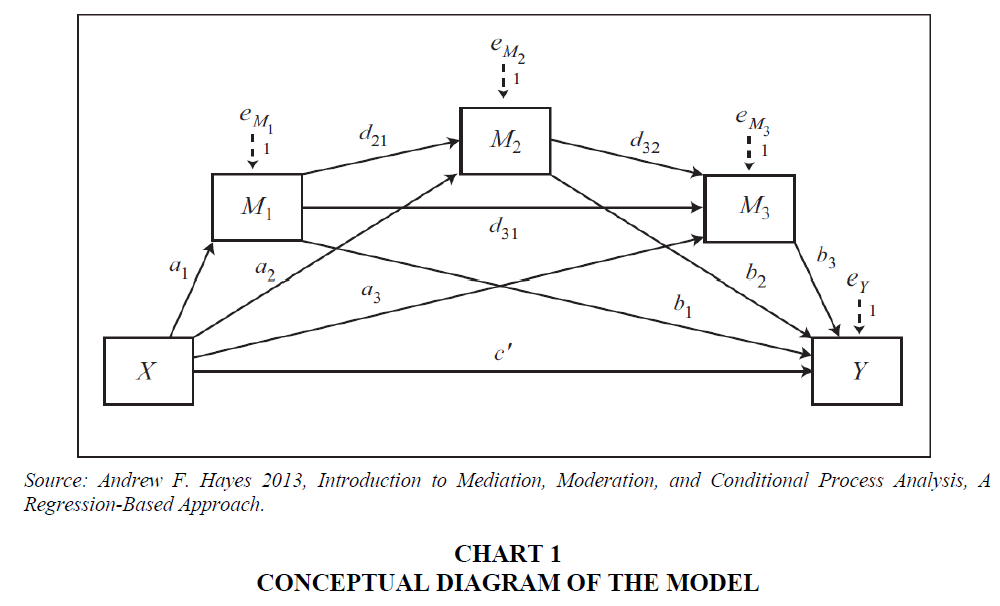

Model used in this study to test the hypothesis is model 6 from Andrew F. Hayes, (2013) Introduction to Mediation, Moderation, and Conditional Process Analysis, A Regression-Based Approach:

Y = a +B1X1+ ε

Indirect effect of X on Y through Mi only = ai bi

Indirect effect of X on Y through M1 and M2 in serial = a1d21b2

Indirect effect of X on Y through M1 and M3 in serial = a1 d31b3

Indirect effect of X on Y through M2 and M3 in serial = a2 d32b3

Indirect effect of X on Y through M1, M2, and M3 in serial = a1d21d32b3

Direct effect of X on Y = c'

Indirect effect of LIR on NPLs through Mi only = ai bi

Indirect effect of LIR on NPLs through M1: Detective Control and M2: Preventive Control in serial = a1d21b2

Indirect effect of LIR on NPLs through M1: Detective Control and M3: Corrective Control in serial = a1 d31b3

Indirect effect of LIR on NPLs through M2: Preventive Control and M3: Corrective Control in serial = a2 d32b3

Indirect effect of LIR on NPLs through M1: Detective Control, M2: Preventive Control, and M3: Corrective Control in serial = a1d21d32b3

Direct effect of LIR on NPLs = c'

NPLs= a +B1LIR+ ε

NPLs = Non-performing loans

Bi = Coefficient of Regression,

LIR = Lending Interest Rate,

M1 = Detective Control as Mediation Variable,

M2 = Preventive Control as Mediation Variable,

M3 = Corrective Control as mediation variable,

ε = Coefficient Error

The sample comprises nine out of ten banks in Kosovo represented by internal audit staff, internal control staff and risk management staff. Primary data were used to achieve the objectives of this research. These data were collected and analysed from a questionnaire specially prepared for this research. The questionnaire was sent electronically and the total observations for all five variables are 180, while for a single variable are 36. The reliability of the questionnaire is measured by Cronbach’s Alpha technique (SPSS v25). The test result of Cronbach’s Alpha is 0.793 or 79.3% which indicates an adequate degree of the reliability of the questionnaire (accepted degree >0.70). The most appropriate method used for this research is the Likert scale method (Gliem & Gliem, 2003).

Study Results

Description of the dependent variable, independent variable and mediation variables used in this research are shown in Table 1.

| Table 1 Description of Variables Type of Variable | ||

| Y : YNPLs | Y:Non Performing Loans | Dependent Variable |

| X : X1LIR | X1LIR: Lending Interest Rate | Independent Variable |

| M1 : M1DC | M1: Mediation 1, Detective Control | Mediation Variable |

| M2 : M2PC | M": Mediation 2, Preventive Control | Mediation Variable |

| M3 : M3CC | M3: Mediation 3, Corrective Control | Mediation Variable |

Correlation coefficient R=0.5073 shown in Table 2 expresses the strong correlation between the dependent variable and independent variable. R-square indicates that dependent variable NPLs can be explained by the independent variable lending interest rate by 0.2573. The result of R square is expected since only one variable is included in the direct effect of the linear regression model. The result of the p value is 0.0016.

| Table 2 Model Summary of Regression Model | ||||||

| R | R-sq | MSE | F | df1 | df2 | p |

| 0.5073 | 0.2573 | 0.7849 | 11.7792 | 1.0000 | 34.0000 | 0.0016 |

As shown in Table 3, the independent variable lending interest rate at p value of 0.0016 has a significant impact on the dependent variable non-performing loans. Regression coefficient of lending interest rate is 0.7871 which shows dependent variable is positively effected by the independent variable. One-degree increase in the value of the lending interest rate results in the increase of the dependent variable non-performing loans for 0.7871, which means if lending interest rate increases then NPLs also increase. Based on the result (H1) hypothesis is approved.

| Table 3 Model | ||||||

| Coeff | se | t | p | LLCI | ULCI | |

| Constant | 1.2194 | 0.7742 | 1.5750 | 0.1245 | -0.3541 | 2.7928 |

| X1LIR | 0.7871 | 0.2293 | 3.4321 | 0.0016 | 0.3210 | 1.2532 |

Indirect effects of X on Y by mediation variables are shown in Table 4. First indirect effect consists of X1LIR (Lending Interest Rate) → Mediated by M1DC (First Mediation Variable Detective Control) → YNPLs. The impact of LIR on NPLs is effected by M1DC = -0.1203 which means that the M1DC has effect on reducing NPLs by -0.1203. Based on the results, the hypothesis H1.1. is approved. Second indirect effect consists of X1LIR (Lending Interest Rate) → Mediated by M2PC (Second Mediation Variable Preventive Control) → YNPLs. The impact of LIR on NPLs is effected by M2DC = -0.0385 which means that the M2PC has effect on reducing NPLs by -0.0385. Based on the results, the hypothesis H1.2. is also approved. Whereas, the third indirect effect consists of X1LIR (Lending Interest Rate) → Mediated by M3CC (Third Mediation Variable Corrective Control) → YNPLs. The impact of LIR on NPLs is effected by M3CC = -0.0070 which means that the M3CC has effect on reducing NPLs by -0.0070. Based on the results, the hypothesis H1.3. is also approved.

| Table 4 Indirect Effect(S) of X on Y | ||||

| Effect | BootSE | BootLLCI | BootULCI | |

| TOTAL | -0.1203 | 0.0777 | -0.3079 | 0.0017 |

| Ind1 | -0.0074 | 0.0909 | -0.2841 | 0.0941 |

| Ind2 | -0.0385 | 0.0464 | -0.1363 | 0.0524 |

| Ind3 | -0.0070 | 0.0256 | -0.0739 | 0.0332 |

| Ind4 | -0.0316 | 0.0403 | -0.1004 | 0.0659 |

| Ind5 | -0.0182 | 0.0511 | -0.0980 | 0.1273 |

| Ind6 | -0.0096 | 0.0302 | -0.0933 | 0.0271 |

| Ind7 | -0.0079 | 0.0238 | -0.0595 | 0.0379 |

Additionally we have combined the indirect effects to see what the effect would be if there are two or three mediation variables included. The forth indirect effect which consists of X1LIR (Lending Interest Rate) → Mediated by M1DC (First Mediation Variable Detective Control) → M2PC (Second Mediation Variable Preventive Control) → YNPLs. The impact of LIR on NPLs is effected by two mediation variables M1DC → M2PC = -0.0316 which means that the combination of M1DC → M2PC has effect on reducing NPLs by -0.0316. While, the fifth indirect effect consists of X1LIR (Lending Interest Rate) → Mediated by M1DC (First Mediation Variable Detective Control) → M3CC (Third Mediation Variable Corrective Control) → YNPLs. The impact of LIR on NPLs is effected by two mediation variables M1DC → M3CC = -0.0182 which means that the combination of M1DC → M3CC has effect on reducing NPLs by -0.0182. The sixth indirect effect consists of X1LIR (Lending Interest Rate) → Mediated by M2PC (Second Mediation Variable Preventive Control) → M3CC (Third Mediation Variable Corrective Control) → YNPLs. The impact of LIR on NPLs is effected by two mediation variables M2PC → M3CC = -0.0096 which means that the combination of M2PC → M3CC has effect on reducing NPLs by -0.0096. The last indirect effect consists of X1LIR (Lending Interest Rate) → Mediated by M1DC (First Mediation Variable Detective Control) → M2PC (Second Mediation Variable Preventive Control) → M3CC (Third Mediation Variable Corrective Control) → YNPLs. The impact of LIR on NPLs is effected by three mediation variables M1DC → M2PC → M3CC = -0.0079, as a result the combination of M1DC → M2PC → M3CC has effect on reducing NPLs by -0.0079.

We can conclude that all mediation variables have effect on reducing NPLs. From Table 5 we can see that the best result or the highest effect on reducing NPLs comes from indirect effect two, Ind2 = -0.0385 or preventive control as mediation variable. While the highest effect from combined mediation variables comes from indirect effect 4, Ind4 = -0.0316, detective control and preventive control.

| Table 5 Indirect Effect Key |

| Ind1 X1LIR -> M1DC -> YNPLs |

| Ind2 X1LIR -> M2PC -> YNPLs |

| Ind3 X1LIR -> M3CC -> YNPLs |

| Ind4 X1LIR -> M1DC -> M2PC -> YNPLs |

| Ind5 X1LIR -> M1DC -> M3CC -> YNPLs |

| Ind6 X1LIR -> M2PC -> M3CC -> YNPLs |

| Ind7 X1LIR -> M1DC -> M2PC -> M3CC -> YNPLs |

Conclusion

The study attempted to identify, if the impact of lending interest rate on NPLs is effected by mediation variables of internal controls. The results support that lending interest rate has significant effect on NPLs at p value of 0.0016. While the results show that all three mediation variables detective, preventive and corrective control have effect on reducing the NPLs. The highest effect on reducing NPLs comes from indirect effect two (Ind2= - 0.0385) or preventive control as mediation variable. While the highest effect from combined mediation variables comes from indirect effect 4 (Ind4 = -0.0316), detective control and preventive control. As a result the four hypothesis are approved. Banks should pay attention to internal preventive control since it has the highest effect (Ind2= - 0.0385) on reducing the NPLs.

References

- Ghosh, A. (2015). Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. Journal of Financial Stability, 20, 93–104

- Dimitrios, A., Helen, L., & Mike, T. (2016). Determinants of non-performing loans: Evidence from Euro-area countries. Finance Research Letters, 18, 116-119.

- Hayes, A.F. (2013). Introduction to Mediation, Moderation, and Conditional Process Analysis, A Regression-Based Approach, New York, NY, The Guilford Press.

- Hayes, A.F. (2018). Introduction to Mediation, Moderation, and Conditional Process Analysis. A regression-Based Approach, New York, NY, The Guilford Press.

- Basel Committee on Banking Supervision (2012). The Internal Audit Function in Banks. Bank for International Settlements.

- Beck, R., Jakubik, P., & Piloiu, A. (2015). Key determinants of non-performing loans: New evidence from a global sample. Open Economies Review, 26, 525–550.

- Dube, D.P., & Gulati, V.P. (2008). Information System Audit and Assurance. Tata McGraw-Hill Publishing Company Limited.

- Espinoza R., & Prasad A. (2010). Nonperforming Loans in the GCC Banking System and their Macroeconomic Effects. International Monetary Fund, WP/10/224.

- European Central Bank (2017). Banking Supervision Guidance to Banks on Non-performing loans.

- Feinberg, F.M. (2012). Mediation analysis and categorical variables: Some further frontiers. Journal of Consumer Psychology, 22, 595–598.

- Gliem, J.A., & Gliem, R.R. (2003). Calculating, interpreting, and reporting cronbach’s alpha reliability coefficient for likert-type scales. Midwest Research to Practice Conference in Adult, Continuing, and Community Education.

- Messai, A. (2013). Micro and macro determinants of non-performing loans. International Journal of Economics and Financial Issues, 3(4), 852–860.

- Makri, V., Tsagkanos, A., & Bellas, A. (2014). Determinants of non-performing loans: The case of Eurozone. PANOECONOMICUS, 2, 193-206.