Research Article: 2022 Vol: 26 Issue: 1S

Effect of Bonus Plan, Debt Covenant, Firm Size and Tunneling Incentive on Tax Avoidance With Transfer Pricing as Intervening Variables

Mariolin A. Sanggenafa, Universitas Cenderawas

Eka Amania Majidah, Universitas Negeri Semarang

Citation Information: Sanggenafa, M.A., Majidah, E.A. (2021). Effect of bonus plan, debt covenant, firm size and tunneling incentive on tax avoidance with transfer pricing as intervening variables. Academy of Accounting and Financial Studies Journal, 25(S5), 1-09.

Abstract

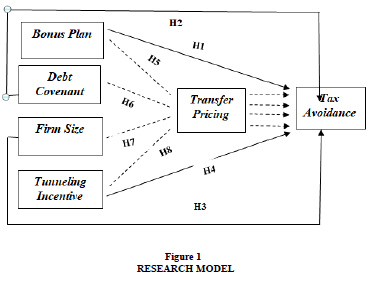

The purpose of this study was to examine the effect of bonus plans, debt covenants, firm size and tunneling incentives on tax avoidance with transfer pricing as an intervening variable. The research sample used was mining companies listed on the Indonesia Stock Exchange (IDX) for the 2014-2018 period as many as 50 companies were obtained by purposive sampling. The analytical method used in this research is multiple linear regression analysis with IBM SPSS Statistics 21 software and path analysis and multiple tests to test transfer pricing in mediating the relationship between bonus plans, debt covenants, firm size and tunneling incentives to tax avoidance. The results showed that the bonus plan and debt covenant had a negative and significant effect on tax avoidance. Firm size and tunneling incentives do not have a significant effect on tax avoidance. Whereas transfer pricing cannot mediate the relationship between bonus plans, debt covenants, firm size and tunneling incentives to tax avoidance.

Keywords

Bonus Plan, Debt Covenant, Firm Size, Tunneling Incentive, Tax Avoidance, Transfer Pricing.

Introduction

The most source of income received by Indonesia for the Budget (APBN) is from the taxes. Taxes can be the most influential source of capital for the advancement of the Indonesian economy. Every year efforts to optimize taxation are increasingly carried out by the Government of Indonesian in order to increase state revenue. However, in carrying out tax optimization efforts, the Indonesian government experienced several obstacles including the existence of tax avoidance practices carried out by taxpayers in order to minimize the burden of the amount of tax that must be paid.

Cases related to tax avoidance were carried out by PT Adaro Energy Tbk. PT Adaro is a company Air gait in the field of mining. PT Adaro me that other State practice tax avoidance by way of transfer pricing conducted from 2009 to 2017 through a subsidiary located in Singapore. Based on a report from Global Witness, PT Adaro uses a transfer pricing method by bringing profits obtained abroad with the aim of reducing tax payable to the Government of Indonesia. Global Witness found PT Adaro sells coal to a subsidiary of PT Adaro who was in Singapore that Coaltrade Services International at low price, to then be sold back to the price expensive. By using the so-called subsidiary, Global Witness managed to find a potential deposit of a lower tax than that owed to the Government of Indonesia see the value of 125 million US dollars. In addition, the Global Witness also accused that there was a role from the state of the tax protection that allowed PT Adaro to reduce the outstanding tax bill of US $ 14 million per year.

Asmirahanti (2018) conducted research on manufacturing companies listed on the Indonesia Stock Exchange (IDX) in 2013-2016 regarding the existence of a bonus plan that affects the practice of tax reporting avoidance and found that the bonus plan has a positive effect on tax reporting avoidance. Research from Rifan (2019) on the effect of bonus plans on tax avoidance also found the results of a positive influence between bonus plans on tax avoidance.

According to Shintya (2019), if the value of the comparison of debt or equity of a company is higher, then the chances of managers using accounting methods that can increase corporate profits are also increasing. This is in line with the positive accounting theory debt covenants hypothesis which states that when a company starts to violate a debt agreement, then the manager of company will choose a way to use accounting methods that can increase the company’s income and profits while still minimizing the company’s tax payable, where it is included in the category of tax avoidance activities.

Research from Puspita & Febrianti (2017) regarding tax avoidance which is influenced by firm size, found the result that tax avoidance is influenced by firm size. In addition, Cahyono et al. (2016) also found that tax avoidance is not influenced by firm size. Research from Lestari (2018) found that the tunneling incentive have an influence on tax avoidance. This statement is in line with research from Tang (2016) which supports that what can be an incentive for tax avoidance practices is tunneling.

Literature Review and Hypothesis Formulation

Agency theory and positive accounting theory are the theories used in this study. Agency theory is a theory that arises because of interests between different agents and principals. Agents and principals who are bound by a contractual relationship are only motivated in their own interest to think about profits (Sulistyawati et al., 2019). This difference in interests often creates a clash between the two, so agency problems arise.

Positive accounting theory is a theory that explains how the process of applying theories that have been understood, abilities, and knowledge about accounting. In addition, this theory also shows the truth about statements or accounting phenomena in accordance with facts and what they are objectively (Nurjanah et al., 2016). According to the positive accounting theory, there are three hypotheses earnings management hypothesis, namely the bonus plan hypothesis, the debt covenants hypothesis, and the political cost hypothesis.

Effect of Bonus Plan on Tax Avoidance

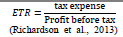

Bonus plan is used by a company to foster enthusiasm and motivate the performance of employees. If the manager manages to improve performance in order to achieve the company's goals, then a bonus will be given. Desai & Dharmapala (2004) conducted research and the results showed that what could be the most significant determinant of tax avoidance practice was the bonus plan. If the bonus plan is increasingly high, protection against taxation will be lower. This is because the company will try to minimize its tax burden and better be distributed as bonus expense. So, the greater the bonus plan, the greater the tendency for companies to do tax avoidance. In other words, the greater the bonus plan, the smaller the effective tax rate (ETR). The hypothesis that can be drawn from the description is.

H1: Bonus plan has a positive effect on tax avoidance

Debt Covenant on Tax Avoidance

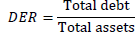

Rosa et al. (2017) a debt covenant is a debt agreement from a creditor and is intended for borrowers whose aim is to impose limits on actions that can jeopardize the value of credit assistance and return of aid. Based on the debt covenant hypothesis that when the debt agreement has been decided by the company, then the manager will make an effort to increase the company’s profits in order to minimize contract costs. In order to increase profits, the selection of accounting methods that can provide greater profits will tend to be used by managers and tax avoidance will tend to be done. So, the greater the debt covenant, the greater the tendency for companies to tax avoidance. In other words, the greater the debt covenants, the smaller the effective tax rate (ETR). Based on the explanation above, the hypothesis formulation is.

H2: Debt covenant has a positive effect on tax avoidance

Effect of Firm Size on Tax Avoidance

Firm size can categorize a company as big, medium or small. If a company has a size larger size, the resulting transactions activity will be more complicated so that the possibility of tax avoidance actions carried out by the company by using the gaps in each transaction will also be even greater. Darmawan & Sukartha (2014) conducted a study on tax avoidance that was influenced by company size in all companies listed on the IDX incorporated in the CGPI category in the 2010-2012 period and the results prove that tax avoidance is influenced by the company size. So the greater the firm size, the greater the tendency for companies to do tax avoidance. In other words, the greater the firm size, the smaller the effective tax rate (ETR). The hypothesis that can be formulated is.

H3: Firm size has a positive effect on tax avoidance

Effect of Tunneling Incentives on Tax Avoidance

Hartati et al. (2015) tunneling incentive is activity of transferring assets and profits of a company for the personal interests of the majority shareholders, but the cost incurred will be borne by the minority shareholders. Tunneling can aim to save taxes, namely by determining transfer pricing. In Lo et al. (2010) shows that the plan used by many companies to reduce the tax liabilities is to use transfer pricing. So as to reduce the tax burden and ultimately be included in tax avoidance activities. So, the greater the tunneling incentive, the greater the tendency for companies to do tax avoidance. In other words, the greater the tunneling incentive, the smaller the effective tax rate (ETR). The hypothesis that can be formulated is.

H4: Tunneling incentive has a positive effect on tax avoidance

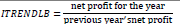

Effect of Bonus Plan on Tax Avoidance through Transfer Pricing

The relationship that occurs between bonuses and profits, where managers who have plans to get bonuses will be more inclined to choose accounting methods that can increase company profits have been explained by the bonus plan hypothesis, in positive accounting theory. The practice of transfer pricing is one way that can be used to increase profits. Research results from Saifudin & Putri (2018) prove that the bonus plan holds a positive influence on transfer pricing. And research from Amidu et al. (2017) found that tax avoidance is influenced by transfer pricing. So, the bigger the bonus, the bigger the tendency to do tax avoidance through transfer pricing. In other words, the bigger the bonus, the lower the transfer pricing tendency, so the ETR level. The hypothesis that can be formulated from the description above is.

H5: Bonus plan has a positive effect on tax avoidance through transfer pricing

The Effect of Debt Covenants on Tax Avoidance Through Transfer Pricing

According to the debt covenants hypothesis, it is explained that if a company approaches the violation of the debt agreement, the manager will tend to use accounting methods that can increase profits. In order to increase profits, efforts that can be made to transfer pricing. Nuradila & Wibowo (2018) conducted a study and found that debt covenants have an influence on transfer pricing. And research from Amidu et al. (2017) revealed the results that transfer pricing has an influence on tax avoidance. So, the greater the debt covenant, the greater the tendency to do tax avoidance through transfer pricing. In other words, the greater the debt covenant, the lower the tendency to transfer pricing so that the ETR level is low. The hypothesis that can be formulated from the description above is.

H6: Debt covenant has a positive effect on tax avoidance through transfer pricing

Effect of Firm Size on Tax Avoidance Through Transfer Pricing

According to Richardson et al. (2013), the tendency for manipulation involvement will be greater for companies with larger sizes. Because with companies that have a larger size will get higher profits, the tax burden owed by the company will also be high. Therefore, the tendency to avoid paying taxes will also be higher. Transfer pricing is a method used so that tax payments are low. This statement is reinforced by research from Nurjanah et al. (2016) that firm size has an influence on transfer pricing and the effect of transfer pricing on tax avoidance (Amidu et al., 2017). So, the greater the firm size, the greater the tendency to do tax avoidance through transfer pricing. In other words, the greater the firm size, the lower the tendency to transfer pricing so that the ETR level is low. The hypothesis that can be formulated from the above explanation is

H7: Firm size has a positive effect on tax avoidance through transfer pricing

Effect of Tunneling Incentives on Tax Avoidance through Transfer Pricing

Marfuah (2014) argues that the tunneling will be carried out by holders of a majority shareholders to temporarily transfer their assets to a subsidiary. The method that can be used is to implement transfer pricing practices. Transfer pricing is done aims to reduce corporate profits by reducing the burden on the company. If the company's profit decreases, the tax burden owed by the company will also be reduced. Research from Shintya (2019) shows that tunneling incentives have an influence on transfer pricing. Research from Amidu et al. (2017) also proves that tax avoidance is influenced by tunneling incentives. So, the greater the tunneling incentive, the greater the tendency to do tax avoidance through transfer pricing. In other words, the greater the tunneling incentive, the lower the tendency to transfer pricing so the ETR level is low. The hypothesis that can be drawn from the description above is

H8: Tunneling incentive has a positive effect on tax avoidance through transfer pricing

Research Method

This study uses quantitative research because in analyzing research data using statistics and in testing using the measurement of variables with numbers. The population taken in in this study are mining companies listed on the Indonesia Stock Exchange (IDX). The purposive sampling method is a method used in research sampling because in this study sample taking uses certain criteria and is equated with the objectives of this study. Moreover, the definition of Operational Variables was detailed in Table 1.

| Table 1 Definition Operational Variables |

||

| Variable | Definition | Indicator |

| Tax Avoidance | Efforts to minimize the tax burden owed by the company by using the loopholes that exist in tax laws and regulations. |  (Richardson et al., 2013) (Richardson et al., 2013) |

| Bonus Plan | Additional bonuses given to managers for good performance results. |  Santosa & Suzan (2018) Santosa & Suzan (2018) |

| Debt Covenant | Debt agreement that aims to keep the lender from the manager’s actions. |  Rosa et al. (2017) Rosa et al. (2017) |

| Firm Size | Description of how big, medium or small size of a company can be seen from the total assets of a company. | SIZE = Ln (Total Assets) Melmusi (2016) |

| Tunneling Incentive | Activities undertaken by the majority shareholder with the aim of transferring the wealth and profits it has left the company. |  Shintya (2019) Shintya (2019) |

| Transfer Pricing | Pricing activities for a production that is carried out between members of a department or between companies that have a special relationship. |  Kiswanto & Purwaningsih (2013) Kiswanto & Purwaningsih (2013) |

Table 2 showed the result of purposive sampling used for the research sample using 10 mining companies listed on the Indonesia Stock Exchange this 2014-2018 period. Moreover, the documentation technique in the form of annual report data is the data collection technique used in this study. While the study hypothesis used is multiple linear regression and path analysis using IBM SPSS Statistics 21. The multiple linear regression model in testing hypothesis in model 1 is Y = ρ 1 X 1 + ρ 2 X 2 + ρ 3 X 3 + ρ 4 X 4 + ρ 5 Z + e 1 and testing the hypothesis in model 2 is Z = ρ 1 X 1 + ρ 2 X 2 + ρ 3 X 3 + ρ 4 X 4 + e 2. Y = tax avoidance, X 1 = bonus plan, X 2 = debt covenant, X 3 = firm size, X 4 = tunneling incentive, Z = transfer pricing, ρ1 ρ2 ρ3 ρ4 ρ5 = regression coefficient, and e1, e2 = error.

| Table 2 Sample Criteria |

||||

| No | Information | Total | ||

|---|---|---|---|---|

| 1 | Mining companies listed on the Indonesian Stock Exchange | 47 | ||

| 2 | Mining companies which do not regularly publish annual report from 2014-2018 | (18) | ||

| 3 | Mining companies that suffered losses during the study period | (14) | ||

| 4 | Mining companies for which data information related to research variables are not present in the annual report | (5) | ||

| Total mining companies that became the study sample | 10 | |||

| Total of units of analysis for the period 2014 ? 2018 (10 x 5) | 50 | |||

The results of the SPSS output, this test is carried out through various stages that must be passed, namely as follows: first, conducting a classic assumption test in the form of a normality test, a multicollinearity test, a heteroskedasticity test, and an autocorrelation test. Second, do a descriptive statistical analysis that contains the average, maximum, and minimum samples. Meanwhile, to determine the effect of mediation, significance testing was performed using the Sobel Test. The level of significance used in this study was 0.05. If the results of the t value> t table and the significance value> 0.05, then there is no mediating effect and vice versa.

For descriptive statistics, Table 3 showed the minimum, maximum, mean and standard. Furthermore, Table 4 showed the hypothesis testing using multiple linear regression methods with a significance level used significance value of 0.05 (5%).

| Table 3 Descriptive Statistics |

||||||

| N | Minimum | Maximum | Mean | Std. Deviation | ||

| Bonus Plan | 50 | .10 | 28.35 | 2.5528 | 5.46319 | |

| Debt Covenant | 50 | .21 | .77 | .4540 | 0.14336 | |

| Firm Size | 50 | 17.20 | 21.24 | 19.4794 | 1.15624 | |

| Tunneling | 50 | .00 | .90 | .3160 | 0.29555 | |

| Transfer Pricing | 50 | .00 | .99 | .3327 | 0.34862 | |

| Tax Avoidance | 50 | .21 | 1.13 | .3338 | 0.14777 | |

| Table 4 Hypothesis Test Results |

|

| Hypothesis | p-value |

|---|---|

| X1 ? Y | 0.000 |

| X2 ? Y | 0.005 |

| X3 ? Y | 0.894 |

| X4 ? Y | 0.769 |

| X1-Z-Y | 0.099 |

| X2-Z-Y | 0.327 |

| X3-Z-Y | 0.128 |

| X4-Z-Y | 0.927 |

Table 4 reveals that H1 testing obtained a significance value of 0.000 (< 0.05) so that H1 was accepted. Based on these results it can be interpreted that companies that have high bonus plans do not necessarily carry out tax avoidance activities. If the bonus plan is high, the ETR will be low. The smaller the ETR value means that the tax avoidance by the company is bigger and vice versa the greater the ETR value the smaller the tax avoidance. This is not in line with the results of research from Desai & Dharmapala (2004) that the higher the bonus plan implemented in companies, the lower the tax supervision.

H2 testing obtained a significant value of 0.005 (< 0.05) so that H2 was accepted. Based on these results it can be interpreted that the company that has a high debt ratio, the lower the ETR value will be. If the ETR value is low, the company manager will try to increase the ETR by lowering the company's profit. Therefore, if the ETR is high then the tendency to avoid tax will also increase. These results do not agree with the debt covenant hypothesis that if a company's debt ratio increases, then the tendency of companies to renege on debt contracts by using accounting methods that can increase profits will also increase.

The significance value obtained from H3 testing was 0.894 (> 0.05). This states that H3 was rejected. This result can be interpreted that large companies do not necessarily take tax avoidance actions, and vice versa smaller companies also do not necessarily take tax avoidance actions. The results of this study reinforce the research from Mulyani et al., (2017)which argues that if firm size is not me have influence on tax avoidance.

H4 test results were rejected. This result can be seen from the significance value of 0.769 (> 0.05). This result can be interpreted that companies that have large tunneling incentives do not necessarily take tax avoidance, and vice versa. This results are not in line with the research of Tang (2016) that one of the tax avoidance incentives is tunneling. The statement is reinforced by the results of descriptive analysis of tunneling incentive and tax avoidance which shows that they are in the low category and indicate that tunneling incentive do not have a positive effect on tax avoidance.

H5 testing obtained a significance value of 0.099 (> 0.05). So H5 is rejected. This result states that tax avoidance is not influenced by the bonus plan through transfer pricing. These results indicate that if the bonus plan is high, then the ETR value will be low. If the ETR value is low, then the company manager will try to increase the ETR by lowering profits not by increasing profits. Research Wafiroh & Hapsari (2015) supports that the bonus plan does not affect the transfer pricing because the increase in profits of a company that has a fairly high ratio but the company that experienced an increase in profits is not indicated to do transfer pricing.

H6 testing obtained a significance value of 0.327 (> 0.05) which means that H6 was rejected. This result proves that tax avoidance is not influenced by debt covenants through transfer pricing. To loosen the limits of credit rules contained in debt covenants, mining companies do not use transfer pricing to make high profits. This is supported by research Indrasti (2016) that the practice of transfer pricing is not influenced by debt covenants.

H7 testing obtained a significance value of 0.128 (> 0.05) so that H7 was rejected. Generally, the public or investors will prefer to see companies that have a larger size as a material in comparison to investing. This makes the company's managers in submitting financial statements more careful and open so that the tendency to increase profits by transfer pricing is low.

H8 testing obtained a significance value of 0.927 (> 0.05) which means that H8 was rejected. Tunneling in research uses a proxy for foreign ownership. This result explains if foreign ownership does not utilize their voting rights to instruct managers to implement transfer pricing practices in the case of tax avoidance activities. This is reinforced by the results of research Saifudin & Putri (2018) that transfer pricing is not affected by tunneling incentives and the results of descriptive analysis also indicate that the transfer pricing action is still very low carried out by mining companies.

Conclusions

This study can be concluded that the bonus plan and debt covenants have an influence with a positive and significant direction on ETR or negative effect on tax avoidance. Firm size and tunneling incentive do not have a significant effect on tax avoidance. While the effect of bonus plans, debt covenants, firm size and tunneling incentives to tax avoidance is not mediated by transfer pricing.

For further researchers, other types of companies can be used as research samples, so the research sample is not limited to the mining sector. For further researchers, can use other variables that can affect tax avoidance and can be used as an intervening variable.

References

Amidu, M., Coffie, W., & Acquah, P. (2017). Transfer pricing, earnings management and tax avoidance of firms in Ghana. Journal of Financial Crime.

Cahyono, D.D., Andini, R., & Raharjo, K. (2016). Pengaruh Komite Audit, Kepemilikan Institusional, Dewan Komisaris, Ukuran Perusahaan, Leverage, dan Profitabilias terhadap Tindakan Penghindaran Pajak of Accounting, 2(2).

Desai, M.A., & Dharmapala, D. (2004). Corporate Tax Avoidance and High Powered Incentives.

Kiswanto, N., & Purwaningsih, A. (2013). Pengaruh Pajak, Kepemilikan Asing, dan Ukuran Perusahaan terhadap Transfer Pricing. Fakultas Ekonomi Universitas Atma Jaya.

Lestari, J. (2018). Pengaruh CSR, Tunneling Incentive, Kompensasi Rugi Fiskal, Kebijakan Hutang, Profitabilitas, dan Ukuran Perusahaan terhadap Tax Avoidance.

Melmusi, Z. (2016). Pengaruh Pajak, Mekanisme Bonus, Kepemilikan Asing, dan Ukuran Perusahaan terhadap Transfer Pricing. Ekobistek Fakultas Ekonomi, 5(2), 1–12.

Nurjanah, I., Isnawati, H., & Sondakh, A.G. (2016). Faktor Determinan Keputusan Perusahaan Melakukan Transfer Pricing.