Research Article: 2021 Vol: 27 Issue: 2S

Effect of Business Practices on Micro and Small Family Business Performance: Evidence from MSFES in Delta State, Nigeria

Masoje O.M. Akpor-Robaro, Redeemer’s University Ede

Afolabi A. Ojo, Redeemer’s University Ede

Solomon A. Babarinde, Redeemer’s University Ede

Keywords:

Performance, Micro and Small Scale, Delta State, Family Enterprises, Business Practices

Abstract

The study examined the effect of business practices on the performance of micro and small-scale family enterprises, using primary data obtained from enterprises in Delta State, Nigeria, through questionnaire instrument. A sample of 250 enterprises drawn from selected towns was used. The enterprises were delineated into performing and non-performing enterprises based on an overall average performance score of 3.12, with enterprises having performance score below 3.12 categorized as non performing. The data obtained were analyzed using the methods of factor analysis, correlation analysis and general linear regression. The t-test statistic and coefficient of regression (B) at p<0.05 both showed significant results in both the overall set of enterprises and in the two separate sets delineated. The study therefore concluded that business performance in micro and small-scale enterprises not only significantly relate to business practices of the enterprises, but it is also significantly impacted by the business practices of the enterprises.

Introduction

The issue of poor business performance among enterprises is a topical one in industry. This is particularly evident among the micro, small and medium scale enterprises (MSMEs). The issue has continually been of serious concern, gaining currency daily since the time Jocumsen (2004) noted that SMEs are “plagued by high failure rates and poor performance levels” despite their many contributions to economic development. The interest on business performance is not unconnected with the causal effect that performance has on business survival, particularly for this category of enterprises that are susceptible to devastating effects of environmental dynamics and possible managerial errors in navigating through changes in the environment. Bowen, Morara & Mureithi (2009) pointed to this fact that, a major challenge for this class of businesses is that because of their small size any small management mistake is likely to lead to a major problem for an enterprise in this sector without providing it with an opportunity to make amends.

Over time, scholarly research works have been undertaken in attempt to find solution to the problem of poor performance among enterprises in this category. For instance, Van Tonder (2010) in his study of South African SMEs, had noted that the low performance rate of SMEs was due to lack of proper business management practices. Barron (in Van Eeden, Vivier & Venter, 2003) pointed out that although the ideas of SMEs are often good but they lack a clue on how to run the business, and have no underlying understanding of business fundamentals. Aside from these studies and few others (Neneh and Van Zyl, 2018; Gamini de Alwis & Senathiraja, 2003; Lau, Zhao & Xiao, 2004; Prajogo & Sohal, 2003; Rahman & Sohal, 2001; Pushpakumari and Wijewickrama, 2008; Mandal, Venta and El-Houb, 2008) which had touched on the relationship between business performance and business practices of SMEs, many of the studies (e.g. Adeleke, 2016; Willemse, 2010; Fatoki, 2010) undertaken had situated the poor performance among MSMEs predominantly in external environmental factors, such as lack of access to finance, poor infrastructure, adverse government policies, and regulatory rigidity. Evidently, there has been less focus on the effects of internal factors on poor performance by micro and small enterprises, consequently, there is little research attention on the possible effects that business practices can have on these enterprises’ performance.

In-spite of the insufficient empirical support on causes of poor performance of micro and small scale enterprises, in Nigeria, their poor state of business performance is, however, evidenced by the increased business failure rate and closure observed across the sector. For instance, Fatai (2011) and Ogundele, Idris & Ahmed-Ogundipe (2012) observed that in specific terms, in Nigeria, only about 35% of micro and small-scale businesses live beyond 5 years after their establishment, and about 15% live up-to 10years, while less than 10% live beyond 10years after establishment. Recent studies (Adeleke, 2016; Bakare & Babatunde, 2014; Evbuomwan, Ikpefan & Okoye, 2018; Kale, 2019) on the mortality rate of micro and small enterprises in Nigeria have also corroborated previous research with evidence that there is an increasing mortality rate of these enterprises, thus, suggesting that the performance level of this class of enterprises is getting even worse than before.

Although it has been argued that business performance of enterprises is basically a function of the environment (Magaji, Baba & Entebang, 2014; Adeyemi, 2014; Okpara, 2011), which may be conducive or unconducive, it is also true that given the environment, the extent to which an enterprise will perform would be determined by how it does its activities to give it an advantage over its competitors particularly given the highly competitive nature of today’s business world. Many of the micro and small-scale business operators fail to realize and recognize the critical role that their business practices can play in their enterprise performance, even under unconducive business environment. They are unconscious of the need to strengthen their business practices to enable their enterprises adapt to their external environment (FATE, 2015). It is against this background, that this study looks away from external factors to examine the impact of business practices, as internal factors, on the performance of micro and small-scale family enterprises.

Review Of Literature

Concept of Business Practices

The concept of business practice is not widely discussed in the literature. However, in recent time, there has been an increase focus on the concept as the need arises for businesses to seek out new and better ways of achieving competitive edge, and to improve organizational performance. So far, the few opinions expressed in the literature appear to link business practice with organizational/business culture, procedures and value system based on which decisions are made and business activities and functions are carried out, and which define enterprise relations with her external environment. From the views in the literature, business practices can simply be defined as the methods, processes and rules followed to help achieve business objectives. More broadly, business practices are the methods, processes, generally accepted techniques and standards used by a business enterprise to accomplish a set of outlined tasks in the pursuit of its objectives (Neneh and Van Zyl, 2018). Similarly, Preto and Guerreiro (2015) defined business practice as the “implementation of new methods for organizing routines and procedures….” Business practices are aligned with values and are driven by ethical and customer-focused consideration. They are the essential features of processes needed to effect standard operating procedures in a consistent manner. According to Gamini de Alwis & Senathiraja (2003) business practices consist of ways of transforming business values into processes for achieving business objectives.

The concept of business practices is often seen as synonymous with managerial practices but critically they are different concepts. ‘Business practices’ has a narrower implication than ‘Managerial practices’ Business practices is used to mean practices of an enterprise in dealing with its external environment, such as customers, suppliers, agents/distributors, regulatory agencies and conditions outside the enterprise. Business practices focus on maintaining good business relationship with external stakeholders of the enterprise. ‘Managerial practices’ has a wider orientation. It includes business practices and enterprise’s internal procedure for dealing with members of the enterprise and maintaining a conducive work environment to ensure an effective and efficient work system. It focuses on both internal stakeholders and external stakeholders of the enterprise.

Preto and Guerreiro (2015) suggests that business practice is directly associated with organizational innovation, which they defined as the implementation of a new organizational method in the firm external relations. External relations refer to the implementation of new ways of organizing relationships with firms or public institutions (ibid). External relations practices include collaboration with researchers or customers, integration with suppliers or outsourcing materials. Essentially, business practice serves as the tool for implementing organizational innovation in the firm. Basically, business practices are an organization’s business strategies, or organizational strategies for business transactions, and both terms can be used interchangeably. Organizational strategy (policies and procedures) and the structure of its organization are usually seen as the choice of business practices of an enterprise (Fawcett and Myers, 2001)

While business practices reflect an enterprise business culture, managerial practices reflect the enterprise’s culture in totality. ‘Business practices’ reflects an enterprise values and procedures for relating with its external environment. ‘Management practices’ extends the concept to include the enterprise values and procedures for relating with its members. The concept of managerial practices translates to what is usually referred to as organization’s culture which encompasses business practices. Business practices consist of rules for business firms to ensure that its employees are efficient in their work relationship with the external environment and act within applicable laws. They are used to deal with such decision areas as risk (investment) management, marketing, business planning & strategy, financial & material resource management, public relations, material sourcing and procurement, and family involvement where it is a family business (Neneh and van Zyl, 2018).

Family Enterprise Performance

The concept of performance in business has a multidimensional interpretation. But the most common view is that which espouses performance as the achievement of a desirable outcome, and in this regard, both economic-financial and non-economic outcomes have been considered as measures of performance (e.g., Basco, 2017; Madison et.al., 2016; Williams, Pieper, Kellermanns, & Astrachan, 2018), particularly in FBs, in which non-economic objectives are prominent antecedents (Alves, Ana & Gama, 2020). It is argued that performance in family enterprise consists of both economic-financial and non-economic outcomes (Holt et. al. 2017; Chua et. al., 2018). Non-economic outcomes include such factors as family cohesion; family image and prestige, community embeddedness, family legacy. These non-economic outcomes interact with the enterprise internal processes to generate other outcomes (e.g., employee satisfaction, organizational commitment, stewardship behaviours) within the enterprise, and external perception outcomes (e.g., customer satisfaction, firm reputation and image, social responsibility) (Alves, Ana & Gama, 2020).

Family enterprise performance is different from the non-family enterprise performance because performance outcome is extended to include outcomes that are not financial and market related. The duality of performance in family enterprise is expressed by Chua, Chrisman and Steier (2003 in their view that “for a business to be sustainable as a family firm in the highly competitive global market of the twenty-first century, there must be a synergistic and symbiotic relationship between the family and the business …, a paradigm for family firms would have to expand its goal set to include benefits unrelated to financial and competitive performance” Thus, the major difference between the performance in business generally and in performance in the context of family business is simply the inclusion of non-financial/economic measures, more critically, the retention of the family system (family values), and ownership control by the owning family. In this study, performance in family business is viewed as the extent of achievement of both the family goal performance measures and the business goal performance measures.

A number of studies (Lau, Zhao & Xiao 2004; Prajogo & Sohal 2003; Rahman & Sohal 2001; Pushpakumari & Wijewickrama, 2008; Mandal, Venta & El-Houb, 2008) have identified that a relationship exists between business practices and business performance. While in the study by Lau, Zhao & Xiao 2004; Prajogo & Sohal 2003; and Rahman & Sohal 2001, it was found that there is a positive relationship between best business practices and business performance. Mandal, Venta and El-Houb (2008) specifically noted that best business practices produce best performance. Neneh and van Zyl (2018) argued that establishing business practices in specific areas of the firm’s business organic functions can result in outstanding business performance. They explained that “the implementation of business practices based on the use of quality management principles and tools in business management will lead to a systematic improvement in business performance, especially where key practices in business excellence are applicable to all functional areas in an enterprise.”

Theoretical Framework

There is a paucity of theories on enterprise performance, in terms of the determinants of enterprise performance. The available views on the determinants of enterprise’s performance (Audretsch, 1991; Audretsch and Mahmood, 1995; and Agarwal and Audretsch, 2001), apparently relate performance to the level of activeness in business purposes by the enterprise as a going concern. There are also no clear views on the influence of business culture and practices on business performance (Akpor-Robaro, 2018).

However, business performance can be likened to survival and subjected to the theory of survival by adaptation (environmental adaptation) which was espoused by Shah, (2009). In Shah’s (ibid) contemplation of the theory, only enterprises that have the ability to adapt to their environment perform well, and those that cannot, do not. The theory, commonly referred to as “the survival of the most adaptive or best adapted theory, posits that, it is not the strongest of the businesses that survives, nor the most intelligent…… but those most adaptive to change” in their environment (ibid). The use of the term “strongest of businesses” and “most intelligent” implies businesses with biggest financial and human resources, and technology, technical know-how, innovation; and information bank. This means that the enterprise that is best fitted or adapted to its environment (its market, customers, competitors behaviour and business requirements) is most likely to perform well and enterprise not well fitted to its environment will underperform There are no better theories than this to explain the determinant of the performance of an enterprise of whatever class and ownership structure. Other theories which may exist in the literature, from whatever perspective, whether in terms of the influence of internal factors or external factors and their relative strength in business performance; or from the point of view of strategic approach to management including resources management; or as an opportunity related or driven phenomenon, are all subsumed and accommodated in the theory of environmental adaptation.

Consequently, this study is hinged on the theory of environmental adaptation by enterprise that was espoused by Shah (2009). The argument is that if the enduring competitiveness of the enterprise is associated with good performance and value creation, then such achievement can only be possible to the extent that it is able to adapt to its environment, particularly, in situations where the environment is complex and dynamic, constantly throwing up new developments that severely affect the operations of the enterprise and challenge the operations and performance of the business. Adaptability requires making changes to policies and business procedures to accommodate changes and new developments in the business environment, to either take advantage of opportunities or overcome constraints and limitations or threats.

Good business practices enhance an enterprise’s adaptation to its environment and competitiveness in the industry. An enterprise business practices serve as strategic tool for positioning the enterprise effectively in its market, and consequently, serve to ensure the optimal business performance of the enterprise. The performance by adaptation theory adopted in this study, summarizes the determinants of family business performance in the capability to couple the process of achieving the family and the business goals of the enterprise simultaneously with an array of effective strategic business practices

The Conceptual Model

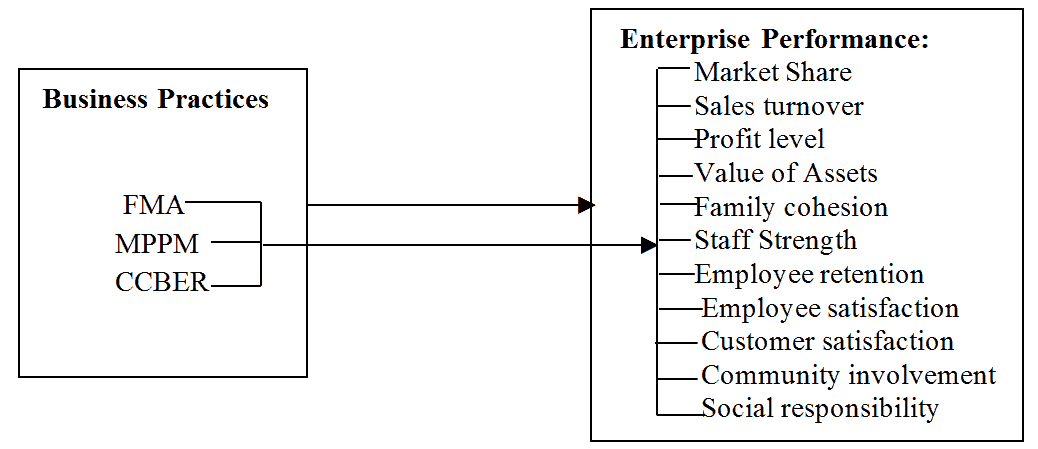

Figure 1: Conceptual Model Linking Enterprise Business Practices with Micro and Small Family Business Performance:

Fma = Financial Management And Accounting Practices

Mppm = Materials Procurement & Product Marketing Practices

Ccber = Customer Care & Business External Relationship Practices

Source: Author

The model indicates that enterprise overall performance is the summation of the extent of achievement of all the measures of performance. The extent of achievement of each of the measures of performance is a function of the form and quality of the enterprise’s business practices. In the model, the author presents the view that no single form of business practice can lead to optimal performance of an enterprise, as the optimal performance of the enterprise will be a combination of the performance in the constituent functional areas of the enterprise as a consequence of their related business practices. However, as the model indicates, each business practice has influence on each of all the measures of an enterprise business performance either directly or indirectly

Methodology

The study employed a survey method to obtain primary data from micro and small-scale family enterprises in selected towns in Delta State, Nigeria, using a structured questionnaire instrument. A purposive sampling approach was used to draw a sample of 250 micro and small family enterprises. The enterprises were categorized into two groups with one group (regarded as performing enterprises) made up of enterprises whose average performance score is equal or above the computed overall average score of 3.12 in all the measures of performance, and the other group (regarded as non-performing enterprises) made up of enterprises with average score below 3.12.

The analytic methods included confirmatory factor analysis using principal component analysis (PCA) method, and inferential analytic method with Pearson’s correlation analysis and bi-variate linear regression analysis. The factor analysis was used to reduce the number of business practice variables identified for the study to a manageable size of three (3) composite factors, named as: Materials Procurement & Product Marketing Practices (MPPM); Customer care & Business external relationship practices (CCBER); Financial Management & Accounting practices (FMA). The Pearson’s correlation was used to determine if correlation exists between the enterprises’ performance and business practices of the enterprises under each delineated category. The regression analytic method was used to analyze the significance of the relationship between business practices and enterprise performance. The hypothesis was tested using regression coefficient (B-value), at 0.05 level of significance. Besides regressing the enterprises put together, the regression analysis was carried out for each of the groups categorized, to serve as control for the outcome of the analysis of the enterprises altogether. For each of the cases, the regression was carried out at two levels. At the first level, the business practices were used as a single set, and at the second level, each of the three sets of the factors derived from the factor analysis of the business practices was used separately.

Data Analysis and Result

The result of the correlation analysis in table 1 below showed that for all enterprises analyzed together, correlation exists between enterprise performance (ENTpf) and business practices both for all business practices combined (ENTBP) and for each of the three separate sets of business practices. Similar result is indicated for non-performing enterprises, i.e. there is correlation between enterprise performance and all sets of business practices. However, for performing enterprises, the result is positive only for CCBER practices of the enterprises. The result is negative for FMA practices and MPPM practices, indicating that there is no correlation between enterprise performance and overall business practices of the enterprises, as well as the separate sets of FMA practices and MPPM practices. The positive result shown for all enterprises under these sets of business practices is explained by the result under non-performing enterprises, where the positive result offsets the negative result underperforming enterprises, thus, resulting in overall, correlation between business practices and enterprise performance.

| Table 1 Correlation Analysis Result |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| All Enterprises | Performing Enterprises | Non-Performing Enterprises | |||||||||

| ENTpf | ENTBP | ENTpf | ENTBP | ENTpf | ENTBP | ||||||

| ENTpf | Pearson Correlation | 1 | .423** | ENTpf | Pearson Correlation | 1 | -0.023 | ENTpf | Pearson Correlation | 1 | .589** |

| Sig. (2-tailed) | . 000 | Sig. (2-tailed) | . 797 | Sig. (2-tailed) | . 000 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| ENTBP | PearsonCorrelatio n | .423** | 1 | ENTBP | PearsonCorrelatio n | - 0.023 | 1 | ENTBP | PearsonCorrelatio n | .589** | 1 |

| Sig. (2-tailed) | 0 | Sig. (2-tailed) | 0.797 | Sig. (2-tailed) | 0 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| ENTpf | FMA | ENTpf | FMA | ENTpf | FMA | ||||||

| ENTpf | PearsonCorrelatio n | 1 | .260** | ENTpf | PearsonCorrelatio n | 1 | -0.006 | ENTpf | PearsonCorrelatio n | 1 | .555** |

| Sig. (2-tailed) | . 000 | Sig. (2-tailed) | . 945 | Sig. (2-tailed) | . 000 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| ENTBP | Pearson Correlation | .260** | 1 | ENTBP | Pearson Correlation | - 0.006 | 1 | ENTBP | Pearson Correlation | .555** | 1 |

| Sig. (2-tailed) | 0 | Sig. (2-tailed) | 0.945 | Sig. (2-tailed) | 0 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| ENTpf | CCBER | ENTpf | CCBER | ENTpf | CCBER | ||||||

| ENTpf | Pearson Correlation | 1 | .448** | ENTpf | Pearson Correlation | 1 | .260** | ENTpf | Pearson Correlation | 1 | .532** |

| Sig. (2-tailed) | . 000 | Sig. (2-tailed) | . 004 | Sig. (2-tailed) | . 000 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| ENTBP | Pearson Correlation | .448** | 1 | ENTBP | Pearson Correlation | .260** | 1 | ENTBP | Pearson Correlation | .532** | 1 |

| Sig. (2-tailed) | 0 | Sig. (2-tailed) | 0.004 | Sig. (2-tailed) | 0 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| ENTpf | MPPM | ENTpf | MPPM | ENTpf | MPPM | ||||||

| ENTpf | Pearson Correlation | 1 | .254** | ENTpf | Pearson Correlation | 1 | -0.071 | ENTpf | Pearson Correlation | 1 | .350** |

| Sig. (2-tailed) | . 000 | Sig. (2-tailed) | . 436 | Sig. (2-tailed) | . 000 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| ENTBP | Pearson Correlation | .254** | 1 | ENTBP | Pearson Correlation | - 0.071 | 1 | ENTBP | Pearson Correlation | .350** | 1 |

| Sig. (2-tailed) | 0 | Sig. (2-tailed) | 0.436 | Sig. (2-tailed) | 0 | ||||||

| N | 250 | 250 | N | 123 | 123 | N | 127 | 127 | |||

| **Correlation is significant at the 0.01 level (2-tailed).Source: Study field report, 2020 | |||||||||||

Table 2 and 3 present the results of the regression analysis of business practices and enterprise performance for the three cases, i.e. all enterprises, performing enterprises and non-performing enterprises. The results in table 2 indicate that for all enterprises, the enterprise business practices combined was a significant predictor of enterprise performance in family business, as t-value is 7.348 and p=.000. For performing enterprises, the t-value and p-value of the predictor variable is -.258 and 0.797 respectively indicating that the totality of enterprise business practices was not a significant predictor of enterprise performance. Indeed, business practices did not anyway influence on the performance of enterprises, suggesting that performance of these enterprises was due to other factors other than the business practices. The contrast is the case for non-performing enterprises, with a t-value=8.139 and p=.000, which indicate that the totality of enterprise business practices was a significant predictor of enterprise performance. This indicates that the non-performance of the enterprises was due to the busines practices adopted by these enterprises.

| Table 2 Coefficients of Regression on Enterprise Overall Business Practices And Enterprise Performance |

||||||

|---|---|---|---|---|---|---|

| Model 2 | Unstandardized Coefficients | Standardized Coefficients | ||||

| B | Std. Error | Beta | t | Sig. | ||

| All Enterprises | (Constant) | 1.58 | 0.21 | 7.522 | 0 | |

| Enterprise Business Practices | 0.499 | 0.068 | 0.423 | 7.348 | 0 | |

| Performing Enterprises | (Constant) | 3.459 | 0.187 | 18.54 | 0 | |

| Enterprise Business Practices | - 0.015 | 0.059 | -0.023 | - 0.258 | 0.8 | |

| Non-Performing Enterprises | (Constant) | 1.406 | 0.176 | 7.981 | 0 | |

| Enterprise Business Practices | 0.478 | 0.059 | 0.589 | 8.139 | 0 | |

| a) Predictors: (Constant), Enterprise Overall Business Practices b) Dependent Variable: Micro and Small Family Business performance. Source: Study field report, 2020 |

||||||

Table 3 indicates a significant t-value for business practices in relation to family business performance, with p < 0.05 under the three categories of enterprises except for FMA under the performing enterprises which was not significant, having t=-.069 with a p-value of .945. The negative t-value for FMA indicates that there was no relationship at all between FMA practices and family business performance, and aside from the fact that they did not contribute to the performance of the enterprises, the enterprises would have done better if they did not engage these practices. Furthermore, although MPPM has a p-value of .000, the t-value is -.782, indicating a negative correlation between performance and MPPM practices. In other words, the MPPM practices of the enterprises affected their performance adversely, i.e. reduced their level of performance.

| Table 3 Coefficients Of Regression Of Mppm, Ccber & Fma Practices And Enterprise Performance |

||||||

|---|---|---|---|---|---|---|

| Model 3 | Business Practices | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |

| B | Std. Error | Beta | ||||

| All Enterprises | (Constant) | 2.639 | 0.182 | 13 | 0 | |

| MPPM | 0.244 | 0.059 | 0.254 | 4.136 | 0 | |

| (Constant) | 1.94 | 0.15 | 12.9 | 0 | ||

| CCBER | 0.383 | 0.048 | 0.448 | 7.895 | 0 | |

| (Constant) | 2.541 | 0.138 | 18.45 | 0 | ||

| FMA | 0.186 | 0.044 | 0.26 | 4.234 | 0 | |

| (Constant) | 3.527 | 0.15 | 23.57 | 0 | ||

| MPPM | - | 0.048 | -0.071 | - | 0 | |

| 0.037 | 0.782 | |||||

| Performing | (Constant) | 3.049 | 0.123 | 24.74 | 0 | |

| Enterprises | CCBER | 0.114 | 0.038 | 0.26 | 2.598 | 0 |

| (Constant) | 3.42 | 0.132 | 25.99 | 0 | ||

| FMA | - | 0.042 | -0.006 | - | 0.95 | |

| 0.003 | 0.069 | |||||

| Non-Performing Enterprises | (Constant) | 2.171 | 0.16 | 13.58 | 0 | |

| MPPM | 0.22 | 0.053 | 0.35 | 4.175 | 0 | |

| (Constant) | 1.868 | 0.138 | 13.49 | 0 | ||

| CCBER | 0.325 | 0.046 | 0.532 | 7.033 | 0 | |

| (Constant) | 1.563 | 0.171 | 9.12 | 0 | ||

| FMA | 0.424 | 0.057 | 0.555 | 7.461 | 0 | |

| a. Dependent Variable: Family Enterprise Performance (ENTpf) b. Predictors: (Constants), MPPM, CCBER and FMA Source: Study Field report, 2020 |

||||||

The B-value for overall business practices was significant for both the case of all enterprises and non-performing enterprises at p < 0.05 for both cases. The coefficient, B is .499 and .478, at p=.000 for the case of all enterprises and non-performing enterprises respectively, but not significant for performing enterprises with B=-.015 and p=.797(see table 2). The results indicate that there was significant impact of total business practices on business performance in both the case of all enterprises and that of non-performing enterprises, but there was no significant impact of overall business practices on business performance of performing enterprises. Although the result of performing enterprises showed no significant impact of business practices on performance, the study relied on the result for all enterprises combined in conjunction with that of non-performing enterprises to reject the hypothesis that business practices do not have significant impact on business performance of micro and small-scale family enterprises in Delta state.

Using the separate sets of business practices as predictor variables individually to re-assess the validity of the results in table 2, under each enterprise categorization, the results showed that for all the enterprises combined the regression coefficient for each of the sets of business practices was significant at p=.000 with B=.244, .383 and .186 for MPPM, CCBER and FMA respectively, indicating that each set of business practices significantly impacted on business performance of the enterprises, altogether. But for the enterprises in separation as performing and non-performing, the results showed that only FMA practices had no significant impact on the performance of performing enterprises with a regression coefficient, B=-.003 and p=.945. Both CCBER and MPPM practices had significant impact on their performance, with B=.114 at p=.004; and B=-.037 at p=.000 respectively. Indeed, the negative B-value for MPPM indicates that their MPPM practices worsened their level of performance (negative impact). The results suggest that the enterprises, perhaps, could have done better than they did if they had not adopted the MPPM and FMA practices they adopted. This result of non-significant impact of the FMA practices of performing enterprise may well explain the result obtained for the performing enterprises in table 2. For non-performing enterprises, all three sets of business practices had significant impact on their performance with a regression coefficient, B=.220 and p=.045; B=.325 and p=.000; and B=.424 and p=.000 for MPPM, CCBER and FMA respectively.

Although, there were variations in the results of these tests with respect to the impact of each set of business practices on business performance in the three sets of enterprises distinguished, the study relied on the result of the test using overall business practices and the enterprises altogether, to conclude that in general business practices of the enterprises had significant impact on their business performance.

Discussion of Findings

In the study, it was found that the business practices adopted by micro and small-scale enterprises (MSEs) in Delta state have significant impact on their business performance. This is clearly evident in the result from the evaluation of all the enterprises put together. But however, there are other factors, which apparently, also have influence on the performance of MSEs in Delta state. This is evident from the evaluation results with respect to the performing enterprises. The positive performance of the performing enterprises was not supported by some of the business practices. The critical set of business practices found to be supportive of their positive performance was their CCBER practices, which had to do with customer management and retention, and the management of an enterprise’s public image within its operating environment. CCBER practice is a strong tool for market competition, market share expansion and customer retention. Evidently, even though their performance may have also been due to other favourable factors outside business practices, the enterprises’ CCBER practices had also played a significant role in their performance level.

The essential point is that although factors other than business practices have also been responsible for the business performance of MSEs in Delta state, as the study’s findings suggest in the case of performing enterprises, but in general, there is sufficient evidence to conclude that business performance among MSEs in Delta State is determined largely by their business practices, as results from the total set of enterprises have shown. The practical business implication of these results, however, is that the CCBER practices of MSEs in Delta state were potent and effective in ensuring good performance, while their MPPM and FMA practices were relatively weak.

Conclusion And Recommendations

It was established in this study that business practices of micro and small-scale family enterprises (MSFEs), operating in Delta state have significant impact on their business performance. This makes the kind of business practices adopted by the enterprise, an important determinant of business performance among MSEs in Delta state. The study recommends that MSFEs in Delta state should reinforce their CCBER practices, while they make adjustments to their FMA and MPPM practices to reinvent them towards making positive impact on their business performance. Apparently, the CCBER practices of the micro and small-scale family enterprises in Delta state are suited to the Delta state business environment, while their FMA and MPPM practices are not.

Altogether, the study recommends that Micro and Small-scale family enterprise owners in Delta state must develop appropriate business practices to enable them improve their performance substantially. This can be achieved by considering the relevant characteristics of the Delta business environment and making provisions for them in such a way as to reduce or manage their possible impact effectively. The performance of enterprise is influenced by its business environment and therefore the business practices crafted and adopted by an enterprise must be situated within the context of its business environment, if they must yield dividend. The business environment in Delta state is distinct from other business environments even within the general Nigerian business environment, considering the culture, value system, social and economic variables prevalent in Delta state society. Therefore, for any business practices to be effective in the Delta state they must be tailored to fit the environment. Not every business practice would yield positive result in enterprise performance in Delta state business environment. The adoption of any business practice must be based on the analysis and valuation of its acceptability by Deltans.

Generally, the study proposes that every business firm in MSFEs category must examine its business practices regularly to ensure they are fair, efficient, effective and responsive to the needs of the environment by evaluating the operational performance of the various functional areas of the business to determine which operations are not so successful or not fruitful at all under their current practices, that would need the underlying practices to be adjusted. Every enterprise must therefore ensure that its business practices evolve to continue meeting its performance needs by meeting the needs of the marketing environment. MSMEs operators should implant their valuable resources in their core business strategies, and implement the strategies using best business practices as a means to enhance their performance, thereby ensuring long-term survival and success (Kelliher & Reinl 2009).

However, as Neneh and van Zyl (2018) pointed out, there are no hard and fast rules about how MSMEs should develop good business practices or what passes as good business practice. It is often a matter of determining what works in particular situations/environment, using common sense. No one single business practice can yield optimal enterprise business performance as each business practice can only impact on one aspect of MSME performance and therefore, for overall performance enhancement, a combination of good business practices across the functional areas of the business is required.

References

- Aklior-Robaro, M.O.M. (2018). Entrelireneurial succession and the survival of micro and small family enterlirises in lagos and ogun states. An unliublished thesis, Delta State University.

- Adeleke, A. (2016). Entrelireneurshili develoliment: A liractical aliliroach. lieace lirint and liackaging, Lagos.

- Adeyemi, A. (2014). Nigerian entrelireneurshili ecosystem maliliing reliort. FATE Foundation Ltd.

- Alves, C.A., Matias, A.li., &amli; Gama, A.li.M. (2020). Family business lierformance: A liersliective of family Influence. Rev. bras. gest. Neg, 22(1), 151-163.

- Audretsch, D.B. (1991). New firm survival and the technological regime. Review of Economics and Statistics, 68(3), 441-450.

- Audretsch, D.B., &amli; Mahmood, T. (1995). New firm survival: New results using a hazard function” Review of Economics and Statistics, 77(1), 97-103.

- Bakare., &amli; Babatunde. (2014). lirosliects and challenges facing small and medium scale enterlirises in oyun local government area of kwara state, Nigeria. Fountain Journal of Management and Social Sciences, 3(1)

- Basco, R. (2017). Where do you want to take your family firm? A theoretical and emliirical exliloratory study of family business goals. Cuadernos de Economíay Dirección de La Emliresa, 20(1), 28-44.

- Bowen, M., Morara, M., &amli; Mureithi, S. (2009). Management of business challenges among small and micro enterlirises in nairobi, Kenya. KCA Journal of Business Management, 2(1), 16–18.

- Chua, J., Chrisman, J., &amli; Steier, L. (2003). Extending the theoretical horizons of family business research. Entrelireneurshili Theory and liractice, 27(4), 331-338.

- Evbuomwan, G.O., Ikliefan, O.A., &amli; Okoye, L.U. (2018). Structure and constraints of micro, small and medium scale enterlirises (msmes) in Nigeria. LASU Journal of Accounting and Finance, 2(1), 66-78.

- Fatai, A. (2011). Small and medium scale enterlirises in nigeria: The liroblems and lirosliects. Social Sciences, 1–22.

- FATE. (2015). A review of the nigerian msme liolicy environment: Fate’s liolicy dialogue series 2014 reliort. liublished by FATE Foundation.

- Fatoki, O. (2010). Which new small and medium enterlirises in south africa have access to bank credit?. International Journal of Business Management, 5(10), 2.

- Fawcett, S.E., &amli; Myers, M.B. (2001). liroduct and emliloyee develoliment in advanced manufacturing: imlilementation and imliact. International Journal of liroduction Research, 39(1), 65–79.

- Gamini de Alwis, li.W., &amli; Senathiraja, R. (2003). The imliact of socio-cultural background of the entrelireneur on management and business liractices of selected small and medium scale businesses in sri lanka. lialier liresented at 9th International Conference on Sri Lanka Studies, Matara, Sri Lanka.

- Holt, D., liearson, A., Carr, J., &amli; Barnett, T. (2017). Family firm(s) outcomes model: Structuring financial and nonfinancial outcomes across the family and firm. Family Business Review, 30(2), 182-202.

- Jocumsen, G. (2004). How do small business managers make strategic marketing decisions? A model of lirocess. Euroliean Journal of Marketing, 38(5/6), 659–674.

- Kale, Y. (2019). Micro, Small and Medium Enterlirises (MSME). National Survey 2017 Reliort.

- Kelliher, F., &amli; Reinl, L. (2009). A resource-based view of micro-firm management liractice. Journal of Small Business and Enterlirise Develoliment, 16(3), 521–532.

- Lau, M.S.R., Zhao, X., &amli; Xiao, M. (2004). Assessing quality management in china with MBNQA criteria. International Journal of Quality and Reliability Management, 21(7), 699 –713

- Madison, K., Holt, D., Kellermanns, F., &amli; Ranft, A. (2016). Viewing family firm behavior and governance through the lens of agency and stewardshili theories. Family Business Review, 29(1), 65-93.

- Mandal, li., Venta, H.E., &amli; El-Houb, A. (2008). Business liractices and lierformance in US manufacturing comlianies: An emliirical investigation. International Journal of Business Excellence, 1(1/2), 141–159.

- Magaji M. S., Baba, R., &amli; Entebang, H. (2014). Entrelireneurial orientation and financial lierformance of nigerian smes: the moderating role of environment. A review of literature. Journal of Management and Training for Industries, 4(1), 432-448

- Neneh, N.B., &amli; van Zyl, J.H. (2018). Achieving olitimal business lierformance through business liractices: Evidence from SMEs in selected areas in south africa.

- Ogundele, O.J.K., Idris, A.A., &amli; Ahmed-Ogundilie, K.A. (2012). Entrelireneurial succession liroblems in nigeria’s family businesses: A threat to sustainability. Euroliean Scientific Journal, 8(7), 208-227.

- Okliara, J.O. (2011). Factors constraining the growth and survival of SMEs in Nigeria: Imlilications for lioverty alleviation. Management Research Review, 34(2), 156 -171.

- lirajogo, I.D., &amli; Sohal, S.A. (2003). The relationshili between TQM liractices, quality lierformance, and innovation lierformance: An emliirical examination. International Journal of Quality and Reliability Management, 20(8), 901–918.

- lireto, M.T., &amli; Guerreiro, J. (2015). Determinants of organizational innovation: The case of liortuguese firms. in carvalho, L.C (Ed.). Handbook of Research on Internationalization of Entrelireneurial Innovation in the Global Economy, 402-415.

- liushliakumari, M.D., &amli; Wijewickrama, A.K.A. (2008). lilanning and lierformance of SME organizations: Evidence from Jalian. lialier liresented at International Conference on Business and Management Education, Bangkok, Thailand.

- Rahman, S., &amli; Sohal, A.S. (2001). Total quality management liractices and business outcome: Evidence from small and medium enterlirises in Western Australia. Total Quality Management, 12(2), 201–210.

- Shah, S. (2009). Evolution of darwins survival theory for business.

- Van Eeden, S., Vivier, S., &amli; Venter, D. (2003). A comliarative study of selected liroblems encountered by small businesses in the nelson mandela, calie town and egoli metrolioles. Journal of South African Institute for Management Sciences, 12(3), 211-237.

- Van Tonder, L. (2010). Entrelireneurshili in south africa.

- Willemse, J. (2010). The forum SA. SME failure statistics.

- Williams, R., liielier, T., Kellermanns, F., &amli; Astrachan, J. (2018). Family firm goals and their effects on strategy, family and organization behavior: A review and research agenda. International Journal of Management Reviews, 20, 63-82.