Research Article: 2023 Vol: 27 Issue: 6

Effect of Credit Risk Management on Loan Performance of Commercial Banks: A Case Study of Gcb Bank

Edward Attah-Botchwey, University of Professional Studies Accra

Kofi Kodua Sarpong, University of Professional Studies Accra

Josephine ofosu Mensah-Ababio, University of Professional Studies Accra

Mary Essiaw, University of Professional Studies Accra

Randy Roland Barnor, University of Professional Studies Accra

Citation Information: Botchwey, E., Sarpong, K., Ababio, J., Essiaw, M., & Barnor, R. (2023). Effect of credit risk management on loan performance of commercial banks: A case study of gcb bank. Academy of Accounting and Financial Studies Journal, 27(S6), 1-29.

Abstract

The banking sector is a wealth-creating sector in all economies, with commercial banks playing a significant role in the development and growth of many local businesses. Credit Risk Management (CRM) is key to a bank's success, as it determines whether a borrower is creditworthy or not. To mitigate credit risk, banks must develop effective strategies like hedging, diversification, and capital adequacy ratio management. This study will analyze GCB Bank's case to determine how credit risk management influences the loan performance of commercial banks. The research method used in this study was a survey that had both descriptive and exploratory features. To determine the sample size, the Yamane formula was used. Therefore, the study randomly sampled 248 respondents out of 650 for data collection. The questionnaire was the research instrument used for collecting data. The survey mainly consisted of closed-ended questions. Descriptive statistics such as frequency, mean, percentage, standard deviation, and mean were all computed using Microsoft Excel. The study's findings reveal a satisfactory performance by GCB Bank in risk avoidance, risk monitoring, and loan performance, as perceived by the respondents. However, opportunities for improvement were highlighted, specifically in the technical feasibility and credit rating components of risk avoidance, regulatory compliance within risk monitoring, and the management of loan default rate in terms of loan performance. Therefore, while the bank's strategies are generally effective, enhancements in these areas could contribute to an even better overall performance. The study recommends enhancing the analysis of credit history in risk avoidance, emphasizing economic and market conditions in risk monitoring, and improving customer service and incentivizing timely loan repayments to improve loan performance.

Keywords

Banking Sector, Commercial Banks, Customer Service, Credit Risk, GCB Bank.

Introduction

Background of The Study

The provision of both short-term and long-term loanable funds as well as other critical services to businesses, government agencies, and individual customers makes the banking sector a wealth-creating sector in all economies, developed or developing. According to Saula et al. (2023), a study conducted in Ghana found that, when compared to funding from other financial institutions, commercial bank funding improved the profitability of small and medium-sized enterprises (SMEs). From the findings of Anane et al. (2023), banks in Ghana played a significant role in the development and growth of many local businesses. This, among other things, shows how important commercial banks, also known as the banking sub-sector, are to Ghana's economy.

Any commercial bank's beating heart can be thought of as Credit Risk Management. It is crucial to a bank's success because it determines whether a borrower is creditworthy or not (Bet et al., 2023). According to Joshi et al. (2023), the lack of a proper loan classification system is the most common cause of bad loans, though this is not the only cause. In this way, bad loans can be identified quickly, and preventative measures can be taken to lessen the likelihood of default and the resulting losses. Understanding the significance of credit risk and developing effective strategies like hedging, diversification, and capital adequacy ratio management are crucial to the success of financial institutions.

Banks face serious challenges from loan defaults, even if by just a few substantial customers. Such credit risks fundamentally affect a bank's performance. Credit Risk Management (CRM) concentrates on elevating the bank's return rate, accounting for costs. It achieves this by curbing credit risk exposure to acceptable levels for the bank's shareholders (Thamae et al., 2023).

It's crucial for banks to manage both internal credit risk linked to their portfolio and external risks resulting from economic conditions. Comparing credit risks with other risks is also a necessity for these institutions. There's also a credit risk in settling financial transactions; failure to settle payments on time results in missed opportunities. The bank may adapt its risk management strategies to manage credit risk, taking corporate governance into account. Recent studies suggest proactive planning to avoid future issues (Obi, 2023).

The loan performance of a commercial bank mirrors its ability to recover its initial loan investments from borrowers. It's a testament to how well a bank manages its credit risk. Poor credit risk management leading to a high percentage of non-performing loans can jeopardize a bank's profitability and security (Apergis, 2023). Each bank competes by assessing loan applications and deciding on an applicant's creditworthiness based on its lending standards (An et al., 2023). However, it's virtually impossible for a bank to know its rivals' credit policies in a fiercely competitive industry. Proper credit risk management is vital for a bank's growth and survival, as emphasized by Fujiwara (2023). Further, Nyebar et al. (2023) stress that banks face heightened credit risk due to their unique clientele and operating circumstances.

A commercial bank's ownership, credit policy, credit scoring system, regulatory environment, and management quality significantly influence its credit risk management approach (Daniliuc, 2023; Jones & Maynard Jr, 2023). Each bank has its distinct approach to credit policy. When the banking industry suffers a negative shock, such as a financial crisis, individual banks may receive more leniency for poor performance. Such circumstances might lead financial institutions to align their credit policies with their competitors in markets prone to herding (Ali-Rind et al., 2023).

Despite commercial banks' clear focus on credit risk management, its potential profit impact has not been fully investigated. Since increasing lending has been shown to increase profits in the short term, banks will relax lending standards when credit growth is rapid and reimpose them when it slows, as noted in Independent Evaluation Group (2023). Therefore, the purpose of this paper is to analyze GCB Bank's case to determine how credit risk management influences the loan performance of commercial banks.

Profile of the Organisation

GCB Bank Limited was founded in 1953 as the Bank of the Gold Coast, making it one of the oldest banks in Ghana. At the time, the bank was established to support the growth of the country's agricultural sector and to provide financial services to Ghanaians. In 1957, Ghana gained independence from British colonial rule, and the bank was renamed the Bank of Ghana to reflect the country's new status.

Over the years, the bank underwent several transformations, including changing its name to Ghana Commercial Bank (GCB) in 1963 and becoming a publicly traded company in 1996. In 2013, the bank rebranded again to GCB Bank Limited to reflect its expanded services and growing customer base. Today, GCB Bank is one of the largest banks in Ghana, with over 200 branches and more than 4,000 employees.

Personal banking, commercial banking, investment management, and corporate banking are just some of the financial offerings available from GCB Bank. All of one’s personal banking needs, from savings to checking to loans to overdraft protection, can be met by the bank. The bank's G-Mobile app makes it possible for customers to manage their accounts and make transactions while they're on the go.

For businesses, GCB Bank provides various products and services such as trade finance, cash management, corporate loans, and project financing. The bank also offers investment management services to help clients grow their wealth through various investment products such as mutual funds, treasury bills, and bonds.

Overall, GCB Bank Limited is a trusted and reputable financial institution in Ghana, providing a wide range of financial products and services to individuals and businesses alike. The bank has a long history of supporting economic growth and development in Ghana and has been recognized for its excellence in the banking industry and its commitment to sustainability. GCB Bank is poised to continue playing a vital role in the Ghanaian economy for years to come.

Business Issue Statement

The number of GCB Bank's non-performing loans has been increasing despite the bank's well-established credit risk management framework (Agbavor, 2019). Consequences of the COVID-19 pandemic have demonstrated the need for stringent credit risk management practices in the banking sector (Opuodho, 2021). Musa & Nasieku (2019) report that in response to the pandemic, banks have modified their credit risk management practices to lessen the impact of the epidemic on loan repayment rates. However, there are questions about how well the bank can manage its credit risk and prevent loan defaults and NPLs.

Credit risk management is a vital aspect of ensuring the financial stability and sustainability of commercial banks, as it helps to reduce the exposure to potential losses from borrowers who fail to repay their loans or meet their contractual obligations. However, the existing literature on the effectiveness of credit risk management practices in the banking industry is scarce and mostly focused on developed countries or regions. There is a lack of empirical evidence on how credit risk management practices are implemented and evaluated in the context of Ghana, especially for one of the largest and oldest banks in the country, GCB Bank (Musa & Nasieku, 2019; Al Zaidanin & Al Zaidanin, 2021; Ali & Dhiman, 2019; Ekinci & Poyraz, 2019; Rehman et al., 2019; Tassew & Hailu, 2019; Sathyamoorthi et al., 2020; Munangi & Bongani, 2020; Mutai & Opuodho, 2021; Agbavor, 2019). Therefore, this study aims to address this gap.

Project Objectives

The main objective of the study is to examine the effect of credit risk management on loan performance of commercial banks using GCB Bank Limited as a case study. This can be achieved through the following objectives:

1. To evaluate the effectiveness of credit risk management practices in minimizing the risk of default and non-performing loans in GCB Bank.

2. To identify the challenges and constraints facing GCB Bank in the implementation of effective credit risk management practices.

Project Significance

There are many reasons why GCB Bank's case study on how credit risk management affects the loan performance of commercial banks is so important:

1. Contribution to knowledge: This research will help fill a knowledge gap in the banking sector, and in Ghana in particular, with regards to credit risk management. The study's results will shed light on how well credit risk management practices protect commercial banks from default and non-performing loans, as well as how these factors affect the banks' bottom lines and ability to weather economic downturns.

2. Policy implications: GCB Bank and other commercial banks in Ghana will benefit from the study's actionable recommendations for enhancing credit risk management. The study's findings will inform the recommendations, which will be tailored to the needs of the banking sector in Ghana.

3. Stakeholder benefits: Shareholders, depositors, and borrowers will all reap the benefits of this research. The study's results will be of interest to investors because they shed light on the long-term viability and safety of commercial banks. Banks will be able to better protect their depositors from default and NPLs if they improve their credit risk management practices. Better methods of managing credit risk will result in lower interest rates and more readily available credit for borrowers.

Project Outline

This dissertation is systematically organized into several sections. Chapter 1, the introduction, provides the study's background, problem statement, objectives, significance, and research outline. Chapter 2 presents the literature review, summarizing previous studies on the topic and identifying gaps this study aims to fill. In Chapter 3, the research methods, the study's research strategy, data sources, and analysis steps are laid out in detail to ensure reproducibility. The results and discussion appear in Chapter 4, where the study's findings are presented and interpreted, drawing comparisons with previous research and discussing their implications. Finally, in Chapter 5, the conclusion, the key findings and their implications related to the research goals are summarized, thereby bringing the research full circle.

Literature Review

This section presents a review of the literature on this topic that has been published so far. It covers both the theoretical and empirical literature review and their respective relevance to the current study. The main concepts that are discussed are: Credit Risk Management Framework, Basel Accords, Loan Performance, Risk avoidance, and Risk Monitoring. These concepts are explained and analyzed in relation to the research objectives of the study.

Theoretical Review

Credit Risk Management Framework

Credit risk management in commercial banks can be approached in a more comprehensive manner with the help of this theory. The four phases of the framework are: recognizing risks, evaluating them, dealing with them, and keeping an eye on the results (Rajawat et al., 2023). According to Miglionico (2023), banks can reduce their exposure to default and nonperforming loans by implementing sound policies and procedures for managing credit risk. Risks associated with loans and other forms of credit are identified, evaluated, and then measures taken to reduce them; this is known as credit risk management. Credit risk management's goal is to maximize profits from credit products while minimizing losses from defaults and non-performing loans. (Latif & Hardiyanti, 2023). Seker et al. (2023) stated that the credit risk management process typically involves several steps, including:

1. Risk identification: This involves identifying the types of credit risk that a bank is exposed to, such as borrower default risk, counterparty risk, and market risk.

2. Risk assessment: This involves assessing the likelihood and impact of credit risks. This is usually done using credit scoring models, financial analysis, and other risk assessment tools.

3. Risk mitigation: This involves taking measures to reduce the likelihood and impact of credit risks. This may include setting credit limits, requiring collateral, and diversifying the loan portfolio.

4. Risk monitoring: This involves ongoing monitoring of credit risk exposure and taking corrective actions when necessary.

According to the results of this analysis, commercial banks' financial security and profitability depend on their ability to effectively manage their credit risk. Losses from defaults and non-performing loans can have a major impact on a bank's bottom line and credibility if proper credit risk management practices aren't implemented. Guidelines and standards for credit risk management practices are set by regulators who oversee credit risk management.

Agency Theory

This theory suggests that conflicts of interest may arise between stakeholders in a firm, and it proposes mechanisms to align the interests of stakeholders (Pan et al., 2023). In the case of commercial banks, the theory highlights the need for effective credit risk management practices to align the interests of shareholders, depositors, and borrowers.

According to Manduku et al. (2023) agency theory is a concept in economics and organizational management that deals with the conflicts of interest that may arise between different stakeholders in an organization, such as shareholders, managers, and creditors. The theory suggests that these conflicts can arise due to differences in goals and motivations and proposes mechanisms to align the interests of stakeholders.

In the context of commercial banks, agency theory is relevant to credit risk management because there may be conflicts of interest between shareholders, depositors, and borrowers. Shareholders may want to maximize profits by taking on more risk, while depositors may want to minimize risk to protect their deposits. Borrowers, on the other hand, may want to take on more debt than they can realistically repay.

To align the interests of these stakeholders, commercial banks need to adopt effective credit risk management practices. According to Phan Thi Hang (2023) these practices include:

1. Setting credit limits: Banks can set credit limits based on the borrower's creditworthiness and repayment capacity. This helps to minimize the risk of default and protect the bank's assets.

2. Requiring collateral: Banks can require borrowers to provide collateral, such as property or equipment, to secure the loan. This reduces the risk of loss in the event of default.

3. Diversifying the loan portfolio: Banks can diversify their loan portfolio across different industries, geographies, and credit ratings. This helps to spread the risk across different types of loans and minimize the impact of any one default.

4. Conducting regular credit reviews: Banks can review the creditworthiness of borrowers regularly to ensure that they are meeting their repayment obligations. This helps to identify potential defaults early and take corrective action.

In summary, agency theory suggests that effective credit risk management is critical for commercial banks to align the interests of stakeholders and ensure their financial stability and profitability.

Capital Asset Pricing Model (CAPM)

The riskiness of an asset is factored into the minimum acceptable rate of return in this model (Jiang et al., 2023). The capital asset pricing model (CAPM) can be used by commercial banks to estimate the return needed on loans based on the credit risk of the borrower. In finance, the Capital Asset Pricing Model (CAPM) is a framework for forecasting investment returns considering risk. Assuming investors are rational and risk-averse, the model seeks to maximize returns while minimizing exposure (Kolari & Pynnönen, 2023).

The capital asset pricing model (CAPM) is commonly used by commercial banks as part of their approach to credit risk management and is used to establish the appropriate rate of return on individual loans considering the risk involved. That's why financial institutions like banks can charge reasonable interest rates on their loans and still turn a profit.

The CAPM formula is as follows:

E(Ri) = Rf + βi * (Rm - Rf)

Where:

E(Ri) is the expected return on the investment.

Rf is the risk-free rate of return (such as the yield on government bonds)

βi is the beta coefficient, which measures the systematic risk of the investment. The beta coefficient is a measure of the sensitivity of the investment's returns to changes in the market.

(Rm - Rf) is the market risk premium, which is the difference between the expected return on the market and the risk-free rate.

When discussing the credit risk of a loan, the beta coefficient is typically used as a metric. Borrowers will pay a higher interest rate and be required to put up a higher rate of return capital for loans with a higher beta coefficient, reflecting the higher default risk associated with these loans. Overall, the Capital Asset Pricing Model (CAPM) is a valuable resource for commercial banks' credit risk management. Banks can effectively manage their credit risk and earn a healthy return on their investments by pricing loans at a rate of return commensurate with the perceived risk of the loan.

Empirical Review

Musa & Nasieku (2019) analyzed the impact of credit risk management on the loan performance of Kenyan commercial banks. The study employed a research design based on secondary data analysis. From January 2012 to December 2017, 48 observations were utilized. The population included all eight of Kenya's premier banks. The data was obtained from the Kenya National Bureau of Statistics, the central bank, and individual banks' audited financial statements. As analytic tools, correlation and multiple regressions were utilized. The absence of laborious studies addressing the dynamics of loan performance in Kenyan commercial banks was the impetus for this research. Higher loan-to-deposit ratios led to improved loan performance at commercial banks, according to the findings. Due to the significance of the effects, it can be concluded that the Loan deposit ratio influences the loan performance of commercial banks. The researcher concluded, based on the study's findings, that capital adequacy has a positive and significant relationship with the loan performance of Kenyan commercial banks. The study suggests that investors and shareholders of commercial banks should be aware of the potential use of provisions for losses on non-performing loans by managers to smoothen loan performance and develop financial reporting models that can aid in preventing the occurrence of the menace. The study recommends that commercial bank management hedge against Moral hazard and adverse selection risks when extending loans to reduce the incidence of nonperforming loans.

Al Zaidanin (2021) investigated the effect of credit risk management on the financial performance of commercial banks in the United Arab Emirates. The secondary data were collected from banks and analyzed using descriptive statistics and the random effect model to test hypotheses. The regression results indicate that the non-performing loans ratio and the cost-income ratio have a significant negative impact on the profitability of commercial banks in the United Arab Emirates, whereas the capital adequacy ratio, the liquidity ratio, and the loans-to-deposits ratio have a very weak positive relationship on the return on assets but are not determinants of bank profitability due to their insignificant statistical impact. To improve financial performance and reduce the risk of non-performing loans in the future, it is recommended that prior to approving loan applications, banks closely monitor the performance of loans and analyze clients' credit histories and ability to repay debts. In addition, banks should continuously improve their asset utilization, liquidity, and techniques for managing operating costs, as well as increase the positive impact of capital adequacy and the use of deposits for lending activities on their profitability.

Ali & Dhiman (2019) analyzed the impact of credit risk management on the profitability of commercial banks in India's public sector. This study attempts to establish a correlation between credit risk management and the financial performance of banks. Attempts have been made to determine, for the period 2010-2017, the statistical impact of credit risk management indicators on the profitability of public-sector commercial banks. This study examines the top ten commercial banks in the public sector based on their total assets. Data analysis is conducted using panel regression. In the panel model equation, credit risk management is the independent variable measured by the non-performing loans ratio (NPLR), loan loss provision ratio (LLPR), capital adequacy ratio (CAR), asset quality ratio (AQ), management (M), earnings (E), and liquidity (L), while banks' profitability is the dependent variable measured by the return on assets (ROA). According to the findings of the study, credit risk management indicators have a significant impact on the financial performance of a selection of public sector banks in India. The empirical findings indicate that ROA (profitability) is positively correlated with CAR, management quality, and earnings ability, but negatively correlated with AQ and liquidity.

Ekinci & Poyraz (2019) evaluated the impact of credit risk on the financial performance of Turkish deposit banks. Between 2005 and 2017, the dataset included 26 Turkish commercial banks. Secondary data collected from the Turkish Banks Association's statistical report. To compare banks based on their ownership structure, data from three panels are considered for state-owned banks, privately-owned banks, and foreign banks. Return on Assets (ROA) and Return on Equity (ROE) were used as surrogates for financial performance indicators, whereas Non-Performing Loans (NPLs) were used as credit risk indicators. The estimation results revealed a negative correlation between credit risk and ROA and ROE. From 2005 to 2017, this result suggests a correlation between credit risk management and the profitability of Turkish deposit banks. Therefore, banks should place a greater emphasis on credit risk management, particularly the control and monitoring of non-performing loans. In addition, managers should place a greater emphasis on contemporary credit risk management techniques.

Rehman et al. (2019) researched on the impact of risk management strategies on the credit risk faced by commercial banks of Balochistan. To carry out multiple regression analyses, quantitative data was gathered from 250 employees of commercial banks, and these data were used in the analysis. According to the findings, there are four areas that have an impact on credit risk management (CRM): corporate governance has the most significant influence, followed by diversification, which has a significant part to play, hedging, and finally the bank's capital adequacy ratio. The study concluded that the four key risk management strategies that commercial banks need to implement to mitigate the credit risk they face.

Tassew & Hailu (2019) investigated the impact of risk management on the financial performance of Ethiopian commercial banks. Using secondary data, a quantitative research methodology was applied for the sample period spanning 2013 to 2017. A panel random effect regression model was used to analyze the collected data. Credit risk, liquidity risk, operating risk, and market risk have a significant negative impact on the financial performance of commercial banks in Ethiopia, according to the study's findings. As a control variable, bank size has a positive effect on the financial performance of commercial banks. The conclusion of the study was that credit, liquidity, operation, and market risks have substantial effects on the financial performance of Ethiopian commercial banks. The study recommended that commercial banks in Ethiopia manage their loan portfolios and hedge their business risks on the market to maintain their financial performance.

Financial performance was analyzed in a study by Sathyamoorthi et al. (2020). In the study, financial performance was evaluated based on Return on Assets as well as Return on Equity. Measures of financial risk such as inflation, interest rates, debt to asset, equity to asset, and loan deposit ratios were used. All 10 commercial banks in Botswana served as the study's population, and the research period extended over eight years, from 2011 to 2018. This descriptive analysis used secondary monthly data from the Bank of Botswana Financial Statistics database. To examine the information, the researcher used correlation and regression analyses in addition to more traditional descriptive statistics. Regression results indicated that interest rates had a negative and statistically significant effect on ROA and ROE. Conversely, return on assets was negatively impacted by total debt relative to total assets, though the effect was marginal. There was a positive but negligible effect of total debt to total assets on ROE. Return on assets and return on equity were both negatively and significantly affected by the loan deposit ratio. According to the results, banks can protect themselves from potential dangers while still making a profit by implementing sound procedures for managing their market, credit, and liquidity risks.

Munangi & Bongani (2020) conducted an empirical investigation into the effect of credit risk on the financial performance of South African banks. To test the relationship between credit risk and financial performance (proxied by non-performing loans (NPLs) and by return on assets (ROA) or return on equity (ROE), respectively), panel data techniques, namely pooled ordinary least squares (pooled OLS), fixed effects and random effects estimators, were employed. The study's findings demonstrated that credit risk is negatively correlated with financial performance. Thus, the bank's profitability decreases in proportion to the proportion of nonperforming loans. Secondly, the study revealed that expansion positively affected financial performance. This indicates that bank development increases the capacity for productivity. Capital sufficiency was found to be positively related to financial performance. While a higher capital adequacy ratio may instill stakeholders with confidence in a bank, thereby enhancing its competitiveness, a high capital base may be perceived as a lack of initiative and as tying up resources that could have yielded better returns through alternative investments. The study found no conclusive link between size and financial performance. The study discovered a negative relationship between bank leverage and financial performance. A micro-level implication of the findings is that banks should adhere to prudent and stringent credit policies to reduce the incidence of nonperforming loans. At a macro level, regulators must strengthen supervision to ensure that banks manage credit risk in accordance with regulations, thereby minimizing the risk of bank failure.

Mutai & Opuodho (2021) examined the impact of credit risk management practices on the loan performance of Kenyan microfinance banks. This study utilized a descriptive cross-sectional methodology. The study population consisted of the 12 microfinance banks in Kenya, as well as the 183 employees currently employed at the head offices of microfinance banks in Kenya. The researcher utilized purposive sampling to decrease standard error by demonstrating some control over variance. Using Slovin's Formula, 126 respondents comprised the sample size. For data collection, the questionnaire was chosen. Employing descriptive statistics, the collected quantitative data was analyzed. Content analysis was utilized to examine qualitative data or qualitative aspects of the data gathered from open-ended questions. To determine the strength of the relationship between the independent and dependent variables, a correlation analysis was conducted. The effect of credit risk management practices on the loan performance of Kenyan microfinance banks was determined through multiple regressions. The study discovered that internal credit risk policy practices, credit granting process practices, credit monitoring practices, and credit control practices have a positive and significant effect on the loan performance of Kenyan microfinance banks. Therefore, the study advises financial institutions to adopt a credit risk management system to increase and improve their profitability. In addition, Microfinance banks should charge interest rates that are affordable to attract a greater number of investors and, consequently, increase interest income.

Agbavor (2019) investigated Credit Officers' Perspectives on Non-Performing Loan Causes. This study is interpretive qualitative research employing a case study methodology. The instruments utilized were interviews and documents available to the public. Using thematic analysis, the data is analyzed. The study reveals that commercial banks subject loan applicants to stringent loan requirement processes to ensure that only borrowers with a low risk of default and the ability to make regular payments are granted loans. In addition, the study reveals that a loan applicant's credit history, cash flow projections, and collateral security in the form of assets or a guarantor are the primary considerations in the loan acquisition process. The study also reveals that business and industry challenges, economic conditions, legal amendments and new regulations, and insufficient collateral security are the primary causes of nonperforming loans in commercial banks. The study recommends that commercial banks ensure due diligence and effective loan monitoring. The banks should also maintain constant communication with loan applicants and modify their payment terms if their cash flow is threatened by a business crisis. Again, there should be a proper credit reference bureau that enables banks to share the credit histories of their customers.

Conceptual Framework

Basel Accords

The Basel Accords are a series of international banking regulations that were first introduced in 1988 by the Basel Committee on Banking Supervision (BCBS), a global forum of central banks and banking supervisory authorities (Quaglia , 2023). According to D'Orazio (2023), the objective of the Basel Accords is to promote global financial stability by standardizing banking regulations and supervisory practices across countries. There have been three versions of the Basel Accords so far:

1. Basel I (1988): The first Basel Accord introduced a standardized approach for banks to calculate their minimum capital requirements based on the level of credit risk in their portfolios. Under Basel I, banks were required to maintain a minimum capital adequacy ratio (CAR) of 8%, with at least half of the capital in the form of Tier 1 capital (equity capital and disclosed reserves).

2. Basel II (2004): Internal risk assessments and management procedures were given more weight in the second Basel Accord's codification of a more nuanced approach to dealing with credit risk. To determine the required level of capitalization for operations, financial institutions were permitted under Basel II to use internal models developed by the institution itself, so long as the models had been approved by the relevant national regulatory authorities. As part of the framework, fresh capital requirements for operational risk and market risk were introduced.

3. Basel III (2010): The third Basel Accord was implemented after the global financial crisis of 2008 with the goal of bolstering banking system stability and enhancing risk management procedures. Minimum capital requirements were raised because of Basel III's implementation; now, the Tier 1 capital ratio must be at least 6%, while the capital conservation buffer must be at least 2.5% and the countercyclical buffer can be as high as 2.5%. It's also possible for the countercyclical buffer to reach 2.5%. New to the framework are requirements for both liquidity standards and stress tests.

Bashir et al. (2023) cited that the Basel Accords have had a significant impact on the banking industry worldwide, with many countries adopting the frameworks as part of their regulatory regimes. The Accords have helped to promote greater transparency, consistency, and stability in the banking sector, and have contributed to the development of best practices in risk management and governance.

Credit Scoring Models

Credit scoring models are statistical algorithms that use data on an individual's credit history to predict their likelihood of defaulting on a loan or other credit obligation (Ekmekcioglu et al. 2023). As explained by Song et al. (2023) credit scoring models are commonly used by lenders, such as banks and credit card companies, to assess the creditworthiness of potential borrowers and make decisions about whether to extend credit to them and at what terms. There are several types of credit scoring models, including:

1. Generic scoring models: These are based on data from a large sample of borrowers and are used to assess credit risk for a broad range of credit products.

2. Application scoring models: These are used to evaluate credit risk for specific credit products, such as credit cards or personal loans.

3. Behavioral scoring models: These are used to track changes in borrower behavior over time and adjust credit risk assessments accordingly.

4. Custom scoring models: These are developed by individual lenders to assess credit risk based on their own internal data and risk management strategies.

In 1989, Fair Isaac Corporation introduced the FICO score, the most widely used credit scoring model. The higher the FICO score, the lower the credit risk. Scores can go from 300 to 850. Payment history, total debt, credit history length, credit mix, and recent credit inquiries are all used in the FICO scoring formula (Li et al., 2023).

Risk avoidance

Risk avoidance refers to the strategy of completely avoiding activities or situations that pose a potential risk or threat. It involves taking steps to eliminate any possibility of harm or negative consequences, rather than managing or mitigating the risk (Albeldawi, 2023). In the context of bank loans, risk avoidance refers to the practice of avoiding lending money to individuals or businesses that are deemed to be too risky or pose a high risk of default. Banks typically use a range of criteria to assess the creditworthiness of loan applicants, such as credit scores, income, employment history, and collateral. Based on this assessment, banks may approve or deny loan applications, or offer loans with higher interest rates or stricter terms for high-risk borrowers (Xu et al., 2023).

According to Colenbrander et al. (2023) banks may also use risk avoidance strategies in their lending practices by limiting exposure to certain industries or geographic regions that are deemed to be high risk. As a result, a bank may avoid lending to companies in industries with high volatility or susceptibility to economic downturns, such as oil and gas, or countries with political instability or weak economies. While risk avoidance can help banks minimize losses and maintain financial stability, it may also limit opportunities for borrowers who are deemed high-risk but still have the potential to repay their loans (Gur et al., 2023). As such, some banks may also offer risk mitigation strategies, such as requiring additional collateral or guarantors, or offering financial education and support to help borrowers improve their creditworthiness.

According to Turvey (2023), risk assessment in banks consists of the following:

Credit History: Credit history is a record of an individual's past borrowing and repayment behavior, as well as other credit-related activities. It is used by lenders, such as banks and credit card companies, to assess the creditworthiness of a borrower and make decisions about whether to extend credit, what interest rates to offer, and how much credit to offer (Rott, 2023).

A credit history typically includes information such as credit accounts, payment history, credit utilization, credit inquiries, and public records. Lenders use this information to evaluate the risk of lending to a borrower and determine whether to approve a loan or credit application.

Financial Viability: Financial viability refers to the ability of an individual, organization, or project to remain financially stable and sustainable over the long term. It involves having the financial resources and strategies necessary to meet current and future obligations, as well as to pursue growth and development opportunities (Mehari et al., 2023). For individuals, financial viability may involve managing income and expenses effectively, saving for emergencies and retirement, and avoiding excessive debt or overspending. For organizations and businesses, financial viability may involve generating sufficient revenue and managing costs effectively to achieve profitability and long-term sustainability. This may include managing cash flow, maintaining adequate reserves, diversifying revenue sources, and managing risk (Hoshovska et al., 2023).

Technical Feasibility: Technical feasibility refers to the assessment of whether a proposed project, product, or system can be successfully designed, developed, implemented, and operated using available technology, resources, and expertise. It involves evaluating the technical requirements, capabilities, and limitations of a project to determine whether it can be achieved within the available resources, timelines, and budget (Zhang et al., 2023). Assessing technical feasibility typically involves analyzing factors such as technical requirements, technical capabilities, technical constraints, and technical risks. Technical feasibility is an important consideration in the planning and development of projects, as it ensures that proposed solutions are technically sound and viable. It also helps to identify potential technical challenges and limitations early on, allowing for adjustments to be made and potential problems to be addressed before significant resources are committed (Pradhananga et al., 2023).

Credit Rating: A person's or business's credit rating indicates how likely it is that they will be able to make their debt payments on time. Standard and Poor's, Moody's, and Fitch Ratings are examples of credit rating agencies (Schroeder, 2023). An A rating is investment-grade, while a D rating is speculative or junk status, as per Yeboah-Smith (2023). Credit ratings are widely used by investors and lenders to assess credit risk and determine interest rates and loan terms. Greer et al. (2023) stated that credit rating agencies evaluate a range of factors when assigning credit ratings, including financial performance, debt levels, credit history, industry, and economic factors. Borrowing costs and availability can be greatly affected by a company's credit rating. Higher credit ratings typically result in lower interest rates and more favorable loan terms, while lower credit ratings can lead to higher interest rates and stricter loan requirements (Pohl et al., 2023).

Risk Monitoring

The term risk monitoring describes the systematic practice of keeping tabs on potential threats to a business. It involves the regular review and evaluation of the organization's risk management strategies and their effectiveness in addressing identified risks (Traore et al., 2023). The purpose of risk monitoring is to ensure that the organization remains aware of its risks and takes appropriate actions to manage them. Risk monitoring is especially critical for banks that issue loans (Anastasiou, 2023).

Loan portfolios represent a significant portion of banks' assets, and therefore, the management of credit risk is a key aspect of their operations. Phan Thi Hang (2023) cited that effective risk monitoring practices can help banks identify and manage potential credit risks, reduce the likelihood of loan losses, and enhance the overall loan performance of the bank. He also stated that below are some key factors that banks should monitor in their loan portfolios:

Creditworthiness of Borrowers: Banks should regularly assess the creditworthiness of their borrowers to ensure that they can repay the loan. This can be done through credit scoring models, credit reports, and financial statements.

Loan Performance: Banks should monitor the performance of their loans to identify potential delinquencies, defaults, or other credit events. This can be done through regular loan reviews, financial statement analysis, and credit monitoring tools.

Collateral: Banks should also monitor the value and quality of collateral pledged to secure loans. This helps to ensure that the bank has sufficient security to recover losses in the event of a default.

Economic and Market Conditions: Banks should monitor economic and market conditions that could impact the creditworthiness of their borrowers, such as changes in interest rates, inflation, or unemployment rates.

Regulatory Compliance: Banks should ensure that their loan portfolios comply with applicable regulatory requirements, such as minimum capital requirements and risk management guidelines.

Loan Performance

The term loan performance is used to describe a borrower's compliance with the terms of a loan by making payments on time and in a consistent manner (Hu et al., 2023). The lender's perspective on loan performance is primarily concerned with whether the borrower is making payments on time and in full.

According to Song et al. (2023) a borrower with good loan performance is typically someone who makes their payments on time and in full, has a good credit score, and has not defaulted on any previous loans. On the other hand, a borrower with poor loan performance may have missed payments, defaulted on previous loans, or have a low credit score.

Lenders and investors use loan performance metrics such as delinquency rates, default rates, and prepayment rates to assess the risk associated with lending money to borrowers. Borrowers with poor loan performance may be subject to higher interest rates, stricter loan terms, or be denied credit altogether. Conversely, borrowers with good loan performance may be eligible for lower interest rates, better loan terms, and have access to additional credit products (Bai et al., 2023).

Loan performance is typically measured using various metrics such as the loan repayment rate, loan default rate, and loan loss rate.

1. The loan repayment rate is the percentage of loans that are repaid on time and in full.

2. The loan default rate is the percentage of loans that are not repaid as scheduled.

3. The loan loss rate is the percentage of loans that are not repaid and result in a loss for the lender.

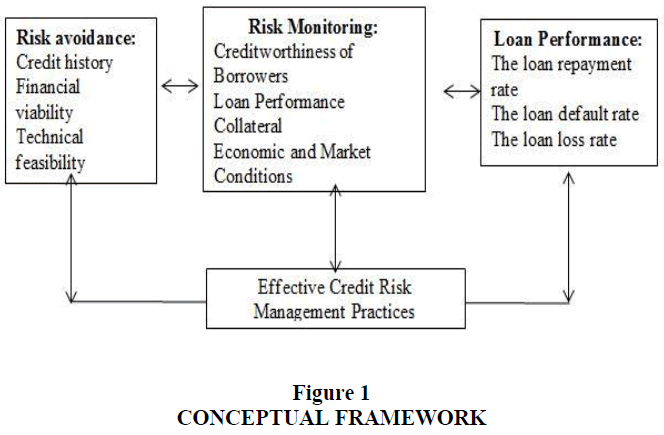

The conceptual framework to be used for the study is shown below in Figure 1: Source: Authors’ Construct, 2023

Research Methods

This section explains the research methods used to investigate how credit risk management influences commercial banks’ loan performance. It describes the design, population, sampling method, data collection tools, methods, and analyses of the study. It also clarifies how the data is gathered and analyzed to achieve the research objectives.

Research Design

The research method used in this study was a survey that had both descriptive and exploratory features. According to David et al. (2023), descriptive research aims to describe and interpret the current situation, while exploratory research seeks to discover new insights or relationships. A descriptive design can capture an individual’s perspective on a policy issue or programme, as suggested by Kratochwill et al. (2023). Moreover, Youyou et al. (2023) noted that a descriptive survey can collect data from a large sample of people, making it suitable for large-scale research projects.

The descriptive survey method has some advantages, such as providing a comprehensive and detailed picture of the phenomenon under study. However, it also has some drawbacks, such as ensuring the validity and reliability of the questions and the responses. As Cooper (2023) pointed out, one of the challenges of the descriptive design is to obtain a sufficient response rate to the questionnaire to enable meaningful analysis.

Despite these limitations, this design was useful for documenting and describing aspects of the situation as they occurred in practice. Bradford (2023) defined a descriptive study as one that seeks to describe existing conditions or relationships, such as clarifying the nature of current situations, practices, and beliefs; identifying ongoing processes or emerging trends; and so on. A descriptive design focuses on data collection and answering questions about the current state of the topic of the study, as per Drakenberg et al. (2023). It also has enough validity and reliability to be applied to some research questions with confidence.

The study adopted a quantitative approach by creating closed-ended surveys to collect the necessary numerical data for achieving the study objectives. Quantitative methods allow data to be compared, analyzed statistically, and replicated with consistency, which enhances their credibility (Jin et al., 2023).

Study Population

The population refers to the entire group of people who are relevant to the study. The population is the group that the study aims to generalize its findings to (Mbah et al., 2023). It is also the total number of units or elements in a statistical analysis. The population of the study is depicted below in Table 1:

| Table 1 Total Population | |

| Department | Number |

| SME Banking | 210 |

| Corporate Banking | 122 |

| Human Resource | 47 |

| Customer Service | 68 |

| Legal | 21 |

| Compliance and Risk | 73 |

| E-banking | 110 |

| Total | 651 |

Sampling

In this study, the sampling technique, as elucidated by Rath et al. (2023), involved selecting a subset of the entire population to conduct the survey effectively using a relatively small group. Bank employees were chosen utilizing the simple random sampling method, which involves unbiased random selection, ensuring equal chances for all individuals or units (Talarico, 2023). This technique enhanced the study's validity and reliability. The sample size was determined using the Yamane formula, a statistical formula developed by Japanese statistician Osamu Yamane in 1967. This formula is n = N / (1 + N(e^2)), where n is the needed sample size, N is the population size (650 in this case), e is the desired precision level (generally 0.05), and ^2 is the population variance (0.5 is often used if unknown). Therefore, the calculation was n = 650 / (1 + 650(0.05^2)), resulting in 247.6, which was rounded up to 248 respondents. As such, the study randomly sampled data from 248 respondents.

Materials/ Data

Primary sources of data

The questionnaire was the research instrument used for collecting data. The survey mainly consisted of closed-ended questions. The closed-ended questions asked the respondents to indicate their level of agreement with each item and their opinion of each statement using a five-point Likert scale, ranging from strongly disagree to strongly agree. All survey questions were based on the theoretical framework of the study. Questionnaires were designed to collect data from GCB Bank employees.

Data Collection Procedure

Before collecting data for the study, an introductory letter was sent to GCB Bank. The surveys were distributed, and data collection was scheduled later, when the study had more time. The completed forms were collected within two weeks of participants completing the surveys. A web-based survey was used as an alternative for those who could not participate in person (online medium of data collection- google docs). The study assisted those who had difficulty completing the online survey until they finished. Two weeks after sending out the surveys, the study collected the responses and analyzed the data in Microsoft Excel.

Validity and Reliability of Instruments

After the questionnaires were written, they were sent to the superiors for review and possible revision. The aim here was to ensure that the instruments adequately and appropriately covered the commercial banks’ loan performance. The validation process was meant to identify the limitations, ambiguities, and issues of the instruments. This allowed time for any necessary adjustments to be made before the actual data collection started. Pilot studies are conducted by researchers to test the waters before diving in headfirst. As stated in Kieu et al. (2023), all instruments must be tested for their validity and reliability to ensure they provide accurate and consistent results. The pilot testing of the questionnaire assessed the validity and reliability of its components. The accompanying instructions were also pilot tested to see if they were clear enough to help respondents fill out the survey with the highest possible accuracy. Microsoft Excel was used to collect the completed questionnaires, check them for accuracy, code them, and then run the analyses. The Cronbach alpha reliability coefficient of the questionnaire was also calculated.

Analytical Tools

Data analysis is a key question in any research project that involves collecting a large amount of data. The aim of data analysis should be to derive insights from the collected data. Data analysis, as defined by Alden (2023), involves giving the collected data some form of organization and meaning. This study used methods for collecting and analyzing data from other studies (Verd, 2023). Some examples are data collection and management, reading, memorization, description, classification, interpretation, and representation and visualization. Codes were assigned to each participant’s response to the item, and the data were tabulated and analyzed statistically. The frequency, mean, percentage, standard deviation, and mean of mean of the ratings were all computed with the help of Microsoft Excel. The study coded the closed-ended responses. Descriptive statistics were used to describe the demographics of the sample and their responses in the study. The study discussed and compared its findings with those already published in the literature, as well as the results of its analyses of the research questions.

Ethical Consideration

The study followed the following procedures to protect the confidentiality of the participants. The study assured that the students’ participation in this study would not affect their grade or other academic standing in any way. The respondents did not have to provide their names on the data collection forms and were given a code instead to protect their identity. The study contacted each respondent individually, and in some cases, formed groups to facilitate the data collection process. The study gave a detailed verbal explanation of the study to each participant during a phone call. After that, the participants could ask any questions they had and get any clarifications they needed. The study informed the participants that they were not obliged to continue with the study at the end of the survey.

Results and Discussion

Overview

This chapter reports and analyzes the results and discussions of the study. It gives a comprehensive overview of the main findings and highlights the significant results of the study. The findings are then compared with existing literature to draw out the implications for practice.

The results show in the Table 2 that there were slightly more male respondents (51.61%) than female (48.39%). This distribution is somewhat representative of the general population as the gender distribution is nearly equal. It is noteworthy to point out that gender is an essential demographic variable as it can influence work experience, perception of work, and career development opportunities.

| Table 2 Background of the Study | |||

| Question | Response | Frequency | Percentage |

| Q1 | Male | 128 | 51.61% |

| Female | 120 | 48.39% | |

| Q2 | 20-30 years | 95 | 38.31% |

| 31-40 years | 84 | 33.87% | |

| 41-50 years | 47 | 18.95% | |

| Above 50 years | 22 | 8.87% | |

| Q3 | SSSCE/WASSCE | 56 | 22.58% |

| Diploma/HND | 63 | 25.40% | |

| Degree | 98 | 39.52% | |

| Master’s degree | 31 | 12.50% | |

| Q4 | Below 1 year | 36 | 14.52% |

| 1-5 years | 107 | 43.15% | |

| 6-10 years | 61 | 24.60% | |

| Above 10 years | 44 | 17.74% | |

For Age The results indicate that the majority of respondents were aged between 20-30 years (38.31%), followed by those aged 31-40 years (33.87%). This result shows that the respondents were relatively young, and this could affect the interpretation of the data as they may not be representative of the entire population. However, the age distribution of the sample is consistent with the demographic of the working population in most industries.

Regarding the educational background, most respondents had a degree (39.52%), followed by diploma/HND (25.40%) and SSSCE/WASSCE (22.58%). Only 12.50% of respondents had a master's degree. The result indicates that the respondents had a relatively high level of education, which could imply that the sample was composed of individuals with higher levels of professional skills and knowledge. It is also worth noting that a higher level of education might lead to better job opportunities and higher pay, which could potentially influence the respondents' perception of work and job satisfaction.

Next, the results indicate that the majority of respondents had worked for 1-5 years (43.15%), followed by those who had worked for 6-10 years (24.60%). Only 14.52% of respondents had worked for less than a year, while 17.74% had worked for over ten years. The distribution shows that the respondents had varied work experience levels, which could provide valuable insights into their perception of work and career development opportunities. Overall, the sample of 248 respondents used in this study provided a broad representation of the working population, with a relatively equal gender distribution and a varied level of educational background and work experience. These demographic variables could potentially influence the respondents' perception of work, job satisfaction, and career development opportunities, which could be further explored in the following sections.

Section 1

Interpretation of Table 3

For question 5, the mean score of 3.68 (in table 3) suggests that most respondents have a neutral opinion on the effectiveness of risk avoidance practices in minimizing the risk of default and non-performing loans in GCB Bank. The standard deviation of 0.75 indicates that the responses were fairly consistent and not widely dispersed. The skewness of -0.09 suggests a slightly left-skewed distribution, indicating that a few respondents strongly disagreed with the statement.

| Table 3 Risk Avoidance | |||||

| Question | Statement | Mean | Standard Deviation | Skewness | Kurtosis |

| 5 | The extent GCB Bank considers the credit history of borrowers in its lending decisions | 3.68 | 0.75 | -0.09 | -0.99 |

| 6 | The extent GCB Bank assesses the financial viability of borrowers before granting loans | 4.23 | 0.85 | -0.15 | -1.20 |

| 7 | The extent GCB Bank assesses the technical feasibility of borrowers' proposed projects before granting loans | 3.97 | 0.82 | -0.27 | -1.12 |

| 8 | The extent GCB Bank relies on credit ratings of borrowers before granting loans | 4.14 | 0.82 | -0.20 | -1.13 |

| 9 | The extent GCB Bank have risk avoidance policies in place to guide its lending decisions | 4.10 | 0.79 | -0.24 | -1.08 |

| 10 | The extent loan officers of GCB Bank are aware of the importance of risk avoidance in their lending decisions | 3.76 | 0.85 | -0.02 | -1.05 |

Regarding question 6, the mean score of 4.23 suggests that most respondents consider risk avoidance practices to be very important in minimizing the risk of default and non-performing loans in GCB Bank. The standard deviation of 0.85 indicates that the responses were fairly consistent and not widely dispersed. The skewness of -0.15 suggests a slightly left-skewed distribution, indicating that a few respondents did not consider risk avoidance practices to be important.

Question 7 findings indicated a mean score of 3.97 which suggests that most respondents believe that GCB Bank often uses risk avoidance practices to minimize the risk of default and non-performing loans. The standard deviation of 0.82 indicates that the responses were fairly consistent and not widely dispersed. The skewness of -0.27 suggests a slightly left-skewed distribution, indicating that a few respondents believed that GCB Bank rarely uses risk avoidance practices.

For question 8, the mean score of 4.14 suggests that most respondents consider credit rating to be an important risk avoidance practice in minimizing the risk of default and non-performing loans in GCB Bank. The standard deviation of 0.82 indicates that the responses were fairly consistent and not widely dispersed. The skewness of -0.20 suggests a slightly left-skewed distribution, indicating that a few respondents did not consider credit rating to be important.

Furthermore, on question 9, the mean score of 4.10 suggests that most respondents consider financial viability to be an important risk avoidance practice in minimizing the risk of default and non-performing loans in GCB Bank. The standard deviation of 0.79 indicates that the responses were fairly consistent and not widely dispersed. The skewness of -0.24 suggests a slightly left-skewed distribution, indicating that a few respondents did not consider financial viability to be important.

Finally, question 10, the mean score of 3.76 suggests that most respondents believe that GCB Bank sometimes considers credit history in its risk avoidance practices minimizing the risk of default and non-performing loans. The standard deviation of 0.85 indicates that the responses were fairly consistent and not widely dispersed. The skewness of -0.02 suggests a fairly symmetric distribution, indicating that the responses were evenly distributed across the options.

Analysis of Table 3

The findings of this study reveal that most respondents have a neutral to positive opinion regarding the effectiveness of risk avoidance practices in minimizing the risk of default and non-performing loans in GCB Bank. The overall consistency of responses across the questions highlights that risk avoidance practices are generally perceived as important and often utilized by the bank.

However, a few respondents strongly disagreed or did not consider some practices to be important, which implies that there might be room for improvement in the implementation and communication of risk avoidance practices within the bank. This emphasizes the need for GCB Bank to continuously review and strengthen its credit risk management policies and procedures to ensure optimal loan performance.

One notable finding is that while credit rating and financial viability are considered important risk avoidance practices by most respondents, the consideration of credit history seems to be less consistent. This suggests that GCB Bank may benefit from placing more emphasis on evaluating borrowers' credit history as part of its risk avoidance strategy. By doing so, the bank could potentially gain a more comprehensive understanding of borrowers' creditworthiness, thereby reducing the risk of default and non-performing loans.

Moreover, the slightly left-skewed distribution across the questions indicates that a small number of respondents held negative opinions about the effectiveness of risk avoidance practices or their importance. This could be due to a lack of understanding or awareness of the bank's credit risk management policies and procedures. To address this, GCB Bank could consider enhancing its communication and training efforts to ensure that all employees are aware of the importance of risk avoidance practices and their role in maintaining loan performance.

Section 2

Question 11 had a mean score of 3.9 (in table 4), indicating that the respondents agreed that GCB Bank regularly monitors the loan performance of clients. The standard deviation of 1.16 indicated that there was some variability in the responses. The skewness score of -0.534 indicated that the distribution was slightly negatively skewed, but not significantly so, while the kurtosis score of -0.221 indicated that the distribution was slightly platykurtic, but not significantly so.

| Table 4 Risk Monitoring | |||||

| Question | Statement | Mean | SD | Skewness | Kurtosis |

| Q11 | GCB Bank regularly monitors the loan performance of clients |

3.9 | 1.16 | -0.534 | -0.221 |

| Q12 | GCB Bank considers collateral when monitoring loans | 4.2 | 1.12 | -1.131 | 0.165 |

| Q13 | GCB Bank considers economic and market conditions | 4.1 | 1.06 | -1.086 | 0.098 |

| Q14 | GCB Bank ensures regulatory compliance | 4.0 | 1.04 | -1.047 | -0.012 |

| Q15 | GCB Bank provides regular training to staff on risk monitoring | 3.8 | 1.08 | -0.604 | -0.155 |

| Q16 | GCB Bank effectively uses technology for risk monitoring | 3.7 | 1.21 | -0.255 | -0.178 |

Question 12 had the highest mean score of 4.2, indicating that the respondents strongly agreed that GCB Bank considers collateral when monitoring loans. The standard deviation of 1.12 indicated that there was some variability in the responses. The skewness score of -1.131 indicated that the distribution was negatively skewed, but not significantly so, while the kurtosis score of 0.165 indicated that the distribution was slightly leptokurtic, but not significantly so.

Question 13 had a mean score of 4.1, indicating that the respondents generally agreed that GCB Bank considers economic and market conditions when monitoring loans. The standard deviation of 1.06 indicated that there was some variability in the responses. The skewness score of -1.086 indicated that the distribution was negatively skewed, but not significantly so, while the kurtosis score of 0.098 indicated that the distribution was slightly leptokurtic, but not significantly so.

Question 14 had a mean score of 4.0, indicating that the respondents generally agreed that GCB Bank ensures regulatory compliance when monitoring loans. The standard deviation of 1.04 indicated that there was some variability in the responses. The skewness score of -1.047 indicated that the distribution was negatively skewed, but not significantly so, while the kurtosis scores of -0.012 indicated that the distribution was approximately mesokurtic.

The mean score for Q15 is 3.8 with a standard deviation of 1.08. The data is negatively skewed with a skewness of -0.604 and has a platykurtic distribution with a kurtosis of -0.155. This suggests that the majority of respondents agreed that GCB Bank provides regular training to staff on risk monitoring.

For question 16, the mean score is 3.7 with a standard deviation of 1.21. The data is also negatively skewed with a skewness of -0.255 and has a slightly platykurtic distribution with a kurtosis of -0.178. This indicates that the majority of respondents agreed that GCB Bank effectively uses technology for risk monitoring.

Analysis of Table 4

The findings from questions 11 through 16 indicate that the respondents generally have a positive perception of GCB Bank's loan monitoring practices. The results suggest that the bank actively monitors loan performance, considers various factors such as collateral, economic and market conditions, and regulatory compliance when monitoring loans, and invests in regular staff training and technology for effective risk monitoring.

However, the presence of some variability in the responses, as well as the slight negative skewness, indicates that a minority of respondents may hold differing opinions about the bank's loan monitoring practices. This could be attributed to differences in personal experiences or a lack of comprehensive understanding of GCB Bank's credit risk management processes. Addressing these discrepancies and ensuring consistency in the implementation of loan monitoring practices across the bank is crucial for maintaining and improving overall loan performance.

The platykurtic or leptokurtic distributions observed in the responses suggest that the opinions of respondents do not deviate significantly from the mean. This indicates that there is a general consensus among respondents about the effectiveness of GCB Bank's risk monitoring practices. Nevertheless, there is still room for improvement to further enhance the bank's credit risk management capabilities.

Section 3

Interpretation of Table 5

Question 17 had a mean score of 3.85 ( in table 5), indicating that respondents were generally satisfied with the loan repayment rate of GCB Bank. The standard deviation was 0.926, indicating that the responses were fairly consistent. The skewness was negative (-0.288), indicating that the data was slightly left-skewed. The kurtosis was negative (-0.923), indicating that the data was slightly platykurtic.

| Table 5 Loan Performance | |||||

| Question | Statement | Mean | SD | Skewness | Kurtosis |

| 17 | How satisfied are you with the loan repayment rate of GCB Bank? |

3.85 | 0.926 | -0.288 | -0.923 |

| 18 | How concerned are you about the loan default rate of GCB Bank? |

3.32 | 1.053 | -0.149 | -0.969 |

| 19 | Loan Loss Rate: How satisfied are you with the loan loss rate of GCB Bank? |

3.64 | 1.029 | -0.500 | -0.401 |

| 20 | To what extent does GCB Bank use loan performance metrics to assess the effectiveness of its credit risk management practices? |

3.77 | 0.990 | -0.340 | -0.861 |

| 21 | How important do you think it is for GCB Bank to improve its loan performance through effective credit risk management practices? |

4.08 | 0.946 | -0.810 | 0.176 |

| 22 | To what extent does GCB Bank provide feedback to borrowers on their loan performance? | 3.69 | 0.990 | -0.471 | -0.688 |

Question 18 had a mean score of 3.32, indicating that respondents were somewhat concerned about the loan default rate of GCB Bank. The standard deviation was 1.053, indicating that the responses were quite variable. The skewness was slightly negative (-0.149), indicating that the data was slightly left-skewed. The kurtosis was negative (-0.969), indicating that the data was slightly platykurtic.

Question 19 had a mean score of 3.64, indicating that respondents were somewhat satisfied with the loan loss rate of GCB Bank. The standard deviation was 1.029, indicating that the responses were fairly consistent. The skewness was negative (-0.500), indicating that the data was slightly left-skewed. The kurtosis was negative (-0.401), indicating that the data was slightly platykurtic.

Question 20 had a mean score of 3.77, indicating that respondents were somewhat in agreement that GCB Bank uses loan performance metrics to assess the effectiveness of its credit risk management practices. The standard deviation was 0.990, indicating that the responses were fairly consistent. The skewness was negative (-0.340), indicating that the data was slightly left-skewed. The kurtosis was negative (-0.861), indicating that the data was slightly platykurtic.

Question 21 evaluates the importance of improving loan performance through effective credit risk management practices. The mean value of 4.08 indicates that the respondents considered it important for GCB Bank to improve its loan performance. The standard deviation value of 0.946 suggests that the responses were fairly consistent and close to the mean. The skewness value of -0.810 indicates a slightly negative skewness. which suggests that there were more responses towards "important" than "very important." The kurtosis value of 0.176 indicates that the distribution was mesokurtic, which means that the distribution was neither too flat nor too peaked.

Question 22 evaluates the extent to which GCB Bank provides feedback to borrowers on their loan performance. The mean value of 3.69 indicates that the respondents were relatively neutral towards this aspect of loan performance. The standard deviation value of 0.990 suggests that the responses were somewhat scattered, with some respondents rating this aspect as important and others rating it as less important. The skewness value of -0.471 indicates a slightly negative skewness, which suggests that there were more responses towards "sometimes" than "never" or "always." The kurtosis value of -0.688 indicates that the distribution was platykurtic, which means that the distribution was flatter than the normal distribution, with fewer extreme values.

Analysis of Table 5

The findings from questions 17 through 22 reveal mixed perceptions of GCB Bank's loan performance and related practices. While respondents were generally satisfied with the loan repayment rate and somewhat satisfied with the loan loss rate, they expressed concerns about the loan default rate. This suggests that although GCB Bank's credit risk management practices have achieved satisfactory results in certain areas, there is room for improvement in addressing and mitigating loan default risks.

The respondents' agreement that GCB Bank uses loan performance metrics to assess its credit risk management practices indicates that the bank is proactive in evaluating the effectiveness of its strategies. This is further supported by the respondents' perception that improving loan performance through effective credit risk management practices is important for the bank.

However, the neutral response regarding the extent to which GCB Bank provides feedback to borrowers on their loan performance suggests that there may be a gap in communication between the bank and its borrowers. Addressing this gap could be beneficial in fostering stronger relationships with borrowers and enhancing their understanding of the bank's credit risk management policies.

Discussion of findings

Objective 1: To evaluate the effectiveness of credit risk management practices in minimizing the risk of default and non-performing loans in GCB Bank.

The effectiveness of GCB Bank's credit risk management practices is evident in its attention to the evaluation of credit history and financial viability when granting loans. This echoes the insights of Agbavor (2019), who underscored the importance of a thorough loan application process in ensuring only borrowers with low default risk and a strong ability to maintain regular payments are granted loans. This approach underscores the critical role of credit history in risk avoidance, reinforcing its importance in GCB Bank's lending decisions. Beyond risk avoidance, GCB Bank also prioritizes risk monitoring. The bank's respondents express positive feedback towards these practices, suggesting an effective balance between loans and deposits. This balance, illustrated by a suitable loan-to-deposit ratio, may contribute to improved loan performance. Musa and Nasieku (2019) made a similar observation in their study of commercial banks in Kenya. Furthermore, the general satisfaction among respondents in terms of loan performance hints at the effectiveness of the bank's credit risk management practices, in accordance with the literature that asserts such practices positively influence loan performance.

Objective 2: To identify the challenges and constraints facing GCB Bank in the implementation of effective credit risk management practices.

While there is evident satisfaction in some aspects of GCB Bank's credit risk management, the survey also uncovers areas needing improvement. These include technical feasibility and credit rating. These areas could be encompassed within broader indicators of credit risk management, as proposed by Ali and Dhiman (2019) in their study on Indian public-sector commercial banks. Thus, this highlights the need to pay greater attention to these parameters in managing credit risk.

Moreover, the survey respondents at GCB Bank show less satisfaction with regulatory compliance, representing another challenge facing the bank. This finding presents a contrast to Rehman et al.'s (2019) study, where they found corporate governance to be a significant influence on credit risk management in commercial banks in Balochistan. The discrepancy could potentially be due to differences in regulatory standards or implementation between regions or types of banks.

Addressing these challenges is critical to ensuring continued loan performance and minimizing the risk of defaults. It is consistent with Ekinci and Poyraz's (2019) findings that there is a negative correlation between credit risk and return on assets and equity.

In conclusion, while GCB Bank's credit risk management practices generally align with industry research and are satisfactory in many respects, there are still opportunities for improvement. These improvements, if properly executed, can further enhance loan performance and minimize defaults, providing benefits for both the bank and its customers. This reinforces the notion that credit risk management is an ongoing, dynamic process that requires consistent monitoring and timely adjustments to meet changing circumstances.

Implications for practice

Risk Avoidance: With respondents indicating satisfaction with GCB Bank's credit history and financial viability, it validates the bank's current practices in these areas. It also highlights the importance of maintaining these robust measures in the future. However, respondents' lesser satisfaction with the bank's technical feasibility and credit rating suggests a need to revisit the existing processes. GCB Bank could benefit from reassessing their credit rating strategies, possibly through technological interventions or by drawing on successful models from other banking institutions. This could lead to enhanced risk avoidance and customer satisfaction.

Risk Monitoring: The satisfaction indicated by respondents with the loan performance and economic and market conditions at GCB Bank suggests that the bank's risk monitoring is functioning effectively in these areas. However, the concern expressed around regulatory compliance underscores a significant area for practice. A strong regulatory compliance not only minimizes risk but also builds trust with stakeholders. Thus, the bank should review its existing compliance mechanisms, seek expert advice, and consider implementing rigorous compliance training programs for its staff.

Loan Performance: The general satisfaction of respondents with GCB Bank's loan repayment rate and loan loss rate provides evidence for the bank's strong performance in these areas. However, the concern around the loan default rate is a call to action for the bank. A high loan default rate has serious implications, impacting the bank's financial health and reputation. It necessitates an immediate review of GCB Bank's credit risk policies, loan disbursement, and borrower evaluation procedures. The bank could also explore alternative ways to support borrowers and prevent default, like financial literacy programs and improved borrower communication.