Research Article: 2019 Vol: 23 Issue: 5

Effect of Risk Profile, Good Corporate Governance, Earnings, and Capital on Growth Income in Banking Services Listed In Indonesia Stock Exchange

Rida Prihatni, State University of Jakarta

Abstract

This study aims to provide evidence of the influence, or lack thereof Risk Profile, Good Corporate Governance (GCG), Earnings, and Capital, or RGEC on profit growth. RGEC is a bank health assessment method. Non-performing loans (NPL) are used as an indicator of the Risk Profile variable, the self-assessment of each bank is used as an indicator of GCG, Return on Assets (ROA) is used as an indicator of Earnings, and Capital Adequacy Ratio (CAR) is used as an indicator of Capital. The population of this research is banking companies listed in Indonesia Stock Exchange (IDX) in the period 2013 to 2015. The research sample consists of 14 banks that have been selected according to several sample criteria. A purposive sampling method is employed and the analysis of research data is carried out using a multiple linear regression test. The results show that ROA has an influence on profit growth, whereas there is no evidence of the influence of NPL, bank self-assessments and CAR on profit growth.

Keywords

Profit Growth, Non-Performing Loan, Good Corporate Governance, Return on Assets, Capital Adequacy Ratio.

Introduction

Every process related to a bank, including institutional, business activities and the management of these activities, can be regarded as banking. In accordance with Bank Indonesia Regulation 2011 concerning the rating of the soundness of commercial banks, banks are required to conduct a risk-based bank rating to evaluate their soundness. A bank's health rating is measured according to either the bank’s individual or consolidated performance. The guidelines for the latest procedures are known as the RGEC method, which stands for Risk Profile, Good Corporate Governance, Earnings, and Capital. This regulation also replaces Bank Indonesia Regulation 2004 with its six assessment factors known as CAMELS (Capital, Asset Quality, Management, Earnings, Liquidity, and Sensitivity to Market Risks).

The soundness of a bank’s finances can be assessed using risk techniques or methods relating to governance, profits, and capital by abbreviation through foreign terms. RGEC is a comprehensive assessment of the integration of risk profile and performance management, which includes the implementation of Good Corporate Governance (GCG) of profitability and capital (Alizatul et al., 2015). A healthy bank can be said to be one which fulfills the requirements of RGEC. Public trust in bank services arises when banks are able to demonstrate their soundness and the quality of their performance. Suhita & Mas'ud (2016) stated that, by applying RGEC, banks can detect and evaluate problems more quickly this means that they can implement GCG more effectively and can manage any risks or crises they may face.

The use of financial ratios as a measure of performance can also assist in assessing the health of a bank (Agustina, 2015). This measure can be used to establish the company's financial condition as the level of performance of a company is directly proportional to its financial condition. If a company's financial performance improves, then its financial condition also improves, so preferably. The performance of a company is indicated by its achievements. One parameter that can be used to assess the achievements of a company is its earnings (Adisetiawan, 2012). Liquidity, profitability, and solvency are the different dimensions of the performance of any bank. Each of these dimensions is equally important as it plays a vital role in the maintenance of the bank financial viability. If the bank is financially viable it would be able to survive for a long time in the future (Tabash & Hassan, 2017).

The ability to generate maximum profits on a bank is very important, because basically the parties concerned, for example investors and creditors measure the success of the bank based on the ability seen from management performance in generating profits. This is indicated by the growth in profits generated by banks. Earnings growth at banks can be influenced by several factors including Risk Profile, Good Corporate Governance, Earnings, and Capital, as shown by Setiani & Asyik (2015). Taruh (2012) also states that the positive profit growth of a company generates profitability. Prasetyo et al. (2016) research shows the results that return on assets, return on equity, gross profit margin, and net profit margin affect profit growth. Fathoni et al. (2012) also conducted a study on banks listed in Indonesia Stock Exchange (IDX )in the period 2007 to 2010 and discovered that profit growth is influenced by the factors of CAR and non-performing loans (NPL). Irma et al. (2016) found that NPL, Return on Assets (ROA), CAR and GCG each had an influence on the profit growth of bank companies listed in IDX in 2013. This study aims to examine the effect of Risk Profile, GCG, ROA, and CAR on earnings growth partially and simultaneously on banks listed in IDX in the period 2013 to 2015.

Literature Review and Development of Hypotheses

Signaling Theory

Signaling Theory emphasizes the importance of information provided by a management company to investors and others; such information acts as a signal for investors, affecting the decisions they make. An example of such a signal is profit information, which has become the main focus of financial statements. Through the disclosure of profit information, management can convey signals that are not communicated publicly; for instance, profit figures can reflect inside information in the form of management policies, management plans, secret strategies and so on (Suwardjono, 2013).

Theory of Regulation

Stigler's (1971) regulatory theory suggests that regulatory activity represents the fraternity between the political forces of an interest group (executive/industry) and legislative demands. This theory argues rules or provisions are necessary in accounting. The government, therefore, should take responsibility for the regulation of provisions relating to information communicated by companies. Such provisions are required to ensure that all users and presenters receive the same balanced information.

Bank Health Level

Bank soundness refers to the ability of a bank to perform normal banking operations and to fulfill all its obligations in accordance with the applicable regulations (Kasmir, 2004: 2005). A healthy bank can be categorized as one which is capable of maintaining soundness in accordance with the provisions of adequate capital, asset quality, quality management, liquidity, profitability, solvency and other aspects related to the business of banking, and which conducts business activities in accordance with the principle of caution.

RGEC Method

According to Bank Indonesia Regulation concerning Commercial Bank Health Rating, RGEC (comprising Risk Profile, Good Corporate Governance, Earnings, and Capital) is the latest bank soundness assessment method required by Bank Indonesia. The Risk Profile enables the assessment of both the bad risk management applied and the risks inherent in the bank performing its operational activities. Eight aspects of risk are assessed in the Risk Profile: credit risk, market risk, operational risk, liquidity risk, legal risk, strategic risk, compliance risk, and reputation risk. In this study, credit risk is proportioned with the NPL ratio to represent the credits that cause problems for banks.

The Risk-Based Bank Rating Method, initiated in 2011 assesses the quality of bank management in applying GCG principles. The assessment involves three main aspects: governance structure, governance process, and governance outcomes in assessing GCG. Earnings refer to a company's ability to earn a profit over a certain period (Riyanto, 2008). The ROA ratio used in this study represents a company's ability to manage its assets for profit (Margaretha, 2013). Capital is a tool used to measure the capital adequacy of a company or the ability of a bank to increase assets involve contain risks. In this study, the CAR ratio is used to assess Capital or bank capital. This ratio reflects a bank's ability to cover its declining assets as a result of owning assets at risk of capital adequacy (Margaretha, 2013).

Profit Growth

Profit is defined as realized revenues less the costs associated with the income in a given period (Hamidu, 2013). Profit information is important to existing and potential investors because profit is an indicator of good corporate prospects in the future; if a company’s profit increases, then existing or potential investors will be more willing to buy shares in the company. However, it is not possible to predict whether the profit obtained by accompany will increase or decrease. The circumstances under which the profits rise or fall each year is known as profit growth. Salvatore (2001) states that high profits are a sign that consumers want more industry output. Profit can provide an important signal for the relocation of community resources as a reflection of changes in consumer tastes and demand over time.

Development of Hypotheses

Any credit problems a company has are detected using a technique involving the NPL ratio. Such problems can be in the form of doubtful or unsuccessful loans. If the NPL ratio of a firm is high, it can be interpreted that it has low loan quality, as evidenced by the large number of unsuccessful loans. Such a condition leads to a high rate of loan failure, which in turn has a negative impact on the company's ability to gain profits (Brock & Rojas, 2000). Therefore, the first hypothesis is as follows:

H1: Risk Profile has a negative effect on profit growth.

ROA is used to measure the ability of bank management to obtain profit generated from the total assets of the bank concerned. In other words, ROA reflects a company's effectiveness in optimizing its assets. The greater the profit generated, the higher the ROA, and therefore the more effective the company is optimizing its assets. High profitability is the goal of every bank, so it is important that profitability be measured accurately. Moreover, the results of research conducted by Fathoni (2012), and Prasetyo et al. (2016) have shown that ROA has a positive influence on the profit growth of banking companies listed in IDX. So, the second proposed hypothesis is as follows:

H2: Earnings have a positive effect on profit growth.

The implementation and management of GCG emphasizes the importance of the shareholder’s right to obtain accurate information in a timely manner. This reflects a company's obligation to disclose all financial performance information accurately, punctually and transparently. Therefore, public or closed companies should view GCG not as a mere accessory, but as an effort to improve financial performance and corporate value (Tjager, 2003). According to Bruno & Claessens (2004), improving corporate governance will have a positive effect on the company's performance. Thus improving the management of GCG will have a positive effect on corporate profit, as one measure of company performance. So, the third proposed hypothesis is as follows:

H3: Good Corporate Governance has a positive effect on profit growth.

CAR is a ratio that specifies the proportion of the total assets of a bank that involve risks and that are financed from their own capital and the proportion of funds from sources outside the bank. CAR is also an indicator of the ability of a bank to cover the decline in its assets as a result of losses caused by the risk of capital adequacy. In other words, the smaller the risk, the higher the profits, and therefore the higher the CAR achieved by the bank, leading to improved bank performance. This is supported by research conducted by Sapariyah (2012) and Fathoni (2012) which found that CAR has a positive effect on profit growth. So, the fourth proposed hypothesis is as follows:

H4: Capital has a positive effect on profit growth.

Methods

The population consists of banking companies that are listed in IDX during the period of research, ending in 2015. For the purpose of the study, samples are selected in accordance with the following criteria:

1. Banks listed in IDX since 2012.

2. Banks that do not have negative earnings.

3. The data used is complete from 2013 to 2015.

Dependent Variables: The dependent variable used in this research is profit growth, which is calculated using the following equation where t represents the current period (Robin, 2013):

Independent Variables In this study, four independent variables are used to measure the level of health of banks. These are as follows:

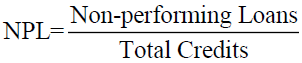

a. Risk Profile is represented by NPL. According to Robin (2013), NPL is formulated using the following equation:

b. GCG is measured using the results of the self-assessment conducted by Commercial Bank as a sample in this research. The composite ratings as determined by Bank Indonesia are as follows: Very Healthy (Composite Rating 1), Healthy (Composite Rating 2), Healthy Enough (Composite Rating 3), Less Healthy (Composite Rating 4), and Unfair (Composite Rating Composite Rating 5).

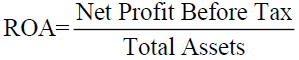

c. Earnings are indicated by ROA. According to Dendawijaya (2009), ROA is formulated using the following equation:

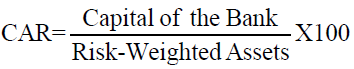

d. Capital is indicated by CAR. According to Dewi et al. (2016), CAR is calculated using the following formula:

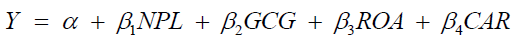

The analytical technique used is multiple regressions. Multiple regressions provide a representation of the power of influence of independent variables on the dependent variable and can be used to predict the rise or fall of a dependent variable if two or more independent variables are used (Ghozali, 2009). With the dependent variable of earnings growth and independent variable that is NPL, Good Corporate Governance based on publication of selfassessment result of each bank, ROA, and CAR. The regression equation used is:

Results and Discussion

Description of Sample

The sample consists of 42 banking companies that were listed in IDX during the period 2013-2015. The distribution of samples is as follows in Table 1:

| Table 1 Distribution of Samples | |

| Banking companies listed in IDX during the period 2013-2015 | 42 |

| Sample criteria: 1. Banks that have negative earnings 2. Incomplete data 3. Outliers |

(4) (8) (16) |

| Number of samples Number of observations during the three-year period |

14 42 |

Regression Output

The classical assumption test discussed above proves that the proposed regression model has fulfilled the four classical assumptions for a normal distribution and is free from symptoms of autocorrelation, multicollinearity and heteroscedasticity. The results of the multiple linear regression testing can be seen in Tables 2-4.

| Table 2 The Results of Coefficient Determination (R2) Test | |||

| R | R Square | Adjusted R Square | |

| 1 | 0.496 | 0.246 | 0.165 |

| Table 3 The Results of F Test | ||||

| F | Sig | Criteria | Conclusion | |

| 1 | 3.020 | 0.030 | < 0.05 | The Model is feasible |

| Table 4 Results of Multiple Linear Regression Analysis | ||||

| Unstandardized Coefficients (B) | Sig | Criteria | Conclusion | |

| (Constant) | -0.863 | 0.406 | < 0.05 | Rejected |

| NPL | 0.086 | 0.255 | < 0.05 | Rejected |

| GCG | -0.108 | 0.824 | < 0.05 | Rejected |

| ROA | 0.209 | 0.005 | < 0.05 | Accepted |

| CAR | 0.039 | 0.056 | < 0.05 | Rejected |

Based on Table 2, the following multiple linear regression equation is generated:

Profit Growth = -0.863 + 0.086 NPL - 0.108 GCG + 0.209 ROA +0.039 CAR

Discussion of Result

NPL Effect on Profit Growth

The results of this study indicate that NPL has no effect on profit growth. This means it cannot be said that companies with low NPL values are more likely to experience an increase in profit growth than companies with high NPL values. This finding is in contradiction to Doloksaribu (2013), who stated that higher NPL values cause higher provision costs of productive assets and other costs that must be borne by the bank, potentially leading to a decrease in bank profit. The results of this study are in line with those of studies conducted by Suryani & Habibie (2017); Dewi (2016), which state that NPL has no significant effect on profit growth, but are not in line with Robin (2013); Fathoni et al. (2012); Annisah (2013); and Rusdianto (2017) who found that NPL does affect profit growth.

GCG Effect on Profit Growth

The results of this study show that GCG has no effect on profit growth. This finding is in line with research conducted by Suryani & Habibie (2017), which states that GCG has no effect on profit growth. However, this research is not in line with the findings of a study conducted by Like (2012), which found that GCG does affect the financial performance of a company. It is worth noting that the data analysis for the GCG composite value shows that for each bank sample over three years of observation, the average rank remains the same each year (that is, Rank 2: healthy), while profit growth result fluctuates. Companies that always have a healthy ranking cannot always increase their profit growth.

ROA Effect on Profit Growth

The results of this study demonstrate that ROA has an influence on profit growth. This finding is in line with research conducted by Afanasieff et al. (2002); Fathoni (2012); Rusdianto (2017); Susanti & Fuadati (2014) and Erawati & Widayanto (2016) show that return on asssets positive effect significantly to profit growth. However, this result is not in line with those of Zainuddin & Hartono (2009), which indicate that ROA is not able to predict profit growth. ROA affects profit growth because it reflects management's ability to manage assets and profits. The assets are divided into earning assets (loans and investments) and non-productive assets (fixed assets and other assets). ROA represents the capability of the capital invested in all assets to generate profits, while profit in an indicator of the effectiveness of a company in optimizing its assets. The greater the ROA, the higher the level of profit achieved by the bank and therefore the higher the rate of profit growth.

CAR Effect on Profit Growth

The results of this study indicate that CAR has no effect on profit growth. This finding is in line with research conducted by Zainuddin & Hartono (2009), which also found that CAR has no significant effect on profit growth. However, this result is not in line with those of the research conducted by Sapariyah (2012); Fathoni (2012); Annisa (2013); Rusdianto (2017) which state that CAR has a significant effect on profit growth. Each company must be able to meet the minimum capital required by Bank Indonesia, and the bank also sets the required CAR value; any bank that cannot meet this requirement is said to be an unhealthy bank. The performance of banks that have relatively small capital and CAR values that are only equivalent to the minimum limit does not affect the amount of profit growth. If CAR does not affect by profit growth, it can be interpreted that the bank that is the sample of this study has not successfully managed the capital to be owned such that it covers the assets that are at risk due to decreased company assets.

Conclusion

Some conclusions about the influence of RGEC variables on profit growth can be drawn based on the results obtained in this study. The value obtained for Adjusted R2 of the regression model is 0.165. It can be concluded that 16.5% of profit growth can be accounted for by the dependent variables: NPL, GCG, ROA, and CAR. Meanwhile, the remaining 83.5% is caused by other factors. The simultaneously obtained test results demonstrate that together the dependent variables, NPL, GCG, ROA, and CAR, have an influence on profit growth. The individual, or partial, test results indicate that the NPL, GCG, and CAR variables do not affect profit growth, while the ROA variable does have an influence on profit growth. The results of this study are in line with research conducted by Afanasieff (2002); Fathoni (2012); Khaddafi & Ummah (2014), Rusdianto (2017); Susanti & Fuadati (2014); Prasetyo et al. (2016); Erawati & Widayanto (2016). The results of this study indicate that the ROA ratio is often considered a signal for investors and creditors in assessing company performance; this is because ROA can influence the company's profit growth. That is because the higher ROA means that the company is more effective in using assets to generate profits. ROA which increases profit growth is considered as a signal that the company has good prospects in the future.

In this study, there are still some limitations that include: this research only focuses on quantitative factors in the form of financial ratios and the research year is only two years, namely from 2013-2015, the RGEC ratio used in predicting profit growth, not all of the RGEC ratio has been assessed. Suggestions that can be given to future researchers to be able to develop further research on profit growth is by adding to the research period, replacing research with other objects, and adding other variables so that it can improve previous research.

References

- Adisetiawan, R. (2012). Analysis of the effect of financial performance in predicting profit growth. Journal of Management Applications, 10(3).

- Afanasieff, T.S., Lhacer, P.M., & Nakane, M.I. (2002). The determinants of bank interest spread in Brazil. Money Affairs, 15(2), 183-207.

- Agustina, F.M. (2015). Ratio Analysis of Bank Soundness Using the RGEC Method at PT. State Savings Bank (BTN) Tbk. Unesa Accounting Journal, 3(2).

- Alizatul, Fadhila., Saifi, M., & Zahroh. (2015). Analysis of bank soundness using the risk based bank rating (RBBR) Method (Study of a central government-owned bank registered on the indonesia stock exchange in 2012-2013). Journal of Business Administration, 2(1).

- Annisa, L. (2013). The influence of bank health level on profit growth in BPR in Indonesia. Journal of Economics and Finance, 1(4).

- Bank Indonesia. (2011). Bank Indonesia Regulation Number 13 / I / PBI / 2011, Concerning the Bank Rating System for Commercial Banks.

- Brock, P.L., & Suarez, L.R. (2000). Understanding the behavior of bank spreads in Latin America. Journal of Development Economic, 63, 113- 134.

- Bruno, V.G., & Claessens, S. (2004). Corporate governance and regulation: Can there be too much of a good thing? The 6th Annual Darden Conference on Emerging Markets.

- Dendawijaya, L. (2009). Banking Management (Second Edition). Jakarta: Ghalia Indonesia.

- Dewi, F.S., Arifati, R., & Andini, R. (2016). Analysis of effect of CAR, ROA, LDR, Company size, NPL, And GCG to bank profitability (Case Study on Banking Companies Listed in BEI Period 2010-2013). Journal of Accounting, 2(2).

- Doloksaribu, T.A. (2013). Effect of indicator ratio of bank soundness to the go public banking company earnings growth (Empirical Study of Banking Companies listed on the Indonesia Stock Exchange in the Period 2009-2011)..

- Erawati, T., & Widayanto, I.J. (2016). Effect of working capital to total assets, operating income to total liabilities, total assets turnover, return on asset, and return on equity against profit growth in manufacturing companies listed on the indonesia stock exchange. Journal of Accounting, 4(2).

- Fathoni, M.I., Sasongko, N., Setyawan., & Anton, A. (2012). The influence of bank health level on profit growth in banking sector companies. Journal of Economic Resource Management, 13(1).

- Ghozali, I. (2009). Multivariate Analysis Application with SPSS Program. Semarang: Diponegoro University Publisher Agency.

- Hamidu, N.P. (2013). The effect of financial performance on profit growth in banking at IDX. Jurnal Emba, 1(3).

- Irma, H., Dwiyanti, R., & Widiastuti, Y. (2016). Assesing the effect of bank performance on profit growth using RGEC approach. Review of Integrative Business & economics, 5(3)

- Kasmir, (2004). Banks and Other Financial Institutions. Jakarta: PT. Raja Grafindo Parsada.

- Kasmir, (2005). Banking Management. Jakarta: PT. Raja Grafindo Persada.

- Khaddafi, M. & Ummah, A. (2014). Influence analysis of return on assets (ROA), return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current ratio (CR), against corporate profit growth in automotive in Indonesia Stock Exchange. International Journal of Academic Research in Business and Social Sciences, 4(12), 101-114.

- Like, M.W. (2012). Effect of good corporate governance practices on corporate financial performance at Indonesia stock exchange. Management Journal, 1(1).

- Margaretha, F., & Zai, M.P. (2013). Factors affecting Indonesia's banking financial performance. Journal of Business and Accounting, 15(2), 133-141.

- Prasetyo, R.Y., Darminto., & Nuzula, N.F. (2016). The effect of profitability on corporate growth. Journal of Business Administration (JAB), 30(1).

- Riyanto, B. (2001). Fundamentals of Corporate Expenditures (Fourth Edition). Seventh Printing. Yogyakarta: BPFE

- Robin. (2013). Influence of CAR NPL, BOPO, LDR, Branches, and BI Rate on Profit Growth: Study of Commercial Banks with Assets ≥ Rp 50 Trillions in Indonesia. Journal of Accounting and Management Research, 8(1).

- Rusdianto, (2017). The effect of variable risk profile, earnings, and a capital against growth of banking profit registered at Indonesia Stock Exchange. International Journal of Business Quantitative Economics and Applied Management Research, 4(3).

- Salvatore, D. (2001). Managerial Economics in A Global Economy, (Fourth Edition). Harcourt College Publishers.

- Susanti, N.H., & Fuadati, S.R. (2014). Financial ratio analysis for predicts profit growth of automotive companies on the IDX. Journal of Management Science & Research, 3(5).

- Sapariyah, R.A. (2012). The effect of capital, assets, earning and liquidity ratios on earnings growth in banking in indonesia (Empirical Study on Banking in Indonesia). Journal of Business and Banking Economics, 18 (13).

- Setiani, F.R., & Asyik, N.F. (2015). The effect of profit growth and corporate social responsibility on corporate value. Journal of Accounting Science & Research, 4(5).

- Suwardjono., (2013). Accounting Theory: Financial Reporting Engineering (Third Edition). BPFE.

- Suhita, M.D., & Imam, M. (2016). The influence of risk profile, capital, and GCG on banking profitability (Empirical Study on Conventional Commercial Banks listed on IDX period 2011-2014). Student Scientific Articles.

- Suryani, Y., & Habibie, A. (2017). Analysis of the influence of bank based risk ratios on earnings growth in banking companies listed on the Indonesia stock exchange. KITABAH Journal, 1(1)

- Stigler, J.G. (1971). The theory of economic regulation. Bell Journal of Management Science, 2(1).

- Tabash, M.I., & Hasan, H.I. (2017). Liquidity, profitability and solvency of UAE banks: A comparative study of commercial and Islamic banks (2017). Academy of Accounting and Financial Studies Journal, 21(2).

- Taruh, V. (2012). Financial ratio analysis in predicting profit growth in manufacturing companies in BEI (Period Year 2007-2010). Journal of Accounting and Auditing Research, 3(2).

- Tjager, I.N., Alijoyo, A., Djemat, H.R., & Sembodo, B. (2003). Corporate governance: Challenges and opportunities for the Indonesian business community. Forum Corporate Governance in Indonesia (FCGI).

- Zainuddin., & Hartono, J. (2009). Benefits of financial ratios in predicting profit growth: An empirical study of banking companies listed on the JSE. Indonesian Accounting Research Journal, 2(1).