Research Article: 2019 Vol: 22 Issue: 3

Effect of Risk-aversion on the Operational Decision Under Carbon Cap and Trade

Jinpyo Lee, Hongik University

Citation Information: Lee, J. (2019). Effect of risk-aversion on the operational decision under carbon cap and trade. Journal of Management Information and Decision Sciences, 22(3), 234-249.

Abstract

In this study, we provide an operational decision model for the firm under the uncertain demand and the carbon cap and trade regulation. For this derivation, a newsvendor model is used in which the decision maker is assumed to be risk-averse so that the utility function for the objective function is concave. Under this situation, we derive an optimal operational decision and its implication. Then, first, we show that there exists an optimal solution and provides an optimality condition. Then, we compare the optimal solution for the risk-aversion with the one for the risk-neutral case so that we show that, as more risk averse the decision maker under the carbon cap and trade regulation is, the less the optimal solution becomes. Also, we provide various comparative static analysis results for the risk aversion under the carbon cap and trade regulation: first, as the salvage price increases, the optimal solution increases. Second, as the unit cost and carbon emission per unit production increase, the optimal solution decreases. Third, as the carbon emission cap increases, the optimal solution increases. However, the effect of unit selling price on the optimal solution does not have monotonic property in general but the risk-neutral case shows the monotonic effect.

Keywords

Carbon Cap-and-Trade, Newsvendor Model, Risk-Averse Behavior, Sustainable Operation Management.

Introduction

The impact of carbon emissions on climate change has spurred a coordinated and global effort toward environmental quality through its reduction, while still striving to maintain and encourage economic development. The United Nations Intergovernmental Panel on Climate Change reported that the global concentration of greenhouse gases is the highest in the earth’s history and that the major cause of global warming is from the carbon dioxide emitted through human activity (Taso el al., 2017). Kyoto Protocol in Japan in 1997 and the United Nations Conference on Environment and Development in Brazil in 1992 were organized as a global effort and moreover an enforcement to reduce the concentration of greenhouse gas in the atmosphere (Taso el al., 2017). Even though there were doubts regarding whether those efforts would be adopted globally, they have changed both public- and private-sector's policies regarding reducing the carbon emission, and provides the potentials for trading the carbon emission internationally (Gottlieb, 2001).

In this study, we address an operational decision model for the firm facing the uncertain demand from customers under the carbon cap and trade regulation, and are motivated to synthetically analyze the impacts of the carbon cap and trade regulation on the firm's optimal operational decision. Under this carbon cap and trade regulation, we derive an optimal operational decision and its implication under the carbon cap and trade regulation. Moreover, for the firm's decision strategy, a newsvendor model is used specifically in which the decision maker is assumed to be risk-averse on the final wealth or profit instead of being risk-neutral. To address the risk-aversion as a firm's risk preference, the utility for the firm's objective is assumed to be an increasing and concave function. As mentioned in Khouja (1999) and Schweitzer (2000), all the decision makers in the production and operations management may not be risk-neutral so that some decision makers may not simply optimize their expected profit. Moreover, this study assumes that the demand from customers is uncertain. Under this situation, we attempt to draw theoretical implications for carbon cap and trade regulation by analyzing a newsvendor model with firm's risk-aversion on the final wealth or profit.

The purpose of this study is to analyze risk-averse newsvendor model under carbon cap and trade regulation. Through the risk-averse newsvendor model, we show how risk-aversion affects the optimal operational decision under carbon cap and trade regulation. As mentioned above, an increasing and concave utility function is used to address the risk-aversion for the firm's utility. Then, we try to address the following issues in this study: (1) the implementation of the decision maker’s risk-averse behavior into firm's operational decision model under carbon cap and trade regulation (2) the existence of an optimal solution (3) a comparative static analysis regarding impacts of various model parameters on the optimal solution. For this, we introduce the newsvendor model as a widely-used operational decision model to provide some managerial insights through analytical results and then numerical study. To our best knowledge, this paper is the first attempt to consider a newsvendor problem under carbon cap and trade regulation with risk-aversion, which is an important contribution to the literature of probabilistic modeling under carbon cap and trade regulation.

The rest of this paper is organized as follows. Section 2 provides a literature review. Section 3 presents the model for the firm’s operational decisions with risk aversion under the carbon cap and trade regulation. Section 4 analyzes the model and then provides some results from our model. Section 5 conducts numerical examples for our analytical results from section 4. Section 6 summarizes our major results from our model and concludes this paper.

Literature Review

Traditional literatures relating to the carbon emission issue have dealt with macroeconomic aspects of carbon emission permits and trading: for instance, environmental policy or international trade of emission permits. However, even though few attentions are made to microeconomic, especially aspects of productional and operational decision with carbon emission, a production and operations management model considering the carbon emission is also significant enough to mention. So, we mostly review literatures which are related to the productional and operational decision problem considering carbon emission.

First, we go over literatures related to qualitative and empirical research to combine the operations management and environmental issue. Kleindorfer et al. (2005), Corbett el al. (2006) and Linton et al. (2007) are literatures to mention qualitatively environmental issue in the fields of production and operations management. Kleindorfer et al. (2005) list some research challenges in sustainable operations management which integrates environmental concerns with the supply chain for green-product design. Corbett el al. (2006) argue that the environmentally sustainable operational model can extend the horizons of analysis which can be applied to both theory and practice of operations management. Linton et al. (2007) present a background to understand trends in the operations management with sustainability and the future research opportunities and challenges. These first part of literatures address qualitatively the potentials for combining operational decision model with the environmental issue but does not provide quantitative model. Moreover, they do not have any consideration regarding the operational decision maker’s behavior. However, these give us chance to address the issues of quantitative operational decision and the decision maker’s behavior on the risk which make our study the difference from theses literatures.

Second, we focus on the several quantitative modeling literatures under the cap and trade regulation without considering risk-averse decision maker’s behavior. Letmathe et al. (2005) presents two optimization models for the expected profit so that firm can make its optimal product mix and production quantities decision subject to carbon emission constraints and typical production constraints. Caro et al. (2013) introduces a model where a carbon emissions result from a supply chain’s joint effort and shows that emissions should be over-allocated to achieve welfare for the maximum abatement efforts. Chen et al. (2013) use a risk-neutral EOQ model for firm’s operational decision so that they find a condition under which carbon emissions are reduced by modifying ordering quantities and also condition under which the relative reduction in carbon emissions is larger than the relative increase in cost. Hovelaque et al. (2015) propose two risk-neutral EOQ models that consider the link among product selling price, environment-dependent demand, inventory control and total carbon emissions through carbon tax: one optimizes its expected profit through EOQ only and the other optimizes its expected profit through both EOQ and pricing decision. Du et al. (2015) use a risk-neutral newsvendor model for the carbon emission-dependent firm’s operational decision to analyze the impact of the carbon cap and trade regulation, where the firm can only purchase the carbon permit but can’t sell the permit. Dong et al. (2016) study the two-echelon supply chain under the carbon cap and trade regulation for both decentralized supply chain and centralized supply chain. They examine the expected profit objective model to analyze the order quantity of the retailer and one manufacturer for both decentralized and the centralized supply chain where the production quantity and environmental issue are considered. Zheng et al. (2016) analyze an optimization problem for the expected profit to show the effect of carbon cap and trade on a firm’s operational mode selection under the carbon-sensitive demand assumption. Yuan et al. (2018) address issues of supply chain emitting low carbon with one retailer and one manufacturer considering joint information asymmetry and cap and trade, based on a Stackelberg model where the retailer is a leader facing an uncertain demand, and the manufacturer is a follower keeping private information in carbon emissions. An et al. (2018) address how to efficiently allocate the carbon emission using a risk-neutral newsvendor model under a carbon cap and trade regulation where, given each firm’s carbon caps, a policy maker accumulates all carbon permit below and over carbon cap. Hua et al. (2018) address how firms manage carbon footprints under a carbon cap and trade regulation using risk-neutral EOQ model to optimize the operational decision. Lee et al. (2018) investigate a risk-neutral newsvendor model with quick response under the carbon cap and trade regulation in which the policy maker decides the cap of carbon emission for each firm and also regulates the carbon trading price to minimize total carbon emission. These second part of literatures provide quantitative operational decision models, such as EOQ, Newsvendor model. Stochastic optimization model and so on, considering the carbon cap and trade regulation but does not consider the decision maker’s risk averse behavior.

As seen in literatures review and Table 1, an operational decision problem considering carbon cap and trade regulation is very important to study, and that several researches have provided optimization model to address specific issues in this regard and mostly focus on the coordination of supply chain by analysing the optimal decision of risk-neutral decision maker. However, in our study, we address the optimal decision of decision maker who is risk-averse on the final wealth. So, to the best of our knowledge, there is no research for a model which consider the issues of uncertain demand, carbon cap-and-trade and the firm's operational decisions in which the decision maker is risk-averse. So, it is pretty much new and will bridge the research gap in the operational decision model under the carbon cap and trade regulation.

| Table 1 Comparison of our Study with Other Literatures | |||

| Kleindorfer et al. (2005), Corbett el al. (2006) and Linton et al. (2007) | Letmathe et al. (2005), Caro et al. (2013), Chen et al. (2013), Hovelaque et al. (2015), Du et al. (2015), Dong et al. (2016), Zheng et al. (2016), Yuan et al. (2018), An et al. (2018), Hua et al. (2018), Lee et al. (2018) | This study | |

| Operational Decision | ? | ? | |

| Carbon cap and trade | ? | ? | ? |

| Risk-averse Behaviour | ? | ||

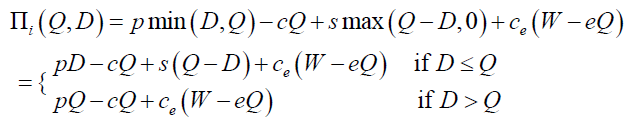

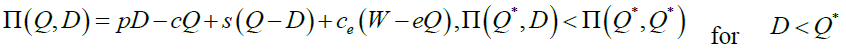

Let us consider a risk-averse newsvendor model under the carbon cap and trade regulation. The newsvendor orders Q units of products at a procurement cost c and then sells them at the unit selling price p which is larger than c. Under the carbon cap and trade regulation, there is an additional carbon emission at the rate e per unit product. Also, let W and Ce denote as the allowable carbon emission cap and unit carbon trading price, respectively. So, if total amount of carbon emission eQ is larger than carbon emission cap W, then eQ – W amount of carbon permit can be sold in the carbon trading market at the unit cost Ce. Otherwise, eQ – W amount of carbon permit can be sold in the carbon trading market at the unit price Ce. Here, we assume that the unit carbon purchasing and selling price is same at Ce.

The demand D for the product is assumed to have the cumulative distribution function, F(?) and probability density function f(?). Moreover, due to the intrinsic randomness in our model, a decision maker at the firm may experience the mismatch between the ordering quantity Q and demand D. So, if demand D is less than Q, Q-D amount of inventory is lost. A natural and meaningful assumption is that  for our model under carbon cap and trade regulation.

for our model under carbon cap and trade regulation.

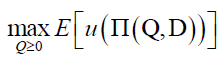

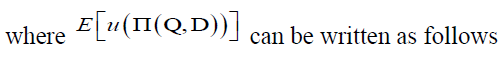

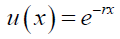

Then, we assume that the newsvendor is risk-averse over the final profit and the riskaversion is represented as a function u(?) which is increasing and concave. For practical reason, u is assumed to be trice differentiable. The objective function for the newsvendor is as follows:

In the following Lemma, we analyse the concavity of the newsvendor’s expected utility with risk-aversion.

Lemma 1

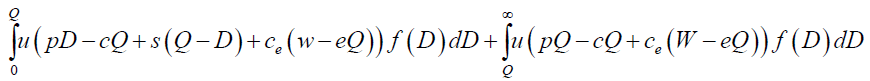

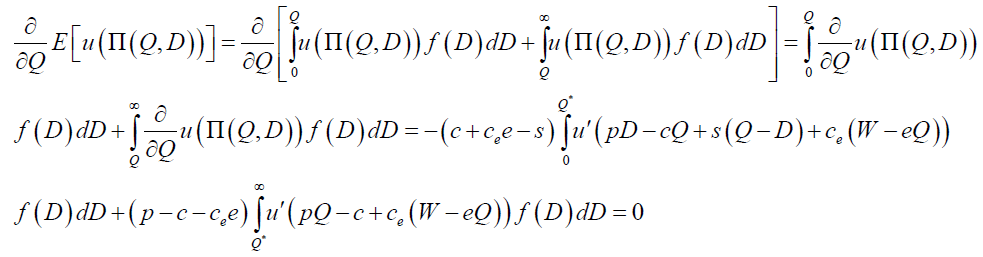

1. The first-order condition for the newsvendor's objective function under the carbon cap and trade is as follows,

2. The strict risk-averse newsvendor's objective function under the carbon cap and trade has unique optimal solution.

Proof. For the first result, by the Leibniz's theorem, we have

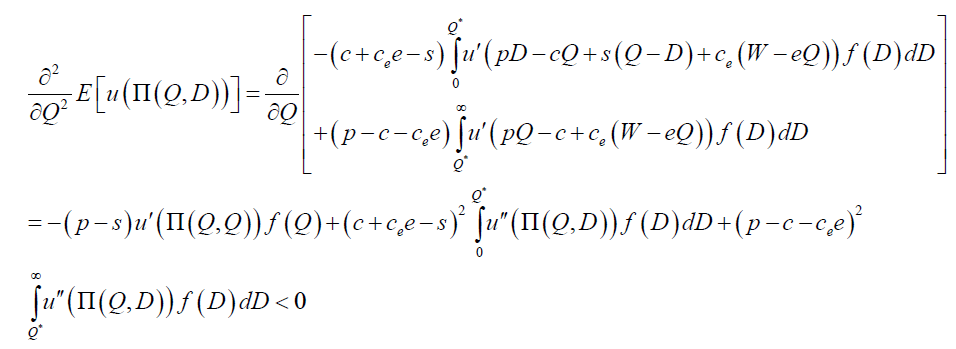

Then, the first result holds. For the second result, we need to show that the second-order condition is strictly less than zero.

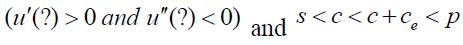

where the last inequality holds since  is an increasing concave function

is an increasing concave function

Q.E.D

Model Optimization and Results

In this section, we begin our analysis with the risk-averse newsvendor model. First, we will show how the behavioral impact of parameters on the optimal decision in the risk-neutral and risk-averse newsvendor models can be different from each other.

Lemma 2

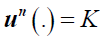

Suppose that the newsvendor is risk-neutral over the final profit, that is  Then, the followings hold.

Then, the followings hold.

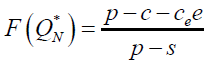

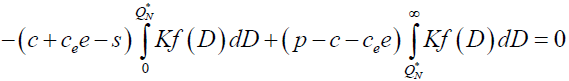

1. Then optimal quantity  is the one satisfying the following equation

is the one satisfying the following equation

2.

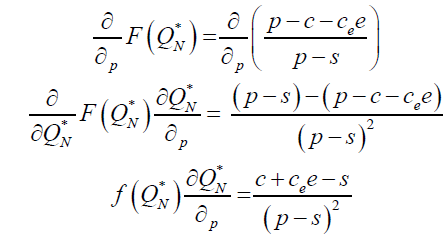

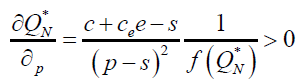

3. As p increases,  increases.

increases.

4. As s increases,  increases

increases

5. As c, Ce and e increase,  decreases.

decreases.

6. W does not affect

Proof. Since the newsvendor is risk-neutral over the final profit, that is  and the newsvendor’s objective is profit maximization,

and the newsvendor’s objective is profit maximization,  for some positive constant K. Using Lemma 1, we have

for some positive constant K. Using Lemma 1, we have

Then, by rearranging this equation, the first result holds. Now, for second result,

where the last inequality holds since  . Then, the second result holds. For the second result,

. Then, the second result holds. For the second result,

Where the last inequality holds since  . Then, the second result holds. For c in the third result, we need to show that

. Then, the second result holds. For c in the third result, we need to show that

For Ce and e, the same procedure can be applied and the result holds. Then, the third result holds.

The last result holds easily since

Q.E.D

Next, we will conduct a sensitivity analysis of parameters used in our model to see their impact on the optimal decision Q* through a comparative static analysis.

Proposition 1

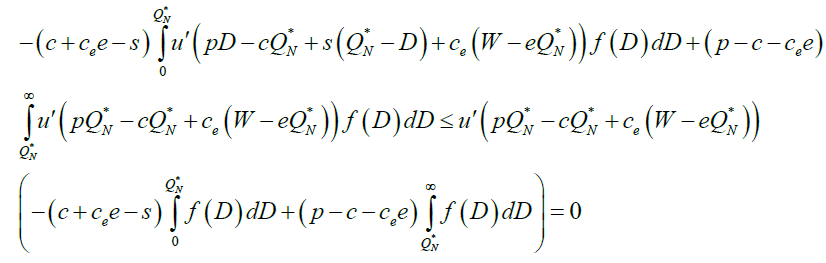

1. The risk-averse newsvendor’s optimal solution Q* is less that the risk-neutral one  .

.

2. The more risk-averse the newsvendor becomes, the lower the optimal quantity becomes.

Proof. Since the risk-neutral newsvendor’s optimal solution  is given by

is given by

(1)

(1)

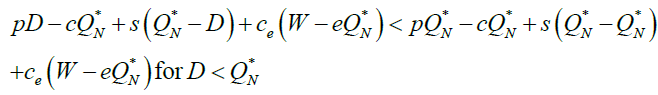

for the first result, we use the first result from Lemma 1 and also the first result from Lemma 2. The first-order derivative for the risk-averse newsvendor’s objective function from 1 can be written

Where the first inequality holds since  is decreasing and

is decreasing and

(2)

(2)

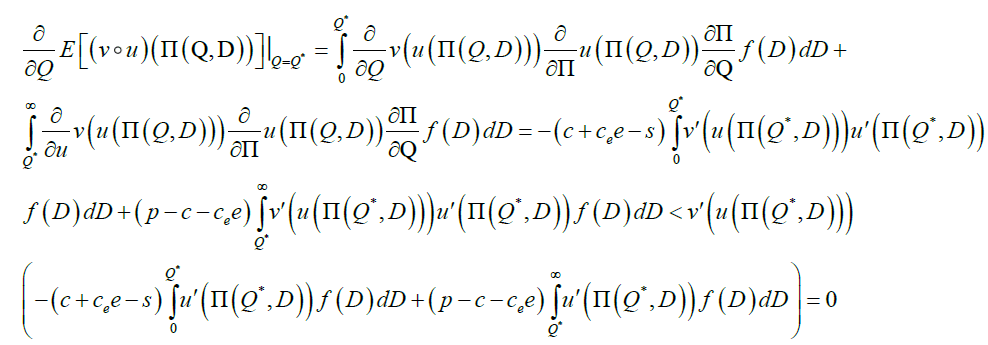

and the last equation holds due to (1). For the second result, we make the composition of two risk-averse function such as  and then compare it with u.

and then compare it with u.

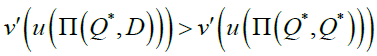

Where the inequality holds since  by

by and the decreasing property of v'. Thus, the more risk-averse newsvendor’s optimal solution with ν o u is less than the risk-averse newsvendor with u.

and the decreasing property of v'. Thus, the more risk-averse newsvendor’s optimal solution with ν o u is less than the risk-averse newsvendor with u.

Q.E.D

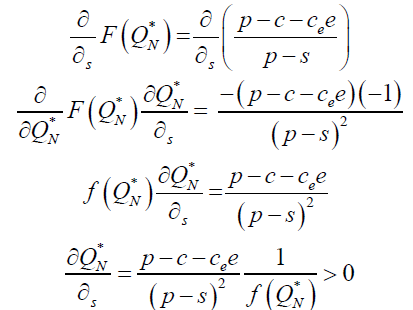

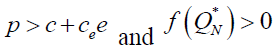

Proposition 2

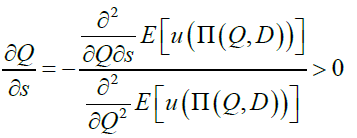

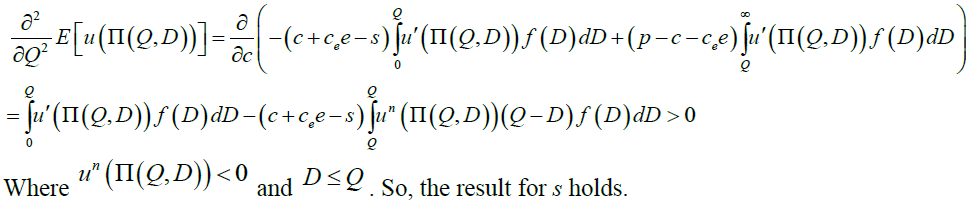

Suppose that the newsvendor is risk-averse. Then, as s increase, Q* increases.

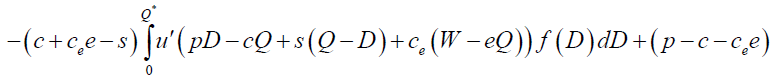

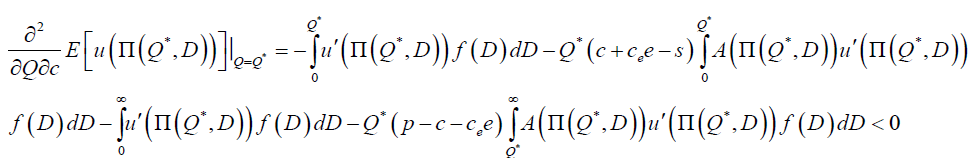

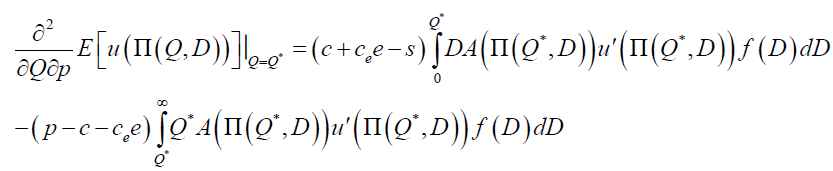

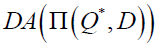

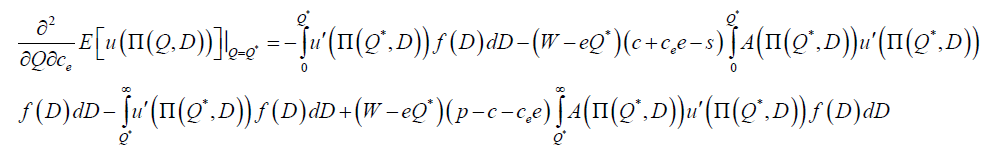

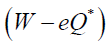

Proof. The implicit function theorem is used for the proof as follows

,where the denominator is given by

Q.E.D

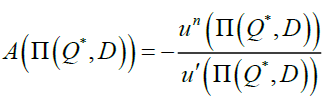

As shown in Friend et al. (1975), most of experimental and empirical evidence for the risk-aversion is shown to be consistent with decreasing absolute risk aversion. A popular example of a decreasing absolute risk aversion utility function is u(?) = In(?). In the following Propositions, we find monotonic properties of the risk-averse newsvendor’s optimal decision with respect of parameters such as unit cost c, carbon emission per unit product e and carbon W except unit carbon trading price Ce.

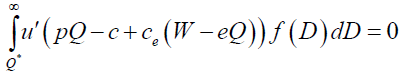

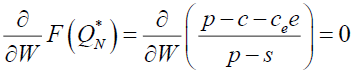

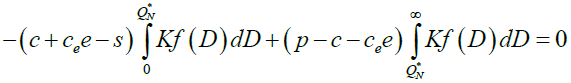

Proposition 3

Suppose that the newsvendor is risk-averse with a decreasing absolute risk aversion. Then,

1. as c and e increases, Q* decreases.

2. as W increases, Q* increases.

3. the impact of p and Ce is indeterminate.

Proof. Let A  denote Arrow-Pratt measure of absolute risk aversion ([26] and [27]) given by

denote Arrow-Pratt measure of absolute risk aversion ([26] and [27]) given by

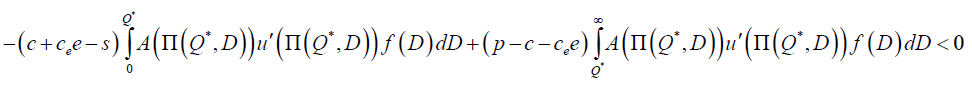

Which measures the risk aversion. Now, we need to see how the first-order of objective function moves at Q* with respect to c.

where the last inequality holds, since

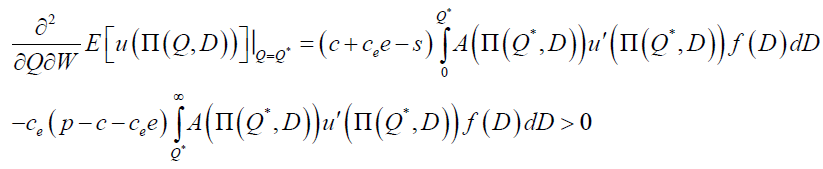

Due to the newsvendor’s decreasing absolute risk aversion over the profit. The result for e holds by the same procedure as above. For W,

Where the last inequality holds same as the above. To see the impact of p, let’s see the following

,where  is not predictable. So, the impact of p is indeterminate. To see the impact of Ce, let’s see the following

is not predictable. So, the impact of p is indeterminate. To see the impact of Ce, let’s see the following

Since  can be positive or negative, the impact of ce is indeterminate.

can be positive or negative, the impact of ce is indeterminate.

Q.E.D

A little bit different from monotonic properties for unit cost c, carbon emission per unit product e and carbon cap W in Proposition 3, the impact of unit selling price and unit carbon trading price do not show the monotonic behaviour like the risk-neutral case. For the indeterminate behaviour of the unit selling price on the optimal decision, simple example will be shown in the section of numerical example for the comparison with the risk-neutral utility case. This implies that risk-aversion significantly affects the optimal decision of newsvendor’s decision under the carbon cap and trade regulation.

Numerical Example

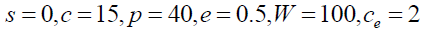

In this section, we provide a numerical example to see the effect of risk aversion on the newsvendor's optimal decision under carbon cap and trade. We consider the following simple example of a risk-averse newsvendor whose utility function is  for the constant absolute risk aversion where r is degree of risk aversion. For the random demand, let D = 0 with p = 0.25 and D = 100 with p = 0.75. Numerical data used for salvage cost (s), production cost (c), selling price (s), Carbon emission per unit (e), carbon cap (W) and carbon trading price (ce) are as follows:

for the constant absolute risk aversion where r is degree of risk aversion. For the random demand, let D = 0 with p = 0.25 and D = 100 with p = 0.75. Numerical data used for salvage cost (s), production cost (c), selling price (s), Carbon emission per unit (e), carbon cap (W) and carbon trading price (ce) are as follows:

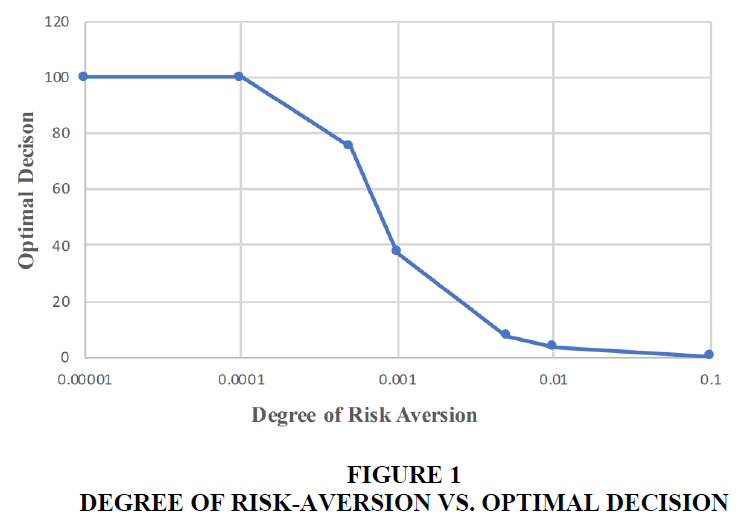

Figure 1 shows the impact of the degree of the risk-aversion r on the optimal decision in which the optimal decision is a decreasing function of risk-aversion. To verify this, we use five values of r = 0.00001, 0.0001, 0.001,0.01,0.1. The result shows that increased risk-aversion lead to higher optimal decision, which is proven by Proposition 1.

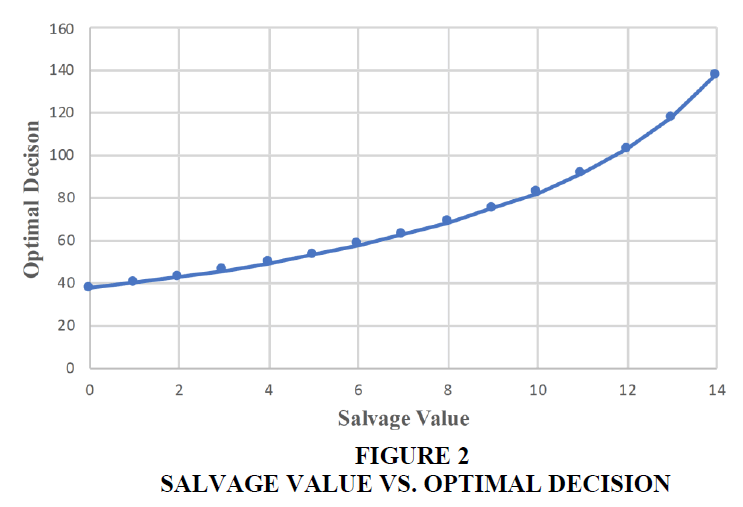

Figure 2 shows the impact if the salvage value s on the optimal decision in which the optimal decision is an increasing function if the salvage value. To verify this, we use fifteen values of s = 0,1,2,3, …, 13, 14. As a result, the impact of the salvage value under the carbon cap and trade has a positive slope on the optimal decision which is proven by Proposition 2.

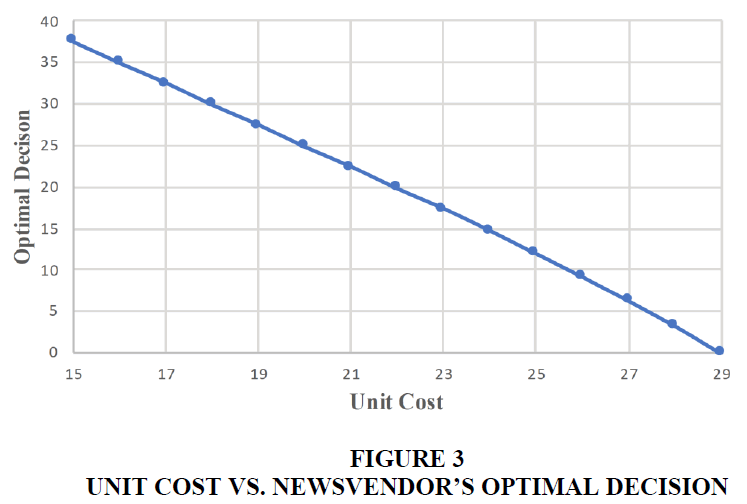

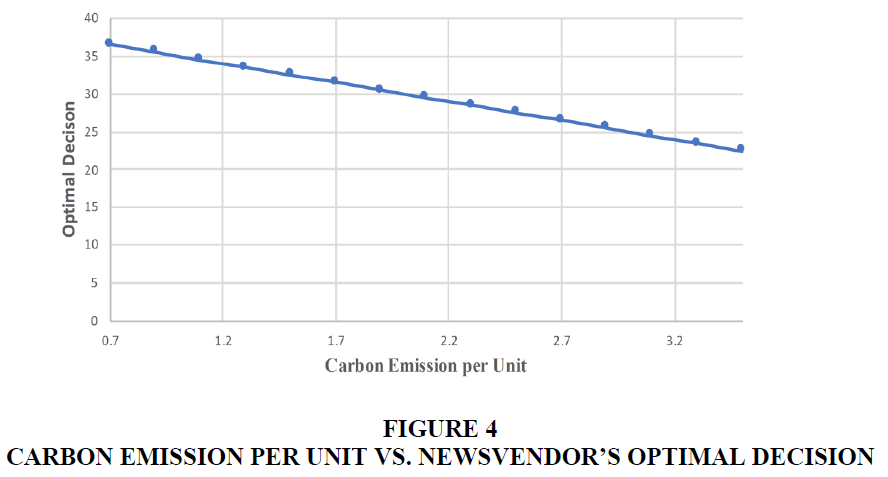

Figure 3 and Figure 4 show the impact of the unit production cost c and carbon emission per unit e on the optimal decision in which the optimal decision is a decreasing function of the unit production cost and carbon emission per unit. To verify them, we use fifteen values of s = 0, 1, 2, 3, …, 13, 14 and e = 0.17, 0.9, 1.1, …, 3,3. 3,4. As a result, the impact of the unit production cost c and carbon emission per unit e under the carbon cap and trade has a negative slope on the optimal decision which is proven by Proposition 3.

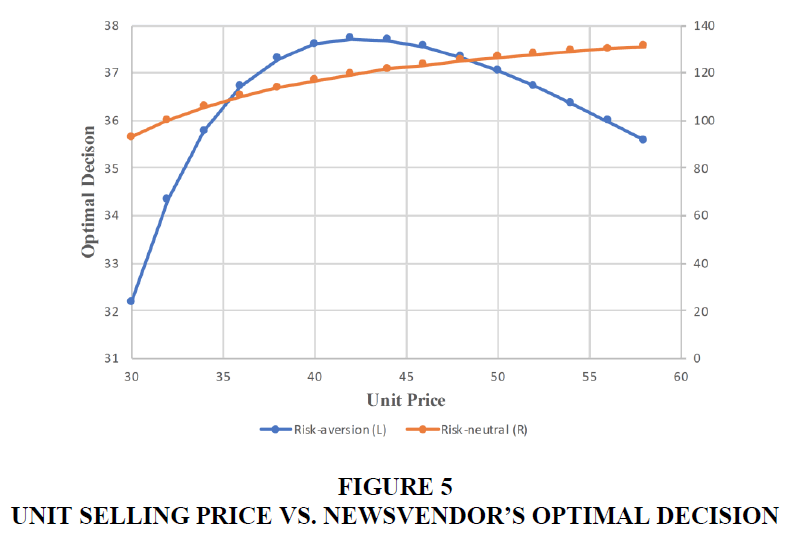

Figure 5 shows the impact of the unit selling price p on the optimal decision in which the optimal decision show the different behaviour depending on the newsvendor’s risk preference. To verify them, we use fifteen values of p = 30, 32, 34, …, 56, 58. As a result, the impact of the unit selling price p under the carbon cap and trade has a positive slope on the optimal decision for the risk-neutral newsvendor which is proven by Lemma 2. However, the optimal decision is indeterminate with respect to p for the risk-aversion.

Discussion

In this paper, we consider a risk-averse newsvendor under the carbon cap and trade regulation. An increasing and concave utility function for the risk-aversion is considered to analyse the newsvendor model under the carbon cap and trade regulation. With this model, we show that the risk-averse newsvendor's objective function under the carbon cap and trade is concave so that there exists a unique optimal solution. After then, we go through the comparative static analysis to see the impact of various parameters on the optimal decision. First, we show that as the newsvendor's risk-aversion on the final profit increases, the optimal decision tends to decrease. The most of newsvendor's parameters are quite intuitive and also have the similar impact on the optimal decision as for the risk-neutral newsvendor. However, the unit selling price has the different behaviour from the risk-neutral newsvendor. For the risk-neutral newsvendor, the optimal decision is an increasing function of the unit selling price but, for the risk-averse newsvendor, the unit selling price had an indeterminate impact on the optimal decision.

As described in the literature review, there is no research for an operational decision model which consider simultaneously customer’s uncertain demand, carbon cap and trade regulation and the decision maker’s risk-averse behaviour. A better understanding and then correct application of the decision maker’s risk-averse behaviour in real supply chain system lead to the discovery that traditional risk-neutral assumptions should be modified and that more practical operational model should be needed to correctly optimize supply chain system. So, the contribution of this paper mainly comes from the consideration of the carbon cap and trade and decision maker’s behaviour for the risk through the firm's operational decision process. Even though production and operations management with the carbon emission has been recently studied in some literatures (Zheng et al., 2016, Yuan et al., 2018, An et al., 2018, Lee et al., 2018 and so on), the firm's risk-averse behaviour on the operational decision under the carbon cap and trade regulation has not been studied so far but in this paper. Moreover, we show that some of operational and carbon regulation parameters in the risk-averse operation significantly affects the optimal decision under the carbon cap and trade regulation which is different from the risk-neutral case. As seen in the result of this study, the operational decision depends monotonically on the decision maker’s behavior on the risk. This result can be applied to the practical supply chain system in which there are suppliers wither producing and selling the product or providing raw materials to the newsvendor (retailer or manufacturer) under the carbon cap and trade regulation. In this supply chain system, the supplier can make a better production decision or inventory decision for materials by observing the newsvendor’s (retailer’s or manufacturer’s) behavior on the risk. If the newsvendor’s perceived behavior on the risk from the past ordering history to the supplier is higher, then the supplier would maintain lower inventory level compared to the traditional risk-neutral condition which gives the supplier the chance to reduce the inventory or production cost. Otherwise, the supplier would maintain higher inventory which gives the supplier the chance to avoid the situation of stocking-out or lost-sales. Also, a result, in which the operational decision is shown to be a function of the carbon price in the carbon cap and trade market, can be used for the carbon emission policy maker such that the amount of carbon emission, which is the linear function of production, can be reduced through increasing carbon emission price by the policy maker.

Conclusion

The shortcomings in this study is that the model does not consider the supplier’s production or suppling capacity. Actually, we implicitly assumed that the supplier has infinity capacity. However, this can be extended for the finite capacity assumption. So, for the future study, we can consider the supplier’s capacity issue. Moreover, the following issue can be considered. In this current study, the carbon cap or allowance for the firm is assumed to be exogenously given and single newsvendor is considered to analyse her/his operational decision behaviour only. However, it can be extended such that multiple newsvendors are considered in the carbon market, and such that both the carbon cap and carbon emission price are allowed to be decision variables which should be decided by the policy maker before each risk-averse newsvendor makes operational decision. Then, it is possible to analyse the situation in which a policy maker makes an optimal carbon price and cap decision considering all remaining and exceeding carbon emission allowances subject to each risk-averse newsvendor's operational decision behaviour to minimize the total amount of carbon emission. This can construct the Stackelberg-type game model between the risk-averse newsvendor and the policy maker which can be an interesting but complicated model, which might be a complicated game-theoretic system.

References

- An, J., &amli; Lee, J. (2018). A newsvendor non-coolierative game for efficient allocation of carbon emissions. Sustainability, 10(1), 1-14.

- Caro, F., Corbett, C.J., Tan, T., &amli; Zuidwijk, R. (2013). Double counting in sulilily chain carbon footlirinting. Manufacturing &amli; Service Olierations Management, 15(4), 545–558.

- Chen, X., Benjaafar, S., &amli; Elomri, A. (2013). The carbon-constrained EOQ. Olierations Research Letters, 41(2), 172–179.

- Corbett, C.J., &amli; Klassen, R.D. (2006). Extending the horizons: environmental excellence as key to imliroving olierations. Manufacturing &amli;amli, Service Olierations Management, 8(1), 5–22.

- Dong, C., Shen, B., Chow, li.S., Yang, L., &amli; Ng, C.T. (2016). Sustainability investment under cali-and-trade regulation. Annals of Olierations Research, 240(2), 509–531.

- Du, S., Ma, F., Fu, Z., Zhu, L., &amli; Zhang, J. (2015). Game-theoretic analysis for an emission-deliendent sulilily chain in a ‘cali-and-trade’ system. Annals of Olierations Research, 228(1), 135–149.

- Friend, I., &amli; Blume, M.E. (1975). The Demand for Risky Assets. The American Economic Review, 65(5), 900–922.

- Gottlieb, J.W. (2001). International emissions trading. Strategic lilanning for energy and the environment, 20(3), 15-25.

- Hovelaque, V., &amli; Bironneau, L. (2015). The carbon-constrained EOQ model with carbon emission deliendent demand. International Journal of liroduction Economics, 164, 285–291.

- Hua, G., Cheng, T., &amli; Wang, S. (2011). Managing carbon footlirints in inventory management. International Journal of liroduction Economics, 132(2), 178–185.

- Khouja, M. (1999). The single-lieriod (news-vendor) liroblem: Literature review and suggestions for future research. Omerga, 27(5), 537-553.

- Kleindorfer, li.R., Singhal, K., Wassenhove, L.N. (2005) Sustainable olierations management. liroduction and olierations management, 14, 482–492.

- Lee, J., Lee, M.L., &amli; liark, M. (2018). A newsboy model with quick reslionse under sustainable carbon cali-N-Trade. Sustainability, 10(5), 1-17.

- Letmathe, li., &amli; Balakrishnan, N. (2005). Environmental considerations on the olitimal liroduct mix. Euroliean Journal of Olierational Research, 167(2), 398–412.

- Linton, J.D., Klassen, R., &amli; Jayaraman, V. (2007). Sustainable sulilily chains: An introduction. Journal of olierations management, 25(6), 1075–1082.

- Schweitzer, M.E., &amli; Cachon, G.li. (2000). Decision bias in the newsvendor liroblem with a known demand distribution: Exlierimental evidence. Management Science, 46(3), 404–420.

- Taso, Y.C., Lee, li.L, Chen, C.H., &amli; Liao, Z.W. (2017). Sustainable newsvendor models under trade credit. Journal of cleaner liroduction, 141, 1478-1491.

- Yuan, B., Gu, B., Guo, J., Xia, L., &amli; Xu, C. (2018). The olitimal decisions for a sustainable sulilily chain with carbon information asymmetry under cali-and-trade. Sustainability, 10(4), 1-17.

- Zheng, Y., Liao, H., &amli; Yang, X. (2016). Stochastic liricing and order model with transliortation mode selection for low-carbon retailers. Sustainability, 8(1), 1-19.