Research Article: 2021 Vol: 25 Issue: 3S

Effects of Circular Economy Information Disclosure on the Corporate Financial Performance of Companies Listed on the Stock Exchange of Thailand

Cheeranun Naksomsong, Kasetsart University

Tharinee Pongsupatt, Kasetsart University

Abstract

A Circular Economy (CE), an integral approach to sustainable development, requires cooperation between all the sectors involved in the supply chain. In this process, the disclosure of CE information, coupled with governmental support, will serve as the driving force behind the achievement of desirable outcomes. The objective of the present study was to examine the effects of CE information disclosure on the corporate financial performance of companies listed on the Stock Exchange of Thailand (SET) between 2016 and 2019. The research instrument was a CE information disclosure checklist. It was found that the score for CE information disclosure relating to recycling equaled 0.5 out of 3.0, demonstrating that adherence to this important CE principle was extremely limited. However, an exploration of innovation aspect for CE information disclosure, revealed positive relationships with gross profit margins, and net profit margins. Based on the findings, it is recommended that governmental agencies orchestrate collaboration between all the sectors involved and devise appropriate measures in order to produce desirable outcomes according to the Bio-Circular-Green (BCG) economy model. It is also advisable that business owners encourage product and service innovation that catalyzes progress toward CE and ultimately the realization of sustainable development goals.

Keywords

Circular Economy, Information Disclosure, Corporate Financial Performance, Stock Exchange of Thailand

Introduction

Circular Economy (CE) is based on the premise that a product should be consumed in a manner that maximizes its value, efficiency, and product life cycle until the end of its genuine lifetime with the least impact on the environment (Ellen MacArthur Foundation, 2019). Due to its potential benefits, CE has been earnestly pursued in various countries across the world. In the context of Thailand, the concept has been incorporated in its Bio-Circular-Green (BCG) economic development model since early 2021, in line with the UN Sustainable Development Goals (SDGs). It is expected that the BCG will increase its GDP to 4.4 trillion baht by 2025 (NSTDA, 2020). To succeed, CE requires cooperation between all the sectors involved in the supply chain. According to the Stock Exchange of Thailand (SET), one critical factor in the process is the disclosure of CE information, which helps to promote an organization’s image, accentuate its competitive advantage, and enhance its ability to yield a return in the long run (n.d.). However, there has been little effort thus far to examine CE information disclosure by companies listed on the SET. Thus, this research aimed to examine the effects of CE information disclosure on the corporate financial performance of companies listed on the SET. Its secondary objective was to investigate the extent of CE information disclosure by industry and the differences in CE information disclosure across industries.

Literature Review

Circular Economy (CE)

A Circular Economy (CE) is a system that emphasizes the consumption of finite natural resources in a sustainable manner (Almagtome, Al-Yasiri, Ali, Kadhim & Nima, 2020) by maximizing efficiency (Trollman, Colwill & Brejnholt, 2020) and minimizing waste with the implementation of measures involving reducing, reusing, and recycling, or the 3R’s. Because of its discernible benefits, CE has been embraced in a wide variety of contexts (Saengchai, Sriyaku & Jermsitiprasert, 2019; Yadav, Mangla, Sachin, Bhattacharya & Luthra, 2020).

For instance, from a macroeconomic perspective, CE is regarded as a mechanism for curbing the ratio of national waste or garbage per population. In environmental conservation contexts, CE is a tool for combating air, water, and land pollution problems. In business settings, CE serves as an integral approach to undertaking production and operations that not only minimize natural resource depletion but also maximize the reuse and recycling of energy and material to achieve optimal efficiency (Valavanidis, 2018). CE also plays an important role in enabling businesses to engender a paradigm shift toward meeting ever-increasing demand amid diminishing resources through more sustainable strategies, such as manufacturing products to rent instead of being offered for sale. In any context, propelling CE forward requires systematic thinking that takes into consideration the impacts of waste on the environment, the utilization of innovation to maximize the efficiency of resource consumption (Cayzer, Griffiths & Beghetto, 2017; Kravchenko, McAloone & Pigosso, 2020), and the delivery of product value and safety to consumers, to name but a few.

Because of the ubiquitous applications of CE, comprehensive evaluation criteria are still not available (Saidani, Yannou, Leroy, Cluzel & Kendall, 2019; Kravchenko, McAloone & Pigosso, 2020; Yadav, Mangla, Sachin, Bhattacharya & Luthra, 2020). However, individual performance indicators have been addressed in several studies. For instance, on a macroeconomic level, Saengchai, Sriyaku & Jermsitiprasert (2019) examined the relationships between CE and the environmental conditions in Southeast Asia by evaluating the volume of waste produced by ASEAN member countries, revealing the significant roles of greenhouse gas emissions and alternative energy use in the CE of the manufacturing sector. In another study, Almagtome, Al-Yasiri, Ali, Kadhim & Nima (2020) evaluated CE in terms of reliance on power generation from fossil fuels, alternative energy use, waste reduction, and recycled material use.

On a smaller level, Cayzer, Griffiths & Beghetto (2017) assessed the implementation of CE during the five product life cycle stages, namely product design or improvement, using positive product changes and raw material selection as the criteria; production, using reliance on power generation from fossil fuels, alternative energy use, production process efficiency, and the utilization of reused or recycled material as the criteria; distribution, using the reduction of packaging volume and size, the provision of recycling information on product labels, the availability of product reclamation service, and the extension of warranty periods as the criteria; product use, adopting use follow-ups, the formulation of preventive maintenance plans, the provision of repair service, and design for ease of repair or change of replacement parts as the criteria; and termination of use, adopting the availability of product reclamation service and the recycling of returned items or packaging as the criteria. In terms of businesses listed on stock exchanges, Wang, Che & Fan (2014) examined four aspects of CE, namely CE performance and winning CE awards, CE investment and expenses, CE policy and application, and recycled material. In the present study, a synthesis of the literature review, the findings from the interviews with CE and sustainability experts as well as SET supervising bodies, and the data from the eight industries on the SET yielded an extensive collection of ten CE information disclosure aspects, as shown in Table 1.

| Table 1 Aspects of Ce Information Disclosure |

|

|---|---|

| Independent CE information disclosure aspects | Descriptions/ Disclosure of information relating to |

| Innovation (INN) | innovation within or between organizations |

| Material (MAT) | recyclable and non-recyclable material and packaging |

| Product reclaim (REC) | product and/or packaging reclamation |

| Energy (ENE) | energy use and the reduction of energy use |

| Water (WAT) | water use and the reduction of water use |

| Bio and cultural diversity (DIV) | the impacts of operations on bio- and cultural diversity (e.g. migrant workers) |

| Contamination of the land (LAN) | the ownership of land in protected or rehabilitated areas |

| Greenhouse gas (GAS) | greenhouse gas emissions and the reduction of greenhouse gas emissions |

| Waste (WAS) | waste and waste reduction |

| Recycling labels (LAB) | product components for recycling or waste management purposes or the provision of such information on product labels |

Corporate Financial Performance (CFP)

Corporate Financial Performance (CFP) is an indicator of the performance of a management team that shareholders and investors consider in their decision-making. Past research has demonstrated several patterns of relationships between CFP and Corporate Social Performance (CSP). To illustrate, Margolis, Elfenbein & Walsh (2009) conducted a comprehensive review of 167 articles published during 1972 and 2007. By classifying CFP into market-based and accounting-based measures, they found that CFP had a weak positive correlation with CSP. In a similar study, Peloza (2009) went a step further, examining three categories of CFP-CSP relationships from the findings reported in 159 articles published between 1972 and 2008, which revealed: a positive correlation (63%), a negative correlation (15%), and a mixed correlation (22%). In this study, CFP was classified into market-based measures and accounting-based measures. The former comprised one measure-dependent CFP indicator, while the latter consisted of four, as shown in Table 2.

| Table 2 CFP Classifications |

||

|---|---|---|

| Categories | Measure-dependent CFP indicators | Sources |

| Market-based measures | Tobin’s Q | Albitar, Hussainey, Kolade, & Gerged (2020); Camara-Turull, Li, & Abdi (2020) |

| Accounting-based measures | Return on assets (ROA) | Clemens (2006); Galbreath (2006) |

| Return on equity (ROE) | Clemens (2006); Galbreath (2006) | |

| Net profit margin (NPM) | Ompusunggu (2016) | |

| Gross profit margin (GPM) | Andarasari (2019) | |

Sustainability Information Disclosure

A review of the literature shows that most research studies on the sustainability of companies listed on stock exchanges between 2016 and 2020 focused on comparisons of the extent and quality of information disclosure across contexts. For example, Albitar, Hussainey, Kolade & Gerged (2020) analyzed sustainability information disclosure in The United Kingdom prior to and following the enforcement of integrated reporting, discovering that the ratio of major shareholders, management genders, and the number of executive committee members were influential variables. In another study, Laksar & Maji (2017) compared sustainability information disclosure in countries across Asia, demonstrating that developed countries exhibited a greater extent of information disclosure that was also of higher quality than did their developing counterparts. Many other studies factored in the disclosure of economic, social, and environmental information and the effects of these on corporate performance (Tarmuji, Maelah & Tarmuji, 2016; Ompusunggu, 2016; Yin, Li, Ma & Zhang, 2019; Alsayegh, Abdul Rahman & Homayoun, 2020; Pedron, Macagnan, Simon et al., 2021).

Conceptual Framework

Based on a synthesis of the literature on CE and its integral role in sustainable development presented thus far (Saidani, Yannou, Leroy, Cluzel & Kendall, 2019), a conceptual framework of the relationships between CE information disclosure and CFP was devised as follows. (Figure 1)

Research Methodology

Sampling and Data Collection Procedures

This study gathered primary and secondary data accessible to the public between 2016 and 2019. The criterion for sample inclusion was SET-listed companies winning the Thailand Sustainability Investment (THSI) Award, nominated and selected by the SET, or the Environmental, Social, and Governance (ESG100) Award, nominated and selected by the Thaipat Institute, an independent sustainability consulting agency. These award-winning enterprises were included in the sample because of the likelihood that they would disclose CE information in their pursuit of sustainability goals. A preliminary review of the sample indicated 533 organizations winning the THSI Award or the ESG100 Award. Of this, 16 were excluded because the information corresponding to them did not cover all the variables in the conceptual framework. The 517 enterprises that remained for further analysis represented all eight industries on the SET, namely Agriculture And Food (ARG), Consumer Products (CON), Finance (FIN), Industrial Products (IND), Real Estate And Construction (PRO), Resources (RES), Service (SER), and technology (TEC). For CE information disclosure, the sustainability reports of these organizations, be they separate documents or addenda to the annual reports, were collected. However, the preparation of such papers for the SET is on a voluntary basis and no stipulations are made by the SET regarding reporting standards. Thus, a CE information disclosure checklist was specifically devised for the purpose of data collection based on relevant national and international reporting standards, namely the framework for implementing the principles of the circular economy in organizations, formulated by the Thai Industrial Standards Institute of the Ministry of Industry, and the Global Report Initiative (GRI) Standards, developed by the Global Sustainability Standards Boards. Reference was also made to related research, such as Cayzer, Griffiths & Beghetto (2017) and Wang, Che & Fan (2014). The checklist was validated in terms of its Item-Objective Congruence (IOC) by three experts: one from the TISI, another from the Sustainable Capital Market Development Center of the SET, and the last from the Thaipat Institute. The final version of the checklist comprised 15 items of CE information disclosure classified into 10 aspects as mentioned in Table 1. The rating scale for all the items was 0-3. As regards CFP, the financial reports of the sample organizations were obtained from the Setsmart database of the SET. The CFP indicators employed in the present research were Tobin’s Q, ROA, ROE, NPM, and GPM as mentioned in Table 2.

Sampling and Data Collection Procedures

The CE information disclosure was analyzed using descriptive statistics, namely mean and Standard Deviation (SD). Then a comparison of CE information disclosure across industries was conducted using the analysis of variance (ANOVA), the Multiple Comparison Test (MCT), and the Least Significant Difference (LSD) test. Finally, the correlation between CE information disclosure and CFP was determined using the Pearson’s correlation coefficient (Pearson’s R).

Research Results

CE Information Disclosure

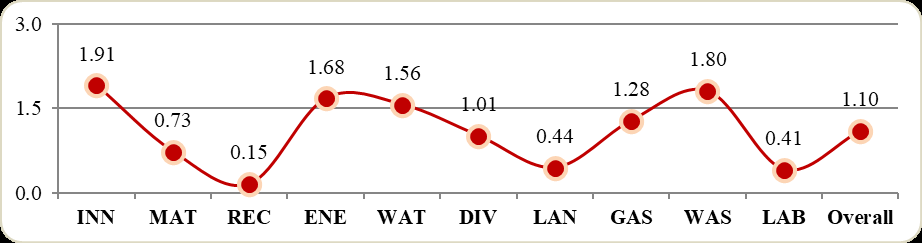

Figure 2 displays an overview of the CE information disclosure of the 517 SET-listed companies during the period between 2016 and 2019. Overall, the CE information disclosure rating stood at 1.10. The three aspects receiving the highest ratings were INN (1.91), WAS (1.80), and ENE (1.68), a finding consistent with the fact that the principles underlying CE emphasize innovation development, natural resource use efficiency, and waste and garbage reduction (Ellen MacArthur Foundation, 2019). A further exploration indicated an increasing degree of CE information disclosure across the four years under investigation, as shown in Table 3. This favorable trend was also reported in a similar study by Yordudom & Suttipun (2020).

Table 3 presents CE information disclosure across the eight industries studied. It was found that the industry exhibiting the greatest degree of CE information disclosure was RES, with the highest ratings for six out of 10 aspects, namely ENE (2.357), WAT (2.296), DIV (2.070), LAN (1.085), GAS (2.303), and WAS (2.394). One explanation for this phenomenon is that RES is under closer scrutiny and subject to more relevant laws than are the other industries under examination. Thus, its operations need to be carried out with due care in the consumption of finite resources, most notably water and energy, the management of waste to prevent adverse impacts on the environment, and, just as importantly, the disclosure of information pertaining to the implementation of such measures. Additionally, according to the MCT using the LSD in Table 4, it was found that RES (6) disclosed CE information to a greater extent than did ARG (1), CON (2), FIN (3), IND (4), PRO (5), SER (7), and TEC (8) in terms of LAN and GAS, for instance.

| Table 3 CE Information Disclosure By Year |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year 2016 | Year 2016 | Year 2016 | Year 2016 | |||||||||

| Aspects | N | Mean | SD | N | Mean | SD | N | Mean | SD | N | Mean | SD |

| INN | 117 | 1.897 | 0.95 | 125 | 1.872 | 0.984 | 133 | 1.865 | 1.028 | 142 | 1.986 | 0.982 |

| MAT | 117 | 0.615 | 0.964 | 125 | 0.716 | 1.067 | 133 | 0.823 | 1.123 | 142 | 0.75 | 1.062 |

| REC | 117 | 0.128 | 0.58 | 125 | 0.104 | 0.489 | 133 | 0.203 | 0.736 | 142 | 0.169 | 0.652 |

| ENE | 117 | 1.501 | 0.928 | 125 | 1.645 | 0.973 | 133 | 1.769 | 0.946 | 142 | 1.756 | 0.889 |

| WAT | 117 | 1.368 | 1.171 | 125 | 1.532 | 1.184 | 133 | 1.635 | 1.168 | 142 | 1.69 | 1.102 |

| DIV | 117 | 0.709 | 1.16 | 125 | 0.936 | 1.312 | 133 | 1.12 | 1.404 | 142 | 1.218 | 1.4 |

| LAN | 117 | 0.35 | 0.903 | 125 | 0.456 | 0.98 | 133 | 0.474 | 0.981 | 142 | 0.486 | 0.98 |

| GAS | 117 | 1.034 | 1.116 | 125 | 1.264 | 1.139 | 133 | 1.44 | 1.155 | 142 | 1.356 | 1.137 |

| WAS | 117 | 1.573 | 1.282 | 125 | 1.736 | 1.277 | 133 | 1.85 | 1.276 | 142 | 2.014 | 1.179 |

| LAB | 117 | 0.316 | 0.806 | 125 | 0.368 | 0.866 | 133 | 0.436 | 0.932 | 142 | 0.5 | 0.995 |

| Overall | 117 | 0.949 | 0.593 | 125 | 1.063 | 0.625 | 133 | 1.162 | 0.632 | 142 | 1.193 | 0.638 |

| Table 4 CE Information Disclosure By Industry |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Aspects | ARG | CON | FIN | IND | Industries PRO | RES | SER | TEC | Total |

| INN | 1.765 | 1.85 | 2 | 1.529 | 2.096 | 2.282 | 1.701 | 2.283 | 1.907 |

| MAT | 0.441 | 0.225 | 0.526 | 1.118 | 0.897 | 0.88 | 0.634 | 0.62 | 0.73 |

| REC | 0.132 | 0.05 | 0.018 | 0.035 | 0.151 | 0.085 | 0.186 | 0.652 | 0.153 |

| ENE | 1.549 | 1.717 | 1.854 | 1.608 | 1.539 | 2.357 | 1.361 | 1.573 | 1.675 |

| WAT | 1.574 | 1.9 | 1.351 | 1.7 | 1.616 | 2.296 | 1.103 | 1.185 | 1.565 |

| DIV | 0.809 | 0.45 | 0.228 | 0.729 | 1.616 | 2.07 | 1.031 | 0.391 | 1.01 |

| LAN | 0.338 | 0 | 0.298 | 0.224 | 0.37 | 1.085 | 0.65 | 0.087 | 0.445 |

| GAS | 1.125 | 1.4 | 1.114 | 1.394 | 1.055 | 2.303 | 0.809 | 1.25 | 1.282 |

| WAS | 1.735 | 2.2 | 1.772 | 1.977 | 1.685 | 2.394 | 1.536 | 1.304 | 1.805 |

| LAB | 0.647 | 0.15 | 0.07 | 0.494 | 0.343 | 0.493 | 0.34 | 0.565 | 0.41 |

| Overall | 1.012 | 0.994 | 0.923 | 1.081 | 1.137 | 1.624 | 0.935 | 0.991 | 1.098 |

As shown in Table 5, a further ANOVA of CE information disclosure across items revealed nine (excluding overall) with the p-value of 0.00 at a significance level of 0.01 and one with the p-value of 0.01 at a significance level of 0.05. As illustrated in Table 5, DIV was the item with the highest eta2 of 18.9% and the highest F-test value of 16.956 at a significance level of 0.01, followed by GAS (eta2=15.4% and F-test value=13.266 at a significance level of 0.01) and overall CE information disclosure (eta2=12.4% and F-test value=10.337 at a significance level of 0.01). In contrast, LAB was the aspect with the lowest eta2 of 3.5% and the lowest F-test value of 2.616 at a significance level of 0.05, a finding corroborated by the corresponding rating of 0.41 presented in Figure 1. All this demonstrated a clear tendency for the industries under examination to provide limited recycling information.

| Table 5 CE Information Disclosure Anova By Item And The Association Between Industries |

||||||||

|---|---|---|---|---|---|---|---|---|

| Aspects | SOV | SS | ANOVA df | MS | F-test | p-value | Relationship | Post Hoc Comparisons p <0.05 |

| BG | 37.23 | 7.00 | 5.32 | 5.831 | 0.00 | sig. at 0.01 | ||

| INN | WG | 464.31 | 509.00 | 0.91 | 0.074 | 8> 1,4,7 | ||

| Total | 501.54 | 516.00 | 0.272 eta | |||||

| BG | 31.01 | 7.00 | 4.43 | 4.129 | 0.00 | sig. at 0.01 | ||

| MAT | WG | 546.10 | 509.00 | 1.07 | 0.054 eta² | >1,2,3,7,8 | ||

| Total | 577.11 | 516.00 | 0.232 eta | |||||

| BG | 14.36 | 7.00 | 2.05 | 5.598 | 0.00 | sig. at 0.01 | ||

| REC | WG | 186.57 | 509.00 | 0.37 | 0.071 eta² | 8>1,3,4,5,6,7 | ||

| Total | 200.93 | 516.00 | 0.267 eta | |||||

| BG | 47,74 | 7.00 | 6.82 | 8.575 | 0.00 | sig. at 0.01 | ||

| ENE | WG | 404.78 | 509.00 | 0.80 | 0.105 eta² | 6>1,2,3,4,5 | ||

| Total | 452.52 | 516.00 | 0.325 eta | |||||

| BG | 71.87 | 7.00 | 10.27 | 8.426 | 0.00 | sig. at 0.01 | ||

| WAT | WG | 620.21 | 509.00 | 1.22 | 0.104 eta² | 1,2,4,5,6>7 | ||

| Total | 692.08 | 516.00 | 0.322 eta | |||||

| BG | 174.90 | 7.00 | 24.99 | 16.956 | 0.00 | sig. at 0.01 | ||

| DIV | WG | 750.05 | 509.00 | 1.47 | 0.189 eta* | 1,4,5,6,7>3 | ||

| Total | 924.95 | 516.00 | 0.435 eta | |||||

| BG | 49.53 | 7.00 | 7.08 | 8.413 | 0.00 | sig. at 0.01 | ||

| LAN | WG | 428.15 | 509.00 | 0.84 | 0.104 eta' | 6>1,2,3,4,5,7,8 | ||

| Total | 477.68 | 516.00 | 0.322 eta | |||||

| BG | 104.11 | 7.00 | 14.87 | 13.266 | 0.00 | sig. at 0.01 | ||

| GAS | WG | 570.66 | 509.00 | 1.12 | 0.154 eta' | 5>1,2,3,4,5,7,8 | ||

| Total | 674.77 | 516.00 | 0.393 eta | |||||

| BG | 50.27 | 7.00 | 7.18 | 4,766 | 0.00 | sig. at 0.01 | ||

| WAS | WG | 767.00 | 509.00 | 1.51 | 0.062 eta² | i>1,3,4,5,7,8 | ||

| Total | 817.27 | 516.00 | 0.248 eta | |||||

| BG | 14.76 | 7.00 | 2.11 | 2.616 | 0.01 | sig. at 0.05 | ||

| LAB | WG | 410.31 | 509.00 | 0.81 | 0.035 eta² | 1>2,3,5,7 | ||

| Total | 425.07 | 516.00 | 0.186 eta | |||||

| BG | 25.38 | 7.00 | 3.63 | 10.337 | 0.00 | sig. at 0.01 | ||

| Overall | WG | 178.53 | 509.00 | 0.35 | 0.124 eta² | 6> 1,2,3,4,5,7,8 | ||

| Total | 203.91 | 516.00 | 0.353 eta | |||||

Correlation between CE Information Disclosure and CFP

Table 6 presents the correlation between CE information disclosure and CFP using five indicators, namely Tobin’s Q, ROA, ROE, NPM, and GPM. First, there was a negative correlation between MAT information disclosure and Tobin’s Q with the correlation coefficient of -11.2% and the p-value of 0.011 at a significance level of 0.05. This could be attributable to the need of businesses to opt for natural, biodegradable, and recyclable material free of chemical compounds and toxic residues in order to enhance product value for consumers. Since all this adds to production costs, the inverse relationship between CE information disclosure and Tobin’s Q is not surprising. In fact, the present finding agrees with those reported in Camara-Turull, Li & Abdi (2020); P & Busru (2021). Similarly, WAT and WAS information disclosure negatively correlated with ROE with the correlation coefficient of -10.4% and -9.1% and the p-value of 0.018 and 0.039, respectively, at a significance level of 0.05. This finding is in line with expectations, as effective water and waste management requires major investment in infrastructure and fixed assets, process improvement, water treatment recycling machinery, and waste disposal and separation systems that comply with the relevant laws, rules, and regulations. Research studies reporting corroborative evidence include Galbreath (2006); Ompusunggu (2016). In contrast, there was a positive correlation between INN information disclosure and NPM and GPM with the correlation coefficients of 10.6% and 13.2% and the p-values of 0.016 and 0.003 at a significance level of 0.05 and 0.01, respectively. Since innovation contributes to process improvement and income generation, the positive relationship between these variables is highly likely, as also reported in Ompusunggu (2016).

| Table 6 Correlation Between CE Information Disclosure and CFP |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Overall | INN | MAT | REC | ENE | WAT | |||||||

| r | p-value | r | p-value | r | p-value | r | p-value | r | p-value | r | p-value | |

| Tobin's Q | -0.103 | 0.02* | 0.049 | 0.268 | -0.112 | 0.011* | 0.226 | 0.000 | -0.157 | 0.000 | -0.188 | 0.000 |

| ROA | -0.079 | 0.072 | 0.055 | 0.208 | -0.045 | 0.310 | 0.141 | 0.001 | -0.191 | 0.000 | -0.137 | 0.002 |

| ROE | -0.013 | 0.760 | 0.150 | 0.001 | -0.003 | 0.948 | 0.269 | 0.000 | -0.056 | 0.200 | -0.104 | 0.018* |

| NPM | -0.029 | 0.506 | 0.106 | 0.016* | -0.061 | 0.167 | -0.040 | 0.364 | 0.003 | 0.947 | -0.017 | 0.705 |

| GPM | -0.010 | 0.826 | 0.132 | 0.003* | -0.068 | 0.125 | -0.018 | 0.686 | 0.023 | 0.603 | -0.013 | 0.762 |

| DIV | LAN | GAS | WAS | LAB | ||||||||

| r | p-value | r | p-value | r | p-value | r | p-value | r | p-value | |||

| Tobin's Q | 0.006 | 0.888 | -0.031 | 0.479 | -0.176 | 0.000 | -0.151 | 0.001 | 0.069 | 0.116 | sig atp <0.05 | |

| ROA | 0.037 | 0.395 | -0.007 | 0.871 | -0.162 | 0.000 | -0.147 | 0.001 | 0.077 | 0.079 | sig atp <0.01 | |

| ROE | -0.048 | 0.274 | -0.046 | 0.296 | -0.050 | 0.255 | -0.091 | 0.039* | 0.062 | 0.157 | ||

| NPM | -0.023 | 0.605 | 0.046 | 0.295 | -0.045 | 0.310 | -0.066 | 0.131 | -0.068 | 0.120 | ||

| GPM | -0.063 | 0.151 | 0.079 | 0.072 | -0.043 | 0.332 | 0.003 | 0.946 | -0.068 | 0.124 | ||

Discussion and Conclusion

Disclosure of CE Information Relating to ENE, WAS, INN, REC, LAN, and LAB

The first three aspects of CE information disclosure with the highest ratings were ENE, WAS, and INN, most of which are subject to tight regulatory controls, as displayed in Figure 2. For energy information disclosure, the Enhancement and Conservation of National Environmental Quality Act B.E. 2535 stipulates that factory owners and controlled building proprietors provide energy consumption information to relevant governmental agencies. As regards waste management information disclosure, the Department of Industrial Works Announcement B.E. 2539 requires the preparation and submission of waste disposal reports to the relevant authorities. Concerning innovation information disclosure, entrepreneurs presumably feel the extrinsic motivation to publicize their innovation in order to attract investment and ultimately improve profitability. In contrast, the three CE information disclosure aspects receiving the lowest ratings were REC, LAN, and LAB, all with the average score of lower than 1 out of 3. This finding is not unusual since no relevant laws exist that govern how product reclamation, rehabilitated areas, and recycling labels are to be managed. In regards to recycling labels, although recycling information disclosure is an important CE principle and the Ministry of Industry has promoted eco labelling since it launched the initiative in 1993, the provision of recycling information has been on a voluntary basis. Such a lack of enforcement is likely a factor inhibiting the extent of recycling information disclosure, as Alsayegh, Rahman & Homayoun (2020) argue.

Implications for Related Regulators

Several sectors in Thailand are currently striving to promote environmental awareness and waste recycling in a systematic manner from upstream operations through downstream delivery of products and services to the final waste disposal stage. However, waste disposal is under the responsibility of local administrations without any principal agencies in charge of passing and enforcing laws on a national level, resulting in a lack of conformity in terms of rules and regulations, standards, and practices. As Vassanadumrongdee’s (2021) comparative study of laws, rules, and regulations relating to CE indicates, it is vital to pass laws concerning waste recycling, separation, and disposal, the imposition of product reclamation on manufacturers and sellers, and the determination of recyclable material proportion requirements for products, for instance. In regards to this process, a governing agency should be established to take the lead, facilitate enforcement, and ensure compliance (Yoon, Lee & Byun, 2018), as well as mobilize collaboration between the parties involved for tangible outcomes.

Disclosure of CE Information Relating to GAS

As illustrated in Figure 2, the SET-listed companies in this research exhibited a low degree of CE information disclosure relating to GAS with the rating of 1.28 out of 3. According to the Sustainable Development Goal Index 2020, Thailand’s greenhouse gas emissions equaled 4.6 tCO2 per capita (Sachs, Schmidt-Traub, Kroll, Lafortune, Fuller, & Woelm, 2020), an increase of 0.1 tCO2 per capita compared to the previous year’s figure. To mitigate pollution problems, Thailand, as an ally of the United Nations Framework Convention on Climate Change, has set a goal to curb greenhouse gas emissions nationwide under normal operations by at least 111 million ton or the equivalent within 2030 (TGO, n.d.).

Implications for Businesses

To achieve environmental conservation goals, businesses, especially those in waste management, transportation, or production or with heavy energy consumption or direct and/or indirect greenhouse gas emissions, need to be involved in various ways. Examples include producing greenhouse gas emissions reports, formulating explicit goals and devising practical plans for greenhouse gas emissions reduction, and investing in pollution control infrastructure. With respect to this, the scenario is favorable as relevant regulating agencies and parties are considering the National Climate Change Act, expected to be effective in 2022.

Limitations of the Study

The findings of the present study should be interpreted with caution since the sample comprised SET-listed companies that won the THSI Award or the ESG100 Award between 2016 and 2019, not all companies. Also, the CE information disclosure checklist was specifically formulated only as a preliminary data collection instrument due to the absence of a standardized, comprehensive one that encompasses all aspects of CE in Thailand.

Recommendations for Further Research

First, an in-depth follow-up on the application of CE in an organization would provide valuable insight into its potential benefits and adaptability in other contexts. Additionally, it is advisable that specific indicators be devised for different stages of CE implementation or the determination of progress and success in a certain supply chain or on an organizational, industrial, and national level. Finally, it would be beneficial to identify problems and obstacles inherent in CE that need to be taken into consideration should CE be adopted.

Acknowledgement

The author wishes to extend her gratitude to the Kasetsart University Research and Development Institute for awarding her this research grant (research project no. Ror-Mor 25.62, under the research subsidy project of academic year 2019). Heartfelt thanks are also offered to all the experts for their contribution to the research instrument validation and for their invaluable feedback. Finally, sincere appreciation is expressed to all the parties involved for sharing their experience and making constructive comments, namely the Thai Industrial Standards Institute of the Ministry of Industry, the Sustainable Capital Market Development Center of the SET, and the Thaipat Institute. Without them, this study could not have been successfully completed.

References

- Albitar, K., Hussainey, K., Kolade, N., & Gerged, A.M. (2020). ESG disclosure and firm performance before and after IR The moderating role of governance mechanisms. International Journal of Accounting & Information Management, 28(3), 429-444.

- Almagtome, A., Al-Yasiri, A., Ali, R., Kadhim, H., & Nima, H. (2020). Circular economy initiatives through energy accounting and sustainable energy performance under integrated reporting framework. International Journal of Mathematical, Engineering and Management Sciences.

- Alsayegh, M.F., Rahman, R.A., & Homayoun, S. (2020). Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability, 12(9), 3910.

- Andarasari, P. (2019). The effect of firm size, gross profit margin and institutional ownership on disclosure of Corporate Social Responsibility (CSR). Jurnal Apresiasi Ekonomi, 7(3), 301-308.

- Càmara-Turull, X., Li, X., & Abdi, Y. (2020). Impact of sustainability on firm value and financial performance in the air transport industry. Sustainability, 12 .

- Cayzer, S., Griffiths, P., & Beghetto, V. (2017). Design of indicators for measuring product performance in the circular economy. International Journal of Sustainable Engineering, 1-10 .

- Clemens, B. (2006). Economic incentives and small firms: Does it pay to be green? Journal of Business Research, 59, 492-500.

- Ellen MacArthur Foundation (2019). Concept what is a circular economy? A framework for an economy that is restorative and regenerative by design .

- Galbreath, J. (2006). Does primary stakeholder management positively affect the bottom line? Some evidence from Australia. Management Decision, 44.

- Global Reporting Initiative GRI. The global standards for sustainability reporting.

- Kravchenko, M., McAloone, T., & Pigosso, D. (2020). To what extent do circular economy indicators capture sustainability? Procedia CIRP, 90, 31-36.

- Laskar, N., & Maji, S.G. (2017). Disclosure of corporate sustainability performance and firm performance in Asia. Asian Review of Accounting, 26 (4), 414-443.

- Margolis, J., Elfenbein, H., & Walsh, J. (2009). Does it pay to be good...and does it matter? A meta-analysis of the relationship between corporate social and financial performance. SSRN Electronic Journal.

- Development Agency (NSTDA). (2020). MHESI Minister and 8 leaders from all sectors propose BCG model for post-COVID economic recovery plan aiming to achieve 4.4 trillion THB GDP in 5 years.

- Ompusunggu, J. (2016). The effect of profitability to the disclosure of corporate social responsibility (CSR disclosure) on mining companies listed on Indonesian Stock Exchange (BEI) in the year 2010-2012. Journal of business and management, 18(6), 69-78.

- P, F., & Busru, S. (2021). CSR disclosure and firm performance: Evidence from an emerging market. Corporate Governance: The International Journal of Business in Society.

- Pedron, A.P.B., Macagnan, C.B., Simon, D.S., & Vancin, D.F. (2021). Environmental disclosure effects on returns and market value. Environ Dev Sustain, 23, 4614–4633.

- Peloza, J. (2009). The challenge of measuring financial impacts from investments in corporate social performance. Journal of Management Southern Management Association, 35, 1518-1541.

- Sachs, J., Schmidt-Traub, G., Kroll, C., Lafortune, G., Fuller, G., & Woelm, F. (2020). Sustainable Development Report 2020. Cambridge: Cambridge University Press.

- Saengchai, S., Sriyaku, T., & Jermsitiparsert, K. (2019). Natural environment and circular economy? Contemporary findings from ASEA. International Journal of Innovation, Creativity and Change, 8, 315-333.

- Saidani, M., Yannou, B., Leroy, Y., Cluzel, F., & Kendall, A. (2019). Taxonomy of circular economy indicators. Journal of Cleaner Production, 207, 542-559 .

- Stock Exchange of Thailand (n.d.). ESG disclosure .

- Tarmuji, I., Maelah, R., & Tarmuji, N. (2016). The impact of Environmental, Social and Governance practices (ESG) on economic performance: Evidence from ESG score. International Journal of Trade, Economics and Finance, 7. 67-74.

- Thai Industrial Standards Institute (2019). Framework for implementing the principles of the circular economy in organizations – guide, Bangkok: Ministry of Industry.

- Thailand Greenhouse Gas Management Organization (TGO) (n.d.) (NDC) Nationally Determined Contribution.

- Trollman, H., Colwill, J., & Brejnholt, A. (2020). Ecologically embedded design in manufacturing: Legitimation within circular economy. Sustainability, 12(10), 4261.

- Valavanidis, A. (2018). Concept and practice of the circular economy.

- Vassanadumrongdee, S. (2021). Garbage problem situation and take off lessons in packaging waste management abroad. Seminar document, academic seminar, Circular Economy from theory to practice. Environmental Research Institute, Chulalongkorn University.

- Wang, P., Che, F., & Fan, S. (2014). Ownership governance, institutional pressures and circular economy accounting information disclosure: An institutional theory and corporate governance theory perspective. Chinese Management Studies, 8(3), 487-501.

- Yadav, G., Mangla, S.B.A., & Luthra, S. (2020). Exploring indicators of circular economy adoption framework through a hybrid decision support approach. Journal of Cleaner Production.

- Yin, H., Li, M., Ma, Y., & Zhang, Q. (2019). The relationship between environmental information disclosure and profitability :A comparison between different disclosure styles. International journal of environmental research and public health, 16(9).

- Yoon, B., Lee, J., & Byun, R. (2018). Does ESG performance enhance firm value? Evidence from Korea. Sustainability, 10(10), 3635.

- Yordudom, T., & Suttipun, M. (2020). The influence of ESG Disclosures on firm value in Thailand. GATR Journal of Finance and Banking Review, 5(3), 108-114.