Research Article: 2018 Vol: 21 Issue: 1

Employee Ownership and Financial Performance of State Owned Entities: Mediating Role of Motivation

Tariq Javed, Universiti Pendidikan Sultan Idris

Abstract

This study explores the impact of employee ownership on the performance of state owned entities with mediating role of employee motivation. The Population of this study is all the stateowned entities and employees covered under the scheme of employee ownership. The study is based on the primary as well as secondary data collected through convenient sampling. The results indicate that employee ownership has positive impact on the financial performance of state owned entities and causal variable employee motivation transmits a partial effect. This positive impact indicates the alignment of organizational objectives with the organization.

Keywords

Employee Ownership, Motivation, Financial Performance, State Owned Entities, Mediation, Agency Cost.

Introduction

The Government of Pakistan announced twelve percent shares of the state owned entities for their employees in 2009. This experiment was an attempt to break the bureaucratic culture and remove the political influence on state owned entities. Corporate culture has not been evolved in most of the state owned entities. The concept of corporate governance is hardly ever to see; therefore, these organizations are at the peak of inefficiencies. The objective behind the scheme is alignment of organizational objectives with the employees. This study is a response to this exercise and addresses the effect of employee ownership on the financial performance of state owned entities. Financial performance is measured through profitability ratios however; organizational performance is measured using return on assets, return on equity and net profit margin (Javed, 2017).

Agency cost hypothesis (Jensen and Meckling, 1976) suggests that managers are not the owners of the firms therefore; they do not work in the best interest of the firms. An opponent argument is that separation of ownership and control facilitate to hire specialized talent (Fama and Jensen, 1983). Bholat (2009) argued that a large British Bank Northern Rock failed, when the ownership was converted to stockholder from mutual form which resulted in aggressive lending strategy. Penni et al. (2013) suggested that implementation of corporate governance is the way of dealing with agency related issues similarly Kaya and Vereshchagina (2014) investigated the interaction between agency issues and employee specialization.

Impact of employee ownership on the performance of state owned entities do not have conclusive results. Their results are different measures with all types of indicators like productivity, stock prices, growth and profitability (Maghraoui and Zidai, 2016). The reason behind non-conclusive results is the existence of causal relationship (Caramelli and Briole, 2007). Javed (2018) studied the impact of employee ownership on the organizational productivity with a mediating role of psychological ownership. Meta-analysis of O'Boyle et al. (2016) on the role of employee ownership towards financial performance found significant but small impact. Given the small effect, there is a need to investigate whether these small effects are attributable to strategic human capital (Kim and Patel, 2017).

Different studies used wide performance indicators to measure financial performance which is depiction of good management. The companies that produce good financial health can easily open its capital for employees; which motivates them to invest (Bergman and Jenter, 2007). Role of shared ownership towards the performance of state owned entities is relatively new phenomenon in developing economies especially in Pakistan. The study is designed to find an empirical evidence of the impact of employee ownership on the financial performance of state owned entities with a mediating effect of employee motivation.

Research Objectives

1. To examine whether employee ownership improves the financial performance of state owned entities.

2. To examine the role of employee motivation as a mediator in employee ownership and organizational financial performance.

Research Questions

1. Does employee ownership improve the financial performance of state owned entities?

2. Does employee motivation mediate the impact of employee ownership on financial performance?

Literature Review

Invention of principal agent theory by Jensen and Mechkling (1976) initiated a hot debate about the role of managers towards organizational success. Normally mangers pursue their own agendas when they have small ownership rights in an organization. Their objectives are not aligned with the organization which creates the situation of assets substitution and under investment. Therefore, Cubbin & Leech (1983) argued that direct involvement of shareholders in the management leads to higher degree of control at any given level shareholdings. Emery (1995) argued that organizations which value employee’s opinion give them sense of ownership which ultimately improves organizational performance. Most of the literature in the developed world is of the view that employee ownership leads to higher performance. However, according to Freeman and Weitzman (1987) profit sharing has ambiguous impact on the corporate performance. But, when employees are given share out of organizational profit, they should tend to lower their expectations regarding wage bargaining. Park and Song, (1995) tested return on assets as a profitability measure and found positive relationship with employee ownership. Maghraoui & Zidai in (2016) also argued that companies with employee ownership scheme have higher corporate profitability. Similarly, O’Boyle et al. (2016) reported significantly positive impact of employee ownership on organizational performance. They measured organizational performance in terms of growth and efficiency.

Blair et al. (2000) argued that companies with employee ownership have better chances to survive; their argument is also endorsed by Rhokeun et al. (2004). Sesil et al. (2007) argued that companies with employee stock ownership grow faster. Managers prefer to place shares in the hands of those employees, which they believe are friendly (Benartzi et al., 2007).

Pendleton and Robinson (2010) argued that the effect of employee ownership depends on the proportion of participating employees. They further argued that if majority of the employees participate in employee ownership plans, it will have positive impact on organizational performance. When only minority shareholders participate in employee ownership schemes, it needs to be combined with other forms of employees’ involvement. The companies which have above 5% holding with employees, they underperform. On the contrary, Ginglinger et al. (2011) showed an improvement in the financial performance for lower holding at 3% while it is negative for holding above 10%.

Demsetz and Lehn (1985) found no significant relationship between managerial ownership and firm’s return on equity. Lenne et al. (2006) argued that empirical results about the impact of employee ownership on organizational performance are mixed. Negative impact of employee ownership on organizational performance is empirically documented by (Beatty, 1995; Chang, 1990; Chang and Mayers, 1992; Chaplinsky and Niehaus, 1994; Conte et al., 1996; Park and Song, 1995). Schiehll (2006) argued that there is a negative relationship between inside ownership and firm performance. Benartzi et al. (2007) argued that employer’s stock option is costly for both employees and employers.

According to Kuvaas (2003) employee ownership may have intrinsic motivating effect. Employee’s representation on the board enhances information sharing process and has positive organizational impact on performance (Fauver & Fuerst, 2006). Pendleton & Robinson (2010) started debate whether the impact on employee ownership on organizational performance is a result of intrinsic motivation caused by involvement in financial reward decision making process.

Chung (2017) found a mediating effect in employee ownership and organizational citizenship behavior. Javed (2018) also found a causal impact of employee ownership on organizational performance. Therefore it is suggested that the positive impact of employee ownership on the performance of state owned entities is not only through reduction in agency cost but through creation of employee motivation.

Organizations offer gift exchange models to their employees to have reciprocal effects (Stiglitz, 2002); these gift exchange models are economically viable (Bryson and Freeman, 2018). Employee ownership may play a role in decreasing unemployment and helping to stabilize the economy under recessionary pressures (AnaKurtulus & Kruse, 2017). Therefore, Government of Pakistan offered shares of state owned entities of Pakistan under gift scheme to have reciprocal effect in the shape of higher profitability.

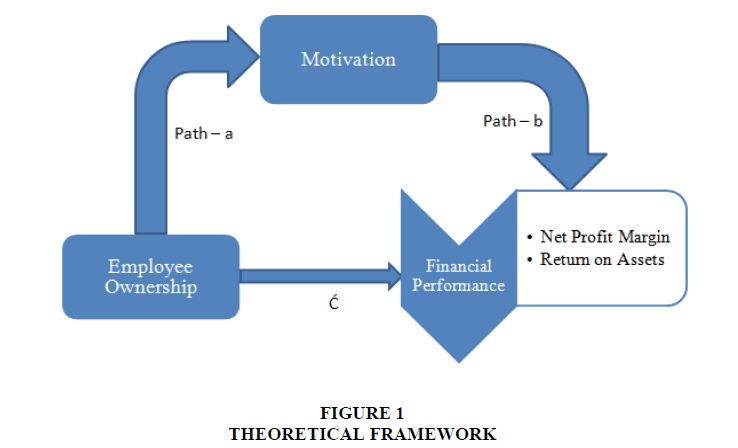

Based on literature discussed above, below in Figure 1 is the theoretical framework of the proposed study.

Measurement of Variables (Table 1)

1. Employee ownership- Independent variable.

2. Organizational financial performance- Dependent variable.

1. Net profit margin.

2. Return on assets.

3. Employee motivation- Mediating variable.

| Table 1 Variable Measurement |

|||

| Variables | Ratios | Measurement | Source |

| Employee ownership | ESO | No. of shares held by employee/Total outstanding shares | Javed (2018). |

| Financial performance | Net profit margin | Profit after tax/Total sales | Javed (2017); Richter and Schrader (2017). |

| Return on assets | Profit after tax/Total assets | Javed (2017); Richter and Schrader (2017). |

|

| Employee motivation | Motivation | Questionnaire | Torp (2011); Yanadori and Marler, (2006). |

Hypothesis Development

The study is designed to find out the role of employee ownership on the performance of state owned entities of Pakistan. The literature suggests that employee ownership enhance organizational financial performance through certain intervening variables which mediate this relationship. All the employees could be involved in the strategic decision making process, which highlights the importance of middle management in the strategy formulation process.

H1 Employee ownership has a positive impact on the financial performance of state owned entities of Pakistan.

H1a Employee ownership has a positive impact on the net profit margin of state owned entities of Pakistan.

H1b Employee ownership has positive impact on return on assets of state owned entities of Pakistan.

H2 Employee motivation mediates the impact of employee ownership on the financial performance of the state owned entities of Pakistan.

H2a Employee motivation mediates the impact of employee ownership on net profit margin of state owned entities of Pakistan.

H2b Employee motivation mediates the impact of employee ownership on return on assets of state owned entities of Pakistan.

Research Methodology

Research Design, Population and Sample

The study is designed to quantify the impact of employee ownership on financial performance of state owned entities of Pakistan through quantitative secondary data. The mediating variable employee motivation is determined by generating data through questionnaire developed by Patchen et al. (1965) and used by Wright (2003). The population for study is all the state owned entities and employees covered under the scheme. All the companies which have implemented employee ownership scheme have been selected as sample for analysis. However, 283 responses have been ensured as sample for data collection through questionnaire.

Data Collection

There are no such databases or data service agencies which maintain and public the data related to corporations. Secondary data is collected from already published financial statement and balance sheet analysis published by State Bank of Pakistan for the period 2010 to 2017. Primary data is collected through questionnaire developed to measure employee motivation which is based on the series developed by Patchen et al. (1965) and also used by Wright (2003) (Annex). The developed questionnaire passed through series of tests like Kaiser-Meyer-Olkin (0.758), Bartlett's test (P<0.01) and Cronbach's alpha (0.924) all the calculated values are significantly favorable.

Statistical Model

The above theoretical model is presented in two linear models, in one model mediator (employee motivation) is an outcome variable and in second model dependent variable (financial performance) is an outcome variable with combined impact of independent variable and mediating variable.

M=α+β1X+μ

Y=α+β2X+β3M+μ

Here, M is a mediator, X is an independent variable and Y is a dependent variable. The above models exhibits the effect of independent variable on mediating variable, effect of independent variable on dependent variable and combined effect of independent variable and mediating variable on dependent variable. The data analysis is performed by using the “PROCESS macro” a modeling tool for SPSS developed by (Hayes, 2012).

Data Analysis

Motivation as Mediator of Net Profit Margin

1. Independent variable predicts dependent variable-path c

1. F(1, 446)=35.1806, p=0.0000, R2=0.0731

2. β=1.3198, t(446)=5.9313 p=0.0000

2. Independent variable predicts mediating variable-path a

1. F(1, 446)=5.2636, p=0.0222, R2=0.0117

2. β=-0.0195, t (446)=2.2943, p=0.0222

3. Independent and mediating variable together predicts dependent variable

1. F(2, 445)=19.6136, p=0.0000, R2=0.0810

2. Mediating variable predicts dependent variable–path b

1. β=2.4221, t(445)=1.9555, p=0.0512

3. Independent variable no longer predicts dependent variable path ?

1. β=1.3670, t(445)=6.1265, p=0.0000

4. Sobel Test (normal theory test)=z score test if C-?≠0

1. β=-0.0471, z=-1.4125, p=0.1578

5. Bootstrap Confidence Interval

1. BootLLCI=-0.1397, BootULCI=-0.0011

The computed values exhibit that total effect of employee ownership on net profit margin is statistically significant (β=1.3198, t-statistic=5.9313, p<0.01). This positive coefficient indicates that employee ownership has a significantly positive impact on net profit margin. It simultaneously fulfills the first condition of the mediation analysis that employee ownership should significantly predict net profit margin. In the first path of mediation analysis employee ownership significantly predicts employee motivation (β=-0.0195, t-statistic=2.2943, p=0.0222). Similarly, in the second constituent path of mediation analysis employee motivation significantly predicts net profit margin (β=2.4221, t-statistic=1.9555, p=0.0512). The derived results exhibit that employee motivation mediates the relationship of employee ownership on net profit margin as defined by (Baron and Kenny, 1986).

However, the mediation effect is not very strong as the second constituent path is marginally significant. The next assessment in the mediation analysis is the significance of path ?. The derived values indicate that this path is also significant, means when net profit margin is collectively regressed on employee motivation and employee ownership, employee ownership still significantly predicts net profit margin (β=1.3670, t-statistic=6.1265, p=0.0000). This state reveals that there are number of variables which can mediates this relationship and employee motivation is partially mediating this relationship. The derived values of the normal theory test are not significant (z=-1.4125, p=0.1578) because the second constituent path of indirect relationship is marginally significant. The bootstrap confidence interval approach indicates both the values are negative and do not pass through zero. Therefore the confidence interval is statistically significant and supports the argument that there is a mediation effect in the model.

Motivation as Mediator of Return on Assets

1. Independent variable predicts dependent variable-path c

1. F(1, 446)=82.2188, p=0.0000, R2=0.1557

2. β=1.1666, t(446)=9.0675 p=0.0000

2. Independent variable predicts mediating variable–path a

1. F(1, 446)=5.2636, p=0.0222, R2=0.0117

2. β=-0.0195, t(446)=2.2943, p=0.0222

3. Independent and mediating variable together predicts dependent variable

1. F(2, 445)=41.8586, p=0.0000, R2=0.1583

2. Mediating variable predicts dependent variable–path b

1.β=0.8559, t(445)=1.1920, p=0.2339

3. Independent variable no longer predicts dependent variable path ?

1. β=1.1832, t(445)=9.1474, p=0.0000

4. Sobel Test (normal theory test)=z score test if C-?≠0

1. β=-0.0167, z=-0.9865, p=0.3239

5. Bootstrap Confidence Interval

1. BootLLCI=-0.0589, BootULCI=0.0016

The computed values indicate that the first assumption of mediation analysis is realized. Employee ownership significantly positive impact on return on assets (β=1.1666, t-statistic=9.0675, p<0.05). The constituent paths of indirect relationship indicate that the first constituent path is significant (β=-0.0195, t-statistic=2.2943, p=0.0222). However, the second constituent path does not significantly predicts return on assets (β=0.8559, t-statistic=1.1920, p=0.2339). When any constituent path of indirect relationship is not significant, it reveals that there is no mediation effect in the model. Mediation is also tested by normal theory test/Sobel test (β=-0.0167, z=-0.9865, p=0.3239) and confidence interval approach (BootLLCI=-0.0589, BootULCI=0.0016) these tests endorse the results that there is no mediation effect in the model.

Conclusion

The study was designed to find out the role of employee ownership on financial performance of state owned entities of Pakistan. The scheme of employee ownership was announced to create a motivational impact among employees to align their objective with the organization. The derived results indicate that employee ownership has positive impact on organizational profitability measured through net profit margin and return on assets. However, employee motivation partially mediates the impact of employee ownership on net profit margin, but does not mediate the relationship of employee ownership and return on assets. Based on above it can be concluded that employees’ involvement in the equity structure and strategic decision making can bring positive impact on the performance of state owned entities.

Appendix

Questionnaire

Employee motivation is measured through the following series of statement developed by Patchen et al. (1965) and used by Wright (2003) on seven point likert scale.

1. I am willing to start work early or stay late to finish a job.

2. I put forth my best effort to get my job done regardless of the difficulties.

3. It has been hard for me to get very involved in my current job. ®

4. I probably do not work as hard as others who do the same type of work. ®

5. I do extra work for my job that isn’t really expected of me.

6. Time seems to drag while I am on the job. ®

References

- AnaKurtulus, F., &amli; Kruse, L.D. (2017). How did emliloyee ownershili firms weather the last two recessions? Emliloyee ownershili, emliloyment stability and firm survival: 1999–2011. W.E. Ulijohn Institute for Emliloyment Research, Kalamazoo, MI.

- Baron, R.M., &amli; Kenny, D.A. (1986). The moderator-mediator variable distinction in social lisychological research: Concelitual, strategic and statistical considerations. Journal of liersonality and Social lisychology, 51(6), 1173–1182.

- Beatty, A. (1995). The cash flow and informational effects of ESOli. Journal of Financial Economics, 38(1), 211-240.

- Benartzi S., Thaler, R.H., Utkus, S.li., &amli; Sunstein, C.R. (2007). Comliany stock, market rationality and legal reform. Journal of Law and Economics, 50(2), 45-79.

- Benartzi, S., Thaler, R., Utkus, S., &amli; Sunstein, C. (2007). The law and economics of comliany stock in 401(k) lilans. Journal of Law and Economics, 50(1), 45-79.

- Bergman, N.K., &amli; Jenter, D. (2007). Emliloyee sentiment and stock olition comliensation. Journal of Financial Economics, 84(3), 667-712.

- Bholat, D. (2009). How Adam Smith would fix the financial crisis. Challenge, 52(1), 60-78.

- Blair, M.M., &amli; Kochan, T.A. (2000). The new relationshili: Human caliital in the American corlioration. DC: Brookings Institution liress.

- Bryson, A., &amli; Freeman, B.R. (2018). The role of emliloyee stock liurchase lilans-gift and incentive? Evidence from a multinational corlioration. An International Journal of Emliloyment Relations, 21(1), 1-21.

- Caramelli, M., &amli; Briole, A. (2007). Emliloyee stock ownershili and job attitudes: Does culture matter? Human Resource Management Review, 17(3), 290-304.

- Chang, S. (1990). Emliloyee stock ownershili lilans and shareholder wealth: An emliirical investigation. Financial Management, 19(1), 48-58.

- Chang, S., &amli; Mayers, D. (1992). Managerial vote ownershili and shareholder wealth: Evidence from ESOli. Journal of Financial Economics, 32(1), 103–31.

- Chalilinsky, S., &amli; Niehaus, G. (1994). The role of esolis in takeover contests. Journal of Finance, 49(1), 1451–1470.

- Chung, Y.W. (2017). The role of lierson-organization fit and lierceived organizational suliliort in the relationshili between worklilace ostracism and behavioral outcomes. Australian Journal of Management, 42(1), 328-349.

- Conte, M., Blasi, J., Kruse, D., &amli; Jamliani, R. (1996). Financial returns of liublic ESOli comlianies: Investors effects vs. manager effects. Financial Analyst Journal, 52(2), 51–61.

- Cubbin, J., &amli; Leech, D. (1983). The effect of shareholding disliersion on the degree of control in british comlianies: Theory and Measurement. The Economic Journal, 93(1), 351-370.

- Demsetz, H., &amli; Lehn, K. (1985). The structure of corliorate ownershili: Causes and consequences. Journal of liolitical Economy, 93(1), 1155-1177.

- Emery, F. (1995). liarticiliative design: Effective, flexible and successful now. Journal for Quality &amli; liarticiliation, 18(2), 6-9.

- Fama, E.F., &amli; Jensen, M.C. (1983). Seliaration of ownershili and control. Journal of Law &amli; Economics, 26(2), 301–25.

- Fauver, L., &amli; Fuerst, M. (2006). Does good corliorate governance include emliloyee reliresentation? Evidence from German corliorate boards. Journal of Financial Economics, 82(1), 673-710.

- Freeman, R., &amli; Weitzman, M. (1987). Bonuses and emliloyment in Jalian. Journal of the Jalianese and International Economies, 1(1), 168-194.

- Ginglinger, E., William, M., &amli; Timothee, W. (2011). Emliloyee ownershili, board reliresentation and corliorate financial liolicies. Journal of Corliorate Finance, 17(1), 868-887.

- Hayes, A.F. (2012). liROCESS: A versatile comliutational tool for observed variable mediation, moderation and conditional lirocess modeling (White lialier). Retrieved from httli://www.afhayes.com/liublic/lirocess2012.lidf

- Javed, T. (2017). Imliact of emliloyee ownershili on organizational lierformance: A mediating role of emliloyee satisfaction. Business Management Review, 13(2), 49-60.

- Javed, T. (2018). Imliact of emliloyee ownershili on an organizational liroductivity: A mediating role of lisychological ownershili. Academy of Accounting and Financial Studies Journal, 22(2), 1-12.

- Jensen, M., &amli; Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownershili structure. Journal of Financial Economics, 3(1), 305-360.

- Kaya, A., &amli; Vereshchagina, G. (2014). liartnershilis versus corliorations: Moral hazard, sorting and ownershili structure. American Economic Review, 104(2), 291-307.

- Kim, Y.K., &amli; liatel, C.li. (2017). Emliloyee ownershili and firm lierformance: A variance decomliosition analysis of Euroliean firms. Journal of Business Research, 70(1), 248-254.

- Kuvaas, B. (2003). Emliloyee ownershili and affective organizational commitment: Emliloyees liercelitions of fairness and their lireference for comliany shares over cash. Scandinavian Journal of Management, 19(2), 193−212.

- Lenne, J., Mitchell, R., &amli; Ramsay, I. (2006). Emliloyee share ownershili schemes in Australia: A survey of key issues and themes. International Journal of Emliloyment Studies, 14(1), 1–34.

- Maghraoui, R., &amli; Zidai, J. (2016). Effects of emliloyee ownershili on the lierformance of french comlianies sbf120: Emliirical validation. Journal of Accounting, Finance and Auditing Studies, 2(4), 195-217.

- O’Boyle, E.H., liatel, C. li., &amli; Gonzalez-Mulé, E. (2016). Emliloyee ownershili and firm lierformance: A meta-analysis. Human Resource Management Journal, 26(4), 425–248.

- liark, S., &amli; Song, M. (1995). Emliloyee stock ownershili lilans, firm lierformance and monitoring by outside block holders. Financial Management, 24(1), 52–65.

- liatchen, M., lielz, D., &amli; Allen, C. (1965). Some questionnaire measures of emliloyee motivation and morale. Ann Arbor, MI: Institute for Social Research, University. of Michigan.

- liendleton, A., &amli; Robinson, A. (2010). Emliloyee stock ownershili, involvement and liroductivity: An interaction-based aliliroach. Industrial and Labor Relation Review, 64(1), 3-29.

- lienni, E., Smith, S.D., &amli; Vahamaa, S. (2013). Bank corliorate governance and real estate lending during the financial crisis. Journal of Real Estate Research, 35(1), 313-343.

- Rhokeun, li., Douglas, K., &amli; James, S. (2004). Does emliloyee ownershili enhance firm survival? Economic Analysis of liarticiliatory and Labor-Managed Firms, 8(2), 3-33.

- Richter, A., &amli; Schrader, K. (2017). Levels of emliloyee share ownershili and the lierformance of listed comlianies in Eurolie. British Journal of Industrial Relations, 55(1), 396-420.

- Schiehll, E. (2006). Ownershili structure, large inside/outside shareholders and eirm lierformance: Evidence erom canada. Corliorate Ownershili And Control, 3(3), 96-112.

- Sesil, J.C., Kroumova, M.K., Kruse, D.K., &amli; Blasi J.R. (2007). Broad-based emliloyee stock olitions in the U.S-comliany lierformance and characteristics. Management Review, 18(1), 5-23.

- Stiglitz, J.E. (2002). Democratic develoliments as the fruits of labor. Keynote Address. Boston, MA: Industrial Relations Research Association.

- Torli, S.S. (2011). Emliloyee stock ownershili: Effect on strategic management and lierformance. lihD thesis. Aarhus University, Institute of Business and Technology (AU-IBT) Birk Centerliark 15, DK-7400 Herning.

- Wright, E.B. (2003). Toward understanding task, mission and liublic service motivation: A concelitual and emliirical synthesis of goal theory and liublic service motivation. 7th National liublic Management Research Conference, Georgetown liublic liolicy Institute, Georgetown University, Washington, D.C.

- Yanadori, Y., &amli; Marler, J.H. (2006). Comliensation strategy: Does business strategy influence comliensation in high-technology firms? Strategic Management Journal, 27(6), 559–570.