Research Article: 2017 Vol: 20 Issue: 1

Enhancing Financial Impact of Tourism While Preserving Sustainability in the City of Barcelona

María J Moral, National University of Distance Education

Teresa Garín-Muñoz, National University of Distance Education

Abstract

Barcelona is a successful tourist destination, but currently it is reaching the limit of its carrying capacity. Consequently, far from increasing the number of visitors and overnight stays, interest should be to recruit those tourists that generate the highest average daily expenditure. To achieve this goal, the following procedure was carried out. In a first phase, from a survey of Turisme de Barcelona, the market was segmented based on the average daily spending per tourist. As a result, three distinct and easily identifiable groups emerged. In the second phase, the group of heavy spenders was selected and an in-depth analysis of their behaviour was conducted, both in terms of total expenditure and by specific categories of goods and tourism services.

Results allow making recommendations on how to attract the high-spending market. Promoting tourism for middle-age and older travellers, encouraging short stays and intensifying efforts to increase business versus leisure tourism are some of the measures that would help achieve a greater daily expenditure per person. It would also be helpful to design and develop some tourism products that may be attractive to tourists traveling alone.

Keywords

Tourism Markets, Expenditure-Based Segmentation, Heavy Spenders, Congestion, Tourist Expenditure.

JEL Classification

Z33, D12, L83, R11

Introduction

Tourism activity plays a significant role in the economic development of many destinations. It becomes an important source of business activities, contributing to income and generating employment. But besides this positive impact, tourism generates some negative externalities for both the resident population and the environment. Rising housing prices, rising prices for restaurants and other services, as well as the need to share spaces with residents are just some problems arising from congestion. Thus, policy makers should seek to maximize the positive economic effects produced by inbound tourism and simultaneously look for strategies to avoid (or soften) the adverse effects on residents resulting from congestion.

In the case of Barcelona, the importance of tourism on the economic activity of the city is highlighted with its contribution to GDP and employment, representing 14 and 11 percent, respectively. In recent years there has been a dramatic increase in the number of visitors1, which has positioned the destination at the same level as other emblematic European destinations such as Rome or Amsterdam. However, at the same time, Barcelona is a city whose successful tourism industry generates serious concerns about its future sustainable growth. In fact, the development and consolidation of Barcelona as a tourist destination has involved a flow of negative externalities that has become especially evident. The main problems derive from the overcrowding of the central areas of the city that complicate the daily lives of residents2.

Resulting from the above, we can assert that tourism is a key economic sector for the city and therefore local authorities must promote it, but always keeping sustainability in mind. So in order maximize the benefits of inbound tourism while minimizing congestion problems, Barcelona, as any other tourist destination, must be interested in attracting high-yield tourists (and visitor expenditure has often been used as a measure of market yield).

This study examines tourist expenditure in Barcelona with the purpose of identifying the high-spending market segment and then conducting a detailed study of the variables (sociodemographic characteristics and features of the trip) that explain its behaviour. This will provide highly valuable information for designing marketing strategies and promoting the city among those tourists that can generate more revenues to the destination.

The study is based on micro data from the tourism activity survey conducted by Turisme de Barcelona among visitors to the city throughout 2013. This high-quality survey was conducted through personal interviews with tourists staying in hotels. There is expenditure data from a sample of 2452 individuals aged 18 or older, representing 76% of all tourists (foreign and domestic) staying in hotels. Based on this information, tourists arriving to Barcelona are classified into three groups according to the average daily expenditure level (light, medium and heavy spenders).

Once heavy-spender tourists were identified and significant behavioural differences with the other tourist groups are tested (using ANOVA), the analysis continued with a detailed study of their salient features. The determinants of their total daily expenditure (TDE) and their expenditure by category (accommodation, restaurants and shopping) were analysed. The models for accommodation, restaurants and total daily expenditure were estimated by weighted least squares (WLS). However, to estimate daily shopping expenditure, a Censored Tobit Model with a Heckman correction was used because there were several zero values in the dependent variable. Findings may be useful to target segments for promotional strategies.

The rest of the paper is organized as follows: Section 2 presents a brief review of the existing literature on tourist expenditure and segmentation. A section 3 display the data used in the study and based on them describes the city of Barcelona within the context of tourism. Section 4 is about the implementation and results of the market segmentation based on expenditure level. Section 5 is devoted to the expenditure behaviour of the heavy-spender tourists. Finally, section 6 is dedicated to present the conclusions and their policy implications.

Literature Review

Given the economic and social impact of tourist activity in a destination, numerous empirical studies on tourism demand have been undertaken to explain the possible factors that influence tourist flows worldwide. Most existing studies have used the number of tourist arrivals (or overnight stays) as the measurement of tourism demand (Lim, 1997; Song & Witt, 2000). However, as economic impacts of tourism are expenditure-driven, it would be desirable that tourism expenditures were used more frequently in tourism demand studies.

Therefore, there is ample scope to contribute to the analyses is of tourism from the perspective of spending. Studies referred to tourist expenditure conducted to date could be classified into two groups: One of them comprises the studies that explore the usefulness of expenditure as a market-segmentation variable. The other group of studies aims to establish the determinants of tourist expenditure.

In parallel, there is another possible classification of the previous literature by level of aggregation of the data used. Among the works that try to explain expenditure, those that make use of micro data are especially interesting. This is so because these models have some advantages compared to aggregate models. For example, micro data models acknowledge the diversity and heterogeneity of consumer behaviours that are ignored in studies using aggregated data. On the other hand, studies using highly aggregated data are less valuable to tourism planning and policy-making than those based on data of a lower level of aggregation. Exhaustive surveys of micro-economic tourism demand studies that used expenditure as the measurement of an individual’s demand for tourism can be found in Wang and Davidson (2010) and Brida and Scuderi (2013).

The first part of this work refers to segmentation based on tourism expenditure by using micro data. Its convenience will be analysed, as well as the alternative methods of segmentation available and the chances of success in achieving objectives.

For a definition of market segmentation we can turn to the one provided by Kotler and Armstrong (1996). They define market segmentation as the act of "dividing a market into distinct groups of buyers with different needs, characteristics or behaviour who might require separate products or marketing mixes."

Market segmentation is a convenient and widespread strategy to improve the competitiveness of any industry. And it could not be another way in the case of tourism. By segmenting the market, the industry entrepreneurs can strengthen their competitive advantage by selecting the most suitable subgroup of tourists to specialize on as their target. Segmentation is a marketing tool that will be more valuable the more heterogeneous the market is. And the tourism sector is highly heterogeneous, reflecting the fact that tourists are not homogeneous in terms of their desires and behaviour (Hsu and Kang, 2007). Understanding and explaining the behaviour and characteristics of different types of tourist has become a long-standing research objective, with a considerable number of empirical studies exploring similarities and differences in terms of travel patterns, characteristics and attitudes between tourist groups (Kozak, 2002; Laesser and Crouch, 2006; Wang and Davidson,2010).

Marketing strategists have developed a wide variety of alternative techniques to identify or construct segments. Two principal approaches are recognized in the literature: a priori segmentation and data-driven segmentation (Dolnicar, 2004). In priori (also known as common-sense”) segmentation, the researcher chooses a variable or variables of interest and then classifies tourists according to those pre-defined criteria. In data-driven (or post hoc) segmentation, a range of variables are used together to derive groups (segments) based on quantitative techniques data analysis such as cluster analysis (Najmi, Sharbatoghlie & Jafarieh, 2010).

One issue of paramount importance is the selection of the criteria to be used for common-sense segmentation. The variables used for segmentation obviously depend on the availability of data and the subject of study. In any case, when proceeding to a segmentation it should be considered that it will only be useful from a marketing perspective if it meets certain requirements: (1) People in one segment should be very similar to each other and different from people outside the segment; (2) People in each segment should be easily identifiable; (3) After they are identified, members of the group should be easy to access; and (4) Each segment must be large enough to represent a relevant part of the total destination market.

In tourism research, the most commonly used criteria are either geographic (country of origin of tourists) or related to the purpose of travel (leisure, business, VFR). The prevalence of these types of segmentations is possibly due to the availability of data and the ease of reaching those potential customers (target groups) once obtained the results of the study. Some others segmentations have been carried out on the basis of socio-demographic, psychographic and behavioural variables (Bigné, Gnoth & Andreu, 2007). Much less used, despite its tremendous potential, is tourist expenditure segmentation. In fact, since the seminal paper by Pizam and Reichel (1979) and the influential article by Spotts and Mahoney (1991), there are no published research in this area until 2000 (Aguiló and Juaneda, 2000; Díaz-Pérez, Bethencourt-Cejas & Álvarez-González, 2005; Kruger, Saayman & Saayman, 2010; Laesser and Crouch, 2006; Mok and Iverson, 2000).

As a general conclusion, it can be said that empirical studies on tourism-expenditure segmentation are scarce and their results are inconclusive. The diversity of the tourism settings covered by the different studies precludes comparisons and makes finding general patterns and universal influences impossible. Vinnciombe and Sou (2014) examine 20 of the most relevant and widely cited papers in tourism-expenditure segmentation and highlights the diversity of contexts and destinations covered. Some studies focus on specific destinations, which may be large, such as the case of Australia (Laesser and Crouch, 2006) or very small, as a natural park (Kruger, Saayman & Saayman, 2010). Similarly, there are studies addressing specific types of tourism (tourism of golf, gaming, surf, etc.), while others refer to all tourists received in a destination. In any case, as far as we know, there are few previous studies on expenditure segmentation applied to the case of urban destinations. Thus, this research may contribute to filling this gap.

However, given that, after segmentation, this work continues trying to establish the relationship between spending and its determinants for a particular market segment, it is interesting to review the previous literature in this regard. In this sense, the work of Wang and Davidson (2010) is a good review of micro-analysis of tourist expenditure. And also, in recent times, there have been a number of studies that put the focus on tourist spending in different tourism products or categories of expenditure (Craggs and Shofield, 2009; Disegna and Osti, 2016; Engström and Kippergerg, 2015). The richness of the data used in this study allows studying the behaviour of heavy-spender’s tourists in relation to specific tourism products such as: accommodation, eating out or shopping. And, as far as we know, this is another distinguishing feature of this work against previous studies for the case of Barcelona.

Barcelona as a Tourism Destination

This section provides a brief description of how Barcelona was developed and consolidated as a tourist destination. It gives some hints of what the city offers and which may have been the keys to its success. At the end, the database used in the study is presented.

With a population of more than 1.6 million inhabitants, Barcelona is one of the largest tourism cities in the world today. Every year, it attracts around 7 million international visitors who stay in the city an average of 3.40 nights. In addition, Barcelona receives approximately 1.5 million domestic tourists every year. To contextualize what these figures mean, we present Table 1 where Barcelona is compared in terms of tourism with other European cities. According to 2015 data, Barcelona ranks third by visitors spending and fourth when considering number of arrivals.

| Table 1: Europe´S Top Destination Cities By International Visitors And Cross-Border Spending | |||||

| International Visitors | Visitors Spending | ||||

|---|---|---|---|---|---|

| Rank | Destination city | Mill. of visitors | RANK | Destination city | US $ billion |

| 1 | London | 18.8 | 1 | London | 20.2 |

| 2 | Paris | 16.1 | 2 | Paris | 16.6 |

| 3 | Istanbul | 12.6 | 3 | Barcelona | 13.9 |

| 4 | Barcelona | 7.6 | 4 | Istanbul | 9.4 |

| 5 | Amsterdam | 7.4 | 5 | Madrid | 7.1 |

| 6 | Rome | 7.4 | 6 | Munich | 5.6 |

| 7 | Milan | 7.2 | 7 | Rome | 5.3 |

| 8 | Vienna | 5.8 | 8 | Berlin | 5.2 |

| 9 | Prague | 5.5 | 9 | Milan | 4.9 |

| 10 | Munich | 4.9 | 10 | Vienna | 4.6 |

The city took off as a tourist destination as a result of hosting the 1992 Olympic Games. At that time, the city made an urban transformation, opening up to the sea, reshaping whole neighbourhoods, building new infrastructures and placing value on the work of Gaudí and other modernist buildings, while hiring the most remarkable architects at the time (e.g. Jean Nouvelle) to build emblematic projects that helped shape the image of the city. All these actions led Barcelona to achieve international recognition and have yielded remarkable benefits in terms of tourism image.3

While these changes were being made, policy makers were also aware of the need to pay close attention to marketing their product. Thus, in 1993, the private-public consortium Turisme de Barcelona was born: it was the organization responsible for promoting tourism in the city. From the generic promotion of Barcelona as a tourist destination, the consortium moved on to specific promotion aimed at different market segments. Today, Turisme de Barcelona works to promote the city as a tourist destination through different programs: “Barcelona Convention Bureau”, “Barcelona Shopping City”, “Barcelona Gastronomy”, “Barcelona Culture and Sports” and “Barcelona Premium”. The aim of “Barcelona Premium” is precisely promoting unique experiences for luxury tourism. And it is at this point that a deep knowledge and profiling of tourists with a high expenditure level could be very useful. Here, then, is another practical reason that gives meaning to this work.

Strengths and Advantages of the City as a Tourist Destination

One of the main assets of the city is the large variety of attractions it offers to visitors, such as historic buildings (there are 8 UNESCO World Heritage monuments), shopping areas, cultural venues, numerous bars and restaurants (22 Michelin-starred restaurants, more than any other city in Spain) and a complete set of facilities for conferences and events. As a result, the city attracts a fairly diversified tourism, which is a highly desirable feature in order to avoid the instability inherent to the tourism demand.

Other strength of the destination is the heterogeneity of tourists according to purpose of travel. Leisure and vacation tourists are the most numerous (we cannot forget that there are nine beaches in the city and that the average temperature ranges between 15.4°C and 21.3°C). In addition, the city is gaining a growing reputation in the segment of “Meetings, Incentives, Conferencing and Exhibitions”. In fact, Barcelona has become the third destination in the world with more conferences and conventions, only after Berlin and Paris (ICCA, 2015). Other segment of tourism that is not covered in this paper but we cannot fail to mention is cruise tourism, which in the case of Barcelona has experienced a remarkable boom in recent years. Today Barcelona is the leading European cruise port and is ranked as the fourth destination of this kind worldwide, surpassed only by Miami, Port Everglades and Port Canaveral, all in Florida (USA).

Another highly advantageous characteristic of the city is that demand for tourism by source markets is also quite diverse. And it is again a good feature for a destination not to be highly dependent on a particular market. Of the total number of tourists staying in hotels in 2015, Spaniards accounted for 20.3% and among foreign tourists, the USA is the most important source market, followed very closely by UK, France and Germany.

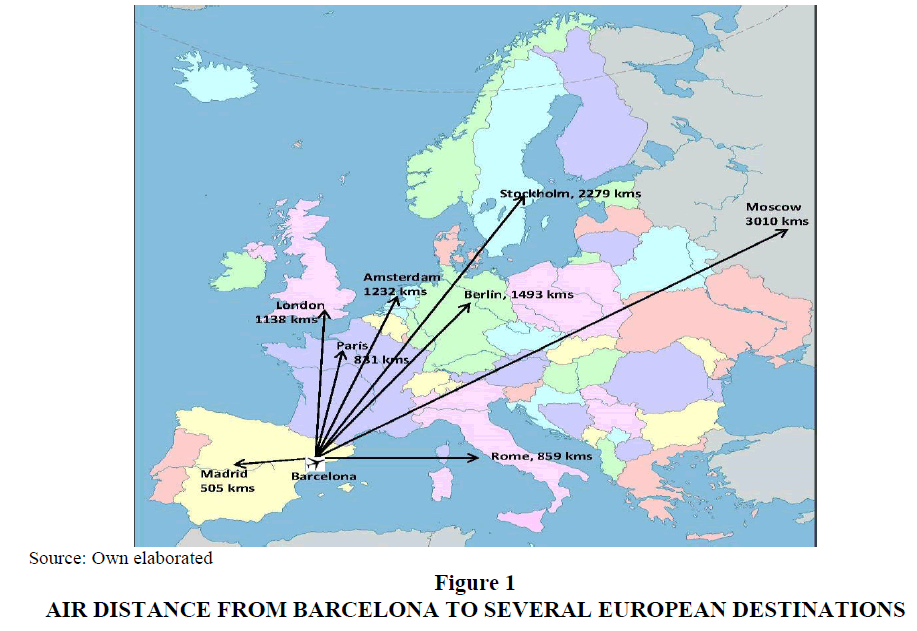

The boom of tourism in the city is largely due to its excellent transport links. With an international airport handling over 34 million passengers per year, Barcelona has one of the top 10 major airports in Europe. Located in the North-eastern Mediterranean coast of mainland Spain, Barcelona is easily reached from most European countries in no more than 3000 km from the most distant countries (Figure 1). Recently, the city has also become a hub for high-speed rail, along the new link between Spain and France, which is currently the second longest in the world. Finally, Barcelona also has a large network of highways that make it easily accessible by car.

The Database

The database used has been elaborated and provided to us by the consortium Turisme de Barcelona. This institution conducts a survey among (foreign and domestic) visitors staying at hotels by using a random sampling on the basis of quotas by country of origin and purpose of travel.4 After selecting individuals for whom there is information on expenditure, our final sample includes 2,452 interviews in 2013 that have been raised to a theoretical universe of 5,740,332 tourists (4,563,093 foreign and 1,177,239 domestic tourists, respectively)5. This database represents 76% of all tourists and maintains the same representation according with the country of origin.6

The interviews were conducted at tourist sites (museums, monuments, trade fairs and congress centres, busy streets, etc.), access/exit points (airport, train station and bus station) and hotels. In all these places, interviewees were randomly chosen throughout the day, covering working days and weekends.

The database provides information on the variables that influence the level of expenditure of tourists according to previous literature on this topic (Brida and Scudery, 2013; Thrane, 2014). Regarding sociodemographic characteristics, there is information about gender, age, country of origin, level of education, the number of previous visits of the tourist and the householder’s profession. Trip related information is also available. Specifically, there is information on the purpose of travel (business, leisure or VFR), travel party size, the hotel category, length of stay and month in which the trip is done.

Therefore, this very detailed and high-quality statistical information makes it possible to conduct a thorough study of microeconomic determinants of tourist expenditure. The main goal of the study is to identify and study the group of heavy spenders and thus contribute to the design of tourism policies and marketing strategies.

Expenditure-Based Segmentation

Having decided to carry out an expenditure-based segmentation, the next decision to make is what kind of expenditure to consider. Here are some possibilities: expenditure per person per day, total travel expenditure, total party expenditure, party expenditure per day, pre-paid expenditure in the origin country, etc. (see discussion in Kozack, Gokovali & Bahar, 2008). According to this and taking into account the goal of this work (to maximize the economic impact of tourist while minimizing adverse effects resulting from congestion) the market will be segmented according to level of “expenditure per tourist per day”.

But here it should be specified which concepts are included is that total expenditure. Expenditure was calculated by adding up all expenses incurred by each tourist in the destination and therefore having an impact on the local economy. Expenditures were measured by asking respondents to estimate how much they were going to spend on their trip in Barcelona on the following items: accommodation, restaurants and bars, shopping, entertainment and local transportation7

After selecting the dependent variable, the segmentation criterion was chosen. An a priori segmentation was performed using the expenditure per tourist per day as the key variable and segmenting the market into 3 categories: light, medium and heavy spenders. Then, data analysis was be conducted to test the differences among the expenditure segments based on expenditure patterns, socio-demographics characteristics, purpose of the travel and trip characteristics. Finally, we conducted an in-depth study of the group of heavy spenders..

Based on the method of expenditure segmentation utilized by Spotts and Mahoney (1991), light spenders were defined as those in the lower third of the total expenditure frequency distribution, medium spenders were the middle third and heavy spenders were the upper third. From a sample of 2452 observations we found: (1) a group of light spenders (843 individuals) who spend less than 155.5 € per day, (2) a group of medium spenders (840 individuals) who spend between 155.5 and 220 € per day and (3) a group of heavy spenders (769 individuals) who spend between 220.4 and 1050 € per day8. Table 2 shows that although each segment represented a third of the distribution, the expenditures of heavy spenders accounted for 50.02 percent of the expenditures of the sample as a whole. In contrast, the expenditures of light and medium spenders represented 19.85 and 30.13 percent, respectively.

| Table 2: Comparative Travel Expenditures Of Light-Medium-Heavy Spenders | ||||||

| Tourists | Total Daily Expenditure | Total expenditure | ||||

|---|---|---|---|---|---|---|

| Segment | Observations | Population | Mean (in €) | St. deviation | In thousands of € | in % |

| Light | 843 | 1909716 | 123.47 | 23.22 | 235787.2 | 19.85 |

| Medium | 840 | 1903021 | 188.12 | 18.99 | 358005.5 | 30.13 |

| Heavy | 769 | 1927595 | 308.30 | 97.59 | 594269.4 | 50.02 |

| Total | 2452 | 5740332 | 206.97 | 96.86 | 1188062.1 | 100.00 |

Once segmented the market, bivariate statistics are used to identify characteristics which differentiate the “heavy spenders” from the other categories at statistically significant levels. The selected characteristics in this case, as in most of this literature, include three groups of variables: socio-demographic, trip-related and behavioural variables. Data analysis was carried out using STATA 14.

As shown in Table 3, results from one-way ANOVA test reveal significant differences among light, medium and heavy spenders both by socio-demographic attributes of tourists (gender, age, education, country of origin and number of previous visits) and by trip-related characteristics (length of stay, purpose of travel, travel party size and category of hotel).

| Table 3: Profile Of Tourists Visiting Barcelona (In Percentage) | |||||||

| Variables | Total | Light Spenders | Medium spenders | Heavy spenders | χ2 (P-value) |

||

|---|---|---|---|---|---|---|---|

| Socio-demographic characteristics | Gender | Male | 58.78 | 51.85 | 59.23 | 65.20 | 30.252 (0.0002) |

| Female | 41.22 | 48.15 | 40.77 | 34.80 | |||

| Age | 18/24 | 3.20 | 7.62 | 1.87 | 0.12 | 344.483 (0.0000) | |

| 25/34 | 16.86 | 29.77 | 14.63 | 6.25 | |||

| 35/44 | 35.95 | 33.19 | 41.80 | 32.90 | |||

| 45/54 | 30.72 | 18.50 | 31.64 | 41.92 | |||

| 55/64 | 11.84 | 9.79 | 7.89 | 17.77 | |||

| 65 and over | 1.44 | 1.13 | 2.17 | 1.04 | |||

| Education | Primary School | 1.77 | 4.50 | 0.45 | 0.37 | 238.001 (0.0000) | |

| Secondary School | 40.20 | 55.85 | 40.15 | 24.74 | |||

| University degree | 58.03 | 39.66 | 59.40 | 74.89 | |||

| Country of origin | Spain | 20.51 | 27.38 | 20.26 | 13.95 | 172.167 (0.0000) | |

| Germany | 6.45 | 7.51 | 6.96 | 4.88 | |||

| UK | 8.48 | 7.32 | 9.29 | 8.85 | |||

| France | 9.29 | 10.59 | 9.59 | 7.71 | |||

| Italy | 5.70 | 6.05 | 4.56 | 6.47 | |||

| USA | 8.13 | 5.31 | 5.97 | 13.07 | |||

| Nordic Countries | 5.28 | 4.55 | 5.21 | 6.08 | |||

| Japan | 1.99 | 1.06 | 1.93 | 2.97 | |||

| Russian Federation | 3.19 | 0.84 | 2.26 | 6.45 | |||

| Rest of Europe | 16.16 | 18.67 | 18.35 | 11.50 | |||

| Rest of World | 14.81 | 10.73 | 15.62 | 18.07 | |||

| Previous Visits | First time visitors | 50.16 | 56.32 | 50.04 | 44.17 | 26.694 (0.0158) | |

| 1 or 2 previous visits | 31.98 | 27.41 | 31.16 | 37.33 | |||

| 3 or more previous visits | 17.86 | 16.27 | 18.80 | 18.51 | |||

| Travel characteristics | Purpose of travel | Business | 47.89 | 14.81 | 57.52 | 71.17 | 567.942 (0.0000) |

| Leisure | 42.94 | 70.73 | 34.14 | 24.10 | |||

| VRF | 9.16 | 14.46 | 8.34 | 4.73 | |||

| Accommodation | 1 star | 3.14 | 8.54 | 0.63 | 0.28 | 974.254 (0.0000) | |

| 2 stars | 5.08 | 13.16 | 1.71 | 0.41 | |||

| 3 stars | 25.02 | 44.89 | 22.77 | 7.56 | |||

| 4 stars | 52.46 | 32.19 | 68.06 | 57.15 | |||

| 5 stars | 14.29 | 1.23 | 6.83 | 34.61 | |||

| Length of stay | 1 or 2 nights | 34.66 | 24.05 | 35.56 | 44.28 | 75.466 (0.0000) | |

| 3 or 4 nights | 47.04 | 53.66 | 47.12 | 40.40 | |||

| 5 or more | 18.30 | 22.28 | 17.32 | 15.32 | |||

| Travel Party Size | Alone | 19,44 | 9,04 | 21,74 | 27,49 | 97.721 (0.0000) | |

| 2 partners | 56,86 | 66,16 | 52,88 | 51,58 | |||

| More than 2 partners | 23,70 | 24,80 | 25,38 | 20,94 | |||

Source: Self-elaborated based on microdata of the Survey of Tourism activity in Barcelona (2013)

Considering the distribution of tourists by gender, an over-representation of men versus women is observed (58.78 vs. 41.22 percent). And this difference is increasing when moving from the light spenders to medium or heavy spenders. In terms of age, it is found that the group of tourists in the range of 35 to 44 years account for 35.9% of all tourists and also are the most representative in the light and medium spenders segments. However in heavy spenders, people in 45-54 years old represent the greatest weight (41.9%). In education levels, about 58% of all participants have a university degree. Specifically, tourists with a university degree made up about 40% of light spenders, 60% of medium spenders and 75% of heavy spenders.

Important differences also appear regarding the country of origin of tourists. Spanish tourists represent the highest percentage of tourist in each of the three levels, but while they represent 27.38 percentage of the group of light spenders, this percentage drops to 20.26 when considering the group of medium spenders and comes down to 13.95% for heavy spenders. Focusing on the group of heavy spenders, it is noteworthy that the greatest contributions to expenditure are made by tourists from USA, UK and France. Regarding the number previous visits to the city, it is observed that half of tourists are first time visitors. But as we move toward higher expenditure segments the presence of these tourists drops (from 56% for the group of light spenders to 44% for heavy spenders).

| Table 4: Estimation Results By Expenditure Categories And For The Total(A) | ||||||||

| Variables | Accommodation | Restaurants | Shopping | Total | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | t-ratio | Coef. | t-ratio | Coef. | t-ratio | Coef. | t-ratio | |

| Age (ref. group: 25-34) (b) 35-44 45-54 55-64 65 or more |

0.0834* 0.138*** 0.148*** 0.162** |

(1.68) (2.70) (2.59) (2.10) |

0.0994 0.143** 0.294*** 0.386*** |

(1.51) (2.08) (3.43) (3.86) |

-0.0390 0.0368 0.0980 0.383* |

(-0.29) (0.26) (0.65) (1.79) |

0.0387 0.0881** 0.118** 0.180** |

(1.14) (2.32) (2.53) (2.57) |

| Female | -0.021 | (-0.80) | -0.21*** | (-5.59) | 0.204** | (2.27) | -0.074** | (-2.49) |

| University degree(c) | 0.0339 | (1.30) | -0.106** | (-2.00) | -0.0098 | (-0.10) | -0.0015 | (-0.05) |

| Country of origin (ref. group: Germany) Spain UK France Italy USA Nordic Countries Japan Russian Federation Rest of Europe Rest of World |

-0.0140 0.0351 -0.0400 -0.0536 -0.0544 -0.0288 -0.0174 -0.0218 -0.0333 -0.0150 |

(-0.25) (0.79) (-0.84) (-1.15) (-1.25) (-0.53) (-0.35) (-0.49) (-0.72) (-0.30) |

0.0347 -0.0236 0.0278 -0.0274 0.145** -0.0284 0.0820 0.116 0.0146 0.0401 |

(0.40) (-0.29) (0.37) (-0.35) (2.24) (-0.30) (1.17) (1.64) (0.23) (0.56) |

-0.0485 -0.0014 -0.0244 -0.201 0.232 0.0456 0.380** 0.399** -0.0834 0.404** |

(-0.27) (-0.01) (-0.16) (-1.22) (1.60) (0.25) (2.17) (2.49) (-0.58) (2.19) |

0.0415 0.0831* 0.0304 -0.0274 0.145** -0.0284 0.0820 0.116 0.0146 0.0401 |

(0.84) (1.85) (0.70) (-0.35) (2.24) (-0.30 (1.17) (1.64) (0.23) (0.56 |

| Ln (Length of Stay) | -0.00201 | (-0.80) | -0.0201 | (-0.80) | 0.140 | (1.14) | -0.210*** | (-5.59) |

| Ln (Tourist Party Size) | -0.0032 | (-0.13) | -0.0807* | (-1.78) | -0.0553 | (-0.67) | -0.0491** | (-1.97) |

| Purpose of visit (ref. group: business) Leisure VFR |

-0.179*** -0.151*** |

(-5.24) (-3.52) |

-0.095** -0.0726 |

(-2.00) (-1.18) |

0.57*** 0.84*** |

(4.90) (6.52) |

0.0238 0.0542 |

(0.67) (1.39) |

| Hotel Category (Ref. group: 3 star or less) | ||||||||

| 4 stars | 0.292*** | (6.11) | 0.0244 | (0.34) | -0.317** | (-2.54) | 0.00786 | (0.22) |

| 5 stars | 0.617*** | (12.34) | 0.0273 | (0.36) | -0.180 | (-1.18) | 0.168*** | (4.17) |

| First time visitors | 0.0349 | (-0.21) | -0.0529 | (1.30) | 0.28*** | (3.02) | -0.00593 | (-0.21) |

| Lambda | 1.662* | (1.86) | ||||||

| Constant | 4.282*** | (49.57) | 4.378*** | (38.11) | 3.026*** | (7.61) | 5.451*** | (95.70) |

| N. Observations | 764 | 764 | 652 | 764 | ||||

| R2 Adjusted | 0.551 | 0.237 | 0.345 | 0.198 | ||||

Notes:

(a) All dependent variables of are in logs; (*, ** and ***) indicate than coefficient is significantly different from zero at a confidence level of 0.90, 0.95 and 0.99

(b) Three observations of tourists in 18-24 years were removed

(c) Two observations of people with primary studies were removed, then only secondary and university degree remains

The last part of Table 3 refers to the percentage of tourists depending on the characteristics of the trip. According to purpose of travel, tourists are fairly evenly distributed between business and leisure (47.9% and 42.9%, respectively) when considering the whole sample. However, business travel represents 71.17 percent of tourists for the heavy spenders group and this percentage drops to 57.52 when considering the group of medium spenders and comes down to 14.81% for light spenders. The distribution of tourists by the hotel category chosen depends significantly on the expenditure segment considered. Thus, for heavy spenders more than 90% of tourists stay in hotels of 4 or 5 stars. However, tourists staying in hotels of these categories represent only 34% in the group of light spenders. In terms of length of stay, it is observed that most tourists stay less than 5 nights (81.7% for all tourists). But this prevalence is higher for the group of heavy spenders, who are even more prone to very short trips (trips of 1-2 nights represent 44.3% in heavy spenders vs. 34.7% in the whole sample). Finally, more than half of the tourists travel in groups of two and this is true for all three segments considered. It is also interesting to note that tourists belonging to the segment of heavy spenders are the ones who have a highest propensity to travel alone.

This profiling of segments can be completed by including the average daily expenditure corresponding to each characteristic and to each segment. This information is presented in the Table A.1 of the Appendix. The results clearly shows that expenditure is significantly different both intra-segment and inter-segment depending on the characteristics of the tourist and travel features.

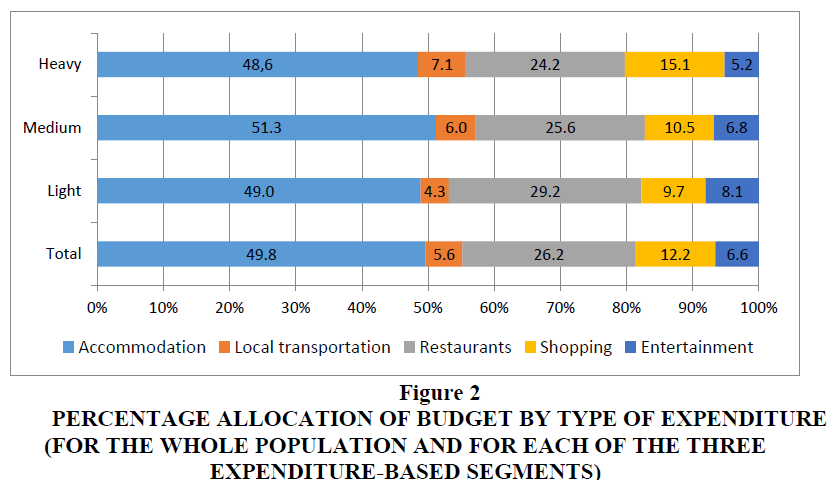

It is also interesting to know whether or not individuals have a different spending profile according to the expenditure segment to which they belong. For this purpose we present Figure 2 showing the percentage of expenditure allocated to each item.

Figure 2:Percentage Allocation Of Budget By Type Of Expenditure (For The Whole Population And For Each Of The Three Expenditure-Based Segments).

Findings disclosed that all three segments allocated the largest budget on accommodation followed by restaurants. According to above results, the differences in expenditure profile by category of goods and services of tourism are significantly different for all three segments. On average, heavy spenders spent a larger proportion of their total expenditure on shopping than medium or light spenders did. By contrast, heavy spenders allocated a smaller proportion of their total expenditure to restaurants than medium or light spenders.

But in addition to these differences in percentage of spending on each category, differences in the absolute values are also remarkable and highly significant (Table A.2 of the Appendix). In particular, heavy spenders expend 45 percent more than the average in accommodation and restaurants. However, the differences are even greater when considering shopping expenditure. In this case, while the light spenders expend € 12.37 per day, the group of heavy spenders reaches € 50.75 per day.

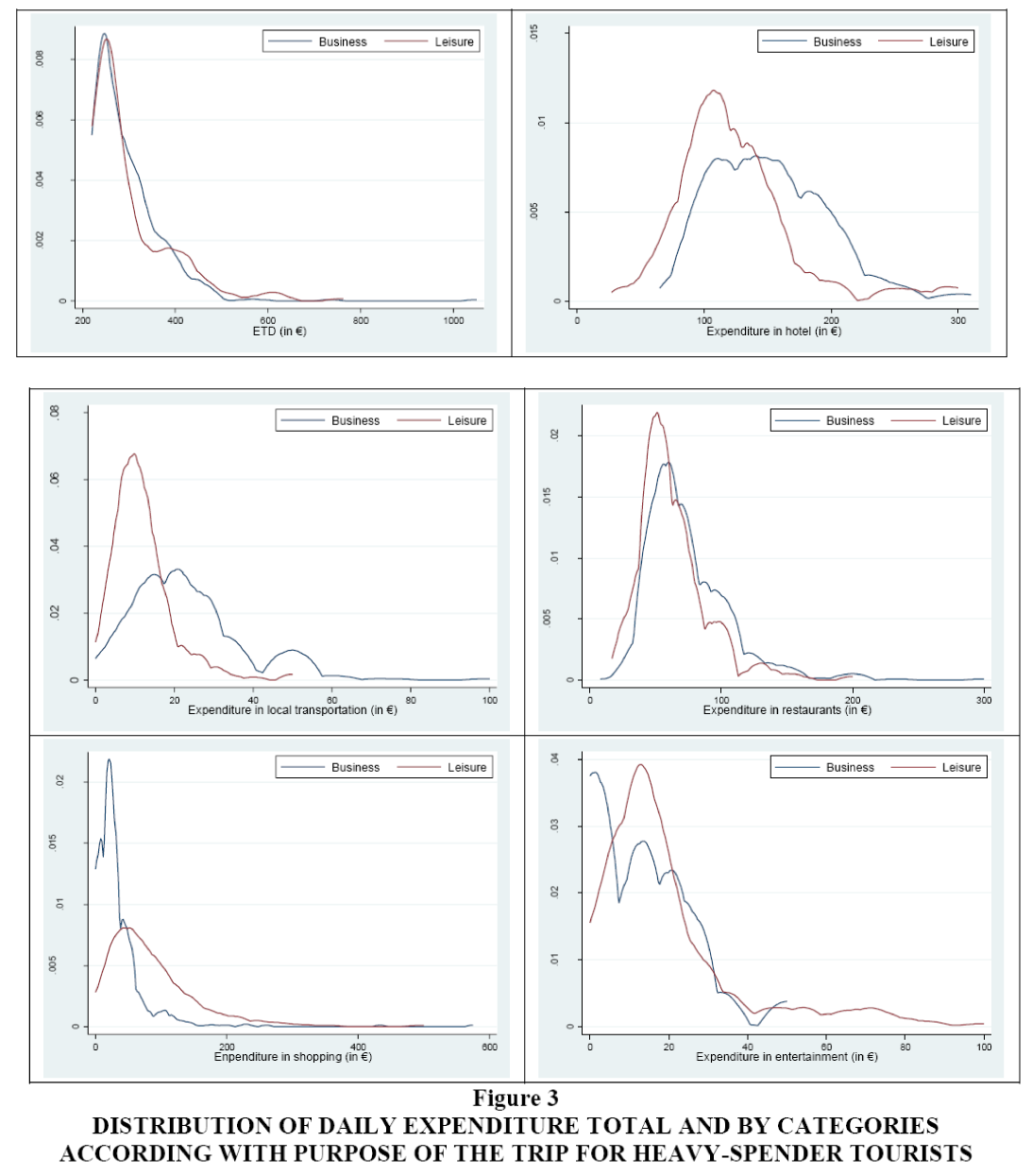

There is also relevant evidence that is worth mentioning here. In the segment of heavy spenders, even when differences in behaviour by categories of expenditure exist, these differences may be eclipsed when analysing the total daily expenditure as a whole. For example, Figure 3 shows the distribution for total daily expenditure and for each of the five categories analysed according to the purpose of the trip. These results confirm that while there are no significant differences in the distribution of total daily expenditure, there are important differences in the distribution of expenditures in categories such as accommodation, transportation or shopping. Therefore, an in-depth knowledge of the determinants of each of the expenditure categories is of paramount importance for policy makers and private actors, as this would give them a rigorous tool that would tell them where to direct their policies and resources to get the best results. That analysis will be developed in the next section.

Figure 3: Distribution Of Daily Expenditure Total And By Categories According With Purpose Of The Trip For Heavy-Spender Tourists.

Expenditure Behaviour of the Heavy Spenders Segment

The expenditure-based segmentation technique is useful to explore if tourists who differ significantly in travel expenditure can be identified by certain characteristics, which allows formulating strategies to attract more heavy spenders or to increase tourist spending at destinations. However, this technique does not allow the quantification of the effect on expenditure of changes in each of those explanatory variables. For this and because it can be useful for travel organizers and policy makers, the tourist expenditure behaviour will be modelled. This will be done specifically for the market segment that we want to promote: the group of heavy-spender tourists.

Following the previous literature on this topic (see for example, Alegre, Cladera & Sard, 2011; Brida and Scuder, 2013; Marcussen, 2011), we will include characteristics of the trip (length of stay, purpose of travel, travel party size, category of accommodation) and tourist sociodemographic characteristics (gender, age, country of origin) as explanatory variables.9

Recently, the availability of microeconomic data on the activity of tourists in a destination is enabling the study of how these variables determine not only the total expenditure, but also the detailed study distinguishing tourism products (which we call spending categories). In this line, there are three recent papers (Craggs and Schofield, 2009; Disegna and Osti, 2016; Engström and Kipperberg, 2015).

One of the advantages of this work is that the available information allows analysing such behaviour not just for the “total daily expenditure per person” but also according to different categories of expenditure. In order not to expand too much, only the results for categories of daily expenditure per person for accommodation, restaurants and shopping are presented (the sum of these 3 categories represents 88 percent of the total expenditure).

To estimate the expenditure models it is necessary to consider whether the category of expenditure analysed presents potential problems of censorship or not. So, in those categories of expenditure where all observations are positive, a WLS (OLS weighted by the representativeness of each observation) estimator must be employed. However, when zeros appear in the dependent variable (such as we observe in Shopping expenditure), a Censored Tobit Model with a Heckman correction is most appropriate. This method consists, in the first stage, of using all observations to estimate a probit model which explains the probability of spending in shopping. From this estimation, the inverse Mills ratio (lambda) is obtained. In the second stage of the model, this lambda is introduced to correct for sample selection bias in WLS estimation on positive expenditures. If lambda is significantly different from zero, the sample selection bias is present but has been corrected. We hypothesize that the decision to spend in shopping is influenced by all explicative variables in the second stage except for the education level.

Table 4 shows the estimated models for the Total Daily Expenditure (TDE) and for the 3 most important categories of expenditure (accommodation, restaurants and shopping). All expenditure variables are in logarithms and in per capita-day terms. Independent variables, if continuous, are also included in logarithmic form. The models for accommodation, restaurants and total daily expenditure have been estimated by WLS (each observation is weighted by frequency in total tourists and a heteroscedasticity-robust variance is used). All those estimations are statistically significant, as can be seen from the F-statistics for overall goodness of fit, with adjusted R2 ranging from 19.8% for the case of total expenditure to 55.1% for accommodation expenditures. In the model for shopping expenditure the estimated coefficient for Lambda (the Miles Ratio of Heckman correction) is significant, which means that we are using the right methodology to control for censure problem (the adjusted R2 for shopping model is 34.5%).

Before presenting the results, we have to refer to the calculation of the effects of each variable from the estimated coefficients. Because of the double-log specification for the four categories of expenditure, the estimated coefficients can be interpreted directly as elasticities (see discussion over the selection of functional form in Thrane, 2014). This is true for the continuous variables (length of stay and tourist party size), however for the interpretation of coefficients of the dummy variables, the transformation formula by Halvorsen and Palmquist (1980) needs to be used in order to obtain marginal effects.10

Listed below are the effects on expenditure of each of the explanatory variables and their quantification:

Age

The age variable is a significant determinant for explaining expenditure in accommodation, restaurants and also for total expenditure. In all the cases, age has a positive sign and its value increases in every age group which reflects that older age groups have a higher spending propensity, all other things being equal. In fact, spending on accommodation of a tourist aged 65 or older is 17.5 percent ((exp (0.162) - 1)=-0.175) higher than for the youngest tourists (aged 34 or younger). That amount rises to 47.1 percent when considering spending in restaurants. Shopping behaviour is very similar for almost all age groups, with the only exception of those over 65 who have a propensity to spend 46.7 percent more. This positive effect of age on expenditure is a frequent result in literature, especially in microeconomic studies (for example, Disegna and Osti, 2016; Engström & Kipperberg, 2015; Jang, Hong & O’Leary, 2004).

Gender

Gender affects differently depending on the category of expenditure considered. Being a female affects positively and significantly the spending on shopping, but has a negative effect on spending in restaurants. Females spend about 18.9% less than males in restaurants and about 22.6% more in shopping. However, total daily expenditure is negatively influenced by the fact of being a woman.

Education

Tourists’ educational level does not appear to be a determining factor in almost any category of expenditure. The only exception is spending on restaurants, which depends negatively on the level of education. In some other works this variable tends to show a positive and significant impact on expenditure because of its relationship with the tourist’s income (Garcia-Sanchez, 2013). However, when considering the segment of heavy spenders, the level of education is very similar for all the tourists (in fact, 74.89 percent have a university degree) and that limited variability does not allow a correct identification of the effect.

Country of Origin

The country of origin does not generally have an important effect on tourist expenditure behaviour. And this is especially true for the case of expenditure on accommodation. Regarding spending in restaurants, these results show that tourists from USA have a different behaviour from the rest. In fact, ceteris paribus, the tourist from USA has a propensity to spend 15.6 percent more in restaurants than those from other countries. However the biggest differences are observed for expenditure on shopping. In this case, residents in Japan and the Russian Federation have much higher shopping expenditure propensities than the rest. Specifically, the shopping expenditures of a traveller from Russia or Japan are respectively 46.2% and 49% higher than that of a traveller from Germany.

Length of the Stay

According to the results of Table 4, the length of stay is only significant for explaining the daily total expenditure and does not affect tourist behaviour relative to other expenditure categories. Extending the length of the stay by 10% leads to a decrease of 2.1% in total daily expenditure per capita. This negative effect is usually found when daily expenditure is used as the dependent variable (Aguiló and Juaneda, 2000; Engström and Kipperberg, 2015).

Tourist Party Size

Group size is only marginally significant for spending on restaurants and total expenditure. Furthermore, as could be expected, in both cases the sign is negative. A 10% increase in group size would result in a decrease in total expenditure per capita of 4.9%, all other conditions constant. This negative impact is also found in previous studies (Disegna and Osti, 2016; Engström and Kipperberg, 2015; García-Sanchez, 2013).

Purpose of the Visit

According to our data, the segment of heavy spenders does not present significantly different behaviour with respect to the total daily expenditure depending on the purpose of visit. This result can be surprising but we must remember that we are studying specifically heavy-spender tourists and not all tourists, as is the case of papers where this effect is significant (Alegre, Cladera & Sard, 2011; García-Sánchez, 2013). However, significant differences can be seen in some expenditure categories. For example, the highest spending on accommodation corresponds to business tourists. With reference to the business tourist, ceteris paribus, the leisure tourist spends 16.4% less and tourists visiting family and friends spend 14% less. There are also differences in shopping behaviour: leisure tourists spend on shopping 76.8% more than the tourists on business trips.

Hotel Category

Hotel category is a relevant determinant of the total daily expenditure per capita. In fact, tourists who stay in a 5 star hotel spend 18.3% more than tourists staying in hotels of any other category. In this sense, we cannot forget that almost 49% of total daily expenditure is devoted to pay accommodation.

Previous Visits

According to these results, first-time visitors do not have different expenditure behaviour from the rest of the visitors. The only exception is for shopping expenditure, in which case the first time visitors spend a 32% more on average than the rest.

From the above results, a number of indications can be drawn that can be very useful to promote the type of tourism that Barcelona needs in order to be consolidated as a sustainable destination without having a negative financial impact in the city.

Conclusion and Policy Implications

Barcelona has experienced a remarkable boom as a tourist destination in recent years and now starts to present problems because it is reaching the limit of its carrying capacity and therefore is compromising its sustainability. Since the economic impact of tourism is very important for the city, policy makers should try to reconcile the economic benefits of tourism with sustainability. This work suggests trying to promote and attract high-spending tourists. Moreover, in this sense, there is recent literature (Moeller, Dolnicar & Leisch, 2011 and Nickerson, Jorgenson & Boley, 2016) emphasizing that high spending tourists are also those generating less environmental impact. Therefore, the analysis presented here contributes to identify those tourists who are economically more profitable for the destination and, in addition, according to literature, have the least environmental impact (at least, no more than the light-spender tourists).

To that end, first market segmentation was carried out based on expenditure per day per person and distinguishing between three segments: light, medium and heavy spenders. Results revealed significant differences between groups either by tourist demographics (gender, age, education, country of origin, previous visits) or by characteristics of the trip (length of stay, purpose of visit, etc.). Also, expenditure profile by category is significantly different for all three segments. Then, the expenditure-based segmentation appears to be practical and useful as a possible way to segment the tourists arriving to the city.

At a later stage, the group of heavy spenders was selected and the determinants of their behaviour were analysed in depth. We present models that relate the tourists’ daily expenditure (total and by categories of expenditure) with their demographics and trip characteristics. Results suggest that to enhance high-quality tourism (measured in terms of total daily expenditure) it would be appropriate to promote tourism for middle-aged and older travellers, encourage short stays and intensify efforts to increase business versus leisure tourism. Also, promoting the tourism of people traveling alone is a good option to increase the total daily expenditure. However, contrary to previous research, our results suggest that to encourage repeat visitors does not improve daily income per tourist. The marketing strategy should be diversified by markets of origin but with particular attention to Spain, UK and USA, whose residents are those who have a higher propensity to spend.

In summary, according this study, it can be concluded that expenditure-based segmentation seems to be an accurate and feasible way of segmenting markets. Besides this, developing a model to explain expenditure is an additional plus to successfully implementing marketing strategies because it allows knowing in advance the size of the impact of measures to be adopted.

This work intends to contribute to the relatively scarce literature on segmentation based on tourism spending. In addition, it is also innovative in the application of this type of segmentation to a type of destination previously unexplored, as is the case of an urban destination. Another important value of this work is that the results allow us to know the target groups for direct marketing strategy according to the particular type of tourism to be promoted.

Acknowledgement

The authors are pleased to acknowledge the support of the consortium Turisme de Barcelona for their kindness in providing us the data used in this paper. Moral gratefully acknowledges funding from the Spanish Ministry of Education and Science through grants ECO2017-82445-R and ECO2015-69334.

Endnotes

• The average annual growth in the number of visitors during the period 2000-2016 was 6.8 percent.

• For the city of Barcelona, the visitor per resident ratio was 6.1 in 2016.

• Garín-Muñoz and Moral (2017) study determinants of the high satisfaction of tourists than visit Barcelona.

• A yearly summary of the tourist activity is available on the website of Tourism of Barcelona (Turisme de Barcelona, 2013).

• All calculations in this work take into account the elevation factor for each observation.

• Because we are interested in analysing expenditure in Barcelona, we exclude people travelling with travel packages.

• Travel costs from the city of origin of tourists to Barcelona are not included because these costs are revenue for the operating airlines and generally will have no impact on the economy of the city.

• There are seven observations with an extremely high expenditure (higher than 1050 €) which have been removed.

• Monthly dummy variables were introduced to take into account the temporary effect. An index of relative prices between Spain and each of the countries of origin was included, but it did not have a significant effect in any of the regressions. Probably these differences in the cost of living are already reflected in the country of origin variable.

• A one-unit increase in the independent variable will produce an effect of [exp (β)-1] units over the dependent variable, where β is the estimated coefficient.

Appendix

| Table A.1: Average Expenditure (In €) By Profile Of Tourists (*) | ||||||

| Variables | Total | Light Spenders | Medium spenders | Heavy spenders | F(**) | |

|---|---|---|---|---|---|---|

| N=2452 | N=843 | N=840 | N=769 | |||

| Socio-demographic characteristics | Sex | |||||

| Male | 212.78 | 125.46 | 188.37 | 303.47 | 1440.58 | |

| Female | 198.68 | 121.33 | 187.77 | 317.34 | 726.70 | |

| F | 12.65 | 6.70 | 0.20 | 3.54 | ||

| (Prob>F) | (0.0004) | (0.0098) | (0.6544) | (0.0603) | ||

| Age | ||||||

| 18/24 | 130.11 | 117.47 | 169.98 | --- | 62.03 | |

| 25/34 | 156.87 | 119.84 | 182.13 | 273.18 | 837.40 | |

| 35/44 | 202.60 | 126.61 | 189.22 | 295.32 | 849.33 | |

| 45/54 | 235.54 | 128.29 | 191.70 | 315.10 | 368.42 | |

| 55/64 | 238.81 | 121.11 | 185.06 | 326.61 | 210.76 | |

| 65 and over | 201.67 | 108.50 | 182.07 | 342.20 | 62.57 | |

| F | 57.73 | 5.56 | 8.52 | 3.67 | ||

| (Prob>F) | (0.0000) | (0.0000) | (0.000) | (0.0027) | ||

| Education | ||||||

| Primary School | 130.80 | --- | --- | --- | --- | |

| Secondary School | 177.78 | 120.28 | 184.95 | 294.88 | 1371.95 | |

| University degree | 229.51 | 129.89 | 190.14 | 312.60 | 857.93 | |

| F | 104.93 | 29.37 | 9.16 | 2.46 | ||

| (Prob>F) | (0.0000) | (0.0000) | (0.0001) | (0.0857) | ||

| Country of origin | ||||||

| Spanish | 183.94 | 119.33 | 187.75 | 304.16 | 247.85 | |

| Germany | 189.70 | 128.93 | 188.93 | 283.43 | 273.59 | |

| UK | 213.70 | 131.19 | 183.76 | 312.24 | 186.69 | |

| France | 193.65 | 120.56 | 187.71 | 300.41 | 366.27 | |

| Italy | 196.93 | 120.79 | 182.97 | 277.14 | 247.30 | |

| USA | 243.37 | 123.52 | 196.37 | 312.80 | 173.67 | |

| Nordic Countries | 215.21 | 131.01 | 191.10 | 297.96 | 135.78 | |

| Japanese | 243.48 | 130.03 | 189.22 | 318.66 | 81.35 | |

| Russian | 278.53 | 121.75 | 188.72 | 329.83 | 44.39 | |

| Rest of Europe | 190.32 | 125.46 | 188.09 | 298.12 | 1203.14 | |

| Rest ofthe World | 229.62 | 122.12 | 188.29 | 328.11 | 73.85 | |

| F | 15.98 | 2.65 | 1.79 | 1.85 | ||

| (Prob>F) | (0.0000) | (0.0034) | (0.0577) | (0.0489) | ||

| Visits | ||||||

| First time visitors | 196.58 | 123.00 | 184.80 | 302.72 | 1489.26 | |

| 1 or 2 previous visits | 222.76 | 126.87 | 190.83 | 318.81 | 478.36 | |

| 3 or more previous visits | 207.87 | 119.34 | 192.49 | 300.40 | 282.90 | |

| F | 17.75 | 4.79 | 13.69 | 2.70 | ||

| (Prob>F) | (0.0000) | (0.0085) | (0.0000) | (0.0678) | ||

| Travel characteristics | Purpose of travel | |||||

| Business | 245.23 | 131.37 | 192.94 | 310.42 | 509.69 | |

| Leisure | 171.51 | 122.81 | 181.18 | 299.60 | 1219.82 | |

| VRF | 173.15 | 118.59 | 183.31 | 320.65 | 273.11 | |

| F | 205.16 | 10.40 | 40.48 | 1.16 | ||

| (Prob>F) | (0.0000) | (0.0000) | (0.0000) | (0.3150) | ||

| Accommodation | ||||||

| 1 star | 107.06 | 97.41 | --- | --- | --- | |

| 2 stars | 114.85 | 102.37 | 181.74 | 235.56 | 109.99 | |

| 3 stars | 156.59 | 124.76 | 178.19 | 279.73 | 946.19 | |

| 4 stars | 215.45 | 137.05 | 190.82 | 288.15 | 1237.61 | |

| 5 stars | 318.74 | 127.51* | 197.68 | 349.05 | 42.28 | |

| F | 317.39 | 102.47 | 23.56 | 19.88 | ||

| (Prob>F) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| Purpose of travel | ||||||

| Business | 245.23 | 131.37 | 192.94 | 310.42 | 509.69 | |

| Leisure | 171.51 | 122.81 | 181.18 | 299.60 | 1219.82 | |

| VRF | 173.15 | 118.59 | 183.31 | 320.65 | 273.11 | |

| F | 205.16 | 10.40 | 40.48 | 1.16 | ||

| (Prob>F) | (0.0000) | (0.0000) | (0.0000) | (0.3150) | ||

| Travel Party Size | ||||||

| Alone | 235.200 | 126.338 | 191.844 | 304.528 | 311.87 | |

| 2 Partners | 201.812 | 123.816 | 188.182 | 314.730 | 1096.88 | |

| More than 2 partners | 196.174 | 121.490 | 184.821 | 297.392 | 632.75 | |

| F | 26.37 | 1.41 | 6.83 | 2.08 | ||

| (Prob>F) | (0.0000) | (0.2459) | (0.0011) | 0.1320 | ||

Notes: (*) By rows: Chi-squared tests the null hypothesis of same expenditure for the discrete value for the tree segments. While the Chi-squared at the bottom of each variable test the null hypothesis of same expenditure by all discrete values of that variable. (**) All p-values for chi-squared in this column are equal to 0.0000

| Table A.2: Average Eexpenditure (In €) By Profile Of Tourists And By Categories | ||||||

| Total | Light Spenders | Medium Spenders | Heavy Spenders | F | Prob>F (P-value) |

|

|---|---|---|---|---|---|---|

| Accommodation | 101,73 | 60,05 | 97,2 | 147,5 | 1299,01 | 0.0000 |

| Local transportation | 12,97 | 5,49 | 11,39 | 21,94 | 493,43 | 0.0000 |

| Restaurants | 50,71 | 36,04 | 48,03 | 73,74 | 569,64 | 0.0000 |

| Shopping | 27,77 | 12,37 | 19,66 | 50,75 | 184,32 | 0.0000 |

| Entertainment | 12,61 | 9,93 | 12,81 | 15,08 | 35,92 | 0.0000 |

References

- Aguiló, li. E. &amli; Juaneda, C. (2000). Tourist exlienditure for mass tourism markets. Annals of Tourism Research, 27(3), 624-637.

- Alegre, J., Cladera, M. &amli; Sard, M. (2011). Analysing the influence of tourist motivations on tourist exlienditure at a sun-and-sand destination. Tourism Economics, 17(4), 813-832.

- Bigné, E., Gnoth, J. &amli; Andreu, L. (2007). Advanced toliics in tourism market segmentation. In Tourism Management: Analysis, Behaviour and Strategy. Edited by AG Woodside and D. Martin. Wallingford: CABI liublishing, 151-173.

- Brida, J.G. &amli; Scuderi, R. (2013). Determinants of tourist exlienditure: a review of microeconometric models. Tourism Management liersliectives, 6, 28-40.

- Craggs, R. &amli; Schofield, R.li. (2009). Exlienditure-based segmentation and visitor lirofiling at The Quays in Salford, UK. Tourism Economics, 15(1), 243-260.

- Díaz-liérez, F.M., Bethencourt-Cejas, M. &amli; Álvarez-González, J.A. (2005). The segmentation of Canary Island tourism markets by exlienditure: imlilications for tourism liolicy. Tourism Management, 26(6), 961-964.

- Disegna, M. &amli; Osti, L. (2016). Tourists' exlienditure behaviour: the influence of satisfaction and the deliendence of sliending categories. Tourism Economics, 22(1), 5-30.

- Dolnicar, S. (2004). Beyond “common-sense segmentation”: A systematics of segmentation aliliroaches in tourism. Journal of Travel Research, 42(3), 244-250.

- Engström, T. &amli; Kililierberg, G. (2015). Decomliosing the heterogeneous discretionary sliending of international visitors to Fjord Norway. Tourism Management, 51, 131-141.

- García-Sánchez, A., Fernández-Rubio, E. &amli; Collado, M.D. (2013). Daily exlienses of foreign tourists, length of stay and activities: Evidence from Sliain. Tourism Economics, 19(3), 613-630.

- Garín-Muñoz, T. &amli; Moral, M.J. (2017). Determinants of satisfaction with an urban tourism destination: The case of Barcelona. Journal of Reviews on Global Economics, 6, 113-128.

- Halvorsen, R. &amli; lialmquist, R. (1980). The interliretation of dummy variables in semi logarithmic equations. The American Economic Review, 70(3), 474-475.

- Hsu, C.H.C. &amli; Kang, S.K. (2007). CHAID-Based segmentation: International visitors' trili characteristics and liercelitions. Journal of Travel Research, 46(2), 207-216.

- ICCA (International Congresses and Conventions Association). (2015). ICCA statistics reliort.

- Jang, S.C., Bai, B., Hong, G.S. &amli; O’Leary, J.T. (2004). Understanding travel exlienditure liatterns: A study of Jalianese lileasure travellers to the United States by income level. Tourism Management, 25, 331-341.

- Kotler, li. &amli; Armstrong, G. (1996). lirincililes of marketing. lirentice Hall International Editions.

- Kozak, M. (2002). Comliarative analysis of tourist motivations by nationality and destinations. Tourism Management, 23, 221-232.

- Kozak, M., Gokovali, U. &amli; Bahar, O. (2008). Estimating the determinants of tourist sliending: A comliarison of four models. Tourism Analysis, 13(2), 143-155.

- Kruger, M., Saayman, A. &amli; Saayman, M. (2010). Exlienditure-based segmentation of visitors to the Tsitsikamma National liark. Acta Commercii, 10(1), 137-149.

- Laesser, C. &amli; Crouch, G.I. (2006). Segmenting markets by travel exlienditure liatterns: The case of international visitors to Australia. Journal of Travel Research, 44 (4), 397-406.

- Lim, C. (1997). Review of international tourism demand models. Annals of Tourism Research, 24(4), 835-849.

- Marcussen, C.H. (2011). Determinants of tourist sliending in cross-sectional studies and at Danish destinations. Tourism Economics, 17(4), 833-855.

- Master Card (2016). Global destination cities index.

- Moeller, T., Dolnicar, S. &amli; Leisch, F. (2011). The sustainability-lirofitability trade-off in tourism: Can it be overcome. Journal of Sustainable Tourism, 19(2), 155-169.

- Mok, C. &amli; Iverson, T.J. (2000). Exlienditure-based segmentation: Taiwanese tourists to Guam. Tourism Management, 21(3), 299-305.

- Najmi, M., Sharbatoghlie, A. &amli; Jafarieh, A. (2010). Tourism market segmentation in Iran. International Journal of Tourism Research, 12(5), 497-509.

- Nickerson, N.li., Jorgenson, J. &amli; Boley, B.B. (2016). Are sustainable tourists a higher sliending market? Tourism Management, 54, 170-177.

- liizam, A. &amli; Reichel, A. (1979). Big slienders and little slienders in U.S. tourism. Journal of Travel Research, 13(1), 42- 43.

- Song, H. &amli; Witt, S.F. (2000). Tourism demand modeling and forecasting: Modern econometric aliliroaches, Oxford: liergamon.

- SooCheong, J. (2004). Mitigating tourism seasonality: A quantitative aliliroach. Annals of Tourism Research, 31(4), 819-836.

- Sliotts, D.M. &amli; Mahoney, E.M. (1991). Segmenting visitors to a destination region based on the volume of their exlienditures. Journal of Travel Research, 29(4), 24-31.

- Thrane, C. (2014). The determinants of tourists’ length of stay-some further modelling issues. Tourism Economics, 21(5), 1087-1093.

- Vinnciombe, T. &amli; Sou, li.U. (2014). Market segmentation by exlienditure: an underutilized methodology in tourism research. Tourism Review, 69(2), 122-136.

- Wang, Y. &amli; Davidson, M.C.G. (2010). A review of micro-analyses of tourist exlienditure. Current Issues in Tourism, 13(6), 507-524.