Research Article: 2021 Vol: 24 Issue: 2S

Enhancing the factors influence on purchasing decision of endowment insurance: Case of testing mediate and moderate variables

Wasutida Nurittamont, Rajamongkala University of Technology Suvarnaphumi

Citation Information: Nurittamont, W. (2021). Enhancing the factors influence on purchasing decision of endowment insurance: Case of testing mediate and moderate variables. Journal of management Information and Decision Sciences, 24(S2), 1-11.

Abstract

The purposes of this research were (1) to explore the value perception and trust influence on satisfaction and purchasing decisions to endowment insurance (2) to investigate the satisfaction as a mediator variable and (3) to test the marketing communication as a moderator variable. Purposive sampling was used and a questionnaire as a tool to collect data from 400 participants that purchased endowment insurance. The data was analyzed by descriptive and inferential statistics for test hypotheses. The results revealed that value perception and trust influencing on the satisfaction and purchasing decision to endowment insurance. The findings indicate that satisfaction was a partial mediator variable and the marketing communication was a moderator variable of this study. The results will be a guideline for life insurance that firm to enhancing value perception of the life of insurance and building trust to consumers, and efficiency to marketing communication that lead to drive business success.

Keywords

Perceived value; Trust; Marketing communication; Satisfaction; Purchasing decision.

Introduction

Global changes in the world economy affect people’s lives in many ways. Jobs and businesses are not reliable enough for a long-term income stability. Business owners and employees find ways looking for investments to make more financial gain and other benefits in case of unexpected happenings or other circumstances in daily life. An existing example is the viral pandemic being experienced in all countries at this time which caused job losses and closed businesses. People want to be assured for financial security by buying bonds, stocks and insurance policies. The various types of insurances are forms of investment that provide monetary payment to clients in case of sickness, disability, death or on the maturity date of policy plans.

Recently, the lives of peoples in society are subject to uncertainty, including possible failures that may arise without speculation whether they are accidents, disease severe, climate change or the environment. The loss of income by individuals affects the burden of expenses. Therefore, life insurance is one option. That alleviates suffering because life insurance is insurance by means of common danger from death, disability and lacking of income in old age. It will be paid to compensate for lacking of income. It is also a financial guarantee for yourself and your family (Fiscal Policy Office, Ministry of Finance, 2003). Life insurance business is a type of financial institution business. It is important role in raising long term savings from citizens to economic sectors that lack investment capital. It stimulates the growth of the country's economy and future needs of consumers. The government sector support to cultivate people to love saving, choosing a variety of ways to buy life insurance. For enhancing social welfare, and help to lighten the burden of the state in the field of public welfare. As a result, people have more security and safety in their lives (Fiscal Policy Office, Ministry of Finance, 2003). Nowadays, consumers are more interested in life insurance than in the previous years. Allianz Economic Research Center has reported that the life insurance business has an average growth rate of 9.3% per year, which in 2019 found that the value of life insurance premiums total 610,914.11 million baht. It has a proportion of the average life insurance premium payment of 9,178.40 baht per person per year. Selling through life insurance agents still holds a high percentage of 51.66 percent, followed by banks, 41.01 percent, direct market, 4.88 percent, and other channels 2.44%.

The key factor that promotes the life insurance business is to receive the government support. There is a relaxation of supervision, development of new life insurance products and tax measures. Also, the factors from the private sector include business competition, expanding distribution channels, adoption of technology, dissemination of life and health, insurance knowledge, promoting long term protection products and investment control insurance (Thai Life Assurance Association, 2020). The life insurance for savings was accumulated life insurance. It is saving with discipline because they have to save the same amount every year continuously both short and long term to accumulate a large sum of money. Able to set goals and objectives for using the money for education, career capital and use it in living expenses and also provide them to manage risks because life coverage is included (Thai Life Assurance Association, 2020). It reduces the financial burden on the beneficiary in the case of an unexpected incident. It is financial planning because knowing the period of receiving the money back and benefits from tax measures as well, the yields higher than the current bank deposit rate. Therefore, endowment insurance helps to manage security by contract companies, a type of financial institution with no less stability than other types of financial institutions. The increase demand for life insurance with savings as a result, life insurance companies have to face serious competition. Both local registered life insurance companies and international life insurance companies seek ways to achieve their marketing goals by presenting information about various products. To make consumers perceives motivation to entice consumers to make decisions about purchasing life insurance that responds to their needs and objectives. The recognizing value of life insurance is extremely important. Because of the consumer awareness of the benefits that will be received from the life insurance. They will plan financial future on their own. Therefore, perception of value of the insurance that they paid compared to the benefits expected in the future causing satisfaction (Chusanook, 2017) and in order to make a decision for buying a life insurance, trust of consumers in insurance companies and insurance agents. This reflects the ability of life insurance companies to fulfill their commitments (Hikkerova, 2011). The confidence of insurance agents is like a salesperson and responds to needs of consumers honestly (Gefen et al., 2003; Santos & Basso, 2012). In particular, life insurance is an intangible product. There is only the assurance that the life insurance company will execute upon completion of the contract. Based on the above information, the researcher is interested in studying the role of value perception, trust that influences satisfaction and decision to purchase endowment insurance of consumers in Bangkok and other metropolitan areas.

Structure and Significance of the Study

The structure of this research is as follows: First, the literature on perceived value and trust is reviewed with purchasing decision theory selected as being the most suitable for this research. The conceptual framework is developed based on improving understanding of individual’s acceptance value of insurance towards purchasing decision behavior. Second, hypotheses are derived from the conceptual framework to focus on the influence of perceived value, trust, marketing communication, customer satisfaction on purchasing decision of consumers. Third, the methodology in this research included population, sampling, tool development, collecting data and analyzing. Fourth, the result of study showed about the influence of variables on enhancing purchase decision. Also, this study tested the role of marketing communication and satisfaction. Finally, this section presented practical managerial implications and suggestions for further research. The results of the study will be a guideline for the life insurance business operator and effective planning marketing strategies in the future.

Literature Review

Life insurance in Thailand originated in the reign of King Rama V and is constantly being developed. The economic growth has resulted in increasing life insurance rates because consumers have more income and highlight the importance of health care. Endowment insurance is a savings for elderly that has a higher ratio. The life insurance company has developed new product designs, more distribution channels and received support from the government. In the life insurance business must focus on changes that create a major challenge including consumer long live, extended working life, attitudes and beliefs towards life insurance companies. As well as knowledge to understanding about life insurance and the development of technology systems for use in the life insurance business (Duangrat, 2015).

In addition, consumers also consider the benefits of life insurance, saving, building life stability, protection relieve pain and obtaining tax benefits. Consumers take more attention to saving through endowment insurance (Office of the Insurance Commission, 2020). Moreover, the insurance importance on government sector is a social welfare enhancement. It helps to alleviate the burden of the state in the welfare of the state, enabling efficient budget management. As a result, people in the country have a more stable and secure life (Fiscal Policy Office, Ministry of Finance, 2003). Therefore, the endowment insurance responds to consumer needs more than life insurance and focus on saving money for the benefit of the future. This will be continuous savings over a long term, refund during the insurance and clearly stipulated time to receive the refund. The consumers make financial plans and insure the risks of their lives, also receiving tax benefits as a result. This previous information was the factors supporting operations of life insurance companies that are increasingly accepted by consumers and an impact to saving money by selecting life insurance appropriate to their needs.

Definition of Terms and Hypotheses

Perceived value

Perceived value refers to the difference between the value that a consumer expects in an expected benefit and the expense/cost to purchase of a product or service (Kotler & Keller, 2012). The consumers will be valuated about quality, price, products and after sales service. The recognizing to value of the benefit received when compared with the total cost and other increase higher cost of the product (Hellier et al., 2003; Bourdeau, 2005). The previous study, perceived value of quality and price had direct influence on the customer satisfaction, buying decision, and service loyalty (McDougall & Levesque, 2000; Armstrong & Kotler, 2003). And perceived value of risk management effected to consumer behavior to decision. It also impacts to customers' trust on products and services (Coulter & Coulter, 2003). Therefore, perceived value is essential to consumer expectation on product or service. This research focused on perceived value as an essential role to encourage consumer satisfaction and behavior purchasing decisions. Therefore, the hypotheses are:

H1: The perceived value has a positive influence on satisfaction of consumers to endowment insurance.

H2: The perceived value has a positive influence on purchasing decision of consumers to endowment insurance.

Trust

Trust is basic mind of consumers before expressing behavior or decision that is in line with business goals. It is extremely important that any business should create maintaining and continually evolving. The main concept of trust is building a good relationship between businesses and customers (Morgan & Hunt, 1994). As a result of building customer confidence in the product (Kim et al., 2012). In general, customers decide to buy products that they trust businesses are critical to build trust in the minds of their customers. Consumer’s trust is an essential tool that can hold customers' hearts sustainably and reflect the capabilities of the business to operate in achieving the goals set (Hikkerova, 2011). Consumer’s confident to salesmen presented to product or service (Santos & Basso, 2012) and the integrity of the seller (Gefen et al., 2003) lead generating to consumer trust. Therefore, trust is the cornerstone of building and maintaining a relationship between the business and the customer and contributes to satisfaction (Berry, 2000; Chiu et al., 2012). It is a strong defense to maintain relationships and leads to loyalty (Verhoef et al., 2002). Therefore, this research focused on trust as an important role to encourage consumer satisfaction and behavior purchasing decisions. Therefore, the hypotheses are:

H3: The trust has a positive influence on satisfaction of consumers to endowment insurance.

H4: The trust has a positive influence on purchasing decision of consumers to endowment insurance.

Marketing communication

Marketing communication is a business activity in the market. It has the purpose of providing information to customers, motivating, as well as building a good relationship and acceptance between business and customers (Solomon, 1996). Marketing communication is the process of transmitting information through various channels that can reach the target consumers in a simple way, able to remember and create a positive attitude (Duncan, 2005), confidence building incentives and remember product of customers (Kotler & Keller, 2012). However, if marketing communication is effective and accurate will lead to acceptance a positive attitude and stimulate the response to the objectives that the business needs. It is cause satisfaction and lead to service purchasing behavior (Laric & Lunagh, 2010; Yeboah & Atakora, 2013; Mihaela, 2015). In this study, marketing communication is a moderator variable influence of prevised value and trust on satisfaction of consumers to endowment insurance. This research focused on marketing communication as an essential role to encourage consumers' satisfaction and purchasing decisions. Therefore, the hypotheses are:

H5: Marketing Communication can moderate influence of prevised value on satisfaction of consumers to endowment insurance.

H6: Marketing Communication can moderate influence of trust on satisfaction of consumers to endowment insurance.

Customer satisfaction

Customer satisfaction study has been studied widely. It is a factor that has a high impact on the success of the business. Kotler (2003) to say that satisfaction is a person's sense of satisfaction. The perceive business/product performance to be compared with the expectations of the customer. If the business is able to respond to customers’ need or exceeds expectations, it will build a feeling of satisfaction with the product. Therefore, the business is effective to response influence on level of consumer satisfaction (Oliver, 1997), where customer satisfaction is the building of both short term and long term relationships, and direct effect to business revenue and profit (Forozia & Gilani, 2013). In this study to confirmed individual satisfaction has a positive influence on product purchasing decisions (Sukwadi, 2017), customer satisfaction is the feeling of the product. If you develop a positive attitude to create a good feeling, it leads to supporting products and services. Therefore, satisfaction plays a role as a mediate variable between the influences on prevised value and trust to purchasing decision to endowment insurance. Therefore, the hypotheses are:

H7: The Customer satisfaction has a positive influence on purchasing decision of consumers to endowment insurance.

H8: Customer satisfaction can mediate influence of prevised value on purchasing decision of consumers to endowment insurance.

H9: Customer satisfaction can mediate influence of trust on purchasing decision of consumers to endowment insurance.

Purchasing decision

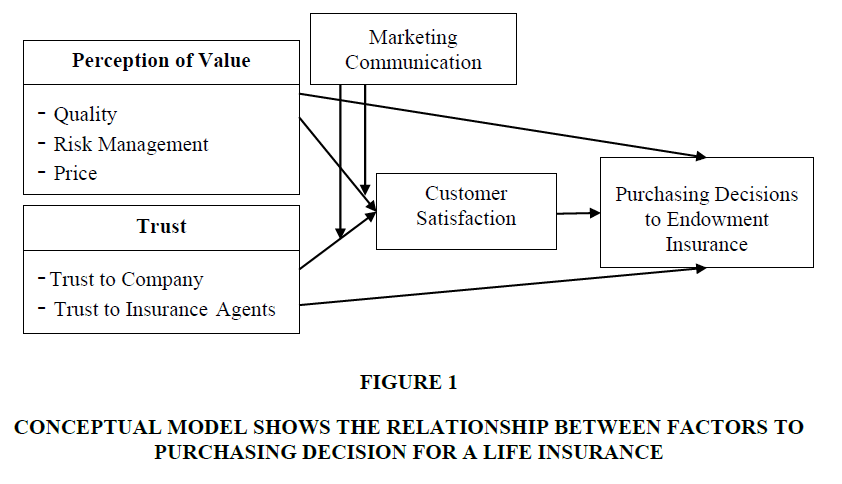

Decisions making by consumers can be an extremely important business step. It leads to the achievement of business objectives. Consumers' purchasing decisions are where consumers exhibit decision making behavior to buy product, use and disposal of the product (Kotler & levy, 1969), integrated information to assess the most appropriate options in the given situation (Peter & Olson, 2004). Individuals assess from the acquisition, use and disposal of goods and services after they have met their needs (David & Albert, 2002; Khuong & Duyen, 2016). In the study of consumer decision making, behavior is important and rather complicated because each consumer is different, and the behaviors that lead to purchasing decisions must be analyzed (Hursh, 1980). Blackwell et al. (2006) describes the consumer decision making process is as follow: 1) need recognition, 2) search for information, 3) pre purchase evaluating alternatives, 4) purchases, 5) consumption and 6) post consumption evaluation. For this study, the researchers aimed to study the factors influencing on the decision to purchase endowment insurance of consumers in Bangkok and Metropolitan Region (Figure 1).

Figure 1 Conceptual Model Shows the Relationship Between Factors to Purchasing Decision for a Life Insurance

Research Methodology

This research focused on the impact of perceived value on consumers purchasing of endowment insurance in Bangkok and other metropolitans in Thailand. The sample size for this study was followed by the concept of Cochran (1977) with a total of 400 respondents. The sampling in this study used non probability sampling by purpose. The researcher collected data from the selected consumers who purchased endowment insurance. A questionnaire was used as a primary data collection tool, each item was a measure on a five point Likert scale, ranging from "strongly disagree" (1) and "strongly agree" (5). The questionnaire is divided into 4 parts that include 1) demographic characteristics of respondents: gender, age, income, education, career, and popular insurance company. 2) the opinions of consumer to factors influence on purchasing decision: perceived value, trust, and customer satisfaction 3) the opinions of consumer to purchasing decision, and 4) the suggestions of the respondents by open ended question.

Moreover, the reliability of the measurements was evaluated by the Cronbach Alpha coefficient. It is to conduct a pre test with 30 respondents before conducting the critical survey. The pre test is to check the questionnaire to help identifying possible issues in a small sample size. It is often essential to understand whether the respondents recognized the language material, sequence, style, ease or complexity of questions, and instructions for improving questionnaires. In the scales' reliability, Cronbach alpha coefficients between 0.79-0.89 are more significant than 0.70 in all construct (Nunnally & Berstein, 1994).

The statistics for quantitative research including the descriptive statistics explain demographic characteristics: gender, age, income, education, career, and popular insurance company by frequency and percentage and inferior statistics is regression analysis by entering for testing hypotheses.

Results

The results of this study explain the influence of perceived value on consumer's purchasing decisions for endowment insurance, and testing the mediator and moderator variables. The descriptive analysis of this research from the total 400 respondents, the majority of respondents were female (68.50%), aged between 41 50 years (70.50%), average monthly income between 35,001 45,000 baht (56.50%), bachelor's degree (62.00%), company employees (40.00%) and Allianz Ayudhya insurance as a popular company (58.00%).

The results from the Table 1 showed that perceived value have significant positive effect to customer satisfaction and purchasing decision (β=0.67, p<0.01; β=0.53, p<0.01). Therefore, hypotheses 1 and 2 are supported. The trust influence positive on customer satisfaction and purchasing decision (β=0.65, p<0.01; β=0.57, p<0.01), hypotheses 3 and 4 are supported. The customer satisfaction influence positive on purchasing decision (β=0.64, p<0.01), hypothesis 7 is supported. Special results to testing the influence of mediator effect, the study revealed to the role of perceived value on customer satisfaction and purchasing decision are stronger significant (β=0.67, p<0.01; β=0.53, p<0.01) and influence of customer satisfaction on purchasing decision (β=0.64, p<0.01). The beta coefficient of model 1: step 1 and 3 are also stronger than the beta coefficient of step 2, the result means that the customer satisfaction should be a mediating variable and increase strongly to examine the influence. Moreover, the model 2 to test the influence of mediator effect, the role of trust on customer satisfaction and purchasing decision are stronger significant (β=0.65, p<0.01; β=0.57, p<0.01) and influence of customer satisfaction on purchasing decision (β=0.64, p<0.01). The result indicated that the customer satisfaction should be a mediating variable and increase strongly to examine the influence. The results are consistent with mediator testing following a study by Baron and Kenny (1986). Therefore, hypotheses 5 and 6 are supported.

| Table 1 Testing the Influence of Mediator Effect | ||

| Testing Step | b | p–value |

| Model 1: Perceived Value >> Satisfaction>> Purchasing decision | ||

| Step 1 Perceived Value influence on Satisfaction | 0.67 | 0.00** |

| Step 2 Perceived Value influence on Purchasing decision | 0.53 | 0.00** |

| Step 3 Satisfaction influence on Purchasing decision | 0.64 | 0.00** |

| Model 2: Trust >> Satisfaction>> Purchasing decision | ||

| Step 1 Trust effect on Satisfaction | 0.65 | 0.00** |

| Step 2 Trust effect on Purchasing decision | 0.57 | 0.00** |

| Step 3 Satisfaction effect on Purchasing decision | 0.64 | 0.00** |

Table 2 shows the testing of the influence of moderator effect in Model 3 the perceived value and marketing communication have direct significantly positive effect to customer satisfaction (β=0.47, p<0.01; β=0.28, p<0.01) and Adjusted R2 =0.50 in the step 1. For the step 2 showed the positive influence of perceived value and interaction with marketing communication on customer satisfaction (β=0.29, p<0.01; β=0.42, p<0.01) and Adjusted R2=0.52. The results of this study indicated that the perceived value interaction with marketing communication on customer satisfaction (Step 2) is stronger significant than Step 1. The result means that the marketing communication should be a moderating variable and increase strongly to examine the influence. Therefore, hypothesis 8 is supported.

| Table 2 Testing the Influence of Moderator Effect | |||

| Testing Step | b | p– value | Adjusted R2 |

| Model 3: Perceived Value * Marketing Communication to Customer Satisfaction | |||

| Step 1 Perceived Value | 0.47 | 0.00** | 0.50 |

| Marketing Communication | 0.28 | 0.00** | |

| Step 2 Perceived Value | 0.29 | 0.00** | 0.52 |

| Perceived Value * Marketing Communication | 0.42 | 0.00** | |

| Model 4: Trust * Marketing Communication to Customer Satisfaction | |||

| Step 1 Trust | 0.42 | 0.00** | 0.51 |

| Marketing Communication | 0.34 | 0.00** | |

| Step 2 Trust | 0.17 | 0.00** | 0.49 |

| Trust * Marketing Communication | 0.44 | 0.00** | |

For the model 4 showed that trust and marketing communication have direct significantly positive effect to customer satisfaction (β=0.42, p<0.01; β=0.34, p<0.01) and Adjusted R2 = 0.51 in the step 1. For the step 2 showed the positive influence of trust and interaction with marketing communication on customer satisfaction (β=0.17, p<0.01; β=0.44, p<0.01) and Adjusted R2 = 0.49. The results of this study indicated that the marketing communication interaction with marketing communication on customer satisfaction (Step 2) is weaker than Step 1. The result indicated that the marketing communication should not be a moderating variable. The results were consistent with moderator testing following a study by Baron and Kenny (1986). Therefore, hypothesis 9 is not supported.

Discussion and Conclusion

Research Discussion

The purpose of this study is to show the influence of perceived value and trust on purchasing decisions endowment insurance of consumers in Bangkok and other metropolitan areas. The role of prevised value has a positive influence on customer satisfaction and purchasing decisions for savings insurance. It is consistent with the studies of Hellier et al. (2003) and Bourdeau, (2005). The perception of value established to consumer comparing the cost of obtaining goods and services with the benefits received from such products. They were considered found that the perceived benefit was higher than the cost. It is accordance with Berry (2000); Chiu et al. (2012). They said that the perceived value impact to the customer’s satisfaction, creating trust and lead to purchasing decisions to meet demand. It also creates long

term relationships with consumers. Therefore, the perception of value plays an important role in the creation of satisfaction and encouraging purchase decisions. For the study, the trust consisted of against a life insurance company and insurance agents have a positive influence on the customer satisfaction and decision of purchasing the accumulated life insurance. It is compliant with (Berry, 2000; Chiu et al., 2012; Verhoef et al., 2002), the cumulative endowment insurance is considered to be a product that is intangible to consumers. It also provides a long term commitment to consumers. Trust of customers to insurance company and insurance agents are extremely important. If consumers trust and reliability will be consumers satisfied and lead to a decision to buy. It also creates long term relationships with consumers and customer loyalty.

In addition, the role of customer satisfaction is the mediate factor of influence between perceived value and trust on the decision to purchase insurance. This is consistent with a study of Forozia and Gilani (2013) and Sukwadi (2017) positive individual satisfaction in purchasing decisions. If consumers have a positive attitude, they will create a good feeling and lead to support the products and services of the business. The role of marketing communication is the moderator variable of influence between perception of value and trust on customer satisfaction. This is consistent with the Mihaela (2015); Yeboah and Atakora (2013) discourse the marketing communication is a major motivator for creating awareness. Information notification build confidence by presenting information that is beneficial to consumers. The cause is a good feeling of positive attitude and lead to satisfaction with the life insurance with savings.

Conclusion

The contributions of this research indicated are both theoretical and managerial. The theoretical contribution is that this study attempts to investigate the influence of perceived value and trust on purchasing decisions to encourage marketing literature. This research explained direct and indirect influence of perceived value and trust on consumers' purchasing decisions on endowment insurance in Bangkok and other metropolitan areas in Thailand. The summary showed that hypotheses are accepted. It means that perceived value and trust are essential for promoting customer satisfaction and contributing to consumer buying decision, which is the last step in buying decision making process. Therefore, prevised value and trust can achieve the response of consumer expectation, reliability to insurance which is a long term commitment and in order to increase purchasing behavior. The consumer's experience sharing through the electronic channel will create higher satisfaction than other mediums with more excellent reliability, image and reputation.

For the managerial contribution, this study enhances insurance company provider's understanding the role of perceived value and trust influence on consumer's purchasing decision on endowment insurance and the testing effect of customer satisfaction and marketing communication. In addition, the attitude of consumers to want insure for their lifestyle and risk management to future are the main reasons for the growth of the industry life insurance sector. Moreover, the government policies that support tax measures help to achieve social welfare. As a result, the competition in the life insurance industry continues to increase. It is becoming higher challenging to respond to customer needs and achieve business goals. The firm attempts to seek the best practice to create effective marketing strategies in the short long term. In the marketing situation, the marketing director must take effective management and understanding the factors which emphasize the consumer's purchasing decision. Also, the endowment insurance agents will be provided with enhancing excellent experience, perceived value trust of customers towards the customers' attitudes and product acceptance, which will increase the level of customer satisfaction and purchasing decision. This empirical study examined to create solutions to business problems that provide the foundation for the business achievement to the competition through the benefit of perceived value and trust. The life insurance firm should provide valuable resources and expand their business capability to encourage building effectiveness and creating new opportunities in the industry. Further studies on practical managerial implications related to endowment insurance and more effective marketing strategies is highly recommended for more research.

Limitation of the Study

The limitations to the current study are: 1) the concept of tax measures that encourages people to purchased endowment insurance for savings to the future. The respondents may not have an understanding of the conditions for tax measures. They did not fully understand the state of regulations. Although this is clearly explained in the archive but it is that the participants may not fully understand. 2) Data collection was carried out before the second round of the Covid 19 virus outbreak in Thailand. At that time, consumers were confident about the economy. They believed that they can manage their household economy and had confidence in the overall economy of the country. Mostly, the people have a positive attitude to long term savings. They may not fully understand how to manage risks that may arise.

References

- Armstrong, G., & Kotler, P. (2003). Marketing and introduction. (6th ed.). New Jersey: Pearson Education.

- Baron, R. M., & Kenny, D. A. (1986). The Moderator–Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. Journal of Personality and Social Psychology, 51(6).1173-1182.

- Berry, L. L. (2000). Cultivating Service Brand Equity. Academy of Marketing Science, 28, 128-137.

- Blackwell, R. D., Miniard, P. W., & Engel, F. J. (2006). Business Research Methods. London: The McGraw-Hill Companies, Inc.

- Bourdeau, L. B. (2005). A New Examination of Service Loyalty: Identification of the Antecedents and Outcomes of Additional Loyalty Framework. Unpublished Doctoral Dissertation, University Gainesville, Florida.

- Chiu, C., Hsu, M. Lai, H., & Chang, C. (2012). Re-examining the Influence of Trust on Online Repeat Purchase Intention: The Moderating Role of Habit and its Antecedent. Decision Support System, 53(4), 835-845.

- Chusanook, A. (2017). Influence of Price Value Perception And quality on the trust, satisfaction, word of mouth and repurchase of Thai Glico consumers in Bangkok. Business Administration Srinakharinwirot, 8(1), 13-26.

- Cochran, W. G. (1977). Sampling techniques. (3rd ed.). New York: John Wilay and Sons.

- Coulter, K. S., & Coulter, R. A. (2003). The Effects of Industry Knowledge on the Development of Trust in Service Relationships. International Journal of Research Marketing, 20, 31-43.

- David L. L., & Albert J. D. B. (2002). Consumer Behavior. New Delhi: McGraw Hill.

- Duangrat, T (2015). Current life insurance business situation and future trends. Retrieved from http://www.oic.or.th/sites/default/files/content/85938/bth1.pdf

- Duncan, T.R., & Moriarty, S. (1997). Driving Brand Value: Using Integrated Marketing to Manage Profitable Stakeholder Relationships. New York: McGraw-Hill.

- Fiscal Policy Office, Ministry of Finance. (2003). Savings in the form of life insurance. Retrieved from http://www2.fpo.go.th/S-I/Source/Article/Article5.htm

- Forozia, Z., & Gilani, (2013). Customre Satisfaction in Hospitality Industry: Middle Fast Tourists at 3 Star Hotels in Malaysia. Research Journal of Applied Sciences, Engineering and Technology, 5(17), 4329-4335.

- Gefen, D., Karahanna, E., & Straub, D. W. (2003). Trust and TAM in Online Shopping: An Integrated Model. Management Information Systems Quarterly, 27(1), 51-90.

- Hellier, P. K., Geursen, G. M., Carr, R. A., & Rickard, J. A. (2003). Customer Repurchase Intention: A General Structural Equation Model. European Journal of Marketing, 37, 1762-1800.

- Hikkerova, L. (2011). The Effectiveness of Loyalty Programs: An Application in the Hospitality Industry. International Journal of Business, 16(2), 150-164.

- Hursh, S. R. (1980). Economic Concepts for the Analysis of Behavior. Journal of the Experimental Analysis of Behavior, 54, 219-238.

- Khuong, N. M., & Duyen, T. H. (2016). Personal Factors Affecting Consumer Purchase Decision Towards Men Skin Care Products-A study in Ho Chi Minh City, Vietnam. International Journal of Trade, Economics and Finance, 7(2), 44-50.

- Kim, C., Galliers, R. D., Shin, N., Han, J., & Kim, J. (2012). Factors Influencing Internet Shopping Value and Customer Repurchase Intention. Electronic Commerce Research and Applications, 11(4), 374-387.

- Kotler, P. & Levy, S. J. (1969). Broadening the concept of marketing. Journal of Marketing, 33(1), 10-15.

- Kotler, P. (2003). Marketing Management. 11th ed. Prentice Hall.

- Kotler, P., & Keller, K. L. (2012). A Framework for marketing Management. 12th Edition, Edinburgh Gate: Pearson Education Limited.

- Laric, M. V. & Lynagh, P. M. (2010). The Role of Integrated Marketing Communications in Sustainability Marketing, American Society of Business and Behavioral Sciences, 17(1), 108-119.

- McDougall, G. H., & Levesque, G. T. (2000). Customer Satisfaction with Services: Putting Perceived Value Into the Equation. Journal of Services Marketing, 14(5), 392-410.

- Mihaela, O. E. (2015). The Influence of the Integrated Marketing Communication on Consumer Buying Behavior. Procedia Economics and Finance, 12, 1446-1450.

- Morgan, R. M., & Hunt, S. D. (1994). The Commitment-Trust Theory of Relationship Marketing. Journal of Marketing, 58(3), 20-38.

- Nunnally, J. C. & Bernstein, I. H. (1994). Psychometric theory. (3th ed). New York: McGraw-Hill.

- Office of the Commission and Promotion of Insurance Business (2020). Retrieved from http://www.oic.or.th/th/consumer

- Oliver, R.L. (1997). Satisfaction A Behavioral Perspective on the Consumer. The McGraw-Hill Companies, Inc., New York.

- Peter, J. P. & Olson, J. 2004. Consumer Behavior and Marketing Strategy. 7th Edition. McGraw-Hill.

- Santos, C. P., & Basso, K. (2012). Do Ongoing Relationship Buffer the Effects of Service Recovery on Customers’ Trust and Loyalty? International Journal of Bank Marketing, 30(3), 168-192.

- Solomon, M. R. (1996). Consumer behavior: buying, having, and being. 3rd, Englewood Cliffs, N.J.: Prentice-Hall.

- Thai Life Assurance Association (2020) .Overview of Thai Life Insurance Business in 2019 and Outlook for Thai Life Insurance Business 2020. Retrieved from https://www.Tlaa.org/page_bx.Php?Cid =23&Cno=1054&cno2=&show=9.

- Verhoef, C. P., Franses, H. P., & Hoekstra, C. J. (2002). The Effect on Relational Constructs on Customer Referrals and Number of Services Purchased From a Multiservice Provider: Does Age of Relationship Matter?. Journal of the Academy of Marketing Science, 30(3), 202-216.

- Yeboah, A., & Atakora, A., (2013). Integrated Marketing Communication: How Can It Influence Customer Satisfaction?. European Journal of Business and Management, 5(2), 41-58.