Review Article: 2022 Vol: 26 Issue: 1

Enterprise Risk Management, Bank Soundness on Market Performance: Evidence from Indonesia

Raudhatul Hidayah, Diponegoro University

Abdul Rohman, Diponegoro University

Agus Purwanto, Diponegoro University

Bestari Dwi Handayani, Universitas Negeri Semarang

Ain Hajawiyah, Universitas Negeri Semarang

Citation Information: Hidayah, R., Rohman, A., Purwanto, A., Handayani, B.D., & Hajawiyah, A. (2022). Enterprise risk management, bank soundness on market performance: evidence from indonesia. Academy of Accounting and Financial Studies Journal, 26(1), 1-08.

Abstract

This study contributes to the theory on the effect of bank health and enterprise risk management on enterprise market management. It provides a reference to the enterprise concerning investor perspective towards enterprise market performance. The study examined the ERM antecedent in bank soundness on financial enterprise market performance. Population using financial enterprises enlisted in the Indonesia Stock Exchange during 2014-2019 with 150 total samples. The study used a purposive sampling technique for sample selection and performed a path analysis to test research hypotheses and a Sobel test to examine the ERM antecedent. Results indicated a significant effect of bank soundness on enterprise market performance. Proved that ERM was the antecedent in the impact of bank soundness on enterprise market performance.

Keywords

Enterprise Risk Management, Bank Soundness on Market Performance.

Introduction

This study examined the effect of bank soundness on enterprise market performance. Previous studies have indicated that bank soundness helps improve investor trust in an enterprise and, eventually. Next, it helps improve the enterprise's market performance. Chabachib et al. (2019) find a positive correlation between bank soundness and profitability. Gunny (2005) documents that bank soundness affects the following asset return, i.e., performance and operation cash flow. Heydari & Abdoli (2015) discover a positive correlation between liquidity ratio and capital adequacy ratio to bank performance. Bushman & Smith (2001) find that better bank soundness helps the enterprise to improve its performance. Uzun & Berberoğlu (2018) conclude that the capital adequacy ratio has a linear correlation to stock value.

Margono et al. (2020) demonstrate a positive effect of bank soundness on bank performance. Dao & Nguyen's (2020) research provides a statistically significant correlation between bank soundness and market performance. Similarly, Rahman et al. (2018) find a significant, positive correlation between bank soundness and market performance of banking enterprises. Umoru & Osemwegie (2016), who performed their research in Nigeria, conclude that the significant effect of bank soundness is a bank's more decisive financial decision-making. Furthermore, Al-Tarawneh et al. (2017) find a significant impact of bank soundness on market performance. Ogboi & Unuafe (2013) provide a result, which demonstrates a positive and significant effect of bank soundness on market performance.

Research from Pradhan & Parajuli (2017) indicates a negative correlation between bank soundness and market performance. Pradhan et al. (2017) also document an adverse effect of bank soundness on commercial bank market performance. Heydari & Abdoli (2015) prove a negative correlation between bank soundness and bank performance. At last, Olalekan & Adeyinka (2013) present a non-significant correlation between bank soundness and banking market performance.

The above summary proves various research findings concerning the effect of bank soundness on market performance, leaving us with a research gap. This study expected that mediating variables are necessarily present concerning the impact of bank soundness on enterprise market performance (Baron & Kenny, 1986). Therefore, this study presented Enterprise Risk Management (ERM) as the mediating variable to determine the effect of bank soundness on enterprise performance. ERM was brought in because globalization has given rise to market integration, leading to fast-growing internal and external situations and more complicated risks in the financial business. By doing so, this study expected that financial enterprises could perform the intermediating function to maintain trust and minimize potential loss.

Bertinetti et al. (2013) find that the application of the ERM has a significant and positive effect on the enterprise market performance. The ERM application is considered a value driver, instead of a cost, for the enterprise. These findings parallel those obtained by Hoyt & Liebenberg (2011). They discover a positive correlation between enterprise market performance and ERM application by presenting an empirical result that ERM helps improve the market performance of the enterprise.

Literature Review

Enterprise Market Performance

Enterprise market performance is a work achievement of an enterprise in a particular period, which is reflected in the enterprise's stock price (Danoshana & Ravivathani, 2019; Roudaki & Bhuiyan, 2015). Market performance can be examined from the price earning ratio (P/E ratio), which correlates stock price to gain. Earning per share (EPS) is a ratio that relates gain to several claims. Market to book value (MBV) is a comparison between stock price and book value. The price earning percentage is helpful to compare enterprise stock prices sold publicly to other financial measurements. The price earning ratio informs the investors on what they should gain from their investments. This ratio helps investors predict the future stock price according to enterprise gain from the existing assets. It is also used for evaluating stock prices from the enterprise stock. The price earning ratio indicates the stock price and contains information about the investors' thoughts about the enterprise and its prospects (Brigham & Houston, 2021; Riyanto, 2010).

Bank Soundness

Bank soundness can be defined as a bank's ability to perform its regular banking operational and fulfill all of its obligations according to the existing banking regulations (Umam, 2019). Using this definition, bank soundness should contain the bank's ability to perform all banking activities. This definition also implies that bank soundness is an explanation of any condition related to financial and managerial factors of the bank and bank obedience to banking regulations in a careful manner. Bank soundness regulation stipulated in the Indonesia Central Bank Act 13/1/PBI/2011 dated January 5, 2011, requires bank soundness improvement as of January 1, 2012. Banks have a mandatory obligation to perform their soundness individually using a risk-based bank rating. The requirements the banks should fulfill to prove their soundness include as follows: a) risk profile; b) good corporate governance (GCG); c) earnings; and d) capital (PBI Nomor 13/1/PBI/2011).

Enterprise Risk Management (ERM)

Risk management, or Enterprise Risk Management, evaluates and manages all risks exposed to the enterprise and reduces the potential effects of such bet. Good risk management ensures an organization gives proper treatment to the threat, which can affect the organization (Susilo & Kaho, 2010). ERM implementation within the enterprise will affect performance and value. Excellent enterprise risk management helps minimize potential risks in the future, allowing the enterprise to produce more optimal income. ERM exists as a bridge on which management safety and operation pass towards the desired direction by considering, detecting, and mitigating potential risks. Information dealing with ERM in the enterprise financial statement becomes one of the managerial responsibility reports in managing investors' funds and providing safety warrants to other stakeholders.

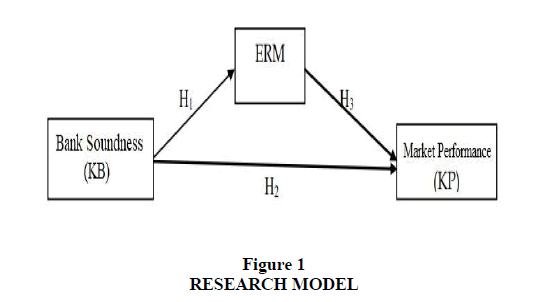

H1: Bank Soundness significantly affected Enterprise Risk Management.

H2: Bank Soundness significantly affected Enterprise Market Performance.

H3: Mediated by Enterprise Risk Management, Bank Soundness significantly affected Enterprise Market Performance

Method

This study used samples collected by a purposive sampling technique from banking enterprises enlisted in the Indonesia Stock Exchange from 2014 to 2019. Criteria to be followed in selecting the research samples were the following: the ISX-listed banking enterprises that consecutively published annual reports for the period ending on December 31, 2014-2019. The enterprises provided ERM disclosure and informed its market performance. The enterprises possessed complete and transparent data listed in their annual financial statement necessary during research observation. Using these criteria, the study managed to select 150 samples for unit analysis.

The study performed a path analysis and Sobel test to analyze the data. Path analysis develops from the regression model, traditionally used for fit testing from the correlation matrix of two or more models comparable by the researchers (Ghozali, 2013; Handayani et al., 2020). Path analysis is used for measuring the direct or indirect correlation between variables in the model. In contrast, the Sobel test is used for finding out the significance rate of the indirect correlation between variables in the model. Therefore, this study performed an AMOS-aided path analysis.

Results and Discsussion

The goodness of fit index indicated that the research model had fulfilled the cut-off value. The RMSEA (Root Mean Square Error of Approximation) proved that the model was a close fit. However, the X2-Chi-Square, Probability level, (GFI), (AGFI), CMIN/DF, (TLI), and (CFI) were all relatively good, resulting in an overall good fit of the model. Therefore, there was significantly no difference between the theoretical model and the research data. The excellent fit results had followed the requirements of the path analysis model. The following table summarizes the results of the Goodness of Fit Index(Table 1).

| Table 1 The Goodness Of Fit Index |

||||

|---|---|---|---|---|

| No. | Good of fit Index | Cut off Value | Result | Model Evaluation |

| 1 | X2–Chi-Square | Low | 0.984 | |

| 2 | Significance Probability | > 0.05 | 0.330 | Good Fit |

| 3 | RMS | > 0.05 | 0.000 | Good Fit |

| 4 | GFI | > 0.90 | 0.998 | Good Fit |

| 5 | AGFA | > 0.90 | 0.942 | Good Fit |

| 6 | CMIN/DF | < 2.00 | 0.998 | Good Fit |

| 7 | TITLE | > 0.90 | 1.004 | Good Fit |

| 8 | CFI | > 0.90 | 1,000 | Good Fit |

Source: Secondary data processed for this study, 2021.

This study tested the hypotheses by performing regression weights for each exogenous variable against the endogenous variable. Such test applied to finding out the significance or non-significance of each exogenous variable against the endogenous variable. The significance rate of > 0.05 (5%) explained acceptable H0 and unacceptable H1, whereas the significance rate of < 0.05 (5%) denoted unacceptable H0 and acceptable H1. The following table presents such regression in the Tables 2 and 3.

| Table 2 Results Of Regression Weights Analysis |

|||

|---|---|---|---|

| Correlation | Estimate | S.E | P |

| KB → ERM | 4.431 | 2.170 | 0.18 |

| KB → KP | 0.39 | 0.16 | 0.13 |

| KP → ERM | 0.23 | 0.009 | 0.10 |

Source: Secondary data processed for this study, 2021.

| Table 3 Standardized Regression Weights |

|

|---|---|

| Correlation | Estimate |

| Bank Soundness → Enterprise Risk Management | 0.376 |

| Bank Soundness →Market Performance | 0.463 |

| Enterprise Risk Management →Market Performance | 0.213 |

Source: Secondary data processed for this study, 2021.

Data testing results revealed the effect of bank soundness on ERM with a parameter estimate value of 0.376 and p-value of 0.018. These figures were considered significant at a p-value < 0.05. The result concluded that bank soundness affected ERM. The evaluation of the bank soundness rate resulted from assessing various aspects concerning the bank's condition or performance. In addition, such evaluation also dealt with identifying potential problems rising from the bank operational due to more complicated business and possible risk profiles. Better bank soundness rate indicates a higher identification rate towards the enterprise operational risk. This study is parallel to those performed by (Chabachib et al., 2019; Handayani et al., 2020).

The effect of bank soundness on the enterprise market performance had a statistical significance rate of = 0.05, proven by a p-value of 0.013, which meant less than 0.05 with a parameter estimate value of 0.463. In conclusion, bank soundness affected enterprise market performance. According to Alwi et al., 2021; Wahyudi & Pamungkas (2020), bank soundness can be understood as a bank's ability to perform normal banking operational activities and fulfill all its obligations according to the existing banking regulations. Good bank soundness is helpful to draw interest and strengthen trust in the bank, either from internal or external parties, faith from other relevant parties in the enterprise's ability to improve its stock price and market performance. Hence, bank soundness affects enterprise market performance. This study supports the similar studies performed by other researchers, such as (Al-Tarawneh et al., 2017; Aymen, 2013; Dao & Nguyen, 2020; Heydari & Abdoli, 2015; Margono et al., 2020; P. Pradhan et al., 2017; Rahman et al., 2018; Saif-Alyousfi et al., 2017).

The ERM-market performance correlation observed during this study revealed that ERM affected enterprise market performance with a parameter estimate value of 0.213 and 0.010. These figures were considered significant at p < 0.05. Therefore, ERM had a substantial effect on enterprise market performance. This means that the ERM affected the enterprise market performance. These results indicated that ERM as non-financial information could signal the investors concerning safety warrants for their invested funds. The better and clearer ERM reported, the stronger the trust from the investors to put the money on it. Results of the current study were similar to those presented by (Bertinetti et al., 2013; Hoyt & Liebenberg, 2011).

Direct and Indirect Effects

Two effect models exist among the research variables, i.e., direct and indirect. Immediate effect deals with a coefficient of all coefficient lines with a one-tip arrow. In contrast, indirect effect relates to the impact of an exogen variable on endogen variable through intervening variable, which is the result of multiplication of two paths connecting the indirect impact (Handayani et al., 2020). The following Table 4 summarises the direct effect and indirect effect found in this study.

| Table 4 Summary Of Direct, Indirect, And Total Effects Between Variables |

|||

|---|---|---|---|

| Effect Between Variables | Direct Effect | Indirect effect Mediated by Intervening Variable | Total effect |

| KB →ERM | 0.256 | 0.256 | |

| ERM → KP | 0.302 | 0.302 | |

| KB →KBP | 0.275 | (0.256) (0.302)= 0.077 | 0.352 |

Source: Secondary data processed for this study, 2021.

Table 4 reveals that bank soundness affected ERM at the rate of 0.256, ERM affected enterprise market performance at 0.302. The table also shows the indirect effect of bank soundness on the enterprise market performance at the rate of 0.352. Therefore, bank soundness resulted in better market performance for the enterprise that disclosed ERM.

Test on Mediating (Intervening) Detection Effect

One of the tests on the effect of mediation detection of a variable can be performed by Sobel Test. In this kind of test, t value < t table and significance rate > 0.05 (5%) denotes acceptable H0 and unacceptable H1, whereas t value > t table and significance rate < 0.05 (5%) denotes unacceptable H0 and acceptable H1. The following paragraph presents the results of the Sobel test on ERM mediating variable in the effect of bank soundness on enterprise market performance.

The value for the test on ERM variable in mediating the effect of bank soundness on enterprise market performance indicated a significant result with a value of 0.002. This figure was lower than alpha 5% (0.005). The Sobel test confirmed the p-value of 0.002 with the value of 2.186, which was higher than the table of 1.960. Therefore, the hypothesis of mediating the effect of the ERM on the impact of bank soundness on the enterprise market performance was acceptable.

Conclusion

Stockholders significantly expected good enterprise market performance because it can maximize profits as the stock price rises. Higher enterprise market performance will strengthen the trust of market actors in the enterprise performance and its managerial performance so that the enterprise's value is higher. These research findings indicated that enterprise market performance of the financial sectors in Indonesia in the research period was affected by the bank soundness. Furthermore, the results also proved that enterprise market performance mediated the effect of bank soundness on enterprise market performance.

References

Brigham, E.F., & Houston, J.F. (2021). Fundamentals of financial management. Cengage Learning.

Ghozali, I. (2013). Aplikasi analisa multivariate dengan program IBM SPSS 25. Semarang: Badan Penerbit Unversitas Diponegoro, 490.

Hoyt, R.E., & Liebenberg, A.P. (2011). The value of enterprise risk management. Journal of Risk and Insurance, 78(4), 795-822.

Riyanto, B. (2010). Dasar-Dasar Pembelanjaan Perusahaan, ed. 4 Yogyakarta: BPFE-Yogyakarta.

Roudaki, J., & Bhuiyan, M.B.U. (2015). Interlocking Directorship in New Zealand.

Susilo, L.J., & Kaho, V.R. (2010). Manajemen risiko berbasis ISO 31000. Jakarta: Penerbit PPM.

Umam, K. (2019). Manajemen Perbankan Syariah.

Uzun, U., & Berberoğlu, M. (2018). An Investigation On The Relationship Between Banks’capital Adequacylevelsand Stock Value: The Case Of Turkish Banking Sector Bankalarin Sermaye Yeterlilik Düzeyleri. Current Debates in Finance & Econometrics: Current Debates in Social Sciences Series, 19, 33.