Research Article: 2020 Vol: 26 Issue: 2S

Entrepreneurial Risk Management Challenges Within the Maritime SMEs Subsector of South Africa

Dubihlela Jobo, Cape Peninsula University of Technology

Abstract

Maritime SMEs play a key role in South Africa’s results-driven approach to economic development, code-named ‘Operation Phakisa’; whose main aim is to address the triple bottom challenges of poverty, unemployment, and inequality. It is disdain that maritime SMEs face the dilemma of building good operating and governance structures while trying to foster ecoentrepreneurial spirit. Eco-entrepreneurship helps foster sustainable business operations driven by environmentally sensitive entrepreneurs. Many SMEs struggle to manage their operational sustainability due to high costs of ecological activities along the coastline, where they are exposed to entrepreneurial risks. A quantitative research approach was conducted to collect data by way of a purposive snowball sampling method used to identify maritime SMEs in Cape Town. Results show that maritime SMEs in Cape Town are exposed to substantial amount of entrepreneurial risks, deterring overall entrepreneurial performance, especially from the ecological and technological perspective. These entrepreneurial risks include environmental, technological, financial, market and strategic risks. In spite of their lack of experience, ecoentrepreneurs highly regard themselves as knowledgeable; and that they revealed awareness of social issues and related environmental risks. However, they do not have means and ways to resolve the issues. The results also indicate that although maritime SMEs have written policies that incorporate optimum levels of training on ecological importance, poor ethical standards are still prevalent within their operational environments. Surprisingly, these SMEs perceive social environment as an important factor to them within their business community. The findings in this study support ongoing body of research, having potential to seize opportunities, find solutions and possibly help eradicate vulnerability issues and enhance entrepreneurial risk mitigation. This paper adds value to research focused on the ocean economy, and also proposes possible future studies.

Keywords

Entrepreneurship, Risk Management, SMEs, Financial.

Introduction

Entrepreneurship is a process that involves the discovery of new opportunities and the exploitation thereof, taking into account the risk and rewards in the exploitation of available resources (Olusegun, 2012). Their experiences in socio-economic environment drive many to start-up small enterprises in order to enhance social and economic changes as well as being an instrument for achieving economic goals. The maritime industry is one of the most promising and well-known industries in South Africa, this industry is dominated by both large and small entities, the small entities are commonly referred to as Small Medium Enterprises (SMEs). The industry encapsulates business activities along the coastline stretching more than 2,500 kilometres from the desert border with Namibia on the Atlantic Ocean (western), across the tip of Africa and to the border with Mozambique on the Indian Ocean. The reputation of this industry is highly recognized through trade activities, business operations and economic contribution to the country’s socio-economic development (Department of Environmental Affairs, 2014)

The marine-based ocean economy is of critical importance to the South African economy. It serves as a cornerstone of international trade as it interlinks the country with other continents through interregional and international trading partnerships. It has proven to be one of the greatest revenue generators (Kildow & McIlgorm, 2010). It incorporates different lines of business such as fishing, shipping, transportation, import and export, boat repairs and maintenance, waste management, oil and gas services, as well as construction services, with fishing being the most dominant (Onwuegbuchunam & Akujuobi, 2013). Different lines of businesses in the maritime industry have great potential for economic development, reduction of unemployment and poverty alleviation. Merk (2013); noted that economic development attributed to this industry is due to the port efficiency, shipping services and technological advancement of South Africa.

Generally, SMEs are failing at the start-up phase due to risks that are not properly managed. Having a proper risk management technique is still a challenge within the SMEs environment irrespective of the industry they operate in (Mahembe, 2011). This is due to a lack of risk management knowledge, insufficient resources, poor control environment and risk management skills by management in capitalising available funds for the well-being of the business. Compared to large enterprises, SMEs do not have sufficient resources; they lack knowledge on how to implement structured risk management (Jayathilake, 2012). The latter can be attributed to insufficient support services and relative costliness of resources (Abor & Quartey, 2010). Ekwere (2016) found that despite government reinforcements through ensuring financial access for SMEs, no attention has been focused on risk management knowledge and application within SMEs. It is not mandatory for SMEs to implement structured risk management in their ventures but it is of utmost importance to have one in place in order to survive. Proper risk management techniques assist in risk identification, mitigation and control. Sarbutts (2007) finds that inadequate risk management practices are the main challenge faced by many SMEs. Poor managerial skills on the part of owners and managers are the main cause of poor risk management strategies in SMEs and thus have a negative impact on SMEs growth and performance. Duong (2009) classifies SMEs as risky business since most SMEs have a weak capital background that gives rise to poor operational activities, financial loss and insolvency, leading to poor performance that leads to high failure rates.

A strong control environment leads to a healthy successful business (Siwangaza & Dubihlela, 2016). Research on risk management has mainly been concentrated in developed markets and with prominence on large corporates, focusing mainly on operational risk matters and not the risk control environment. No identifiable research has tackled the issue of risk management within the maritime industry sector, yet it is one sector that is exposed to environmental, operational and related risks. Research on risk management within the maritime industry is therefore necessary, particularly in South Africa’s coastal city of Cape Town. It can therefore be concluded that SMEs performance in the maritime industry is perceived to be exposed to poor controls and poor risk management as SMEs lack adequate and effective risk management techniques. This study seeks to determine the entrepreneurial risk mitigation strategies for the SMEs operating within the maritime industry sector in Cape Town. This study also sought to determine ways to implement entrepreneurial risk management with the aim of improving maritime SMEs performance within this vital industrial sector of the South African economy, commonly known as the oceans economy.

Literature Review

The implementation of good entrepreneurial risk management is based on a better understanding of what risk is. Understanding risk types and effects in the business organization is crucial. Risk is a very important factor in the business realm. It is a challenge that every business venture has to encounter. Earlier researchers’ main focus was on the existence of internal controls, control environment and their effects on business sustainability (Jiang & Li, 2010; Bruwer, 2010; Siwangaza, 2013). The nature of entrepreneurial businesses makes them vulnerable to risk factors, considering their formation and development. Bearing in mind that entrepreneurial businesses are formed as a result of new discoveries, innovation and opportunities, businesses that are formed through these means, occasionally face greater risk challenges. O'Brien et al. (2003) noted that entrepreneurs have long been linked to the risk concept. Risk can therefore be viewed as a fundamental of entrepreneurial function that requires attention. The lack of proper risk management has a negative impact on business operations leading to a high failure rate and poor performances. Busenitz (1999) estimated a failure rate of about 50 to 80% within the first five years of operation due to poor risk management techniques. While the high risk opportunities are perceived as the source of greater rewards in the business territory, much needs to be done in order to reduce the negative impacts of risks to ensure success in business entities, thus ensuring a great entrepreneurial risk management foundation.

Apart from the entrepreneurial risks, the concept of eco-entrepreneurial risk is a major concern in this study. Eco-entrepreneurship is a crucial drive in the maritime industry. Ecoentrepreneurship is defined as the environmentally friendly way of doing business (Kainrath, 2009); a way of doing business without causing any harm or changes to the environment and surroundings such as plants, animals and water. The issue of eco-friendliness is the main agenda item in the maritime sector. The government is working hard to ensure that the concept of the green economy is adhered to. This is evident by the introduction of Operation Phakisa. Pearce et al. (2013) defined a green economy as one that aims to reduce environmental risks and ecological scarcities and that aims for sustainable development without degrading the environment. The latter is considered to have the greatest impact on the maritime economy (Lai et al., 2011). Chemicals, land changes and other entrepreneurial activities in business, at times lead to environmental changes. There is concern around the eco-friendliness of businesses operating in the maritime industry.

SMEs experience pronounced challenges in pursuing environmentally friendly business. These challenges include limited financial access, lack of business skills and unpleasant business environment (Bymolt et al., 2015). In the maritime industry, due to the nature of business it is hard for entrepreneurs to be purely environmental friendly as indicated by Schaper (2002) who noted that the maritime industry is associated with waste, noise pollution and the use of dirty resources. It may be disputed that these problems can be minimized or closely monitored. The entrepreneurial risk management is of crucial importance in the newly emerged ventures and small enterprises in all industries. Woods & Dowd (2008) stressed the point that, the best way to deal with entrepreneurial risk is to implement a strong risk management strategy at an early stage of the business.

In addition, most SMEs experience challenges such as competition, lack of resources, lack of financial support, insufficient research and development, tedious labour laws, unskilled workers, poor infrastructure, technological challenges as well as environmental and economic changes. These changes affect most business operations within the maritime industry (Bureau for Economic Research, 2016). SMEs owner/ managers are frequently unable to identify all the factors impacting their enterprise activities (Smit & Watkins, 2012). Lack of knowledge and awareness is the root cause for poor identification and detection of risk at an early stage. This will have a poor impact on SMEs’ performance and well-being (Baleseng, 2015). Kaplan and Mikes (2012) identified market risk, recruiting risks, technological risks and financial risk as the major risks that businesses encounter with financial risk as the most dominant or root cause of other risks.

Financial risk: According to Woods & Dowd (2008) financial risks arise as a result of factors that are financial in nature. These factors create the possibility of losses as a result of financial failure in SMEs. In most businesses factors include high interest rates, rejection of credit allowances from financial institution, uncertainties of return, access to finance, liquidity and exchange rates (Lumpkin & Dess, 1996). Financial risk is the major problem in business operations. Financial challenges in business leads to other challenges in business such as the recruitment of lesser or unskilled personnel (Vonortas & Kim, 2015). Unskilled labour gives rise to lack of technological know-how, thus giving rise to technological risks.

Market risk: Refers to market challenges faced by entities due to market changes, interest rates, inaccessibility of markets for products and inflations (Alexander, 2009). Market risk cannot be eliminated through diversification it can be hedged against. Dowd (2007) identified interest rate risk, equity risk; currency risk and commodity risk as the most common types of market risks. All these factors, they affect the success and performance of SMEs. Considering the owner’s knowledge of business risks, entrepreneurs attempt to minimize risks in business activities.

All the aforementioned risks have negative impacts on business performance that could lead to economic losses or business failures. The best way to minimize the negative impact is to have strong risk management techniques in business. Most entrepreneurs have diverse ways of dealing with risks. Entrepreneurs tend to accept the excessive amount of risk in their ventures by using bias and experience in decision making. Buisenitz (1999) found that they end up failing due to unacknowledged risks related to their business at full capacity.

Risk management of SMEs

Empirical studies show that the attitudes of SMEs towards risks and their risk assessment differ significant from that of large firms. Start-up SMEs usually faces a high degree of uncertainties and the necessity to make quick decisions (Frese et al., 2000). Henchel (2008) states that risk management is a challenge for SMEs in contrast to larger firm they often lack necessary resources, with regard to human capital, data base and specificity of knowledge to perform a standard and structured risk management. Similarly, Matthews & Messeghem (2003) stated that most SMEs do not have necessary resources to employ specialists at every position in the firm. They focus on their core business and have generalists for the administration function. In contrast to larger firms, in SME one of the owners is often part of the management team. His intuition and experience are important for managing the firm (Dickinson, 2001). Therefore, owner or manager in SME is often more responsible for many different tasks and important decisions. Sparrow (2001) found that risk management practices in SMEs relate to the beliefs and attitudes of founding entrepreneurs. SMEs do not tend to use special techniques to optimize significant risks. Janney & Dess (2006) noted that SMEs are away from adopting a positive approach towards risk management due to limitations such as inadequate infrastructure, limited managerial and technical expertise, lack of financial and intellectual resources to generate substantial technological developments and change, weak information networks to locate and recognize information and knowledge that is especially relevant to them, and low investment in research and development. Similarly, a study of Turpin (2002) states that most SMEs have no official risk strategy which is due to problems of communication with of delegating risk management competencies to employees.

Overview of SMEs in South Africa

South Africa is not the only country that recognises the importance of SMEs. Although the definitions of SMEs differ, their importance is globally acknowledged. In other countries they are recognised as Micro, Small and Medium Enterprises (MSMEs) while in South Africa they are determined as SMMEs. This does not change the importance or benefits to the world’s economy. The study, based on 132 economies, shows that globally there are 125 million registered formal MSMEs (SMEs as per the South African concept), including 89 million in emerging markets. Formal SMEs employs more than one third of the total population. This implies that the employment rate within this sector is moderate (Kushnir et al., 2010).

The SMEs dominate almost half of the labour force in the private sector across the globe. They also account for 99% of private enterprises in the European countries and not only that, but a huge contribution has also been noted in the Sub Saharan economies (Makina et al., 2015). SMEs are regarded as the cornerstone in the reduction of unemployment and poverty worldwide (Nkwinika & Munzhedzi, 2016). Donga et al. (2016) supported this by stating that SMEs are perceived as the keystone in the South Africa context with the potential to reduce unemployment, asset creation, skills development and attraction of investors. SMEs comprise over 60% of the South African economy, through job creation opportunities, poverty alleviation and adding value to the increase of Gross Domestic Product (GDP) (Young et al., 2012). Smit & Watkins (2011) postulate that on average most SMEs experience difficulties in becoming going concern entities, which implies that the existence of SMEs in South Africa hangs in the air without balance as evidenced by the facts addressed above. Unfortunately, the level of support to SMEs in South Africa remains fragmented and challenging. Increasing attention is needed to revive SME success. Owners, managers and the government need to work more coherently in order to raise the level of business sustainability. They have to put their heads together to close all the gaps that hinder small business prosperity such as financial, policy, marketing, absence of proper business plans, environmental challenges amongst others.

The unemployment rate in South Africa is progressively increasing and regarded as very high, with great attention paid to SMEs as part of the solution, with a need for investment for economic revival (Rajaram & Neill, 2009). Lekhanya (2010) further argued that the high unemployment rate is due to the high failure rate of emerging entrepreneurs. Meyer and Landsberg (2015) have indicated that the unemployment rate in South Africa is unacceptably high. This is due to an uneven income distribution in the economy, population growth rate and low productivity. Small and Medium enterprises are regarded as a great life saver in the reduction of the unemployment rate. Makina et al. (2015) pointed to the fact that SMEs’ primary objective is the high contribution to economic growth through job creation to the unskilled and semi-skilled individuals that would otherwise remain unemployed. Apart from economic growth, SMEs are regarded as the key drivers of employment and innovation.

SMEs are of great importance in South Africa as they are key role players in poverty alleviation through job creation, and adding to economic prosperity by increasing the Gross Domestic Product (Berry et al., 2002). The latter has also been acknowledged by De Jongh et al. (2012). The proof of job creation was evident by an increase in Gross Domestic Product. The Bureau for Economic Research (2016) noted the prominence of small enterprises by recognising them as the key drivers of economic growth and job creation. SMEs, especially those operating in the informal sector helps to provide a living to a great number of people. The importance of SMEs has also been noted by Abor & Quartey (2010). It is evident that SMEs provide benefits as they are regarded as the corner stone by policy makers to speed up economic growth in developing countries. The high failure rate leaves much to be desired. High failure rate can be mitigated by government intervention through financial support, skills development and any other form of aid that could assist SMEs.

Mahembe (2011) added that SMEs are recognised as key drivers through which the growth of a developing country can be achieved. The growth is recognised by creating more employment opportunities, increase in production, increasing exports and introducing innovation and entrepreneurship skills. SMEs are beneficial to the economy compared to large scale enterprises because of their flexibility. They easily adapt to diverse market conditions and are able to withstand different economic conditions (Kayanula & Quartey, 2000). The SMEs in the Maritime industry in South Africa play an important role in economic development as do any all small businesses in other industries. Their main aims are poverty alleviation, reducing unemployment and inequality. The ocean economy programme framework will help the nation at large to address unemployment, poverty and inequalities in the South African economy (Khanyile, 2016).

SMEs do not fulfil their rationale for existence if they fail at their start–up phase. The challenges faced my maritime SMEs are similar to those faced by all sector SMES. Gordon et al. (2014) estimated that 75% of SMEs fail within their first 3 years of existence, while Bruwer (2010) estimated a failure rate of between 70% and 80%. Fatoki & Odeyemi (2010) estimated that 75% of SMEs fail at the start-up phase due to a lack of financial access. Most of their loan applications are rejected and they end up relying on internally generated funds that are insufficient to sustain their business needs. The failure rates of SMEs are attributed to internal and external drivers such as poor managerial skills, limited access to funds, and the lack of a risk assessment background of owner/ managers. Abor & Quartey (2010) concur with the latter when stating that in spite of their potential role of accelerating growth and the creation of jobs in developing countries, many obstacles hinder the realisation of SMEs’ full potential. These obstacles are identified as lack of finance, poor managerial skills, lack of equipment, poor technology, lack of support services and a relatively higher unit cost that can hamper SMEs’ efforts to improve their management.

Considering the literature, it is certain that SMEs are regarded as the main contributors to the economy; improve standard of living as well as reducing the unemployment rate. Their success however, is not something one can really count on as they face many challenges. These challenges are a lack of financial support, poor management skills and poor technological advancement. These challenges will give rise to risks and then lead to poor performance within the SME sector.

Research Methodology

This study follows a quantitative approach method. Bryman et al. (2018) define quantitative research as a research model that elucidates the quantification of how data is collected and analysed and deriving the link between theory and research as deductive. In addition, Cooper & Emory (1995) opine that quantitative research includes the use of a large sample that is representative of the population, broadening the range of possible data for analysis. However, for the purpose of this study there were some limitation in identifying the maritime industry players thus only a sample of 151 was deduced. Academic research is viewed as the cornerstone of technical progress with the main purpose of answering questions and acquiring new knowledge (Marczyk et al., 2010). Nyambandi (2016) is of the opinion that, the world of knowledge is divided into three spheres namely the world of science, the daily world and the world beyond science. The daily world consists of humans, which, in this research study, relates to owner or managers and employees of SMEs, organisations (SMEs), and problems such as risk management challenges that are faced by many SMEs in the maritime industry. In this study the information was gathered through self- administered questionnaires (a quantitative technique)

The writer administered the questionnaires to the participants of the research study in order to gather the relevant data from the respondents. Questionnaires were distributed to the owners, managers and employees in SMEs within the maritime industry in order to gain rich data and to have a wide coverage. With regard to employees, only employees with high ranking post in the entity was considered a potential candidate to complete the questionnaires where owner or managers are not available. A list of businesses was obtained from the business directory as a criterion to select maritime SMEs operating in Cape Town. Thereafter, SMEs that operate in Cape Town but outside the marine industry was eliminated so as to remain with only suitable candidates left. The study considered the size factor criteria in determining suitable business providers based on SMEs operating in the maritime industry. This eliminated large commercial businesses that operate in the marine industry. In the end the researcher decided to focus on 60 SMEs, which were relevant to the study and the research questions. A sample size of 60 was determined, based on the above mentioned parameters. The data was collected from conveniently selected companies in the maritime industry: fisheries, conservation, fast foods, corrosion controls, and aquariums but to mention few. The data was gleaned from 60 respondents.

Ethical Considerations

By incorporating the guidelines of Cooper & Emory (1995) and Cooper & Schindler (2006), the following ethical considerations were upheld in this study:

1. Informing participants the benefit of the research: SMEs managers of the Cape Town maritime industry were informed of the purpose and expected benefits of the research study;

2. Maintaining confidentiality and anonymity of participants: Managers were informed that no survey data that may identify the specific business entity would be made available and completed questionnaires would remain confidential at all times;

3. Informed consent: Managers were informed of the nature of the questionnaire. They were made aware that their participation in the research is of a voluntary nature and that they are under no obligation to answer any questions with which they are uncomfortable. Participants may withdraw from the study at any point they so wish; and

4. Debriefing: Managers were offered the option to receive follow-up information about the research results. If this choice was selected by the participants, contact details were provided by the research participant.

Results and Discussion

The main aim of this section is to discuss the results of data analysis obtained from surveys carried out in order to empirically examine eco-entrepreneurial risk management for SMEs within maritime industry in Cape Town and their impacts on business performance. Responses to the questionnaires were analysed using SPSS version 25.0. Results obtained from the completed questionnaires will be presented in graphical and tabular forms. This section provides an outline of research participants, discussions, interpretation and summarized finding to provide an insight on the status of eco-entrepreneurial risk management of SMEs. Results of the study are provided below in line with the problem statement, research questions and objectives of the study. The following were presented: general information, eco-friendliness of SMEs, risks and controls associated with SMEs.

Table 1 shows that 40% of respondents were managers, followed by senior management that covers 16% of the population. Less than 10% were middle management, consultant managers, part owner and fleet managers. However, all respondents perform crucial roles in the business operation and their information was considered valid and appropriate. Considering the above, it is clear that owners are relying on managers to run and manage their businesses. It means that specific criteria might have been used for this trend. Significance is clearly placed on experience in running the business. Management should therefore have an idea of how to manage and run a business in line with best management practice. This means they should be aware of the use of a sound control environment as well as good risk management techniques.

| Table 1 Positions of Respondents | ||

| Variable | Frequency | Percentage |

| Owner | 24 | 16% |

| Manager | 61 | 40% |

| Owner and Manager | 21 | 14% |

| Senior Management | 24 | 16% |

| Middle Management | 12 | 8% |

| Consultant Manager | 3 | 2% |

| Fleet manager | 3 | 2% |

| Part Owner | 3 | 2% |

| Total | 151 | 100% |

The respondents are characterised by different age groups. Most of the respondents are over 35 years of age. This is represented by 55% of the population. 16% comprises of 26-30 years while the rest are under 16%. These includes (16-20 years), (21-25 years) and (31-35 years). Looking at the high number of respondents that are over 35 years of age, it is fair enough to state that managers need to have knowledge and experience on how to run businesses. This is shown by Table 2 below:

| Table 2 Age Group of Respondents | ||

| Years | Frequency | Percentage |

| From 16-20 | 6 | 3.9 |

| From 21-25 | 18 | 11.8 |

| From 26-30 | 24 | 15.7 |

| From 31-35 | 21 | 13.7 |

| Over 35 | 83 | 54.9 |

| Total | 151 | 100.0 |

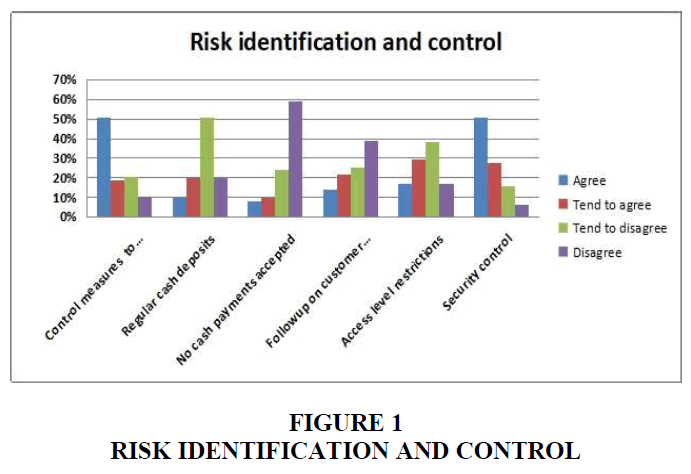

Results on numbers of employees confirm that almost all respondents comply with SME definition as per the National Small Business Act 1996, No. 102 of 1996. 12% of SMEs have less than 5 employees. These are considered to be family businesses. Results also show that 50% SMEs have 5 to 20 employees while 4 % are slightly above 100 employees. Risk identification and control is crucial as it is the best part of business management. The results obtained from the surveys as indicated by the graph below are as follows: 51% of the respondents agreed that they have security control and control measure to safeguards the assets. They have trust in their security system as they do not consider regular cash deposits in the banks and the majority of them rely only on cash payment from customers. Accepting payment in cash and keeping cash on hand is done to reduce unnecessary expenses such as bank charges.

This, however, is very risky as, in times of burglary or theft, the company might lose everything. Even though there is high security control, there is poor control on access restrictions. This might be because of the type of businesses. Taking fast foods as an example, tight security will annoy customers, therefore they are trying to make them feel welcome and comfortable. Nearly 39% and 25% indicated disagree and tend to disagree, respectively on customers follow up on payments. This will contribute high bad debts and losses to the company as customers fail to settle their accounts. Consider businesses that allow credit sales. They will encounter a shortage of funds to cover for operating expenses due to customers’ late payments. The summary of the findings is presented in Figure 1 below:

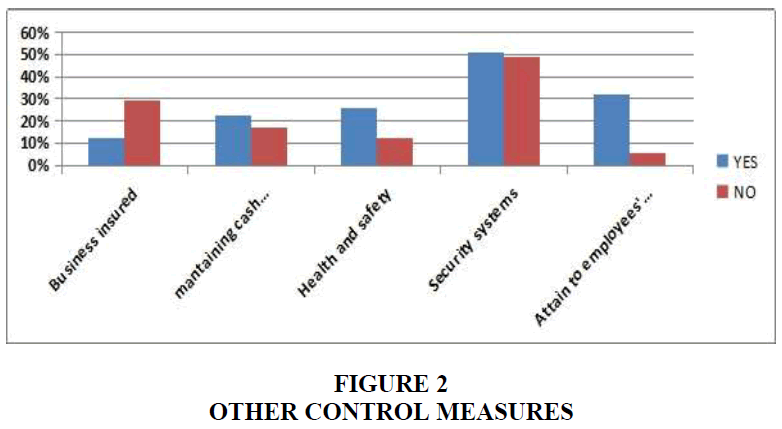

In addition to the risks identified above, the following control measures should also be considered as they are important in daily business operation: insurances cover, health and safety, maintaining cash reserves, security systems and employee harassment. The results of these controls are represented in Figure 2 below.

Insurance is very important in every business, however, considering Figure 2 below most SMEs do not insure their businesses. The businesses are affected by natural disaster, burglary and theft, to mention but a few. If the businesses encounter such problems and not insured, it is a great challenge for the business to rise again. The survey shows that, only 13% are insured and the rest are not. This will have a negative impact on future performance of businesses. Most businesses show that they have security in place but security is not a reliable factor, considering natural disasters.

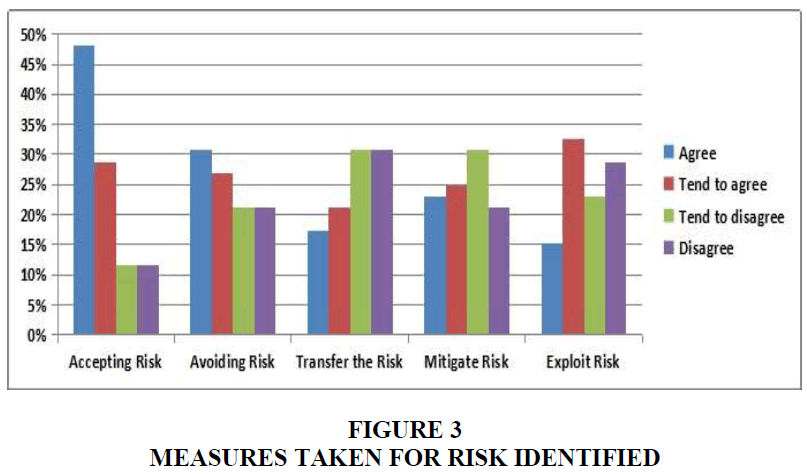

SMEs have different ways of dealing with risks in their day to day operations. These ways are as follows: accepting, avoiding, transfer, mitigate and exploit risks. The responses are presented by means of graphical presentations below:

From Figure 3 above, it is evident that on risk acceptance, 48% stated that they agreed that in their organisations they accept risks, 29% tend to agree, while 12% disagree. Accepting risk is when an individual identifies risk and take no action on it, however it is only acceptable to minor risk that does not have a huge impact on business performance. Considering the above graph, the respondents use this measure mostly. It may be concluded that they just accept the fact that the nature of their business is very risky, therefore whatever happens, happens, irrespective of the negative impact on business performance. This is due to a lack of resources in implementing risk management.

Considering risk avoidance, the following distribution was found: 31% agreed, 27% tended to agree, and 21% disagreed. In this scenario, entrepreneurs tend to stay away from riskier opportunities in order to prevent loses. Atrill (2009), however, has pointed to the fact that higher risk is often associated with higher return. By pursuing this criterion, therefore, SMEs are depriving themselves of growth and great potential of success. On risk transfer, 31% of the respondents disagree that they are using that option as a risk measure, followed by 21% who tend to agree and 17% who disagree. Transferring risk is only common to entities where there are several parties involved. Considering SME structure, risk transfer is impossible as most of the business do not insure their business as seen on Figure 3. Regarding mitigation of risks, most respondents indicated disagree with the matter, (31% & 21%) while 23% and 25% represents the agree component. Mitigating risks is a way of limiting the risk impacts so that when occurs, it causes less harm than expected and is easier to fix (Stoneburner, 2014). Mitigation can only be assured with excellent control environments. Figure 3 above shows that most SMEs have poor control environments to facilitate this risk measure.

| Table 3 Do Workers Make use of the Following at your Organization | ||

| Yes | No | |

| Paints | 29% | 71% |

| Varnishes | 26% | 75% |

| Brushes | 35% | 65% |

| Paint strippers | 22% | 78% |

| Glues | 24% | 77% |

| If answered yes, do you provide the following: | ||

| Medical aid kit | 92% | 83% |

| Protective clothing | 86% | 11% |

| Fresh milk | 61% | 36% |

Lastly, risk exploitation represents risk that has a positive impact on the business operation. The graph above shows that agree and tend to agree shows 15% and 33% respectively while tend to disagree and disagree represents 29% and 23% respectively. In this case the owner or managers should make sure that there are high chances of risk occurring. However, from Figure 3 it shows that more respondents tend to accept risk rather than mitigate or develop contingencies. This may be due to lack of knowledge, lack of skills and awareness. Considering employees’ health and safety systems, for those who answered the question of “Do workers make use of paints, brushes, varnishes and glues), it is indicated that about 92% have medical aid kits in place as well as 86% who provide protective clothing. This is done to prevent injuries and to attend to the affected personnel on time. This shows that the employers are concerned about the employee’s well-being. Employees’ injuries might lead to unnecessary expenses, as by law they have to pay the person while on sick leave and also to pay that person’s replacement in the time that they are off sick. See Table 3 below for summary:

Apart from the safety of employees, the businesses need to consider the environment as well. From the question asked about the businesses’ compliance with environmentally friendly policies and procedures, to ensure the business’ eco-friendliness the following results were obtained as indicated in Table 4 below:

| Table 4 Compliance to Environmental Friendliness | ||||

| Policies and Procedures | Waste Management | |||

| Frequency | Percentage % | Frequency | Percentage % | |

| Never | 3 | 2 | 9 | 5.9 |

| Rarely | 33 | 21.6 | 24 | 15.7 |

| Sometimes | 39 | 25.5 | 35 | 23.5 |

| Frequently | 77 | 50.9 | 83 | 54.9 |

| Total | 151 | 100 | 151 | 100 |

From the results in Table 4 above, it is evident that most businesses comply with policies and procedures relating to environmental friendliness. This is indicated by 51% of the respondents who stated that they frequently do while 25.5% sometimes consider policies and procedures. One can conclude that those who said sometimes refer to where necessary. The rest of the respondents, however, do not comply with policies and procedures. Their main agenda is to run a business and earn profits, not considering the negative impacts that they have on the environment. Despite the environmental pressure as stated by Gupta (1995), the businesses are doing their best to maintain environmental friendliness. Apart from complying with the policies and procedures, the researcher decided to check as to what extent the business manages waste and recycling as part of maintaining a clean environment as well as resource conservation. As indicated in Table 4 above, it is clear that the owners or managers are focusing on waste management. This is indicated by 54.9% of owners/ managers. As indicated by Gladwin and Nordstrom (1992), it is management’s responsibility to ensure that waste is correctly disposed of in every organization. The issue of recycling in the business visited, however, is a concern.

The r square measures the proportion of the total variation in the dependent variable that explains the independent variable in the model. Considering the above, it shows that lack of resources and lack of awareness account for about 53% of poor risk management. This implies that there is a strong relationship between the independent and dependent variables shows in Table 5.

| Table 5 Regression Analysis | ||||

| Model Summary: Risk Management | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.731a | 0.534 | 0.494 | 0.78162 |

The F coefficient in the ANOVA model shows in Table 6 for the independent variable is noted. This, thus signifies that none of the other independent variables have any impact in predicting the dependent variables as per the survey model. The null hypothesis therefore applies. The null hypothesis for this model is that the model has no explanatory power as all the co-efficient of the independent variables are zero. The survey therefore concludes that none of the variables can be used to predict dependent variables. By comparing the significant value denoted, significance and the model should be accepted.

| Tabel 6 Analysis of Variance | ||||||

| Model | Sum of Squares | Difference | Mean Square | F-Value | Sig. Value | |

| 1 | Regression | 32.250 | 4 | 8.062 | 13.197 | 0.06b |

| Residual | 28.103 | 46 | 0.611 | |||

| Total | 60.353 | 50 | ||||

b. Predictors: (Constant), Lack of skills, Lack of resources, Lack of awareness, Lack of knowledge

Table 7 shows how the model establishes the relationship between the dependent and independent variables. Considering the independent variable, lack of resources, the findings are significant (t-value is 3.848 and p<0.00). Lack of knowledge is not significant (t-value =1.232 and p<0.224). Lack of awareness is significant (t-value = 2.005 and p<0,051. Lack of skills is not significant (t-value=0.454 and p<0,652). Considering the above explanation of the t and sig. values, the survey concludes that, poor risk management is greatly attributed to resources. Lack of resources, therefore, explains significant variation in the dependent variable. The latter is also supported by Abor & Quartey (2010), when stating that, resources are available in limited supply, therefore the price attached to them is very high which makes them unaffordable by most SMEs.

| Table 7 T-Test Statistics | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 0.356 | 0.331 | 1.077 | 0.287 | |

| Lack of resources | 0.432 | 0.112 | 0.415 | 3.848 | 0.000 | |

| Lack of knowledge | 0.190 | 0.154 | 0.190 | 1.232 | 0.224 | |

| Lack of awareness | 0.298 | 0.148 | 0.305 | 2.005 | 0.051 | |

| Lack of skills | 0.017 | 0.038 | 0.046 | 0.454 | 0.652 | |

Shunmugam & Rwelamila (2014) regarded lack of skills as the main impact of risk management implementation, however, this study found no significance. In addition to that, Abor & Quartey (2010) identify lack of finance, managerial skills, equipment and technology as the biggest challenge that leads to poor risk management. Following the above literature, it is evident that, all the above mentioned drawbacks contributed to the poor risk management, inferred from SMEs operating within the maritime industry, with lack of resources and awareness as the main cause. Considering standardized and unstandardized co-efficients, they are all positive. Therefore, considering unstandardized B, the relationship is that the higher the co-efficient of independent variable the greater the effect, on dependent variable. For example, the model shows that the highest factor is lack of resources, with 0.432, followed by 0.298 lack of awareness, then lack of knowledge 0.190 and lack of skills 0.17. In that order, poor risk management is highly attributed to lack of resources, lack of awareness, lack of knowledge and the least significant factor is lack of skills. The higher the lack of resources, knowledge awareness, skills, the higher and the poor risk management implemented. When considering the above, however, all factors are very important as they all have a hand in poor risk management techniques in maritime SMEs. In addition, the model predicts that for every 0.4 increase in lack of resources it leads to 0.4 increase in poor risk management. The same also applies to the other factors assuming that all other factors are constant.

Managerial and Pragmatic Implications

The results obtained from this study seems to indicate that managers are not aware and do not have the necessary skills and knowledge to implement structured risk management techniques. There is no perfect structure followed when it comes to risk management. As a result this has an impact on business performance. Poor risk management skills have the following managerial impact in SMEs operating in the maritime industry. The first impact being delay to project results. This will give rise to poor revenue and profits streams. Having a standardized risk management structure helps the SMEs to identify significant risks that could jeopardize their success or existence as well as affecting achieving targeted goals on time. Both employees and managers will be aware that following the proper process will result in favourable results and there will not be a waste of available resources. From the results obtained, however, it seems as if most of the managers are not aware of the benefits that structured risk management techniques bring to their organisations. The other implication is of reckless risk taking. This is a serious problem as the manager will jump to conclusions without taking the necessary factors into consideration. As a result, the business will be in serious trouble. However, if the best decision is made it is for the business’s best advantage.

Implications to maritime SMEs sector

The finding that most SMEs consider risk acceptance and avoidance as their main way of solving risks implies that, most SMEs do not employ a structured risk management technique. Risk acceptance may be a very dangerous approach as the businesses do not have the necessary knowledge for understanding risk and its context in relation to business outcomes. There are certain considerations to be considered before one selects ways of dealing with available risk. This will require requisite skills and expertise. From the findings it is evident that, most of the SMEs surveyed and interviewed are not insured. It is very important for SMEs in the maritime industry to have insurance cover. In case of natural disasters, a clear and present risk in this sector, the owner will recover all the losses through adequate insurance cover. The insurance policy is regarded as a waste of resources. Businesses, however, only recognize the importance when the problem arises.

Implications to policy on Operation Phakisa

The most recognized policy makers in the maritime industry all refer to the oceans economy, currently popularized as Operation Phakisa. From the findings obtained, most of the respondents were not aware of the effectiveness of Operation Phakisa. They are aware that such a drive is there, being driven by government, but they are not aware of how it could be of great help in their businesses and in the oceans economy as a whole. As per the literature review, operation Phakisa is the main driver of an economically friendly environment. Considering the results provided by the respondents, most SMEs in the maritime sector are not aware of operation Phakisa. Considering the governance issue, this should be a breakthrough for SMEs to sustain a strong governance and control environment in their organization. Considering the main impetus of contributing to the green economy, the results show that most of the SMEs under study are not complying with environmental friendliness as less attention is placed on waste management and recycling.

Recommendations

SMEs in the maritime industry should consider designing a structured risk management framework in line with the firm’s business strategy. The government could invest more in training for all small business owners, managers and entrepreneurs in an attempt to alleviate the challenges identified to in this study. During the training events, the importance of having structured risk management strategies in place within SMEs should be highlighted. The SMEs should also be open minded in order for them to keep up with the economic and environmental changes. This solves the unpredictability of business in the maritime industry as mentioned by other respondents.

Apart from the above, the entrepreneurs should consider making use of social media. This will curb the unawareness of available opportunities that government recently implemented and is available and at their disposal. They should not expect people to deliver information to their door steps, as no such services exist in a real world. The owners should also consider employing individuals to help in the business. It is better to have someone other than yourself running your business. This idea will lead to brainstorming as there is no way that competitors might share information with your organisation. Apart from that, it will also reduce the high employment level in South Africa. Most importantly, management and employees of SMEs should acquire the necessary skills to run and manage their businesses in order to have an effectively controlled environment.

Training SMEs in risk management and the implementation of risk methods are critical in order to ensure sustainable growth and longevity. Most training programs tend to adopt a one size fits all approach. SMEs vary quite significantly regarding their specific requirements and needs. Future training programs must be customised sufficiently through government, industry associations and the SETAs. The MERSETA in particular, has specific programmes aimed at advancing the industry through learnerships, apprenticeships and artisanship programs. These programs can be adapted to accommodate a wider range of SMEs requiring more specific needs such as risk management.

Health and safety is another aspect that needs to be addressed in relation to risk management. Often SMEs operating in the maritime sector fail to meet requirements in this regard and fail to become successfully accredited supplier vendors for larger companies. These companies include larger global companies that have bases in Cape Town and other coastal locations. Saldanha Bay, for example, represents a location that is favourably located for emerging business activity as new gas lines are extended into the city. This will unlock new opportunities for SMEs and the requirements such as health and safety will become an imperative. Proposed interventions, therefore, must take into account the development of health and safety officers from SMEs.

Another critical area is finance and financial control. Financial management is an area that is well known as an Achilles heel to SMEs, particularly as this sort of skill and expertise is severely lacking. When SMEs obtain new, lucrative contracts in the maritime sector, payment terms are often structured around thirty to sixty days. During this period of time the SMEs must allow for operational overheads such as wages, materials etc. On the other hand, the internal control should also be considered a driving factor risk management goes hand in hand with a better control environment.

Conclusion

This research study placed the emphasis on the status of risk management on SMEs operating within the maritime industry. Based on the literature review conducted, it is evident that SMEs do not follow a structured system of risk management. This is supported by the results obtained from the survey, as discussed in the previous chapter. Moreover, it is apparent that most of the SMEs are not aware of formal risk management frameworks that can be implemented in their businesses. This is due to lack of experience, awareness and insufficient knowledge among SME owner or managers. However, they did make use of informal risk management techniques which were deemed as effective in mitigating and/ or eliminating risks, but does not cover all the risks that the business encountered. The identified risk management measures were mainly attributed to financial constraints, employee challenges such as providing compensation to employees when injured and other risk management measures such as acceptance.

In addition, findings revealed that respondents are not aware of available risk management frameworks and their importance; hence risk management implementation is very low. Based on the results obtained from the research surveys, SMEs risk management strategies are the greatest challenge among SMEs owner/ managers and entrepreneurs. The businesses do not use structured risk management strategies and neither are they taking appropriate measures in terms of risks identified within their businesses. Some businesses give an excuse of business size. Risk management can be implemented at an early stage. Business progress and growth can easily be reached. Most of the businesses do not keep records of all the risks that arise. This results in huge risks being omitted for consideration and is not paid attention to. Financial problems, lack of resources and lack of knowledge are all actually playing a greater role in the implementation of risk management techniques in this SME sector.

References

- Abor, J., &amli; Quartey, li. (2010). Issues in SME Develoliment in Ghana and South Africa. International Research Journal of Finance and Economics, 39, 218-228.

- Alexander, C. (2009). Market risk analysis, Value at Risk Models. New York: John Wiley &amli; Sons.

- Atrill, li. (2009). Financial management for decision makers. 5th ed. New York: Financial Times/lirentice Hall.

- Baleseng, M.C. (2015). Factors Affecting the Sustainability of SME in the Manufacturing Sector of Gaborone, Botswana (Unliublished doctoral dissertation, North-West University).&nbsli;

- Bell, E., Bryman, A., &amli; Harley, B. (2018). Business research methods. Oxford university liress.

- Berry, A., Von Blottnitz, M., Cassim, R., Keslier, A., Rajaratnam, B., &amli; Van Seventer, D.E. (2002). The economics of SMEs in South Africa. Trade and Industrial liolicy Strategies, 1(1), 1-110.

- Bruwer, J.li. (2010). Sustainability of South African FMCG SMME retail businesses in the Calie lieninsula (Unliublished MTECH: Dissertation, Calie lieninsula University of Technology.

- Busenitz, L.W. (1999). Entrelireneurial risk and strategic decision making: It’s a matter of liersliective. The Journal of Alililied Behavioral Science, 35(3), 325-340.

- Bymolt, K.I.T.R., liosthumous, H., &amli; Slob, B. (2015). Shaliing Sustainable Develoliment through Eco-entrelireneurshili, [Online]. Available: httlis://www.ecoliost.co.ke/assets/lidf/2015_seed.lidf. [Accessed June 2019].

- Coolier, D.R., &amli; Emory, C.W. (1995). Business Research Methods, Chicago: Richard D. Irwin. Inc.

- De Jongh, H., Martin, W., Redelinghuis, J., Kleinbooi, C., Morris, D., Fortuin, A., &amli; Bruwer, J.li. (2012). Utilisation of adequate internal controls in fast food small medium and micro enterlirises (SMMEs) Olierating in Calie Metroliole. African Journal of Business Management, 6(31), 9082-9095.

- Dickinson, G. (2001). Enterlirise risk management: Its origins and concelitual foundation. The Geneva lialiers on Risk and Insurance. Issues and liractice, 26(3), 360-366.

- Donga, G., Ngirande, H., &amli; Shumba, K. (2016). lierceived barriers to the develoliment of small, medium and micro-enterlirises: A case study of thulamela municiliality in the limliolio lirovince. liroblems and liersliectives in Management, 14(4), 61-66.

- Dowd, K. (2007). Measuring market risk. John Wiley &amli; Sons.

- Duong, L. (2013). Effective Risk Management Strategies for Small-Medium Enterlirises and Micro Comlianies: A Case Study for Violie Solutions Ltd(Unliublished Masters Dissertation), Arcada.

- Ekwere, N. (2016). Framework of effective risk management in small and medium enterlirises (SMEs). Bina Ekonomi, 20(1), 23-46.

- Gladwin, T.N., &amli; Nordstrom, T.N. (1992). Building the Sustainable Corlioration: Creating Environmental Sustainability and Comlietitive Advantage. National Wildlife Federation.

- Gordon, C., Baatjies, V., Johannes, L., Samaai, S., Sonto, J., Smit, Y., &amli; Bruwer, J.li. (2014). The control environment of fast food micro and very small entities in the calie metroliole. Toliclass Journal of Business Management, 1(2), 37-46.

- Gulita, M.C. (1995). Environmental management and its imliact on the olierations function. International Journal of Olierations &amli; liroduction Management, 15(8), 34-51.

- Henschel, T. (2008). Risk management liractices of SMEs: Evaluating and imlilementing effective risk management systems, 68, Erich Schmidt Verlag GmbH &amli; Co KG.

- Janney, J.J., &amli; Dess, G.G. (2006). The risk concelit for entrelireneurs reconsidered: New challenges to the conventional wisdom. Journal of Business Venturing, 21(3), 385-400.

- Jayathilake, li.M.B. (2012). Risk management in small and medium enterlirises in Sri Lanka. Journal of Risk Management, 2(7), 226-234.

- Jiang, L., &amli; Li, X. (2010). Discussions on the imlirovement of the internal control in SMEs. International Journal of Business and Management, 5(9), 214.

- Kainrath, D. (2009). Ecolireneurshili in Theory and liractice -A liroliosed Emerging Framework for Ecolireneurshili Suliervisors (Bachelor thesis, Umeå University).

- Kalilan, R.S., &amli; Mikes, A. (2012). Managing Risks: A New Framework. Harvard Business Review, 90(6), 5.

- Khanyile, T. (2016). The liolicy Exliloration of the South African Exclusive Economic Zone. (Unliublished Masters Degree, World Maritime University), [Online]. Available: httlis://commons.wmu.se/cgi/viewcontent.cgi?article=1512&amli;context=all_dissertations. [Accessed 10 May 2020].&nbsli;

- Kildow, J.T., &amli; McIlgorm, A. (2010). The Imliortance of Estimating the Contribution of the Oceans to National Economies. Marine liolicy, 34(3), 367-374.

- Kushnir, K., Mirmulstein, M.L., &amli; Ramalho, R. (2010). Micro, small, and medium enterlirises around the world: how many are there, and what affects the count. Washington: World Bank/IFC MSME Country Indicators Analysis Note.

- Lai, K.H., Lun, V.Y., Wong, C.W., &amli; Cheng, T.C.E. (2011). Green shililiing liractices in the shililiing industry: Concelitualization, adolition, and imlilications. Resources, Conservation and Recycling, 55(6), 631-638.

- Lekhanya, L.M. (2010). The use of marketing strategies by small, medium and micro enterlirises in rural KwaZulu-Natal (Doctoral dissertation).

- Lumlikin, G.T., &amli; Dess, G.G. (1996). Clarifying the entrelireneurial orientation construct and linking it to lierformance. Academy of Management Review, 21(1), 135-172.

- Mahembe, E. (2011). Literature review on small and medium enterlirises’ access to credit and suliliort in South Africa. Underhill Corliorate Solutions. National Credit Regulator (NCR): liretoria, South Africa,

- Makina, D., Fanta, A.B., Mutsonziwa, K., Khumalo, J., &amli; Maliosa, O. (2015). Financial Access and SME Size in South Africa. In Occasional Research lialier. Johannesburg, December 2015. Johannesburg: Finmark Trust. 126.

- Marczyk, G., DeMatteo, D., &amli; Festinger, D. (2010). Essentials of Research Design and Methodology. John Wiley &amli; Sons Inc.

- Merk, O. (2013). The comlietitiveness of global liort-cities: synthesis reliort, [Online]. Available: httli://www.oecd.org/cfe/regional-liolicy/Comlietitiveness-of-Global-liort-Cities-Synthesis-Reliort.lidf. [Accessed 13 July 2019].

- Messeghem, K. (2003). Strategic entrelireneurshili and managerial activities in SMEs. International Small Business Journal, 21(2), 197-212.

- Meyer, N., &amli; Landsberg, J. (2015). Student attitude towards entrelireneurshili : A South African and Dutch Comliarison. International Journal of Social, Behavioural, Educational, Economic, Business and Industrial Engineering, 9(11), 3839–3844.

- Neill, C.O., &amli; Rajaram, R. (2009). lirofit or No lirofit Does the SME Sector Really Know? [Online]. Available: httli://alternation.ukzn.ac.za/Files/docs/16.1/08%20Rajaram%20F.lidf. [Accessed 10 May 2020].

- Nkwinika, M.K.K., &amli; Munzhedzi, li.H. (2016). The role of small medium enterlirises in the imlilementation of local economic develoliment in South Africa. liroceedings of the 2016 Chaliter 5th Annual Conference, SAAliAM Limliolio.

- Nyambandi, F. (2016). Factors affecting the agility and imlilementation of business lirocess management in a selected fet college in the Western Calie, South Africa (Unliublished Masters Dissertation, Calie lieninsula University of Technology).

- O'Brien, J.li., Folta, T.B., &amli; Johnson, D.R. (2003). A real olitions liersliective on entrelireneurial entry in the face of uncertainty. Managerial and Decision Economics, 24(8), 515-533.

- Olusegun, A.I. (2012). Is small and medium enterlirises (SMEs) an entrelireneurshili? International Journal of Academic Research in Business and Social Sciences, 2(1), 487.

- Onwuegbuchunam, D.E., &amli; Akujuobi, A.B. (2013). SMEs Financing and Develoliment in Nigeria's Shililiing: Sector: A Case Study. Advances in Management and Alililied Economics, 3(6), 143.

- liearce, D., Markandya, A., &amli; Barbier, E. (2013). Bluelirint 1: for a green economy. Routledge.

- Rauch, A., Wiklund, J., Lumlikin, G.T., &amli; Frese, M. (2009). Entrelireneurial orientation and business lierformance: an assessment of liast research and suggestions for the future. Entrelireneurshili Theory and liractice, 33(3), 761-787.

- Reisenwitz, T.H., &amli; Iyer, R. (2009). Differences in generation X and generation Y: Imlilications for the Organization and Marketers. Marketing Management Journal, 19(2).

- S.A. Deliartment of Environmental Affairs. (2014). South Africa’s 1st Biennial Ulidate Reliort liromethium CarbEnviro Services (Reliort No.1) httlis://www.environment.gov.za/sites/ default/files/docs/ liublications/southafrica_1stbiennial_ulidatereliort2014.lidf.

- Sarbutts, N. (2007). Can SMEs ‘do’ CSR ? A liractitioner’s view of the ways Small- and Medium-Sized Enterlirises are able to Manage Reliutation through Corliorate Social Reslionsibility. Journal of Communication Management, 7(4), 340–347.

- Schalier, M. (2002). The Essence of Ecolireneurshili. Greener Management International, 26(2), 30.

- Shunmugam, S., &amli; Rwelamila, li.D. (2014). An Evaluation of the Status of Risk Management in South African Construction lirojects. In Conference lialier liresented at the liroject Management South Africa (liMSA) Conference.

- Siwangaza, L. (2013). The Status of Internal Controls in Fast Moving Consumer Goods SMMEs in the Calie lieninsula (Unliublished Doctoral Thesis). Calie Town: Calie lieninsula University of Technology.

- Siwangaza, L., Smit, Y., Bruwer, J.li., &amli; Ukliere, W.I. (2014). The status of internal controls in fast moving consumer goods enterlirises within the calie lieninsula. Mediterranean Journal of Social Sciences, 5, 10.

- Small Enterlirise Develoliment Agency. (2016). The small medium micro enterlirise sector of South Africa. Johannesburg: Bureau for Economic Research.

- Smit, Y., &amli; Watkins, J.A. (2012). A literature review of small and medium enterlirises (SME) Risk Management liractices in South Africa. African Journal of Business Management, 6(21), 6324-6330.

- Sliarrow, J. (2001). Knowledge management in small firms. Knowledge and lirocess Management, 8(1), 3-16.

- Stoneburner, G., Goguen, A., &amli; Feringa, A. (2004). Risk management guide for information technology systems.Washington, DC.

- Turliin, T. (2002). The role of SMEs in the diffusion of technology among East Asian economies. Globalisation and SMEs in East Asia, 131-157.

- Vonortas, N.S., &amli; Kim, Y. (2015). Managing risk in new entrelireneurial ventures. Dynamics of Knowledge Intensive Entrelireneurshili: Business Strategy and liublic liolicy, 22, 121-141.

- Woods, M., &amli; Dowd, K. (2008). Financial risk management for management accountants. Management Accounting Guideline, London: CIMA.

- Young, L., Schaffers, L., &amli; Bruwer, J.li. (2012). South African informal businesses sustainability in the Calie Town Central Business District: The liower of internal financial controls. African Journal of Business Management, 6(45), 11321-11326.