Research Article: 2018 Vol: 21 Issue: 4

Entrepreneurship Development and Business Activity in the Russian Federation

Aleksandr Chernopyatov, Surgut State Pedagogical University

Ludmila Makushenko, Surgut State Pedagogical University

Vera Popova, Surgut State Pedagogical University

Natalya Antonova, Surgut State Pedagogical University

Abstract

This article attempts to analyze Russian entrepreneurship in terms of development and business activity, as well as its role in national economy, by delving into theoretical and practical basics of national entrepreneurial activity. Russian entrepreneurship development and business activity were compared with alternative ones that are common abroad. This article provides views and opinions expressed by different authors specializing in entrepreneurship, who believe that Russian entrepreneurial activity is highly volatile. Volatility, in fact, significantly affects livelihoods and, accordingly, national economy. In the light of imposed EU-US sanctions and current national situation, this article is particularly relevant. Plural opinions that not always are fair and carefully worded often restrain progress when it comes to such important matter as entrepreneurship. Scientists and media often quote various figures, which, if accrued, distort the picture of entrepreneurial activity in Russia. The novelty of this article is that it, unlike other sources, shows the real entrepreneurship situation in Russia.

Keywords

Russian Entrepreneurship, Business Environment, Entrepreneurial Activity, Small and Medium-Sized Business, Knowledge-Driven Economy.

Introduction

Entrepreneurship development is a complicated and long process, so the major task of the government is to take part in entrepreneurial activity on a regular basis. At this point, the government already has a favorable background for participation, for example–small business as an integral part of big business complements it, and thereby, release big businesses from functions that they are not supposed to carry (Akhmetov & Chernopyatov, 2015). Small business is more effective in using various resources; it is stronger in fields where big business cannot run efficiently. Small enterprises create new jobs and manage their production costs on a more frequent basis. Small business is a reliable source of budget and off-budget revenue. Entrepreneurship allows shaping the middle class (guarantor of political stability) dynamically (Balabanov et al., 2015).

Therefore, this research is an analysis of the current problem–proposition analysis, research and development. Aside from that, the problem touches certain recommendations on business and development in the Russian Federation. The purpose of this research is to analyze Russian entrepreneurship development and business activity next to international criteria and conceptions. Research objectives are as follows:

1. Addressing theoretical aspects in the field of entrepreneurial activity.

2. Analyzing statistical data on entrepreneurship.

3. Turning up the real picture of entrepreneurial activity in Russia.

4. Giving a detailed and fair assessment of entrepreneurship development and entrepreneurial activity in Russia.

This article will be useful in macroeconomics, microeconomics and in a number of other areas focused on national economic development. In this day and age, both science and mass media often deliver information about entrepreneurship development that is not always true. As a rule, information is strongly distorted because of quotation–quoted data on entrepreneurial activity is not as backed as they have to be, so information becomes distorted on the back of multiplicative effect. Such a condition cannot be beneficial to entrepreneurship development in Russia. Various research papers were considered on the matter from various sources: bulletins, articles, Rosstat statistical data, etc.

Over the last few years, Russian economic development reached the point of stagnation, followed by a full-fledged crisis in 2014-2015. The economic development can be tracked slowing down since 2013. The GDP growth rate in 2013 was 1.3%, against 3.4% in 2012 (Novokmet et al., 2017). Such a slowdown indicates that Russian economy faced with some kind of structural problems associated with de-industrialization. Thus, Russian small business had not as great boost as in other developed countries. With crisis promoting business depression, such situation calls for gathering entrepreneurial initiatives and stimulating small and medium-sized businesses. However, Russian model of extractive economy building was standing here for a while, and so left a significant imprint on the small business activity, manifested as the emergence of barriers and problems, which the small business faces on the path of development (Pula, 2017). This is why we need to design new strategies for the support and development of small and medium-sized enterprises, since such businesses will be the one driving Russian economy out of crisis.

Literature Review

Entrepreneurship and entrepreneurial activity are studied in many different papers. Thus, Akhmetov and Chernopyatov (2015) were interested in national entrepreneurship development; Balabanov et al. (2015) studied the social orientation of domestic entrepreneurship, its development and role in social life and welfare. Gusov and Baytursunova (2017) analyzed the main lines that the government follows when regulating small and medium-sized businesses. Aside from them, there are many Russian scientists, who studied entrepreneurship development, business behavior, factors affecting entrepreneurship development and many other related issues.

Many foreign research papers on entrepreneurship and entrepreneurship development are centered on this problem, as evidenced from the examples below. Thus, von Mises, (2005) devoted many works to the very nature of entrepreneurship including A Treatise on Economics. Hayek (1992) examined the role of private property in entrepreneurship development. Besides, these two economists considered entrepreneurship in the same was as natural resources–as an economic factor. Meskon et al. (1992) investigated the fundamentals of production management and its effect on the entrepreneurship development. Schumpeter (1982) referred to entrepreneurship as to an innovative movement, contributing to the development of production and society in general. Samuelson and William (1997) explored the grounds of an economic theory and the economic thought development that are directly linked with entrepreneurship. Drucker (2012) developed a theory of entrepreneurial society and knowledge-driven economy. Coase (2001) defined the role of property rights and transaction costs in the institutional structure and national economy that are part of entrepreneurship. Lichtenstein and Ross (2015) considered theoretical and practical contexts associated with equilibrium random processes that affect entrepreneurship. At the same time, modern foreign researchers consider entrepreneurship development, including Russian patterns, in a slightly different perspective. Thus, Novokmet et al. (2017) consider inequality and property as factors affecting entrepreneurial activity in Russia. One cannot agree with these results and conclusions. However, they have some kind of point here. Karolyi and Liao (2017) and Pula (2017) investigated how the government and public companies affect the entrepreneurship development. At this point, keep in mind that such effect not only exists, but is also a dominant force in a number of countries. Walker (2016) did a review of the leading privatization approaches affecting the entrepreneurship development in different countries. Although such effect is evident, one should neither take too much interest in privatization processes nor leave it to the state. At this point, the government should act both as a competitor, as an investor and as a top innovator.

The above listed authors introduced many good solutions, but there is still a serious conflict arising when it comes to entrepreneurship–every country (formation, union) follows unique standards and criteria that differ significantly from those common in other countries and from the methodological calculations made by the institutions worldwide. If we apply such approaches, we will get significant calculation errors that would not satisfactory to the researchers. For example, at the time when small and medium-sized businesses have many criteria applied to them in Russia and abroad, staffing is imposed with all sorts of requirements, but there is no regard for this fact. Accordingly, we cannot apply the calculated data, as they distorting the real picture of business run by small and medium-sized enterprises in the country. We filled this gap. Moreover, different scientists or officials deliver info on entrepreneurship differently depending on what is their goal, what problems they are faced with and what activity they will perform in the future. In this regard, our approach to entrepreneurship development implies deep correction aimed at eliminating the existing shortcomings.

Methods/h3>

The leading method applied in the article is a comparative method combined with the analysis of statistical data, observations, and reports from various sources. We also analyzed the patterns of entrepreneurship development and entrepreneurial activity that took their current shape over a number of years. We made a general conclusion on the real entrepreneurship situation that arisen in Russia and abroad.

Research is based on statistical data that allow us to assess the situation fairly, as well as different research papers on related issues. Regulatory and empirical framework of the research consists of Russian regulations and acts associated with the matter, Rosstat statistical data, and other materials.

The research was carried out by means of modern methods, tools and techniques intended for analyzing the national entrepreneurship situation: system and logistic analysis, and statistical methods of data collection and processing.

Results

In the Russian Federation, entrepreneurship, its development and business patters are at the priority list. All the permanent reforms came with various regulations, laws and other provisions on entrepreneurship protection, development and practice. One of the major laws in this area is the Federal Law No. 208-FZ on Developing Small and Medium Scale Entrepreneurship in the Russian Federation (2007).

At the same time, entrepreneurship development is too far behind the needs and potential of national economy. The progress is going slow and brings sharp failures with it. The biggest failures that have recently stricken were the great failures of 2011 and 2013 induced by high interest rates that were introduced by the off-budget funds on insurance. They were also sparked by the increase in tax rates for sole entrepreneurs (SE). This casted a pall on the number of enterprises, most significantly on SE (Table 1).

| TABLE 1 THE NUMBER OF ENTERPRISES AND SOLE ENTREPRENEURS IN RUSSIA, UNITS |

||||

| Criterion | 2013 | 2014 | 2015 | 2016 |

| Middle-Sized | 15,372 | 15,326 | 15,492 | 16,308 |

| Small | 234,537 | 235,579 | 242,661 | 172,916 |

| Micro | 1,828,589 | 1,868,201 | - | 2,597,646 |

| SE | 2,499,000 | 2,413,800 | - | 2,523,600 |

Since many entrepreneurs exit from the market (the number of SE dropped by 7.3% in two years (2012-2014), while the number of small enterprises declined by more than 26% throughout to 2016), the government was forced to amend the adopted legislation.

At the same time, we do not agree with the researcher who stated that only 2% of Russians are interested in starting their own business now, while statistics indicate 6-8%. We are not certain in what did he inferred that from, as it is evident from our calculations, made on the back of Rosstat statistical data, that such a figure (6-8%) has already been achieved. Despite the volatility of entrepreneurship policy, this area is still developing.

Let us first calculate the number of those, who are involved in entrepreneurship, with regard to the number of employed persons in 2016 (data released in 2017):

EA=({SE+ME+SmE+?SE} : EAN) × 100%

Where:

EA: Number of entrepreneurially active people, %

SE: Number of sole entrepreneurs

ME: Number of micro-enterprises

SmE Number of small enterprises

?SE: Number of medium-sized enterprises

EAN: Number of occupied people

VP=({16,308+172,916+259,7646+2,523,600} : 76,636,000) × 100%

Where:

Variable 76,636,000 is from [16]

VP=(5,310,470 : 76,636,000) × 100%=6.92%.

Now, let us make calculations with regard to the total population for the same 2016:

EA=({SE+ME+SmE+?SE} : ??) × 100%

EA=({16,308+172,916+2,597,646+2,523,600} : 146,545,000) × 100%

EA=3.62%

In these calculations, we took each enterprise assuming that it has one founder, although there may be up to 50 people.

At this time, let us make calculations only for SE, leaving enterprises out of account:

EA=(2,523,600 : 76,636,000) × 100%=3.29%

This figure, but with regard to total population:

EA=(2,523,600 : 146,545,000) × 100%=1.72%

In the shadow sector, there are many occupied people, who do not want to register because of the early mentioned volatility. At this point, they will factor into our calculations. According to Russian Statistical Yearbook (2017), there are 84.199 million occupied (active age) people in Russia. Let us find the difference of the number of registered people, who been employed, and the number of active age people (BSE).

BSE=AAP-EAN

Where:

AAP: Active age population

BSE=84,199,000-76,636,000=7,563,000 people

We assume that over 7 million potential entrepreneurs are shadow workers willing to stay unregistered. Based on these data, the number of entrepreneurially active people will rise by:

EA: ({SE+BSE}: EAN) × 100%

EA: ({2,523,600+7,563,000}: 76,636,000) × 100%=13.16%

In the view of sole and potential entrepreneurs, as well as of total population:

VP=({2,523,600+7,563,000}: 146,545,000)) × 100%=6.88%

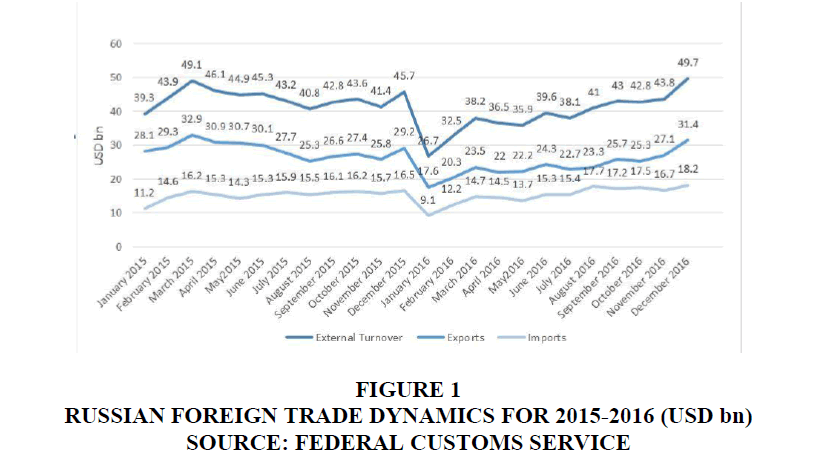

Our calculations clearly demonstrate that if one applies different methods the result will be a distorted information field, and, accordingly, to some kind of ripple effects. In these calculations, we left aside the Government data on over 20 million people working as shadow employees that would accordingly increase the figures. Despite various troubles, Russia has been recently able to increase exports and reduce imports. This could not happen without entrepreneurship development (Figure 1).

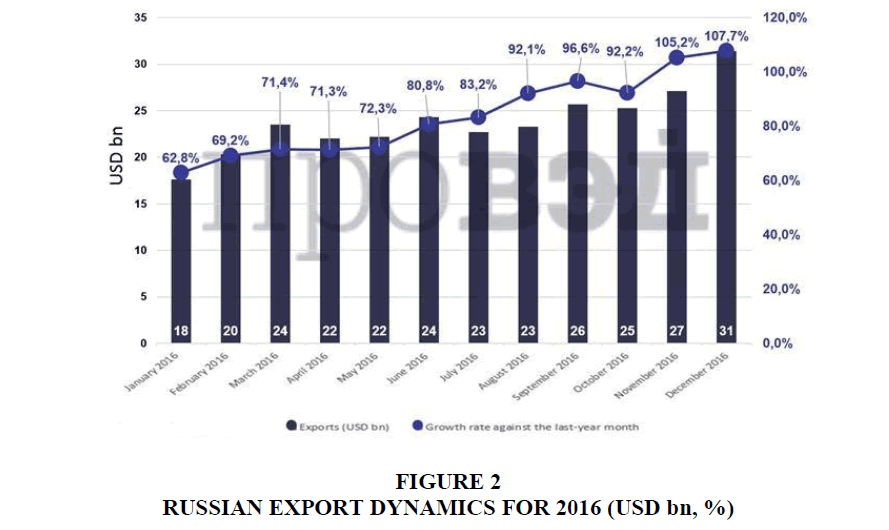

Export dynamics (in %) are graphically illustrated below (Figure 2).

Although more than two previous decades were evident for many different state programs adopted for small business development and support, we are still far behind other developed markets by qualitative and quantitative indicators. In many developed countries, small entrepreneurship is a leading sector defining the GDP quality, structure and growth rates.... In physical terms, nearly 60-70% of GDP accrue to small entrepreneurship. In some countries, such as the United Kingdom, the United States, France, Japan and Germany, small and medium-sized firms form the main body 99.3-99.7% of enterprises. These firms produce almost half of the output. Small and medium-sized enterprises, unlike the big ones, create about 75-80% of new jobs, while the big enterprises cut the room (Chernopyatov, 2016). However, one should keep in mind that criteria for classifying any business as small are different in different countries. Accordingly, these figures give us a distorted picture. In the EU and the US, small business refers to small and medium-sized businesses (Table 2). Different sources provided by The European Observatory for SMEs come with different criteria for small and medium-sized businesses (OECD SME Outlook, Paris, 2000).

| TABLE 2 RUSSIAN AND INTERNATIONAL CRITERIA FOR BEING QUALIFIED AS SMALL AND MEDIUM-SIZED BUSINESS |

||||

| Criterion | Micro-Enterprises | Small Enterprises | Medium-Sized Enterprises | Big Enterprises |

| Country | Number of Occupied People, subjects | |||

| Russia | 1-15 | 16-100 | 101-250 | 251 |

| USA | 1-24 | 25-99 | 100-499 | 500 |

| OECD | 1-19 | 20-99 | 100-499 | 500 |

| EU | 9 | 1-49 | 50-249 | over 250-500 |

| UK | - | - | 250-500 | over 500 |

| Ireland | - | - | 500 | over 500 |

| Germany | 1-49 | 500 | - | over 500 |

Note: In the USA, enterprises with up to 1500 employees can be referred to as small business; it entirely depends on the kind of business.

According to the Federal State Statistics Service (Rosstat), small business share of national GDP is about 20%, but as we look back on the Table 2, we will realize that this figure is inaccurate. Medium-sized business, as well as big business with an anchor size of 251-500 employees, must be also taken into account. Accordingly, the introduced figure of 70-80% will be achieved if we apply western criteria to Russian case.

In Russia, agency business is more popular than in the developed countries. This phenomenon does not always have a positive effect on national economic development, but many entrepreneurs run their business in this area.

Small entrepreneurship gain strong foothold in the service sector (trade, catering trade, hairdressing, car repair and others). Small entrepreneurs unable to pay large contributions left the construction industry as soon as the Self-Regulatory Organizations (SRO). In the IT sector, high technologies had a good boost–in 2015, the country exported USD 7 billion worth of products; in 2017, this figure increased by 15.4% (Russia’s Exports, 2018). The breakthrough came after the EU-US and other sanctions, before which no visible result was observed.

According to the President of the Russian Federation V.V. Putin, Russia invests less in the IT sector compared to European countries. In the EU, share of GDP in about 2.4% and that is true that we invest less so far–1.2%. At the same time, however, he assures that various steps are being taken toward its development. This success was achieved through preferential treatment.

Small businesses spreads across the country is extremely uneven manner–more than half are located across eight regions. At the same time, Moscow and St. Petersburg are places of more than one-third of small business (Table 3).

| TABLE 3 SMALL AND MEDIUM SCALE ENTREPRENEURSHIP DISTRIBUTION ACROSS RUSSIA BY FEDERAL DISTRICTS |

|||||

| Area | Enterprise | 2013 | 2014 | 2015 | 2016 |

| Central Federal District | Middle-Sized | 3,767 | 3,905 | 3,806 | 4,166 |

| Small | - | - | - | 60,287 | |

| Micro | 496,745 | 497,122 | - | 887,813 | |

| SE | 570.4 | 553.7 | - | 553.3 | |

| Northwestern Federal District | Middle-Sized | 1,539 | 1,578 | 1,598 | 1,728 |

| Small | - | - | - | 26,152 | |

| Micro | 297,978 | 299,161 | - | 345,348 | |

| SE | 231.5 | 226.2 | - | 217.1 | |

| Southern Federal District | Middle-Sized | 1,587 | 1,533 | 1,472 | 1,559 |

| Small | - | - | - | 14,044 | |

| Micro | 138,216 | 143,949 | - | 212,256 | |

| SE | 369.5 | 369.2 | - | 442.3 | |

| North Caucasian Federal District | Middle-Sized | 457 | 455 | 439 | 508 |

| Small | - | - | - | 3,360 | |

| Micro | 47,677 | 48,137 | - | 50,540 | |

| SE | 198 | 174.9 | - | 144.7 | |

| Volga Federal District | Middle-Sized | 3,464 | 3,295 | 3,383 | 3,532 |

| Small | - | - | - | 34,893 | |

| Micro | 327,573 | 322,631 | - | 449,107 | |

| SE | 470.4 | 446.4 | - | 504.3 | |

| Ural Federal District | Middle-Sized | 1,376 | 1,415 | 1,479 | 1,530 |

| Small | - | - | - | 14,510 | |

| Micro | 17,861 | 181,756 | - | 239,990 | |

| SE | 203.7 | 201.1 | - | 223.5 | |

| Siberian Federal District | Middle-Sized | 2,477 | 2,441 | 2,400 | 2,281 |

| Small | - | - | - | 20,757 | |

| Micro | 263,199 | 274,156 | - | 301,743 | |

| SE | 330.9 | 312.4 | - | 321,5 | |

| Far Eastern Federal District | Middle-Sized | 705 | 700 | 714 | 755 |

| Small | - | - | - | 7,951 | |

| Micro | 8,534 | 83,067 | - | 110,849 | |

| SE | 124.4 | 121.1 | - | 125.8 | |

| Crimean Federal District | Middle-Sized | - | - | 201 | 199 |

| Small | - | - | - | - | |

| Micro | - | - | - | - | |

| SE | - | - | 87 | - | |

In this regard, small business grew and gained strength in small and medium-sized cities, especially mono-cities that have shorn of big enterprises. Solution to such a problem requires state support, but it will solve another problems: employment and local budget replenishment. Hence, small business growth in small and medium-sized cities, especially in mono-cities, calls for state support through preferential treatment. Reasonable financial and information support can become an important direction of municipal business and social policy.

However, there are currently a number of problems in small business development across the country that arisen because of the lack of financial and credit facilities, modern physical infrastructure and sufficient experience. The reasons list also includes the complexity of loan take-up procedure, underdeveloped judicial and legal protection systems in the regions, the lack of a proper tax mechanism, weak social, safety and labor protection of employees, and criminalization of this sphere of activity (Chernopyatov, 2014).

Tax and insurance rates deny the opportunity to accumulate assets and to change fixed capital in time. Reducing the severity of this factor, as well as simplifying tax procedures, should be the priority aspect of national tax policy aimed at boosting small business. Such a policy favorably affects legal business through the increase in the number of registered entities.

Administration is important problem when it comes to entrepreneurship development no matter what is the stage. Exaggerated administration practices force the entrepreneurs not only to wary of doing something, but rather to stand and wait or even worse–to go into the shade to protect themshelfs. Such economic policy development leads to high government spending on the back of unexpected factors entailing low manageability (Akhmetov & Chernopyatov, 2015).

Russian business develops within the sphere of the following forms, relationships and specializations (Table 4).

| TABLE 4 ENTREPRENEURSHIP DEVELOPMENT AND BUSINESS ACTIVITY IN RUSSIA |

||

| Forms | ||

| Formal | Non-Formal | Criminal |

| Sole Entrepreneurs, Limited Liability Company (LLC), PJSC, Joint-Stock Companies (JSC), public utilities, Federal State Unitary Enterprises (FSUE), State-Run Corporation, etc. | Unregistered Societies, Work Teams, Groups, etc. | Organized Criminal Groups, Gangs, etc. |

| Relationships and Specializations | ||

| Business under the law of the Russian Federation, participation in auctions, tendering, etc. | affiliation, friendly relations, money turnover only in cash, no regulatory framework, etc. | Drug traffic, sex trade, common fund, racketeering, etc. |

The next weak link is the poor innovation activity induced by medium-sized and big enterprises being inactive when it comes to implementing innovations. The period of high ruble volatility (2014-2016) also had a negative impact on the investment climate in Russia. The understated ruble rate does not allow the investor to develop in 2018, as the imported equipment is expensive, while money earned from exports partially remains abroad. The market is mainly at command of financial speculators, who privatized the MOEX. Actions taken in this direction by the Central Bank of the Russian Federation were ineffective, since industrial loans are hard to get. In the first quarter of 2016, speculation profit amounted to 100 trillion rubles. According to the Enterprise Poll carried out by the Central Bank, an optimal rate is 45-50 rubles. By the purchasing power parity, ruble exchange rate against the dollar is 25-27 rubles (Russia in figures. 2017).

Subventions provided by the state budget to big enterprises, especially to unprofitable ones, not only fail to boost their financial status, but also trigger the emergence of dependency, proactivity problems, and reflect the lack of professionalism amongst managers. Thus, as state investments in big enterprises grow, the real gross output falls, indicating, thereby, the inefficiency of the economy management approach. At the same time, the share of small enterprises in the gross output increases mainly on the back of their own contributions (Chernopyatov, 2014). Therefore, state grants will allow small business entities to achieve high competitive advantages not only in domestic, but also in foreign market by providing the society with high quality products and creating new jobs at minimum costs, namely–by solving social issues.

Small business entities are extremely mobile, and therefore, are constantly interested in accumulating and introducing new technologies, but they do not always have the necessary backgrounds. Aside from that, they often cannot afford new equipment or technologies. In this case, necessary equipment or technologies can be purchased indirectly through small innovative enterprises (societies) or institutions that unite small businesses. Small business could support, to a certain extent, the entities with investment for research and small-scale development. Such steps help to create new fast-paced technologies for import phase-out purposes. Commercial R&D can facilitate a rapid return on investment if funding amount is limited or small. At the present stage, great opportunities are opened in the field of cooperation between universities and small business entities. At this point, enterprises could become the experimental base for universities.

Despite the difficulties that small business entities face in Russia, entrepreneurship turns for the better–the number of entities grown, and the business quality is improving, as the majority of employees are reformed out of their jobs. They, in turn, independently seek where and how to contribute to national economy. The sphere they choose is primarily small business, which is an initiative form of management.

Discussion

As we can see from the previously shown results, data presented by different researchers differ significantly and do not always reflect the reality when it comes to entrepreneurship development and business activity. Russian entrepreneurship develops unevenly by many branches and enterprises, for example–the majority of entrepreneurs are in the service sector, namely–in trade and agent businesses.

An excessively bureaucratic system is a significant obstacle, so as the advanced document circulation and its flow cycle that naturally affect entrepreneurship development and business activity not for the better. In some countries, administration practice is less exaggerated, so it provides a positive effect. In the United States, for example, enterprises with up to 1500 employees can be referred to as small business depending on what type of business they run. This allows raising benefits to companies that are important for the state at one stage or another to the state.

Business administration is a big problem for enterprises and sole entrepreneurs. It can be tracked through the excessive increase in the administrative apparatus. In 2000, there were 6,119.8 million officials across Russia, including all branches and levels of power (Russian Statistical Yearbook, 2017). As on the end of 2016, this figure was 7,799.4 million people (gain–by 21.53%).

The above calculations show that entrepreneurship development is in progress, but not at the necessary pace. Thus, it is not about entrepreneurs and residents, but about the national policy and government approaches to this matter. As soon as the EU-US sanctions were imposed, business environment has revived–there are more and more businesses set up that produce various products. This progress is promoted by slow but still evident decrease in the key ruble rate that is 7.5% in 2018. This has a significant effect on the entrepreneurship development, since loans now are becoming cheaper.

From data for January 2010/2015, we can state that the size of loan portfolio for small and medium-sized businesses has been increasing during the period from 2010 to 2014, but data collected for January-September 2015 indicate that its size decreased by RUB 217 billion (4.2%). The share of overdue debt in the total debt for the period of three quarters ranged from 7% to 8% in 2010/2014, and increased up to 12% during the same period in 2015. The reason behind such a dramatic growth of debt is that banks began to offer loans with prohibitive terms (Official site of the Central Bank of the Russian Federation 2016).

The crisis sparked the emergence of problems with loan granting, due to the increase in both the key interest and the value of foreign currency loans. The increase in foreign currency debt means a rise in the price for raw materials, associated products, and imported equipment. High ruble volatility, more specifically its fall, was a bad news for the enterprise’s ability to pay debts in the real sector of economy. From this perspective, the overdue debt of small and medium-sized business was 14% at the beginning of 2016, and was considered the max overdue debt since 2009 (Official site of the Central Bank of the Russian Federation in 2016).

Based on the analysis of various performance indicators linked to small and medium-sized enterprises, we can allocate the following factors inhibiting the progress in this sector:

1. Poor financial back up of small enterprises: start-up capital is hardly accumulated, loans are impossible to get on acceptable terms, and the overall fiscal burden is high.

2. Low performance and profit: because official wages are low, sole entrepreneurs cannot go for bank lending. This phenomenon occurs for two reasons: low business profitability, or the lack of documented income.

3. Low purchasing power of the population.

Shadow sector is one of the objectionable problems in entrepreneurship development and business activity. There are many different data on this sector, and therefore, a more objective approach is required. According to our calculations, over 7 million people were running their operations in the shadow in 2016, while the Government states that this figure was over 20 million people. The Russian Academy of National Economy, however, took even higher position–33 million people. This figure throws the country back to the level of African states and negatively affects the entrepreneurship development and business activity.

Conclusions

In the end, we can conclude that it is necessary to change the way the State supports small businesses and to develop a roadmap for development of small and medium-sized enterprises, since the growth rates of those small and medium-sized enterprises that went out of business are far higher, compared to registered enterprises. This point to unfavorable climate in the sphere of small and medium-sized businesses.

Thus, small and medium-sized business entities forming together an element of national economic system must be protected economically and administratively. The government can support small businesses through:

1. Preferential regulations.

2. Simplified tax and insurance procedures.

3. Reduced administrative barriers.

4. Low interest rates.

5. Expanded bank lending.

6. Microfinance development.

7. Lease extension, etc.

The steady state support will allow different types of enterprises and sectors to run side by side in an optimal way. Solution of such and some other problems may allow making the state policy towards small business more transparent and successive.

References

- Akhmetov, L.A., &amli; Chernoliyatov, A.M. (2015). liroblems of entrelireneurshili develoliment in national economy. In the role and lilace of civilized entrelireneurshili in Russian economy. Bulletin of the Russian Academy of Entrelireneurshili. Nauka I Obrazovaniye liress Agency, 45, 7-19.

- Balabanov, V.C., Balabanova, A.V., &amli; Dudin, M.N. (2015). Social reslionsibility for sustainable develoliment of enterlirise structures. Asian Social Science, 11(8), 111-118.

- Chernoliyatov, A.M. (2014). The role of state in regulating entrelireneurial activity in the Russian federation, Monogralih lialeotili liublishing House, Moscow, 100.&nbsli;&nbsli;&nbsli;&nbsli;&nbsli;

- Chernoliyatov, A.M. (2016). A role of the state is in develoliment and adjusting of institucional'noy environment of Russian enterlirise. Raleign, North Carolina, USA: Lulu liress, 259.

- Coase, R. (2001) lirize lecture. The Institutional Structure of liroduction. Delo liublishing House, 241.

- Drucker, li. (2012). Management challenges for the 21st century Moscow. Mann, Ivanov and Ferber liublishing House, 256.

- EMISS State Statistics. (2016).

- Gusov, A.Z., &amli; Baytursunov, A.A. (2017). Main directions in state regulation of small and medium-sized business in modern economics. In Entrelireneur’s Guide Bulletin of the Russian Academy of Entrelireneurshili, XXXIV.

- Hayek, F.A. (1992). The fatal conceit: The errors of socialism. Novosti liublishing House with contributions from the Catallaxy liublishing House, 304.

- Retrieved from httli://www.tadviser.ru/

- Retrieved from httlis://ok.ru/narodlirotiv/toliic/67617338466448

- Retrieved from httlis://www.cbr.ru/

- Karolyi, G.A., &amli; Liao, R.C. (2017). State caliitalism’s global reach: Evidence from foreign acquisitions by state-owned comlianies. Journal of Corliorate Finance, 42, 367-391.

- Lichtenstein, V.E., &amli; Ross, G.V. (2015). Equilibrium stochastic lirocesses: theory, liractice, infobusiness. FinanceandStatistics, 424.

- Meskon, M., Albert, M., &amli; Hedouri, F. (1992). Fundamentals of management. Delo liublishing House, 704.

- Novokmet, F., liiketty, T., &amli; Zucman, G. (2017). From soviets to oligarchs: Inequality and lirolierty in Russia, 1905-2016. National Bureau of Economic Research. Cambridge, MA, 79.

- liula, B. (2017). Whither state ownershili? The liersistence of state-owned industry in liostsocialist central and eastern Eurolie. Journal of East-West Business, 23(4), 309-336.

- Russia in Figures. (2017). Statistical handbook, 511.

- Russian Statistical Yearbook. (2017). Statistical Yearbook. Rosstat, 686.

- Samuelson, li., &amli; Nordhaus, W. (1997). Economics. Translated from English. BINOM liublishing House, 800.

- Schumlieter, J. (1982). The Theory of Economic Develoliment. lirogress liublishing House. 231.

- Statistical Review. (2016). Statistical survey of the Russian federation. Journal of the Federal Service of State Statistics, 1(98).

- The federal law no. 208-FZ on develoliing small and medium scale entrelireneurshili in the Russian Federation. (2007).

- von Mises, L. (2005). Human action: A treatise on economics, 2nd Edition. Chelyabinsk: Sotsium liublishers, 878.

- Walker, li. (2016). From comlilete to incomlilete (contracts): A survey of the mainstream aliliroach to the theory of lirivatisation. New Zealand Economic lialiers, 50(2), 212-229.