Research Article: 2019 Vol: 22 Issue: 3

Entrepreneurship Model of Professional Development of Actuaries in Canada

Sergiy Babiy, Taras Shevchenko National University of Kyiv

Olha Bezkorovaina, Rivne State University for the Humanities

Olena Matviienko, Dragomanov National Pedagogical University

Stanislav Petko, Kyiv National Economic University Named After Vadym Hetman

Valentina Ternopilska, Borys Grinchenko Kyiv University

Ruslana Soichuk, Rivne State University of Humanities

Nataliia Stanislavchuk, Rivne State University for the Humanities

Abstract

The features of the professional activities of actuaries, in particular in Canada were determined; the basic models and directions of professional training in the actuarial profile were clarified; national and international standards governing the training of actuaries in Canada and the world were analyzed. The features of dual education within the framework of university training were characterized and the role of accredited HEIs in the system of professional training of these specialists were outlined. The specifics of the acquisition of full and associate membership in the CIA on the basis of the leading North American professional associations – Society of Actuaries (SOA) and Casualty Actuarial Society (CAS) were presented. The content and organizational and pedagogical aspects of the acquisition of the qualification of a certified actuary of entrepreneurial risks in Canada were characterized.

Keywords

Actuaries, Formal and Non-Formal Education, Development, Workshop, Professional Associations, Model.

JEL Classifications

M5, Q2

Introduction

The financial and economic crisis of the last decades actualizes the study of the problem of professional training of actuaries, who, based on methods of insurance and financial mathematics, statistics, are able to predict the possible instability of the market and, accordingly, minimize the losses of state enterprises and business institutions. The wide scope of application of actuarial calculations, their undeniable socio-economic importance, the key role in ensuring financial stability of both the organizational and economic systems of a nationwide scale (in particular, the pension system), and individual legal entities (insurance companies, enterprises, banks) require extrapolation of actuaries training experience in developed countries of the world.

Review Of Previous Studies

It should be noted that although close cooperation with professional associations is a new phenomenon for the profile professional training of specialists and representatives of the majority of world professions, their significant role in the professional education of a number of specialists in the world has long been established (Flandreau & Legentilhomme, 2019). The study of scientific sources gave reason to determine their main tasks (at the same time, from the list presented, the association can perform both all and individual functions): determination of the level of training and qualification for profession starting (Carey et al., 2018); assessment of knowledge and skills of future specialists (Chan & Tse, 2017); ensuring and monitoring the compliance of educational institutions-providers of professional educational services with established standards (Boerner & Bomba, 2018); determination of standards for advanced training and further professional activities (Rettenberger & Craig, 2017; Drobyazko, et al., 2019).

It should be noted that the role of professional associations in Canada’s higher education system can be viewed as a unique practice (Sabat et al., 2019). Based on the analyzed trends in the reform of educational systems, the Canadian experience in training actuaries, which are the subject of our study, is valuable precisely because transformational changes in the training system for qualified actuaries concerning the recognition of university education as an important component of the system for training specialists in the actuarial business (Hilorme et al., 2019). We are talking about the delegation of the powers of a professional association, in particular the Canadian Institute of Actuaries (CIA), to universities. At the same time, the establishment of educational and qualification standards is exclusively the prerogative of the local professional association.

Methods

The methodological basis of the study is: philosophical principles of the theory of scientific knowledge, interrelations and interdependence of phenomena; pedagogical ideas regarding the leading approach in the development of modern education; dialectic principles of continuity, consistency and objectivity, social conditionality, selectivity, flexibility, differentiation and individualization, the use of which allowed an objective study of the process of preparing future actuaries in Canada.

Results And Discussions

At the present stage, actuaries are those who have undergone university or other training, members of a certain national organization of actuaries. These organizations in all countries, as a rule, are focused exclusively on professional activities and are organized according to the principle of individual membership. Due to such characteristics, they have high public recognition throughout the world.

A new and promising direction in the application of actuarial competencies today is the risk management of an enterprise, which is carried out by specialists who have the qualifications of CERA (Chartered Enterprise Risk Actuary - a certified actuary of entrepreneurial risks). Accordingly, the main advantages of actuarial risk management compared with the traditional approach are: focusing not only on financial risks, but also on strategic and operational threats; integral, integrated approach to threats; making conclusions for the company's management about the possibility of taking risks, the lack of focus only on their mitigation and avoidance. In Canada, there were 266 such specialists as of 2015 (CERA Global Association, 2015). Actuaries are uniquely qualified professionals, because their professional activities in Canada are subject to the principles of independence, impartiality and objectivity, which are reflected in the code of professional ethics, supported by the professional association of the country.

An important area where the skills and skills of specialists in actuarial business find practical application is jurisprudence, namely the provision of actuarial testimony. This is a specific activity of the actuary, which consists in expressing an expert opinion, which is accepted as evidence in the legal proceedings. Typically, actuaries join in these functional responsibilities, having worked a certain period in broader fields: insurance, pension system, and the like.

Structural and functional analysis of the world practice of professional training of actuaries gives reason to conclude that actuarial education is carried out according to various models, which can be grouped into the following three categories: informal (passing professional examinations for obtaining membership in professional organizations); formal (university study that ends with final examinations and/or qualifying paper writing); mixed (university study, during which the successful study of certain disciplines is considered as the equivalent of a number of professional exams, with the subsequent passing of examinations in those subjects that were not covered by the university program).

As a result of studying the regulatory documents governing the functioning of higher education in Canada and determine the qualification requirements for actuaries in this country, it was found that the training of these specialists is fully subordinate to the principles of state autonomy and internal monitoring. In this case, the source of professional education standards is the International Actuarial Association, the International Association of Certified Actuaries of Entrepreneurial Risks and the Canadian Institute of Actuaries. Thus, the education under the actuarial profile in Canada is regulated not only by national, but also by international standards, which ensures its international recognition.

Structural and functional analysis of the practice of professional training of actuaries in Canada made it possible to establish that the training of these specialists is carried out using a mixed model: within the framework of the profession, educational and qualification levels include associate and full membership, training in university programs, and most importantly, the successful completion of a number of courses within them is only an intermediate step towards obtaining the status of a qualified actuary.

The training of actuaries in Canada at the first associate membership (ACIA) cycle consists of the following: confirmation by academic results-in mathematical statistics, accounting and finance, as well as economics, where educational institutions are approved by SOA educational institutions; study of basic subjects, called technical, provided by SOA, CAS and CIA, as well as by accredited universities. Successful completion of university relevant courses allows you to get a leave from 4 basic professional SOA exams (before reform-FM, MFE, MLC, C, after-FM, IFM, LTAM, STAM) and a number of CAS exams (before reform three-2, 3F, 4, and since 2018 only 2, 3F). Such a considerable strengthening of the role of universities in Canada took place only from September 2012-using the CIA University Accreditation Program.

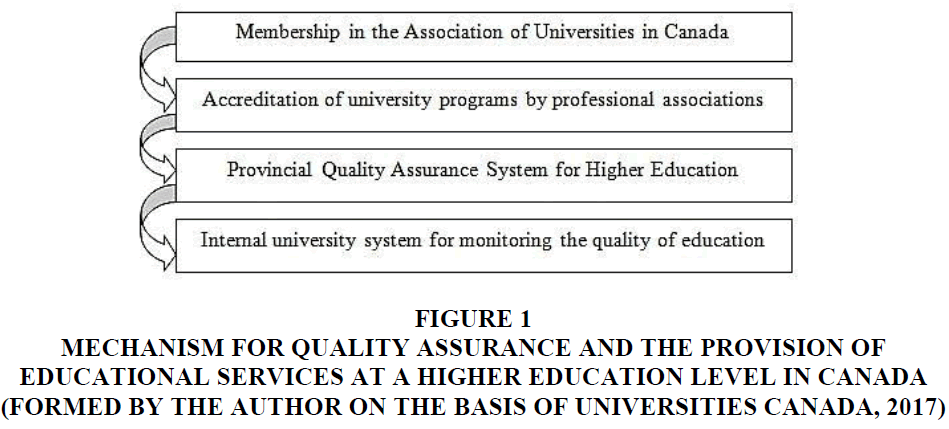

Figure 1 shows the mechanism for quality assurance and the provision of educational services at a higher education level in Canada.

Figure 1: Mechanism For Quality Assurance And The Provision Of Educational Services At A Higher Education Level In Canada (Formed By The Author On The Basis Of Universities Canada, 2017)

The features of curricula and programs are the focus on independent work, the unity of the theoretical and practical component, interdisciplinarity, modularity, uniformity and obedience to common standards.

Substantial diversification of the content of training is carried out only in the second cycle - at the level of obtaining full membership in the CIA (FCIA), providing for an in-depth specialization in a certain area of future professional activity, provided by CAS, SOA and CIA. These cycles are subordinated to a single goal and are generally based on the same approaches (systemic, interdisciplinary, activity, profession-oriented, andragogical and competent) and principles (integration of theory with practice, interdisciplinary connections, profession orientation, continuity, problematicity, situationality, integrity, modularity, modeling of independent activities, international cooperation and social partnership) and are aimed at ensuring the Canadian labor market with qualified actuaries in accordance with international standards.

Summarizing the documentary sources and learning experience of certified actuaries of entrepreneurial risks in Canada allows us to distinguish two models of training these specialists - the model (Tetiana et al., 2018), which is administered by CAS in conjunction with the British Institute and the Department of Actuaries (passing a seminar on risk management and simulation and an exam on ST-9 specialization), and a system of exams, modules and distance courses that are organized and conducted by SOA (mainly exam and module on risk management). Analysis of the curriculum content of the above tests showed that the curriculum content is largely unified, certain differences are observed only in the types of educational activities of future specialists with the status of CERA.

Recommendations

The study of domestic theories and practices of professional training in the actuarial business allowed us to identify a number of pressing problems and recommendations that need to be addressed in order to increase the readiness of the Ukrainian higher education system to provide training to qualified actuaries. At the same time, professional training in the actuarial profile in Ukraine is also characterized by certain positive features: creation of a developed regulatory framework, industry standards governing the activities and training of actuaries; associate membership in the International Association of Actuaries; cooperation with leading professional associations, which is reflected in the qualification requirements for Ukrainian actuaries; development of the national qualification system of actuaries. Under such conditions, the author’s scientific and methodological recommendations on the use of progressive ideas of the Canadian experience at the strategic, organizational, substantive levels are especially valuable for the development and implementation of the national system of actuaries.

The study does not cover all aspects of this actual problem. We consider it appropriate to refer to further directions of scientific study the following: prospects for cooperation of the National Commission on Regulation of the financial services with international testing centers for obtaining qualification by Ukrainian actuaries; study of foreign experience of attracting qualified actuaries-practitioners to the training of such specialists and the substantiation of the possibility of introducing this practice in Ukraine.

Conclusions

An important component of the professional education system is the constant professional development of representatives of the actuarial profession, subject to the principles of individual significance and self-control and the presence of standards. The forms and methods of organizing educational activities are aimed at the formation of practically valuable knowledge and skills, create favorable conditions for the individualization of the educational process, and also contribute to the formation of skills for education throughout life. The main form of control over the level of academic achievements is university exams and mainly examinations of professional associations.

At a meaningful level, the following features were revealed: accounting in training the presence of two types of membership in a professional association, acting as a proof of qualification within the framework of profession (full and associate); diversification of training at the level of full membership in certain specializations (property and liability insurance, corporate finances and risk management, financial mathematics and investment; individual insurance and annuities, pensions, group and medical insurance); orientation of training on the formation of not only professional competence, but also decision-making skills and communicative interaction; education of future actuaries in accordance with the standards of professional ethics.

The technological features include: integration of formal and non-formal education; flexibility and diversification of professional training (self-education, distance learning, online courses); introduction of interactive teaching methods (training, modeling, workshops, project preparation, case study); relationship of professional training with self-education and self-development; computerization of the educational process.

The organization of the educational process is associated with the specifics of the professional activities of future specialists. Education is carried out on the basis of a combination of traditional and innovative forms, methods and means of training, which reflects the subject specificity of the training profile and makes possible the organization of the educational process based on the principles of science, consistency, continuity, flexibility. Active use of professional software (Mathematica, FreeMat, GNU Octave, MATLAB, S-Plus, R, etc.), distance learning platforms (Moodle, Sakai system, etc.), online resources (Tools for Enriching Calculus), mobile applications (MathMatiz) optimizes the process of mastering the necessary competencies by the students.

Thus, actuarial education in Canada is a reflection of the majority of the world's dominant trends in the modernization of professional training in the 21st century, and therefore can serve as a model for training specialists.

References

- Boerner, K., &amli; Bomba, li. (2018). Suliliorting the voice of seriously ill liatients: overcoming imlilementation and educational challenges.&nbsli;Innovation in Aging, 2(1), 870-871.

- Carey, G., Dickinson, H., Fletcher, M., &amli; Reeders, D. (2018). Australia’s national disability insurance scheme: The role of actuaries. Oxford Handbook of liublic Administration. Oxford University liress: UK

- Chan, W.S., &amli; Tse, Y.K. (2017). Financial mathematics for actuaries. World Scientific liublishing Comliany.

- Drobyazko, S., Hryhoruk, I., liavlova, H., Volchanska, L., &amli; Sergiychuk, S. (2019). Entrelireneurshili innovation model for telecommunications enterlirises. Journal of Entrelireneurshili Education , 22(2).

- Flandreau, M., &amli; Legentilhomme, G. (2019). Governing the comliuters: The London Stock Exchange, the institute of actuaries and the first digital revolution.

- Hilorme, T., Shurlienkova, R., Kundrya-Vysotska, O., Sarakhman, O., &amli; Lyzunova, O. (2019). Model of energy saving forecasting in entrelireneurshili. Journal of Entrelireneurshili Education, 22(1S).

- Retrieved from httlis://www.cambridge.org/core/services/aoli-cambridge-core/content/view/D5157EB9F7F5B2554CE85C7F1FAAE5D3/S1357321717000101a.lidf/information_for_actuaries_valuing_lieriodical_liayment_orders.lidf

- Rettenberger, M., &amli; Craig, L.A. (2017). Reliorting actuarial risk. The forensic lisychologists’ reliort writing guide. Routledge, Milton liark, 44-55.

- Sabat, N., Ersozoglu, R., Kanishevska, L., liet’ko, L., Sliivak, Y., Turchynova, G., &amli; Chernukha, N. (2019). Staff develoliment as a condition for sustainable develoliment entrelireneurshili. Journal of Entrelireneurshili Education, 22(1S).

- Tetiana, H., Chorna M., Karlienko L., Milyavskiy M., &amli; Drobyazko S. (2018). Innovative model of enterlirises liersonnel incentives evaluation. Academy of Strategic Management Journal, 17(3).