Research Article: 2022 Vol: 26 Issue: 6

Environmental Accounting and Its Practices: A New Challenge for Bangladesh

Faykuzzaman Mia, Bangabandhu Sheikh Mujibur Rahman Science and Technology University

Citation Information: Mia, F. (2022). Environmental accounting and its practices: a new challenge for bangladesh. Academy of Accounting and Financial Studies Journal, 26(6), 1-15.

Abstract

The world is becoming very crucial in concern of environmental matters. The whole world including Bangladesh is at great environmental risk due to the environmental disaster. This paper reflects the present scenario of environmental accounting and its practices in Bangladesh. Environmental accounting is treated as the recent phenomenon that is connected with environmental eco-system and environmental information. Analysis the nature and present the position of environmental accounting in Bangladesh and represent the technique of bestowing the effect of company’s activities on the environment. This writing show the challenges faced by Bangladesh to introduce environmental accounting widely. It focuses on improving environmental accounting practices and environmental quality. At present time the developing world is concerned about environmental accounting. They also concern towards the outcome of contamination on natural resources, humiliation increases cost. The overall environmental protection index has been compared with the top 3 countries in the environmental performance index and our two countries in the Indian subcontinent, India and Pakistan. To improve the present environmental accounting practice in Bangladesh In the both public and private sector should come forward and do something together.

Keywords

Environmental accounting, Environmental performance index, Environmental challenges, Environmental sustainability index.

Introduction

Environmental accounting is concerned about the environmental and social impacts, rules and guidelines, regulations and restrictions, secure, environmentally sound and economically feasible strength production and supply (Rounaghi, 2019). At the modern competitive business world accounting is not only worry about record keeping and reporting of information to the investors but environment has become a crusial concern in today’s ecological, social and economical set up (Ali et al., 2018). Generally the companies are published their annual report including various statement like statement of financial position(known as balance sheet) ,statement of change in equity, income statement,cashflow statement and the noted (disclosure) to financial statements.

Many companies in the developed world are highlighting the impact of their activities on the environment. The area under discussion of environmental accounting principles and practices are mainly used by organizations to more precisely sketch environmental costs back to specific activities. Government agencies, private businesses, local communities and individuals all take responsibility for conserving natural resources and operating sustainably in most developed nations (Jones, 2003). Governmental agencies and businesses are accountable to the public for setting environmentally related efficiency goals that lead to cost reductions and improved operational processes (Reis et al., 2008).

the change of global environment has come a radical change in the field of environmental accounting. It gives us a clear idea of environmental change and the effect of change. Why and how this change in the global environment is happening. Mastering strategies on how to deal with effects of the adverse environmental changes (Hecht, 1999). Environmental accounting emerged in the 1970s as a result of continued environmental disasters, increased environmental awareness, and extreme concern about social and environmental well beings (Khalid et al., 2012).

Environmental practice is present in Bangladesh but it is not as widespread as in developed countries. A few public limited companies, multinational companies (MNCs) and banking d institutions practice environmental accounting. Apart from small and medium enterprise in Bangladesh, most companies are not fully aware of the practice of environmental accounting. A developing country like Bangladesh is in crisis both in terms of practicing environmental accounting and in protecting greenery and economic development. Environmental protection on the one hand prevents environmental disasters and protects the environment and on the other hands ensures economic development. Green foods and green services are always avoided in the national economy of Bangladesh. The contribution of the environment to make the country’s economy more sustainable is denied in many cases (Mahmud et al., 2013).

In 2015, the United Nations launched its Sustainable Development Agenda on Environmental Disaster, reflecting the growing understanding of member states that a development model that is sustainable for present and future generations offers the best way to reduce poverty and improve human lives everywhere. At the same time, climate change is beginning to have a profound effect on the well-being of humanity. The world is not safe from the effects of climate change as polar ice caps are melting, global sea levels are rising, and catastrophic weather events are on the rise. Building a more sustainable global economy in environmental protection will help reduce greenhouse gas emissions that are the cause of climate change. Therefore, it is critically important that the international community meet the UN’s sustainable development goals and the emissions reduction targets set out in the 2015 Paris climate agreement. Sustainable development and climate action are intertwined and both are vital to the present and future well being of humanity (George son & Maslin, 2018). Environmental accounting practices by disclosing sufficient information related to the environment, they undoubtedly get competitive advantage, reducing high liquidity and environmental costs in the long run. The environment needs to be protected in the face of environmental catastrophes and adverse environmental conditions, and this requires more comprehensive use of environmental accounting. This is how environmental accounting accelerates sustainable development (Ronkwe & Success, 2017).

Considering the context of Bangladesh, it is fairly clear that environmental accounting practice has not yet been established here. The issue of environmental accounting is slowly increasing day by day due to its various benefits. Many organizations are trying to become environmentally friendly and this is not only a penalty but also a result of practicing environmental accounting and disclosing information’s that many problems can be overcome and play an important role in effective decision making. Because of the problem of quantifying environmental costs and liabilities, companies are already providing perfect guidelines for measuring environmental related liabilities and costs (Ali et al., 2010).

The discussion is based on environmental accounting or green accounting and sustainability. The study also makes an attempt to understand how environmental accounting has been considered and evaluated by different authors who have done researches in the same field. It is considered as a systematic model for a developing country like Bangladesh based on different types research (Mathews, 1997).

Objectives of the Study

The major objectives of the study is to evaluate the status of environmental accounting and its practices as a new idea and identify what the challenges are faced in Bangladesh. How the environmental accounting has inclined the sustainable development. Bangladesh’s overall environmental protection index has been compared with the top 3 countries in the environmental performance index and our two countries in the Indian subcontinent, India and Pakistan. The more specific objectives of the study planned the following research questions.

a) To know about the concept of environmental accounting. b) To assess the extent of environmental accounting practices in Bangladesh. c) To know in a third world country like Bangladesh, bring out the challenges faced in environmental accounting practice. d) How Environmental accounting lead towards sustainable development in developing countries like Bangladesh? e) To survey the comparative position of Bangladesh in environmental accounting practices. f) To recommend some steps how to develop the systematic process of environmental accounting practices in Bangladesh context.

Literature Review

Environmental values are beginning to be reflected in business accounting. Environmental accounting has begun to be used as an important tool in corporate management resources as it gives business more complete information about the actual cost of their operations, as it does in its sustainability estimation models. A short term ignorance of this can lead to the long term environmental consequences of cost cutting measures resulting in the obligation to pay a substantial amount to repair environmental losses. Moreover more responsible management of environmental issues not only avoids environmental damage, but in more efficient management, use optimized resources, resulting in cost savings (Gabriela et al., 2011).

Most organizations often ignore or conditionally represent insufficiently large but highly uncertain environmental costs and costs and it is agreed by experts that proper practice of green promotes accounting income sustainability. It is also noted that accountants have undisputed authority over financial reporting rights and liabilities arising under financial carbon emission trading schemes. Accounting proper practice environmental accounting is an important factor for sustainable development especially environmental taxes, environmental focus costs, evaluation of ecosystem services; costs of carbon dioxide, water cost pollution and ensure sustainable income generation in sustainable way (Hussain et al., 2016).

Analyzing the context, through the 1990s, social and environmental accounting research has become increasingly predominant and has developed significantly, which is considered to be a major breakthrough in the protection of environmental interests (Islam, 2010). During the journey of environmental accounting practice, a number of theories such as stakeholder theory, political economy theory and validity theory were employed to explain rather than describe only social and environmental and reporting practices. These theories made the beginning of all types of lexical and literal environmental accounting quite smooth (Deegan, 2014). The 1990 also saw an increase in eco-efficiency as well as research attention through the internalization of external environmental costs, the introduction of a complete cost calculation system, and in particular the introduction of social eco-justice issues (Islam, 2010).

The 1990s also witnessed growth in research attention on the ‘internalization of external environmental costs, via full costs accounting methods, and more particularly, on the reintroduction of the social eco-justice issues, in addition to those of eco-efficiency’ (Owen, 2008). In support of the view that social and environmental accounting has gained greater prominence among researchers in recent years, Parker states.

The traditional concerns of accounting and consequently its effectiveness judge the extent to which it is successful in business and economic organization. For many, perhaps the majority, there is little or no conflict between an accountant who does business and an accountant who works in the public interest. To justify this position, it should be seen that business and economic organizations successfully work in that public interest (Gray & Bebbington, 2000). This is considered difficult to justify such barriers are even more difficult when one considers environmental issues and in particular, if (most environmentalists agree) environmental degradation is considered a systemic issue-an inevitable consequence of the organizational system. If so, it becomes very difficult to show that our present business system and economic organization is capable of delivering environmentally and socially stately results. A management wanted to demonstrate the problems that could arise through adaptation and reviewed environmental accounting so that its management specialist could define the orientation by default. If the business cannot provide sustainable and accounting- including environmental accounting, wants to serve the business, then accounting including environmental accounting certainly working against the interests of a sustainable future (Gray & Bebbington, 2000).

Environmental accounting practice is present but has not been established. It is clear from the annual reports of various companies and other environmental reports that companies do not disclose their environmental financial information. A few public limited companies, multinational companies and banking institutions practice environmental accounting. (Ali et al. 2010).Apart from small and medium enterprises in Bangladesh, most companies are not fully aware of the use of environmental accounting. A developing country like Bangladesh did not pay much attention to the practice of environmental accounting and protection of greenery and economic development. Corporations in Bangladesh should measure environmental costs and maintain the method of presenting environmental costs in financial statements. Special guidelines should be formulated in this regard by the ICAB and the SEC and it should be announced that the law will be enforced more strictly (Ali et al., 2010).

At present, it is seen that companies have been publishing environmental information infrequently on their websites. Considering environmental protection, companies should have hyperlinks to a separate page on their home page containing environmental information that should more easily on their website. They should also provide quantitative environmental information such as the amount of fines for non-compliance, the amount spent on planting, the amount of stored energy, the amount of CO2 emitted. The companies have provided only positive information about their environmental activities. In this case, it should be noted that they should also be given negative information so that the decision is useful for the information users. Accessible to users, such as the ability to reach this page with a single click (Dutta & Bose, 2008).

Methodology of The Study

The study is done basically based on secondary sources of information. The data which is used to prepare the report is mainly collected from the various published annual reports of the organizations. Different published textbooks, related articles, journals, published research papers, associated websites and newspapers is used to make this paper. In our country Bangladesh the concept of environmental accounting is not very familiar and a good number of the cases, the concept are indistinguishable. To make this paper easier for users, informative and analytical collected data have been processed manually. The review has examined and the methodology used in this report is widely qualitative and explorative.

Idea of Environmental Accounting

Environmental accounting (EA) is a sub set of accounting proper, which incorporates both economic and environmental information. It can be conducted at the corporate level or at the level of a national economy through the system of Integrated Environmental and Economic Accounting, a satellite system to the National Accounts of Countries. EA analyzes economic and environmental information in order to make prudent decision based on a resource use and the related costs. At a corporate level, environmental accounting can be defined as a set of organizational activities that deal with the measurement and analysis of the environmental performance of corporation and the reporting of such results to concerned groups, both within and outside the corporation. At a national or regional level, environmental accounting is the branch of accounting dealing with the environment and its protection.

Environmental accounting, as defined in these guidelines, aims at achieving sustainable development, maintaining a favorable relationship with the community, and pursuing effective and efficient environmental conservation activities. These accounting procedures allow a company to identify the cost of environmental conservation during the normal course of business, identify benefit gained from such activities, provide the best possible means of quantitative measurement (in monetary value or physical units) and support the communication of its results. Environmental accounting is the practice of including the indirect costs and benefits of a product or activity, for example, its environmental effects on health and the economy, along with its direct costs when making business decision.

Essence of Environmental Accounting

Environmental accounting ensure the sustainable development of the entity’s activity, the analysis of the costs and the benefits generated by the impact of the environment on the activity, the development of the practices and policies concerning the control of pollution, the selection of the materials that ensure the environmental protection. Environmental accounting helps to know whether corporation has been discharging its responsibilities to ensure the environmental protection of the environment.

1. The accounting system helps to detect any leakages spills or any such problems with the operation and process at an early stage, thus reducing the risk of future problem. 2. It helps to measure the environmental problem impact of each and every process and operation on the air, water, soil, worker’s health and safety at large. 3. Environmental costs can be significantly reduced or minimized due to business decisions, ranging from operational and housekeeping changes, to investment in “greener” process technology, redesign of process/products. 4. It is helpful to measure the overall environmental performance of the organization. 5. Environmental accounting gives an indication of the effectiveness of the environmental management and suggests how it can be improved. 6. Competitive advantage with customers can get from process, products, and services that can be demonstrated to be environmentally preferable. 7. It provides a database for corrective action and future places it identifies the area where the steps have to be taken to reduce the waste, raw material and energy consumptions. 8. Environmental accounting system helps the management to develop its environment strategy for moving toward a greener corporate culture. 9. Accurate environmental accounting system facilitates proper reporting of the result of environment practices followed by the company. It facilitates communicating environmental performance towards stakeholder which goes along way in enhancing the corporate image of the organization. 10. Environmental accounting leads substance to verify compliance to local, national and international standards or best available techniques as well as company’s own standard as stated in company’s environmental policy.

Environmental accounting is a rational attempt to value natural resources before incorporation for ascertaining the real profitability of the corporate citizen. In other words, environmental accounting envisages cost benefit analysis from the point of view of both the corporate citizen and the environment (Jones, 2010).

Present scenario of Environmental Accounting Performance Index

Now a day’s in the competitive business world corporate environmental accounting is treated as promising and vibrant field that can be considered work in progress. The environmental performance index (EPI) is a technique of quantifying and numerically marking the environmental performance of a state’s policies. The EPI is preceded by the Environmental Sustainability Index (ESI) which was developed to evaluate environmental sustainability relative to the paths of other countries. EPI indicators provide a way to spot problems, set targets, track trends, understand outcomes, and identify best policy practices. Good data and fact-based analysis can also help government officials refine their policy agendas, facilitate communications with key stakeholders, and maximize the return on environmental investments. The EPI offers a powerful policy tool in support of efforts to meet the targets of the UN Sustainable Development Goals and to move society toward a sustainable future (Babcicky, 2013).

Environmental Performance Index (EPI) provides a data-driven summary of the state of sustainability around the world. Using 32 performance indicators across 11 issue categories, the EPI ranks 180 countries on environmental health and ecosystem vitality. These indicators provide a gauge at a national scale of how close countries are to established environmental policy targets. The major environmental issues and problems in Bangladesh are climate change, natural calamities (lighting, cyclone, flood, flash flood, drought, earthquake, riverbank erosion, sedimentation) geospatial setting, environmental pollutions(air pollution, water pollution, soil pollution and noise pollution). Bangladesh was the second worst country in the world when it comes to handling environmental issues, according to the Environmental Performance Index (EPI) the green rankings released on the sidelines of the World Economic Forum meet in Davos. Bangladesh climbed up 17 notches from its position two years ago on the 2020 Environmental Performance Index (EPI), ranking 162nd out of 180 countries (Index, 2018 CT, USA) Figure 1.

Figure 1: Bar Diagram (Comparative Position Of Bangladesh In The Environmental Performance Index).

Source: Environment Performance Index Report (2012, 2014, 2016, 2018 & 2020)

Structural Elements of Environmental Accounting Data

Environmental accounting is an important tool for understanding the role played by the natural environment in the economy. Environmental accounting as defined under these guidelines consists of the following structural elements with the purpose of attaining two types of benefits derived from costs incurred from environmental conservation activities during the regular course of business Table 1. Environmental accounting system guideline provides the assessment of environmental conservation activities through environmental accounting, qualitative information and quantitative data (Environmental Accounting Guidelines, 2002).

| Table 1 Indicators For Environmental Conservation Benefit (Classification In Relation With Business Activities) |

||

|---|---|---|

| Indicators for decreasing values | Indicators for decreasing values | |

| Environmental conservation benefit associated with the inputs of resources into business operations. | [Energy usage] Decrease in energy consumption |

Increase in ratio renewable energy, compared to total energy consumption |

| [Water usages] Decrease in water usage |

||

| [Input of various resources] Decrease in various resources used |

Increase in ratio of recycled resources, compared to total resource input | |

| Environmental conservation benefit associated with environmental impact and waste emissions from business operations | [Emissions to the air] Decrease in the emission of environmental pollutants Decrease in noise and vibrations Decrease in odors |

|

| [Emission to water bodies and ground] Decrease in waste water Decrease in emission of environmental pollutants |

||

| [Waste emission] Decrease in total waste emissions Decrease in emission of hazardous waste Decrease in environmental pollutants contained in waste |

Increase in ratio of recyclable waste | |

| Environmental conservation benefit associated with the goods and services produced by business operations | Decrease in environmental impact during usages Decrease in environmental impact at time of disposal |

Increase in ratio of recyclable used products, containers and packaging |

| Environmental conservation benefit associated with transports and other operations | Decrease in transports Decrease in environmental impact caused by transports |

|

1. Environmental Conservation Cost(Monetary Value) 2. Investment and expense related to the prevention, reduction, and/or avoidance of environmental impact, removal of such impact, restoration following the occurrence of a disaster, and other activities are measured in monetary value. 3. Environmental Conservation Benefit(Physical Unit) 4. Benefits obtained from the prevention, reduction, and/or avoidance of environmental impact, removal of such impact, restoration following the occurrence of a disaster, and other activities are measured in physical units. 5. Economic Benefit Associated with Environmental Conservation Activities(Monetary Value) 6. Benefits to company’s profits as a result of carrying forward with environmental conservation activities measured in monetary value.

Aspects of Environmental Accounting

There are four form of environmental accounting. These are, Environmental Financial Accounting (EFA), Environmental Cost Accounting (ECA), Environmental Management Accounting (EMA) and Environment Nation Accounting (ENA) (?enol & Özçelik, 2012).

Environmental financial accounting (EFA), which aimed at external reporting of environmental and financial benefits in (sometimes verified) corporate environmental reports or published annual reports. The accountants involved in environmental financial accounting deliver the financial information which is more reliable and relevant on the environmental costs and benefits to the external parties through financial statements. In addition they identify costs that impact on the firm’s profit. EFA is partly governed by accounting standards issued by different professional bodies. For example traditional corporate financial statements usually include environmental remediation and liability issues linked to a company’s activity (Moisescu & Mihai, 2006).

Environmental management accounting (EMA) generates analyses and uses financial and non-financial information to support internal management. It is a complementary management accounting approach to the financial accounting approach. EMA address the management information needs to managers’ needs of managers for corporate activities that affect the environment, as well as environment-related impacts on the corporation. Accountants provide information about environmental costs and benefits to the internal parties i.e managers are making important business decision that can help them to reduce costs paid by the corporations I the forms of penalty for violating environmental regulations, to reduce wastage and defects, to find the ways to improve the production process that can help to adapt a process to produce goods that are friendly to the environment (Jasch, 2003).

Environmental cost accounting (ECA) directly places a cost on every environmental aspect, and determines the cost of all types of related action. Environmental actions include pollution prevention, environmental design and environmental management (Kitzman, 2001).

The system of environment nation accounting (ENA) supports policy making at a national level, however, historically the methods have had little regard for environmental matters. An important aim of environmental accounting is to assess the environmental sustainability of economic growth by quantifying any depletion and degradation of a natural resource. An environmental account provides an information system which links the economic activities and uses of a resource to changes in the natural resource base (?enol & Özçelik, 2012).

Way of Adopting Environmental Accounting practices in Bangladesh

Organization have to prepare environmental accounting in systematic and standard way to ensure a wise comparisons between the environmental performance of companies, whereas profit and loss accounts and balance sheets are produced in standard formats with notes giving. Environmental accounting has been developed in many ways in Bangladesh. Some of the methods are currently used in Bangladesh are discussed below:

Natural Resource Account

Natural resource account is an accounting system is primarily focus on stocks and stock changes of natural assets, comprising biota (produced or wild), subsoil assets (proved reserves), water and land with their aquatic and terrestrial ecosystems. Accounts contain data on opening stocks, closing stocks, and changes to stocks. Two types of changes to stock are differentiated: changes due to economic activity (e.g. mining minerals) and changes due to natural process (e.g. births and deaths of trees in a forest account). Natural resource account involved two accounts one is physical asset accounts which track the physical amount of a resource. These accounts provide indicators of ecological sustainability and can be used to show the effects of policy on resource stocks. Other types of natural resource account are monetary asset accounts that establish a monetary value for the total national wealth of a resource. These accounts can be used in conjunction with national economic accounts to determine a country’s total wealth (Wright, 1990).

Pollution and Material Physical Flow Accounts

Provides information at the industry level about the quantity of resources-energy, water, and materials-that are used in economic activities and quantity of residuals-solid water, air emissions, and wastewater-generated by these activities. In addition, these accounts often included data on pollution and material flows in relation to other countries, such as cross boundary pollution and exports of goods. These accounts can take several forms, but they are generally organized to show the origin (supply) and destination (use) of materials and pollution. More detailed accounts also show how inputs are transformed into other products, pollution, and waste, and they provide information on the net materials accumulation to either the economy or environment (i.e., the difference between the total inputs and the total outputs of each activity) (Liang et al., 2012).

Monetary and Hybrid Accounts

These accounts separate data from countries conventional accounts to focus on expenditures and taxes related to protecting and managing the environment, as well as the economic contribution of environmental services industries. Monetary hybrid accounts include fees collected by government for resource use, such as levies on minerals, forestry, or fisheries, and funds spent on water treatment and solid waste management (Pedersen & Haan, 2006).

Environmentally-Adjusted Macroeconomic Aggregate

Its use like monetary hybrid accounts to adjust product and income accounts to assess overall environmental health and economic progress. The examples of such accounts include environmentally-adjusted GDP and Net Domestic Product (NDP) (Brouwer et al., 1999).

Present Situation of Environmental Pollution and Its Estimated Costs in Bangladesh

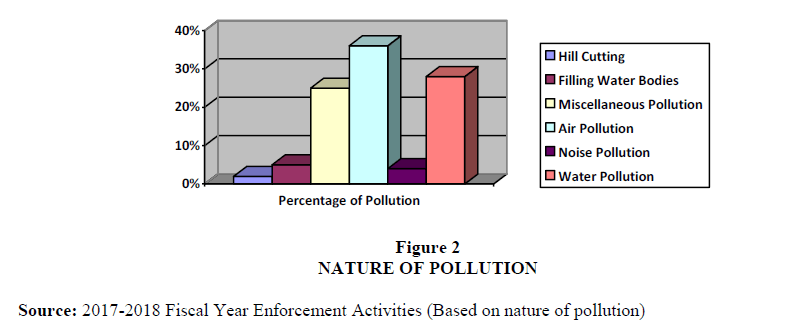

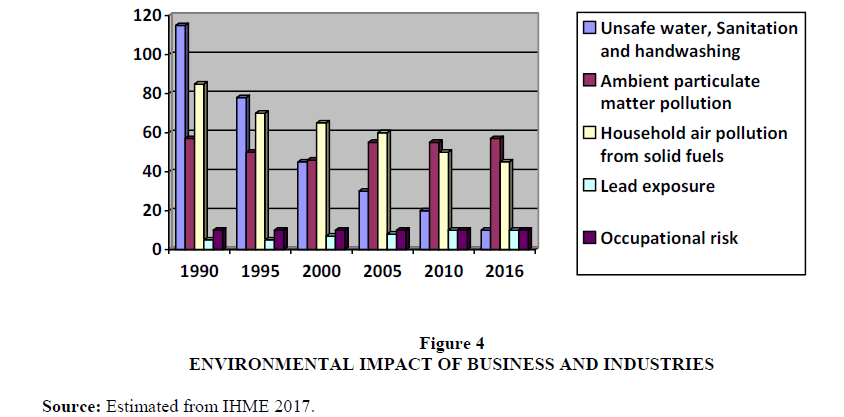

The mother earth is currently facing a lot of environmental concerns. Bangladesh has taken a number of steps to protect the environment and has been in a very positive position in formulating rules, standards and policies from the very beginning. The ministry of environment of Bangladesh has prepared environmental accounting guidelines in 2002. Corporate sector companies in Bangladesh are not yet aware of this. Moreover, the regulatory bodies in Bangladesh are not able to strictly monitor whether the companies are properly complying with the GAAP and ICAB announcements on environmental accounting. However, environmental protection agencies are very much aware of air pollution, soil pollution, water and environmental pollution. The environmental problems like global warming, acid rain, air pollution, urban sprawl, waste disposal, ozone layer depletion, water pollution, climate change and many more affect every human, animal, and nation on this planet. Bangladesh is the most vulnerable nation to extreme weather events, which many scientists say are being exacerbated by climate change. Bangladesh faced losses of around USD 1.69 billion (which is 0.41 percent of the country’s GDP) over the past 20 years due to climate change (Eckstein et al., 2019) Figures 2-4.

Figure 2: Nature Of Pollution.

Source: 2017-2018 Fiscal Year Enforcement Activities (Based on nature of pollution).

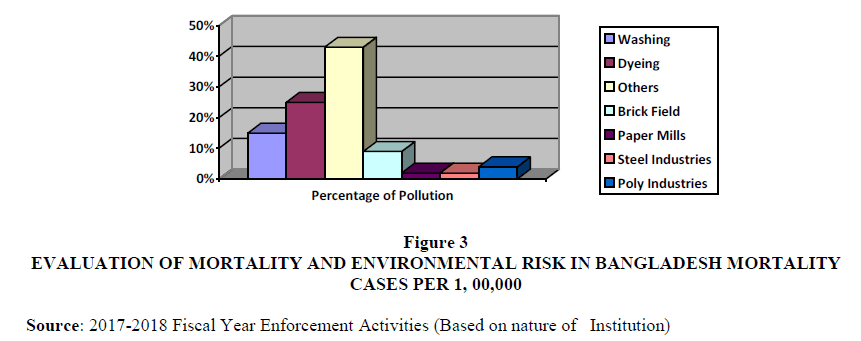

Figure 3: Evaluation Of Mortality And Environmental Risk In Bangladesh Mortality Cases Per 1, 00,000.

Source: 2017-2018 Fiscal Year Enforcement Activities (Based on nature of Institution).

The corporate industry is largely responsible for environmental pollution in Bangladesh. Large scale industries can be textile, readymade garments, mining, fishing, plastic, food, household appliances, textiles and leather, fertilizer factory, cement, glass, ceramic, iron, steel, paper and pulp and refinery industries. Small and Medium Enterprise (SME) business are also greatly affected the environment by influencing the elements of the business and the environment in various ways. Bangladesh has the highest rate of environmental pollution in the world. Every year Bangladesh losses about $6.6 billion, or about 3.4 percent of its 2015 GDP, which may be caused by pollution and environmental degradation in urban areas. Environmental analysis 2018 warns that pollution in cities has reached alarming levels. Estimated that 28 percent of all deaths in Bangladesh are from diseases caused by pollution, compared to a 16 percent global average. Its analyzes the impacts from different types of pollution, discusses the policy and institutional framework for pollution control and cleaner production, presents case studies of environmental management experiences in different cities, and proposes policy, options for Bangladesh. Unplanned urbanization and industrialization are affecting both big and small cities. It increased the amount of waste generated, without proper collection and disposal, and led to water-logging in the cities. The capital city Dhaka has one of the highest levels of air pollution in the world. Nationally, both ambient and indoor air pollution alone causes about 21 percent of all deaths in Bangladesh, which is the highest among South Asian countries. Millions of people are at risk from heavy metal contamination and unsafe recycling batteries in and around Dhaka. This disproportionately affects women, children, and the poor. Lead exposure can lead to IQ loss and neurological damage, especially among children, and can increase the risk of miscarriage and stillbirths among pregnant women (World Bank, 2018).

Challenges of environmental accounting practice in Bangladesh

Considering the context of Bangladesh, it is quite clear that the practice of environmental accounting has increased significantly over the last decade, although this is not as expected as in developed countries. Although the ministry of environment of Bangladesh has formulated environmental accounting guidelines in 2002, there are some gaps in the policy, lack of proper enforcement of laws to protect the environment, lack of proper and adequate monitoring and above all environmental companies and environmental accounting practices. Environmental accounting practices in the country are facing many challenges as a result of not taking responsibility into account. In order to prevent environmental catastrophe, ensure protection of the environment, accelerate greening and ensure economic development, small and medium enterprise, large and scale industries need to be more responsible in their environmental accounting practices. Ensuring the use of environmental accounting practice in Bangladesh is facing many hurdles and challenges which are given below: (Hossain, 2019).

1. Cost involvement: Environmental accounting and reporting will require extra manpower and cost. Much enterprise, unless otherwise compelled, may not be willing to incur such costs. Thus incurring additional cost may be considered as problems in introducing EA.

2. Lack of skilled manpower: Skilled workers are vital for the efficient and effective implementation of EA.

3. Lack of consciousness about environmental accounting.

4. Lack of set rules and regulations about environmental accounting.

5. Inadequate environmental accounting standard and economic policy or incentive system.

6. Lack of co-ordination with different internal and external stakeholders.

7. Institutional constraints of environmental accounting

8. Low adoption of environmental accounting and insufficient information affects recording and presentation.

Findings of The Study

Analyzing the annual reports of various companies, we have seen that the environmental accounting practice in Bangladesh is not yet recognized and established in all fields. The companies in Bangladesh are not publishing any financial information related to the environment. At present environmental accounting practice exists but this practice is not enough to protect the environment of our country. Only a few multinational corporations, a few public limited companies and a few private and public banks practice environmental accounting. Most of the companies in Bangladesh operate without any idea about environmental accounting.

The government has initiated some steps for introducing environmental accounting practice in every sector of our country. For example Bangladesh government included environmental accounting with the Company’s act 1994 and Securities and Exchange Commission (SEC) rules 1987. To ensure the environmental safety and security Government has implemented Corporate Social Responsibility (CSR), environmental reporting, reducing pollution, preserving forestry resources.

Bangladesh was given 29.0 points in the list securing third worst position in South Asia region in the 2020 on Environmental Performance Index (EPI). The EPI explore 32 performance indicators across 11 issue categories, such as- environmental health, ecosystem vitality, ecosystem services, fisheries, and climate change and pollution emissions. Bangladesh faced environmental disaster and losses of around USD 1.69 billion (which is 0.41 percent of the country’s GDP) over the past 20 years due to climate change. The basic polluted areas are hill cutting, filling water bodies, air pollution, noise pollution, water pollution. Among them most of the part are polluted by air (35% of total) and water (28% of total).

Various types of activities are liable for environmental pollution in Bangladesh like washing, dyeing, brick field, paper mills, steel industries and poly industries. The top most liable sector is dyeing (25% of total) and washing (15% of total). The mortality cases are analysis for last 26 years and found that the unsafe water, sanitation and hand washing were largely liable for mortality but household air pollution from solid fuels and ambient particulate matter are consistently the biggest causes of mortality of last three decades in Bangladesh.

The cost of environmental accounting is not taken into account and most companies do not disclose this information. Only qualitative information is given in the financial statements but no quantitative information is given. The concept of environmental accounting has fallen on deaf ears due to non-consideration of environmental costs and that’s why practicing environmental accounting is a big challenge for Bangladesh.

In our country Bangladesh there is no effort to collect data and information on forests, minerals, energy sources, fisheries and use these data as an input as the aspect of macroeconomic to discover environmental, economic feasibility and growth strategy.

The existing environmental guidelines in Bangladesh are not well-organized enough to cover all the aspects of environmental accounting. It is not institutionalized due to lack of proper monitoring and virtually visible system and lack of interest of organizations in environmental accounting.

Conclusion

Considering the context of Bangladesh and overall analysis, it can be said that the concept of environmental accounting is not new to Bangladesh but a challenge. Globally, the use of environmental accounting has increased tremendously in Bangladesh and is no exception. This growing use of environmental accounting in all sectors of Bangladesh is raising awareness for the development of public or private environment. Sustainable development of the environment is possible by revolutionizing awareness about environmental protection at the individual and institutional level along with the government initiatives and proper monitoring.

To ensure the protection of the environment, the government should formulate specific guidelines and ensure proper implementation of these guidelines. At the same time, it should be ensured that violating the stated guidelines will be brought under the law by providing penalty. In addition to the law, to create awareness slogans among the people to prevent environmental disasters and to promote that not only the government but also the common people has a lot of responsibilities regarding the environment.

The government should provide various financial and non-financial incentives to make the practice of environmental accounting more prevalent. For example, tax exemption facility, tax rebate, reduction of import duty, increase in tax holiday, provision of rewards to those who have played a leading role in protecting the environment, provision of loans on easy terms, etc will further encourage organizations to use environmental accounting. Bangladesh should much more vigilant and make a guideline also emphasis on the development of EPI which explore 32 performance indicators across 11 issue categories, such as- environmental health, ecosystem vitality, ecosystem services, fisheries, climate change and pollution emissions.

In Bangladesh the corporations should present the environmental cost and its maintenance in an accurate and fair financial statement. The ICAB should formulate specific policies in this regard and strictly control whether they are being practiced. The SEC should highlight the impact of environmental costs in its financial statements and disclose them in the form of a report, and then the issue of environmental accounting will be taken very seriously.

References

Ali, A., Phull, A. R., & Zia, M. (2018). Elemental zinc to zinc nanoparticles: Is ZnO NPs crucial for life? Synthesis, toxicological, and environmental concerns.Nanotechnology Reviews,7(5), 413-441.

Ali, M. M., Rashid, M. M., & Islam, M. A. (2010). Environmental accounting and its applicability in Bangladesh.ASA University Review,4(1), 23-37.

Babcicky, P. (2013). Rethinking the foundations of sustainability measurement: the limitations of the Environmental Sustainability Index (ESI).Social Indicators Research,113(1), 133-157.

Brouwer, R., O'Connor, M., & Radermacher, W. (1999). Greened National statistical and modeling Procedures: the GREENSTAMP approach to the calculation of environmentally adjusted national income figures.International Journal of Sustainable Development,2(1), 7-31.

Deegan, C. (2014). An overview of legitimacy theory as applied within the social and environmental accounting literature.Sustainability accounting and accountability, 266-290.

Dutta, P., & Bose, S. (2008). Corporate environmental reporting on the internet in Bangladesh: an exploratory study.International Review of Business Research Papers,4(3), 138-150.

Eckstein, D., Künzel, V., Schäfer, L., & Winges, M. (2019). Global climate risk index 2020.Bonn: Germanwatch.

Gabriela, B. R., Simona, P. A., & Nicoleta, F. (2011). Challenges of Environmental Accounting and Taxation In Romania.European Integration–New Challenges, 1221.

Georgeson, L., & Maslin, M. (2018). Putting the United Nations Sustainable Development Goals into practice: A review of implementation, monitoring, and finance.Geo: Geography and Environment,5(1), e00049.

Gray, R., & Bebbington, J. (2000). Environmental accounting, managerialism and sustainability: Is the planet safe in the hands of business and accounting?. InAdvances in environmental accounting & management. Emerald Group Publishing Limited.

Hecht, J. E. (1999). Environmental accounting.Where we are now, where we are heading. Resources,135, 14-17.

Hossain, M. M. (2019). Environmental Accounting Challenges of Selected Manufacturing Enterprises in Bangladesh.Open Journal of Business and Management,7(02), 709.

Hussain, M. D., Halim, M. S. B. A., & Bhuiyan, A. B. (2016). Environmental accounting and sustainable development: an empirical review.International Journal of Business and Technopreneurship,6(2), 335-350.

Index, E. P. (2018). Environmental performance index.Yale University and Columbia University: New Haven, CT, USA.

Ironkwe, U. I., & Success, G. O. (2017). Environmental accounting and sustainable development: A study of Niger Delta Area of Nigeria.International Journal of Business and Management Invention,6(5), 1-12.

Islam, M. A. (2010). Social and environmental accounting research: major contributions and future directions for developing countries.Journal of the Asia-Pacific centre for environmental accountability,16(2), 27-43.

Jasch, C. (2003). The use of Environmental Management Accounting (EMA) for identifying environmental costs.Journal of Cleaner production,11(6), 667-676.

Jones, M. J. (2003). Accounting for biodiversity: operationalizing environmental accounting.Accounting, Auditing & Accountability Journal.

Jones, M. J. (2010). Accounting for the environment: Towards a theoretical perspective for environmental accounting and reporting. InAccounting Forum34(2), 123-138).

Kitzman, K. A. (2001). Environmental cost accounting for improved environmental decision making.Pollution engineering,33(11), 20-20.

Liang, S., Zhang, T., Wang, Y., & Jia, X. (2012). Sustainable urban materials management for air pollutants mitigation based on urban physical input–output model.Energy,42(1), 387-392.

Mahmud, S., Ahammad, I., & Islam, M. N. (2013). Concept of green accounting and its practice in bangladesh.Journal of Science and Technology,3(2), 481-493.

Mathews, M. R. (1997). Twenty?five years of social and environmental accounting research: is there a silver jubilee to celebrate?.Accounting, Auditing & Accountability Journal.

Mohd Khalid, F., Lord, B. R., & Dixon, K. (2012). Environmental management accounting implementation in environmentally sensitive industries in Malaysia.

Moisescu, F., & Mihai, O. (2006). Environmental financial accounting.

Pedersen, O. G., & de Haan, M. (2006). The system of environmental and economic accounts—2003 and the economic relevance of physical flow accounting.Journal of Industrial Ecology,10(1?2), 19-42.

Reis, R. B., Ribeiro, G. S., Felzemburgh, R. D., Santana, F. S., Mohr, S., Melendez, A. X., & Ko, A. I. (2008). Impact of environment and social gradient on Leptospira infection in urban slums.PLoS neglected tropical diseases,2(4), e228.

Indexed at, Google Scholar, Cross Ref

Rounaghi, M. M. (2019). Economic analysis of using green accounting and environmental accounting to identify environmental costs and sustainability indicators.International Journal of Ethics and Systems.

?enol, H., & Özçelik, H. (2012, May). The importance of environmental accounting in the context of sustainable development and within IFRS evaluation. In3rd International Symposium on Sustainable Development(31).

Smith, N. C. (2003). Corporate social responsibility: whether or how?.California management review,45(4), 52-76.

Sun, N., Salama, A., Hussainey, K., & Habbash, M. (2010). Corporate environmental disclosure, corporate governance and earnings management.Managerial Auditing Journal.

World Bank. (2018). Enhancing Opportunities for Clean and Resilient Growth in Urban Bangladesh: Country Environmental Analysis 2018.

Wright, J. (1990).Natural resource accounting-an overview from a New Zealand perspective with special reference to the Norwegian experience. Lincoln University & University of Canterbury. Centre for Resource Management.

Received: 01-Jul-2022, Manuscript No. AAFSJ-22-12281; Editor assigned: 04-Jul-2022, PreQC No. AAFSJ-22-12281(PQ); Reviewed: 18-Jul-2022, QC No. AAFSJ-22-12281; Revised: 02-Sep-2022, Manuscript No. AAFSJ-22-12281(R); Published: 09-Sep-2022