Research Article: 2021 Vol: 25 Issue: 5S

Environmental Management Information Disclosure and Firm Value: A Panel Data Analysis

Mehedi Hasan Tuhin, Sylhet International University

Md. Aminul Islam, Universiti Malaysia Perlis

Munira Sultana, Jagannath University

Mazeda Sultana, Jagannath University

Abu Obida Rahid, CCN University of Science and Technology

Citation: Tuhin, M.H., Islam, M.A., Sultana, M., Sultana, M., & Rahid, A.O. (2021). Environmental management information disclosure and firm value: a panel data analysis. Academy of Accounting and Financial Studies Journal, 25(S5), 1-10.

Abstract

An effort has been made in this paper to identify whether there is any significant impact of environmental management information disclosure in adding value to a firm. This research is carried out on the basis of fifteen randomly selected listed banking institutions’ annual reports covering 2013 to 2017. The selected banks are enlisted under both the Dhaka Stock Exchange and Chittagong Stock Exchange. A disclosure checklist with 10 important categories of environmental management information is utilized to assess the magnitude of environmental management information disclosure. Using panel data regression analysis the finding indicates that the value of a firm is not significantly affected by environmental management information disclosure. This research work adds to the current body of knowledge by supporting the view that environmental management information disclosure alone cannot create firm value from the perspective of a developing country.

Keywords

Environment Management Information Disclosure, Firm Value, Annual Report, Listed Banks, Panel Data.

Introduction

The value of a firm depends not only on its performances but also on its capability to fulfill the demand of various stakeholders such as environment, employee and society (Sharma et al., 1999; Utomo et al., 2020). Careless behavior to the environment by organizations can create negative impact on the environment such as “Global warming, climate change, natural disaster, and water, air, and soil pollutions” (Utomo et al., 2020).

As a result, the demand for environmental information of companies has been increasing day by day all around the world since users of the information become increasingly conscious. Nowadays investors prefer profit maximization along with social and environmental welfare. Bangladesh is observing the bitter effects of global environmental pollution caused by huge carbon emissions and irresponsible industrialization (Redwanuzzaman, 2020). Apart from manufacturing organizations, banks and other financial companies are held indirectly responsible for environmental pollution since they provide fund to major industries (Hossain et al., 2016; Dhar & Chowdhury, 2021). Currently, the situation demands environmental pollution control measures in all industries including the financial industry (Redwanuzzaman, 2020).

Environmental disclosure presents information related to environmental initiatives, policy, strategy and implementation of the firm in the past, present and future (Utomo et al., 2020). An organization can disclose environmental information in various forms, including financial and non-financial statements, annual reports or footnotes (Al-Tuwaijri et al., 2004; Utomo et al., 2020). Realizing the importance of environmental disclosure for banking industry Bangladesh, like many countries, has formulated and issued mandatory guidelines known as ‘green banking disclosure’ (Bose et al., 2018; Khan et al., 2021). Green banking includes “online banking, less paper, mobile banking, green credit cards, green mortgages, environmental friendly projects through lowering interest rates etc.” (Dhar & Chowdhury, 2021).

Environmental disclosure practices in Bangladesh are not satisfactory compare to other countries (Dhar & Chowdhury, 2021). With few exceptions, maximum number of the previous studies concentrated either on disclosure nature and extent or on the determinants of environmental reporting (Sobhani et al., 2009). Moreover, a limited number of studies are based on environmental reporting practices of banking institutions (Dhar & Chowdhury, 2021). The topic ‘economic consequence of environmental reporting’ has been researched by a number of researchers (Montabon et al., 2007; Arafat et al., 2012; Saka & Oshika, 2014; Khan et al., 2021) but no concrete evidence has been found. It is necessary to identify the economic consequence of environmental management information disclosure in banking sector separately since it may help the bank managers to realize the importance of environmental management and thus encourage them to adopt and implement environmental strategy and policy effectively and efficiently. Thus, an effort has been made in this study to identify the possible link between environmental management information disclosure and firm’s value in the context of the banking industry in Bangladesh.

Literature Review

Over the years, numerous researchers have conducted studies to ascertain the impact of environmental reporting on corporate value (For example, Montabon et al., 2007; Arafat et al. 2012; Saka & Oshika, 2014; Plumleea et al., 2015; Chang, 2015; Nor et al., 2016; Qiu et al., 2016; Nor et al., 2016; Chen et al., 2016; Masud et al., 2017; Li et al., 2018; Rakiv et al., 2019; Yang et al., 2020; Dhar & Chowdhury, 2021). Some recent studies related to this particular issue have been discussed below.

Masud et al. (2017) examined the level of environmental disclosure practices by listed banking companies in Bangladesh. The sample consisted of 20 banks listed under the Dhaka Stock Exchange. Analyzing data of sample banks’ annual reports (2010-2014), the findings showed that the sample banks reported considerable amount of environmental details under selected headings in the annual reports and the reporting tendency increased sharply within the study period (from 16 percent in 2010 to 83 percent in 2014).

Rakiv et al. (2019) carried out a study to measure the correlation between environmental reporting and firm’s performance. This study was based on annual reports. The sample included each manufacturing firm listed under Dhaka Stock Exchange. To measure the environmental reporting, an Environmental Accounting Reporting Disclosure Index of 21 major environmental disclosure items was used. On the other hand, Return on Asset was used to measure firm’s profitability. Using descriptive analysis, ANOVA, and regression analysis, the findings show that only 41 of 166 companies disclose environmental information. Moreover, environmental reporting is positively associated with firm’s profitability.

Yang et al. (2020) undertook an empirical study in china to determine interrelation between environmental reporting and firm’s valuation. To accomplish this objective, listed manufacturing firms were taken as sample. The study period covers from 2006 to 2016. The study found that environmental reporting had significant effect on the listed manufacturing firms’ performance.

Gerged et al. (2021) investigated the influence of environmental reporting in case of firm valuation in the Gulf Cooperation Council countries. An un-weighted disclosure checklist of fifty five environmental information items was used to measure environmental disclosure level whereas Tobin's Q was used to proxy economic value. The findings from multivariate analysis support positive impact of environmental reporting on firms’ value. The employment of alternative measures such as ROA, weighted index, individual countries and environmental disclosure sub-indices also ensures the robustness of the main findings.

Hypothesis Development

According to Hope (2003), one particular theory cannot give complete explanation of disclosure phenomenon. Thus, over the years, the researchers use a set of theories like agency theory, legitimacy theory, and stakeholder theory extensively to make clear the motives for environmental disclosure (Jaleel, 2018).

The agency theory states that enhanced reporting practices may reduce the information gap between management and shareholders (Jensen & Meckling, 1976) which in turn can reduce agency cost (Mak, 1991). For example, Huang et al. (2010) founds that increased environmental disclosure reduces the agency costs. Thus, to reduce agency cost and increase firm value a company can report environmental information (Jaleel, 2018).

Legitimacy theory is often used to explain the motive for environmental disclosure (Milne & Patten, 2002; Deegan et al., 2002). The theory claims that through legitimizing its activities a company tries to justify its existence in the society. In accordance with this theory, a firm utilizes information disclosure as a means to improve its communication to society so that it can manage social pressure and also establish itself a good corporate citizen (Guthrie & Parker, 2012). Some prior studies shows that environmental-friendly companies can substantially enhance their legitimacy to the environment by disclosing environmental information (Kuo & Chen, 2013) which can also lead to better financial performance and firm value (Barkemeyer, 2007).

The stakeholder theory states that a firm should be accountable not only to stockholders but also to various stakeholders. An entity should focus on stockholders’ interest as well as other stakeholders’ interest in case of firm value maximization (Utomo et al., 2020). Thus, it is not right for a responsible entity to attain its financial objectives at the cost of environmental pollution (Jensen, 2001). Many researchers have used stakeholder theory to interpret the reasons for making environmental disclosure (Sengupta, 1998). Through environmental reporting a firm can fulfill information demand of different stakeholders and establish its image as an environment responsible entity (Huang & Kung, 2010).

The prior literature shows variety of findings regarding the association between environmental reporting and firm value. While some studies provided the evidence of positive relationship (for example, Montabon et al., 2007; Saka & Oshika, 2014; Plumleea et al., 2015; Chang, 2015; Qiu et al., 2016 and Dhar & Chowdhury, 2021), other studies provided negative relationship (for example, Chen et al., 2016; Li et al., 2018; Mathuva & Kiweu, 2016). In contrast, Arafat et al. (2012) and Nor et al. (2016) have reported no effect of environmental reporting on firm valuation.

On the basis of theoretical foundation and the findings of most of the previous empirical studies it is hypothesized that:

H1: High environmental management information disclosure is associated with high firm value.

Research Methodology

Sample and Data Collection

The sample includes 15 banking companies listed under both the stock exchanges of the country (Dhaka Stock Exchange and Chittagong Stock Exchange).The sample banks are selected randomly. The study period covers five years from 2013 to 2017. The main source of data is secondary source comprising sample banks’ published annual reports. The collected data is balanced panel data in nature and total firm year observation is 75 (15 sample × 5 years).

Construction of Environmental Management Information Disclosure Index

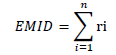

Based on the previous research (for example, Cooke, 1992; Ahmed and Nicholls,1994; Masud et al., 2017; Dhar & Chowdhury, 2021), the unweighted approach has been used in constructing environmental management information disclosure index. In case of unweighted approach all the information items are given equal importance and equal weights. In the present study, ‘1’ is given to a bank for reporting a particular information item anywhere in the annual report, and ‘0’ is given for not reporting that particular information. The formula (Cooke, 1992; Dhar & Chowdhury, 2021) which is employed to calculate total environmental management information disclosure score is as follows:

Where, r = 1, if the item ri is reported

0, if the item ri is not reported

n= number of items

The environmental management information disclosure checklist used in the present study is compiled from Masud et al. (2017) with some modification. The checklist is presented in the Appendix 2.

Measurement of Variables

The study’s dependent variable is firm value and independent variable is environmental management information disclosure. Apart from independent variable, three control variables: size, age and leverage are used in this research. A lot of prior studies often used control variables in the regression model to control dependent variable (for example, Muhammad et al., 2015; Bhuyan, 2018; Dhar & Chowdhury, 2021). Various indicators are used in previous researches to measure these dependent, independent and control variables. Consistent with prior studies, Table 1 provides the measurement of study variables.

| Table 1 Measurement of Variables |

|||

| Variable Name | Variable Nature | Measurement | Source |

|---|---|---|---|

| Firm Value | Dependent | ROA=Net Profit/Total Asset | Gerged et al., 2021; Khan et al., 2021;Dhar & Chowdhury, 2021 |

| Environmental Management Information Disclosure Score (EMIDS) | Independent | EMIDS=1, if disclosed anywhere in the annual report EMIDS=0, if not disclosed anywhere in the annual report |

Dhar & Chowdhury, 2021 |

| Size | Control | Log of Total Assets | Gerged et al., 2021; Khan et al., 2021; Dhar & Chowdhury, 2021 |

| Age | Control | No. of years since foundation | Welbeck et al., 2017 |

| Leverage | Control | Total Debt/Total Shareholders’ Equity | Khan et al., 2021; Dhar & Chowdhury, 2021 |

Source: Compiled by Researchers

Model Specification

The following general regression model is developed to determine the impact of environmental management information disclosure on the firm value:

ROAit = β0 + β1EMIDSit + β2TAit +β3AGEit + β4LEVit +εit

Where,

ROAit = Return of Assets of Bank i at period t

β0 = The intercept

EMIDSit = Environmental Management Information Disclosure Score of Bank i at period t

TAit = Total Assets of Bank i at period t

AGEit = No. of years since establishment of Bank i at period t

LEVit = Debt to equity ratio of Bank i at period t

εit = Error term

In case of panel data, three models are often employed for hypothesis testing: Pooled OLS, Fixed-effect and Random-effect models. Since pooled OLS model has number of limitations such as generating understated standard errors and inefficient regression estimators (Johnston & DiNardo, 1997), it is decided to use either fixed effects or random effects model in the present study.

Based on the Hausman specification test (chi2(4) = 1.83; Prob > chi2=0.7675) it is decided to employ random effects model to test the hypotheses.

Empirical Results

Descriptive Analysis

Table 2 presents descriptive statistics of research variables

| Table 2 Descriptive Statistics |

||||

| Variable | Minimum | Maximum | Mean | Standard Deviation |

|---|---|---|---|---|

| ROA (percentage) | .31 | 2.36 | 1.105 | .4322 |

| EMIDS (ratio) | .40 | 1.00 | .828 | .1351 |

| LogTA (million taka) | 11.54 | 14.25 | 12.277 | .4936 |

| Age (years) | 12 | 40 | 20.533 | 7.4241 |

| LEV (times) | 7.56 | 28.24 | 12.654 | 4.0802 |

Source: Researchers’ calculation based on secondary data

According to Table 2, the mean of ROA is about 1.1%. It also indicates that the mean of EMIDS is .83 and standard deviation is .1351, which indicates that listed banks of Bangladesh are disclosing most of the environmental matters and there is not much variability regarding this practice among sample banks. Age and leverage of listed banks have also broad ranges. Age varies between 12 years to 40 years while leverage ranges from 7.56 to 28.24.

Multiple Regression Analysis

Checking of regression assumptions

The assumptions of Multicollinearity, Homoskedasticity, and Serial Correlation have been tested before running regressions model. The VIF (Variance Inflation Factor) value ranges between 1.13 and 1.97. Since VIF value of all the independent variables are below 10, we can say that the data is free from multicollinearity problem. The results of Breusch-Pagan test (chi2(1) = 0.30; Prob > chi2=0.5845) indicate no heteroscedasticity problem. According to the results of Wooldridge test (F [1, 14] = 13.492; Prob > F=0.0025), the variables in the model are auto correlated.

The above results reveal that all the multiple regression assumptions are not fulfilled. In case of not satisfying the multiple regression assumptions, robust approach can be employed (Draper, 1988 as cited in Cooke, 1998; Das, 2015). Thus, random effect model with robust standard error has been used in the present study.

Hypothesis Testing

Table 3 presents the empirical result of random effect model.

| Table 3 Result of Random Effect Model |

||||

| Variable | Coefficient | Robust Standard Error | z | P-value |

|---|---|---|---|---|

| EMIDS | .248 | .2943 | .84 | .399 |

| LogTA | .141 | .0759 | 1.85 | .064 |

| AGE | -.010 | .0087 | -1.11 | .267 |

| LEV | -.066 | .010 | -6.45 | .000 |

| Wald chi2(4) | 54.73 | |||

| Prob.>chi2 | .0000 | |||

Source: Researchers’ calculation based on secondary data

The above results indicate that the model is significant at p<.01 and environmental management information disclosure score has positive but insignificant association with the firm value. Thus, hypothesis 1 is not supported which implies that environmental management information disclosure does not affect the firm value of a listed bank in Bangladesh. The finding of this study supports the finding of Arafat et al. (2012) who has also found that environmental reporting does not impact firm value significantly. On the contrary, this finding is not similar with the results of Saka & Oshika (2014), Chang (2015), Khlif et al. (2015) and Plumleea et al. (2015), who have found positive effect of environmental disclosure on firm value. The reason might be that environmental disclosure by listed banks has recently flourished in Bangladesh. As a result, it may not have gained much attention from the investors during their investment decision.

Sensitivity Analysis

To ensure robustness of the results, profit margin is used instead of ROA in the original model. Results regarding the robustness check are presented below.

Based on the Hausman specification test (chi2(4) = 34.24; Prob > chi2=0.0000) it is decided to employ fixed effects model to test the hypotheses. Since the VIF values are below 10, we can say that the dataset is free from multicollinearity. The results of Breusch-Pagan test (chi2(1) = 48.90; Prob > chi2=0.0000) indicate that the data suffers from heteroscedasticity problem. According to the results of Wooldridge test (F [1, 14] = 11.278; Prob > F=0.0047), the variables in the model are auto correlated.

The above results indicates that fixed effect model with robust standard error should be used. Table 4 shows the empirical result of fixed effect model.

| Table 4 Results of Fixed Effect Model |

||||

| Variable | Coefficient | Robust Standard Error | t | P-value |

|---|---|---|---|---|

| EMIDS | 1391.739 | 1199.141 | 1.16 | .265 |

| LogTA | 112.841 | 123.201 | .92 | .375 |

| AGE | 226.062 | 106.935 | 2.11 | .053 |

| LEV | -126.486 | 52.432 | -2.45 | .028 |

| F-statistic | 3.61 | |||

| Prob.>F | .0318 | |||

Source: Researchers’ calculation based on secondary data

The above model indicates that the result is consistent with the study’s main finding. Therefore, the result seems to be robust.

Conclusion

The present research has conducted empirical tests to find out whether the value of a firm is affected by the environmental management information disclosure in case of listed banks. The result indicates that environmental management information disclosure does not affect the value of a firm significantly. The study has supported some previous studies’ findings to some extent. More extensive research is required in this context to reach final conclusion.

There are certain limitations to this study. At first, the study concentrates only on the listed commercial banks. Future researchers could replicate this study using samples from non-banking financial organizations to generalize the findings. Secondly, this study uses common accounting-based indicators, namely ROA and profit margin to capture firm value. Future researchers can use both accounting based and market based measures in measuring firm value. Thirdly, the environmental management information checklist of this study is limited to only 10 items as compiled from Masud et al. (2017). More comprehensive index with vast area of environmental disclosure should be used in future studies as to capture environmental disclosure practices effectively and efficiently.

Nevertheless, in spite of some limitations we can say that the findings of this research has provided valuable insights in case of environmental management information disclosure especially in terms of the association between environmental management information disclosure and firm value across Bangladeshi banking companies.

| Appendix 1 List of Sample Banks |

||

| Al-Arafah Islami Bank Ltd. | Eastern Bank Ltd. | Merchantile Bank Ltd. |

| Bank Asia Ltd. | First Security Islami Bank Ltd. | One Bank Ltd. |

| BRAC Bank Ltd. | IFIC Bank Ltd. | Shahjalal Islami Bank Ltd. |

| City Bank Ltd. | Islami Bank Bangladesh Ltd. | Social Islami Bank Ltd. |

| Dutch-Bangla Bank Ltd. | Jamuna Bank Ltd. | Standard Bank Ltd. |

Source: DSE

| Appendix 2 Environmental Management Information Disclosure Items |

|

| Serial No. | Items |

|---|---|

| 1. | Air Pollution and control mechanism |

| 2. | Water Pollution and control mechanism |

| 3. | Water management |

| 4. | Renewable energy |

| 5. | Energy saving |

| 6. | Environmental management policy and strategy |

| 7. | Award and appreciation for environmental management |

| 8. | Green banking initiatives, policy, strategy and implementation |

| 9. | Training on environmental awareness and management |

| 10. | Climate change and global warming |

Source: Compiled from Masud et al., 2017.

References

- Ahmed, K., & Nicholls, D. (1994). The Impact of Non-Financial Company Characteristics on Mandatory Disclosure Compliance in Developing Countries: The Case of Bangladesh. The International Journal of Accounting, 29(1), 62-77.

- Al-Tuwaijri, S.A., Christensen, T.E., & Hughes Ii, K.E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Accounting, Organizations and Society, 29(5-6), 447-471.

- Arafat, M.Y., Warokka, A., & Dewi, S.R. (2012). Does environmental performance really matter? A lesson from the debate of environmental disclosure and firm performance. Journal of Organizational Management Studies, 1.

- Barkemeyer, R. (2007). Legitimacy as a key driver and determinant of CSR in developing countries. Paper for the 2007 Marie Curie Summer School on Earth System Governance, Amsterdam.

- Bhuyan, M.S.S. (2018). Determinants and effects of voluntary disclosure with a focus on corporate governance and firm performance: Evidence from Bangladesh. Master Thesis, University of Wollongong.

- Bose, S., Khan, H.Z., Rashid, A., & Islam, S. (2018). What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pacific Journal of Management, 35(2), 501-527.

- Chang, K. (2015). The impacts of environmental performance and propensity disclosure on financial performance: Empirical evidence from unbalanced panel data of heavy-pollution industries in China. Journal of Industrial Engineering and Management (JIEM), 8(1), 21-36.

- Chen, P.H., Ong, C.F., & Hsu, S.C. (2016). Understanding the relationships between environmental management practices and financial performances of multinational construction firms. Journal of Cleaner Production, 139, 750-760.

- Cooke, T.E. (1992). The impact of size, stock market listing and industry type on disclosure in the annual reports of Japanese listed corporations. Accounting & Business Research, 22(87), 229-237.

- Cooke, T.E. (1998). Regression analysis in accounting disclosure studies. Accounting and Business Research , 28(3), 209-224.

- Das, S. (2015). An investigation of corporate internet reporting in an emerging economy: a case study of Bangladesh (Doctoral dissertation, University of Sunderland).

- Crisóstomo, V.L., Freire, F.D.S., & Vasconcellos, F.C.D. (2011). Corporate social responsibility, firm value and financial performance in Brazil. Social Responsibility Journal, 7(2), 295-309.

- Deegan, C., Rankin, M., & Tobin, J. (2002). An examination of the corporate social and environmental disclosures of BHP from 1983-1997: A test of legitimacy theory. Accounting, Auditing & Accountability Journal, 15(3), 312-343.

- Dhar, S., & Chowdhury, M.A.F. (2021). Impact of Environmental Accounting Reporting Practices on Financial Performance: Evidence From Banking Sector of Bangladesh. International Journal of Asian Business and Information Management (IJABIM), 12(1), 24-42.

- Draper, D. (1988). Rank - Based Robust analysis of Linear Models. Statistical Science , 3(2), 239-257.

- Gerged, A.M., Beddewela, E., & Cowton, C.J. (2021). Is corporate environmental disclosure associated with firm value? A multicountry study of Gulf Cooperation Council firms. Business Strategy and the Environment, 30(1), 185-203.

- Guthrie, J., & Parker, L.D. (2012). Legitimacy theory corporate social reporting: A rebuttal of legitimacy theory. Accounting and Business Research, 19(76), 343-352.

- Hope, O.K. (2003). Disclosure practices, enforcement of accounting standards, and analysts' forecast accuracy: An international study. Journal of Accounting Research, 41(2), 235-272.

- Hossain, D.M., Bir, A.T., Tarique, K.M., & Momen, A. (2016). Disclosure of green banking issues in the annual reports: A study on Bangladeshi banks. Middle East Journal of Business, 11(1), 19–30.

- Huang, C.L., & Kung, F.H. (2010). Drivers of environmental disclosure and stakeholder expectation: Evidence from Taiwan. Journal of Business Ethics, 96(3), 435-451.

- Jaleel, F.A., (2018). Environmental Disclosure And Its Impact On Firm Value And Cost Of Capital: The Case of GCC Listed Chemical And Petro-Chemical Sector [Master's thesis]. Qatar University.

- Jensen, M.C. (2001). Value maximization, stakeholder theory, and the corporate objective function. Journal of Applied Corporate Finance, 14(3), 8-21.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Johnston, J., & DiNardo, J. (1997). Econometric Methods (4th ed.). New York: McGraw-Hill.

- Khan, H.Z., Bose, S., Sheehy, B., & Quazi, A. (2021). Green banking disclosure, firm value and the moderating role of a contextual factor: Evidence from a distinctive regulatory setting. Business Strategy and the Environment.

- Khlif, H., Guidara, A., & Souissi, M. (2015). Corporate social and environmental disclosure and corporate performance. Journal of Accounting in Emerging Economies, 5(1), 51.

- Kuo, L., & Chen, V.Y.J. (2013). Is environmental disclosure an effective strategy on establishment of environmental legitimacy for organization?. Management Decision, 51(7), 1462-1487.

- Li, Y., Gong, M., Zhang, X.Y., & Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. The British Accounting Review, 50(1), 60-75.

- Mak, Y.T. (1991). Corporate characteristics and the voluntary disclosure of forecast information: a study of New Zealand prospectuses. The British Accounting Review, 23(4), 305-327.

- Masud, M.A.K., Bae, S.M., & Kim, J.D. (2017). Analysis of Environmental Accounting and Reporting Practices of Listed Banking Companies in Bangladesh. Sustainability, 9(10), 1–15. doi:10.3390/su9101717

- Mathuva, D.M., & Kiweu, J.M. (2016). Cooperative social and environmental disclosure and financial performance of savings and credit cooperatives in Kenya. Advances in accounting, 35, 197-206.

- Mbekomize, C.J., & Wally-Dima, L. (2013). Social and Environmental Disclosure by Parastatals and Companies Listed on the Botswana Stock Exchange. Journal of Management and Sustainability, 3(3), 66-75.

- Milne, M.J.J., & Patten, D.M. (2002). Securing organizational legitimacy: An experimental decision case examining the impact of environmental disclosures. Accounting, Auditing & Accountability Journal, 15(3), 372-405.

- Montabon, F., Sroufe, R., & Narasimhan, R. (2007). An examination of corporate reporting, environmental management practices and firm performance. Journal of Operations Management, 25(5), 998-1014.

- Muhammad, N., Scrimgeour, F., Reddy, K., & Abidin, S. (2015). The relationship between environmental performance and financial performance in periods of growth and contraction: evidence from Australian publicly listed companies. Journal of Cleaner Production, 102, 324-332.

- Nor, N.M., Bahari, N.A.S., Adnan, N.A., Kamal, S.M.Q.A.S., & Ali, I.M. (2016). The effects of environmental disclosure on financial performance in Malaysia. Procedia Economics and Finance, 35, 117-126.

- Plumlee, M., Brown, D., Hayes, R.M., & Marshall, R.S. (2015). Voluntary environmental disclosure quality and firm value: Further evidence. Journal of Accounting and Public Policy, 34(4), 336-361.

- Qiu, Y., Shaukat, A., & Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1), 102-116.

- Rakiv, M., Islam, F., & Rahman, R. (2016). Environmental Accounting Reporting Disclosure and Company Profitability: A Case Study on Listed Manufacturing Companies of Bangladesh. International Journal of Ethics in Social Sciences, 4(2), 21-30.

- Redwanuzzaman, M. (2000).The Determinants of Green Banking Adoption in Bangladesh: An Environmental Perspective. Business Review, 15(1), 18-26.

- Sengupta, P. (1998). Corporate Disclosure Quality and the Cost of Debt. Accounting Review, 73(4), 459-475.

- Sharma, S., Pablo, A.L., & Vredenburg, H. (1999). Corporate environmental responsiveness strategies: The importance of issue interpretation and organizational context. The Journal of Applied Behavioral Science, 35(1), 87-108.

- Saka, C., & Oshika, T. (2014). Disclosure effects, carbon emissions and corporate value. Sustainability Accounting, Management and Policy Journal, 5(1), 22-45.

- Sobhani, F.A., Amran, A., & Zainuddin, Y. (2009). Revisiting the practices of corporate social and environmental disclosure in Bangladesh. Corporate Social Responsibility and Environmental Management, 16(3), 167-183.

- Utomo, M.N., Rahayu, S., Kaujan, K., & Irwandi, S. A. (2020). Environmental performance, environmental disclosure, and firm value: empirical study of non-financial companies at Indonesia Stock Exchange. Green Finance, 2(1), 100-113.

- Welbeck, E.E., Owusu, G.M.Y., Bekoe, R.A., & Kusi, J.A. (2017). Determinants of environmental disclosures of listed firms in Ghana. International Journal of Corporate Social Responsibility, 2(1), 1-12.

- Yang, Y., Wen, J., & Li, Y. (2020). The impact of environmental information disclosure on the firm value of listed manufacturing firms: Evidence from China. International Journal of Environmental Research and Public Health, 17(3), 916.