Research Article: 2022 Vol: 26 Issue: 1

Environmental Sustainability Disclosure and Firm Performance of Quoted Oil and Gas Companies in Sub-Saharan Africa Countries

Faith E. Onyebuenyi, University Of Nigeria

Grace N. Ofoegbu, University Of Nigeria

Citation Information: Onyebuenyi, F.E., Ofoegbu, G.N. (2022). Environmental sustainability disclosure and firm performance of quoted oil and gas companies in sub-saharan africa countries. Academy of Accounting and Financial Studies Journal, 26(1), 1-18.

Abstract

This study examined the effect of environmental sustainability disclosure on financial performance of listed oil and gas companies in three countries within sub-Sahara Africa: Nigeria, Namibia, and Kenya. Based on descriptive and ex-post facto research design panel data set collected from fifteen (15) oil and gas listed firms in all three countries of interest within a nine (9) year time frame (2011 to 2019) were utilized. Six hypotheses were formulated, using content analyses procedure based on Global Reporting Initiative (GRI) standard to extract required information on environmental sustainability disclosure proxies: Emission and Energy disclosure, Effluent and Waste information disclosure, sustainability compliance policy disclosure, protection expenditure and investment disclosure and grievance policy disclosure been the independent variables of interest. Firm financial performance which is the dependent variable is measured in terms of return on equity, gross profit margin and earnings per share together with a control variable were all included in specifying three econometric models. In this study, we employed Robust Least Square Regression analyses technique to test the stated hypotheses. The model’s goodness of fit as captured by the Fisher statistics and the corresponding significant probability value suggest that the specified models are fit and can be employed for interpretation and policy recommendation. Among the outcomes from the analyses, we find that emission and energy disclosure have significant negative and positive effect on performance measure of return on equity and gross profit after tax margin respectively. Particularly the effect of effluent and hazardous waste disclosure is seen to be statistically significant on performance measure of earnings per share during the period under investigation. Further, we find that biodiversity and water disclosure significantly affect performance measures of return on equity(positively) and gross profit after tax margin(negatively) while the effect of environmental sustainability protection expenditure disclosure is seen to be positive and statistically significant on performance measure of gross profit after tax margin during the period under investigation. Notable among others, we recommend that environmental regulatory agencies complimented by governments prescribed environmental information disclosure standard policies in all three countries of interest should be strengthened. Environmental sustainability disclosure compliance should be made mandatory for listed oil and gas companies and the guidelines for environmental assessment should be established to compel companies to accommodate environmental disclosure. This will go a long way to sustain the positive narratives on financial performance evidenced in this study

Keywords

Environmental Sustainability Disclosure, Financial Performance, Namibia, Nigeria, Kenya & Oil, Gas Firms.

Introduction

Over the years, the assessment of environmental impact and disclosure by companies has become imperative, and this has also taken different dimensions (Ofoegbu et al., 2018). The necessity for environmental assessment disclosure is geared towards providing a sustainable environment that will be conducive for human and corporate organizations to operate efficiently and effectively (Ofoegbu et al., 2018). Environmental accounting has attracted international communities and environmental bodies for its role in increasing transparency and disclosure in corporate reports (Islam, 2010). Environmental accounting is essential and relevant in sustainability reporting because studies reveal that it is a factor that influences the level of firm financial performance (Omer & Andrew, 2014). Through environmental disclosure, firms plan how effectively they have performed; in promoting sustainability, accountability, and transparency (Ajibolade & Uwuigbe, 2013). Several definitions have been proffered for Environmental Accounting. According to the US Environmental Protection Agency (1995), Green Accounting or Environmental Accounting is defined as, Identifying, and measuring the costs of environmental materials and activities and using this information for environmental management decisions. The purpose is to recognize and seek to mitigate the negative environmental effects of activities and systems.

International corporations, especially those in the oil and gas industries, are faced with incidents resulting in calamities affecting the environment, such as oil spillage, oil tankers collusion, fuel tanks explosion, gas flaring and so on (Elajayash et al., 2013). Donwa (2011) asserts that host communities strongly believe that oil companies show high levels of neglect to environmental damages caused by their operations, leading to continuous agitations by those inhabiting the immediate community. This neglect and avoidance of environmental sustainability accountability leaves a wide gap in financial information reporting and breeds incompleteness and correctness of fair view to users of financial information (Ludema et al., 2012). Also, conventional approaches of cost accounting have become inadequate since the practices have ignored important environmental sustainability elements (Iwata & Okada, 2010; Rakos & Antohe, 2014).

In 2010, Africa accounted for 13% of global oil production, with Sub-Saharan Africa, (SSA) (which is the focus of this study), contributing 7.25% accounting for more than half of total oil production (Baumuller et al., 2011). Most of the Sub-Saharan oil production takes place in Nigeria and Angola while other African countries produce on smaller scales or are still in the exploratory phase. Baumuller et al. (2011) stated that the European Union relied on SSA for around 7% of its oil imports, amounting to about 314 million barrels worth $65 billion. However, due to uncontrolled production activities emanating from “leakages” in regulatory framework and weaknesses in environmental sustainability policy implementation, issues related to energy and emissions, effluents and waste, biodiversity and water and other related global warming agents have been documented to pose huge environmental threat (Umoren et al., 2018).

Several studies have examined the effect of environmental sustainability disclosure on firm financial performance but most of these existing studies have been country-specific (e.g. Dibia & Onwuchekwa, (2015); Utile, (2016); Udih (2015), Collectively, these studies show that corporate environmental reporting is necessary for improving firm performance. Extant literature show that most cross-country studies have been conducted within the confine of developed countries.

However, in this study we explore a cross-country perspective where integrated sustainability information reporting is voluntary and big companies (listed) engage in it either to enhance reputation, increase their brand visibility, show their commitment for concern on community, environmental protection, or employee welfare. Extant related studies have focused on differentiating their cross-country sample size with regard to difference in common law and civil law failing to consider the tendency of similarities in laws and reporting framework. As noted by Gatimbu &Wabwire (2016); Utile, (2016), the integration of sustainability programs (environmental sustainability specifically) in the operational strategies of companies in Nigeria, Namibia and Kenya is a new reporting practice but there has been increased adoption among listed firms in all stock exchanges of interest. While some listed companies in Kenya adopted environmental reporting practices in year 2010 (Gatimbu & Wabwire, 2016), in the Nigerian and Namibia context sustainability reporting practices of listed firms began gaining attention in year 2011 (Utile, 2016; Moller, 2016). Furthermore, it is observed that only a handful of scholars employed Global Reporting Initiative (GRI) guidelines (the most adopted frameworks for voluntary reporting worldwide, Brown et al. (2009) as a standard for measuring environmental sustainability information which suggests a huge, short fall in sustainability measurement index among related existing studies. Importantly too, there are few extant related studies that employed market performance proxies in their studies. Instead, accounting performance ratio such as Return on Asset which is a less efficient measurement tool in the event of a take or buy over of the firm have been mostly employed. Hence, this study is set to provide deep investigation into whether environmental sustainability disclosure practices via biodiversity and water disclosure, energy and emission disclosure, effluents and waste disclosure, environmental sustainability compliance policy disclosure, environmental sustainability protection expenditure disclosure, environmental sustainability grievance policy disclosure have significant effect on corporate performance. The rest of this paper is organised as follows. Section 2 provides the conceptual literature, literature review, hypotheses development and theoretical framework. Section 3 discusses the research methodology, and Section 4 displays the results and provide appropriate discussion. Finally, Section 5 deals with the conclusions and limitations as well as directions for future studies.

Literature Review

Environmental Accounting

In the views of Murthy, (2014), environmental accounting is taken to mean the identification and description of the environments’ exact costs, such as liability charges or waste disposal charges. Godschalk, (2008) in ‘ecological management’ interprets ecological accounting as an administrative tool that integrates financial significances of environmental matters to enhance productive decision making and encourage environmental and financial accountability. Benneth & James, (1998), posited that environmental accounting practices are complementary administrative accountable approaches to economic accounting approach. Environmental accounting provides a structure for coordinating data on the rank, and worth of natural assets and ecological asset including fisheries and plantation anecdotes, amidst other items, which may include expenditures on environment defence and asset management. Environmental reporting relates to the communication of environmental performance information by organizations to its stakeholders, which include information on; influence of the environment, performance in managing those impacts and contribution to ecological and sustainable development. But for the purpose of this study, a much more general delineation of environmental accounting is utilized. We note here that environmental accounting is more than accounting for ecological benefits and charges. It is accounting for any charges and benefits that arise from changes to a firm’s goods or methods, where the changes also involve a change in ecological influences.

Environmental Performance

Hahn (2013) defines environmental performance as “the measurable results of an organization’s management of its environmental aspects.” Environmental performance is environmental efficiency and effectiveness of resource conservation and pollution control acquired by enterprises when engaging in environmental management. Based on the view of Parmawati, (2018) the company's environmental performance is a company's performance in creating a good environment. According to Pien (2020), the minimizing of environmental impact from economic activities measures environmental performance of a firm. However, the number of environmental issues that have sprung up has prompted the creation of standards that regulates environmental disclosure issues, with the hope that companies have an obligation to convey more accurate information about their environmental performance. Environmental performance considerations include, among other things: the reduction of greenhouse gas emissions and air contaminants; improved energy and water efficiency; reduced waste and support reuse and recycling; the use of renewable resources; reduced hazardous waste; and reduced toxic and hazardous substances.

Firm Financial Performance

Financial performance is one of the most important variables in management research and arguably, the most important indicator of firm growth (Wahla et al., 2012). Lebas & Euske (2006) provide a set of definition to illustrate the concept of firm performance and describe performance as a set of financial and non-financial indicators which offer information on the degree of achievement of objectives and results (Lebas & Euske, 2006; Kaplan & Norton, 1992).

Environmental Information Disclosure and Financial Performance

One of the benefits of environmental information disclosure is that companies get more environmental Waddock & Graves (2007) ly aware about the effect of their business activities and their position in the environment, as they want to report positive environmental news. The financial benefit connected with this argument, is that it provides better environmental news, and improve their environmental performance through eco-efficiency which is an estimate of the economic value a company creates in relation to the waste it generates (Derwall et al., 2013). They found that companies with high eco-efficiency outperform companies with a low eco-efficiency. Therefore, environmental disclosures are a trigger for companies to create more eco-efficiency process. According to an improved relationship with customers, investors and employees could create a certain level of loyalty which leads to an improved financial outcome through extra sales.

Specifically, environmental information disclosures may help the firm avoid fines. Companies that invest in the publications of environmental information intend to be more environmental aware. They don’t want get in the position where they have to publish breaking environmental laws or regulations. They want to show the public their socially responsible way of acting in business. The opinion of the public is important, and they communicate with them through extra information disclosures (Waddock & Graves, 2007). Acting according to the law will lead to improved reputation. These companies want to avoid the risks of getting fines which will also damage their good reputation.

Emission and Energy Disclosure and Financial Performance

Greening represents an important practice that corporations must exercise; such a practice has benefits beyond those of producing goods for profit. In this context, companies are expected to implement activities that mitigate natural environmental damage, enhance its preservation, and promote its recovery. However, the debate concerning carbon emissions and corporate financial performance has not yet resolved. Some schools of thought have postulated that the relationship between emissions and firm financial performance is negative, while others argue that it is positive, with others hinting that it is mixed.

Hayami et al. (2005) demonstrate that firms that generate less waste tend to produce high corporate financial performance. Furthermore, Philip and Shi (2016) postulated that financial risk corporate management teams that utilize state-dependent hedge ratios to manage carbon emissions portfolio risks on the market could generate superior hedging financial gains. Cucchiella et al. (2012) suggested that inclusion of an EMS (Environmental Management System) along with improved control of emissions increases profitability through a combination of heightened demand and productivity. Further, Lucas & Noordewier (2016) demonstrated that environmental management practices in dirty sectors along with non-proactive industries generated a positive marginal impact on firm financial performance from the introduction of pollution control initiatives. Hence in this study, we hypothesize that.

H1: Emission and energy disclosure has a significant positive effect on firm financial performance.

Effluents & Hazardous Waste Disclosure and Financial Performance

Several studies in the recent past have focused on effluents and waste as it relates to corporate performance strategy. Rogers & Tibben-Lembke (2002), noted that the main barrier for waste reduction is that the issue has received less priority within the organization. Another barrier is company policies, which might be motivated by fearing the danger of waste costs. To emphasize the significance of effluents and waste on performance, Rogers & Tibben-Lembke (2002) focused on quantitative implication in which they found that effluents and waste accounts for approximately four percent of their total logistics costs in the publishing industry. In the oil and gas sector, it is estimated that waste reduction accounts for 5-6 percent of total logistics costs. Based on Resource Based View, Zhu et al. (2008) observed that, effluents and waste management as a strategic resource will have higher chances of minimizing cost of production through lowering waste management fees, lowering hazardous material management fees, less time and costs for reporting. Hence, we hypothesize that.

H2: Effluents and Waste disclosure has a significant positive effect on firm financial performance.

Biodiversity and Water Disclosure and Financial Performance

Anchoring natural capital in business’ non-financial reporting provides information and can influence the decisions made by financers and investors and shift sectorial investment flows in a more biodiversity-friendly direction (PBL, 2014). When changes in ecosystem services occur, alterations in potential of direct use of resources take place. Subsequently, this may impact the business’ own activities and simultaneously affect corporate performance. Both direct and indirect impacts are significant for biodiversity itself and the ecosystem services upon which humanity depends. Stakeholders therefore expect organizations to be aware of the impacts of biodiversity on firm performance (GRI, 2007). The perspectives of businesses on biodiversity are highly dependent on the kind of sector of the business. The stronger the dependency of a business on natural resources and ecosystem services, the bigger the risks and the more it is likely to want to secure the business’s activities for the future (KPMG, 2012). Consequently, the interest in biodiversity from businesses can be approached from two different angles. On the one side the risks of the direct and indirect dependency of (vulnerable) ecosystems for businesses are outlined. On the other hand, the opportunities for businesses in biodiversity emphasized (TEEB, 2010). Hence, we hypothesize that.

H3: Biodiversity and water disclosure has a significant positive effect on firm financial performance.

Sustainable Compliance Policy Disclosure and Financial Performance

Environmental policies aim to achieve their objective by increasing the opportunity costs of pollution and environmental damage, curbing polluting behaviour, supporting investment and inducing innovation in less environmentally harmful technologies and so forth. Traditionally, more stringent environmental policies have often been viewed as burdensome to economic performance – for instance by posing additional costs on producers without increasing output levels. Hence, they were considered detrimental to the profitability of the firm. For example, several studies attempted to attribute a significant part of the 1970s productivity slowdown in the United States to the increasing role of environmental policies (Christainsen & Haveman, 1981). On the other hand, Porter (1991) suggested that well-designed environmental policies might enhance productivity and increase innovation, yielding direct economic benefits next to the environmental benefits (Porter & van der Linde, 1995). In the short term, environmental policies may improve productivity in some specific activities – for instance industries using water as an input may benefit from the fact that water becomes cleaner, via reduced inputs devoted to water purification (Jaffe et al., 1995). Similarly, workers may become more productive if the adverse effects of air pollution on their health are curbed (Ostro, 1983, Graff Zivin & Neidel, 2012). Similarly, to the degree that some environmental policies provide budgetary revenues, the use of these may have effects on aggregate productivity (towards performance) – for instance if these are used to reduce distortionary taxation or reduce relative labour costs – as often argued considering the double-dividend of Pigouvian-style taxes. Hence, we hypothesize that:

H4: Sustainable Compliance Policy disclosure has a significant positive effect on firm financial performance.

Protection Expenditure and Investment Dusclosure and Financial Performance

As the public is increasingly concerned about the environment, the government requires business to take more responsibility for resolving environmental problems (Brolund & Lundmark, 2017). Excessive environmental expenditure could crowd out the firm’s productive investment in innovation and thus reduce its efficiency to an extent. For instance, Eiadat et al. (2008) argued that the ever-growing demands on firms to protect the environment could increase capital and labour cost, divert management attention and crowd out productive investments. Studies on the literature showed mixed results, some of them indicate that there is a strong negative relationship between government’s environmental regulation and firm’s financial performance, while others hint at a possibility of a positive relationship. Porter and van der Linde (1995) argued that the trade-off between government environmental regulation and firms’ business performance is probably due to a static approach towards the problem. Al-Tuwaijri et al. (2004) hinted that good environmental performance is significantly associated with good economic performance. Hence, we hypothesize that:

H5: Protection Expenditure and Investment disclosure has a significant positive effect on firm financial performance.

Grievance Policy Disclosure and Financial Performance

Community grievance mechanism which is a product of corporate environmental sustainability grievance policy is a process for receiving, investigating, responding to and closing out complaints or grievances from affected communities in a timely, fair and consistent manner. This mechanism is designed to deal with complaints as they arise such that an effective grievance mechanism shows willingness to address concerns promptly and effectively and can help to build local trust and goodwill. Good stakeholder engagement, and grievance handling are mutually supportive. Effective engagement supports better impact management, while effective community grievance mechanism contributes to both through early identification of potential problems. Community grievance mechanism also enable a company to generate cumulative learning to prevent recurrence. Hence, we hypothesize that:

H6: Grievance policy disclosure has a significant positive effect on firm financial performance

Theoretical Framework

Stakeholder Theory

According to Kriyantono (2014), Stakeholder theory pays attention to the concept of who is at risk of being influenced or potentially influencing organizational activities. Stakeholders can be defined as individuals, groups, or organizations, directly or indirectly, who have the potential or possibility to influence the activities of the organization. The stakeholder theory reminds managers to pay attention to all people and groups who can be influenced or influence the goals of the company.

Legitimacy Theory

The view of Utomo (2019), sees legitimacy theory as a theory that focuses more on the interaction of relationships between organizations and society. Legitimacy is a management system that is oriented on taking the side of the company towards the community. Legitimacy theory explains the social contract relationship between the company and the community, where the company must have integrity in implementing ethics in doing business and increase social and environmental responsibility, so that the company can be accepted by its existence in the community. Legitimacy is considered important for the company because the community's legitimacy to the company is a strategic factor for the company's future development.

Empirical Studies

The effect of carbon performance on financial performance was studied by He, Tang and Wang (2016). The authors employed a sample of US S&P 500 corporations and used emissions reduction to measure carbon performance while Tobin’s Q to measure financial performance. To mitigate the concern of endogeneity, the authors consider the influence of carbon disclosure on the relationship by conducting simultaneous equations analysis. The results show a positive relationship between carbon performance and financial performance. In addition, the authors observed that firms with better financial performance tend to be more transparent in carbon disclosure. Conclusively, higher degree of correspondence between carbon performance and financial performance indicates that managers who have financial and social obligations and who have chosen carbon projects have not only improved firm green image but have also generated tangible economic benefit.

Gatimbu & Wabwire (2016) assessed the effect of corporate environmental disclosure on financial performance of sixty-one listed firms at the Nairobi Securities Exchange, Kenya. This study made use of longitudinal secondary data from the annual reports and financial statements of listed companies at the Nairobi Securities Exchange. Content analysis of sampled listed companies’ annual reports was undertaken to examine environmental disclosure practices. A checklist of environmental disclosure items and categories was developed, and environmental disclosure indices computed. Casual research design was employed to determine the cause-effect relationship between corporate environmental disclosure and financial performance. Purposive sampling was employed in selecting firms that have been listed for entire period of study and whose annual reports are available at the Nairobi Securities Exchange. The result show that environmental disclosure has a positive significant effect on the mean financial performance.

Wasara & Ganda (2019) investigated the relationship between corporate sustainability disclosure and financial performance in terms of return on investment (ROI) among ten (10) companies listed on the Johannesburg Stock Exchange for a period of five years from 2010 to 2019. Data was extracted from corporate sustainability report and measured using the content analysis approach. Adopting the multi-regression analysis, the results revealed that there is a positive association between social disclosure and return on investment but revealed a negative relationship between environmental disclosure and return on investment. This implies that an increase in the reporting of social issues led to an improved financial performance in terms of return on investment.

Olayinka & Oluwamayowa (2014) carried out a study on corporate environmental disclosure and market value of quoted companies in Nigeria. Descriptive research design is adopted, and secondary data only was used. A sample size of fifty firms quoted, on the Nigerian Stock Exchange (NSE) were purposively selected for analysis. The correlation analyses result showed that the inclusion of environmental disclosure will enhance market value and the authors recommended that business should take caution in areas where environmental activities impact negatively on value and invest in areas that enhance value for the firm.

Nyirenda et al. (2013) in their study of environmental Practices and Firm Performance in a South African Mining Firm for the period 2003 to 2011 used return on equity as the dependent variable and carbon emission reduction, energy usage and water usage as the independent variable. The model was controlled by net income and shareholders’ equity. Furthermore, the authors adopted ordinary least square technique as method for its analysis. Which showed no significant relationship between Carbon Emission Reduction, Energy Usage Water Usage and Return on Equity. However, there exist a significant relationship between the control variables- shareholders’ equity, net income and Return on Equity. The authors concluded that it may not be in all cases that firms’ environmental management practices are driven by financial motive and, that firms may still possess the moral and ethical obligation to curb negative climate impact and to respect environmental regulations.

Methodology

A combination of descriptive and exploratory research designs has been employed in this study consistent with the studies of Mohammed, (2018). However, to achieve the objectives of this study, we focused on three oil producing countries which are among the largest oil producing nations in Sub-Saharan Africa viz: Nigeria, Namibia, and Kenya for the periods between 2011 and 2019. All three countries of interest show almost the same timeline (2011) in their commencement of environmental sustainability reporting exercise. Further, their annual reports are readily accessible for comparison. Nonetheless, using judgmental sampling technique, a total of twenty-one (30) oil and gas companies which represents fourteen (14), nine (9) and seven (7) companies for Nigeria, Namibia and Kenya respectively are employed for this study. Secondary sources of data which refers mostly to all such information obtained from published document that are relevant to the study is employed for the analyses. However, to obtain the sample size for the Nigerian population and based on the nature of this research work, we employed cross-section (sample oil and gas firms) that poses similar characteristics and attributes to enable us to draw the sample size via sampling filtering procedure. Hence, we include 8 oil and gas firms drawn from Nigerian population during the period under consideration. Also, for the sample size in Kenya, we employ the same sampling filtering process which helped us arrive at three (3) listed oil and gas companies necessary for this study. Four (4) listed oil and gas firms were drawn from Namibia using the same sample filtering procedure. We selected these samples since they have complete and relevant data points for the period under consideration.

Specifically, in this study we employ the Global Reporting Initiative (GRI) Environmental Ratings index/checklist due to its comprehensive and prominence on corporate environmental sustainability concerns (Coombs & Gilley, 2005) and public data availability (Deckop et al., 2006). This checklist employed for scoring provides robust measures as regards the volume of environmental sustainability information which companies make available. In collating the relevant data points for this study, we carry out content analysis on various relevant annual report based on GRI checklist consistent with the study of (Chatterji et al., 2009). We sum the disclosure points along each environmental sustainability dimension for each company and then compute the scores by dividing the total sum by the number of possible items obtainable in the GRI standard. In this study, we subject the collated data to descriptive statistics analysis, correlation analyses, and regression analysis. Due to the nature of the data which we collated for this study, we carried out effect regression analyses (fixed and random). The results obtained from the effect regression is subjected to diagnostic testing to ensure a non-violation of least square regression assumptions which goes a long way to enhance the credibility of the estimates. Further, in determining the effect of environmental sustainability disclosure on firm performance, we formulate three econometric models which we intend to employ for hypotheses testing. Particularly, we adopt and modify the models of Laskar (2020) and Hardivansah & Agustini (2020) and re-specify as model specification.

Model Specification

Return on Equity Environmental Sustainability Model Specification 1

![]()

Gross Profit after Tax Environmental Sustainability Model Specification 2

Earnings Per Share Environmental Sustainability Model Specification 3

Where:

roe = Return on Asset

gptm = Gross Profit after Tax Marin

eaps = Earnings Per Share

emiene = Emission and Energy Sustainability Performance

effwst = Effluent and Waste Sustainability Performance

biowat = Biodiversity and Water Sustainability Performance

suscom = Environmental Sustainability Compliance Policy Performance

prexiv = Environmental Sustainability Protection Expenditure and Investment Performance

grpoly = Environmental Sustainability Grievance Policy Performance

roce = Return on Capital Employed

i = cross sections (sample companies)

t = time effect (2011 to 2019)

μit = Stochastic error Term

Data Presentation & Analysis

Data Analysis

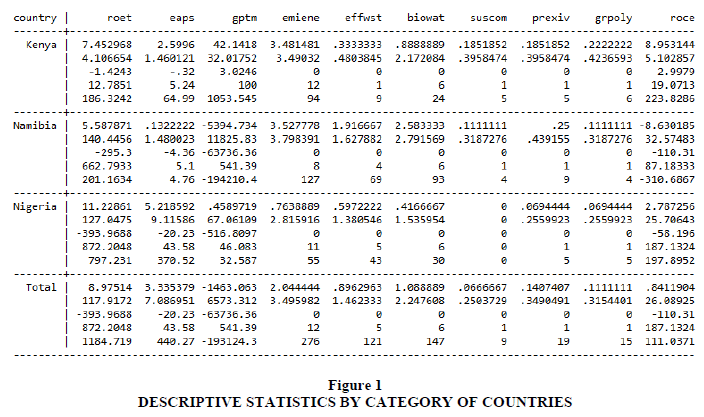

Descriptive statistics provided in the tables below provides good insight into the nature of the selected listed oil and gas companies that have been employed in this study Figure 1.

Authors’ Computation 2021

Figure 1 shows the descriptive statistics of the study. From the figure we observed that firms in Nigeria (11.23) were more profitable in terms of return on equity than firms in Kenya (7.45) and of those in Namibia (5.59). In the same vein, we find that earnings per share on average was higher for firms under study in Nigeria (5.22) followed by those in Kenya (2.60) and Namibia (0.13). For profitability in terms of gross profit margin, the table shows that on average the selected firms under study in Kenya (42.14) were far more profitable than those in Nigeria (0.46). On average, the highest gross loss (-5394) is observed for firms in Namibia. In considering the independent variables, we find that for the variable of Emission and Energy, on average, the sample firms in Namibia (3.53) disclosed more information when compared to Kenya (3.48) and Nigeria (0.76). The same is observed for the variables of effluents and waste where we observed that the managers of sampled firms in Namibia (1.92) disclose more information followed by those in Nigeria (0.60) and Kenya (0.33) respectively. Similarly, we find that on average sampled firms in Namibia (2.58) disclosed more environmental information as it relates to biodiversity and water followed by firms in Kenya (0.89) and then those in Nigeria (0.42). In terms of sustainability compliance, the sampled firms in Nigeria did not comply at all to sustainability policies compared to those firms in Kenya (0.19) and Namibia (0.11). A closer look at the variable of protection expenditure disclosure indicates that disclosure for this item is highest for Namibia (0.25) followed by Kenya (0.19) and then for companies in Nigeria (0.07). Furthermore, the descriptive statistics table also shows that oil and gas firms in Kenya recorded more information relating to issues on grievance indicating that these firms were more aggrieved about the sustainability policies in Kenya (0.22) followed by those in Namibia (0.11) and Nigeria (0.07). For the control variable of return on capital employed, we find that on average, the sampled firms in Kenya (8.95) were more profitable in terms of return on capital employed closely followed by firms in Nigeria (2.79). However, for net profit after margin, we find that the sampled firms in Nigeria (48.81) had the highest value.

Regression Analysis

We follow the study of McManus (2011) who noted that General Linear Model is the foundation of linear panel model estimation. The Ordinary Least Square (OLS) estimator is consistent when the regressors are exogenous and optimal in the class of linear unbiased estimators when the errors are homoscedastic and serially uncorrelated. Under these conditions, the method of Least Squares provides minimum-variance mean-unbiased estimation when the errors have finite variances. Hence, the researcher first carries out Panel Ordinary Least Square regression analysis and proceed to check for possible regression errors. The summarized results obtained from the panel least square regression of the three models are as shown in the Table 1:

| Table 1 Ordinary Least Square Regression |

|||

|---|---|---|---|

| (1) | (2) | (3) | |

| roet | eaps | gptm | |

| Emiene | -1.599 | -.092 | 260.652 |

| (3.704) | (.305) | (313.914) | |

| effwst | -18.061* | -1.845** | -1225.632 |

| (10.219) | (.842) | (866.079) | |

| biowat | 29.212*** | .803 | 776.891 |

| (7.923) | (.653) | (671.436) | |

| suscom | -115.364** | -20.372*** | -1371.731 |

| (48.267) | (3.979) | (4090.603) | |

| prexiv | -52.377* | 2.488 | -100.899 |

| (29.34) | (2.419) | (2486.583) | |

| grpoly | -11.587 | 17.662*** | 181.496 |

| (39.146) | (3.227) | (3317.657) | |

| roce | 3.386*** | .05** | 77.413*** |

| (.257) | (.021) | (21.777) | |

| _cons | 9.71 | 3.258*** | 1739.492** |

| (7.934) | (.654) | (672.43) | |

| Observations | 132 | 132 | 132 |

| R-squared heteroskedasticity |

.627 0.0000 |

.298 0.0000 |

.137 0.0000 |

| Standard errors are in parentheses | |||

| *** p<.01, ** p<.05, * p<.1 | |||

Authors’ Computation 2021.

Test for Homoscedasticity

The assumption of homoscedasticity states that if the errors are heteroscedastic then it will be difficult to trust the standard errors of the least square estimates. Hence, the confidence intervals will be either too narrow or too wide. The presence of heteroscedasticity tends to produce p-values that are smaller than they should be due to increased variance of the coefficient estimates which unfortunately least squares’ estimators does not detect this increase. The result obtained from the Breusch-Pagan test reveals statistically significant probability values in all three models. This result indicate that the assumption of homoscedasticity has been violated due to very low P-values which is seen to be statistically significant at 1%. Therefore, due to the presence of heteroscedasticity obtained from the panel least square regression estimator, the researcher proceeds to employ the Eicker-White standard errors which is relied upon for hypotheses testing. The result is presented in Table 2:

| Table 2 Robust Least Square Regression Estimation |

|||

|---|---|---|---|

| (1) | (2) | (3) | |

| roet | eaps | gptm | |

| emiene | -2.35*** | .183 | 1.437** |

| (.338) | (.101) | (.574) | |

| effwst | -1.883 | -.635** | 2.614 |

| (.965) | (.278) | (1.582) | |

| biowat | 3.208*** | -.158 | -17.432*** |

| (.919) | (.216) | (1.227) | |

| suscom | -32.344*** | -22.129*** | -5.045 |

| (5.022) | (1.313) | (7.474) | |

| prexiv | 3.454 | 1.452 | 71.002*** |

| (2.918) | (.798) | (4.543) | |

| grpoly | 17.415*** | 22.616*** | 5.88 |

| (3.442) | (1.065) | (6.061) | |

| Roce | 2.109*** | .029*** | .447*** |

| (.034) | (.007) | (.04) | |

| _cons | 4.374*** | 1.387*** | 8.579*** |

| (.699) | (.216) | (1.229) | |

| Observations | 129 | 132 | 132 |

| R-squared Probability F Heteroscedasticity |

.975 0.0000 0.0000 |

.857 0.0000 0.0000 |

.853 0.0000 0.0000 |

| Standard errors are in parentheses | |||

| *** p<.01, ** p<.05 Authors’ Computation 2021 |

|||

Table 2 shows the result obtained from robust standard error estimator for the three models. Specifically, the researcher provide interpretation for the robust standard error estimator as recommended by (Gujarati, 2004). The model’s goodness of fit as captured by the Fisher statistics and the corresponding probability value (0.00000) shows a 1% statistically significant level for all three models suggesting that the entire model is fit and can be employed for interpretation and policy recommendation. More than this, an R2 value of 0.98, 0.86 and 0.85 for the dependent variables of return on equity, earnings per share and gross profit margin respectively indicates that about 98%, 86%, and 85% of the variation in the dependent variables respectively is being explained by all the independent variable and the control variable in the model. This also means that about 2%, 14%, and 15% of the variation in the dependent variables respectively is left unexplained but have been captured by the error term.

Discussion of Findings

As the public is increasingly concerned about the environment, the government requires business to take more responsibility for resolving environmental problems. In this instance, pressure from government agencies on firms to make more environmental expenditure comes with a cost on the corporation since environmental expenditure might drastically increase its production costs, in relation to material and electricity costs, and negatively affect its profitability. This is in line with our findings which buttresses the study outcomes of (Cao et al., 2017; Chong et al., 2017; Yang et al., 2017; Dechezlepretre & Sato, 2017; Chong et al., 2016). The outcome of this study is also seen to be consistent with those of Eiadat et al. (2008) who argued that the ever-growing demands on firms to protect the environment could increase capital and labor cost, divert management attention, and crowd out productive investments. Further, we align our findings to that of McGuire (1982) who documents that excessive environmental expenditure could crowd out the firm’s productive investment in innovation and thus reduce its efficiency to a great extent. Hence the question; is it possible for the firm to overcome the trade-off relationship between the firm’s environmental expenditure and its profitability? More than this, we opine that the voluntary approach towards regulatory authorities’ guidelines for environmental disclosure in Nigeria also support a neutral effect of emission and energy on firm financial performance during the period under investigation. It is more of no enforcement or mandatory requirements for disclosure contents. To maximize firms’ interests, executives usually disclose selectively which brings about different environmental disclosure. The result from this study supports those of (Dhaliwal et al., 2014; Griffin & Sun, 2011; Clarkson et al., 2013; Matsumura et al., 2014).

We also find the result obtained from the effect of grievance policy disclosure on firm performance measures of earnings per share and return on equity to be in tandem with the stake holder theory which states that companies that have a working relationship with its stakeholders tends to notice the positive influence on the activities and outcomes of the company. Two kinds of stakeholders are known, namely internal and external. Like shareholders, stakeholders can demand something from the company. Sometimes, the company faces criticism from non-shareholding individuals (for instance the Niger Delta Militants in Nigeria) whose negativity could be the reason for decline of the company’s shareholding value because these individuals can impose their demand through boycott, lawsuit, and others. Similarly, we align the findings to that of Brouwers et al. (2014) who explained that social and environmental performances must be achieved by satisfying the demands of many stakeholders. Satisfying the demand of stakeholders has been considered as inevitable business costs but controlled at a certain amount. This also substantiate the opinion of Jensen (2001) who noted that during value maximization activity, the company should not ignore stakeholder interest. In other words, the company should not only maximize economical goal but also environmental goals. The argument is also in line with Resource-Based View (RBV) theory which stipulates that environmental responsibility is a way toward competitive advantage and better firm performance.

Conclusion

The issue of environmental sustainability reporting is increasingly becoming a serious issue such that environmental sustainability disclosure practices have now gathered great momentum in recent years. Most companies are concerned with creating wealth and distributing it in form of dividend to shareholders, while neglecting other stakeholders. However, civil society pressure group, non-governmental organization group, government regulations and corporate governance codes, green consumer pressure and other similar pressure group make it imperative for corporate body to consider environmental sustainability disclosure which takes care of the needs of various stakeholders. In the light of these, this empirical study employed six proxies of environmental sustainability disclosure; Emission and Energy Disclosure, Biodiversity and Water Disclosures, Effluent and Hazardous Waste Disclosure, Environmental Protection Expenditure Disclosure, Environmental Sustainability Compliance Policy disclosure and Environmental Sustainability Grievance Policy disclosure in attempt to determine their effects on firm performance. Overall, the findings revealed that all the proxies of environmental sustainability have significant effect on financial performance of oil and gas listed firms in Nigeria, Kenya and Namibia. The finding is interesting as we document variations in performance outcomes suggesting differentials in cultural, economic, and political environments represented in the three countries of interest.

Recommendations

Following the empirical evidence recorded in this study we carefully recommend the following.

1. The empirical result reveals that emission and energy have no significant effect on earnings per share. The researcher recommends that priority should be given to policies regarding emission and energy management to promote optimal energy consumption. A careful mix of such policies should be considered as over-appropriation or under appropriation may lead to a decline in values of return on equity.

2. To mitigate the negative effect of effluent and hazardous waste activities on financial performance managers must develop a strong capability to identify and solve diverse managerial problems through creative ways. These capability does not have to be specifically related with environmental aspects, but it can be a broad or general competence to innovate, which is closely linked with the firm’s overall research and development capability. Managers should develop new methods to cut waste and effluents without it affecting productivity.

3. The empirical result reveals that environmental protection expenditure disclosure have a significant effect on financial performance hence the researcher recommends that more attention should be given to policies regarding environmental protection expenditure management of the firm.

4. The researcher also recommends that environmental regulatory agencies complimented by governments prescribed environmental information disclosure standard policies of all three countries of interest should be strengthened. Disclosure compliance should be made mandatory for all listed companies and the guidelines for environmental assessment should be established to compel companies to accommodate environmental disclosure. This will go a long way to sustain the positive effect of biodiversity and water on return on equity which is recorded in this study.

Suggestion for Further Studies

This study is restricted to listed oil and gas companies in Nigeria, Namibia, and Kenya for a period of nine years that span from 2011-2019. There are other players in the manufacturing sector, mining, industrial goods, and household items whose operations have impact on the environment which apply disclosure principles of accounting in their operations. This calls for further study which would ensure wider/better generalization of the study findings for the countries in Sub-Saharan in the oil and gas sector. Similar studies can be conducted but with a longer time span and an increased sample size of oil and gas companies to take care of time series and increased reliability of the findings.

References

Cao, Y.H., You, J.X., & Liu, H.C. (2017). Optimal environmental regulation intensity of manufacturing technology innovation in view of pollution heterogeneity.Sustainability,9(7), 1240.

Christainsen, G.B., & Haveman, R.H. (1981). The contribution of environmental regulations to the slowdown in productivity growth.Journal of Environmental Economics and Management,8(4), 381-390.

Coombs, J.E., & Gilley, K.M. (2005). Stakeholder management as a predictor of CEO compensation: Main effects and interactions with financial performance.Strategic Management Journal,26(9), 827-840.

Dechezlepretre, A., & Sato, M. (2017). The impacts of environmental regulations on competitiveness.Review of Environmental Economics and Policy,11(2), 183-206.

Derwall, J., Koedijk, K., & Ter Horst, J. (2011). A tale of values-driven and profit-seeking social investors.Journal of Banking & Finance,35(8), 2137-2147.

Donwa, P. (2011). Environment accounting and host community agitation in Nigeria: The petroleum industry experience.International Review of Business Research Papers,7(5), 98-108.

Eljayash, K.M., Kavanagh, M., & Kong, E. (2013). Environmental disclosure practices in national oil and gas corporations and international oil and gas corporations operating in organization of Arab petroleum exporting countries.International Journal of Business, Economics and Law,2(1), 35-52.

Gujarati, D. (2004). Basic Econometrics Fourth (4th) Edition.Magraw Hill Inc, New York.

Hayami, Y., Godo, Y., Hayami, Y., & Godo, Y. (2005).Development economics: From the poverty to the wealth of nations. Oxford University Press.

Islam, M.A. (2010). Social and environmental accounting research: major contributions and future directions for developing countries.Journal of the Asia-Pacific centre for Environmental Accountability,16(2), 27-43.

Jensen, M.C. (2001). Value maximization, stakeholder theory, and the corporate objective function.Journal of Applied Corporate Finance,14(3), 8-21.

Kaplan, R.S., & Norton, D.P. (2001). Transforming the balanced scorecard from performance measurement to strategic management: Part 1.Accounting Horizons,15(1), 87-104.

Kriyantono, R. (2009). Practical Techniques of Communication Research.Jakarta: Prenada Media Group.

Ludema, J.D., Laszlo, C., & Lynch, K.D. (2012). Embedding sustainability: How the field of organization development and change can help companies harness the next big competitive advantage. InResearch in organizational change and development. Emerald Group Publishing Limited.

McGuire, M.C. (1982). Regulation, factor rewards, and international trade.Journal of Public Economics,17(3), 335-354.

Mohammed, S.D. (2018). Mandatory social and environmental disclosure: A performance evaluation of listed Nigerian oil and gas companies pre-and post-mandatory disclosure requirements.

Moller, L. (2016). Namibia. In Hammerson, M. and Antonas, N. (eds.) Oil and Gas Decommissioning: Law, Policy and Comparative Practice, 2nd edition. Working: Globe Law and Business, 359-372.

Ofoegbu, G.N., Odoemelam, N., & Okafor, R.G. (2018). Corporate board characteristics and environmental disclosure quantity: Evidence from South Africa (integrated reporting) and Nigeria (traditional reporting).Cogent Business & Management,5(1), 1551510.

Elsakit, O.M., & Worthington, A.C. (2014). The impact of corporate characteristics and corporate governance on corporate social and environmental disclosure: A literature review.International Journal of Business and Management,9(9), 1.

Pien, C.P. (2020). Local environmental information disclosure and environmental non-governmental organizations in Chinese prefecture-level cities.Journal of Environmental Management,275, 111225.

Porter, M.E. (1991). Towards a dynamic theory of strategy.Strategic management journal,12(S2), 95-117.

Emeakponuzo, D.E., & Udih, M. (2015). Environmental accounting practices by corporate firms in emerging economies: Empirical evidence from Nigeria.Advances in Research, 209-220.

Utile, B.J. (2016). Effect of sustainability reporting on firm’s performance: A review of literature.International Journal of Business & Management,4(7), 203-208.

Waddock, S.A., & Graves, S.B. (1997). The corporate social performance–financial performance link.Strategic Management Journal,18(4), 303-319.

Yang, Z., Liu, W., Sun, J., & Zhang, Y. (2017). Corporate environmental responsibility and environmental non-governmental organizations in China.Sustainability,9(10), 1756.