Research Article: 2021 Vol: 25 Issue: 4S

Equity Returns, Consumption and Investment in Risky Assets in Nigeria: A Generalised Method of Moment Approach

Busayo Aderounmu, Covenant University

Philip Olomola, Obafemi Awolowo University

Sunday Oladeji, Obafemi Awolowo University

Victoria Okafor, Covenant University

Oluwarotimi Owolabi, Covenant University

Oluranti Olurinola, Covenant University

Citation Information: Aderounmu, B., Olomola, P., Oladeji, S., Okafor, V., Owolabi, O., & Olurinola, O. (2021). Equity returns, consumption and investment in risky assets in nigeria: a generalised method of moment approach. Academy of Accounting and Financial Studies Journal, 25(S4), 1-17.

Abstract

Asset pricing is a crucial issue in financial economics as it provides information that prompts the decision as to whether to undertake investment as well as consumption. The understanding of how equity returns affect consumption and investment thus need to be investigated, hence the study. The study examined the effects of equity return on consumption and investment in risky assets using monthly data for a period of 1999-2014. The generalized method of moments (GMM) estimation technique was adopted in this study. This paper established that per capita income, past values of consumption growth, stock market wealth influences the growth of consumption per capita positively while lending rate and U.S interest rate had negative effects on the growth rate of consumption in Nigeria. Also, past values of investment in risky assets and the risk-free rate of returns significantly and negatively affect investment in risky assets while the lending rate and U.S interest rate had a negative relationship with investment in risky assets although the effects were not statistically significant. Though market returns had a positive and significant relationship with investment in risky assets, per capita income positively but insignificantly affect investment in risky assets. Therefore, the empirical analysis of the effects of equity return on consumption showed a positive relationship exists although not statistically significant while the effects of equity return on investment were positive and statistically significant.

Introduction

Most key economic decisions taken by investors and individuals on daily basis are determined by the behavior of asset prices. Pricing of assets have been a fundamental issue in financial economics because of the information it provides in making economic decision as regards investment and consumption. Savings, the suspension of present consumption for future returns, is carried out by rational consumers in order to maximize future benefits through the investment/ savings nexus. If the benefits on savings exceed the cost to save, consumers are motivated to save. However, saving is not done for the sake of suspending current consumption today, instead, the opportunity cost for saving is reflected in the dividend received in the future. This means that an individual will always want to know the risk and return on his or her savings. Thus, knowing how equity returns may influence consumption is an interesting empirical issue that needs further investigation. Since the economy is being affected by the effect of consumption and investment in the financial market, the knowledge of the effect of rate of return on consumption and investment is very crucial, hence the study.

Consumption, as a component of Gross Domestic Product (GDP), constitutes about two-third of GDP in Nigeria. It is one of the indicators that has been used in determining the standard of living of the people (NBS, 2012). Consumption can be grouped into private (household) consumption and public (government) consumption. Private consumption can be defined as the worth of goods and services bought and used up by families while on the other hand public consumption is the values of goods and services received by an individual from the public sector.

Furthermore, private consumption comprises expenditure on durable goods, non-durable goods and services and it represents the largest component of the total demand. The percentage change in household consumption expenditure to GDP in Nigeria increased by 9.98% between 2008 and 2009 but decreased by 9.09% between 2009 and 2010 and by 2012, it decreased by 7.03% (WDI, 2014). This makes private consumption an exceptionally significant constituent of the total demand as it influences economic cycle. The need to study private consumption has, however, been the heartbeat of academic researchers (Tapsin & Hepsag, 2014; Kazmi, 2015) because of the effect it has on standard of living and economic growth.

On the other hand, investment is the sacrifice or deferring of current consumption for future benefits. Domestic investment in developing countries is generally financed by domestic savings, and private consumption is an important determinant of it. Investors’ choice to keep their savings in bank or financial assets depends on their expected risks and returns (Grobys, 2014). This enables individual to consider how much to consume now, how much to invest, and which financial assets they should invest in (Bjorheim, 2014).

An overview of the Nigerian stock exchange equity market capitalization during the global financial crises in 2008 showed that there was 35% decrease in market capitalization during the year (SEC, 2008). The market capitalization fell from 13.88 trillion in February, 2008 to about 7.89 trillion by the beginning of November, 2010 (SEC, 2010). The listed equities market capitalization grew by 47.33% from N8.98 trillion in the last quarter of 2012 to N13.23 trillion last quarter of 2013 (NSE, Annual Report 2014).

The bullish run in the capital market that started in the second half of 2012 continued with greater impetus throughout the first quarter of 2013, and was sustained through most of the year excluding in the third quarter. Total market capitalization in 2013 rose from N14.80 trillion to N19.08 trillion leading to 28.92% increase by the last trading day of the year (NSE, 2013) while the equities market capitalization of the year ended at N13.23 trillion. The total equity market capitalization increased at the end of 2014 second quarter by 7.24%. By the end of second quarter in 2014 equity market capitalization was N14.03 trillion (NSE, Annual Report 2014). This surpassed that of the fourth quarter in 2008 which was 6.96 trillion by 101.58%, a noteworthy milestone in the recovery from the 2008 economic financial meltdown in the Nigeria capital market. This made the Stock Market in Nigeria to be regarded as the worst performing worldwide for the month of January, 2019 (SEC, 2014; Olokoyo et al., 2020).

The global financial and economic crisis with the excessive lending rate mounted pressure iin the stock market due to the enormous borrowed fund in this market thereby causing the capital market performance especially the Nigerian Stock Market to be low in 2009. Lending rate which was formerly 15.48% in 2008 rose to 18.36% by 2009 resulting to an increase of 2.88% in the lending rate (WDI, 2014). Stock investors in the haste trying to liquidate their investment and the fall in share price Adedokun, (2013) and the high public offers and private placements (Yahaya, Abdulrahem, et al.,) caused Nigerian Stock Market to crash. These had prevented a substantial number of potential investors and participants from being active players on the Nigerian Stock Market (Audu et al., 2018).

Hence, the attraction of most investors nowadays is to get the greatest return for any investment they embark on whether the investment is on risky security or commercial project. In a bid to achieve this, it is therefore imperative for investors to ascertain the amount of return they will get on any investment carried out especially investment done on risky security.

Investment as well as consumption are, thus, crucial and important issues to the financial market as they have vital feedback effects on the financial markets and are the most insightful empirical work in macroeconomics over the past few decades (Romer, 1996; Tapsin & Hepsag, 2014). Thus, understanding the empirical linkage between macroeconomic variables and financial markets has been the goal of financial economists because the impacts of financial markets on consumption affect the economy as a whole. There is therefore need to understanding the extent to which equity return affect consumption and investment, hence the study.

Literature Review

Review of Investment Theories

Investment plays a very important role in economic growth and development, which implies that the level of development in any economy lies on the magnitude of investment in such economy (Agénor, 2007). Economists define investment as the production of capital goods like building, rail road, etc. while in finance, investment is seen as the purchase of assets or contracts in papers or electronic form like stocks and bonds. Public and private investment are one of the major sources of growth in any economy due to the fact that they increase wealth of individuals, create more jobs, lead to human capital development, increase national income, and increase consumption. Thus, the strength of any nation is measured through the value of her wealth accumulation and the growth rate of wealth through savings and investments (Ahmed, 2009).

Based on the argument of Keynes and Fisher, investments are carried out up to the point where the present value of anticipated future return is equivalent to the alternative forgone cost of capital (discount rate). While Fisher refers to the discount rate as the rate of return over costs, Keynes calls it the marginal efficiency of capital. Various investment theories have emerged from Keynes and Fisher proposition by incorporating various aspect of their works into the theories.

The Accelerator Theory of Investment

Accelerator theory of investment is one of the earliest empirical investment models. It is mostly related with the Keynessian approach which is based on the supposition of fixed prices. Clark (1917) was the first to suggest the accelerator principle but it was well applied by (Samuelson, 1939). The assumption here is that apart from income and rate of interest, the level of planned investment is related also to the size of changes in income instead of the absolute level of income or output. This implies that the recent investment is a function of change in output. The tested hypothesis also states that stock of capital in the economy is proportionally related with the level of output in the economy. This implies that firm’s preferred capital-output ratio is roughly constant, that is, it forecasts that investment is proportionate to rise in output in the coming period (Eklund, 2013).

The major shortcoming of this theory arises from its assumptions that net investment responds only to changes in output and there is also a strict proportionality between net investment and changes in total output. Firms do not perceive forthcoming output with certainty which implies that the future value of output is interpreted as expectation. However, since the firm’s expectations about future output are unobservable then accelerator model creates a problem when implementing it.

Neoclassical Theory of Investment

Jorgenson (1963) developed the neoclassical theory of investment that formalizes the concepts put in place by Fisher. The starting point of neoclassical investment theory is the firms’ optimization problem. The maximization of profit in each period will result into an optimum capital stock. Jorgenson’s investment equation was derived from the profit maximization theory of a firm. This implies that the maximization of the present value the firms’ object (i.e. the firms’ stream of net proceeds) to market and non-market constraints is used in determining the optimal level of capital stock. Neoclassical theory is an extension of simple accelerator theory in which investment output-expectations are augmented to include the effect of the relative price of variables, specifically the user cost of capital. This is calculated from the additional capital purchased, the rates of interest on bank loans and bond issues, and the cost of equity finance, depreciation and the levels of important taxes. However, Jorgenson’s theory was criticized on the basis that he did not elucidate the adjustment of actual capital stock to the optimal stock. Expected quantities and prices in his analysis were based on foresight which was never perfect. Also, his theory was founded on the postulation of full employment.

The failure of the accelerator and the neoclassical investment theory is created on the fact that both theories embraces that the capital stock adjustment to its anticipated level is immediate and complete each period.

The Financial Theory of Investment

James Duesenberry developed the financial theory of investment which is also known as the cost of capital theory of investment. The assumption here is that interest rate in the market denotes the firms’ cost of capital which does not vary with the quantity of investment he makes. This implies that limitless fund are accessible to the firm at the interest rate in the market. However, this is not so in reality as firms may have to borrow in the market at whatsoever interest rate obtainable and as more funds are required for investment rate of interest increase. There are two sources of fund, internal funds such as retained earnings and external funds such as borrowing which may be from financial market. The sources of funds for firm can cause the cost of capital to firms to vary

Tobin’s q

James Tobin propounded a theory of investment based on financial markets. It is a theory that links the decision of a firm to invest to stock market fluctuations. The argument by Tobin that investment level of firm should be based on the ratio of present value of installed capital to the replacement capital. The theory hypothesizes that it is worthwhile to investment as long as the value of the firm in the stock market is higher than the cost of acquiring the machinery and equipment of the firm in the product market. He believes that there will be an urge by the firms to increase their capital when q is more than one and vice versa (Eklund, 2013).

Tobin argues that investment should be an increasing function of the ration of capitalized financial value to the replacement cost of the unit of capital. In this theory, there are two measures of Q, which is, the marginal Q and the average Q. Marginal Q is the ratio of forthcoming marginal returns on investment to present marginal costs of investment while Average Q is the ratio of market value of the firm to the replacement cost of capital. Marginal Q is unobservable, only average Q can be measured. However, in a situation where production and adjustment cost functions follow certain homogeneity conditions, then marginal is equal to average Q. In practice, measure of average Q is being included in investment equation.

Review of Empirical Literature

In India, Kapoor and Ravi (2009) investigated the effect of interest rate on household consumption using monthly data from July 2005- June 2006 and July 2000-June 2001. They found using Ordinary Least Square method that 50 point base increase on interest rate on deposits caused 12% decline of consumption expenditure of non-food and non-essential items of citizens above sixty years. Nwabueze (2009) examined the causal relationship between Gross Domestic Product and personal consumption expenditure in Nigeria from 1994-2007 using regression analysis. The result of the analysis showed that an increase in gross domestic product does not have a significant impact in the personal consumption expenditure of Nigeria. Aderounmu, Olomola & Oladeji (2018) using data from 1999 to 2014 examined the trend and pattern of equity return and consumption in Nigeria. The result showed that considerable fluctuation exist in stock market due to the changes in equity return which may be attributed to the effect of the worldwide financial crises and the economic meltdown, decline in investors’ confidence in stock market trading, liberalization of the market among others.

Zhou (2015) examined American household stockholding behaviour throughout the great financial crisis between 2007 and 2009 using panel study of income dynamics. The result showed that there was 2.6% decrease in the overall stock market participation during the period which was attributed to the withdrawal of the poor, less educated and minority households from the market after the crash.

According to Wang (2008), the selection and allocation of household risky assets with reference to both financial and nonfinancial assets using 2004 Survey of Consumer Finances in U.S showed that household asset selection in risky financial and non-financial assets were interrelated with each other which implies that it is important to examine household’s asset allocation while considering their investment in each type of risky asset jointly. Using Tobit analysis to estimate the share of each type of risky asset to total asset, he found that income risk resulting from households’ risky non-financial asset investment had substitution effect on household risky financial asset investment, that is, households with investment in real estate usually invest lower proportions of their assets in stocks and vice versa. Thus, it showed that portfolio section and allocation of household in any particular type of asset was influenced by their investment in the other type of risky assets.

Faig & Shum (2004) used Tobit, Probit and Conditional linear regression analysis to examine the determinant of household stockholdings using data from the Survey of Consumer Finances for 1992, 1995, 1998 and (a preliminary section on) 2001. They observed that ownership of stock was correlated positively with carious wealth measures (financial bet worth and labour income), age and |proxies indicating long time holding of stock and negatively correlated with alternative risky investment (real estate and private business) and non-financial investment (invest in own home and own business).

In the same vein, Sousa (2009) using Dynamic Ordinary Least Squares and Instrumental Variables/ generalized Method of Moments discovered that the effect of financial wealth on consumption were relatively large and statistically significant; hosing wealth effects were almost zero and insignificant; growth in consumption exhibited strong doggedness and responded slowly to financial and housing asset shocks; consumption responded very well to financial liabilities and mortgage loans and that consumption did not respond immediately to wealth substantially in the short run as the long run wealth effects. He also disaggregated financial wealth into constituents and found that wealth effects were principally huge for currency and deposits, and shares and mutual funds.

Also, Millard and Power (2004) used VAR to investigate the relationship between equity price movement and consumption and investment in UK between 1978Q1 and 2002Q2. While the effect of equity price movement on consumption depended on the sources of shock to equity prices that of investment did not.

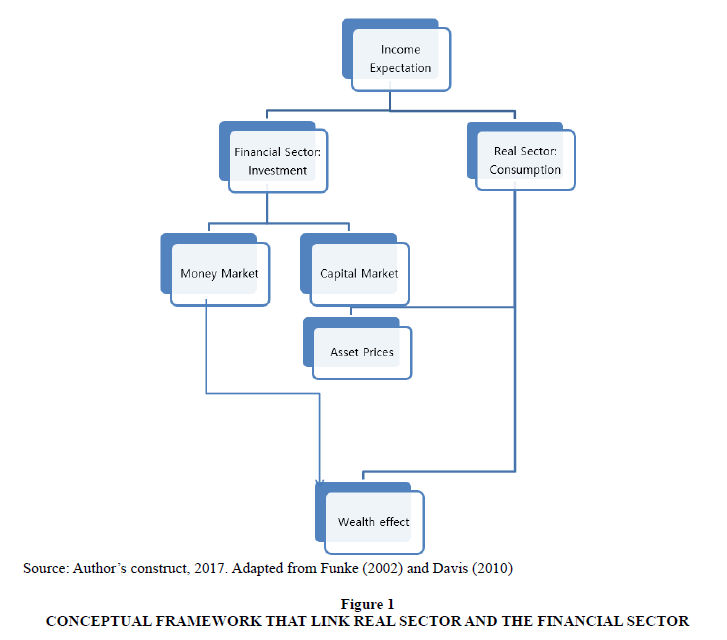

Transmission mechanism between Real Sector and Financial Sector

It is highly imperative to understand the transmission channels that exist between the financial and the real sectors in the economy. Activities in the real economy affect the financial economy and vice versa. The channel through which the financial sector affects the real sector is through wealth effect. Wealth effect implies an increase in spending that occurs as a result of increase in wealth. This aggregate wealth is the summation of human wealth and non-human or asset wealth (Lettau & Ludvigson, 2001; Babajide et al., 2021). The assumption of wealth effect is that economic agents would actually believe that their portfolio of investment are valued more whenever there is an increase in prices of security and consequently increase their consumption spending (Lettau & Ludvigson, 2001).

Ando and Modigliani (1963) were the first to give an assertion that wealth, not just income, affected the spending of consumer. Ever since, there has been continual analysis by economists on the extent to which consumer spending reacts to changes in the different components of wealth, such as total household wealth and stock market wealth. There is high volatility and unpredictability experienced in the stock market compared to other assets such as savings, real estate, or automobiles (Ungerer, 2003). Fluctuations in asset prices as highlighted in literature are likely to influence real activities through three major channels- a credit channel (improved collateral which reduces adverse selection problem and reduce risks associated to profitable investments); increase in firms demand for investment through rise in asset prices which automatically lower firm’s cost of capital; and wealth effect (increase in permanent income) (Ohiomu, 2011). Thus, the means that have been recommended through which stock markets influence economy is the stock market wealth effect (Hau, 2011).

Investors will make effort to smooth out transitory movement in their assets wealth holding, which arises as a result of the variation in expected return if they intend to maintain flat consumption pattern overtime. A forward looking investor that expects a rise in excess return in the forthcoming period will increase current consumption from current asset wealth and labour income which subsequently causes consumption trend to rise above its trend. Also, the expectation of a decrease in excess return in the market will cause prospective investors to reduce consumption out of (current asset) wealth and labour income leading to a fall in consumption.

Economists have suggested that asset prices influence private consumption through wealth effect. This goes in line with life cycle hypothesis which suggests that increase in wealth will result in increase in private consumption overtime (Hau, 2011). Equity return may affect consumption through various channels. Realised gains from capital may directly affect the private consumption while unrealized capital gain may have effect on current and future consumption as a result of anticipated future wealth expected. Increase in the wealth of an individual may either cause the individual to increase his or her present consumption, save the excess wealth for future use or transfer or give the wealth to somebody (Hau, 2011).

All these channels however will still lead to stimulating consumption at one period or the other. Thus, stock market returns affect the investors’ wealth which invariably and consequently affects their spending. The implication of this is that a boom in the stock market will increase the gravity on consumption while a recession in the stock market will hamper economic activities. It can thus be deduced that consumption and investment are the main avenue by which prices of asset affect the real economy. The diagram below illustrates this point.

The above diagram shows the link between the real sector and the financial sector. At the peak of the diagram is the income an individual is expected to obtain at any particular point in time. Individual can either decide to consume all his income but a rational individual will always want to save for future purpose. Income not spent is therefore being invested in either the money market and/or the capital market. Investment in either the money market or capital market is the commitment of money or capital to buy financial instruments for the purpose of receiving profitable returns in the form of interest. This implies that domestic investment is majorly financed by domestic saving which is basically determined by the extent of private consumption.

Investment activity however contains purchasing and se and selling of financial assets e.g. bank deposits, physical assets e.g. houses, land, building or consumer durables, and marketable assets like shares, government securities in primary and secondary markets. Investment activity comprises using of funds or savings for further formation of assets or acquisition of existing assets.

The motive for saving now is to create future consumption. Preference drives the division of income between consumption and saving in a situation where the individual do not value saving. An individual attitude towards risk drives the economic decision about the level of savings to set aside. Investment in either the capital market or money market increases consumption through wealth effect. Household consumption decision therefore affects how the economy behave both in the long run and short run.

Methodology

Theoretical Framework

The theoretical underpinning consumption function is based on the assumption that its primary determinant is income (disposable) (Tapsin & Hepsag, 2014). However, this may be inadequate as it does not incorporate the flow and balance sheet effect related to personal saving and wealth. Life cycle hypothesis suggested that increases in wealth leads to increases in private consumption overtime.

Life-cycle model is however the basic theory that links wealth and consumption. The basic idea is that there is accumulation of and reduction of wealth by household in order to maintain a steady consumption pattern. The model suggests that when asset prices are predictable, planned consumption should remain constant while an unexpected change will cause consumption pattern to change. Thus, allowing for the likelihood that consumption responds to anticipated variations in wealth or sluggishly to permanent variations in wealth. Economists form empirical models that quantify the connection concerning consumption and wealth using life-cycle theory as the foundation. These models however have been used to determine the reaction of consumption to changes in wealth.

Model Specification and Estimation Technique

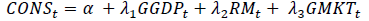

In a bid to examine the impact of equity return on consumption and investment in risky assets, this study builds on Davis (2010); Kazmi (2015) model. Economic theory says that fluctuations in asset prices have impact on private consumption through a wealth effect (Funke, 2002; Davis, 2010). Incorporating the wealth effect gives:

where CONSt is growth rate of consumption per capita

GGDPt is the per capita disposable income

RMt is the market return

GMKTt is the stock wealth effect variable which is proxy by growth in market capitalization

The equation for estimating the effect of equity return on consumption is thus stated using three different equations. This is to be able to analyze the impact of some other variables on consumption growth. The three equations are:

However two equations were analyzed in the consideration of the effect of equity return on investment in risky asset (GVOLT

The use of GMM in estimating caused the application or inclusion of instruments for analyzing these models (Ogundipe, Oluwatobi and Ogundipe, 2021). Thus, the lagged values of the dependent as well as predetermined variables were used as instruments to analyze these models. GDP per capita (GGDP), Market return (RM), inflation (INF), risk free interest rate (RF), lending rate (LR) and U.S interest rate (USIR) were used to capture some of the factors that can influence growth rate of consumption and investment in risky assets. The generalized method of moments (GMM) IS a technique of estimation that give room for an economic model to be presented in ways where unwanted and unnecessary assumptions that accommodate for errors can be prevented.

Results

Analysis of the effect of Equity Returns on Consumption in Nigeria

Table 1 presents the result of the effects of equity returns on consumption using model one. The model one displays that the lagged value of consumption had a coefficient of 0.32 which is statistically significant with a t-statistic of 5.87. This implies that past value of consumption growth rate significantly affect the current growth rate of consumption. The same thing applies to per capita income which has a coefficient of 0.020 and a t-statistic of 2.36. This goes in line with the theory that income and consumption are positively related, that is, individual tends to increase their consumption habit as their income rises.

| Table 1 Model 1 on the Effects of Equity Returns on Consumption Dependent Variable: Cons |

||||||||||

| Independent variable | C | CONS(-1) | GGDP | RM | LR | R2 | Durbin-Watson stat | Instrument rank | J-statistic | Prob(J-statistic) |

|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient | 0.53 | 0.32 | 0.020 | 0.000181 | -0.0012 | 0.10 | 2.15 | 8 | 1.27 | 0.74 |

| t-Statistic | 6.05** | 5.87** | 2.36* | 0.28 | -1.26 | |||||

Source: Author’s computation (2019)

However, the coefficient of equity return though positively related to consumption growth is statistically insignificant with a t-statistic of 0.28 and a coefficient of 0.00018 (a value almost tending towards zero). This implies that equity return does not have a significant impact on the consumption growth rate. Lending rate has a negative coefficient of -0.0012 and it’s statistically not significant with a t-value of -1.26. This implies that a unit change in lending rate will reduce the growth rate of per capita private consumption by 0.0012.

The explanatory power of the model shows that the model can only explain about 10% variation of consumption growth which is very small. The Durbin-Watson is 2.14, a value very close to 2 and it shows that there is no problem of serial autocorrelation with the model. The J-statistics value was used to evaluate the validity of the instruments used within GMM estimate. The small J-statistic indicates correctly specified model while a large value of J-statistic cast doubt on the satisfaction of moment condition underlying GMM. It is a value similar to the Sargen-Hansen test of over-identifying restrictions and it validates the instruments used for estimation. To examine the validity of instruments used, J-statistic and instrument rank are examined. The result in model one showed the number of parameters estimated (5) (J-statistic of 1.27 and the probability (J-statistic) value of 0.74) is less than the instrument rank (8) which implies that Sargan-hansan test of over-identifying restrictions can be carried out under the null hypothesis that established the validity of over-identifying restriction. This notion established the validity f instruments used and the reliability of GMM estimates. This means that the instruments are valid since they are not correlated with the error terms in Table 2.

| Table 2 Model 2 on the Effects of Equity Returns on Consumption Dependent Variable: Cons |

|||||||||||

| INDEPENDENT VARIABLE | C | CONS(-1) | GGDP | RM | LR | USIR | R2 | Durbin-Watson stat | Instrument rank | J-statistic | Prob(J-statistic) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient | 0.49 | 0.28 | 0.033 | 0.000219 | -0.0017 | -0.0037 | 0.12 | 2.09 | 10 | 2.05 | 0.73 |

| t-Statistic | 3.31** | 5.70** | 1.76* | 0.87 | -1.57 | -0.88 | |||||

Source: Author’s computation (2019)

Furthermore, the result of model two, the lagged value of consumption was statistically significant with a positive coefficient 0.28 and a t-value of 5.7. This implies that a unit increase in the lagged values of consumption per capita will increase the growth rate of consumption by 0.28. The a-priori expectation is that income should be positively related to consumption. Per capita income thus has a positive and significant relationship with consumption growth. Thus, a unit increase in the value of per capita income will increase the growth rate of consumption by 0.033. Though the equity return follows the a-priori expectation to have a positive relationship with consumption, its impact on consumption growth is not significant and the co-efficient tends towards zero. This is in line with the findings of Funke (2002) who found that a positive but not significant relationship exists between return and consumption using data from 16 emerging markets.

Interest rate proxy by lending rate and U.S interest rate also have a negative relationship with consumption growth although they are not statistically significant. Their coefficients are -0.0017 and -0.0037 with a t-statistic of -1.57 and 0.88 respectively. This implies that a unit increase in lending rate will reduce consumption by 0.0017 while a unit increase in U.S interest rate will also reduce consumption growth by 0.0037. This goes in line with the findings of Ungerer (2003) who found a negative relationship between consumption expenditure and interest rates in U.S.

The statistical verification of the result shows that the R-Squared was about 12 percent. This means that 12% variation in consumption growth rate can only be explained by the effect of the variables considered. Thus, instrument rank (10) which is greater than the numbers of parameters estimated (6) shows that Sargan-hansen test of over-identifying restrictions can be estimated under the null hypothesis that established the validity of over-identifying restriction. With a probability ((J-statistic) value of 0.73 and a J-statistic of 2.05, this established the validity of the instruments used and the reliability of the GMM estimates. The implication of this is that there is no correlation between the instruments and the error terms, hence the instruments are valid. Also, the freedom from serial correlation problem is ascertained by the Durbin-Watson statistic which stood at 2.09, a value close to 2 in Table 3.

| Table 3 Model 3 on the Effects of Equity Returns on Consumption Dependent Variable: Cons |

|||||||||||

| Independent Variable | C | CONS(-1) | GGDP | RM | RF | GMKT | R2 | Durbin-Watson stat | Instrument rank | J-statistic | Prob(J-statistic) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient | 1.58 | 0.93 | 0.043 | 0.00024 | 0.0012 | 0.47 | 0.96 | 1.51 | 11 | 6.31 | 0.28 |

| t-Statistic | 2.40* | 30.46** | 1.72* | 0.43 | 1.39 | 3.34** | |||||

Source: Author’s computation (2019)

Finally, the model three showed that the lagged value of consumption was statistically significant with a positive coefficient 0.93 and a t-value of 30.46, this implies that a unit increase in the lagged values of consumption per capita will increase growth rate of current consumption by 0.93%. Per capita income follow the a-priori expectation that income should be positively related to consumption thus has a positive and significant relationship with consumption. A unit increase in per capita income will increase the growth rate of consumption by 0.043. Though the equity returns follow the a-priori expectation to have a positive relationship with consumption, its impact on consumption growth is not significant and the co-efficient tends towards zero. This implies that equity returns have positive effect on consumption although it is not significant. For instance, when individual receive expected higher return on their investment the monetary value of their investment (wealth) increases which will lead to higher income and afterwards increases consumption. An increase in consumption will lead to a decrease in savings which will bring about an increase in savings rate in order to attract prospective investors to invest more and vice versa. This goes in line with the theory that wealth effects have a positive impact on future consumption.

Risk free interest rate proxy by treasury bills rate also have a positive relationship with consumption although it shows that it is not significant with a coefficient of 0.02 and a t-statistic of 0.95. This implies that a unit increase in government treasury bills rate does not have a significant effect on the growth rate of consumption though a positive relationship exit. A rise in risk free interest rate will lead to fall in equity prices which will cause present consumption to fall relative to future consumption. Thus, a fall in present consumption will increase future consumption by the same amount plus the yield. This implies that increases in treasury bills rate will have positive effect on the growth rate of consumption.

Stock market wealth has positive and significant relationship with the growth rate of consumption with a coefficient value of 0.47 and a t-statistic of 3.34. This implies that a unit increase in wealth will increase consumption by 0.47. It is expected that stock market wealth effect may be lower for developing and emerging economies like Nigeria (Funke, 2002) due to the prevalent economic situations. The statistical verification of the result showed that the R-Squared is 96 percent. This means that the model is able to explain about 96% variation in consumption growth rate. The probability ((J-statistics) value of 0.28 supports the validity of over-identifying restrictions and a J-statistics of 6.31 showed that over-identification restrictions (and the instruments excluded and included are independently distributed of the error process) is valid as a result of applying 11 instruments but estimated only 6 parameters. Also, the Durbin-Watson statistic is 1.51.

Discussion of Findings

The results obtained from the effects of equity returns on consumption using three models showed that the lagged values of consumption growth have positive and significant effect on consumption growth which implies that past consumption have effects on current consumption. The per capita income have positive and significant effect on consumption growth while equity return and risk free rate of return showed a positive effect on consumption growth but these effects are not in any way statistically significant. Stock market wealth variable had a positive and statistically significant relationship with the growth rate of consumption. This implies that the standard of living of an average individual will increase as a result of investment in stock market which yields a return that increases the wealth of an individual. Funke (2002) using data from 16 emerging economy established a positive although not significant relationship between return and consumption. Ohiomu (2011) found a positive and significant stock market wealth effect on consumption in Nigeria.

However, lending rate and U.S interest rates albeit not statistically significant have a negative relationship with consumption growth. Interest rates do not directly affect consumption but indirectly through its effect on income. Udok & Roland (2012) found a negative relationship between interest rate and gross domestic product in Nigeria Ungerer (2003) found a negative relationship between consumption expenditure and interest rates in U.S. Thus, this objective established that per capita income, past values of consumption growth, stock market wealth, all statistically significant as well as equity return and risk free interest rate although not significant, influences the growth of consumption per capita positively while lending rate and U.S interest rate have a negative impact on consumption growth rate in Nigeria in Table 4

| Table 4 Model 1 on the Effects of Equity Returns on Investment in Risky Assets Dependent Variable: GVOLT |

||||||||||||

| INDEPENDENT VARIABLE | C | GVOLT(-1) | GGDP | RM | RF | USIR | R2 | Durbin-Watson stat | Instrument rank | J-statistic | Prob(J-statistic) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient | -2.13 | -0.35 | 0.47 | 0.03 | -0.21 | -0.07 | 0.17 | 2.15 | 7 | 1.80 | 0.18 | |

| t-Statistic | -0.51 | -8.24** | 0.84 | 5.09** | -1.71* | -0.57 | ||||||

Source: Author’s computation (2019)

Effects of Equity Returns on Investment in Risky Assets

In a bid to examine the effect of equity return on investment in risky assets the table 4 showed the results of the analysis. The coefficient of the lagged value of the growth rate in investment in risky asset in model one is negatively related, but statistically significant, with the growth rate of investment. The coefficient value of -0.35 have a t-statistic of -8.24 and this implies that a unit change in the lagged values of growth rate of investment in risky assets will cause a decrease in the present growth rate of investment by 0.35. However, per capita income (GGDP) had a positive but not significant relationship with investment in risky assets with a coefficient of 0.47 and a t-statistic of 0.84. This implies that an increase in per capita income (GGDP) by 1 will increase investment in risky asset by 0.47 although this is statistically not significant. This shows that as income increase, it will affect investment positively but the rate or the level at which this transmission effect occur in investment is not significant (minute) which implies that income is not the main determinant of investment in risky assets though it had a positive effect on the growth of investment in risky assets.

Also, market return had a positive and significant relationship with investment in risky assets. This implies that a unit increase in the market return will bring about 0.028 increases in the growth rate of the volume of investment in risky assets (GVOLT). Just as the a-priori expectation of a rational investor is to maximise his or her profit and minimise risk, an individual whose motive for investing is to obtain return will increase the amount he or she invest as the market return increase. The low coefficient can be attributed to the investment habit of individual in risky assets in particular stock exchange market.

On the other hand, treasury bills rate has a negative coefficient of -0.21 and a t-statistic of -1.71 which signifies that there is a negative relationship between government treasury bills rate and growth rate of investment in risky assets. The opportunity cost of investing in risky asset (stock) is the riskless asset which bears a risk free interest rate. This implies that an increase in government treasury bills rate makes government bonds (securities) more attractive and it encourages investors to invest in money market rather than stock market by buying more bonds instead of a risky asset. However, U.S interest rate had a negative but not significant relationship with the growth rate of investment in risky assets. This implies that an increase in U.S interest rate will reduces the growth rate of investment in risky assets because U.S market will be more attractive for investor than Nigeria. This may be as a result of the decrease in U.S. interest rate after the great economic recession which is aimed at helping developing economy overcome the problem of great recession. A fall in U.S interest rate made domestic investment more attractive to foreign investors.

The R-square showed that the model explain 17% variation of the variations in the growth rate of investment in risky assets. The Durbin-Watson statistics of 2.15 which is very close to 2 signifies that this model is free from the problem of serial correlation. Also, J-statistic for testing the validity of over-identifying restrictions that arise because we have 7 instruments and estimated 6 parameters is 1.8 and the Probability of J-statistic is 0.18, this also implies that the model support the validity of over-identifying restrictions in Table 5.

| Table 5 Effect of equity return on investment in risky assets Dependent variable: GVOLT |

||||||||||

| Independent Variable | C | GVOLT (-1) | RM | LR | USIR | R2 | Durbin-Watson stat | Instrument rank | J-statistic | Prob(J-statistic) |

|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient | 1.72 | -0.38 | 0.09 | -0.015 | -0.004776 | 0. 83 | 2.02 | 8 | 3.43 | 0.33 |

| t-Statistic | 4.995** | -4.84** | 3.28** | -0.94 | -0.19 | |||||

Source: Author’s computation (2019)

In table 5 above, the coefficient of the lagged value of the growth rate in investment in risky asset is negative but statistically significant with the growth rate of investment. The coefficient of -0.38 have a t-statistics of -4.84 and this implies that a unit change in the lagged values of growth rate of investment in risky assets will cause a decrease in the present growth rate of investment by 0.38. This may be as a result of investors’ apathy due to global and economic recession which caused the decline of investors in the Nigerian stock exchange market. The decline in the level of investment of investors’ (foreign and domestic) reduces the total or actual level of investment in the stock market which have a negative effect on the growth.

Also, market return had a positive and significant relationship with investment in risky assets. This implies that a unit increase in the market return will bring about 0.091 increases in the growth rate of investment in risky assets (GVOLT). Just as the a-priori expectation of a rational investor is to maximise his or her profit and minimise risk, an individual whose motive of investing is the gain or return associated with such investment will increase the amount he or she invest as the market return increase. However, treasury bills rate had a negative coefficient of -0.17 and a t-statistic of -1.56 which signifies that there is a negative relationship between government treasury bills rate and growth rate of investment in risky assets. This implies that though risk free rate may have effect on investment in stock market, it decreases the growth rate of investment in risky asset. That is, if government should continue to increase treasury bills rate, which is used as a proxy for risk free interest rate, a rational investor who always want to maximise profit or gain and minimise loss will invest in riskless asset than invest in risky asset (Akpan & Chukwudum, 2014). By implication, this will lead to reduction of investment in risky assets.

Lending rate had a negative coefficient of 0.014 with a t-statistic of 0.94 which is statistically not significant. This implies a unit change in lending rate will reduce investment in risky assets by 0.014. In the paper by Akpan and Chukwudum (2014), the authors said that an investor will prefer to choose a higher return and low risk investment than investing in stock market. This means that high interest rate reduces consumption as well as investment in risky assets as individual prefers to invest in less risky assets (Humpe, 2008). Also, the U.S interest rate had a negative but not significant effect with the growth rate of investment in risky assets. A unit change in U.S interest rate will decrease growth rate of investment in risky assets by 0.0048.

The R-square showed that the model explain 83% variation of the changes in the growth rate of investment in risky assets. The Durbin-Watson statistics value is 2.01 which is very close to 2 and it signifies that this model is free from the problem of serial correlation. Also, J-statistic is 3.43 and the Probability of J-statistic is 0.33 implies that the model validates the over-identifying restriction and it is well specified with an instrument rank of 8 and 5 estimated parameters

Discussion of Findings

The findings from the analysis of the effect of equity return on investment in risky assets showed that for both models, past values of investment in risky assets have negative effect on the current values. This implies that investors are not motivated to invest in risky assets as a result of the past growth experienced. This might be a resultant effect of the fluctuations experienced in the stock market which made investors to be sceptical about their investment habit. The relationship between per capita income and investment in risky assets is positive although not significant. This implies that investors habit to investment in stock market is not proportional to (the function of) their income that is, there is no significant relationship between individual stock market investment and income. Market returns have a positive and significant relationship with investment in risky assets. Risk free rate of returns have a negative and significant relationship with investment in risky assets. Lending rate and U.S interest rate had a negative relationship with investment in risky assets although the effects are not significant. This is in line with the paper by Akpan & Chukwudum (2014), they found a negative but not significant relationship between interest rate and All Share Price index in Nigeria.

Summary and Conclusion

Equity returns had a positive though not significant effect on growth rate of consumption per capita. The lagged values of consumption growth had positive and significant effect on consumption growth which implies that past consumption had positive effects on current consumption. The per capita income had positive and significant effect on consumption growth. Risk free rate of return showed a positive but not significant effect on consumption growth while stock market wealth variable had positive and statistically significant relationship with the growth rate of consumption.Stock market wealth influenced the growth of consumption per capita in Nigeria. Lending rate and U.S. interest rate had a negative albeit not significant relationship with growth rate of per capita consumption.

On the effect of equity return on investment in risky assets, the past values of investment in risky assets had negative effect on the current values. The relationship between per capita income and investment in risky assets was positive although not significant. Equity return had positive and significant effect on investment in risky assets. Risk free rate of returns had a negative and significant relationship with investment in risky assets. Lending rate and U.S interest rates had negative although statistically not significant effect on investment in risky assets. An increase in U.S interest rate reduced the growth rate of investment in risky assets because U.S market was more attractive for investor than the Nigeria market.

In conclusion, the findings of this study showed that stock market wealth effect, gross domestic product per capita, the lagged value of consumption and equity return affected private consumption growth positively while lending rate and U.S interest rate negatively influenced consumption growth. Conversely, equity return and gross domestic product per capita affected the growth rate of investment in risky assets while risk free rate of interest, the lagged value of investment in risky asset and U.S interest rate negatively affected investment in risky assets.

Acknowledgment

The authors hereby use this opportunity to acknowledge all the authors whose studies were cited in this manuscript. Also, our appreciation goes to Centre for Research, Innovation, and Discovery (CUCRID), Covenant University, Nigeria, for sponsoring the publication of this article.

References

- Aderounmu, B.O., Olomola, P.A., Oladeji, S.I. (2018). Equity Return and Consumption in Nigeria. International Journal of Economics and Finance, 7(1), 1-25.

- Agénor, P. (2007). Consumption, Saving and Investment. World Bank.

- Ahmed, I. (2009). Effects of Liberalization on Stock Return Volatility in Nigerian Stock Exchange. Seminar paper submitted to the Department of Business Administration, Ahmadu Bello University, Zaria.

- Akpan, I.T., & Chukwudum, Q. (2014). Impact of Interest Rates on Stock Prices: An Analysis of the All Share Index. International Journal of Finance and Accounting, 3(2), 96-101.

- Akinlo, A.E., & Akinlo, O.O. (2009). Stock market development and economic growth: Evidence from seven sub-Sahara African countries. Journal of Economics and Business, 61, 162–171.

- Ando, A., & Modigliani, F. (1963). The ‘Life-Cycle’ Hypothesis of Saving: Aggregate Implication and Tests. American Economic Review, 53, 55-84.

- Arestis, P., Demetriades, P., & Luintel, K. (2001). Financial Development and Economic Growth: The Role of Stock Markets. Journal of Money, Credit and Banking, 33, 16-41.

- Babajide, A.A., Ishola, L.A., Adekunle, A.K., Achugamonu, B.U & Akinjare, V.B. (2021). Financial Sector Reform and Economic Development in Nigeria. Asian Economic and Financial Review, 11(2), 160-172.

- Bjorheim, J. (2014). The Epistemological Value of the Consumption Based Capital Asset Pricing Model.

- Clark, J.M. (1917). Business Acceleration and the Law of Demand: A Technical Factor in Economic Cycles. Journal of Political Economy, 25(1), 217-235.

- Davis, E.P. (2010). New International Evidence on Asset-Price Effects on Investment, and a Survey for Consumption. OECD Journal: Economic Studies.

- Eklund, J.E. (2013). Theories of Investment: A Theoretical Review with Empirical Applications. Swedish Entrepreneurship Forum and Jönköping International Business School Working Paper 22.

- Faig, M., & Shum, P. (2004). What Explains Household Stock Holdings?

- Felicia O. Olokoyo., Oyakhilome W., Ibhagui & Abiola Babajide. (2020). Macroeconomic indicators and capital market performance: Are the links sustainable? Cogent Business & Management, 7(1), 1792258.

- Funke, N. (2002). Stock Market Developments and Private Consumer Spending in Emerging Markets IMF Working Paper.

- Grobys, K. (2014). Essays on Empirical Asset Pricing. https://www.univaasa.fi/materiaali/pdf/isbn_978-952-476-575-6.pd.

- Hansen, B.E., & West, K.D. (2002). Generalized Method of Moments and Macroeconomics. American Statistical Association Journal of Business & Economic Statistic, 20(4), 460-469.

- Hau, L. (2011). Stock Market and Consumption: Evidence from China. Berkeley Undergraduate Journal, 24(3).

- Humpe, A. (2008). Macroeconomic Variables and the Stock Market: An Empirical Comparison of the US and JAPAN. A Thesis Submitted for the Degree of PhD at the University of St. Andrews.

- Jorgenson, D. (1963). Capital Theory and Investment Behavior. American Economic Review, 53(2), 247-259.

- Kapoor, M., & Ravi, S. (2009). The Effect of Interest Rates on Household Consumption: Evidence from a Natural Experiment in India.

- Kazmi, S.M.A. (2015). Real Private Consumption Expenditure Modeling an Empirical Study on Pakistan. Journal of Economics and Sustainable Development, 6(17), 36-47.

- Kristina, L. (2010). Investment Analysis and Portfolio Management: Development and Approbation of Applied Courses Based on the Transfer of Teaching Innovations in Finance and Management for Further Education of Entrepreneurs and Specialists in Latvia, Lithuania and Bulgaria. Vytautas Magnus University Kaunas, Lithuania.

- Lettau, M., & Ludvigson, S. (2001). Consumption, Aggregate Wealth, and Expected Stock Returns. The Journal of Finance, 3.

- Ludvigson, S., & Steindel, C. (1999). How Important Is the Stock Market Effect on Consumption? Economic Policy Review.

- Millard, S., & Power J. (2004). The effects of stock market movements on consumption and investment: Does the shock matter? Bank of England Working paper no. 236.

- National Bureau of Statistics (NBS) (2012). Consumption Pattern in Nigeria 2009/10 Preliminary report March, 2012. www.nigerianstat.gov.ng/.../Consumption%20Pattern%20in%20Nigeria%202009-10

- Nwabueze, J.C. (2009). Causal relationship between gross domestic product and personal consumption expenditure of Nigeria. African Journal of Mathematics and Computer Science Research, 2(8), 179-183.

- Ogundipe, A.A., Oluwatobi, S.& Ogundipe, O. (2021). Exploring Growth Inducing Knowledge in Africa: A System GMM Approach, Cogent Arts & Humanities, 8(1), 1883918,

- Ohiomu, S. (2011). The Stock Market Fluctuations and Consumer Behaviour in Nigeria, JORIND, 9(2),193-201.

- Olowe, O., Matthew, O., & Fasina, F. (2011). Nigerian Stock Exchange and Economic Development. http://eprints.covenantuniversity.edu.ng/1690/1/Nigerian%20stock%20exchange%20and%20Economic%20Development.pdf

- Oladeji, T.F., Ikpefan, O.A., & Alege, P.O. (2018). Stock market volatility and non-macroeconomic factors: A vector error correction approach. Journal of Applied Economic Sciences,13(2), 303-315.

- Romer, D. (1996). Advance Macroeconomics. McGraw-Hill advanced series in Economics, 319-341.

- Samuelson, P. (1939a). Interaction between the Multiplier Analysis and the Principle of Acceleration. Review of Economics and Statistics, 21(2), 75-78.

- Samuelson, P. (1939b). A Synthesis of the Principle of Acceleration and the Multiplier. Journal of Political Economy, 47(6), 786-797.

- Sousa, R.M. (2009). Wealth Effects on Consumption evidence from the Euro Area. European Central Bank Working Paper Series No 1050.

- Tapsin, G., & Hepsag, A.(2014).An Analysis of Household ConsumptionExpenditures in EA-18. European Scientific Journal, 10(16).

- The Nigerian Stock Exchange (NSE). (2013). Bolder Strides Annual Report and Accounts, 1-147.

- The Nigerian Stock Exchange (NSE) (2014) Changing Times Enduring Values Annual Report and Accounts. 1-140.

- Udoka, C.O., & Roland, A.A. (2012). The Effect of Interest Rate Fluctuation on the Economic Growth of Nigeria, 1970-2010. International Journal of Business and Social Science, 3(20).

- Ungerer, R. (2003). The Effect of the Stock Market on Consumer Spending: October, 1990 – April, 2002. Issues in Political Economy, 12, 1-21.

- Wang, C. (2008). Household Risky Assets: Selection and Allocation (Doctoral dissertation, The Ohio State University).

- Zhou, J. (2015). Household Stockholding Behavior During the Great Financial Crisis (No. 2015-15). Bank of Canada Working Paper.