Research Article: 2022 Vol: 26 Issue: 1

Euro Interest Rates Impact on Kosovo Government Securities Yield

Shkendije Nahi, Prishtina University

Gazmend Luboteni, Prishtina University

Citation Information: Nahi, S., & Luboteni, G. (2022). Euro interest rates impact on kosovo governement securities' yield. Academy of Accounting and Financial Studies Journal, 26(1), 1-06.

Abstract

The purpose of this research is to identify the Euro interest rates impact on trading of the Kosovo Government securities. The main suggestion of this analysis is that Kosovo Government securities bidders’ reactions were due to the changes in market conditions of the European Central Bank (ECB) interest rates. Accordingly, the aim of this study is to analyze the impact of ECB interest rates in Kosovo Government Securities market. The study results supported the suggestion that the Euro interest rates had significant effect on Kosovo Government Securities trading. The questions that need to be addressed are whether secondary market instruments and longer-term debt instruments would facilitate the bidding and lending in the international debt markets.

Keywords

Yields, Interest Rates, Euribor Rate, OLS.

Introduction

Kosovo’s government debt accounted for 21.83 per cent of the country's nominal GDP whereas general debt ceiling is up to 40 percent of GDP (M.F.L&T, 2021). Domestic debt securities is becoming an important liquidity and financing component of the government budget. Similarly, to emerging market economies, Kosovo is also continuing to use the multiple-price bidding format at auctions for issuing dematerialized government securities. The Kosovo government securities auctions considered successful, where almost all the actions continue to be oversubscribed.

According to the main findings of this study, the ECB short-term interest rates have an impact on the performance of Kosovo government securities yields. Based on common explanatory variables used in the literature the main factors expected to influence auction results includes euro market uncertainty. Bidders’ aim was to maximize the difference between the accepted yields of their bids and the average market yield in order to avoid overvaulting the securities. This means that rational yields offered were higher than their estimate of the expected market yield.

According to this study, the competitiveness through bid /offer ratio for Treasury bill and treasury bonds issued by the Kosovo Government had an impact on the performance of Kosovo government securities yields.

In normal market circumstances, macroeconomic indicators are very important variables in determining the performance of the securities yields. However this study finds that there was no statistically significant impact of macroeconomic indicators on volatility of the Kosovo government securities yield. The monthly data used in this empirical analysis, cover the period 2012 Q1-2020 Q4. The data availability on government securities auctions is limited given that the Kosovo authorities launched the government securities issuance program in early 2012.

The main sources of data are the Central Bank of the Republic of Kosovo (CBK), Ministry of Finance (2021) Labour and Transfers (MFLT) as well as the Kosovo Agency of Statistics (KAS).

Literature Review

Many authors have studied and analyzed the bidding impact on securities markets in response to the liquidity needs. Many market economies continue to use the multiple-price format for trading government securities. Keynesian theory had a common standpoint with regard to the market interest rate being determined. According to Keynesian theory interest rate is important determinant of investment, established by the interplay of demand and supply for money. Essentially, Keynesian theory postulates that interest rate had a negative relation with financial markets (NKWEDE, 2020). The studies of the effects of negative interest rates have typically focused on developments in the countries in the core euro area, or those in Southern Europe that were most affected by the global financial crisis (Reigl & Karsten, 2020). Liquidity management is considered crucial for the first leg of monetary transmission, i.e. transmission of policy rate changes to overnight money market rate. In an emerging market economy, where financial markets are not fully developed the efficacy of the interest rate channel of monetary policy transmission is impeded (Singh, 2020). During periods of higher uncertainty and if quantitative analysis showed that the announcement of certain economic indicators had a significant impact on government securities prices, the treasury should avoid scheduling auctions thereby avoiding losses in revenues. In the opposite case, the treasury need not worry about the timing of its auctions (Djukic & Djukic, 2004).

European sovereign debt markets experienced a strong deterioration of market liquidity at the beginning of the Covid-19 pandemic in February and March 2020 by issuing the Pandemic Emergency Purchase Program (PEPP) on the 18th March 2020 with the aim to “counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the outbreak and escalating diffusion of the coronavirus, COVID-19” (Moench et al., 2021). During the pandemic situation Central banks, activated their own role of being the lender of last resort. In the new market circumstances, they directed their operations in the government securities markets to bringing those levels in line with their statutory objective (Allen, 2020).

Methodology

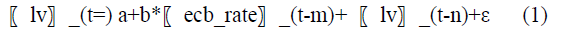

The paper followed the methodology of Ordinary Least Squares regression (OLS). In order to assess the impact of ECB monetary policy on Kosovo government securities interest rates, OLS Methodology was used, according to the following specification:

Where lv indicates the subordinate indicator representing the securities of the Government of Kosovo (three, six, twelve-month or two year bond maturity);

Ecb_rate represents the Euribor rate (three, six, twelve and two –year bond maturity); m and n represent appropriate time delays to ensure that specification satisfied the necessary diagnostic tests, while ε represents the regression error term as constant term (or more precisely the value of lv when the Euribor rate is zero and b represents the impact of the Euribor rate on the respective security rate.. For the purpose of this study, the OLS Methodology was chosen for two main reasons. First, the choice of this methodology was conditioned by a limited number of observations.Second, the relationship between the dependent and the independent indicator (in this case between the government securities and the Euribor) is conisdered to be one-sided (ie, not two- sided).

Study Results

According to economic intuition, the Euribor rate had an impact on Government of Kosovo's securities and not the other way around, given that Kosovo as a small open economy had no impact on external financial markets.

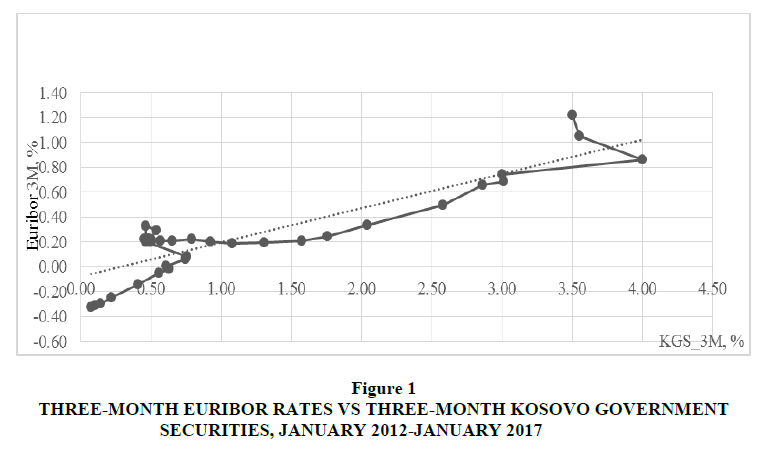

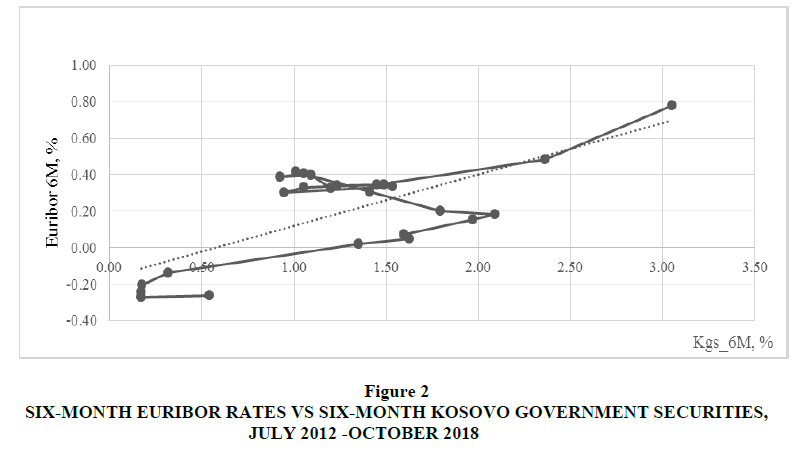

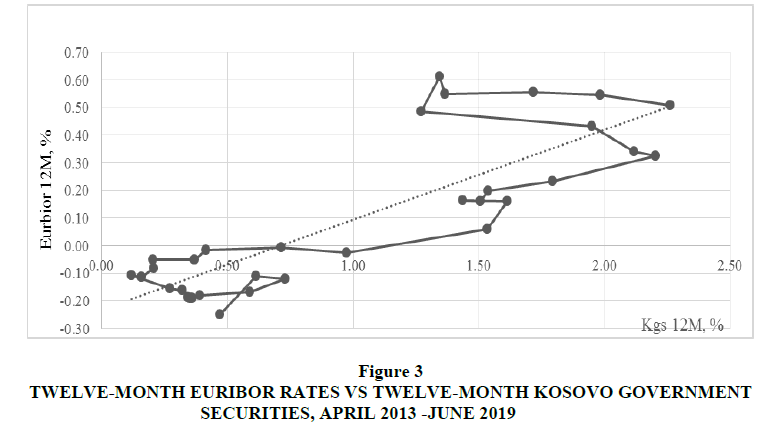

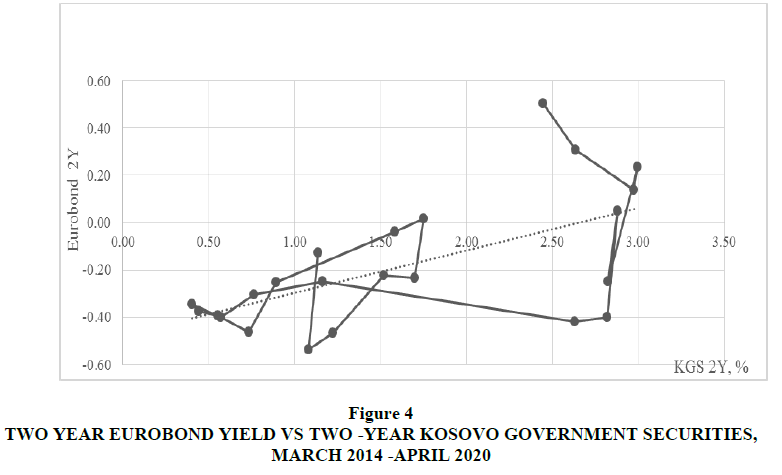

Prior to estimating the OLS, Figures 1,2,3 and 4 visually illustrate the existence of co-movement between the Euribor (three, six, twelve and two year maturity) and the respective Government securities yield. It is clear from the following Figures that there is a positive association between the government securities of Kosovo and Euribor, which means that higher Euribor rates are associated with higher securities rates, and vice versa.

Figure 1: Three-Month Euribor Rates Vs Three-Month Kosovo Government Securities, January 2012-January 2017.

Figure 2: Six-Month Euribor Rates Vs Six-Month Kosovo Government Securities, July 2012 -October 2018.

Figure 3: Twelve-Month Euribor Rates Vs Twelve-Month Kosovo Government Securities, April 2013 -June 2019.

This correlation was stronger and clearer in the case of twelve-month securities, to be followed by those with three-month maturities whereas in the case of six-month securities this positive move was less convincing.

According to economic intuition, the Euribor rate had an impact on Government of Kosovo's securities and not the other way around, given that Kosovo as a small open economy had no impact on external financial markets.

Prior to estimating the OLS, Figures 1,2,3 and 4 visually illustrate the existence of co-movement between the Euribor (three, six, twelve and two year maturity) and the respective Government securities yield.

It is clear from the following Figures that there is a positive association between the government securities of Kosovo and Euribor, which means that higher Euribor rates are associated with higher securities rates, and vice versa.

This correlation was stronger and clearer in the case of twelve-month securities, to be followed by those with three-month maturities whereas in the case of six-month securities this positive move was less convincing in Table 1.

| Table 1 The Impact Of Euribor Rates On Kosovo Government Securities |

||||

|---|---|---|---|---|

| Dependent Variable | ||||

| -1 | -2 | -3 | -4 | |

| lv_3m | lv_6m | lv_12m | lv 2 year | |

| Ecb rate_3m | 0.110*** | |||

| -3.336 | ||||

| Ecb rate_6m | 1.881*** | |||

| -5.196 | ||||

| Ecb rate 12m | 2.14741*** | |||

| -8.5217 | ||||

| Eu.gov bond_2y | 2.015*** | |||

| -3.441 | ||||

| Constant | 0.321*** | 0.878*** | 0.800*** | 2.009*** |

| -9.147 | -7.391 | -11.059 | -10.474 | |

| Observations | 35 | 26 | 33 | 23 |

| R2 | 0.1182 | 0.5294 | 0.7008 | 0.3605 |

| Adj. R2 | 0.1076 | 0.5098 | 0.6912 | 0.3301 |

| Residul std. Error | 0.2827 | 0.5019 | 0.3916 | 0.7605 |

| F Statistic | 11.126 | 26.9975 | 72.6195 | 11.8405 |

| Stationarity of the residual | I(0) | I(0) | I(0) | I(0) |

| Note: | p<0.1; p<0.05; p<0.01 | |||

Furthermore, the results of the unit root test on the residuals of each of the following regressions showed that only the first three specifications (three, six,twelve-month and two year maturity) represent long -term relationship between the Euribor rates and the respective T-bills rates and two year bond maturity, given that their residuals were found to be stationary at the level. Whereas, in the fourth specification, the unit root test concluded that there is no long-term relationship between the two-year Euribor rate and the two- year T-bond rate in Table 2.

| Table 2 Descriptive Statistics |

||||||||

|---|---|---|---|---|---|---|---|---|

| Kgs 3M |

Euribor 3M | Kgs 6M |

Euribor6M | KGS 12M |

Euribor12M | KGS 2Y |

EU Bond 2Y |

|

| Average | 1.17 | 0.25 | 1.22 | 0.18 | 1.01 | 0.10 | 1.64 | -0.18 |

| Median | 0.62 | 0.21 | 1.22 | 0.30 | 0.73 | -0.02 | 1.52 | -0.25 |

| Maximal value | 4.00 | 1.22 | 3.05 | 0.78 | 2.26 | 0.61 | 2.99 | 0.50 |

| Minimal value | 0.07 | -0.33 | 0.17 | -0.27 | 0.12 | -0.25 | 0.40 | -0.54 |

| Standard deviation | 1.12 | 0.35 | 0.72 | 0.28 | 0.70 | 0.27 | 0.93 | 0.28 |

| Asimetry | 1.24 | 0.81 | 0.36 | -0.29 | 0.32 | 0.59 | 0.24 | 0.93 |

| skewness | 3.16 | 3.89 | 3.09 | 2.41 | 1.62 | 1.91 | 1.53 | 2.96 |

| Jarque-Bera | 9.27 | 5.16 | 0.58 | 0.74 | 3.18 | 3.55 | 2.27 | 3.30 |

| Probability | 0.01 | 0.08 | 0.75 | 0.69 | 0.20 | 0.17 | 0.32 | 0.19 |

| Amount | 42.23 | 8.82 | 31.79 | 4.77 | 33.21 | 3.17 | 37.67 | -4.24 |

| Σσ 2 | 43.80 | 4.29 | 12.85 | 1.92 | 15.89 | 2.42 | 18.99 | 1.69 |

| Observations | 36 | 36 | 26 | 26 | 33.00 | 33.00 | 23 | 23 |

Conclusion

The study attempted to identify the euro interest rates impact on Kosovo government securities market. The empirical results revealed that Euribor rates have a positive effect on the yields of Kosovo Government securities.

Government securities market had irregular and small number of auctions for issuance of short-term government securities. Despite the limited number of observations, data clearly showed that Kosovo government securities yields are decreasing over years.

Typically, pension funds and insurance companies prefer longer-dated assets to match their longer-dated liabilities, largely determining the ability of the government to issue longer-dated securities and thereby facilitate the extension of the yield curve. In this respect, the Government of Kosovo should work to obtain an official credit rating by issuing an international bond in the international debt markets.

The Government of Kosovo must try to diversify its funding sources as much as possible on the international financial markets in the short and long term, by lowering the price of risks in periods of elevated uncertainty. Assessing the longer-term implications of policies for the pricing of government securities and quantifying the macroeconomic impact of policies can be addressed in future research attempts. This study recommends further research on the institutional determinants of Government Securities market development with attention to country‘s specific characteristics.