Research Article: 2021 Vol: 24 Issue: 6

European experience in assessing the potential of innovative consulting services

Olena Levishchenko, National Transport University

Oksana Dziuba, National Transport University

Halyna Lavryk, National Transport University

Antonina Zeliska, Polissya National University

Citation Information: Kumar, S., Yadav, A. S., Sharma, V., Ahlawat, N., & Arunachalam, G. (2021). An inventory model with price dependent demand rates as power law form using ANT colony optimization. Journal of Management Information and Decision Sciences, 24(6), 1-10.

Abstract

Innovative consulting services in various sectors of the EU economy are popular due to the potential of companies to attract private and public financial resources. The purpose of this article was to study the implementation of innovative consulting services to assess their potential. The research methodology is based on a statistical analysis of the system of indicators of innovative consulting services and a correlation analysis of the impact on the activities of EU firms. The results show that the most common form of innovation consulting are self-development, product improvement, process, customer search, access to new customer segments, etc. Involvement of consulting organizations in the development of innovative products is carried out by 40% of companies, and the introduction of information and communication technologies and business process updates is the most popular type of consulting in the EU.

Keywords

Consulting; Consulting services; Potential; Innovative development; Innovations; Business models.

Introduction

Innovative consulting services in various sectors of the EU economy are popular due to the potential of attracting financial resources from companies, both private and public. The most common types of consulting among European companies are decision-making on the implementation of information services, marketing activities, business processes, business strategy development, ensuring business sustainability in terms of spreading the concept of sustainable development. Within the EU, government programs aimed at opening innovative companies in the field of consulting are being actively implemented. Firms involve third-party organizations to improve business strategies, business processes, products, finding new customers, the introduction of information technology. This requires a study of the potential of innovative consulting services in the EU.

Literature Review

Consulting services are seen as “knowledge-intensive business services” that are becoming increasingly relevant in the knowledge economy (Hertog, 2000; Cătoiu et al., 2016), as they ensure the growth of enterprise competitiveness. Consulting firms are innovation facilitators or co-producers of innovative products. Process-oriented and intangible knowledge flows between the client and the consulting service provider play a crucial role in the development of innovative products. The scientific literature uses quantitative methodology to assess the potential of innovative consulting services, in particular based on surveys of enterprises (Darie, 2019) and consumers of consulting services (Zafeiropoulou & Nadan, 2015); regression analysis of causal relationships between the factors involved in consulting bureaus and the choice of consulting companies (Tamulienė et al., 2017), multifactor regression analysis (Arias‐Aranda et al., 2001; Lee, 2021), cluster analysis of the results of a survey of the management of agricultural companies based on a structured interview (Andreopoulou, 2014), multidimensional statistical analysis of the relationship between management services/consulting services and indicators of economic efficiency of business, between firm size in engineering consulting and level of innovation (Martin & Matlay, 2003; Cătoiu et al., 2016), exploratory multiple case studies of over 30 innovative European and US companies and semi-structured interviews of managers from product management, research and development, information technology, and marketing (Baloh et al., 2008). The turnover indicator was used to measure the size of the firm (Martin & Matlay, 2003).

A review of the literature indicates the lack of a comprehensive assessment of the state, trends and features of the market of innovative consulting services, which will identify the potential for development of consulting.

Methodology

This article uses statistical and correlation analysis of indicators of the potential of innovative consulting services in the EU and in particular on the example of Bulgaria, the Czech Republic, Germany, Spain, and Italy for 2010-2019, given the availability of data for different time periods. These countries were selected for analysis due to different levels of economic development, including entrepreneurship and the functioning of consulting agencies. The following indicators were selected for analysis:

1. Business enterprise expenditure on R&D, Percentage of GDP in EU-27, 2010-2019.

2. Business enterprise expenditure on R&D in services in EU countries, 2010-2018.

3. Structure of business enterprise expenditure on R&D in different sector of economy.

4. Enterprises that introduced a business process innovation by developer, 2018.

5. Enterprises that introduced new or improved processes by type of innovation, 2018.

6. Total enterprises turnover in EU-27 from innovation core activities, 2018.

7. Enterprises by type of business strategy applied, 2018.

8. Turnover of enterprises from new or significantly improved products in 2016-2018.

Results

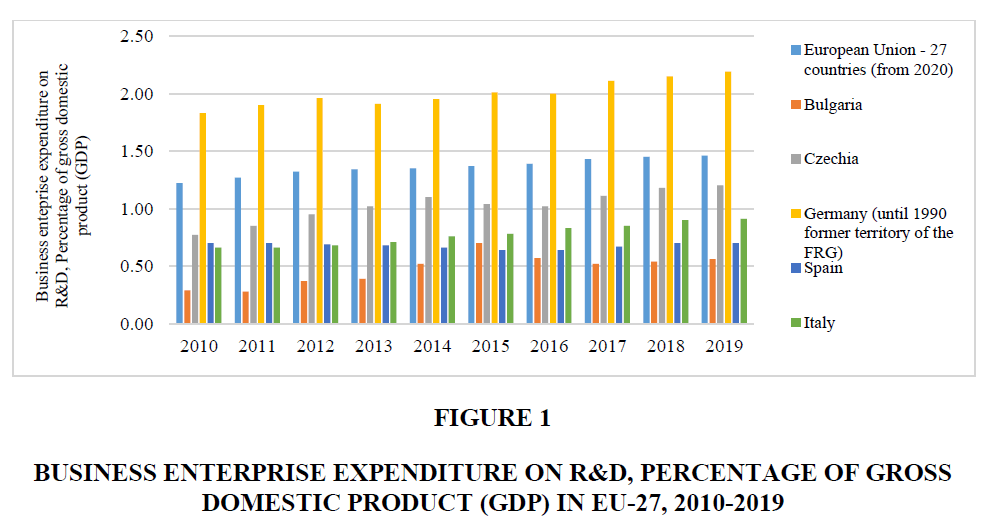

Innovative consulting services in the EU are used to ensure the stability of cash flows, especially in times of crisis. According to Eurostat (2021a), in 2018, 516 thousand EU-27 enterprises presented innovations, including 217 thousand (42%) - product, 299 thousand (58%) - business process innovations. Enterprise spending on research and development averaged 1.36% of GDP in 2010-2019 within the EU-27 (Figure 1).

Figure 1 Business Enterprise Expenditure on R&D, Percentage of Gross Domestic Product (GDP) in EU-27, 2010-2019

In the services sector, R&D expenditures of enterprises in the EU countries as a share of GDP for 2010-2018 were as follows: Bulgaria - 0.34%, the Czech Republic - 0.42%, Germany - 0.27%, Spain - 0.32%, and Italy - 0.20% (Table 1).

| Table 1 Business Enterprise Expenditure on R&D in Services of the Business Economy in EU Countries, % of GDP, all Source of Funding 2010-2018 | ||||||||||

| Country | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Average, % |

| Bulgaria | 0.24 | 0.25 | 0.31 | 0.33 | 0.42 | 0.48 | 0.36 | 0.33 | 0.35 | 0.34 |

| Czech Republic | 0.31 | 0.34 | 0.39 | 0.39 | 0.44 | 0.46 | 0.45 | 0.49 | 0.51 | 0.42 |

| Germany | 0.24 | 0.26 | 0.26 | 0.25 | 0.24 | 0.28 | 0.29 | 0.3 | 0.3 | 0.27 |

| Spain | 0.34 | 0.32 | 0.33 | 0.33 | 0.31 | 0.31 | 0.3 | 0.32 | 0.34 | 0.32 |

| Italy | 0.17 | 0.16 | 0.16 | 0.18 | 0.19 | 0.2 | 0.22 | 0.23 | 0.26 | 0.20 |

The calculation of the R&D share expenditures by service enterprises in the total R&D expenditures of enterprises of all types of activity shows (Table 2) that the service sector is the most popular sector in Bulgaria, financed from various sources (government programs, private sector, NGOs), high in demand in the Czech Republic and Spain, to a lesser extent in Germany and Italy.

| Table 2 Share of Financing of R&D of Enterprises in the Service Sector in the Total Financing of R&D of Enterprises of all types of Activity, 2010-2018, % | ||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Average, % | |

| Bulgaria | 84 | 88 | 84 | 85 | 81 | 68 | 63 | 62 | 65 | 76 |

| Czech Republic | 40 | 40 | 42 | 38 | 40 | 45 | 44 | 44 | 43 | 42 |

| Germany | 13 | 14 | 13 | 13 | 12 | 14 | 14 | 14 | 14 | 14 |

| Spain | 48 | 47 | 47 | 48 | 47 | 48 | 48 | 48 | 49 | 48 |

| Italy | 26 | 25 | 23 | 25 | 26 | 26 | 27 | 27 | 28 | 26 |

R&D financing of various sectors of the economy indicate that services and manufacturing attract the most financial resources to finance innovation (Table 3). This means that innovative consulting services are in high demand, especially in countries with low levels of production.

| Table 3 Structure of Business Enterprise Expenditure on R&D in Different Sectors of Economy | ||||||

| All sectors | Agriculture, forestry and fishing | Mining and quarrying | Manufacturing | Electricity, gas, steam and air conditioning supply; water supply; sewerage, waste management and remediation activities | Services of the business economy | |

| Million euros | ||||||

| Bulgaria | 304,777 | 0.166 | 0.274 | 100,638 | 0.282 | 198,116 |

| Czech Republic | 2,481,912 | 7,637 | 1,617 | 1 354,952 | 16,432 | 1,075,239 |

| Germany | 72 101.3 | 171.6 | 23.8 | 61 574.4 | 156.8 | 10,088.7 |

| Spain | 8 445 | 94 | 18 | 3 830 | 150 | 4 139 |

| Italy | 15,934,029 | 8,007 | 74,963 | 10,716,963 | 113,689 | 4,531,631 |

| Share, % | ||||||

| Bulgaria | 100.00% | 0.05% | 0.09% | 33,02% | 0.09% | 65,00% |

| Czech Republic | 100.00% | 0.31% | 0.07% | 54,59% | 0.66% | 43,32% |

| Germany | 100.00% | 0.24% | 0.03% | 85,40% | 0.22% | 13.99% |

| Spain | 100.00% | 1.11% | 0.21% | 45,35% | 1.78% | 49,01% |

| Italy | 100.00% | 0.05% | 0.47% | 67,26% | 0.71% | 28,44% |

The main producers of innovative business processes are either enterprises or enterprises together with consulting companies (Table 4). For example, in all EU-27 countries, 65% of companies have independently developed innovative business processes, 41% - in collaboration with consulting agencies, 13% - adapting or modifying a product/process developed by other organizations, 14% - business processes are fully developed consulting firms (Eurostat, 2021b). In Bulgaria and the Czech Republic, the most common forms of developing innovative business processes are autonomous and co-production, in Germany co-production predominates, although autonomy is almost equal in volume. In Spain, the autonomous form of implementation of innovative business processes prevails (64%), in Italy, there is the largest share of independence of enterprises in the development of innovations (79%).

| Table 4 Enterprises that Introduced an Business Process Innovation by Developer, 2018, Number and Share | |||||

| Developer of Business process innovation | |||||

| Total | Enterprise itself | Enterprise together with other enterprises or organizations | Enterprise by adapting or modifying products and/or process originally developed by other enterprises or organizations | Other enterprises or organizations | |

| European Union - 27, million euros | 299 102 | 194 692 | 121 620 | 39 632 | 42 548 |

| Share,% | 100.00 | 65,09 | 40,66 | 13.25 | 14.23 |

| Bulgaria, million euros | 3 220 | 2 162 | 1 065 | 447 | 473 |

| Share,% | 100.00 | 67,14 | 33,07 | 13.88 | 14.69 |

| Czech Republic, million euros | 9 787 | 6 790 | 3 399 | 647 | 1150 |

| Share,% | 100.00 | 69,38 | 34,73 | 6.61 | 11.75 |

| Germany, million euros | 81 827 | 41 247 | 42 808 | 10 450 | 12 558 |

| Share,% | 100.00 | 50,41 | 52,32 | 12.77 | 15.35 |

| Spain, million euros | 16 828 | 10 778 | 2 997 | 2 084 | 2 480 |

| Share,% | 100.00 | 64,0 | 17.81 | 12.38 | 14.74 |

| Italy, million euros | 63 780 | 50 583 | 21 561 | 4 871 | 9 033 |

| Share,% | 100.00 | 79,31 | 33,81 | 7.64 | 14.16 |

The main types of innovative business processes of EU-27 enterprises are (Eurostat, 2021c): improved production methods, methods of information communication, organization of responsibility in the workplace, decision-making or human resource management, methods of organizing procedures or external relations, accounting, administrative operations, marketing methods (promotion, packaging, pricing, product placement or after sales services), and innovations in logistics (Table 5).

| Table 5 Enterprises that Introduced New or Improved Processes by Type of Innovation in 2018 | ||||||

| GEO / INNOVAT | European Union-27 | Bulgaria | Czech Republic | Germany | Spain | Italy |

| Business process innovation | 299 102 | 3 220 | 9 787 | 81 827 | 16 828 | 63 780 |

| New or improved methods for producing goods or providing services | 152 294 | 1 799 | 4 817 | 35 270 | 8 004 | 35 839 |

| Innovations in logistics | 94 003 | 805 | 2 639 | 21 778 | 3 674 | 24 487 |

| New business practices for organizing procedures or external relations | 111 217 | 1 418 | 3 275 | 29 235 | 3 018 | 24 841 |

| New methods of organizing work responsibility, decision making or human resource management | 149 261 | 1 287 | 4 663 | 47 402 | 4 772 | 32 824 |

| New or improved methods for information processing or communication | 166 508 | 1 374 | 4 370 | 50 500 | 7 721 | 38 412 |

| New methods for accounting or other administrative operations | 128 192 | 936 | 3 613 | 37 701 | 5 453 | 27 268 |

| New marketing methods for promotion, packaging, pricing, product placement or after sales services | 121 104 | 1 338 | 5 376 | 34 143 | 5 565 | 26 551 |

In general, the turnover of EU-27 enterprises from the introduction of innovative products is growing. The share of turnover of enterprises exclusively with innovative products was 5% in Bulgaria, 3% in the Czech Republic, 6% in Germany; 6% in Spain and 2% in Italy (Eurostat, 2021d). The share of turnover of enterprises exclusively with innovative business processes was 23% in Bulgaria, 20% in the Czech Republic, 17% in Germany; 17% in Spain and 18% in Italy (Eurostat, 2021d). This shows that innovative business processes and consulting in this area are the most profitable for EU companies.

Among the types of strategies used by enterprises with innovative activity, in Bulgaria the focus is on improving existing products, finding new customer groups, focusing on high quality, customer satisfaction. In the Czech Republic, companies are focused mainly on finding new customer groups, addressing specific customer needs, high quality, and customer satisfaction. In Germany, such strategies of innovation activity prevail as high product quality, solving specific customer needs, improving existing products, customer satisfaction, finding new customer groups, and expanding the product range. In Spain, the main strategies are to focus on quality and customer satisfaction, finding new customer groups and improving products, and addressing specific customer needs. In Italy, companies mostly use strategies to meet customer needs, high product quality, product improvement, low price, and expanding the range.

The volume of trade turnover of enterprises with new or significantly improved products, including for the market, for 2016-2018 increased in Bulgaria by 129%, in the Czech Republic - by 120%, in Germany - by 33%, in Spain - by 98%, in Italy - by 211% (Table 6). At the same time, the turnover of enterprises with constant products or minimal changes decreased: in Bulgaria by 82%, in the Czech Republic - by 79%, in Germany - by 93%, in Spain - by 69%, in Italy - by 84%. On average, trade turnover increased by 70% in 2016-2018, but the growth can be explained by other factors. Correlation analysis of trade turnover (Table 7) and the number of innovations by type (Table 8) shows a close direct relationship between even insignificant innovative changes in products with the growth of trade turnover of enterprises.

| Table 6 Enterprises by Type of Business Strategy Applied, 2018, % | |||||

| Strategy | Bulgaria | Czech Republic | Germany | Spain | Italy |

| Focus on improving existing goods or services | 25.2 | 28.3 | 44.4 | 34.6 | 22.6 |

| Focus on introducing entirely new goods or services | 11.1 | 14.8 | 16.7 | 8.4 | 16.7 |

| Focus on reaching out to new customer groups | 32.2 | 30.3 | 30.4 | 35.7 | 9.1 |

| Focus on customer specific solution | 19.4 | 22.7 | 54.4 | 31.6 | - |

| Focus on low-price | 15.7 | 10.9 | 12.0 | 16.1 | 17.4 |

| Focus on high quality | 39.7 | 38.1 | 66.2 | 45.2 | 33.1 |

| Focus on a broad range of goods and services | 15.9 | 10.1 | 23.6 | 15.5 | 16.9 |

| Focus on key goods and services | 12.6 | 7.8 | 13.7 | 11.7 | 7.8 |

| Focus on satisfying established customer groups | 35.4 | 44.5 | 40.7 | 44.2 | 38.6 |

| Focus on standardized goods or services | 14.4 | 11.0 | 11.8 | 12.8 | 11.8 |

| Table 7 Matrix of Correlation Between the Turnover of Enterprises and the Number of Innovations Introduced by Enterprises by Type, According to Bulgaria, the Czech Republic, Germany, Spain and Italy in 2018 | |||||||||||

| Ta | Tb | Tc | Bi | On | Il | Nb | Nc | Sun. | Nf | Ng | |

| Turnover from New or significantly improved products that were new to the firm, Ta | 1.00 | ||||||||||

| Turnover from New or significantly improved products that were new to the market, Tb | 1.00 | 1.00 | |||||||||

| Turnover from Unchanged or marginally modified products (of product innovators), Tc | 0.95 | 0.91 | 1.00 | ||||||||

| Business process innovation, Bi | 0.94 | 0.92 | 0.94 | 1.00 | |||||||

| New or improved methods for producing goods or providing services, Na | 0.87 | 0.83 | 0.91 | 0.98 | 1.00 | ||||||

| Innovations in logistics, Il | 0.82 | 0.79 | 0.88 | 0.96 | 1.00 | 1.00 | |||||

| New business practices for organizing procedures or external relations, Nb | 0.90 | 0.88 | 0.90 | 0.99 | 0.99 | 0.98 | 1.00 | ||||

| New methods of organizing work responsibility, decision making or human resource management, Nc | 0.95 | 0.94 | 0.91 | 0.99 | 0.96 | 0.94 | 0.99 | 1.00 | |||

| New or improved methods for information processing or communication, Nd | 0.94 | 0.92 | 0.93 | 1.00 | 0.98 | 0.96 | 0.99 | 1.00 | 1.00 | ||

| New methods for accounting or other administrative operations, Nf | 0.95 | 0.93 | 0.93 | 1.00 | 0.97 | 0.95 | 0.99 | 1.00 | 1.00 | 1.00 | |

| New marketing methods for promotion, packaging, pricing, product placement or after sales services, Ng | n0.93 | 0.91 | 0.92 | 1.00 | 0.98 | 0.96 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Table 8 Turnover of Enterprises from new or Significantly Improved Products in 2016, 2018 | ||||||

| Country / Innovation | New or significantly improved products that were new to the firm | New or significantly improved products that were new to the market | Unchanged or marginally modified products (of product innovators) | |||

| 2016 | 2018 | 2016 | 2018 | 2016 | 2018 | |

| Bulgaria | 2,486,779 | 5,694,717 | 2,080,345 | 3,194,120 | 14,040,733 | 2,500,597 |

| Czech Republic | 21,540,909 | 47,424,856 | 20,975,236 | 23,810,276 | 112,492,571 | 23,614,580 |

| Germany | 546,241,268 | 727,510,605 | 148,743,503 | 556,240,802 | 2,632,498,998 | 171,269,803 |

| Spain | 105,455,873 | 208,894,142 | 108,945,981 | 120,020,263 | 288,653,109 | 88,873,879 |

| Italy | 110,979,444 | 345,289,219 | 137,736,779 | 216,084,855 | 827,200,278 | 129,204,364 |

| Average | 157,340,855 | 266,962,708 | 83,696,369 | 183,870,063 | 774,977,138 | 83,092,645 |

| Standard deviation | 222,770,270 | 290,718,591 | 67,794,090 | 224,742,902 | 1084,842,822 | 706,53,455 |

The analysis of innovative consulting services shows the following main trends in EU markets:

1. Growth of the share of expenditures in GDP for research and development, financed by the enterprises themselves, in 2010-2019;

2. A high share of financing the innovative activities of service enterprises at the expense of the public, private sectors, non-governmental organizations;

3. The predominance of the service sector and the production sector in the structure of funding for research and development;

4. 65% of EU enterprises develop innovative products and services independently, 40% - with the involvement of third-party organizations;

5. Introduction of innovative information technologies in business processes in various subsystems (communication, accounting, management, human resources management, decision-making, etc.) is the most common type of innovative business processes;

6. Among the strategies of innovative activity of enterprises prevail: focus on reaching out to new customer groups, focus on improving existing goods or services, focus on customer specific solution, focus on satisfying established customer groups, focus on high quality;

7. Innovative business processes provide a significant positive impact on the turnover of enterprises.

Discussion

This article reveals that even minimal changes in innovation activities affect the firm's turnover, and the development of innovations with consulting agencies is significantly used to conduct innovation activities by firms. These results correlate with the findings of Evangelista et al., (2013): business services have a positive impact on firms' innovation performance and industry value added growth.

In this research was found that 40.66% of companies develop innovative business processes with the involvement of consulting organizations. Consulting firms are innovation facilitators or co-producers of innovative products (Hertog, 2000). Baloh et al. (2008) have shown that partnerships provide companies with information flows and knowledge in the field of innovation. The access to an information and integration to it from different sources significantly improves the knowledge base and stimulates sustainable innovation. The main models of a strategic alliance to innovate are “acquisition, strategic alliances, and open source” (Baloh et al., 2008), which can be the basis of innovation projects or programs. Therefore, the potential of innovative consulting services includes the tools of strategic partnership, which are widespread in the EU. The use of consulting services, especially innovative ones, is characterized by complexity due to the attitude of owners towards consultants and different strategies for implementing services (Werr & Pemer, 2007).

The results of this study show that 65% of firms carry out innovation, research and development on their own, without the involvement of outside firms. This means that the perception of consultants as potentially effective actors in business transformation and the impact on profitability growth in the EU still remains low. Consulting services for the implementation of information technology (communication, accounting, and marketing) are most in demand, which may be due in particular to the lack of competence of the management of firms in their integration into activities. This may be because technology transforms business processes and services of firms (Ali et al., 2017), reducing operational risks and ensuring the implementation of innovative production processes (Andreopoulou et al., 2014). Process-oriented and intangible knowledge flows between the client and the consulting service provider play a crucial role in the development of innovative products (Hertog, 2000). Consulting companies also need a digital transformation of business (Nissen, 2018), and therefore consultants must constantly update the range of services, especially digital, given the high level of demand from companies for information technology and support in their implementation.

Instead, business leaders may have more knowledge about product innovation and consumer market demands for products, as evidenced by the active use of product update strategies, quality assurance, and customer focus. According to a study by Lee (2021), accounting consulting services are effective when staff are competent, use e-commerce, high market concentration, a high percentage of consultants and a sufficient number of management consultants.

Conclusion

In this article, the experience of implementing innovative consulting services and assessing their potential is carried out on the example of Bulgaria, the Czech Republic, Germany, Spain and Italy. German and Italian companies mostly use consulting services to transform business processes, while Spanish, Bulgarian and Czech companies are less likely to attract consultants. The most common form of using consulting to implement innovations are self-development, product improvement, process, customer search, access to new customer segments and more. 40% of companies are involved in the development of innovative products in the studied countries. The introduction of information and communication technologies and the renewal of business processes is the most popular type of consulting in the EU. Differentiation of innovative strategies of enterprises of these countries is identified. The main trends in innovative consulting services are identified, which allows to assess the potential within the EU: further growth of the consulting market with an emphasis on the implementation of digital technologies that transform business processes; stimulating consulting activities through government programs and private financial resources to develop innovative products in various sectors of the EU economy; increasing the level of involvement of consulting agencies in the innovative activities of firms; more active use by firms of such strategies of innovative activity as satisfaction of clients, search of new segments of target groups of clients and satisfaction of requirements of clients that will lead to growth of level of attraction of consultants; growth of volumes of innovative business processes which provide introduction by firms of one of the most used strategies of innovative activity - updating of assortment, maintenance of high quality of a product and improvement of the existing assortment of products.

References

- Ali, A., Warren, D., & Mathiassen, L. (2017). Cloud-based business services innovation: A risk management model. International Journal of Information Management, 37(6), 639-649.

- Andreopoulou, Z., Tsekouropoulos, G., Theodoridis, A., Samathrakis, V., & Batzios, C. (2014). Consulting for sustainable development, information technologies adoption, marketing and entrepreneurship issues in livestock farms. Procedia Economics and Finance, 9, 302-309.

- Arias‐Aranda, D., Minguela‐Rata, B. and Rodríguez‐Duarte, A. (2001). Innovation and firm size: an empirical study for Spanish engineering consulting companies, European Journal of Innovation Management, 4(3), 133-142.

- Baloh, P., Jha, S., & Awazu, Y. (2008). Building strategic partnerships for managing innovation outsourcing. Strategic Outsourcing: An International Journal, 1(2), 100-121.

- Cătoiu, I., Tudor, L., & Bisa, C. (2016). Knowledge-intensive business services and business consulting services in romanian changing economic environment. Amfiteatru Economic Journal, 18(41), 40-54.

- Darie, M., Mocanu, O., Gasparotti, C., & Schin, G. C. (2019). Assessment of the performance of management consulting services–a correlational survey. In Forum Scientiae Oeconomia, 7(3), 3147-3147.

- Eurostat (2021a). BERD by NACE Rev. 2 activity and source of funds. Retrieved from https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=rd_e_berdfundr2&lang=en

- Eurostat (2021b). Enterprises that introduced an innovation by type of innovation, developer, NACE Rev.2 activity and size class. Retrieved from https://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do

- Eurostat (2021c). Enterprises that introduced new or improved processes by type of innovation, NACE Rev. 2 activity and size class. Retrieved from https://appsso.eurostat.ec.europa.eu/nui/setupDownloads.do

- Eurostat (2021d). Enterprises, employed persons and turnover by type of enterprise, NACE Rev. 2 activity and size class. Retrieved from https://appsso.eurostat.ec.europa.eu/nui/setupDownloads.do

- Eurostat (2021e). Enterprises by type of business strategy applied, importance of the strategy, NACE Rev. 2 activity and size class. Retrieved from https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=inn_cis11_strat&lang=en

- Eurostat (2021f). Turnover of enterprises from new or significantly improved products, by NACE Rev. 2 activity and size class in 2018. Retrieved from https://appsso.eurostat.ec.europa.eu/nui/setupDownloads.do

- Eurostat (2021g). Turnover of product innovative enterprises from new or significantly improved products, by NACE Rev. 2 activity and size class in 2016. Retrieved from https://appsso.eurostat.ec.europa.eu/nui/setupDownloads.do

- Evangelista, R., Lucchese, M., & Meliciani, V. (2013). Business services, innovation and sectoral growth. Structural change and economic dynamics, 25, 119-132.

- Hertog, P. D. (2000). Knowledge-intensive business services as co-producers of innovation. International journal of innovation management, 4(04), 491-528.

- Lee, C. C. (2021). Analysis on the strategy of improving management consulting business performance: Evidence on a management consulting company established by an accounting firm. Asia Pacific Management Review. In Press.

- Martin, L. M., & Matlay, H. (2003). Innovative use of the Internet in established small firms: the impact of knowledge management and organisational learning in accessing new opportunities. Qualitative Market Research: An International Journal, 4(3), 133-142.

- Nissen V. (2018) Digital Transformation of the Consulting Industry - Introduction and Overview. In: Nissen V. (eds) Digital Transformation of the Consulting Industry. Progress in IS. Springer.

- Tamulienė, V., Raupelienė, A., & Kazlauskienė, E. (2017). Farmers’ Preferences Selecting Agricultural Consulting Services. Montenegrin Journal of Economics, 13(4), 79-87.

- Werr, A., & Pemer, F. (2007). Purchasing management consulting services - From management autonomy to purchasing involvement. Journal of Purchasing and Supply Management, 13(2), 98-112.

- Zafeiropoulou, S., & Nadan, J. (2015, August). Increasing the value of innovation consulting services in the technology age. In 2015 Portland International Conference on Management of Engineering and Technology (PICMET) pp. 704-717.