Research Article: 2022 Vol: 26 Issue: 2S

Evaluation of continuity impact under the Covid 19 pandemic, during the preparation of 2020 financial reports, and external auditors report of public limited shares companies in Jordan

Nahed Habis Alrawashedh, Amman Arab University

Citation Information: Alrawashedh, N.H. (2022). Evaluation of continuity impact under the covid 19 pandemic, during the preparation of 2020 financial reports, and external auditors report of public limited shares companies in Jordan. Academy of Accounting and Financial Studies Journal, 26(S2), 1-17.

Keywords

Public Shareholding Company, Jordan, Covid-19, Financial Reporting, Financial Statements

Abstract

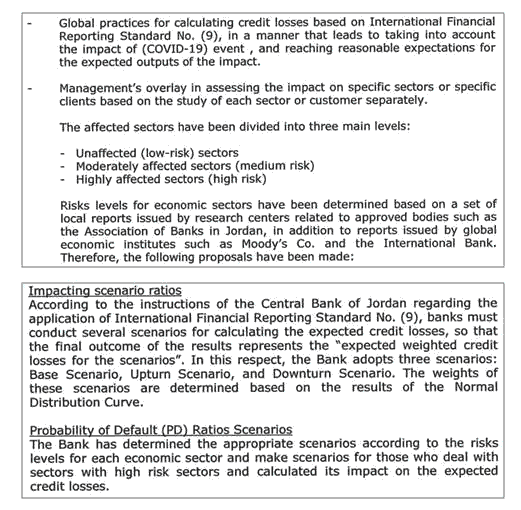

From the start of the second quarter of 2020, the Covid-19 health crisis seriously undermined the growth engines of the world economy, making the exit from the crisis as complex as it is uncertain. Some developing countries, especially those in the MENA region, have been strongly affected by the disruptions induced by the covid-19 crisis, which disrupted the activities of companies leading to the closure of some of them, and to the implementation of extended social distancing measures. In addition, the effect of the volatility of financial markets, and the climate of uncertainty surrounding the persistence of the covid-19 epidemic in the region, make it difficult to declare the accounts of companies where a certain number of aspects related to financial information are affected by the health crisis. It is therefore important that entities provide sufficient information in the notes to the financial statements as well as information about the company that is useful to current and potential investors, lenders and other decision-making creditors. To answer this problem, a study based on a descriptive analysis was carried out on a sample of 35 limited share companies. These analyze show that 23% of the entities published financial reports in the first quarter of 2020 on time. A result which improved markedly over the next two quarters. Thus, the majority of the interim financial reports published by the Jordanian entities in our sample mention the impacts of covid-19 on the preparation of said reports as well as the impact on the turnover and profits of the companies. Various limited stock companies. This information must indeed appear in the reports to guarantee investors the availability of reliable data on the situation impacted by the health crisis. In addition, this information obtained can allow a careful assessment of cash flow projections for the next reporting season taking into account several scenarios. At the end of the analysis, one of the recommendations made is to include narrative information on how the various uncertainties encountered affected the estimates made and the strategy undertaken to deal with Covid-19.

Introduction

From the start of the second quarter of 2020, the Covid-19 health crisis seriously undermined the growth engines of the world economy, making the exit from the crisis as complex as it is uncertain. The unprecedented shocks having thus affected supply and demand simultaneously, under the effect of disruptions in global value chains, have caused, according to estimates by the World Trade Organization (WTO), a collapse of 17.2% of the volume of trade in the second quarter of 2020 against a contraction of 3% a quarter earlier.

Some developing countries, especially those in the MENA region, have been strongly affected by the disruptions induced by the covid-19 crisis, which disrupted the activities of companies leading to the closure of some of them, and to the implementation of extended social distancing measures (Deloitte, 2020). As is usually the case in times of international economic crisis, a race for secure financial assets has been unleashed around the world and has taken a heavy toll on developing countries. The MENA region has not been spared (Folio, 2020).

Indeed, according to the IMF, emerging and developing economies should plunge into a deep recession in 2020 (a contraction of the GDP of these countries by 3.3% in 2020) under the influence of the covid-19 pandemic, of which the he magnitude in the MENA region varies by country. This is how important measures have been taken by these states to face the health crisis leading to a stabilization of the incidence of the disease during the third quarter of 2020. From the start of the fourth quarter of 2020, there has been an upsurge in infections prompting health authorities to question the need to provide populations with vaccines against covid-19 (Köster & Igoe, 2020). Clinical trials have given encouraging results to provide a vaccine, especially for those at risk.

In addition, the recession in MENA economies, the effect of volatility in financial markets, as well as the climate of uncertainty surrounding the persistence, over time, of the covid-19 epidemic in the region, makes it difficult to declare the accounts of companies where a number of aspects related to financial information are affected by the health crisis (Köster & Igoe, 2020). It is therefore important that entities provide sufficient information in the notes to financial statements as well as information about the company that is useful to current and potential investors, lenders and other decision-making creditors (BDO, 2020).

Jordan, like the other MENA countries, has been strongly affected by the consequences of the said crisis, straining both the capacity of its health system to respond to a strong demand for care and the resilience of its economy to absorb the repercussions of this unprecedented crisis. This situation raises questions about the impact of this pandemic on the financial statements of Jordanian companies and on the preparation of their interim financial reports for the first 3 quarters of fiscal 2020. Especially since the consequences of the health crisis on the preparation of financial reports and the establishment of the financial statements of these companies, in particular those with limited shares for the last quarter of 2020, could be important due to the slowdown in the Jordanian economy, the uncertainty of the magnitude of the level of contagion by covid-19, and the generalized effect on sales, supply chain and financial markets (Igoe, 2020). Moreover, the depreciation of assets, the recognition of income and penalties, the restructuring of debts and repayments are all elements that add significant uncertainties to the financial results and to the outlook that require careful consideration in communication with investors (IAASB, 2014).

The good management of the pandemic by the MENA countries, in particular the Jordanian State by maintaining the emphasis on public health has helped to mitigate the rate of infection in these countries and help to relax restrictions in such a way, gradual and progressive (UNHCR, 2020). This has had an impact on the economies of these countries even if we fear an increase in covid-19 patients in the last quarter of 2020. A situation that could upset the financial statements of Jordanian companies (Singh, 2020).

In order to adequately prepare financial reports as of December 31, 2020, it is important to show how Jordanian companies have prepared financial reports for the first three quarters of 2020 and to what extent the information provided and updated is useful to investors and adequately reflect the expected impact of Covid-19 on the financial statements of Jordanian limited stock companies (IFA, 2013). It will therefore be possible to provide guidelines and recommendations for the next year-end financial reporting season and remove ambiguities on the main risks and uncertainties to which entities are exposed (International Federation of Accountants, 2013).

To achieve our objective, we have used the quarterly financial reports of 35 companies listed on the stock exchange in Jordan as of September 30, 2020. Our analysis focuses on the non-financial sector. These companies are in the following sectors: banking, insurance, real estate, pharmaceuticals, chemicals, consumer goods, transport, mining, telecommunications, travel and leisure.

Our analysis focuses on the following questions:

• What is the level of degradation of key performance indicators following the covid-19 pandemic during the first three quarters of the year 2020?

• What is the impact of covid-19 on financial results and to what extent has the information provided adequately reflect this impact?

• To what extent are uncertainties about the conduct of business activities communicated (especially for businesses affected by covid-19)?

• What solutions are being provided in view of the effects and risks posed by the pandemic for Jordanian limited companies, measures to mitigate the repercussions of covid-19?

The research hypotheses are as follows:

• Half of the Jordanian listed companies in our sample published full interim financial statements.

• The Jordanian companies listed on the stock exchange in our sample and which are active in the fields of transport, travel and leisure, are negatively impacted by covid-19.

• Covid-19 has had a positive impact on the income development of publicly traded telecommunications companies located in Jordan.

Methodology

This study is a descriptive research employing the quantitative research method to achieve the objective of the study which is to identify the impact of covid-19 on the financial reporting of Jordanian public limited companies during the year 2020. These types of studies are suitable for examining the evolution of turnover and profits of these different companies.

Sample

We selected 35 companies in the sample from the following sectors: pharmaceuticals, banking, insurance companies, mining, industries, construction, consumer goods, transport and logistics, telecommunications, travel and leisure and other services.

Of these 35 companies, only one has not published financial reports for the first three quarters of 2020 (this is the Jordan Press Foundation). All of the remaining 34 have produced at least one interim financial statement report. as shows Table 1.

| Table 1 Distribution Of Public Entities With Limited Actions By Sector Of Activity |

|

|---|---|

| Entities | Number |

| Bank | 3 |

| Insurance | 3 |

| Real Estate | 3 |

| Health Care Services | 2 |

| Educational Services | 2 |

| Hotels and Tourism | 3 |

| Transportation | 3 |

| Technology and Communication | 2 |

| Media | 1 |

| Utilities and Energy | 2 |

| Commercial Services | 1 |

| Pharmaceutical and Medical Industries | 1 |

| Chemical Industries | 1 |

| Food and Beverages | 1 |

| Mining and Extraction Industries | 3 |

| Engineering and Construction | 2 |

| Electrical Industries | 1 |

| Textiles Leathers and Clothing’s | 1 |

| Grand Total | 35 |

Groups and Information Provided

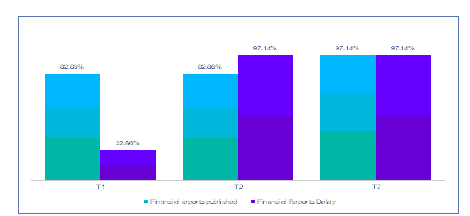

In the first quarter of 2020, out of the 35 public limited companies in our sample, 29 (83% of the entities in our sample) published full interim financial reports in accordance with IFRS respectively. The other 6 did not publish any financial statement report, nor even sales and production reports. In the second quarter of 2020, 83% of the sample of entities released a report of financial statements for the period April 1, 2020 to June 30, 2020 in accordance with IFRS. In addition, these reports were published within the recommended timeframe, that is to say, before the end of the third quarter of 2020. However, with regard to the financial reports for the first quarter of 2020, several public limited-share companies were unable to publish their financial reports so much. Indeed, of the 35 entities sampled, only 8 were able to publish their financial reports or 23% of the total sample. In addition, in the second and third quarters of 2020, the publication of financial statement reports was more general. In fact, 34 out of 35 entities (i.e., 97% of the total population of companies) were able to do so and above all within the required deadlines. as shows in Figure 1.

Figure 1: Details of Financial Reporting Process

Source: Exploitation of data from Jordanian companies (ASE)

Impacts on Results and Industries

In Quarter 1

The consequences of the covid-19 outbreak on the Q1 2020 financial statements of Jordanian limited-stock companies have been quite different. Indeed, their impact on financial performance, overall position or cash flow is moderate if we take into account that the health crisis only started in the second half of March 2020. However, it is important to specify that the influence of the health crisis is evident in the quarterly reports already drawn up by Jordanian companies. as shows in Table 2.

| Table 2 Statement Of Sales And Profits Between The First Quarters Of 2019 And 2020 |

||

|---|---|---|

| Industry | Change in Income | Change in Results |

| Bank | 3.35% | -95.86% |

| Insurance | 24.70% | 26.69% |

| Real Estate | -70.83% | -47.54% |

| Health Care Services | -6.83% | -116.38% |

| Educational Services | 127.36% | 37.84% |

| Hotels and Tourism | -20.61% | -528.24% |

| Transportation | -9.13% | -71.74% |

| Technology and Communication | -1.73% | -78.49% |

| Utilities and Energy | 27.00% | -14.97% |

| Commercial Services | 29.43% | 38.31% |

| Pharmaceutical and Medical Industries | 48.35% | 93.45% |

| Chemical Industries | -23.35% | -5.97% |

| Food and Beverages | -13.51% | -72.32% |

| Mining and Extraction Industries | 19.47% | -227.19% |

| Engineering and Construction | -83.81% | 49.24% |

| Electrical Industries | -41.63% | 271.83% |

| Textiles Leathers and Clothings | -24.56% | -37.48% |

The sample of Jordanian firms, the subject of the study, was not subject to probability sampling. Therefore, it is not representative of all limited share companies across Jordanian territory. However, it should be noted that there are clearly significant differences between the entities when it comes to the effects of the health crisis. In view of this context, sector activity was affected in a different way depending on the nature of the sectors. Thus, the deeply affected sectors include activities dependent on external demand, due to the substantial drop in demand addressed to Jordan, the rupture of global value and supply chains, to which are added the sanitary measures imposed (Raouf et al., 2020).

The hospitality and tourism sector saw a sharp decline in these revenues due to a sudden drop in travel and consumer spending. The repercussions are not limited to the leisure sector: construction companies could be forced to reduce the number of their employees; retailers could have supply chain problems with reduced profits for the food industries; distributors could not receive their stocks delivered from abroad and entities could incur significant penalties in the event of contract cancellation. Generally speaking, many limited stock companies across a wide range of industries have suffered economic losses from this virus (Raouf et al., 2020).

Sectors classified as resilient have, for their part, been able to maintain positive growth in their turnover or profits, although below the rate of trend change, bringing together domestic activities that support economic activity ( banks, insurance companies), administered non-market sectors (health, education, administration), production activities in this context of crisis (agrifood industries, pharmaceutical industries) and export activities where Jordan holds a position a major player in the MENA region (phosphate and derivatives activities).

The positive growth of entities like the medical sciences is based on the effects of stockpiling. Indeed, the pharmaceutical industries have experienced an explosion in their turnover due to the increased need for drugs to absorb the covid-19 pandemic in the early hours of the epidemic (Raouf et al., 2020).

Regarding the profits obtained in the first quarter of 2020 by the Jordanian public limited-stock companies in our sample, only companies in the insurance, commercial services, pharmaceutical and construction engineering sectors made profits during this period of health crisis. The other entities suffered heavy financial losses, in particular those in the tourism and hotel sectors and mining.

Based on the information available in Quarter 1, there is significant uncertainty over the next two quarters that could cast significant doubt on the ability of Jordanian limited-stock companies to continue operating at the shareholder level. Hence the need to provide them with the adequate information needed to make the decision to invest in the future.

In Quarter 2

The chemical industries saw, on reading Table 4, their turnover increase substantially (245% more between the first quarter and the third quarter of 2020). An increase in turnover was also observed in the following sectors: Bank, Utilities and Energy, Food and Beverages, Mining and Extraction Industries, Engineering and Construction, and Electrical Industries. It is thus noted that consumer goods as well as economic activities in general, have experienced a positive development linked to the gradual lifting of the foreclosure in Jordanian territory. as shows in Table 3.

| Table 3 Statement Of Sales And Profits Between The Third Quarters Of 2019 And 2020 |

||

|---|---|---|

| Industry | Change in Income | Change in Results |

| Bank | 3.23% | -38.28% |

| Insurance | -8.73% | -11.10% |

| Real Estate | 304.40% | -60.73% |

| Health Care Services | -15.89% | -1339.02% |

| Educational Services | 1.46% | -9.73% |

| Hotels and Tourism | -72.84% | -1025.30% |

| Transportation | -17.18% | -74.59% |

| Technology and Communication | -20.48% | -50.02% |

| Utilities and Energy | 11.20% | 87.17% |

| Commercial Services | -92.17% | -134.61% |

| Pharmaceutical and Medical Industries | 5.74% | 15.45% |

| Chemical Industries | -11.58% | 278.88% |

| Food and Beverages | 23.97% | 768.71% |

| Mining and Extraction Industries | 14.04% | -197.82% |

| Engineering and Construction | -50.96% | 63.23% |

| Electrical Industries | -2.22% | 157.75% |

| Textiles Leathers and Clothings | -10.58% | 268.32% |

| Table 4 Evolution Of Turnover And Profits Between The First And Third Quarters Of 2020 |

||

|---|---|---|

| Industry | Change in Income | Change in Results |

| Bank | 6.34% | -48.52% |

| Insurance | -68.17% | -96.49% |

| Real Estate | 36.88% | 177.26% |

| Health Care Services | -4.84% | -86.63% |

| Educational Services | -44.99% | 74.06% |

| Hotels and Tourism | -60.84% | 78.64% |

| Transportation | -15.08% | 291.79% |

| Technology and Communication | -27.77% | -34.75% |

| Utilities and Energy | 5.13% | 981.31% |

| Commercial Services | -91.28% | -136.94% |

| Pharmaceutical and Medical Industries | -5.82% | -39.39% |

| Chemical Industries | 245.27% | 80.67% |

| Food and Beverages | 10.57% | 725.39% |

| Mining and Extraction Industries | 16.80% | -179.76% |

| Engineering and Construction | 643.26% | 131.89% |

| Electrical Industries | 25.41% | 14.51% |

| Textiles Leathers and Clothings | -41.20% | -47.56% |

On the other hand, travel and leisure, commercial services, textile industries and transport continue to be affected by the health crisis because they present significant risks of contagion. In terms of revenue, travel and leisure, commercial services, and textile industries were strongly impacted year on year with a decline of 61%, 91%, and 41%, respectively, in the third quarter.

As shown by the results shown in Table 4, the outbreak of the Covid-19 pandemic and the extent of its spread in Jordan had negative effects in these different sectors of activity during the first nine months of the year. 2020. This shows a sharp contraction in their turnover. The mining sector has not really been negatively impacted by the pandemic. Travel and leisure mainly suffered from a sharp drop in demand, mainly due to travel restrictions and associated uncertainties over the entire 9-month period.

Notwithstanding the health crisis, certain branches of activity display a more resilient behavior. Thus, the real estate sector was able to compensate for its losses in the first quarter of 2020. Indeed, the covid-19 pandemic has subjected the sector to the effects of a double shock, on the supply side in relation to the stoppage of construction sites during the containment period and on the demand side following the establishment of containment for a relatively long period.

Automotive and Transportation & Logistics showed positive development in the third quarter, which translated into positive earnings trends. Therefore, this climate of uncertainty shows the need for Jordanian limited-stock companies to provide up-to-date information that is useful to investors to adequately reflect the expected impact of Covid-19 on financial statements as well as the main risks to which the entities are exposed.

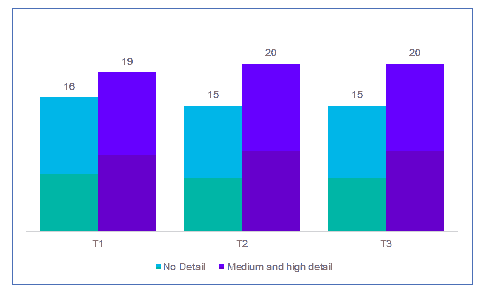

In these circumstances, regulators realize the importance of greater transparency in the disclosure of financial information. In its statement on "The importance of disclosure on COVID-19" published in June 2020, the International Organization of Securities Commissions (IOSCO) specified the 3 major axes which require greater transparency in the communication of information on the significant impacts of the covid-19 pandemic and the resulting level of uncertainties (IMF, 2020). This is how the majority of the interim financial reports published by the Jordanian entities in our sample, mentions the impacts of covid-19 on the preparation of said reports as well as the impact on the turnover and profits of the various limited share companies. This information must indeed appear in the reports to guarantee investors the availability of reliable data on the situation impacted by the health crisis. as shows in Figure 2.

Figure 2: Details of Covid's Impact on Financial Reports from Jordanian Entities

Source: Author's calculations

Looking closely at the reports of Jordanian companies in our sample, the amount of detail presented in the first quarter increased slightly in the second quarter and remained constant in the third quarter. This stability in the third quarter is due to the fact that Jordanian public limited companies are obliged to publish complete and timely quarterly interim financial reports. Companies that have been providing complete interim financial information since the start of fiscal 2020 have at least maintained their level of detail.

Potential impacts of Covid-19

Most of the business sectors in Jordan are severely impacted but to differentiated degrees, even if some companies show a strong resilience manifested by their capacity to continue their exploitation while accommodating the health requirements due to the pandemic (Raouf et al., 2020). There are indeed changes in business models over a longer period of time following short-term measures such as the almost total suspension of trading activities (Igoe, 2020). Since shareholders need relevant information to understand the data coming from the financial statements prepared for each quarter, the uncertainties introduced in the conduct of the activities of the limited share companies in Jordan necessitate the updating of the financial information. From that moment, it will be possible to estimate the measure of the impact of covid-19 on the valuation of the assets and liabilities of these entities, and the ability of an entity to continue operating (Igoe, 2020). In addition, this information obtained can allow a careful assessment of cash flow projections for the next reporting season taking into account several scenarios. These different scenarios are based on reasonable, justifiable and realistic estimates and assumptions to convince investors. This information obtained can allow a careful assessment of cash flow projections over the next reporting season taking into account several scenarios. These different scenarios are based on reasonable, justifiable and realistic estimates and assumptions to convince investors. This information obtained can allow a careful assessment of cash flow projections over the next reporting season taking into account several scenarios. These different scenarios are based on reasonable, justifiable and realistic estimates and assumptions to convince investors.

Investing becomes a real problem if the health crisis persists. Jordanian limited stock companies must provide detailed financial reports so that financiers and investors can view and analyze them thoroughly with a view to making informed decisions on whether or not to invest (Igoe, 2020). To this end, entrepreneurs will have to put in place a strategy and define objectives in line with the economic recovery of companies and reassure shareholders at the same time as the health crisis. In other words, analyze the significant trends and risks that have had an impact on the financial statements, as well as those that could have a future impact in the medium to long term (CSA, 2020).

However, IOSCO strongly recommends entities not to adjust their existing alternative performance measures or to set up new Alternative Performance Measures (“APM”). In particular, businesses especially Jordanian ones should refrain from characterizing a disability as being related to COVID-19, especially where triggers for the impairment existed prior to the pandemic. Additionally, displaying sales and hypothetical results without the effect of COVID-19 is considered inappropriate (Igoe, 2020).

It is in this logic that ESMA recommends making quantitative and qualitative information available to investors and shareholders on how covid-19 impacts or will impact the turnover and profits of companies. The latter have the obligation to produce detailed financial reports, especially with regard to the assumptions used and the way in which the various uncertainties encountered have affected the estimates made and the strategy undertaken to deal with the impacts of Covid-19 (Igoe, 2020).

Through this study where it is a question of exploiting the financial reports of the first three quarters of the year 2020 of Jordanian public limited-share companies, we have set ourselves the objective of giving examples which constitute good indications in the presentation of information in the financial statements and in the management reports at December 31, 2020.

Reporting Approaches

Publication of Information: Relevance and Reliability

Jordanian and foreign shareholders need quality information through the financial reports published by companies in order to decide to invest. It is therefore essential for them to be aware of the consequences of the Covid-19 epidemic on the quarterly financial statements, as well as the related uncertainties and risks. It is also useful for them to know how the entities faced the many challenges to be taken up linked to the health crisis, both in terms of finances and the management of the internal organization of each company.

Stock prices of publicly traded companies can fluctuate, sometimes rapidly and abruptly, due to factors specific to specific companies, industries or sectors or the market as a whole (Templeton, 2020). Investments in companies with limited shares involve specific risks linked in particular to fluctuations in exchange rates and socio-economic instability. Such investments can experience significant price volatility in any given year.

Thus, reliable information, as specific and detailed as possible, helps to maintain the confidence of investors, the main users of financial statements. In the context of covid-19, it is all the more important that quarterly financial information allows shareholders to better understand the situation and financial performance of companies. In this period of great uncertainty, investors are particularly keen on forward-looking information, in particular on the liquidity situation and the financial needs of companies (Igoe, 2020).

On the other hand, a good understanding of the financial performance of a company requires the use of an income statement. Indeed, it is a financial statement which presents the formation of the net result over the past financial year by showing all the income and expenses. In order to reflect the past performance of an entity, in particular taking into account the effects of the pandemic, it is crucial to distribute this financial information throughout the income statement; some elements cannot be isolated because the consequence is a decrease in products (such as on turnover) or because the impact of Covid-19 cannot be determined reliably (AMF, 2020). Such a result would be more in line with IFRS standards.

Therefore, understanding the impact of the health crisis and its long-term uncertainties is crucial given that the Covid-19 crisis results in an unprecedented deterioration in global economic conditions. Care should therefore be taken to provide local and foreign shareholders with detailed financial information on past and future performance and in full transparency in this time of great uncertainty (Beazley, 2019).

It is important to specify that in the interim and annual financial reports of companies, certain parts appearing therein (financial statements, management comments) as well as the information presented to current or future investors lead to the implementation of an economic resilience program and social within these entities. However, the information in these accounting documents must be detailed and clear in order to encourage private investment flows (De Mello, 2020).

How to Respond and Protect Against the Covid-19 Pandemic?

The economic and employment crisis engendered by the coronavirus pandemic is having far-reaching effects on businesses around the world, undermining the development of sustainable businesses and the creation of decent and productive jobs (Mahler et al., 2020). Efforts to contain the spread of the virus have disrupted production flows, reduced demand for goods and services, and forced companies to suspend or reduce their operations (IOSCO, 2020).

Following compulsory confinement in the majority of countries affected by the health crisis, including Jordan, many of the limited-share companies have ceased their activities due to restrictions on national economic activity, in order to limit the spread of the epidemic. This resulted in a reduction in the supply of the local market with basic necessities, a disruption of the global value chain of several industrial branches which led to a decrease in demand (Kalinina, 2019). With containment policies easing in early summer, companies can restart or scale up operations.

However, with the risks of resuming containment looming (to avoid or mitigate the impact of coronavirus infections), many Jordanian limited-stock companies are unable to move quickly to full speed and could be subject to further market disruptions (ILO, 2020). Consequently, Jordanian businesses will have to operate under various forms of constraints: these measures will vary by industry, and business productivity will continue to be constrained by legal and regulatory measures (social distancing, and others. public health measures).

It is fundamental to understand whether the measures undertaken and the efforts made to cope with the significant repercussions of the global covid-19 pandemic are adequate because, indeed, it makes it possible to assess the effects of the health crisis situation on past results. Moreover, it is difficult to separate the variations in turnover and company profits from the impact of the coronavirus (Igoe, 2020). However, the Jordanian limited share entities have proceeded to the production of their quarterly financial reports according to various approaches so as to extend the level of detail of the financial information provided to investors, on the impact of covid-19 on the financial statements of the companies. 3 first quarters of the year 2020.

Referring to Figure 2, it emerges that overall, the Jordanian limited-stock companies in our sample provided detailed information during the first three quarters of 2020. This information, mostly quantitative, was relevant and reliable sources to understand the impact of the covid-19 epidemic on quarterly financial reports.

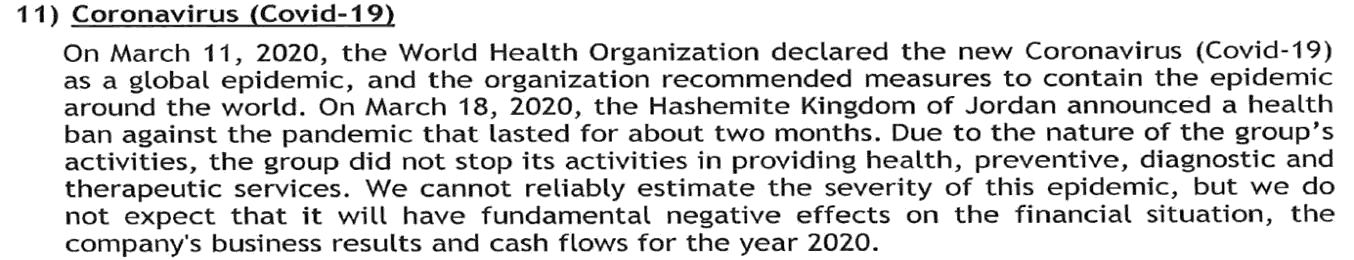

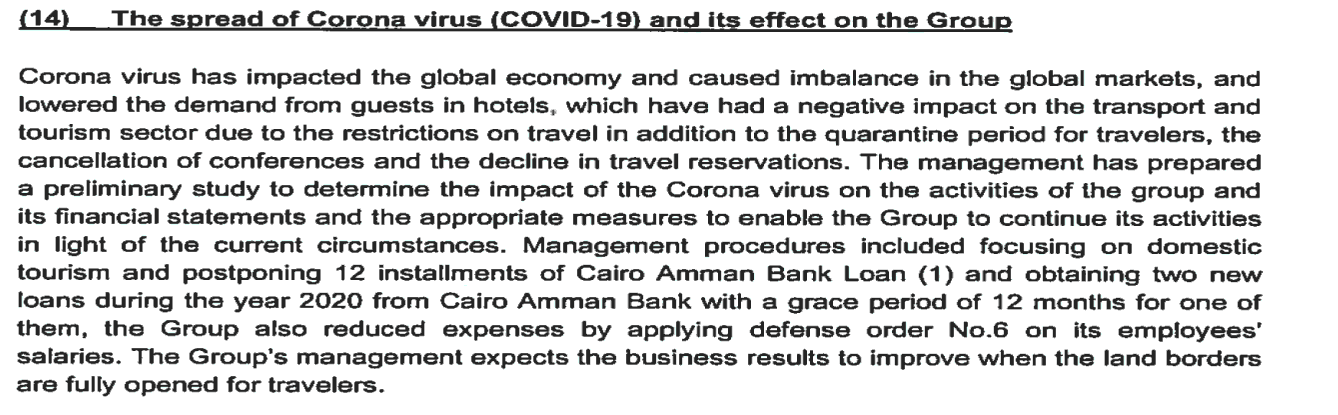

Effects on Performance of Previous Years

In order to provide relevant information for better decision-making for local and foreign investors, the financial information presented in the quarterly reports useful to shareholders is presented either in a specific chapter dedicated to the effects of Covid-19 on the financial statements of the company, or in various chapters of the financial report. These approaches exclusively concern entities that wanted to make more reliable and detailed information available to investors (Deloitte & Touche LLP, 2021). as shows in Figure 3 and Figure 4.

Figure 3: Significant Events Disclosure: Positive Impacts

Source: AL-BILAD MEDICAL SERVICES quarterly results release

Figure 4: Significant Events Disclosure: Measures Taken

Source: JORDAN EXPRESS TOURIST TRANSPORT quarterly results release

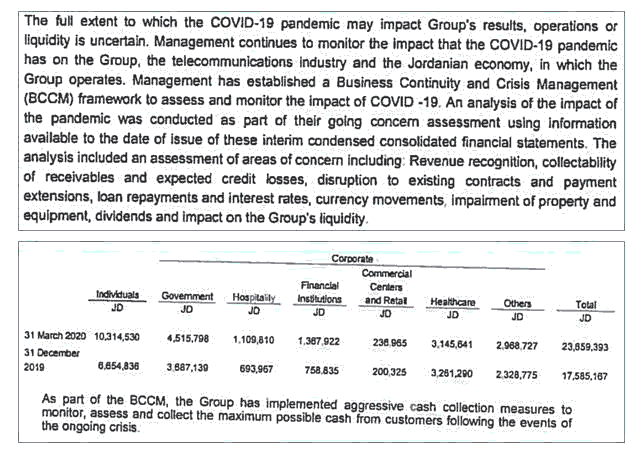

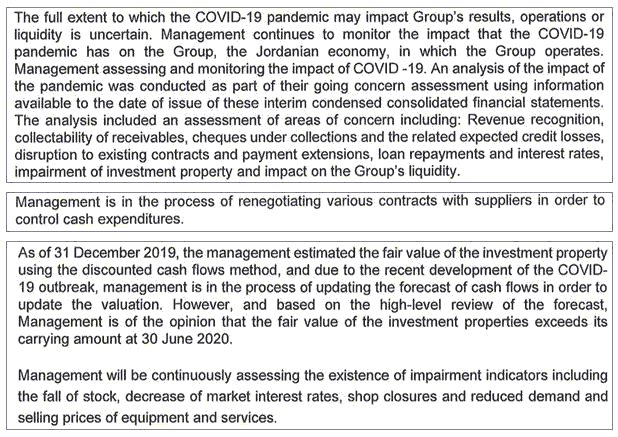

JORDAN TELECOM mentions the effects of the Covid-19 epidemic in a specific chapter of their quarterly financial report. It also took care to carry out a quantitative analysis of the effects of the health crisis on their financial statements. as shows in Figure 5.

Jordan Telecom also focused in its financial report on uncertainties related to the continuity of the epidemic of covid-19 on the financial statements recorded in the quarterly reports. We also note that it mentions the importance of having more information in order to determine the estimates useful to investors.

The consequences of the health crisis on financial statements require a quantitative assessment of the information available because it can accurately inform investors (PCAOB, 2017). In addition, related information on the measures taken to contain the Covid-19 pandemic is fundamental. Indeed, once in possession of this crucial information, investors will be able to understand the main risks and uncertainties to which limited-share companies are exposed (Igoe, 2020). It will also be possible for them to know the assumptions used to determine the future impact of the pandemic on the company's activities.

Liquidity Information

First, the management of Jordanian companies must determine whether the “going concern” assumption is valid. The notion of “going concern” assumes that the company has enough resources at its disposal to continue its activities for the next twelve months (CNC, 2020). The assessment of this ability of the company to continue operating takes into account many factors, in other words, more reliable information. Among these factors, some rely heavily on the judgment of company management due to the uncertainty surrounding the Covid-19 pandemic (Igoe, 2020). Among the elements requiring such an exercise of judgment, we can mention the assessment of the support expected from the government as well as the duration and extent of the epidemic.

However, we did not observe many Jordanian companies focusing more on going concern assumptions and related judgment, but we do expect an increase in year-end 2020 financial data. as shows in Figure 6 and Figure 7.

Figure 7: Expenditure and Cost Reduction

Source: AL-TAJAMOUAT FOR TOURISTIC PROJECTS CO PLC quarterly results release

The continuity of the operation of a business is not the only thing to be taken into account by the investors especially in these times of great uncertainty. Indeed, companies must analyze the impact of the covid-19 pandemic on liquidity risk. As evidenced by a recent survey of investors, which suggests that information about liquidity risks and how management addresses them should be included in annual or quarterly financial statements (e.g. FRC LAB, 2020). The information provided sheds light on the immediate or future financial constraints of the company, which helps users of financial statements in their decision-making process (CNC, 2020).

In severely affected sectors (tourism, transport, chemical industries and construction), it is essential to obtain more information on the amount of liquidity available so that the different stakeholders feel comfortable in their decision-making to invest or not. As a result of travel restrictions, airlines lose a large portion of revenue and therefore a large portion of their operating cash inflows, forcing additional information on securing liquidity to be provided (BDO Global, 2021).

Future Prospects

Investors place a lot of importance on past performance. In the majority of cases, financial institutions do not hesitate to highlight them as part of a better decision-making process. Indeed, past performances are interesting if an investor wishes to have an idea of the investment risk, provided that they are presented over a sufficiently long period, in particular in a context of a health crisis. For an equity investment, an investor should rely on the past performance of an investment to estimate its future return (ICAEW, 2021).

Therefore, for proper investor information, companies must provide information on the various indications relating to investment risks. A detailed update of the strategy put in place to mitigate the effects of the crisis and the means implemented is vital (Igoe, 2020). In summary, it is important to take into account, beyond the short-term impacts of the crisis on cash flows, the effects on the company's long-term projections based on management's best estimate (AMF, 2020).

Apart from reducing liquidity constraints and increasing additional funds, the main steps to be taken to recover are as follows:

• Reduce costs and expenses

• Reduction in capital expenditure

• Review of dividend policies

With 9 months already passed, the financial statements for the third quarter, with regard to the Jordanian limited share entities, are already a good opportunity to reflect the impact on the measures taken (PWC, 2017).

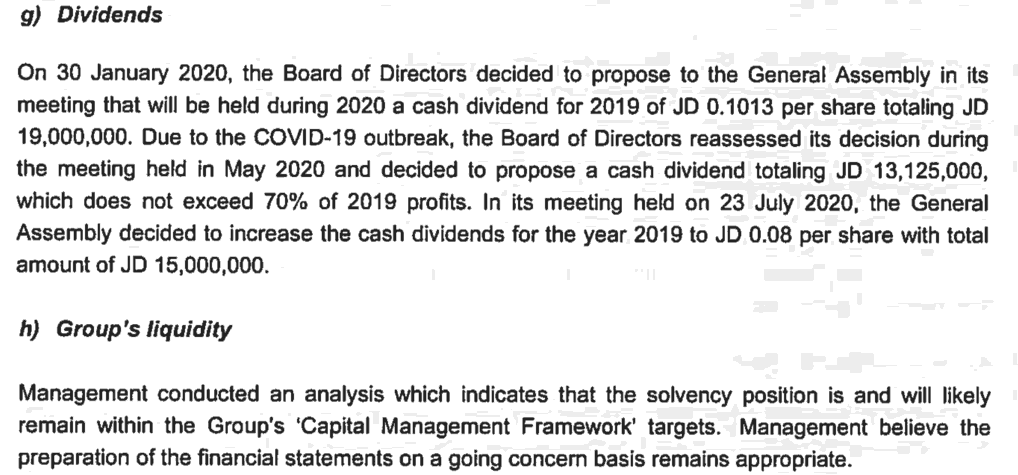

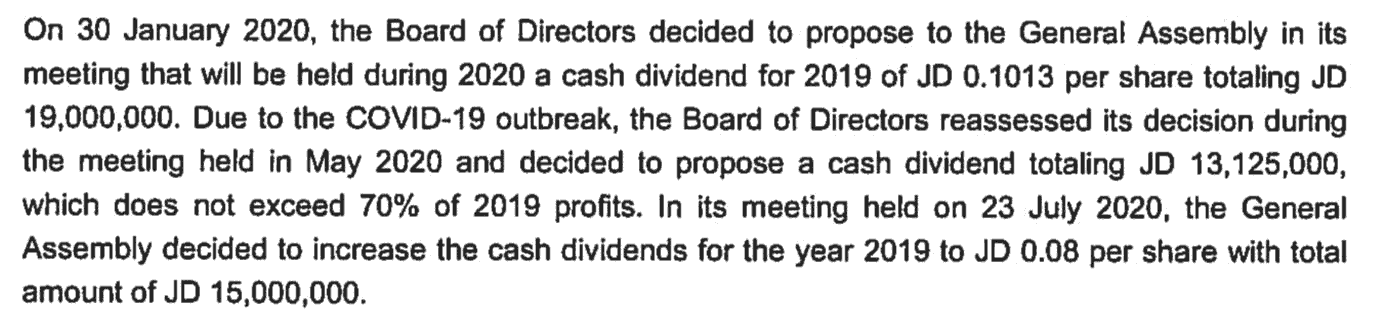

The rapid and unexpected spread of the virus in early 2020 necessitated drastic measures in Jordan and led to the temporary shutdown of businesses and economic activities with unexpected results and the need for timely recovery measures (cf. AIHC Quarterly Report, 2020). Among Jordanian limited-share companies, there are some that have considered reforms in their dividend policy, as well as a reduction or postponement of the sharing of these profits (UNCTAD, 2020). Therefore, the provision of transparent information on the explanations and choices of these decisions will be very useful to maintain investor confidence. as shows in Figure 8.

Information for Better Decision Making

The impact of the covid-19 pandemic is significant on economies, markets and businesses globally. In this unpredictable context, Jordanian companies, especially those affected by the health crisis, will have to consider the possible implications in their financial statements that they deliver to targeted financial users (investors) to communicate information on long-term projections term cash flows in a transparent manner based on management's best estimate (Igoe, 2020).

It is crucial to identify the main risks and their factors, the opportunities opening the way for the growth of companies, especially those emerging from the crisis. Given that the outlook remains marred by great uncertainties, particularly with the hypothesis of a longer-than-expected pandemic, weakening of trade, disruption of value and supply chains, current or future shareholders must necessarily take knowledge of this information through the financial statements. as shows in Figure 9.

Conclusion

The global covid-19 epidemic continues to have significant repercussions on the growth engines of the world economy, especially those in the Middle East and North Africa, making the end of the crisis as complex as it is uncertain. The disruption induced by the health crisis during the first three quarters of 2020 has plunged MENA countries into a spiral of uncertainties and risks that are difficult to quantify to the point where financial reporting poses major challenges for Jordanian companies, especially those economically affected by the pandemic.

As the financial statements are affected, taking past performance into account to establish financial projections may not be useful for investors who for their part need relevant and detailed information on cash flows as well as on the capacity of Jordanian companies with limited shares to continue their operation. This calls into question the strategic position of certain Jordanian companies which have suffered the most from financial contractions. Therefore the forecasts, projections and estimates for the calculation of depreciation as at December 31, 2020 will need to be carefully reviewed to ensure that material events related to covid-19 are properly incorporated into companies' financial statements. Since then, In this context, it is important to make sustained efforts in the production of financial reports of Jordanian limited companies. This therefore requires the collection of sufficiently detailed and reliable information on the consequences of the covid-19 epidemic on the quarterly financial statements, the strategy undertaken to deal with the impacts of the health crisis, the determination of calibrated scenarios on the basis of reasonable, justifiable and realistic estimates and assumptions to remove uncertainties among potential investors.

As the drafting of the annual report and of the last quarter of 2020 is current, we mainly recommend:

• To write a summary of the effects of the covid-19 epidemic on the various financial statements in order to identify the necessary adjustments to the estimates of uncertainties.

• Extend the level of detail and transparency of the information usually provided in quarterly and annual financial statements regarding the effects of covid-19 on past performance and understand the future prospects of limited-stock companies in Jordan.

• Provide information on the management outlook, on the careful assessment of cash flow projections, consideration of scenarios, and an update of the assumptions and judgments used to determine the future impact of the pandemic on the business limited-share companies.

• Include narrative information on how the various uncertainties encountered affected the estimates made and the strategy undertaken to deal with covid-19.

• Since the level of uncertainty over the duration of the pandemic is large, it is crucial to use quantitative information in a sustained manner.

The management of the health crisis has generated encouraging dynamics and the covid-19 epidemic could be mitigated in the coming months. A situation that thrills optimists, however, the economic and financial stakes are enormous and the preparation of financial reports will always be subject to great uncertainty whether it is true that one crisis usually follows another.

References

Allain-Dupré, D. (2020). OECD policy responses to coronavirus (COVID-19). The territorial impact of COVID-19: Managing the crisis across levels of government.

Crossref , Google scholar , Indexed at

AUDITING 705 (REVISED). Modifications to the opinion in the independent auditor’s report. Independent auditor’s report.

Crossref , Google scholar , Indexed at

Alrawashedh, N.H. (2020). Management of earnings and shareholding structure: Evidence from Jordan.

Alrawashedh, N.H. (2021). Voluntary disclosure of intellectual capital: The case of family and non-family businesses In Jordan. Psychology and Education Journal, 58(1), 2819-2837.

BDO Global. (2021). IFRS IN PRACTICE 2020-2021. IAS 36 Impairment of assets including guidance on the impact of COVID-19.

Crossref , Google scholar , Indexed at

Beazley, I.E. (2019). Decentralisation and performance measurement systems in health care. OECD working papers on fiscal federalism, 28, OECD Publishing.

Chernick, H.D. (2020). The fiscal effects of the Covid-19 pandemic on cities: An initial assessment. National Tax Journal.

Crossref , Google scholar , Indexed at

De-Mello, L.A.M. (2020). Digitalisation challenges and opportunities for subnational governments. OECD Working Papers on Fiscal Federalism, 31.

Crossref , Google scholar , Indexed at

Deloitte & Touche LLP. (2021). Financial reporting considerations related to COVID-19 and an economic downturn. Financial Reporting Alert, 20(2).

Crossref , Google scholar , Indexed at

Deloitte. (2020). Accounting considerations related to coronavirus disease 2019.

IAASB. (2014). A framework for audit quality key elements that create an environment for audit quality. International Auditing and Assurance Standards Board (IAASB).

Crossref , Google scholar , Indexed at

ICAEW. (2021). COVID 19: Interim reporting and the auditor’s role. What are the requirements for publishing interim financial reports?

Igoe, S. (2020). How COVID-19 infects financial reporting and results presentations.

Crossref , Google scholar , Indexed at

IMF. (2021). Policy responses to COVID-19.

International Federation of Accountants. (2013). Small and medium practices committee international federation of accountants. Guide to Review Engagements.

Crossref , Google scholar , Indexed at

Kalinina, V.e. (2019). The impact of decentralisation on the performance of health care systems: A non-linear relationship.

Crossref , Google scholar , Indexed at

Kattaa, M. (2020). Impact of COVID-19 on Syrian refugees and host communitiesin Jordan and Lebanon.

Khan, A. (2020). Jordan Securities Commission (JSC). Finance Brokerage.

OECD. (2018). Deauville partnership compact for economic governance stocktaking report: Jordan. Compact for Economic Governance: JordanIndicator Dashboard.

PCAOB. (2017). The auditor's report on an audit of financial statements when the auditor expresses an unqualified opinion and related amendments to pcaob standards. PCAOB Rulemaking Docket Matter No. 034.

Crossref , Google scholar , Indexed at

PWC. (2017). Understanding afinancial statement audit.

Tewodros Aragie Kebede, S.E. (2020). Impact of the COVID-19 pandemic on enterprises in Jordan.

Crossref , Google scholar , Indexed at

The International Trade Centre. (2020). SME competitiveness outlook 2020: COVID-19: The Great Lockdown and its Impact on Small Business. Geneva: International Trade Centre (ITC). SME Competitiveness Outlook 2020: COVID-19: The Great Lockdown and its Impact on Small Business.

Crossref , Google scholar , Indexed at

UNCTAD. (2020). World investment report - united nations conference on trade and development. International production beyond the pandemic.

Crossref , Google scholar , Indexed at

Received: 25-Dec-2021, Manuscript No. AAFSJ-21-9280; Editor assigned: 27-Dec-2021, PreQC No. AAFSJ-21-9280(PQ); Reviewed: 08-Jan-2022, QC No. AAFSJ-21-9280; Revised: 17-Jan-2022, Manuscript No. AAFSJ-21-9280(R); Published: 25-Jan-2022