Research Article: 2021 Vol: 25 Issue: 3

Evaluation the Performance of the Financial Portfolio: Evidence from Emerging Stock Exchange Market

Mohammad Sulieman Mohammad Jaradat, Ajloun National University

Abstract

In addition to fulfilling the most key aspects used for evaluating its performance, this study aimed at: Identify the definition of financial portfolio investment, to finally deposit those indicators into those financial portfolios in the Amman stock of exchange. The study ended with Investment, hence its methods and means vary according to the vision and desires of the investor. The creation of an investment financial portfolio is one of the most critical methods and procedures must be carried out in the financial portfolio.

Keywords

The financial portfolio, Performance, Stock, Market, Sharpe, Treynor, Jensen, Evaluation.

Introduction

The specific issue of financial portfolios, in particular following the developments in this field over the last two decades of the twentieth century, has become one of the most important recent topics for financial specialist and financial theorist to focus on. The financing portfolio represents a combination of a variety of alternative investment financings, as the investor seeks to pick up a combination of diversified financial products to reduce the risk, and so in order to form a financial portfolio of securities, a number of considerations, in particular return, risk and diversification, must be taken into account. Their strategy has affected by changes in their objectives following the formation process of the management level, the latter which involves scientific knowledge and extensive experience in investment in securities.

Financial portfolio performance evaluation is one of the main benefits of determining viability for individuals and companies to use financial resources, increasing disputes about financial resources involve searching for areas to use of such funds in securities financial portfolios to benefit from the benefits of diversification, hence reduction of financial portfolio risk.

As a breakthrough in the field of investment research, financial portfolios have been committed to addressing new needs of investors who consider investing in securities as the first line of defense. Therefore, their financial portfolio performance is a priority when consider creating it and I will consider using classical methods of financial portfolio performance evaluation in my analysis. This study assumes that the three classical policies (Sharpe ratio, Treynor ratio and Jensen alpha) possess different outcomes for the same portfolios. This study chooses these investments from Amman's stock as a research study, as we're going through it to prove the previous hypothesis. In order to finally drop these indicators in some financial portfolios of Amman's stock, we seek to reveal the definition of the investment in a financial portfolio as well as to address the key indicators used to evaluate its performance.

The focus of this subject is underlined by the study of the financial portfolio and its various components in emerging market in particular Amman Stock exchange in Jordan, which are connected with different institutions with diverse activities and need financial capital in order to meet their needs. Surplus financial surplus exceeds are used, preventing, on the one hand, the accumulation and disturbance of funds. It enables them to seek specialist institutions effectively and efficiently in the creation and management of the financial portfolios.

Literature Review

It is the duty of the scientist, to formulate the issue, to define the definitions uses and when that description is simple and correct, it is easy for the following study to understand the meanings and ideas that the scientist wishes to convey without any discrepancies at all in science.

Before considering the financial portfolio concept, this study will explain that the investment concept of the financial portfolio wider and more general than the financial portfolio concept. The financial portfolio is an instrument for reducing the risk of investments, and measuring the effectiveness of the financial portfolio manager in his formation by using performance indicators. A collection of individual property, whether the property, land, shares, bonds or any other properties, is known as an asset (Mashhadani, 2013).

The financial portfolio is described as a group of financial assuages and securities owned, i.e. to establish and optimize the financing of those properties, by the investor for the purpose of trading and investment (Al-Hanawi, 2005). It is also known as an asset-set container with a value of thousands, millions or trillions of such assets and the financial portfolio may also be a single, a group of individuals or property of the business. It is also known as a container with an asset set and a value of thousands, millions and billions of such assets, and it may also be the financial portfolio of the person, group or company property. (Moumni, 2009).

The analysis of previous studies serves as the basis for deciding the capacity of existing study and helps establish the key features of the attributes used to assess the precision of the testing environment and the research environment, as follows:

A study of Fares (2011), entitled "Application to the Egyptian stock market to assess the performance of financial portfolios." The analysis sought to explore the intellectual framework of current metrics to assess financial portfolio performance. Apart from analyzing the features of these indicators and address the shortcomings of such indicators, the analysis also reached an adjustment of the performance of the securities financial portfolios on the basis of a system of the actual daily rate of return weighted in time, and based on the fix's average return. Most research applied the Sharpe, Treynor & Jensen metrics in order to evaluate the performance of the financial portfolios and did not analyze the components to achieve the fundamental strengths and limitations of these indicators and instead attempted to fix these indicators.

In the same sense, the Nedal Al-Fayoumi (2009), analysis investment success assessment financial portfolios in the Foreign Market of Amman. The study was intended to assess investment performance. The financial portfolios of Sharp, Traynor and Jensen, based on the risk-adjusted return index during 2009, were carried over to a sample of 116 firms, and the study found that most stock price movements were due to market influence rather than to corporate factors, because the study found that the use of the advertising. The assessment of financial portfolio performance by Sharpe, Treynor, and Jensen indicators differs and the evaluation of financial portfolio performance by Sharpe, Treynor and Jensen indicators differs. This is a measure that focuses on a specific risk aspect.

While, Ngene (2004), determine the portfolio efficiency of pension funds. The estimation of portfolio risk was the biggest obstacle faced by investors. He concluded. Other difficulties included uncertain economic conditions, lack of a standard portfolio return computing system, considerations of corporate governance, the need for management accountability, political risk and instability, and bursary liquidity. The legal obligation is that institutional investors should monitor the quality of their investment portfolios. The different portfolio performance measures available to fund managers include Sharpe Measure, Treynor Measure, Jensen Measure (alpha), Information Ratio, Modigliani and Modigliani (M2) Measure and Fama Total Selectivity Evaluate (Reilly & Brown, 2000).

Radcliffe (1997) The serious concerns surrounding the quality of the results figures dependent on CAPM were clarified. To date, no observational test has shown that the predicted and obtained returns are directly linked to the beta projections used in the experiments. This may be because the CAPM has insufficient beta estimates or insufficiency. In an effort to address this problem, Grinblatt et al (1993) in an effort to prevent the dispute, a performance measuring mechanism was introduced which required no metrics based on stock characteristics such as business sizes and 7 book-to-market ratios. In view of the problem with market indexes, the beta factor is substantially decreased by diversification as a measure of systemic risk and the use of the overall risk of market returns, this analysis explores the portfolio performance metrics used by fund management, why the actions are used and how they find the correct benchmarks.

Roll (1981) Noted that the Capital Asset Pricing Model (CAPM), which takes into account a stock portfolio, 6 comprising of the risky assets in the economy, is the basis of all success metrics of the equity portfolio. This is intended to be a fully diversified portfolio. This portfolio is theoretical and might not be available in real life since not all businesses on the market are involved. Only a sample of quoted companies are available. The problem is that this theoretical portfolio is found to have a concrete proxy. This inadequacy has consequences for portfolio efficiency assessment. The performance metrics primarily use the portfolio of the business when assessing portfolio performance as the benchmark to determine the risk measures.

One of the most comprehensive studies that have investigated the factors influencing interest rates in microfinance is by (Janda & Zetek, 2018). The duo considered both the internal (MFIs specific characteristics, labour costs, technical support and inventions) and external (political risks, macroeconomic and legislative risk) factors based on data from Latin America and the Caribbean and concluded that the effect of macroeconomic factors depends largely on the proxy used for interest rates (e.g.: profit margin and yield on gross loan portfolio). Addition, Rosenberg et al. (2009) found that there are four main factors that affect the interest rates in MFIs. These are operating expenses, cost of funds, loan loss expenses and profit margin. Rosenberg et al. (2009) further explored that the operating costs of MFIs represent about 60% of the total cost, which usually depends on the loan size, age of the MFI, location and clients rating, etc.

Based on the previous studies formulate the issues, the goals, the curriculum and the means of formulating it, the current study can be used for enrichment of the theoretical context and the provision of different sources for Arab and international analysis, and these studies are used to discuss and agree or disagree on the results of this study.

Research Methodology

Data Collection

Primary data was gathered using a historical data and annual reports issued by Amman stock of exchange and data sources from the websites of different companies.

Models

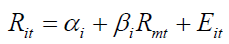

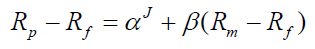

This study is a descriptive research that attempts to understand the difference among Sharpe ratio, Treynor ratio and Jensen's alpha. The study therefore employs a regression analysis to examine the Jensen's alpha of portfolios under single index model. I use the regular min-square (OLS) regression way. The linear relationship between the basic and the independent variables is determined. The single index model is:

(1)

(1)

It may also include real estate and land and incorporates shares, stocks and bonds; securities must best be the financial portfolio. As a result, a key issue has been discussed by economists and selection makers in the issue of the overall performance of a Securities Financial portfolio and will be addressed in this context by defining the conceptual basis for the performance of the Securities of a financial Portfolio. Financial portfolio: a complex investment device composed of one or more originals and managed by the financial portfolio manager (Al-bayati, 1990).

Any investor seeking to develop or shape a securities financial portfolio is aimed at gaining extra benefits, but here it demands an exchange between: Threat and return prediction, Future expense and regular income delivered and Some of the risks. It is good to mention miles, but the important aim of every investee is to reach a truly perfect financial portfolio, i.e. to achieve the best at a certain level of threat or the minimum viable risk stage at a fixed point of return, so the fundamental goal of an investor is to attain the equal level of threat. The main objective is the quality of a study (Joelink & Gitman, 2005).

Instead of savings, investors have several objectives to build a financial portfolio: firstly, Capital security, that's the key goal secondly, to reach an acceptable liquidity level and finally enhancement of capital. The following included are kinds of financial portfolios:

The financial portfolio of earnings (normal returns), this Financial portfolio has the goal of achieving the investor's best profit with certain hazards, which means it offers a very high level of profits, and in order for an investor to do so, a cautious approach should be followed to protect the financial portfolio and the bonds should be used periodically to ensure the profit stability. Increasing financial portfolios (profit), i.e. acquiring an acceptable risk level based on income growth income volume, as a consequence, in addition to boosting distributions: the financial portfolio that takes care of approximately shares of rising companies; the company that grows income and grows after year;

Mixed the financial portfolio (profit and revenue), a financial portfolio that combines extremely strong income and back growth through the financing of the financial portfolio, in which the investor is faced with a selection and re-extension of the combo of the securities of various risk (Moumni, 2009).

The contraptions of the financial securities portfolio are: Shares: securities that indicate that the holder holds, taking possession of all the rights, a share of the capital of the entity that issued it (Al-shadifat, 2006). Bonds are a long-term contract issued via organizations or administrations and the owner accepts a nominal value, a particular date and a selected rate of interest in accordance with this contract (Abu Mossi, 2005).

Mechanisms for the formation of a financial portfolio: Through explaining the following, this study will be able to make these processes clear: Governs the creation of a financial portfolio of securities. The investor must obey the following controls when forming a financial portfolio. The investor should rely on its own resources without recourse to borrow, to fund its financial portfolio. Part of a financial portfolio should consist of low chance companies after an investor has decided if it will last but part of the excess risk securities, consistent with an investor's willingness to meet certain risks, must be included in the financial portfolio. If the investor has adjusted its circumstances to take on greater risks, or vice versa based on a condition in the market or if it appears that the overall performance of the stock is substantially underperformed, he must make revisions now and again in the financial portfolio components (Sarah, 2007).

Principles of creating a successful a financial portfolio are several principles that the investors who own the financial portfolio or are based totally on its formation have to keep in mind whilst forming it for the financial portfolio in order to obtain a successful the financial portfolio of securities, we will point out some of them, for example however not confined to. On the other hand, the principle of quantification which means the possibility of measuring the cost of the predicted go back on securities fashioned by using the financial portfolio, and in return the possibility of measuring the diploma of threat concerned in the financial portfolio, and to degree the return and risk, enough statistics at the destiny yield and monetary statistics, which is relied upon in assessing the anticipated go back of the financial portfolio as an entire (Hamid, 1993).

The principle of affiliation objectives to reduce the diploma of chance related to the formation of the securities financial portfolio in the diploma of correlation between the returns carried out from making an investment between the securities of various groups, the correlation element the returns on securities shaped in the financial portfolio have a direct dating with the diploma of danger of this financial portfolio. The precept of inclusiveness consists of maximum securities traded at the inventory market. Shares, bonds, government bonds, treasury payments, and many others. In order that a pretty high and solid go back is accomplished at the lowest viable hazard (Dahl, 2003).

The principle of first-class is a method that satisfactory of a security and the opportunity of promoting or shopping for it inside the marketplace without any challenge and loss, The satisfactory of the security ceases to be the danger of marketplace volatility, and it can be stated that the provision of high-quality in a safety method the supply, extended market susceptibility and stepped forward possibilities for its advertising.

The principle of diversification accurate financial portfolio formation calls for the aggregation of securities sorts, i.e. with an expansion of traits. Diversification can take several paperwork, the most important of that are: Diversification of the sectors "diversification sectors, monetary interest". Marketplace diversification "present-future markets, domestic-overseas markets" and the diversification in securities shares - bonds. Diversification within the fine of a security: Top rate stocks/regular stocks, Company bonds - authority’s bonds, Variable-hobby bonds - constant-hobby bonds and Stocks - funding certificates (Victory, 2003). Finally, stages of building the financial portfolio is a well-kept portfolio and vital to the prosperity of every investor in today's financial marketplace. As a sole investor, it is critical that you know how to evaluate an asset assignment that best meets your personal investment priorities and risk tolerance. In other words, your portfolio should fulfill and have peace of mind to meet your potential capital needs Investors should construct investments that are systematically matched with investing objectives (Ben Moussi, 2005).

Data Selection

To build up the main index portfolios, we pick 7 ASE stocks and several of Jordan's leading companies are registered with ASE. This study used ASE as the market index, since there is a wide number of members that spread the risk to more reflect market transition and the details are shown in the table below: stocks are arranged in orders, sorted by its existence in each portfolio, respectively (Al-Hamdoni, 2011) in Table 1.

| Table 1 Stock Selected in this Study | ||

| Stock | Ticker | Industry |

| Islamic Jordan Bank | JOIB | Financial services |

| Alshamekha Real. | VFED | Real state |

| United Cable Industries | UCIC | Electrical |

| Union Investment Corporation | UINV | Financial services |

| The Consultant & Investment Group | CICO | Healthcare |

| Arab Phoenix Holdings | PHNX | Real state |

| Al-Isra For Education and Investment "PLC" | AIFE | Educational Services |

Basic Concepts

First, we introduce some basic concepts about stocks and portfolios, which will serve us in the following analysis of portfolio performance evaluations.

Concepts about Stock & Portfolio

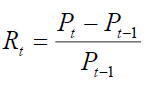

Two of the most basic but important concepts are return and risk. These two concepts apply to both stocks and portfolios. Return of stock at time t is defined as:

(2)

(2)

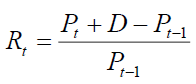

Where Pt and Pt−1 are closing prices of stock at time t and t-1 respectively. When the stock pays dividend, the formula can be modified as:

(3)

(3)

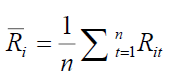

Where D is the dividend paid during the period from t-1 to t. In our analysis, we use monthly return of stocks for our calculations and ignore any dividends paid by stocks. Based on this formula, we have the expected return for stock i as:

(4)

(4)

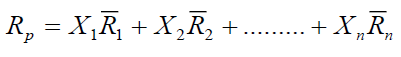

Then the return of portfolio can be represented as:

(5)

(5)

Where X1, X2 …Xn are percentages of each stock in portfolio.

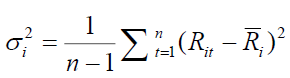

The standard deviation of stock is always referred as the risk of stock, while the variance of stock i is defined as:

(6)

(6)

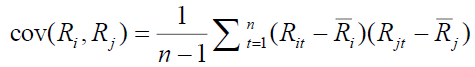

And the covariance between the return of stock I and j is defined as:

(7)

(7)

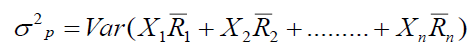

Then the variance of portfolio is defined as:

(8)

(8)

Capital Asset Pricing Model (CAPM)

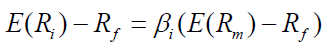

The capital asset pricing model is a description of the relationship between expected return and risk of assets and its formula is:

(9)

(9)

Where E (R) is the expected return of the asset, E (Rm) is the expected return of the market (index), (Rf) is the risk-free rate, and (β) is the beta of stock. It can be used to calculate a required rate of return of an investment (in our analysis, stocks or portfolios). It shows the investment's sensitivity to systematic risk, often known as beta of an asset. In other words, the CAPM says that the expected return of an asset equals to the risk free rate of return plus a risk premium.

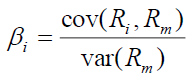

Beta of Stock

The beta value of asset, as mentioned in the concept of CAPM, measures the volatility of an asset compared with the market index. Due to CAPM, beta can be measured by:

(10)

(10)

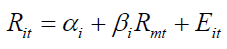

Single Index Model

The single index model is based on a pricing model for capital assets, which states a linear relationship between the rate of return of an asset and market. The single index model is:

(11)

(11)

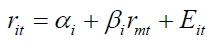

Where (Rit) is the return of stock at time t, while mt Rmt is the return of the market at time t. (αi) and (βi) are the coefficients of this linear model. Alternatively, single index model can also be expressed as the linear model between the excess return of stock and the excess return of market as following:

(12)

(12)

Where rit = Rit-Rf and rmt = Rmt-Rf are the excess returns of stock and market.

Models for Portfolio Performance Evaluation

There are many evaluation methods to test the performances of different portfolios. Among the traditional measures, Sharpe, Treynor ratios and are typical. Comparing the rate of return of the managed portfolio to the return of a benchmark portfolio which is comparable and alternative to the one we evaluate, is the main idea behind the classical measure of investment performance. In our analysis, we choose the ASE market index as our benchmark portfolio (Aragon & Ferson, 2006).

Jensen’s Alpha

The purpose of Jensen’s alpha is to compare the excess return of managed portfolio to the benchmark portfolio (market index) in a linear model as:

(13)

(13)

Where α J is considered the alpha of Jensen that reflects an investor's abnormal return on the benchmark portfolio. Possible alpha means that the economy is beaten by the trader, while the negative alpha means that the investor is lower than the market index.

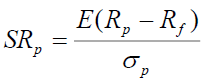

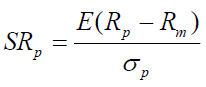

Sharpe Ratio

Sharpe ratio (2020) is a method of portfolio output risk adapted metric. It calculates the estimated excess return per unit of risk of the controlled portfolio. The Sharpe Ratio Formula is:

(14)

(14)

Then again, we can use the return of market instead of risk free rate of return to determine the Sharpe ratio as follows:

(15)

(15)

Large Sharpe ratio means good performance and vice versa.

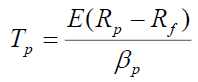

Treynor Ratio

The Treynor ratio also reflects a risk-adjusted metric close to the Sharpe ratio. The Treynor ratio lets the portfolio beta risk taking place. This is, instead of the overall probability, the risk it uses is non-diversifiable. Treynor's formula ratio is:

(16)

(16)

Still, the higher the Treynor ratio (2020), the better the performance of a portfolio.

Results and Discussion

Firstly, analysis of portfolio performance evaluation, this study starts with examining the application of the three measures of portfolio evaluation of performance in one financial model with one way of grouping stocks in Table 2. We grouped the stocks by prices.

| Table 2 Arranging Stocks in Portfolios with its Industries | ||

| Portfolio A | ||

| Stock | Ticker | Industry |

| Islamic Jordan Bank | JOIB | Financial services |

| Alshamekha Real. | VFED | Real state |

| United Cable Industries | UCIC | Electrical |

| Portfolio B | ||

| Union Investment Corporation | UINV | Financial services |

| The Consultant & Investment Group | CICO | Healthcare |

| Portfolio C | ||

| Arab Phoenix Holdings | PHNX | Real state |

| Al-Isra for education and investment "PLC" | AIFE | Educational Services |

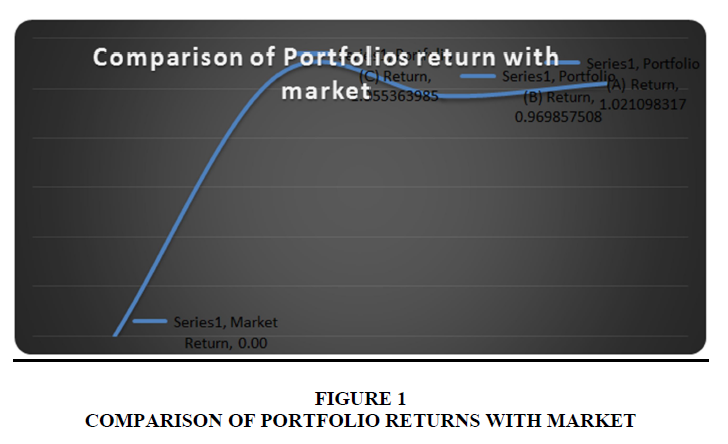

First of all, we have calculated the return for each portfolio and the risk of these portfolios by calculating variance and standard deviation for each one using the formulas discussed below in Table 3 and Figure 1.

| Table 3 Rate of Return of each Portfolio | |

| Portfolio (A) Return | 1.021098317 |

| Portfolio (B) Return | 0.969857508 |

| Portfolio (C) Return | 1.055363985 |

| Market Return | 0.00 |

| Return of portfolios | #A > #C > #B |

We organized the rate of return for each portfolio from biggest to littlest and as we appeared over, portfolio (A) has the biggest rate of return at that point portfolio (C) and (B). Also, all of these ones have a rate of return exceeds the market return In Table 4.

| Table 4 Risk of each Portfolio | ||

| Variance | Standard deviation | |

| Portfolio (A) | 8.43E-05 | 0.009179909 |

| Portfolio (B) | 9.64E-05 | 0.009820358 |

| Portfolio (C) | 0.000309988 | 0.017606488 |

| Risk of portfolios | #C > #B > #A | |

We measured the risk for each portfolio by formulas mentioned above which result in that portfolio (C) has the highest risk then portfolio (B) and (A). Finally, we got that portfolio (A) has the highest rate of return with lowest risk which makes it the best portfolio among all the groups in Table 5.

| Table 5 Beta of each Portfolio | |

| Beta | |

| Portfolio (A) | -13% |

| Portfolio (B) | -8% |

| Portfolio (C) | -37% |

From the table shown above, portfolio (c) has the highest systematic risk compared to other portfolios with a percentage of (-37). Also, negative beta in all portfolios means that the portfolios is inversely correlated to the market benchmark (ASE).

Single Index Model

For the three groups of stocks with different price levels, we use single index model to set up portfolios for each group of stocks. Then we apply the three measures of portfolio evaluation (Sharpe, Treynor ratio and Jensen's alpha) on these three groups in a year period from 07-01-2020 to 07-01-2021. The rate of risk free during this year is 0.049. Then we use the formulas discussed above to calculate these measures. For the Sharpe ratio, we exam using the risk free rate and the market index as benchmark portfolio. The results of each measure can be expressed by either figure or table.

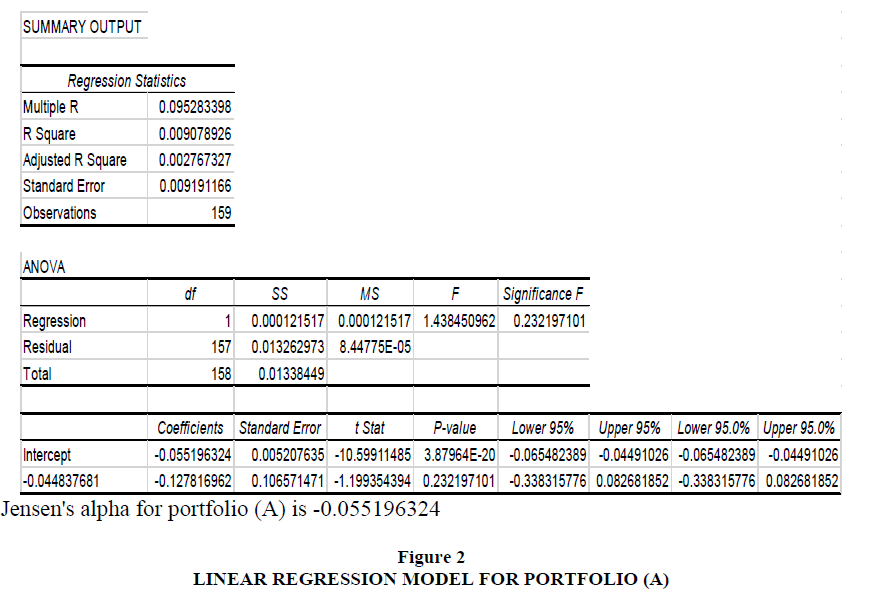

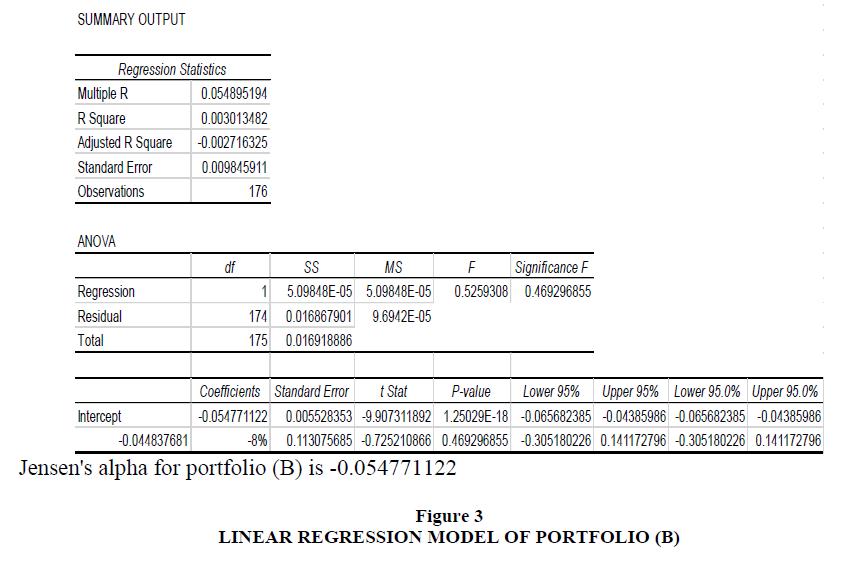

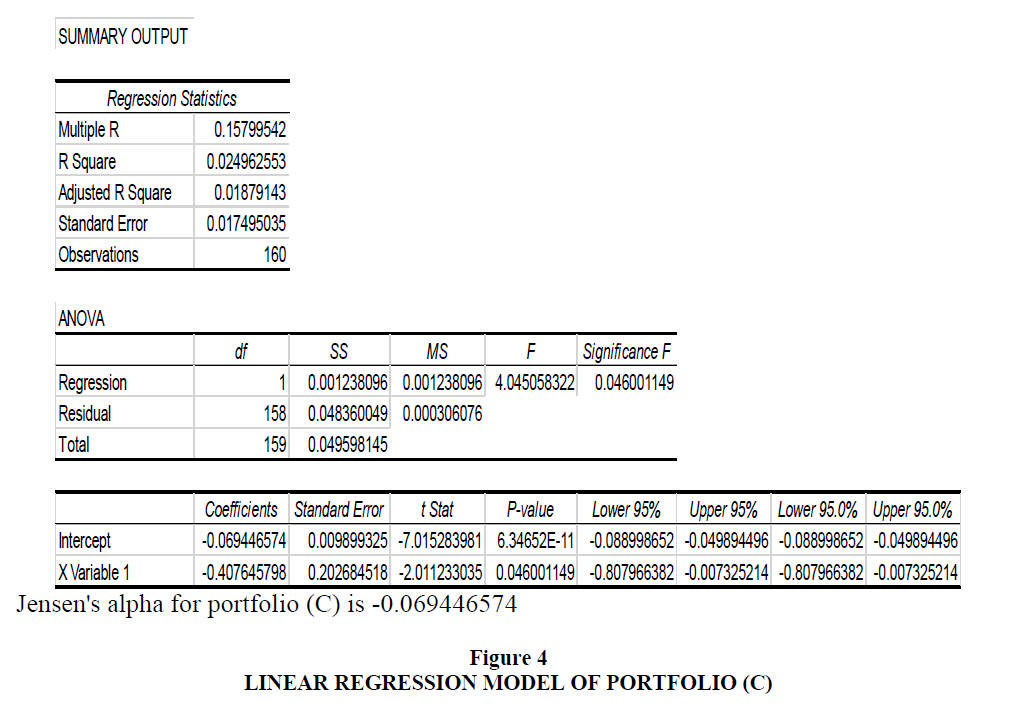

Jensen's Alpha

Jensen's alpha is measured by a linear regression model as the intercepts is the Jensen's alpha, while the slope can be thought as beta of each portfolio in Figures 2-4.

As our purpose is to compare all these measures, a table containing exact numbers is more intuitive for our analysis. Thus, we use tables as our main tool to analyzing the three portfolios performances. The results of all measures for the three portfolios are shown in Table 6 below:

| Table 6 Portfolio Performance Under SIM | |||

| Sharpe Ratio | Treynor Ratio | Jensen's alpha | |

| Portfolio (A) | 108.8135362 | -7.51391045 | -0.05519632 |

| Portfolio (B) | 96.49928249 | -12.2818976 | -0.05477112 |

| Portfolio (C) | 58.68086833 | -2.76161378 | -0.06944657 |

Based on the Table above, we can order the performances of the three portfolios by each measure as followings in Table 7:

| Table 7 Order of Portfolio Performance Under SIM | |

| Sharpe Ratio(Rf) | #A > #B > #C |

| Treynor Ratio | #C > #A > #B |

| Jensen's alpha | #B > #A > #C |

Based on my analysis above, we can see that for portfolios with stocks grouped by their prices, Sharpe ratio beats other measures in all of the single index model, while Sharpe ratio with risk free-rate as benchmark is even more reliable. The other two measures work well in some portfolios, but there are no obvious patterns to show which measures among these two kept being good at any kind of portfolio. Jensen's alpha is measured using a simple linear regression model as it represents the intercept of the equation. Overall, based on my analysis, Sharpe ratio is the most reliable portfolio performance evaluation measure among these three typically classical measures, while using market index as benchmark is even more stable.

Conclusion

Single investor may not be inferred with a single test to determine portfolio efficiency. The investors use a combination of portfolio value appraisal indicators among the most common measures used included the Jensen’s alpha, Treynor's ratio, and Sharpe’s ratio. Sharpe ratio doesn't provide the same result on the same portfolios based on my previous analysis. Also, Treynor ratio and Jensen's alpha possess different outcomes for the same portfolios which proves my research hypothesis. It is therefore, important for investors and policy makers to conduct and use all models to evaluate the portfolio performance.

References

- Al-Hamdoni, E.K. (2011). Evaluation of the performance of investment the financial portfolios by applying to the Amman Financial Market, Anbar University Journal of Economic and Administrative Sciences, M4, P7.

- Al-Hanawi, M.S. (2005). Analysis and Evaluation of Stocks and Bonds, University Publishing Corporation, Egypt.

- Al-Shadifat, A. (2006). Investment in the stock exchange (shares- bonds - securities), Al-Hamid Publishing and Distribution House, Amman, Jordan.

- Aragon, G.O., & Ferson, W.E. (2006). The financial portfolio Performance Evaluation, The essence of Knowledge, 2.

- Ben Moussi, K. (2005). Investment The financial portfolio (Composition and Risks), Researcher's Journal, University of Ouargla, Algeria, 3.

- Dahl, R. (2003), Financial Instruments, Development Bridge Series Magazine, Arab Institute of Planning, Kuwait, 15.

- Fares, H.I. (2011), measuring the performance of the financial portfolios by applying to the Egyptian capital market, Scientific Journal of Commercial and Environmental Studies, Suez Canal University, Ismailia School of Commerce, M2, P2.

- Hamid, M.I. (1993). Capital Markets, Securities Exchange and Project Finance Sources, Arab Renaissance House, Cairo.

- Janda, K., & Zetek, P. (2018). Macroeconomic Factors Influencing Interest Rates of Microfinance Institutions in the Latin America and the Caribbean. Agricultural Economics (Zeme?de?lská Ekonomika), 60(4), 159-173.

- Moumni, G.F. (2009). Management of Modern Investment the financial portfolios, Dar Al-Curricular Publishing and Distribution, Amman, Jordan. Jensen's Measure, by James Chen, Reviewed by Michael J Boyle, Updated Sep 30, 2020

- Rosenberg, R., Gonzalez, A., & Narain, S. (2009). The new Moneylenders: are the Poor Being Exploited by High Microcredit Interest Rates? In Moving Beyond Storytelling: Emerging Research in Microfinance, 145-181. Berlin: Emerald Group Publishing Limited.

- Sharpe Ratio. (2020). By Jason Fernando, Reviewed by Amy Drury, Updated Dec 28, 2020.

- Treynor Ratio. (2020). By Will Kenton, Reviewed by Margaret James, Updated Oct 14, 2020.