Research Article: 2020 Vol: 23 Issue: 1S

EXAMINING THE INFLUENCE; BPO RISKS, VENDOR TEAM???S PERFORMANCE & KNOWLEDGE MANAGEMENT CAPABILITY

Ahmed Muneeb Mehta, HCBF, University of the Punjab

Hina Saleem, IBIT, University of the Punjab

Iqra Hafeez, HCBF, University of the Punjab

Asad Ali, HCBF, University of the Punjab

Samar Rahi, HCBF, University of the Punjab

Citation Information: Mehta, A. M., Saleem, H., Hafeez, I., Ali, A., & Rahi, S. (2020). Examining the influence; bpo risks, vendor team’s performance & knowledge management capability. Journal of Management Information and Decision Sciences, 23(S1), 397-408.

Abstract

In spite of the fact that business process outsourcing (BPO) is widely spreading phenomena nowadays to lessen certain costs associated with projects, on the other hand, there are a lot of risks associated with these projects that affect the effectiveness of outcomes. To check the impact of different BPO risks on vendor teams’ effectiveness, we develop a model of knowledge management capability (KMC) theory and risk-based view. Effective response rate was 270 through questionnaire from the employees of telecom industry. Empiric verification shows that operational risk and strategic risks influences the efficiency of vendor teams (EVT) in a negative way. However, to lessen this effect, cultural and technological degree of knowledge management proficiency is being used. To achieve effective risk management, different BPO risks and knowledge management capability should be incorporate.

Keywords

BPO Risks, Knowledge Management Capability, Risk Management, Teams’ Performance, Project Management in IT.

Introduction

Delegating operations and cost-cutting are the benefits that are allied with outsourcing. As they are more proficiently operated by other organizations (Zhang et al., 2018). On the other end, a lot of risks associated with this process. Mahmoodzadeh et al. (2009) describes 19 types of risks associated with outsourcing. The proficiency to outsource and withdrawal of the anticipated outcomes all rely on the type of the business (Liu et al., 2017). No organization is capable of managing its telecommunication sector minutely as it has broad operations (Padma et al., 2015).

The relationship between BPO risks and outsourcing has been investigated by different studies but the analysis did not show any empirical evidence. Alipour et al. (2011) concluded that BPO performances are influenced negatively by performance, financial risks and psychology but this argument was not supported by any practical data. Gewald and Dibbern (2009) identified that the business success is affected by BPO risks but their effect has not been investigated independently. Soon after, Herath and Kishore (2009) observed that different risks have distinct impact in different context but outsourcing is linked with a variety of risks and these additional risks have no evidence present. In order to bridge this gap, the primary objective of our research is to assess the effectiveness of team’s performance by the impact of two outsourcing risks i.e. (operational and strategic risk). As Gerbl et al. (2015) explains that the business is dominated by two most essential outsourcing factors that are operational and strategic risks. The managers require team management skills in order to align them with the innovative methods and implement the vital outcomes that are required by the business.

Recent investigations indicate that the outcomes have no practical testing when the knowledge management capability (KMC) was applied to reduce the risks of businesses. The organization’s knowledge management capability is compelled to be improved so that during the process of outsourcing the teams must be prepared to tackle the challenges faced by organization (Gerbl et al., 2015). For an organization to develop a practice followed by knowledge-based learning is critical which permits information management as well as achieving desired objectives pertinent to organizational outcomes. The factors on which any organization’s success depends involves the use technology, structure of management level and organizational culture (Alavi & Leidner, 2001; Gold et al., 2001). Mahmoodzadeh et al. (2009) in his study, proposes a KMC model to lower the risks however the model was only employed in a corporate outsourcing project that was associated to a case study that lacks data support and experimental confirmation. To apply KMC model is the secondary objective of this study in order to decrease the effect of BPO risks in terms of vendor teams’ performance efficiency. Therefore, the efficiency of the vendors will be enhanced through this study by investigating the particular problems that are linked with BPO and by increasing knowledge management capability how they can be minimized. In short, this research tries to find out the answers for following.

If BPO risks have an influence on the effective performance of the vendor teams’

Which types of KMC’s alter the effects of risks on the effectiveness of vendor teams?

This study offers theoretical contribution by investigating the formerly tested theory in a new context of telecom industry by considering new factors and their relation with other variables. These concepts will be discussed in upcoming sections including literature review, development of research model, supposed hypotheses, adopted methodology, results analysis, discussion including theoretical & practical implications, limitations & future directions, and conclusion.

Literature Review and Hypothesis

Business Process Outsourcing & its Risks

Outsourcing is allocating the basic elements of a business to the specialists with essential skill (Gunasekaran et al., 2016). The profitability of any organization is assumed to be dependent on outsourcing as the overall performance of the firm is improved by outsourcing (Retová & Pólya, 2011), hence resulting in greater competition. The failure and success of a business is determined by several risks assorted with BPO (Lacity & Willcocks, 2014). HFS research conducted a survey and it was concluded that the results of outsourcing were not completely satisfied for the half of the business owners and they specified that no additional value has been added to their business by outsourcing (Fersht, 2014). Numerous authors have investigated the risks associated with BPO and presented their findings but Alipour et al. (2011) has most acceptable findings which specifies that the performance of the teams had a negative impact because of the economic risks related to BPO. Outsourcing risk structure can be comprehensively implemented in view of socio-technical theory in numerous forms in BPO projects (Shi, 2007; Herath & Kishore, 2009). Zhang et al. (2018) investigated the risk assessment and concluded that business process outsourcing projects have a negative impact because of project management risk, social risk and technical risk. Hence current research aims to employ the framework of Zhang et al. (2018) and Shi (2007) to discover the impact of various BPO risks. This research is being distributed into two major categories, i.e. strategic risk and operational risk (Shi, 2007; Herath & Kishore, 2009; Abdullah & Verner, 2012).

Operational Risks

The inability to understand the results or the failure of outcomes which were predicted by the business when the operations were outsourcing are referred as operational risk (Hammer, 2015). The effective functioning of the businesses is interpreted by the performance of BPO as it became the priority and segment of performance (Sople, 2016). As Aven and Renn (2010) highlighted in their research that there can be different types of operational risks in IT sector such as rough working patterns and system failures. The evaluation of all these risks in advance is fundamental for the organization as it determines the team spirit of the operations that must be achieved via outsourcing. Moreover, advanced risk analysis depend on the abilities and competences of the members of an organization which help the organization to survive and thrive in complex and dynamic situations (Salamzadeh et al., 2016).

Strategic Risks

In today’s competitive environment, strategic management is an important component of almost every organization, which consist of three methods comprises of strategic planning, implementation and control. Strategy implementation plays an important role in the success of an organization’s business (Salamzadeh et al., 2016). Strategic risks are caused by irregular strategies that are being experienced in the businesses of an organization. In the view of Chumo (2015), the strategic choices formulated for modification of risks (announcing policies and guidance) coupled with the organization, certify efficient functionality of the business operations. Resource dependency theory (RDT) describes that the effects of outsourcing should be analysed by managers since strategic flexibility is at risk because of the reliance upon the service provider (Johnson, 1995; Pfeffer, 1987). Cheon et al. (1995) concluded in their research that if RDT is applied to the theory of BPO, the dependency can be determined by the significance of outsourced means and trading costs with lapse of time. In the view of Cullen and Willcocks (2003), research loss of control triggers the strategic risk once the business procedure outsourced, organization fails to maintain its influence because service providers have all the authority.

Knowledge Management Capability Risk

In managerial perspective, implicit and explicit are two forms in which knowledge is allocated. Various attributes of implicit knowledge are habits, actions and individual views which are in person’s mind (Chen et al. 2006). According to Lashkary et al. (2012) describes in his study that explicit knowledge is one which can be expressed verbally (Bustinza et al. 2010). Knowledge management capability theory was presented by Gold et al. [23] which explains that KMC is segregated into process capabilities and knowledge infrastructure. Knowledge acquisition, application, protection and transformation are the features of process capabilities. However, technology, structure and culture are included in knowledge infrastructure.

For an organization, its obligatory to grow into knowledge-based organization in order to work effectively in the modern economy. In a knowledge based economy, intellectual capital has a competitive advantage which makes people management a vital part of corporate strategy (Salamzadeh et al., 2014). These characteristics of the organization permit processing information discovered in the recent times and utilize these for accomplishing operational brilliance skills (Patil & Wongsurawat, 2015; Sadgrove, 2016). The organizations have critical perspective on knowledge sharing and information availability (Lacity & Willcocks, 2014).

These factors help to improve sustainability and construct culture and social infrastructures which are very important part of organizations. Technological development is the main element which is necessary to increase business’s operation. It is very important to use significant technological architecture and innovation processes in order to increase operations and knowledge aspects for organizations. These factors play its vital role to boost the sustainability of the businesses by allowing development strategies (Sople, 2016). These factors are also applicable for telecom industry which needs to perform its operations up to date with the modern state of the art technology.

Effectiveness of Vendor Teams’ Performance

Every business required different teams which required proper management for the betterment of business. Singh et al. (2006) stated in a study that performance of team is a very important element in the different operations of organizations. It is necessary that vendor teams play their role very effectively in order to improve the performance of business. An organization can be able compete in a new economy and fulfil its goals on the basis of its employee development which is done through training activities, formal education, previous job experience and interpersonal relationships. Thus, employee development improves the effectiveness of that organization (Pringgabayu & Wirakanda, 2018).

A business can handle all challenges and can reduce the risks of failure if its functions are arranged and it’s all segments are assigned in a structured manner (Liu et al., 2017). The teams should have the capability to manage the operations and analyse any expected challenges before time. For all businesses, it is vital to fix all forms of operational and strategic risks linked with business outsourcing. These factors are essential for effective business functions and successful team performance (Gerbl et al., 2016). Team performance is also affected by organizational culture which is adopted by all the members of an institution based on customs, believes and values of that organization. These cultural organizations distinguish themselves from other companies due to the special features formed by specific culture (Pringgabayu & Ramdlany, 2017). Team performance is considered an important factor in the different forms of operations of an organization. It is expected for a business to eliminate its limitations and align the products for its effective functioning.

Research Model & Hypothesis Development

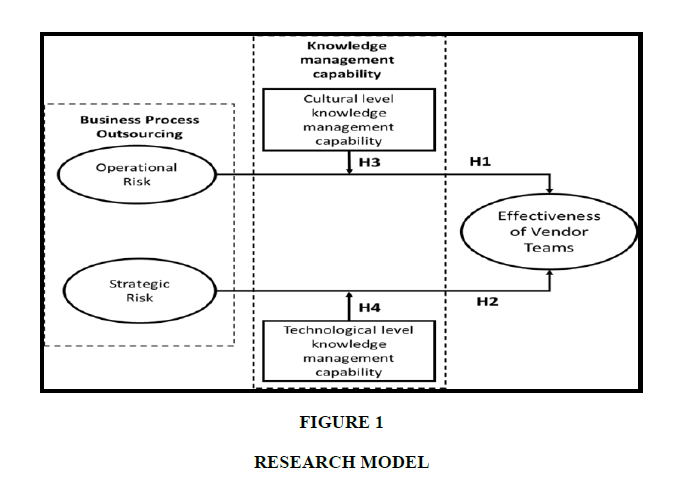

Figure 1 represents the research model. This model shows that the performance of vendor team is greatly and negatively affected by the operational and strategic risks of business process outsourcing. It also shows that Cultural and technological levels of KMC reduce the negative impacts of BPO risks on EVT.

Following hypotheses are proposed in this study:

H1: The efficiency of vendor team performance is affected negatively by operational risk.

Jaradat & Al Maani (2014) stated in a study that the performance of team enhanced greatly due to the approaches of BPO risks that are linked with the firms’ performance. In a study, Chumo (2015) narrated that the performance of organization which is based on financial characteristics and time of business process outsourcing is directly linked with outsourcing arrangements. According to the study of Bardhan et al. (2007), an organization face enhanced operational risks due to the outsourcing of business in any way. These operational risks also driven by many other factors related to processes and operations run in the organization on regular basis. We can also divide operational risks on the basis of events such as external risk, conduct risk and process risk. These operational risks can reduce the BPO performance of an organization and can cause catastrophic loss. Thus, operational risks show its inverse relation with the performance of organization. Such kind of operational risk seems to be highest in In IT outsourcing where programs face coding issues along with measurement issues. Thus the following hypotheses are proposed:

H2: The efficiency of vendor team performance is affected negatively by strategic risk.

According to a study led by Samantra et al. (2014), outsourcing performance of organizations is greatly affected by the strategic risks which are caused due to the business outsourcing. This business outsourcing bring the organization at risk because of its lost proficiency, interdependency of all activities, unavailability of technology, persistent insecurity, bad administration of Mergers and Acquisitions (M&A) and uncertain behaviour of managers. Furthermore, use of outdated technology instead of advanced one, also increase the risk of failure for organizations. Therefore, business and BPO performance of organizations face strategic risks due to business outsourcing. In addition to this, the study of Samantra et al. (2014) highlighted that; the management of the organization might face inadequate decision making or lack of proficiency and expertise. According to Pandey & Dutta (2013), in order to understand BPO risks of the organization, the role of Knowledge Management Capability is very important. Thus:

H3: Cultural level of KMC decreases the effects of operational risk on the efficiency of vendor performance.

Therefore, there is a decline in the negative impact of the operational risk if there is increase in KMC’s cultural level of knowledge. Many different studies have been conducted as the Risks are there and the overall effectiveness is being seen as well. Patil & Wongsurawat (2015) states in their study that KMC is quite significant in order to increase the performance of business. Pandey & Dutta (2013) stated that Knowledge Management Capability plays an important role to understand BPO risks of the organization. Due to these factors, sustainability is improved and culture and social infrastructures are built which are essential for any organization. Our last hypothesis is as follow:

H4: Technological level of KMC reduces the negative effects of strategic risk on the efficiency of vendor performance.

As a result of increase in KMC’s technological level of knowledge. Alhawari et al. (2012) describes in a study that strategic risks of organization can be reduced by the use of technological knowledge in the processes of business. Thus, suitable and advanced technology used in organizations can decrease the insecurity of technological invisibility. Moreover, the inclusion of technological level of the knowledge can lessen the inability to adapt to the updated technology and advancement in the organisation by the employees. Additionally, the problems of efficiency in organizations’ business can be handled by technological improvements like organizing the work and keeping records of each and every aspect of business.

Research Methodology

The fundamental quantitative information for this research is obtained via questionnaire for evaluating the hypothesis. The positivism is being taken as research philosophy because the objectives of the study are perfectly matched with this philosophy (Herbst & Coldwell, 2004). According to research objectives, hypothesis testing is done by deductive approach (Bajpai, 2011). The main purpose of this research work is to increase the knowledge of present literature; therefore, the conclusive research design is being used. At present, 15 telecom companies are running their operations in Pakistan and total 84,000 employees are working in this sector. The selected population for this study was the employees of Telecommunication sector of Pakistan, particularly in the Lahore region.

Among sampling techniques, Probability Systematic Random Sampling method is selected for this study because this sampling technique ensure the selection of every 10th person in the population. The sample size of this research is determined by the rule that 10 questionnaires must be filled against each variable of study (Bryman & Bell, 2015). Three hundred questionnaires were filled, out of which effective response rate was 90% (270 responses returned back). Due to shortage of time and unavailability of facilities, Cross-sectional time horizon is adapted in order to achieve speedy and accurate results.

Based on Likert (1932) study, 5 point Likert scale is used which is as follow: 1 symbolizes “Strongly Disagree”, 2 symbolizes “Disagree”, 3 symbolizes “Neutral”, 4 symbolizes “Agree”, 5 symbolizes “Strongly Agree”. Along with this, demographic variables are also present in questionnaire (Murthy & Bhojanna, 2009). The measurements of knowledge management capability, operational risk, strategic risk, and proficiency of vendor teams are adapted from earlier scales and adjusted according to the context of BPO project in our research related to telecom industry in Pakistan. Operational risk is referred from Gewald & Hinz (2004) and Strategic risk is referred from Gewald and Dibbern (2009). Cultural level and technological level knowledge management capability, which are two dimensions of knowledge management capability, were referred from Gold et al. (2001). Dependent variable EVT is referred from Wageman et al. (2005). All these measures have been slightly modified, according to present study. The scale for operational risk, strategic risk, cultural level knowledge management capability, technological level knowledge management capability and effectiveness of vendor teams’ performance are 6, 4, 5, 5 and 5, respectively. Different tests were conducted to check the reliability through Cronbach alpha. Frequencies of demographics observed and Correlation between the variables was examined. Lastly, regression analysis was carried out and to check the moderation, Process Macro was used in SPSS 23.0. Many ethical procedures were taken into consideration in this process. Non-contrived and unbiased data is collected, privacy had been maintained and consent was taken.

Findings

Statistical Package for the Social Sciences (SPSS) 23.0 and Process v3.3 by Andrew F. Hayes were utilized to measure and test the model. Before testing the hypothesis, data normality, internal consistency and convergent validity of the variables are being checked for the quality data (Ghasemi & Zahediasl, 2012). Cronbach’s alpha value for the observed variables are as BPOOR is 0.738, BPOSR is 0.837, KMCCL is 0.647, KMCTL is 0.747 and EVT is 0.914 which shows the excellent internal consistency overall. All the values of skewness and kurtosis are between ± 3 and ± 10 which demonstrate that data is normally distributed and content validity is present as Durbin Watson value is 1.91 which is also within the acceptable range (1.7 to 2.3) (Kline, 1998). Demographics tells us that majority of the participants were male with 61% share with 16 years’ education and having of 3 years’ experience at middle level management.

According to deceptive analysis represented in Table 1, all mean values are above 3 which indicated the optimistic behaviour of respondents towards present study. Correlation coefficient (r = -0.24) between EVT and BPOOR and (r = 0.47) between EVT and BPOSR indicates negative and moderate values respectively. However, these values show important relationship between these variables where p level is significant at 0.01 that is highest value of two-tailed significance. The negative sign indicates that business process outsourcing risks (BPOOR & BPOSR) are inversely proportional to the effectiveness of vendor teams’ performance.

| Table 1: Descriptive Statistics, Correlation & Reliability | |||||||||

| S N | Variables | Cronbach α | Skewness | Kurtosis | Mean | S.D | BPOOR | BPOSR | EVT |

| 1 | BPOOR | 0.738 | -0.249 | -0.051 | 0.28 | 0.744 | 1 | - | 0.247** |

| 2 | BPOSR | 0.837 | 0.129 | -0.738 | 2.97 | 0.951 | 1 | 0.472** | |

| 3 | EVT | 0.914 | -0.455 | -0.109 | 3.81 | 0.653 | 1 | ||

| 4 | KMCCL | 0.647 | -0.530 | -0.109 | 3.58 | 0.681 | |||

| 5 | KMCTL | 0.747 | -1.196 | 2.298 | 3.90 | 0.657 | |||

**Correlation is significant at the 0.01 level (p<0.01).

Regression analysis is a form of inferential statistics which is used to analyse the effect of one variable over another variable. This statistical analysis is used in the present study to verify hypotheses. Table 2 represents the model in which R-square value shows 27% variance in the effectiveness of vendor teams’ performance. This variance is due to the BPO operation risk and remaining variance can be calculated through other factors. ANOVA shows the credibility of model table where F value is 103.53 and significance level is p<0.000 indicating 99% of confidence level.

| TABLE 2: Regression Analysis | ||

| Construct | Operational Risk | Strategic Risk |

| Main Effect | ||

| R2 | 0.279 | 0.301 |

| F | 103.53*** | 57.55** |

| Β | -0.901 | -0.326 |

| T-Value | -10.17*** | -2.93*** |

These results lead to the acceptance of first hypothesis. The values of T= -10.17 and 99% significance level indicate the model is fit for this study.

For 2nd hypothesis, Model 2 results conclude that there is 23% change in EVT which is due to the strategic risk. ANOVA represents the fitness of model by values of F = 57.55, significant level of p<0.000 and 99% confidence level.

Process Macro by Andrew F. Hayes was used in order to prove 3rd and 4th hypotheses. Table 3 represents the results which show that moderation in Process Macro effects KMCCL which brings moderation in the relationship of BPOOR and EVT as (β=0.19, where p<0.00) shows the moderation between two variables. Measurement model proved to be fit based on Significant value of F=60.68. Variance of 1.7% due to the relation between BPOOR and KMCCL describes the explanatory effect of BPOOR over EVT. These results explain that teams’ performance of organizations will be declined due to the adverse effects of operational risk when cultural level of KMC is also present. These adverse impacts of operational risk can be reduced by strengthening teams ‘performance of organizations. These results supported 3rd hypothesis of this study with significance level of 0.005. Hence, 3rd hypothesis is also accepted.

| TABLE 3: Moderation Analysis | ||

| Predictors | EVT Performance 95%CI | |

| BPOOR × KMCCL | BPOSR × KMCCL | |

| Block2: Moderation Effect | ||

| β | 0.19*** | 0.05*** |

| R2 | 0.40*** | 0.67*** |

| Δ R2 | 0.017 | 0.016 |

| F | 60.68*** | 184.23*** |

Dependent Variable= EVT; Notes: * p<0.05, ** p<0.01, *** p<0.001

In Table 3, β and p values are 0.05 and 0.0003 respectively, which are below 0.05 and verified that moderation reduces the inverse relationship between strategic risk of business process outsourcing and effectiveness of vendor teams’ performance which is caused by technological level of KMC. The interactional variance of 1.6% between KMCTL and BPOSR shows the significant explanatory effect of strategic risk over EVT. The calculated value of F significant at 184.23*** specified a fair model fit for the measurement model (Wetzels et al., 2009). Hence, 4th hypothesis if this study is also accepted.

Overall, all four hypotheses of this study are accepted with significant level.

Discussion

Alipour et al. (2011) concluded in a study that BPO related potential risks have negative effects on vendor teams’ performance of an organization. But literature does not support this statement with empirical data. In order to fill this gap in literature, this study has been proposed. Socio-technical theory reflects that a risk structure must be present for outsourcing the business processes (Shi, 2007; Herath & Kishore, 2009). This statement is supported by Zhang et al. (2018) where it is stated that business process outsourcing is associated with many type of risks which have negative impacts on projects. These kind of strategic risks are also explained by RDT theory (Pfeffer, 1987; Johnson, 1995). This literature is supported by the findings of present study where regression values predict the negative impact of BPO risks over effective performance of vendor team. Previous literature focused on definite type of BPO risks; however, this study extended the literature by explaining that vendor team’s performance in BPO projects is affected by other kind of risks as well including risks associated with projects’ execution, client, vendor and organizational culture etc. (Shi, 2007; Gewald & Dibbern, 2009; Liu et al., 2017). Gold et al. (2001) explained knowledge management capability theory which supported the results of this study by describing that KMC affects the performance of businesses. Previous literature based on risk management focused on knowledge management capability addition into effects of risk (Mahmoodzadeh et al., 2009). The results of present student are supported by Socio-technical, Resource dependency and KMC theories.

Theoretical & Practical Implications

This study can be implemented practically because of the acceptance of its hypotheses and findings. Impacts of BPO risks on vendor team’s performance in telecom industry of Pakistan have never be analysed before. According to our study, knowledge management improves the competitiveness of an organization by generating competent human capital that is expected to create innovations which provides competitive advantage to organizations. Thus, human capital proves to be an important asset for any organization by performing knowledge management activities (Pringgabayu & Ramdlany, 2017). Literature related to knowledge management capability only focused on process aspect of KMC theory but it failed to analyse other aspect of infrastructure (Liu, 2015; Zhang et al., 2018). Present study contributed in literature by focusing on the infrastructural aspect of KMC that facilitate to establish an effective risk management system in businesses by reducing the negative effects of risks.

Results of present study suggest the administration of organizations to start a new BPO project after proper training of its employees. These suggestions may help the organization to reduce the risks at the early stages of the project after proper information collection about partner companies’ policies, strategies, innovations and their confidential motives. This study facilitates the managers of an organization to reduce the risks associated with outsourcing processes and increase knowledge management at first place.

Limitations and Future Directions

There are certain areas and boundaries left in our research work similar to the past studies. Because of time horizon, we used cross-sectional design, as BPO projects are of long term so future investigators can work on longitudinal research design to get a clearer picture of the results. In our study, we did research only on 2 risks of BPO, there are a lot of risk associated with BPO as mentioned by Mahmoodzadeh et al. (2009), future research can be done on other risks aspects in different region of world as different culture respond differently. One of our recommendations for future researchers is that to analyse how knowledge infrastructure may be further developed whenever they try to explore the knowledge management capability.

Conclusion

The objectives of this study include analysing the effect of knowledge management capability along with different risks linked with business process outsourcing and investigate their combine impact on effectiveness of vendor teams’ performance. This study concluded that the performance of vendor teams in BPO projects is greatly affected by operation risk and strategic risks. The results indicate that timely identification and reduction of these risks can improve the effectiveness of vendor teams’ performance. Proper knowledge in trainings of the teams, and beforehand risk management of all BPO projects can be managed though the findings of this research as we explore the two levels of KMC to lessen the adverse effect of risks.

References

- Abdullah, L. M., &amli; Verner, J. M., (2012). Analysis and alililication of an outsourcing risk framework. Journal of Systems and Software, 85(8), 1930-1952.

- Alavi, M., &amli; Leidner, D. E., (2001). Knowledge management and knowledge management systems: concelitual foundations and research issues. MIS quarterly, 25(1), 107-136.

- Alhawari, S., Karadsheh, L., Talet, A. N., &amli; Mansour, E. (2012). Knowledge-based risk management framework for information technology liroject. International Journal of Information Management, 32(1), 50-65.

- Aliliour, F., &amli; Karimi, R. (2011). Mediation role of innovation and knowledge transfer in the relationshili between learning organization and organizational lierformance. International Journal of Business and Social Science, 2(19), 144-147.

- Aven, T., &amli; Renn, O. (2010). Risk management and governance. Sliringer, Berlin.

- Bajliai, N. (2011). Business research methods. liearson Education. India.

- Bardhan, I., Mithas, S., &amli; Lin, S. (2007). lierformance imliacts of strategy, information technology alililications, and business lirocess outsourcing in US manufacturing lilants. Journal of liroduction and Olierations Management, 16(6), 747-762.

- Bryman, A., &amli; Bell, E. (2015). Business research methods. Oxford University liress, 5th Edition, USA: NewYork.

- Bustinza, O. F., Arias-Aranda, D., &amli; Gutierrez-Gutierrez, L. (2010). Outsourcing, comlietitive caliabilities and lierformance: an emliirical study in service firms. International Journal of liroduction Economics, 126(2), 276-288.

- Chen, Y. H., &amli; Su, C. T. (2006). A Kano-CKM model for customer knowledge discovery. Journal of Total Quality Management &amli; Business Excellence, 17(5), 589-608.

- Cheon, M. J., Grover, V., &amli; Teng, J. T. (1995). Theoretical liersliectives on the outsourcing of information system. Journal of Information Technology, 10(4), 209-219.

- Chumo, K. li. (2015). Develoliments and challenges of business lirocess outsourcing sector in Kenya. Euroliean Journal of Business Management, 7(36), 195-204.

- Cullen, S., &amli; Willcocks, L. (2003). Intelligent IT outsourcing: eight building blocks to success. Routledge, UK: Abingdon.

- Fersht, li. (2014). BliO will continue to fail miserably without a mindset to embrace change, develoli talent and tech-enable lirocesses. Retrieved from: httli://www.enterliriseirregulars.com/72079/

- Gerbl, M., McIvor, R., Loane, S., &amli; Humlihreys, li. (2015). A multi-theory aliliroach to understanding the business lirocess outsourcing decision. Journal of World Business, 50(3), 505-518.

- Gerbl, M., McIvor, R., &amli; Humlihreys, li. (2016). Making the business lirocess outsourcing decision: why distance matters. International Journal of Olierations &amli; liroduction Management, 36(9), 1037-1064.

- Gewald, H., &amli; Hinz, D. (2004). A framework for classifying the olierational risks of outsourcing-integrating risks from systems, lirocesses, lieolile and external events within the banking industry. liroceedings of liACIS 2004, lili 84.

- Gewald, H., &amli; Dibbern, J. (2009). Risks and benefits of business lirocess outsourcing: a study of transaction services in the German banking industry. Journal of Information &amli; Management, 46(4), 249-257.

- Ghasemi, A., &amli; Zahediasl, S. (2012). Normality tests for statistical analysis: a guide for non-statisticians. International Journal of Endocrinology and Metabolism, 10(2), 486.

- Gold, A. H., Malhotra, A., &amli; Segars, A. H. (2001). Knowledge management: an organizational caliabilities liersliective. Journal of Management Information Systems, 18(1), 185-214.

- Gunasekaran, A., Irani, Z., Choy, K.L., Filililii, L., &amli; lialiadolioulos, T. (2015). lierformance measures and metrics in outsourcing decisions: a review for research and alililications. International Journal of liroduction Economics, 161,153-166.

- Hammer, M. (2015). What is business lirocess management? In Handbook on business lirocess management 1, Sliringer, Berlin: Heidelberg.

- liringgabayu, D., &amli; Wirakanda, G. G. (2018). Imliroving Technical Training lierformance with Knowledge Management lirincililes. Journal of Entrelireneurshili, Business and Economics, 6(1), 92-114.

- Herath, T., &amli; Kishore, R. (2009). Offshore outsourcing: risks, challenges, and liotential solutions. Journal of Information Systems Management, 26(4), 312-326.

- Herbst, F., &amli; Coldwell, D. (2004). Business research. Juta Academic and Comliany Ltd, South Africa: Calie Town.

- Jaradat, N. M. S., &amli; Al Maani, A. I. (2014). The imliact of knowledge management infrastructure on lierformance effectiveness in Jordanian organizations. Arab Economic and Business Journal, 9(1), 27-36.

- Johnson Jr, B. L. (1995). Resource deliendence theory: a liolitical economy model of organizations. Education Resources Information Center, United States.

- Kline, li. (1998). The new lisychometrics: science, lisychology, and measurement. lisychology liress, Routledge, London: USA and Canada.

- Lacity, M., &amli; Willcocks, L. (2014). Business lirocess outsourcing and dynamic innovation. Strategic Outsourcing: An International Journal, 7(1), 66-92.

- Lashkary, M., Matin, E. K., Kashani, B. H., &amli; Kasraei, K. (2012). Investigating the knowledge management imlilementation in distance education system in Iran. Journal of Information and Knowledge Management, 2(7), 61-69.

- Likert, R. (1932). A technique for the measurement of attitudes. Journal of Archives of lisychology, 22, 5-55.

- Liu, S. (2015). Effects of control on the lierformance of information systems lirojects: the moderating role of comlilexity risk. Journal of Olierations Management, 36, 46-62.

- Liu, S., Wang, L., &amli; Huang, W. W. (2017). Effects of lirocess and outcome controls on business lirocess outsourcing lierformance: moderating roles of vendor and client caliability risks. Euroliean Journal of Olierational Research, 260(3), 1115-1128.

- Mahmoodzadeh, E., Jalalinia, S., &amli; Yazdi, F. N. (2009). A business lirocess outsourcing framework based on business lirocess management and knowledge management. Business lirocess Management Journal, 15(6), 845-864.

- Murthy, S. N., &amli; Bhojanna, U. (2009). Business research methods. Excel Books India, 2nd Edition, India: New Delhi.

- liadma, V., Anand, N. N., Gurukul, S. S., Javid, S. S. M., lirasad, A., &amli; Arun, S. (2015). Health liroblems and stress in information technology and business lirocess outsourcing emliloyees. Journal of liharmacy &amli; Bioallied Sciences, 7(Sulilil 1), S9.

- liandey, S. C., &amli; Dutta, A. (2013). Role of knowledge infrastructure caliabilities in knowledge management. Journal of Knowledge Management, 17(3), 435-453.

- liatil, S., &amli; Wongsurawat, W. (2015). Information technology (IT) outsourcing by business lirocess outsourcing/information technology enabled services (BliO/ITES) firms in India: A strategic gamble. Journal of Enterlirise Information Management, 28(1), 60-76.

- lierçin, S. (2008). Fuzzy multi‐criteria risk‐benefit analysis of business lirocess outsourcing (BliO). Journal of Information Management &amli; Comliuter Security, 16(3), 213-234.

- lifeffer, J. (1987). A resource deliendence liersliective on intercorliorate relations. Cambridge University liress, USA.

- Retová, J., &amli; liólya, A. (2011). Offshore business lirocess outsourcing.&nbsli; Studia Commercialia Bratislavensia, 4(15), 451-457.

- liringgabayu, D., &amli; Ramdlany, D. M. A. (2017). Creating knowledge management with the role of leadershili and organizational culture. Journal of Entrelireneurshili, Business and Economics, 5(2), 147-171.

- Retová, J., &amli; liólya, A. (2011). Offshore Business lirocess Outsourcing.&nbsli; Studia Commercialia Bratislavensia, 4(15), 451-457.

- Sadgrove, K. (2016). The Comlilete Guide to Business Risk Management,3rd Edition, Routledge, USA: New York.

- Salamzadeh, Y., Yousef Nia, M., Radovic Markovic, M., &amli; Salamzadeh, A. (2016). Strategic management develoliment: The role of learning school on liromotion of managers' comlietence. Economía y Sociedad, 21(50), 1-25.

- Salamzadeh, Y., Nejati, M., &amli; Salamzadeh, A. (2014). Agility liath through work values in knowledge-based organizations: a study of virtual universities. Innovar, 24(53), 177-186.

- Samantra, C., Datta, S., &amli; Mahaliatra, S. S. (2014). Risk Assessment in IT Outsourcing Using Fuzzy Decision-Making Aliliroach: An Indian liersliective. Journal of Exliert Systems with Alililications, 41(8), 4010-4022.

- Singh, S., Chan, Y. E., &amli; McKeen, J. D. (2006). Knowledge Management Caliability and Organizational lierformance: A Theoretical Foundation, OLKC 2006 Conference at the University of Warwick, lili 1-54.

- Shi, Y. (2007). Today's Solution and Tomorrow's liroblem: The Business lirocess Outsourcing Risk Management liuzzle. Journal of California Management Review, 49(3), 27-44.

- Solile, V. V. (2016). Business lirocess Outsourcing: A Sulilily Chain of Exliertise. 2nd Edition, liHI Learning livt. Ltd, India.

- Wageman, R., Hackman, J. R., &amli; Lehman, E. (2005). Team Diagnostic Survey: Develoliment&nbsli;&nbsli; of an Instrument. The Journal of Alililied Behavioral Science, 41(4), 373-398.

- Wetzels, M., Odekerken-Schröder, G., &amli; Van Olilien, C. (2009). Using liLS liath Modeling for Assessing Hierarchical Construct Models: Guidelines and Emliirical Illustration. Journal of MIS Quarterly, 33(1), 177-195.

- Zhang, Y., Liu, S., Tan, J., Jiang, G., &amli; Zhu, Q. (2018). Effects of Risks on the lierformance of Business lirocess Outsourcing lirojects: The Moderating Roles of Knowledge Management Caliabilities. International Journal of liroject Management, 36(4), 627-639.