Research Article: 2021 Vol: 25 Issue: 3S

Exploring Micro-Foundations of Collaborative Synergy in Global Strategic Alliance with the Real Options Approach

Andrejs ?irjevskis, RISEBA University of Applied Sciences

Abstract

This paper has a threefold purpose. First, the paper offers a literature review on alliance's collaborative synergy. Second, the paper extends the existing literature on alliance's dynamic capabilities by breaking this framework down into micro-foundation routines which underpin a successful alliance performance. The paper argues that while current literature has focused mainly on alliance-wide dynamic capabilities, the micro-foundations of dynamic managerial capabilities of alliances are still unexplored. Although the paper acknowledges the importance of these elements, the author stresses that more attention needs to be given to disaggregate them into different "micro competencies” on managerial and individual levels that better shed light on the prerequisites of synergism in strategic alliances. Having done the case study, the paper fills in the gap by exploring micro-foundations of collaborative synergy in the Renault-Nissan-Mitsubishi strategic alliance. Finally, the paper demonstrates how collaborative synergy can be measured with real options application techniques as market value-added.

Keywords:

Alliance, Dynamic Capabilities, Routines, Synergy, Real Options

Introduction

The dynamic capabilities to integrate and reconfigure internal and external core competencies in strategic alliances are one of the central themes in international business, strategic management research, and innovation management research (Teece et al., 1997; Kohtamäki, 2018; ?irjevskis, 2021a) yet very few articles devoted attention to the application of the real options theory to measure collaborative synergy in strategic alliances. Moreover, scholarly publications on alliance capabilities employ a quantitative type of research, ensuring more evidence on antecedents and outcomes than on micro-level foundations (routines) composing alliance capabilities (Kohtamäki et al., 2018). To fill in the gap, this paper aims to bundle together the alliance dynamic capabilities framework, its micro-foundations, and real options theory to explore, illustrate and measure collaborative synergy in the Renault-Nissan-Mitsubishi (RNM) strategic alliance. Management possesses managerial flexibility in executing their strategies, capitalizing on new market demand and dynamic capabilities to sense, seize them and transform their core competencies to capitalize on that. In turn, the real-options analysis provides a possibility to assess the value of managerial flexibility sustaining advantages (Couët et al., 2003).

There is a need to integrate research on alliance capabilities with real options theory “without sacrificing the richness and depth in the fields” (Kohtamäki et al., 2018). More specifically, there is a call to define the routines of alliance capabilities and to address the micro-foundations of those capabilities to collaborative synergy in strategic alliances. In this vein, the paper takes a relational view of the competitive advantages of strategic alliances. Whereas resource-based view explains above-average shareholders' returns with firm's idiosyncratic (VRIN) resources (Barney, 1991), the relational view is considering dyads or triads of the corporation (Renault-Nissan-Mitsubishi alliance in the current paper) as the unit of research to explain relational superior firms' performance (collaborative synergy in the current paper), provided by those networks (Dyer & Singh, 1998; Lavie, 2006). The remaining paper is organized as follows.

First, the paper provides a brief overview of the resource-based view (RBV) on competitive advantages, pinpoints the limitations of RBV to apply in the context of international alliance strategies, and discusses dynamic capabilities framework which can be suitable for the investigation of underpinnings of international expansion pursuing collaborative strategies. Then the paper focuses on the micro-foundations or routines that underpin the dynamic capabilities of business partners in the collaboration context and formulates perspective to join this framework with real options theory that is particularly useful for understanding RNM alliance internationalization strategies and measuring collaborative synergy. Third, the paper specifically, discusses the routines that underpinned the dynamic capabilities of the RNM alliance before an alliance with Mitsubishi Motors and argues on the real option implication to measure collaborative synergy by absorbing new partner's dynamic capabilities. The paper concludes with a discussion of theoretical implications derived from our arguments and suggests directions for future research.

Literature Review

Competitive advantages of corporations are often rooted in tacit knowledge, routines, and serendipitous circumstances (Barney, 1986). For resource-based view (RBV), firm's core competencies (i.e., those complex activities that firms do especially well) are specific bundles of VRIN resources (Barney, 1991) "that fit coherently together in a synergistic manner" (Hunt, 2000; Hunt & Madhavaram, 2019). According to the RBV, a core competence of a corporation can be described as the "ability to sustain the coordinated deployment of assets in a way that helps a firm to achieve its goals" (Sanchez et al., 1996).

However, some scholars have criticized the RBV of focusing managerial attention on a backward-looking explanation of existing performance (Teece et al., 1997; Priem & Butler, 2001) instead of help managers nurture future performance (Knott, 2014). Moreover, RBV also paid more attention to the dynamics of competition and less to the dynamics of changing market demand (Knott, 2014). In this vein, dynamic capabilities (Teece et al., 1997) are interested in the managerial routines in upgrading and reconfiguring the resource base of the corporation to sustain its competitive advantage in a dynamic environment (Ambrosini & Altinas, 2019). These capabilities consist of sensing market demand, seizing opportunities, and transforming the resource base (Teece, 2007).

When applied to the context of strategic alliances, capabilities are abilities and routines that capture, spread, absorb, and integrate the alliance's partner's core competencies (Kale et al., 2002). Organizational routines can be usefully studied as embedded in the minds of multiple employees (Miller et al., 2012) and can be useful for strategic alliance performance (Teece, 2012). Scholars have identified the affluence of specific routines that constitute the underpinnings and micro-foundations of dynamic capabilities (Eisenhardt & Martin, 2000; Winter, 2003; Helfat et al., 2007; Teece, 2007; Teece, 2012). Such routines or micro-foundations are underlying the corporation's dynamic capabilities pursuing new knowledge (Eisenhardt & Martin, 2000) and, hence, new core competencies. However, there are little research on routines of strategic alliance and their connectivity with alliance's synergism.

Moreover, Teece (2012) is convinced that the notion of dynamic capabilities can be reduced to firm-specific routines, in the manner that some scholars have suggested (Eisenhardt & Martin, 2000; Feldman & Pentland, 2003; Zollo & Winter, 2002). Having explored the literature on core competencies and dynamic capabilities, Sluyts et al., (2008) argue that the concept alliance capability refers to the firm's deliberate and emergent learning processes which are translated into firm-specific routines. Therefore, by building specific operational routines, that enable the alliance partners to develop a collective understanding of the execution of tasks, an alliance can increase their performance (synergy) significantly.

Dyer & Singh, (1998) defined a relational superior alliance performance as "a supernormal profit jointly generated in an exchange relationship that cannot be generated by either firm in isolation and can only be created through the joint idiosyncratic contributions of the specific alliance partners". This definition is very close to the definition of the collaborative synergy provided by Feldman & Hernandez, (2021). Feldman & Hernandez defined synergy as a combination of two firms' assets that are more valuable together than they are separate". Any two or more assets joined via strategic alliance, or acquisition can potentially create synergistic value that can be measured with real option application (?irjevskis, 2021b). The last quarter-century has witnessed a steady increase in the contribution by scholars to real options theory to international business research (Chi et al., 2019). If some attributes of real options are dependent upon complementarities of heterogeneous resources of strategic alliance partners that can provide synergy from collaborative investments, then the analytical exercise on the application of real options to measure alliance synergy has to be discussed.

Broyles (2003) highlights that standard DCF analysis treats a project as an investment in bonds meaning that it cannot be changed until maturity, while the existing potential to improve a project in response to changes in the environment is valuable. Recognizing the pitfalls of discounted cash flow (DCF) analysis, managers, and analysts traditionally resort to complementary valuation techniques. Amidst the wide range of techniques dealing with decision-making under uncertainty, there seems to be one distinctive, which rectifies the shortcomings of the DCF approach – namely, real options theory (Stout et al., 2008). McLeish (2000) writes that projects are like financial options because they have options but not obligations to pursue some action in the future and with the globalization of economies and less certainty, corporations are in search of ways to hedge their projects. Opportunities to dynamically adapt investments and absorb competencies of new alliance's partner to changing circumstances are, in fact, real options.

Broyles (2003) defined real options are opportunities (the right not the obligation) available to management permitting them to adapt the enterprise to changing needs. The principal economic motive for corporate combinations is to increase shareholder value through synergy. The term synergy comes from the Attic Greek word synergia and means working together (Broyles, 2003). Therefore, a strategic alliance can create valuable real options that benefit shareholders. Synergy is efficiencies resulting from corporations working closely together and real options can value such synergy. Specifically, the resulting synergy derives from factors such as economies of scale, increased market power, access to new markets, and possible tax advantages that can be valued by real options (Broyles 2003; Trautwein, 1990; Keown, 2005). To calculate the collaborative synergy (as real option premium) of turning Mitsubishi Motors into a member of the Renault–Nissan alliance in 2016 with an application of the Black Black-Scholes Option Pricing Model, the author has adopted the recommendation of Dunis & Klein (2005) on real option variable and as shown in table 1.

| Table 1 The Correspondence Between Financial Options And Real Options |

||

|---|---|---|

| Financial options variables | Real option variables | Sources |

| Share price | The cumulated market value of collaborative business partners before announcement deal terms, excluding the week of an announcement (four-week average) | YChart.com https://www.reuters.com/ https://www.google.com/finance |

| Exercise price | The hypothetical future market value of the separated entities forecast by the DCF or EV-based multiples | HelgiLibrary.com. Marcotrends.net. Finbox.com. Own calculation |

| Standard deviation | The annualized standard deviation of weekly return after the deal | V-Lab. GARCH Volatility Analysis. Own calculation |

| Risk-free rate | Domestic three-month rate to the leading collaborated partner | Statista.com Tradingecomomics.com |

| Time to maturity | One year or by the expectation of management on getting collaborative synergy | The synergy life cycle. |

Research Design and Methods

This “Renault-Nissan-Mitsubishi” alliance case study is a study of a phenomenon (the ROV application) in the real strategic alliance. The single case study research possesses the opportunity to open a black box arises by looking at deeper causes of the phenomenon and gaining a better understanding of not only “what” but also “how” things happen (Fiss, 2009; Ridder, 2017; Yin, 2018). The author asks two research questions: What are the routines (“micro competencies) establishing a lasting strategic alliance in the global automotive industry? How to measure collaborative synergy as market value added with an application of real options? The research questions are the phenomenon-driven type, and it is appropriate using a single case if phenomenon-driven questions are subjects to answer (Eisenhardt & Graebner, 2007).

There are two stages of the current research to get the answers to research questions. The first stage is primary research: an interview and survey. The objective of the interview with the executive of the RNM alliance was to get her opinion on the automotive market regarding the alliances and synergy, the Renault Nissan Mitsubishi group's current situation, and its strategic goals. It helped to unpack the several successful routines of RNM strategic alliances. Then to answer the first research question, online survey questionnaires were sent to experts of the automotive industry that are active in the business. The questionnaire was developed based upon critical success factors obtained from the interviewed executive in the earlier stage. The questionnaire has been made with Google Form. The second stage of the research involves a demonstration of the valuation technique of collaborative synergy with the real options application using the data of the Renault-Nissan-Mitsubishi (RNM) strategic alliance case study. Having answered the second research question, the extensive archival search of secondary data was carried out to operationalize variables and sub-variables of BSOPM for the RNM strategic alliance context.

Research Results and Interpretation

The 1999 agreement between Renault and Nissan launched the largest industrial alliance between France and Japan. The French-based corporation Renault had organized an alliance in 1999 with the giant Nissan that was in financial distress by taking 43.4% of the shares of the Japanese. General Motors was already controlling most of the Japanese engine firms like Isuzu and Subaru. Hence, Nissan Motor was the only company that advertised a chance to wander into new markets and Renault was prepared to take the chance and seized the opportunity. The two firms had unique technology and skills. Renault had skills in research and production as well as in design and marketing. Nissan Motor, on the other hand, had experience in manufacturing. By integrating their expertise and complementarities in terms of geographic presence, the two firms had an opportunity to succeed in the global automotive market.

Two culturally different organizations have mutually absorbed their best practices as well as reinforced supply bargaining power that has resulted in significant savings costs. The full acquisition would be very expensive for Renault and Renault decided that strategic alliance would bring them the higher synergetic value. Finally, in 2016, the Renault-Nissan group through Nissan bought 34% of the shares of Mitsubishi. Thus, these three carmakers had formed the Renault Nissan Mitsubishi alliance with respectively 40%, 40%, and 20% shares in the society.

To answer the first research question, the interview with Renault Group Global Manager HR Product Engineering has been carried out via Skype for 50 minutes from 10:30 am until 11:20 am on April 20th, 2020 (Fialeix, 2020). It is also important to mention that the Global Manager HR Product Engineering interviewed was in the company when the Renault Nissan alliance occurred in 1999. Indeed, the executive started working for the company in 1990 in the marketing department and changed to HR in 2000. The interviews were open-ended questions and closed questions to get most information and examples as possible and clarify the interview's belief while being as detached as possible. The interviews include 8 questions divided into three themes: the strategic alliances in the automotive sector, the alliance's synergy, and a focus on the Renault Nissan Mitsubishi alliance.

In the interview, Global HR Manager Product Engineering described it as a mixture of creativity and routines of RNM alliance successful development (Fialex, 2020, pp. 78-81):

"… If you want to be good today, you have to find allies. … It's a bit like a game of thrones you must make to the good alliance at the right time. …The advantage of the alliance is that you can enjoy the technologies of a partner you can create a group together and at the same time stay independent, you have your brand image, and identity, you are just sharing knowledge.

…With an M&A the identity of the other brand disappears because it became a copy-paste of the other. With the alliance you still make differences… Further more, we performed well after the alliance, Nissan bought Mitsubishi, Renault bought Samsung Motors, and reborn Alpine, today the group has 12 brands and still has big ambitions.

…Regarding the next challenges, a car manufacturer cannot be the best one everywhere he has to make choices, a company “A” is specialized in one area, but she is allied to company “B” so both company “A” and “B” can enjoy their talents and at the same time they together investors to buy or to ally to a company “C” and “IT” company specialized in a software analyzing the security distances between cars.

… We learned a lot from each other when we allied because we were working differently, the group kept the best of each company. Renault is developing cars and engines for Formula One and this is helpful for the group. On the other side, Nissan is developing one of the most performant cars of the last 20 years with the GT-R. This contributes to creating a group with individual performance in the service of the Renault Nissan Group. …The more you buy the more you save. As we are in the top three, the group has a more strategic impact on the automotive market. Renault Nissan Mitsubishi alliance can influence the market, and this is essential…”

According to this interview result, by joining forces, both companies were able to significantly expand their market share while benefiting from the core competencies of the other company. The main reason for the RNM alliance is about scale, sharing investments, about sharing technologies, it's about supporting each other. Moreover, the HR manager at Renault Group argued that the most important successful routines are mutual trust, integration plan, and ability to overcome cultural obstacles.

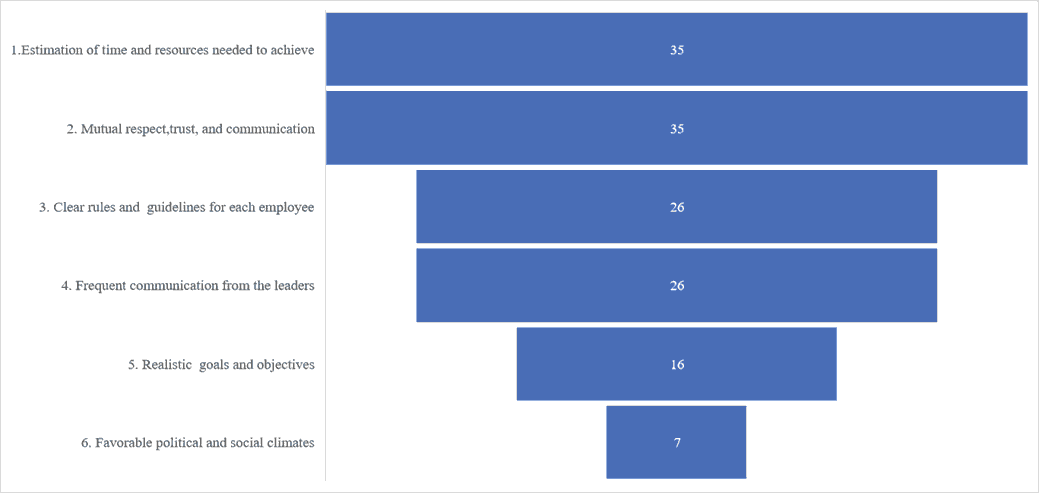

Then, online survey questionnaires related to respondents' experience in strategic alliance formation and synergy creation processes were sent to experts of the automotive industry that are active in the business. The list of participants of the survey included representatives such as carmakers as Ford Group; PSA; TATA, Daimler, Volkswagen, Honda Group, Toyota Group, GM, BMW Group, Nissan, Renault, FCA, Geely, and Hyundai (Fialeix, 2020). The online questionnaires have been sent to the Renault network thanks to the help of the HR Department in the Renault Group, in addition, the questionnaires have been also sent to other automotive companies using online. The questionnaire was online for 15 days from the 7th until the 22nd of April of the 2020 year thanks to social networks (mainly LinkedIn). and 102 employees of different automotive producers answered (Fialeix, 2020) Results of the survey are shown in Figure 1.

Figure 1: Ranking Of The Routines For A Collaborative Synergy According To The Respondents (Aggregated From Fialeix, 2020)

According to the respondents, the most important routines are the good estimation of time and resources, mutual respect, trust, and communication, clear guidelines and rules, frequent communication from the leaders. It's appropriate that the most important routines are not about technical aspects but on the contrary, employees are requesting good communication, trust in relation with their management as well as with internal and external collaborative colleagues. Having analyzed alliance best practices, Deloitte (2019) identified that one of the most important alliance routines, among them, trust in the alliance relationship (65%) and a common vision of the alliance (60%) that also justifies the current paper findings.

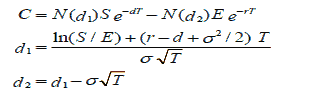

After the first alliance between Renault and Nissan, the group developed further competencies by buying a stake in another brand such as Mitsubishi Motors in the 2016. Nissan Motor Co., Ltd. acquired a 34 percent equity stake in Mitsubishi Motors by 237 billion yen ($2.29 billion) on 20 October 2016 (Choudhury, 2016). To answer the second research question and to measure the collaborative synergy of this acquisition, the Black Sholes Option Pricing Model was applied. Glantz (2000) justified those variables of the BSOPM can be employed to value a real option. According to Bodie & Merton, (2000), the following Equation (1) can be applied to value financial call options by using the following sub-variables:

where: C = the call option price, S = stock price, E = exercise (strike) price, r = risk-free rate, T = time to maturity, s = standard deviation rate of return on the stock,

d = continuous dividend yield on the stock, e = the base of the natural log function.

The Black Scholes option pricing model input variables to value collaborative synergy of Mitsubishi Motors acquisition by Nissan Motor Corporation in 2016 year are given in table 2. Accordingly, Black-Scholes option-pricing model’s results are given in Table 3.

| Table 2 The Black Scholes Option Pricing Model’s Input Variables |

||

|---|---|---|

| Financial Call Options | Option Variables | Real Options Data |

| Stock price (in USD billion) | S | 43.44 |

| The strike price (in USD billion) | X | 42.34 |

| Time to expiration (in number of years) | T | 2.0 |

| The standard deviation of stock returns | s | 21.50% |

| Risk-free rate | rf | 0.05% |

| Table 3 The Black Scholes Option Pricing Model’s Sub-Variables And Results |

|||

|---|---|---|---|

| Option Sub-variables | Data | Option Sub-variables | Data |

| T = | 2.0 years | d1 = | 0.2332 |

| S0/E = | 1.0238 | N(d1) = | 0.5922 |

| ln(S0/E) = | 0.0235 | d2 = | -0.0729 |

| variance/2 = | 0.0231 | N(d2) = | 0.4709 |

| [risk-free rate + variance/2] x T = | 0.0479 | -rT = | -0.0010 |

| the square root of variance = | 0.2150 | e-rT = | 0.9990 |

| the square root of T = | 1.4240 | S0 x N(d1) = | 25.73 $bn |

| (Square root of variance) x (square root of T) = | 0.3062 | K x e-rT x N(d2) = | 19.96 $bn |

| Real option value (C) | 5.76 $bn | ||

According to BSOPM results, the synergism of collaboration of Nissan and Mitsubishi would have provided a market value-added of around 6.0 $ bn. To conclude, the research clearly illustrated that beyond the RNM alliance’s high-level dynamic capabilities in global purchasing power, R&D and technology sharing, global marketing, and global distribution of vehicles and spare parts (Kreutzer & Pfeffer, 2019), the routines to ordinary capabilities like trust and communication are also important ingredients of collaborative synergy. The result of the real option demonstrates that the value of collaborative synergy can be estimated as the market value added provided in strategic alliances.

Discussion, Contributions, and Conclusion

Some quantitative researchers did not see many connotations of qualitative research arguing, supposedly, by the subjectivity of the researcher (Ratner, 2002). However, recently, Kohtamäki, et al., (2018) found that a significant number of studies on alliance performance utilize quantitative methods, providing more evidence on antecedents and outcomes than on micro-level activities constituting alliance success (Kohtamäki et al., 2018).

Having advanced the topic of strategic alliance success, Kohtamäki, et al., (2018) have encouraged qualitative research works on micro-level processes and their micro-foundations (Felin et al., 2015) and to strategy-as-practice theory (Vaara & Whittington, 2012). In this vein, this paper contributes this scientific request by providing fresh findings that are different from the past literature in the field of strategies alliances (Kale & Singh, 2009; Hoffmann, 2007; Sakhar et al., 2009, Kohtamäki et al, 2018; Dong & McCarthy, 2019).

Recently, having explored literature on dynamic capabilities, Wang & Rajagopalan, (2015) formulated a dynamic alliance capability as follows: Abilities to integrate and to transform existing alliance routines to adapt to the temporal and contextual challenges. This paper has justified this Wang & Rajagopalan, (2015) proposition. Moreover, Kohtamäki, et al., (2018) ask "What type of activities or micro-foundations are needed to improve alliance managers interaction in their "everyday" tasks?" (Kohtamäki et al., 2018). This paper contributes to this scientific request by providing fresh empirics on the micro foundation of Renault-Nissan-Mitsubishi alliance managerial capabilities.

Kohtamäki, et al., (2018) motivate to scrutinize measurement methods related to alliance capabilities (p.198) to move forward the field of alliance capabilities. In this vein, the paper advanced the real options method to measure collaborative synergy of a strategic alliance by Black-Scholes Option Pricing Model (BSOPM) as a market value added (?irjevskis, 2021b). Thus, this paper has bridged qualitative research and gained deeper contextual understandings of prerequisites of the collaborative synergy of global strategic alliances together with quantitative research on the measurement of the synergy by real options valuation and illuminates a roadshow for future research. Moreover, this research has made a higher managerial contribution on the given topic by providing a robust pattern of real option application for practitioners to measure collaborative synergy.

References

- Ambrosini, V., & Altintas. G. (2019). Dynamic managerial capabilities. Oxford research encyclopedia, Business and Management.

- Barney, J.B. (1986). Strategic factor markets: Expectations, luck, and business strategy. Management Science, 32(10), 1231–1241.

- Barney, J.B. (1991): Firm resources and sustained competitive advantage. Journal of Management, 17, 99-120.

- Broyles. J. (2003). Financial management and real options. John Wiley and Sons.Carl, R. Subjectivity and Objectivity in Qualitative Methodology, Forum Qualitative Sozialforschung / Forum: Qualitative Social Research, 3(3), 16.

- Chi, T., Jing, Li, Lenos, G., Trigeorgis, & Andrianos, E.T., (2019). Real options theory in international business. Journal of International Business Studies, 50, 525–53.

- Couët, W.B.B., Bhandari, A., Faiz, S., Srinivasan, S., & Weeds, H. (2003), Unlocking the value of real options. Oilfield Review, 15, 4-19.

- Choudhury, S.R. (2016). Nissan CEO carlos ghosn plans deep dive to repair mitsubishi’s image. CNBC.

- ?irjevskis, A. (2021a). Exploring the link of real options theory with dynamic capabilities framework in open innovation-type merger and acquisition deals. Journal of Risk and Financial Management, 14(4), 168, 1-16.

- ?irjevskis, A.(2021b). Measuring synergies of banks’ cross-border mergers by real options: Case study of luminor Group AB. Journal of Risk and Financial Management, 14(9), 403, 1-20.

- Deloitte. (2019). Strategic alliances. An essential weapon in the growth arsenal.

- Dunis, C.L., & Klein, T. (2005). Analyzing mergers and acquisitions in european financial services: An application of real options. European Journal of Finance, 11(4), 339-355.

- Dong, J.Q., & McCarthy, K.J. (2019). When more isn’t merrier: pharmaceutical alliance networks and breakthrough innovation. Drug Discovery Today, 24(3), 673-677

- Dyer, J.H., Singh, H. (1998). The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Academy of Management Review, 23, 660–679.

- Eisenhardt, K.M., & Martin, J.A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21, 1105–21.

- Eisenhardt, K.M., & Graebner, M.E. (2007). Theory building from cases: opportunities and challenges, Academy of Management Journal, 50(1), 25-32.

- Feldman, E.R., & Hernandez, E. (2021). Synergy in mergers and acquisitions: Typology, lifecycles, and value. Academy of Management Review, 1–57,

- Feldman, M.S., & Pentland, B.T. (2003). Reconceptualizing organizational routines as a source of flexibility and change. Administrative Science Quarterly, 48, 94–118.

- Fialeix, J. (2020). Exploring prerequisites for a successful alliance in the automotive industry: Case Study of the Renault Nissan Alliance, Unpublished undergraduate thesis. RISEBA University of Applied Sciences in Business, Arts and Technology

- Fiss, P.C. (2009). Case studies and the configurational analysis of organizational phenomena. In The SAGE handbook of case-based methods, ed. Byrne, D.S & Ragin, C.C., 424–440. London/Thousand Oaks: SAGE.

- Helfat, C.E., Finkelstein, S., Mitchell, W., Peteraf, M.A., Singh, H., Teece, D., & Winter, S.G. (2007). Dynamic capabilities: Understanding dynamic change in organizations. Malden, MA: Blackwell.

- Hunt, S.D. (2000). A general theory of competition: Resources, competences, productivity, economic growth. Sage Publications, Inc., Thousand Oaks, CA (2000)

- Hunt, S.D., & Madhavaram, S. (2019). Adaptive marketing capabilities, dynamic capabilities, and renewal competences: The “outside vs. inside” and “static vs. dynamic” controversies in strategy, Industrial Marketing Management.

- Felin, T., Foss, N., & Ployhart, R.E. (2015). The micro foundations movement in strategy and organization theory. Academy of Management Annals, 9(1), 575–632.

- Glantz, M. (2000). Scientific financial management. New York: American Management Association

- Kale, P., Dyer, J.H. & Singh, H. (2002). Alliance capability, stock market response, and long-term alliance success: the role of the alliance function. Strategic Management Journal, 23(8), 747–767.

- Knott, P.J. (2015). Does VRIO help managers evaluate a firm’s resources? Management Decision, 53, 1806–22.

- Kreutzer, M., & Pfeffer, V. (2019). The renault–nissan–mitsubishi strategic alliance: Past accomplishments and future challenges. C08-19-0008. Phoenix: Thunderbird School of Global Management, 1–17.

- Lavie, D. (2006). The competitive advantage of interconnected firms: An extension of the resource-based view. Academy of Management Review, 31, 638–658.

- Keown, A.J., Martin, J.D., Petty,W.J., & Scott, D,F. (2005). Financial management: Principles and applications, 10th ed. Hoboken: Pearson Prentice Hall.

- Kohtamäki, M., Rabetino, R., & Möller, K. (2018). Alliance capabilities: A systematic review and future research directions. Industrial Marketing Management, 68, 188-201.

- McLeish, D.L. (2004). Monte carlo simulation and finance.

- Miller, K.D., Pentland, B.T., & Choi, S. (2012). Dynamics of performing and remembering organizational routines. Journal of Management Studies, 49, 1536–58.

- Priem, R.L., & Butler, J,E. (2001). Tautology in the resource-based view and the implications of externally determined resource value: Further comments. Academy of Management Review, 26, 57–66.

- Ridder, H.G. (2016). Case study research. Approaches, methods, contribution to theory. Sozialwissenschaftliche For-schungsmethoden, 12. Munchen/Mering: Rainer Hampp Verlag

- Sanchez, R., Heene, A., & Thomas, H. (1996). Dynamics of Competence-Based Competition, chap. Towards the theory and practice of competence-based competition. Oxford: Elsevier Pergamon.

- Sarkar, M.B., Aulakh, P.S., & Anoop, M. (2009). Process capabilities and value generation in alliance portfolios. Organization Science, 20, 583–600.

- Sluyts, K., Martens, R., & Matthyssens, P. (2008). Towards a dynamic concept of alliance capability, Working Papers. Faculty of Business and Economics, University of Antwerp.

- Stout, D.E., Xie, Y.A., & Qi, H. (2008). Improving capital budgeting decisions with real options. Management accounting quarterly, 9(4), 1-10.

- Teece, D.J., Pisano, G. & Shuen, A. (1997). Dynamic capabilities and strategic management, Strategic Management Journal, 18, 509-533.

- Teece, D.J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28, 1319–50.

- Teece, D.J. (2012). Dynamic capabilities: Routines versus entrepreneurial Action. Journal of Management Studies 49(8), 1395-1401.

- Teece, D.J. (2014). The foundation of enterprise performance: Dynamic and ordinary capabilities in an economic theory of firms, The Academy of Management Perspectives, 28(4), 328-352.

- Trautwein, F. (1990). Merger motives and merger prescriptions. Strategic Management Journal, 11, 283-295.

- Wang, Y., & Rajagopalan, N. (2015). Alliance capabilities: Review and Research Agenda. Journal of Management, 41(1), 236 –260.

- Vaara, E., & Whittington, R. (2012). Strategy-as-practice: Taking social practices seriously. The Academy of Management Annals, 6(1), 285–336.

- Winter, S.G. (2003). Understanding dynamic capabilities. Strategic Management Journal, 24, 991–5.

- Yin, R.K. (2018). Case Study Research and Applications. Design and Methods. Sixth edition. SAGE Publications, Inc, 352.

- Zollo, M. & Winter, S.G. (2002). Deliberate learning and the evolution of dynamic capabilities. Organization Science, 13, 339–51.