Research Article: 2021 Vol: 25 Issue: 3

Exploring the Impact of Seasonal and Political Cycles on International Financial Markets

Olga Benenson, Open Text Software GmbH

Serge Velesco, University of Applied Sciences Mittweida

Oleksii Dzhusov, Oles Honchar Dnipro National University

Abstract

The article is devoted to the topical issue of research of cyclical patterns in economy and their practical use for forecasting the direction of financial markets. The aim of the work is to find out the peculiarities of seasonal-cyclical patterns "January barometer", "First five days of January" and "Presidential election cycle" in the USA stock market in modern conditions and to develop recommendations for practical use of these patterns in investment activities. The US stock market, as a part of the global financial market, was chosen as the basis for research. The research was conducted by statistical processing of data on the values of the broad market index Standard & Poor's - 500 (for the period from 1950 to the end of 2020) and the Dow Jones Industrial Average (for the period from 1897 to the end of 2020). Peculiarities of manifestation of seasonal cyclical patterns "January Barometer" and "The First Five Days of January" at the US stock market in modern conditions were determined. An algorithm for using these regularities has been worked out and suggested for making forecasts of the prevailing market movement direction for the coming year. The authors have also studied the peculiarities of "Presidential election cycle" manifestation in the modern economy. We have suggested rational ways of using this cycle to predict the dominant trend on the stock market in the every coming year. The practical application of the results of the study will improve the accuracy of the forecasting of the prevailing trends in the international stock markets.

Keywords

Seasonality, Cyclicality, Financial Market, Presidential Election Cycle, Standard & Poor's - 500 Index, Dow Jones Industrial Average, Forecasting.

Introduction

The cyclical nature of natural and social phenomena has been investigated by many scientists since the middle Ages, and the cyclical nature of the world order is now a recognized fact. At the same time if such phenomena as change of seasons during the year, change of day and night are evident proof of cyclic nature, then cyclic nature of many social and economic phenomena require additional study. Since the beginning of the 19th century, many scientists have tackled the cyclical nature of economics, and many scientific works have been written on this topic, describing a wide variety of cyclical patterns. But as of today many of these regularities are still not adequately adapted for application in practice.

The financial market, as part of the global socio-economic system, is also cyclical in nature, and many of the cycles that manifest themselves in financial markets are still poorly understood. The following types of cycles are commonly identified in financial markets:

1. Time cycles, when price fluctuations are estimated with reference to time;

2. Seasonal cycles, when price fluctuations are estimated depending on the season or weather conditions;

3. Event (socio - political) cycles, when an event causes a price movement and this behavior is repeated.

We present a work that is devoted to the study of some cycles, representing the last two types, namely, seasonal: "January Barometer", "The first five days of January" and socio-political: "Presidential Election Cycle". Despite the fact that at the moment there is already a fairly large number of works devoted to the study of these cyclical patterns, we believe there is still a significant gap in knowledge about them. This gap lies in the fact that the works are either purely theoretical in nature and are difficult to use in practice, or there are experimental works presenting relatively brief studies over a short period of time.

Therefore, we believe that in-depth applied research on seasonal and political cycles is very promising, as knowledge and understanding of cyclical laws and the ability to find their practical application can bring significant profits to entities operating in financial markets.

Literature Review

Methodological aspects of functioning of complex open dynamic systems based on cyclic patterns are covered in the works of a number of scientists: (Afonin et al., 2008; Bell, 2004; Korotaev, 2006; Mochernyi, 2000; Poletaev & Savel'eva, 1993; Toffler, 2010, Schekin, 2005) and many others. The most famous works devoted to financial market cyclicity are the works of V.L. Krum and D. Kitchin, who when analyzing the history of quotations of commercial bills in circulation in New York, discovered the existence of a recurrent cycle lasting 40 months; the work of Ch. Dow and his follower P. Hamilton, who actually described the cyclicality of financial markets (Colby, 2000).

A very interesting study is the work of Adam & Merkel (2019), which allows the use of a complex model that can simultaneously reproduce the behavior of stock prices and business cycles in the United States. Based on the model presented in the paper, the authors formulate general forecasts for future developments, particularly in the stock market. However, the given forecasts are too general and the results of modeling are rather problematic to be used in practical investor activity.

There are quite a lot of studies related to the construction, mainly of mathematical models that describe the impact of various factors (wages, rental rates and other factors) on business cycle performance (Eusepi & Preston, 2011; Angeletos et al., 2018; Bhandari et al., 2019 etc.). But despite of the profound fundamentality of these papers, none of these papers consider the implications for the stock price. To some extent, this drawback is eliminated in the work of F. Winkler (Winkler, 2016), However, both the Winkler papers and the papers mentioned above are mainly theoretical, and their results are difficult to apply in practice.

The works of B. Wolfe (the author of the "Wolfe Waves" method) are based on the cyclic theory. He suggests methods to determine the approximate time to reach the price level. So, using this method, the investors can roughly calculate how long they will have to hold the position to reach the target (Hoilov, 2019).

The issues of seasonal cyclicality are most extensively discussed in the works of Yale and Jeffrey Hirsch (Hirsch & Hirsch, 2005; Hirsch, 2012; Kaeppel, 2009). D. Katz and D. McCormik developed and in 1990 published the Calendar Effects Diagram – a set of tables and a chart which shows the relationship between the behavior of the Standard & Poor's - 500 index and the current calendar date (Katz & McCormik, 1990).

A. Hoilov in his works considers the possibility of using time, seasonal and event cycles to predict the direction of movement of the markets of a number of assets, in particular, the change in prices for Brent Crude Oil depending on the season. The author associates the annual growth of quotations in July each year with a regular deterioration in the weather in the Gulf of Mexico and, accordingly, a decrease in production rates at this time (Hoilov, 2021). Yaroslav Naidenov also bases his research on seasonal cycles. In his research he considers the seasonal cycle of the annual upward movement of GBPUSD quotes from January to early May (Naidanov, 2017). In the same work the author raises a question about the necessity to periodically consider the relevance of cycles. Thus, in his opinion, a number of cycles which took place in financial markets 20-30 years ago are no longer working today.

H. Hanula, while trading stocks, has used observations that show that stocks rise most rapidly in the first days of each month and the "January effect", according to which stocks tend to rise in January (Hanula, 1991). Very interesting, from a practical point of view, are the works of D. Kaim, who found that if small-cap stocks grow more than large-cap stocks in January, then the annual growth of the stock index is likely to be positive, and vice versa - if small-cap stocks lag behind large-cap stocks in January, then stock market indices are highly likely to show a negative growth at year end (Sincere, 2019).

In 1972, Yale Hirsch developed a seasonally cyclical indicator, the so-called January Barometer (Hirsch, 2006, 2012). The meaning of this indicator is that the performance of the Standard & Poor's - 500 stock market index in January determines whether the index will end the whole year with positive or negative growth. Another seasonal-cyclical pattern "The first five days of January" was also described by Yale Hirsch. The paper of R. Colby and T. Meyers presents the correlation between what happens in the stock market during the first five days of January and the whole year (Colby & Meyers, 2002). According to this correlation, if the index Standard & Poor's - 500 closed higher on the fifth trading day of January than it opened on the first trading day of January, then the closing of the index on the last trading day of the year should also be higher than it closed on the last day of the preceding year. If on the fifth trading day in January the closing level of the index was lower than its opening on the first day of the year, then a lower closing level can be expected on the last trading day of the year than on the last day of the preceding year. Some of J. Hirsch's research has been continued and published by us earlier (Dzhusov, 2013, 2019).

Recently, works devoted to the practical use of these two seasonal-cyclical patterns have begun to appear: "January Barometer" (Davies, 2019; Galipeau, 2021; Martchev, 2021 and others) and "The First Five Days of January" (Krantz, 2021; Townes, 2020 and others). Undoubtedly, these works have a high practical value, but their disadvantages, from our point of view, include not sufficiently deep studies of the mentioned cycles.

The first fundamental studies of the manifestation of the presidential election cycle in the U.S. stock market appeared in the 1980s. In this regard, one should mention the fundamental work of M. Krauss, in which the author traces the manifestation of the presidential election cycle in the US stock market from 1924 to 1982. (Krauss, 1983), as well as the work of Arthur Merrill, who studied the period from 1886 to 1983. (Merrill, 1984). The researchers found that US stock market prices rose a month before the presidential election, then rose until late January of the following year, but began to decline almost immediately after the the presidential inauguration. The decline usually lasted until June of the second year of the presidency, after which the market began rising again until the next president was sworn in. This cycle was called the "Presidential Election Cycle" (Merrill, 1984). Merrill's research was extended and continued by J. Hirsch, who confirmed the identified cyclicality (Hirsch, 2012).

Many research works (Green, 2020; Heilner, 2019) are devoted to the aspects of the practical use of this cycle, but all of them consider mainly, only ways of using the cycle. At the same time, either there is no detailed consideration of the manifestation of the cycle during a sufficiently long historical period of its existence (Meisler, 2015) or the analysis of the peculiarities the manifestation of this pattern in financial markets is not sufficiently presented (Green, 2020; Heilner, 2019).

Thus, summing up the above, we can say that the study of the features of cycles in financial markets is a very promising area of research. As for seasonal political cycles, such as “January Barometer”, “First Five Days of January” and “Presidential Elections Cycle”, the analysis of published works on these topics leads us to conclude that these cyclical patterns are still not enough studied. In addition, it's been a long time since they were identified and therefore their relevance in financial markets needs to be verified with contemporary data.

The purpose of this work is to establish the features of the manifestation of seasonal political cyclical patterns of the "January Barometer" (hereinafter "JB"), the "First Five Days of January" (hereinafter "FFDJ") and the "Presidential Election Cycle" (hereinafter "PEC") on the international financial markets in modern conditions and to develop recommendations for the practical application of these patterns in investment activities.

Research Methodology and Results

Our research, which results are presented below, can be considered as a continuation of the studies published earlier (Dzhusov et al., 2019). The necessary statistical data for the work were collected from publicly available sources of information (Hirsch & Hirsch, 2015 - 2018; Bloomberg, 2021; Amadeo, 2021). To update the research presented in (Dzhusov et al., 2019), we collected the data of the numerical values of Standard & Poor's - 500 index on the days of the year of interest to us for the period from January 2019 to 31.12.2020.

In contrast to our previous studies, where we looked at the peculiarities of the manifestation of seasonal cyclical patterns "JB" and "FFDJ" over the entire observation period, i.e. from 1950 to 2018, in this paper we decided to extend the study to 31.12.2020, and divide the entire period into two: from 1950 to 1991, and from 1992 to 31.12.2020.

Since 1991, there have been global processes in the world economy which have brought the significant changes in its further development. First of all, the socio-economic collapse in the socialist camp and the collapse of the Soviet Union, which contributed to the USA becoming the world's only superpower-state. A second no less important reason to single out the aforementioned period of global economic development is the beginning of the planet's transition from industrial to informational societies, the massive spread of the internet and the rapid development of technologies associated with it. For this reason we have conducted research separately for those two mentioned periods.

We do not consider it necessary to present here the full version of the table containing the data on the growth/decline of the Standard & Poor's - 500 Index in January and year-end results for the entire observation period, i.e. from 1950 to the end of 2020, as it would largely duplicate a similar table that is presented in our previously published work (Dzhusov, 2019). Therefore, we limited to present such a Table 1 only for the period of the "newest economy", i.e., from 1992 to the end of 2020.

The table is divided into three sectors: Sector I presents the following data: column 1 - observation number; column 2 - year; column 3 - the numerical value of the Standard & Poor's - 500 index at the close of the preceding year on December 31; column 4 - the percentage change in the value of the Standard & Poor's - 500 index by the end of the year.

Sector II - "JB" presents the values of the Standard & Poor's-500 index at the close of January 31 of the current year (column 5); the percentage change in the Standard & Poor's-500 index for the period from 01 to 31 January of the current year (column 6), and the mark of the failure of "JB" indicator (column 7).

Sector III - "FFDJ" presents values of Standard & Poor's - 500 index at the moment of closing on the fifth trading day of January of the year in question (column 8); percentage change of Standard & Poor's - 500 index for the first five days of January (column 9), and the mark of the failure of "FFDJ" indicator (column 10).

The table has 30 rows, corresponding to the number of observations from 1992 to the end of 2020. However, the 30th row is not filled up to the end, as it will be possible to fill it only after the end of 2021, according to the closing of the trading session of 31.12.2021 (the corresponding cells in the table are marked - N/D, i.e., no data). Thus, all estimates given in this work were based on 29 observations.

The analysis of sectors I and II of the table shows that the "JB" indicator failed in 9 of the 29 observations (marked with an "X" in the table), i.e. incorrectly predicted the change sign of the index value for the year (positive or negative). For instance, in 1992 the Standard & Poor's - 500 index had fallen from 417,09 points as of 31.12.1991 (line 1 of Table 1) to 408,79 points at the close of the trading session of 31.01.1992. (i.e. decreased by 1,99 %, rounded off to 2,0 % in the table). According to the interpretation of the "JB" indicator, a negative change of the Standard & Poor's - 500 index in the period from 01 to 31 January of the observed year signals a negative growth of the Standard & Poor's - 500 index for the whole year, i.e, on December 31, 1992 there should have been a negative change of the Standard & Poor's - 500 index in comparison with its value of December 31, 1991. But, as is seen in the table, on December 31, 1992 the Standard & Poor's - 500 index had the value 435,71 (line 2 of Table 1), which means that instead of the expected fall the index has increased by 4,46% (in Table 1 rounded to 4,5%). Consequently, the "JB" indicator showed a wrong forecast, or "failed". Thus, in this case, in column 7, the symbol "X" is put down.

| Table 1 The Effectiveness of the “January Barometer” ("JB") and the “First Five Days of January” ("FFDJ") Seasonal Indicator | |||||||||

| No. | Year | Index value as at 31 December of the preceding year | Year-end index change, % | Index value as of January 31 of the current year | Index change for the period 01.01-31.01, % | Mark about indicator not working | Index value on the 5th day of January of current year | Index change for the first 5 days of January, % | Mark about indicator not working |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| I | II - “JB” | III - “FFDJ” | |||||||

| 1 | 1992 | 417,09 | 4,5 | 408,79 | -2,0 | ? | 418,10 | 0,2 | |

| 2 | 1993 | 435,71 | 7,1 | 438,78 | 0,7 | 429,05 | -1,5 | ? | |

| 3 | 1994 | 466,45 | -1,5 | 481,61 | 3,3 | F | 469,90 | 0,7 | F |

| 4 | 1995 | 459,27 | 34,1 | 470,42 | 2,4 | 460,83 | 0,3 | ||

| 5 | 1996 | 615,93 | 20,3 | 636,02 | 3,3 | 618,46 | 0,4 | ||

| 6 | 1997 | 740,74 | 31,0 | 786,16 | 6,1 | 748,41 | 1,0 | ||

| 7 | 1998 | 970,43 | 26,7 | 980,28 | 1,0 | 956,04 | -1,5 | ? | |

| 8 | 1999 | 1229,23 | 19,5 | 1279,64 | 4,1 | 1275,09 | 3,4 | ||

| 9 | 2000 | 1469,25 | -10,1 | 1394,46 | -5,1 | 1441,46 | -1,9 | ||

| 10 | 2001 | 1320,28 | -13,0 | 1366,01 | 3,5 | ? | 1295,86 | -1,8 | |

| 11 | 2002 | 1148,08 | -23,4 | 1130,20 | -1,6 | 1160,71 | 1,1 | ? | |

| THE EFFECTIVENESS OF THE “JANUARY BAROMETER” ("JB") AND THE “FIRST FIVE DAYS OF JANUARY” ("FFDJ") SEASONAL INDICATOR | |||||||||

| 12 | 2003 | 879,82 | 26,4 | 855,70 | -2,7 | ? | 909,93 | 3,4 | |

| 13 | 2004 | 1111,92 | 9,0 | 1131,13 | 1,7 | 1131,91 | 1,8 | ||

| 14 | 2005 | 1211,92 | 3,0 | 1181,27 | -2,5 | F | 1186,19 | -2,1 | F |

| 15 | 2006 | 1248,29 | 13,6 | 1280,08 | 2,5 | 1290,15 | 3,4 | ||

| 16 | 2007 | 1418,30 | 3,5 | 1438,24 | 1,4 | 1412,11 | -0,4 | ? | |

| 17 | 2008 | 1468,36 | -38,5 | 1378,55 | -6,1 | 1390,19 | -5,3 | ||

| 18 | 2009 | 903,25 | 23,5 | 825,88 | -8,6 | ? | 909,73 | 0,7 | |

| 19 | 2010 | 1115,10 | 12,8 | 1073,87 | -3,7 | ? | 1144,98 | 2,7 | |

| 20 | 2011 | 1257,64 | -0,0 | 1286,12 | 2,3 | F | 1271,5 | 1,1 | F |

| 21 | 2012 | 1257,60 | 13,4 | 1312,41 | 4,4 | 1280,7 | 1,8 | ||

| 22 | 2013 | 1426,19 | 29,6 | 1498,11 | 5,0 | 1457,15 | 2,2 | ||

| 23 | 2014 | 1848,36 | 11,4 | 1782,59 | -3,5 | ? | 1837,49 | -0,6 | ? |

| 24 | 2015 | 2058,90 | -0,73 | 1994,99 | -3,1 | F | 2062,14 | 0,2 | F |

| 25 | 2016 | 2043,94 | 9,54 | 1940,24 | -5,1 | ? | 1922,03 | -6,0 | ? |

| 26 | 2017 | 2238,83 | 19,42 | 2278,87 | 1,8 | 2268,90 | 1,3 | ||

| 27 | 2018 | 2673,61 | -6,24 | 2823,81 | 5,6 | ? | 2747,71 | 2,8 | ? |

| 28 | 2019 | 2506,85 | 28,88 | 2704,10 | 7,9 | 2574,41 | 2,7 | ||

| 29 | 2020 | 3230,78 | 16,26 | 3225,52 | -0,2 | ? | 3253,05 | 0,7 | |

| 30 | 2021 | 3756,07 | N/D | 3714,24 | -1,1 | N/D | 3824,68 | 1,8 | N/D |

Further, in 4 observations, the index showed a slight increase or decrease (in cases where the value of the annual change in the index value was less than or equal to 3%, the table was marked with "F", short for "Flat market", or market without a clear trend). These cases are presented in lines 3, 14, 20 and 24 of Table 1 (the year-end change in the Standard & Poor's - 500 Index was -1,5%, 3,0%, 0,0% and -0,73%, respectively). We considered it appropriate to exclude these observations from the performance calculations of the "JB" and "FFDJ" indicators.

Thus, the table shows that in 9 of 25 observations (out of a total of 29 observations we excluded 4 observations marked with "F", when the annual change of the index Standard & Poor's - 500 was insignificant) indicator "JB" worked incorrectly, which id 36,0%. Thus, the accuracy of this indicator, or indicator performance, is 64,0% (100% - 36% = 64%). This figure differs significantly for the worse from the results of studies conducted between 1950 and 2018, which were 81,4% (Dzhusov, 2019). Consequently, it can be noted that the performance of the “JB” indicator has deteriorated sharply under the conditions of the "newest economy". Such an indicator performance (64%) can hardly be considered satisfactory, as this value is not much higher than the probability of guessing the result of flipping a coin (50%).

If we calculate the efficiency of indicator separately for positive growth and separately for negative growth, we come to the following result: in case of positive growth of indicator from 1992 till the end of 2020 (15 observations), the indicator failed in two cases - in 2001 and in 2018, i.e. the error rate is 13,3% and, respectively, the efficiency rate is 86,7%. This value agrees well with the results of studies conducted earlier and published in (Dzhusov, 2013, 2019).

Further, out of 10 observations (the years of the Standard & Poor's - 500 index decline in January from 1992 to the end of 2020), the indicator predicted the annual results incorrectly in 7 cases (Table 1, Sectors I and II), which is 70% (the indicator efficiency is 30,0%). This value of indicator performance is unsatisfactory and therefore, in such cases, it is not appropriate to use the indicator to predict the direction of the market.

Thus, testing the "JB" indicator in the period of "newest economy" has shown that it is effective when the change in the Standard & Poor's - 500 index for January is a positive value. In cases where the index is down by the end of January, it is not appropriate to use the indicator.

To expand our past research (Dzhusov, 2019) on peculiarities of "FFDJ" indicator manifestation in modern conditions, we used the same statistical material, which was collected to study "JB" indicator performance in the "newest economy" conditions.

In processing the statistical material (Table 1), it was found that 4 observations are characterised by insignificant changes in the Standard & Poor's - 500 index for the year. These observations are marked as "F" in sector III of the table and are excluded from further research. Thus, as in the studies above, all subsequent calculations are based on 25 observations. Of those 25 observations, in 7 cases (marked with "X" in the table) the indicator has failed, that is, it has incorrectly predicted the area of year-end index increase (positive or negative) which is 28,0%. Thus, the accuracy of this indicator (efficiency) is 72, 0%.

If we consider the indicator operation separately for negative and positive values of the Standard & Poor’s - 500 index growth, then the result is as follows. In the period from 1992 till the end of 2020 the efficiency of "FFDJ" indicator was 88,2% (2 fails out of 17 observations) for positive changes of the index in first five days of January, and 37,5% (5 fails out of 8 observations) for negative changes in the index in first five days of January.

Thus, testing of “FFDJ” indicator in conditions of “newest economy” shows that it is effective when the growth of Standard & Poor's - 500 index in the first five days of January is positive. In cases where the index in the first five days of January shows a decline, it is not appropriate to use the indicator. We obtained a similar result earlier (Dzhusov, 2019), and calculations based on data from the last two years (2019, 2020), which were not included in the mentioned work, only confirmed the correctness of our conclusions.

We have also conducted research to find a correlation between the size of the increase in the Standard & Poor's - 500 index in the January periods and the full year results. To do this, we selected from the entire dataset for the period 1950-2000 all the cases where we could form predictions on the basis of prevailing market trends (i.e. all the cases where there were positive index rises both in the first 5 days of January and over the entire January-month period), and formed a table from this data. The first column contains the number in order, the second column contains the year for which the calculation is made, the third column contains the values of the annual increase in the Standard & Poor's - 500 index at the end of the year, the fourth column contains the index values as of January 31 of that year, and the fifth column contains the index values at the fifth trading day closing. For ease of reference, the table has been reformatted so that the values of the percentage change in the Standard & Poor's - 500 index by the end of the year (column 3) are placed in ascending order.

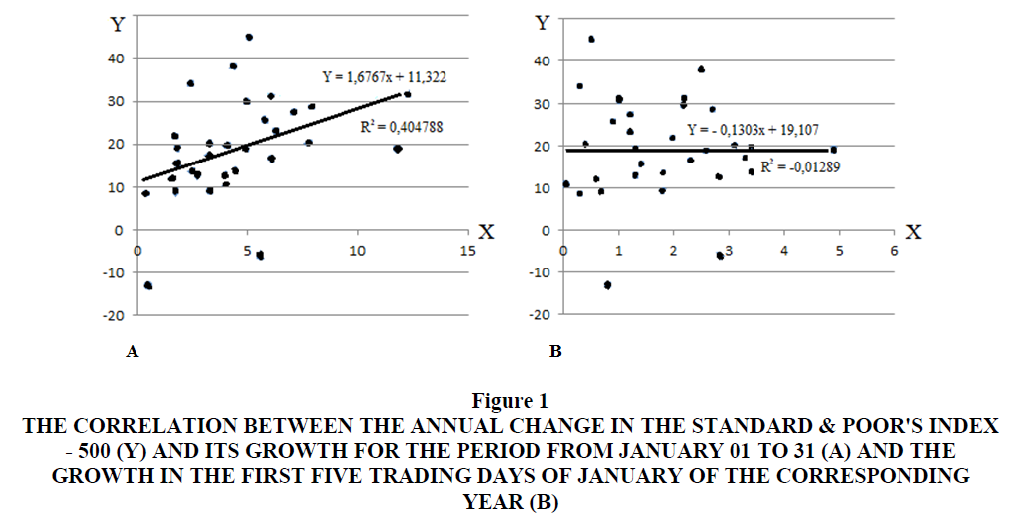

To determine the presence or absence of a correlation between the annual change of the Standard & Poor's index - 500 (column 3 of Table 2) and its growth for the period from 01 to 31 January (column 4 of Table 2) and the increase in the first five days of January of the corresponding year (column 5 of Table 2), two charts were built. The ordinate axis (Y) of both graphs plotted the value of the annual change in the Standard & Poor's index - 500, and the abscissa axis (X) - the value of the increase in the index in the period from January 01 to 31 of the corresponding year (Figure 1A) and the value of the increase in the Standard & Poor's - 500 in the first five days of this year (Figure 1B).

| Table 2 Interrelation of the Annual Change in the Standard & Poor's - 500 Index with the Values of its Increment for the Period from January 01 Till January 31 and the Increment for the First Five Days of January of the Respective Year | ||||

| No. | Year | Year-end index change, % | Index change for the period 01.01-31.01, % |

Index change for the first 5 days of January, % |

| 1 | 2 | 3 | 4 | 5 |

| 1 | 1966 | -13,1 | 0,5 | 0,8 |

| 2 | 2018 | -6,2 | 5,6 | 2,8 |

| 3 | 1959 | 8,5 | 0,4 | 0,3 |

| 4 | 2004 | 9,0 | 1,7 | 1,8 |

| 5 | 1965 | 9,1 | 3,3 | 0,7 |

| 6 | 1971 | 10,8 | 4,0 | 0,04 |

| 7 | 1952 | 11,8 | 1,6 | 0,6 |

| 8 | 1979 | 12,3 | 4,0 | 2,8 |

| 9 | 1964 | 13,0 | 2,7 | 1,3 |

| 10 | 2012 | 13,4 | 4,4 | 1,8 |

| 11 | 2006 | 13,6 | 2,5 | 3,4 |

| 12 | 1972 | 15,6 | 1,8 | 1,4 |

| 13 | 1951 | 16,5 | 6,1 | 2,3 |

| 14 | 1983 | 17,3 | 3,3 | 3,3 |

| 15 | 1963 | 18,9 | 4,9 | 2,6 |

| 16 | 1976 | 19,1 | 11,8 | 4,9 |

| 17 | 2017 | 19,4 | 1,8 | 1,3 |

| 18 | 1999 | 19,5 | 4,1 | 3,4 |

| 19 | 1967 | 20,1 | 7,8 | 3,1 |

| 20 | 1996 | 20,3 | 3,3 | 0,4 |

| 21 | 1950 | 21,8 | 1,7 | 2,0 |

| 22 | 1961 | 23,1 | 6,3 | 1,2 |

| 23 | 1980 | 25,8 | 5,8 | 0,9 |

| 24 | 1989 | 27,3 | 7,1 | 1,2 |

| 25 | 2019 | 28,9 | 7,9 | 2,7 |

| 26 | 2013 | 29,6 | 5,0 | 2,2 |

| 27 | 1997 | 31,0 | 6,1 | 1,0 |

| 28 | 1975 | 31,5 | 12,3 | 2,2 |

| 29 | 1995 | 34,1 | 2,4 | 0,3 |

| 30 | 1958 | 38,1 | 4,3 | 2,5 |

| 31 | 1954 | 45,0 | 5,1 | 0,5 |

Figure 1 The Correlation Between the Annual Change in the Standard & Poor's Index - 500 (Y) And Its Growth for the Period from January 01 To 31 (A) And The GROWTH In The First Five Trading Days of January of the Corresponding Year (B)

Examining the graphs obtained, we can note that the first graph (Figure 1A) visually shows a small straight-line correlation between the annual change in the index and its growth between January 01-31. However, in the same figure one can clearly see 6 points which deviated significantly from the trend line (this represents 19,4% of the total number of observations) and which would have introduced significant errors in the formation of forecasts. We do not consider it possible to exclude these cases from the calculations, as such, which are very different from the series, as their number is quite large (almost 20%). The second Figure 1B does not show any correlation between the parameters studied.

A correlation-regression analysis was also carried out on the data in Table 2. In one case, the value of the annual change in the Standard & Poor's - 500 index was selected as “Y”, and the value of the index increase in the period from 01 to 31 January of the same year as “X” (the results are shown in Figure 1A). In the other case with the same value of “Y”, the value of the index increase in the first five days of January was taken as “X” (the results are shown in Figure 1B). As a result of these calculations 2 regression equations have been obtained:

For the pair "annual change in the index - value of increase in the index between 01 January and 31 January":

Y = 1,6767x + 11,322; R2 = 0,40479 (1)

For the pair "annual change in the index - value of increase in the index in the first five days of January":

Y = -0,1303x + 19,107; R2 = -0,01289 (2)

The value of R2 = 0,40479 for the pair "annual change in the index - index increase over the period of January 01-31" suggests that despite the visually distinguishable straight-line correlation between the two parameters, it is inappropriate to use the value of X to predict the value of Y in this case, as the coefficient R2 is below the minimum value (R2 = 0,5), at which the correlation can be assumed to exist.

The value of the coefficient R2 = -0,01289 for the second data pair "annual change of the index - increase of the index for the first five trading days of January" confirmed our conclusion drawn on visual inspection of the chart (Figure 1B) about the absence of any correlation at all.

As part of the present work, we have also repeated and updated the calculations for all the items for which we made calculations in our previous work and which have been published previously (Dzhusov, 2019). Both the statistical material given in (Dzhusov, 2019) and the updated data in Table 1 were used as the basis for the calculations. The results of these calculations was summarized and presented in Table 3.

| Table 3 The Efficiency of the Indicators "The January Barometer" ("JB") and "The First Five Days Of January" ("FFDJ") for Different Options of Their Application | |

| The individual or joint application option of indicators | Value, % |

| The effectiveness of the “JB” indicator application according to the method proposed by Y. Hirsch over the entire observation period, i.e. from 1950 to the end of 2020. | 80,3 |

| The effectiveness of “JB” indicator application using the method proposed by Y. Hirsch for the period from 1950 to 1991. | 91,7 |

| The effectiveness of “JB” indicator application using the method proposed by Y. Hirsch for the period from 1992 to the end of 2020. | 64,0 |

| The effectiveness of " JB " indicator application only in case of a positive increase of the Standard & Poor's-500 index at the end of January for the period from 1950 to the end of 2020. | 92,5 |

| The effectiveness of " JB " indicator application only in case of a positive increase of the Standard & Poor's-500 index at the end of January for the period from 1950 to 1991. | 96,0 |

| The effectiveness of " JB " indicator application only in case of a positive increase of the Standard & Poor's-500 index at the end of January for the period from 1992 to the end of 2020. | 86,7 |

| The effectiveness of "JB" indicator application only in case of a negative increase of the Standard & Poor's-500 index at the end of January for the period from 1950 to the end of 2020. | 57,1 |

| The effectiveness of "JB" indicator application only in case of a negative increase of the Standard & Poor's-500 index at the end of January for the period from 1950 to 1991. | 81,8 |

| The effectiveness of "JB" indicator application only in case of a negative increase of the Standard & Poor's-500 index at the end of January for the period from 1950 to the end of 2020. | 30,0 |

| The effectiveness of the “FFDJ” indicator application using the method proposed by Y. Hirsch over the entire observation period, i.e. from 1950 to the end of 2020. | 73,8 |

| The effectiveness of the “FFDJ” indicator application using the method proposed by Y. Hirsch for the period from 1992 to the end of 2020. | 72,0 |

| The effectiveness of " FFDJ " indicator application only in case of a positive increase of the Standard & Poor's-500 index at the end of the first five days of January for the period from 1950 to the end of 2020. | 87,5 |

| The effectiveness of " FFDJ " indicator application only in case of a positive increase of the Standard & Poor's-500 index at the end of the first five days of January for the period from 1950 to 1991. | 87,0 |

| The effectiveness of "FFDJ" indicator application only in case of a positive increase of the Standard & Poor's-500 index at the end of the first five days of January for the period from 1992 to the end of 2020. | 88,2 |

| The effectiveness of "FFDJ" indicator application only in case of a negative increase of the Standard & Poor's-500 index at the end of the first five days of January for the period from 1950 to the end of 2020. | 47,6 |

| The effectiveness of " FFDJ " indicator application only in case of a negative increase of the Standard & Poor's-500 index at the end of the first five days of January for the period from 1950 to 1991. | 53,8 |

| The effectiveness of "FFDJ" indicator application only in case of a negative increase of the Standard & Poor's-500 index at the end of the first five days of January for the period from 1992 to the end of 2020. | 37,5 |

| The effectiveness of joint application of both indicators. For the forecast, only cases of positive growth of the Standard & Poor's - 500 index in both the end of first five days of January and at the end of the whole month for the period from 1950 to the end of 2020 are considered. | 93,5 |

Source: compiled on the authors’ research.

Another cyclical pattern which is discussed in this paper is the Presidential Election Cycle (“PEC”) which has been observed in the US stock market since 1832 and its duration is four years. The theory behind this phenomenon is that in an attempt to win re-election to a new four-year term, the ruling party starts using incentives to support the economy before the election. It is believed that all presidents since Hoover (Herbert Clark Hoover, President of the United States from 1929 to 1933) have traditionally done so.

This means that when there is still enough time before an election, the ruling party needs to stick to tough economic policies in order to have room to maneuver afterwards. As a result, share prices tend to rise more strongly in the last two years of the presidential mandate than in the first two years after the election.

Statistics from the US market confirm that the presidential cycle is indeed taking place. For example, according to available data, between 1833 and 2004, the cumulative increase in the Dow Jones Industrial Average index for the two years prior to the election was 746%, while in the two years after the election, the cumulative increase in the index was only 228%, i.e., three times less (Shabanov, 2008). However, the most stable growth was observed during the pre-election year.

There are also studies in which the whole period of observing the cycle was divided into two parts - from 1832 to 1904 and from 1904 to 1986 (Meladze, V.). In accordance with this division yields of each year of the cycle were calculated and then returns of all years were summed up, according to division of the whole period into two parts. The results of these studies are shown in Table 4.

| Table 4 Total Changes in the us Stock Market for Each Year Of the Presidential Cycle |

||

| Cumulative change between 1832 and 1986, % | Cumulative change over the period from 1904 to 1986,% | |

| Election year | 235 | 197 |

| Post-election year | -37 | -38 |

| Midterm year | 89 | 70 |

| Pre-election year | 280 | 202 |

As can be seen from the table, despite some discrepancies in the figures for the calculation periods, the general market trends for each of the four years of the cycle are very similar. Thus, the Election year and the Pre-election year are distinguished from the other two by increased returns.

In 1973, David D. MacNeil proposed an investment strategy based on the identified seasonal component of the presidential cycle. He suggested investing in stocks during those two years (pre-election and the election year) and in government bonds during the next two. The total return of such a strategy would have been 1860% between 1962 and 1984. Meanwhile, the so-called “Buy and hold” strategy (which consists of buying stocks and holding them for a long time) would have yielded 518% in the same period (Colby, 2000).

In order to investigate the phenomenon of the presidential cycle in more detail, our first desire was to compile a summary table of the annual changes in the US stock market over the entire observation period of the stock market, i.e., from 1833 to 2021. However, a serious problem turned out to be the fact that the stock market index Standard & Poor's - 500 (on the basis of which we carried out studies of cycles "JB" and "FFDJ") was published only beginning from 04.03.1957. But to track the presidential election cycle, the period from 1957 to 2021 is not sufficiently representative, as only 16 complete cycles (from President Eisenhower's administration to Trump) can be tracked during this period. Therefore it was decided to take the Dow Jones Industrial Average as the basis.

As it knows, the Dow Jones Industrial Average was first published on 26.05.1896. But it turned out that 1896 was the last year of the cycle, which fell under the presidency of Stephen Grover Cleveland (term of office: 04.03.1893 - 04.03.1897). Therefore, it was decided to start the research from the first year of the new cycle, i.e. from 1897.

As an information base, we used the statistical data contained in the works of R. Colby and T. Meyers (Colby, 2000), Hirsch and T. Brown (Hirsch, 2006), D. Hirsch and J. Hirsch (Hirsch & Hirsch, 2015 - 2018) and D. Keppel (Kaeppel, 2009). The data collected from these works on the annual changes in the leading US stock market index in each year of the four-year presidential cycle are presented in Table 5. The Latin letters “D”, and “R” in the third column of the table denote the ruling parties: D - Democratic party, R - Republican party.

| Table 5 Annual Changes of the Dow Jones Industrial Average (%) by Year of the Four-Year Presidential Cycle From 1897 to the end of 2020 | |||||||

| No. | President | Party | Cycle Beginning | Post-election year | Midterm year | Pre-election year | Election year |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | McKinley | R*) | 1897 | 21,3 | 22,5 | 9,2 | 7,0 |

| 2 | McKinley | R | 1901 | -8,7 | -0,4 | -23,6 | 41,7 |

| 3 | ?. Roosevelt | R | 1905 | 38,2 | -1,9 | -37,7 | 46,6 |

| 4 | Taft | R | 1909 | 15,0 | -17,9 | 0,4 | 7,6 |

| 5 | Wilson | D | 1913 | -10,3 | -5,4 | 81,7 | -4,2 |

| 6 | Wilson | D | 1917 | -21,7 | 10,5 | 30,5 | -32,9 |

| 7 | Harding | R | 1921 | 12,7 | 21,7 | -3,3 | 26,2 |

| 8 | Coolidge | R | 1925 | 30,0 | 0,3 | 28,8 | 48,2 |

| 9 | Hoover | R | 1929 | -17,2 | -33,8 | -52,7 | -23,1 |

| 10 | F. Roosevelt | D | 1933 | 66,7 | 4,1 | 38,5 | 24,8 |

| 11 | F. Roosevelt | D | 1937 | -32,8 | 28,1 | -2,9 | -12,7 |

| 12 | F. Roosevelt | D | 1941 | -15,4 | 7,8 | 13,8 | 12,1 |

| 13 | F. Roosevelt | D | 1945 | 26,6 | -8,1 | 2,2 | -2,1 |

| 14 | Truman | D | 1949 | 12,8 | 17,6 | 14,4 | 8,4 |

| 15 | Eisenhower | R | 1953 | -3,8 | 44,0 | 20,8 | 2,3 |

| 16 | Eisenhower | R | 1957 | -12,8 | 34,0 | 16,4 | -9,3 |

| 17 | Kennedy | D | 1961 | 18,7 | -10,8 | 17,0 | 14,6 |

| 18 | Johnson | D | 1965 | 10,9 | -18,9 | 15,2 | 4,3 |

| 19 | Nixon | R | 1969 | -15,2 | 4,8 | 6,1 | 14,6 |

| 20 | Nixon | R | 1973 | -16,6 | -27,6 | 38,3 | 17,9 |

| 21 | Carter | D | 1977 | -17,3 | -3,1 | 4,2 | 14,9 |

| 22 | Reagan | R | 1981 | -9,2 | 19,6 | 20,3 | -3,7 |

| 23 | Reagan | R | 1985 | 27,7 | 22,6 | 2,3 | 11,8 |

| 24 | G.H.W. Bush | R | 1989 | 27,0 | -4,3 | 20,3 | 4,2 |

| 25 | Clinton | D | 1993 | 13,0 | 2,1 | 33,5 | 26,0 |

| 26 | Clinton | D | 1997 | 22,6 | 16,1 | 25,2 | -6,2 |

| 27 | G.W. Bush | R | 2001 | -7,1 | -16,8 | 25,3 | 3,1 |

| 28 | G.W. Bush | R | 2005 | -0,6 | 16,3 | 6,4 | -33,8 |

| 29 | Obama | D | 2009 | 18,8 | 11,0 | 5,5 | 7,3 |

| 30 | Obama | D | 2013 | 26,5 | 7,5 | -2,2 | 13.4 |

| 31 | Trump | R | 2017 | 24.1 | 5.64 | 22.34 | 7,2 |

| Total index change | 223,9 | 147,24 | 376,24 | 236,2 | |||

| Average growth over the whole period | 7,22 | 4,75 | 12,14 | 7,62 | |||

| The total change in the index for the period from 1897 to 1944 | 77,8 | 35,6 | 82,7 | 141,3 | |||

| Average growth for the period from 1897 to 1944 | 6,48 | 2,97 | 6,9 | 11,78 | |||

| The total change in the index for the period from 1945 to 1992 | 48,8 | 69,8 | 177,5 | 77,9 | |||

| Average growth for the period from 1945 to 1992 | 4,1 | 5,82 | 14,8 | 6,49 | |||

| The total change in the index for the period from 1993 to 2021 | 97,3 | 41,84 | 116,04 | 17,0 | |||

| Average growth for the period from 1993 to 2021 | 13,9 | 5,98 | 16,58 | 2,43 | |||

Source: compiled based on statistical material contained in the works (Hirsch & Hircsh, 2015-2018; Colby & Meyers, 2000; Hirsch & Brown, 2006; Kaeppel, 2009) and on the authors' calculations

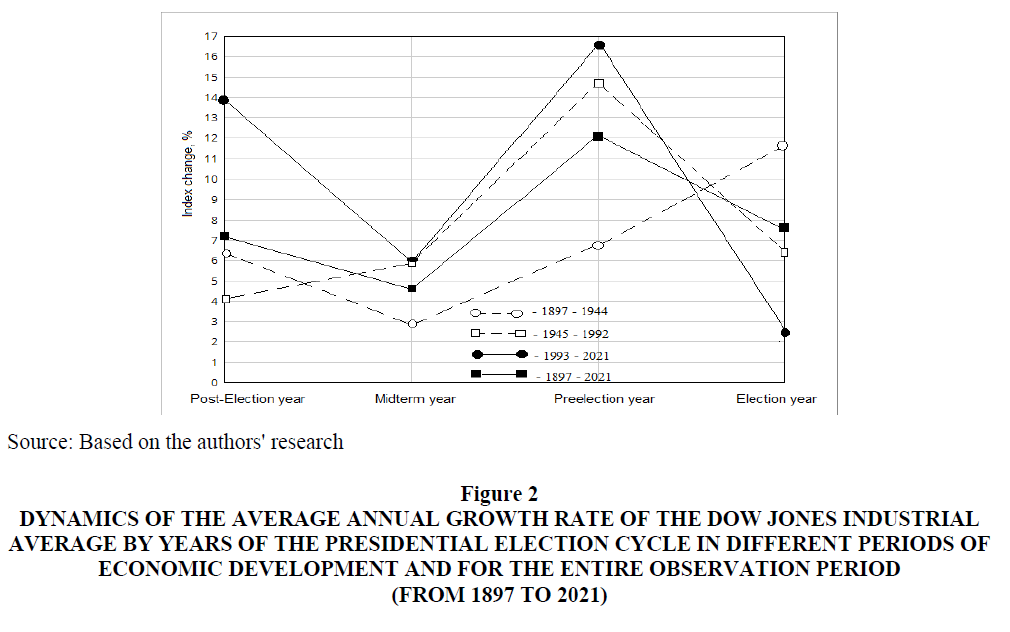

The whole data set was divided into 3 periods: the period of the "old economy" (from 1887 to 1944), when the leaders of the stock market were enterprises with large amounts of fixed assets on their balance sheets. These were enterprises, operating mainly in the field of railway transportation, metallurgy. The second period was from 1945 to 1991. This was the period of reconstruction after World War II and subsequent development. The third period began in 1992 and continues to the present day. The separation of this period into a separate period is associated with a number of socio-political and technological changes in the world (we have written about this earlier in this paper). But 1992 corresponds to the end of “PEC” cycle - it is the last year of the Bush administration. Therefore, we decided to extend the second period to 1992, and to start counting the third period from 1993, i.e. from the beginning of a new presidential cycle. The results are presented graphically in Figure 2.

Figure 2 Dynamics of the Average Annual Growth Rate of the Dow Jones Industrial Average by Years of the Presidential Election Cycle in Different Periods of Economic Development and for the Entire Observation Period (From 1897 to 2021)

As follows from what is shown in Figure 2 charts, the “PEC” cycle as first presented by Arthur Merrill was only traced from 1897 to 1944. In all other periods, the largest increase was observed only in the year before the elections, after which there was a significant decrease in the Dow Jones Industrial Average. At the same time, the election year is marked by a significantly smaller increase in the index than the year before the elections.

If we look at the “PEC” cycle in two years - the two best and two worst years - we find that the total increase in the Dow Jones Industrial Average over the entire period of our research, i.e. from 1897 to the present, during the first year after the election was 223,9% and during the Midterm year was 147,24 %. The increase in the index during the same period in the Preelection year was 376,24 % and in the Election year 236,2 %. Thus, in the period from 1897 to the present, in the two years (Preelection and Election year), the market has achieved an increase of 612,44 %, which corresponds to 9,88 % per year, whereas in the two years after the election, the index has increased by only 371,14 %, or 5,99 % per year. That is, during the last two years of the “PEC” cycle (Pre-election year and Election year), the market showed an annual growth rate of 1,65 higher than the first two years of the cycle (Post-election year and Midterm year).

If we calculate the change of the market index in the other two periods, 1945 to 1992 and 1993 to 2021, the following result emerges. Between 1945 and 1992, the average Dow Jones Industrial Average increment during the Preelection year and the Election year is 10,65% per year, while in the two Post-election years it is only 4,96% per year, i.e., 2,15 times less. Between 1993 and 2020, the average Dow Jones Industrial Average increase during the Preelection year and the Election year is 9,1% per year, and for the two years after the election it is almost the same: 9,94 % per year.

Thus, it appears that the trend of the index has changed in the various years of the presidential cycle in today's economy. Only the year preceding the election (Preelection year) still stands out. In this year, the average increase in the index is much higher than in other years of the cycle. Therefore, in modern conditions of “newest economic”, only one year out of the four years of the presidential cycle - the Preelection year is the most appropriate for making projections. Since 1943 (F. Roosevelt administration) until now, only once, in 2015, has the Dow Jones Industrial Average experienced a slight (-2,2%) annual decline. In all other 19 cycles there has been a rise in the index (from 2,3% in 1987 to 38,3% in 1975), with an average annual increase of 16,3% during these 19 cycles.

There is evidence in the literature that the stock market tends to grow more when the Democratic Party is in power. Thus, there is evidence that $10'000 USD invested in the stock market under the Democrats would have grown to $279'705 USD between 1901 and 2004, whereas during the same period under the Republicans it would have grown to only $80'466 USD (Hirsch, 2006). According to the same studies, during the 48 years in power of the Democratic Party, the stock market grew 639,6% (average annual growth of 13,3%), whereas during the 56 years while the Republican Party was in power, the market grew only 383,7% (average annual growth: 6,9%).

According to more recent studies covering the period from 1913 to 2011, the growth of Dow Jones Industrial Average during the Democrats was 176,1% (6,8% average annual growth); during the Republicans it was 172,4% (4,8% average annual growth) (Dzhusov, 2013), therefore the author of the research concludes that the thesis that the stock market is growing faster under the ruling Democratic Party is also confirmed in the current economy. However, it is noted that the difference between the market growth under different parties is flattening with each year. That is, while from 1901 to 2004 the average annual market growth under the ruling Democrat party was 1,9 times higher than the average annual market growth under the Republicans, from 1949 to 2011 the market growth rate under the Democrats was only 1,4 times higher than under the ruling Republican party.

We conducted a similar study for the time period corresponding to the development of the “newest economy”, i.e., from 1993 to the end of 2020. Within that period, the Dow Jones Index increase during the Democratic administration was 220,1% (corresponding to an average annual increase of 13,8%); the index increase during the Republican administration was 52,1% (an average annual increase of 4,3%). In other words, the average annual growth of the Dow Jones Index under the ruling Democrats was 3,4 times higher than the average annual growth under the Republicans. Thus, the trend of faster growth of the stock market in the old economy under the Democratic Party is even more pronounced in the modern economy. The revealed regularity may be of certain interest when making forecasts about the direction of future market movement.

The aim of the further study of the four-year presidential cycle was to test two previously known cyclical patterns for the conditions of the “newest economy”. The first pattern is that during the period 1913 to 2010 there was a relatively deep decline in the US equity market between the Post-election year and the Midterm year. The second pattern is that in the interval between the Midterm year and the Preelection year, there was significant market growth, with the percentage of growth from the low of the Midterm year to the high of the Preelection year typically being at least 30% (Dzhusov, 2013).

In order to carry out the necessary calculations, statistical material on the Dow Jones Industrial Average minimum and maximum values from 1993 to the present was collected. For this purpose we used the materials from the reference publication of Y. Hirsch and J. Hirsch (Hirsch & Hirsch, 2017), as well as statistical data contained in the work of K. Amadeo (Amadeo, 2021). For ease of research, the data collected were appropriately grouped and presented in Table 6 below.

| Table 6 Change in the Dow Jones Industrial Average Between Post-Election Year Maximum and the Midterm Year Minimum | |||||

| No | Post election year maximum | Midterm year minimum | Index change, % | ||

| Date | Index value | Date | Index value | ||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | 29.12.1993 | 3794,33 | 04.04.1994 | 3593,35 | -5,3 |

| 2 | 06.08.1997 | 8259,31 | 31.08.1998 | 7539,07 | -8,7 |

| 3 | 21.05.2001 | 11337,92 | 09.10.2002 | 7286,27 | -35,7 |

| 4 | 04.03.2005 | 10940,55 | 20.01.2006 | 10667,39 | -2,5 |

| 5 | 30.12.2009 | 10548,51 | 02.07.2010 | 9686,48 | -8,2 |

| 6 | 31.12.2013 | 16576,66 | 03.02.2014 | 15372,80 | -7,3 |

| 7 | 28.12.2017 | 24719,22 | 24.12.2018 | 21792,20 | -11,8 |

| 2021 | N/D | 2022 | N/D | ||

| Average change in index | -11,4 | ||||

As shown in the table, the average Dow Jones Industrial Average change between its maximum in the first Post-election year and the minimum in the Midterm year from 1993 to the present was -11,4%.

This value confirms the known pattern of a fall in the Dow Jones Industrial Average from its maximum in the Post-election year to the minimum in the Midterm year, but not as explicitly as in earlier studies. Thus, the following data are available in the literature on the change in the Dow Jones Industrial Average from its maximum value in the Post-election year to the minimum value of the Midterm year:

1. 1913 - 2010; the percentage of decline averaged 20,5% (Dzhusov, 2013);

2. 1949 - 2010; the percentage of decline was 17,6% (Dzhusov, 2013).

The result of the present research, covering the period from 1994 to 2019, showed that the percentage of decline is 11,4%.

Thus, it should be noted that in today's economy, the previous downward trend of the Dow Jones Industrial Average within a four-year presidential cycle from its maximum value in the Post-election year to the minimum value of the Midterm year is markedly weakening.

The same primary data sources were used to investigate the second pattern, mentioned above, which is that there is significant market growth between the Midterm year and the Preelection year, with an increase percentage from the minimum of the Midterm year to the maximum of the Preelection year of at least 30%. A table based on publicly available statistical information is shown Table 7 below.

| Table 7 Change in the Dow Jones Industrial Average Between The Minimum of the Midterm year and the Maximum of the Preelection Year |

|||||

| No | Midterm year minimum | Preelection year maximum | Index change, % | ||

| Date | Index value | Date | Index value | ||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | 04.04.1994 | 3593,35 | 13.12.1995 | 5216,47 | 45,2 |

| 2 | 31.08.1998 | 7539,07 | 31.12.1999 | 11497,12 | 52,5 |

| 3 | 09.10.2002 | 7286,27 | 31.12.2003 | 10453,92 | 43,5 |

| 4 | 20.01.2006 | 10667,39 | 09.10.2007 | 14164,53 | 32,8 |

| 5 | 02.07.2010 | 9686,48 | 29.04.2011 | 12810,54 | 32,3 |

| 6 | 03.02.2014 | 15372,80 | 19.05.2015 | 18312,39 | 19,1 |

| 7 | 24.12.2018 | 21792,20 | 27.12.2019 | 28645,26 | 31,4 |

| 2022 | N/D | 2023 | N/D | ||

| Average change in index | 36,7 | ||||

According to the calculations made, the average value of the percentage increase from the minimum of the Midterm year to the maximum of the Preelection year from 1994 to the present was 36,7%. If we compare this result with data available in the literature, we can see that the average value of the percentage increase in the Dow Jones Industrial Average from the minimum of the Midterm year to the maximum of the Pre-election year is gradually decreasing. The change in the indicator in question, depending on the time periods in question, is as follows:

1. 1914 - 2011; the percentage increase averaged 48,6% (Dzhusov, 2013);

2. 1950 - 2011; the percentage increase was 47,0% (Dzhusov, 2013);

The result of the present study, covering the period from 1994 to 2019, showed that the percentage increase was 36,7%.

Thus, despite the gradual decline of the indicator in recent decades, a consistent pattern can be observed, namely, that within a four-year presidential cycle, the Dow Jones Industrial Average rises from its minimum in the Midterm year to its maximum in the Post-election year by an average of 36,7%. This cyclical pattern is clearly evident in the US stock market from 1914 to the present.

Conclusion and Recommendations

The seasonal-cyclical patterns "January Barometer" and "First Five Days of January" are quite effective tools for predicting the prevailing direction of the stock market for the coming year.

Using the cyclical patterns "January Barometer" and "First Five Days of January" is possible only for forecasting the direction of the prevailing trend of the Standard & Poor's - 500 for the coming year, but it is not possible to calculate the index change value based on the index change values in the January periods.

The use of both the “January Barometer” and the “First Five Days of January” indicators is appropriate when the increase in the Standard & Poor's - 500 both for the first five days of January and for the whole month of January is positive. In cases where the index in either of the two cases shows a decline, it is not advisable to use these forecasting tools.

If both indicators - the "January Barometer" and the "First Five Days of January" - are used simultaneously to make forecasts of the prevailing trend of the Standard & Poor's 500 for the coming year, and only in cases where positive growth of the index was registered both for the first five days of January and for the whole month, the efficiency of forecasts can reach 93,5%.

The patterns of average growth in the Dow Jones Industrial Average in different years of the presidential election cycle in today's economy are different from those that existed before 1993. At present, only the year preceding the US presidential election can be of practical interest. In that year, the average increase in the index is 2-4 times higher than in other years of the cycle. Therefore, under current conditions, it is advisable to use only this year of the cycle to make forecasts.

The well-known thesis that the U.S. stock market grows faster under the ruling Democratic Party is also confirmed under the conditions of modern economy. Moreover, this trend is even stronger in the "modern economy" (1993-2020).

Within the framework of the "Presidential election cycle" there is a consistent pattern of the Dow Jones Industrial Average falling from its peak in the Post-election year to its minimum in the Midterm year. However, in recent decades the declining percentage has tended to decrease, with an average value of 11,4% for the period from 1993 to the present.

There is a consistent pattern within the "Presidential election cycle" in that the Dow Jones Industrial Average rises from its minimum in the Midterm year to its maximum in the Post-election year. However, the percentage increase has tended to decrease in recent decades, averaging 36,7% from 1993 to the present.

The findings of this paper form the basis for similar research for European and Asian financial markets, as well as for the identification and investigation of other cyclical patterns in international financial markets, in order to develop applied investment vehicles that enhance investment efficiency. The paper may be of interest to professionals working in the field of investment in international financial markets.

References

- Hanula, H. (1991). The Seasonal Cycle. Technical Analysis of Stocks & Commodities, 11, 65-68.

- Krauss, M. (1983). The Presidential Election Stock Market Cycle Theory: Implications For Future Investment Opportunities. Lehigh Preserve Institutional Repository. Retrieved March 20, 2021, from https://preserve.lib.lehigh.edu/islandora/object/preserve%3Abp-8455935

- Meladze, V. (2021). Teoriia economicheskih tsiklov. Retrieved February 08, 2021, from http://www.parusinvestora.ru/systems/book_meladze/book1_p2.shtm

- Sincere, M. (2021) Three holiday Indicators to Bring you Cheer. Retrieved February 08, 2021, fromhttps://michaelsincere.com/three-holiday-indicators-to-bring-you-cheer/

- Adam, K., & Merkel, S. (2019). Stock price cycles and business cycles. European Central Bank, Working Paper Series No 2316, September 2019. Retrieved March 20, 2021, from https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2316~4effe6153e.en.pdf

- Afonin, E.A., Bandurka, O.M., & Martynov, A.Y. (2008). Sotsial'ni tsykly : istoryko-sotsiolohichnyj pidkhid [Social cycles: AHistorical-Sociological Approach]. Kharkiv: Tytul [in Ukrainian].

- Amadeo K. (2021). Dow Jones Highest Closing Records. Retrieved February 08, 2021, from https://www.thebalance.com/dow-jones-closing-history-top-highs-and-lows-since-1929-3306174

- Angeletos, G.M., Collard F., & Dellas H. (2018). Qantifying Confdence, Econometrica (Journal of the econometric society). September 2018, 86(5), 1689-1726. https://doi.org/10.3982/ECTA13079

- Bell, D. (2004). Griaduschee postindustrialnoe obschestvo. Obrazets sotsialnogo prognozirovania. Moscow: Academia [in Russian].

- Bhandari, A., Borovicka J., Ho P. (2019). Survey data and subjective beliefs in business cycle models. Working Paper 19-14, Federal Reserve Bank of Richmond. Retrieved March 20, 2021, from https://www.richmondfed.org/-/media/richmondfedorg/publications/research/working_papers/2019/wp19-14.pdf

- Bloomberg the Company & its Products. (2021). Retrieved February 04, 2021, from https://www.bloomberg.com/markets/stocks

- Colby, R.W., & Meyers, T.A. (2000). The Encyclopedia of Technical Market Indicators. Moscow: Alpina. [in Russian].

- Davies, C. (2019). January barometer” and Trifecta Indicator Predict Bull Market. Retrieved March 21, 2021, from https://www.avcadvisory.ru/blog/yanvarskij-barometr-i-indikator-trifecta-2019-goda-predskazyvayut-bychij-rynok

- Dzhusov, O.A. (2013). Investuvannia na mizhnarodnomu rinku aktsyi: aspect upravlinnya: monography [Investing in the International Stock Market: The Aspect of Management]. Dnipropetrovsk: Dnipropetrovsk national university Publishing [in Ukrainian].

- Dzhusov O., Smerichevskyi S., Sardak S., Benenson O. (2019). Th? application features of seasonal-cyclic patterns in international financial markets. Academy of Accounting and Financial Studies Journal 23(5).

- Eusepi, S., & Preston, B. (2011). Expectations, Learning, and Business Cycle Fluctuations. The American Economic Review, 101(6), 2844-2872.

- Galipeau, C.J. (2021) The January barometer. Putnam Perspectives. Retrieved March 21, 2021, from https://www.putnamperspectives.com/the-january-barometerGreen, J.M. (2020). Timing the Market With the 2020 Presidential Election. Retrieved March 21, 2021, from https://www.thebalance.com/the-presidential-election-cycle-2466843

- Heilner, J. (2019). Presidential Election Cycle Theory. Wealthmanagement white paper. Retrieved March 21, 2021, from https://www.wtwealthmanagement.com/documents/pdf/WTWealth_2019-06.pdf

- Hirsch, J. (2012). The little book of Stock Market Cycles. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Hirsch, J., & Hirsch, Y. (2015). Stock Trader’s Almanac 2015. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Hirsch, J., & Hirsch, Y. (2016). Stock Trader’s Almanac 2016. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Hirsch, J., & Hirsch, Y. (2017). Stock Trader’s Almanac 2017. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Hirsch, J., & Hirsch, Y. (2018). Stock Trader’s Almanac 2018. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Hirsch, J.A., & Brown T.J. (2006).The Almanac Investor. Profit from Market History and Seasonal Trends. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Hoilov, A. (2021) Kak primeniat teoriu tsiklov na finansovih rinkah? Retrieved March 19, 2021, from https://blog.roboforex.com/ru/blog/2021/02/26/kak-primenyat-teoriyu-cziklov-na-finansovyh-rynkah/

- Hoilov, A. (2019) Volni Vulfa: opisanie, strategia torgovli. Retrieved March 21, 2021, from https://blog.roboforex.com/ru/blog/2019/08/22/volny-vulfa-opisanie-strategija-torgovli/

- Kaeppel, J. (2009). Seasonal Stock Market Trends. The Definitive Guide to Calendar-Based Stock Market Trading. Hoboken, New Jersey: John Wiley & Sons, Inc.

- Katz, J.O., & McCormik, D.L. (1990). Calendar Effects Chart New York: Scientific Consultant Services.

- Korotaev, A.V. (2006). Dolgosrochnaya politico-demograficheskaya dinamika Egipta: tsikli i tendentsii. Moscow: Vostochnaya literature [in Russian].

- Krantz, M. (2021). Can Stocks Keep Soaring In 2021? Just Look At The Past Five Days. Investor’s Business Daily. Retrieved March 21, 2021, from https://www.investors.com/etfs-and-funds/sectors/sp500-stocks-first-five-days-good-news-2021/

- Martchev, I. (2021). The January Barometer Is Not Bulletproof. Retrieved March 21, 2021, from https://seekingalpha.com/article/4402647-january-barometer-is-not-bulletproof

- Meisler, S. (2015). The Presidential Election Cycle and the Seven-Year Itch Retrieved March 21, 2021, from https://www.affiancefinancial.com/news/presidential-election-cycle-and-seven-year-itch

- Merrill, A., 1984. The Behavior of Prices on Wall Street. Chappaqua, New York: Analysis Press.

- Mochernyi, S. (2000). Ekonomichnyi tsikl. Ekonomichna entsiklopedia: u 3 t. – Kyiv: Tsentr Akademia, T. 1. [in Ukrainian].

- Naidanov, Y. (2017). Tsikli na finansovih rinkah. Retrieved March 20, 2021, from https://smart-lab.ru/blog/394286.php

- Poletaev, A.V., & Savel'eva, I.M. (1993). Cikly Kondrat'eva i razvitie kapitalizma (opyt mezhdisciplinarnogo issledovanija) [Kondratieff cycles and the development of capitalism (an experience of interdisciplinary research)]. Moscow: Nauka [in Russian].

- Shabanov D.(2008). Tsikl dlinoi v chetire goda. Retrieved February 08, 2021, from http://fintraining.ru/print.php?sid=2490

- Sincere, M. (2019). How to follow stock-market money flows. Retrieved February 10, 2021, from https://michaelsincere.com/what-is-the-market-telling-us/

- Townes E. (2020) ‘First Five Days’ Rule Signals Bullish 2020 But It’ll Be a Bumpy Ride. Retrieved March 19, 2021, from https://moneyandmarkets.com/first-five-days-rule-markets-2020/

- Winkler, F. (2016). The Role of Learning for Asset Prices and Business Cycles. Finance and Economics Discussion Series 2016-019. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2016.019r1. Retrieved March 20, 2021, from https://www.federalreserve.gov/econres/feds/files/2016019r1pap.pdf