Research Article: 2021 Vol: 25 Issue: 2S

Exploring the Relationship between Employees Turnover and Corporate Social Responsibility: A Case Study of Banking Sector in Pakistan

Andrews Salakpi, Simon Diedong Dombo University of Business and Integrated Development Studies,Ghana

Theophile Bindeoue Nasse , Simon Diedong Dombo University of Business and Integrated Development Studies, Wa, Ghana

Clement Nangpiire, Simon Diedong Dombo University of Business and Integrated Development Studies, Wa, Ghanat

Citation Information: Salakpi, A., Nasse, T. B. & Nangpiire, C. (2024). Exploring the relationship between financial sector development and domestic investment in africa. Academy of Accounting and Financial Studies Journal, 28(S3), 1-13.

Abstract

This study is developed to view the employee’s perception about the Corporate Social Responsibility Practices (CSR) and its impact on employee’s turnover within the organizations. CSR practices have evolved much attention into business organization in recent years that they are considered like a path through which a company may achieve its economic and social goals. CSR has strong relation with turnover intentions. Organizations can reduce its employee turnover by practicing CSR as these practices can motivate to perform better and provide them a feeling of pride and meaning within the company. Primary data was collected through questionnaires. The results show a direct impact of CSR practices on reducing employee turnover in banking sector of Pakistan. The results of this research are beneficial for other researchers and managers in improving CSR practices and therefore, reducing the rate of employee turnover.

Keywords

Financial Sector, Domestic Investment, Africa, Cointegration Test.

Introduction

Every economy's growth and improvement are tied to the performance of its numerous subsectors and to some specific success factors (Carbonell & Nassè, 2021). When the economy expands and advances, the financial sector benefits as well. One of the many advantages of a prospering financial industry is increased efficacy in procuring financial services and products. Financial sector advancements permit a greater flow of capital, which in turn stimulates demand and investment, increases economic output, generates more employment, and aids more individuals in escaping destitution (Tchamyou & Asongu, 2017). A strong financial sector and intermediation process can improve the size of local savings and improve efficiency of financial policies in a country by allocating limited economic funds for the most crucial monetary possibilities, results and investments (Tchamyou, 2020, Odhiambo & Asongu,2019) and by improving the audit procedures (Abdulai, Salakpi, & Nasse, 2021).

Between late 1980s and late 1990s, the majority of African nations loosened their financial sectors to enhance the growth prospects of finance, largely as the outcome of structural adjustment initiatives funded by the IMF and the World Bank. Credit limits were raised, interest rates were liberalised, state-owned banks were restructured and privatised, and new policies were enacted to foster the expansion of private banking and financial markets. Not only were these reforms executed, but also bank regulation and supervision programmes, such as deposit insurance in certain nations (Cull et al., 2005).

The favourable impacts of economic growth to investment and financial innovation have been given considerable weight in the hypothetical works going back to authors such as McKinnon (1973), Shaw (1973), Schumpeter (1911), Bagehot (1873), and Hicks (1969). Economic tools, financial markets, and organisations are shown to reduce the negative effects that information asymmetry, enforcement, and transaction costs on saving rates, investment choices, technical progress, and steady-state growth rates. In this context, effective financial systems reduce the external financial constraints that impede the growth of businesses and industries (Boyd & Prescott, 1986; Burcu, 2009; Greenwood & Jovanovic, 1990; King & Levine, 1993a, 1993b; Levine, 1997; Acharya, Amanulla, & Joy, 2009; Boyd & Prescott, 1986; Burcu, 2009; Greenwood & Jovanovic, 1990; Levine, 1997).

Others scholars have contended that the importance of a thriving financial system facilitates the flow of national and international financial resources that propel monetary progress. With that in mind, monetary markets observed as a crucial component for the expansion and improvement engine, facilitating evolution through corporate governance improvement and risk diversification, information establishment, resource deployment and aggregation, and capital formation (Bencivenga et al. 1996, Smith & Starr 1996, Devereux & Smith 1994, Irving 2000, King & Levine 1993a, Levine & Zervos 1996, Obstfeld 1994, Saint-Paul 1992, Senbet & Otchere 2005, Shleifer & Vishni 1995).

Though, the vast majority of the study in this area has focused on the impact of fiscal advancement on financial growth, while neglecting the connection between financial Sector progress and investment. First, financial advancement affects the creation of capital or investment, and then it results into the financial growth; therefore, the goal of capital market and financial intermediary resources mobilization to finance private investment. Existing research has analysed this mode of disseminating information infrequently, if it exists at all. The significance of these topic cannot be overstated, since theoretical estimates the route of the connection among the financial expansion and investment are now lacking. One point of contention in the writings on finance and investment is the method of transmission procedure from financial success to progress, as discussed by Gregorio and Guidotti (1995). There is conflicting evidence about the link connecting financial growth, savings, and investment, with some research supporting the argument that finds a positive relationship from financial growth to investment.

In addition, the African economy is rarely discussed in the majority of research conducted in this discipline, which focuses on nations with a high and moderate per capita income. The are no distinguishing roles for the growth of the stock market or the banking industry in Africa's economic development, very little research efforts were made to look into this issue. The possibility exists that the two sub-sectors are replacements, but these analyses presume they are not. The majority of the research we have seen on this topic centres on the financial industry or the stock market and its function in fostering national growth. The vast majority of research on African stock markets is qualitative, and the few quantitative studies, such as Agarwal's (1999), only cover a limited number of countries or a brief period of time. To avoid a possible oversimplification, this study evaluates the influence of financial sector expansion on the local investment using three separate metrics. The functioning of the financial industries is monitored by keeping tabs on monetary aggregates such as the ratio to local private-industries, credit to national bank and the total money supply. The augmented mean group (AMG) estimator will be use, since it is resistant to cross- sectional dependency which is probably existing in Africa. This synopsis is proceeded by a brief literature review, a discussion of the research methodology and data employed, a dissection of the findings, and policy recommendations. This research adds to the previous body of knowledge using more up-to-date dataset to analyze the influence of local investment in Africa. To further eliminate estimate bias, the research additionally takes into consideration the possibility of cross-sectional dependency. None of the previously conducted panel data investigations were analyzed taking this into consideration. The other parts of this study are as follows: section 2 presents the literature review. Section 3 provides the methodology adopted for the study. Sections 4 and 5 discuss data sources and the empirical results, respectively. The last part looks at the implication and conclusions of the study.

Literature

The majority of research conducted on financial industries progress has focused its effect on economic evolution. Examples of such research includes Odeniran and Udeaja (2010), Esso (2010), and Iheonu et al. (2020) 6:29 Page 3 of 15. Citations: Kar, Nazlioglu, and Agir (2011); Adusei (2013); Agbelenko and Kibet (2015); Abubakar, Kassim, and Yusoff (2015). The research focused on the influence of financial industries expansion on local investment. Ndikumana (2000) conducted an analyses on the impact of financial industry growth and domestic investment in thirty of sub-Saharan African nations applying a similar data panel approach. Financial systems performance and domestic investment in sub-Saharan Africa are positively correlated, as shown by the empirical evidence from the changing serial correlation model. Nyamongo and Misati (2011) used data from panels between 1991 to 2004 to assess the connection among private investment and financial industry growth in a selection of 18 sub-Saharan African nations, through a modified version of the basic accelerator model. The study shown that in African nations, there were distinct indications of substantial interest rate disparities and private investment and interest rates have an adverse connection. They revealed also hat, the turnover ratio is not significantly related to private investment, whereas loans to the private sector are significantly related to investment. Stock market indices are not extensively observed because the stock market is underdeveloped in the majority of African countries.

Asare (2013) performed an experimental on the effect of economic liberalisation on private investment in Ghana between the years 1980 and 2007, and his findings indicated of the reaction between private investment and financial openness was almost nothing. The impact of expanding financial industries on Ghana's private sector investment was analysed using autoregressive and distributed lag (ARDL) model in separate research conducted between 1970 and 2014.

Improvements in the financial industry influence on long run private investment. A more developed financial sector have significant effect on the private investment, although this impact is temporary and it dependents on the amount of progress made in this area (Sakyi, Boachie, & Immurana, 2017). Using the ARDL model, Muyambari (2017) examined the connection throughout financial industry expansion and investment in Botswana, South Africa, and Mauritius between 1976 and 2014. The research has separated financial industry expansion into two categories: financial-based and economic-base. The growth of Botswana's financial-based economic sectors was originate to have significant short run and long run effects on the investment. The growth of a market-based financial industry had no effect on investment, however. It was demonstrated that the expansion of South Africa's banking and finance industry will have a significant influence on investments in the short run, but will have no influence on investments in the long run. Only economic based financial industry expansion in Mauritius has been indicated a significant impact on investment. This advantage was transient. Based on a trivariate Granger causality analysis employing the identical ARDL model (Odhiambo & Muyambiri 2018), it was shown that both financial based and economic based financial industry expansions Granger cause investment in the short run and long run.

Using a vector autoregressive method, a vector error correction model for long-run and short-run effects, and a Granger causality test, Asongu (2014) analysed the connection between money and investment (domestic, international, portfolio, and total). The efficiency, activity, and the magnitude of Iheonu et al. 2022 were the means by which the study's objective was attained. Other research incorporated financial depth, but this was omitted from our predictions for Financial Innovation in 2020, Page 4 our analysis. According to the data, the elasticity of finance-driven investments is positive while investment elasticity is negative. In addition, contrary to the findings of prior studies, there was no evidence of portfolio investment financing in Mozambique, Guinea Bissau, or Togo. The policy repercussions encompass a caution against employing a one-size-fits-all approach to the finance investment association.

Love (2003) developed a Structural Model Based on the Euler equation for savings to analyse the impact of financial industry growth and financing constraints on growth through the efficiency of corporate investment. They utilised company data from forty countries. Results demonstrated an adverse association between financial market growth and the sensitivity of investments to internal cash flow (a proxy for financing constraints). Other possible explanations include the scale effect, economic cycles, and the legal system. According to Wurgler (2000), the expansion of the financial sector improves resource distribution and the efficacy with which investment funds are transmitted among businesses in response to fluctuations in request.

Methodology

Data and Data Sources

We utilise data for 45 distinct African nations from 1986 to 2020 for this analysis. Data accessibility and methodological constraints influence the data acquisition employed. Panel cointegration and unit root tests for the cross-sectional Im Pesaran Shin (IPS) devised by Westerlund (2007), balanced panel data is required. This study, similar to Acquah and Ibrahim (2020) and Ibrahim and Alagaide (2018), monitors the progress in financial industry using three indicators: private credit, domestic credit and money supply. The general money supply is the sum of the whole amount of legal tender in circulation, non-government demand deposits, non-government time, savings, and foreign currency deposits, bank and traveler's checks, and other securities like certificates of deposit and commercial paper articulated as a percentage of gross domestic product. Loans, purchases of non-equity securities, trade credits, and other accounts receivable are all examples of private credit extended by financial institutions to the business sector in return for payback. Among these assertions for certain nations is government owned enterprise debt. Financial institutions that do not take convertible deposits but have liabilities such as time and savings deposits are included in this tally. Institutions including banks, pension funds, insurance firms, and currency exchanges also contribute to economic growth. A country's domestic credit is the total amount of money given by domestic financial institutions to domestic businesses and organisations (Sare et al., 2018; Balago 2014; Levine et al., 2000; Ibrahim and Alagidede, 2017; Nkoro and Uko, 2013).

The model takes into account domestic investment using gross fixed capital creation in constant US dollars per capita. This metric is calculated by dividing a country's total population by its gross fixed capital creation. Gross savings (as a proportion of GDP) and GDP per capita (in constant US dollars) serve as benchmarks. Domestic savings is calculated by subtracting GDP from FCE (total consumption) to arrive at the value. For understanding, each parameter was transformed into logarithmic form. Table 1 provides a summary of the econometric model's parameters.

| Table 1 Descriptive Statistics | ||||||

| GFCF | Broad | Pcre | Dcre | RGDPP | Sav | |

| Mean | 21.14 | 32.10 | 20.09 | 68.88 | 1962.57 | 16.04 |

| S.D | 9.58 | 23.87 | 22.61 | 47.25 | 2362.30 | 16.28 |

| CV | 0.45 | 0.74 | 1.13 | 0.69 | 1.20 | 1.01 |

| Skewness | 1.31 | 1.87 | 2.67 | 0.61 | 2.62 | 0.69 |

| Kurtosis | 8.06 | 6.81 | 10.66 | 2.13 | 11.00 | 4.39 |

| Min | -2.42 | 2.86 | 0.000 | 0.000 | 167.25 | -48.51 |

| Max | 93.55 | 171.24 | 142.42 | 171.42 | 16438.64 | 83.28 |

| Jarque-Bera | 1876.82 | 1756.89 | 4924.33 | 15.67 | 6071.54 | 222.41 |

| Prob. | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

(Source: Statistical Analysis of the Data of World Development Indicators, 1986 to 2020)

Empirical Strategy

This section delves into the particulars of the empirical methodology employed to analyse how development of African financial institutions has impacted domestic investment. Using panel data, the connection between financial improvement and domestic investment was investigated. Several scholars (Asteriou & Hall, 2011; Gujarati & Porter, 2009), for instance, assert that Pooled Ordinary Least Square imposes homogeneous interception & slope variables that conceal variation across nations, possibly allowing the deviation component to correlate with particular regressors. However, when certain regressors are endogenous and linked to incorrect terms, the fixed effects provide a significant distortion (Baltagi, 2008). Since a mistake component at every stage may display rigorous exogeneity and be uncorrelated with previous and subsequent series, random-effects models are time-invariant (Arellano, 2003). Given various difficulties, the research uses a dynamic panel developed by Pesaran et al. (1999) to overcome these obstacles and recommend the adoption of mean groups (MG) to average country-level estimates and pooled mean groups (PMG) to aggregate of long run variables.

Pesaran et al. (1999) state that the PMG is preferable because it allows for substantial differences in the intercepts, resultant variances, and short-term estimators across nations while requiring the equality of the long-term coefficients. Therefore, the PMG offers significant advantages over more conventional methods. To begin with, the error terms are evenly split among the regressors and are never repeatedly associated. Despite the homogeneity of the parameters, the PMG is able to provide long-term estimates that are accurate and reliable. This research depend on PMG, that combines efficacy of the pooled approximation without introducing the discrepancy issues that arise when combining data from various forms of changing nexuses.

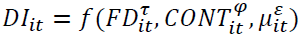

Using a paradigm in which domestic investment is a function of financial development (as indicated by the equation), the relationship between the two can be examined (1).

Where Domestic Investment indicators ( ), financial sector development indicators (

), financial sector development indicators ( ); and1

); and1  control variables is the real GDP per capita and savings; I is th county and t is the time while

control variables is the real GDP per capita and savings; I is th county and t is the time while  indicate the error term which measures the impact of other variables not seen in the Mortgage Financing equation. Using equation (1), the study accomplishes the following. Equation of production function by Cobby-Douglas

indicate the error term which measures the impact of other variables not seen in the Mortgage Financing equation. Using equation (1), the study accomplishes the following. Equation of production function by Cobby-Douglas

(2)

(2)

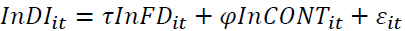

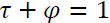

By jotting down the equation (2) and using a constant, the research group conclude at equation (3).

(3)

(3)

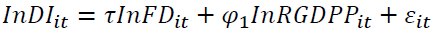

In equation (3), the coefficients represent elasticities. Since a Cobb-Douglas production function is required by the research,  . Moreover, the research explicitly models equation (4) as, given that it depends on two control variables. This is shown as;

. Moreover, the research explicitly models equation (4) as, given that it depends on two control variables. This is shown as;

(4)

(4)

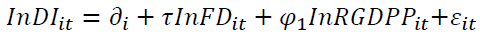

Equation (4) shows that  . The τ determines the significant of financial institution progress to domestic investment, φ1 measures the real GDP per capital savings and φ2 rmeasures savings to domestic investment in Africa. As stated in Equation (5) below, the research implements fixed impact estimator to approximate the pool mean group (PMG), building on the work of Pesaran et al. (1999)

. The τ determines the significant of financial institution progress to domestic investment, φ1 measures the real GDP per capital savings and φ2 rmeasures savings to domestic investment in Africa. As stated in Equation (5) below, the research implements fixed impact estimator to approximate the pool mean group (PMG), building on the work of Pesaran et al. (1999)

(5)

(5)

indicate a fixed effect.

indicate a fixed effect.

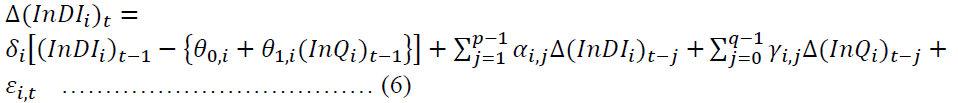

The investigation establishes the aforementioned equation (5) as an autoregressive scattered lag (ARDL) framework that allow the domestic investment -dependent variable – to regulate changes in investment and other independent parameters. This research particularly approximations of the the PMG by Pesaran et al. (1999) applying an error correction model to an ARDL (p, q) technique, as specified in equation (6) as:

Where i = 1, 2 and t = 1, 2,

where Q shows the regressors such as  and γ are the short-run coefficients related to Domestic Investment and its drivers; θi are long-run coefficients; δi is the coefficient of the error correction term which measures the speed of adjustment to long-run equilibrium while �� represents the time-varying disturbance. Indeed, given the lag orders p and q appropriately specified, the PMG calculations using the aforementioned ARDL framework provide consistent results.

and γ are the short-run coefficients related to Domestic Investment and its drivers; θi are long-run coefficients; δi is the coefficient of the error correction term which measures the speed of adjustment to long-run equilibrium while �� represents the time-varying disturbance. Indeed, given the lag orders p and q appropriately specified, the PMG calculations using the aforementioned ARDL framework provide consistent results.

Preliminary Findings

Table 1 presents the research immediate data for the panel variables utilised between 1986 and 2020. The fixed gross capital creation was employed as a surrogate for domestic investment, and its mean was 21.14% with a standard deviation of 9.5%. The coefficient of variation of 9.58 suggests domestic investment has been fairly steady during the sample timeframe. The outcomes of kurtosis, skewness, and Jarque Bera indicate that domestic credit is statistically distributed in a normal way.

Regarding the indicators of financial sector growth, it is evident that private credit, the quality indicator for finance for the sampled period, averaged 20.09% less than broad money supply (32.10%) and domestic credit (68.88%), respectively. This demonstrates that the majority of economic resources are not distributed to productive sectors. With a CV value of 0.61, domestic credit is least volatile variable, whereas private credit is highly volatile. Africa's real GDP per capita of $1962.57 indicates that it belongs to the ranking of low-income economies for the sample timeframe and is the most volatile variable among the variables analysed for the sample period. According to Table 2 correlation coefficient, domestic investment, as measured by gross fixed capital creation, have a significant correlation with broad money supply and savings, and an insignificant relationship with domestic credit, private credit, and real GDP per capita, albeit a weak relationship.

| Table 2 Correlation Coefficient | ||||||

| GFCF | Broad | Pcre | Dcre | RGDPP | Sav | |

| GFCF | 1.000 | |||||

| Broad | 0.049 | 1.000 | ||||

| Pcre | -0.23 | 0.64 | 1.000 | |||

| Dcre | -0.29 | 0.74 | 0.94 | 1.000 | ||

| RGDPP | -0.34 | 0.39 | 0.87 | 0.065 | 1.000 | |

| Sav | 0.56 | -0.23 | -0.25 | 0.573 | -0.21 | 1.000 |

(Source: Statistical Analysis of the Data of World Development Indicators, 1986 to 2020)

Stationarity Test of the Variables

Determining whether or not the variables in question are cointegrated is essential for understanding as the long run and short run imapct of financial industry expansion on domestic investment. Cointegration may be evaluated by using the panel unit tests root to examine the consistency qualities of panel data. To this end, this study employed five (5) different panel unit root tests, including (i) the augmented Dickey-Fuller (AsDF)-Fisher test (ii) the Phillips-Perron (2000) Z statistic. (iii) Hadri's (2000) Z statistic, (iv) the Levine et al. (LLC) 2002 test, , and (v) Breitung's (2000) t statistic,

The paper revealed a deterministic temporal trend when all panel unit root experiments were carried out. The article employed five (5) distinct of panel unit test root to address the limitations of their individual constructions and the benefits of others. Several statistical tests, including LLC, Hadri's tests, Breitung, and Harris-Tzavalis, have been developed for the case of shared panel unit root, in which all the auto-correlation coefficients are identical. In contrast, the ADF-Fisher test implies that each variable has a unit root and allows for cross-sectional variations in autocorrelation coefficients. Furthermore, whereas cross-sectional dependence is allowed by the Hadri panel root test unit, it is eliminated by omitting the cross-sectional means from the LLC, Hadri's tests, Breitung, and Harris-Tzavalis. The Bayesian data standard was used to establish latency ructure of the unit root tests Breitung, Fisher, and LLC, with the supreme lag of three for Breitung, Fisher, and LLC. The article used the Bartlett Kernel Approach to autonomously determine a maximum latency of 8 for the LLC test, enabling an approximation of the long-run variance.

The outcome of of six distinct root test analyses are showed in the Table 3 to determine the linearity or lack thereof of the dataset.

| Table 3 Unit Root Test Results | |||||

| Series | LLC‐stat Ho: Panels contain unit root | Breitung t stat Ho: Panels contain unit root | Hadri Z stat Ho: All panels are stationary | ADF–Fisher Ho: All panels contain unit root | Phillips-Perron stat Ho: Panels contain unit root |

| GFCF | -29.9398*** [0.0000] |

-15.1802** [0.0000] |

13.8793*** [0.0000] | 789.631*** [0.0000] |

1876.0188*** [0.0000] |

| Dcre | -7.1639 *** [0.0000] |

-3.9549*** [0.0000] |

17.3186*** [0.0000] |

66.2502*** [0.0000] |

97.4065*** [0.0000] |

| Pcre | -29.9398*** [0.0000] |

-15.1802*** [0.0000] |

13.8793*** [0.0000] |

789.6319*** [0.0000] |

1876.0188*** [0.0000] |

| Broad | -26.0268*** [0.0000] |

-7.8281*** [0.0000] |

15.3094*** [0.0000] |

731.2177*** [0.0016] | 1602.8887*** [0.0000] |

| RGDPP | -24.1159*** [0.000] |

-13.1791*** [0.0000] |

15.5351*** [0.0000] |

648.658*** [0.0000] |

905.7697*** [0.0000] |

| Sav | -35.4836*** [0.0000] |

-14.9157*** [0.0000] |

10.0508*** [0.0000 |

1018.5742*** [0.0000] | 3332.9993*** [0.0000] |

| Government Expenditure | -35.2038*** [0.0000] |

-20.5334*** [0.000] |

10.8991*** [0.0000] |

970.4633*** [0.0000] | 3401.8780*** [0.0000] |

Notes: GFCF = Gross Fixed Capital Formation; Dcre= Domestic Credit; Max = Maximum and Pcre ; Broad = Broad Money Supply; RGDPP= Real GDP per capita; Sav = Savings; CV = Coefficient of Variation; S.D = Standard Deviation; Min = Minimum; = Private Credit.

(Source: Statistical Analysis of the Data of World Development Indicators, 1986 to 2020)

Starting with dependent variable domestic credit which is proxied by fixed gross capital formation rejected the insignificant hypothesis irrespective of the utilisation panel unit root testing. This implies that with the exception of Hadri Z stat, the remaining four-unit roots tests confirms the stationarity of the panel variable gross foxed capital formation. Similarly, while all four panel unit root tests save the Hadri Z stat corroborate the stationary features of the three-panel data, null hypothesis state that financial sector growth is proxied by wide money supply, private sector, domestic credit and domestic credit was rejected.

The control panel variables of savings and government expenditure also exhibited similar outcome implying that all the panel variables are do not contain unit root hence confirming their stationarity. Since the panel variables have been found to be stationary, the paper proceeds to run the cointegration test. In climax, all the unit root tests confirmed stationarity of the panel variables whilst none of the panel variables were stationary when Hadri Z statistical test was applied. This makes it appropriate to perform the cointegration test by relying on Pedroni and Westlund tests of cointegration for panel variables.

Panel Cointegration Test

The paper further ascertained on long run association of panel data beyond the determination of stationarity ovariables by relying on two cointegration tests which are Pedroni and Westlund tests (Sare et al.,2018). The Westlund test focuses on the determining the extent to which the adjustment of the coefficient within the error rectification model structure is significant whilst Pedroni is analysed using the long run static regression residuals with the acceptable lag structure determined by the application of Bayesian information criterion. The study relied on Barlett Kernel for the estimations where Newey-West alogarithm was used to select the bandwidth with a maximun lag of 10. For the Pedroni and Westlund tests, the alternative hypothesis of cointegration was tested against the null hypothesis of no cointegration.when the is rejection of the null hypothesis at significance level of 10% or below, the research concludes the presence of the long term connection. otherwise, the study finds there is no presence of a long term connection or cointegration. The outcome of Westlund and Pedroni test for cointegration is shown in the Table 4. The pedroni test showed cointegration among the domestic investment proxy fixed grooss capital creation and the independent variables, as can be observe in the Table 4. Specifically, the Modified Phillips-Perron test statistic rejected the null hypothesis becouase the is no connection at 5% significant level, whereas Phillips-Perron t-test statistic disallowed the null hypothesis of no cointegration at a 1% significance level. In addition, the results of the Pedroni test are substantially similar to those of the Westlund tests, which disallow the null hypothesis of no relationship by applying ADF test statistic and Variance Ratio test statistic. While the ADF test statistic rejected the null hypothesis at a 1% significance level, the Variance ratio statistic did so at a 10% significance level. The denial of the null hypothesis by Pedroni and Westlund's test statistics provides significant indication for the existence of a long-run relatioship between domestic investment and independent construct.

| Table 4 Financial Sector Development and Investment | ||

| Approach P - values | Test Statistics | Z value |

| Pedroni | ||

| 0.0190 | Modified Phillips-Perron | -2.0747 |

| 0.0000 | Phillips-Perron t | -4.2384 |

| 0.0000 | Augmented Dickey-Fuller t | -9.4760 |

| Westlund | ||

| 0.0987 | Variance Ratio | -1.2893 |

The results strengthen the argument that the panel parameters all show comparable stochastic tendencies along a long-run trend for the dependent variables domestic investment. We now have sufficient evidence of cointegration between domestic investment and the independent variables to compute the short term and long term connections between domestic investment (the proxied by fixed gross capital creation), growth in financial sector indicators (broad money supply, private credit, and domestic credit), savings, and real GDP per capita.

Estimation of Short and Long Run Relationships among Domestic Investment and financial sector development

In this section, we analyse the data about the time priod impact of domestic investment on the growth of the financial industry. In order to determine the degree of resilience of the metrics of banking industry growth, we used three proxies: wide money supply, domestic credit and private credit (Table 5). The paper involved ARD PMG to examine the impact of financial institution growth on domestic investment as a measured by gross fixed capital creation, employing indication of cointegration from the Pedroni and Westlund tests.

| Table 5 Shows Financial Sector Development and Investment | |||

| Model | 1 | 2 | 3 |

| Variables | Broad Money | Private Credit | Domestic Credit |

| Short run | |||

| FSD | 0.14773 [0.1167] | -0.0692 [0.6516] | -0.0891[0.5617] |

| RGDPP | 0.0203* [0.01090] | 0.01609*[ 0.0219] | -0.0007[0.8688] |

| Sav | -0.06198 [0.2852] | - | - |

| Long run | |||

| FSD | 0.0972**** [0.0000] | -0.1092*** [0.0007] | 0.0022[0.9463] |

| RGDPP | -0.0013*** [0.0000] | 0.0042***[0.0000] | 0.0004**[0.0045] |

| Sav | 0.4439*** [0.0000] | - | - |

| Error Correction | -0.2620***[0.0000] | -0.3016***[0.0000] | -0.3094***[0.0002] |

| Term | |||

| Constant | 3.4397***[0.0000] | 3.6024**[0.0020] | 6.2518**[0.0082] |

| Diagnostics | |||

| Log Likelihood | -2296.2196 | -2716.1069 | -132.1137 |

| Number of Groups | 45 | 45 | 45 |

| Reverting Period/yrs | 3.8 | 3.3 | 3.2 |

(Source: Statistical Analysis of the Data of World Development Indicators, 1986 to 2020)

The above estimation was completed discretely of the three proxies of financial institution progress to ascertain their robustness and precise effect of each of the proxies. The application of the single equation panel ARDL model enables the examination of the contemptuous effect and the error was ratified towards the achievement of long-run equilibrium. The calculated coefficient is explained as elasticity because all the variables were in their logarithm form. Table 5 above shows the findings of the influence of financial institutional development on domestic investment. Result from model 1 of table 5 shows the financial sector expansion proxied by broad money has a P-value more than 10% which signal that broad money supply has insignificant positive effect on domestic investment in the short run. This implies that even though broad money supply has a significant influence on domestic investment, the significance of the effect is dependent on the time period. This further portrays that, the monetary policies of broad money supplies are not having immediate effect on the investment activities on the economy studied for the data period. However, broad money supply indicates a coefficient of 0.097 in the long run and P-values 0.000.

This shows that, the broad money supply has less than proportionate positive influence on domestic investment in the long run. This implies that Dang et al. (2020) confirms long run influence broad money supply on investment where the author’s found that, broad money supply significant influence on investment. Similar observation was made by Brima and Brima (2017) when the authors said that, broad money supply has significant effects on investment activity. This research was conducted in Sierra Leone.

More precisely, Table 5 shows that real GDP per capita has a positive influence on domestic investment in the short run but a negative effect on domestic investment in the long run, both of which are consistent with the results found for the control variables in model 1. It is verified by the larger long run coefficient that the short run consequences of real GDP per capita, a proxy for economic growth, is larger than the long run effect. So, although real GDP per capita does have an influence on domestic investment, the magnitude of that impact varies over time. A rise of 1% in real GDP per capita has a short-term positive effect on domestic investment of 0.0203% but a long-term negative effect of 0.0013%. For the nations analysed over the time period in question, an increase in income is anticipated to contribute to an increase in savings and investment inside the local economy, therefore a rise in real GDP per capita has a large influence on domestic investment in the near term. As a result, the outcome for the near future is predictable.

Also from model 1 table 5, the result show that savings have a negative but negligible influence on domestic investment in the short run, but it has a positive and very significant effect on domestic investment in the long run. This result explains that, the degree of wealth creation over time determines the appropriateness of investment in a sector. The need to boost interest rates by central banks to entice savings has a negative impact on investment in the short term, but the subsequent reduction in interest rates by the central bank has a favourable impact on domestic investment in the long run. In the long run, the size of the savings impact on savings is much larger than in the short run, as shown by the PMG estimation's savings result Mishra et al.'s (2010) and Nasiru and Usman's (2013) findings showing savings have a long-run beneficial influence on domestic investment in Nigeria are consistent with these results.

Turning to model 2 of Table 5, the study revealed that private credit private credit affects domestic investment negatively in the short and long term, with the latter being more noticeable above 1%. This is surprising as private credit untilise quality proxy for financial industry progress with the intention that monies extended to the private individuals go into the productive sectors of the country. The insignificant influence of private credit on domestic investment can be credited to the high important dependence of African economies where businesses even import a larger chunk of their production inputs thereby affecting the quality of domestic investment. This is contrary to the findings of Ibrahim and Alagaide (2018) as well as Acquah and Ibrahim (2020) where the authors indicated a positive influence of the private credit on investment which improve country growth. No matter what era private credit is used as a proxy for financial sector growth, higher real GDP per capita has a very beneficial impact on domestic investment.

As can be seen from Model 3 of Table 5, which displays the time influence of financial industry expansion as proxy by domestic lending on growth in the economy, domestic credit has an adverse impact on domestic investment in the short run but a positive, but insignificant, consequence on domestic investment in the long run. Dependent on the time frame, real GDP per capita may either have a positive or negative impact. Real GDP per capita, for example, may have an unfavourable and negligible influence in the short term but a positive and substantial consequence in the long run.

Beyond estimating the coefficients of the panel variables, the research used the error correction term generated by the PMG approach to investigate the models' error-correcting behaviour. In accordance with standard theory, all the coefficients of the three models show a negative sign confirming mean reverting process at 15 significance level. As the error adjustment coefficient imply, shocks cause a temporary disruption in equilibrium, but in the long term, everything returns to normal. The paper further determined the number of years it will take for the disequilibrium occasioned by shocks to return to their steady state path by taking the unit ratio of the error correction term coefficient for each estimated model. By implication we divided 1 by the coefficients of the error rectification terms of each model to ascertained the number of years. The numbers of years the instability can be empty will take a minimum of 3.2years for the domestic credit model (model 3) and a maximum of 3.8years for the broad money supply model (model 1).

Policy Implications and Recommendations

This report relies on the study's results to lay out significant policy consequences and give vital suggestions. The was significant reforms in the African financial industries over the past two years, with the goals of strengthening bank intermediary services, decreasing data disparity, and bolstering capital market operations in order to increase domestic investment by means of the more effective use of inactive resources. The study utilize the panel data technique (PMG) to examine the effect expansion of the financial sector had on domestic investment in 45 African countries within 1996 and 2021.

The research found the exact influence of financial sector progress and domestic investment varied with both proxies used to determine financial industry progress and time horizon over which the impact was measured. In the near term, the degree of progress in the financial industry makes little difference. The result of real GDP per capita on domestic investment, however, is very context with model-dependent. Economic development, according to supply-siders, the result of increased savings and private investment. A well-developed financial system allows an economy to invest because it can effectively raise money and distribute it to worthwhile endeavours. Businesses may protect themselves against the risk of losing money on international trade and currency inflows with this insurance. Investment activity is slowed by the high transaction expenses and lending rates caused by an undeveloped financial system. If we want to encourage people and companies to put their money to work, we need to make sure that their money and credit are allocated as efficiently as possible.

Conclusion

The aim of the research determines how much the connection between domestic investment and financial sector growth is robust to the proxy of financial sector growth and the influence of timeframe. Depending on the proxy of financial sector growth and the time period, the research found the exact influence of financial institutions progress and the domestic investment varies. Short- and long-term domestic investment stimulation requires the best possible distribution of the country's wide money supply, private credit, and domestic credit more generally.

References

Abdulai, I., Salakpi, A., & Nasse, T. B. (2021). Internal audit and quality of financial reporting in the public sector: The case of University for Development Studies. Finance & Accounting Research Journal, 3(1), 1-23.

Indexed at, Google Scholar, Cross Ref

Acquah, A. M., & Ibrahim, M. (2020). Foreign direct investment, economic growth and financial sector development in Africa. Journal of Sustainable Finance & Investment, 10(4), 315-334.

Indexed at, Google Scholar, Cross Ref

Arellano, M., & Carrasco, R. (2003). Binary choice panel data models with predetermined variables. Journal of econometrics, 115(1), 125-157.

Indexed at, Google Scholar, Cross Ref

Asongu, S. (2014). Financial development dynamic thresholds of financial globalization: Evidence from Africa. Journal of Economic Studies.

Indexed at, Google Scholar, Cross Ref

Asongu, S. A. (2014). Linkages between investment flows and financial development: Causality evidence from selected African countries. African Journal of Economic and Management Studies, 5(3), 269-299.

Asongu, S.A. & Odhiambo, N.M. (2020). Economic development thresholds for a green economy in sub-Saharan Africa. Energy Exploration & Exploitation, 38(1), pp.3-17.

Indexed at, Google Scholar, Cross Ref

Born, B., & Breitung, J. (2016). Testing for serial correlation in fixed-effects panel data models. Econometric Reviews, 35(7), 1290-1316.

Indexed at, Google Scholar, Cross Ref

Breitung, J. (2005). A parametric approach to the estimation of cointegration vectors in panel data. Econometric Reviews, 24(2), 151-173.

Indexed at, Google Scholar, Cross Ref

Brima, S., & Brima, A. S. (2017). Monetary policy effect on private sector investment: Evidence from Sierra Leone. International Journal of Economics and Financial Issues, 7(1), 476-488.

Bryan, M. L., & Jenkins, S. P. (2016). Multilevel modelling of country effects: A cautionary tale. European Sociological Review, 32(1), 3-22.

Indexed at, Google Scholar, Cross Ref

Campos, N., & Kinoshita, Y. (2008). Foreign direct investment and structural reforms: Panel evidence from Eastern Europe and Latin America. IMF Staff Papers, (08/26).

Carbonell Launois, N., & Nasse, T. B. (2021). Entrepreneur leadership, adaptation to Africa, organisation efficiency, and strategic positioning: What dynamics could stimulate success?. International Journal of Entrepreneurship, 25(6), 1-10.

Cull, R., Senbet, L. W., & Sorge, M. (2005). Deposit insurance and financial development. Journal of Money, Credit and Banking, 43-82.

Indexed at, Google Scholar, Cross Ref

De Gregorio, J., & Guidotti, P. E. (1995). Financial development and economic growth. World Development, 23(3), 433-448.

Hadri, K., & Kurozumi, E. (2012). A simple panel stationarity test in the presence of serial correlation and a common factor. Economics Letters, 115(1), 31-34.

Indexed at, Google Scholar, Cross Ref

Hou, Y. J., Okuda, K., Edwards, C. E., Martinez, D. R., Asakura, T., Dinnon III, K. H., & Baric, R. S. (2020). SARS-CoV-2 reverse genetics reveals a variable infection gradient in the respiratory tract. Cell, 182(2), 429-446

Indexed at, Google Scholar, Cross Ref

Ibrahim, M., & Sare, Y. A. (2018). Determinants of financial development in Africa: How robust is the interactive effect of trade openness and human capital?. Economic Analysis and Policy, 60, 18-26.

Indexed at, Google Scholar, Cross Ref

Iheonu, C. O., Asongu, S. A., Odo, K. O., & Ojiem, P. K. (2020). Financial sector development and Investment in selected countries of the Economic Community of West African States: Empirical evidence using heterogeneous panel data method. Financial Innovation, 6(1), 1-15.

Indexed at, Google Scholar, Cross Ref

Katircioglu, S. (2012). Financial development, international trade and economic growth: The case of sub-Saharan Africa. Ekonomista, 15(1), 117-127.

Khan, S. M., Sherazi, H., & Liaqat, S. (2020). Impact of money supply and domestic credit on economic well-being: A case of Pakistan. European Online Journal of Natural and Social Sciences, 9(3), pp-618.

Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of Economic Literature, 35(2), 688-726.

Indexed at, Google Scholar, Cross Ref

Love, I. (2003). Financial development and financing constraints: International evidence from the structural investment model. The Review of Financial Studies, 16(3), 765-791.

Indexed at, Google Scholar, Cross Ref

Mingiri, K. F., Ikhide, S. I., & Tsegaye, A. (2016). The relationship between external financial flows and economic growth in the Southern African Development Community (SADC): The role of institutions.

Indexed at, Google Scholar, Cross Ref

Misati, R. N., & Nyamongo, E. M. (2011). Financial development and private investment in Sub-Saharan Africa. Journal of Economics and Business, 63(2), 139-151.

Indexed at, Google Scholar, Cross Ref

Muyambiri, B., & Odhiambo, N. M. (2018). Financial development and investment dynamics in Mauritius: A trivariate Granger-causality analysis. SPOUDAI-Journal of Economics and Business, 68(2-3), 62-73.

Muyambiri, B., & Odhiambo, N. M. (2018). The causal relationship between financial development and investment: A review of related empirical literature.

Indexed at, Google Scholar, Cross Ref

Ndikumana, L. (2000). Financial determinants of domestic investment in Sub-Saharan Africa: Evidence from panel data. World Development, 28(2), 381-400.

Indexed at, Google Scholar, Cross Ref

Nkoro, E., & Uko, A. K. (2013). Financial sector development-economic growth nexus: Empirical evidence from Nigeria. American International Journal of Contemporary Research, 3(2), 87-94.

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American statistical Association, 94(446), 621-634.

Indexed at, Google Scholar, Cross Ref

Rogerson, C. M. (2018). Tourism-led local economic development: The South African experience. In Local Economic Development in the Developing World (pp. 297-320). Routledge.

Indexed at, Google Scholar, Cross Ref

Rohde, M. M., BeMent, S. L., Huggins, J. E., Levine, S. P., Kushwaha, R. K., & Schuh, L. A. (2002). Quality estimation of subdurally recorded, event-related potentials based on signal-to-noise ratio. IEEE Transactions on Biomedical Engineering, 49(1), 31-40.

Indexed at, Google Scholar, Cross Ref

Tchamyou, V. S., & Asongu, S. A. (2017). Information sharing and financial sector development in Africa. Journal of African Business, 18(1), 24-49.

Indexed at, Google Scholar, Cross Ref

Tidd, J., & Bessant, J. R. (2020). Managing innovation: Integrating technological, market and organizational change. John Wiley & Sons.

Wurgler, J. (2000). Financial markets and the allocation of capital. Journal of Financial Economics, 58(1-2), 187-214.

Indexed at, Google Scholar, Cross Ref

Received: 20-Feb -2024, Manuscript No. AAFSJ-24-14526; Editor assigned: 22-Feb -2024, Pre QC No. AAFSJ-24-14526(PQ); Reviewed: 06-Mar -2024, QC No. AAFSJ-24-14526; Revised: 11-Mar -2024, Manuscript No. AAFSJ-24-14526(R); Published: 18-Mar -2024