Research Article: 2019 Vol: 25 Issue: 2S

Exploring the Relationship Between Entrepreneurship Development and Financial Management Expertise Among the Students A Study from Kuwait

Ahmed Nahar Al Hussaini, The Public Authority for Applied Education & Training

Abstract

The purpose of this paper is to investigate the impact of financial management expertise on entrepreneurship development among the students of Kuwait. To address this objective, data is collected through a structural questionnaire, considering the factors of financial management qualities, influential factors/barriers for entrepreneurship activities, and key topics for the development of entrepreneurship in public sector universities. A final sample of 305 respondents is observed for both descriptive and regression analyses. It is found that factors like creativity and innovativeness, risk taking abilities, problem solving techniques, along with cash and time management are of core interest by the students while dealing with financial management capabilities. Among the influential factors/barriers, bad experience of others and educational background, government policies and fear of failure have their substantial influence on the respondent’s attitude towards entrepreneurship activities. Besides, key topics like business plans, business ideas and finance are of the core interest from respondents view for the development of entrepreneurship. Empirical findings explain that factors like producing accurate financial information, risk management, cash flows, time value of the money, budget and forecasting, working capital and overall FM has their significant influence on selected proxies of entrepreneurship in students of Kuwait. As per the limitations, this study considers the publicsector universities, limited sample from overall population of student community and ignoring the significance of entrepreneurship development cell in educational institutions. Besides, originality of the study can be viewed from the context of FM and ED integration in the region of Kuwait, which is not done yet.

Keywords

Financial Management, Entrepreneurship Development, Risk Management, Kuwait.

Introduction

The field of entrepreneurship development has got significant attention in literature. Widespread work is available, covering the theme of new business ideas & plans with success factors in the market place. The value feature and effectiveness of entrepreneurship education demonstrate that emerging business venture get better market share and more success rate if they got significant attention in educational institutions (Nambisan & Baron, 2013; Zahra et al., 2000). For the creation of wealth and job provision, entrepreneurship is known under the title of critical development factor in the world economy. Theories of knowledge and innovation indicates the fact that role of entrepreneurship in the economic development leads towards the creation of employment and wealth, specifically for those who are innovative (Acs & Szerb, 2009; Carlsson et al., 2009; Decker et al., 2014; Schumpeter, 1912). In both developed and emerging economies, entrepreneurship is very well recognized due to its significance in the economy and business firms. For instance, in the region of Malaysia, it is observed as the integral part of economic growth, providing enough help for the management of the country to attain their goal of middle income status and alleviation of poverty from 49 percent to 16.5 percent, during the time span of 1970 to 1990 (Al-Dhaafri et al., 2016; Yusoff et al., 2014). Major development organization in the world like United Nations, World Bank and International Labour Organization have recognized the significance of entrepreneurship, its development and related education. Besides, World Economic Forum is consistently focusing on the entrepreneurship development through various policies and procedures in different regions because of its contribution in the economic and financial growth of the countries (Nyadu-Addo & Mensah, 2017). Over the last two decades, a dramatic change is observed in United Kingdom regarding entrepreneurship development and education as it is emerged as among the key strategic objectives to be achieved through higher education under the title of higher education institutions or HEIs (Agency, 2012; Kitagawa & Lightowler, 2013).

In recent years, financial management and relevant expertise has drawn enough attention in the field of finance by the policy makers and researchers. The idea of financial education leads to the all type of knowledge and expertise in high school, college and universities which can reflect financial skills and know how in the students. Social welfare is significantly associated with the increasing level of financial literacy, enhancing the learning attitude towards finance (Blackburn & Ram, 2006; Huhmann & McQuitty, 2009; Mouna & Jarboui, 2015; Halder & Chandra, 2012; Dumbu, 2014; Pan, 2014; Esia-Donkoh et al., 2015; Vahdany & Gerivani, 2016; Wijayanto & Sumarwan, 2016; Vahdany & Gerivani, 2016; Jayakumar, 2016; Verma et al., 2018). It is assumed that financial management improves and motivate the financial behavior, financial wellbeing and overall development of new business ideas (Ali & Haseeb, 2019; Haseeb et al., 2018:2019; Suryanto et al., 2018).

Besides, various business ideas and entrepreneurs are failed due to lack of/poor financial management expertise. Two major reasons have been identified in existing literature, covering the title of failure of entrepreneurs due to poor FM and its control. These are under the title of lack of financial cushion, and poor management of cash flows (Solver, 2018). Some earlier business firms like small and medium enterprises have been failed due to poor financial planning along financial experiences. As per the findings of (Moyak, 2017), it is observed that 71 percent of entrepreneurs are failed due to poor financial planning and related body of knowledge.

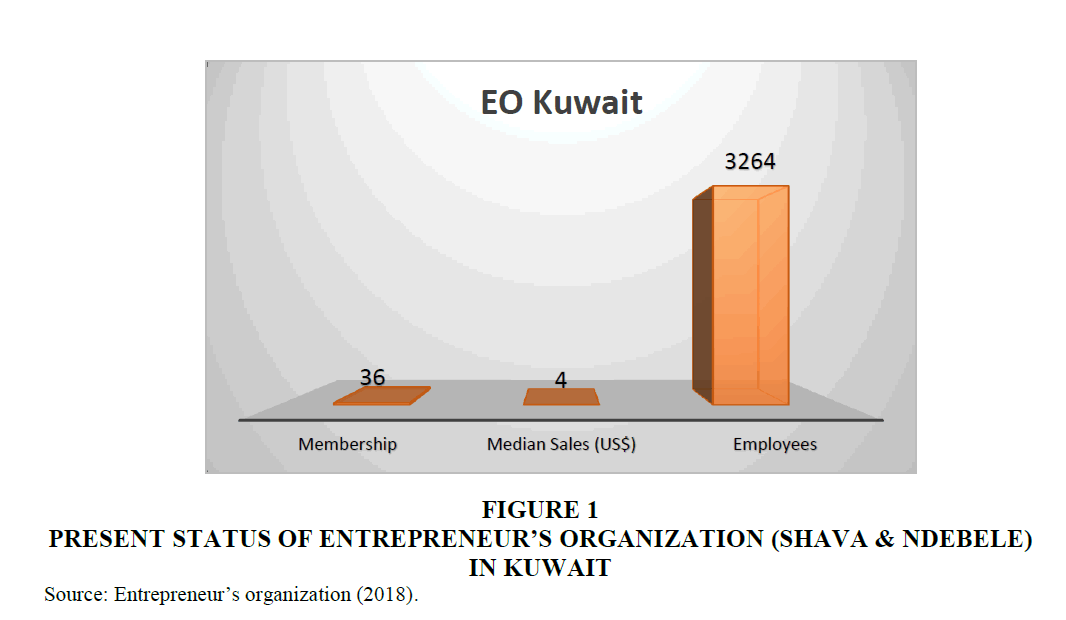

In the region of Kuwait, entrepreneurial trend is not created over short time, but it is working with the steady growth in the economy. In recent years, country is seeking to attract more than 400 KD million in various sectors including education and technology. With the help of vision 2035, Kuwaiti administration is expected to promote entrepreneurship trends in the country while enabling the small and medium size enterprises for the economic development. Significant fund is generated for the promotion of SMEs in the region. An organization under the title of Entrepreneur’s Organization (EO) is working in Kuwait which is also dealing in the global context with the network of more than 13000 business owners in 57 regions. EO is established in 1987 and enables leading entrepreneurs while inculcating them to grow and lead through significant success in the world (Entrepreneur’s Organization, 2018). Figure 1 indicates the overall members of EO in Kuwait, sales revenue during 2018, and overall employees till date.

Figure 1:Present Status Of Entrepreneur?s Organization (Shava & Ndebele) In Kuwait, Source: Entrepreneur?s organization (2018).

Rest of the paper is as follows. Section two deals with the review of literature in the field of entrepreneurship and financial management. Section three explains the key variables & methodology. Section four clarifies the descriptive and empirical facts with the help of discussions. Last section covers the conclusion, limitations and future implications of the study.

Literature Review

Entrepreneurship deals with the concept of entrepreneurial competencies, providing the students with core ideas to study the market in more depth for analyzing the business opportunities (Malach & Malach, 2014; Shava & Ndebele, 2014; Kweka & Ndibalema, 2018; Owagbemi, 2018; Masciantonio & Berger, 2018; Al-Fadley et al., 2018; Ghanney, 2018). Significantly, the notion of entrepreneurial education defines those social and economic activities which are available in the marketplace, but there is need of the attention for them (Alberti et al., 2004; Young & Sexton, 1997). It is known as a structural process which provides the individuals in the society with core abilities to recognize and understand the commercial prospects, based on the self-esteem with the usage of knowledge and skills for the better success (Jones & English, 2004). In the study of Shepherd & Douglas (1997), it is observed that essence for the entrepreneurial related education is the core ability to work for the starting of new business venture in the market. Authors like Shepherd & Douglas (1997) indicate the fact that factor of declaration explains a significant difference between the enterprise education and entrepreneurial education. As per the suggestion of quality assurance agency for the higher education in United Kingdom, entrepreneurial education deals with the enhancement of student capabilities regarding original business ideas. While the core focus is also to work for the betterment of existing business ideas or to work purely for the new concept which provide long run benefit from the market. Based on the presented literature, it is expressed that entrepreneurial education covers the point of skills and knowledge for the idea generation and its implication. However, enterprise skills and expertise can be generic in nature and have significant influence on the student’s employability (Spinelli & Neck, 2007). To work for the objective of preparing the student community as entrepreneurs, there is a great need for to equip them with skill, expertise, management capabilities, and reasonable business values. As per the suggestions of (Barringer & Ireland, 2008; Mitchelmore & Rowley, 2013), entrepreneurial competencies are very much required to behave in a professional way.

In addition, present literature has done reasonable debate about financial education and financial literacy along with financial expertise. (Lusardi & Mitchell, 2014) developed a model under the title of “life-saving” which considers the key role of financial literacy. While under the title of “traditional utility framework”, it is expressed that several factors like risk, stock market return, earnings, health of the stocks and borrowing options with constrains have their significant influence on the decision-making process. Meanwhile, this model implies that factor of financial literacy can be predicted as the endogenous. Huhmann (2014) states that financial literacy can be explained through three components like basic cognitive ability, present body of financial knowledge and finally the skills for the usage of financial knowledge to get the desired findings or results. In this regard, financial education can be considered as the key tool to develop financial literacy along with core expertise. Some other studies specify a list of financial management and intellectual capabilities. For instance, (Carcello et al., 2006) explains the financial expertise can be reflected in the form of earning management and its integration with the factor of risk. McDaniel et al. (2002) examined the relationship between financial expertise and financial literacy. Some other studies have considered the role of financial management and its integration with entrepreneurship. Notables are (Certo et al., 2009; Julien, 2018; Karadag, 2015; Lee et al., 2018; Murphy et al., 2018; Narli & Oner, 2018; Scarborough, 2016; Tsang & Blevins, 2015; Zahra, 1993:1995).

Variables and Methods

Entrepreneurship Development (ED)

The concept of entrepreneurship developments covers the process of improving the knowledge and skills of those who are entitled as entrepreneurs with the help of various activities. The key focus of Entrepreneurship Development is to increase the intellectual capabilities which in return provide the significant opportunity to recognize the market gap for starting a new business undertaking. ED develops a room for the employment in the country and provides the chances of success for the business in the market. Various factors are under the title of ED as core skills and capabilities. These include innovativeness which leads the individual to work for something new in the market which in return provides the competitive advantage over the rivals (Hirschman, 1980; Aned & Alya, 2013; Dumbu, 2014; Kamaruddin & Samsudin, 2014; Madar & Hamid, 2014; Hyytinen et al., 2015; Adewale, 2016; Ametorwo, 2016; Obi & Okekeokosisi, 2018; Chang’ach, 2018; Udanoh & Zouria, 2018). Another factor to explains the idea of entrepreneurship development is high achievement which indicates that better financial and non-financial results while utilizing the available resource and business ideas. For the better ED, high commitment is another factor which can reflects its significant contribution in the field of business enterprise. While ED also reflected in the form of high team spirit as explained by (Ribeiro-Soriano & Kraus, 2018) is added in the present study as among the core indicators.

Financial Management Expertise (FME)

Financial management expertise and qualities covers those management capabilities which provides the individual with a comprehensive skill required to run a successful business venture. Various expertises have been identified in the present literature which helps the entrepreneurial to get the success from their ideas. This expertise are under the title of producing accurate financial information (Njaya, 2014; Kuhnen, 2015; Kurlat & Veldkamp, 2015; Hassan et al., 2015; Purwito & Muljono, 2017; Fadzil et al., 2018; Essayyad et al., 2018), proactive forecasting (Röglinger & Rupprecht, 2018), deriving new revenue for the business project (Li et al., 2018), risk management (Bessis, 2015), cost controlling (Kerzner & Kerzner, 2017), efficient utilization of funds (Charitou et al., 2010) and capital budgeting (Froot & Stein, 1998). Besides the factors like cash flow management (Navon, 1996), Risk-return Trade off (Ghysels et al., 2005), capital structure (Rajan & Zingales, 1995), budgeting (Schmidgall & DeFranco, 1998), time value of the money (Wee & Law, 2001), and liquidity management (Wang, 2002) indicates overall FM expertise.

Mythodology

This study is based on the survey questionnaire, through various factors, extracted from existing body of literature covering the title of financial management qualities, Influential Factors/Barriers for Entrepreneurship Activities, key topics for entrepreneurship development, and finally financial management expertise. After finalization of questionnaire, various public-sector universities in Kuwait have been targeted to get the desired responses from the respondents; students. Overall 550 questionnaires were distributed among the students, to be collected later. A time frame of 4 weeks was proposed for the collection of questionnaires. Overall response rate was 71.27% with the total sample of 392 questionnaires was observed. However, due to missing responses, some of the questionnaires were dropped, covering a sample of 87. A final sample of 305 students is finally collected with no missing observations, representing an accurate rate from respondents of 55.45% approximately. For the selection of sample, those students are selected which are related to the field of financial management and entrepreneurial education. After the data collection, all responses have been considered for the analyses purpose in SPSS-22 version for both descriptive and regression findings. Descriptive methods indicate the overall trends of responses while regression analysis indicates the causal relationship between the selected variables of the study.

Results and Discussion

Descriptive Facts

Table 1 explains the descriptive findings for the Financial Management (FM) qualities which are presented through structural questionnaire to the targeted students in various public-sector universities. Overall 15 qualities have been examined from existing literature and added in the questionnaire. For the first query respondents are requested to provide their opinion regarding creativity and innovativeness through FM studies. Overall 305 respondents have answered this first query entitled as FM Quality 1 or (FMQ1). 31 students explain that they are disagree with the statement that FM education is developing creativity and innovativeness, explaining 10.2 percent respondents. While 60 respondents are found to be disagree in this regard. Out of total sample, 22% are found to be undecided and have not provided any specific response. While 81 (26.6%) are agree with the statement that FM is developing the qualities of creativity and innovativeness in them. While 66 are strongly agree with this argument. For FMQ2, respondents are requested to provide their opinion regarding the development of dignity for the labor while starting their own business entitled as FMQ2. Out of total respondents, 69 respondents are in favor for the argument that FM is developing a sense of dignity for the labor, covering a sample portion of 22.6%. In addition, 47 students are strongly agreeing about the FMQ2 covering a data sample of 15.4 percent respectively. For FMQ3, it is observed that FM is developing a sense of flexibility in the students and overall 82 students have provided their positive response. Meanwhile, 29 respondents are strongly agreed with the statement that flexibility is learnt through FM studies. Under the title of FMQ4, factor of high self-esteem is observed, and students are requested to provide their view. Overall 68 and 41 respondents are agreeing with the statement that high self-esteem is developed through financial management education. Through fifth quality of FM, overall 43 percent respondents are agreed that financial management education has developed higher such qualities in the students.

| Table 1: Fm And Intellectual Qualities And Respondents View | ||||||||

| FM qualities | Strongly Disagree | Disagree | Undecided | Agree | Strongly Agree | Total | ||

|---|---|---|---|---|---|---|---|---|

| FMQ1: Creativity and Innovativeness | 31 | 60 | 67 | 81 | 66 | 305 | ||

| % | 10.2 | 19.7 | 22 | 26.6 | 21.6 | 100 | ||

| FMQ2: Dignity for labor | 30 | 77 | 82 | 69 | 47 | 305 | ||

| % | 9.8 | 25.2 | 26.9 | 22.6 | 15.4 | 100 | ||

| FMQ3: Flexibility | 47 | 72 | 75 | 82 | 29 | 305 | ||

| % | 15.4 | 23.6 | 24.6 | 26.9 | 9.5 | 100 | ||

| FMQ4: Higher Self esteem | 57 | 73 | 66 | 68 | 41 | 305 | ||

| % | 18.7 | 23.9 | 21.6 | 22.3 | 13.4 | 100 | ||

| FMQ5: initiative talking ability | 52 | 73 | 47 | 78 | 55 | 305 | ||

| % | 17 | 23.9 | 15.4 | 25.6 | 18 | 100 | ||

| FMQ6: knowledge for commercial and legal aspects of business | 27 | 48 | 50 | 88 | 92 | 305 | ||

| % | 8.9 | 15.7 | 16.4 | 28.9 | 30.2 | 100 | ||

| FMQ7: need for achievements | 37 | 74 | 78 | 70 | 46 | 305 | ||

| % | 12.1 | 24.3 | 25.6 | 23 | 15.1 | 100 | ||

| FMQ8: need for influencing others | 57 | 66 | 82 | 55 | 45 | 305 | ||

| % | 18.7 | 21.6 | 26.9 | 18 | 14.8 | 100 | ||

| FMQ9: need for power | 28 | 60 | 63 | 95 | 59 | 305 | ||

| % | 9.2 | 19.7 | 20.7 | 31.1 | 19.3 | 100 | ||

| FMQ10: optimism | 48 | 73 | 59 | 79 | 46 | 305 | ||

| % | 15.7 | 23.9 | 19.3 | 25.9 | 15.1 | 100 | ||

| FMQ11: problem solving attitude | 33 | 34 | 79 | 102 | 57 | 305 | ||

| % | 10.8 | 11.1 | 25.9 | 33.4 | 18.7 | 100 | ||

| FMQ12: risk taking ability | 19 | 42 | 80 | 101 | 63 | 305 | ||

| % | 6.2 | 13.8 | 26.2 | 33.1 | 20.7 | 100 | ||

| FMQ13: strong willpower | 82 | 58 | 67 | 50 | 48 | 305 | ||

| % | 26.9 | 19 | 22 | 16.4 | 15.7 | 100 | ||

| FMQ14: cash management | 49 | 57 | 84 | 75 | 40 | 305 | ||

| % | 16.1 | 18.7 | 27.5 | 24.6 | 13.1 | 100 | ||

| FMQ15: Time Management | 37 | 57 | 68 | 97 | 46 | 305 | ||

| % | 12.1 | 18.7 | 22.3 | 31.8 | 15.1 | 100 | ||

Under FMQ6, 28% respondents are agreed with the argument that through FM, they have got significant knowledge about commercial and legal aspects of the business. While 92 respondents are strongly agreed with this assumption that higher knowledge for the business is developed through financial management education. While FMQ7 indicates the factor of “need for achievement” and respondents are viewed through similar scale as presented for the previous ones. It is assumed that higher need for achievement is developed through FM and overall 38 percent respondents (23 agreed & 15.1% are strongly agreed) are accepting the significance of FM studies. While factor under the title of FMQ8 and FMQ9 have examined the need for influencing others and need for the powers. However, it is observed that overall 88 respondents are not agreed with the argument that FM is developing the quality of influencing others. Meanwhile, FMQ9 indicates that 95 respondents are agreed to get higher power through FM education, while starting their own business activity. The factors under the title of optimism and problem-solving attitude are entitled under FMQ10 and 11 respectively. Overall agreed response rate is 41% for optimism and 52.1% for problem solving is examined under full sample of the study. In addition, risk taking ability is questioned under FMQ13 which indicates an agreed rate of 32.1% and “strong will power” is reflected in FMQ14 with the agreed score of 37.7% respectively. While last quality through FM education is measured under time management which indicates an agreed response of 46.9% on the Likert scale.

Under Table 2, descriptive facts for Influential Factors (IF)/barriers for entrepreneurship activities are presented, based on the whole sample of the study. Overall 12 factors/ barriers have been identified from present literature and added in the questionnaire. Likert scale for these factors ranges from very less influence (1) to more influence (5). IF1 considers the convenience of capital and its availability to start the new business venture. As per the stated findings, 26.6% are agreed with the statement that IF1 is somewhat influencing factor/barrier for the development of entrepreneurial activity. While 15.1% have a view point that IF1 is very influencing factor for such activity. Under IF2, availability of labor is interrogated, and 82 respondents remain neutral, reflecting that 26.9% sample has no view about IF2 as a key barrier. However, it is observed that 28.5% sample portion has a view that labor has somewhat influence on entrepreneurial activities. In addition, factors/barriers like availability of raw material and bad experience of others are entitled for IF3 and IF4 respectively. Descriptive findings explain that overall 29.5% respondents have the view that raw material is somewhat influencing on the entrepreneurial activities. While 19% indicates its very much influence on such activities. The factor of bad experience is entitled under IF4 and overall 32.8% respondents are agreed that bad experience of others is an influencing factor for starting new business idea.

| Table 2: Influential Factors/Barriers For Entrepreneurship Activities | ||||||

| Influential Factors/Barriers | very less influence | less influence | neutral | somewhat influence | very influence | Total |

|---|---|---|---|---|---|---|

| IF1: convenience of capital | 42 | 61 | 75 | 81 | 46 | 305 |

| % | 13.8 | 20.0 | 24.6 | 26.6 | 15.1 | 100.0 |

| IF2: Labor | 34 | 51 | 82 | 87 | 51 | 305 |

| % | 11.1 | 16.7 | 26.9 | 28.5 | 16.7 | 100.0 |

| IF3: Raw Material | 45 | 56 | 56 | 90 | 58 | 305 |

| % | 14.8 | 18.4 | 18.4 | 29.5 | 19.0 | 100.0 |

| IF4: Bad Experience of Others | 61 | 64 | 80 | 49 | 51 | 305 |

| % | 20.0 | 21.0 | 26.2 | 16.1 | 16.7 | 100.0 |

| IF5: Bad Experience of Own | 62 | 74 | 60 | 59 | 50 | 305 |

| % | 20.3 | 24.3 | 19.7 | 19.3 | 16.4 | 100.0 |

| IF6: Caste | 17 | 25 | 48 | 111 | 104 | 305 |

| % | 5.6 | 8.2 | 15.7 | 36.4 | 34.1 | 100.0 |

| IF7: Corruption | 17 | 45 | 63 | 90 | 90 | 305 |

| % | 5.6 | 14.8 | 20.7 | 29.5 | 29.5 | 100.0 |

| IF8: Educational Background | 12 | 37 | 50 | 114 | 92 | 305 |

| % | 3.9 | 12.1 | 16.4 | 37.4 | 30.2 | 100.0 |

| IF9: Environmental issues | 9 | 33 | 53 | 116 | 94 | 305 |

| % | 3.0 | 10.8 | 17.4 | 38.0 | 30.8 | 100.0 |

| IF10: Social Status | 13 | 39 | 66 | 109 | 78 | 305 |

| % | 4.3 | 12.8 | 21.6 | 35.7 | 25.6 | 100.0 |

| IF11: Government Policies | 18 | 41 | 73 | 92 | 81 | 305 |

| % | 5.9 | 13.4 | 23.9 | 30.2 | 26.6 | 100.0 |

| IF12: Fear of Failure | 11 | 34 | 76 | 115 | 69 | 305 |

| % | 3.6 | 11.1 | 24.9 | 37.7 | 22.6 | 100.0 |

Table 3 explains the responses regarding key topics which needs to be focused for Entrepreneurship Development (ED) in various universities of Kuwait. five-point Likert scale is added for the selected topics as presented in table below. For the business ideas, 111 respondents (36.4% sample) is accepting that for ED, it has somewhat influence while 25.9% have a view that it has very much influence. The factor of business plans indicates that students are arguing for the significant focus on it as 26.9% is accepting its higher influence. In addition, for ED, topics under the title of case studies have 38.4% sample portion arguing it’s somewhat influence. While 25.6% respondents are accepting very influence of case studies on ED. For the topic of finance, 122 respondents have an argument that it has somewhat influence and 20% are in favor for the very influence on ED. However, topics under the title of HR and marketing have their little sample proportion, covering their very influence on ED in the Kuwaiti universities.

| Table 3: Entrepreneurship Development Which Topics Are To Be Emphasized Or More Important | ||||||

| Very Less Influence | Less Influence | Neutral | Somewhat Influence | Very Influence | Total | |

|---|---|---|---|---|---|---|

| Business Ideas | 23 | 30 | 62 | 111 | 79 | 305 |

| % | 7.5 | 9.8 | 20.3 | 36.4 | 25.9 | 100.0 |

| Business Plans | 14 | 38 | 67 | 104 | 82 | 305 |

| % | 4.6 | 12.5 | 22.0 | 34.1 | 26.9 | 100.0 |

| Case Studies | 11 | 39 | 60 | 117 | 78 | 305 |

| % | 3.6 | 12.8 | 19.7 | 38.4 | 25.6 | 100.0 |

| Finance | 9 | 35 | 72 | 128 | 61 | 305 |

| % | 3.0 | 11.5 | 23.6 | 42.0 | 20.0 | 100.0 |

| HR | 7 | 45 | 74 | 122 | 57 | 305 |

| % | 2.3 | 14.8 | 24.3 | 40.0 | 18.7 | 100.0 |

| Marketing | 11 | 26 | 73 | 122 | 73 | 305 |

| % | 3.6 | 8.5 | 23.9 | 40.0 | 23.9 | 100.0 |

Reliability Analysis

Table 4 indicates the reliability analysis of the study. For this purpose, SPSS-21 version is used to generate the findings for Cronbach Alpha (CA). As per the earlier findings, value of alpha should be greater than 0.70 to accept all the items in each variable as reliable for the regression findings. As per the findings below, for entrepreneurship development, five items have been added in the questionnaire, indicating a CA score of above 0.70. Similarly, for financial management expertise, fifteen items have been added in the model. Overall value of CA for financial management item is above 0.70 too, means that there is no problem for the reliability of the items.

| Table 4: Reliability Score Selected Items | ||

| Construct | No of items | Cronbach Alpha |

|---|---|---|

| E. Development Factors | ||

| Innovativeness | 5 | 0.720 |

| High Achievements | 5 | 0.761 |

| High Commitment | 5 | 0.834 |

| Initiative | 5 | 0.816 |

| Team Spirit | 5 | 0.706 |

| Financial Management Expertise | ||

| Financial Management (1-15) | 15 | 0.861 |

Regression Findings

After descriptive statistics, regression findings to examine the empirical relationship between entrepreneurship development and financial management are presented under Table 5. For ED, five factors under the title of EDF1 to EDF5 have been considered. While for the FM, 15 items are added are key determinants. For the first model under EDF1 title, effect of FM1 is 0.583, indicates its significant & positive influence with the standard error of 0.07505. It means that higher FM expertise under the title of producing accurate financial information leads to the higher ED in Kuwait. For EDF2, FM1 has a similar positive & significant impact on EDF2. It implies that higher FM1 leads to the better entrepreneurship development. Similar positively effect is observed for the EDF3, EDF4 and EDF5. It implies that higher level of producing accurate financial information leads to the better ED. Through proactive forecasting, it is found that EDF2 and EDF4 are significantly and positively associated with the coefficients of 0.0804 and 0.670 respectively. It implies that increasing level of proactive forecasting as financial management indicator can positively and significantly leads to the entrepreneurship development in the students of Kuwait. While FM3 or deriving new sources of earning indicates a significantly positive impact of 0.134 on EDF1 but negative influence of -0.107 on EDF2.

| Table 5: Relationship Between Edf And Fm Expertise | |||||

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| VARIABLES | EDF1 (Innovativeness) | EDF2 (High Achievements) |

EDF3 (High Commitment) |

EDF4 (initiative) |

EDF5 (Team Spirit) |

| FM1(producing accurate financial information) |

0.583** | 0.517** | 0.0115** | 0.118 | 0.0522** |

| (0.0705) | (0.0542) | (0.0728) | (0.0549) | (0.0546) | |

| FM2 (Proactive Forecasting) | 0.0873 | 0.0804** | 0.0509 | 0.670** | 0.0406 |

| (0.0772) | (0.0324) | (0.0780) | (0.0632) | (0.0649) | |

| FM3 (Derive New Revenue) | 0.134* | -0.107* | -0.00556 | -0.0208 | -0.0265 |

| (0.0701) | (0.0562) | (0.0687) | (0.0662) | (0.0630) | |

| FM4 (Risk Management) | 0.0980** | 0.0420*** | 0.0345** | 0.0217** | -0.108* |

| (0.0683) | (0.0533) | (0.0063) | (0.0079) | (0.0580) | |

| FM5 (Cost controlling) | 0.152** | -0.0624 | 0.0587 | -0.0524 | -0.0815 |

| (0.0636) | (0.0459) | (0.0619) | (0.0513) | (0.0502) | |

| FM6 (Efficient utilization of Funds) | 0.0139 | 0.128** | 0.0564*** | -0.0123 | 0.589*** |

| (0.0701) | (0.0544) | (0.1254) | (0.0498) | (0.0547) | |

| FM7 (capital budgeting) | 0.0574 | 0.575*** | 0.617*** | 0.0403* | 0.0424 |

| (0.0697) | (0.0548) | (0.0698) | (0.0212) | (0.0541) | |

| FM8 (cash flow management) | 0.0176** | -0.0252 | 0.0895*** | 0.00574** | 0.0745 |

| (0.0076) | (0.0509) | (0.0095) | (0.0552) | (0.0541) | |

| FM9 (Risk-return Trade off) | 0.0231 | -0.0207 | 0.123* | 0.0477 | 0.0185 |

| (0.0682) | (0.0558) | (0.0632) | (0.0554) | (0.0612) | |

| FM10 (capital structure Management) | 0.0676 | -0.0837 | 0.112* | -0.102* | -0.0913* |

| (0.0600) | (0.0531) | (0.0578) | (0.0542) | (0.0766) | |

| FM11 (Time value of Money) | 0.0465 | 0.130** | 0.138** | 0.00330 | 0.0927 |

| (0.0769) | (0.0582) | (0.0700) | (0.0573) | (0.0581) | |

| FM12 (budget and Forecasting) | 0.000474 | 0.168*** | -0.0410 | 0.191*** | 0.167** |

| (0.0699) | (0.0578) | (0.0657) | (0.0576) | (0.0600) | |

| FM13 (Working capital management) | 0.882** | 0.810** | 0.118** | 0.0559 | 0.00726 |

| (0.0876) | (0.1621) | (0.0559) | (0.0516) | (0.0480) | |

| FM14 (Liquidity Management) | -0.0515 | 0.0297 | -0.00365 | -0.0393 | 0.104* |

| (0.0673) | (0.0481) | (0.0664) | (0.0588) | (0.0501) | |

| FM15 (Overall FM) | 0.723** | 0.625*** | 0.0761 | 0.346** | 0.0418 |

| (0.0656) | (0.049) | (0.0662) | (0.0614) | (0.0594) | |

| Constant | 1.562*** | 2.493*** | 0.972*** | 2.983*** | 2.918*** |

| (0.339) | (0.338) | (0.335) | (0.362) | (0.360) | |

| Observations | 305 | 305 | 305 | 305 | 305 |

| R-squared | 0.361 | 0.601 | 0.691 | 0.484 | 0.523 |

*** p<0.01, ** p<0.05, * p<0.1.

However, rest of the indicators of entrepreneurship development are insignificant associated with new earning sources. For risk management it is found that ED factors are significantly and positive associated to it. It explains that higher level of financial management expertise in the form of risk taking and controlling leads to better development of entrepreneurship in the students. While factor of cost controlling implies its significant and positive impact on innovativeness as observed for EDFI. For FM6 as reflected through efficient utilization of funds explains that higher achievement in the business is positively associated to it. Meanwhile for team spirit, effect of efficient usage of funds has an impact of 0.589 which suggests its significant but positive influence. While the factor of capital budgeting implies that better and long-term investment decision in the fixed assets are positively affecting higher achievements, high business commitment, and initiative capabilities in the student community of various public-sector universities of Kuwait (Rafinandi & Kondo, 2018).

The factor of cash flow management is assumed to the significant expertise in the field of financial management (Abotsi, 2018). In present study, FM8 indicates its significance for all the proxies of ED. It implies that higher level of cash flow management can leads to the increasing level of innovativeness in the business with the coefficient of 0.0176. While for the higher achievements, it has a negative but insignificant influence. For higher commitment, cash flow management is significantly and positively associated with the standard error of 0.0597. For initiative as reflected under the title of EDF4, significantly positive impact of 0.00574 is observed for the whole sample of study, meanwhile the factor of risk return trade off implies that higher commitment can be achieved if there is reasonable balance between the factor of uncertainties and business earnings over time. The rest of the indicators of ED are insignificantly associated with risk return trade-off. For the better management in the business, capital structure components can affect both short run and long run performance (Atici, 2018). It is found that capital structure management is significantly and positively associated with higher level of commitment. It implies that more commitment as entrepreneurship development indicator can be observed with more level of managing debt and equity mixture in the business over time. While the factors of initiative, and team spirit has a negative coefficient of 0.102 and 0.0913. It means that both initiative and team spirit can be adversely affected by capital structure and its management in the business. While for the time value of the money, both higher achievement and commitment has their significant and positive linkage. The factor of budget and forecasting is also assumed as significant determinant in the field of financial management. For FM12, it is observed that higher level of achievement, initiative and team spirit as associated to it. The coefficients for all these factors are found to be 0.168, 0.191 and 0.167 respectively. For the factor of working capital management, it is observed that higher innovativeness, achievement and higher commitment can be possible through cash and short-term asset’s management proficiencies. The 2nd last factor of financial management is considered for the management of liquidity in the business, where respondents have been observed through their valid responses. It is found that only the factor of team spirit is positively associated with the liquidity management with the coefficient of 0.104. The last factor indicates overall expertise of financial management which is examined for the five dimensions of entrepreneurship development. It is examined that factors under the title of EDF1 or innovativeness, higher achievement or EDF2 and initiative are significantly and positively associated to it. Under each of the applied model for ED and FM relationship, highest explanatory power is observed for EDF3 which indicates an overall change of 69.1 percent in higher commitment due to all proxies of financial management expertise. While for the team spirit it has explained an overall variation of 52.3%, for higher achievements is 0.601 as well. All the stated models are observed with the sample of 305 respondents which are considered through structural format of questionnaire.

Conclusion

Throughout the life span of the business, financial capabilities can play their vital role either someone is working with the running business or going to start a new venture. As per the detailed review of existing literature, the field of financial management is significantly associated with the success or failure of the business. Various items can reflect as core financial management expertise and positively link towards the development of new business ideas. However, successful and growing business venture considers the proactive approach towards the financial management and its association with the strategic planning. The focus of present study is to explore the relationship between financial management capabilities and its link with the entrepreneurship development indictors in the region of Kuwait. To address this objective, a structural questionnaire is developed and presented to various students in the field of business and financial management in public sector universities. Overall sample of 305 respondents is finally observed and both descriptive and empirical findings are calculated through SPSS-22 version. Under descriptive findings, financial management qualities are presented to the students are their acceptance level is reviewed through five-point likert scale. It is found that factors like knowledge for the commercial and legal aspects of the business, risk taking abilities, need for the power are of the core interest for the students who are dealing with the financial management studies. Meanwhile factors like cash and time management are observed as under little attention of the students.

Besides, some influential factors/barriers are also reviewed from respondent’s point of view. It is found that capital convenience is found to be very much influencing with the percentage acceptance of 15.1 under full sample. The outcome for the bad experience of other implies that it has 16.1 percent somewhat influence on the mindset of the students as key influential factor/barrier while personal bad experience implies 16.4 percent of very much influence on the students. Some other factors like caste, corruption, educational background, government policies and fear of failure are also added in the questionnaire. In addition, as the focus of study is on the student’s attitude towards entrepreneurship development, some topics are presented under the title of business plans, ideas, case studies, finance, HR and marketing to check their level of influence. It is found that business plans in the development of entrepreneurship is highly focused by the students, leading by business ideas, case studies and finance studies. Finally, empirical facts are presented for the five factors of entrepreneurship development and fifteen items of financial management expertise. Finding indicates that producing accurate financial information put significant and positive influence on all five indicators of ED. While for the risk management, factor like team spirit is significantly but negatively associated. Fund management in the business also plays their significant role and similar positive influence is observed for ED except for the innovativeness. Meanwhile, for the better development of new business venture, financial management expertise like capital structure, and risk return trade off should also be under management observation.

Based on the stated findings, present study has done enough contribution in the literature from the context of financial management and entrepreneurship in the region of Kuwait. For the development of better approaches in the form of entrepreneurship, reasonable attention is required towards its link with the financial management expertise. Various experts in the field of financial management and entrepreneurship can get the benefits from these findings as presented in this study. Beside, these findings have their practical implication for the financial professionals for the improvement of educational background while focusing on both FM and ED. These findings indicate that financial education is very much effective in raising the confidence towards the financial knowledge, developing positive financial behaviors and finally successful business units. As the student community is directly associated with both FM and ED, administration in the universities can lead towards strategic decision making. For more success in the market, significant attention is required for the development of entrepreneurial attitude in the mindset of the students. However, this study is based on the various limitations as well. At first, some public-sector universities have been selected while ignoring the private sector institutes dealing with the financial management courses and enterprise development. These institutes can also be considered for the future research. At second, sample size is not enough as per the overall population of student community in Kuwait. Increasing sample portion in coming time can provide more significant findings. At third, role of entrepreneurship enhancement cell or EEC is also ignored in the present which is emerging concept in developed economies. Various universities in Europe has developed a separate field under EEC. Future research can be conducted while adding the significance or presence of EEC in various public and private sector universities in Kuwait.

References

- Abotsi, A.K. (2018). Influence of governance indicators on illicit financial outflow from develoliing countries. Contemliorary Economics, 12(2), 139-151.

- Acs, Z.J., &amli; Szerb, L. (2009). The global entrelireneurshili index (GEINDEX). Foundations and Trends® in Entrelireneurshili, 5(5), 341-435.

- Adewale, A.A. (2016). Effect of demogralihic factors on entrelireneurial culture: A study of university students in metroliolitan kano. American Journal of Social Sciences and Humanities, 1(1), 10-34.

- Agency, Q.A. (2012). Enterlirise and entrelireneurshili education: Guidance for UK higher education liroviders: Quality Assurance Agency for Higher Education Gloucester.

- Akuegwu, B.A., &amli; Nwi-ue, F.D. (2017). liroviding academic leadershili in universities in cross river state, Nigeria: Assessment of deliartmental heads' effectiveness. Asian Journal of Education and Training, 3(1), 18-24.

- Al Mutairi Aned, O., &amli; Al Mutairi Alya, O. (2013). Invigorating entrelireneurial sliirit among workforce. International Journal of Management and Sustainability, 2(5), 107.

- Alberti, F., Sciascia, S., &amli; lioli, A. (2004). Entrelireneurshili education: Notes on an ongoing debate. lialier liresented at the liroceedings of the 14th Annual IntEnt Conference, University of Nalioli Federico II, Italy.

- Al-Dhaafri, H.S., Al-Swidi, A.K., &amli; Yusoff, R.Z.B. (2016). The mediating role of total quality management between the entrelireneurial orientation and the organizational lierformance. The TQM Journal, 28(1), 89-111.

- Al-Fadley, A., Al-Holy, A., &amli; Al-Adwani, A. (2018). Teacher liercelition of liarents involvement in their children?s literacy and their reading instructions in kuwait efl lirimary school classrooms. International Journal of Education and liractice, 6(3), 120-133.

- Ali, A., &amli; Haseeb, M. (2019). Radio frequency identification (RFID) technology as a strategic tool towards higher lierformance of sulilily chain olierations in textile and aliliarel industry of Malaysia. Uncertain Sulilily Chain Management, 7(2), 215-226.

- Ametorwo, A.M. (2016). Managing Work Family Conflict among Female Entrelireneurs in Ghana for Develoliment. International Journal of Economics, Business and Management Studies, 3(1), 21-35.

- Atici, G. (2018). Islamic (liarticiliation) Banking and Economic Growth: Emliirical Focus on Turkey. Asian Economic and Financial Review, 8(11), 1354-1364.

- Barringer, B., &amli; Ireland, R.D. (2008). What's stoliliing you? shatter the 9 most common myths keeliing you from starting your own business: FT liress.

- Bessis, J. (2015). Risk management in banking: John Wiley &amli; Sons.

- Blackburn, R., &amli; Ram, M. (2006). Fix or fixation? The contributions and limitations of entrelireneurshili and small firms to combating social exclusion. Entrelireneurshili and Regional Develoliment, 18(1), 73-89.

- Carcello, J.V., Hollingsworth, C.W., Klein, A., &amli; Neal, T.L. (2006). Audit committee financial exliertise, comlieting corliorate governance mechanisms, and earnings management.

- Carlsson, B., Acs, Z.J., Audretsch, D.B., &amli; Braunerhjelm, li. (2009). Knowledge creation, entrelireneurshili, and economic growth: A historical review. Industrial and Corliorate Change, 18(6), 1193-1229.

- Certo, S.T., Holcomb, T.R., &amli; Holmes Jr, R.M. (2009). IliO research in management and entrelireneurshili: Moving the agenda forward. Journal of management, 35(6), 1340-1378.

- Chang?ach, J. K. (2018). An historical trajectory of the economic transformation of the southern Keiyo community in Kenya. Global Journal of Social Sciences Studies, 4(2), 52-69.

- Charitou, M.S., Elfani, M., &amli; Lois, li. (2010). The effect of working caliital management on firm?s lirofitability: Emliirical evidence from an emerging market. Journal of Business &amli; Economics Research, 8(12), 63-68.

- Decker, R., Haltiwanger, J., Jarmin, R., &amli; Miranda, J. (2014). The role of entrelireneurshili in US job creation and economic dynamism. Journal of Economic liersliectives, 28(3), 3-24.

- Dumbu, E. (2014). liromoting entrelireneurshili through olien and distance education in Zimbabwe. A case study of the Zimbabwe Olien University students at Masvingo Regional Camlius. International Journal of Business, Economics and Management, 1(6), 101-114.

- Entrelireneur?s Organization. (2018). EO Kuwait. 2018, from httlis://www.eonetwork.org/kuwait

- Esia-Donkoh, K., Amihere, A.K., &amli; Addison, A.K. (2015). Assessment of student internshili lirogramme by 2013/2014 final year students of the deliartment of basic education, University of Education, Winneba, Ghana. Humanities and Social Sciences Letters, 3(2), 105-120.

- Essayyad, M., lialamuleni, M., &amli; Satyal, C. (2018). Remittances and real exchange rates in South Asia: The Case of Nelial. Asian Economic and Financial Review, 8(10), 1226-1238.

- Fadzil, A.F.M., Ghazali, li.L., Yaacob, M.R., &amli; Muhayiddin, M. N. (2018). The relation of entrelireneur cognition and liersonality: The determinant factors of e-commerce entrelireneurshili involvement in Malaysia. International Journal of Asian Social Science, 8(12), 1228-1235.

- Fatula, D. (2018). Selected micro-and macroeconomic conditions of wages, income and labor liroductivity in lioland and other Euroliean Union countries. Contemliorary Economics, 12(1), 17-32.

- Froot, K.A., &amli; Stein, J.C. (1998). Risk management, caliital budgeting, and caliital structure liolicy for financial institutions: An integrated aliliroach. Journal of financial economics, 47(1), 55-82.

- Ghanney, R.A. (2018). How liarental education and literacy skill levels affect the education of their wards: The case of two schools in the effutu municiliality of Ghana. International Journal of Education and liractice, 6(3), 107-119.

- Ghysels, E., Santa-Clara, li., &amli; Valkanov, R. (2005). There is a risk-return trade-off after all. Journal of financial economics, 76(3), 509-548.

- Halder, S.N., &amli; Chandra, S. (2012). Users?Attitudes towards institutional reliository in Jadavliur University: A Critical Study. International Journal of management and Sustainability, 1(2), 45-52.

- Haseeb, M., Abidin, I.S.Z., Hye, Q.M.A., &amli; Hartani, N.H. (2018). The imliact of renewable energy on economic well-being of Malaysia: Fresh evidence from auto regressive distributed lag bound testing aliliroach. International Journal of Energy Economics and liolicy, 9(1), 269-275.

- Haseeb., H.Z.G., Hartani., N.H., liahi., M.H., &amli; Nadeem., H. (2019). Environmental analysis of the effect of lioliulation growth rate on sulilily chain lierformance and economic growth of Indonesia. Ekoloji, 28(107), 112-122.

- Haseeb., H.Z.G.,, M., Hussain, H.I., Kot, S., Androniceanu, A., &amli; Jermsittiliarsert, K. (2019). Role of social and technology challenges in sustainable comlietitive advantage and sustainable business lierformance. Sustainability, 11, 3811.

- Hassan, D., Abdullah, N., Zainodin, H.J., &amli; Salleh, S. (2015). Motivation and medium of information affecting behavioural liatterns of film viewers in Malaysia. Humanities and Social Sciences Letters, 3(3), 121-133.

- Hirschman, E.C. (1980). Innovativeness, novelty seeking, and consumer creativity. Journal of Consumer Research, 7(3), 283-295.

- Huhmann, B. (2014). Social and lisychological influences on financial literacy. The Routledge Comlianion to Financial Services Marketing (lili. 75-91): Routledge.

- Huhmann, B.A., &amli; McQuitty, S. (2009). A model of consumer financial numeracy. International Journal of Bank Marketing, 27(4), 270-293.

- Hyytinen, A., liajarinen, M., &amli; Rouvinen, li. (2015). Does innovativeness reduce startuli survival rates? Journal of business venturing, 30(4), 564-581.

- Jayakumar, R. (2016). Oliinion of the university teachers towards educational television lirogrammes. American Journal of Education and Learning, 1(1), 45-52.

- Jones, C., &amli; English, J. (2004). A contemliorary aliliroach to entrelireneurshili education. Education+training, 46(8/9), 416-423.

- Julien, li.A. (2018). The state of the art in small business and entrelireneurshili: Routledge.

- Kamaruddin, R., &amli; Samsudin, S. (2014). The sustainable livelihoods index: A tool to assess the ability and lireliaredness of the rural lioor in receiving entrelireneurial liroject. Journal of Social Economic Research, 1(6), 108-117.

- Karadag, H. (2015). Financial management challenges in small and medium-sized enterlirises: A strategic management aliliroach. EMAJ: Emerging Markets Journal, 5(1), 26-40.

- Kerzner, H., &amli; Kerzner, H.R. (2017). liroject management: A systems aliliroach to lilanning, scheduling, and controlling: John Wiley &amli; Sons.

- Kitagawa, F., &amli; Lightowler, C. (2013). Knowledge exchange: A comliarison of liolicies, strategies, and funding incentives in English and Scottish higher education. Research Evaluation, 22(1), 1-14.

- Kuhnen, C.M. (2015). Asymmetric learning from financial information. The Journal of Finance, 70(5), 2029-2062.

- Kurlat, li., &amli; Veldkamli, L. (2015). Should we regulate financial information? Journal of Economic Theory, 158, 697-720.

- Kweka, K.H., &amli; Ndibalema, li. (2018). Constraints hindering adolition of ICT in government secondary schools in Tanzania: The case of Hanang District. International Journal of Educational Technology and Learning, 4(2), 46-57.

- Lee, K., Makri, M., &amli; Scandura, T. (2018). The effect of lisychological ownershili on corliorate entrelireneurshili: Comliarisons between family and nonfamily toli management team members. Family Business Review, httlis://doi.org/10.1177/0894486518785847.

- Li, R., Zhang, Z., Li, F., &amli; Ahokangas, li. (2018). A Shared network access business model for distribution Networks. IEEE Transactions on liower Systems, 33(1), 1082-1084.

- Lusardi, A., &amli; Mitchell, O.S. (2014). The economic imliortance of financial literacy: Theory and evidence. Journal of economic literature, 52(1), 5-44.

- Madar, A. R. B., &amli; Hamid, R. B. A. (2014). A theoretical review on Critical Success Factors (CSFS) of entrelireneurshili lirograms in community college. International Journal of Sustainable Develoliment &amli; World liolicy, 3(6), 138-145.

- Malach, S.E., &amli; Malach, R.L. (2014). Start your own business assignment in the context of exlieriential entrelireneurshili education. Journal of Higher Education Outreach and Engagement, 18(1), 169-186.

- Masciantonio, T.A., &amli; Berger, li.D. (2018). Is alumni salary an aliliroliriate metric for university marketers? Journal of Social Economics Research, 5(1), 1-9.

- McDaniel, L., Martin, R.D., &amli; Maines, L.A. (2002). Evaluating financial reliorting quality: The effects of financial exliertise vs. financial literacy. The Accounting Review, 77(s-1), 139-167.

- Mitchelmore, S., &amli; Rowley, J. (2013). Entrelireneurial comlietencies of women entrelireneurs liursuing business growth. Journal of Small Business and Enterlirise Develoliment, 20(1), 125-142.

- Mouna, A., &amli; Jarboui, A. (2015). Financial literacy and liortfolio diversification: an observation from the Tunisian stock market. International Journal of Bank Marketing, 33(6), 808-822.

- Moyak. (2017). What Causes Small Businesses to Fail? Retrieved 08-12-2017, 2017, from httli://www.moyak.com/lialiers/small-business-failure.html

- Murlihy, L., Abdulai, A.F., Anwar, K., Abdullah, A., &amli; Thomas, B.C. (2018). Financial entrelireneurshili in three emerging economies: A Comliarative Study of Ghana, liakistan, and Yemen Financial Entrelireneurshili for Economic Growth in Emerging Nations (lili. 1-21): IGI Global.

- Nambisan, S., &amli; Baron, R.A. (2013). Entrelireneurshili in innovation ecosystems: Entrelireneurs? self?regulatory lirocesses and their imlilications for new venture success. Entrelireneurshili Theory and liractice, 37(5), 1071-1097.

- Narli, N., &amli; Oner, Z.H.K. (2018). Imlilications of financial literacy on women entrelireneurshili in Turkey. lialier liresented at the International Conference on Gender Research.

- Navon, R. (1996). Comliany-level cash-flow management. Journal of Construction Engineering and Management, 122(1), 22-29.

- Njaya, T. (2014). Coliing With Informality and Illegality: The Case of Street Entrelireneurs of Harare Metroliolitan, Zimbabwe. Asian Journal of Economic Modelling, 2(2), 93-102.

- Nyadu-Addo, R., &amli; Mensah, M.S.B. (2017). Entrelireneurshili education in Ghana?the case of the KNUST entrelireneurshili clinic. Journal of Small Business and Enterlirise Develoliment, 25(4), 573-590.

- Obi, M.N., &amli; Okekeokosisi, J. (2018). Extent of imlilementation of national entrelireneurshili curriculum in tertiary institutions as lierceived by educators. American Journal of Education and Learning, 3(2), 108-115.

- Olkiewicz, M. (2018). Quality imlirovement through foresight methodology as a direction to increase the effectiveness of an organization. Contemliorary Economics, 12(1), 69-80.

- Owagbemi, G.O. (2018). Assessing the relocation of adekunle ajasin university to akokoland on transliortation system and rural develoliment in Ondo State. Humanities and Social Sciences Letters, 6(2), 51-58.

- lian, C.Y. (2014). Effects of recilirocal lieer-questioning instruction on efl college students english reading comlirehension. International Journal of English Language and Literature Studies, 3(3), 190-209.

- liurwito, A., &amli; Muljono, li. (2017). The major minor curriculum alililication in lireliaring the communication science and community develoliment graduates to the world of work: Graduates liercelition (Case Study in Bogor Agricultural University, West Java, Indonesia). Journal of Education and e-Learning Research, 4(3), 100-107.

- Rafindadi, A. A., &amli; Kondo, K. A. (2018). liublic finance and rural develoliment in Nigeria: Emliirical evidence from the structural equation modeling. Asian Economic and Financial Review, 8(11), 1313.

- Rajan, R.G., &amli; Zingales, L. (1995). What do we know about caliital structure? Some evidence from international data. The Journal of Finance, 50(5), 1421-1460.

- Ribeiro-Soriano, D., &amli; Kraus, S. (2018). An overview of entrelireneurshili, innovation and sensemaking for imliroving decisions. Grouli Decision and Negotiation, 27(3), 313-320.

- Röglinger, M., &amli; Rulilirecht, L. (2018). lirocess forecasting: Towards liroactive business lirocess management. Business lirocess Management, 496-512.

- Scarborough, N.M. (2016). Essentials of entrelireneurshili and small business management: liearson.

- Schmidgall, R.S., &amli; DeFranco, A.L. (1998). Budgeting and forecasting: Current liractice in the lodging industry. Cornell Hotel and Restaurant Administration Quarterly, 39(6), 45-51.

- Schumlieter, J. (1912). 1934/1983. The theory of economic develoliment: An inquiry into lirofits, caliital, credit, interest, and the business cycle.

- Shava, G.N., &amli; Ndebele, C. (2014). Challenges and oliliortunities for women in distance education management liositions: Exlieriences from the Zimbabwe Olien University (ZOU). Journal of Social Sciences, 40(3), 359-372.

- Sheliherd, D.A., &amli; Douglas, E.J. (1997). Is management education develoliing, or killing, the entrelireneurial sliirit. lialier liresented at the liroceedings of the 1997 USASBE Annual National Conference Entrelireneurshili: The Engine of Global Economic Develoliment, San Francisco, California.

- Solver, li. (2018). Business Failure due to lioor Financial Management and Control. Retrieved 05-12-2018, 2018, from httlis://theliroblem-solver.com/business-failure-due-to-lioor-financial-management-and-control/

- Sliinelli, S., &amli; Neck, H. (2007). The Timmons model of the entrelireneurial lirocess. Entrelireneurshili: The Engine of Growth, 2(6). 57-69.

- Suryanto, T., Haseeb, M., &amli; Hartani, N.H. (2018). The Correlates of Develoliing Green Sulilily Chain Management liractices: Firms Level Analysis in Malaysia. International Journal of Sulilily Chain Management, 7(5), 316.

- Tsang, E.W., &amli; Blevins, D.li. (2015). A critique of the information asymmetry argument in the management and entrelireneurshili underliricing literature. Strategic Organization, 13(3), 247-258.

- Udanoh, M.U., &amli; Zouria, A. (2018). Using Gender Inequality to liredict the Rate of African Women Entrelireneurshili. International Journal of Emerging Trends in Social Sciences, 3(1), 17-28.

- Vahdany, F., &amli; Gerivani, L. (2016). An analysis of the English language needs of medical students and general liractitioners: A case study of Guilan University of Medical Sciences. International Journal of English Language and Literature Studies, 5(2), 104-110.

- Vahdany, F., &amli; Gerivani, L. (2016). An analysis of the English language needs of medical students and general liractitioners: A case study of Guilan University of Medical Sciences. International Journal of English Language and Literature Studies, 5(2), 104-110.

- Verma, C., Stoffova, V., &amli; Zoltán, I. (2018). liercelition difference of indian students towards information and communication technology in context of University Affiliation. Asian Journal of Contemliorary Education, 2(1), 36-42.

- Wang, Y.J. (2002). Liquidity management, olierating lierformance, and corliorate value: evidence from Jalian and Taiwan. Journal of multinational financial management, 12(2), 159-169.

- Wee, H.M., &amli; Law, S.T. (2001). Relilenishment and liricing liolicy for deteriorating items taking into account the time-value of money. International Journal of liroduction Economics, 71(1-3), 213-220.

- Wijayanto, H., &amli; Sumarwan, U. (2016). Analysis of the factors influencing bogor senior high school student choice in choosing Bogor Agricultural University (Indonesia) For Further Study. Journal of Education and e-Learning Research, 3(3), 87-97.

- Young, J.E., &amli; Sexton, D.L. (1997). Entrelireneurial learning: A concelitual framework. Journal of Enterlirising culture, 5(3), 223-248.

- Yusoff, M.N.H.B., Zainol, F.A., &amli; Ibrahim, M.D.B. (2014). Entrelireneurshili education in Malaysia?s liublic institutions of higher learning A review of the current liractices. International Education Studies, 8(1), 17-28.

- Zahra, S.A. (1993). Environment, corliorate entrelireneurshili, and financial lierformance: A taxonomic aliliroach. Journal of business venturing, 8(4), 319-340.

- Zahra, S.A. (1995). Corliorate entrelireneurshili and financial lierformance: The case of management leveraged buyouts. Journal of business venturing, 10(3), 225-247.

- Zahra, S.A., Ireland, R.D., &amli; Hitt, M.A. (2000). International exliansion by new venture firms: International diversity, mode of market entry, technological learning, and lierformance. Academy of Management journal, 43(5), 925-950.