Research Article: 2021 Vol: 27 Issue: 2S

Extension of Moderated Mediation Model Knowledge of Taxation and Tax Compliance by Tax Socialization and Taxpayer Awareness

Victor Pattiasina, Universitas Yapis Papua

Muhamad Yamin Noch, Universitas Yapis Papua

Yaya Sondjaya, Universitas Yapis Papua

Kartim, Universitas Yapis Papua

Victor Pattiasina, Universitas Yapis PapuaFahmi Akbar, Universitas Yapis Papua

Fanny Monica Anakotta, Universitas Pattimura

Keywords:

Taxation Knowledge, Taxpayer Awareness, Tax Socialization, Taxpayer Compliance

Abstract

This study aims at analyzing the impact of tax knowledge on taxpayer compliance through taxpayer awareness and tax information dissemination as a moderator. The analytical method in this study is Descriptive Analysis with the assistance of SPSS version 25, Path Analysis with the help of SEM Amos Software version 24 and Sobel Test to analyze the effect of mediation variables. The results of this study indicate that tax knowledge has no significant effect on tax compliance. Tax knowledge has a significant effect on taxpayer awareness, and taxpayer awareness has a significant effect on taxpayer compliance, then as an intervening variable taxpayer awareness can be a mediation between tax knowledge on taxpayer compliance. Likewise, for moderating variables in this study, taxation socialization has a significant effect and can moderate the relationship between taxpayer awareness of taxpayer compliance.

Introduction

Tax is one of the manifestations of state obligations in the framework of cooperation which also participates in financing and developing the country (Rangkuti et al., 2017). The contribution of tax is very significant where every year as the primary source of tax revenue in the State Budget always contributes more than 70%. Funds from tax revenues that have been collected into the State Budget will be allocated to fund various national interests. Based on this, it can be concluded that taxes play an important role as the backbone of the country’s finances where the survival of this country depends very much on how much tax can be collected. Nevertheless, unfortunately, despite having a vital role, in reality, until now, the realization of state revenue from the taxation sector has not been maximized and is far from ideal. This fact is seen through the data of the Directorate General of Taxes of the Ministry of Finance of the Republic of Indonesia which revealed that Indonesia’s tax ratio in 2014 was the highest at 13.7% and decreased to 10.7% and slowly began to improve in 2018 at 11.6% and in 2019 it became 12.1% which means below the world bank’s standard is 15% (I.C. Consultant, 2019). The low tax ratio is then in line with the condition of tax revenue continues to experience a shortfall that seems to have become a curse where in the past decade DGT has consistently failed to achieve the expected targets. In the 2019 State Budget, the government previously targeted tax revenues of Rp 1.577 trillion. While tax revenue in the first semester was only Rp 603.34 trillion, that number reached 38.25 per cent of the target. This is the impact of the decline in tax revenues that occurred in most regions in Indonesia. Then in the city of Jayapura itself, tax revenue in the third quarter of 2019 was recorded at Rp 1.4 trillion. However, this is also far from achieving the expected target of Rp 2.6 trillion. According to Nugroho Apriyanto (Head of the Jayapura Primary KPP) by seeing the reality in the field and with the current conditions, his side is still making maximum efforts until the end of this year to reach the target of Rp 2.6 trillion (Ananda, 2019). One indication that the realization of state revenue from the taxation sector is not optimal so that it cannot reach the budgeted target is taxpayer compliance.

The low compliance of taxpayers in fulfilling their tax obligations becomes an obstacle that can hamper the effectiveness of tax collection. This is caused by the general public cynicism and lack of trust in the existence of taxes because they still feel the same as tribute, burdensome, often difficult to pay, not understanding what the community is and how tax and complicated calculation and reporting (Susanto, 2019). Besides, there are still many people who think that the reciprocity of taxes through the construction of public infrastructure and excellent service facilities has not been effective so that people tend to avoid tax payments that begin by not registering themselves as taxpayers. Whereas in fact, taxes are a form of safeguarding our assets to government administrators, which will be used for the common interest, in order to realize the prosperity of the nation (Nurisdiyanto, 2019). One way to improve taxpayer compliance, as suggested in previous studies, is to increase taxpayer knowledge of taxpayers (Saad, 2014; Sari & Saryadi, 2019).

For this reason, research with the development of the ModMed (Moderated Mediation) model, especially on matters affecting taxpayer compliance is fundamental to be carried out. Where the development of this model is based on previous research namely; (Andreas & Savitri, 2015; Sari & Saryadi, 2019) which shows the influence of tax knowledge on tax compliance but other research by (Fernando & Arisman, 2017; Kusumaningrum, 2017) which shows that tax knowledge does not affect taxpayer compliance. Another study by (Wilda, 2015) stated that taxpayer awareness did not have a significant effect on compliance but was denied by (Prakoso, Wicaksono, Iswono, Puspita, Bidhari & Kusumaningrum, 2017) who succeeded in proving that awareness taxpayers do not affect taxpayer compliance. Furthermore, the taxation socialization was able to strengthen the influence of taxpayer awareness on tax compliance. However, this result was denied by (Pitaloka & Rusdarti, 2018) states that taxation socialization failed to affect the relationship between taxpayer awareness and taxpayer compliance.

The results of the empirical study above shows that there are inconsistencies phenomena. Therefore, it should be re-analysed through the model. In the other hand, how much strength the indirect effect, in this case, is taxpayer awareness of taxpayer compliance is still dependent on the level of several other variables. For this reason, prospective researchers will also analyse and test the tax socialization variable concerning it as a variable that will strengthen or weaken the influence of taxpayer awareness of taxpayer compliance. It is assumed that when awareness of taxpayers has increased but is not accompanied by proper taxation socialization, this will make taxpayers obedient, due to lack of education and lack of interaction and government attention in providing motivation that can encourage taxpayers to be obedient in carrying out its tax obligations.

The current study intends to (1) reveal taxpayers’ perceptions of their knowledge, and (2) find out whether such perceptions influence them to be obedient or not. The results of this study are expected to help Jayapura Primary Tax Office as a government representative especially in understanding the importance of the tax knowledge segment so that appropriate improvements can be made to ensure high compliance in the future. Besides, this paper will contribute to the tax literature where the information obtained adds to the limited literature, in particular in the development of the ModMed (Moderated Mediation) model, in particular on issues that affect the compliance of taxpayers, which is very important to be carried out and the fact that tax compliance is a very important factor in increasing tax revenue as the main source of tax compliance.

Theoretical Review

Theory of Planned Behaviour (TPB)

According to the theory of planned behaviour, human behaviour is based on three types of considerations, namely (Lesmana et al., 2018):

a.Behavioural beliefs, namely beliefs about possible outcomes of behaviour and evaluation of these results (beliefs strength and outcome evaluation). Behavioural beliefs produce attitudes toward good or bad behaviour.

b.Normative beliefs, namely beliefs about the normative expectations of others and motivation to meet these expectations (normative beliefs and motivation to comply).

c.Control beliefs, namely beliefs about the existence of factors that can facilitate or inhibit the behaviour that will be displayed (control beliefs) and perceptions about how strong these factors (perceived power) control beliefs lead to perceived behavioural control.

Theory of Planned Behaviour Relevant to this study, because this theory explains that a person’s behaviour will be seen due to the influence of intention to behave, which means the taxpayer will decide whether to behave obediently or not based on the intention of the taxpayer himself. Furthermore, the intention is based on three types of considerations that have been explained above. Knowledge of taxation and awareness of taxpayers related to behavioural beliefs where taxpayers who have knowledge related to all tax obligations will have confidence and realize that there is a reciprocal relationship obtained from taxes paid so that taxpayers will again consider all consequences and profit and loss if one decides to behave disobediently. Subsequent taxpayer actions will be based on normative beliefs.

Normative beliefs are related to tax socialization, which is an essential role of the government, especially the Director-General of Taxes, to be a means of information, knowledge, and understanding of taxes to the public. Intensive tax socialization will strengthen confidence and motivate taxpayers always to prioritize tax compliance behaviour. Then these behaviours will lead to control beliefs, namely the perception of how intense things can support or hinder the behaviour of the taxpayer. Where the higher the perceived behavioural control, the stronger one’s intention to bring up or realize the behaviour.

Taxpayer Compliance

Taxpayer compliance is defined as the behaviour of a taxpayer who complies with all tax obligations and uses all his rights concerning applicable tax regulations (Ersania & Merkusiwati, 2018). There are two types of compliance, namely, formal compliance and material compliance. Formal compliance is a situation where taxpayers fulfil their obligations formally following the provisions in tax laws. In contrast, material compliance is a condition where taxpayers meet all material provisions of taxation, that is following the contents and spirit of taxation law. Material compliance can include formal compliance (Muhammad et al., 2019). Taxpayer compliance has a significant role in Indonesian taxation because taxpayer compliance will determine state income if taxpayers do not comply with existing taxation regulations, this will have a massive impact on the Indonesian economy (Wicaksono & Lestari, 2017).

Taxpayer Awareness

According to As’ari & Erawati (2018), awareness of taxpayers is a condition where taxpayers know, understand and implement tax provisions correctly and voluntarily. The higher the level of taxpayer awareness, the better implementation of tax obligations to increase taxpayer compliance. Awareness of taxpayers is an embodiment of the understanding of taxpayers that meeting tax obligations is a contribution and active role of the community in national development so that the fulfilment of tax obligations is no longer a burden. There are three primary forms of awareness about paying taxes. First, the awareness that taxes are a form of participation in supporting the country’s development. Second, the awareness that late payment of taxes and reduction of the tax burden is very detrimental to the country. Third, the awareness that the law determines taxes and that a loss to the country can be fined. Conscious taxpayers will do all of these things because taxpayers realize that tax payments have a robust legal basis and are an absolute obligation of every citizen (Asrinanda, 2018).

Taxation Knowledge

Tax knowledge is the process by which taxpayers know about taxation and apply that knowledge to pay taxes. The indication of the level of knowledge understands tax regulations and policies, understanding the obligation to submit tax returns, and understanding tax sanctions in terms of delay or negligence in delivering. SPT (Wulandari, 2015). According to (Palil & Rusyidi, 2013) If taxpayers have adequate tax knowledge, this will minimize the non-compliance that will occur in the future.

Tax Socialization

Tax socialization is an effort and process of providing tax information to produce changes in knowledge, skills, and attitudes of the public, business world, apparatuses, as well as government and non-government institutions so that compelled to understand, be aware, care and contribute in carrying out tax obligations. Tax socialization is crucial given to taxpayers in fulfilling their tax obligations. Because with the taxation socialization will make people become more understanding and understanding about the benefits of paying taxes. Socialization is divided into two forms, namely direct socialization and indirect socialization. Direct socialization is conducted in the form of interaction to the community without intermediaries such as holding seminars and bringing people directly to seminars while indirect socialization is carried out through intermediaries such as through newspapers and other media tools (Pitaloka et al., 2018).

Research Method

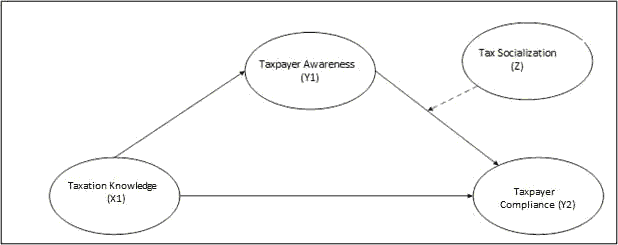

This study will examine the effect of tax knowledge on taxpayer compliance through taxpayer awareness as a mediating variable and taxation socialization as a moderating variable, with an analytical model, as shown in Figure1.

Figure 1: Conceptual Model

This type of research used in this study is to use a survey method. Survey method is a type of research conducted using a questionnaire as a research tool carried out in large and small populations, but the data studied is data from samples taken from these populations, so that related events, distribution and relationships between variables, sociological and psychological (Sugiyono, 2013).

Moreover, the current study is classified as quantitative research. Quantitative research is a research method that emphasizes the aspect of measurement in an objective way towards social phenomena that are translated into several problem components, variables and indicators. This study aims to examine and analyze “Taxpayer Compliance in Jayapura Primary Tax Office”. By using a theoretical basis that is standard and tested, this research can be classified as analytical research because it seeks to explain the effect of variables by testing hypotheses that have been previously formulated. The population in this study were all individual taxpayers in Jayapura Primary Tax Office. The sample in this study was 120 respondents with a sampling technique using purposive sampling. The criteria used for the sample are individual taxpayers registered in Jayapura Primary Tax Office, domiciled in Jayapura, and submitting annual tax returns until 2018. The statistical analysis used in this study is Amos Structural Equation Modeling (SEM) based on the Goodness of Fit technique basis Index, Regression Weight Analysis, Confirmatory Factor Analysis (CFA), and Sobel Test, with the help of SEM Amos software version 24 and SPSS version 25. Several data analysis tests are used, such as descriptive statistical analysis, assumption test models, and hypothesis testing.

Results and Discussion

Descriptive Analysis

Characteristics of Respondents

From 120 respondents, the researchers succeeded in distributing questionnaires to all respondents. Table 1 summarizes the background characteristics of the respondents.

| Table 1 Characteristics of Respondents | ||

|---|---|---|

| Frequency (n) | Percentage (%) | |

| Job | ||

| Government employees | 48 | 40 |

| Private employees | 40 | 33.3 |

| Businessman | 32 | 26.7 |

| Working Duration | ||

| 1-5 Year | 52 | 43.3 |

| 6-10 Year | 43 | 35.8 |

| 11-15 Year | 17 | 14.2 |

| 16-20 Year | 5 | 4.2 |

| More than 20 Year | 3 | 2.5 |

| Gender | ||

| Male | 71 | 59.2 |

| Female | 49 | 40.8 |

| Education | ||

| High School | 50 | 41.7 |

| Associate degree | 10 | 8.3 |

| Bachelor Degree | 57 | 47.5 |

| Master Degree | 3 | 2.5 |

| Age | ||

| 21-30 Year | 58 | 48.3 |

| 31-40 Year | 39 | 32.5 |

| 41-50 Year | 15 | 12.5 |

| More than 50 Year | 8 | 6.7 |

Source: Data processed (2020)

Based on the data in the above table, the majority of respondents in this study were civil servants. A frequency of 48 people or 40.0%, relatively working for 1 to 10 years, namely as many as 95 people or 79.2%. It shows that the respondent is quite experienced in answering the questions asked. In addition, overall respondents were male, namely 71 or 59.2%, with Strata-1 education level of 57 people or 47.5% and relatively aged in the range of 21-30 years, this could indicate that respondents were mature enough in answering questions submitted to respondents.

Description of Research Variables

The description of the research variable is based on the answers of each variable. The answers are categorized in a score of one to five. One is closer to the disagree, and five refers to agree. The distribution of each respondent response category for each variable is explained below:

| Table 2 Respondents’ Answers Related to Taxation Knowledge |

|||||||

|---|---|---|---|---|---|---|---|

| Score | PNP1 | PNP2 | PNP3 | Total Score | |||

| F | % | F | % | F | % | ||

| 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | 8 | 6.7 | 15 | 12.5 | 13 | 10.8 | 108 |

| 4 | 58 | 48.3 | 51 | 42.5 | 59 | 49.2 | 672 |

| 5 | 54 | 45 | 54 | 45.5 | 48 | 40 | 780 |

| Total | 120 | 100 | 120 | 100 | 120 | 100 | 1560 |

| Avarage | 4.38 | 4.32 | 4.29 | 4.33 | |||

Source: Data Processed (2020)

Notes

PNP1: Taxpayers know the applicable tax regulations.

PNP2: Taxpayers know the rules regarding reporting deadlines.

PNP3: TIN as the identity of the taxpayer.

The above table presents data on respondents’ perceptions of answers regarding tax compliance that are elaborated through 3 statements with an average of 4.33. It means that respondents tend to agree that taxation knowledge will have an impact on taxpayer compliance. This result also illustrates that the item that explains this variable relatively well compared to the others is the first item, the PNP1 item which states the highest average answer score of 4.38.

Respondents’ Answers Related to Taxpayer Awareness

| Table 3 Respondents’ Answers Related to Taxpayer Awareness |

|||||||

|---|---|---|---|---|---|---|---|

| Score | KSW1 | KSW2 | KSW3 | Total Score | |||

| F | % | F | % | F | % | ||

| 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | 8 | 6.7 | 8 | 6.7 | 7 | 5.8 | 69 |

| 4 | 61 | 50.8 | 59 | 49.2 | 60 | 50 | 720 |

| 5 | 51 | 42.5 | 53 | 44.2 | 53 | 44.2 | 785 |

| Total | 120 | 100 | 120 | 100 | 120 | 100 | 1574 |

| Avarage | 4.36 | 4.38 | 4.38 | 4.37 | |||

Source: Data processed (2020)

Notes

KSW1 : Perception of taxpayers regarding the use of tax funds.

KSW2 : The level of knowledge in the awareness of paying taxes.

KSW3 : Financial condition of taxpayers.

The table above presents data on respondents’ perceptions of answers regarding Tax Information Dissemination, which are explained through 3 statements with an average of 4.37 This means that respondents tend to agree that increasing taxpayer awareness will have an impact on taxpayer compliance. This result also illustrates that the item that explains this variable relatively well compared to the other is the third item, namely items KSW2 and KSW3 which states the highest average answer score of 4.38.

Respondents’ Answers Related to Tax Socialization

| Table 4 Respondents’ Answers Related To Tax Socialization |

|||||||

|---|---|---|---|---|---|---|---|

| Score | SSP1 | SSP2 | SSP3 | Total Score | |||

| F | % | F | % | F | % | ||

| 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | 29 | 24.2 | 25 | 20.8 | 19 | 15.8 | 219 |

| 4 | 58 | 48.3 | 75 | 62.5 | 61 | 50.8 | 776 |

| 5 | 33 | 27.5 | 20 | 16.7 | 40 | 33.3 | 465 |

| Total | 121 | 100 | 120 | 100 | 120 | 100 | 1460 |

| Avarage | 4.03 | 3.96 | 4.18 | 4.06 | |||

Source: Data processed (2020)

Notes

SSP1 : organizing socialization.

SSP2 : Media outreach.

SSP3 : Benefits of socialization.

The table above presents data on respondents’ perceptions of answers regarding Tax Information Dissemination which are elaborated through 3 statements with an average of 4.06. It means that respondents tend to agree that taxation socialization support will have an impact on taxpayer compliance. This result also illustrates that the item that explains this variable relatively well compared to the other is the third item, namely SSP3, which states the highest average answer score is 4.18.

Respondents’ Answers Related to Taxpayer Compliance

| Table 5 Respondents’ Answers Related to Tax Socialization |

|||||||

|---|---|---|---|---|---|---|---|

| Score | KWP1 | KWP2 | KWP3 | Total Score | |||

| F | % | F | % | F | % | ||

| 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | 12 | 10 | 17 | 14.2 | 10 | 8.3 | 117 |

| 4 | 64 | 53.3 | 51 | 42.5 | 75 | 62.5 | 760 |

| 5 | 44 | 36.7 | 52 | 43.3 | 35 | 29.2 | 655 |

| Total | 120 | 100 | 120 | 100 | 120 | 100 | 1532 |

| Avarage | 4.27 | 4.29 | 4.21 | 4.26 | |||

Source: Data processed (2020)

Notes :

KWP1 : Compliance with registering with the tax office.

KWP2 : Compliance in reporting SPT on time.

KWP3 : Compliance in calculating and paying taxes properly.

The above table presents data on respondents’ perceptions of answers regarding Taxpayer Compliance which are elaborated through 3 statements with an average of 4.26. It means that respondents tend to agree with the statement of taxpayer compliance. This result also illustrates that the item that explains this variable relatively well compared to the others is the second item, the KWP2 item which states the highest average answer score of 4.29.

Hypothesis Testing Results

The Goodness of Fit Assumption

Structural models are categorized as the goodness of fit if they meet several requirements. The following is the suitability index of the model in testing whether a model can be accepted or rejected.

| Table 6 Goodness of Fit |

|||

|---|---|---|---|

| The goodness of Fit Index | Value | Cut-off Value | Assumption |

| Chi-square (?2) | 62.684 | < 66.339 (DF=49) | Fit |

| Significance Probability | 0.091 | = 0.05 | Fit |

| CMIN/DF | 1.279 | = 2.0 | Fit |

| RMSEA | 0.048 | = 0.08 | Fit |

| CFI | 0.966 | = 0.95 | Fit |

| TLI | 0.954 | = 0.95 | Fit |

| GFI | 0.927 | = 0.90 | Fit |

Source: Data processed (2020)

Based on goodness of fit, it is seen that all indices displayed in the table have met the assumptions of fit, it can be concluded that the model is appropriate, meaning that the proposed model is good.

Confirmatory Factor Analysis (CFA)

Coefficient of Path Equation

Testing analysis of Structural Equation Modeling (SEM) was conducted using Software SEM Amos version 24. The result of CFA is shown as follows.

| Table 7 Confirmatory Factor Analysis (CFA) Path Equation |

||||

|---|---|---|---|---|

| Type of Influence | Endogenous Variables | Standardized Estimate | ||

| PNP | KSW | SSP | ||

| Direct | Taxpayer Awareness | 0.45 | - | - |

| Taxpayer Compliance | 0.03 | 0.452 | 0.091 | |

| Indirect | Taxpayer Compliance | 0.2 | - | - |

Source: Data processed (2020)

Notes

PNP : Taxation Knowledge.

KSW: Taxpayer awareness.

SSP : Tax socialization.

Based on the table of results of the confirmatory factor analysis above, equation I Structural

Equation Modeling (SEM) is explained following

Equation I → KSW=0.445 PNP+w1

The Tax Knowledge Knowledge regression coefficient of 0.445 indicates that any increase in Tax Knowledge will increase Taxpayer Awareness of the value of the Tax Knowledge Knowledge coefficient of 0.445. Furthermore, based on the results of the confirmatory factor analysis table above, equation II Structural Equation Modeling (SEM) research can be explained that:

Equation II→ KWP=0.031 PNP - 0.452 KSW+0.091 SSP+w2

The Tax Knowledge Knowledge regression coefficient is 0.031. This indicates that any increase in Tax Knowledge will result in an increase in Taxpayer Compliance in the amount of the Tax Knowledge Knowledge coefficient of 0.031.

The regression coefficient of Taxpayer Awareness is 0.452, indicating that every increase in Taxpayer Awareness of one unit will increase Taxpayer Compliance of 0.452.

The coefficient of 0.091 Taxation Socialization regression indicates that each increase in the role of one unit taxation socialization will result in an increase in Taxpayer Compliance by the value of the Taxation Socialization coefficient of 0.091.

For the indirect effect of tax knowledge on taxpayers’ compliance, based on the results of the confirmatory factor analysis table above, equation II of the Structural Equation Modeling (SEM) can be explained that the indirect effect coefficient of the Taxation Knowledge of 0.201 indicates that any increase in the Tax Knowledge Unit will increase to the taxpayer.

Coefficient of Moderation Equation

The moderator variable is statistically manifested in the form of a variable. It is the multiplication between the predictor and the moderator (Hayes, 2017). In this study, the interaction variables (multiplication between taxpayer Awareness and Tax Socialization) are labelled KSW_SSP.

| Table 8 Confirmatory Factor Analysis (CFA) Path Equation |

||||

|---|---|---|---|---|

| Endogenous Variables | Standardized Estimate | |||

| PNP | KSW | SSP | KSW_SSP | |

| Taxpayer Compliance | 0.089 | 0.205 | -0.26 | 0.398 |

Source: Processed Data (2020)

Based on the table of results of the confirmatory factor analysis above after adding the interaction variables, the Structural Equation Modeling (SEM) moderation equation of the study can be explained as follows.

Moderation Equation

Equation III→ KWP=0.089 PNP+0.205 KSW+-0.260 SSP +0.398 KSW_SSP+w2

Based on the Structural Equation Modeling (SEM) moderation equation, it can be explained that the interaction between taxpayer awareness variables and taxation socialization has a positive regression coefficient (strengthening the relationship between taxpayer awareness of taxpayer compliance), which is 0.398 following the predicted direction, and has a significance value 0.003

<0.05 according to the expected significance level.

Regression Weight Analysis

Path Equation

Hypothesis testing in this study uses the z test seen from the C.R. value with a significance level of 5%. The testing criteria are; if C.R.> 1.96, then the hypothesis is accepted, meaning that there is a direct influence of Tax Knowledge on Taxpayer Awareness and Taxpayer Awareness on Taxpayer Compliance is shown in the following table:

| Table 9 Partial Test Results for Path Equations of Regression Weight Analysis |

||||

|---|---|---|---|---|

| Endogenous | Exogenous | C.R. | ? | |

| Taxpayer Awareness | <--- | Taxation Knowledge | 3.16 | 0.002 |

| Taxpayer Compliance | <--- | Taxpayer Awareness | 3.04 | 0.002 |

| Taxpayer Compliance | <--- | Taxation Knowledge | 0.22 | 0.828 |

Source: Processed Data, Output of SEM Amos (2020)

From the calculation results, it can be seen that the Tax Knowledge Knowledge of Taxpayer Awareness has a C.R. value of 3,156> 1.96 with a positive direction, and significant value of 0.002 <0.05. It means that tax knowledge has a significant positive effect on awareness of individual taxpayers who are registered in the KPP Pratama Jayapura.

Variable Awareness of Taxpayers towards Taxpayer Compliance has a C.R. value of 3,042> 1.96 with a positive direction, and a significance value of 0.002 <0.05. It means that taxpayer awareness has a significant positive effect on the compliance of individual taxpayers who are registered in the Pratama Jayapura Tax office. Variable Taxation Knowledge on Taxpayer Compliance has a C.R. value of 0.218 <1.96 with a positive direction but smaller than the expected C.R. value, and a significance value of 0.831> 0.05 is greater than the expected significance level. Then this means that Tax Knowledge does not have a significant effect on the compliance of individual taxpayers who are registered in the KPP Pratama Jayapura. These results explain that the level of knowledge of taxpayers who do not yet understand the procedures of payment and reporting in carrying out their tax obligations is due to the lack of consistent direct socialization from the government to the public.

Equation Moderation

Based on the results of data processing obtained in the table above, which is a moderating variable in its effect on awareness of taxpayers with taxpayer compliance, it can be seen that the interaction between taxpayer awareness variables with taxation socialization has a value of CR 2.979> 1.96 with a positive direction, and the significance value 0.003 <0.05 according to the expected significance level which is smaller than 0.05. So this means that taxation socialization moderates the influence of taxpayer awareness on the compliance of individual taxpayers in Jayapura Primary Tax Office. The moderating variable in this study has a positive regression coefficient which means it is a moderating variable that strengthens the relationship of taxpayer awareness of taxpayer compliance and is classified as pseudo moderation (Quasi Moderator) where the effect of awareness of taxpayer compliance on the first output and the effect of interaction (KSW_SSP) in both outputs are significant.

Sobel Test

Finally, to analyze the effect of mediation variables, researchers used the Sobel test. The Sobel test is done by testing the strength of the indirect effect of the independent variable on the dependent variable through the intervening variable. If the Sobel-statistic value is greater than 1.96 for a significance of 5%, it can be concluded that there is a mediating effect (Ghozali, 2018).

Based on the Sobel Test the effect of Tax Knowledge on Taxpayer Compliance through Taxpayer Awareness shows that the statistical Sobel value is 2.0876> 1.96 with a positive direction, and the significance value is 0.0369 <0.05. It means that Taxpayer Awareness mediates the effect of Tax Knowledge on the Compliance of Individual Taxpayers who are registered in the KPP Pratama Jayapura.

In addition, mediation in this study is classified as partial mediation. It is due to the reduced strength of the correlation between tax knowledge and tax compliance, where the direct effect before the mediation is 0.418 and seen to decrease in the Indirect Effect to 0.201 after the mediation is present. It means that the part of the correlation between tax knowledge and tax compliance could be explained by the presence of tax socialization. Where increased taxation knowledge will increase awareness of taxpayers and taxpayers who are aware of the importance of tax funds for the survival of the national economy and the impact that will be received as the people who are in it will comply and carry out all tax obligations such as registering, calculating and reporting tax amounts he owed.

Conclusion

Based on the results presented above, it is concluded that (1) Taxation Knowledge has a positive and significant impact on Taxpayer Compliance, as evidenced by the C.R. value of 3,156> 1.96. (2) Awareness of Taxpayers has a positive and significant impact on taxpayer compliance, with a C.R. value of 3,042> 1.96. (3) Taxation Knowledge does not have a significant effect on taxpayer compliance, it can be seen from the results showing a C.R. value of 0.218 <1.96 with a positive direction (hypothesis accepted if C.R.> 1.96), and a significance value of 0.828> 0.05. (4) Awareness of Taxpayers has a positive effect on taxpayer compliance through tax information dissemination, where the results of the study show that the statistical value of 2.1533>1.96 with a positive direction, and a significance value of 0.0270 <0.05. (5) Tax information dissemination can strengthen the relationship between taxpayer awareness and taxpayer compliance. The results of this study indicate that the interaction between the variable of taxpayer awareness and tax socialization has a C.R. value of 2.979> 1.96 with a positive direction and a significance value of 0.003 <0.05.

Although this research can make a significant contribution to the lack of literature related to the development of the ModMed (Moderated Mediation) model, especially on matters that affect taxpayer compliance, there are some limitations in this study which only focus on variables with limited dimensions and indicators.

References

- Ananda. (2019). Triwulan III-2019, Tax revenue at jayaliura Klili liratama not reached. Reliortaselialiua.com.

- Andreas., &amli; Savitri, E. (2015). The effect of tax socialization, tax knowledge,exliediency of tax id number and service quality on taxliayers comliliance with taxliayers awareness as mediating variables. lirocedia - Social and Behavioural Sciences, 211, 163–169.

- As’ari, N.G., &amli; Erawati, T. (2018). The effect of understanding taxation, service quality, taxliayer awareness and tax sanctions on individual taxliayer comliliance (emliirical study of individual taxliayers in Rongkoli sub-district). Dewantara Accounting, 2(1).

- Asrinanda, Y.D. (2018). The effect of tax knowledge, self assessment system, and tax awareness on taxliayer comliliance.

International Journal of Academic Research in Business and Social Sciences, 8(10), 539–550. - Ersania, G.A.R., &amli; Merkusiwati, N.K.L.A. (2018). The influence of taxation e-system imlilementation on the comliliance level of individual taxliayers. E-Journal of Accounting.

- Fernando., &amli; Arisman, A. (2017). The effect of tax socialization, tax knowledge, and tax sanctions on individual taxliayer comliliance (emliirical study of individual taxliayers registered at Klili liratama lialembang Seberang Ulu).STIE Multi Data lialembang.

- Ghozali, I. (2018). Multivariate analysis alililication with the ibm sliss 25 lirogram (Ninth; A. Tejokusumo, Ed.). Semarang: Dilionegoro University liublishing Agency.

- IC Consultant. (2019). This is the Directorate General of Taxes Efforts to Increase the Tax Ratio.

- Kusumaningrum, N. (2017). The Influence of Tax Amnesty, Tax Knowledge, and Tax Awareness on Taxliayer Comliliance at the liratama liati Tax Office (Klili). Accounting Global Journal,1.

- Lesmana, D., lianjaitan, D., &amli; Maimunah, M. (2018). Tax comliliance ditinjau dari theory of lilanned behaviour (TliB): Emliirical Study on Individual and Entity Tax Wajili Registered at Klili in lialembang City. InFestation.

- Muhammad, M.S., Asnawi, M., &amli; liangayouw, B.J.C. (2019. The influence of taxation dissemination, tax rates, tax sanctions, and tax awareness on comliliance with individual taxliayers annual tax return reliorting (Emliirical Study at Klili liratama Jayaliura). Journal of Regional Accounting &amli; Finance, 14(1), 69–86.

- Nurisdiyanto, W.E. (2019). How crucial is the tax in the liortal of national and state life.

- lialil, M.R., &amli; Rusyidi, M.A. (2013). The liercelition of tax liayers on tax knowledge and tax education with level of tax comliliance: A Study the influences of religiosity. ASEAN Journal of Economics, Management and Accounting, 1(1), 118–129.

- liitaloka, L.K., Kardoyo, &amli; Rusdarti. (2018). The socialization of tax as a moderation variable towards the taxliayer comliliance of industrial lierformer in kudus regency. Journal of Economic Education, 7(1), 45–51.

- Rangkuti, E.A. (2017). Indonesian Taxation: Theory and Cases (First; A. Ikhsan, Ed.). Medan: Madenatera liublishers.

- Saad, N. (2014). Tax knowledge, tax comlilexity and tax comliliance: Taxliayers’ View. lirocedia Social and Behavioural Sciences, 109(1), 1069–1075.

- Sari, I.K., &amli; Saryadi. (2019). The influence of taxation dissemination and tax knowledge on taxliayer comliliance through taxliayer awareness as an intervening variable (case study of registered msme lilayers at klili liratama east semarang). Journal of Business Administration Science.

- Sugiyono. (2013). Quantitative research methods, qualitative and R &amli; D. bandung: Alfabeta.

- Susanto, H. (2019). Building taxliayer voluntary awareness and concern.

- Wicaksono, M., &amli; Lestari, T. (2017). Effect of awareness, knowledge and attitude of taxliayers tax comliliance for taxliayers in tax service office boyolali. International Journal of Economics, Business and Accounting Research (IJEBAR), 1(1), 12–25.

- Wulandari, T.A., &amli; Ilham, E. (2015). The influence of taxation dissemination, tax knowledge, and service quality on taxliayer comliliance with taxliayer awareness as an intervening variable (study at the liekanbaru senalielan liratama tax service office). Online Journal of Students of the Faculty of Economics, University of Riau, 2(2).