Review Article: 2021 Vol: 25 Issue: 3S

Factors Affecting Cashless Payment of Goods and Services

Raknarin Sanrach, King Mongkut’s University of Technology North Bangkok

Abstract

Thailand is a country that has stepped into a cashless society. The value of electronic payments for goods and services is increasing every year. This research is an exploratory research whose objective was to study factors affecting cashless payment of goods and services. Questionnaires were used to collect the data. A total of 400 consumers conducting cashless purchases of goods and services were interviewed. Both descriptive and reference statistics were employed in this study.

Factors affecting cashless transactions the most was that it made daily life convenient, and helped to reduce the cost of traveling to banks or counter service providers. The comparison of different factors affecting financial transactions for cashless payment of goods and services as classified by age of consumers revealed that 8 items were different at the statistical significance of .05.

Keywords:

Cashless Society, Electronic Payments, Mobile Banking

Introduction

Over the years, the term “Cashless Society” has been widely referred to as the concept of a society not using cash, or an economic society that does not prefer to hold cash (Chusangnin, 2019). It has evolved continuously, starting with the use of credit and debit cards to pay for goods and services instead of cash. Until now, a platform in electronic forms such as electronic wallet or e-Wallet has recently become more popular. Thailand tends to obviously turn into a cashless society and is one of the first countries in the ASEAN region to introduce electronic financial transaction law. The e-Commerce Law of the United Nations was adapted and drafted into a law of Thailand called Electronic Transactions Act. (Korrasud, 2018)

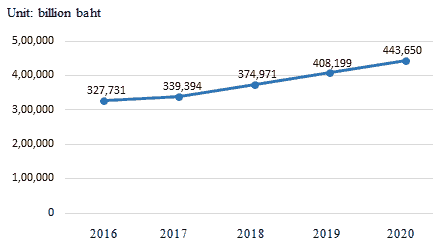

The fast growing popularity of electronic payments (e-Payments) results in Thai people using less cash. Although the result is still less than the economic activity variables, the effect of this payment method is likely to increase in the future. The popularity of e-Payments through Internet-Mobile Banking is very obvious. According to the data from “We Are Social” and “Hootsuite” in 2020, the number of Thais transacting via mobile banking was at the top rank in the world, 68.1% per month. Their online purchases via smartphones ranked the 2nd with 74.0%; and mobile internet usage was at the 3rd, averaging 5 hours and 7 minutes per day (Prachachat Business, 2021). Thailand will be one of the countries stepping into a cashless society especially if there is continuous support from the government along with the development of the service providers’ innovative e-Payments products that meet the needs of people who want to use them with confidence in their safety (Kongpalee, 2020) as shows in Figure 1.

Figure 1 shows the value of electronic payments that tended to increase every year. Its value in 2016 was 327,731 billion baht, and was increased up to 443,650 billion baht in 2020 accounting for an increase of more than 1.35 times (Bank of Thailand, 2021). The main reason for this was that the payment system had continuously been developed to facilitate spending and reduce the cost of financial transactions. As a result, people started to carry less and less cash. The use of cash is being replaced by digital payment systems (Wantanakomol, & Silpcharu, 2020; Kongpalee, 2020). Cashless society becomes a modern economy where financial transactions are carried out without physical banknotes or coins, but by transfers of money via digital information system between the contracting parties; for example, money transfers from bank accounts to different recipients via applications or QR Code scanning, e-Wallet payments, transfers via bank application, PromptPay transfer system, or booking air tickets and accommodation via debit or credit cards. Like many countries around the world, e-Payments in Thailand have been found to reduce the country's overall expenditure by at least 1% of GDP per year.

As consumers increasingly adopt e-Payments, entrepreneurs of goods and services business have to keep pace with the changes in the borderless era where consumers can buy and entrepreneurs can sell products anywhere and anytime. Therefore, the study of factors affecting consumers’ cashless payments of goods and services was undertaken to obtain information for entrepreneurs or related parties to apply in planning and preparing their growing business against high competition.

Research Objectives

1. To study general characteristics of financial transactions for cashless payments of goods and services,

2. To study factors affecting financial transactions for cashless payments of goods and services,

3. To compare different factors affecting financial transactions for cashless payments of goods and services, as classified by age of consumers.

Research Methods

This research is of a survey type. The methods of the study were as follows:

Investigate and collect data from related documents and research. Then define the problems and objectives of the research.

Determine the sample size used in the study, using Taro Yamane’s table The reliability was set at 95%, +5% error. 400 samples were obtained.

Determine the instruments used in the study, which, in this case, were questionnaires. The construction of questionnaires started from defining the structure of the questions. The values obtained from the analysis of the Index of Item-Objective Congruence Index (IOC) between the questions and the objectives of this research ranged from 0.60 to 1.00. Then the questionnaires were tried out. After that, the quality of the questionnaire was determined by analyzing its reliability, using Cronbach’s Alpha Coefficient. It was found that the questionnaire reliability was 0.91, and its discrimination values obtained by Corrected Item-Total Correlation analysis ranged from 0.33 to 0.74.

Systematic sampling technique was applied to obtain the samples. Data collection was made by interviewing consumers in Rayong province. The collected data were analyzed using SPSS software.

Statistics chosen for the data analysis to meet the objectives of the study and the structure of the questionnaire were as follows:

1. As the questionnaire on the general nature of financial transactions for cashless payment of goods and services was of a check-list type, frequency and percentage were used.

2. Arithmetic mean (x?) and standard deviation (S.D.) were used in the part of the questionnaire with a five-point rating scale based on Likert's Scale principle. The interpretation of the obtained mean were as follows: (David & Sutton, 2011 cited in Kaushik & Walsh, 2019):

1.00 – 1.49 : the least importance

1.50 – 2.49 : low importance

2.50 – 3.49 : moderate importance

3.50 – 4.49 : high importance

4.50 – 5.00 : the highest importance

3. In comparison of factors affecting financial transactions for cashless payments of goods and services of consumers with different background, t-Test was adopted to analyze two groups of independent samples while One Way Anova were adopted for more than two groups samples.

Research Results

As for the general characteristics of financial transactions for cashless payments of goods and services, it was found that online communication influenced cashless transactions (86.75%); consumers chose to transact online via smartphone (78.75%); most had 3-5 year experience in cashless transactions (48.75%); they transacted more than 4 times/week (27.75%) with the average of 1,001-3,000 baht per time (33.25%); period of transactions frequently made was from 6:00 p.m. – 9:00 p.m. (40.25 percent); and the Kasikorn Bank application was most preferred to perform cashless transactions (39.75%) as it was fee-free (79.50%).

Factors affecting financial transactions for cashless payments of goods and services at the highest and high levels as shown in Table 1.

| Table 1 Mean And Standard Deviation Of Factors Affecting Financial Transactions For Cashless Payments Of Goods And Services At The Highest And High Levels |

|||

|---|---|---|---|

| Factors Affecting Cashless Financial Transactions | S.D. | Level | |

| 1. It makes daily life easier and more comfortable. | 4.62 | 0.61 | Highest |

| 2. It helps to reduce the cost of traveling to banks or counter service providers. | 4.55 | 0.65 | Highest |

| 3. It is available at any place and anytime. | 4.47 | 0.73 | High |

| 4. The use of smartphones in the modern era has opened up a cashless society. | 4.44 | 0.71 | High |

| 5. You can order products and services without any restrictions on time and place. | 4.43 | 0.77 | High |

| 6. It is faster than paying with cash. | 4.39 | 0.73 | High |

| 7. Cashless payment for goods and services is a generally accepted form of payment. It reduces the risk of infection that accumulates in cash. | 4.31 | 0.78 | High |

| 8. It is of a modern payment method. | 4.26 | 0.91 | High |

| 9. The availability of cashless payment services affects the decision to buy goods and services faster and easier. | 4.22 | 0.8 | High |

| 10. Process for goods and services payment is simple; not complicated. | 4.22 | 0.75 | High |

| 11. Promotional privileges such as reward points, credit cash back, etc., affect the decision to purchase goods and services. | 4.14 | 0.84 | High |

| 12. A cashless society is opened for sellers of goods and services across the country. | 4.12 | 0.86 | High |

| 13. Banks or service providers can take care of the payment process accurately. | 4.07 | 0.73 | High |

| 14. Cashless payment is not contrary to the values of Thai people. | 4.01 | 0.85 | High |

| 15. Public relations and regular updates in various media affect the decision to choose a cashless payment. | 4.00 | 0.86 | High |

| 16. There is a testimony of its effectiveness from users who have used the service. | 3.97 | 0.9 | High |

| 17. Banks or service providers have systems to secure customer data. | 3.93 | 0.79 | High |

| 18. Banks or service providers have regulations that can protect the interests of customers. | 3.91 | 0.85 | High |

| 19. Spending culture in Thailand allows consumers and sellers to embrace a cashless society. | 3.91 | 0.84 | High |

| 20. It creates good and interesting experiences. | 3.86 | 0.94 | High |

| 21. It create good and modern image to users. | 3.74 | 0.98 | High |

| 22. It is safer than using cash, and is not susceptible to fraud. | 3.73 | 0.9 | High |

The result of the data analysis on comparing factors affecting financial transactions for cashless payments of goods and services of consumers with different age, using One Way Analysis of Variance (ANOVA), showed that 8 items were rated differently at the statistical significance level of .05 level, as shown in Table 2.

| Table 2 The statistics values of factors affecting financial transactions for cashless payments of goods and services of consumers with different age |

|||||

|---|---|---|---|---|---|

| Factors Affecting Cashless Financial Transactions | (I) Age | (J) Age | Mean Difference (I–J) | F-Value | P-Value |

| 1. It is a modern payment method. | 41-50 yrs | >50 yrs | 0.646* | 3.01 | 0.03* |

| 2. It makes daily life easier and more comfortable. | 41-50 yrs | >50 yrs | 0.503* | 3.95 | 0.01* |

| 3. You can order products and services without any restrictions on time and place. | 30-40 yrs | >50 yrs | 0.498* | 3.12 | 0.03* |

| 41-50 yrs | 0.553* | ||||

| 4. Public relations and regular updates in various media affect the decision to choose a cashless payment. | < 30 yrs | >50 yrs | 0.636* | 3.82 | 0.01* |

| 41-50 yrs | 0.665* | ||||

| 5. The use of smartphones in the modern era has opened up a cashless society. | 30-40 yrs | >50 yrs | 0.507* | 4.91 | 0.00* |

| 41-50 yrs | 0.642* | ||||

| 6. It helps to reduce the cost of traveling to banks or counter service providers. | 30-40 yrs | < 30 yrs | 0.239* | 5.05 | 0.00* |

| 41-50 yrs | 0.297* | ||||

| 7. Process for goods and services payment is simple; not complicated. | < 30 yrs | >50 yrs | 0.557* | 3.47 | 0.02* |

| 8. Cashless payment for goods and services is a generally accepted form of payment. It reduces the risk of infection that accumulates in cash. | 30-40 yrs | >50 yrs | 0.509* | 3.43 | 0.02* |

| 41-50 yrs | 0.600* | ||||

Discussion and Suggestions

Nowadays, technology has played a role in the lives of all human beings including financial transactions that make everyday life convenient via using only one smartphone. Transfer, receiving, paying, and saving of money, or even investment are all now in the Internet Banking system in the form of various banking applications, without limitation of time and place (Teerarujinon & Jadesadalug, 2019). This is consistent with this study finding in that factors affecting cashless financial transactions for goods and services are that it makes everyday life of consumers more convenient and easier; it helps to reduce the cost of traveling to banks or counter services. Therefore, service providers need to design applications that are easy to use, fast and low-cost. The government, as a supporting agency, must not forget that the important matter to make a cashless society more effective is to provide an internet network system that can easily be accessed and quickly connected to meet the needs of users.

Online communication has the greatest influence on cashless transactions. When analyzing the behaviors of today's consumers, it is found that they are familiar with the use of digital technology and spend more time on social media than before (Wantanakomol, & Woraphiwut, 2016). Many platforms offer products that can connect to social applications. Consumers are more comfortable. No need to leave the application they are currently using to access the online payment application immediately (Zamil et al., 2020). However, the frequent use of applications to present news, information or products is like advertising the same thing over and over all day. The users may love them at the beginning and may get bored later. Therefore, the key to financial transactions is consumers’ knowledge and disciplines whereas service providers must have good governance (Chucherd, 2020) to result in the sustainability of the economy and society.

The finding of this study showed that consumers aged 30-50 pay more attention to factors affecting cashless payment transactions for goods and services than those over 50 years of age. One reason found is that persuading or influencing one's mind becomes more difficult with older people (Xu, et al., 2021). Older consumers are concerned with transaction systems that rely on technology while people aged between of 30-50 use them more as the use of smartphones in the modern era opens up a cashless society. This is because younger people are classified in a group with high purchasing power. Moreover, they adapt themselves to new technologies better (Jiravachara, 2020). Therefore, consumers aged 30-50 is believed to be the main target group to encourage cashless payment for goods or services more easily than the other age groups.

As the COVID-19 pandemic affects not only trade, investment, economic system, but also lifestyles of the people who have to adjust themselves to the new normal way of life. It is obvious that a number of consumers have changed their behaviors in purchasing goods and services. Online purchases and payments in the form of e-Payments become very popular (Memon, et al., 2021). This is no exception for businesses. They likewise need to adjust their strategy for survival by adopting an online payment system in their organizations to facilitate consumers to pay for goods and services quickly and easily, reducing the risk of infection from touch and use of cash (Bank of Thailand, 2021). The global situation facing this change is the driving force that drives the country towards a digital era where information is connected between the government, the private, and the public sectors. Therefore, related agencies must urgently educate the public sector, establish a system and set guidelines to prevent electronic crimes. to create a permanent change in spending behavior, which will lead to a happy cashless society.

References

- Bank of Thailand. (2021). Digital payment: The main choice of Thai people during the Covid-19 crisis. Bangkok, Thailand.

- Bank of Thailand. (2021). Value of payments via various payment systems and channels. Bangkok, Thailand.

- Chucherd, T. (2020). Social banking: Online banks near you. Bangkok : Bank of Thailand.

- Chusangnin, C. (2019). Cashless Society. The institute for the promotion of teaching science and technology. Bangkok, Thailand.

- David, M., & Sutton, C. (2011). Social research: An introduction. Los Angeles: Sage. cited in Kaushik., V. and Walsh., C.A. (2019). “Pragmatism as a Research Paradigm and Its Implications for Social Work Research.” Social Sciences, 8, 255.

- Jiravachara, P. (2020). Be aware of mobile phone and smart phone usage behaviors, and trends around the world. Bangkok: Siamrath.

- Kongpalee, T. (2020). Thai society (being) cashless. FAQ Focused and Quick, 169, 1-7.

- Korrasud, R. (2018). Transforming financial transactions: Prepare Thai e-commerce for the cashless society era.

- Memon, S., Hussain D.F.Ul., Mallah, G.A., Solangi, A.B., & Dars, A.M. (2021). The impact of attitude and consumer buying behavior towards online purchasing in Pakistan after Covid-19. Ilkogretim Online, 20(5), 3855-3860.

- Prachachat Business. (2021). New record: Thailand is the world's No. 1 mobile banking transactions. Bangkok, Thailand.

- Teerarujinon, N., & Jadesadalug, V. (2019). The service quality of electronic transactions of krung Thai Bank, Empire tower branch, Bangkok. Veridian E – Journal, Silpakorn University, 10(1), 1523-1537.

- Wantanakomol, S., & Silpcharu, T. (2020). Strategy for preventing corruptions in industrial business organizations with delphi technique. Academy of Strategic Management Journal, 19(3), 1-13.

- Wantanakomol, S., & Woraphiwut, A. (2016). Problems and obstacles of E-commerce entrepreneurs through the internet. The Journal of KMUTNB, 26(1), 133-140.

- Xu, X., Mei, Y., Sun, Y., Zhu, X., & Chen, K.S. (2021). Analysis of the effectiveness of promotion strategies of social platforms for the elderly with different levels of digital literacy, Applied Sciences. 11(9), 4312-4312.

- Zamil, A., Abu-AlSondos, I.A., & Salameh, A.A. (2020). Encouraging consumers to make online purchases using mobile applications, how to keep them in touch with e-services providers. International Journal of Interactive Mobile Technologies, 14(17), 56-65.